Abstract

This study assessed the role of financial development (FD) and its distributional effects in explaining consumption-based carbon (ConCO2) emissions, in a framework that also examined the environmental Kuznets curve (EKC) hypothesis, in the context of 19 Sub-Saharan African countries. A composite index was used as measure of FD in a set of data spanning over the period 1995–2017, while controlling for population size (PS), energy intensity (EI) and natural resource rents (Nrr). Given that the variables deviate from expected normal distribution as adjudged by results of pre-estimation tests, the method of moments quantile regression (MM-QR) estimation technique was used to account for distributional effects of FD on ConCO2. Results of the fixed-effect regression based on Driscoll-Kray standard errors (FE-DK) which was validated by three other estimators (fully modified ordinary least squares (FMOLS), dynamic ordinary least squares (DOLS), canonical cointegration regression (CCR)) statistically provided support for FD, PS and EI as drivers of ConCO2. Distributional effects of this show that FD exerts significant positive effect on ConCO2 among countries in the higher quantiles, but insignificant positive effect among those at the lower quantiles. The model provided no support for the EKC hypothesis for SSA; policy implications of these results were presented.

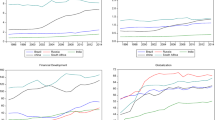

source: World Development Indicators, World Bank

Similar content being viewed by others

Data Availability

The datasets used and/or analysed during the current study are freely available as follows: Global Carbon Budget (Friedlingstein, et al., 2019) is available at https://10.5194/essd-11–1783-2019; WDI available at https://databank.worldbank.org/source/world-development indicators#advancedDownloadOptions; financial development index is available at http://data.imf.org/fdindex; and World Uncertainty Index is available at https://worlduncertaintyindex.com/wp-content/uploads/2020/07/WUI_Data.xlsx.

References

Acheampong A O, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econs, 88: 104768.

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Agbanike TF, Nwani C, Uwazie UI, Anochiwa LI, Onoja TG, Ogbonnaya IO (2019) Oil price, energy consumption and carbon dioxide (CO2) emissions: insight into sustainability challenges in Venezuela. Latin Am Econ Rev 28(1):8

Ali, M., & Kirikkaleli, D. (2021). The asymmetric effect of renewable energy and trade on consumption‐based CO2 emissions: the case of Italy. Integr Environ Assess Manag.

Al-mulali U, Lee JY (2013) Estimating the impact of the financial development on energy consumption: evidence from the GCC (Gulf Cooperation Council) countries. Energy 60:215–221

Aslan A, Apergis N, Topcu M (2014) Banking development and energy consumption: evidence from a panel of Middle Eastern countries. Energy 72:427–433

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70(April):117–132

Blanford GJ (2009) Investment strategy for climate change. Energy Econ 31(27):e36. https://doi.org/10.1016/j.eneco.2008.03.010

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res Int 25:36589–36603

Chen Y, Wang Z, Zhoug Z (2019) CO2 emissions, economic growth, renewable energy production, and foreign trade in China. Renew Energy 131:208–216

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42(3):310–335. https://doi.org/10.1006/jeem.2000.1161

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci 94(1):175–179

Dietz T, Rosa E A (1994) Rethinking the environmental impacts of population, affluence and technology. Human Ecol Rev, 1(2), 277–300. https://www.jstor.org/stable/24706840.

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization, and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213

Ehigiamousoe KU, Lean HH (2019) Effect of energy consumption, economic growth, and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res 26:22611–22624

Encycropaedia Britanica (2021) Greehousegass – air pollution, www.britanica.com. greenhouse gasses

Farhani S, Solarin SA (2017) Financial development and energy demand in the United States; new evidence from combined cointegration and asymmetric causality tests. Energy 134:1029–1037

Friedlingstein P, Jones M, O’sullivan M, Andrew R, Hauck J, Peters GD, Bakker O (2019) Global carbon budget 2019. Earth Syst Sci Data 11(4):1783–1838. https://doi.org/10.5194/essd-11-1783-2019

Grossman, G. M., & Krueger, A. B. (1991). Environmental impacts of a North American free trade agreement.

A Gyamfi ST Onifade BFV NwaniC 2021 Accounting for the combined impacts of natural resources rent, income level, and energy consumption on environmental quality of G7 economies: a panel quantile regression approach Environ SciPollut Res https://doi.org/10.1007/s11356-021-15756-8

Hao Y, Zhang Z, Liao H, Wei Y, Wang S (2016) Is C02 emission a side effect of financial development? An empirical analysis for China. Environ Sci Pollut Res 23(20):21041–21057

He X, Adebayo TS, Kirikkaleli D, Umar M (2021) Consumption-based carbon emissions in Mexico: an analysis using the dual adjustment approach. Sustain Prod Consumpt 27:947–957

IEA (2019) Global energy and CO2 status report 2019 – analysis International Energy Agency (IEA).

Im, K.S, Pesaran, M.H., and Shin, Y.C., (2003) “Testing for units roots in heterogeneous panels” J Econ, Vol.115, pp 53–74.

IMF (2013) Boom, bust, or prosperity? Managing sub Saharan, Africa’s natural resource wealth. www.inf.org/external/pubs/ft/dp/2013/dp1302pdf.

IPCC (2014) Climate change 2014: synthesis report. Contributions of Working Groups I, II, &III, to the Fifth Assessment Report of the Intergovernmental Panel on the Climate Change. Retrieved from https://www.ipcc.ch/report/er5/syr/.

Jian C, Ma X (2019) The impact of financial development on carbon emissions: a global perspective. MDPI Sustain 11:5241

Khan S, Kahn MK, Muhammed B (2021) Impact of financial development and energy consumption on environmental degradation in 184 countries using a dynamic panel data model. Environ Sci Pollut Res 28:9542–9557

Khan, S. A. R., Yu, Z., Belhadi, A., & Mardani, A. (2020). Investigating the effects of renewable energy on international trade and environmental quality. J Environ Manag, 272, 111089.

Kwakwa, P.A., Alhassan, H., Adu, G. (2018), Effect of natural resources extraction on energy consumption and carbon dioxide emission in Ghana, ‘Munich Personal RePEc Archive (MPRA) Paper Number 85401. p1–19.

Lu WC (2018) The impacts of information and communication technology, energy consumption, financial development, and economic growth on carbon dioxide emissions in 12 Asian countries. Mitig Adapt Strat Glob Change 23:1351–1365

Machado JA, Silva JS (2019) Quantiles via moments. J Econ 213(1):145–173

S Mukhtarov S Humbatova Segfullagev I, Kaibiyev, Y 2020 The effect of financial development on energy consumption in the case of Kazakhstan J Appl Econ 23 1 75 88

Nasir M A, Canh N P, Le T N L (2021) Environmental degradation and role of financialization in economic development, industrialization and trade liberalization. J Environ Manag 277: 111471.

Nguyen D K, Huyuh T C D, Nasir M A (2021) Carbon emissions determinants and forecasting: evidence from G6 countries. J Environ Manag, 385: 111988.

Nwani C (2021) Taking Venezuela back to the sustainability path: the role of financial development and economic integration in low-carbon transition. Nat Resour Forum 45:37–62

Nwani, C., & Adams, S. (2021). Environmental cost of natural resource rents based on production and consumption inventories of carbon emissions: assessing the role of institutional quality. Resourc Policy, 74, 102282.

Nwani C, Effiong E L, Okpoto S I, Okere I K (2021) Breaking the carbon curse: the role of financial development in facilitating low-carbon and sustainable development in Algeria. African Develop Rev: 1–16.

Nwani C, Omoke PC (2020) Does credit to the private sector promote low-carbon development in Brazil? An extended STIRPAT analysis using dynamic ARDL simulations. Environ Sci Pollut Res 27:31408–31426

Odhiambo NM (2020) Financial development, income inequality and carbon emissions in Sub-Saharan African countries: a panel data analysis. Energy Explor Exploit 38(5):1914–1931

Omoke PC, Nwani C, Effiong EC, Evbuomwan OO, Emenekwe CC (2020a) The impact of financial development on carbon, non-carbon and total ecological footprint in Nigeria: new evidence from asymmetric dynamic analysis. Environ Sci Pollut Res 27:21628–21646

Omoke PC, Opuala-Charles S, Nwani C (2020b) Symmetric and asymmetric effects of financial development on carbon dioxide emission in Nigeria: evidence from linear and nonlinear autoregressive distributed lag analysis. Energy Explor Exploit 38(5):2059–2078

Omri A, Kahouli B (2014) Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous–equations models. Energy Policy 67:913–922

Ouyang YF, Li P (2018) On the nexus of financial development, economic growth, and energy consumption in China-new perspective from a GMM panel VAR approach. Energy Econ 71:238–252

Paramati SR, Sudharshan R, Alam MS, Apergis N (2018) The role of stock market on environmental degradation: a comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30

Park JY (1992) Canonical cointegrating regressions. Econometrica 6(1):119–143

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bull Econ Stat 61:653–670

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Economet Rev 34(6–10):1089–1117

Pesaran MH (2007) A simple panel unit root test in presence of cross-section dependence. J Appl Economet 22(2):265–312

Pesaran, M.H. (2004). General diagnostic tests for cross-sectional dependence in panels. CESifo working papers, No. 1233.

Peters GP, Minx JC, Weber CL, Edenhofer O (2011) Growth in emission transfers via international trade from 1990 to 2008. Proc Natl Acad Sci 108(21):8903–8908

Phillips PCB, Hansen BE (1990) Statistical inference in instrumental variables regression with I (1) processes. Rev Econ Stud 57:99

Qayyum M, Ali M, Nizamani MM, Li S, Yu Y, Jahanger A (2021) Nexus between financial development, renewable energy consumption, technological innovations and CO2 emissions: the case of India. Energies 14(15):4505

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Sahay R, Čihák M, N'Diaye P, Barajas A (2015). Rethinking financial deepening: stability and growth in emerging markets. Revista de Economía Institucional, 17(33), 73–107. https://doi.org/10.18601/01245996.v17n33.04.

Sarkodie, S. A., Owusu, P. A., & Leirvik, T. (2020). Global effect of urban sprawl, industrialization, trade and economic development on carbon dioxide emissions. Environ Res Lett 15(3), 034049.

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Loganathan N, Zeshan M, Zaman K (2015) Does renewable energy consumption add in economic growth? An application of auto-regressive distributed lag model in Pakistan. Renew Sustain Energy Rev 44:576–585

Shahbaz M, Tiwari AK, Nasir M (2013) The effects of financial development on economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shen, Y., Su, Z. W., Malik, M. Y., Umar, M., Khan, Z., & Khan, M. (2021). Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci Total Environ 755, 142538.

Stock, J. H., & Watson, M. W. (1993). A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica: J Econ Soc 783–820.

Svirydzenka K (2016) Introducing a new broad–based index of financial development. IMF Work. Pap. WP/16/5. 2016. Available online: https://www.imf.org/external/pubs/ft/wp/2016/wp1605.pdf (accessed on 10 December, 2020).

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRICS countries. Energy Policy 37:246–253

Topcu M, Payne JE (2017) The financial development–energy consumption nexus revisited. Energy Sour Part b: Econ Plan, Pol 12(9):822–830

Tsaurai K (2019) The impact of financial development on carbon emissions in Africa. In J Energy Econ Policy 9(3):44–153

Ulucak R, Khan SUD (2020) Relationship between energy intensity and CO2 emissions: does economic policy matter? Sustain Dev 28(5):1457–1464

United Nations (2019). United Nations, Department of Economic and Social Affairs, Population Division: world population prospects 2019, Online Edition. Rev. 1.

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748

Xiong L, Qi S (2018) Financial development and carbon emissions in Chinese provinces: a spatial panel data analysis. Singapore Econ Rev 63(2):447–464

York R, Rosa EA, Dietz T (2003) STIRPAT, IPAT and ImPACT: analytic tools for unpacking the driving forces of environmental impacts. Ecol Econ 46(3):351–365

Yu, Y., & Qayyum, M. (2021). Impacts of financial openness on economic complexity: cross‐country evidence. Int J Finance Econ.

Zafar MW, Zaidi SAH, Sinha A, Gedikli A, Hou F (2019) The role of stock market and banking sector development, and renewable energy consumption in carbon emissions: insights from G-7 and N-11 countries. Resour Policy 62:427–436

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development, and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543

Zeqiraj V, Sohag K M, Soytas U (2020) Stock market development and low-carbon economy: the role of innovation and renewable energy. Energy Econ, 91: 104908.

Acknowledgements

The authors would like to thank the responsible editor and anonymous reviewers for their time and suggestions which were most helpful in improving this paper.

Author information

Authors and Affiliations

Contributions

LIA conceived the idea, designed the study and wrote the initial draft of the manuscript. TFA wrote the introduction and methodology of the study. MI reviewed relevant literature, collected the data for the study and wrote the conclusions and policy implications. Formal analysis and investigation, and discussion of results were performed by ROO while PCO supervised the study and revised the manuscript. All authors read and approved the final draft of the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Anochiwa, L.I., Agbanike, T.F., Ikpe, M. et al. Assessing the distributional effects of financial development on consumption-based carbon emissions in Sub-Saharan Africa: a quantile-based analysis. Environ Sci Pollut Res 29, 49870–49883 (2022). https://doi.org/10.1007/s11356-022-18671-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-18671-8