Abstract

People are increasingly paying much attention to battery technology, especially the zinc-nickel battery and the lithium battery, for solving energy shortages and environmental contamination. Meanwhile, the drastic change in the external outside environment has brought a huge challenge to manage the battery industry chain. Therefore, in the uncertain external environment, the study of supply chain competition between lithium battery and new nickel battery manufacturers is the focus of this paper. We build a cooperative game model under the demand disturbance and a non-cooperative game under the background of product promotion. The results show that (i) the price set by the manufacturer increases with technical improvement when consumers are more sensitive to the technical level. (ii) The optimal price of all manufacturers will drop as the CETRC (carbon emission technology renewal coefficient) increases. (iii) The price of zinc-nickel batteries will be higher than that of lithium battery as the market promotion rate is in the middle range. In the model, the supply chain determines different optimal prices according to the different ranges of the demand disturbance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

At present, energy shortage and environmental pollution are greatly challenging the survival of human beings. Fossil energy, as the main body of energy consumption, has limited reserves and is not renewable. According to BP Energy Statistical Year (2018), it is reported that the world’s crude oil reserves can be exploited by human beings for less than 50.2 years; meanwhile, the other kinds of traditional energy, such as gas and coal, are also facing a negative outlook. Worse still, the consumption and waste of energy are constantly increasing, and the problem of energy supply is extremely serious. Based on this background, the emergence of chemical power supply, especially batteries, has become the focus of attention, and it has great advantages in energy and power density, efficiency, and cost. In recent years, the demand for batteries has constantly been increasing. Batteries have greatly influenced the lifestyle, communication, transportation, and some other fields of modern people, applying widely wearable electronic devices, RFID devices, smart cards, and electric vehicles.

Among the existing batteries, lithium-ion batteries and zinc-nickel batteries are the power sources with strong competitiveness and development prospects. Rechargeable lithium battery derives from the concept of solid solution electrode and rocking chair battery proposed in the 1970s. Nowadays, the lithium-ion battery has become one of the most widely used power sources for many energy storage devices (such as wearable electronic devices, electric and hybrid vehicles, and fixed purpose devices). However, the shortage of lithium and cobalt has brought huge challenges to the mass production of lithium batteries. Also, the development of lithium-ion batteries has reached the upper limit of the technical level. Under such limitations, people turn their attention to a new type of high-energy power supply with high energy density, green, safe, and sustainable development to replace lithium-ion batteries for energy conversion and energy storage. As a kind of alkaline cell, zinc-nickel batteries have been widely applied in electronic components, fixed power supplies, and other fields. It has the advantages of low cost, high discharge voltage and energy density, large discharge current, green environmental protection, and so on.

Although zinc-nickel batteries have a promising future, lithium batteries still occupy a dominant position in the industrial pattern. There is a long way to go for zinc-nickel batteries to give full play to their advantages, expand their market share, and occupy a place in which the remodeling and management and the game strategies of different manufacturers are of crucial importance, especially under the background of the drastic change of exterior environments, such as 5G, sharing economy, low-carbon policy, trade protectionism, and Covid-19. How to make good use of the external environment, give full play to its advantages, avoid risks, and obtain advantages in the competition will become an important factor for the development of zinc-nickel batteries.

In addition, with the vigorous development of the mobile Internet, the task of product promotion has gradually shifted from retailers to third-party platforms or institutions. For example, the e-commerce platform not only provides consumers with product information but also provides businesses with advertising promotion and other services, just as domestic communication giants can provide advertising and promotion services for cooperative businesses through SMS push (short message service push). Through an accurate website and SMS push, we can dig deep into the target users, further explore the potential market demand, and enhance the competitiveness of this product. How to make good use of this promotion service in the competition will also become the top priority in the development of zinc-nickel batteries as a latecomer.

In this paper, we will establish the basic model of the non-cooperative game of three oligarchs under the background of product promotion and the cooperative game model under the fluctuations of demand. This paper focuses on the following questions:

-

(1)

the equilibrium strategy of the three oligarchs game in the basic model,

-

(2)

the effect of the cooperative promotion model on the equilibrium strategies of battery manufacturers, and

-

(3)

the effect of demand fluctuations on the equilibrium strategies of the three oligarchs.

The marginal contributions of this paper are as follows: First, this paper innovatively explores the game relationship between lithium battery manufacturers and new nickel battery manufacturers in the case of uncertain consumer demand and clarifies the changes in consumer game relationships in the uncertain environment. Second, this paper finds that for zinc-nickel battery manufacturers, an appropriate market promotion rate should be selected, while too high or too low market promotion rate may cause damage to profits, which provides a reference for new nickel battery manufacturers to set reasonable prices in practice.

Literature review

Zinc-nickel battery

The zinc-nickel battery studied in this paper has the advantages of being low-cost, high power density, and environmental-friendly and is considered to be one of the most potential electric vehicle batteries. In recent years, research on zinc-nickel battery have never halted, and breakthrough achievements have also been made. For instance, Meng et al. (2019) have succeeded in growing Zn Al LDHs/HC on hollow carbon spheres, showing large specific surface area and good mechanical stability, facilitating the deposition and growth of zinc, and the core–shell structure is beneficial to electrolyte diffusion. Meanwhile, the material takes hollow carbon spheres as the conductive substrate, organizes and forms a developed conductive network structure, and establishes an efficient and stable path for electron transport successfully. Chen and others designed 3D ZnO-Cu-C hybrid microspheres. There is copper decorating on the surface and internal in-situ carbon, forming a 3D penetrating conductive frame as the path for electron transport, and the external copper can also restrain the dissolution of active ingredients effectively. Such structure provides with large effective surface area, promoting the quick move of ions. Chen et al. (2019) prepared gel precursors and then prepared carbon-coated nano ZnO by heat treatment. The nano ZnO is combined with carbon physical cover, maintaining the efficient utilization of nano ZnO and also preventing the dendritic growth and densification of an anode, showing high electrochemical activity, low resistance, and high discharge capacity of 622 mAhg−1. Cui et al. (2018) prepared graphene/ZnO by physical method. In the process of charging and discharging, graphene cut Zn in situ and anchored zinc atoms, which effectively inhibited the dissolution of zinc oxide in an alkaline solution. In addition, carbon nanotube-coated zinc oxide was also synthesized (Cui et al. 2019). In this way, the reaction of zinc oxide with alkali liquor was prevented effectively.

Cooperative promotion

Some scholars have considered cooperative promotion in the research on the supply chain. Huang and Li (2001) studied the optimal advertising strategy of cooperative advertising between manufacturers and agents in the supply chain by applying the method of game theory; Zhou et al. (2018) studied the optimal cooperative advertising and ordering strategy of a two-level supply chain based on risk aversion preference. Chutani and Sethi (2018) analyzed the optimal advertising decision-making problem in a closed-loop supply chain when only one member of the supply chain invested in advertising. Lin and Shao (2014) studied the investment strategy of online advertising in the Internet environment. Karray (2015) studied two cooperative promotion strategies in the supply chain based on game theory. Karray et al. (2017) studied the cooperation effect of two competitive manufacturers and one retailer. Xie et al. (2017) studied the coordination contract considering cooperative advertising in a dual-channel closed-loop supply chain.

In terms of carbon quota and carbon trading, Ji et al. (2017) studied the O2O retailing supply chain in a low-carbon environment and set up three models including unlimited carbon trading, grandfather carbon trading, and benchmarking carbon trading. Research shows that benchmarking can effectively promote manufacturers to produce low-carbon products. Under the policy of quota and carbon trading, Xu et al. (2017) considered consumers’ preferences and manufacturer’s carbon emission reduction, set up the centralized decision-making and decentralized decision-making models, and coordinated the supply chain with a wholesale price contract, a cost-sharing contract, and two-part pricing contract. Yang et al. (2017) built two competitive supply chains in the context of carbon cap trading and explored the impact of its horizontal cooperation and vertical cooperation on carbon emission reduction. Li et al. (2018) considered the game model of carbon emission benchmark for government decision-making, analyzing how the manufacturers’ production decisions change with the change of government carbon trading policy under consumers’ carbon preference and technology upgrading. Wang et al. (2018) proposed a mechanism that considers carbon trading of fresh food supply chain and cold chain logistics services. Different from previous research, this one studied the carbon trading behaviors within the supply chain, revealing the relationship between carbon trading and logistic service and its influence on the cooperation between suppliers and retailers. Qian et al. (2020) considered retailers’ equity concerns in the context of carbon trading and set up the wholesale price contract and two pricing contracts, and the supply chain coordination is realized through the bargaining model. Results show that the intensification of equity issues will reduce the carbon emission reduction level of manufacturers. Ji et al. (2020) studied the impact of the inverse relationship between carbon trading price and carbon quota on supply chain production decisions, deduced the optimal carbon quota under a wholesale price contract and an income-sharing contract, and found that the social welfare performance of the two contracts is different under different environmental concern parameters.

Supply chain risk

The problem of supply chain risk has been widely concerned by academia for a long time. Kleindorfer and Saad (2005) believe that the risks affecting the operation and management of the supply chain are mainly divided into two types, namely, the risk caused by the uncoordinated supply and demand and the risk caused by the disruption of normal operation by emergencies. While as for emergence risk in the supply chain, Chopra and Sodhi (2004) pointed out that because of the characteristics of low occurrence probability and low predictability, emergencies are often ignored in practice and research. Emergency management in response to supply chain emergencies includes a variety of research directions, and disturbance management, which is closely related to the research focus of this paper, was first proposed by Clausen et al. (2010). In the research of supply chain emergency disturbance management, the existing literature has studied different supply chain modes, disturbance factors, emergency coordination mechanisms, and so on. Xiao et al. (2007) studied the decision-making of the supply chain composed of one manufacturer and two retailers after the sudden change of demand caused by emergencies and pointed out that the supply chain coordination after the production deviation cost can be realized by adjusting the quantity discount contract. Zhang et al. (2012) analyzed the coordination problem of multi-retailer competition in the supply chain under demand disturbance and proposed that emergency coordination can be carried out through revenue sharing contract. Ma and Xie (2016) took the duopoly air conditioning market under demand disturbance as the research object and analyzed the impact of disturbance on the dynamic game system. Xie et al. (2021) studied a two-echelon supply chain composed of buyers and sellers and buyers. Considering the buyer’s uncertain demand and income, the repurchase contract in the supply chain is studied, and the effects of income uncertainty and relative bargaining power on the performance of the repurchase contract are studied.

The evolutionary game of supply chain

In the end, related researches of this paper are on the evolutionary game of supply chain in a complex system. In actual economic activities, due to the complex environment, it is difficult for supply chain members to make completely rational decisions, while the nonlinear system dynamics model can be used to study the process of the dynamic game. Chen and Hu (2018) constructed a dynamic evolutionary game model of government and manufacturer time based on carbon tax and subsidy and analyzed the game behavior between manufacturer and government under dynamic and static carbon emission reduction policies. Tong et al. (2019) considered the carbon trading policy and consumers’ low-carbon preference, constructed the retailer-led Stackelberg game, and studied the equilibrium solution and stability of the evolutionary game. Zhang et al. (2019) constructed an evolutionary game model between the government and manufacturers under the background of carbon quota and carbon trading and studied the impact of government policies on the carbon trading market under the conditions of static carbon trading price and dynamic carbon trading price. The results show that when the government implements the static carbon trading price, the evolutionary game cannot achieve stability. Under the dynamic carbon trading price, there is a stable strategy. In the multi-channel recycling supply chain of duopoly manufacturers, Zhan et al. (2019) explored the impact of the carbon tax on manufacturers’ recycling and carbon emission reduction strategies, further constructed a multi-cycle dynamic game model, and analyzed the complex characteristics of bifurcation, chaos, and sensitivity. Bao et al. (2020) considered the government subsidy behavior and consumers’ low-carbon preference factors, studied the short-term and long-term game behavior of duopoly carmakers, and compared the optimal strategies under three game models (cooperation, noncooperation, and cost-sharing). Ma and Wu (2014) constructed a supply chain including strategic consumers, the government, and two manufacturers producing electric vehicles and fuel vehicles, respectively, and analyzed how subsidies and carbon emission constraints affect the operation of the supply chain based on an evolutionary game. Gao and Ma (2009) studied the complex dynamic behavior of a financial system. Through numerical simulation, the path of a singular non-chaotic attractor is found, the time-delay feedback system is considered, and the stability and Hopf bifurcation of the controlled system are studied. Xu and Ma (2021) established a solar photovoltaic supply chain including the government, utility grid, exclusive solar panel retailers, and households. The long-term equilibrium strategy of a nonlinear dynamic system is studied, and how the stability of equilibrium, conservative, and aggressive strategies affect the system is studied. Ma and Xu (2022) proposed a Stackelberg game model to investigate the competition between solar energy and traditional fossil energy under the regulation of renewable portfolio standards. The result shows that the government should enact a strict requirement instead of announcing a low requirement rate if a high punishment rate has already been implemented. Ma et al. (2020) studied the supply chain system composed of electric vehicles and fuel vehicles under policy intervention and analyzed and revealed the impact of government subsidies and carbon emission constraints on the operation of the supply chain system under different pricing time sequences. Ma and Xie (2016) studied a dual-channel supply chain including a single manufacturer and retailer, considering that the manufacturer has symmetrical or asymmetric channel attributes. Ma and Sun (2017), Lou and Ma (2018), and Ma and Sun (2017) established a mixed game model containing four oligarchs and studied the complexity of the system and the influence of parameters on the stability of the system (Zhu et al. 2021a, b).

Combing the existing literature is not hard to find as the world environment problem is becoming more and more serious, people’s attention to lithium battery and nickel batteries gradually improves, so clear under the background of demand uncertainty, lithium battery and zinc-nickel battery maker is very important for the competitive relationship, correctly how to coordinate the interest conflicts between the two, guide enterprises to realize win–win competition. Boosting sales of lithium battery and zinc-nickel battery is very important to reduce carbon emissions, so this article constructed the uncertain demand situation, the lithium battery manufacturers, and zinc-nickel battery manufacturers of the game model; combining with the evolutionary game theory to explore the long-term stability of the both under the condition of uncertainty, lithium battery manufacturer for practice and zinc-nickel battery maker gives reference to the decision-making.

Methodology

Basic model

Here, we consider a market structure in which there are competitions between two zinc-nickel battery manufacturers and one lithium battery manufacturer. We assume that all of them are able to adopt a price competition strategy. In addition, the manufacturers of zinc-nickel battery cooperate with China Mobile and other communication companies to expand their market influence. In this paper, we set subscript 1 to represent the lithium battery enterprise, referred to as lithium battery for short; subscripts 2 and 3 indicate zinc-nickel battery enterprises cooperating with China Mobile (Table 1).

Impacted by technology barriers, different manufacturers often take the form of non-technical cooperation in the competitive game. Among the three manufacturers, we set the actual technical level of lithium battery as \(l_{1}\), zinc-nickel No. 1 battery as \(l_{2}\), and zinc-nickel No. 2 battery as \(l_{3}\). Battery manufacturers can gain higher technology level with more investment, so the technology update function is as follows:

In formula (1), we set the basic battery level of lithium battery manufacturers when building the plant as \(l_{L}\), and the basic battery level of both Zn Ni batteries is \(l_{ZN}\), and \(l_{ZN} \geq l_{L}\). \(C_{Ii} \left( {i = 1,2,3} \right)\) is the investment capital in the technology of battery manufacturers. Here, we assume that the technology capital conversion rate of all enterprises is the same; set as \(\tau\) and \(\tau > 0\). It is not difficult to see that the higher the capital invested is, the higher the technical level of capital conversion will be.

In the battery market, we set the total market demand as a. Due to consumers’ preference for a zinc-nickel battery is different, we set it as θ, while the preference for a lithium battery is set as 1-2θ. The manufacturer’s battery price is set as \(p_{i}^{N} \left( {i = 1,2,3} \right)\), so that the manufacturers’ demand function is shown below, and \(q_{i}^{N} \left( {i = 1,2,3} \right)\) represents the market sales volume of each manufacturer:

In formula (2), the parameter \(\rho\) represents the market promotion rate of the two zinc-nickel manufacturers after they cooperate with China Mobile and \(\sigma\) represents the promotion degree of the zinc-nickel No. 1 battery manufacturer. Since the consumers can see the price of battery manufacturers intuitively, the price has a great influence on sales, and we set the influence coefficient of battery price on sales as \(\alpha_{1}\). Meanwhile, the technology level of the battery influences its product quality directly, so the batteries which can be used longer attract more consumers and, in turn, let the influence coefficient of battery technology on sales be \(\alpha_{2}\). Moreover, product price would also lead to consumption transfer of consumers to a large extent, which results in a cross-change of sales volume in price competition, and here, we set the sales cross coefficient of the three batteries due to price as β. So, manufacturers can attract more consumers by setting different prices.

In the marketing process, average battery costs vary from manufacturer to manufacturer; we set it as \(c_{i} \left( {i = 1,2,3} \right)\). In order to encourage the manufacturers to improve quality and service efficiency and prolong the service life, governments will offer subsidies according to their technology and the subsidy rate is \(r\). Besides, in order to deal with global climate issues, governments often adopt a series of carbon limitation policies, restricting the carbon emission of enterprises. Accordingly, we set the carbon limit given by the government to enterprises as \(E\), and the basic unit carbon emission of each lithium battery is \(e_{L}\), and that of zinc-nickel battery is \(e_{ZN}\), and the unit carbon price is set as \(p_{e}\). Meanwhile, an improvement in technology can enhance the green degree of battery production and reduce carbon emission to some extent, so we set it as the carbon emission technology renewal coefficient \(\gamma\). Due to the cooperation between zinc-nickel No. 1 battery manufacturer and China Mobile, the battery manufacturer will pay a certain fee according to the promotion rate to China Mobile, and the cost rate of promotion and transformation is set as \(\varepsilon\). Thus, we can get the profit function of three manufacturers:

Equilibrium strategy

Two zinc-nickel battery manufacturers and a lithium battery manufacturer make the optimal price at the same time. By deriving the prices of the three manufacturers according to formulas (2) and (3):

Let \(\frac{{\partial \pi_{1}^{N} }}{{\partial p_{1}^{N} }} = 0\), \(\frac{{\partial \pi_{2}^{N} }}{{\partial p_{2}^{N} }} = 0\), \(\frac{{\partial \pi_{2}^{N} }}{{\partial p_{2}^{N} }} = 0\), the price equilibrium strategy can be obtained as follows:

See the Appendix for the proof of optimality of the price equilibrium.

Model analysis

Lemma 1: As for lithium manufacturers, when \(\alpha_{2} > e_{l} p_{e} \left( {\alpha_{1} + \beta } \right)\gamma\), \(p_{1}^{N}\) increases with the increase of \(l_{1}^{N}\); otherwise, it decreases. For zinc-nickel battery manufacturers who promote cooperation, when \(\alpha_{2} > \frac{{e_{z} p_{e} \left( {\alpha_{1} + \beta } \right)\gamma }}{1 - \varepsilon \rho \sigma }\), \(p_{2}^{N}\) increases with the increase of \(l_{2}\); otherwise, it decreases. For zinc-nickel battery manufacturers who do not promote cooperation, when \(\alpha_{2} > \frac{{e_{z} p_{e} \left( {\alpha_{1} + \beta } \right)\gamma }}{1 - \varepsilon \rho + \varepsilon \rho \sigma }\), \(p_{3}^{N}\) increases with the increase of \(l_{3}\); otherwise, it decreases.

Proof:

The following formula can be obtained by deriving \(l_{1}^{N}\) from \(p_{1}^{N}\) in formula (7):

It is easy to get that the denominator is positive. In the numerator, when \(\alpha_{2} > e_{l} p_{e} \left( {\alpha_{1} + \beta } \right)\gamma\), the original formula is greater than 0, namely, \(p_{1}^{N}\) increases with the increase of \(l_{1}^{N}\); otherwise, it decreases.

The following formula can be obtained by deriving \(l_{2}\) from \(p_{2}^{N}\) in formula (7):

\(\varepsilon\), \(\rho\), \(\sigma\) are all greater than 0 and less than 1, so \(- 1 + \varepsilon \rho \sigma < 0\), and therefore, the denominator is less than 0 and \(\alpha_{2}\) is negative. Namely, when \(\alpha_{2} > \frac{{e_{z} p_{e} \left( {\alpha_{1} + \beta } \right)\gamma }}{1 - \varepsilon \rho \sigma }\), \(p_{2}^{N}\) increases with the increase of \(l_{2}\); otherwise, it decreases.

The following formula can be obtained by deriving \(l_{3}\) from \(p_{3}^{N}\) in formula (7):

Similarly, when \(\alpha_{2} > \frac{{e_{z} p_{e} \left( {\alpha_{1} + \beta } \right)\gamma }}{1 - \varepsilon \rho + \varepsilon \rho \sigma }\), \(p_{3}^{N}\) increases with the increase of \(l_{3}\); otherwise, it decreases.

Lemma 1 gives the relationship between different manufacturers’ technical level, the impact of technology on sales, and the optimal price. It can be seen that for every battery manufacturer, when technology has a great influence on sales, or when consumers are sensitive to the technical level, the price set by the manufacturer will increase with the improvement of its technical level. However, when technology has little influence on sales, or consumers are less sensitive to the technical level, the price set by manufacturers decreases with the improvement of their technical level. Therefore, in order to realize the positive incentive of technology level to price, we should actively publicize and cultivate consumers' sensitivity to technology level.

Lemma 2: \(\frac{{\partial p_{1}^{N} }}{\partial \theta } < 0\), \(\frac{{\partial p_{2}^{N} }}{\partial \theta } > 0\), \(\frac{{\partial p_{3}^{N} }}{\partial \theta } > 0\); \(\frac{{\partial p_{1}^{N} }}{\partial \gamma } < 0\), \(\frac{{\partial p_{2}^{N} }}{\partial \gamma } < 0\), \(\frac{{\partial p_{3}^{N} }}{\partial \gamma } < 0\).

Proof:

Let \(p_{1}^{N}\), \(p_{2}^{N}\), and \(p_{3}^{N}\) in formula (7) take a deviation of \(\theta\) and get.

\(\frac{{\partial p_{1}^{N} }}{\partial \theta } = - \frac{2a}{{2\alpha_{1} + 3\beta }} > 0\), \(\frac{{\partial p_{2}^{N} }}{\partial \theta } = \frac{{\partial p_{3}^{N} }}{\partial \theta } = \frac{a}{{2\alpha_{1} + 3\beta }} > 0\); Lemma 2 is proven.

Let \(p_{1}^{N}\), \(p_{2}^{N}\), and \(p_{3}^{N}\) in formula (7) take a deviation of \(\gamma\) and get

The denominator is less than zero. In the numerator, \(l_{3} - l_{3} \varepsilon \rho \sigma > 0\) and \(l_{2} + l_{2} \varepsilon \rho \left( { - 1 + \sigma } \right) > 0\) can be easily gotten, namely, \(e_{z} \beta \left( {l_{2} + l_{3} + l_{2} \varepsilon \rho \left( { - 1 + \sigma } \right) - l_{3} \varepsilon \rho \sigma } \right) > 0\),\(- 1 + \varepsilon \rho + \varepsilon^{2} \rho^{2} \left( { - 1 + \sigma } \right)\sigma < 0\),\(- e_{l} l_{1} \left( {2\alpha_{1} + \beta } \right)\left( { - 1 + \varepsilon \rho + \varepsilon^{2} \rho^{2} \left( { - 1 + \sigma } \right)\sigma } \right) > 0\), so we can get \(\frac{{\partial p_{1}^{N} }}{\partial \gamma } < 0\),\(\frac{{\partial p_{2}^{N} }}{\partial \gamma } = \frac{{p_{e} \left( {\alpha_{1} + \beta } \right)\left( {e_{l} l_{1} \beta \left( {1 - \varepsilon \rho - \varepsilon^{2} \rho^{2} \left( { - 1 + \sigma } \right)\sigma } \right) + e_{z} \left( {l_{2} \left( {2\alpha_{1} + \beta } \right)\left( {1 + \varepsilon \rho \left( { - 1 + \sigma } \right)} \right) + l_{3} \beta \left( {1 - \varepsilon \rho \sigma } \right)} \right)} \right)}}{{2\alpha_{1} \left( {2\alpha_{1} + 3\beta } \right)\left( {1 + \varepsilon \rho \left( { - 1 + \sigma } \right)} \right)\left( { - 1 + \varepsilon \rho \sigma } \right)}}\),\(\frac{{\partial p_{3}^{N} }}{\partial \gamma } = - \frac{{p_{e} \left( {\alpha_{1} + \beta } \right)\left( {e_{l} l_{1} \beta \left( { - 1 + \varepsilon \rho + \varepsilon^{2} \rho^{2} \left( { - 1 + \sigma } \right)\sigma } \right) + e_{z} \left( {l_{2} \beta \left( { - 1 + \varepsilon \rho - \varepsilon \rho \sigma } \right) + l_{3} \left( {2\alpha_{1} + \beta } \right)\left( { - 1 + \varepsilon \rho \sigma } \right)} \right)} \right)}}{{2\alpha_{1} \left( {2\alpha_{1} + 3\beta } \right)\left( {1 + \varepsilon \rho \left( { - 1 + \sigma } \right)} \right)\left( { - 1 + \varepsilon \rho \sigma } \right)}}\). Similarly, \(\frac{{\partial p_{2}^{N} }}{\partial \gamma } < 0\), \(\frac{{\partial p_{3}^{N} }}{\partial \gamma } < 0\) can easily be gotten from the two formulas above.

According to Lemma 2, the greater the consumer preference for the zinc-nickel battery is, the higher the price of the zinc-nickel battery and the lower the price of lithium battery will be. With the improvement of the carbon emission technology renewal coefficient, the optimal prices of the three battery manufacturers will decrease. Due to the improvement of emission technology renewal coefficient, the green degree of products will be improved, which will further reduce carbon emissions, reduce the cost of products, and reduce the price of products.

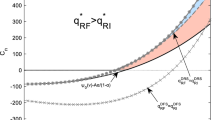

Lemma 3: (1) When \(\rho_{1} < \rho < \rho_{2}\), \(p_{1}^{N} < p_{2}^{N}\); otherwise \(p_{1}^{N} > p_{2}^{N}\).

(2) When \(\rho_{3} < \rho < \rho_{4}\), \(p_{1}^{N} < p_{3}^{N}\); otherwise, \(p_{1}^{N} > p_{3}^{N}\).

Proof:

Subtract \(p_{2}^{N}\) and \(p_{3}^{N}\) from \(p_{1}^{N}\) in formula (7):

It is easy to get that the numerator of \(p_{1}^{N} - p_{2}^{N}\) is a quadratic function about market promotion rate, and \(a\varepsilon \left( { - \sigma - \sigma^{2} } \right)\), the quadratic term coefficient is negative, while the denominator of \(p_{1}^{N} - p_{2}^{N}\), \(\left( {2\alpha_{1} + 3\beta } \right)\left( { - 1 + \varepsilon \rho \sigma } \right)\), is always negative. As a result, it is a quadratic function with the opening upward for the numerator. Therefore, we can draw the conclusion that when the market promotion rate is in the range between two solutions, \(p_{1}^{N} < p_{2}^{N}\). If the difference is zero, we can get \(\rho_{1}\) and \(\rho_{2}\). Similarly, we can further analyze the contrast between \(p_{1}^{N}\) and \(p_{3}^{N}\).

Lemma 3 shows the influence of the market promotion rate on the price comparison of lithium battery and zinc-nickel battery. When the marketing rate is in the middle range, the price of the zinc-nickel battery will be higher than that of the lithium battery, and a higher or lower marketing rate will reduce the market competitiveness of the zinc-nickel battery. Therefore, an appropriate degree of market promotion should be selected.

Numerical simulation

Since the profit expression of great complexity, which is hard to analyze, here, it will be analyzed by numerical simulation in this section. First, according to the previous value of related research, assign the following values to the relevant parameters:

Market promotion rate

The influence of the marketing rate on the profit of battery manufacturers under different promotion degrees is shown in Fig. 1. It can be seen that the profit of zinc-nickel battery manufacturers increases with the promotion of the market-promoting rate, while that of the lithium battery manufacturers is the opposite. Meanwhile, under different promotion degrees, the influence of marketing rate on profit is different. That is to say, the higher the promotion degree of zinc-nickel battery manufacturers is, the greater the impact will be. The above conclusion shows that zinc-nickel battery manufacturers are supposed to strengthen the cooperation with China Mobile and improve the marketing rate to increase profits. Moreover, they should also improve promotion extent in order to gain more advantages in the competition of zinc-nickel battery.

The impact of the marketing rate on the profits of battery manufacturers under different promotion rates is shown in Fig. 2. It can be seen that although the profit of zinc-nickel battery is increasing with the improvement of the market promotion rate, the profit of zinc-nickel battery manufacturers will be affected if the rate of cooperative promotion continues to increase. By comparing the three pictures, we can draw the conclusion that the rate of cooperative promotion has a greater impact on zinc-nickel battery manufacturer 3 than on zinc-nickel battery manufacturer 2. Thus, the zinc-nickel battery manufacturers should control the corresponding cooperation rate to avoid affecting their own profits.

Carbon emission reduction technology renewal coefficient

Under different unit carbon prices, the influence of carbon emission reduction technology update coefficient on battery manufacturers’ profits is shown in Fig. 3. It can be seen that with the increase in carbon emission reduction technology renewal coefficient, the profits of the three battery manufacturers are increasing. At the same time, with the increase of unit carbon price, the renewal coefficient of carbon emission reduction technology has a greater impact on zinc-nickel battery, and its profit and lithium battery profit are gradually decreasing. Therefore, with the continuous improvement of the carbon emission reduction market, the advantages of the zinc-nickel battery will become increasingly prominent.

Demand disturbance model

In this section, the demand fluctuations are considered. Demand fluctuation refers to the sudden increase or decrease of product demand caused by sudden time. If demand fluctuates obviously in the short term, a serious supply chain bullwhip effect might be triggered under the further promotion of poor information transmission in the supply chain, and in turn, there will be a loss of customers or unsalable products in the enterprises in the supply chain. In recent years, the 3C electronic products and new energy automobile industry are booming, so the demand for batteries is increasing, but there are uncertain factors behind the stable increase of the market. For instance, in terms of policy, the extension or cessation of national subsidies for new energy vehicles will promote or inhibit the total market demand for new energy vehicles. In terms of technology, a series of security problems with certain new energy vehicles will lead consumers to take a wait-and-see attitude toward new energy vehicles again, further decreasing the total demand for batteries. On the aspect of trade, the rise of international trade protectionism and populism has hindered cross-border trade and further caused demand fluctuations. As a consequence, we set total market demand as \(a\). However, the overall market demand of the battery industry tends to fluctuate due to the impact of sudden factors such as epidemic situation, trade protectionism, or policies. We set demand fluctuation as \(\Delta a\). When demand disturbance promotes the development of the battery industry, \(\Delta a > 0\), while when demand disturbance is a brake on the development of the battery industry, \(\Delta a < 0\), assuming that \(\Delta a > - a\). When there is an emergence in the market, we assume the three manufacturers will unite to form a unified price decision, that is, centralized decision-making. The demand expressions of the three manufacturers are as follows.

Make \((Q^{ \sim } - Q^{*} )^{ + } = \max \{ 0,Q^{\sim } - Q^{*} \} ,(Q^{*} - Q^{ \sim } )^{ + } = \max \{ 0,Q^{*} - Q^{ \sim } \}\) to represent the adjustment amount of the total production of the supply chain when the total market demand increases and decreases, respectively. The actual demand is \(Q^{ \sim } = q_{1}^{D} + q_{2}^{D} + q_{3}^{D}\), and the planned demand is the total demand after the balanced price is brought in in the previous section.

So that the profit function after disturbance can be shown as

Now, the total profits of the three manufacturers are

When the actual demand is over the planned demand, that is, \(Q^{ \sim } \geq Q^{*}\), the profit function of the supply chain is

\(u_{1}\) represents the out-of-stock cost of the whole supply chain.

When the planned demand is over the actual demand, that is, \(Q^{ \sim } < Q^{*}\), the profit function of the supply chain is

\(u_{2}\) represents the inventory cost of the whole supply chain.

Equilibrium strategy

In case of an emergency, the three battery manufacturers cooperate to determine the battery price jointly; that is, the decision-making goal is to maximize the total profit of the supply chain. This section will discuss and derive solutions for cases \(Q^{ \sim } \geq Q^{*}\) and \(Q^{ \sim } < Q^{*}\), respectively.

When \(Q^{ \sim } \geq Q^{*}\), the optimal decision-making problem of the supply chain can be expressed as

Since \(\frac{{\partial^{2} \pi_{D} }}{{\partial (p_{d} )^{2} }} = 2\left( {\alpha_{1} - \beta } \right)\left( { - 3 + \varepsilon \rho } \right) < 0\), \(\pi_{D}\) is a concave function of \(p_{d}\), and the constraints are linear inequality constraints. The above optimization problems can be solved according to KKT conditions:

When \(Q^{ \sim } < Q^{*}\), the optimal decision-making problem of the supply chain can be expressed as

The above optimization problems can be solved according to KKT conditions:

Lemma 4:

When \(\Delta a < \Delta a_{2}\),\(p_{d} { = }p_{{_{d(\lambda = 0)} }}^{2}\).

When \(\Delta a_{2} < \Delta a < \Delta a_{1}\),\(p_{d} { = }p_{{_{d(\lambda > 0)} }}^{1} = p_{{_{d(\lambda > 0)} }}^{2}\).

Whe n \(\Delta a_{1} < \Delta a\),\(p_{d} { = }p_{{_{d(\lambda = 0)} }}^{1}\).

Among them

Proof:

For Lemma 4, firstly, according to the calculation results in the previous section and the assumptions in this section, we can get.

Among them.

\(T = a + \left( {l_{1}^{N} + l_{2} + l_{3} } \right)\alpha_{2} + \left( {\alpha_{1} - \beta } \right)\left( { - c1 - c2 - c3 + p_{e} \left( {e_{l} \left( { - 1 + l_{1}^{N} \gamma } \right) + \frac{{e_{z} \left( { - 1 + l_{3} \gamma } \right)}}{{1 + \varepsilon \rho \left( { - 1 + \sigma } \right)}} + \frac{{e_{z} - e_{z} l_{2} \gamma }}{ - 1 + \varepsilon \rho \sigma }} \right)} \right)\) When \(\lambda = 0\), the total profit of the supply chain obtains the first-order derivative of the price, and the derivative function is 0 to obtain the optimal price at this time:

When \(\lambda > 0\), let \(Q^{\sim } - Q^{*} = 0\), and get the optimal price:

Bring the optimal price \(p_{d}\) in \(\frac{{\partial \pi_{D} }}{{\partial p_{d} }} + \lambda \frac{{\partial (Q^{\sim } - Q^{*} )}}{{\partial p_{d} }} = 0\), and get the value of \(\lambda\):

Due to \(\lambda > 0\), the \(\Delta a\) satisfies

Similarly, we can get \(p_{{_{d(\lambda = 0)} }}^{2}\), \(p_{{_{d(\lambda > 0)} }}^{2}\), and \(\Delta a_{2}\).

According to Lemma 4, when the demand disturbance is in different ranges, the optimal price of supply chain decision-making is not the same, which is divided into three different regions according to the size of the supply chain. At that time, the original production plan of the supply chain could not meet the increased market demand after the disturbance, and the battery manufacturer needs to increase the output to improve the profits of the supply chain temporarily. At that time, the original production plan of the supply chain greatly exceeded the reduced market demand after the disturbance, and battery manufacturers needed to temporarily reduce production to improve the profits of the supply chain. Finally, when the disturbance is satisfied, the manufacturer only needs to complete the production according to the original plan, in which way the unnecessary replenishment costs and processing costs could be avoided. The manufacturer only needs to adjust the sales price to maximize the profit of the supply chain.

Numerical simulation

According to the calculation results in the previous section, this section will bring conduct numerical values to carry out a numerical simulation analysis of optimal supply chain pricing strategies and profit under demand disturbance. In order to be consistent with the previous analysis, the assignment of this section is the same as the previous one, that is,

Different from the previous section, in this section, we assign the out-of-stock cost and inventory cost of the supply chain. In the following, we will focus on the analysis of supply chain pricing, that is, the impact of profit under the changes in total market demand, inventory cost, and out-of-stock cost.

According to Lemma 4, the change in inventory cost and out-of-stock cost will affect the price decision in the supply chain. The impact of the change in inventory cost and out-of-stock cost on the change threshold of total market demand, \(\Delta a_{1}\) and \(\Delta a_{2}\), is shown in Fig. 4. The out-of-stock cost, \(u_{1}\), has an influence on \(\Delta a_{1}\), and the inventory cost, \(u_{2}\), has an influence on \(\Delta a_{2}\). It can be seen that \(\Delta a_{1}\) increases generally with the rise of \(u_{1}\), while \(\Delta a_{2}\) decreases generally with the rise of \(u_{2}\). Thus, the rise in inventory cost and out-of-stock cost will expand the \(\Delta a_{2} < \Delta a < \Delta a_{1}\) area among the three. In this area, the supply chain will make the planned demand equal to demand after disturbance by changing the price. So, the high inventory cost and out-of-stock cost will make the supply chain increasingly ignore the changes in market demand and, in turn, produce according to original plans.

Figure 5 displays the influence of the total change in market demand on supply chain prices. According to Lemma 4, the influence of the total change of market demand on price is a piecewise function, so this figure shows the three periods of influence of demand disturbance. With the rise of demand disturbance, the optimal price of the supply chain is constantly rising. In the opposite stage, when the actual demand is greater than the planned demand, the growth of demand disturbance has the same effect on the change of price, while when the actual demand is equal to the planned demand, the influence of demand disturbance on price change is obviously higher than the other two stages. In short, when the demand disturbance is in a moderate region, the optimal price sensitivity of the supply chain is higher.

Figure 6 describes the change in the optimal price of the supply chain under different out-of-stock costs and inventory costs. When the inventory rises, the optimal price decreases in the region of \(\Delta a < \Delta a_{2}\), while when the out-of-stock costs rise, the optimal price decreases in the region of \(\Delta a_{1} < \Delta a\). As a result, out-of-stock cost and inventory cost have different effects on the optimal price of the supply chain. The increase in inventory cost will reduce the optimal price. The increase in out-of-stock cost will increase the optimal price.

Figure 7 depicts the change in supply chain profit caused by demand disturbance. The variation diagram of the total profit of the supply chain disturbed by demand is still composed of a piecewise function. It can be seen from the figure that with the increase in demand disturbance value, the profit of the supply chain is increasing.

Figure 8 then compares the supply chain profits under different shortage costs and inventory costs. Figure 8a shows that the profit of the supply chain decreases when the inventory cost increases and the out-of-stock cost remains unchanged, and Fig. 8b shows that the profit of the supply chain also decreases when the out-of-stock cost increases and the inventory cost remains unchanged. The difference is that different costs will affect the supply chain profit in different regions. Inventory cost affects the supply chain profit in the region with small demand disturbance, while shortage cost affects the supply chain profit in the region with large demand disturbance.

Evolutionary game model

In the game of the basic model, it is assumed that the members of the supply chain are completely rational, and they would not be disturbed by the exterior environment. Now, all the members of the supply chain reach the optimal solution directly, but one cycle game does not have long-term effectiveness. In the evolutionary game, the supply chain members who participate in the game are affected by incomplete information and an uncertain environment, and they can only make limited-rational decisions. That is, the players are not completely forward-looking, making the system reach equilibrium gradually rather than once. Each participant will gradually adjust his decision variables to the equilibrium point according to a certain adjustment speed.

In the evolutionary game model, the battery manufacturer adjusts to the optimal price according to the sales price of the previous period, which forms a complex system. Meanwhile, it can be seen that the decision-making process is a Markov process, including three decision variables, \(p_{1(t)}^{N}\), \(p_{2(t)}^{N}\), \(p_{3(t)}^{N}\), and in turn, the discrete system dynamic model can be constructed according to the process of state transition:

\(v_{1}\) represents the price adjustment speed of lithium battery manufacturers; \(v_{2}\) represents the price adjustment speed of No.1 zinc-nickel battery manufacturers; \(v_{3}\) represents the price adjustment speed of No.2 zinc-nickel battery manufacturers.

Next, the system stability of the model will be analyzed. Firstly, the Jacobian matrix of the dynamic system is solved as follows:

The specific stable point of the system is solved by bringing in relevant numerical values:

Bring the parameters in the Jacobian matrix, and get the coefficients of characteristic polynomials as follows:

According to the Jury criterion, when the characteristic polynomial above satisfies the constraint conditions below, the system enters a stable state.

In this paper, the stability region of the system under the change of adjustment speed is drawn by using Mathematica software according to the restraining conditions above. As shown in Fig. 2, the three coordinates respectively represent the adjustment speed of the sales price level of the three battery manufacturers, and the region surrounded by the yellow curved surface is the stability region of the system. When the adjustment speed is in the stable region, there is a stable solution to the manufacturers’ multi-cycle game. However, when the adjustment speed is beyond the stability region, the system would lose stability and enter a period of doubling bifurcation state or chaotic state. This phenomenon shows that in order to make the market enter an orderly and balanced state, battery manufacturers should control the adjustment speed of decision variables within a certain range.

The 3D Fig. 9 directly shows the adjustment speed stability region of the long-term game of the three battery manufacturers. In order to analyze the specific effect of adjustment speed on the long-term game in detail, this paper makes a detailed analysis in the form of a bifurcation diagram by using MATLAB software. The specific methods are as follows: The system is iterated continuously under different adjustment speed values, and then the strategy changes after a certain number of iterations are drawn into a scatter diagram.

Figure 10 shows the influence of the sales price adjustment speed of lithium battery manufacturers, \(v_{1}\), on manufacturers’ sales price decision, and \(v_{2} { = }0.1\), \(v_{3} { = }0.1\). When \(v_{1} { = }0.19\), the sale prices of the two manufacturers remain unchanged; when \(0.19 < v_{1} < 0.24\), the system enters the double period bifurcation state; when \(0.24 < v_{1} < 0.249\), the system enters the quadruple period bifurcation state; when \(0.249 < v_{1}\), the system falls into chaos.

Figure 11 shows the influence of the sales price adjustment speed of No.1 zinc-nickel battery manufacturers, \(v_{2}\), on manufacturers’ sales price decision, and \(v_{1} { = }0.1\),\(v_{3} { = }0.1\). When \(v_{2} < 0.215\), the sale prices of the two manufacturers remain unchanged; when \(0.215 < v_{2} < 0.31\), the system enters the double period bifurcation state; when \(0.31 < v_{2} < 0.323\), the system enters the quadruple period bifurcation state; when \(v_{2} > 0.323\), the system falls into chaos.

Figure 12 shows the influence of the sales price adjustment speed of No. 2 zinc-nickel battery manufacturers, \(v_{3}\), on manufacturers’ sales price decision, and \(v_{1} { = }0.1\),\(v_{2} { = }0.1\). When \(v_{2} < 0.236\), the sale prices of the two manufacturers remain unchanged; when \(0.236 < v_{2} < 0.298\), the system enters the double period bifurcation state; when \(0.298 < v_{2} < 0.31\), the system enters the quadruple period bifurcation state; when \(v_{2} > 0.323\), the system falls into chaos.

In Fig. 13, the price time series diagram of three game participants is plotted when the price adjustment speed of zinc-nickel battery manufacturer 1 is 0.01 and 0.26 respectively. In Fig. 13a, zinc-nickel battery manufacturer 1 adopts a robust price adjustment strategy. Although all parties will make regular price adjustments due to the influence of mutual price prediction, due to the restraint of many parties, the price trend of the market is stable and easy to predict. Such a stable market makes it easier for the market to obtain opportunities for sustainable development. In Fig. 13b, when the No. 1 zinc-nickel battery manufacturer adopts a radical price adjustment strategy and takes a higher value affecting the price adjustment speed in the bounded rational expectation, there are fierce fluctuations in the supply chain system. In the multi-party multi-cycle game, it is difficult for the participants of the game to accurately predict the future market price changes. Therefore, there are complex and unpredictable risks in a multi-cycle game. From the perspective of market stability, battery manufacturers should carefully use different price adjustment strategies.

In conclusion, if the price adjustment speeds of the batteries manufacturers are out of a certain range in the evolutionary game, the competition and game in the market will be out of order, damaging the profits of every member of the supply chain. Therefore, there should be corresponding adjustment speed controlled to maintain the stability of the system and the order of the market competition.

Chaos control of the evolutionary game

The above shows the impact of the price adjustment coefficient \(v_{i} (i = 1,2,3)\) of each battery manufacturer in the evolutionary game model of the supply chain on the system entering the chaotic state. The change in the price adjustment coefficient will cause the system to produce unstable phenomena such as bifurcation or chaos, which makes it difficult for all participants to accurately predict the future price trend and profit change, and affect the decision-making efficiency of all participants in the supply chain. Therefore, the chaotic state of the system is extremely harmful to each battery manufacturer. When the game parties in the system make decisions, the reference coefficients cannot be customized at will. Therefore, this paper uses the variable feedback control method to control the chaotic state of the supply chain system so as to make the evolutionary game model enter a stable state from chaos. In the process of gradual control, the game is easier to predict and analyze. By introducing variable feedback control coefficient to control the change of battery manufacturer’s price adjustment coefficient \({\text{G}}\) in the process of evolutionary game, so as to suppress and control the possible chaos in the process of supply chain game, the dynamic model of supply chain discrete system can be written as follows:

For the original discrete system dynamics model of the supply chain, we did not modify the setting of the original parameters, but set the price adjustment parameters of the battery manufacturer as \(v_{1} = 0.24,v_{2} = 0.24,v_{3} = 0.24\), respectively. Through the adjustment of the variable feedback control coefficient \({\text{G}}\), the bifurcation diagram of the system after chaos control by the variable feedback control method can be obtained (Fig. 14).

In Fig. 14, after being controlled by the variable feedback control method, the price of each variable in the original discrete system dynamics model decreases with the increase of the variable feedback control coefficient. At the same time, the system returns from the unstable state of chaos to the period-doubling bifurcation and finally returns to a stable state. Therefore, the evolutionary game model of zinc-nickel battery manufacturer in the stable state has a stable and unique solution state so that the chaos of the system can be controlled.

In Fig. 15, the time series diagram of the zinc-nickel battery manufacturer’s price adjustment speed \(v_{1} = 0.01\) and \(v_{1} = 0.45\) is given. By comparing Fig. 13, it is obvious that for the original supply chain discrete system dynamics model, the larger the price adjustment parameter is, the more likely it is to bifurcation, which makes the system to enter a chaotic state, making it difficult for all participants in the game to predict future price fluctuations. After using the variable feedback control method, we can see that if a higher price adjustment speed is adopted, that is, the zinc-nickel battery manufacturer adopts a more radical price adjustment strategy; it will not affect the zinc-nickel battery manufacturer’s systematic control, but can stabilize the overall trend of price. Therefore, in terms of system stability, the chaos control method of variable feedback control method in the model can enable zinc-nickel battery manufacturers to build a system model suitable for their own development and easy to predict and control so as to realize the sustainable development of battery supply chain.

Results and discussion

This paper studies the competition and cooperation of the battery supply chain including two zinc-nickel battery manufacturers and a lithium battery manufacturer. Two models are established in this paper: a basic model and a demand disturbance model. In the basic model, two zinc-nickel battery manufacturers and a lithium battery manufacturer adopt the price competition strategy at the same time, and the zinc-nickel battery manufacturers expand their market effect by cooperating with China Mobile and other communication companies. In the demand disturbance model, due to social emergencies, the three battery manufacturers cope with the demand disturbance in the market by cooperating.

Through the analysis of the above two models, the main conclusions are as follows.

In the basic model, when the consumers are sensitive to the technology level, the prices set by manufacturers rise with the improvement of the technology level. The greater the consumer preference for zinc-nickel battery, the higher the price of zinc-nickel battery. With the rise of the updating parameters of carbon emission technology, the optimal prices of the three manufacturers will decrease. When the market promotion rate is in the moderate range, the price of zinc-nickel batteries will be higher than that of lithium batteries.

In the demand disturbance model, the supply chain makes different decisions of optimal prices according to different ranges of demand disturbance. In the numerical simulation, with the increase of out-of-stock costs and inventory costs, the region in which the planned demand is equal to the disturbed demand will expand, and the increase of inventory costs will reduce the optimal price, while the increasing out-of-stock cost will increase the optimal price.

In the evolutionary game model, the price adjustment speed of battery manufacturers should be controlled within a certain range so as to maintain the stability of the system and the orderly market competition.

This paper has clear management significance: (1) This article discusses the uncertain demand, lithium battery manufacturers and zinc-nickel battery manufacturers of competition and cooperation relations, has been clear about the optimal pricing strategy, and explores the stability of the long-term evolution of game behavior in the west that could help to practice the game strategy of battery manufacturers and zinc-nickel battery manufacturers to provide the reference. (2) It can be seen from the conclusions that if we want to realize the positive incentive of technology to the price of products, we need to improve consumers’ sensitivity to technology level; that is, we need to enhance the propaganda of technology. In terms of energy-saving and emission reduction, the battery manufacturers should improve the level of carbon emission technology so that their products can gain more advantages in competition with products at the same level. In terms of zinc-nickel battery manufacturers, they are supposed to choose an appropriate market-promoting rate, while a higher or lower rate may lead to damage to profits. Facing emergencies, the supply chain can formulate the optimal price according to demand disturbance.

Data availability

Supplementary data to this article will be provided upon request.

References

Bao B, Ma J, Goh M (2020) Short-and long-term repeated game behaviours of two parallel supply chains based on government subsidy in the vehicle market. Int J Prod Res 58(24):7507–7530

Chen L, Yang Z, Wang L, Qin H (2019) Rational synthesis of 3D ZnO-Cu-C yolk-shell hybrid microspheres and their high performance as anode material for zinc-nickel secondary batteries. Ceramics International, 45(8), 10792–10799. Ceramics International, 2019, 45(8): 10792–10799

Chen W, Hu ZH (2018) Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J Clean Prod 201:123–141

Chopra S, Sodhi MS (2004) Supply-chain breakdown. MIT. Sloan Management Review 46(1):53–61

Chutani A, Sethi SP (2018) Dynamic cooperative advertising under manufacturer and retailer level competition. Eur J Oper Res 268(2):635–652

Clausen J, Larsen A, Larsen J (2010) Disruption management-foreword. Comput Oper Res 37(5):807–808

Cui C, Li M, Zhang X (2018) In-situ cutting of graphene into short nanoribbons with applications to Ni-Zn batteries. Sci Rep 8(1):1–9

Cui C, Li M, Zhou X, Zhang X (2019) Synthesis of ZnO/carbon nanotube composites for enhanced electrochemical performance of Ni-Zn secondary batteries. Mater Res Bull 112:261–268

Gao Q, Ma J (2009) Chaos and Hopf bifurcation of a finance system. Nonlinear Dyn 58(1):209–216

Huang Z, Li SX (2001) Co-op advertising models in manufacturer–retailer supply chains: a game theory approach. Eur J Oper Res 135(3):527–544

Ji J, Zhang Z, Yang L (2017) Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int J Prod Econ 187:68–84

Ji T, Xu X, Yan X, Yu Y (2020) The production decisions and cap setting with wholesale price and revenue sharing contracts under cap-and-trade regulation. Int J Prod Res 58(1):128–147

Karray S, Martin-Herran G, Sigué SP (2017) Cooperative advertising for competing manufacturers: the impact of long-term promotional effects. Int J Prod Econ 184:21–32

Karray S (2015) Cooperative promotions in the distribution channel. Omega 51:49–58

Kleindorfer PR, Saad GH (2005) Managing disruption risks in supply chains. Prod Oper Manag 14(1):53–68

Li G, Zheng H, Ji X, Li H (2018) Game theoretical analysis of firms’ operational low-carbon strategy under various cap-and-trade mechanisms. J Clean Prod 197:124–133

Lin H, Shao P (2014) Research on enterprise network advertising investment strategy based on Internet environment. Chinese Management Science 22(2):65–74

Lou W, Ma J (2018) Complexity of sales effort and carbon emission reduction effort in a two-parallel household appliance supply chain model. Appl Math Model 64:398–425

Ma J, Xu T (2022) Optimal strategy of investing in solar energy for meeting the renewable portfolio standard requirement in America. J Oper Res Soc 1–14

Ma J, Hou Y, Yang W, Tian Y (2020) A time-based pricing game in a competitive vehicle market regarding the intervention of carbon emission reduction. Energy Policy 142:111440

Ma J, Sun L (2017) Complexity analysis about nonlinear mixed oligopolies game based on production cooperation. IEEE Trans Control Syst Technol 26(4):1532–1539

Ma J, Xie L (2016) The comparison and complex analysis on dual-channel supply chain under different channel power structures and uncertain demand. Nonlinear Dyn 83(3):1379–1393

Meng J, Yang Z, Liu L, Cui F, Jiang Y (2019) The in-situ growth of zinc-aluminum hydrotalcite on hollow carbon spheres and its application as anode material with long cycle life for zinc-nickel secondary battery. J Alloy Compd 809:151842

Qian X, Chan FT, Zhang J, Yin M, Zhang Q (2020) Channel coordination of a two-echelon sustainable supply chain with a fair-minded retailer under cap-and-trade regulation. J Clean Prod 244:118715

Tong W, Mu D, Zhao F, Mendis GP, Sutherland JW (2019) The impact of cap-and-trade mechanism and consumers’ environmental preferences on a retailer-led supply chain. Resour Conserv Recycl 142:88–100

Wang M, Zhao L, Herty M (2018) Modelling carbon trading and refrigerated logistics services within a fresh food supply chain under carbon cap-and-trade regulation. Int J Prod Res 56(12):4207–4225

Xiao T, Qi X, Yu G (2007) Coordination of supply chain after demand disruptions when retailers compete. Int J Prod Econ 109(1–2):162–179

Xie J, Liang L, Liu L, Ieromonachou P (2017) Coordination contracts of dual-channel with cooperation advertising in closed-loop supply chains. Int J Prod Econ 183:528–538

Xie L, Ma J, Goh M (2021) Supply chain coordination in the presence of uncertain yield and demand. Int J Prod Res 59(14):4342–4358

Xu T, Ma J (2021) Feed-in tariff or tax-rebate regulation? Dynamic decision model for the solar photovoltaic supply chain. Appl Math Model 89:1106–1123

Xu X, He P, Xu H, Zhang Q (2017) Supply chain coordination with green technology under cap-and-trade regulation. Int J Prod Econ 183:433–442

Yang L, Zhang Q, Ji J (2017) Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int J Prod Econ 191:286–297

Zhan X, Ma J, Li Y, Zhu L (2019) Design and coordination for multi-channel recycling of oligopoly under the carbon tax mechanism. J Clean Prod 223:413–423

Zhang R, Liu B, Wang W (2012) Pricing decisions in a dual channels system with different power structures. Econ Model 29(2):523–533

Zhang S, Wang C, Yu C (2019) The evolutionary game analysis and simulation with system dynamics of manufacturer’s emissions abatement behavior under cap-and-trade regulation. Appl Math Comput 355:343–355

Zhou YW, Li J, Zhong Y (2018) Cooperative advertising and ordering policies in a two-echelon supply chain with risk-averse agents. Omega 75:97–117

Zhu M, Li X et al (2021a) Study on complex dynamics for the waste electrical and electronic equipment recycling activities oligarchs closed loop supply chain. Environ Sci Pollut Res 8:2021

Zhu M, Li X, Zhu L, Zhan X, etc. (2021b) “Dynamic evolutionary games and coordination of multiple recycling channels considering online recovery platform”, Discrete Dynamics in Nature and Society. Article ID 9976157:2021

Acknowledgements

We thank the reviewers and associate editor for their careful reading and helpful comments on the revision of the paper. The research was supported by the Innovation Fund of Tianjin University.

Author information

Authors and Affiliations

Contributions

Bing Zhang, Meihong Zhu, Li Zhao: thesis architecture design, writing the original draft.

Junhai Ma, Li Zhao: supervision and project administration.

Bing Zhang, Tiantong Xu: reviewing, preparing the final draft, and formatting.

Junhai Ma, Li Zhao, Meihong Zhu: investigation, validation, programming and calculation, and editing.

Bing Zhang, Tiantong Xu: methodology and experimental calculations.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues.

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

(1) The proof of “Equilibrium strategy”.

Let \(\frac{{\partial \pi_{1}^{N} }}{{\partial p_{1}^{N} }} = 0\), \(\frac{{\partial \pi_{2}^{N} }}{{\partial p_{2}^{N} }} = 0\), \(\frac{{\partial \pi_{3}^{N} }}{{\partial p_{3}^{N} }} = 0\), the price equilibrium strategy can be obtained as follows:

and

So, \(p_{1}^{N}\) \(p_{2}^{N}\) \(p_{3}^{N}\) are optimal price equilibrium points.

Rights and permissions

About this article

Cite this article

Zhang, B., Zhu, M., Zhao, L. et al. Research on equilibrium strategy and emergency management of three oligarch battery manufacturers under cooperative promotion and low-carbon policy. Environ Sci Pollut Res 29, 87645–87667 (2022). https://doi.org/10.1007/s11356-022-20679-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-20679-z