Abstract

Reducing coal overcapacity is an important strategy to achieve carbon peak and carbon neutralization in China. Determining the drivers of coal overcapacity is the first step toward this strategy. The existing literature focuses mainly on the macro determinants of coal overcapacity. Micro factors such as local officials’ intervention motivation also plays a role, but has received less attention in the literature. Using data from 25 coal-producing provinces in China, we demonstrate that local officials’ promotion pressure under the GDP-based promotion system significantly leads to coal overcapacity. Mediation effect analysis suggests that factor market distortion is one important channel through which local officials’ promotion pressure affects overcapacity in the coal sector, and the distortion in the capital market plays a more dominant role than distortion in the labor market. To alleviate the negative effect of officials’ promotion pressure on capacity utilization rate, we build a diversified promotion system incorporating environmental indicators. Results show that when the environmental pressure index accounts for at least 50% of the weights in the diversified promotion system, the negative effect of promotion pressure disappears. Our results suggest that to reduce coal overcapacity problem, policymakers may wish to weaken the GDP-based political promotion incentive by adding environmental and ecological indicators and reducing interventions on factor allocation. Results from the present paper has implications for resource-dependent countries facing similar overcapacity problems, especially in the context of the open economy and green recovery in the post-COVID-19 period.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The negative environmental impacts of greenhouse gas (GHG) emissions have been the subject of global concern for several decades (Işik et al. 2018). To adapt to climate change and mitigate GHG emissions, 177 countries signed the Paris Agreement in 2015 (Sutter et al. 2015). As one of the signatories, China has implemented the Paris Agreement and set the goal of carbon peak by 2030 and carbon neutral by 2060. Under these sustainable development goals, China has taken a series of measures to reduce carbon emissions (Anwar et al. 2021; Arain et al. 2020). Among them, developing information technology (Godil et al. 2020; Godil et al. 2021) and renewable energies (Sharif et al. 2021) and reducing the production and consumption of fossil energies are important measures (Adebayo et al. 2022; Işik et al. 2019a, b, 2021; Pata and Isik 2021).

Coal is the most carbon-intensive fossil fuel and the biggest source of energy-related carbon emission in China and the world (Steckel et al. 2015). Reducing coal production and consumption is essential for sustainability, climate change, and energy transition (Guo et al. 2022; Shi et al. 2020). Nevertheless, coal overcapacity makes phasing out coal use much more difficult (Wang et al. 2018a). On the one hand, the specificity of coal production equipment causes high capacity withdrawal barriers. The invested equipment must be used for a period of time before it can be scrapped, which leads to more coal production. On the other hand, due to local officials’ GDP-oriented performance system and promotional pressure, coal-based cities tend to persistently develop coal mining and production under the restriction of a single industrial structure, resulting in more coal production. Coal overcapacity, i.e., production capacity in the industry being significantly and persistently larger than actual production or demand, leads to lower coal prices, thus incentivizing more use of coal domestically and globally (Walker 2016). Therefore, further reducing coal overcapacity remains an important task to achieve carbon peak and carbon neutralization in China.

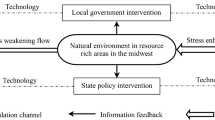

Determining the drivers of coal overcapacity is the premise of successful overcapacity reduction. Exiting research focuses on the debate between government and market failures. The “Wave Phenomena” (Lin et al. 2010), the expansion market signals (Dong and Sun 2022), the firm’s factor hoarding and entry deterrence strategy (Yang et al. 2019), and the market’s weak effect on capacity exit (Dong and Sun 2022) are main ideas under the market failure strand of literature. In terms of government failure, government intervention behavior such as government subsidy (Yu et al. 2021; Zhang et al. 2016) and credit support (Ma et al. 2020) have been extensively analyzed. Since China is in the process of transition to a market economy and has not fully established a mature market mechanism, it is more reasonable to study the causes of excess capacity from the perspective of government intervention. However, the existing literature focuses more on the macro factor of government intervention behavior while failing to explore the underlying micro aspect of local officials’ intervention motivation.

Local officials’ promotion pressure under China’s GDP-based promotion system may explain the overcapacity problem from the micro perspective. Although the GDP-based official promotion system is an important reason for China’s economic growth miracle (Pu and Fu 2018), it also causes local officials to focus on short-term economic performance for personal political promotion (He et al. 2019), thus leading to redundant construction and excessive investment (Wu and Zhou 2018), and subsequently overcapacity. This problem may be particularly severe in coal cities. The industrial structure of coal cities is relatively single, and the economic growth mainly depends on coal mining and production. To promote short-term economic growth and gain political promotion, local officials will constantly expand the exploitation, construction, and investment of coal resources. These factors may be important reasons for China’s severe coal overcapacity that began in 2013. However, little research has studied this problem.

One purpose of this paper is to empirically examine whether local officials’ promotion pressure under the GDP-based promotion system leads to coal overcapacity in China, and the mechanism through which local officials’ promotion pressure drives coal overcapacity. The other purpose of this paper is to explore whether alternative local officials’ promotion systems may help mitigate the overcapacity problem. Using data from 25 coal-producing provinces in China from 2002 to 2016, we find that local officials’ promotion pressure under the GDP-based promotion system is an important micro factor that leads to coal overcapacity. We further find that factor market distortion is a key channel through which local officials’ promotion pressure affects overcapacity in the coal sector, and the distortion in the capital market plays a more dominant role than distortion in the labor market. Moreover, an optimized promotion system that incorporates environmental indicators would help alleviate the negative effect of promotion pressure on capacity utilization rate.

Contributions of this paper are as follows. Firstly, this paper demonstrates that local officials’ promotion pressure is an influential factor in coal overcapacity, which supplements a new micro perspective on the causes of coal overcapacity. Secondly, this paper investigates how local officials’ promotion pressure influences coal overcapacity and reveals two different mediating effects, i.e., capital factor distortion and labor factor distortion. Thirdly, this paper puts forward an optimized local officials’ promotion system that comprehensively considers economic and environmental indicators. The new system significantly helps to reduce coal overcapacity and could act as a new countermeasure widely promoted.

The research content of this paper is of great significance. This paper proposes a new countermeasure for reducing coal overcapacity by optimizing local officials’ promotion system. This enriches the research perspective theoretically and adds ways to reduce coal overcapacity practically. Meanwhile, the results of this paper can guide other countries in reducing overcapacity. Other developing countries whose economic growth mainly rely on resource exploitation may also have the problem of excess capacity caused by local officials’ promotion pressure. This paper’s results and policy implications could provide them with a new idea to reduce overcapacity and help them develop more sustainably. Furthermore, this paper supports the “Green economy recovery” strategy in the post-COVID-19 period. An important task in the post-COVID-19 period is to revive the economy. Resource-based countries may accelerate the exploitation and development of resource-based industries due to the single industrial structure, which may cause the problem of overcapacity. Our findings can help these countries prevent overcapacity and achieve green economic development.

The remainder of this paper is organized as follows. The “Literature review” section reviews relevant studies. The “Empirical models” section discusses empirical methods. The “Variables and data” section presents the variables and data used in the paper. Estimation results are discussed in the “Empirical results” section. The “Discussions” section presents the discussion and policy recommendations. The last section summarizes the conclusions.

Literature review

To study the cause and resolving mechanism of coal overcapacity from the micro perspective of local officials’ promotion pressure, we review the literature from three aspects to find the research gap, including the cause of overcapacity, the influence mechanism of local officials’ promotion pressure on overcapacity, and the methods of overcapacity reduction.

Cause of overcapacity

The research results on causes of overcapacity can be classified into two types, including government failure and market failure. The “Wave Phenomena” (Lin et al. 2010), the expansion market signals (Dong and Sun 2022), and the firm’s factor hoarding and entry deterrence strategy (Yang et al. 2019) are main ideas of market failure. In terms of government failure, existing studies have found that government intervention and government spending can lead to pollutant emissions and overcapacity (Işik et al. 2022; Zhang et al. 2017). Specifically, government subsidy (Wang et al. 2018b; Xiang and Kuang 2020; Yu et al. 2021; Zhang et al. 2016) and credit support (Ma et al. 2020) are the main factors. Because the mature market mechanism has not been established, studying the causes of overcapacity from the perspective of government intervention is more in line with China’s national conditions.

According to the above literature review, the existing literature mostly focuses on the macro factor of government intervention behavior. However, the underlying micro factor of local officials’ intervention motivation has not been further explored. Local officials’ promotion pressure under China’s GDP-based promotion system may explain the formation of overcapacity from the micro perspective, whereas none of the existing studies has accounted for this. Therefore, this paper tries to make up for this research gap and empirically examine whether local officials’ promotion pressure leads to the overcapacity problem in China’s coal sector.

The influence mechanism of local officials’ promotion pressure on overcapacity

Some studies show that the distorting factor market is an important means for local officials to seek political promotion (Bond and Samuelson 1986). Although the Chinese government has made great progress in market-oriented reform of productive factors (Gong 2018). Nevertheless, due to some institutional constraints, the pace of establishing integrated markets for essential productive factors still lags behind (He et al. 2019; Yang et al. 2018), resulting in serious factor market distortion (Ji 2020; Tan et al. 2019).

In China, local officials will coordinate loans and provide land at low prices for enterprises to attract investment to promote regional economic growth (Jiang et al. 2012; Zhang et al. 2014). Besides, local officials will provide preferential policies and financial subsidies to accelerate the development of specific industries (Liu et al. 2019; Yang et al. 2018). These actions will distort the factor market and trigger the externalization of enterprise investment risks and further promote the expansion of enterprise investment, thus resulting in overcapacity. Therefore, the factor market distortion may have mediating effects on coal overcapacity caused by local officials’ promotion pressure. Nevertheless, none of the existing literature has studied on it. In this paper, we hypothesize that labor and capital market distortions are key channels that local officials’ promotion pressure affects coal overcapacity and test whether the hypothesis holds empirically.

Methods of overcapacity reduction

Several studies put forward suggestions for reducing overcapacity, but most of them are qualitative research (Chi et al. 2021; Feng et al. 2018). Some literature empirically studied the influence of factor change on resolving excess capacity, including outward foreign direct investment (OFDI) (Chen et al. 2021b), export (Dai and Zhao 2021), annexation, and reorganization of enterprises (Liu and He 2019). On the role of optimizing the promotion system for local officials in resolving excess capacity, the existing studies only analyze its impact from the qualitative perspective (Gan et al. 2015). However, no literature has provided empirical support for the governance effect of the optimized local officials’ promotion system on overcapacity.

Some scholars believe that environmental regulation can promote environmental sustainability (Khan et al. 2020) and the withdrawal of excess capacity in China’s energy sector (Du and Li 2019). Under environmental regulation, local officials will reduce inefficient and highly polluting redundant construction investment activities. In addition, environmental regulation increases the production cost of enterprises and promotes the withdrawal of inefficient enterprises from the market, which is conducive to the elimination of excess capacity. Therefore, the inclusion of environmental indicators in the officials’ promotion system may help control coal overcapacity. Thus, this paper provides a quantitative assessment of whether an optimized promotion system can mitigate the coal overcapacity problem.

Empirical models

We start with a reduced-form linear regression model to examine the relationship between the coal industry’s overcapacity and local official’s promotion pressure, as in (1):

where cuit represents the degree of coal capcacity utilization rate in province i at time t, proit is the promotion pressure faced by local officials, and Xit is a set of control variables that affect the degree of coal overcapacity. Additionally, ηit is the disturbance term that includes two orthogonal components: a fixed effect term that accounts for time-invariant unobserved factors affecting the capacity utilization rate, and a random error term that represents time-variant idiosyncratic unobserved factors. Since the degree of coal capacity utilization rate is likely to be correlated with the overcapacity in previous years, we include the lagged capacity utilization rate (cui, t − 1) in the model to allow the factors affecting coal overcapacity to have a long-term effect. If the promotion pressure faced by local officials leads to a higher level of overcapacity, then β2 is expected to be negative in the regression equation.

Next, we estimate Eqs. (2) and (3) to determine whether the effect of promotion pressure manifests itself through factor market distortion:

where zdistit represents the degree of factor market distortion. Although promotion pressures may affect capacity utilization rate in many ways, we focus our discussion on the factor market distortion channel. To promote economic growth, local officials in coal-producing provinces may engage in activities that move factor market prices away from the efficient market prices, leading to over-or under-investment in the coal sector. Since a larger value of zdistit indicates the further the market price is below the efficient price (hence a higher degree of factor overuse), we expect γ2 to be positive in Eq. (2). Following the framework outlined in Baron and Kenny (1986) on testing mediating effect, the intermediary role of factor market distortion is verified if the coefficient of zdistit is significant in Eq. (3), and the magnitude of the coefficient for promotion pressure is smaller in Eq. (3) compared to the value in Eq. (1). In other words, once controlling for factor market distortion, the promotion pressure has a smaller effect on the capacity utilization rate.

There are two potential pitfalls in Eqs. (1)~(3), which will bias the ordinary least square (OLS) estimates. First, the lag of the dependent variable appears as an independent variable in the econometric model. Second, some independent variables may adversely affect the dependent variable. Therefore, these will lead to endogeneity in the model. In this paper, we treat this endogeneity by using the generalized method of moments (GMM) for the estimation of the dynamic panel model. For the case with a strong endogeneity, the two-stage least squares (2SLS) could also have been a possible method choice to proceed. However, estimations provided by 2SLS are often weak in the presence of heteroscedasticity (Lin and Lee 2010). In this context, the GMM method is more efficient (Lee 2007). Precisely, the GMM method is well known to solve the problem of endogeneity in dynamic panel models.

Arellano and Bond (1991) first proposed the difference generalized method of moments (diff-GMM), in which the lagged dependent variables in levels are used as instruments for the first-differenced lagged dependent variables. However, the diff-GMM estimation method often suffers from a weak instrument problem, especially if the dependent variable is close to a random walk. Arellano and Bover (1995) and Blundell and Bond (1998) subsequently proposed the system generalized method of moments (sys-GMM) by including both lagged levels as well as lagged differences of the dependent variable as the instruments. The sys-GMM estimation method is superior to the diff-GMM method, especially if the dependent variable is highly persistent. In the present paper, we use sys-GMM as the main model to test the linkage between promotion pressure and the capacity utilization rate in the coal sector and use diff-GMM for robustness check.

Variables and data

Capacity utilization rate refers to the amount of actual output as a percentage of the total nameplate capacity. Following previous literature (Cheng and Liu 2015; Zhang et al. 2014), we define the overcapacity ratio in the coal sector as 1—capacity utilization rate, or the idol capacity not utilized in production. A stochastic production frontier approach is used to compute the capacity utilization rate. The stochastic frontier method not only considers the elasticity of factor substitution in the production process but also allows for individual heterogeneity in the production frontier. Specifically, the stochastic production frontier model (Aigner et al. 1977; Greene 2005) is specified as:

where yit is the actual output of region i at time t, xit is a vector of inputs, f(.) is the production function, and vit is the random error term. Furthermore, uit is the half-normally distributed error term that measures the technical inefficiency of production, or the amount of the actual output (yit) deviates from the optimal frontier (f(xit, t) + vit) that each individual unit pursues. A time-trend t is included in the production function to account for technological progress over time.

To allow for a flexible functional form, we use a translog specification of the production function as in Eq. (5):

where the actual output (yit) is modeled as a function of capital stock (K) and labor input (L) and a compound residual term εit, which can be replaced by vit − uit in Eq. (4). The maximum attainable output (\({y}_{it}^{\ast }\)) can be calculated based on the estimation results of the stochastic frontier translog production function. It follows that the capacity utilization rate (cuit) is calculated as the actual output divided by the maximum possible output, as in Eq. (6):

In calculating the capacity utilization rate, the actual output refers to the inflation-adjusted sales value of the coal industry in each province, using 2002 as the base year. The capital stock is calculated using the perpetual inventory methodFootnote 1, with the base year determined by the method of Shan (2008)Footnote 2 and the depreciation rate estimated by the method outlined in Chen (2011)Footnote 3. Labor input is measured by the number of employees in the coal industry.

Our core explanatory variable is local officials’ promotion pressure during their tenure. Wang et al. (2018a, b) note that local officials are ranked among each other under the current political system, with the better-preformed ones moving up along the political career ladder. Previous studies show that this ranking is mainly determined by the economic performance of the respective region among all regions under consideration (Li and Zhou 2003; Maskin et al. 2000; Xu 2011). Therefore, we use an index constructed by GDP growth rate similar to the ones used in Qian et al. (2011) and Wang et al. (2018a, b) to represent local officials’ promotion pressure. Specifically, local officials face zero promotion pressure if the region’s GDP growth rate is higher than that year’s national average GDP growth rate. Otherwise, the promotion pressure equals 1.

We consider coal factor market distortion as the key channel through which promotion pressure affects the industry’s overcapacity. Efficient allocation is achieved if the factor price equals the marginal value of output. Following Chen and Hu (2011), we calculate the degrees of capital (kdist) and labor (ldist) market distortion in a given region as in Eqs. (7) and (8):

where Ki/K (Li/L) represents the actual proportion of capital (labor) used in region i over those used in all regions, Si is the proportion of output value in region i over all regions, \({\beta}_{K_i}\) (\({\beta}_{L_i}\)) represents the coefficient of capital (labor) contribution to output in the production function, and \({\overline{\beta}}_K\) (\({\overline{\beta}}_L\)) is the weighted value of capital (labor) contribution across all regions based on the total output. Therefore, \({S}_i{\beta}_{K_i}/{\overline{\beta}}_K\)measures the theoretical proportion of capital used in region i when capital is efficiently allocated. If kdisti is greater than one, capital is overused in the region and the capital price is too low compared to the efficient market price. A value less than one for kdisti would represent insufficient capital use in the region with relatively high capital prices, or an upward distortion in the capital market. Similar definitions are used for the labor market. The total degree of coal factor market (zdist) distortion is calculated as in Eq. (9):

To measure the ceteris paribus effect of promotion pressure on coal overcapacity, it is necessary to account for other variables that affect the variation in the overcapacity across regions. Following previous literature, we consider four variables, namely the innovation capacity, economic cycle, and revenue growth rate of the coal industry, as well as the degree of overall government interventions in the province. Below, we discuss each factor separately.

Innovation capacity

Following previous literature, the innovation capacity of the coal industry is measured by its total R&D expenditure (in logarithms) each year. R&D activities promote innovation and product differentiation, supplying the market with high-quality products that better meet the demand and contributing to a greater capacity utilization rate (Li et al. 2019). Furthermore, by improving innovation ability, firms may enter the high-tech production chain, diversifying their investment portfolios that help alleviate the overcapacity problem. It is expected that a higher innovation capacity is associated with a greater capacity utilization rate (or equivalently, a lower overcapacity).

The economic cycle of the coal industry

Given the vital role coal plays in China’s industrial production, the economic cycle can greatly impact the overall performance of the coal industry. In economic downturns, the demand for coal decreases, exacerbating the overcapacity problem. On the other hand, when the economy is in the boom phase, the rise in demand would improve the capacity utilization rate in the industry. We use the Hodrick-Prescott (HP) filter method to decompose the coal industry’s sales value in each province into a fluctuating and a time trend factor, with the former used as a measure of the economic fluctuation cycle of the industry (He et al. 2013).

The growth rate of coal industry revenue

Another demand-side factor that affects the coal industry capacity utilization is its total revenue growth rate. A higher revenue growth rate reflects greater demand for coal hence a less severe overcapacity problem (Ju et al. 2016). We obtain the coal industry’s total revenue for each coal-producing province considered in the analysis, which is further deflated using the base year of 2002.

Degree of government interventions

Guo (2016) finds that fiscal policies such as the economic stimulus package of 586 billion dollars that the Chinese government put forth in 2008 led to a severe overcapacity problem in the coal industry after 2010. Wang et al. (2014) show that intervention measures such as government purchases and subsidies resulted in non-cyclical overcapacity in the coal sector. Following Lu and Ou (2011), we use the proportion of fiscal revenue over the total GDP in coal-producing provinces to measure the overall degree of government interventions.

Data used in the paper are collected from various official government databases, including the China Industrial Economy Yearbook, China Statistical Yearbook, China Labor Statistics Yearbook, and China Science and Technology Statistics Yearbook. We consider 25 coal-producing provinces and province-level cities in China, including Beijing, Hebei, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Jiangsu, Anhui, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang for 2002 to 2016Footnote 4. Table 1 provides the summary statistics of the variables considered in the analysis.

As can be seen, the estimated average capacity utilization rate of the coal industry across all 25 provinces over the sample period is 75.7%, suggesting an overcapacity of 24.3%. This number is in line with Wang et al. (2018) who find that nationally, the coal industry in China faced an overcapacity of 10 to 40% between 1989 and 2016, as well as Ju and Wang (2019), who note that the capacity utilization rate in China’s coal industry ranged between 64 and 79% in 2001–2016. For promotion pressure, the mean value is around 0.5, suggesting that on average, half of the sample faced intense promotion pressure due to a lower-than-average GDP growth rate. On average, both labor and capital market show a high degree of resource overuse, suggesting that market prices are lower than the efficient prices. However, the degree of market distortion is higher for labor than capital. The level of government interventions, measured as the percentage of fiscal revenue over the total GDP, ranges between 4 and 18.5%, reflecting a large degree of heterogeneity among provinces over the sample period.

Empirical results

This section discusses the empirical results based on the data for 25 coal-producing provinces in China over the sample period of 2002–2016. We first quantify the effects of promotion pressure on coal overcapacity and then investigate whether promotion pressure affects overcapacity by distorting factor market prices. Several robustness checks, including using an alternative proxy for promotion pressure, a different estimation procedure, various sub-samples of the data, and further decomposition of the factor market distortions, are conducted to check the sensitivity of the estimation results.

Effects of local officials’ GDP-based promotion pressure on coal overcapacity

To avoid false regressions, a stationarity test of data must be carried out before regression estimation. Table 2 shows the unit root test results derived from the three test methods.

As can be observed from the above table, all variables are horizontally stable and can be directly estimated by regression. Table 3 shows the baseline regression results for Eqs. (1)–(3) based on the sys-GMM method. The Hansen overidentifying test fails to reject the null hypothesis of exogenous instruments, suggesting the validity of the instruments. The Arellano-Bond test shows no second-order serial correlation in the models. Overall, the diagnostic test results indicate that the models are well-specified.

Regression results in Table 3 provide strong evidence in favor of our hypothesis that local officials’ promotion pressure reduces the capacity utilization rate and increases overcapacity in the coal industry. All else equal, the overcapacity rate is expected to increase by an average of 3.3 percentage points when the local officials face promotion pressure. The variable cut−1 is significantly positive, indicating that the excess capacity in the previous period significantly affects the current period’s capacity utilization. The long-run effect of promotion pressure, calculated as β2/(1 β1), equals the −10.8 percentage points, suggesting that promotion pressure will increase the overcapacity level by 10.8 percentage points in the long run.

Regressions (2) and (3) are used to test the intermediary role of coal factor market distortion on overcapacity. Estimation results for model (2) show that local officials’ promotion pressure in coal-producing provinces will increase factor market distortion in the coal industry. Regression results of model (3) further show that zdist is significantly negative; in other words, factor market distortion reduces the capacity utilization rate of the coal industry. Comparing the two regression results in (1) and (3), although the promotion pressure variable is significant in both regressions, the magnitude of the coefficient decreases from 3.3 to 2.8 percentage points when the distortion variable is added. Results suggest that the coal factor market distortion is an important channel that promotion pressure affects coal overcapacity in China.

In addition, regression results show that an enhancement of innovation ability improves the capacity utilization rate. The coefficient of cycle is significantly positive, suggesting that when the economy is in the booming stage, the capacity utilization rate increases. We further find that a strong coal market demand reduces overcapacity. Meanwhile, government interventions as measured by the percentage of GDP from fiscal revenues do not significantly affect the capacity utilization rate after controlling for other factors.

Robustness checks

We consider several robustness checks for our baseline regression results. Firstly, we use the ratio of regional GDP to total foreign investment utilized by the region as an alternative proxy for local officials’ promotion pressure. Previous studies show that local officials are strongly incentivized to attract foreign investment into the region to promote economic growth (Tsui and Wang 2004). Zhang et al. (2007) used the ratio between the total amount of foreign direct investment utilized by a region and the GDP to measure the degree of competition among local governments, with a lower ratio suggesting that the government is less successful in attracting foreign investment. We follow a similar approach as in Zhang et al. (2017), except that we take the reciprocal of this ratio. It is expected that in regions with a higher GDP to total foreign investment ratio (or lower foreign investment to GDP ratio), local officials would face a higher promotion pressure.

Regression results are overall consistent with the findings of the baseline models. One standard deviation increase in promotion pressure as measured by foreign investment decreases the capacity utilization rate by 4.13% based on the results in Table 4 model (1). When the factor market distortion variable is accounted for in the regression model (model (3)), the effect of the promotion pressure disappears. The results again provide strong evidence that promotion pressure faced by local officials influences coal overcapacity by distorting factor market prices.

As a second robustness check, we use the differenced GMM to estimate the relationship between promotion pressure and coal overcapacity. Estimation results shown in models (4)–(6) of Table 4 suggest that local officials’ promotion pressure significantly reduces coal capacity utilization rate when the alternative estimation procedure is used. Furthermore, an increase in the promotion pressure will exacerbate the level of factor market distortion, contributing to overcapacity in the coal sector.

In the third robustness check, we exclude the data for Beijing, Hubei, Qinghai, and Guangxi from the regression analysis. The four provinces only produce a small amount of coal and revenues from the coal industry account for a minor portion of the total GDP. As suggested by regression results in models (1)–(3) in Table 5, the direction and statistical significance of each variable are consistent with the baseline model in Table 3.

In the fourth robustness check, we limit our sample period to 2002–2012. The coal industry in China has been in recession and entered a new phase since 2013. We exclude the data from 2013 to account for the potential structural break due to declining demand and a shift in the energy structure. Results in models (4)–(6) in Table 5 show that using the restricted sample period, the direction and significance of each variable remain unchanged.

As a final robustness check, we decompose the factor market distortion into capital and labor market distortions to determine which factor plays a more important role and whether the results are sensitive to the specification of the distortion variable. Table 6 models (1) and (3) suggest that officials’ promotion pressure distorts both capital and labor market prices. In models (2) and (4), the regression coefficient for promotion pressure remains negatively significant, suggesting that after controlling for either capital or labor market distortions, promotion pressure still negatively affects capacity utilization rate. While capital market distortion significantly reduces the capacity utilization rate (model (2)), the effect of labor market distortion is non-significant (model (4)).

Estimation results in Table 6 suggest that capital market distortion is an important channel that local officials’ promotion pressure influences the capacity utilization rate in the coal industry, whereas distortion in the labor market plays little role in transmitting the effect. The coal industry in China is highly capital-intensive. Compared to labor, capital is also a relatively scarce resource in China. Local governments often intervene in banks’ financial resource allocations using instruments such as interest subsidies to achieve regional GDP growth and personal promotion. With the reduced financing costs, combined with the high-profit margin in the “golden decade” of the coal industry, a large amount of fixed-asset investment poured into the sector. These actions taken by the local officials acted to distort capital prices and cause coal firms to have more capital to expand investment and production, leading to overcapacity in the coal sector.

Overall, regardless of the specification considered, the empirical method used, and the sub-sample analyzed, our results consistently point to the significant negative impact of GDP-based promotion pressure on the capacity utilization rate of the coal sector. We further find that factor market distortion, in particular, the preferential policy in the capital market that lowers capital prices, plays an important role in transmitting the negative impact of promotion pressure from the GDP-based promotion system.

Effects of an optimized local officials’ promotion system on coal overcapacity

In this section, we explore whether using alternative performance evaluation methods helps reduce coal overcapacity. To do so, we incorporate ecological and environmental indicators into the official promotion evaluation system. Du and Li (2019) argue that environmental regulations help reduce the excess capacity in China’s coal sector, and a promotion assessment system incorporating environmental and ecological indicators is the key to achieving this goal. Under the comprehensive evaluation system, local officials would be incentivized to reduce inefficient and high-polluting investment activities, as well as to set more stringent environmental regulations more in line with sustainable development goals. With the increased production cost due to environmental regulations, firms will reduce investment scale in low-profit projects, improve production efficiency, and carry out R&D innovation activities, all of which help reduce excess capacity. In addition, some firms may be forced to withdraw from the market due to the high environmental compliance costs.

Following Qian et al. (2011), we construct an environmental pressure index based on five indicators, including sulfur dioxide emissions per unit of GDP, smoke and dust emissions per unit of GDP, wastewater emissions per unit of GDP, per capita afforestation area, and the proportion of forestry investment in regional GDP. Of the five factors, higher sulfur dioxide, smoke and dust, and wastewater emissions indicate higher environmental pressure faced by local officials. On the other hand, local officials face lower environmental pressure if the per capita afforestation area and the proportion of forestry investment in regional GDP are higher. We first normalize the five variablesFootnote 5 and then aggregate them into a comprehensive index for each province. If the aggregate index is higher (lower) than the national average, the green pressure index is set to one (zero) since the environmental indicators of the province are worse (better) than the national average.

We construct the comprehensive promotion pressure index by taking a weighted average of the green pressure and the GDP pressure indexes, as in Eq. (10):

where zpro is the comprehensive promotion pressure, epro is the green index, and m and n are the weights for the economic and green pressure indexes, respectively. We restrict m + n = 1 and consider various combinations of the weights with ranging from 0.1 to 0.9 (or when ranges from 0.9 to 0.1) when constructing the comprehensive index.

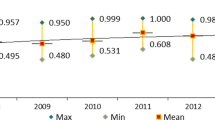

Estimation results are presented in Table 7. As can be seen, when the proportion of the environmental pressure indicator in the comprehensive promotion pressure index (zpro) exceeds 50%, the coefficient for zpro becomes statistically insignificant. When the proportion of green pressure in the comprehensive promotion pressure index reaches 90%, the coefficient of the zpro becomes positive, although it remains statistically non-significant. Results suggest that incorporating environmental indicators into the promotion assessment system for local officials can alleviate the negative effect of the promotion pressure of local officials on coal capacity utilization rate.

Discussions

Comparison with existing studies

In this paper, there is an important result that local officials’ promotion pressure under the GDP-based promotion system can lead to coal overcapacity. We find several studies supporting our results. The study from Chen et al. (2021a) showed that local governments’ incentive to reach GDP growth targets affects the local firms’ capacity utilization. Research results of Xie et al. (2021) also indicated that the promotion incentives of enterprise leaders can lead to capacity expansion in the electric power enterprise. These results all show that officials’ GDP-based promotion pressure is an important factor causing overcapacity. It indicates that resource-based areas should change their GDP-oriented development goal and reduce local officials’ GDP-oriented promotion pressure.

Besides, we find an interesting result that factor market distortion is one important channel through which local officials’ promotion pressure affects overcapacity in the coal sector. The study by Yang et al. (2019) pointed out that government investment incentives are the main driving factor behind coal overcapacity in China. Meanwhile, according to the research results of Yu et al. (2021), government subsidies are a determinant of overcapacity in the wind energy industry and PV industry. Government intervention and subsidies lead to factor price distortion and factor allocation distortion. Therefore, these results reveal that factor distortion is an important channel causing excess capacity. This indicates the importance of reducing government interventions in the factor market.

Concerning the effect of an optimized local officials’ promotion system on coal overcapacity, we find that a diversified promotion system incorporating environmental indicators can help mitigate the negative effect of promotion pressure on capacity utilization rate. There is an important study supporting this finding. Feng and Yu (2019) found that after adding ecological progress into the local officials’ promotion assessment, fixed asset investment of enterprises decreased significantly. This means that adding environmental indicators to the officials’ promotion evaluation system can reduce over-investment and overcapacity. It indicates that optimizing local officials’ promotion system is an important method to reduce overcapacity.

Policy implications

According to the empirical conclusions of this paper, we put forward the following policy recommendations to mitigate overcapacity in the coal sector.

-

(1)

The central government should weaken the GDP-based political promotion incentive. Under the current GDP-based promotion system, local officials would artificially lower factor prices to attract investment, leading to market inefficiency and overcapacity. Therefore, a reform of the local officials’ promotion evaluation system is needed. The central government should construct a diversified promotion appraisal system for local officials that includes environmental and ecological indicators, to reduce the effect of GDP-based promotion pressure on coal overcapacity.

-

(2)

The market-oriented reform of factors in the coal industry should be accelerated. Given that factor market distortion plays a crucial role in transmitting local officials’ promotion pressure to the coal sector, furthering factor market reform in the coal-producing region may be an essential step to reduce coal overcapacity. Policymakers should design regulations that reduce government interventions in the labor and capital markets, allowing resource allocation to be based on market supply and demand. Besides, in the current financial system, the government plays a key role in commercial banks’ credit granting and interest rate determination. Reforms are needed to reduce the impact of government intervention on the financial system to restore the market-based pricing mechanism for capital factor.

-

(3)

Local governments should focus on developing a green economy and creating new economic growth points. In the open economy context, people’s demand for product quality increases. They pay more attention to green and healthy products and lifestyles, especially in the post-COVID-19 period. Therefore, resource-based cities should not only focus on exploiting and producing single resource-based products. Local governments should expand the upstream and downstream of the industrial chain based on the original competitive industries to develop diversified industries. Besides, low-carbon industries and emerging industries can also be developed to create new economic growth points. This will help reduce overcapacity and meet the people’s needs to improve their lives, health, and living environment and achieve a green economic recovery in the post-COVID-19 period.

Research limitations

Restricted by data, in this paper, we only incorporate environmental indicators to construct the diversified promotion evaluation system. Future studies may wish to consider a more comprehensively constructed promotion evaluation system that takes into account other sustainable development goals in addition to environmental indicators. Such factors may include, among others, the unemployment rate, the quality of public services, and the capacity for technological innovations. Another area for future research is to investigate other channels that promotion pressure affects the capacity utilization rate in the coal sector.

Conclusions

This paper estimates the effect of GDP-based promotion pressure faced by local officials on coal overcapacity in China. Moreover, whether an optimized local officials’ promotion system can help reduce coal overcapacity is explored. Using data from 25 coal-producing provinces from 2002 to 2016, we obtain the following findings: (1) Local officials’ promotion pressure under the GDP-based promotion system is an important micro factor that leads to coal overcapacity, with the promotion pressure reducing the capacity utilization rate by 3.3 percentage points in the short-run and 10.8 percentage points in the long run. (2) The factor market distortion is one important channel through which local officials’ promotion pressure affects overcapacity in the coal sector, and the distortion in the capital market plays a more dominant role than distortion in the labor market. (3) A diversified promotion system that incorporates environmental indicators can help alleviate the negative effect of officials’ promotion pressure on the capacity utilization rate. When the environmental pressure index accounts for at least 50% of the weights in the diversified promotion system, the negative effect of promotion pressure disappears.

Unlike previous studies, this paper explains the problem of overcapacity from a new micro perspective of local officials’ promotion pressure, which expands the research perspective on the causes of overcapacity. The conclusion that an optimized local officials’ promotion system is helpful to reduce excess capacity provides a new idea to control overcapacity for China and other countries.

Notes

The calculation is based on Kt = Kt − 1(1 − δ) + It, where Kt is the capital stock in the t year, δ is the depreciation rate, and It is the actual investment amount which is measured by the total fixed-asset investment.

The calculation formula is K0 = I0/(η + δ) , where K0 is the capital stock in the base year, I0 is the fixed asset investment in the base year, η is the annual growth rate of fixed asset investment, and δ is the depreciation rate.

The calculation formula is \({\delta}_t=\frac{ND_t}{OVFA_{t-1}}\), where NDt is the amount of depreciation in period t. OVFAt−1 is the original value of the fixed assets in period t−1.

Note: To avoid the impact of China’s coal capacity reduction policy after 2016, the research data of this paper is up to 2016.

Indexes of sulfur dioxide emissions per unit of GDP, smoke and dust emissions per unit of GDP, and wastewater emissions per unit of GDP are normalized using the calculation: \({x}_i=\frac{\ {v}_i-\min\ {v}_i}{\max\ {v}_i-\min\ {v}_i}\). Indexes of per capita afforestation area, and the proportion of forestry investment in regional GDP are normalized using the calculation: \({x}_i=\frac{\max\ {v}_i-{v}_i}{\max\ {v}_i-\min\ {v}_i}\).

References

Adebayo TS, Rjoub H, Akadiri SS, Oladipupo SD, Sharif A, Adeshola I (2022) The role of economic complexity in the environmental Kuznets curve of MINT economies: evidence from method of moments quantile regression. Environ Sci Pollut Res 29:24248–24260

Aigner D, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econ 6:21–37

Anwar A, Sharif A, Fatima S, Ahmad P, Sinha A, Rehman Khan SA, Jermsittiparsert K (2021) The asymmetric effect of public private partnership investment on transport CO2 emission in China: Evidence from quantile ARDL approach. J Clean Prod 288:125282

Arain H, Sharif A, Akbar B, Younis MY (2020) Dynamic connection between inward foreign direct investment, renewable energy, economic growth and carbon emission in China: evidence from partial and multiple wavelet coherence. Environ Sci Pollut Res 27:40456–40474

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error components models. J Econ 68:29–51

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51:1173

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87:115–143

Bond EW, Samuelson L (1986) Tax holidays as signals. Am Econ Rev 76:820–826

Chen J, Chen X, Hou Q, Hu M (2021a) Haste doesn't bring success: top-down amplification of economic growth targets and enterprise overcapacity. J Corp Finan 70:102059

Chen S (2011) Reconstruction of sub-industrial statistical data in China (1980—2008). China Econ Quarterly 10:735–776

Chen Y, Hu W (2011) Distortion, misallocation and losses: theory and application. China Econ Quarterly 10:1401–1422

Chen Z, Yan T, Zhao W, Ni G (2021b) Capacity utilization loss of the belt and road countries incorporating carbon emission reduction and the impacts of China’s OFDI. J Clean Prod 280:123926

Cheng J, Liu Z (2015) Excess capacity, factor distortion and economic fluctuation. Economist 11:59–69

Chi J, Wang B, Zhang H, Kang J, Lu T, Huang Y, Yang W, Zhang H, Sun L (2021) Regional coal power overcapacity assessment in China from 2020 to 2025. J Clean Prod 303:127020

Dai X, Zhao Z (2021) Can exporting resolve overcapacity? Evidence from Chinese steel companies. Econ Model 102:105578

Dong K, Sun W (2022) Would the market mechanism cause the formation of overcapacity?: evidence from Chinese listed firms of manufacturing industry. Int Rev Econ Financ 79:97–113

Du W, Li M (2019) Can environmental regulation promote the governance of excess capacity in China’s energy sector? The market exit of zombie enterprises. J Clean Prod 207:306–316

Feng Y, Wang S, Sha Y, Ding Q, Yuan J, Guo X (2018) Coal power overcapacity in China: province-Level estimates and policy implications. Resour Conserv Recycl 137:89–100

Feng Z, Yu M (2019) Research on environmental protection, performance evaluation of local officials and enterprise investment. Reform of Econ Syst 4:136–144

Gan C, Zou J, Wang J (2015) Term of local officials, enterprise resource acquisition and excess capacity. China Industrial Econ 3:44–56

Godil DI, Sharif A, Agha H, Jermsittiparsert K (2020) The dynamic nonlinear influence of ICT, financial development, and institutional quality on CO2 emission in Pakistan: new insights from QARDL approach. Environ Sci Pollut Res 27:24190–24200

Godil DI, Yu Z, Sharif A, Usman R, Khan SAR (2021) Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: a path toward sustainable development. Sustain Dev 29:694–707

Gong B (2018) Agricultural reforms and production in China: changes in provincial production function and productivity in 1978–2015. J Dev Econ 132:18–31

Greene W (2005) Fixed and Random Effects in Stochastic Frontier Models. J Prod Anal 23:7–35

Guo C (2016) Fiscal expansion,vertical structure of industries and capacity utilization rate in China. Manag World 10:13–33

Guo J, Dong H, Farzaneh H, Geng Y, Reddington CL (2022) Uncovering the overcapacity feature of China’s industry and the environmental & health co-benefits from de-capacity. J Environ Manag 308:114645

He Q, Xu M, Xu Z, Ye Y, Shu X, Xie P, Wu J (2019) Promotion incentives, infrastructure construction, and industrial landscapes in China. Land Use Policy 87:104101

He Y, Wang B, Wang J, Xiong W, Xia T (2013) Correlation between Chinese and international energy prices based on a HP filter and time difference analysis. Energy Policy 62:898–909

Işik C, Dogru T, Turk ES (2018) A nexus of linear and non-linear relationships between tourism demand, renewable energy consumption, and economic growth: Theory and evidence. Int J Tour Res 20:38–49

Işik C, Ongan S, Bulut U, Karakaya S, Irfan M, Alvarado R, Ahmad M, Rehman A (2022) Reinvestigating the Environmental Kuznets Curve (EKC) hypothesis by a composite model constructed on the Armey curve hypothesis with government spending for the US States. Environ Sci Pollut Res 29:16472–16483

Işik C, Ongan S, Özdemir D (2019a) The economic growth/development and environmental degradation: evidence from the US state-level EKC hypothesis. Environ Sci Pollut Res 26:30772–30781

Işik C, Ongan S, Özdemir D (2019b) Testing the EKC hypothesis for ten US states: an application of heterogeneous panel estimation method. Environ Sci Pollut Res 26:10846–10853

Işik C, Ongan S, Ozdemir D, Ahmad M, Irfan M, Alvarado R, Ongan A (2021) The increases and decreases of the environment Kuznets curve (EKC) for 8 OECD countries. Environ Sci Pollut Res 28:28535–28543

Ji Z (2020) Does factor market distortion affect industrial pollution intensity? Evidence from China. J Clean Prod 267:122136

Jiang F, Geng Q, Lv D, Li X (2012) Mechanism of excess capacity based on China’s regional competition and market distortion. China Industrial Econ 6:44–56

Ju L, Gao Y, Wang L (2016) Excess capacity governance from the perspective of supply side: distortion of factor market and excess capacity. Macroeconomics 5:3–15

Khan SAR, Yu Z, Sharif A, Golpîra H (2020) Determinants of economic growth and environmental sustainability in South Asian Association for Regional Cooperation: evidence from panel ARDL. Environ Sci Pollut Res 27:45675–45687

Lee L (2007) GMM and 2SLS estimation of mixed regressive, spatial autoregressive models. J Econ 137:489–514

Li H, Zhou LA (2003) Political turnover and economic performance: the incentive role of personnel control in China. J Public Econ 89:1743–1762

Li J, Liu Y, Wang B (2019) Tax burden and overcapacity——evidence from World Bank survey. Public Fin Res 1:103–115

Lin JYF, Wu HM, Xing YQ (2010) Wave phenomena and formation of excess capacity. Econ Res J 10:4–19

Lin X, Lee L (2010) GMM estimation of spatial autoregressive models with unknown heteroskedasticity. J Econ 157:34–52

Liu G, Zhang X, Zhang W, Wang D (2019) The impact of government subsidies on the capacity utilization of zombie firms. Econ Model 83:51–64

Liu P, He D (2019) Can Merger and Reorganization Resolve Overcapacity: based on PSM-DID Empirical Test. J Guangdong Univ Fin Econ 34:4–13

Lu M, Ou H (2011) High growth and low employment: empirical research on government intervention and employment elasticity. J World Econ 12:3–31

Ma H, Mei X, Tian Y (2020) The impacts and potential mechanisms of credit support with regard to overcapacity: based on theoretical and empirical analyses of steel enterprises. Res Policy 68:101704

Maskin E, Qian Y, Xu C (2000) Incentives, Information, and Organizational Form. Rev Econ Stud 67:359–378

Pata, Isik (2021) Determinants of the load capacity factor in China: a novel dynamic ARDL approach for ecological footprint accounting. Res Policy 74:102313

Pu Z, Fu J (2018) Economic growth, environmental sustainability and China mayors’ promotion. J Clean Prod 172:454–465

Qian X, Cao T, Li W (2011) Promotion Pressure, officials’ tenure and lending behavior of the city commercial banks. Econ Res J 46:72–85

Shan H (2008) Reestimating the capital stock of China:1952~2006. J Quantitative Tech Econs 25:17–31

Sharif A, Bhattacharya M, Afshan S, Shahbaz M (2021) Disaggregated renewable energy sources in mitigating CO2 emissions: new evidence from the USA using quantile regressions. Environ Sci Pollut Res 28:57582–57601

Shi X, Wang K, Zhang Y (2020) A permit trading scheme for facilitating energy transition: a case study of coal capacity control in China. J Clean Prod 256:120472

Steckel JC, Edenhofer O, Jakob M (2015) Drivers for the renaissance of coal. Sustain Sci 112:3775–3781

Sutter, Berlinger, Ellis, 2015. Obama: Climate agreement“best chance we have” to save the planet. Cable News Network(CNN) Retrieved from http://www.cnn.com/2015/12/12/world/global-climate-change-conference-vote

Tan R, Lin B, Liu X (2019) Impacts of eliminating the factor distortions on energy efficiency—a focus on China's secondary industry. Energy 183:693–701

Tsui KY, Wang Y (2004) Between Separate stoves and a single menu: fiscal decentralization in China. China Q 177:71–90

Walker B (2016) China stokes global coal growth. https://chinadialogue.net/en/energy/9264-china-stokes-global-coal-growth/

Wang D, Wan K, Song X (2018a) Quota allocation of coal overcapacity reduction among provinces in China. Energy Policy 116:170–181

Wang D, Wang Y, Song X, Liu Y (2018b) Coal overcapacity in China: multiscale analysis and prediction. Energy Econ 70:244–257

Wang W, Ming J, Yue C (2014) Enterprise size, local government intervention and overcapacity. Manag World 10:17–36

Wu M, Zhou L (2018) Political incentives and city construction: the visibility of public projects. Econ Res J 53:97–111

Xiang H, Kuang Y (2020) Who benefits from China’s coal subsidy policies? A computable partial equilibrium analysis. Resour Energy Econ 59:101124

Xie L, Wang Y, Jin J (2021) Promotional incentives, competition driven and capacity expansion: evidence from the electricity sector reform in China. J World Econ 44:106–130

Xu C (2011) The Fundamental Institutions of China's Reforms and Development. J Econ Lit 49:1076–1151

Yang M, Yang F, Sun C (2018) Factor market distortion correction, resource reallocation and potential productivity gains: An empirical study on China’s heavy industry sector. Energy Econ 69:270–279

Yang Q, Hou X, Han J, Zhang L (2019) The drivers of coal overcapacity in China: an empirical study based on the quantitative decomposition. Resour Conserv Recycl 141:123–132

Yu S, Lu T, Hu X, Liu L, Wei Y (2021) Determinants of overcapacity in China’s renewable energy industry: Evidence from wind, photovoltaic, and biomass energy enterprises. Energy Econ 97:105056

Zhang H, Li L, Zhou D, Zhou P (2014) Political connections, government subsidies and firm financial performance: Evidence from renewable energy manufacturing in China. Renew Energy 63:330–336

Zhang H, Zheng Y, Ozturk UA, Li S (2016) The impact of subsidies on overcapacity: a comparison of wind and solar energy companies in China. Energy 94:821–827

Zhang J, Gao Y, Fu Y (2007) Why does china enjoy so much better physical infrastructure? Econ Res J 3:4–19

Zhang Y, Zhang M, Liu Y, Nie R (2017) Enterprise investment, local government intervention and coal overcapacity: the case of China. Energy Policy 101:162–169

Data availability

The datasets used, generated, and analyzed during the current study are available in the China Industrial Economy Yearbook, China Statistical Yearbook, China Labor Statistics Yearbook, and China Science and Technology Statistics Yearbook.

Funding

This research was supported by the Young Teachers’ Research Ability Improvement Plan of Beijing University of Civil Engineering and Architecture(Grant No. X21009) and the China Postdoctoral Science Foundation (Grant No. 2020M680435).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study’s conception and design. Material preparation, data collection, and analysis were performed by Qianqian Zhang, Xiaoli L Etienne and Ze Wang. The first draft of the manuscript was written by Qianqian Zhang, Xiaoli L Etienne and Ze Wang and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, Q., Etienne, X.L. & Wang, Z. Reducing coal overcapacity in China: a new perspective of optimizing local officials’ promotion system. Environ Sci Pollut Res 29, 90364–90377 (2022). https://doi.org/10.1007/s11356-022-22010-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22010-2