Abstract

Given the dominant role of oil in terms of foreign exchange earnings in Nigeria, this study revisits the oil rents and output growth nexus, using the novel dynamic autoregressive distributive lag (DYNARDL) model and kernel-based regularized least squares (KRLS) approach over the period 1973–2020. The major finding from this study is that oil rents are less significant for output and also exhibit decreasing marginal effect on output growth in Nigeria. However, our robustness result shows that oil revenue is positive and significantly affects output growth, while corruption dampens output growth. Result from the oil revenue model with a minimum root square mean error, when compared with the oil rents model, corroborate the finding. We are thus of the opinion that oil revenue is more important for output growth in Nigeria than oil rents. Having established this fact, it is recommended that policymakers and the government should accord utmost attention to boosting oil revenue via transparency and accountability. They should also ensure a lasting solution to the nation’s high dependency on refined crude oil products importation for a sustainable economic growth and development. Also, more efforts should be directed at developing the seven identified strategic solid minerals to further enhance the revenue base of the government.

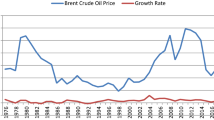

Source: Authors’ compilation from data obtained from the World Bank

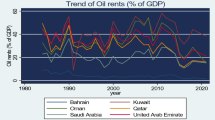

Source: Authors’ compilation from data obtained from the CBN (2019)

Similar content being viewed by others

Data availability

As discussed in text.

Notes

− 6.10 and − 3.62 GDP growth rate in 2020Q2 and 2020Q3, respectively.

The choice of the timeframe was governed by data availability.

Detailed description of the model is provided in Sarkodie and Owusu (2020).

Utilizing several unit root tests such as Phillips and Perron (1988), augmented Dickey and Fuller (1979), and Kwiatkowski et al. (1992), we discover a mixture of level and first difference outcomes. However, the condition that the dependent variable must be strictly I(1) required by dynamic ARDL is satisfied. The results are available upon reasonable request.

Natural logarithms (LNRGDP) RGDP is the dependent variable, and is stationary at first-difference.

With over 100% convergence (obtained by multiplying 0.019 by 100).

We fail to reject the null hypothesis of no serial correlation based on 5% significance level, hence confirming that the residuals of the estimated ARDL (1,0,0,0) model are free from autocorrelation.

The null hypothesis of homoscedasticity cannot be rejected at 5% significance level, thus confirming that the residuals are homoscedastic.

The null hypothesis of normal distribution cannot be rejected at 5% significance level.

It shows that the estimated test statistic is within the 95% confidence band, hence confirming the stability of the estimated coefficients over time.

This means the unbeneficial impact of corruption in the economy.

This is based on the DYNARDL and KRLS.

References

Abdulahi ME, Shu Y, Khan MA (2019) Resource rents, economic growth, and the role of institutional quality: a panel threshold analysis. Resour Policy 61(71673081):293–303. https://doi.org/10.1016/j.resourpol.2019.02.011

Abdussalam NB, Usman N, Akadiri SS (2021) Appraising the oil-stock nexus during the COVID-19 pandemic shock: a panel threshold analysis. Environ Sci Pollut Res Int 29(8):11418–11431

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU, Balsalobre-lorente D (2020) Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284. https://doi.org/10.1016/j.scitotenv.2019.136284

Antonakakis N, Cunado J, Filis G, de Gracia FP (2017) Oil dependence, quality of political institutions and economic growth: a panel VAR approach. Resources Policy 53(October 2016):147–163. https://doi.org/10.1016/j.resourpol.2017.06.005

Apergis N, El-Montasser G, Sekyere E, Ajmi AN, Gupta R (2014) Dutch disease effect of oil rents on agriculture value added in Middle East and North African (MENA) countries. Energy Economics 45:485–490. https://doi.org/10.1016/j.eneco.2014.07.025

Balcilar M, Usman O, Agbede EA (2019) Revisiting the exchange rate pass-through to inflation in Africa’s two largest economies: Nigeria and South Africa. Afr Dev Rev 31(2):245–257

Balcilar M, Usman O, Musa MS (2020) The long-run and short-run exchange rate pass-through during the period of economic reforms in Nigeria: is it complete or incomplete? Journal for Economic Forecasting 1:151–172

Balcilar M, Roubaud D, Usman O, Wohar ME (2021a) Testing the asymmetric effects of exchange rate pass-through in BRICS countries: does the state of the economy matter? The World Economy 44(1):188–233

Balcilar M, Roubaud D, Usman O, Wohar ME (2021) Moving out of the linear rut: a period-specific and regime-dependent exchange rate and oil price pass-through in the BRICS countries. Energy Econ 98:105249

Balcilar M, Usman O (2021) Exchange rate and oil price pass-through in the BRICS countries: evidence from the spillover index and rolling-sample analysis. Energy 229:120666

Badeeb RA, Lean HH, Smyth R (2016) Oil curse and finance-growth nexus in Malaysia: the role of investment. Energy Economics 57:154–165. https://doi.org/10.1016/j.eneco.2016.04.020

Badeeb, R.A., Szulczyk, K.R., Lean, H.H. (2020). Asymmetries in the effect of oil rent shocks on economic growth: a sectoral analysis from the perspective of the oil curse. researchgate.net

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Canh NP, Thong NT (2020) Nexus between financialisation and natural resources rents: empirical evidence in a global sample. Resour Policy 66:101590. https://doi.org/10.1016/j.resourpol.2020.101590

Charfeddine L, Barkat K (2020) Short- and long-run asymmetric effect of oil prices and oil and gas revenues on the real GDP and economic diversification in oil-dependent economy. Energy Economics 86:104680. https://doi.org/10.1016/j.eneco.2020.104680

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Ebeke C, Omgba LD, Laajaj R (2015) Oil, governance and the (mis)allocation of talent in developing countries. J Dev Econ 114:126–141. https://doi.org/10.1016/j.jdeveco.2014.12.004

Ekokoi S (2016) Sustainable management of Nigeria’s oil wealth: legal challenges and future directions. Journal of Sustainable Development Law and Policy (The) 7(2):135. https://doi.org/10.4314/jsdlp.v7i2.7

Energy Information Agency. (2019). Retrieved from https://www.eia.gov/beta/international/country.cfm?iso=NGA Assessed on 6/11/2019

Erdoğan, S., Yıldırım, D. Ç., & Gedikli, A. (2020). Natural resource abundance, financial development and economic growth: an investigation on Next-11 countries. Resources Policy, 65(August 2019). https://doi.org/10.1016/j.resourpol.2019.101559

Erum N, Hussain S (2019) Corruption, natural resources and economic growth: evidence from OIC countries. Resour Policy 63(June):101429. https://doi.org/10.1016/j.resourpol.2019.101429

Fasanya I, Akinbowale S (2019) Modelling the return and volatility spillovers of crude oil and food prices in Nigeria. Energy 169:186–205. https://doi.org/10.1016/j.energy.2018.12.011

Galadima MD, Aminu AW (2020) Nonlinear unit root and nonlinear causality in natural gas-economic growth nexus: evidence from Nigeria. Energy 190:116415. https://doi.org/10.1016/j.energy.2019.116415

Ghassan HB, AlHajhoj HR (2016) Long run dynamic volatilities between OPEC and non-OPEC crude oil prices. Appl Energy 169:384–394. https://doi.org/10.1016/j.apenergy.2016.02.057

Hainmueller J, Hazlett C (2014) Kernel regularized least squares: reducing misspecification bias with a flexible and interpretable machine learning approach. Polit Anal 22(2):143–168

Hamdi H, Sbia R (2013) Dynamic relationships between oil revenues, government spending and economic growth in an oil-dependent economy. Econ Model 35:118–125. https://doi.org/10.1016/j.econmod.2013.06.043

Idemudia U (2012) The resource curse and the decentralization of oil revenue: the case of Nigeria. J Clean Prod 35:183–193. https://doi.org/10.1016/j.jclepro.2012.05.046

Jordan S, Philips AQ (2018) Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stand Genomic Sci 18(4):902–923

Jarrett U, Mohaddes K, Mohtadi H (2019) Oil price volatility, financial institutions and economic growth. Energy Policy 126(October 2018):131–144. https://doi.org/10.1016/j.enpol.2018.10.068

Jović S, Maksimović G, Jovović D (2016) Appraisal of natural resources rents and economic development. Resour Policy 50(October):289–291. https://doi.org/10.1016/j.resourpol.2016.10.012

Kripfganz S, Schneider DC (2020) Response surface regressions for critical value bounds and approximate p-values in equilibrium correction models 1. Oxford Bull Econ Stat 82(6):1456–1481

Kwiatkowski D, Phillips PC, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic time series have a unit root? Journal of Econometrics 54(1–3):159–178

Kyarem, R., Sani, I. A., Oyolola, F., & Lawal, O. (2020). Political elites’ corruption, political stability and economic growth in Nigeria: bound testing approach. Acta Universitatis Danubius. Œconomica, 16(2).

Lee CC, Olasehinde-Williams G, Saint Akadiri S (2021) Are geopolitical threats powerful enough to predict global oil price volatility? Environ Sci Pollut Res 28(22):28720–28731

Majumder MK, Raghavan M, Vespignani J (2020) Oil curse, economic growth and trade openness. Energy Economics 91:104896. https://doi.org/10.1016/j.eneco.2020.104896

Marques AC, Pires PS (2019) Is there a resource curse phenomenon for natural gas? Evidence from countries with abundant natural gas. Resour Policy 63(June):101466. https://doi.org/10.1016/j.resourpol.2019.101466

Matallah, S., & Matallah, A. (2016). Oil rents and economic growth in oil-abundant MENA countries: governance is the trump card to escape the resource trap. Topics in Middle Eastern and African Economies, 18(2). Retrieved from http://meea.sites.luc.edu/volume18/pdfs/25-Oil Rents and Economic Growth in Oil-Abundant MENA Countries.pdf

Mohammed JI, Karimu A, Fiador VO, Abor JY (2020) Oil revenues and economic growth in oil-producing countries: the role of domestic financial markets. Resour Policy 69:101832. https://doi.org/10.1016/j.resourpol.2020.101832

Montclos, D. P. (2018). Oil rent and corruption: the case of Nigeria.

Moradbeigi M, Law SH (2017) The role of financial development in the oil-growth nexus. Resources Policy 53(October 2016):164–172. https://doi.org/10.1016/j.resourpol.2017.06.016

National Bureau of Statistics. (2019). (Q1 2019) report date: May 2019 (May). Retrieved from https://nigerianstat.gov.ng/download/937

Nigerian Extractive Industry Transparency Initiative. (2018). Annual progress report. Retrieved from https://eiti.org/files/documents/neiti-apr-2018-280619.pdf

Omoregie, U. (2014). Nigeria’s petroleum sector and GDP: the missing oil refining link.

Opaleye SS, Nwachukwu CE (2019) Does oil rent increase happiness? A partial efficiency analysis of selected African countries. Trends Econ Manag 13:34–97. https://doi.org/10.13164/trends.2019.34.97

Opaleye SS, Okowa W, Ohale L (2018) Oil rent and socioeconomic outcomes in selected oil producing countries in Africa. Int J Res Bus Econ Manag 2(2):27–43

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16:289–326

Phillips PCB, Perron P (1989) Testing for a unit root in time series regression. Biometrika 75:335–346

Ramcharran H (2002) Oil production responses to price changes: an empirical application of the competitive model to OPEC and non-OPEC countries. Energy Economics 24(2):97–106

Report, C. (2019). Nigeria upstream summary.

Sachs, J., & Warner, A. (1995). Natural resource abundance and economic growth. NBER working paper 5398. 3. https://doi.org/10.3386/w5398

Sarkodie SA, Owusu PA (2020) How to apply the novel dynamic ARDL simulations (dynardl) and Kernel-based regularized least squares (krls). Methods X 7:101160

Sinha A, Sengupta T (2019) Impact of natural resource rents on human development: what is the role of globalization in Asia Pacific countries? Resour Policy 63(May):101413. https://doi.org/10.1016/j.resourpol.2019.101413

Tiba, S. (2019). Modeling the nexus between resources abundance and economic growth: an overview from the PSTR model. Resources Policy, 64(May). https://doi.org/10.1016/j.resourpol.2019.101503

Usman, O. (2021). Does the pass‐through of exchange rate and globalization validate the rockets and feathers hypothesis in Nigeria? Evidence from a nonlinear model. Journal of Public Affairs, 21(1), e2151.

World Bank Data. (2020). Retrieved from https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.KD?locations=NG

Yahaya KA, Bakare TO (2018) Effect of petroleum profit tax on economic growth in Nigeria. Journal of Public Administration, Finance and Law 13:100–121

Zakharov N (2020) Asymmetric oil price shocks, tax revenues, and the resource curse. Econ Lett 186:108515. https://doi.org/10.1016/j.econlet.2019.06.021

Author information

Authors and Affiliations

Contributions

Ibrahim is responsible for the study development.

Seyi sourced for data, methodology, and estimations.

Corresponding author

Ethics declarations

Ethics approval

Authors mentioned in the manuscript have agreed for authorship, read and approved the manuscript, and given consent for submission and subsequent publication of the manuscript.

Consent to participate

Note applicable.

Consent for publication

Note applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The contents of this paper are authors’ sole responsibility. They do not represent the views of the institution

Rights and permissions

About this article

Cite this article

Abubakar, I.S., Akadiri, S.S. Revisiting oil rents-output growth nexus in Nigeria: evidence from dynamic autoregressive distributive lag model and kernel-based regularized least squares approach. Environ Sci Pollut Res 29, 45461–45473 (2022). https://doi.org/10.1007/s11356-022-19034-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19034-z