Abstract

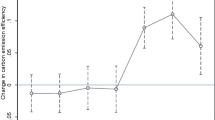

Green financial policy is one of the important policy tools for China to implement the national carbon peak goal and carbon neutral vision through financial means. This policy has an important impact on the business strategy of corporates. Based on the data of listed corporates from 2013 to 2020, this study examines the impact mechanism of China’s green financial reform and innovation pilot zones (GFRIPZ) on corporate financialization (CF) using the difference-in-difference method. The results show the following: (1) The implementation of GFRIPZ significantly restrains the CF. (2) GFRIPZ reversed the short-sighted behavior of firms and guided them to accelerate the green transformation and upgrading for long-term development. Firms’ environmental capital expenditure and research and development expenditure increased significantly. (3) The restraining effect of GFRIPZ on CF is stronger in state-owned firms, firms with low-degree managerial myopia, and high-polluting firms. The research clearly identifies the causal relationship and mechanism between GFRIPZ and CF and reveals the formation mechanism and solution path of CF from the green finance perspective. In addition, this study has implications for guiding the green transformation of entity firms and stopping firms from deviating from their intended purpose.

Similar content being viewed by others

Data availability

Data are available on request.

References

Cai HJ, Xie QX, Zang HM (2021) Active adaptability or short-run profit pursuing: institutional logic of entity enterprises financialization from the perspective of environmental regulation. Account Res 4:78–88

Cai L, Cui J, Jo H (2016) Corporate environmental responsibility and firm risk. J Bus Ethics 139(3):563–594

Carolyn F (2017) Environmental protection for sale: strategic green industrial policy and climate finance. Environ Resour Econ 66(3):553–575

Chiara C, Carlo M (2015) Environmental policies and risk finance in the green sector: cross-country evidence. Energy Policy 83(08):38–56

Davis LE (2016) Identifying the “financialization” of the nonfinancial corporation in the U.S. economy: a decomposition of firm-level balance sheets. J Post Keynesian Econ 39(1):115–141

Demir F (2009) Financial liberalization, private investment and portfolio choice: financialization of real sectors in emerging markets. J Dev Econ 88(2):314–324

Deschenes O, Greenstone M, Shapiro JS (2017) Defensive investments and the demand for air quality: evidence from the NOx budget program. Am Econ Rev 107(10):2958–2989

Ding H, Shi DQ, Zhu WB (2021) Environmental legal construction and pollution enterprises financialization—based on a natural experiment of new environmental protection law. Q J Financ 31:84–114

Ding S, Guariglia A, Knight J (2013) Investment and financing constraints in China: does working capital management make a difference? J Bank Finance 37(5):1490–1507

Du J, Li C, Wang Y (2017) A comparative study of shadow banking activities of non-financial firms in transition economies. China Econ Rev 46:35–49

Du Y, Xie J, Chen JY (2019) CEO’s financial background and the financialization of entity enterprises. China Ind Econ 5:136–154

Hu J, Song XZ, Wang HJ (2017a) Informal institution, hometown identity and corporate environmental governance. J Manag World 3:79–94

Hu YM, Wang XT, Zhang J (2017b) The motivation for financial asset allocation: reservoir or substitution? — Evidence from Chinese listed companies. Econ Res J 1:181–194

Li K, Tan XJ, Yan YX et al (2022a) Directing energy transition toward decarbonization: the China story. Energy 261:124934

Li QY, Chen SL, Chen H (2022b) Effect of strong financial regulation on real economy: empirical evidence from the new asset management regulations. Econ Res J 57(01):137–154

Liu C, Xiong MX (2022) Green finance reform and corporate innovation: evidence from China. Financ Res Lett 48:102993

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135

Luo W, Guo X, Zhong S (2019) Environmental information disclosure quality, media attention and debt financing costs: evidence from Chinese heavy polluting listed companies. J Clean Prod 231(9):268–277

Martincus CV, Blyde J (2013) Shaky roads and trembling exports: assessing the trade effects of domestic infrastructure using a natural experiment. J Int Econ 90(1):148–161

Muhammad I, Asif R, Arshian S et al (2022) Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol Forecast Soc Chang 182:121882

Ng AW (2018) From sustainability accounting to a green financing system: institutional legitimacy and market heterogeneity in a global financial centre. J Clean Prod 195:585–592

Peng YC, Han X, Li JJ (2018) Economic policy uncertainty and enterprise financialization. China Ind Econ 1:137–155

Porter ME (1991) America’s Green Strategy. Sci Am 264(4):193–246

Qi SZ, Duan BH (2022) Research on the impact of carbon trading policy on the financialization of enterprises. J Xi’an Jiaotong Univ (social Sciences) 8:1–12

Qi SZ, Zhou CB, Li K et al (2021) Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Climate Policy 1:1–19

Shi JY, Yu CH, Li YX et al (2022) Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol Forecast Soc Chang 179:121678

Su CW, Li WH, Muhammad U et al (2022) Can green credit reduce the emissions of pollutants? Econ Anal Policy 74:205–219

Tang DP, Wu JM, Chen ZB (2021) Does the social security fund help non-financial enterprises to transform from the virtual to the real? China J Account Res 15:100238

Tang H, Zhang C (2019) Investment risk, return gap, and financialization of non-listed non-financial firms in China. Pac Basin Financ J 58:101213

Tori D, Onaran O (2018) The effects of financialization on investment: evidence from firm-level data for the UK. Camb J Econ 42:1393–1416

Wang HT, Qi SZ, Zhou CB et al (2022) Green credit policy, government behavior and green innovation quality of enterprises. J Clean Prod 331:129834

Yan C, Mao ZC, Ho KC (2022) Effect of green financial reform and innovation pilot zones on corporate investment efficiency. Energy Economics 113:106185

Yang G (2022) Can the green credit policy enhance firm export quality? Evidence from China based on the DID model. Front Environ Sci 10:969726

Zheng ZL, Gao X, Ruan XL (2019) Does economic financialization lead to the alienation of enterprise investment behavior? Evidence from China. Physica A 536:120858

Zhou CB, Qi SZ (2022) Has the pilot carbon trading policy improved China’s green total factor energy efficiency? Energy Economics 114:106268

Zhou CB, Qi SZ, Li YK (2023a) China’s green finance and total factor energy efficiency. Frontiers in Energy Research 1:1076050

Zhou CB, Sun ZX, Qi SZ (2023b) Green credit guideline and enterprise export green-sophistication. J Environ Manage 336:117648

Acknowledgements

Thanks are due to the partial support of Ningbo philosophy and Social Sciences Key Research Base “regional open cooperation and free trade zone research base.”

Funding

This work was supported by the Major Program of the National Social Science Foundation of China (No. 18ZDA107).

Author information

Authors and Affiliations

Contributions

Chaobo Zhou: conceptualization, writing—original draft preparation, methodology, and writing—review and editing. Shaozhou Qi: funding acquisition, supervision, and writing—review and editing.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

All authors participated in the process of draft completion. All authors have read and agreed to the published version of the manuscript.

Consent for publications

All authors agree to publish.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhou, C., Qi, S. Does green finance restrain corporate financialization?. Environ Sci Pollut Res 30, 70661–70670 (2023). https://doi.org/10.1007/s11356-023-27476-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27476-2