Abstract

This research examines the linkage between financial risk and carbon emissions using a quarterly dataset spanning from 1991 to 2019 for top carbon emitting countries. To achieve the study objective, this study apply quantile-on-quantile regression (QQR), the quantile regression (QR) approach for robustness check, and the nonparametric predictive test that identifies causality in mean and variance. Empirical findings from the QQR technique disclose the following: (i) financial risk decreases carbon emissions in the USA, Russia, Germany, and Canada; (ii) in China, India, Japan, Brazil, and Indonesia, financial risk enhances carbon emissions (iii) while we find mixed reactions in the case of South Korea. The outcomes of the conventional quantile regression also confirm the QQR outcomes, while that of nonparametric causality discloses evidence of causality in majority of quantiles from financial risk to carbon emissions. Based on these empirical outcomes, policymakers in the financial risk-induced-environmental degradation regions should consider implementing policies or reforms that would keep financial systems sound, in order to prevent shocks to the environment, and its attendant multiplier impact on the environmental sustainability targets implemented to protect both the immediate and the future generations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environmental deterioration poses a serious threat to human life. Environmental damage is the depletion of the globe’s natural resources, and hence poses a danger to long-term growth (Alola et al., 2021). The rapid expansion of the globe’s economic activities constitutes a severe danger to the environment and has significantly influenced global climate owing to increase fossil fuel demand (Adebayo, 2022; Adedoyin et al. 2021; Shahzad 2020). The use of fossil fuels (e.g., oil, natural gas, and coal) has progressively grown with the fast expansion of contemporary industrial civilization around the world in recent years, causing the release of a substantial amount of carbon dioxide (CO2) (Adebayo et al. 2022; Agyekum et al. 2021a). According to BP (2021), worldwide CO2 emissions have been steadily increasing over the last few decades. In reality, worldwide CO2 emissions surged by 31.79% from 25,715.7 million tonnes of CO2 in 2003 to 33,890.8 Mt of CO2 in 2018, a rate of growth of 31.79%. CO2 emissions, being the major constituent of greenhouse gases (GHGs), have a significant influence on global warming. The progressive escalation of the greenhouse effect has also resulted in a slew of environmental and social issues, including increasing ocean levels, desertification, and glacier melting, all of which can have disastrous consequences for human society’s development (M. Ahmad et al. 2018; Ikram et al. 2021). Various nations have made major contributions to the progressive attainment of CO2 reduction objectives, from the Kyoto Protocol to the Paris Agreement and the latest Glasgow Accord in 2021 (Adebayo et al. 2022).

The connection between CO2 emissions and its drivers has been the subject of a plethora of studies (see Acheampong and Boateng 2019; Agyekum et al. 2021b; Ahmad et al. 2020; Ahmad et al. 2021; Akadiri et al. 2021a; Akadiri et al. 2021b; Sadiq-Bamgbopa et al. 2022; Kirikkaleli and Adebayo 2021; Pata 2018, 2021; Shahbaz et al. 2017). Some researchers have focused on the influence of financial risk (FR) on CO2 emissions in recent times, but they have yet to come to agreement. For example, using dataset from 1985 to 2014, Zhang and Chiu (2020) assessed the nonlinear effect of FR on CO2 emissions using panel smooth transition regression model and the research outcome unveiled a negative FR-emissions interrelationship. Moreover, the studies of Shahbaz et al. (2017), Zaidi et al. (2019), and Abbasi and Riaz (2016) reported similar finding with Zhang and Chiu (2020) by reporting a negative FR-CO2 emissions interconnection. On the flipside, some studies reported that FR exacerbate CO2 emissions. For instance, the research of Zhao et al. (2021) reported that FR culminate CO2 emissions in China which is also validated by the research of Shahbaz et al. (2013). Furthermore, Ozturk and Acaravci (2016) reported that FR does not have substantial effect of level of emissions.

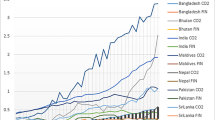

It will be theoretically right to assume that a stable financial and economic environment could facilitate increased investment and production in non-renewable energy sources, in an unregulated environment, and raise CO2 emissions and energy utilization to some degree. Activities by market participation and financial authorities could ruin or strengthen confidence, integrity, and market practices by discouraging or encouraging more transparency on the practices, current products, and tools employed in financial markets. This is could achieved by encouraging the capital reallocation towards greener choices, while discouraging capital reallocations to carbon exhaustive schemes and vice versa. In addition, it may boost research and development (R&D), clean technologies, and innovation by giving financial assistance to speed up the technological innovation process. This helps to reduce carbon emissions substantially (Zhao et al. 2021). Financial instability can also increase people’ desire for a high-quality environment, resulting in CO2 emissions being efficiently reduced (Adom et al. 2018; Song et al. 2021). Figure 1a presents the trend of financial risk in the selected nations.

Two important questions are considered because of the preceding debates: (1) does financial risk increase/decrease CO2 emissions. (2) Is the effect of financial risk on CO2 emissions heterogeneous across each quantile? Consideration of the two concerns above can aid in the achievement of decarburization goals as well as the establishment of well-functioning financial institutions. As a result, in order to adequately measure the financial risk-CO2 emissions nexus, this research first creates a broad index of financial risk, and then evaluates the influence of financial risk on CO2 emissions using a quarterly dataset from 1991Q1 to 2019Q4. The nations studied (Brazil, Canada, USA, Indonesia, Germany, South Korea, China, India, Russia, Japan) are the big nations in economic development and trade, as well as the biggest emitters. The biggest sources (emitters) of CO2 emissions are the major and most industrialized economies. These top-ten polluting nations account for over 62% of global GDP (BP 2021), on the flipside, consume about 65% of global energy and are accountable for 67% of world CO2 emissions (BP, 2020). Figure 1b is the trend of CO2 emissions by the top-ten nations. Such shocking results drive us to conduct a comprehensive research of CO2 emitter countries in order to create a new financial stability strategy.

As a result, the following five components of this research add to the ongoing studies. First, the existing literature on the risk-emission connection focuses mostly on the influence of national broad risk on CO2 emissions; nonetheless, only a few investigations have thoroughly evaluated the influence of financial risk on CO2 emissions. To close this gap, this research used an all-inclusive financial risk index to examine the effect of financial risk on CO2 emissions. Second, nations with various CO2 emissions level and financial risk typically have a clearly different CO2-risk relationship; therefore, this research aims to explore the heterogeneous and asymmetric effects of financial risk on CO2 emissions. This is very helpful when developing specific initiatives to maximize carbon reduction and reduce financial risk. Third, this study examines the effect of financial risk on CO2 emissions in the top-ten emitting nations; this not only solves the mystery of whether financial risk has efficaciously resolved CO2 emissions but also provides new proof to substantiate the development of suitable initiatives to abate CO2 emissions and encourage financial stability in the top-ten emitting nations. Lastly, we apply the novel QQR approach to explore how the quantiles of financial risk affect the provisional quantiles of CO2 emissions, which would lead to superior reliability in the estimated results compared with the conventional econometric approaches.

The concluding segments of the paper are depicted as follows: “Data and methodology” section presents source of data and methods utilized. Results and discussions are presented in the “Results and discussion of findings” section. Conclusion and policy ramifications are presented in the “Conclusion and policy recommendations” section.

Data and methodology

Data

The current paper assesses the effect of financial risk (FR) on carbon emissions (CO2) using quarterly dataset spanning from 1991 to 2019 for top 10 emitters. The endogenous variable is CO2 and exogenous variable is FR. CO2 data is gathered from BP database and it is measured in metric tonnes per capita. The dataset of FR is gathered from PRS group database. The FR index is fashioned based on five parts. The sub-parts are current account as a percentage of exports of goods and services, net international liquidity as months of import cover, foreign debt as a percentage of GDP, and exchange rate stability and foreign debt service as a percentage of exports of goods and services. The financial risk index has a score range of 0 to 50, with zero indicating a very high-risk scenario and 50 indicating a very low-risk one. All the data used are transformed to natural logarithm to ensure conformity of normal distribution. The flow of analysis is portrayed as follows (Fig. 2):

Methodology

We employed the PP and ADF tests to identify the stationarity attribute of the variables of the research. Furthermore, we check the cointegration feature between load capacity factor and each independent variable. The cointegration vector appears to shift across the distribution, according to empirical literature in finance and economics. As a result, the quantile cointegration offered by Xiao (2009) is used in this research. The beauty of this approach is that it allows one to investigate the effect of conditioning variables on the scale, location, and shape of the feedback variable’s conditional distribution. Moreover, Xiao (2009) splits the errors of the cointegrating equation into lead-lag components using the approach proposed by Saikkonen (1991) and in this way, Xiao (2009) employs a new model to address the endogeneity difficulties that plague classic co-integration frameworks.

Moreover, we evaluate the interrelationship between load capacity factor and its drivers using (Sim and Zhou 2015) quantile-on-quantile (QQ) technique. This method is a refinement on normal quantile regression (QR), which investigates the impact of independent variable’s quantiles on the distinct quantiles of the endogenous variable. The utilization of nonparametric estimations and QR is the foundation of this approach. To begin, we use traditional QR to explore the impact of exogenous variables on the endogenous variable. The conventional QR initiated by the model (Bassett and Koenker 1978) is a variant of the standard least square framework. Unlike the linear regression (LR) model, QR investigates the impact of a variable not only on the conditional mean of the dependent variable but also on distinct quantiles. In this sense, the QR, as compared to the least square method, shows a more complete association. Furthermore, conventional linear regression (LR), as advocated by Stone (1977) and Cleveland (1979), is used to investigate the influence of the exogenous variable’s particular quantile on the dependent variable. Blending the two approaches, namely standard QR and traditional LR, allows researchers to investigate the influence of different quantiles of the independent variable on different quantiles of the dependent variable. As a result, combining these two strategies can help us comprehend the underlying link better than using only one methodology, such as OLS or ordinary QR.

Thus, we applied QQ estimation initiated by Sim and Zhou (2015) to assess the influence of different quantiles of X on the various quantiles of Y.

where, the load capacity factor in period t is portrayed by \({Y}_{t}\), and \({X}_{t}\) stands for the independent variables in time t. Moreover, \(\sigma\) is the \({\sigma }^{th}\) quantile on the independent variables. Furthermore, \({\mu }_{t}^{\sigma }\) denotes quantile error-term, where \({\sigma }^{th}\) quantile estimated is 0. Furthermore, \({\propto }^{\sigma }(.)\) is unidentified because of no availability of information on the interrelationship between LCF and the independent variables. Finally, it is crucial to comprehend bandwidth determination while performing nonparametric analysis. This bandwidth has the advantage of assisting in the simplicity of the goal point, the size of the quarter backgrounds, and, as a result, bandwidth gearshifts the pace of the conclusion. A large bandwidth, h, decreases variability while raising estimate deviation, and vice versa. We use a bandwidth value of h = 0.05 in this investigation, as advised by Sim and Zhou (2015).

Lastly, we utilize the novel nonparametric causality initiated by Balcilar et al. (2018) centered on the models of Jeong et al. (2012) and Nishiyama et al. (2011). The three novelty of the causality-in-quantile method are as follows: First, it is resistant to errors of misspecification because it recognizes the underpinning dependence structure between the variables under consideration. This is extremely significant because financial and economic variables are well recognized to have nonlinear dynamics (Aladenika et al. 2022; Shahbaz et al., 2017), which we demonstrate to be true in the current research. Second, we can use this approach to test not just for causation in the mean (1st instant), but also for causality in the tails of the variables joint distribution. Finally, we can look into causality-in-variance and hence look into higher-order dependence. This research is essential because, at times, causation in the conditional mean may not occur whereas higher-order interdependencies may become relevant.

Results and discussion of findings

Results of preliminary tests

In this section, we report the results of preliminary tests conducted. The descriptive (summary) statistics and the stationarity (unit root) tests outcome for financial risk and carbon emissions for the sampled countries are reported in Table 1. Summary statistics show that Japan (44.174) has the highest mean value in terms of financial risk exposure followed by Canada (39.676), South Korea (39.542), China (38.687), India (37.023), and USA (35.786) with the lowest Russia (29.379) respectively. In terms of carbon emissions, the USA is with the highest mean value of (19.386), followed by Canada (16.990), Russia (11.208), Germany (10.762), Japan (9.707), South Korea (6.419), and Brazil (6.419) while India have the lowest mean value of (1.163) respectively. In terms of skewness and kurtosis, both series are positively skewed and leptokurtic in nature. To say but the least, the Jarque–Bera (JB) test results show non-normality of the series. Having established the nonlinearity features of the series, we examine stationarity properties of the individual series using the traditional unit root tests, i.e., the augmented Dickey-Fuller (ADF) and Philip-Perron (PP) unit root tests. From our stationarity test outcomes, we infer that the series are stationary at I(1), i.e., integrated of order one (see RHS Table 1).

To affirm these non-normality features of the series, we conduct non-normality test suggested by Broock et al. (1996) known as the BDS nonlinearity test. From the BDS nonlinearity test (see Table 2), we could not accept null hypothesis of linearity for the series under investigation. Statistically, this implies that both financial risk and carbon emissions are nonlinear for the sampled countries of the sample period. This explains the reason for making use of the novel nonlinearity methods of quantile-on-quantile regression (QQR) and the nonparametric causality test approach. For detailed explanation on technique adopted, see Adebayo and Acheampong (2022) published paper.

Table 3 presents the correlation coefficient (r) test between the series. For the purpose of this study, this test is a statistical measure of the strength of the nexus between financial risk and carbon emissions. Recall that the value of r implies the strength of the relationship: if r is equal to zero, this indicates the absence of correlation among the series, and if it equals to one, this indicates perfect positive correlation nexus among the series, while if equal minus one, it implies a perfect negative correlation among the series respectively. A value less or close to one indicates weak and/or strong associations among the series. As interesting as correlation coefficient value may seems, remember that while they are useful for prediction, they are not for causation. An existence of correlation between series does not necessarily mean that one series causes another. Thus, correlation and causation are two distinct issues. Having said that results reported in Table 3 show that somewhat weak negative correlation between financial risk and carbon emissions in the USA (0.38), Russia (0.49), Germany (0.30), and Canada (0.54), while we find weak positive correlation between financial risk and carbon emissions in South Korea (0.415), Brazil (0.20), and Japan (0.31). However, results show strong positive correlation in China (0.68), India (0.66), and Indonesia (0.61) respectively.

Quantile cointegration results

Table 4 presents the quantile cointegration results. We provide the coefficients of the constancy examination of the quantile cointegration that reveal whether a long-run nexus exist between the series under observation. Following the outcomes, we find the existence of a nonlinear long-run nexus between the quantiles of financial risk and carbon emissions for the sampled countries.

Quantile-on-quantile regression results

Having established the cointegration nexus between the series, we continue with the empirical investigation by capturing the effect of financial risk on carbon emissions across quantiles. For sound empirical analysis on how financial risk affects environmental degradation, we grouped the quantiles (0.1–0.95) into two; the lower quantiles range from 0.1 to 0.50 and the higher quantiles range from 0.055 to 0.95. Figure 3 reports the effect of financial risk on carbon emissions for each of the country. We reported China in (3a), USA in (3b), India (3c), Russia (3d), Japan (3e), Germany (3f), Brazil (3 g), South Korea (3 h), Indonesia (3i), and Canada in (3j) respectively.

Across all quantiles (0.1–0.95) of financial risk and carbon emissions, we observe that the impact of financial risk on carbon emissions is positively significant. See Fig. 3a, c, e, h, and i for China, India, Japan, Brazil, Indonesia, and South Korea respectively. This indicates that across quantiles of both financial risk and carbon emissions, financial risk has an emissions-increasing effect on environmental quality in these nations. For China, this finding is not farfetched. On the surface, China might be lending to world economies, thus a creditor to global economy. However, the nation is also punctured with public debt. China is one of the most indebted large economies globally, most specifically when it comes to cooperate and public debt. Even worse, the indigenous banks are battered with high non-performing loans (NPLs) and bad debts, particularly in the real-estate sector (Graceffo, 2021). Underneath the nation is staggering on huge amount of misty debt, local government funding vehicles, wealth management products, and off-balance-sheet lending. China’s debt is huge than it appears and high that some policymakers feel it is at grievous levels and could spill over, doing severe damage to the rest of the world economies. What does this say about the environmental sustainability targets of China and the global economy at large? Bad financial position of China could steer CO2 emissions as recorded in late 2020 and early 2021, as inability to finance energy-saving construction and heavy industrial activity led the recovery from the initial COVID-19 lockdowns. This could slowdown environmental sustainability targets of the nation, while transferred unwanted emissions to the rest of the world via financial integration/globalization. However, the sectoral implementation plans of China specifically for construction materials, steel, industry, power, and among others are ongoing and could introduce more measurable targets.

India, since 1992, has undergone some significant changes, most specifically in their financial system. These noticeable changes in financial system have brought an element of competition, marking the gradual end of financial repression featured by non-price and price controls in the process of financial intermediation (Gopinath and Prasad 1998). It is paramount to state here that, while financial markets in this region are fairly developed, there remains a huge extent of segmentation of the financial markets as well as non-level playing field among the market participants. This in one way or another has significantly contribute to the volatility in asset prices of the nation. This noticeable volatility in asset prices is exacerbated by inadequate liquidity in the secondary markets. Since financial system plays a huge role in financial intermediation, failure in financial system would spring up risks, such as credit risk, asset-backed risk, liquidity risk, equity risk, currency risk, and foreign investment risk, which might influence on the overall economy and environmental policy at large. Thus, it will be theoretically right to link financial risks and inadequacy of this region to the increased in air pollution, water scarcity/pollution, poor management of waste, quality of forests and preservation, biodiversity loss, and land and/or soil degradation among other environmental issues facing the nation of India today. India was in the bottom five countries for its poor performance on environmental ecosystem vitality and health globally. This justify our finding that financial risk has an emissions-increasing effect on environmental quality in India (British Safety Council 2019).

Japan as reported in Fig. 3e also shows a strong and positive impact of financial risk on carbon emissions across quantiles over the sampled period. It is paramount to state here that Japan’s financial system is becoming more susceptible to the impacts of financial interaction with the rest of the world. The Bank of Japan has warned that stagnant returns would prompt the nation and its authorities to ramp up their exposure to US leveraged loans (Financial Times 2019). While issues related with supply chain, politics, rising labor costs, and poor financial system have highlighted problems with Japan’s reliance on China, as a base for its manufacturing investments. This is one way or another impact on the overall macroeconomic objectives and environmental targets. For instance, in terms of energy conservation and effective anti-pollution policy, Japan is a global leader. Recently, however, the nation has faced the top-priority issue in terms of adjusting its domestic energy mix in the wake of the triple 3/11 disaster. While the primary target of the government is to create a circular and ecological economy, targets that captures environmental concerns and public-policy domains have suffered a setback in terms of energy policy. Policymakers in this region have reiterated that nuclear power is a crucial energy source and it will remain a significant component of the nation’s energy mix in the end. In addition, Japan is facing a grievous plastics issue. Following the United Nations (UN) 2018 report, the nation is the second-largest consumer of single-use plastic packaging per head, followed by the USA, and the second-largest exporter of plastic waste globally. As much as the government support research into biodegradable plastic and its applications couple with plastic recycling facilities, it appears that the nation 2030 target for a 25% reduction in single-use plastics is passive and unenterprising as the financial integration of the nation with rest of the world antagonize its environmental policy (Weidner 2020). This also support our finding that financial risk has an emissions-increasing effect on environmental quality in India.

Brazil also show an interesting result across quantiles. We find financial risk have strong emissions-increasing impact on environmental degradation over the sampled period. Calice et al. (2021) argued that the credit market in Brazil is historically featured and rely on government interventions for allocative design. When considering a business-as-usual scenario, the nation according to World Bank (2021) report, projected lose about 6.5 million hectares of its land (natural) between 2021 and 2030 the highest for a single nation. Notably, cropland and conversion to pastureland are factors to consider when it comes to land use changes in this region. The loss of land-use led to grievous impacts on the availability of ecosystem services, that is, the pollination, marine fisheries, provision of timber, and carbon sequestration. These factors majorly influence economic growth prospects of Brazil. Compare with the rest of the world, Brazil real gross domestic product (GDP) is projected to decline by about US $90 billion by 2030, which could rise to US $225 billion, if and only if, climate change damages that have been associated with the loss of ecosystems are captured in policy frameworks. Calice et al. (2012) asserted that banks in Brazil lend to businesses, individuals, and firms that are in one way or another depend on ecosystem services for the production activities. Thus, financial risk could enhance environmental degradation, which would lead to financial losses and disruption of business activities, hence, overall economic growth and development.

In addition, for Indonesia across quantiles, financial risk has a strong emissions-increasing effect on environmental quality. Indonesia is unique when it comes to financial risk and its impact on the economy at large. We all believe that investing commonly encompasses various risks, especially financial risk. While the notion that the higher the risks, the higher the yields can become is no longer a news, this notion specifically relates to an emerging market like Indonesia (Indonesia Investment, 2019). Doing business in this nation could be profitable. However, it is also more risky than doing business in a developed country, because Indonesia has a number of country-specific features and dynamics that may frustrate investors and undermine a business climate and conducive environment (https://www.indonesia-investments.com/business/risks/item76). Some of these country-specific features and dynamics that affects financial system and may frustrate investors and undermine a business climate and conducive investment includes corruption, poor governance, inadequate infrastructure, natural disasters, poor macroeconomic content, radical religion beliefs, and ethnic and religious violence among others. In terms of environmental quality, Indonesia has been battling environment issues which include among deforestation, haze from forest fires, water pollution (from industrial waste and sewage), air pollution in urban areas, and smoke among others. However, based on prompt execution of the Energy Mix Policy (EMP), Indonesia’s National Climate Change Council (INCCC) reported that Indonesia has the potential to curb emissions by 2.3 Gt by 2030. This is equal to 7% of global emissions reduction, as necessitated by the Intergovernmental Panel on Climate Change.

The results of finance-emissions association for South Korea is somewhat mixed across quantiles. We find that financial risk has strong emissions-increasing impact on environmental degradation in the lower tail of the quantiles (0.1–0.30) while financial risk decreases carbon emissions in the middle and upper tail of the quantiles (0.30–0.80) over the sampled period. It appears that financial risk contributes to emissions-increasing when financial system is in stress; however, the reverse is the case in a situation of sound financial response to economic and environmental issues. This is theoretically right to assume that sound financial system is an advantage to respond promptly to issues that affects both the private and public institutions and the economy at large, conversely. On the other hand, South Korea has a strong financial situation, coupled with low public debt. The nation is sound financially, when compared with other high-income economies of the world, most especially in this COVID-19 pandemic era (North and Lindstrom 2021). This justifies the inverse response across the medium and upper quantiles this study empirically confirmed. However, the fiscal balance position enjoyed by this nation is set to nosedive as public authorities have intensified imperialistic policies to chip the shock of COVID-19. To this effect, three (3) supplementary budgets to the tune of KRW59tn, approximately 3% of 2020 GDP was use as at July 2020. This stimulus meant to raise local demand concerning infrastructure spending, household cash transfers among others, to assist small and medium enterprises (SMEs) financially and support the labor market and the affected local industries. The administration of the stimuli packages be enough to bring the South Korean economy back to a mild recovery path, most especially consumption renewables by households and production activities by firms via energy-saving and efficient technologies for a sustainable environment both for the immediate and for the generations to come. The forthcoming study of Akadiri et al. (2022) discussed this in detail.

The USA, Russia, Germany, and Canada show an interesting outcome. As observe across all quantiles (0.1–0.95) of financial risk and carbon emissions, the impact of financial risk on carbon emissions is significantly strong and inverse (see Fig. 3b, d, f, and j respectively). This indicates that, across quantiles of both financial risk and carbon emissions, financial risk has an emissions-decreasing effect on environmental quality in these nations. We quickly discuss the peculiarity of the interaction between these variables for these countries. For example, this finding is not surprising in the case of the USA. The POTUSFootnote 1 on executive order on climate-related financial risk asserted that increase in climate change has a grievous impact, physical risk to assets, private investments, publicly traded securities, and businesses, which includes, risen weather condition leading to disruptions in supply chain. Furthermore, the shift from carbon-intensive industrial processes and energy sources by the world economies presents transition risk to individuals and businesses. Nevertheless, this shift gives future opportunities to the world economies to increase competitiveness, hence economic growth. He argued that the inability of the financial systems to measure and account for these transition and physical risks would erode the competitiveness of markets, firms, and the ability of financial systems to serve communities in the USA. As a measure to cushion the effect of financial risk on the environment, he advocated for government participation in conducting prudent fiscal management and prioritizing investments among other relevant policies.Footnote 2 According to the report, these policies will enhance creativity, build courage, and attract capital necessary to reinforce the resilience needed by its citizenry and financial systems at large, when face with climate crisis, rather than aggravate its causes. This would put the USA in a position of power to lead world economies to a more sustainable and prosperous future. This finding resonate the study of Zhao et al. (2021) for the USA.

Russia on the other hand is moderate in terms of financial risk, since the OECD country credit grade for the nation is four (4). Over the years, Russia’s self-governing credit ratings have climbed into investment grade region. This is supported by preservation of large fiscal, external buffers, and economic liberalization policies. Generally, this implies a moderate likelihood that Russia will be able to meet its external debt obligations. To cushion the impact of financial shocks on the environment, government buildup reforms that constitute federal legal system with environmental matters planned at both the regional and federal level. This takes the form of codes, laws, and subordinate regulations approved by the government and other state bodies (Omelchenko et al., 2021). However, financial risk remains a key concern for investors in this region. Despite it inspiring transnational setting, Germany remains on a healthy growth pathway, against its numerous geopolitical crises (terrorism, uncertainty about Greece, Ukraine, and Middle East, Brexit and a massive influx of refugees among others). The nation enjoys robust consumer demand due to real income, higher rate of foreign competitiveness, and labor-market developments (Zhao, et al. 2021). Germany does specifically well with regard to growth, social security, employment, and environmental protection. Lastly, Canada’s recent survey reveals that on a systemic level, there is high confidence in the resilience of the financial system and its ability to manage risks and environmental issues (Zhao, et al. 2021).

Comparison of the QQR and QR estimates

For sensitivity/robustness validity, this study applies the quantile regression (QR) to validate the QQR outcomes. This is presented in Fig. 4a–j respectively. For the sake of analysis, we reported China in (4a), USA in (4b), India (4c), Russia (4d), Japan (4e), Germany (4f), Brazil (4 g), South Korea (4 h), Indonesia (4i), and Canada in (4j) respectively. In all tails (0.1–0.90), the effect of financial risk on CO2 emissions is positive, as shown by the outcomes of both QQR and QR for China, India, Indonesia, Brazil, and Japan, except for South Korea that reveal mixed reaction across quantiles. In addition, across tails (0.1–0.90), the effect of financial risk on CO2 emissions is negative, as shown by the outcomes of both QQR and QR for the USA, Russia, Germany, and Canada, respectively. We find that the outcomes of the conventional QR mimic that of the QQR approach. This substantiates our empirical results.

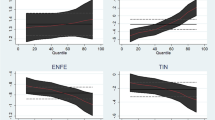

Non-parametric causality outcomes

Lastly, we conduct the non-parametric causality-in-quantiles tests to affirm the predictive powers of the series. Figure 5a–j report the results of the predictive tests conducted from financial risk to carbon emissions. In Fig. 5a–j, the horizontal and vertical axis show the t-statistics of the test and the quantiles, while the 90 and 95% critical values are depicted by the black dashed line and green solid line. The purple solid line is the predictive result for financial risk while the red solid line shows volatility of the predictive outcome. Summarily, reports of the predictive relation from financial risk to carbon emissions for individual country are reported based on the previous outcome. That is, we reported China in (5a), USA in (5b), India (5c), Russia (5d), Japan (5e), Germany (5f), Brazil (5 g), South Korea (5 h), Indonesia (5i), and Canada in (5j) respectively.

Figure 5a, c, e, g, i, and h present the outcome for the predictive relation of financial risk on carbon emissions for China, India, Indonesia, Brazil, and Japan, except for South Korea that reveal mixed reaction across quantiles. Based on the conditional distribution of carbon emissions, we find strong predictive relation from financial risk to carbon emissions in lower quantiles in almost all the sampled countries. The effect becomes robust and strongly significant across quantiles. We also observe the volatility of financial risk across Fig. 5a, c, e, g, i, and h. We find that across quantiles, the conditional distribution is significant, thus we infer that the causal effect of the volatility is asymmetric. In contrast, for the USA, Russia, Germany, and Canada, based on the conditional distribution of carbon emissions, we find a strong predictive relation from financial risk to carbon emissions across quantiles. The effect becomes robust and strongly significant across quantiles. We also observe the volatility of financial risk in Fig. 5b, d, f, and j respectively. We find that across quantiles, the conditional distribution is significant, thus we infer that the causal effect of the volatility is asymmetric.

Conclusion and policy recommendations

Having affirm the effect of financial risk on carbon emissions using advanced quantiles approaches over the sampled periods for the top-ten most carbon emitters’ economies in the world. The policy recommendations are as follows. First, nations like China, India, Indonesia, Brazil, and Japan despite their financial systems correctness and stability, financial risk exercises an emissions-increasing effect on their environmental sustainability targets. For instance, China’s debt is huge than it appears and high that some policymakers feel it is at grievous levels and could spill over, doing severe damage to the rest of the world economies. Bad financial position of China could steer CO2 emissions as inability to finance energy-saving construction and heavy industrial activity led the recovery from the initial COVID-19 lockdowns. India on the other hand has fairly developed financial market, and Japan’s financial system is becoming more susceptible to the impacts of financial interaction with the rest of the world. Recall that the higher the risks, the higher the yields, this notion specifically relates to an emerging markets like Brazil and Indonesia. We are of the opinion that adequate effort should be put in place to fix past and/or existing financial sluggishness that can hinder policymaker’s efforts in finding a lasting solution to environmental issues. Thus, it become paramount to implement policies or reforms that would keep financial systems sound and robust to face external shocks and its attendant grievous multiplier impact on the environmental sustainability targets that are meant to protect both the immediate and the future generations.

Results show a mixed reaction of financial risk on carbon emissions in South Korea, i.e., financial risk contribute to emissions-increasing when financial system is in stress; however, the reverse is the case in a situation of sound financial response to economic and environmental issues. This is theoretically right to assume that sound financial system is an advantage to respond promptly to issues that affect both the private and public institutions and the economy at large, conversely. Financial failure is dangerous for the environmental sustainability and sustainable developmental goals in this nation. At moderate level of financial risk, prompt response is accorded to economic and environmental concerns. Government should conduct an extensive gap-analysis to separate areas of improvement and build robust monitoring system to ensure that financial system contributes their quota to achieving sustainable development goals. Lastly, for nations like the USA, Russia, Germany, and Canada, financial risk has an emissions-decreasing effect on environmental degradation across all quantiles. Policymakers in such economies should focus on other drivers of environmental degradation in order to promote the existing environmental sustainability targets for both the present and future generations. These policies would promote and sustained existing environmental policies as it relate with green economy. Lastly, this study employed bivariate empirical method, which might be constrained, considering the issues we are addressing.

Data availability

Corresponding authors can provide data used in the study on appropriate request.

Notes

President of the USA.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Acheampong AO, Boateng EB (2019) Modelling carbon emission intensity: application of artificial neural network. J Clean Prod 225:833–856. https://doi.org/10.1016/j.jclepro.2019.03.352

Adebayo TS (2022) Renewable energy consumption and environmental sustainability in Canada: does political stability make a difference?. Environ Sci Pollut Rese 1–16

Adebayo TS, Acheampong AO (2022) Modelling the globalization-CO2 emission nexus in Australia: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 29(7):9867–9882

Adebayo TS, Agyekum EB, Kamel S, Zawbaa HM, Altuntaş M (2022) Drivers of environmental degradation in Turkey: designing an SDG framework through advanced quantile approaches. Energy Rep 8:2008–2021. https://doi.org/10.1016/j.egyr.2022.01.020

Adedoyin FF, Ozturk I, Agboola MO, Agboola PO, Bekun FV (2021) The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: the role of economic policy uncertainties. Energy Policy 150:112115. https://doi.org/10.1016/j.enpol.2020.112115

Adom PK, Kwakwa PA, Amankwaa A (2018) The long-run effects of economic, demographic, and political indices on actual and potential CO2 emissions. J Environ Manage 218:516–526. https://doi.org/10.1016/j.jenvman.2018.04.090

Agyekum EB, Adebayo TS, Bekun FV, Kumar NM, Panjwani MK (2021a) Effect of two different heat transfer fluids on the performance of solar tower CSP by comparing recompression supercritical CO2 and rankine power cycles, China. Energies 14(12):3426. https://doi.org/10.3390/en14123426

Agyekum EB, Kumar NM, Mehmood U, Panjwani MK, Haes Alhelou H, Adebayo TS, Al-Hinai A (2021b) Decarbonize Russia—a best–worst method approach for assessing the renewable energy potentials, opportunities and challenges. Energy Rep 7:4498–4515. https://doi.org/10.1016/j.egyr.2021.07.039

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manag 9(6):631–644. https://doi.org/10.1080/17583004.2018.1529998

Ahmad F, Draz MU, Ozturk I, Su L, Rauf A (2020) Looking for asymmetries and nonlinearities: the nexus between renewable energy and environmental degradation in the Northwestern provinces of China. J Clean Prod 266:121714. https://doi.org/10.1016/j.jclepro.2020.121714

Ahmad M, Ahmed Z, Majeed A, Huang B (2021) An environmental impact assessment of economic complexity and energy consumption: does institutional quality make a difference? Environ Impact Assess Rev 89:106603. https://doi.org/10.1016/j.eiar.2021.106603

Akadiri SS, Asuzu OC, Onuogu IC, Oji-Okoro I (2022) Testing the role of economic complexity on the ecological footprint in China: a nonparametric causality-in-quantiles approach. Energy Environ, 0958305X221094573

Akadiri SS, Adedapo AT, Adebayo TS, Usman N (2021) Does interaction between technological innovation and natural resource rent impact environmental degradation in newly industrialized countries? New evidence from method of moments quantile regression. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-17631-y

Akadiri SS, Rjoub H, Adebayo TS, Oladipupo SD, Sharif A, Adeshola I (2021b) The role of economic complexity in the environmental Kuznets curve of MINT economies: evidence from method of moments quantile regression. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-17524-0

Aladenika B, Akadiri SS, Akpan U (2022) Asymmetric effect of financial globalization on carbon emissions in G7 countries: fresh insight from quantile-on-quantile regression. Energy Environ, 0958305X221084290

Alola AA, Adebayo TS, Onifade ST (2021) Examining the dynamics of ecological footprint in China with spectral Granger causality and quantile-on-quantile approaches. Int J Sust Dev World 0(0):1–14. https://doi.org/10.1080/13504509.2021.1990158

Balcilar M, Ozdemir ZA, Shahbaz M, Gunes S (2018) Does inflation cause gold market price changes? Evidence on the G7 countries from the tests of nonparametric quantile causality in mean and variance. Appl Econ 50(17):1891–1909. https://doi.org/10.1080/00036846.2017.1380290

Bassett G, Koenker R (1978) Asymptotic theory of least absolute error regression. J Am Stat Assoc 73(363):618–622. https://doi.org/10.1080/01621459.1978.10480065

BP (2020) British Petroleum. https://www.bp.com/content/dam/bp/. https://www.bp.com/en/global/corporate/careers/professionals/locations/sweden.html#/. Accessed 22 May 2022

BP (2021) British Petroleum. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019. https://www.bp.com/en/global/corporate/careers/professionals/locations/sweden.html#/. Accessed 30 May 2022

British Safety Council (2019) https://www.britsafe.org/publications/safety-management-magazine/safety-management-magazine/2019/room-for-improvement-india-and-the-environment/. Accessed 23 Jan 2022

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Econom Rev 15(3):197–235

Cleveland WS (1979) Robust locally weighted regression and smoothing scatterplots. J Am Stat Assoc 74(368):829–836. https://doi.org/10.1080/01621459.1979.10481038

Calice P, Chando VM, Sekioua S (2012) Bank Financing to Small and Medium Enterprises in East Africa: findings of a Survey in Kenya, Tanzania, Uganda and Zambia. ABDC 7(3):22–31

Calice P, Diaz Kalan F, Miguel F (2021) Nature-related financial risks in Brazil. Assessed 12 April 2021

Financial Times (2019) https://www.ft.com/content/5f9631d4-f636-11e9-9ef3-eca8fc8f2d65. Accessed 2 Feb 2021

Gopinath S, Prasad A (1998) Managing Financial Risks in India: RBI Occasional Papers 417–438

Graceffo A (2021) https://warontherocks.com/2021/12/could-chinas-massive-public-debt-torpedo-the-global-economy/

Ikram M, Xia W, Fareed Z, Shahzad U, Rafique MZ (2021) Exploring the nexus between economic complexity, economic growth and ecological footprint: contextual evidences from Japan. Sustain Energy Technol Assess 47:101460. https://doi.org/10.1016/j.seta.2021.101460

Indonesia Investment (2019) https://www.indonesia-investments.com/business/risks/item76. Accessed 3 March 2022

Jeong K, Härdle WK, Song S (2012) A Consistent Nonparametric Test For Causality In Quantile. Economet Theor 28(4):861–887. https://doi.org/10.1017/S0266466611000685

Kirikkaleli D, Adebayo TS (2021) Do public-private partnerships in energy and renewable energy consumption matter for consumption-based carbon dioxide emissions in India? Environ Sci Pollut Res 28(23):30139–30152. https://doi.org/10.1007/s11356-021-12692-5

Nishiyama R, Watanabe Y, Fujita Y, Le DT, Kojima M, Werner T, Vankova R, Yamaguchi-Shinozaki K, Shinozaki K, Kakimoto T, Sakakibara H, Schmülling T, Tran L-SP (2011) Analysis of cytokinin mutants and regulation of cytokinin metabolic genes reveals important regulatory roles of cytokinins in drought, salt and abscisic acid responses, and abscisic acid biosynthesis. Plant Cell 23(6):2169–2183. https://doi.org/10.1105/tpc.111.087395

North D, Lindstrom A (2021) (https://www.eulerhermes.com/en_US/resources/country-reports/south-korea.html)

Omelchenko E, Serebrennikova A, Gumenyuk D, Chivragova M, Anichkin A, Mikhaleva A (2021) https://uk.practicallaw.thomsonreuters.com/w-013-5609?transitionType=Default&contextData=(sc.Default)&firstPage=true). Accessed 4 March 2022

Ozturk I, Acaravci A (2016) Energy consumption, CO2 emissions, economic growth, and foreign trade relationship in Cyprus and Malta. Energy Sources Part B 11(4):321–327. https://doi.org/10.1080/15567249.2011.617353

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Pata UK (2021) Linking renewable energy, globalization, agriculture, CO2 emissions and ecological footprint in BRIC countries: a sustainability perspective. Renewable Energy 173:197–208. https://doi.org/10.1016/j.renene.2021.03.125

Sadiq-Bamgbopa Y, Akadiri SS, Asuzu OC, Pennap NH (2022) Impact of tourist arrivals on environmental quality: a way towards environmental sustainability targets. Curr Issues Tourism, pp 1–19

Saikkonen P (1991) Asymptotically efficient estimation of cointegration regressions. Economet Theor 7(1):1–21. https://doi.org/10.1017/S0266466600004217

Shahbaz M, Kumar Tiwari A, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Shahbaz M, Shafiullah M, Papavassiliou VG, Hammoudeh S (2017) The CO2–growth nexus revisited: a nonparametric analysis for the G7 economies over nearly two centuries. Energy Economics 65:183–193. https://doi.org/10.1016/j.eneco.2017.05.007

Shahzad U (2020) Environmental taxes, energy consumption, and environmental quality: theoretical survey with policy implications. Environ Sci Pollut Res 27(20):24848–24862. https://doi.org/10.1007/s11356-020-08349-4

Sim N, Zhou H (2015) Oil prices, US stock return, and the dependence between their quantiles. J Bank Finance 55:1–8. https://doi.org/10.1016/j.jbankfin.2015.01.013

Song C-Q, Chang C-P, Gong Q (2021) Economic growth, corruption, and financial development: global evidence. Econ Model 94:822–830. https://doi.org/10.1016/j.econmod.2020.02.022

Stone CJ (1977) Consistent nonparametric regression. Ann Stat 5(4):595–620

Weidner E (2020) Imaging method for mass transport measurements in a two phase bubbly flow of supercritical CO2 and viscous liquids in a static mixer. J Supercrit Fluids 159:104757

World Bank (2021) World Development Indicators. http://data.worldbank.org/country. Accessed 4 Jan 2022

Xiao Z (2009) Quantile cointegrating regression. J Econom 150(2):248–260. https://doi.org/10.1016/j.jeconom.2008.12.005

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zhao J, Shahbaz M, Dong X, Dong K (2021) How does financial risk affect global CO2 emissions? The role of technological innovation. Technol Forecast Soc Chang 168:120751. https://doi.org/10.1016/j.techfore.2021.120751

Zhang W, Chiu Y-B (2020) Do country risks influence carbon dioxide emissions? A non-linear perspective. Energy 206:118048. https://doi.org/10.1016/j.energy.2020.118048

Author information

Authors and Affiliations

Contributions

Tomiwa collected data, analyzed the data, the introduction, and literature review. Seyi is responsible for the study development and proofreading, the conclusion, and policy suggestion.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

NA.

Consent for publication

NA.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Akadiri, S.S., Adebayo, T.S. The criticality of financial risk to environment sustainability in top carbon emitting countries. Environ Sci Pollut Res 29, 84226–84242 (2022). https://doi.org/10.1007/s11356-022-21687-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21687-9