Abstract

Green credit plays a crucial role in reducing energy consumption and environmental degradation in China. Using data on China’s new energy listed companies from 2007 to 2018, this study explores the impact of green credit on new energy firms’ value, as well as the mediating effects of financing constraints and external supervision on the relationship between green credit and new energy companies’ economic benefits. Our results suggest that green credit significantly improved new energy firms’ value, and this positive impact can last over the long term. The above result is robust to using alternative measures, replacement of fixed effects, exclusion of abnormal samples, and placebo test. Additional tests reveal that green credit improves new energy companies’ value by alleviating financing constraints and strengthening external supervision. Finally, green credit’s value-enhancement effect is heterogeneous, depending on corporate property rights, business life cycle, implementation of Green Credit Guideline policy, and the firms’ geographical location. Our conclusions suggest that government should not only pay attention to the continuity of green credit commitment but also the mitigation of financing constraints and improvement of external supervision for new energy companies. Moreover, heterogeneous factors should be considered to formulate and calibrate related policy rather than a one-size-fits-all policy.

Similar content being viewed by others

Data availability

The datasets used during the current study are available from the corresponding author on reasonable request.

Notes

Taking into account the shortage of financial resources in the development of the green industry and urging microeconomic entities to pay more attention to environmental benefits, the Chinese government has formulated a series of green credit development policies to make banks incorporate environmental factors into the credit decision-making process. One of the most representative policies, named “Opinions on Implementing Environmental Protection Policies and Regulations and Preventing Credit Risks,” jointly promulgated by China’s Environmental Protection Administration (renamed Ministry of Ecology and Environment of the People’s Republic of China in 2018), the People’s Bank of China, and the China Banking and Insurance Regulatory Commission in 2007, was used as an important market tool for environmental protection, energy conservation, and emission reduction, marking the official launch of the green credit policy. Green Credit Guidelines policy, which is issued by the China Banking and Insurance Regulatory Commission in 2012, formulated the detailed standards and norms for financial institutions to implement green credit policy, signifying a leap in the strategic level of GC development.

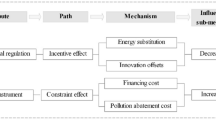

Figure 1 includes the following contents: first, the “Overall effect” part shows the results of the baseline regression and dynamic effect of GC on NECs’ value, aiming to explore the influence of GC on NECs’ value and the duration of this effect. The second part is “Intermediary mechanisms,” which examines the influencing mechanism of GC on NECs’ value, including internal financing constraints and external monitoring. Thirdly, the section of “Heterogeneity factors” analyzes the heterogeneous effect of GC on firm value of NECs, including the internal factors (property rights and life cycle) and external factors (the implementation of Green Credit Guidelines policy and geographic attributes) to identify which types of NECs’ value are more likely to be enhanced by GC.

We choose to use the OLS regression method based on the following two considerations: first, referring to the previous studies on firm value, e.g., Desai and Dharmapala (2009), Tambe (2014), Servaes and Tamayo (2013), and Li et al. (2018a, 2018b), we find that OLS regression method is widely used to analyze the influencing factors of enterprise value, which provides important clues and reference basis for our choice of OLS method; second, dependent variables (FV), core explanatory variables (GC), and control variable (CVs) of this study are all continuous variables, which makes classical OLS estimation method in linear regression models may be more appropriate than the truncated tail regression with a right-skewed data structure (e.g., Tobit model) and logit regression with dummy variables (e.g., Probit model).

The distribution of GC funds to provinces is executed by financial institutions, but the number of financial institutions in different regions of China varies greatly. For example, among the 31 provinces and municipalities in China, Tibet had only 723 financial institution branches as of 2019, whereas Guangdong Province, the province with the largest number of financial institution branches, has 16,959. It is generally believed that GC resources obtained by NECs located in areas with more financial institution branches tend to have more abundant GC financing than firms in other areas.

The former China Banking Regulatory Commission (CBRC) has been renamed as China Banking and Insurance Regulatory Commission in 2018. In addition, the “Report on Corporate Social Responsibility of the Banking Industry in China” began disclosing GC data in 2013. Before 2013, only data on the national “loan balance of energy conservation and environmental protection project and service” can be obtained, which accounts for an important part of the GC balance (in recent years, the proportion of loan balance of energy conservation and environmental protection project and service in GC has been consistently maintained at about 70%), which can reasonably reflect the GC development situation.

ST stands for special treatment and refers to listed companies that have had two consecutive years of negative net profits.

China’s financial system is mainly dominated by indirect financing. Direct financing accounts for a relatively small share. In 2020, the share of direct financing such as stocks and bonds in the scale of social financing in China’s capital market was only 12.59%, implying that the indirect financing system dominated by commercial banks has become the primary way of corporate external financing. This not only determines that the GC business conducted by commercial banks dominates the overall green financial system (which is an important reason why this study uses GC as the main explanatory variable), but also reflects the close correlation between GC and green finance. Therefore, we use the green finance indicator (GC3) as a proxy for GC in robustness tests.

The basis for the heterogeneity clustering is as follows: as far as the attributes of enterprises are concerned, given the widespread presence of “credit discrimination” in banking institutions, SOEs are likely to have easier access to bank loans than NSOEs because SOEs possess lower default risk due to their government-related attribute. Additionally, because of the profit-driven nature of capital, banks and other financial institutions tend to allocate credit resources to companies in growth stage due to their better development prospects and companies in mature stage as a result of their high repayment capabilities. Meanwhile, those companies in the shakeout stage usually are deemed as having high financial risk and thereby have difficulty in obtaining bank loans. These conjectures are only on a theoretical level. Whether GC has different impacts on NECs’ value for NECs with different property rights and life cycles need to be verified through empirical evidence.

Regarding the external environment of enterprises, the CBRC issued the “Green Credit Guidelines” in 2012, which detailed the standards and principles for banks carrying out GC. The implementation of this policy encouraged the concentration of bank credit resources to environmentally friendly enterprises (Xing et al. 2020), but whether it can strengthen the value-enhancement effect of GC on NECs is still unknown. Moreover, there is a serious spatial misallocation of credit resources in the developed eastern regions and the less-developed areas, including central and western regions; thus, it is valuable to examine whether the differences in geographic attributes produce significant differences in the relationship between “GC and NECs’ value.”.

Regarding the division of companies’ life cycle, drawing on the practice employed by Dickinson (2011), cash flow pattern is used to capture the cycle, considering the characteristics of listed companies in China. “Introduction stage” and “growth stage” are deemed as the “growth stage”; the definition of the maturity stage is the same as that of Dickinson (2011); the “shakeout stage” and “decline stage” are merged as the “shakeout period.” The whole life cycle is finally displayed as three stages of growth, mature, and shakeout periods.

Drawing on the National Bureau of Statistics of China, Hebei, Beijing, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, and Hainan are classified as the eastern region. The remaining provinces of mainland China are categorized as the central and western regions.

References

Aboud A, Diab A (2018) The impact of social, environmental and corporate governance disclosures on firm value: evidence from Egypt. J Account Emerg Econ 8(4):442–458. https://doi.org/10.1108/JAEE-08-2017-0079

Aizawa M, Yang C (2010) Green credit, green stimulus, green revolution? China’s mobilization of banks for environmental cleanup. J Environ Dev 19(2):119–144. https://doi.org/10.1177/1070496510371192

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5(1):31–56. https://doi.org/10.1016/S1386-4181(01)00024-6

Bai C, Feng C, Du K, Wang Y, Gong Y (2020) Understanding spatial-temporal evolution of renewable energy technology innovation in China: evidence from convergence analysis. Energ Policy 143:111570. https://doi.org/10.1016/j.enpol.2020.111570

Ball R, Shivakumar L (2008) Earnings quality at initial public offerings. J Account Econ 45(2–3):324–349. https://doi.org/10.1016/j.jacceco.2007.08.002

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173–1182. https://doi.org/10.1037//0022-3514.51.6.1173

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Financ 22(6–8):613–673. https://doi.org/10.1016/S0378-4266(98)00038-7

Biswas N (2011) Sustainable green banking approach: the need of the hour. Bus Spectr 1(1):32–38

BP Energy Outlook (2018) BPP L C. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2018.pdf. Accessed 20 Feb 2018

Chen H, Liu C, Xie F, Zhang T, Guan F (2019) Green credit and company R&D level: empirical research based on threshold effects. Sustain 11(7):1918. https://doi.org/10.3390/su11071918

Chen J, Cumming D, Hou W, Lee E (2016) Does the external monitoring effect of financial analysts deter corporate fraud in China? J Bus Ethics 134:727–742. https://doi.org/10.1007/s10551-014-2393-3

Cheng Q, Du F, Wang X, Wang Y (2016) Seeing is believing: analysts’ corporate site visits. Rev Account Stud 21(4):1245–1286. https://doi.org/10.1007/s11142-016-9368-9

Cornett MM, Marcus AJ, Saunders A, Tehranian H (2007) The impact of institutional ownership on corporate operating performance. J Bank Financ 31(6):1771–1794. https://doi.org/10.1016/j.jbankfin.2006.08.006

Desai MA, Dharmapala D (2009) Corporate tax avoidance and firm value. Rev Econ Stat 91(3):537–546. https://doi.org/10.1162/rest.91.3.537

Dickinson V (2011) Cash flow patterns as a proxy for firm life cycle. Account Rev 86(6):1969–1994. https://doi.org/10.2308/accr-10130

Faulkender M, Petersen MA (2006) Does the source of capital affect capital structure? Rev Financ Stud 19(1):45–79. https://doi.org/10.1093/rfs/hhj003

Freeman R (2019) Doubling the global workforce: the challenges of integrating China, India, and the former Soviet block into the world economy. Doubling the Global Work Force.

Ge L, Huang HF, Wang MC (2016) Research on the credit risk of the green credit for new energy and high pollution industry-based on empirical data test of KMV model. Math Practice Theory 46(1):18–26 ((in Chinese))

Geddes A, Schmidt TS, Steffen B (2018) The multiple roles of state investment banks in low-carbon energy finance: an analysis of Australia, the UK and Germany. Energ Policy 115:158–170. https://doi.org/10.1016/j.enpol.2018.01.009

Gerged AM, Beddewela E, Cowton CJ (2021) Is corporate environmental disclosure associated with firm value? A multicountry study of Gulf Cooperation Council firms. Bus Strateg Environ 30:185–203. https://doi.org/10.1002/bse.2616

Guo Q, Zhou M, Liu N, Wang Y (2019) Spatial effects of environmental regulation and green credits on green technology innovation under low-carbon economy background conditions. Int J Environ Res Public Health 16(17):3027. https://doi.org/10.3390/ijerph16173027

Hadlock CJ, Pierce JR (2010) New evidence on measuring financial constraints: moving beyond the KZ index. Rev Financ Stud 23(5):1909–1940. https://doi.org/10.1093/rfs/hhq009

He L, Liu R, Zhong Z, Wang D, Xia Y (2019a) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

He L, Liu L (2018) Stand by or follow? Responsibility diffusion effects and green credit. Emerg Mark Financ Trade 54(8):1740–1760. https://doi.org/10.1080/1540496X.2018.1430566

He L, Zhang L, Zhong Z, Wang D, Wang F (2019b) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372. https://doi.org/10.1016/j.jclepro.2018.10.119

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(10):10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Kang H, Jung SY, Lee H (2020) The impact of green credit policy on manufacturers’ efforts to reduce suppliers’ pollution. J Clean Prod 248:119271. https://doi.org/10.1016/j.jclepro.2019.119271

Lemmon M, Roberts MR (2010) The response of corporate financing and investment to changes in the supply of credit. J Financ Quant Anal 45:555–587. https://doi.org/10.1017/S0022109010000256

Li C, Gan Y (2021) The spatial spillover effects of green finance on ecological environment-empirical research based on spatial econometric model. Environ Sci Pollut Res 28. https://doi.org/10.1007/s11356-020-10961-3

Li J, Shan Y, Tian G, Hao X (2020) Labor cost, government intervention, and corporate innovation: evidence from China. J Corp Financ 64:101668. https://doi.org/10.1016/j.jcorpfin.2020.101668

Li K, Fang L, He L (2019) How population and energy price affect China’s environmental pollution? Energ Policy 129:386–396. https://doi.org/10.1016/j.enpol.2019.02.020

Li P, Lu Y, Wang J (2016) Does flattening government improve economic performance? Evidence from China. J Dev Econ 123:18–37. https://doi.org/10.1016/j.jdeveco.2016.07.002

Li R, Ramanathan R (2018) Exploring the relationships between different types of environmental regulations and environmental performance: evidence from China. J Clean Prod 196:1329–1340. https://doi.org/10.1016/j.jclepro.2018.06.132

Li W, Cui G, Zheng M (2021) Does green credit policy affect corporate debt financing? Evidence from China. Environ Sci Pollut R. https://doi.org/10.1007/s11356-021-16051-2

Li Y, Gong M, Zhang X, Koh L (2018a) The impact of environmental, social, and governance disclosure on firm value: the role of CEO power. Brit Account Rev 50(1):60–75. https://doi.org/10.1016/j.bar.2017.09.007

Li Z, Liao G, Wang Z, Huang Z (2018b) Green loan and subsidy for promoting clean production innovation. J Clean Prod 187:421–431. https://doi.org/10.1016/j.jclepro.2018.03.066

Liu J, Xia Y, Fan Y, Lin S, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Lyon TP, Maxwell JW (2011) Greenwash: corporate environmental disclosure under threat of audit. J Econ Manag Strat 20(1):3–41. https://doi.org/10.1111/j.1530-9134.2010.00282.x

MacKay P, Moeller SB (2007) The value of corporate risk management. J Finance 62(3):1379–1419. https://doi.org/10.1111/j.1540-6261.2007.01239.x

Modigliani F, Miller MH (1958) The cost of capital, corporation finance and the theory of investment. Am Econ Rev 48(3):261–297

Modigliani F, Miller MH (1963) Corporate income taxes and the cost of capital: a correction. Am Econ Rev 53(3):433–443. https://doi.org/10.2307/1809167

Nekhili M, Nagati H, Chtioui T, Rebolledo C (2017) Corporate social responsibility disclosure and market value: family versus nonfamily firms. J Bus Res 77:41–52. https://doi.org/10.1016/j.jbusres.2017.04.001

O’Brien PC, Bhushan R (1990) Analyst following and institutional ownership. J Account Res 28(3):55–82. https://doi.org/10.2307/2491247

Servaes H, Tamayo A (2013) The impact of corporate social responsibility on firm value: the role of customer awareness. Manage Sci 59(5):1045–1061. https://doi.org/10.1287/mnsc.1120.1630

Smith A (1776) An inquiry into the nature and causes of the wealth of nations. University of Chicago Press.

Smith C, Warner J (1979) On financial contracting-an analysis of bond covenants. J Financ Econ 7:117–161. https://doi.org/10.1016/0304-405X(79)90011-4

Song Y, Yang T, Li Z, Zhang X, Zhang M (2020) Research on the direct and indirect effects of environmental regulation on environmental pollution: empirical evidence from 253 prefecture-level cities in China. J Clean Prod 269:122425. https://doi.org/10.1016/j.jclepro.2020.122425

Song Z, Storesletten K, Zilibotti F (2011) Growing like China. Am Econ Rev 101(1):196–233. https://doi.org/10.1257/aer.101.1.196

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India. Agric Econ (Czech Republic) 62(1): 35–44. https://doi.org/10.17221/174/2014-AGRICECON

Sun J, Wang F, Yin H, Zhang B (2019) Money talks: the environmental impact of China’s green credit policy. J Policy Anal Manag 38(3):653–680. https://doi.org/10.1002/pam.22137

Tambe P (2014) Big data investment, skills, and firm value. Manage Sci 60(6):1452–1469. https://doi.org/10.1287/mnsc.2014.1899

Wang E, Liu X, Wu J, Cai D (2019) Green credit, debt maturity, and corporate investment-evidence from China. Sustain 11(3):583. https://doi.org/10.3390/su11030583

Wang Y, Lei X, Long R, Zhao J (2020) Green credit, financial constraint, and capital investment: evidence from China’s energy-intensive enterprises. Environ Manage 66:1059–1071. https://doi.org/10.1007/s00267-020-01346-w

Wen H, Lee CC, Zhou F (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099. https://doi.org/10.1016/j.eneco.2021.105099

Xing C, Zhang Y, Wang Y (2020) Do banks value green management in China? The perspective of the green credit policy. Financ Res Lett 35:101601. https://doi.org/10.1016/j.frl.2020.101601

Xu X, Li J (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574. https://doi.org/10.1016/j.jclepro.2020.121574

Zhang B, Yang Y, Bi J (2011) Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manage 92(4):1321–1327. https://doi.org/10.1016/j.jenvman.2010.12.019

Zhang W, Hong M, Li J, Li F (2021) An examination of green credit promoting carbon dioxide emissions reduction: a provincial panel analysis of China. Sustain 13:7148. https://doi.org/10.3390/su13137148

Zhou X, Tang X, Zhang R (2020) Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res 27:19915–19932. https://doi.org/10.1007/s11356-020-08383-2

Zhou Y, Tupper L, Chowdhury M, Klotz L (2010) Green credits versus environmentally sustainable traffic operations: comparison of contributions to energy and emissions reductions. Transp Res Rec 2163(1):103–111. https://doi.org/10.3141/2163-12

Acknowledgements

The authors are grateful to the Editor, as well as the anonymous referees for valuable suggestions and comments that helped us improve our paper significantly.

Funding

This study was supported by the Humanities and Social Science Foundation of the Ministry of Education of China (grant number 20YJA790085), National Natural Science Foundation of China (grant number 71503039), Social Science Fund of Jiangsu Province (grant number 17GLB008), the Major Project of Philosophy and Social Science Research Funds for Jiangsu Universities (grant number 2020SJZDA059).

Author information

Authors and Affiliations

Contributions

Xiaobing Lai: conceptualization, methodology, data curation, writing—review and editing. Shujing Yue: conceptualization, formal analysis, methodology, validation. Hongtao Chen: conceptualization, writing—original draft.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lai, X., Yue, S. & Chen, H. Can green credit increase firm value? Evidence from Chinese listed new energy companies. Environ Sci Pollut Res 29, 18702–18720 (2022). https://doi.org/10.1007/s11356-021-17038-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17038-9