Abstract

Narratives are playing an increasingly important role in economics since their performative character has been realised. Banks are not unaffected by this, as they face many future challenges and are thus directly affected by narratives. For this reason, this article aims to reveal the future prospects within the academic landscape on the basis of a scoping literature review to create transparency about where the narratives come from. So, it is not the intention to make another prediction about the future of the banks. The paper presents contributions that make explicit statements about the future of banks, either a description of the future or an assessment of the future prospects of banks. Two databases were searched in this context, IDEAS/RePEc and Scopus, for the period from 2001 to 2021. A total of 99 relevant contributions were identified and finally used to answer three questions: (1) What challenges are seen for banks in the future? (2) What kind of future is depicted? (3) How are the future prospects derived? It turns out that challenges are seen in profitability, regulation, technology, and customer behaviour. The future prospects vary considerably, which puts the focus on the last question. Among other things, an overemphasis on intermediation theory tends to generate negative future prospects. It can be seen that the importance of the assumptions for the derivation of future prospects has not yet been recognised and further research is necessary to get a more complete picture of the future of banks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Banks are not ordinary companies. This quickly becomes clear when one considers the last financial crisis. The special role of banks results in an additional responsibility for the scientific community, especially economists, to recognize future developments in time to warn banks, politicians, and society as a whole about possible undesirable developments, and even to protect them from those developments.

Dealing with the future in the social sciences is a tricky business. Because there are a large number of influencing factors, making predictions of the kind characteristic of the natural sciences is difficult, if not impossible. Unlike predictions of planetary movements, for example, forecasts in the social sciences depend on the social context, which includes the uncertain behavior of people and institutions. The situation is even more complex when feedback effects are taken into consideration, as knowledge about the future changes behavior in the future. The dilemma is thus obvious. Although it is in the interest of society not to neglect the future, dealing with the future in a scientific manner presents great difficulties.

Why it is nevertheless worthwhile to address the issue of the future of banks and how this is possible will be briefly explained in the following. There has been already considerable public debate about the future of banks. Particularly notable is the regular publication of books with striking titles such as “Breaking Banks” (King 2014), “Bank 4.0: Banking Everywhere, Never at a Bank” (King 2019), “The End of Banking” (McMillan 2014), and “Reinventing Banking and Finance” (Panzarino and Hatami 2020). Also worth mentioning are statements such as the following, said to have been made by Bill Gates in 1994/1995: “Banking is essential, banks are not” and “Banks are dinosaurs, they can be bypassed.” These phrases have become firmly established in the linguistic usage of many people in the financial sector. In German, too, terms such as “Bankensterben” (translated roughly as “dying of banks”) are well established. It should come as no surprise that new challengers such as fintechs and BigTechs play a role in this context and inspire such or similar narratives. Such narratives, once entrenched and adopted, can drive the future in precisely the direction they describe.

In this context, Shiller (2019) points out the importance of such narratives for economics: “We need to incorporate the contagion of narratives into economic theory. Otherwise, we remain blind to a very real, very palpable, very important mechanism for economic change, as well as a crucial element for economic forecasting. If we do not understand the epidemics of popular narratives, we do not fully understand changes in the economy and in economic behavior” (Shiller 2019, p. xi). One can also speak of performativity, i.e. the fact that theories have a direct impact on the object of study itself. This is nothing new in the field of finance. For example, Callon (1998) and MacKenzie (2006) have shown that the emergence of modern finance and its highly mathematized models has significantly influenced practice.

Against this background, the aim of this paper is not to write about the “factual” future of banks, or to predict the future. The aim is rather to clarify the state of the debate by conducting a literature review that makes visible the narratives in what has already been written about the future of banks. The focus should thus be on the banks as institutions and not so much on banking as their business activity, although the two components of course cannot be completely separated from each other.

Three research questions help to achieve this aim. We start by identifying the future challenges that are listed repeatedly in the literature. This sets the context and allows for a more structured discussion of the topic. Accordingly, the first research question is: What challenges are seen for banks in the future? Asking this question makes it possible to present the different perspectives on the future against the background of the thematized challenges. Accordingly, the second research question is: What kind of future is depicted? For a future outlook to be taken seriously, it must be justified. In addition to arguments, the focus of interest here is the underlying assumptions, and it is understandable that authors can rarely agree on certain basic assumptions. Therefore, it is important to achieve transparency in regard to these assumptions so that the reader knows from the outset where he or she stands and can, if necessary, make adjustments to the picture presented. Thus, the third research question is: What lies behind the future prospects? After these three questions have been addressed, this review goes on to consider a cluster of literature of the US community banks. This section is based on a specific example and takes account of the fact that banks are not homogeneous entities. This approach follows the structure of the previous sections by addressing the questions on future challenges, future prospects, and what lies behind those prospects that were previously asked about banks in general.

In order to avoid misunderstandings with regard to future prospects, it should be noted that no evaluation of future prospects is intended. Some of the prospects may appear to be out of date; the conditions under which they arose have changed over the last 20 years, and their authors would certainly wish to adapt their statements to the new circumstances.

To the present author’s knowledge, such a review of the literature has not been carried out before, and it is hoped that this will be an important contribution to the debate on the future of banks.

The paper is structured as follows. Section 2 describes the methods used in the review. Sections 3, 4, and 5 are devoted to the research questions in the order stated above. Taking into account the fact that banks are not homogeneous entities, Sect. 6 examines the literature on a specific group of banks (US community banks). Section 7 addresses the implications and limitations of this review, and Sect. 8 concludes with possible areas for future research.

2 Methodology

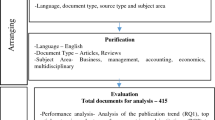

For this review, a first literature search was conducted in July/August 2020 using the online search platform IDEAS/RePEc. This platform was chosen because it covers all the important economic journals and contains 3.6 million items.Footnote 1 This represents almost 2 million more records than EconLit, making it the largest bibliographic database of economic content.Footnote 2

This review is a scoping review: a review that is primarily suitable for identifying the scope and nature of the existing literature in a research field (Paré et al. 2015, p. 186). Such reviews are “a technique to ‘map’ relevant literature in the field of interest” (Arksey and O’Malley 2005, p. 20). In this context, the scope of the question is broad and the search strategy is comprehensive. The search aims to identify both conceptual and empirical contributions (Paré et al. 2015, p. 186).

Boolean operators were used to search for “bank OR banks AND future.” The period covered by the search was 2001–2020, and the search was conducted in three publication forms, Articles, Papers, and Chapters. This broad search yielded 3944 hits, many of which had nothing to do with the topic of the future of banks. In particular, the term ‘future’ is regularly used in scientific abstracts (for example, in connection with ‘future research’), and this generated a considerable number of nonrelevant hits.

In order to separate the relevant results from the nonrelevant ones, the author carried out an initial screening to identify results whose titles or abstracts indicated that they were likely to include statements on the future of banks. To avoid fatigue but to enable as many articles as possible to be screened, the author read a maximum of 100 abstracts each day. This process yielded 239 papers.

The initial screening was followed by a selection based on specific criteria. To be included in the literature review, the contributions had to refer explicitly to the future of banks; that is, it had to be possible to find at least one statement that was indicative of the future. Such statements could take either of two forms: a qualitative content statement that describes the future or a qualitative-evaluative statement that comments on the viability of banks. It was not sufficient, for example, to highlight a particular parameter or coefficient as important and then indicate that it would continue to be important in the future. This more detailed selection yielded 48 contributions.

The results of the selection were reviewed independently by a second person. For the screening of the 239 articles, the agreement was 92.05 percent. In relation to the selection of the 48 articles, the agreement was 72.91 percent. All cases of disagreement were reviewed by the author.

Hereafter, a second literature research was conducted from January to March 2022 using the online search platform Scopus. The platform was used to guarantee high quality results from mostly peer reviewed journals. During the initial search via IDEAS/RePEc, the quality of the search results was less of a priority, as the focus was more on finding out what future prospects could generally be found within the scientific landscape. For this purpose, grey literature (working papers and discussion papers) should also be consulted. Novarese and Zimmermann (2008) praise RePEc in this context because RePEc does not execute a referee process or have any quality control. In this way there is no discrimination of heterodox economic directions and RePEc thus contributes to a “democratized research” (Novarese and Zimmermann 2008, p. 199).

Boolean operators were also used for the research via Scopus: “bank OR banks AND future.” The research was limited to English journal articles in the years 2001 to 2021 in the subject area “Economics, Econometrics and Finance” and “Business, Management and Accounting.” As a result 3,308 hits were generated.

The selection based on the same specific criteria mentioned above was conducted by two student assistants after they had been trained how to select the relevant literature on the basis of the abstract and title of an article. For 60 items, the two assistants found a match, which they then submitted to the author of this article. 4 out of the 60 articles were non-accessible, despite different attempts to get access to the literature. Another 2 of the 60 articles were already part of the first research selection via IDEAS/RePEc. Finally, 26 of the 60 articles were included in the literature review after reviewing the full texts. This further depletion of the literature can be explained by the instruction given to the two student assistants that they should, in case of doubt, include an article so that the author of this article could make the final decision on uncertain cases. Hence, 28 of the 60 articles had to be removed because there were no noteworthy statements on the future of banks, even though some of them suggested at first glance there might be a hidden proposition on the future of banks.

In the run-up to and in the course of the search, the author became aware of articles that were not displayed in the literature search via IDEAS/RePEc and Scopus. Faced with the choice of either proceeding systematically and excluding the additional contributions from the review or covering the topic as far as possible in terms of content and including the contributions in the review, the author opted for the latter option. The aim of the review is to enliven the debate on the future of banks, which to date has not been very dynamic, by involving as many authors as possible. This goal is more likely to be achieved if less consideration is given to strict formal constraints, even at the risk of disadvantaging articles on the future of banks that are still unknown to the author of this review.

Ultimately, alongside the 48+26 contributions from the planned literature search, 25 contributions were obtained from an unsystematic search (see Appendix: Table 1).

The term “bank” is not further defined in what follows, except in the examination of the literature on community banks. This is entirely appropriate for a scoping review in which the search strategy is designed to be comprehensive.

3 What challenges are seen for banks in the future?

In order to be able to talk about the topic in question, it is reasonable first to determine which challenges are emphasized by the authors who write explicitly about the future of banks.

The same challenges are mentioned repeatedly: technology, regulation, changing customer behavior, and a lack of profitability or increased competition. Among the challenges of technology, one can highlight technological innovations themselves, such as crowdfunding with its subcategory of peer-to-peer lending (Pointner and Raunig 2018, p. 36), blockchain technology, which promises to remove barriers to entry in finance once and for all (Hatami et al. 2020, pp. 6–7; Boot 2016, p. 445), the exploitation of big data, which is putting big technology companies on the map (Thorbecke 2020, p. 4), and digital currencies, which will probably be more of a challenge for central banks (Stulz 2019).

Reference is also made to the weaknesses of banks in this context: “Payment services has been considered the Cinderella of banks’ services, but once technology has started evolving they changed into a kind of Trojan horse” (Omarini 2018c, p. 108); “The Achille’s heel of large banks are IT systems that have been built not from scratch, but through a decades-long process of ‘add-ons”’ (Stulz 2019, p. 87).

Where some typical banking functions such as payment processing, intermediation, and risk management are considered separately in the literature, it is stated that these functions can also be performed by nonbank organizations (Gup 2003a, pp. 1–3). Reference is therefore also made to new competitors.Footnote 3

First of all, there are fintechs, with which banks are in a “state of war” (Boustani 2020, p. 347). Thanks to their specialization, they are disaggregating the value chain (Boot 2016, pp. 442–443). Their big standout feature is their “application programming interfaces [...] because they affect the way in which customers consume products and services online, and also the way of working and understanding the corporate world” (Omarini 2018b, p. 27). There is also increasing attention to the so-called BigTech companies (Stulz 2019) or techfins (Omarini 2018b), which are primarily characterized by their large user numbers. Not to be forgotten in this context is the shadow banking sector, which consists of three types of nonbank lenders: “(i) finance companies who are funded by bond issues and equity rather than deposits; (ii) business development corporations; (iii) private equity funds” (Saunders 2020, p. 2,075,001–2) as well as asset managers (Fender and McGuire 2016, p. 205).

The challenge of regulation often focuses on a bank–bank relationship. This involves regulation of small banks relative to banks that are considered too big to fail (Saunders 2020, p. 2,075,001–3), as well as regulation in a spatial context across national borders. As long as regulations are not designed at a supranational level, regulatory arbitrage by large financial institutions will maintain the ineffectiveness of regulation: “One of the challenges facing the banking system is the absence of an effective global supervisory system” (Moshirian 2012, pp. 2675–2676). Moshirian (2012) presents the solution right away: “A world central bank has the potential to remove regulatory arbitrage” (Moshirian 2012, p. 2678).

In addition to the bank–bank relationship, a bank–nonbank relationship can also be considered. Banks are disadvantaged as long as nonbanks that offer some of the same financial products are not subject to the same regulatory standards (Fender and McGuire 2016, p. 205; Huertas 2016, p. 71).

Regulation also affects the profitability of banks. Hintz and Smith (2017) can be cited in this context: “Thus, the global banks are caught in a global regulatory dilemma that has limited their freedom and undermined their business performance. Today, many bankers believe their ‘number 1 client is the government’ [Wall Street Journal (2013)], and this seems unlikely to change” (Hintz and Smith 2017, pp. 167–170).

Omarini (2018a) takes a similar approach, recognizing the need to adapt risk management to reflect increased regulation and reduced profitability (Omarini 2018a, p. 110). For some time, more complex market conditions have been explained in part by the increasing role of capital markets in financial intermediation (Benston et al. 2007, p. 127). Corporate financing via bond markets thus leads to a disintermediation of banks (Marchetti 2016, p. 98). In addition, the connection to macroeconomic developments has also been observed: “Banks’ profitability is correlated with macroeconomic developments” (Smaghi 2018, p. 145).

Interest rate policy, in particular, has been in the spotlight. With reference to Bernanke and Gertler (1995), it has been stated that “Policies that lower short-term interest rates or the interest rate spread may adversely affect bank profitability. If banks become less profitable, this may hinder their ability to extend loans” (Thorbecke 2020, p. 10). Gärtner and Flögel (2017) noted the same connection for the German banking system (Gärtner and Flögel 2017, pp. 52–53). Going one step further, Dailami and Adams-Kane (2012) included the fiscal policy of EU countries in the situation of banks: “The important implication that emerges from the current policy configuration and public debt profiles is that the banking sector may bear a significant part of the burden of heightened sovereign debt distress. For euro area banks affected by sovereign debt distress, the most visible signs, so far, have been deteriorating funding market conditions, significant credit rating downgrades, and a decline in market capitalization” (Dailami and Adams-Kane 2012, p. 7).

The change in customer behavior reveals two characteristics. First, bank customers are using new technologies and are thus accessible through different channels than previously. Banks face the challenge of establishing a convenient customer interaction and creating a pleasant user experience (Gjino and Ilollari 2014, p. 49). Second, bank customers are acting in a more capital market-oriented way and are thus less dependent on banks. In this case, too, one can speak of disintermediation (Cocca and Csoport 2003, p. 288) or a “drift from intermediaries to markets” (Harper and Chan 2003, p. 38).

4 What kind of future is depicted?

This section will proceed from the micro to the macro level in the broadest sense. It will start with the attested information monopoly of the banks and the direct influence of technology on the banks themselves. Then, the new challengers and increased competition will be examined. Finally, questions about banks in the overall financial system and the related disintermediation will be addressed.

The starting point is the assumption that markets exhibit information asymmetries and that banks can help to overcome these, through economies of specialization, economies of scale, or economies of scope (Thorbecke 2020, p. 2). However, for some time now, the Internet has been credited with reducing or completely eliminating such information asymmetries (Lamberti and Büger 2009, p. 34). This process leads to a loss of identity or a problem of legitimacy for banks, and some authors characterize this as a primarily technology-induced change in the banking sector: “Technology does not only support existing business processes but increasingly constitutes a driver for changes within the actual banking business” (Lamberti and Büger 2009, p. 35). This point is emphasized by Omarini (2018b), who believes that digital transformation is not only a technological revolution but also requires new business models (Omarini 2018b, p. 25).

On this view, a promising way to “stay in the game” is to practice so-called open banking. This means providing third parties with open access to customer data via application programming interfaces (APIs). This comes with a risk that banks can no longer control interactions with customers, but it offers them the opportunity to innovate and broaden their offerings (Omarini 2018b, p. 33). In this connection, Dicuonzo et al. (2019) make the case for banks “to import nonconventional technologies (IoT [Internet of Things], business intelligence, big data and blockchain) that allow the processing of huge quantities of data quickly and accurately, which is useful not only in CRM [customer relationship management], but also in cyber security, fraud detection and the optimisation of decision-making processes. A technological innovation must be accompanied by a cultural change and, in this case, the formation of teams composed of statistical, mathematical and technological skills and data scientists who can combine data analysis skills with functional skills to create automatic processes of value” (Dicuonzo et al. 2019, p. 46). Lamberti and Büger (2009) believe that banks have been preparing for the impact of new technologies over the long term, and they recognize a future in which the banking and technology sectors will increasingly converge (Lamberti and Büger 2009, p. 35). Raja Rao et al. (2019) argue that IoT and access to big data will enable banks to better understand their customers and offer more targeted products with “the flow of information” continuing “to create value,” leading to risk mitigation (Raja Rao et al. 2019, pp. 4315–4317). General advantages of IoT for banks are cost reduction and effective risk management, improvement of customer service, and increased security in payment transactions (Raja Rao et al. 2019, p. 4316).

Referring in general terms to the Internet as a technological innovation and bringing the bank branch into focus, Beck (2001), among others, argues that the Internet has broken down barriers to market entry and that a branch network will no longer be needed. Products can increasingly be compared from home (Beck 2001, pp. 16–17). The survey by Prodanova et al. (2015) also shows that this channel will become more important and is an important factor for banks to maintain the customer relationship (Prodanova et al. 2015, pp. 109–111). As a result, the other channels, such as the branch and the ATM, are losing importance (Prodanova et al. 2015, p. 115). Hine and Phillips (2003) also highlight the prospect of the end of “brick and mortar institutions” in the new millennium (Hine and Phillips 2003, p. 171). Supporting this argument for online banking, Gjino and Ilollari (2014) claimed that mobile banking would become established and standard over the following five to 10 years [as of 2014] (Gjino and Ilollari 2014, p. 49). Boustani (2020) builds on this point, noting that “conventional and classic bankers have a volatile and gloomy future ahead due to the invasion of finance technology” (Boustani 2020, p. 346) and that “The future belongs to virtual banks, and hybrid-banking structure could be defined as transitory only” (Boustani 2020, p. 357). This assessment is shared by Ilie et al. (2017), who argue that “traditional banks need to turn into a digital bank” (Ilie et al. 2017, p. 288). Omarini (2018a) goes so far as to claim that the bank of tomorrow is a “customer-centered platform” (Omarini 2018a, p. 126).

At the same time, the Internet is contributing to an increasing abundance of information, which could lead to a bank’s reputation becoming even more important (Beck 2001, p. 20). Closely related to this question is the trust that bank customers place in their bank. On this point, banks definitely have an advantage over the new challengers (Omarini 2018c, p. 109).

Accordingly, there are a number of authors who see continuing value in the bank branch. Bulgărea (2011) claims that “the branch is by no means dead” and justifies the claim as follows: “The most important financial decisions made by individual customers, such as, for example, taking out a mortgage, or deciding on investments for their retirement, are normally taken through people, and not by means of mere computerized simulators or consultants at remote centers. This happens not because standard on-line solutions do not suit customers, but rather because in the last analysis, this whole process involves a ‘trust’ factor” (Bulgărea 2011, p. 21). With reference to a number of other studies, the author concludes that the branch will remain the customer’s preferred channel, even if the number of branches decreases (Bulgărea 2011, pp. 20–21).

Bulgărea (2011) is not alone in expressing doubt in relation to the demise of the banks. Kroszner (2015) follows suit, noting that “commercial banking is not dead” (Kroszner 2015, p. 6) and praising the “local knowledge of soft information” of branches (Kroszner 2015, p. 12). A more ambivalent attitude to the role of branches is taken by Scornavacca and Hoehle (2007). They argue that banks will choose a “multi-channel strategy,” going beyond traditional banking to perform a so-called “channel extension” with online banking and mobile banking (Scornavacca and Hoehle 2007, p. 316). On their view, banks will adopt mobile banking, continuing to reduce costs in this area as the number of users increases and the pace of development accelerates (Scornavacca and Hoehle 2007, p. 317). This is also the view of experts in the Delphi study by Bradley and Stewart (2003), in which they interviewed 71 people from Ireland and the USA, primarily from the retail banking industry, concluding that branch activities will decline and Internet banking will become more important in the future. Nevertheless, a multi-channel strategy will remain the most promising apporach (Bradley and Stewart 2003, pp. 276–277). Interesting in this context is the study by Moser (2015), who reviewed the mobile banking literature with a discourse analysis and came to the conclusion that the academic literature did not follow the latest trends or fashions as the literature did at times in practitioner articles and that mobile banking will experience broad adoption over the next years (Moser 2015, p. 172). Degryse and Ongena (2004) concur, seeing no way for new technologies to overcome distance completely (Degryse and Ongena 2004, p. 586). The work of Go et al. (2020) makes the point that AI will be integrated into all channels to meet the needs of customers (Go et al. 2020, pp. 115–116).

Focusing less on branches than on markets, Gup (2003a) offers a different assessment: “There will be an erosion of geographic barriers between markets, a blurring of distinction between different types of financial institutions, further consolidation, and completeness of markets” (Gup 2003a, p. 13).

Since the financial crisis, however, a trend toward greater regionalization of banking has been identified, i.e., a decrease in cross-border lending (Huertas 2016; Marchetti 2016; Claessens and van Horen 2016a, b; Fender and McGuire 2016). For example, Huertas (2016) sees a shift away from “big, broad, borderless” and toward “small(er), simple(r), separable” (Huertas 2016, p. 69). This shift is due to political factors; during the crisis, banks benefited from government bailouts and refinancing programs, and since then have refocused on the domestic market (Marchetti 2016, p. 105). Some see this trend as set to continue (Claessens and van Horen 2016a, p. 140; Fender and McGuire 2016, pp. 200–201) and even to intensify, especially in developing countries (Claessens and van Horen 2016b, p. 288).

Another aspect of the future of banks that is under discussion is big data. According to Kroszner (2015), “We will see a transformation of many banks that are no longer primarily seen as ‘financial companies’ but as technology/data analytics companies, i.e., as a technology and data analytics company that deals with financial services rather than a financial services company that uses technology and data analytics” (Kroszner 2015, p. 15). Lamberti and Büger (2009) also see such a development: “Banks could increasingly turn into factories where machines are computers and their input and output is data” (Lamberti and Büger 2009, pp. 35–36). However, they dismiss the idea that banks will disappear: “That the bank could become superfluous and be replaced by a provider of technological services hardly seems realistic” (Lamberti and Büger 2009, p. 35). Boot (2016), on the other hand, sees the danger of specialized lenders entering the scene and replacing relationship lending with algorithm-based lending procedures based on big data mining (Boot 2016, p. 443).

In general, however, big data is seen as a major opportunity for banks (Ilie and Iacob 2018, p. 81). Dicuonzo et al. (2019) justify their stance on this issue mainly in terms of risk management: “Risk management—especially credit and reputational risk management—through BDA [big data analytics] technologies would allow the bank to use its vast amounts of data more effectively and gain more precise, detailed, and accurate information. Real-time implementation could help the risk manager be more timely and accurate in risk identification, assessment, and mitigation, and extract hidden value from the data by using new metrics to monitor data quality useful for unquantifiable risk typologies” (Dicuonzo et al. 2019, p. 45).

Thus, a somewhat positive interim conclusion on the role of technology emphasizes “the potential gains that technology and digital can generally have for banks: time savings, storage and sharing of secure documents, cost savings. In addition, the electronic vault presents new complementary sources of income: a fee based on the amount of files to be stored and additional services (electronic certification of the date of the deposit and its non-modification etc.)” (Ilie and Iacob 2018, p. 82).

When competitors are included in the outlook, then the topic of (dis)intermediation moves into focus. Omarini (2018a) argues for a future in the form of a “customer-centered platform,” thus casting banks as the victims of a form of disintermediation (Omarini 2018b, p. 25). Although Lenz (2015) regards the trend toward disintermediation as being temporarily halted by regulatory efforts in the wake of the financial crisis, he, too, sees a future in which capital is mediated via platforms. Because of the implications that Lenz (2015) sets out, he is quoted here at length: “A media-adequate continuation of this trend is the web-based mediation of capital via Internet platforms, which is gradually replacing the traditional bank as an intermediary. Commercial banks that recognize this trend and have the courage to enter the platform business at an early stage will continue to exist in a completely different organizational structure. The banks will establish their own platforms, offer their expertise in assessing creditworthiness, advise customers on investment opportunities in their own and also third-party platforms, and continue to process payment transactions. The bank will thus gradually become the ‘front end’ of the digital platforms behind it, without, however, taking its own risk positions ‘on the books,’ but instead solely conducting the business of capital intermediation” (Lenz 2015, p. 526 author’s own translation). In this respect, the future prospects for banks are gloomy: “Web-based capital intermediation will prevail as an economically superior form of organization over the traditional business model ‘bank’. This is beyond question. The only question is how long it will take for this system change to take place in the financial market” (Lenz 2015, p. 527 author’s own translation). It should be noted that the danger of disintermediation is not new. As far back as 2001, Beck (2001) had predicted that competition would increase, that this would reduce the interest margin and associated profits, and that this in turn would lead to disintermediation (Beck 2001, p. 21).

In the area of peer-to-peer lending (P2P), it is open to question whether platform operators are profiting from the poor economic situation in the aftermath of the financial crisis and the associated low-interest phase. Experience shows that banks are reluctant to lend in times of crisis. At the same time, during such periods, central banks influence the key interest rate, adjusting their interest rates downward (Pointner and Raunig 2018, p. 49). Reinforcing this criticism of the platforms, Pointner and Raunig (2018) believe that P2P platforms tend to move in a direction where they practice balance sheet lending, which requires a banking license. Thus, they move further in the direction of traditional banking over time (Pointner and Raunig 2018, p. 49).

A different trend is recognized by Boot (2016), who sees greater market integration due to technologies, anticipating that this will move commercial banking in the direction of investment banking (Boot 2016, p. 437). Cocca and Csoport (2003) predict the future viability of traditional banking both in the form of universal banks and on the model of financial portals, which they regard as the greatest competition for universal banks. In the long term, they expect to see an alignment between the two (Cocca and Csoport 2003, p. 296). Likewise, Cobas et al. (2003) see a trend for banks to play a smaller role as financiers for nonfinancial corporations, although they believe that it will be a very long time before small businesses will no longer be dependent on banks for financing (Cobas et al. 2003, pp. 70–71).

Predictions of less banking and more nonbanking prevail in the literature, although according to Bossone (2001), the demand for both banking and nonbanking services will increase (Bossone 2001, pp. 2264–2265). Kodres and Narain (2010) emphasize that banks will lose ground to nonbanks: “Unless savers become highly risk averse, placing their funds on protected deposit accounts, intermediation outside the banking system is going to grow” (Kodres and Narain 2010, p. 12). The reasons for this are obvious; fintechs, in particular, offer many substitutes for traditional bank financial products (e.g., Boustani 2020, p. 346). This view also seems to have been adopted by Feldman (2020), who looks at the impact that fintech deposits and digital wallets has on the market values of commercial banks. His insight is that when digital wallet growth occurs, then the decline of bank deposits takes place, from which it follows that the market value of banks declines (Feldman 2020, p. 42). Thus, for him, “FinTech banking companies [are] a complete alternative to traditional banking” (Feldman 2020, p. 46).

As far back as 2001, Beck (2001) had already incorporated many of the aspects mentioned so far into his picture of the future. He even anticipated the phenomenon of BigTech: “The potential financial intermediaries of the future: large firms with a high reputation among customers and insurance companies. These firms will have large funds of capital under control, their reputation will be high enough that customers may put their money into the hands of these firms, and they are well known to the public so they can acquire a potential of customers large enough to pool risks. If this is true, banks will face new rivals in the battle for customers: Insurance companies and large companies may enter the market especially for the emission and the trade of bonds and stocks as well as the credit business. This will be true for the account business and payment systems. In a few years it may be possible that customers will be given credits by Microsoft or may put their savings to Microsoft. This may not be true for financial services with low standardization and high risks” (Beck 2001, pp. 20–21).

The challenge posed by BigTech companies is also the central point for Stulz (2019), who regards fintechs as relatively dependent on banks, be it through the cash they place with banks or through the lines of credit granted to them by banks. In contrast, BigTech companies are independently viable and can operate a platform bank with their strong customer base (Stulz 2019, p. 95). This gives BigTech many advantages over fintechs as well as banks: “A BigTech firm with a platform bank would not have to rely on existing banks. It could have its own affiliated bank through which it could have deposit accounts, provide customers with credit cards, and enable them to use e-cash. It could also make available to its customers a great variety of financial services from third parties. It could help them make choices among these services” (Stulz 2019, p. 95).

According to Bossone (2001), one factor that both Beck (2001) and Stulz (2019) omit is the increasing competition in the nonbanking sector. Although banks are losing their quasi-monopoly on information and will have to cede market share to the nonbank sector, banks themselves will also become more active in that sector in order to tap new sources of profit. This will increase competition in the nonbanking sector and diminish profit margins. Accordingly, there will be incentives for nonbanks to cooperate or merge with banks (Bossone 2001, p. 2266). Bossone (2001) concludes that this will lead to a consolidation of the banking sector, in which the active banks will be larger and fewer in number (Bossone 2001, p. 2266).

Nevertheless, for some authors, what is at stake is no less than the survival of banks. For example, at the 44th Economics Conference 2017 of the Oesterreichische Nationalbank, which focused on the future of the financial system, Puschmann (2017) argued that “from a technical point of view, the internet developed from the ‘internet of information’ to the ‘internet of services’ and currently takes another step towards the ‘internet of values’,” whereby “[t]he third phase focuses on standards around blockchain, standards for digital payments, smart contracts and other areas for the exchange of values” (Puschmann 2017, p. 30). Puschmann (2017) concluded that “If for example a firm can self-issue security papers fully digitally on a blockchain, it can initiate and coordinate all processes in a decentralized manner without the need for a central party like a bank (e.g., for an IPO) or a stock exchange (e.g., for trading)” (Puschmann 2017, pp. 30–31). This view of the matter prompted Beer et al. (2017), in their reflection on Puschmann’s presentation, to claim that “in the future, we will transfer values among individuals and organizations directly without intermediaries” (Beer et al. 2017, p. 36). In particular, financial institutions would need to act to avoid having a so-called Kodak moment. In the 1980s, Kodak was the world’s leading company for photographic materials, but, for various reasons, it missed the transition to digital photography and went from being a world leader to bankruptcy.

When the special position of banks is acknowledged, authors tend to reach a different assessment, such as that of Hatami et al. (2020): “Banks will never live through a Kodak moment [...]. As a systemically important and thus highly regulated industry, banking is different from photography, IT, or even telecommunications” (Hatami et al. 2020, pp. 7–8).

Gup (2003a) does not view the future transformation of the banking sector as a “smooth transition,” which is why he dresses his article on the future of banks in the Schumpeterian terminology of “creative destruction” (Gup 2003a, p. 13). According to this approach, the institutions that will survive in the market are those that have a “strong brand identity” and enter into strategic alliances with new challengers (Gup 2003b, p. 145).

In what follows here, the special role of banks in the economic and financial system will be discussed in connection with regulation, especially the relationship between regulation and economic growth. Kodres and Narain (2010) argue that, on the one hand, a more regulated financial system can lead to a more stable system in which the real economy can thrive, but on the other hand, it can lead to lower and/or slower economic growth (Kodres and Narain 2010, p. 4). Opinions differ on this point. For Kodres and Narain (2010), the regulation enacted in the wake of the 2007/2008 financial crisis has led to a simpler and safer system with lower but stable growth (Kodres and Narain 2010, p. 17). Similarly, Huertas (2016) emphasizes the positive effects of the new regulatory regime, which not only protects banks from failing but also makes things safer when they do fail (Huertas 2016, p. 68).

In contrast, Smaghi (2018) emphasizes an increase in the cost of capital for banks, which he expects will further affect profitability in the future. This lack of profitability in the banking system cannot generate stable economic growth (Smaghi 2018, p. 151). Swagel (2016) sees no signs of a new financial crisis hitting the banking sector in the foreseeable future, even though he considers regulation in the US (in the form of the Dodd–Frank Act) to be counterproductive for a stable financial system (Swagel 2016, p. 469).

This critical approach to regulation is reminiscent of the views of Shull (2003), who looked at the future of banks before the financial crisis in the deregulatory context of the Gramm–Leach–Bliley Act and the Glass–Steagal Act: “American banking, then, can be seen as a continuation of the course that had emerged prior to 1933 and that had been arrested for nearly 70 years” (Shull 2003, p. 93).

Monvoisin (2017) focuses more on stability. She notes a long period of neglect of one of the core functions of banks, namely, to supply the production of the real economy with sufficient money (Monvoisin 2017, p. 190). Instead, banks themselves create instability in the financial sector because they are insufficiently regulated: “The sad realization is that banks have evolved to such an extent that the financial system is no longer at the service of the productive side of the economy. Moreover, as it grows in importance, this system becomes a dominant sector and therefore can become increasingly destabilizing for the economy as a whole” (Monvoisin 2017, p. 187).

Size can play a central role in the relationship between regulation and economic growth. Bossone (2001) saw this early on, declaring that “Size will matter” (Bossone 2001, p. 2264), and that this is why the banking sector will consolidate into fewer but larger banks (Bossone 2001, p. 2260).

In the aftermath of the financial crisis, however, the large banks came under criticism, leading Kodres and Narain (2010) to the conclusion that “After this interim period the banking sector will likely be scaled back to a smaller, but more stable, size, particularly if the activities that a bank is able to undertake are more restricted” (Kodres and Narain 2010, p. 13). This approach has been challenged by Moshirian (2012): “However, the recent global financial crisis does not appear to have had profound effects to create a more internationally based and accountable banking system. Yet in science, larger aircrafts with a large capacity are built, such as the A380, while scientists learnt how to also contain their risk. In global banking environment, the emphasis is more on how to reduce the size of banks rather than thinking how to improve global and regional financial systems in the 21st century which could minimise banks financial risks even if they further expand their global and national business activities” (Moshirian 2012, p. 2677). Swagel (2016), too, considers the big banks as scapegoats that will retain their place as such in the political discourse (Swagel 2016, p. 471). In this respect, Hintz and Smith (2017) attest to a “grim” future in which banks “will have to be smaller and more manageable, at least until they settle into a new economic model that works” (Hintz and Smith 2017, p. 169). However, it remains unclear whether this really bucks the trend for fewer but larger banks: “The keys to the likely future of the size of large banks would then be the existence and magnitude of scale and scope economies as well as regulation” (Kroszner 2015, p. 7).

In this respect, it is worth mentioning other macroeconomic factors that make the future of banks difficult to assess. Thorbecke (2020), who is particularly concerned with US banks, states: “Trade wars could worsen or a recession could hit and impair the ability of their borrowers to repay. The outlook for collateralized loan obligations could worsen and harm exposed banks. Problems in the shadow banking system could arise and spread to the regulated banking sector. These or other factors could spark a crisis and be deleterious for an already challenged banking system” (Thorbecke 2020, p. 9).

Finally, the location factor should be mentioned. As Fender and McGuire (2016) point out, it is particularly important to pay attention to the prevailing banking system and the region in which the decision-makers operate (Fender and McGuire 2016, p. 197). In relation to the future of the Swiss banking system, Cocca and Csoport (2003) conclude that successful retail banks can increase their profitability thanks to falling variable costs and an increase in volume. At the same time, technological innovations will restructure the value chain, which will lead to a decline in the vertical product offering. However, they are pessimistic about the prospects for purely online retail banks (Cocca and Csoport 2003, pp. 292–293).

For Germany, Gischer and Jüttner (2003) conclude from their econometric analysis that competition in the banking sector will increase and that profitability (in the form of the rate of return before tax and interest rate margins) will continue to decline. As a result, in overbanked countries such as Germany, the consolidation process will continue, branch closures will increase, and services will be outsourced to the Internet (Gischer and Jüttner 2003, pp. 243–244). With regard to the low interest rate environment, Dombret et al. (2019) conclude that German banks will overcome what they call the “biggest challenge facing the German banking sector” due to their reserves, which the German Commercial Code (HGB) allows banks to build up in good times (Dombret et al. 2019, pp. 157–166).

Serbia is another country with a bank-centric financial system, and Loncar and Rajic (2012) see this situation as likely to continue. However, they anticipate a progressive consolidation in the Serbian banking sector, with an accompanying reduction in the number of banks and an increase in the market power of the largest banks (Loncar and Rajic 2012, p. 384).

A set of articles deals with the future prospects of Islamic banking. Banks that operate this kind of banking are subject to certain rules, namely not charging interest. Instead, debt-like instruments such as mark-up financing are used to circumvent this rule. Alam and Parinduri (2017) assume that this form of Islamic banking practice will continue to dominate in the future and they do not see a shift from mark-up to equity financing (Alam and Parinduri 2017, pp. 546–547). Gündüz (2020) predicts far-reaching growth for Islamic banking institutions, especially compared to conventional banks (Gündüz 2020, p. 339). For Malaysia, Ariff (2017) shares to a lesser extent this optimism for Islamic banks. Basically, Islamic banks compete more with each other than with conventional banks and he notes that many conventional banks have Islamic subsidiaries that are stronger than pure Islamic banks (Ariff 2017, p. 10). Islamic banks are still at an “infant stage” and they can only overcome this status through innovative products, although here too Islamic subsidiaries are in a better starting position (Ariff 2017, p. 11). For Malaysia, Shanmugam and Nair (2004) look at the mergers and acquisitions of the entire banking sector in the past, finding that as of 2004 there are 10 anchor banks and in future there will be more mergers, possibly with foreign banks (Shanmugam and Nair 2004, pp. 12–13).

For Pakistan, Tahir et al. (2016) also deal with the issue of mergers and acquisitions. They find monopolistic competition in the banking sector in Pakistan and do not see the banking sector in long-run equilibrium. The authors conclude that many mergers and acquisitions will take place in the future, as this will increase the competitive dynamics (Tahir et al. 2016, p. 251). For the neighbouring country India, bank managers themselves get a chance to speak in the article by Kamath et al. (2003), and explain four trends that can be observed: “consolidation, globalisation of operations, development of new technologies, and universalization of banking” (Kamath et al. 2003, p. 83).

For Bangladesh, the article by Rahman and Abedin (2021) conducted a survey and interview of 30 public commercial banks with 183 participants. Here, the authors state that technology has never provided such a rapid and comprehensive change and they conclude that technology will greatly change the banking landscape, the bank branch being replaced by “banking from everywhere” (Rahman and Abedin 2021, pp. 1292, 1297). The change also affects security aspects that can arise with “technological platforms such as fraud, forgery and anti-money laundering” (Rahman and Abedin 2021, p. 1297).

Another group of articles focuses on China. For this region, Allen et al. (2015) note that the five largest banks, which are all state-owned, have high rates of non-performing loans (NPL) (Allen et al. 2015, p. 222). However, NPLs are a problem for neither the government nor the banks (Allen et al. 2015, p. 230). With the financial sector liberalisation, the authors see an intensification of competition among banks in the future, which can also change the incentive structures towards issuing loans of better quality (Allen et al. 2015, p. 303). The market will become more important, but China is still a bank-based system (Allen et al. 2015, p. 283).

Chen et al. (2017) focus on the Chinese market. In their case study on the Industrial and Consumer Bank of China (ICBC) and Citigroup, they conclude that traditional financial institutions are turning into technology companies (Chen et al. 2017, p. 4). Accordingly, they see mobile internet finance as the future of banking (Chen et al. 2017, p. 15).

According to Selmier (2018), behavioural aspects are also taken into account (guanxi and renqing), which are of enormous importance for banking in China. This is a kind of accommodation service, a “quasi-contractual debt obligation,” which is characterised by strong relationship banking (Selmier 2018, pp. 9–10). Furthermore, the author notes that the internationalisation or expansion of Chinese banks is cautious and slow, as China historically learns from the mistakes of Japan (Selmier 2018, p. 3). He further assumes that state-owned banks will play a significant role in the future and thus also Chinese banks (Selmier 2018, p. 10).

For Hong Kong, Wan et al. (2005) highlight the growing importance of a multi-channel strategy for banks, especially electronic banking and “virtual banking.” However, these cannot simply replace all other channels (Wan et al. 2005, p. 255). Bank branches are still needed, especially for corporate image building, not only towards individual customers but in general: “Such a positive corporate image can help the bank develop and maintain long-term competitiveness in the society” (Wan et al. 2005, p. 255).

Japan, too, has a bank-centric financial system. Baba and Hisada (2002) predicted that capital market pressures would increase in the long term, although not to the level seen in the United States. At the same time, they expected pressure from new competitors to increase, which would strongly affect profitability. Ultimately, then, the conditions for a sound bank-centric system cannot be maintained (Baba and Hisada 2002, p. 77).

For South Africa, Coetzee (2018) sees a challenge to banks posed by fintechs, which are disruptive and threaten the very existence of banks (Coetzee 2018, p. 6). For him, the future is “fundamentally technology driven” and switching costs will become lower and lower, seriously threatening the survival of banks and leading to fewer and fewer branches (Coetzee 2018, pp. 8–9). In the article by Wessels and Van Rooyen (2010), the connection between stability and economic growth is addressed. They also look primarily at South Africa. They predict that bank revenues will decline because fewer loans are being granted and interest rates are falling, so that the future is not rosy overall (Wessels and Van Rooyen 2010, p. 400). Because South Africa did comparatively well in the financial crisis, the authors infer a positive effect that new capital can flow into the country (Wessels and Van Rooyen 2010, p. 401). What is not discussed, however, is why South Africa did so well and whether there is perhaps a connection between the good performance and the less developed financial system.

Turning to the South American continent, an extremely fruitful article by Miralles-Quirós et al. (2017) can be addressed, in which the authors test Gibrat’s Law for the banking market in Brazil. This states that there is no relationship between size and growth and thus that all firms have the same probability of growing (Miralles-Quirós et al. 2017, p. 1658). So far there is disagreement in the literature on whether Gibrat’s law holds or not (Miralles-Quirós et al. 2017, p. 1660). The authors’ empirical results suggest that there is a non-linear relationship between size and growth in the shape of an inverted U, which means that small firms have greater growth potential and the banking market will develop accordingly, i.e. the concentration in the banking sector will decrease and the market shares of the players will equalise (Miralles-Quirós et al. 2017, pp. 1667–1668).

In less developed countries, the future of banking is viewed more optimistically, as there is considerable need to catch up in the deepening of financial structures (Seelig 2003, pp. 28–29).

5 How are the future prospects derived?

In order for a future outlook to be taken seriously, it must be justifiable. In addition to the arguments put forward by authors, the focus here is on the assumptions behind the arguments, something that authors rarely agree on. Accordingly, it is important to achieve transparency concerning these assumptions so that the reader knows from the outset where he or she stands and, if necessary, can make adjustments. In this context, it will again become clear that the different areas of focus are closely interrelated.

One important factor in the justification of an outlook relates to whether banks are seen as playing a special role in the economic and financial system. There are different starting points for such special status. For example, Stulz (2019) points out that “[d]eposits are at the core of what makes a bank on economic grounds as well” (Stulz 2019, p. 88) and emphasizes that special regulatory relationships for banks exist because of deposit opportunities and not simply because banks are lenders (Stulz 2019, p. 87). Thus, although banks compete with nonbanks for deposits, nonbanks do not enjoy the same rights as banks, for example, over deposit insurance (Stulz 2019, pp. 87–88). Kroszner (2015) echoes this point, noting that “banks are still ‘special’ in that non-banks without deposits behave differently during liquidity shocks and that this deposit–credit creation link is unique to banks” (Kroszner 2015, p. 12).

A different approach to the specificity of banks is Bossone (2001) and his monetary circuit approach: “[Banks] issue debt claims on themselves that are accepted as money by the public” (Bossone 2001, p. 2252, emphasis added). Therefore, Bossone continues, “Banks are special because they can finance new production by creating money; this makes production cheaper than if banks were only to intermediate claims backed by pre-existing real resources” (Bossone 2001, p. 2253).

Bossone (2001) distinguishes between a credit market, where liquidity is generated for use in production, and a financial market, where existing accumulated liquidity is merely distributed. Bossone (2001) associates the credit market with banks and the financial market with nonbank financial intermediaries. These nonbank financial intermediaries “transfer money across agents with different liquidity preferences, in no case do they create money” (Bossone 2001, p. 2252). Whereby Bossone (2001) points out that no one is prevented from “using a nonbank liability as money” (Bossone 2001, p. 2252, emphasis added).

In support of Bossone’s view, we can cite the post-Keynesian approach of Monvoisin (2017), who claims that an analysis of banking behavior is not possible without an analysis of money (Monvoisin 2017, p. 183). “The abandonment of the mainstream causality between savings and investment implies that production must now be financed, and it is this necessity to finance production that makes banks and bank credit so important in the discussion over the role of banks” (Monvoisin 2017, p. 193).

The focus of consideration can be either the asset side of the balance sheet (loans) or the liability side (deposits). Depending on where the focus lies, it can also be determined whether the bank is an active or a passiveFootnote 4 player. In this respect, authors who focus on the deposit side of the balance sheet advocate a typical intermediation approach, according to which banks depend on deposits in order to be able to grant loans (Sealey and Lindley 1977).Footnote 5

According to this approach, banks are dependent on customer deposits and play a somewhat passive role. In contrast, the emphasis on money creation attributes to banks an active role that goes well beyond their role as mere intermediaries. The associated scope for banks to shape the economy tends to place producers in a relationship of dependence on banks.

With regard to future prospects, it can be assumed that passive or dependent actors have less room for shaping the economic field, whereas active actors have room for action that they can use to structure the future in their own interests.

Feldman (2020) sees the banks in this respect, at the mercy of the new competitors, which for him represent a complete alternative to banks. This view is taken to the extreme by Othman et al. (2019). They look at the challenge of blockchain technology in the form of cryptocurrencies on banks with a vector autoregression (VAR) and a vector error correction model (VECM). They find that growing market capitalization of crypto-industry “has a negative long-run equilibrium relationship with bank deposit variability.” The authors even calculate a 1% deterioration in the market capitalisation of cryptocurrencies, which means that bank deposit variability will increase by approximately 4.381% (Othman et al. 2019, p. 122). How meaningful this calculation is can be questioned, because, as in the authors’ own words, “public perception is consistently influenced by the media” (Othman et al. 2019, p. 122). All in all, such an indicator reveals a strongly (natural) science-based understanding of society, which does not take humans as anticipating beings into account at all. With regard to “the bank’s future performances and survival,” there are two alternative courses of action: (1) to invest in cryptocurrencies themselves during economic upswings and to avoid them during downturns and (2) to implement blockchain technology, which, however, does not seem particularly promising for the authors themselves. Ultimately, cryptocurrencies eliminate the functions of a bank (Othman et al. 2019, p. 110, 119). Broby (2021) also takes a strong look at the bank as an intermediary. Here, the author attempts to expand the theory of the banking firm by Klein (1971) to include the aspect of digital banking. Disintermediation is a particular focus of attention, which understandably darkens the outlook for the future. However, Broby (2021) also points to the advantages of banks, such as trust. For the banks, the primary goal is therefore also to expand this trust and customer loyalty. Brandl (2020) would certainly argue against this, seeing no danger in blockchain technology and above all not the end for banks, but rather points out that “capitalist economies are fundamentally dependent on intermediaries that can generate confidence in the temporal as well as the spatial stability of the value of money” (Brandl 2020, p. 560 author’s own translation).

So far, the specialness of banks has been related to one side of the balance sheet of each bank. A more general view of the situation is taken by Hatami et al. (2020), who refer to the banking license, which will ensure the continued existence of the banking sector (Hatami et al. 2020, p. 9). In this sense, a more institutional approach can be detected here.Footnote 6

Omarini (2018a) offers a view that already finds it difficult to identify one unique feature of banks: “Banks have to recognize that the blurring of the lines between banks and Fintech startups is causing a rethinking of the definition of a bank itself. According to regulators, they are deposit-taking institutions, but they do not necessarily need to be defined by that. [...] Fintech companies may be considered enablers or social constructs, because they are not banks in the traditional sense, but they are banks because they let customers store money. All this boils down to the construct of what people feel is a bank” (Omarini 2018a, pp. 128–129). As outlined in the previous section, such a view ultimately leads Omarini (2018b) to describe banks as “victims of disintermediation” (Omarini 2018b, p. 25). The notion of victim should not be overemphasized in this respect, but this assessment goes far beyond allocating banks a passive role in the future.

Another facet of the specialness of banks concerns their role in economic growth. Again, Bossone (2001) attributes special capabilities: “Banks are thus essential for a growing real and financial economy” (Bossone 2001, p. 2261). What becomes particularly clear from this quotation is that banks are of enormous importance for the real economy and for economic growth. When this aspect is recognized by political decision-makers, banks enjoy influence and are protected in the public interest, which helps them weather future crises and may save them from unwelcome regulation.

Kodres and Narain (2010) also integrate banks into the overarching goal of economic growth. Everything must be subordinated to this goal. According to Kodres and Narain (2010), regulation can be an obstacle to innovation and thus can slow growth (Kodres and Narain 2010, pp. 11–12); on this view, regulation must not be too strict. In this context, the International Monetary Fund (IMF), to which the authors are close, will work to ensure that “a redesigned financial system benefits all its members, not just some” (Kodres and Narain 2010, pp. 16–17). They continue: “The new higher capital requirements and other regulatory strictures on banks imply that in the steady state, after the deleveraging effects of the crisis have worn off, the banking system is likely to be smaller overall. In the near term, bank deleveraging may overshoot and reduce the size of the banking system below its long-run equilibrium” (Kodres and Narain 2010, p. 13). The reliance on neoclassical growth theory is hard to miss (“steady state,” “long-run equilibrium,” “growth path”). What is relevant for the future prospects of banks is that neoclassical growth theory, which relates exclusively to real economic aspects, is mixed up here with the monetary sector, resulting in policy recommendations that do not follow from the theory at all. The model, which takes no account of money as such, of institutions, or of regulation, is used to infer a loose regulatory policy for banks (Petrakis 2020, p. 321). The application of neoclassical growth theory is also interesting against the background of the hope expressed that all members will benefit from IMF involvement. After all, IMF policies with this intention have not been able to fulfill these hopes over the past 70 years (Abe 2003; Vreeland 2003; Copelovitch 2010; Breen 2013; Moosa and Moosa 2019, chap. 5). It is clear that the theory has provoked more optimism than might be advisable.

At this point, we need to return to the interactions of regulation discussed in the last section and to the causal relationship between regulation and economic growth. Regulation can be seen as an obstacle to innovation (Kodres and Narain 2010), as causing higher costs and thus lower profitability for banks, or as detrimental to the growth of banks themselves (Stulz 2019, p. 87). Moreover, de Andrés et al. (2019) argue that regulation of managerial salaries will have a negative impact on European banks because the best managers will go elsewhere. Regulation is seen as a constraint that prevents managers from finding the optimal risk level for the bank (de Andrés et al. 2019, p. 222). Behind this lies a strong market thought. Through impaired profitability, regulation can also lead to growth problems for the economy as a whole (Smaghi 2018, p. 151). However, the focus can move toward stability. In that case, regulation is a barrier to entry for further competitors, which is conducive to banks’ profitability (Stulz 2019, p. 87). To a certain extent, this view is held by Kodres and Narain Kodres and Narain (2010), provided that the regulation is not too strong. Similarly, Monvoisin (2017) considers stronger regulation to be indispensable if banks are once again to fulfill their role in the “monetary economy of production” in order to generate economic growth (Monvoisin 2017, p. 196). Cullen (2018) criticises the standard narrative of the pre-crisis practice of securitisation, in short that the originate-to-distribute approach of mortgage loans creates the wrong incentives and that regulation should reduce these kinds of incentives and instead increase transparency and reduce complexity (Cullen 2018, p. 76). Such regulation is merely process-focused regulation and is nice in theory because of its efficient results, but it fails to recognise the behavioural aspects of bubbles, which is why it is better to address the capacity of the credit channel (Cullen 2018, pp. 76–77). In this context, Cullen (2018) makes his future prediction (for banks in the UK, which are facing just such a process-forced regulation with the EU Regulation on Securitization) that banks will mutate into monolines, which will become more receptive to lending greater volumes in property markets and specialise almost exclusively in mortgage lending (Cullen 2018, p. 104). In his argumentation, Cullen (2018) draws both on post-Keynesian authors such as Minsky and authors who emphasise the instability of the financial market, such as Shiller (Cullen 2018, p. 91). In addition to the regulatory aspect of securitisation, financialisation can also be highlighted, as Hardie and Howarth (2009) do. The authors refer to the “increased trading of risk,” which in their eyes is responsible for French banks having survived the financial crisis more successfully than German banks (Hardie and Howarth 2009, p. 1018). For German banks, however, they see a trend that points further towards financialisation and, especially for German regional/country banks, goes hand in hand with a stronger international orientation, which in turn means a move away from the core business of regional financing of SMEs (Hardie and Howarth 2009, p. 1036). Thus, depending on where the focus lies, either there is positive scope for banks (regulation \(\rightarrow\) stability) or there are existential concerns (regulation \(\rightarrow\) costs of regulation).

In this respect, it is worth recalling Kindleberger (1983), who had already dealt with the question in a modified form. He focused on the relationship between international banking and international trade, asking whether banks follow international business activities or enable them. However, even Kindleberger (1983) could not provide a simple answer to this question. When the relationship between banks and nonbanks is considered in the context of regulation, different approaches become apparent here, too. For example, Stulz (2019) blames regulation for the rise of nonbank financial institutions (or the shadow banking sector), with reference to the savings and loan crisis of the 1980s (Stulz 2019, p. 89). Recognizing the confrontation between banks and nonbanks, however, Kroszner (2015) sees banks as winning out over nonbanks in terms of regulation in the wake of the 2007 financial crisis; in the US, regulation hit the shadow banking sector much harder (Kroszner 2015, p. 6). Dugan (2016) agrees, noting that all the financial institutions that survived the crisis are now affected by “bank-style regulation” (Dugan 2016, pp. 454–455). Lenz (2015), in contrast, does not see this phase as a battle of banks versus nonbanks, but rather highlights the responsibility of banks for nonbanks: “In the 1990s, banks increasingly established off-balance-sheet transaction platforms with their own legal personality, as these were much more flexible in terms of the possibilities of securitization” (Lenz 2015, p. 526 author’s own translation).

Despite this view that banks can create money and that the central bank has only a limited ability to influence the money supply, Lenz (2015) foresees a bleak future for banks in which they act merely as platforms and can no longer exercise their special capabilities. In this context, he clearly distances himself from Bossone (2001) and Monvoisin (2017). This is because the essential part of Lenz’s analysis depends on a network effect: “That is, the economic advantage of a behavioral change in terms of the individual turning to something new must be so severe that it justifies the transaction costs of familiarizing oneself with the new and the associated initial uncertainty of acting. As the number of new users increases, at a certain point the network effect kicks in, giving the process of reorganization and system change a momentum of its own” (Lenz 2015, p. 523).

At this point, a changeover from quantity to quality or a kind of emergence can be seen. For Lenz (2015), this process is so important that the specialness of the banks takes a back seat. Again, a similar effect is noted by Bossone (2001). With the increasing loss of market share to nonbanks, traditional banking will change: “As many believe, the quantitative loss reflects a qualitative change” (Bossone 2001, p. 2259). However, according to Bossone, even if banks give up market shares to nonbanks, they can maintain their special role in the economic and financial system. This is because competition in the nonbank sector will also increase and reduce profit opportunities, such that nonbanks will merge or cooperate more with banks (Bossone 2001, p. 2266). Thus, despite considering similar aspects to Lenz (2015), Bossone (2001) arrives at a very different picture of the future.

A critical attitude toward regulation in connection with economic growth reveals one major assumption, which tends to be tacit. The underlying idea is that market efficiency is impaired by regulation. Although this finding may sound trivial to many economists, it is a fundamental assumption for the future of banks. This is because policy recommendations are derived from the critical attitude, which are then implemented by political decision-makers. In this context, it is worth taking a look back. In a review article, Benston et al. (2007) revisit their influential book from two decades earlier (Benston et al. 1986),Footnote 7 in which they examined the “safety and soundness of the banking industry” in order to draw lessons for the future: “Time-traveling is so valuable that sifting through the dust of our ancient study can help one to understand the forces driving financial change today and how these forces might eventually take the industry back into trouble” (Benston et al. 2007, p. 132). Of particular interest is the almost casual remark about markets, made in the context of finance theory: “If markets are efficient (as we all believe them to be), leverage does not add to the value of the firm” (Benston et al. 2007, p. 130). The authors then explicitly attest this efficiency of the markets in relation to securities and mortgage markets: “They do for the securities that compose part of a bank’s portfolio and for mortgage loans that may make up a larger part” (Benston et al. 2007, p. 131). This is a statement that, if made just one year later, would have astonished many people.

It is in this context that we should consider the following quote, in which one of the authors expresses his satisfaction with the policy measures taken since the publication of the book: “I take pride in our ability to identify issues and to point public policy in the right direction. Over recent years we have moved significantly in that direction, but we still have a way to go” (Benston et al. 2007, p. 131). It is important to note that the period between the publication of the book in 1986 and the self-praise in 2007 concerning the book’s impact on policy was accompanied by far-reaching liberalization and deregulation of markets in the financial sector (Helleiner 1994, chap. 7; Arestis 2004; Arestis and Sawyer 2005; Arestis 2016). The notion of efficient markets has had a significant influence on what has happened in the real world of banking, not to mention its performative character. Since the role of the market has been understood in a range of ways, both in economic history and economic theory, such an aspect cannot be disregarded for the future of banks.

Kroszner (2015) also mentions efficiency reasons due to the market, regarding deregulation and the resulting deepening of the financial sector in the US as a “win–win” result; both the banks and the state would have benefited from higher growth rates, a claim that the author tries to substantiate by identifying correlative relationships (Kroszner 2015, p. 10). Kodres and Narain (2010) express a similar view: “Action on numerous fronts by the various public entities could result in over-regulation to a degree that certain markets may simply disappear and valuable financial innovations and products are blocked” (Kodres and Narain 2010, p. 4). At this point, the specificity of banks can again be included and considered in terms of market credibility. For example, Harper and Chan (2003) see banks as merely a “substitute for missing financial markets.” According to them, if financial markets are available, they operate more cheaply and efficiently (Harper and Chan 2003, p. 44).

Similarly, Cocca and Csoport (2003) state that “The banking and financial sector is primarily an information processing branch of the economy [...] the economic justification of their existence, is based on a guaranteeing of various transformation and transaction functions within the scope of financial intermediation” (Cocca and Csoport 2003, p. 281). If technological innovations such as the Internet eliminate information asymmetries, Harper and Chan (2003) see forces at work that have the potential to eliminate banking (Harper and Chan 2003, p. 43). From the “death of banking” it follows that “banks have forever lost their uniqueness” (Harper and Chan 2003, p. 47). Therefore, according to the authors, “The future of banks will not be in banking but rather in the market exchange of financial instruments” (Harper and Chan 2003, p. 45). Cocca and Csoport (2003) regard customers as the biggest winners in the wake of greater competition and technological innovations. To this end, they also make use of Adam Smith’s concept of the “invisible hand” (Cocca and Csoport 2003, p. 313). It is very clear here how strongly a belief in the market as an abstraction, or in the financial markets as a more concrete phenomenon, goes hand in hand with foreseeing a negative future for banks.

Smaghi (2018) highlights another effect. He tries to show the difference between US banks and European banks with reference to profitability as an important factor: “Banks that are more profitable are better valued by the markets” (Smaghi 2018, p. 144). The fact that profitability is an important factor will not be questioned here, but behind that view lies a belief in the market that is difficult to understand when looking at companies other than banks. This belief would not explain the capitalization of companies such as Spotify or Tesla, and hence it can be insisted here that banks are not normal companies. However, even then, some evidence would have to be provided to account for why “the market” behaves differently for banks than for “normal” companies. Smaghi also gives reasons why US banks are more profitable than European banks. However, some of these reasons are connected to the relative lack of depth of the capital market on the European side, which penalizes banco-centric financial systems more (Smaghi 2018, pp. 148–150). In terms of the future of banks, a deeper capital market is likely to result in more profit opportunities. Sargu and Roman (2010) note the importance of payment transactions for bank profitability, and they link the lower profitability in Europe and Asia to a “more fragmented retail payment infrastructure” than in the US (Sargu and Roman 2010, p. 684).