Abstract

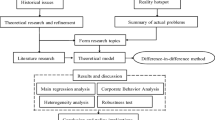

Green finance is one of the most important ways to help companies achieve green transformation and development. We construct a quasi-natural experiment with the “Green Credit Guidelines” and establish a difference-in-differences model to empirically test the implementation effect of the green credit policy in China. The results show that after the implementation of China’s green credit policy, the debt financing scale of listed companies in heavily polluting industries has decreased significantly, the debt financing cost has increased significantly, and the debt financing maturity has been shortened significantly, indicating that the green credit policy has inhibited the debt financing of heavily polluting enterprises. We further find that this inhibition has also been affected by the nature of controlling shareholders, environmental information disclosure levels, regional environmental regulations and regional financial development levels. China’s green credit policy has played a role in guiding listed companies to go green through the redistribution of debt financing.

Similar content being viewed by others

Data availability

The datasets analysed during the current study are publicly available in the WIND database and are available from the corresponding author on reasonable request.

References

Aghion P, Askenazy P, Berman N, Cette G, Eymard L (2012) Credit constraints and the cyclicality of R&D investment: evidence from France. J Eur Econ Assoc 10(5):1001–1024. https://doi.org/10.1111/j.1542-4774.2012.01093.x

Aupperle KE, Carroll AB, Hatfield JD (1985) An empirical examination of the relationship between corporate social responsibility and profitability. Acad Manag J 28(2):446–463. https://doi.org/10.5465/256210

Chang K, Zeng Y, Wang W, Wu X (2019) The effects of credit policy and financial constraints on tangible and research & development investment: firm-level evidence from China's renewable energy industry. Energy Policy 130:438–447. https://doi.org/10.1016/j.enpol.2019.04.005

Dragomir VD (2018) How do we measure corporate environmental performance? A critical review. J Clean Prod 196:1124–1157. https://doi.org/10.1016/j.jclepro.2018.06.014

Esteban-Sanchez P, La Cuesta-Gonzalez MD, Paredes-Gazquez JD (2017) Corporate social performance and its relation with corporate financial performance: international evidence in the banking industry. J Clean Prod 162:1102–1110. https://doi.org/10.1016/j.jclepro.2017.06.127

Freeman RE (1984) Strategic Management: A Stakeholder Approach. Pitman, Boston

Ghoul SE, Guedhami O, Kwok CC, Mishra DR (2011) Does corporate social responsibility affect the cost of capital. J Bank Financ 35(9):2388–2406. https://doi.org/10.1016/j.jbankfin.2011.02.007

Goss A, Roberts GS (2011) The impact of corporate social responsibility on the cost of bank loans. J Bank Financ 35(7):1794–1810. https://doi.org/10.1016/j.jbankfin.2010.12.002

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27:10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Jiao Y (2010) Stakeholder welfare and firm value. J Bank Financ 34(10):2549–2561. https://doi.org/10.1016/j.jbankfin.2010.04.013

Li W, Xu J, Zheng M (2018) Green governance: new perspective from open innovation. Sustainability 10(11):3845–3864. https://doi.org/10.3390/su10113845

Li W, Zheng M, Zhang Y, Cui G (2020) Green governance structure, ownership characteristics, and corporate financing constrains. J Clean Prod 260:121008. https://doi.org/10.1016/j.jclepro.2020.121008

Liu JY, Xia Y, Fan Y, Lin SM, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Liu Z, Li W, Hao C, Liu H (2021) Corporate environmental performance and financing constraints: an empirical study in the Chinese context. Corp Soc Responsib Environ Manag 28(2):616–629. https://doi.org/10.1002/csr.2073

Lu W, Chau KW, Wang H, Pan W (2014) A decade’s debate on the nexus between corporate social and corporate financial performance: a critical review of empirical studies 2002-2011. J Clean Prod 79:195–206. https://doi.org/10.1016/j.jclepro.2014.04.072

Luo W, Guo X, Zhong S, Wang J (2019) Environmental information disclosure quality, media attention and debt financing costs: evidence from Chinese heavy polluting listed companies. J Clean Prod 231:268–277. https://doi.org/10.1016/j.jclepro.2019.05.237

Su D, Lian L (2018) Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. Financ Res 12:123–137

Wang H, Lu W, Ye M, Chau KW, Zhang X (2016) The curvilinear relationship between corporate social performance and corporate financial performance: evidence from the international construction industry. J Clean Prod 137:1313–1322. https://doi.org/10.1016/j.jclepro.2016.07.184

Williamson OE (1985) The Economic Institutions of Capitalism. Free Press, New York

Xu F, Yang M, Li Q, Yang X (2020) Long-term economic consequences of corporate environmental responsibility: evidence from heavily polluting listed companies in China. Bus Strateg Environ 29(6):2251–2264. https://doi.org/10.1002/bse.2500

Zak PJ, Knack S (2001) Trust and growth. Econ J 111(470):295–321. https://doi.org/10.1111/1468-0297.00609

Zhang B, Yang Y, Bi J (2011) Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manag 92(4):1321–1327. https://doi.org/10.1016/j.jenvman.2010.12.019

Zhou Z, Zhang T, Wen K, Zeng H, Chen X (2018) Carbon risk, cost of debt financing and the moderation effect of media attention: Evidence from Chinese companies operating in high-carbon industries. Bus Strateg Environ 27(8):1131–1144. https://doi.org/10.1002/bse.2056

Funding

This research is funded by the Key Program of National Natural Science Foundation of China (71533002).

Author information

Authors and Affiliations

Contributions

Weian Li and Guangyao Cui contributed to the study conception and design. Data collection and analysis were performed by Guangyao Cui and Minna Zheng. The first draft of the manuscript was written by Guangyao Cui and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Li, ., Cui, G. & Zheng, M. Does green credit policy affect corporate debt financing? Evidence from China. Environ Sci Pollut Res 29, 5162–5171 (2022). https://doi.org/10.1007/s11356-021-16051-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16051-2