Abstract

The study investigates the asymmetric effect of temperature, exchange rate, metals (rare metals and electrical conductors), and investor sentiments on solar stock price performance in China. The novel econometric techniques, i.e., QARDL (quantile autoregressive distributive lag) approach and Granger causality-in-quantiles to analyze the results. In both short- and long-run estimations, the findings suggest that rare metals (cadmium, germanium, indium, and selenium) and electrical conductors (silver, aluminum, and copper) have significant and positive linkage with solar energy stocks at different quantiles based on bullish, bearish, and normal market conditions. On the other hand, negative effects are found for temperature, RMB exchange rate, and investor sentiments in both the short- and long-run. In the short run, the effect of exchange rate varies across different quantiles but it confines to only lower quantiles (bearish market condition) in the longer run. Solar stocks are more prone to investor sentiments under higher quantiles (bullish market conditions). Lastly, we find that temperature is not merely a behavioral anomaly for the solar energy market as it spreads across middle quantiles (normal market conditions) in the longer run. The findings of Granger causality in quantiles further confirm the results of QARDL.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The rapid economic and social development of China has significantly increased energy demands which were previously met by non-renewable energy sources (Zhao et al. 2020; Lee and Lee 2022; Peng et al. 2022). The drastic upsurge in environmental pollution caused by fossil fuel consumption turns the spotlight on power consumption and production through renewable energy resources (Andrews-Speed 2020). One of the widely used renewable energy resources is solar energy which has the potential to reduce pollutant emissions (Shahsavari and Akbari 2018). In order to grow the economy following sustainable development goals (SDGs), China finds solar energy an efficient source to meet the energy demands. At the end of the year 2020, China’s photovoltaic (PV) power generation capacity reached 253 GW and is expected to be elevated by 26% (around 65 GW) by the end of 2021. These figures are substantially large compared to European Union (Xu and Singh 2021).

Owing to the serious environmental threats faced by China, listed Chinese energy firms are improving their environmental performance and fetching ecofriendly technologies under government support (Zhang et al. 2017; Fonseka et al. 2019). Thus, investors’ enthusiasm toward renewable energy stocks is increasing due to portfolio diversification opportunities (Wan et al. 2021). Nonetheless, the green market sizeFootnote 1 of China is still not passable despite receiving a large scale of green bonds and credit (Liu et al. 2021), as the solar energy market is still underdeveloped and more sensitive to economic shocks (Wang et al. 2021). Investment into listed clean energy firms and related technology can be engrossed along with the improvement in their efficiency and stock price performance. Even though solar energy has made its place in eco-friendly energy sources, there is a lack of empirical evidence to guide investors and policy makers regarding the factors that influence the market performance of these firms. Given the momentousness of financial markets in promoting clean energy, this study attempts to examine the factors affecting the solar stock performance in China to gain support from the stock market. The findings of the study will provide crucial implications for investors to hold assets in alternative energy sector stock markets.

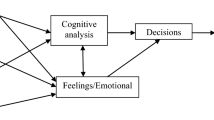

The efficiency of solar energy firms and their stock price depends on several factors including meteorological conditions (Bakirci and Kirtiloglu 2022), metal prices (Dutta 2019), oil prices (Hammoudeh et al. 2021), exchange rates (Gürtürk et al. 2021), and investor sentiments (Song et al. 2019). For instance, solar panels work efficiently between 59 and 95°F. Lower or higher temperatures may distort the efficiencyFootnote 2 of solar energy (Dubey et al. 2013). Previously, the temperature is considered a behavioral anomaly leading to the change in investors’ moods. Extreme temperatures (low or high) distort the optimal risk-taking propensity of investors (Cao and Wei 2005; Shahzad 2019; Yahya et al. 2021). Nevertheless, we presume that temperature may have a more direct relationship with solar stock prices as the sales may decrease during extreme weather. Thus, solar stocks may attract the attention of investors in moderate temperatures.

Similarly, the price of certain metals may have a significant effect on solar energy stocks. Previously, Dutta (2019) investigated the association between silver market uncertainty and the stock performance of solar energy firms. Since SilverFootnote 3 is heavily used in the production of solar panels, the increasing uncertainty of the silver market also increases the volatility of the solar energy sector. By further advancing this domain, we have examined other common and minor non-ferrous metals along with silver that is currently used in photovoltaic cell technology and solar panel development. For example, copper is also an efficient conductor of electricity and heat. Certain properties of copper such as longevity, mechanical strength, sealability, ease of fabrication, resistance to aqueous and atmospheric corrosion, and high heat conductivity extensively support solar heating applications. Additionally, it is used in photovoltaic cell ribbons, inverters, earthing, and cabling (Moreno-Leiva et al. 2020). Likewise, aluminum is used in almost all solar module frames. Owing to its lightweight and resistance to corrosion, aluminum is considered an ideal solution for maintaining the structural stability of modules (El Mays et al. 2017). Some rare metals such as tellurium, selenium, indium, germanium, gallium, and cadmium are used in current PV cell technology. A sufficient supply of these mineral materials can support the large-scale global PV systems (Bleiwas 2010; Fizaine 2013). Thus, grounded on the findings of Dutta (2019), we conjecture that the variability of other electrical conductors and rare metals can also explain the stock price movements of solar energy firms.

According to Statista Research Department, China is one of the net exporters of PV modules. Within the first 5 months of the year 2019, exports of PV modules to solely EU exceeded 9200 MW. Thus, based on a flow-oriented approach (Dornbusch and Fischer 1980), we believe that exchange rate movements may largely affect the solar stock performance. If the firm is a net exporter, then its stock price may decrease with the currency appreciation. The depreciation of currency increases the products’ competitiveness in the global market leading to a jump in the stock price (Aloui 2007). Lastly, we have incorporated the distinguishing factor, i.e., investor sentiments, that explains the movements in energy and financial markets (Ji et al. 2019; Song et al. 2019). Previous studies have utilized the investor sentiment index utilized by Baker and Wurgler (2007); however, recently, Long et al. (2021b) and Li et al. (2019) revealed that the Chinese volatility index can reflect investor sentiments up to a considerable degree.

This paper extends the research on the determinants of clean energy stocks in several ways. First, our study offers a fresh perspective on the nexus between temperature and solar energy stocks. Since extreme weather disrupts the solar panels’ efficiency, the demand for solar energy may decline. This frame of reference is more pragmatic compared to the behavioral perspective of Cao and Wei (2005). Second, to our best knowledge, this study is the first attempt to examine the effect of copper and aluminum along with rare metals (tellurium, selenium, indium, germanium, gallium, and cadmium) on solar energy stocks. Previously, the prices and volatility of crude oil, silver, gold, natural gas, and coal are empirically explored with clean energy stocks (Dutta 2019; Song et al. 2019). Third, this study assesses whether a flow- or stock-oriented approach exists in the Chinese solar energy market by incorporating the effect of exchange rate movements. Fourth, we have utilized the Chinese volatility index (iVX) to capture investor sentiments which is earlier assessed through Google trends (Song et al. 2019), Twitter trends (Reboredo and Ugolini 2018), and S&P VIX (Piñeiro-Chousa et al. 2021) in green energy markets studies.

Lastly, we have investigated the asymmetric linkages among underlying variables to devise long-term sustainable policies for solar energy firms. In the presence of asymmetric dependence, conventional linear methodologies may provide biased estimates (Lee et al. 2022). Theoretical arguments in favor of non-linear relationships between stock market return and its determinants suggest that financial markets follow non-linear behavior due to the existence of heterogeneous investors (noise and arbitrage traders), transactions costs, different market dynamics, and the interactions of market frictions (McMillan 2003, 2005). Unlike previous studies, we have employed the dynamic quantile autoregressive distributed lag (QARDL) model developed by Cho et al. (2015) to assess the association between temperature, electrical conductors, rare metals, investor sentiments, exchange rate, and solar energy stock performance. The QARDL model has the capability to simultaneously investigate long-run and short-run movements over a series of quantiles of the dependent variable’s conditional distribution as it is the combination of conventional ARDL (Pesaran et al. 2001) and quantile regression (Koenker and Bassett Jr 1978) methodology. In this manner, the QARDL method allows locational asymmetry given that how the solar energy stocks respond to variation in metal prices, temperature, exchange rates, and investor sentiments within their conditional distribution. The results will guide the investors regarding the diversification and hedging abilities of solar energy firms for stock returns. The heterogeneous effects of metal prices, temperature, exchange rates, and investor sentiments on solar energy stocks under different market conditions (bearish, bullish, and normal) may not just drive environmentally conscious investors, but also traditional investors by realizing the potential financial benefits of clean energy investments.

The remainder of this paper is organized as follows. A brief literature review is presented in “Theoretical framework and literature review” section. The methodology and data are demonstrated in “Methodology” section. In “Data analysis and discussion” section, we discuss the empirical results of the relation between underlying variables and the solar energy industry of China. Finally, we summarize the research conclusions and remarks in the last section.

Theoretical framework and literature review

Intense market penetration of the renewable energy sector over the last two decades draws the attention of scientists to develop a link of different factors with the stock price performance of clean energy firms. Using conventional and advanced econometric techniques, previous studies have examined directional spillover, linear, asymmetric, and causal relationships between oil prices (Ahmad 2017; Zhang et al. 2020), technology stocks, carbon prices (Kumar et al. 2012), financial distress, gold prices (He et al. 2021), fossil energy, investor sentiments (Song et al. 2019), precious metals, energy resources (Bibi et al. 2021), and clean energy stocks. To further contribute to the clean energy stocks literature, we have identified certain factors that remain underexplored.

Temperature, solar energy, and stock market

With the emergence of behavioral finance theories, researchers explored different phenomena that how meteorological conditions affect investors’ moods and risk-taking behavior. Based on eight financial markets including Taiwan, Japan, Australia, Sweden, Germany, Britain, Canada, and the USA, Cao and Wei (2005) evaluated the effect of temperature on stock market returns. They argued that higher temperature can lead to both apathy and aggression while lower temperature provokes aggressive behavior only. Consequently, apathy impedes risk-taking while aggression spurs risk-taking behavior. In tandem with the evidence of Cao and Wei (2005), Floros (2011) also found aggressive risk-taking behavior of investors under lower temperatures in Lisbon Stock Exchange using the AR(1)-TGARCH(1,1) model. In the context of greater China, Shahzad et al. (2019) also found the significant emotional effects of local weather (including temperature) on stock returns. On the other hand, Yoon and Kang (2009) suggest that the weather anomaly starts fading with the improvement in market efficiency in the Korean stock market. Similarly, Hou et al. (2019) argued that the weather effect on stock markets was largely mitigated with the introduction of cooling systems.

Weagley (2019) presented a different view compared to the conventional behavioral perspective that extreme weather shocks increase demand for electricity leading to an upsurge in the firm’s operational cost. This tentative increase in cost may signal “bad news” which consequently boosts the systematic risk. Since the variability of solar stock prices is the main concern of the study, an equivocal rise in temperature affect solar panel efficiency and thereby can intimidate investors to shuffle their portfolio. Especially in summers, the efficiency of solar panels reduces when the surface temperature rises above 95 °F (Dubey et al. 2013). Although extreme temperatures increase energy demand (Weagley 2019), the lower efficiency of solar panels may alter investor preference to buy energy-efficient stocks. From the sales perspective, energy firms are largely affected by extreme temperatures compared to non-energy firms (Addoum et al. 2020). Although advocates of behavioral finance argue that mispricing from weather anomalies corrects itself in the long run (Yoon and Kang 2009; Hou et al. 2019), Bansal et al. (2016) argued that temperature risk negatively influences the returns of global markets in the long run due to the significant social cost of carbon emissions associated with it. Assets of firms (such as solar energy firms) that are highly sensitive to carbon emissions and temperature are more exposed to temperature fluctuations in both the short and long run.

Metals and energy stocks

Although the demand for cleaner energy and technologies has been drastically increased, their development requires scarce metals. There are several PV solar technologies but each one of them has a constraining metal supply. Elshkaki and Graedel (2013) argued that both base metals (such as iron, lead, nickel, chromium, copper, and aluminum) and rare metals like cadmium, indium, germanium, and tellurium are critical for the production of cleaner energy technologies. Depletion and scarcity of these metals are some of the ultimate threats to eco-friendly energy production in the future. Consequently, these precious metals have high volatility and time-varying correlation with stock markets around the globe (Creti et al. 2013; Mensi et al. 2017; Al-Yahyaee et al. 2019).

Boako et al. (2020) found long-term cointegration and comovement of precious metals with stock returns in African countries. Ali et al. (2020) revealed that industrial and precious metals prove to be valuable safe-haven and hedging properties against various international stock markets. Farid et al. (2021) computed the intraday volatility of precious metals using the MCS-GARCH model and asserted their strong connectedness across US stocks before and during the COVID-19 outbreak. In contrast, using Markov switching vector autoregressive model, Reboredo and Ugolini (2020) purported weak connectedness between rare earth stocks and the clean energy stock market; however, rare earth stocks receive and transmit price spillover with base metals. Bibi et al. (2021) analyzed energy resources and precious metals with clean energy stocks using the ARDL approach. Their findings suggest that goal prices and energy commodities prices (oil and coal) significantly affect clean energy stocks in both the short and long run.

Using the GARCH-jump process, Dutta (2019) estimated the impact of silver volatility on global energy stocks. The author reveals the negative effect of silver volatility on solar energy stocks even after controlling for oil price volatility. Likewise, silver, scarcity, and price fluctuation of other base and precious metals can directly influence the solar energy stocks as they are the raw material of PV technologies. Along with silver, we have considered other electrical conductors (copper and aluminum) and rareFootnote 4 base metals (cadmium, germanium, indium, and selenium). To our best knowledge, no previous studies have empirically investigated the asymmetric effect of these underlying metals on the solar energy stocks of China. In tandem with Dutta (2019), our study is interested to know if other rare and common metals encourage or discourage investments in solar energy firms.

Investor sentiments and energy stocks

The previous empirical literature has demonstrated the important role of investor sentiments in affecting energy markets and commodities. Qadan and Nama (2018) applied different proxies of investor sentiments and analyzed their significant relationship with oil prices. On the other hand, Reboredo and Ugolini (2018) found no sizable impact of investor sentiments (measured by Twitter trends) on stock returns of renewable energy firms. Song et al. (2019) assessed investor sentiment with the google search index and revealed its effect on clean energy stocks up to a certain level. Using the TVP-VAR-based connectedness approach, Liu and Hamori (2021) found dynamic volatility connectedness between investor sentiments and clean energy stocks which is more sensitive to financial turmoil.

Especially during the COVID-19 pandemic, fear- and pessimism-induced investor sentiments were one of the major reasons that plummeted clean energy stock returns (Yahya et al. 2021). Recent studies on the Chinese volatility index (iVX) show its predictive power to reflect investor sentiments (Xu and Zhou 2018; Long et al. 2021b). Li et al. (2019) argued that the iVX index reflects investor fear sentiments and negatively affects the Chinese market (Shanghai 50ETF). Long et al. (2021b) argued that the Chinese volatility index can be utilized as investor sentiment at the micro, meso, and macro-level. Since we are evaluating the major predictors of the Chinese solar energy market, we find iVX a more relevant index to gauge investor sentiments.

Besides the effect of investor sentiments in the short run, we also argue that it persists in the long run. Behavioral finance advocates the price reversals due to investor sentiments in the long run (Buttimer et al. 2005; Cornelli et al. 2006; Zaremba et al. 2020). However, certain evidence indicates that investor sentiments affect asset returns in the long run due to the average bullishness of the noise traders (Ding et al. 2019). Additionally, the market overreaction and volatility persevere in the long run if the sentiments capture industrial supply/demand shifts (Ni et al. 2015; Shahzad et al. 2019). Accordingly, studies found a significant long-run relationship between fear index (VIX) and stock returns (Bollerslev et al. 2013; Akdag et al. 2020). Since clean energy stocks are highly sensitive and dependent on demand (supply) shocks (Maghyereh and Abdoh 2021), we expect that the effect of investor sentiments (iVX) on solar energy stocks is negative and significant in the long run.

Exchange rate and energy stocks

Theoretically, the relationship between exchange rate fluctuation and stock price movement can be explained by the stock-oriented model (Branson and Henderson 1985) and flow-oriented model (Dornbusch and Fischer 1980). According to the portfolio balance phenomenon of the stock-oriented model, investors shuffle their portfolios from foreign assets to domestic assets when the price of domestic assets ascends. The demand for local currency goes up eventually leading to an increase in interest rate. This is how stock-oriented model explains the currency appreciation due to stock price fluctuation. In contrast, the flow-oriented model exhibits a positive linkage between exchange rates and stock prices. The competitiveness of domestic firms improves through low-cost exports with the local currency depreciation. Consequently, higher exports increase the domestic stock prices due to more wealth inflow in the country.

Albeit conflicting estimates, a wide range of studies has examined the association between exchange rate and stock market performance (Jebran and Iqbal 2016; Parsva and Tang 2017; Gokmenoglu et al. 2021). Nonetheless, there is a dearth of literature in the context of clean energy firms. Only Kocaarslan and Soytas (2021) studied the effect of exchange rate and volatility of clean energy stocks. They revealed that the US dollar value increases the risk premia and mitigates the liquidity of risky clean energy stocks under an unstable economic environment. Since China is the biggest exporter of PV systems, exchange rate movements may influence solar energy stocks due to a number of reasons including the level of international openness (Auboin and Ruta 2013), the structure of producer-importer (Bahmani-Oskooee et al. 2013), risk-behavior of traders (McKenzie 1999), or availability of hedging instruments (Hall et al. 2010). Grounded on the flow-oriented model, we presume that the exchange rate plays an important role in explaining the solar energy market of China.

Methodology

Theoretical and empirical background

This study investigates the asymmetric link between temperature, exchange rate, metals (rare and electrical conductors), investor sentiments, and solar stock performance. Since the early 2000s, solar energy becomes a critical renewable energy industry for China. Even after the 2008 global financial crisis when the export-dependent PV industry drastically declined, the Chinese government substantially supported and subsidized their renewable energy sector. Subsequently, their solar systems exports hit 58 GW in the year 2019 (Xu and Stanway 2019). At the domestic level, China’s installed capacity reached 253 GW by the end of the year 2020 (Xu and Singh 2021). Both consumption and production of clean energy facilitate the economic growth of China (Wang and Lee 2022). Although China is devoting its money and mind to cutting coal and other fossil fuel consumption to foster green growth, it is still the largest carbon emitter in the world (Qin et al. 2021).

Since solar energy efficiency is largely dependent on climatic conditions, the temperature is expected to influence the solar energy stock performance of China. From the year 1952 to 2017, China’s average temperature rose by 0.24 °C, over and above the global rate (Sun et al. 2019b). Thus, the role of temperature is imperative to explain the solar energy stock performance of China. Being the largest exporter of solar energy, the share price of solar energy firms may react largely to RMB exchange rate movements. Appreciation of RMB reduces the probability of penetrating the export market (Li et al. 2015). As China does not have a float exchange rate, it is generally accused of artificially manipulating and depreciating its currency to spur exports (Yu 2020). However, China had let its currency appreciate based on a “managed float” system due to the pressure from major trading partners. Consequently, Yuan hits its strongest level against US dollars (Ping 2021). This policy-induced RMB volatility affects the Chinese financial market (Xiong and Han 2015; Qin et al. 2018) including solar energy firms.

Previously Chinese market was considered inefficient (Groenewold 2004); however, some evidence of market efficiency can be observed in the post-SOE period (Chong et al. 2012). Despite certain momentum toward market efficiency, the Chinese financial market is an emerging capital and is largely influenced by investor sentiments (Chi et al. 2012; Ni et al. 2015; Wu et al. 2022). The effect of sentiments gets stronger during a crisis or uncertain period (Cheema et al. 2020; Sun et al. 2021). Thus, it is imperative to incorporate the role of investor sentiments in evaluating the important determinants of solar energy stock variation. Lastly, we presume that the price fluctuation of certain non-ferrous metals directly influences solar energy stocks in China due to their sizeable use in PV technology and solar systems.

The synergetic change of non-ferrous metal explains the stock market movements in China (Kong and Gou 2019). Empirical evidence shows that changes in the price of copper and aluminum influence the economic activities and volatility of Chinese financial markets (Guo 2018; Klein and Todorova 2021). Recently, extreme volatility and price hike of non-ferrous metals are observed due to the COVID-19 crisis and scarcity of rare metals. The critical materials (i.e., cadmium, tellurium, indium, gallium, selenium, and germanium) required for solar power in China are all under high shortage and supply risk threatening the sustainable production of PV systems (Wang et al. 2019). Thus, the inclusion of these metals into the empirical model shall increase the predictability of the Chinese solar stock market. Unlike Kong and Gou (2019), we have disaggregated the critical non-ferrous metals into best electrical conductors (copper, aluminum, and silver) and rare (cadmium, germanium, indium, and selenium) base metals. Accordingly, the comprehensive model to investigate the underlying variables is expressed in Eq. (1) based on available theoretical, practical, and empirical explanation:

Where SESP denotes solar energy stock performance, TEMP indicates temperature, EXR represents exchange rate, INVS represents investor sentiments, RM denotes rare metals, EC represents electrical conductors, t is the time dimension, while β1, β2, β3, β4, and β5 represent the parameters, α denotes constant term, and εt is the error term.

As discussed earlier, the study aims to investigate both short- and long-run relationships. It is important to capture these relationships due to the heterogeneous impact of commodities, metals, risk, government policies, etc., on stock prices in the short and long run. For instance, Mishra et al. (2019) revealed a positive effect of oil prices on Islamic stocks, but a negative effect in the long run. On the other hand, Godil et al. (2020) argued that stock prices (both conventional and Islamic) are hardly influenced by geopolitical risk, economic policy uncertainty, oil prices, and gold prices unless extreme market conditions (bullish or bearish) exist. The diversification opportunity exists in the long run only. Similarly, He et al. (2021) revealed that exogenous factors such as oil prices, financial stress, and gold prices affect differently on clean energy stocks in the short and long run under different market conditions (normal, bearish, or bullish). Oil prices positively affect the USA and European clean energy markets under higher quantiles (bullish market condition) only in the long run; however, the relationships persist in all quantiles (all market conditions) in the short run.

Similarly, macroeconomic variables, energy price shocks, investor attention, and policy uncertainties affect stock prices differently across quantiles (Benkraiem et al. 2018; Hashmi and Chang 2021; Lee and Chen 2021). At lower quantiles of distribution, large negative fluctuations (oil price shocks or geopolitical risks) decrease the interest and investments of green investments (Lee et al. 2021). Therefore, assuming a linear relationship may produce biased estimates while analyzing the effect of exogenous variables on stock prices. Accordingly, analyzing the asymmetric effect of temperature, exchange rate, metals, and investor sentiments on solar energy prices in both the short and long run across low-high quantiles will provide a more holistic view of the underlying relationships.

Description of data

In order to determine the stock performance of Chinese solar energy firms, the top 10 solar energy firms were selected. Developing a composite index to estimate the performance of a financial market is a common practice (Lin 2018; Sun et al. 2019a). The composite index is also developed for electrical conductors (aluminum, copper, and silver) and rare metals (cadmium, germanium, indium, and selenium). While developing the index, we made sure that (1) there is a high but no negative correlation among variables to avoid conceptual issues (Becker et al. 2017), (2) the value of the Kaiser–Meyer–Olkin (KMO) test is greater than 0.6 to confirm sampling adequacy, (3) significant value of Bartlett’s sphericity test to verify independence among variables and aptness of factor analysis, and (4) rotated factor loading is at least 0.5.

One of the solar energy firms (i.e., Jinko Solar) with a negative correlation coefficient and lower factor loading was excluded while developing the solar stock performance index. Consequently, all three indexes show reliable KMO values (SESP = 0.785, RM = 0.882, EC = 0.831). The historical prices of solar energy firms, metals, and exchange rates were collected from investing.com while China volatility index from Fred’s economic database. The data on temperature is collected from National Centers for Environmental Information database. Owing to the unavailability of rare metals data, we restricted our time series from Mar 2017 to Oct 2021.

Econometric techniques

Quantile ARDL

This study employs QARDL by Cho et al. (2015) to investigate the nonlinear relationship between underlying variables. The method allows testing the cointegration relationship and asymmetries between non-ferrous metals, exchange rate, temperature, investor sentiments, and solar stock performance for China across the different grid of quantiles. Besides examining the long-term quantile equilibrium effect, the Wald test is applied to check time-varying integration and dependability parameters for both short- and long-term equilibrium.

Before moving to more advanced models, the conventional linear ARDL model is composed as follows:

where 𝜖𝑡 is the white noise error explained by the lowest field created by (SESPt, ECt, RMt, INVSt, EXRt, TEMPt, …), and p, q, m, n, r, and v are the lag orders selected by the Schwarz Info Criterion (SIC).

The quantile adjustments are made in the Eq. (2) to develop the QARDL framework in Eq. (3):

where \({\varepsilon}_t\left(\tau \right)={SESP}_t-{Q}_{SESP_t}\left({~}^{\tau }\!\left/ \!{~}_{{\varepsilon}_{t-1}}\right.\right)\) and 0 < τ < 1 is the quantile. The subsequent pair of quantiles τ belongs to (0.05, 0.10, 0.20, 0.30… 0.90, and 0.95) are utilized to perform data analysis. Additionally, a more inclusive QARDL model is inscribed in Eq. (4) due to the probability of sequential correlation in the white noise error.

In addition, Eq. (4) is transformed to develop a dynamic quantile error correction model of QARDL shown below:

where 𝜌 is the speed of adjustment which should be significant but negative. Based on ∆ technique, the collective short-term effect of the previous stock performance on the current stock performance is created by 𝛽∗ =\(\sum_{i=1}^{p-1}{\beta}_1\); however, the collective short-term effect of current and previous TEMP on the present stage of stock performance is captured as 𝛽∗ =\(\sum_{i=1}^{q-1}{\beta}_2\). The rest of the short-term effects of the explanatory variables are estimated with the same method. Lastly, we apply the Wald test to examine the short- and long-term asymmetric effect of non-ferrous metals, temperature, exchange rate, and investor sentiments on solar stock performance. The within and between the quantile boundaries on the short- and long-term coefficients can also be evaluated using the Wald test.

Granger-causality in Quantiles test

The Granger-causality in quantiles test is analyzed to observe the causality in the different grids of quantiles of solar stock performance and other explanatory variables. We have utilized Granger (1969) test to examine whether a variable is a precursor to another variable or not. The Granger causality test presumes that the current value of the regressand is influenced by itself and the lagged values of the explanatory variable. A variable 𝑋𝑖 does not Granger-cause other variable 𝑌𝑖 if previous 𝑋𝑖 does not support to estimate 𝑌𝑖, giving the previous 𝑌𝑖. To address the Granger-causality in quantiles, a modified version was developed by Troster (2018). We suppose that there is an explained vector \({\left({N}_i={N}_i^y{N}_i^x\right)}^{\prime }\)∈ ℝ𝑒, s = o + q, where \({N}_i^x\)is the past indication group of \({X}_i{N}_i^x:={\left({X}_{i-1},\dots, {X}_{i-q}\right)}^{\prime }\)∈ ℝq. The null hypothesis for Granger non-causality from Xi to Yi is inscribed as follows:

where \({F}_y\left(.|{N}_i^y,{N}_i^x\right)\) is the provisional distribution purpose of Yi if \({F}_y\left({N}_i^y,{N}_i^x\right)\) is dependent on Eq. 6. In tandem with the method of Troster (2018), the DT check is applied by organizing the QAR method (∙) for complete 𝜋 ∈ Γ ⊂ [0,1]. Accordingly, the null hypothesis for no Granger causality is described below:

where the coefficient 𝜕(𝜋) = 𝜆1(𝜋), 𝜆2(𝜋), and 𝜇𝑡 are estimated by the highest likelihood in an equal point of quantiles, and \({\varOmega}_{\gamma}^{-1}(.)\) is the opposite of a conventional basic distribution function. To ensure the causality between the underlying variables, the current study estimates the QAR method in Eq. (7) with lagged factor to alternative factor. Finally, QAR(1) model derived from Eq. (7) is formulated as follows:

Data analysis and discussion

The descriptive statistics for all underlying variables are given in Table 1. The findings indicate negative solar stock returns. The average solar stock returns were negative in the pre-pandemic period (Dutta 2019) which worsen during the Covid-19 pandemic (Yahya et al. 2021). Compared to metals and exchange rates, solar stocks are more volatile. The average temperature is around 67 °F which is ideal for the efficiency of PV panels. The average RMB/USD exchange rate is 6.73 with only 0.24 S.D. suggests persistent and asymmetric volatility after exchange rate reforms in China (Wu et al. 2020). Owing to the inclusion of the pandemic period, returns for both rare metals and electrical conductors show lower levels of returns. Additionally, the significant value of the Jarque-Bera test for all variables suggests opting for a non-linear econometric technique.

For further confirmation of non-linearity, the BDS test by Broock et al. (1996) (BDS) is applied to explore the residuals of the linear ARDL model. The results of the BDS non-linearity test are shown in Table 2. The findings suggest the rejection of the null hypothesis, confirming the strong evidence of a non-linear relationship.

Before estimating QARDL, the order of integration of the time series data is evaluated through unit root tests. Accordingly, we perform the Augmented Dickey-Fuller (ADF) test and Phillips Perron (PP) test and reported their results in Table 3. Owing to the unbalanced datasets, ADF and PP are utilized. The findings suggest that all variables are integrated at the order I(1) expect investor sentiments which is also stationary at I(0) level as per the PP test. The non-linearity, order of integration at I(1), and dynamic trend suggest the aptness of the QARDL model (He et al. 2021; Razzaq et al. 2021; Zhan et al. 2021).

The results of QARDL results for both long- and short-run estimates are reported in Tables 4 and 5, respectively. For better understanding, we categorize the quantiles from 0.05 to 0.30 as bearish market conditions, from 0.40 to 0.60 as stable or regular market conditions, and from 0.70 to 0.95 as bullish market conditions. The estimation parameter ρ is negative and significant in moderate (0.40 to 0.60) and high (0.70 to 0.95) quantiles. Since seven out of eleven quantiles are significant, it indicates a reversal toward the long-run equilibrium between solar energy stocks and explanatory variables. The results for rare metals show that their effect is positive, significant, and stronger in the long run when market conditions are either bullish (0.60 to 0.95) or bearish (0.10 to 0.30). On the other hand, in normal market conditions when sentiments are generally neutral, the RM effect is insignificant on solar energy stocks. In contrast, the stable market conditions are favorable to explain the RM-SESP relationship in the short run.

Our results can be partially supported by the findings of Song et al. (2021) who found strong interdependence between rare metals and clean energy stocks, especially during the recession period. Despite the availability of rare metals in different geographical regions, China enjoys a near-monopoly in supply. Additionally, China introduced a stringent export policy for rare metals at the end of the year 2010. When a country is an exporter of metal, the increase in metal price sends positive signals to the financial market (Gutierrez and Vianna 2020). On the other hand, electrical conductors significantly and positively influence solar energy stock performance when the market move from a stable to bullish market trend in both the long run (0.5 to 0.95) and short run (0.6 to 0.95). Following linear approaches, previous studies suggest that industrial metals (such as copper and aluminum) serve as a signal for a healthy global economy (Sockin and Xiong 2015). An increase in their prices predicts positive stock returns, especially in Asian equity markets (Hu and Xiong 2013). Our findings also elucidated that underlying metals do not have a safe haven or hedging properties against solar energy stocks compared to other industries/markets (Sakemoto 2018; Uyar et al. 2021; Mighri et al. 2022), rather their time-varying comovement in different market conditions indicates their strong interdependence.

For investor sentiments, the effect is negative in all quantiles for both short- and long-run estimations. Nonetheless, the empirical findings suggest that the effect is significant in the long run when bullish market conditions exist while sentiments affect solar energy stocks in the short run under extreme market conditions. Thus, it is suggested that likewise US VIX (Sarwar 2012; Dutta 2019), the Chinese VIX is also an investor fear gauge in the Chinese solar energy market. In the short run, enough evidence is available to support the significant effect of investor sentiments on stock returns (Li et al. 2017; Yahya et al. 2021). Our long-run findings are consistent with You et al. (2017) who estimated investor sentiments (measured by Twitter’s daily happiness) and stock returns’ predictability using quantile regression. They argued that investor sentiment shows no significant effect on the stock market when the market conditions are normal or bearish. It can also be argued that solar energy stocks with higher level of returns are more prone to investor sentiments compared to other firms with lower returns.

The significant impact of the exchange rate in the short-run varies across different quantiles; nonetheless, the effect is negative across all quantiles for both short- and long-run estimations. This evidence is consistent with the flow-oriented approach (Dornbusch and Fischer 1980). Especially when the market condition is moving toward either a bullish or bearish trend, the appreciation in RMB signals high-cost exports of solar technology/equipment leading to negative solar energy stock returns. Nonetheless, in the long run, this effect only holds for the recession period. Although this relationship is not assessed using quantile approaches, our evidence can be supported by Long et al. (2021a) who also revealed negative symmetric and asymmetric effects of the RMB exchange rate on China’s stock prices using ARDL and NARDL approaches.

Last but not least, the effect of temperature on solar stock returns is significant and negative in the short run under the bear phase only. Nonetheless, the effect expands to the normal market condition in the long run. From the behavioral finance perspective, temperature drifts as an anomaly in the capital market. Higher levels of temperature induce apathy leading to risk-aversion and negative returns (Cao and Wei 2005; Floros 2011). Nonetheless, previous studies argued that behavioral anomalies (including climatic effect) persist for a shorter period and under extreme market conditions (Woo et al. 2020), but in the case of solar energy stocks, the effect spills over to normal market conditions. It indicates that temperature is more pertinent to explaining the variability of solar stock performance.

Overall, the results of QARDL suggest that the effect of underlying variables is largely heterogeneous on solar stock returns in both the short and long run. The behavior of clean energy stocks differs from that of conventional securities. Therefore, metals cannot be considered a safe haven and good hedge for solar energy stocks. Nonetheless, they largely explain the variability in solar stock returns under different market conditions. On the other hand, the effect of temperature, exchange rate, and investor sentiments is negative but varies across different quantiles. Especially in the context of the bearish solar energy market, an increase in temperature largely affects the sales of PV solar panels which further reduces their stock returns. However, investor sentiments push the solar energy stocks downward when the market is bullish. Higher capital gains in the bullish market lead to higher volatility which induces herd behavior. Accordingly, the free-rider effect and market bubbles due to high volatility led to price adjustment (correction). Lastly, our findings suggest that the exchange rate has hedging properties against solar stocks under bullish and bearish markets for active traders. For passive management, the exchange rate can be a good hedge under a bearish market only.

After analyzing the QARDL, the Wald test is applied to examine the time-varying integration association that allows testing the consistency of integrated coefficients around the grid of quantiles. The findings of the Wald test reported in Table 6 show that the null hypothesis of linearity in the parameter adjustment speed is rejected. The null hypothesis of constancy in parameters for long-term integrating parameters βRM, βER, βINVS, βEXR, and βTEMP are also rejected at a 1% significance level, showing the dynamic nature of cointegrating parameters between the underlying variables.

The null parameter constancy of short-term influence for RM, EC, INVS, EXR, and TEMP is significantly rejected by the Wald test. The findings suggest the presence of asymmetric lagged and contemporaneous effects of all explanatory variables on solar energy stock performance in China. The quantile-wise Granger-causality test results are presented in Table 7. The findings further confirm the validity of QARDL estimates, as there is one-way causality running from all explanatory variables, i.e., ΔRM, ΔEC, ΔSESP, ΔINVS, ΔEXR, and ΔTEMP to solar stock performance (ΔSESP) at 1% significance level in all 11 quantiles. The causal relationship exists from ΔSESP to ΔRM when market conditions move to normal and bullish phases while the causality from ΔSESP to ΔEC exists in bullish market conditions only. This evidence shows stronger independence between SESP and rare metals compared to electrical conductors.

Conclusion and policy implications

This study is one of the preliminary attempts to explore the asymmetric relationship between temperature, metals (rare and electrical conductors), investor sentiments, exchange rate, and solar energy stocks performance in China by employing the quantile ARDL technique. The solar energy sector is one the most prominent and booming sources of green energy to address the challenges related to oil price shocks, climate change, and energy security. The main results indicate a significant short- and long-run association between temperature, metals, investor sentiments, exchange rate, and solar energy stocks’ performance in China. Although all our underlying variables are important pricing signals for the solar energy sector, the significant values differ across different quantiles depending on bullish, bearish, or normal market conditions. The increase in temperature, RMB exchange rate, and investor sentiments have a detrimental effect on solar energy stocks while the good performance of metals acts as a positive shock subsequently increasing solar stock prices.

Important policy implications can be derived from our empirical findings. It is essential to incorporate non-linear properties in the investment decision. The time-varying long- and short-term effect of metals, sentiments, temperature, and currency on solar energy stocks exhibit decision-making of investors based on heterogeneous market conditions. The positive relationship between metal prices and solar energy stock returns postulates limited hedging opportunities for investment in the solar energy sector. Although the RMB exchange rate appears to be a sufficient hedging tool against solar energy stocks, the government should optimally control the appreciation of RMB and speculative investment to prevent extensive shocks to the solar stocks. Furthermore, investors should give more attention to the investor sentiments when solar energy stocks are following the bullish trend. Since the temperature rise also affects solar stock returns even under normal market conditions in the longer run, it suggests investors pay special attention to extremely high temperatures while managing the portfolio of their solar stocks.

Future studies should consider other metals to check their hedging properties against solar stocks to successfully diversify the portfolio risk. The average temperature of Shanghai, Shenzhen, and Beijing is used that might not precisely reflect China’s climate trends. There are certain regions in China with more extreme temperatures. Employing the temperature of those regions may alter/robust the results. Future studies can also ensure the effect of other meteorological conditions on solar stocks including the cloud cover effect, average sunshine, precipitation, wind, and humidity.

Notes

Government of China supported green initiatives with around 1.13 trillion yuan in the form of green bonds and green credits in year 2018. However, the amount of finance and refinance received by Chinese green firms through the financial markets was merely 22.42 billion yuan. Thus, Chinese stock market is not proactive enough to extract benefits from green investments.

The performance of solar PV cells decreases with the increase in temperature due to increased internal carrier recombination rates, caused with increased carrier concentrations.

According to Silver Institute, around 20 g of silver is used in a solar panel. A paste is created by silver powder to load into a silicon wafer. Electrons are set free when light strikes the silicon and silver carries the power for instant consumption or pile it in batteries for future utilization.

Although other metals such as tellurium is also important raw material of PV technology and solar panels, the underlying metals are considered based on data availability.

References

Addoum JM, Ng DT, Ortiz-Bobea A (2020) Temperature shocks and establishment sales. Rev Financ Stud 33(3):1331–1366

Ahmad W (2017) On the dynamic dependence and investment performance of crude oil and clean energy stocks. Res Int Bus Financ 42:376–389

Akdag S, İskenderoglu Ö, Alola AA (2020) The volatility spillover effects among risk appetite indexes: insight from the VIX and the rise. Lett Spat Resour Sci 13(1):49–65

Ali S, Bouri E, Czudaj RL, Shahzad SJH (2020) Revisiting the valuable roles of commodities for international stock markets. Res Policy 66:101603

Aloui C (2007) Price and volatility spillovers between exchange rates and stock indexes for the pre-and post-euro period. Quant Finance 7(6):669–685

Al-Yahyaee KH, Mensi W, Sensoy A, Kang SH (2019) Energy, precious metals, and GCC stock markets: is there any risk spillover? Pac Basin Financ J 56:45–70

Andrews-Speed P (2020) China’s efforts to constrain its fossil fuel consumption. In: In The Palgrave Handbook of Managing Fossil Fuels and Energy Transitions. Springer, Cham, pp 109–137

Auboin M, Ruta M (2013) The relationship between exchange rates and international trade: a literature review. World Trade Rev 12(3):577–605

Bahmani-Oskooee M, Harvey H, Hegerty SW (2013) The effects of exchange-rate volatility on commodity trade between the US and Brazil. N Am J Econ Finance 25:70–93

Baker M, Wurgler J (2007) Investor sentiment in the stock market. J Econ Perspect 21(2):129–152

Bakirci K, Kirtiloglu Y (2022) Effect of climate change to solar energy potential: a case study in the Eastern Anatolia Region of Turkey. Environ Sci Pollut Res 29:2839–2852

Bansal R, Kiku D, Ochoa M (2016) Price of long-run temperature shifts in capital markets. Natl Bureau Econ Res (No. w22529)

Becker W, Saisana M, Paruolo P, Vandecasteele I (2017) Weights and importance in composite indicators: closing the gap. Ecol Indic 80:12–22

Benkraiem R, Lahiani A, Miloudi A, Shahbaz M (2018) New insights into the US stock market reactions to energy price shocks. J Int Financ Mark Inst Money 56:169–187

Bibi M, Khan MK, Shujaat S, Godil DI, Sharif A, Anser MK (2021) How precious metal and energy resources interact with clean energy stocks? Fresh insight from the novel ARDL technique. Environ Sci Pollut Res:1–14

Bleiwas DI (2010) Byproduct mineral commodities used for the production of photovoltaic cells. US Department of the Interior, US Geological Survey, Reston

Boako G, Alagidede IP, Sjo B, Uddin GS (2020) Commodities price cycles and their interdependence with equity markets. Energy Econ 91:104884

Bollerslev T, Osterrieder D, Sizova N, Tauchen G (2013) Risk and return: long-run relations, fractional cointegration, and return predictability. J Financ Econ 108(2):409–424

Branson WH, Henderson DW (1985) The specification and influence of asset markets. Handb Int Econ 2:749–805

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Econ Rev 15(3):197–235

Buttimer RJ, Hyland DC, Sanders AB (2005) REITs, IPO waves and long-run performance. Real Estate Econ 33(1):51–87

Cao M, Wei J (2005) Stock market returns: a note on temperature anomaly. J Bank Financ 29(6):1559–1573

Cheema MA, Man Y, Szulczyk KR (2020) Does investor sentiment predict the near-term returns of the Chinese stock market? Int Rev Financ 20(1):225–233

Chi L, Zhuang X, Song D (2012) Investor sentiment in the Chinese stock market: an empirical analysis. Appl Econ Lett 19(4):345–348

Cho JS, Kim T-H, Shin Y (2015) Quantile cointegration in the autoregressive distributed-lag modeling framework. J Econ 188(1):281–300

Chong TT-L, Lam T-H, Yan IK-M (2012) Is the Chinese stock market really inefficient? China Econ Rev 23(1):122–137

Cornelli F, Goldreich D, Ljungqvist A (2006) Investor sentiment and pre-IPO markets. J Financ 61(3):1187–1216

Creti A, Joëts M, Mignon V (2013) On the links between stock and commodity markets’ volatility. Energy Econ 37:16–28

Ding W, Mazouz K, Wang Q (2019) Investor sentiment and the cross-section of stock returns: new theory and evidence. Rev Quant Finan Acc 53(2):493–525

Dornbusch R, Fischer S (1980) Exchange rates and the current account. Am Econ Rev 70(5):960–971

Dubey S, Sarvaiya JN, Seshadri B (2013) Temperature dependent photovoltaic (PV) efficiency and its effect on PV production in the world–a review. Energy Procedia 33:311–321

Dutta A (2019) Impact of silver price uncertainty on solar energy firms. J Clean Prod 225:1044–1051

El Mays A, Ammar R, Hawa M, Abou Akroush M, Hachem F, Khaled M et al (2017) Improving photovoltaic panel using finned plate of aluminum. Energy Procedia 119:812–817

Elshkaki A, Graedel T (2013) Dynamic analysis of the global metals flows and stocks in electricity generation technologies. J Clean Prod 59:260–273

Farid S, Kayani GM, Naeem MA, Shahzad SJH (2021) Intraday volatility transmission among precious metals, energy and stocks during the COVID-19 pandemic. Res Policy 72:102101

Fizaine F (2013) Byproduct production of minor metals: threat or opportunity for the development of clean technologies? The PV sector as an illustration. Res Policy 38(3):373–383

Floros C (2011) On the relationship between weather and stock market returns. Stud Econ Financ 28(1):5–13. https://doi.org/10.1108/10867371111110525

Fonseka M, Rajapakse T, Richardson G (2019) The effect of environmental information disclosure and energy product type on the cost of debt: evidence from energy firms in China. Pac Basin Financ J 54:159–182

Godil DI, Sarwat S, Sharif A, Jermsittiparsert K (2020) How oil prices, gold prices, uncertainty and risk impact Islamic and conventional stocks? Empirical evidence from QARDL technique. Res Policy 66:101638

Gokmenoglu K, Eren BM, Hesami S (2021) Exchange rates and stock markets in emerging economies: new evidence using the Quantile-on-Quantile approach. Quant Finance Econ 5(1):94–110

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica: journal of the Econometric Society 37(3):424–438

Groenewold N (2004) The Chinese stock market: efficiency, predictability, and profitability. Edward Elgar Publishing, Camberley

Guo J (2018) Co-movement of international copper prices, China’s economic activity, and stock returns: structural breaks and volatility dynamics. Glob Financ J 36:62–77

Gürtürk M, Ucar F, Erdem M (2021) A novel approach to investigate the effects of global warming and exchange rate on the solar power plants. Energy 239:122344

Gutierrez JP, Vianna AC (2020) Price effects of steel commodities on worldwide stock market returns. N Am J Econ Finance 51:100849

Hall S, Hondroyiannis G, Swamy P, Tavlas G, Ulan M (2010) Exchange-rate volatility and export performance: do emerging market economies resemble industrial countries or other developing countries? Econ Model 27(6):1514–1521

Hammoudeh S, Mokni K, Ben-Salha O, Ajmi AN (2021) Distributional predictability between oil prices and renewable energy stocks: is there a role for the COVID-19 pandemic? Energy Econ 103:105512

Hashmi SM, Chang BH (2021) Asymmetric effect of macroeconomic variables on the emerging stock indices: a quantile ARDL approach. Int J Finance Econ. https://doi.org/10.1002/ijfe.2461

He X, Mishra S, Aman A, Shahbaz M, Razzaq A, Sharif A (2021) The linkage between clean energy stocks and the fluctuations in oil price and financial stress in the US and Europe?Evidence from QARDL approach. Resources Policy 72:102021

Hou J, Shi W, Sun J (2019) Stock returns, weather, and air conditioning. PLoS One 14(7):e0219439

Hu C, Xiong W (2013) The informational role of commodity futures prices. In: Apres le Deluge: Finance and the Common Good after the Crisis. University of Chicago Press, Chicago. http://www8.gsb.columbia.edu/rtfiles/finance/misc/Information_Commodity4_c.pdf. Accessed 20 Nov 2021

Jebran K, Iqbal A (2016) Dynamics of volatility spillover between stock market and foreign exchange market: evidence from Asian countries. Financ Innov 2(1):1–20

Ji Q, Li J, Sun X (2019) Measuring the interdependence between investor sentiment and crude oil returns: new evidence from the CFTC’s disaggregated reports. Financ Res Lett 30:420–425

Klein T, Todorova N (2021) Night trading with futures in China: the case of aluminum and copper. Res Policy 73:102205

Kocaarslan B, Soytas U (2021) Reserve currency and the volatility of clean energy stocks: the role of uncertainty. Energy Econ 104:105645

Koenker R, Bassett G Jr (1978) Regression quantiles. Econometrica: journal of the Econometric Society 46(1):33–50

Kong Q, Gou S (2019) A study on the synergistic change of non-ferrous metal futures and stock prices in China—based on the complex system synergy degree. In: MATEC Web of Conferences: EDP Sciences, 04009

Kumar S, Managi S, Matsuda A (2012) Stock prices of clean energy firms, oil and carbon markets: a vector autoregressive analysis. Energy Econ 34(1):215–226

Lee C-C, Chen M-P (2021) The effects of investor attention and policy uncertainties on cross-border country exchange-traded fund returns. Int Rev Econ Financ 71:830–852

Lee C-C, Lee C-C (2022) How does green finance affect green total factor productivity?Evidence from China. Energy Econ 107:105863

Lee C-C, Lee C-C, Li Y-Y (2021) Oil price shocks, geopolitical risks, and green bond market dynamics. N Am J Econ Finance 55:101309

Lee C-C, Xing W, Lee C-C (2022) The impact of energy security on income inequality: the key role of economic development. Energy 248:123564

Li H, Ma H, Xu Y (2015) How do exchange rate movements affect Chinese exports?—a firm-level investigation. J Int Econ 97(1):148–161

Li H, Guo Y, Park SY (2017) Asymmetric relationship between investors’ sentiment and stock returns: evidence from a quantile non-causality test. Int Rev Financ 17(4):617–626

Li J, Yu X, Luo X (2019) Volatility index and the return–volatility relation: intraday evidence from Chinese options market. J Futur Mark 39(11):1348–1359

Lin Z (2018) Modelling and forecasting the stock market volatility of SSE Composite Index using GARCH models. Futur Gener Comput Syst 79:960–972

Liu T, Hamori S (2021) Does investor sentiment affect clean energy stock? Evidence from TVP-VAR-based connectedness approach. Energies 14(12):3442

Liu F, Kang Y, Guo K, Sun X (2021) The relationship between air pollution, investor attention and stock prices: evidence from new energy and polluting sectors. Energy Policy 156:112430

Long S, Zhang M, Li K, Wu S (2021a) Do the RMB exchange rate and global commodity prices have asymmetric or symmetric effects on China’s stock prices? Financ Innov 7(1):1–21

Long W, Zhao M, Tang Y (2021b) Can the Chinese volatility index reflect investor sentiment? Int Rev Financ Anal 73:101612

Maghyereh A, Abdoh H (2021) The impact of extreme structural oil-price shocks on clean energy and oil stocks. Energy 225:120209

McKenzie MD (1999) The impact of exchange rate volatility on international trade flows. J Econ Surv 13(1):71–106

McMillan DG (2003) Non-linear predictability of UK stock market returns. Oxf Bull Econ Stat 65(5):557–573

McMillan DG (2005) Non-linear dynamics in international stock market returns. Rev Financ Econ 14(1):81–91

Mensi W, Al-Yahyaee KH, Kang SH (2017) Time-varying volatility spillovers between stock and precious metal markets with portfolio implications. Res Policy 53:88–102

Mighri Z, Ragoubi H, Sarwar S, Wang Y (2022) Quantile Granger causality between US stock market indices and precious metal prices. Res Policy 76:102595

Mishra S, Sharif A, Khuntia S, Meo MS, Khan SAR (2019) Does oil prices impede Islamic stock indices? Fresh insights from wavelet-based quantile-on-quantile approach. Res Policy 62:292–304

Moreno-Leiva S, Haas J, Junne T, Valencia F, Godin H, Kracht W et al (2020) Renewable energy in copper production: a review on systems design and methodological approaches. J Clean Prod 246:118978

Ni Z-X, Wang D-Z, Xue W-J (2015) Investor sentiment and its nonlinear effect on stock returns—new evidence from the Chinese stock market based on panel quantile regression model. Econ Model 50:266–274

Parsva P, Tang CF (2017) A note on the interaction between stock prices and exchange rates in Middle-East economies. Econ Res-Ekonomska istraživanja 30(1):836–844

Peng W, Lee C-C, Xiong K (2022) What shapes the impact of environmental regulation on energy intensity? New evidence from enterprise investment behavior in China. Environ Sci Pollut Res 1–18

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Piñeiro-Chousa J, López-Cabarcos MÁ, Caby J, Šević A (2021) The influence of investor sentiment on the green bond market. Technol Forecast Soc Chang 162:120351

Ping CK (2021) China’s Yuan hits strongest level in nearly three years [Online]. World Street J. Available: https://www.wsj.com/articles/chinas-yuan-hits-strongest-level-in-nearly-three-years-11621950836. Accessed 30 Dec 2021

Qadan M, Nama H (2018) Investor sentiment and the price of oil. Energy Econ 69:42–58

Qin F, Zhang J, Zhang Z (2018) RMB exchange rates and volatility spillover across financial markets in China and Japan. Risks 6(4):120

Qin L, Hou Y, Miao X, Zhang X, Rahim S, Kirikkaleli D (2021) Revisiting financial development and renewable energy electricity role in attaining China’s carbon neutrality target. J Environ Manag 297:113335

Razzaq A, Sharif A, Ahmad P, Jermsittiparsert K (2021) Asymmetric role of tourism development and technology innovation on carbon dioxide emission reduction in the Chinese economy: fresh insights from QARDL approach. Sustain Dev 29(1):176–193

Reboredo JC, Ugolini A (2018) The impact of twitter sentiment on renewable energy stocks. Energy Econ 76:153–169

Reboredo JC, Ugolini A (2020) Price spillovers between rare earth stocks and financial markets. Res Policy 66:101647

Sakemoto R (2018) Do precious and industrial metals act as hedges and safe havens for currency portfolios? Financ Res Lett 24:256–262

Sarwar G (2012) Is VIX an investor fear gauge in BRIC equity markets? J Multinatl Financ Manag 22(3):55–65

Shahsavari A, Akbari M (2018) Potential of solar energy in developing countries for reducing energy-related emissions. Renew Sust Energ Rev 90:275–291

Shahzad F (2019) Does weather influence investor behavior, stock returns, and volatility? Evidence from the Greater China region. Physica A: Stat Mech Appl 523:525–543

Shahzad SJH, Bouri E, Raza N, Roubaud D (2019) Asymmetric impacts of disaggregated oil price shocks on uncertainties and investor sentiment. Rev Quant Finan Acc 52(3):901–921

Sockin M, Xiong W (2015) Informational frictions and commodity markets. J Financ 70(5):2063–2098

Song Y, Ji Q, Du Y-J, Geng J-B (2019) The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ 84:104564

Song Y, Bouri E, Ghosh S, Kanjilal K (2021) Rare earth and financial markets: dynamics of return and volatility connectedness around the COVID-19 outbreak. Res Policy 74:102379

Sun C, Ding D, Fang X, Zhang H, Li J (2019a) How do fossil energy prices affect the stock prices of new energy companies? Evidence from Divisia energy price index in China’s market. Energy 169:637–645

Sun C, Jiang Z, Li W, Hou Q, Li L (2019b) Changes in extreme temperature over China when global warming stabilized at 1.5° C and 2.0° C. Sci Rep 9(1):1–11

Sun Y, Wu M, Zeng X, Peng Z (2021) The impact of COVID-19 on the Chinese stock market: sentimental or substantial? Financ Res Lett 38:101838

Troster V (2018) Testing for Granger-causality in quantiles. Econ Rev 37(8):850–866

Uyar SGK, Uyar U, Balkan E (2021) The role of precious metals in extreme market conditions: evidence from stock markets. Stud Econ Finance 39:63–78

Wan D, Xue R, Linnenluecke M, Tian J, Shan Y (2021) The impact of investor attention during COVID-19 on investment in clean energy versus fossil fuel firms. Financ Res Lett 43:101955

Wang E-Z, Lee C-C (2022) The impact of clean energy consumption on economic growth in China: is environmental regulation a curse or a blessing? Int Rev Econ Financ 77:39–58

Wang P, Chen L-Y, Ge J-P, Cai W, Chen W-Q (2019) Incorporating critical material cycles into metal-energy nexus of China’s 2050 renewable transition. Appl Energy 253:113612

Wang Q-J, Chen D, Chang C-P (2021) The impact of COVID-19 on stock prices of solar enterprises: a comprehensive evidence based on the government response and confirmed cases. Int J Green Energy 18(5):443–456

Weagley D (2019) Financial sector stress and risk sharing: evidence from the weather derivatives market. Rev Financ Stud 32(6):2456–2497

Woo K-Y, Mai C, McAleer M, Wong W-K (2020) Review on efficiency and anomalies in stock markets. Economies 8(1):20

Wu X, Zhu S, and Zhou J (2020). Research on RMB exchange rate volatility risk based on MSGARCH-VaR model. Discrete Dyn Nat Soc 2020

Wu Y, Lee C-C, Lee C-C, Peng D (2022) Geographic proximity and corporate investment efficiency: evidence from high-speed rail construction in China. J Bank Financ 140:106510

Xiong Z, Han L (2015) Volatility spillover effect between financial markets: evidence since the reform of the RMB exchange rate mechanism. Financ Innov 1(1):1–12

Xu M, Singh S (2021) China to add 55-65 GW of solar power capacity in 2021 -industry body [Online]. Reuters. Available: https://www.reuters.com/business/energy/china-add-55-65-gw-solar-power-capacity-2021-industry-body-2021-07-22/. Accessed 29 Dec 2021

Xu M, Stanway D (2019) China solar exports hit 58 GW in first three quarters of 2019 [Online]. Reuters. Available: https://www.reuters.com/article/us-china-solarpower-idUSKBN1Y906Z [Accessed]

Xu H-C, Zhou W-X (2018) A weekly sentiment index and the cross-section of stock returns. Financ Res Lett 27:135–139

Yahya F, Shaohua Z, Waqas M, Xiong Z (2021) COVID-induced investor sentiments and market reaction under extreme meteorological conditions: evidence from clean energy sector of Asia-Pacific. Problemy Ekorozwoju 16(1):7–15

Yoon S-M, Kang SH (2009) Weather effects on returns: evidence from the Korean stock market. Physica A: Stat Mech Appl 388(5):682–690

You W, Guo Y, Peng C (2017) Twitter’s daily happiness sentiment and the predictability of stock returns. Financ Res Lett 23:58–64

Yu M (2020) China will never manipulate its currency. In: In China-US Trade War and Trade Talk. Springer, Singapore, pp 253–254

Zaremba A, Kizys R, Raza MW (2020) The long-run reversal in the long run: insights from two centuries of international equity returns. J Empir Financ 55:177–199

Zhan Z, Ali L, Sarwat S, Godil DI, Dinca G, Anser MK (2021) A step towards environmental mitigation: do tourism, renewable energy and institutions really matter? A QARDL approach. Sci Total Environ 778:146209

Zhang L, Yu J, Sovacool BK, Ren J (2017) Measuring energy security performance within China: toward an inter-provincial prospective. Energy 125:825–836

Zhang H, Cai G, Yang D (2020) The impact of oil price shocks on clean energy stocks: fresh evidence from multi-scale perspective. Energy 196:117099

Zhao P, Lu Z, Fang J, Paramati SR, Jiang K (2020) Determinants of renewable and non-renewable energy demand in China. Struct Chang Econ Dyn 54:202–209

Acknowledgements

Chien-Chiang Lee is grateful to the Social Science Foundation of Jiangxi Province of China for financial support through Grant No. 21JL02.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study’s conception and design. Material preparation, data collection, and analysis were performed by Dr. C.C. Lee, Dr. Farzan Yahya, and Dr. Asif Razzaq. The first draft of the manuscript was written by Dr. C.C. Lee and Dr. Farzan Yahya. All authors read and approved the final manuscript

Data availability and materials

Data is available and can be provided upon request.

Corresponding author

Ethics declarations

Ethics approval

The manuscript should not be submitted to more than one journal for simultaneous consideration. Our research does not involve human participants or animals.

Consent to participate

Our study has used secondary data due to which no consent from individuals was required.

Consent for publication

We have not considered already published work. Thus, no related consent was required.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lee, CC., Yahya, F. & Razzaq, A. The asymmetric effect of temperature, exchange rate, metals, and investor sentiments on solar stock price performance in China: evidence from QARDL approach. Environ Sci Pollut Res 29, 78588–78602 (2022). https://doi.org/10.1007/s11356-022-21341-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21341-4