Abstract

This paper runs a bibliometric analysis in order to present the characteristics and evolution of the publications of the research on board financial expertise. Our sample is composed of all the documents from the Web of Science for the period 1900–2020. The findings show that financial expertise research activity has grown exponentially, although in Europe it has been scantly developed. The analysis also reveals the most cited authors and papers, including the most frequent topics in this research area, highlighting that current trends are moving toward corporate social responsibility and ethical aspects. Potential research directions are also provided by suggesting specific research themes and conceptual approaches. This analysis has direct implications for academics in positioning their future research. The increasing importance of the assessment of scientific production has also made bibliometric studies have significant implications for universities and policymakers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Boards of directors have been traditionally considered a crucial corporate governance mechanism (Cuomo et al. 2016; Fama and Jensen 1983). The effectiveness of boards is strongly linked to their composition (Amorelli and García-Sánchez 2020) and, particularly, the financial expertise of directors has increasingly caught the attention of regulators, professionals, and academics. In this regard, the majority of codes or rules issued in the developed countries have called for the presence of financial experts on the board of directors in order to enhance its monitoring functions (Blue Ribbon Committee 1999; Sect. 2003; Directive 2014/95/EU). As a result, research on directors’ financial expertise has significantly grown in the current century. In particular, the vast majority of the papers have analyzed the effects of this kind of expertise (Abbott et al. 2004; Badolato et al. 2014; Bédard et al. 2004; Das et al. 2020; Zhang et al. 2007).

Despite the ever-increasing importance of board financial expertise, previous research has overlooked carrying out a systematic review of the literature on this matter. To the best of our knowledge, this paper is the first to run a bibliometric analysis on the research about board financial expertise. This study is timely and relevant for several reasons. First, boards and their committees are facing major challenges regarding a variety of financial issues due to the unprecedented risks, volatility and changes in business environments (Deloitte 2020; EY 2020; KPMG 2021). Accordingly, remarkable research opportunities are presented to unravel the role of board financial expertise in the current scenario. Given the fact that the literature in this field is experiencing a quick growth, our review and the associated future research agenda that we shape are opportune, not only because of the complexity of tasks that a board of directors faces today, but also due to the increased attention that financial expertise is receiving in the regulatory and professional contexts. Second, the use of bibliometric techniques provides systematization and replication processes that help to understand the advancement of the discipline by analyzing long periods, which is difficult with qualitative reviews (Aparicio et al. 2019; Hota et al. 2019). Third, bibliometric methods enable measuring different aspects of publications (authors, keywords, citations, collaboration patterns, among others) to evaluate research on a specific topic and explore the intellectual structure of a specific domain in the extant literature and uncover emerging trends and gap opportunities (Klarin 2020; Merediz-Solà and Bariviera 2019; Zupic and Č 2015). Therefore, bibliometric reviews have become a valuable instrument for the academic community in research evaluation and act as a guide for researchers established in this research area and for those who want to begin to delve into these topics (Ellegaard and Wallin 2015). In a similar way to recent bibliometric analyses (Cisneros et al. 2018; Kent Baker et al. 2020; Zheng and Kouwenberg 2019), our study addresses the following research questions (RQ) concerning the research on board financial expertise:

-

RQ1: What is the volume of publication over the years?

-

RQ2: Which are the most productive countries?

-

RQ3: Which are the most productive journals?

-

RQ4: Who are the most influential and productive authors?

-

RQ5: Which publications are the most cited in the research period?

-

RQ6: What are the most important research topics studied and potential research gap opportunities?

Our study makes several contributions to the literature. First, we identify publication standards in a recent, but consolidated branch of research concerning board financial expertise. The proliferation of studies on that matter merits a systematic review to analyze and evaluate the progress in this research area. Second, the information segmented by years and by countries (RQ1 and RQ2) helps to detect the most important events and contexts in the research on financial expertise. In this regard, our study summarizes the main international regulations or recommendations on board financial expertise and offers a guide for scholars to understand how research has reacted to changes in legislation or professional recommendations. Third, the identification of the top journals, authors, and their connections (RQ3 and RQ4) is crucial to ascertain scientific productivity and provides valuable information to position future studies on board financial expertise. Fourth, we recognize the most relevant publications in the field and categorize the main themes and current dynamics of research on board financial expertise (RQ5 and RQ6). The knowledge regarding research trends will help academics to learn about past and current research interests, which proves vital in shaping future research directions. In addition, several potential research avenues are identified. To sum up, our study provides a clear picture of research on board financial expertise, and contributes a significant advance in the literature to map intellectual structure and research trends in this topic.

The sample is composed of all the publications on board financial expertise from the main collection of the Web of Science (WOS), which is a fundamental input of the evaluation process in academia. Specifically, a total of 314 publications have been analyzed to answer our research questions. Using the VOSviewer software, our paper maps research on board financial expertise through the combination of techniques based both on performance analysis and science mapping, including the analysis of publications by year, country, journal, author, as well as a citation analysis and a content analysis.

The structure of the paper is as follows. The next section overviews the theoretical framework and the previous literature. Section 3 describes the sample and the methodology employed in the analysis. Section 4 reports the main results and Sect. 5 summarizes our study’s main conclusions and implications.

2 Theoretical framework and literature review

In recent years, the relevance of the directors’ financial expertise has been underlined by a number of regulatory and professional bodies across the world. In 1999, the Blue Ribbon Committee in the United States highlighted the importance of the financial expertise of audit committee members to enhance their oversight functions. In 2003, the Sarbanes-Oxley Act (Sect. 2003), also passed in the United States, became a worldwide reference. This law required that “at least one member of the audit committee must be a financial expert or a person who has an understanding of financial statements and Generally Accepted Accounting Principles (GAAP), experience in preparing, auditing, analyzing or evaluating financial statements, experience in actively supervising one or more persons engaged in such activities, or an understanding of internal accounting controls and procedures for financial reporting”. Further, the New York Stock Exchange (NYSE 2004) and the National Association of Securities Dealers Automated Quotations (NASDAQ 2004) obliged listed firms to fulfill this requirement. In the European setting, it was recommended that “the members of the audit committee, should, collectively, have a recent and relevant background in and expertise of finance and accounting for listed companies appropriate to the company’s activities” (European Commission 2005, p. L52/56). Later, the publication of Directive 2006/43/EC required the presence of financial experts in the audit committee of public-interest entities. More recently, the Directive 2014/56/EU extended this requirement to all listed companies. In particular, this regulation indicated that audit committee members should have specific competences in auditing and/or accounting, therefore narrowing the definition of financial expertise provided in the Anglo-Saxon context. Additionally, in the Asia Pacific region, the implementation of corporate governance regulations concerning directors’ financial expertise operates generally on a “comply or explain” approach, where most codes specify the need for at least one or more audit committee members with accounting or finance expertise (KPMG 2017). Moreover, financial expertise has also been considered for international professional organizations as a decisive attribute for directors to improve board oversight and monitoring capabilities (Deloitte 2018; Ernst and Young 2020).

Consequently, in the current century research on financial expertise has awakened great interest. The previous literature has considered this kind of expertise as an important director characteristic in the exercise of monitoring responsibilities and, prior research has examined the relevance of financial expertise at the boardlevel (Güner et al. 2008; Minton et al. 2014; Sarwar et al. 2018; Shaukat et al. 2016), at the level of the audit committees (Badolato et al. 2014; Chen and Komal 2018; Defond et al. 2005; Khemakhem and Fontaine 2019; Krishnan and Lee 2009), and at an individual level of CEOs (Baatwah et al. 2015; Custódio and Metzger 2014; Dhar et al. 2022; Rezaee et al. 2021). This branch of research has generally examined the effect of directors’ financial expertise on the oversight of different corporate policies. Particularly, researchers have investigated the impact of financial expertise on earnings management (Badolato et al. 2014; Zalata et al. 2018), fraud (Farber 2005), accounting restatement (Abbott et al. 2004; Das et al. 2020), the quality of financial disclosures (Chychyla et al. 2019; Mangena and Pike 2005), voluntary disclosures (Abad and Bravo 2018; Helfaya and Moussa 2017), and internal control (Hoitash et al. 2009; Lisic et al. 2019; Oradi and E-Vahdati 2021; Zhang et al. 2007).

Nonetheless, despite the proliferation of studies on board financial expertise, the previous research has overlooked qualitative and quantitative reviews in this line of research. Only a few studies have performed a content analysis of the papers that have examined the effect of financial expertise on specific financial outcomes, such as earnings management (Chen and Komal 2018) or the timeliness of financial reporting (Baatwah et al. 2013). Our study fills a gap in the literature by employing a bibliometric analysis to assess scientific production in this research area. Bibliometric analyses have been proved to be an important tool for the academic community in the evaluation of the research progress of a topic (Ellegaard and Wallin 2015) and still remain an emerging discipline both in corporate governance research and in the accounting and finance field.

In this regard, Durisin and Puzone (2009) used bibliometric methodologies, such as author citation analysis and author co-citation analysis, to analyze research activity on corporate governance in different journals to demonstrate whether corporate governance research is rather a subject of multi-disciplinary research or whether it exhibits the traits of a discipline. Huang and Ho (2011) also reviewed research on the corporate governance field, developing a publication analysis using the Social Science Citation Index from 1992 to 2008. In recent years, given the ever-increasing importance of boards of directors in the academic sphere, Zheng and Kouwenberg (2019) performed a bibliometric analysis to identify the theoretical evolution and intellectual structure of knowledge about boards. More specifically, bibliometric analyses have also been taken as an approach to evaluate the evolution of research on particular board characteristics that have gained interest recently, such as board interlocking (Smith and Sarabi 2020), board diversity (Kent Baker et al. 2020) and the relationship between board characteristics and corporate social responsibility (Dwekat et al. 2020). Therefore, our study complements this literature by focusing on directors` financial expertise, which has received growing attention in the last decades from regulators, companies, and academics.

3 Data and methodology

3.1 Data

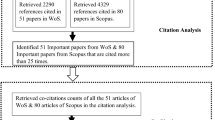

The initial sample consisted of 314 documents collected from the main collection of ISI Thomson Reuters’ Web of Science (WOS) for the entire period available, from 1900 to 2020. The documents regarding financial expertise have been compiled through a search in December 2020 in the topic field in titles, abstracts, and keywords (Zheng and Kouwenberg 2019), by the expressions “financial expertise” or “financial experts” and restricted to the studies that contain the terms “audit committee” or “board of directors” or “board” or “CEO” or “director” or “chair” or “chairman” or “chairwoman”. The data selection process is summarized in Table 1.

3.2 Methods

Pritchard (1969, p. 348) defined bibliometric analysis as “the application of mathematical and statistical methods to books and other media”. Bibliometrics analysis allows controlling, analyzing, and evaluating the research activity over the years (Patra et al. 2006). In addition, this methodology allows structuring the research area as it develops as well as guides future lines of research (Albort-Morant et al. 2018). Therefore, bibliometric methods have become relevant in assessing institutional investigation and positioning future academic research (Daim et al. 2006; Ellegaard and Wallin 2015).

A bibliometric analysis is capable of offering an analysis, among others, referring to the number of publications, the most influential authors, the countries where the topic has been most investigated or the journals that focus their publications on issues related to the object of analysis (Albort-Morant et al. 2018). In order to respond to our research questions, this paper presents different sections: the analysis of publications by year (RQ1); the analysis of research activity by country (RQ2); the analysis of publications by journal (RQ3); the analysis of the author’s influence and its productivity (RQ4); a citation analysis (RQ5); and a content analysis to present the main themes in this stream of research and the evolution of the most important trends (RQ6). The bibliometric analysis is based on a set of indicators that enable objectively measuring different aspects of publications, and allow a comparability between researchers, research groups, publications and organizations (Haustein and Larivière 2015).There are three types of indicators (Durieux and Gevenois 2010): (1) quantity, referring to the productivity of any unit of measure; (2) quality, which determines the impact of the research; (3) structural, which examines connections between publications, authors, or keywords.

Consistent with the recent literature (Behrend and Eulerich 2019; Tunger and Eulerich 2019; Zheng and Kouwenberg 2019), the VOSviewer software is employed in our analysis. This software was designed to construct and view bibliometric maps, and enables performing different actions such as zooming, scrolling, and searching as well as providing relevant graphical representations, which are significant advantages in comparison to other softwares (Van Eck and Waltman 2010). Table 2 presents the structure of the methodology.

4 Results

Almost 88% of the publications are articles (276 documents) and 99% are written in English (311) since this is the most used language in the field of scientific publications. This section is divided into several parts concerning every research question.

4.1 Publication by year

Although the search started in 1900, when the WOS was launched, the first publication about board financial expertise dates from 2002. Specifically, the paper “Evaluating financial reporting quality: the effects of financial expertise vs. financial literacy” by Linda McDaniel, Roger D. Martin and Laureen A. Maines, signals the beginning of this research topic (McDaniel et al. 2002). Figure 1 shows the evolution of research activity on financial expertise in the period 2002 to 2020, and several stages can be detected, where the effect of different international regulations on this specific research area is clearly visible.

First, during the period 2002–2008 the number of publications remained relatively stable, but low. The initial research on financial expertise likely appeared due to the issuance of important legislations on that matter as a response to the succession of financial scandals, such as the Blue Ribbon Committee (BRC 1999) and the Sarbanes-Oxley Act (SOX) in the United States (Sect. 2003). In the US context, NYSE (2004) and NASDAQ (2004) requirements strengthened the role of financial experts.

Second, in the period 2009–2014, research on board financial expertise rose significantly. In 2009, more than 10 documents were published, and in 2013 the barrier of 20 publications was surpassed. As the failure of various internal governance mechanisms has frequently been cited among the key contributing factors to the 2007–2008 financial crisis (Minton et al. 2014), the study of board attributes gained great interests in this period. The controversial initial definitions of financial expertise and the inconclusive previous results (Abad and Bravo 2018; Dhaliwal et al. 2010), as well as the first legislations in the European context about this topic, still limited to certain entities, may have also contributed to this rise in the number of publications.

Third, regardless of the one-off decrease in 2015, research activity on financial expertise has been in the last five years strengthened and significantly higher than in previous years. Indeed, 57% of the documents were published between 2016 and 2020, which underlines the importance of financial expertise in recent research, and several reasons may be found to explain this increase. The Directive 2014/56/EU introduced into the discussion the relevance of financial expertise as a corporate governance mechanism for European firms. The Directive 2014/95/EU promoted superior non-financial reporting practices, and the European Securities and Markets Authority (ESMA, 2015) also encouraged the enhancement of the quality of disclosure, these being tasks directly linked to audit committees. In addition, the positive trend in research activity may have also been affected by those publications from emerging economies where the regulation of corporate governance, and especially the audit committee, arrived later (Almarayeh et al. 2020; Zgarni et al. 2016).

4.2 Publications by country

The analysis of the number of publications by country, which is shown in Table 3, is based on the affiliation of the authors at the moment of the publication of the paper. This analysis highlights several relevant findings. First, research on financial expertise is scattered across countries. A total of 55 countries contribute to the knowledge of this area. Second, Anglo-Saxon countries are the main contributors. Almost half of the publications have affiliations from the United States (110), United Kingdom (38) and Australia (30). In these countries the basis for the research on financial experts emerged under the influence of the Blue Ribbon Committee (BRC 1999) and the Sarbanes-Oxley Act (Sect. 2003). Third, research activity on financial expertise is also significant in emerging countries, some of them appearing in the top positions in Table 3. In line with the legislations from developed economies, regulations on corporate governance and audit committee functions have also been recently promulgated in emerging countries (Almarayeh et al. 2020; Zgarni et al. 2016). Finally, in the European Union context there is a noteworthy low level of research activity on this matter. Only Spain has published more than 10 documents. This is particularly surprising, considering the legislations and the recommendations from professional bodies concerning financial expertise commented on in the previous sections.

4.3 Publications by journal

The 314 documents from our sample have been published in 158 journals. The number of publications, the quartile and category, the impact factor (JCR), the ranking in the Academic Journal Guide (AJG) of the Chartered Association of Business Schools (CABS), and the number of issues for each journal are shown in Table 4. The main categories where these journals are classified are Business, Finance, Economics, and Management, which shows the disciplinary character of this branch of investigation.

The top 10 most relevant journals publishing articles on financial expertise are “Managerial Auditing Journal”, “Accounting Review”, “Auditing: A Journal of Practice & Theory”, “International Journal of Auditing”, “Contemporary Accounting Research”, “Accounting and Finance”, “Advances in Accounting”, “Corporate Governance: An International Review”, “Corporate Governance: The International Journal of Business in Society”, and “Journal of Accounting and Public Policy”. Table 4 highlights that most of these journals belong to the Business and Finance category, many of them ranked in the first and second quartiles, which serves to signal the high impact of research on financial expertise.

4.4 Authors’ influence and productivity

This analysis presents an effective way to identify the most relevant researchers of a topic, by considering both their citations and their number of publications (Ferreira et al. 2016). In particular, the citations reflect the influence that authors have in a specific field of research (Merigó and Yang 2017), while productivity is associated with the number of publications from a researcher.

Specifically, there are 708 authors who have contributed to research on financial expertise. Table 5 shows the information of the 20 authors with the most citations, which becomes crucial for academics to recognize the most influential authors in this research area. At the same time, this table also shows their total number of publications, as well as their affiliation. There are three authors with more than 900 of citations each (Lawrence Abbot, Susan Parker and Gary Peters). However, the most productive authors in this top 20 are Gopal Krishnan and Jagan Krishnan, with five and four publications each.

The information about authors can be expanded from the perspective of co-authorship analysis, which consists of studying the collaborations that two or more authors make between them when they publish together (Barabâsi et al. 2002). At this stage, those studies that only have one author cannot be analyzed since there is no network (Perianes-Rodriguez et al. 2016). Cooperation between authors is relevant considering that the specialization of the research and the complex methodologies increasingly lead to the need for an alliance between authors (Cisneros et al. 2018).

The results from Fig. 2 present a total of 708 authors, connected by 232 different clusters. The largest of the connection group, which is shown in Fig. 3, has a total of 19 authors. The nodes more centered in each of the clusters represent the influence of these authors. In addition, those authors who have published more are represented with the largest nodes.

It can be observed that there is no extensive collaboration between the different authors in this branch of research. These findings suggest that a greater network between authors, countries and different organizations could be beneficial for the extension and development of conclusive scientific evidence on financial expertise.

4.5 Citation analysis

Citation analysis shows the influence of publications on financial expertise in the literature (Merigó and Yang 2017). Citation analysis has been extensively used to judge the impact of publications and as a measure of the scientific quality of researchers and institutions (Ellegaard and Wallin 2015). At the same time, this analysis remains crucial for scholars to map the previous literature and position their research. Specifically, the analysis focuses on showing global citationsFootnote 1, verifying the impact on the publications studied in this research (Kent Baker et al. 2020). Table 6 shows the 20 most cited documents.

As financial expertise is a specific attribute of board of directors and audit committees, and most of the research on this matter has been conducted recently, it is not surprising that the number of citations is not especially high. Only Abbot et al. (2004), Agrawal and Chadha (2005), Bédard et al. (2004), and Farber (2005) exceed 500 citations (635, 568, 524, and 510 respectively). The papers by Defond et al. (2005), and Krishnan (2005) exceed four hundred citations (482 and 406, respectively). These are the most influential publications in our sample.

4.6 Content analysis

The content analysis has been conducted in two stages. First, a network analysis has been performed by using VOSviewer in order to spot the words with the highest occurrence in titles and abstracts of the publications. This illustrates the structure and central themes of a research area (Tunger and Eulerich 2018) and therefore we pinpoint specific topics within the existing research on board financial expertise. Second, new search criteria have been introduced in the WOS, adding these words, which are considered (individually or grouped by topics) as part of the search restrictions in the WOS. On the one hand, this allows singling out the frequency of publications regarding specific topics in this research field. On the other hand, in addition to the whole period of analysis (2002–2020), two subperiods are considered (2010–2020 and 2018–2020) in order to examine the trends in the publication of these topics.

Table 7 contains the results from the content analysis and several general findings can be highlighted. First, most of the papers of the total sample, selected through the primary search criteria (considering “financial expertise” or “financial experts” and “audit committee” or “board of directors” or “board” or “CEO” or “director” or “chair” or “chairman” or “chairwoman”), have been published in the last decade (279 out of 314), and especially in the last three years (128 out of 314). Second, when the initial search is particularly restricted to audit committee or committees, our findings show that the majority of the publications, about 70% in all the periods, refer to audit committee financial expertise. Legislations and recommendations from regulators and professionals focus on this matter and, accordingly, academics tend to examine the role of financial experts in the audit committee (Abbott et al. 2004; Abernathy et al. 2014; Bravo and Reguera-Alvarado 2019; García-Sánchez et al. 2017a). Third, the number of publications that specifically deal with accounting financial expertise may be particularly low and have been published in the last decade (Das et al. 2020). Surprisingly, only about 10% of the papers (31 out of 314) have addressed this specific type of financial expertise, thus resulting in encouraging research opportunities to unravel the role of financial experts.

On the other hand, the main boundaries of research regarding financial expertise are reviewed, and our results reveal that publications mostly analyze the effects of financial expertise on different firm outcomes, this research being highly fragmented and without a unique focus. In this regard, the previous literature has predominantly focused on the impact of financial expertise on financial decisions made by boards and traditional functions assigned to the audit committee, such as earnings quality (Badolato et al. 2014; Chan et al. 2013), the financial reporting process (Hesarzadeh and Rajabalizadeh 2020; Velte 2018), risk oversight (García-Sánchez et al. 2017a), internal control (Almaqoushi and Powell 2020; Zhang et al. 2007), relations with external auditors (Salleh and Stewart 2012), and firm financial performance (Aldamen et al. 2012; Huang et al. 2016). Particularly, a significant number of studies regarding financial expertise consider the topics of “earnings quality/earnings management/earnings conservatism” (34.4%), “financial reporting/financial disclosure” (28%), “risk” (21%), “internal control” (18.8%), “auditor/external auditor” (17.8%), and “firm performance” (14.3%). While the inclusion of some of these terms (“risk”, “auditor/external auditor”, “firm performance”) have been slightly enhanced in the most recent studies, the frequency of use of other topics (“earnings quality/earnings management/earnings conservatism”, “financial reporting/financial disclosure”, and “internal control”) have decreased, which can denote a progressive loss in research interest. In addition, our findings highlight that there is a new trend, still incipient, related to social and ethical issues, such as “gender diversity” (Bravo and Alcaide-Ruiz 2019), “corporate social responsibility” (Appuhami and Tashakor 2017), “ethics” (García-Sánchez et al. 2017b), “sustainability” (Buallay and Al-Ajmi 2020) and “voluntary disclosure” (Mohammadi et al. 2020). Although the number of publications regarding these topics remains relatively low for the entire period, resulting in 60 papers altogether, all of them have been published in the last decade, and significantly in the last three years (39 publications). Therefore, the publications regarding financial expertise that consider any of these topics mean over 30% of the research activity for the last three years. This underlines the novelty and relevance of these issues and, at the same time, encourages scholars to explore these lines of research to find out insightful evidence.

Moreover, Table 7 confirms that the number of studies that include the term “theory” remains low, which suggests that the main body of current research regarding financial expertise is mainly empirical, without putting the emphasis on theoretical foundations. In this regard, agency theory is predominantly employed in this research area. In addition, the low number of publications that consider the terms “interaction” or “moderation” is surprising.

5 Discussion

This section provides a discussion about the findings of the bibliometric analysis and presents several gaps for future research. The analysis of the publications per country has made it clearly visible that the development of research on financial experts may need to be increased in the European Union countries, where the legislation emphasizes the need for specific competences in auditing and/or accounting for directors in the audit committee. It may be particularly relevant to enhance international collaboration, which can prove crucial to assess how the current global volatility and uncertainty affects the role of financial expertise of boards of directors. In this regard, future research could also explore inter-country differences. Firms are likely to have to adjust their boards of directors to various cultural and national attributes and regulatory frameworks.

In a similar vein, since most of the studies focus on listed firms without taking into account the industrial differences, industry-specific and cross-industry studies would also enable considering the unique features of a single industry and enlighten decisions by firms and policymakers.

On the other hand, the controversy concerning the broad definition of financial expertise provided by the SOX (Dhaliwal et al. 2010; Krishnan and Visvanathan 2008) and the approval of European legislations explicitly focusing on the relevance of accounting expertise have contributed to a slight increase in research on this kind of expertise. However, the effects of accounting expertise are clearly under research. This has become a fundamental issue in the current context, characterized by great volatility and uncertainty, where boards face important challenges from an accounting perspective, including tasks related to forecasting and disclosure, assessment of risks derived from accounting impairment, fair value estimates, accounting fraud, and business interruption, among other matters (BDO 2020; KMPG 20,220) Therefore, future studies should be more specific in order to address the questions about how much financial expertise is needed and about whether accounting financial expertise makes a difference.

Moreover, the content analysis indicates that previous studies lack an emphasis on theoretical foundations, agency theory being the main theoretical approach. Future research can thoroughly go into conceptual foundations and incorporate multiple theoretical perspectives to explore the role of board financial experts from different views and build more comprehensive frameworks. In particular, behavioral aspects or the resources provided by financial experts can be further analyzed.

In addition, although there are emerging studies on board financial expertise that also focus on director gender diversity, there is still an absence of focus on specific characteristics of board financial experts. The previous literature generally employs a one-size-fits-all perspective, where financial experts are assumed to have the same role regardless of other personal features. However, beyond their gender, the decisions made by board financial experts could be influenced by their age, their tenure, their power within the board, or their interlocking directorates, among others.

Similarly, more in-depth moderation analyses would help to better understand the actual influence of board financial experts. Recent studies have stressed the need to consider the moderation of the context to provide more conclusive evidence on the role of directors so that policymakers and practitioners can carry out their legislations and recommendations more effectively (Bravo and Reguera-Alvarado 2019; Jain and Jamali 2016). However, despite being theoretically clear, there is scarce empirical evidence on how the context, firm characteristics, or board characteristics can moderate the influence of financial experts.

Finally, the content analysis also highlights that the previous research has mainly investigated the effect of board financial expertise on traditional financial functions assigned to boards and to the audit committee, although there is an emerging line of research that focuses on social and ethical issues. In the present context, professional bodies are calling for a number of major challenges for boards and their committees regarding financial aspects (Deloitte 2020; EY 2020; KPMG 2021), and this may represent a great opportunity to really understand the current value of board financial expertise. In this regard, future research might explore the effect of financial experts on specific reporting policies related to ESG issues and climate change. Studies may also analyze the influence of financial experts in the access to capital, the changes in internal control due to the new business environment, the forecasting ability, and the valuation of risks derived from a variety of issues, such as cybersecurity, asset impairment, fair value estimates, and business interruption.

6 Conclusions and limitations

Our paper offers a unique and global vision concerning research on financial expertise by performing a bibliometric analysis of the publications obtained from the main collection of the WOS, which enables mapping the intellectual structure of this research line, evaluating its progress, and identifying current and future research trends. The use of the Internet and the existence of powerful software have led to the widespread use of bibliometric analysis to evaluate the bibliography in a research field (Merigó and Yang 2017). In our paper, this analysis is particularly relevant since boards and audit committee attributes are at the center of regulatory and professional debates, including director financial expertise, and research activity on this topic has gained increasing interest.

Our bibliometric analysis addresses several specific research questions and interesting evidence, with direct implications for academics, has been found. First, research activity has grown exponentially, especially in the last decade. The review of almost two decades of investigation has revealed the origin of this research line and the legislations and recommendations that may explain its expansion. Second, research on financial expertise has been predominantly developed in the US context and in other Anglo-Saxon countries. In addition, this topic has also gained interest in emerging economies. However, despite the approval of specific legislations and the ever-increasing academic attention on this matter, financial expertise remains under-researched in the European Union setting. This evidence provides encouraging opportunities for scholars to offer a full picture of the role of financial experts from an international point of view. Third, the analysis of publishing activity by journal is helpful for academics in orienting their research. In this regard, although the main journals that contain publications on this topic are in the Business and Finance category, our paper suggests that the future research trends may also consider social and ethical views, and this may enable positioning research on financial expertise in journals with a broader scope, thereby increasing the multidisciplinary nature of this stream of research. Fourth, the analysis of authors’ productivity and influence proves vital for scholars to have an updated review of the literature, considering the most influential authors and therefore understanding the intellectual structure of this research line. This analysis also reveals that research networks in this research area are generally small and limited to their own research groups or professional organizations. This encourages the creation of new working relationships and the expansion of collaborations. Fifth, the citation analysis proves vital to an understanding of the most notable and influential publications in this research field, which is necessary for scholars to understand research gaps and position their efforts. Sixth, the content analysis shows the most frequent themes in the literature regarding financial expertise. The consideration of different periods allows identifying the progressive transaction toward topics more related to corporate social responsibility or ethical perspectives. This analysis also reveals that research on specific accounting financial expertise might be expanded to obtain a more comprehensive view of the role of financial experts. Moreover, our findings as well highlight that future papers may strengthen theoretical frameworks and methodologies by considering that the influence of financial experts is likely to be moderated by contextual factors.

In addition to these implications for academics, the increasing importance of the assessment of scientific production has made bibliometric studies also have significant implications for universities and policymakers. In this regard, bibliometric analyses remain important in faculty recruiting processes as well as in setting the research strategies of universities and research organisms (Merediz-Solà and Bariviera 2019). Bibliometric techniques also play an increasing role in the ranking of research departments and institutions (Waltman et al. 2012) and have been proven to be important for judging the impact of research of individuals and organisms (Ellegaard and Wallin 2015). This is important for policymakers in the assignment of funds.

Nonetheless, the analysis performed in this paper has certain limitations. First, this study analyzes the documents included in the WOS database, and other databases can be considered for future research. Second, bibliometric research analyzes the documents based on the number of citations and the number of publications, without considering the content of the document. Third, our search criteria are based on our literature review, and other keywords could emerge in the future.

Notes

Global citations show the number of times an article is cited by other papers in the WOS, including other research areas (Kent Baker et al. 2020).

References

Abad C, Bravo F (2018) Audit committee accounting expertise and forward-looking disclosures: a study of the US companies. Manag Res Rev 41(2):166–185. https://doi.org/10.1108/MRR-02-2017-0046

Abernathy JL, Beyer B, Masli A, Stefaniak C (2014) The association between characteristics of AC accounting experts, AC chairs, and financial reporting timeliness. Adv Acc 30(2):283–297

Abbott LJ, Parker S, Peters GF, Raghunandan K (2003) The association between audit committee characteristics and audit fees. Audit J Pract Theory 22(2):17–32. https://doi.org/10.2308/aud.2003.22.2.17

Abbott LJ, Parker S, Peters GF (2004) Audit committee characteristics and restatements. Audit J Pract Theory 23(1):69–87. https://doi.org/10.2308/aud.2004.23.1.69

Agrawal A, Chadha S (2005) Corporate governance and accounting scandals. J Law Econ 48(2):371–406. https://doi.org/10.1086/430808

Albort-Morant G, Leal-Rodríguez AL, Fernández-Rodríguez V, Ariza-Montes A (2018) Assessing the origins, evolution and prospects of the literature on dynamic capabilities: a bibliometric analysis. Eur Res Manag Bus Econ 24(1):42–52. https://doi.org/10.1016/j.iedeen.2017.06.004

Aldamen H, Duncan K, Kelly S, McNamara R, Nagel S (2012) Audit committee characteristics and firm performance during the global financial crisis. Acc Finan 52(4):971–1000. https://doi.org/10.1111/j.1467-629X.2011.00447.x

Almaqoushi W, Powell R (2020) Audit committee quality indices, reporting quality and firm value. J Bus Finan Account 48:185–229. https://doi.org/10.1111/jbfa.12478

Almarayeh TS, Aibar-Guzmán B, Abdullatif M (2020) Does audit quality influence earnings management in emerging markets? Evidence from Jordan. Rev Contab-Span Account Rev 23(1):64–74. https://doi.org/10.6018/rcsar.365091

Amorelli MF, García-Sánchez IM (2020) Critical mass of female directors, human capital, and stakeholder engagement by corporate social reporting. Corp Soc Responsib Environ Manag 27(1):204–221. https://doi.org/10.1002/csr.1793

Aparicio G, Iturralde T, Maseda A (2019) Conceptual structure and perspectives on Entrepreneurship education research: a bibliometric review. Eur Res Manag Bus Econ 25(3):105–113. https://doi.org/10.1016/j.iedeen.2019.04.003

Appuhami R, Tashakor S (2017) The impact of audit committee characteristics on CSR disclosure: an analysis of australian firms. Aust Acc Rev 27(4):400–420. https://doi.org/10.1111/auar.12170

Baatwah SR, Salleh Z, Ahmad N (2013) Whether Audit Committee Financial Expertise is the only relevant expertise: a review of Audit Committee Expertise and Timeliness of Financial Reporting. Issues Soc Environ Account 7(2). https://doi.org/10.22164/isea.v7i2.76

Badolato PG, Donelson DC, Ege M (2014) Audit committee financial expertise and earnings management: the role of status. J Acc Eco 58:208–230. https://doi.org/10.1016/j.jacceco.2014.08.006

Barabâsi AL, Jeong H, Néda Z, Ravasz E, Schubert A, Vicsek T (2002) Evolution of the social network of scientific collaborations. Phys: Statis Mech Appl 311(3–4):590–614. https://doi.org/10.1016/S0378-4371(02)00736-7

Baatwah SR, Salleh Z, Ahmad N (2015) CEO characteristics and audit report timeliness: do CEO tenure and financial expertise matter? Manag. Audit J 30(8/9):998–1022. https://doi.org/10.1108/MAJ-09-2014-1097

BDO (2020) BOARDS’ HIGH STAKES BALANCING ACT: Navigating Through Crisis

Bédard J, Chtourou SM, Courteau L (2004) The effect of audit committee expertise, independence, and activity on aggressive earnings management. Audit: J Pract Theory 23(2):13–35

Behrend J, Eulerich M (2019) The evolution of internal audit research: a bibliometric analysis of published documents (1926–2016). Acc Hist Rev 29(1):103–139

Blue Ribbon Committee on Improving the Effectiveness of Corporate Audit Committees (1999) Report and recommendations of the Blue Ribbon Committee on improving the effectiveness of corporate audit committees. Bus Law 54(3):1067–1095

Bravo F, Alcaide-Ruiz MD (2019) The disclosure of financial forward-looking information: does the financial expertise of female directors make a difference? Gend Manag 34(2):140–156. https://doi.org/10.1108/GM-09-2018-0120

Bravo F, Reguera-Alvarado N (2019) Sustainable development disclosure: Environmental, social, and governance reporting and gender diversity in the audit committee. Bus Strateg Environ 28(2):418–429. https://doi.org/10.1002/bse.2258

Buallay A, Al-Ajmi J (2020) The role of audit committee attributes in corporate sustainability reporting: evidence from banks in the Gulf Cooperation Council. J Appl Account Res 21(2):249–264. https://doi.org/10.1108/JAAR-06-2018-0085

Carcello JV, Hermanson DR, Ye Z (2011) Corporate governance research in accounting and auditing: insights, practice implications, and future research directions. Audit J Pract Theory 30(3):1–31. https://doi.org/10.2308/ajpt-10112

Chan H, Faff RW, Khan A, Mather PR (2013) Exploring the moderating role of growth options on the relation between board characteristics and management earnings forecasts. Corp Gov: Int Rev 21(4):314–333. https://doi.org/10.1111/corg.12027

Chen S, Komal B (2018) Audit committee financial expertise and earnings quality: a meta-analysis. J Bus Res 84:253–270

Chychyla R, Leone AJ, Minutti-Meza M (2019) Complexity of financial reporting standards and accounting expertise. J Acc Econ 67(1):226–253. https://doi.org/10.1016/j.jacceco.2018.09.005

Cisneros L, Ibanescu M, Keen C, Lobato-Calleros O, Niebla-Zatarain J (2018) Bibliometric study of family business succession between 1939 and 2017: mapping and analyzing authors’ networks. Scientometr 117:919–951. https://doi.org/10.1007/s11192-018-2889-1

Council Directive 2006/43/EC of 17 May 2006 on statutory audits of annual accounts and consolidated accounts, amending Council Directives 78/660/EEC and 83/349/EEC and repealing Council Directive 84/253/EEC.

Council Directive 2014/56/EU of 16 April 2014 amending Council Directive 2006/43/EC on statutory audits of annual accounts and consolidated accounts

Council Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups

Cuomo F, Mallin C, Zattoni A (2016) Corporate governance codes: a review and research agenda. Corp Gov: Int Rev 24(3):222–241. https://doi.org/10.1111/corg.12148

Custódio C, Metzger D (2014) Financial expert CEOs: CEO’s work experience and firm’s financial policies. J Financ Econ 114(1):125–154. https://doi.org/10.1016/j.jfineco.2014.06.002

Daim TU, Rueda G, Martin H, Gerdsri P (2006) Forecasting emerging technologies: use of bibliometrics and patent analysis. Technol Forecast Soc Chang 73(8):981–1012. https://doi.org/10.1016/j.techfore.2006.04.004

Das S, Gong JJ, Li S (2020) The Effects of Accounting Expertise of Board Committees on the short-and long-term consequences of Financial Restatements. J Acc Audit Financ 0148558X20934943. https://doi.org/10.1177/0148558X20934943

Dechow PM, Myers LA, Shakespeare C (2010) Fair value accounting and gains from asset securitizations: a convenient earnings management tool with compensation side-benefits. J Acc Eco 49(1–2):2–25. https://doi.org/10.1016/j.jacceco.2009.09.006

DeFond ML, Hann RN, Hu X (2005) Does the market value financial expertise on audit committees of boards of directors? J Acc Res 43(2):153–193. https://doi.org/10.1111/j.1475-679x.2005.00166.x

Deloitte (2018) Audit Committee Resource Guide

Deloitte (2020) Stepping in: The board’s role in the COVID-19 crisis

Dhaliwal DS, Naiker V, Navissi F (2010) The association between accruals quality and the characteristics of accounting experts and mix of expertise on audit committees. Contempor Acc Res 27(3):787–827. https://doi.org/10.1111/j.1911-3846.2010.01027.x

Dhar BK, Harymawan I, Sarkar SM (2022) Impact of corporate social responsibility on financial expert CEOs’ turnover in heavily polluting companies in Bangladesh. Corp Soc Responsib Environ 29:701–711. https://doi.org/10.1002/csr.2230

Durisin B, Puzone F (2009) Maturation of corporate governance research, 1993–2007: an assessment. Corp Gov: Int Rev 17(3):266–291

Durieux V, Gevenois PA (2010) Bibliometric Indicators: Quality Measurements of Scientific Publication. Radiology 255(2):342–351. https://doi.org/10.1148/radiol.09090626

Dwekat A, Seguí-Mas E, Tormo-Carbó G (2020) The effect of the board on corporate social responsibility: bibliometric and social network analysis. Econ Res-Ekon Istraž 33(1):3580–3603. https://doi.org/10.1080/1331677X.2020.1776139

Ellegaard O, Wallin JA (2015) The bibliometric analysis of scholarly production: how great is the impact? Scientometric 105(3):1809–1831. https://doi.org/10.1007/s11192-015-1645-z

European Commission Recommendation of 15 February 2005 on the role of non-executive or supervisory directors of listed companies and on the committees of the (supervisory) board

European Securities and Markets Authority (ESMA) (2015) Improving the quality of disclosures in the financial statements. In: Paris: Statement European Common Enforcement Priorities for 2014 Financial Statements

EY (2020) Four ways to advance risk oversight Content

Fama EF, Jensen MC (1983) Separation of ownership and control. J Law Econ 26(2):301–325. https://doi.org/10.1086/467037

Farber DB (2005) Restoring trust after fraud: does corporate governance matter? Acc Rev 80(2):539–561. https://doi.org/10.2308/accr.2005.80.2.539

Ferreira JJM, Fernandes CI, Ratten V (2016) A co-citation bibliometric analysis of strategic management research. Scientometric 109(1):1–32. https://doi.org/10.1007/s11192-016-2008-0

García-Sánchez IM, García-Meca E, Cuadrado-Ballesteros B (2017a) Do financial experts on audit committees matter for bank insolvency risk-taking? The monitoring role of bank regulation and ethical policy. J Bus Res 76:52–66. https://doi.org/10.1016/j.jbusres.2017.03.004

García-Sánchez IM, Martínez-Ferrero J, García-Meca E (2017b) Gender diversity, financial expertise, and its effects on accounting quality. Manag Decis 55(2):347–382. https://doi.org/10.1108/MD-02-2016-0090

Goh BW (2009) Audit committees, boards of directors, and remediation of material weaknesses in internal control. Contempor Acc Res 26(2):549–579. https://doi.org/10.1506/car.26.2.9

Güner AB, Malmendier U, Tate G (2008) Financial expertise of directors. J Financ Econ 88(2):323–354

Haustein S, Larivière V (2015) The use of bibliometrics for assessing research: possibilities, limitations and adverse effects. Incent perform 121–139. https://doi.org/10.1007/978-3-319-09785-5_8

Helfaya A, Moussa T (2017) Do board’s corporate social responsibility strategy and orientation influence environmental sustainability disclosure? UK evidence. Bus Strateg Environ 26(8):1061–1077. https://doi.org/10.1002/bse.1960

Hesarzadeh R, Rajabalizadeh J (2020) Does Securities Commission Oversight reduce the complexity of Financial Reporting? Rev Contab-. Span Acc Rev 23(1):1–17. https://doi.org/10.6018/rcsar.389791

Hoitash U, Hoitash R, Bedard JC (2009) Corporate governance and internal control over financial reporting: a comparison of regulatory regimes. Acc rev 84(3):839–867

Hota PK, Subramanian B, Narayanamurthy G (2019) Mapping the intellectual structure of social entrepreneurship research: a citation/co-citation analysis. J Bus Eth 66:89–114. https://doi.org/10.1007/s10551-019-04129-4

Huang C, Ho Y (2011) Historical research on corporate governance: a bibliometric analysis. Afr J Bus Manag 5(2):276–284

Huang H, Lee E, Lyu C, Zhu Z (2016) The effect of accounting academics in the boardroom on the value relevance of financial reporting information. Int Rev Financ Anal 45:18–30. https://doi.org/10.1016/j.irfa.2016.02.003

Jain T, Jamali D (2016) Looking inside the black box: the effect of corporate governance on corporate social responsibility. Corp Gov: Int Rev 24(3):253–273. https://doi.org/10.1111/corg.12154

Khemakhem H, Fontaine R (2019) The audit committee chair’s abilities: beyond financial expertise. Int J Audit 23(3):457–471. https://doi.org/10.1111/ijau.12173

Kelton AS, Yang YW (2008) The impact of corporate governance on Internet financial reporting. J Acc Public Polic 27(1):62–87. https://doi.org/10.1016/j.jaccpubpol.2007.11.001

Kent Baker H, Pandey N, Kumar S, Haldar A (2020) A bibliometric analysis of board diversity: current status, development, and future research directions. J Bus Res 108:232–246

Klarin A (2020) The decade-long cryptocurrencies and the blockchain rollercoaster: mapping the intellectual structure and charting future directions. Res Int Bus Financ 51:101067. https://doi.org/10.1016/j.ribaf.2019.101067

KPMG (2017) Audit Committee Handbook

KPMG (2021) Top issues for audit committees in 2021

Krishnan J (2005) Audit committee quality and internal control: an empirical analysis. Acc Rev 80(2):649–675. https://doi.org/10.2308/accr.2005.80.2.649

Krishnan GV, Visvanathan G (2008) Does the SOX definition of an accounting expert matter? The association between audit committee directors’ accounting expertise and accounting conservatism. Contemp Acc Res 25(3):827–857. https://doi.org/10.1506/car.25.3.7

Krishnan J, Lee JE (2009) Audit committee financial expertise, litigation risk, and corporate governance. Audit: J Pract Theory 28(1):241–261. https://doi.org/10.2308/aud.2009.28.1.241

Linck JS, Netter JM, Yang T (2009) The effects and unintended consequences of the Sarbanes-Oxley Act on the supply and demand for directors. Rev Financ Stud 22(8):3287–3328. https://doi.org/10.1093/rfs/hhn084

Lisic LL, Myers LA, Seidel TA, Zhou J (2019) Does audit committee accounting expertise help to promote audit quality? Evidence from auditor reporting of internal control weaknesses. Contemp Acc Res 36(4):2521–2553. https://doi.org/10.1111/1911-3846.12517

Mangena M, Pike R (2005) The effect of audit committee shareholding, financial expertise and size on interim financial disclosures. Acc Bus Res 35(4):327–349. https://doi.org/10.1080/00014788.2005.9729998

McDaniel L, Martin RD, Maines LA (2002) Evaluating financial reporting quality: the effects of financial expertise vs. financial literacy. Acc Rev 77(s–1):139–167. https://doi.org/10.2308/accr.2002.77.s-1.139

Merediz-Solà I, Bariviera AF (2019) A bibliometric analysis of bitcoin scientific production. Res Int Bus Financ 50:294–305. https://doi.org/10.1016/j.ribaf.2019.06.008

Merigó JM, Yang JB (2017) Accounting Research: a bibliometric analysis. Aust Acc Rev 27(1):71–100. https://doi.org/10.1111/auar.12109

Minton BA, Taillard JP, Williamson R (2014) Financial expertise of the board, risk taking, and performance: evidence from bank holding companies. J Financ Quantit Anal 49(2):351–380. https://doi.org/10.1017/S0022109014000283

Mohammadi S, Saeidi H, Naghshbandi N (2020) The impact of board and audit committee characteristics on corporate social responsibility: evidence from the iranian stock exchange. Int J Product Perform Manag. https://doi.org/10.1108/IJPPM-10-2019-0506

NASDAQ (National Association of Securities Dealers Automated Quotations) (2004) Corporate Governance Certification Form. January. http://www.nasdaq.com/about/cg-certificationform.pdf

Nguyen BD, Nielsen KM (2010) The value of independent directors: evidence from sudden deaths. J Financ Econ 98(3):550–567. https://doi.org/10.1016/j.jfineco.2010.07.004

NYSE (New York Stock Exchange) (2004) Sect. 303.A.01 Corporate Governance Standards

Oradi J, E-Vahdati S (2021, July) Female directors on audit committees, the gender of financial experts, and internal control weaknesses: evidence from Iran. Acc Forum 45(3):273–306. https://doi.org/10.1080/01559982.2021.1920127

Patra SK, Bhattacharya P, Verma N (2006) Bibliometric study of literature on bibliometrics. DESIDOC J Libr Inf Tech 26(1):27–32

Perianes-Rodriguez A, Waltman L, van Eck J (2016) Constructing bibliometric networks: a comparison between full and fractional counting. J Informetr 10(4):1178–1195

Pritchard A (1969) Statistical bibliography or bibliometrics? J Doc 24:348–349

Rezaee Z, Asiaei K, Delooie TS (2021) Are CEO experience and financial expertise associated with financial restatements?¿ existe asociación entre la experiencia del director general y los conocimientos financieros con las reformulaciones financieras? Rev. Contab -Span Account Rev 24(2):270–281. https://doi.org/10.6018/rcsar.379991

Salleh Z, Stewart J (2012) The impact of expertise on the mediating role of the audit committee. Manag Audit J 27(4):378–402. https://doi.org/10.1108/02686901211217987

Sarwar B, Xiao M, Husnain M, Naheed R (2018) Board financial expertise and dividend-paying behavior of firms. Manag Decis 56(9):1839–1868. https://doi.org/10.1108/MD-11-2017-1111

Shaukat A, Qiu Y, Trojanowski G (2016) Board attributes, corporate social responsibility strategy, and corporate environmental and social performance. J Bus Ethics 135(3):569–585. https://doi.org/10.1007/s10551-014-2460-9

Smith M, Sarabi Y (2020) “What do interlocks do” revisited–a bibliometric analysis. Manag Res Rev. https://doi.org/10.1108/MRR-05-2020-0258

Securities and Exchange Commission (SEC) (2003) Final Rule: Disclosure Required by Sects. 406 and 407 of the Sarbanes-Oxley Act of 2002. U.S. Securities and Exchange Commission, 2003

Tunger D, Eulerich M (2018) Bibliometric analysis of corporate governance research in german-speaking countries: applying bibliometrics to business research using a custom-made database. Scientometric 117(3):2041–2059. https://doi.org/10.1007/s11192-018-2919-z

Van Eck NJ, Waltman L (2010) Software survey: VOS viewer, a computer program for bibliometric mapping. Scientometric 84(2):523–538. https://doi.org/10.1007/s11192-009-0146-3

Velte P (2018) Is audit committee expertise connected with increased readability of integrated reports: evidence from EU companies. Probl Perspect Manag 16(2):23–41. https://doi.org/10.21511/ppm.16(2).2018.03

Waltman L, Calero-Medina C, Koste J, Noyons ECM, Tijssen RJW, van Eck NJ et al (2012) The Leiden ranking 2011/2012: data collection, indicators, and interpretation. J Am Soc Inf Sci Tech 63(12):2419–2432. https://doi.org/10.1002/asi.22708

Zalata AM, Tauringana V, Tingbani I (2018) Audit committee financial expertise, gender, and earnings management: does gender of the financial expert matter? Int Rev Financ Anal 55:170–183. https://doi.org/10.1016/j.irfa.2017.11.002

Zhang Y, Zhou J, Zhou N (2007) Audit committee quality, auditor independence, and internal control weaknesses. J Acc Public Polic 26(3):300–327. https://doi.org/10.1016/j.jaccpubpol.2007.03.001

Zheng C, Kouwenberg R (2019) A bibliometric review of Global Research on Corporate Governance and Board Attributes. Sustain 11(12):3428. https://doi.org/10.3390/su11123428

Zgarni I, Hlioui K, Zehri F (2016) Effective audit committee, audit quality and earnings management: evidence from Tunisia. J Acc Emerg Econ 6(2):138–155. https://doi.org/10.1108/JAEE-09-2013-0048

Zupic I, Čater T (2015) Bibliometric methods in management and organization. Organ Res Method 18(3):429–472. https://doi.org/10.1177/1094428114562629

Funding

Funding for open access publishing: Universidad de Sevilla/CBUA

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Statements and declarations

“The authors declare that no funds, grants, or other support were received during the preparation of this manuscript”.

“The authors have no relevant financial or non-financial interests to disclose”.

“The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions”.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alcaide-Ruiz, M.D., Bravo-Urquiza, F. Board’s financial expertise: a bibliometric analysis and future research agenda. Manag Rev Q 74, 951–976 (2024). https://doi.org/10.1007/s11301-023-00322-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-023-00322-y

Keywords

- Financial expertise

- Boards of directors

- Audit committee

- Bibliometric analysis

- Systematic literature review

- Content analysis