Abstract

The substantial growth of e-commerce during the last years has led to a surge in consumer returns. Recently, research interest in consumer returns has grown steadily. The availability of vast customer data and advancements in machine learning opened up new avenues for returns forecasting. However, existing reviews predominantly took a broader perspective, focussing on reverse logistics and closed-loop supply chain management aspects. This paper addresses this gap by reviewing the state of research on returns forecasting in the realms of e-commerce. Methodologically, a systematic literature review was conducted, analyzing 25 relevant publications regarding methodology, required or employed data, significant predictors, and forecasting techniques, classifying them into several publication streams according to the papers’ main scope. Besides extending a taxonomy for machine learning in e-commerce, this review outlines avenues for future research. This comprehensive literature review contributes to several disciplines, from information systems to operations management and marketing research, and is the first to explore returns forecasting issues specifically from the e-commerce perspective.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

E-commerce has witnessed substantial growth rates in recent years and continues growing by double-digit margins (National Retail Federation/Appriss Retail 2023). However, lenient consumer return policies have resulted in $212 Billion worth of merchandise being returned to online retailers in the U.S. in 2022, accounting for 16.5% of online sales (National Retail Federation/Appriss Retail 2023). While high rates of consumer returns mainly concern specific sectors and product categories, online fashion retailing is particularly affected (Diggins et al. 2016). Recent studies report average shipment-related return rates for fashion retailers in the 40–50% range (Difrancesco et al. 2018; Karl and Asdecker 2021). In addition to missed sales and reduced profits (Zhao et al. 2020), consumer returns pose operational challenges (Stock and Mulki 2009), including unavoidable processing costs (Asdecker 2015) and uncertainties regarding logistics capacities, inventory management, procurement decisions, and marketing activities. Hence, effectively managing consumer returns is an essential part of the e-commerce business model (Urbanke et al. 2015).

Similar to the research conducted by Abdulla et al. (2019), this work focuses on consumer returns in online retailing (e-commerce), excluding the larger body of closed-loop supply chain (CLSC) management, which encompasses product returns related to end-of-life and end-of-use scenarios involving raw material recycling or remanufacturing. In contrast to CLSC returns, retail consumer returns are typically sent or given back unused or undamaged shortly after purchase, without any quality-related defects. These returns should be reimbursed to the consumer and are intended to be resold “as new” (de Brito et al. 2005; Melacini et al. 2018; Shang et al. 2020).

Regarding forecasting aspects, demand forecasting is a crucial activity for successful retail management (Ge et al. 2019). In contrast to demand and sales, returns constitute the “supply” side of the return process (Frei et al. 2022). Consequently, forecasting becomes a complex task and a significant challenge in managing returns due to the inherently uncertain nature of customer decisions regarding product retention (Frei et al. 2022). Moreover, return forecasts are interconnected with sales forecasts and promotional activities (Govindan and Bouzon 2018; Tibben-Lembke and Rogers 2002). Hence, forecasting objectives may vary, encompassing return quantities, timing (Hachimi et al. 2018), and even individual return probabilities. Minimizing return forecast errors is critical to reduce and minimize reactive planning (Hess and Mayhew 1997). Accurate forecasts rely on (1) comprehensive data collection, e.g., regarding consumer behavior, and (2) information and communications technology (ICT) for data processing, such as big data analytics. Despite extensive research in supply chain management (SCM), Barbosa et al. (2018) noted a lack of relevant publications exploring the "returns management" process of SCM in conjunction with big data analytics. Specifically, “the topic of forecasting consumer returns has received little attention in the academic literature” (Shang et al. 2020). Nonetheless, precise return forecasts positively impact reverse logistics activities’ economic, environmental, and social performance, primarily concerning quantity, quality, and timing predictions (Agrawal and Singh 2020). Hence, forecasting returns holds significant relevance across various supply chain stages.

1.1 Previous meta-research

Hess and Mayhew (1997) emphasized the need for extensive data analysis concerning reverse flows, which forms the basis for returns forecasting. Subsequently, research on consumer returns and reverse logistics has proliferated. Thus, before collecting data and reviewing the topic of consumer returns forecasting, we first examined existing reviews and meta-studies relevant to the subject matter. To accomplish this, we referred to Web of Science, Business Source Ultimate via EBSCOhost, JSTOR and the AIS Electronic Library as primary sources of knowledge (search term: "literature review" AND "return*" AND "forecast*”). As a secondary source, we appended the results of Google Scholar,Footnote 1 for which a different search term was used (intitle:"literature review" ("product return" OR "consumer return" OR "retail return" OR "e-commerce return") forecast) due to unavailable truncations and to reduce the vast amount of literature with financial focus the search term “return” would lead to. Table 1 presents the most pertinent literature reviews related to the scope of this paper.

Agrawal et al. (2015) identified research gaps within the realm of reverse logistics, finding “forecasting product returns” as a crucial future research path. However, among 21 papers focusing on “forecasting models for product returns”, the emphasis was predominantly on CLSC, reuse, remanufacturing, and recycling, which do not align with the aim of this review. Agrawal et al. also noted a lack of comprehensive analysis of underlying factors in returns forecasting, such as demographics or consumer behavior.

Similarly, Hachimi et al. (2018) addressed forecasting challenges within the broader context of reverse logistics. They classified their literature using various forecasting approaches: time series and machine learning, operations research methods, and simulation programs. The research gaps they identified included a limited number of influencing factors taken into account, the absence of established performance indicators, and methodological issues related to dynamic lot-sizing with returns. Although this review focused on reverse logistics, the call for research into predictors of future returns is equally applicable to consumer returns in e-commerce.

The review of Abdulla et al. (2019) centers on consumer returns within the retail context, particularly in relation to return policies. While they discuss consumer behavior and planning and execution of returns, they do not present any sources explicitly focused on forecasting issues.

Micol Policarpo et al. (2021) reviewed the literature on the use of machine learning (ML) in e-commerce, encompassing common goals of e-commerce studies (e.g., purchase prediction, repurchase prediction, and product return prediction) and the ML techniques suitable for supporting these goals. Their primary contribution is a novel taxonomy of machine learning in e-commerce, covering most of the identified goals. However, within the taxonomy developed, the aspect of return predictions is disregarded.

The most exhaustive literature review to date regarding product returns, conducted by Ambilkar et al. (2021), analyzed 518 papers and adopted a holistic reverse logistics approach encompassing all supply chain stages. The authors categorized the papers into six categories, including “forecasting product returns”, for which they found and concisely described 13 papers. Due to the broader research scope, none of the analyzed papers focused on consumer returns within the retail context.

The review by Duong et al. (2022) employed a hybrid approach combining machine learning and bibliometric analysis. Regarding forecasts of product returns, they identified three relevant papers (Clottey and Benton 2014; Cui et al. 2020; Shang et al. 2020) within the “operations management” category. They explicitly call for further research on predicting customer returns behavior in the pre-purchase stage, highlighting the importance of a better understanding of online product reviews and customers’ online interactions.

1.2 Research gaps and research questions

Why is a systematic literature review necessary for investigating consumer returns and forecasting? On the one hand, there are empirical and conceptual papers that touch upon this topic, including brief literature reviews that align with the subject’s focus (e.g., Hofmann et al. 2020). However, narrative reviews lack transparency and replicability (Tranfield et al. 2003) and often induce selection bias (Srivastava and Srivastava 2006) as they tend to approach a field from a specific perspective. In contrast, systematic reviews strive to present a holistic, differentiated, and more detailed picture, incorporating the complete available literature (Uman 2011). On the other hand, existing systematic reviews provide structured yet relatively superficial overviews of literature on end-of-use and end-of-life forecasting (Shang et al. 2020), but they do not specifically address consumer returns. Furthermore, we contend that a review dedicated to general reverse logistics forecasting would not adequately capture the distinctive context and requirements inherent in the consumer-retailer relationship within the realm of e-commerce (Abdulla et al. 2019).

Consequently, based on existing reviews and papers, we have identified research gaps worth examining more in detail: (1) Returns forecasting techniques and relevant predictors for the respective underlying purposes, especially in the context of e-commerce (RQ1 and RQ2); (2) the integration of return forecasts into an existing but incomplete taxonomy of machine learning in e-commerce (Micol Policarpo et al. 2021; RQ3); and (3) future research directions pertaining to e-commerce returns forecasting (RQ4). Therefore, this review aims to shed more light on consumer returns forecasting in the retail context. The following research questions outline the primary objectives:

-

RQ1: What key research problems (e.g., forecasting purposes, technological approaches) have been addressed in the literature on forecasting consumer returns over time?

-

RQ2: What are the …

-

(a)

Publication outlets and research disciplines,

-

(b)

Research types and methodologies,

-

(c)

Product categories and industries,

-

(d)

Data sources and characteristics,

-

(e)

Relevant forecasting predictors,

-

(f)

Techniques and algorithms

-

(a)

-

… used to address these key problems?

-

RQ3: How can returns forecasting be integrated into a taxonomy of machine learning in e-commerce?

-

RQ4: What are promising or emerging future research directions regarding forecasting consumer returns?

The paper is organized as follows: Sect. 2 describes selected fundamental concepts and the delimitation of the research field on consumer returns forecasting. Section 3 contains the methodology for the review, drawing on the PRISMA guideline (Page et al. 2021) while integrating the approaches of Denyer and Tranfield (2009) and Webster and Watson (2002). Section 4 presents the review’s main results, answering RQs 1 (Sect. 4.1), RQ2 (Sects. 4.2–4.5), and RQ 3 (Sect. 4.6). A research framework developed in Sect. 5 structures the discussion regarding future research directions (RQ4). Section 6 subsumes the overall contribution of this review.

2 Consumer returns and forecasting

2.1 Consumer returns and return reasons

Reverse product flows, commonly referred to as product returns, can be classified into three categories: manufacturing returns, distribution returns, and consumer returns (Shaharudin et al. 2015; Tibben-Lembke and Rogers 2002). Among these, consumer returns are further differentiated between returns in brick-and-mortar retail or mail-order/e-commerce returns (Tibben-Lembke and Rogers 2002) and are also known as commercial returns (de Brito et al. 2005) or retail (product) returns (Bernon et al. 2016). With sky-rocketing e-commerce sales, online consumer returns have emerged as the dominant segment, making them a highly relevant field of research (Abdulla et al. 2019; Frei et al. 2020). Additionally, the digitization of retail provides numerous opportunities for data collection, as digital customer accounts facilitate more efficient analytical monitoring of customer behavior (Akter and Wamba 2016). Simultaneously, as competitive pressures intensify in e-commerce due to increased price transparency and substitution possibilites, retailers aiming to stimulate impulse purchases face hightened return rates (Cook and Yurchisin 2017; Karl et al. 2022).

The spatial decoupling of supply and demand introduces a higher level of uncertainty for e-commerce customers regarding various product attributes compared to bricks-and-mortar retailing (Hong and Pavlou 2014). As consumers are unable to physically assess the products they order, this translates into returns being essential part of the e-commerce business model. Besides fit uncertainty, other reasons for returns exist. Stöcker et al. (2021) classify the drivers triggering consumer returns into consumer behavior related reasons (e.g., impulsive purchases, showrooming), fulfillment/service related reasons (e.g., wrong/delayed delivery) and information gap related reasons (product fit, insufficient visualization). By mitigating customers’ return reasons, retailers try to reduce the return likelihood (“return avoidance”) (Rogers et al. 2002). Another, but less promising way of reducing returns, is preventing customers who intend to return from actually doing so (e.g., by incurring additional effort or by rejecting returns) (Rogers et al. 2002).

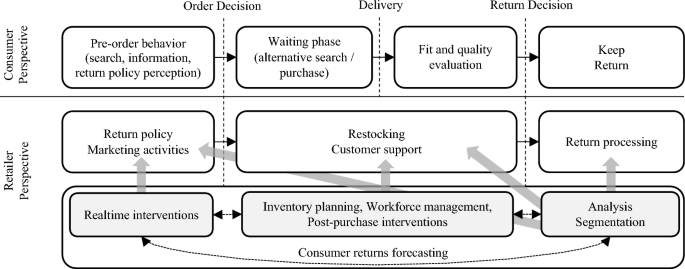

Adapted from Abdulla et al. (2019) and Vakulenko et al. (2019), a simplified parallel process of a return transaction from the consumer’s and retailer’s perspective is visualized in Fig. 1. Retailers can use forecasting in all transaction phases (Hess and Mayhew 1997). Targeting customer interventions pre-purchase (real-time forecasting) could be implemented by using dynamically generated (Dalecke and Karlsen 2020) digital nudging elements (Kaiser 2018; Thaler and Sunstein 2009; Zahn et al. 2022) in case of a predicted high return propensity. In the post-purchase phase, forecasting could stimulate different interventions (e.g., customer support) or can be helpful for logistics and inventory planning activities (Hess and Mayhew 1997). In the phase after the return decision, data analysis, including segmentation on different levels, e.g., for customers, products, or brands (Shang et al. 2020), can support managerial decision-making regarding assortment or (individualized) return policies for future orders (Abdulla et al. 2019). In other words, forecasting (or modeling) of returns in later phases of the process can substantiate interventions in earlier phases of the process (e.g., a temporary return policy change, or the suspension of product promotions due to particular forecasts). However, such data-driven interventions itself also represent an influencing factor to be taken into account in future forecasts; thus, different forecasting purposes can be linked, at least when it comes to the data required. All these interdependencies hint at the circularity of the returns process, with an adequate management of returns representing an opportunity for generating customer satisfaction and retention (Ahsan and Rahman 2016; Röllecke et al. 2018).

Although primarily focussing on the online retailers’ process, it is worth noting that the issue at hand is equally applicable to brick-and-mortar retail (Santoro et al. 2019), which can benefit from the application of advanced data analysis techniques for forecasting purposes (Hess and Mayhew 1997).

2.2 Forecasting purposes and corresponding techniques

Accurate forecasting holds significant importance in the realm of e-commerce. Precise demand forecasts (“predictions”) play a pivotal role in inventory planning, pricing, and promotions and ultimately impact the commercial success of retailers (Ren et al. 2020). Forecasting consumer returns affects similar business aspects and resorts to comparable existing technical procedures. The data science and statistics literature offers diverse methods and algorithms for forecasting consumer returns. The choice of approach depends on the specific objective, with the outcome variable being scaled accordingly. For instance, when forecasting whether a single product will be returned, the dependent variable is either binary or expressed as a propensity value ranging form 0 to 1. On the other hand, forecasting the quantitay or timing of returns entails continuous outcome variables. As a result, various techniques, from time-series forecasting to machine learning approaches can be applied, which will be briefly outlined in the subsequent sections.

2.2.1 Return classifications and propensities

A naïve method for determining the propensity or return decision forecast is using lagged (historical) return information (return rates), either for a given product, a given customer, or any other reference, to calculate a historical return probability (Hess and Mayhew 1997). Return rate forecasts are a reference-specific variant of forecasting return propensities.

Simple causal models based on statistical regression methods utilize one or more independent exogenous variables. The logistic regression (logit model) is employed when the dependent variable is binary or contains more nominal outcomes (multinomial logistic regression). For each observation, the binary logistic regression assesses the probability that the dependent variable takes the value “1” (Hastie et al. 2017). Consequently, this approach finds application for return decisions and return propensities. Comparatively, linear discriminant analysis (Fisher 1936) bears a resemblance to logistic regression by generating a linear combination of independent variables to best classify available data. This classification process involves determining a score for each observation, subsequently compared to a critical discriminant score threshold, and distinguishing between return and keep.

More sophisticated machine learning (ML) techniques such as neural networks, decision tree-based methods, ensemble learning, and boosting methods are highly suitable for this forecasting purpose. For a general exposition of ML techniques in the domain of e-commerce, we refer to Micol Policarpo et al. (2021). Additionally, for a comparative study of several state-of-the-art ML classification techniques, see Fernández-Delgado et al. (2014). Artificial Neural Networks (NN) consist of interconnected nodes (“neurons”) organized in layers, exchanging signals to ascertain a function that accurately assigns input data to corresponding outputs. Typically, supervised learning techniques such as backpropagation compare the network outputs with known actual values (Hastie et al. 2017). Notably, neural networks are the most popular machine learning algorithm in last years’ e-commerce research (Micol Policarpo et al. 2021), and deep learning extensions like Long Short-Term Memory (Bandara et al. 2019) are gaining attention. Decision Trees (DT) manifest as hierarchical structures of branches representing conjunctions of specific characteristics and leaf nodes denoting class labels. This approach endeavors to construct an optimal decision tree for classifying available observations. Many decision tree algorithms have been introduced to serve this purpose (e.g., Breiman et al. 1984; Pandya and Pandya 2015). Ensemble learning methods adopt a voting mechanism involving multiple algorithms to enhance predictive performance (Polikar 2006). Analogously, boosting and bagging techniques are incorporated in algorithms like AdaBoost or the tree-based Random Forest (RF) to augment the input data, aiming at more generalizable forecasting models less prone to overfitting issues (Hastie et al. 2017). Support Vector Machines (SVM) stand as another example of a supervised ML algorithm, having demonstrated efficacy in tackling classification problems within e-commerce (Micol Policarpo et al. 2021).

2.2.2 Return timing and volume forecasts

For product returns, timing is crucial in forecasting end-of-life, end-of-use, or remanufacturing returns that can occur years after the initial purchase (Petropoulos et al. 2022). In contrast, for consumer returns, the possible time window in which products are regularly returned in new condition with the aim of a refund is much shorter (usually less than 100 days and mostly less than 30 days), and priorities are more on forecasting return volumes. Forecasting return volumes can be multi-faceted, ranging from forecasting the total return volume a retailer has to process within its logistics department through forecasting product-specific return numbers up to forecasting costly return shares, e.g., return fraud volume. Because returns depend on fluctuating sales, time-series forecasting of return volumes performs only well with constant sales volumes or under risk-pooling (Petropoulos et al. 2022). Thus, for a naïve return volume forecast, sales forecasts for a given timeframe are multiplied by the lagged return rate (historical data of products/consumers or any other reference). Possible algorithms for estimating historical return rates include time series forecasting to causal predictions comprising ML approaches (Hachimi et al. 2018).

Time-series techniques, e.g., single exponential smoothing (SES) or Holt-Winters-approaches (HW), are based on the assumption that the future development of an outcome variable (e.g., return volume) is dependent on its past numbers, while time acts as the only predictor. Most of these models can be generalized as autoregressive moving averages (ARIMA) models, for which numerous extensions are available. These models can approximate more complex temporal relationships. Similarly, time-series regression models use univariate linear regression with time as a single exogenous variable.

The mentioned multivariate regression models are essential statistical tools and can predict metric variables such as return volume or time. The logic is to fit a linear function of a given set of input variables (“features”) to the outcome variable with the criteria of minimizing the residual sum of squares (Hastie et al. 2017). Many variants of regression models are derived from this logic (e.g., generalized linear models), and various extensions are built upon this base (e.g., LASSO for variable selection, Tibshirani 1996).

Emerging from more complex statistical methods and using the possibilities of continuously increasing computing power, IT-based machine learning (ML) approaches were developed. Some of these approaches have already been presented in Sect. 2.2.1, being suitable for predicting metric variables in addition to classification tasks, e.g., neural networks, decision tree algorithms, and especially ensemble techniques like random forests.

3 Methodology

Methodologically, the research process of this review follows the PRISMA guideline (Page et al. 2021) where applicable and is structured in five steps (Denyer and Tranfield 2009; Webster and Watson 2002): (1) question formulation; (2) locating studies; (3) study selection and evaluation; (4) (concept-centric) analysis and synthesis; and (5) reporting and using the results for defining an agenda for future research.

The first step refers to the research questions already formulated in the introduction. The second step involves selecting the databases and defining the search terms. In that respect, five scientific databases were selected, aiming at journal as well as conference publications: AIS Electronic Library (AISeL), Business Source Ultimate (BS) via EbscoHost, JSTOR (JS), Science Direct (SD), and Web of Science (WoS). To ensure inclusivity and to account for potential variations in spelling or phrasing, the final search strings incorporate truncations where applicable. The search query utilized in this review comprises two key components. Firstly, it pertains to consumer returns, encompassing products returned by consumers, primarily in the context of e-commerce, to the retailer. While it is recommended to use reasonably general search terms, the term “return” alone would yield results for various stages of reverse logistics and a vast amount of financial literature. Therefore, we conducted a more specific search using the phrase “consumer return*” and the related terms “e-commerce return*”, “product return*”, “return* product”, “customer return*”, and “retail return*”. Secondly, this paper specifically focuses on forecasting (“forecast*”), which can be alternately referred to as “predict*” or “prognos*”. The combination of these terms was searched for in the Title, Abstract and Keywords fields.

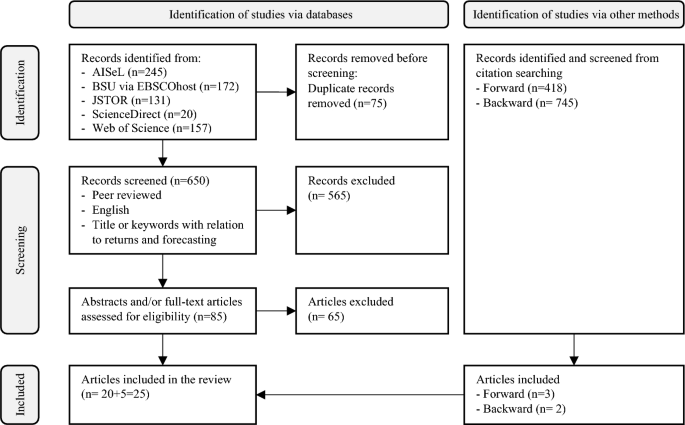

The search includes results up to the middle of 2022 and resulted in 725 initial search hits (see Fig. 2). As this review aims to identify papers dealing with consumer returns and forecasting, the inclusion criteria for eligibility were:

-

The title or keywords referred to consumer returns or forecasting (in a broader sense, including data preparation). A connection to the respective subject area and applicability to the retail domain should at least be plausible.

-

Manuscript in English: No important study would be written and published in a language different than English.

-

The paper has undergone a single- or double-blind peer-review process, either as a journal publication or as a publication in peer-reviewed conference proceedings.

In the third step, duplicates were removed, resulting in a set of 650 unique records. Subsequently, the papers underwent screening based on title, keywords, and language to determine whether they warranted further examination. This preliminary screening phase reduced the number of papers to 85. These papers’ abstracts and full texts were thoroughly reviewed to assess their relevance. This step encompasses all papers pertaining to returns forecasting for retailers or direct-selling manufacturers while excluding those focused on closed-loop supply chain management or remanufacturing, recycling, and end-of-life returns. Ultimately, a final sample of 20 publications was identified, serving as a foundation for identifying additional relevant papers (vom Brocke et al. 2009; Webster and Watson 2002) through a forward search using Google Scholar and snowballing via backward search. This process yielded an additional five papers, resulting in a total of 25 papers included for review (Table 2).

The fourth step comprises the analysis and synthesis of the relevant papers. Data, including bibliographic statistics, were collected in accordance with the research questions. A two-way concept-centric analysis, as described by Webster and Watson (2002), was conducted, encompassing confirmatory aspects based on the fundamentals outlined in Sect. 2 of this paper, as well as exploratory elements aimed at enriching existing categories and concepts. The objective was to comprehensively describe the relevant concepts, approaches, and dimensions discussed in the literature.

Moving on to the fifth and final step (Denyer and Tranfield 2009), the results are presented. Initially, the main scope of the papers included in the analysis is presented. Next, bibliographic data pertaining to the included papers are provided to offer a concise overview of the research area and its recent developments, followed by a content analysis and synthesis of the relevant literature to delve into the current state of research and highlight key findings. Finally, Sect. 5 outlines a research agenda for the domain (vom Brocke et al. 2009).

4 Results of the systematic review

After outlining the main scope of the relevant publications (4.1), a short bibliographic characterization (4.2) is given. Next, this section presents the results of the systematic review, focussing on the methodology and datasets used (4.3), predictors used for returns forecasting (4.4), and forecasting techniques employed (4.5). The integration of consumer returns forecasting into an existing taxonomy for e-commerce and machine learning (Micol Policarpo et al. 2021) summarizes and concludes the presentation of the results.

4.1 Overview and main scope of the relevant publications

Table 3 provides an overview of the forecasting purpose of the papers, the data source for the forecasting, the algorithms employed, and the predictors used in the forecasting models. The contributions of the respective papers regarding forecasting issues are summarized in the Appendix.

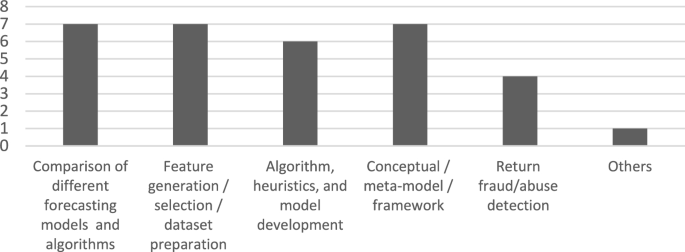

For identifying research streams, the publications are analyzed regarding the intention and main scope, as described in the abstract, the respective research questions, and the remainder of the papers. Most papers were assigned to an unequivocal research scope, while some contributed to two key topics (Fig. 3).

At first, we identified a stream of literature regarding the comparison of different forecasting models and algorithms (Asdecker and Karl 2018; Cui et al. 2020; Drechsler and Lasch 2015; Heilig et al. 2016; Hess and Mayhew 1997; Hofmann et al. 2020; Imran and Amin 2020). These papers use existing approaches, adapt them for individual forecasting purposes, apply models to one or more datasets, and compare and evaluate the resulting forecasting performance. One paper claims that the difference in forecasting accuracy of easily interpretable algorithms is relatively small compared to more sophisticated ML algorithms (Asdecker and Karl 2018). This statement is partially confirmed (Cui et al. 2020), as the ML algorithms show advantages over simpler models in the training data set but have lower prediction quality due to overfitting issues in the test data. Nevertheless, fine-tuned ML approaches (e.g., deep learning with TabNet) outperform simpler models and gain accuracy when correcting class imbalances during the data preparation phase (Imran and Amin 2020). When confronted with large class imbalances (e.g., low return rates), boosting algorithms like Gradient Boosting work well without oversampling (Hofmann et al. 2020). Fundamentally, ensemble models incorporating different techniques show the maximum possible accuracy (Asdecker and Karl 2018; Heilig et al. 2016). Forecasting of return timing is more erroneous than return decisions, and split-hazard-models outperform simple OLS approaches (Hess and Mayhew 1997). Time series prediction only works reliably when return rates do not fluctuate heavily (Drechsler and Lasch 2015).

The second stream we identified focuses on feature generation or selection and dataset preparation (Ahmed et al. 2016; Ding et al. 2016; Hofmann et al. 2020; Rezaei et al. 2021; Samorani et al. 2016; Urbanke et al. 2015, 2017). Besides this central topic, some papers also compare different forecasting algorithms (Ahmed et al. 2016; Hofmann et al. 2020; Rezaei et al. 2021; Urbanke et al. 2015, 2017). For example, random oversampling of data with large class imbalances can improve the performance of different forecasting algorithms, while models based only on sales/return history perform worse than models with more features (Hofmann et al. 2020). Two similar approaches are based on product, basket, and clickstream data, using different algorithms for feature extraction (Urbanke et al. 2015, 2017). The first developed a Mahalanobis Feature Extraction algorithm, proving superior to other algorithms like principal component analysis or non-negative matrix factorization (Urbanke et al. 2015). The second develops a NeuralNet algorithm to extract interpretable features from a high-dimensional dataset, showing superior performance and giving reasonable interpretability of the most important factors (Urbanke et al. 2017). For the automated integration of different data sources into single flat tables and the generation of discriminating features, a rolling-path algorithm is developed, improving performance when data is imbalanced (Ahmed et al. 2016). Similarly, the software “Dataconda” can automatically generate and integrate relational attributes from different sources into a flat table, which is often the required prerequisite for forecasting algorithms (Samorani et al. 2016). A different selection approach clusters the features into groups and applies selection algorithms to the groups, aiming to select a smaller set of attributes (Rezaei et al. 2021). As quite an offshoot, one paper predicts a seller’s overall daily return volume dependent on his current “reputation” measured by tweets (Ding et al. 2016), which needs sentiment analysis to be integrated into the forecast.

A quite heterogenous research stream belongs to the development of algorithms, heuristics, and models that go beyond a straightforward adaption of existing approaches (Fu et al. 2016; Joshi et al. 2018; Li et al. 2018; Potdar and Rogers 2012; Rajasekaran and Priyadarshini 2021; Shang et al. 2020; Sweidan et al. 2020; Zhu et al. 2018). Potdar and Rogers (2012) developed a methodology for forecasting product returns based on reason codes and consumer behavior data. Fu et al. (2016) developed a conditional probability-based statistical model for predicting return propensities while revealing return reasons and outperforming some baseline benchmark models. Li et al. (2018) describe their “HyperGo” approach as a ‘framework’ and develop an algorithm for forecasting return intention after basket composition. Zhu et al. (2018) describe a “LoGraph” random walk algorithm for predicting returned customer/product combinations within their framework. Although Joshi et al. (2018) label their approach as a “framework”, they describe a specific two-stage algorithm for forecasting return decisions based on network science and ML. Rajasekaran and Priyadarshini (2021) developed a hybrid metaheuristic-based regression approach to predict return propensities.

Seven papers deal with concepts, meta-models, or substantial frameworks for returns forecasting (Fu et al. 2016; Fuchs and Lutz 2021; Heilig et al. 2016; Hofmann et al. 2020; Li et al. 2018; Shang et al. 2020; Zhu et al. 2018). A generic framework for a scalable cloud-based platform, which enables a vertical and horizontal adjustment of resources, could enable the practical real-time use of computationally intensive ML algorithms for forecasting returns in an e-commerce platform (Heilig et al. 2016). Two papers (Fuchs and Lutz 2021; Hofmann et al. 2020) are based on design science research (DSR, Hevner et al. 2004) for developing artifacts like meta models and frameworks. The first also refers to CRISP-DM, the “Cross Industry Standard Process for Data Mining” (Wirth and Hipp 2000), and develops a shopping-basket-based general forecasting approach suitable across different industries without domain knowledge and attributes needed (Hofmann et al. 2020). In a similar approach, based on the basket composition and user interactions, a generic model for real-time return prediction and intervention is developed (Fuchs and Lutz 2021) and prepared for integration into an ERP system. Fu et al. (2016) present a generalized return propensity latent model framework by decomposing returns into different inconsistencies (unmet product expectations, shipping issues, and both factors combined) and enriching the derived propensities with product features and customer profiles. Li et al. (2018) developed a “HyperGo” framework for forecasting the return intention in real-time after basket composition, including a hypergraph representation of historical purchase and return information. Similarly, Zhu et al. (2018) developed a “HyGraph” representation of historical customer behavior and customer/product similarity, combined with a “LoGraph” random-walk-based algorithm for predicting customer/product combinations that will be returned. Shang et al. (2020) discuss two opposing forecasting concepts, demonstrating that their predict-aggregate framework is superior to common and more naïve aggregate-predict approaches.

The last stream covers the detection and forecasting of return fraud and abuse (Drechsler and Lasch 2015; John et al. 2020; Ketzenberg et al. 2020; Li et al. 2019). On the employees’ side, one paper tries to automatically predict fraudulent return behavior of agents (employees), e.g., regarding unjustified refunds, by a penalized logit model, enabling a lift in detection (John et al. 2020). On the customers’ side, misused returns as a cost-incurring problem are the forecasting purpose of different time series prediction models (Drechsler and Lasch 2015). Instead of focussing on fraudulent transactions, a trust-aware random walk model identifies consumer anomalies, enabling retailers to apply targeted measures to specific customer groups (selfish, honest, fraud, and irrelevant customers) (Li et al. 2019). Similarly, returning customers can be categorized into abusive, legitimate, and nonreturners (Ketzenberg et al. 2020). Based on the characterization of abusive return behavior, a neural network classifier recaptures almost 50% of lost profits due to return abuse (Ketzenberg et al. 2020).

One paper (Sweidan et al. 2020) could not be assigned to the other scopes. It applies a single algorithm (RF) to a given dataset, and it contributes to the idea that only forecasted return decisions with high confidence should be used for targeted interventions due to their overproportional reliability.

4.2 Bibliographic literature analysis

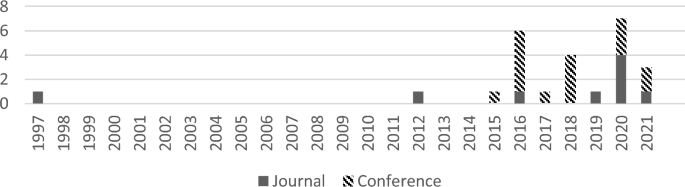

Forecasting consumer returns has gained more research attention since 2016 (Fig. 4). The majority of the sample are conference publications, a couple of years ahead of the rise in journal publications. Compared to the publications on returns forecasting in the broader context of reverse logistics, which emerged in 2006 (Agrawal et al. 2015), the research on consumer returns moved into the spotlight about ten years later. This development is linked to a massive increase in e-commerce sales pre- and in-pandemic (Alfonso et al. 2021).

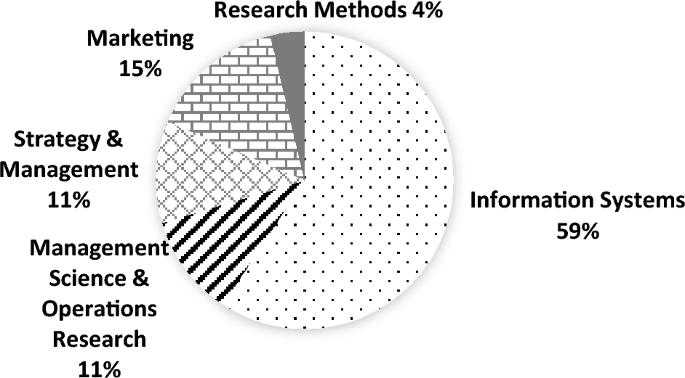

Out of 9 journal publications in the final sample, only two are published in the same journal (Journal of Operations Management). Out of 16 conference papers, 6 are published at conferences of the Association for Information Systems. In total, 16 of the 25 papers found are published in Information Systems (IS) and related outlets. Others can be assigned to the Management Science / Operations Research discipline (3), Strategy & Management in a broader sense (4), Marketing (1), and Research Methods (1) (Fig. 5).

Regarding the researchers’ geographical perspective, one paper was jointly published by authors from the US and China, 10 of 25 papers were authored from North America, followed by authors from Germany (7), India (3), China (1), and one paper each from Bangladesh, Singapore, and Sweden.

The most cited paper (200 external citationsFootnote 2) from Hess and Mayhew (1997) could be thought of as the root of this research field (Table 4). However, only 10 out of 24 papers reference this work. Although Urbanke et al. (2015) received only 15 citations in total, within the sample, it is the second most cited paper (8 citations) and could eventually be classified as a research strand and origin of returns forecasting in the IS domain. Concerning the remaining papers, no unique strands of literature are recognizable based on citation analysis.

4.3 Methodology and data characterization

Regarding methodology, most of the papers start with a short narrative literature review regarding their respective focus. Not a single paper was based on interviews, surveys, questionnaires, or field experiments. 3 out of 25 papers formulated and tested conventional hypotheses. All of the publications use quantitative data for analysis and forecasting in a “case study” style, including numerical experiments based on real or simulated data.

Table 5 lists further details about the data used in the publications. 4 out of 25 papers rely on simulated data, and 23 out of 25 integrate actual data gained from a retailer. Two papers use both data types. 5 papers use more than one dataset (Ahmed et al. 2016; Cui et al. 2020; Rezaei et al. 2021; Samorani et al. 2016; Shang et al. 2020). The most frequently studied industry is fashion/apparel (10 papers), followed by five consumer electronics datasets. Two publications are based on data from a Taobao cosmetics retailer, and two datasets originate from general and wide assortment retailers. Two datasets incorporate building material and hardware store articles, and the detailed products are not named for three publications. Based on the previous studies, it is evident that consumer returns forecasting is most relevant for e-commerce, as 19 of the 25 publications refer to e-tailers. Nevertheless, 7 publications refer to brick-and-mortar retailing. Direct selling/marketing is represented in 2 data sets.

4.4 Predictors for consumer returns

There is an individual stream of research into factors that influence or help avoid consumer returns (e.g., Asdecker et al. 2017; De et al. 2013; Walsh and Möhring 2017), which is not part of this review. Nevertheless, the forecasting literature gives insights into return drivers, as the input variables (features, predictors, exogenous variables) for forecasting models represent some of these factors. Table 6 presents the most used predictors and tries to map these to the return driver categorization from Sect. 2.2 (Stöcker et al. 2021).

Although only a part of the publications interprets the predictors, some insights can be extracted. For total return volume, sales volume is the most critical predictor (Cui et al. 2020; Shang et al. 2020). Historical return volume trends can include behavioral aspects (e.g., impulse purchases) in a given timeframe (Cui et al. 2020; Shang et al. 2020). The product type significantly impacts the volume of returns (Cui et al. 2020), confirmed by widely varying return rates between different industries/sectors. Adding transaction-, customer-, or product-level predictors led to a surprisingly small forecasting accuracy gain (4% reduction of RMSE, Shang et al. 2020). The latter input variables may be more critical in forecasting return decisions and propensities.

Regarding product attributes, product or order price is one of the most common predictors, while some papers also include price discounts. In most models, price is hypothesized to increase returns (e.g., Asdecker and Karl 2018; Hess and Mayhew 1997). Promotional (discounted) orders also seem to result in more returns (Imran and Amin 2020), which could be explained by the stimulation of impulse purchases.Footnote 3 Brand perception influences return decisions (positive brands, lower returns) (Samorani et al. 2016). The order and return history of products are also relevant for predicting future orders and returns (Hofmann et al. 2020). Fit importance as a product attribute does not significantly change return propensities (Hess and Mayhew 1997).

Concerning customer attributes, gender seems essential, as female customers return significantly more items than men (Asdecker and Karl 2018; Fu et al. 2016). Younger customers show a slightly lower propensity to return (Asdecker and Karl 2018), but age played a more prominent role in predicting return fraud among employees than in customers (John et al. 2020 observed more fraud among younger employees). Customers with low credit scores returned more (Fu et al. 2016). The return history of a customer is possibly the most important predictor of future return behavior (Samorani et al. 2016). Some papers argue that consumer attributes, including purchase and return history (e.g., number and value of orders), are more relevant predictors than product or transaction profiles, reflecting more or less stable consumer preferences (Li et al. 2019).

Basket interactions are significant (Urbanke et al. 2017) in returns prediction. E.g., the larger the basket, the higher the return propensity will be (Asdecker and Karl 2018). Selection orders (same product in different sizes or colors) increase the return propensity (Li et al. 2018). Logistics attributes like delivery times only show minor effects (Asdecker and Karl 2018). Regarding the payment method, prepaid products are sent back less frequently than those with post-delivery payment options (Imran and Amin 2020), confirming other research results (Asdecker et al. 2017).

One literature stream focuses on the automated generation of features, as different and large-scale data sources need to be integrated and prepared for forecasting algorithms. Thus, possible interrelationships are complex to find manually, and ML approaches might outperform human analysts (Rezaei et al. 2021). While some approaches generate a large number of features that are hard to make sense of (Ahmed et al. 2016), the approach of Urbanke et al. (2017) aims to maintain the interpretability of automatically generated input variables. Some unexpected but meaningful interrelations might be found by automatic feature generation, e.g., the price of the last returned orders (Samorani et al. 2016). Nevertheless, automatic feature generation might be computation-intensive; thus, a parallel integration of feature selection could be advantageous for large data sets (Rezaei et al. 2021).

A remarkable research path based on artificial intelligence is integrating qualitative information like product reviews as predictors, going beyond numerical feedback (Rajasekaran and Priyadarshini 2021) or tweets. These data can be processed and made accessible for forecasting with ML-based sentiment analysis techniques (Ding et al. 2016).

4.5 Forecasting techniques and algorithms

To describe the techniques and algorithms employed, we sorted the papers by forecasting purpose as described in Sect. 2, then assigned them to different algorithms, either from time series forecasting, statistical techniques, or ML algorithms. Table 7 lists all papers for which an assignment was possible, and the respective techniques used. If a comparison was possible, the best-performing algorithm is marked in this table.

The approaches listed in Table 7 are overlap-free, but some papers use more than one version of an approach, i.e., more than one algorithm from a category. E.g., TabNet is a DeepLearning version of neural networks (NN), and different variants of GradientBoosting are compared in one paper (CatBoost/LightGBM, not differentiated in the table below) (Imran and Amin 2020).

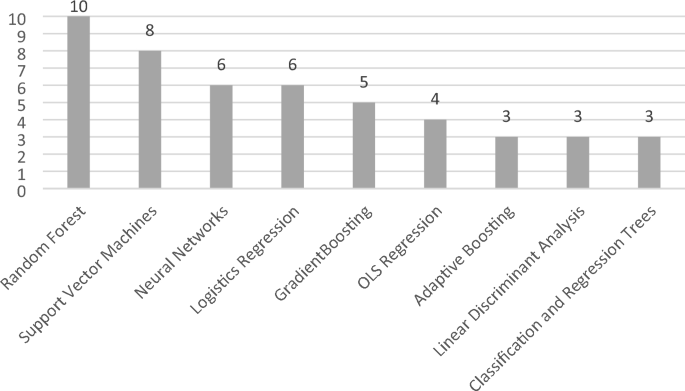

The algorithm used most frequently (Fig. 6) is the Random Forest algorithm (RF, 10 papers), followed by Support Vector Machines (SVM, 8 papers), Neural Networks (NN, 6 papers), logistic regression (Logit, 6 papers), GradientBoosting (5 papers), Ordinary Least Squares regression (OLS, 4 papers), Adaptive Boosting (AdaBoost), Linear Discriminant Analysis (LDA), and CART (Classification and Regression Trees, 3 papers each).

The papers focusing on return volume use time series forecasts like (AutoRegressive) Moving Averages (MA), Single Exponential Smoothing (SES), and Holt-Winters Smoothing (HWS) more frequently than ML algorithms. Nevertheless, when considering a predict-aggregate approach as proposed by Shang et al. (2020), these ML techniques could be helpful in forecasting return decisions first and cumulating the propensity results for the volume prediction in the second step.

In forecasting binary return decisions, Random Forests (RF) (Ahmed et al. 2016; Heilig et al. 2016; Ketzenberg et al. 2020), Neural Networks (NN) (Imran and Amin 2020; Ketzenberg et al. 2020), as well as Adaptive Boosting (AdaBoost) (Urbanke et al. 2015, 2017) showed high prediction performance. The performance of different algorithms varies depending on the data set, the implementation, and the parameterization used. For this reason, it is hardly possible to make a generally valid statement regarding performance levels. Combining several algorithms in ensembles (Asdecker and Karl 2018; Heilig et al. 2016) seems advantageous, at least for retrospective analytical purposes, when the required computing resources are less relevant.

When evaluating different forecasting algorithms for return decisions, imbalanced classes (especially evident for low return shares in non-fashion datasets) seem to be handled differently depending on the algorithms. Class imbalances might distort comparison results in some publications. Random oversampling as a measure of data preparation can solve this problem (Hofmann et al. 2020).

High-performance algorithms are needed for real-time predictions, e.g., graph and random-walk-based (Li et al. 2018; Zhu et al. 2018). According to Li et al. (2018), the proposed algorithm “HyperGo” performs best for most performance metrics.

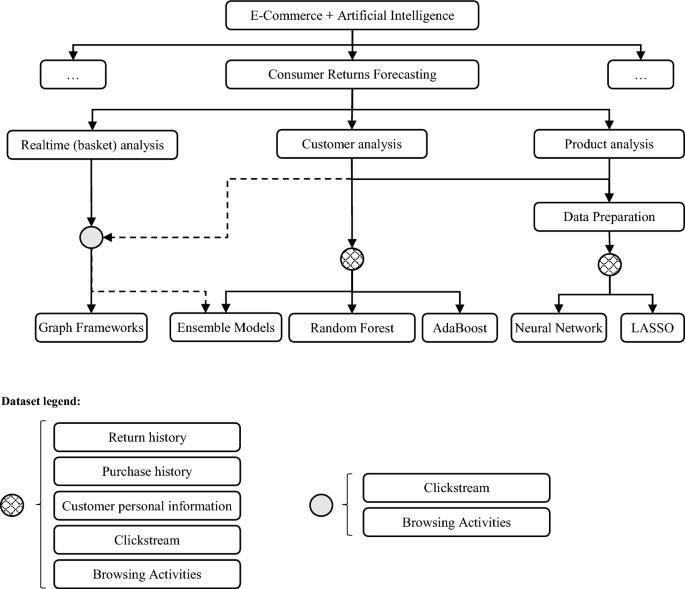

4.6 E-Commerce and machine learning taxonomy extension

In their literature review regarding the use of ML techniques in e-commerce, Micol Policarpo et al. (2021) propose a taxonomy to visualize specific ML algorithms in the context of e-commerce platforms. This novel kind of taxonomy is based on direct acyclic graphs, i.e., all input variables need to be fulfilled to reach the target. The first level of the taxonomy represents different target goals for the use of ML in e-commerce. While returns forecasting (“product return prediction”) is identified as an essential goal among others (purchase prediction, repurchase prediction, customer relationship management, discovering relationships between data, fraud detection, and recommendation systems), it was excluded from the taxonomy they developed, possibly because the review comprised only two relevant papers on this topic (Micol Policarpo et al. 2021). The review at hand proposes an extension of Micol Policarpo’s taxonomy, renaming the goal to “consumer returns forecasting”. This extension reflects and synthesizes the consumer returns forecasting studies reviewed.

The middle level of the taxonomy represents properties and features that support this superordinate goal. On this level, our extension does not include return fraud detection, which we propose to be integrated into the existing category of “fraud detection”, separated into transaction analysis and consumer analysis (Micol Policarpo et al. 2021). Circles represent the necessary data to execute the analysis, referring to categories introduced in (Micol Policarpo et al. 2021), with an additional “return history” category. The bottom level presents the algorithms described frequently, while some streamlining is required regarding the tools and approaches that seem the most common or most appropriate.

The schematic above (Fig. 7) is to be read as follows: In the context of E-Commerce + Artificial Intelligence (Layer 1), Consumer Return Forecasting (Layer 2) is an essential goal among six other goals. Layer 3 presents different purposes of analysis, which are the base for return forecasting. Realtime Basket Analysis is based on clickstream data and basket composition (browsing activities) to target interventions. Basket analysis benefits from customer and product information (dotted line). Graph-based approaches (Li et al. 2018; Zhu et al. 2018) are promising for real-time analysis due to their lower computing requirements, although cloud-based implementation of more complex algorithms or ensemble models might be feasible (Fuchs and Lutz 2021; Heilig et al. 2016; Hofmann et al. 2020). Customer Analysis and Product Analysis (e.g., Potdar and Rogers 2012) require adequate Data Preparation in the sense of input variable generation, extraction, and selection (Urbanke et al. 2015, 2017). For these purposes, data regarding return history (e.g., Hofmann et al. 2020; Ketzenberg et al. 2020), purchase history (e.g., Cui et al. 2020; Fu et al. 2016), customer personal information (e.g., Heilig et al. 2016; Ketzenberg et al. 2020), clickstream data, and browsing activities are required as input (shown by cross-hatched circles). For each purpose, one or more possible algorithms are shown.

Proposed consumer returns forecasting extension to the E-commerce and Machine Learning techniques taxonomy of Micol Policarpo et al. (2021, p. 13)

Compared to predicting purchase intention, return predictions seem to require more levels of data. Nevertheless, even simple rule-based interventions can promise benefits, e.g., selection orders that inevitably lead to a return shipment can be easily recognized (Hofmann et al. 2020; Sweidan et al. 2020). Different ML techniques are helpful for data preparation and input variable (feature) extraction and generation when considering more complex interrelations. NeuralNet is one example of an automatic selection of relevant features (Urbanke et al. 2017). These approaches are not only able to enhance forecasting accuracy (Rezaei et al. 2021) but can also render the many possible variables interpretable about their content.

5 Discussion

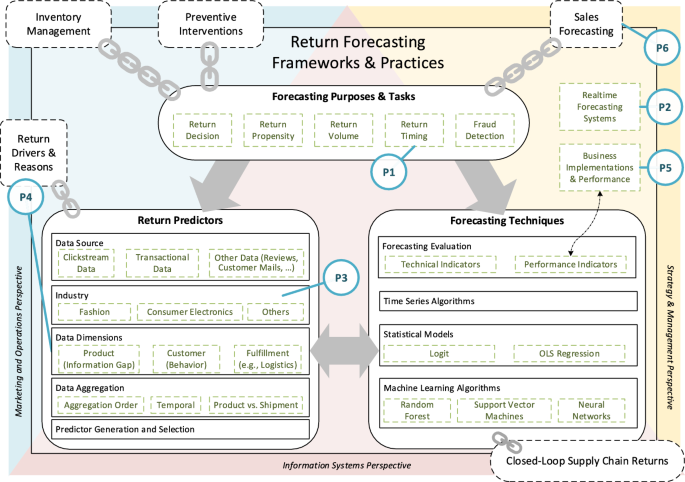

The analysis of the papers above revealed that research in this discipline seems heterogeneous and partly fragmented, and clear-cut research strands are still hard to identify. Thus, the existing literature calls for further publications to render this research field more comprehensive. Below, research opportunities are derived and embedded in a conceptual research framework derived from the results of the existing literature, also integrating the extension of the E-Commerce and Machine Learning taxonomy (Fig. 7). A conceptual framework improves the understanding of a complex topic by naming and explaining key concepts and their relationships important to a specific field (Jabareen 2009; Miles et al. 2020). Thus, this framework aims to organize problems and solutions discussed in the consumer returns forecasting literature and to embed and classify potential future research topics in the existing knowledge base (Ravitch and Riggan 2017). The subsections following the framework outline some potential research avenues (P1–P6) that have been touched on in the past but still leave considerable opportunities for further insights. These proposals should not be seen as comprehensive due to numerous other research opportunities in this field but rather as prioritization based on the current literature.

The framework derived (Fig. 8) underlines the interdisciplinary nature of this research field, integrating different perspectives (information systems research, marketing and operations perspective, and strategy and management perspective). From a managerial point of view, the literature included in this review is biased towards the information systems perspective. Thus, in contrast to the framework developed by Cirqueira et al. (2020) for purchase prediction, we do not take a process perspective but instead emphasize the interdependencies and interactions between research topics and highlight the managerial need to take a strategical perspective similar to the framework developed by Winklhofer et al. (1996). Consequently, a meta-layer on forecasting frameworks and practices includes the mainly technical development frameworks in this review but also accentuates the need for further research regarding actual organizational forecasting practices (e.g., P2, P5, P6). Around this meta-layer, some related research strands are linked in order to embed the topic of returns forecasting in the research landscape. E.g., in general, forecasting purchases and returns could be linked (P6), also effecting inventory decisions.

The center of the framework consists of three dimensions, namely purposes and tasks, predictors, and techniques. Depending on the strategical purpose, tasks are derived that determine (1) the data (predictors) needed and (2) the usable techniques to execute the forecasting. Different forecasting techniques require an individual set of predictors, whereas the availability of specific data allows and determines the use of more or less sophisticated algorithms.

In the literature, some forecasting purposes were more pronounced (return decisions or propensities), while others have gained less attention (return timing, P1). Regarding the data necessary for accurate forecasting, the return predictors discussed often were hardly comparable, as they originated from different data sources, different industries, were related to different dimensions, or were aggregated in another way. Systematically linking forecasting predictors and research on return drivers and reasons could contribute significant insights (P4) that, from a marketing perspective, may support the development of effective preventive instruments. Furthermore, the literature mainly refers to the fashion or consumer electronics industry, leaving room to validate the findings in the context of other industries (P3).

When (automatically) selecting or creating predictors, the boundaries between predictors and prediction techniques are blurred as machine learning algorithms prepare the input data before executing a forecasting model. Regarding forecasting techniques, time series forecasting was seldom used in recent publications. Machine learning algorithms were the most popular subject of investigation, with random forests, support vector machines, and neural networks as the most popular implementations. Classical statistical models like logit models for return decisions or OLS regression gained less research attention. Literature on end-of-life return forecasting could complement the research on techniques and their accuracy. Most publications used technical indicators for assessing the accuracy of forecasting models, which is the information systems perspective. From a managerial position, evaluating (monetary) performance outcomes (e.g., Ketzenberg et al. 2020) of forecasting systems should be more relevant.

5.1 Research proposal P1: return timing for consumer returns

Toktay et al. (2004) encouraged the integrated forecasting of the return rate and the return time lag. In line with this, Shang et al. (2020) criticize the missing focus on the timing of return forecasts. The reviewed literature confirms that forecasting return propensities and decisions are more prominent than timing and volume forecasts. While the knowledge of when a return is expected is vital in managing end-of-life returns that occur over the years, for retail consumer returns, return periods are mostly 14–30 days. Thus, the variability of return timing seems limited compared to end-of-life returns in this context, which makes this forecasting purpose less critical. Nevertheless, some retailers offer up to 100 days of free returns (e.g., Zalando). Consequently, more studies about the importance of return timing forecasts in the e-commerce context from a business and planning perspective and their interdependence with return processing or warehousing issues could shed light on this topic and complement the current literature (Toktay et al. 2004; Shang et al. 2020).

5.2 Research proposal P2: realtime forecasting systems

Another research gap became apparent regarding the real-time use of forecasting systems and the associated activities and interventions, building on the initial research and the frameworks already published (e.g., Heilig et al. 2016; Urbanke et al. 2015). The generic framework developed by Fuchs and Lutz (2021) could serve as a launching pad for this stream of research.

-

The paper from Ketzenberg et al. (2020) could act as a stimulus and inspiration for a similar approach, not only focusing on return abuse as already examined but on return forecasting in general, the possible associated interventions for various consumer groups, and the resulting consequences for the retailer’s profit. Even the methodology of customer classification could be helpful for many retailers in targeting interventions.

-

Before real-time return forecasting is implemented, associated preventive return management instruments need to be designed and evaluated. Many of these measures are discussed (e.g., Urbanke et al. 2015; Walsh et al. 2014), but an overview of which preventive measures (for some examples, see Walsh and Möhring 2017) are effective in general (1) and how forecasting accuracy interdepends with their usefulness (2) is still missing, to substantially link the topics of forecasting and interventions. No answers could be found to the call by Urbanke et al. (2015) for field experiments to investigate such a link.

-

Thanks to cloud and parallelization technologies and the associated scalability of computing power (Bekkerman et al. 2011), algorithm runtimes are becoming less relevant. However, especially for real-time use, it should be evaluated which algorithms and underlying datasets exhibit an appropriate relationship between the targeted forecasting accuracy, the expected benefit, and the required computing power.

-

Recommendations concerning the algorithms and techniques can be derived (Urbanke et al. 2015), and a generic implementation framework was developed (Fuchs and Lutz 2021). However, from a business perspective, no contributions could be found regarding the actual implementation of real-time forecasting systems, the interventions involved, and their impact on consumer behavior or profit (also see proposal P5). In addition, the implementations of such systems need to be analyzed concerning the cost-effectiveness of the required investments.

5.3 Research proposal P3: cross-industry and multiple dataset studies

Many publications rely on a single data set from a specific industry or retailer. Only a few compare several retailers (e.g., Cui et al. 2020). Studies including and comparing different countries are missing, which is especially interesting since legal regulations for returns vary. For example, in contrast to the U.S., citizens within the EU are granted a 14-day right of withdrawal for distance selling purchases.Footnote 4 Although in most developed countries, liberal and broadly comparable returns policies are standard in practice due to competitive pressure, the generalizability of the results is frequently limited. One remedy for this problem is to use multiple data sets from different retailers (e.g., electronics vs. jewelry, Shang et al. 2020). Admittedly, it is challenging to simultaneously collaborate with several retailers and to combine different data sets, due to reasons of preserving corporate privacy and synchronizing various data sources. Nevertheless, research needs to draw conclusions from single data points, as well as logically replicate or falsify those results by integrating more data points to find patterns of similarities and differences, either within or cross-study (Hamermesh 2007). Therefore, we suggest that future studies acquire industry-related datasets from several retailers at once or replicate existing studies, which aligns with the aim and scope of Management Review Quarterly (Block and Kuckertz 2018). Cross-industry or cross-country manuscripts, which go beyond the mere assertion of an industry-agnostic approach (Hofmann et al. 2020) and jointly investigate data from several sectors, would promise an additional gain in knowledge and could be less challenging from a privacy perspective.

5.4 Research proposal P4: extended study of relevant predictors in forecasting applications

Although not the main focus of this review, predictors of consumer returns are especially interesting for marketing and e-commerce research, for example, regarding preventive measures for avoiding returns. In the past, many consumer return papers highlighted single aspects or a limited selection of return drivers or preventive measures employed but rarely attempted to model return behavior as comprehensively as possible. However, the latter is the very objective of returns forecasting, which is why the findings on influencing factors in articles with a forecasting focus tend to be more holistic, although not sufficiently complete (Hachimi et al. 2018). Some return reasons named in the literature (e.g., Stöcker et al. 2021) have not yet been included in forecasting approaches, and vice versa, only a part of the influencing factors investigated could be mapped to a return reason categorization. The reason categories assigned (Sect. 4.4, Table 6) still contain some uncertainty. For example, a customer’s product return history may reflect the general returning behavior of a customer to some extent, while it can not be ruled out that repeated logistical problems caused the returns. Product attributes may reflect information gaps that consumers can only assess after physically inspecting the product, whereas product price–frequently cited and influential product attribute—is only related to information gaps when considering the price-performance ratio (Stöcker et al. 2021). Technical information about the web browser or device used by the customer is difficult to categorize, as it may reflect behavioral (impulse-driven mobile shopping) as well as informational (small display with few visible information) aspects. The payment method chosen by a customer, for example, could not be linked to one of the reason categories.

This reasoning should serve as a basis for linking forecasting predictors and return reasons more closely in the future. For example, the respective relative weighting of return drivers is more likely to be obtained considering as many factors involved as possible, minimizing the unexplained variation. From the reviewed literature, we extracted 18 different return predictor categories. For instance, seven papers (Cui et al. 2020; Fu et al. 2016; Ketzenberg et al. 2020; Li et al. 2018, 2019; Urbanke et al. 2015, 2017) integrated more than five predictor categories. But even though some papers integrate more than 5,000 features for automated feature selection (Ketzenberg et al. 2020), there are still combinations of input variable categories that have not been investigated and, more importantly, interpreted yet. Therefore, we call for more comprehensive research on return predictors and their interpretation, including associated preventive return measures, in the context of return forecasting.

5.5 Research proposal P5: descriptive case studies and business implementations surveys

This review identified a lack of publications regarding the actual benefit and the diffusion of consumer returns forecasting systems in different scopes and industries, building on the papers presenting return forecasting frameworks. In 2013, less than half of German retailers analyzed the likelihood of returns (Pur et al. 2013). Most of those who did were using naïve approaches that might be outperformed by the models presented in this review. Still, we do not know the status quo regarding the degree of adoption and implementation of forecasting systems for consumer returns in e-commerce firms (e.g., see Mentzer and Kahn 1995 for sales forecasting systems), country-specific and internationally.

Furthermore, the impact of return forecasting practices on company performance should be examined not only based on modeling, but on retrospective data (e.g., see Zotteri and Kalchschmidt 2007 for a similar study on demand forecasting practices in manufacturing). A possible hypothesis to examine might be that accuracy measures like RMSE or precision/recall and subsequently even the choice of the most accurate machine learning algorithm (e.g., see Asdecker and Karl 2018) are less relevant from a business perspective: (1) No algorithm clearly outperforms all other algorithms, and (2) the correlation between technical indicators and business value is unstable (Leitch and Tanner 1991). Methodologically, implementations of consumer returns forecasting in e-commerce should thus be surveyed and analyzed with multivariate statistical methods to examine critical factors and circumstances of return forecasting systems – similar to publications on reverse logistics performance (Agrawal and Singh 2020).

5.6 Research proposal P6: holistic forward and backward forecasting framework for e-tailers

Some publications present frameworks for forecasting returns (Fuchs and Lutz 2021). Nevertheless, in the past, forecasting in retail and especially e-commerce commonly focused more on demand (Micol Policarpo et al. 2021) than returns. Current approaches for demand forecasting try to predict individual purchase intentions based on click-stream data, online session attributes, and customer history (e.g., Esmeli et al. 2021). Our systematic approach could not identify any paper that connects and integrates both directions in e-commerce forecasting, neither conceptual (frameworks) nor with a quantitative or case-study-like approach. Nevertheless, first implementations of return predictions in inventory management are presented (e.g., Goedhart et al. 2023). Subsequently, similar to Goltsos et al. (2019), we call for research addressing both demand and return uncertainties by providing a holistic forecasting framework in the context of e-commerce.

6 Conclusion

To date, no systematic literature review has undertaken an in-depth exploration of the topic of forecasting consumer returns in the e-commerce context. Previous reviews have primarily focused on product returns forecasting within the broader context of reverse logistics or closed-loop supply chain management (Agrawal et al. 2015; Ambilkar et al. 2021; Hachimi et al. 2018). Regrettably, the interdisciplinary nature of this subject has often been overlooked, also neglecting the inclusion of results from information systems research.

The review first aims to provide an overview of the existing literature (Kraus et al. 2022) on forecasting consumer returns. The findings confirm that this once novel topic has significantly evolved in recent years. Consequently, this review is timely in examining current gaps and establishing a robust foundation for future research, which forms a second goal of systematic reviews (Kraus et al. 2022). The current body of work encompasses various aspects from different domains, including marketing, operations management/research, and information systems research, highlighting the interdisciplinary nature of e-commerce analytics and research. As a result, future studies can find suitable publication outlets in domain-specific as well as methodologically oriented journals and conferences.

Scientifically, the algorithms and predictors investigated in previous research serve as a foundational reference for subsequent publications and informed decisions regarding research design, ensuring that specific predictors and techniques are not overlooked. Researchers can utilize this review and the research framework developed as a structuring guide, e.g., regarding relevant publications on already examined algorithms or predictors.

Managerially, the extended taxonomy for machine learning in e-commerce (Micol Policarpo et al. 2021) can serve as a guideline for implementing forecasting systems for consumer returns. This review classifies possible prediction purposes, allowing businesses to apply them based on their respective challenges. Exploring the most frequently used predictors reveals the data that must be collected for the respective purposes. This review also offers valuable insights into data (pre-)processing and highlights popular algorithms. Furthermore, frameworks are outlined that support the design and implementation phase of such forecasting systems, supporting analytical purposes or enabling direct interventions during the online shopping process flow. As an exemplary and promising application, return policies could be personalized (Abbey et al. 2018) by identifying opportunistic or fraudulent basket compositions or high-returning customers, thereby reducing unwanted returns (Lantz and Hjort 2013).

Finally, a limitation of this review is the exclusion of forecasting algorithms for end-of-use returns, which could potentially be applicable to forecasting shorter-term retail consumer returns. However, the closed-loop supply chain and reverse logistics literature has been systematically excluded. Hence, future reviews could synthesize previous reviews on reverse logistics forecasting with the more detailed findings presented in this paper.

Notes

The use of Google Scholar for systematic scientific information search is controversely discussed (e.g., Halevi et al. 2017) due to the missing quality control and indexing guidelines, as well as limited advanced search options. But as an additional database for an initial search, the wide coverage of this search system can enrich the results.

External citations according to Google Scholar, which is preferable for citation tracking over controlled databases (Halevi et al. 2017).

Other literature also describes a counteracting effect of a reduced price due to lowered quality expectations or a higher perceived value of the “deal” itself (e.g., Sahoo et al. 2018).

It should be noted that the relevance of the forecasting topic depends on the maturity of the e-commerce sector. In most developing countries, B2C e-commerce is comparatively young and consumer returns are not yet a common phenomenon, which is why research on return forecasts is relatively insignificant for these countries.

References

Abbey JD, Ketzenberg ME, Metters R (2018) A more profitable approach to product returns. MIT Sloan Manag Rev 60(1):71–74

Abdulla H, Ketzenberg ME, Abbey JD (2019) Taking stock of consumer returns: a review and classification of the literature. J Oper Manag 65(6):560–605. https://doi.org/10.1002/joom.1047

Agrawal S, Singh RK (2020) Forecasting product returns and reverse logistics performance: structural equation modelling. MEQ 31(5):1223–1237. https://doi.org/10.1108/MEQ-05-2019-0109

Agrawal S, Singh RK, Murtaza Q (2015) A literature review and perspectives in reverse logistics. Resour Conserv Recycl 97:76–92. https://doi.org/10.1016/j.resconrec.2015.02.009

Ahmed F, Samorani M, Bellinger C, Zaiane OR (2016) Advantage of integration in big data: feature generation in multi-relational databases for imbalanced learning. In: Proceedings of the 4th IEEE international conference on big data, pp 532–539. https://doi.org/10.1109/BigData.2016.7840644

Ahsan K, Rahman S (2016) An investigation into critical service determinants of customer to business (C2B) type product returns in retail firms. Int Jnl Phys Dist Log Manage 46(6/7):606–633. https://doi.org/10.1108/IJPDLM-09-2015-0235

Akter S, Wamba SF (2016) Big data analytics in e-commerce: a systematic review and agenda for future research. Electron Markets 26(2):173–194. https://doi.org/10.1007/s12525-016-0219-0

Alfonso V, Boar C, Frost J, Gambacorta L, Liu J (2021) E-commerce in the pandemic and beyond. BIS Bulletin 36

Ambilkar P, Dohale V, Gunasekaran A, Bilolikar V (2021) Product returns management: a comprehensive review and future research agenda. Int J Prod Res. https://doi.org/10.1080/00207543.2021.1933645

Asdecker B (2015) Returning mail-order goods: analyzing the relationship between the rate of returns and the associated costs. Logist Res 8(1):1–12. https://doi.org/10.1007/s12159-015-0124-5

Asdecker B, Karl D (2018) Big data analytics in returns management–are complex techniques necessary to forecast consumer returns properly? In: Proceedings of the 2nd international conference on advanced research methods and analytics, Valencia, pp 39–46. https://doi.org/10.4995/CARMA2018.2018.8303

Asdecker B, Karl D, Sucky E (2017) Examining drivers of consumer returns in e-tailing with real shop data. In: Proceedings of the 50th Hawaii international conference on system sciences (HICSS). https://doi.org/10.24251/HICSS.2017.507

Bandara K, Shi P, Bergmeir C, Hewamalage H, Tran Q, Seaman B (2019) Sales Demand forecast in e-commerce using a long short-term memory neural network methodology. In: Gedeon T, Wong KW, Lee M (eds) Neural information processing: proceedings of the 26th international conference on neural information processing, 1st edn., vol 11955, pp 462–474. https://doi.org/10.1007/978-3-030-36718-3_39

Barbosa MW, La Vicente AdC, Ladeira MB, de Oliveira MPV (2018) Managing supply chain resources with big data analytics: a systematic review. Int J Log Res Appl 21(3):177–200. https://doi.org/10.1080/13675567.2017.1369501

Bekkerman R, Bilenko M, Langford J (2011) Scaling up machine learning. In: Proceedings of the 17th ACM SIGKDD international conference tutorials, p 1. https://doi.org/10.1145/2107736.2107740

Bernon M, Cullen J, Gorst J (2016) Online retail returns management. Int J Phys Distrib Logist Manag 46(6/7):584–605. https://doi.org/10.1108/IJPDLM-01-2015-0010

Block J, Kuckertz A (2018) Seven principles of effective replication studies: strengthening the evidence base of management research. Manag Rev Q 68(4):355–359. https://doi.org/10.1007/s11301-018-0149-3

Breiman L, Friedman JH, Olshen RA, Stone CJ (1984) Classification and regression trees. Wadsworth & Brooks/Cole Advanced Books & Software, Monterey, CA

Cirqueira D, Hofer M, Nedbal D, Helfert M, Bezbradica M (2020) Customer purchase behavior prediction in e-commerce: a conceptual framework and research Agenda. In: Ceci M, Loglisci C, Manco G, Masciari E, Raś Z (eds) New frontiers in mining complex patterns, vol 11948. Springer, Cham, pp 119–136. https://doi.org/10.1007/978-3-030-48861-1_8

Clottey T, Benton WC (2014) Determining core acquisition quantities when products have long return lags. IIE Trans 46(9):880–893. https://doi.org/10.1080/0740817X.2014.882531

Cook SC, Yurchisin J (2017) Fast fashion environments: consumer’s heaven or retailer’s nightmare? Int J Retail Distrib Manag 45(2):143–157. https://doi.org/10.1108/IJRDM-03-2016-0027

Cui H, Rajagopalan S, Ward AR (2020) Predicting product return volume using machine learning methods. Eur J Oper Res 281(3):612–627. https://doi.org/10.1016/j.ejor.2019.05.046

Dalecke S, Karlsen R (2020) Designing dynamic and personalized nudges. In: Chbeir R, Manolopoulos Y, Akerkar R, Mizera-Pietraszko J (eds) Proceedings of the 10th international conference on web intelligence, mining and semantics. ACM, New York, pp 139–148. https://doi.org/10.1145/3405962.3405975