Abstract

This document seeks to identify the associated factors that lead banking institutions to adopt and disclose CSR practices, considering that previous studies show contradictory results. Therefore, is important to integrate the findings from previous research, given the importance of CSR practices for the financial performance and the level of risk of organizations. The study employed the random effect meta-analysis technique, the data analysis was carried out with papers published between 2005 and 2021 and integrates the results of research that has analyzed a total of 6208 observations in 40 countries. The results of the research show a significant positive association between, legitimacy of existence and reputation as associated factors for developing CSR practices, whereas the regulation, the inclusion of foreign board members, and stakeholder relationships have an insignificant positive association as an associated factor with the development of CSR practices. Corporate governance factors have a significant positive relationship with the presence of women on the board and the size of the board. In addition, the board’s independence and the duality of the CEO have an insignificant negative association. This paper provides evidence of the need for research in CSR practices in the banking sector, especially in Latin America where the literature is almost non-existent. In addition, it also shows the need for research on corporate governance factors, especially on how the presence of women on the board influences the development of CSR practices, considering the scarce existing literature that analyses these factors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The factors associated with the development and disclosure of CSR practices have been approached from a different perspective. Studies developed by Morsing and Schultz (2006) identify that the relationship between stakeholder theory and the development of CSR practices requires a more rigorous level of knowledge of the different types of stakeholders, which may involve sectors that are quite critical of the actions of organizations. Another vision that underlies the development of CSR practices is related to the theory of legitimization of existence. In this respect, Deegan (2002) states that organizations develop CSR actions to legitimizing their existence in society, since companies choose to voluntarily report their actions if they perceive that these are expected in the community in which they operate.

On the other hand, the study by Platonova et al. (2016) shows that reputation is positively associated with the development of CSR practices. Considering that institutions with more social activity increase customer loyalty by receiving more support, this is another key factor to consider in the analysis of the development of CSR practices. Similarly, regulation is a factor that influences the development of CSR practices from different perspectives, such as the imposition of taxes, the creation of subventions, or the regulation of the disclosure of information associated with CSR (Polishchuk 2009).

Other factors that influence the development of CSR practices are those associated with corporate governance, such as the presence of women on the board, the size of the board, the independence of the board, the presence of foreigners on the board and the duality of the CEO, considering that good corporate governance would improve the development of CSR practices (Jizi et al. 2014).

The banking sector is considered a powerful engine of business performance because it positively promotes the economy through its financial brokerage function by facilitating cash flow between lenders and borrowers (Levine 2005; Shen and Lee 2005; Beck, Demirgüç-Kunt and Levine 2010; Khan 2010). In this sense, the banking sector is a unique industry in society, and its role today involves establishing new trends and strategies, providing the necessary services for clients in a way that reduces financial exclusion (Platonova et al. 2016).

Banking institutions are considered decisive in the development of the economy. Chambers and Day (2009) establish that “Banks are institutions making decisions affecting much of society and as such would be expected to fulfil the widest CSR agenda.” When banking institutions execute their work properly, technological innovation is facilitated given the financing granted because they support entrepreneurs who are successful in introducing innovative products and processes (Wu and Shen 2013). In this sense, King and Levine (1993) claim that a healthy banking system is key to a country’s sustained prosperity. In addition, banks attract more attention from citizens and the academic world because their resources come largely from resources obtained from the public.

Banks can be highly disruptive to society when they are poorly managed. An example of this can be seen by the negative effects from US financial institutions during the loan crisis that occurred in 2007 and 2008. That is why there is increasing pressure for banking institutions to expand their view of their investors’ and other stakeholders’ interests, an aspect in which Corporate Social Responsibility (CSR) is essential (Jizi et al. 2014).

CSR in the banking sector is of great importance due to its impact on decision-making, for example, when it comes to financing projects, negative or positive effects may occur in society. Therefore, understanding the factors associated with the development of CSR practices would allow us to delve into the possible variables that promote socially responsible actions. In this sense, the objective of this study is to use a meta-analysis to identify the reasons associated with the development and disclosure of CSR practices, considering that previous research in the banking sector has presented contradictory results, and all the above aspects are important in the banking sector, because these entities do not always enjoy a good reputation and constantly have growth needs with objectives that are increasingly difficult to meet. That is why CSR can be seen as an optimal tool to help achieve the lofty goals that these entities set for themselves.

This research integrates the findings of previous studies compiling 6,208 observations from 40 countries around the world. Additionally, this study is the first known research that collectively examines all the associated factors established in the literature that banking institutions consider in developing CSR practices, a research need that Margolis et al. (2007) and Velte (2021) agree with. This research shows that although there is extensive literature on CSR practices, it tends to exclude the financial sector and there is a clear need for research in this sector. A similar situation arises with research in Latin America, since only one of the studies included in this meta-analysis examine Brazil as a focus of research, so it is necessary to deepen research that addresses CSR practices in Latin America.

The main positions regarding the associated factors with the development and disclosure of CSR practices are presented below. Then, the methodology used to create this document is explained. Subsequently, the results are presented related to the associated factors that lead banking institutions to engage in CSR practices. The paper closes with the study’s conclusions.

2 Associated factors in adopting and disclosing CSR practices

CSR is understood as an organizational practice that has evolved over the years. The current definition of CSR, accepted by the World Bank and cited by Jizi et al. (2014), establishes that “CSR is the commitment of businesses to contribute to sustainable economic development by working with employees, their families, the local community and society at large to improve their lives in ways that are good for business and for development” (Starks 2009, p 465).

There are different motivations associated with banking sector businesses incorporating CSR practices in their environment. Considering the existing literature, a total of 9 motivations are seen in relation to why businesses choose to develop CSR practices. These variables include reputation, relationship with stakeholders, legitimization, regulation, and corporate governance factors (Lewis 2001; Newson and Deegan 2002; Platonova et al. 2016; Wu and Shen 2013).

Corporate governance factors are associated with CSR practices, versus decisions made by the board in relation to sustainable business strategies. Majumder et al. (2017) establish that corporate governance plays a vital role in CSR by disclosing social issues. Boards of directors at companies can take on CSR from 2 perspectives. First, a strategy can be presented to appease managers’ concerns without necessarily impacting society. The second vision of CSR that companies can adopt involves maintaining positive relationships with interest groups, recognizing the legitimate concerns of society in such a way that the company’s sustainability improves (Jizi et al. 2014). Along the same lines, the study conducted by Chedrawi et al. (2020) on banking institutions in Lebanon shows that the success of CSR largely depends on the strategies approved by senior management. If management does not believe in CSR or does not develop strategies to incorporate it into the bank’s culture, CSR will not work. Some important corporate governance variables that act as associated factors of CSR practices are the presence of women on the board, the size of the board, the independence of the board, foreigners on the board and the duality of the chief executive officer (CEO) (Ayuso and Argandoña 2009; Burgess and Tharenou 2002; Fama and Jensen 1983; Lee and Chen 2011; Majumder et al. 2017).

Next, the 9 variables that were considered in the meta-analysis presented in this document are described.

2.1 Relationship with stakeholders

CSR is seen by Ayadi et al. (2014) as a significant characteristic for value creation, generating competitive advantages. In this regard, Lewis (2001) demonstrated that stakeholders want to know which companies are behind the brands and products they commonly buy. Stakeholders also evaluate not only a company’s financial aspects but also the impact the company has on society. Therefore, messages related to social initiatives can promote positive reactions and satisfy stakeholders’ demands (Morsing and Schultz 2006; Ven and Jeurissen 2005).

Hence, there are studies that subdivide and group stakeholders. One of the most followed classifications, according to Chedrawi et al. (2020), is the one developed by Olander (2007), who creates 2 categories. The first one groups internal stakeholders, those that actively participate in the organization. The second group consists of external stakeholders, those that are affected by the decisions made by the company.

In this sense, Chedrawi et al. (2020) shows that banking institutions engage in CSR practices as a response to their shareholder commitment and the responsibilities assumed with suppliers, employees, the government, investors, and the local community. In this case, CSR is understood as a vehicle that helps meet stakeholder expectations. Again, this aspect has an impact on the company’s short and long-term financial gains (Polishchuk 2009). Furthermore, McWilliams and Siegel (2001) state that banks continually face demands from stakeholders to dedicate resources to CSR activities.

Similarly, Wu and Shen (2013) establish that companies in the banking sector largely depend on depositor resources for their survival and growth because there is a strong tendency to establish relationships of trust and cooperation between companies and various institutions or individuals interested in the company (Platonova et al. 2016). For this reason, stakeholders’ point of view is essential for these companies, an aspect with which Grove et al. (2011), Khan (2010), and Veronesi and Zingales (2010) concur. They claim that banking institutions aim to defend the interests and benefits of bank depositors because they provide the most significant portion of a bank’s assets and funds. This leads companies to get involved in CSR aspects to attract depositors. Based on that established by Ioannou and Serafeim (2010), this results in better financial performance, in turn offering companies a competitive advantage (Jizi et al. 2014).

In this regard, the study by Chedrawi et al. (2020) on banking institutions in Lebanon shows a positive relationship between stakeholders and CSR because companies recognize that CSR has an audience of stakeholders that allows them to establish CSR goals and practices aimed at said audience. This aspect coincides with the research carried out by Farook et al. (2011) on Islamic banking institutions, showing that the level of performance and disclosure of CSR practices depends on the degree of influence that the public has on the organization.

2.2 Legitimization of existence

The second topic identified in the literature as a reason companies choose to adopt CSR practices is associated with the legitimization theory. This theory is understood by Suchman (1995) as “a generalized perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs, and definitions.” Similarly, the author identifies 3 types of legitimacy: pragmatic, moral, and cognitive. Pragmatic legitimacy is achieved when a company accomplishes practical results in an immediate environment. Moral legitimacy occurs when the public perceives a company to be complying with the same values and normative principles. Finally, cognitive legitimacy occurs when a company pursues goals that the company considers appropriate and desirable.

Therefore, organizations strategically manage their institutional environments by adopting instrumentalized management perspectives to display symbols that help them obtain society’s support (Suchman 1995). According to Deegan (2002), companies voluntarily report on activities that the community expects from the company, an aspect that contributes to the dialog between the company and society (Gray, Kouhy and Lavers, 1995). In this sense, organizational legitimacy may be affected if companies do not provide disclosures that demonstrate they are meeting society’s expectations (Newson and Deegan 2002). In this regard, Patten (1991), Nurunnabi (2016), Kiliç et al. (2015) and Delgado, Pedauga and Cordón (2017) show that larger companies are more politically visible and have greater social exposure, which implies that they have a greater need to legitimize their existence.

Banking institutions promote CSR practices to legitimize their existence through positive measures that these businesses adopt to curb poverty, eradicate illiteracy and unemployment, and contribute to the education sector and the community as a whole (Haniffa and Cooke 2005; Khan 2010). On this matter, Guthrie and Parker (1989) and Lindblom (1993) report how organizational legitimacy becomes a motivator to adopt and inform social practices.

Reynaud and Walas (2015) analyze reports from French banks between 2004 and 2011 and demonstrate that these financial institutions are trying to restore legitimacy through CSR practices. The results show that in postcrisis times, banking institutions better communicate their information to reestablish their legitimacy and improve their financial performance. Along these same lines, the study by Farook et al. (2011) demonstrates that organizations operating in relatively repressed societies face lower social expectations, while organizations operating in relatively open communities must provide more justification to legitimize their existence.

Chedrawi et al. (2020) analyze banking institutions in Lebanon, showing that these companies adopt CSR practices to guarantee their legitimacy and survival. Similarly, in a study on banks in the United States, Tasnia et al. (2020) show that these institutions issue CSR reports as a strategy to legitimize their activities. However, it is important to specify that as established by Khan (2010) and Buhr (1998), CSR reports may have little in common with actual company practices. In addition, Ali et al. (2017); Frerichs and Teichert (2021) and Campbell et al. (2003) show that legitimization theory is the dominant theoretical framework that explains the associated factors for institutions that engage in CSR practices in developed and developing countries.

2.3 Reputation

Reputation is one of the main associated factors that leads institutions to develop CSR practices in the banking sector (Wu and Shen 2013) because CSR reporting promotes a company’s image and improves its reputation (Gray et al. 1995; Li et al. 2010; Vanhamme et al. 2012; Jizi et al. 2014). There are 2 trends surrounding CSR at banks. First, Chemmanur and Fulghieri (1994) demonstrate that banks with stronger reputations have stricter policies with respect to allocating loans, leading to more rigorous evaluations of borrowers. Second, more reputable banks are more profitable, have higher credit quality, and have higher quality accounting figures. Based on this, institutions with stronger reputation indices attract more solvent borrowers, thus increasing profits and improving the quality of assets in financial institutions (Wu and Shen 2013).

Reputation includes aspects such as brand positioning because socially responsible companies can charge higher commissions and fees. Customers are willing to pay them because they consider the institutions to be socially friendly (Wu and Shen 2013). Consequently, with brand positioning, customers find one institution to be better than others (Kim et al. 2005). This situation leads to brand loyalty (Mackenzie 2007).

Maintaining a positive reputation is essential for companies. So that, CSR reports are used to mitigate harm to companies’ reputation caused by negative information that may be uncovered (Soana 2011). Deegan et al. (2000), Patten (1991), and Walden and Schwartz (1997) show that companies often change CSR reporting disclosure practices after specific incidents that affect their image. Therefore, company exposure is decisive in the disclosure of CSR reports because companies with a high public profile are more willing to present a positive social image than those that are less well-known (Khan 2010).

Brønn and Vrioni (2001) indicate that reputational aspects also have a strong relationship with an organization’s financial performance. In this sense, companies use CSR practices to build their reputation (Fombrun and Shanley 1990), providing these institutions with a competitive advantage over other companies in the market because it creates a brand distinction and a sense of identity with the client, thus improving profitability (Brine et al. 2007; Platonova et al. 2016; Wu and Shen 2013). In fact, reputation is considered essential in the study carried out by Chedrawi et al. (2020) on Lebanese banks. That study indicates that a bank’s reputation is directly related to CSR.

The relationship between reputation and CSR can also be reflected in the practices associated with strategic choices. For example, companies may choose to take action in protecting the environment and promoting the banking institution’s brand (Wu and Shen 2013). This vision of CSR is described by Bénabou and Tirole (2010) as a win–win because CSR is used strategically to take a socially responsible position and profit from it, which implies adopting CSR practices to strengthen the company’s position in the market in order to increase benefits. This approach has collateral effects: observed environmental improvements and reduced tension with respect to social problems.

In addition, banking institutions take altruistic CSR actions that do not involve price increases to improve their income (Wu and Shen 2013). However, taking these actions can lead to positive collateral effects related to an organization’s financial performance, such as attracting new clients, which would bring an economic benefit associated with enhancing its reputation.

Another practice that institutions adopt to improve their reputation through CSR is greenwashing, which is not actually associated with real actions or CSR policies implemented by companies. In contrast, companies that use greenwashing resort to dishonest acts that are intended to portray a company’s actions and policies as if they were environmentally friendly (Wu and Shen 2013). However, in reality, these actions are just words on paper, with no tangible result.

2.4 Regulation

The fourth reason identified in the literature as an associated factor for issuing CSR reports is associated with the regulatory aspects that banks are required to follow. In this sense, companies that operate in regulated industries disclose more information due to the rules that regulate institutional activities (Delgado, Pedauga and Cordón 2017). They do so considering the regulatory pressures associated with laws or regulations, including those that affect parent companies and force organizations to change their structure (Masud, Hossain and Kim 2018). In this regard, it is important to highlight that in 2014, the European Union defined the guidelines for submitting nonfinancial information related to issue such as society, the environment, personnel, respect for human rights, corruption, and bribery. Similarly, India implemented a requirement to disclose CSR reports after that time period (Masud, Hossain and Kim 2018).

In other contexts, some banking institutions must comply with religious requirements, as is the case of Islamic banks that are required to follow the guidelines established by AAIOFIFootnote 1 (Platonova et al. 2016). In Bangladesh, Masud et al. (2018) note the existence of 3 regulations related to the disclosure of nonfinancial information associated with environmental aspects. Of these, only one is mandatory; therefore, it is expected that in the future, regulations related to disclosing nonfinancial information will increase, leading more companies to include this type of disclosure. In fact, Nurunnabi (2016) argues that the lack of regulations is one of the reasons for the low level of disclosure.

Regulations have been shown to have positive effects on increasing CSR disclosures. Masud et al. (2018) demonstrate that in periods after the implementation of regulations, banking institutions in Bangladesh increased their disclosure of environmental aspects; however, they specify that ignorance and a lack of knowledge in how to disclosure nonfinancial information prevent regulations from being extended. Similarly, a study carried out by Ortiz et al. (2016) in North American and European countries shows that regulatory pressure boosts reporting in the region.

Khan (2010) reports that companies in Bangladesh have a regulatory framework in which companies receive tax exemptions on the portion of income that they invest in CSR activities. This exemption is intended to encourage private companies to participate in economic, environmental, and social development activities within the CSR framework. Farook et al. (2011) concurs, demonstrating in a study of Islamic banking establishments that external economic incentives given by regulatory measures influence CSR disclosures. In contrast, studies conducted by Li et al. (2010) and Tasnia et al. (2020) demonstrate a negative association between regulations and the development of CSR practices.

Jizi et al. (2014), quoting the OECD (1999), establishes that while governments have responsibilities to establish regulatory frameworks for the proper functioning of companies, the board of directors is responsible for developing sustainable business strategies, as well as supervisory strategies against using the company’s resources, where corporate governance becomes relevant.

2.5 Women on the board

One corporate governance factor is the presence of women on the board of directors; women play a vital role in getting companies involved in social causes. Studies carried out by Burgess and Tharenou (2002) suggest that women are more sensitive to society, and thus, more women on a board can increase the focus on CSR-related issues. In previous studies by Kiliç et al. (2015) and Rouf and Hossan (2020), involving banks in Turkey and banking companies listed on the Dhaka Stock Exchange, there was a positive and significant relationship between the participation of women on the board and increased disclosure of CSR practices, an aspect that coincides with studies carried out by Jahid et al. (2020) and Shukor et al. (2020). On the other hand, for developing countries, a study conducted by Kiliç et al. (2015) reflects a insignificant positive association. These findings align with the research conducted by Nwude and Nwude (2021) regarding commercial banks in Nigeria.

2.6 Board size

The size of a board refers to the total number of directors at a company (Majumder et al. 2017). Board size is considered an efficient control mechanism for corporate governance because the larger the board of directors, the greater the number of information activities (Collier and Gregory 1999; Lee and Chen 2011). Lui et al. (2020) studied banks in Malaysia, identifying a positive and significant relationship between board size and the disclosure of CSR practices. These findings coincide with the research conducted by Jahid et al. (2020) and Shukor et al. (2020) on Islamic banking institutions. In contrast, the study of Nigerian commercial banks carried out by Nwude and Nwude (2021) demonstrates a insignificant positive relationship with board size.

2.7 Independence of the board

This variable refers to the number of independent directors on the board. Independent directors can improve the effectiveness of the board of directors, as they pay more attention to shareholder interests (Fame and Jensen 1983) and they play a decisive role in the CSR actions taken by the board of directors (Abdullah et al. 2011). The study carried out by Nwude and Nwude (2021) indicates a positive, but insignificant, relationship between board independence and the disclosure of CSR practices in Nigerian commercial banks. These findings align with the research carried out by Jahid et al. (2020). Another previous study of banks in Turkey, Kiliç et al. (2015) show a positive and significant relationship between board independence and the disclosure of CSR practices.

In contrast, in a study of banks in Malaysia conducted by Lui et al. (2020), board independence has a negative and significant association with the disclosure of CSR practices. The results of a study by Rouf and Hossan (2020) on banking companies listed on the Dhaka Stock Exchange are consistent with these results. The contradictory results obtained in previous studies can be explained by explanatory variables that are not considered in previous research studies. Therefore, the meta-analysis proposed herein helps identify variables that influence research and that can generate contradictory results.

2.8 Foreigners on the board

Foreign directors often play a key role in supporting CSR reporting strategies (Ayuso and Argandoña 2009). Masud et al. (2018) agree with these findings, stating that the presence of foreigners on the board of directors is a relevant factor in providing nonfinancial information. Khan (2010) indicates that diversity on boards of directors at banks in Bangladesh ensures that banks disclose more CSR information. In this sense, Jahid et al. (2020) show a positive association with the presence of foreigners on the board and the disclosure and performance of CSR practices. These findings are consistent with the results reported by Li et al. (2010), who indicate that companies with a higher percentage of foreign board members can increase the strength of CSR communications; however, results from the research carried out by Li et al. (2010) and Shukor et al. (2020) indicate a negative association between the presence of foreign board members and the development of CSR practices.

2.9 Duality of the CEO

The duality of the CEO signifies that the same person serves as chairman of the board and CEO, an aspect that can generate conflicts of interest (Lee and Chen 2011). Thus, the dual position of the CEO may be associated with a lower level of disclosure because CSR activities gain less attention (Haniffa and Cooke 2005; Li et al. 2010). The study carried out by Shukor et al. (2020) on Islamic banking institutions shows a negative relationship between the duality of the CEO and the adoption and disclosure of CSR practices, a finding that agrees with the results for the research carried out by Ortiz et al. (2016). In contrast, results from a study conducted by Jizi et al. (2014) indicate that the duality of the CEO is positively related to the disclosure of CSR information.

3 Methodology

This study seeks to identify the existing relationships among associated factors that lead banks to incorporate CSR into their environment. The following Boolean search terms were used “CSR (Corporate Social Responsibility) and Bank,” “Reputation and CSR and Bank,” “legitimization and CSR and Bank,” “stakeholder and CSR and Bank,” “Regulation and CSR and Bank,” and “Corporate governance and CSR and Bank.” These terms were selected given their direct relationship with the object of study. After several tests, it was possible to demonstrate that these terms guaranteed the greatest sensitivity in locating a large number of articles and were the most specific, demonstrated by the relevance of the articles found.

The inclusion criteria for the articles were as follows: (1) the banking sector was the focus of the study; (2) the study addressed CSR in the business environment; and (3) the research development framework occurred within the publication period of 2000 and later. Articles that did not cover the banking sector and that did not directly address CSR aspects were excluded from the study. Additionally, studies that analyzed employability and its relationship with CSR were excluded, as they were not related to the object of study.

The databases used to select articles were Scopus and Web of Science. Articles published between 2000 and 2021 were included in the search. The period of time studied was chosen based on the United Nations Millennium Declaration, signed in 2000, in which world leaders committed to eradicating extreme poverty and guaranteeing environmental sustainability, along with 8 other millennium development goals, thus impacting the practices of organizations (UN, 2000). In addition, with the aim of reducing the risk of bias, other articles were included. While they did not include some of the inclusion factors previously addressed, they were decisive in the literature on the topic in question, due to being regularly cited in the texts consulted.

Articles were selected using the PRISMA statement (Preferred Reporting Items for Systematic reviews and Meta-Analyses). As indicated by Urrútia and Bonfill (2010), this methodology emerges from the healthcare sector to establish norms to improve the quality of literature reviews and meta-analyses, as they are used in various training fields today. The flow chart below presents the selection of articles in accordance with this statement (Fig. 1).

A total of 59 articles were selected, of which 35 theoretically analyze the reasons banking institutions adopt and disclose CSR practices and 24 articles present empirical evidence that was used to conduct a meta-analysis to identify associated factors that lead companies to engage in CSR practices.

3.1 Sample included in the meta-analysis

The sample is composed of 24 articles published between 2005 and 2021, with a total sample size of 6,208. The inclusion and exclusion criteria previously mentioned were utilized to select the articles. The study characteristics selected in the sample are presented in Table 1. In total, among the articles in the sample, 9 independent variables related to associated factors of CSR are analyzed: relationship with stakeholders, legitimation of existence, reputation, and regulatory aspects, as well as the corporate governance variables presence of women on the board, board size, board independence, foreigners on the board, and the duality of the CEO.

3.2 Method

Meta-analysis is a technique based on statistical methods that enables the integration and quantitative comparison of empirical research associated with the same topic. This approach is used to develop a conclusion about the variables studied (Cooper and Hedges 1994; Glass et al. 1981; Rosenthal 1991; Sanchez-Meca 1999). There are different methods that can be used in developing a meta-analysis. In particular, this study uses the restricted maximum likelihood technique (Raudenbush 2009), a method of random effects, that has its origins in Morris (1983). This technique has been used specifically for CSR studies ( Preuss et al. 2016 and Borman et al. 2003).

Studies that analyze CSR practices in banking institutions tend to yield contradictory results regarding the associated factors that lead businesses to adopt such practices. These differences in results may be due to the country analyzed, the size of the sample, and when the study was conducted, among other characteristics. In this sense, meta-analyses help overcome the problems of different findings and contribute to obtaining consistent results (Ahmed and Courtis 1999).

The association between the dependent and independent variables of the studies is measured using the effect size, defined by Cohen (1969, p.23) as “the degree to which a study phenomenon is present in the population.” In this study, the Pearson correlation coefficient, r, was selected, as suggested for correlation studies (Rosenthal 1991). For each independent sample included in the study, r obtained from the t statistic, as developed in previous studies (Hunter et al. 1982; Ahmed and Courtis 1999; Rodriguez et al. 2014; Siddiqui 2015; Majumder et al. 2017). In this case: \(r = \sqrt {t^{2} /\left( {t^{2} + df} \right)}\), where df corresponds to the degrees of freedom.

Additionally, the 95% confidence interval is calculated to assess the significance of the mean effect sizes. Finally, the Cochran’s homogeneity test (Q) is performed. The value of the between-study variance parameter is \(TAU^{2}\), and calculated \(I^{2}\) which estimates the percentage of the between study variability to verify homogeneity problems, and \(H^{2}\) describes the relative excess in Q over its degrees of freedom (Higgins and Thompson 2002), which will allow subsequent decisions to be made about the study moderates variables. These calculations are carried out using the statistical software Stata.

4 Results

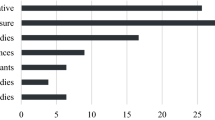

The effect size calculated via the Pearson correlation coefficient r is shown in Table 2, where the relationship between the variables studied for each study included in the sample are presented. In addition, Table 3 provides the results of the meta-analysis to identify whether there is a significant or insignificant relationship between the associated factors under study and CSR practices in banking institutions. Similarly, when the heterogeneity test was not met, where possible, additional tests were conducted for moderating variables, including subgroup analyses for developed and developing countries. The results for the variables relationship with stakeholders, legitimization of existence, reputation, and board size are shown in Table 4. The use of moderating variables to eliminate the observed heterogeneity was suggested by Sanchez-Meca (1999) and was used in studies conducted by Majumder et al. (2017) and Rodríguez et al. (2014). The empirical results for each variable analyzed are shown below.

4.1 Relationship with stakeholders

The results obtained in the meta-analysis, with a sample of 5,554 observations from 15 studies, are presented in Table 3 and indicate a positive and insignificant association (r = 0.081, with a 95% confidence interval of -0.106; 0.267) between relationship with stakeholders, as an associated factor, in the adoption and disclosure of CSR practices in the banking sector. These results are consistent with findings by Chedrawi et al. (2020), Farook et al. (2011), and Khan (2010). Although, the results of this research are insignificant. The homogeneity test, as tested using the chi-squared statistic \(\left( {x_{k - 1}^{2} = 184.07} \right)\), with a significance level of \(\left( {p < 0.01} \right),\) was rejected. Similarly, the \(I^{2}\) was 96.75%, indicating that more analyses were necessary to eliminate the observed heterogeneity. Table 4 shows the studies grouped by developed and developing countries. In this case, for developed economies, there is a positive and insignificant relationship (r = 0.115, with a 95% confidence interval of -0.170; 0.399). However, in developing countries, there is a small insignificant positive relationship (r = 0.059, with a 95% confidence interval of – 0.0248; 0.366).

Identifying the direction of causality in stakeholder relations involves two approaches. On the one hand, companies may be pressured to carry out CSR actions by the interest groups that exist in their environment. On the other hand, carrying out CSR actions can increase the interest of external stakeholders, promoting investments in the banking institution. This double causal line that occurs in the relationship with stakeholders may be due, in part, to the segmentation that exists between internal and external stakeholders, which pursue different objectives in an organization. In this sense, although this study shows a positive, non-significant relationship with the implementation of CSR practices, it is not decisive in establishing the direction of causality of this relationship, an aspect on which future studies could focus.

4.2 Legitimization of existence

As seen in Table 3, for a sample of 5,636 observations from 18 studies that analyze the legitimization theory, there is a significant and positive association (r = 0.310, with a 95% confidence interval of 0.192; 0.428) between legitimization of existence, as an associated factor, and the adoption of CSR practices. These results are consistent with those reported by Ali et al. (2017), Campbell et al. (2003), Reynaud and Walas (2015), Tasnia et al. (2020) and Khan et al. (2020). The homogeneity test, as determined via the chi-squared statistic \(\left( {x_{k - 1}^{2} = 163.72} \right),\) was rejected, with a significance level of \(p < 0.01\). In addition, the \(I^{2}\) was 91.28%; therefore, further analysis using the country as a moderating variable was necessary. In this case, as seen in Table 4, there is a positive and significant correlation (r = 0.207, with a confidence interval of 0.037; 0.377) for developed countries. Similarly, for developing countries, there is a positive and significant correlation (r = 0.458, with a 95% confidence interval of 0.294; 0.621). Therefore, the subgroup analysis indicates that the differences among countries do not produce an effect on the relationship between the legitimization of existence and the disclosure of CSR practices.

The direction of causality in the implementation and disclosure of CSR practices and the legitimization of existence deserves further study. An important section of the literature identifies that CSR actions are carried out to legitimize the existence of organizations, generating symbols in society that allow establishing that these companies are necessary and that they also meet society's expectations, which could be seen as an effect of CSR on the legitimization of the existence of entities (Newson and Deegan 2002). However, the search for legitimization of existence by some banking entities promotes the development of CSR practices, such as financial intermediation in environmentally friendly projects, or the non-financing of projects that have a negative impact on society. Therefore, the direction of causality in this aspect is not completely defined and future studies could investigate these characteristics.

4.3 Reputation

The results presented in Table 3 reflect a positive and significant association (r = 0.311, with a 95% confidence interval of 0.071; 0.55) for a sample of 536 observations taken from 8 studies. These results are consistent with those in studies conducted by Khan (2010), Soana (2011) and Wu and Shen (2013). Similarly, the homogeneity test, as assessed via the chi-squared test \(\left( {x_{k - 1}^{2} = 38.23} \right)\) at a significance level of \(p < 0.01\), was rejected. The \(I^{2}\) was 84.73%; therefore, additional tests were applied, which are shown in Table 4. The results for developed countries indicate a positive and significant association (r = 0.597, with a confidence interval of 0.298; 0.897). For developing countries, an insignificant positive relationship (r = 0.107, with a confidence interval of -0.074; 0.288) was found. Therefore, country is a variable that affects the relationship between reputation, as an associated factor, and the adoption and disclosure of CSR practices.

While the disclosure of CSR reports can lead to improvements in the reputation of entities, it is also clear that when companies are exposed to reputational damage, they may choose to develop strategically focused CSR practices. This generates improvements in the disclosure of CSR and positively impacts the reputation of the entities, hence the direction of causality between the development of CSR practices and reputation deserves to study the motivations that individual organizations consider for the development of these practices.

4.4 Regulation

Table 3 shows the results for a sample of 3,680 observations of 7 studies, in which an insignificant positive association (r = 0.035, with a 95% confidence interval of −0.254; 0.325) is observed. These results are consistent with those reported by Khan (2010), Masud et al. (2018) and Ortiz et al. (2016) but differ from those reported by Delgado et al. (2017), Li et al. (2010) and Tasnia et al. (2020). The homogeneity test, as assessed using the chi-squared test \(\left( {x_{k - 1}^{2} = 87.97} \right),\) with a significance level of \(p < 0.01\), was rejected. Similarly, the \(I^{2}\) was 95.95%. However, no further testing was possible as most studies present data for developing economies or do not separate results by country type.

4.5 Women on the board

This analysis includes 165 observations from 6 studies. The results are presented in Table 3 and indicate a positive and significant correlation (r = 0.355, with a 95% confidence interval of 0.183; 0.526). These results are consistent with the research carried out by Jahid et al. (2020), Rouf and Hossan (2020) and Shukor et al. (2020). The homogeneity test, as tested using the chi-squared statistic \(\left( {x_{k - 1}^{2} = 5.26} \right)\), with a significance level of \(p < 0.01\), was accepted Similarly, the \(I^{2}\) was 9.92%; therefore, it is not necessary to carry out more tests. Previous research suggests that the presence of women on the board influences the development of CSR actions (Burgess 2002). Similarly, it is important to note that the increase in the number of women on the board is also seen as a characteristic of improvement in the CSR practices of the entities, by adopting policies of inclusion and gender equality. Future studies could analyze this relationship in depth, segmenting the analyzes between developed and developing economies, as this can impact the results of the studies.

4.6 Board size

The results for a sample of 638 observations corresponding to 9 studies are presented in Table 3; the findings indicate a positive and significant association (r = 0.248, with a 95% confidence interval of 0.071; 0.424) between the size of the board and the adoption of CSR practices. These results are consistent with those reported by Jahid et al. (2020), Lui et al. (2020) and Shukor et al. (2020). The homogeneity test, as assessed using the chi-squared test \(\left( {x_{k - 1}^{2} = 26.95} \right)\), with a significance level of \(p < 0.01,\) was rejected. In this sense, the \(I^{2}\) was 71.41%. Therefore, further analysis was necessary to eliminate the observed heterogeneity. Table 4 presents the studies divided into developed and developing countries, in developed economies indicating positive and insignificant relationships (r = 0.249, with a 95% confidence interval of -0.207; 0.704) and significant positive association in developing economies (r = 0.289, with a 95% confidence interval of 0.131; 0.447) respectively. Therefore, the subgroup analysis indicates that the differences between countries have an effect on the relationship between the board size and the adoption of CSR practices. On the other hand, the size of the board in banking institutions may be related to the size of the entities, then future studies that analyze the relationship between these two variables could consider additional factors such as the size of the entity.

4.7 Board independence

The meta-analysis results for board independence as an associated factor for the adoption of CSR practices are shown in Table 3; the findings indicate a negative and significant association (r = -0.158, with a 95% confidence interval of -0.478; 0.162) for 566 observations of 8 studies. The results are consistent with those reported by Lui et al. (2020) and Rouf and Hossan (2020). The homogeneity test, as determined using the chi-squared test \(\left( {x_{k - 1}^{2} = 49.87} \right)\), with a significance level of \(p < 0.01\) was rejected. Similarly, the \(I^{2}\) was 90.81%. However, it was not possible to carry out additional analyses because most of the studies that analyze this variable correspond to developing economies. On the other hand, studies that analyze the relationship between board independence and the development and disclosure of CSR practices in depth could consider other factors such as board members' experience and the knowledge of the organization's operations.

4.8 Foreigners on the board

Table 3 shows the results obtained for 204 observations among 4 studies, revealing a small positive and insignificant association (r = 0.006, with a 95% confidence interval of -0.414; 0.425) between the presence of foreigners on the board and the adoption of CSR practices. These results contrast with research conducted by Jahid et al. (2020). The homogeneity test, as tested using the chi-squared test \(\left( {x_{k - 1}^{2} = 24.15} \right),\) with a significance level of \(p < 0.01,\) was rejected. In addition, the \(I^{2}\) was 86.53%. In this case, additional analyses could not be conducted to eliminate the observed heterogeneity because most of the studies address developing economies. Similarly, in the analysis of the relationship between board independence and the disclosure of CSR actions, studies that analyze these aspects in greater depth could consider other characteristics of the board, such as knowledge and experience in the sector.

4.9 Duality of the CEO

The results of the meta-analysis carried out on the duality of the CEO as an associated factor for the implementation of CSR practices are presented in Table 3. For the analysis, there were 922 observations of 6 studies; the findings indicate a negative and insignificant association (r = -0.135, with a 95% confidence interval of -0.320; 0.049). These data are consistent with those reported by Grove et al. (2011), Li et al. (2010) and Ortiz et al. (2016). The homogeneity test, as assessed using the chi-squared statistic \(\left( {x_{k - 1}^{2} = 30.03} \right),\) with a significance level of \(p < 0.01\), was rejected. The \(I^{2}\) was 86,48%. However, no further analysis was possible as most of the studies addressed developed economies. Future studies could integrate other variables of analysis between the relationship of the CEO duality and the development and disclosure of CSR practices, such as the exercise of auditing within organizations, since CEO duality may reduce supervision and increase the possibilities of acting for their own benefit (Grove et al. 2011).

5 Conclusions

Through a meta-analysis, this study identifies the reasons associated with the development and disclosure of CSR practices in the banking sector. Previous studies using this method do not focus on the banking sector and do not jointly analyze the associated factors of CSR based on the influence that corporate governance exerts on these practices. This is the first known meta-analysis that identifies the associated factors for adopting CSR practices in the banking sector and their relationship with corporate governance activities.

This research incorporates 24 previous studies including 6208 observations for 40 countries which are used to analyze 9 explanatory variables. The results lead to the conclusion that there is a positive and significant association between the adoption of CSR practices and the legitimacy of existence, reputation, board size, and presence of women on the board; a negative and insignificant relationship is seen for the variables board independence, and duality of the CEO. In this regard, it is important to note that the presence of women on the board is one of the least included factors in the studies that were analyzed. Therefore, this variable could be used as a future focus of study.

Additionally, there is an insignificant positive relationship between relationship with stakeholder, foreigners on the board, and regulation and the development of CSR practices. The relationship between stakeholders and the development of CSR practices could be analyzed in future studies by segmenting stakeholders into internal and external groups, since both pursue different objectives in organizations and this may affect the results. Regarding the analysis of foreigners on the board, future research could consider the knowledge and experience of these board members as a control variable.

On the other hand, regarding regulatory aspects, this result may be due to the diversity of variables that influence regulation, which may affect the results. These include CSR practices that Islamic banks apply according to the guidelines set by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). In this regard, in the analyzed sources, there is significant research carried related to Islamic financial institutions, thus potentially producing bias in the results. Similarly, another aspect that affects the association between regulation and CSR practices is related to the different regulations that regulators may issue, such as those in India and in Europe related to disclosing nonfinancial information, or aspects associated with green taxes regulations.

The subgroup analysis by developed and developing economies showed that relationship with stakeholders and reputation are insignificant in developing countries. Only legitimization of existence and board size are significant variables in the development of CSR practices. In addition, the literature shows that legitimization of existence is the most common factor in studies as an associated factor of the adoption and disclosure of CSR practices.

Furthermore, future studies could analyze the direction of association of the variables studied and the development of CSR practices, since some variables can be considered, at first glance, as effects of CSR. However, the literature shows that they can also cause CSR actions in organizations. Therefore, future studies that analyze the causality of variables should consider additional variables that affect the development of CSR practices, such as analyzing the relationship with stakeholders, segmenting them into external or internal groups, considering that they pursue different objectives. Similarly, the studies can consider variables specific to the business context, such as exposure to the bad reputation of these entities. Other variables to be included in studies that seek to identify the association and causality between CSR practices could include the audit characteristics of the entities and the experience and knowledge of the board members.

Additionally, the literature shows that the associated factors for engaging in CSR practices may be related to a company’s financial performance and the level of risk. Therefore, studies that seek to analyze correlations between CSR and different factors such as financial performance and risk may be affected by the associated factors that drive companies to engage in such practices. Therefore, a correlation analysis applied to companies in the same sector may offer different results depending on the reasons that lead companies to adopt and disclose CSR practices.

Finally, the majority of studies consulted do not include Latin American countries. Only one study included Brazil as one of its areas of study, thus constituting a limitation of the results obtained. This situation may have occurred because the banking sector is generally excluded from the population under study due to its specific characteristics. Additionally, many of these articles are written in Spanish, and there are barriers to their publication in databases where English publications predominate. Therefore, these studies fail to reach the indices used in this study. However, this limitation also constitutes an opportunity to carry out future research to analyze the associated factors for developing CSR practices in Latin American banking institutions and their relationship with aspects such as financial performance, level of risk, and corporate governance structure.

Availability of data and material

Data and material are available on request.

Notes

Accounting and Auditing Organization for Islamic Financial Institutions.

References

Abdullah SN, Mohamad NR, Mokhtar MZ (2011) Board independence, ownership and CSR of Malaysian large firms. Corp Ownersh & Control 8(2):467–483

Ahmed K, Courtis JK (1999) Associations between corporate characteristics and disclosure levels in annual reports: a meta-analysis. Br Account Rev 31(1):35–61. https://doi.org/10.1006/bare.1998.0082

Ali W, Frynas JG, Mahmood Z (2017) Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: a literature review. Corp Soc Responsib Environ Manag 24(4):273–294. https://doi.org/10.1002/csr.1410

Ayadi M, Kusy MI, Pyo M, Trabelsi S (2015) Corporate social responsibility, corporate governance, and managerial risk-taking. Corp Gov Manag Risk-Taking. https://doi.org/10.2139/ssrn.2438177

Ayuso S and Argandoña A (2009) Responsible corporate governance: towards a stakeholder board of directors?, Working Paper No. 701, IESE Business School, University of Navarra, 25 February

Beck T, Demirgüç-Kunt A, Levine R (2010) Financial institutions and markets across countries and over time: the updated financial development and structure database. World Bank Econ Rev 24(1):77–92

Bénabou R, Tirole J (2010) Individual and corporate social responsibility. Economica 77(305):1–19

Borman G, Hewes G, Overman I, Brown S (2003) Comprehensive school reform and achievement: a meta-analysis. Rev Educ Res 73(2):125–230. https://doi.org/10.3102/00346543073002125

Brine M, Brown R and Hackett G (2s007) Corporate social responsibility and financial performance in the Australian context. Econ Round-Up

Brønn PS, Vrioni A (2001) Corporate social responsibility and cause-related marketing: an overview. Int J Advert 20:207–222

Buhr N (1998) Environmental performance legislation and annual report disclosure: the case of acid rain and Falconbridge. Account, Audit Account J 11(2):163–190

Burgess Z, Tharenou P (2002) Women board directors: characteristics of the few. J Bus Ethics 37(1):39–49

Campbell D, Craven B, Shrives P (2003) Voluntary social reporting in three FTSE sectors: a comment on perception and legitimacy. Account, Audit Account J 16(4):558–581

Chambers CL, Day R (2009) The banking sector and CSR: an unholy alliance. Financ Regul Int 12(9):13–20

Chedrawi C, Osta A, Osta S (2020) CSR in the Lebanese banking sector: a neo-institutional approach to stakeholders’ legitimacy. J Asia Bus Stud 14(2):143–157. https://doi.org/10.1108/JABS-03-2018-0093

Chemmanur T, Fulghieri P (1994) Investment bank reputation, information production, and financial intermediation. J Financ 49:57–79

Cohen J (1969) Statistical power analysis for the behavioural sciences. Academic Press, New York

Collier P, Gregory A (1999) Audit committee activity and agency costs. J Acc Public Policy 18(4–5):311–332. https://doi.org/10.1016/S0278-4254(99)00015-0

Cooper H and Hedges LV (1994) The handbook of research synthesis. Russell Sage Foundation

Deegan C (2002) The legitimizing effect of social and environmental disclosures: a theoretical foundation. Account, Audit & Account J 15(3):282–311

Deegan C, Rankin M, Voght P (2000) Firms disclosure reactions to major social incidents: Australian evidence. Account Forum 24(1):101–130. https://doi.org/10.1111/1467-6303.00031

Del MirasRodriguez MM, Carrasco Gallego A, Escobar Perez B (2014) Corporate social responsibility and financial performance: a meta-analysis. Span J Financ and Account-Revista Espanola De Financiacion Y Contabilida 43(2):193–215. https://doi.org/10.1080/02102412.2014.911000

Delgado-Márquez BL, Pedauga LE, Cordón-Pozo E (2017) Industries regulation and firm environmental disclosure: a stakeholders’ perspective on the importance of legitimation and international activities. Org & Environ 30(2):103–121

Fama EF, Jensen MC (1983) Separation of ownership and control. J Law Econ 26(2):301–325

Farook S, Kabir Hassan M, Lanis R (2011) Determinants of corporate social responsibility disclosure: the case of Islamic banks. J Islam Account Bus Res 2(2):114–141. https://doi.org/10.1108/17590811111170539

Fombrun CJ, Shanley M (1990) What is in a name? Reputation building and corporate strategy. Acad Manag J 33(2):233–259

Frerichs I, Teichert T (2021) Research streams in corporate social responsibility literature: a bibliometric analysis. Manag Rev Q. https://doi.org/10.1007/s11301-021-00237-6

Glass GV, McGaw B, Smith ML (1981) Meta-analysis in social research. Sage Publications Incorporated, USA

Gray RH, Kouhy R, Lavers S (1995) Corporate social and environmental reporting: a review of the literature and a longitudinal study of UK disclosure. Account, Audit Account J 8(2):47–77

Grove H et al (2011) Corporate governance and performance in the wake of the financial crisis: Evidence from US commercial banks. Corp Gov: Int Rev 19(5):418–436

Guthrie JE, Parker LD (1989) Corporate social reporting: a rebuttal of legitimacy theory. Account Bus Res 19(76):343–352

Haniffa RM, Cooke TE (2005) The impact of culture and governance on corporate social reporting. J Account Public Policy 24(5):391–430

Higgins JP, Thompson SG (2002) Quantifying heterogeneity in a meta-analysis. Stat Med 21(11):1539–1558

Hunter, J. E., Schmidt, F. and Jackson, G. (1982) ‘Meta-Analysis Cumulating research findings across studies’, in Studyng organizations: Innovations in Methodology.

Hunter JE, Schmidt FL (1990) Methods of meta-analysis. Sage, Beverly Hills, CA

Ioannou I and Serafeim G (2010) The impact of corporate social responsibility on investment recommendations. Best Paper Proceedings. Academy of Management 2010 Annual Meeting (Montreal Canada. Social Issues in Management (SIM) Division

Jahid MA et al (2020) Impact of corporate governance mechanisms on corporate social responsibility disclosure of publicly-listed banks in Bangladesh. J Asian Financ, Econ Bus 7(6):61–71. https://doi.org/10.13106/jafeb.2020.vol7.no6.061

Jizi MI et al (2014) Corporate Governance and Corporate Social Responsibility Disclosure: Evidence from the US Banking Sector. J Bus Ethics 125(4):601–615. https://doi.org/10.1007/s10551-013-1929-2

Kay J (1993) Foundations of corporate success. Oxford University Press, Oxford

Khan H (2010) The effect of corporate governance elements on corporate social responsibility (CSR); reporting: empirical evidence from private commercial banks of Bangladesh. Int J Law Manag 52(2):82–109. https://doi.org/10.1108/17542431011029406

Khan H et al (2020) “Green washing” or “authentic effort”? An empirical investigation of the quality of sustainability reporting by banks. Account, Audit Account J 34(2):338–369. https://doi.org/10.1108/AAAJ-01-2018-3330

Kiliç M, Kuzey C, Uyar A (2015) The impact of ownership and board structure on Corporate Social Responsibility (CSR) reporting in the Turkish banking industry. Corp Gov. https://doi.org/10.1108/CG-02-2014-0022

Kim M, Kristiansen EG, Bent V (2005) Endogenous product differentiation in credit markets: What do borrowers pay for? J Bank Financ 29(3):681–699

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108(3):717–737

Kolk A, Pinkse J (2010) The integration of corporate governance in corporate social responsibility disclosures. Corp Soc Responsib Environ Manag 17(1):26–150

Lee SP, Chen HJ (2011) Corporate governance and firm value as determinants of CEO compensation in Taiwan: 2SLS for panel data model. Manag Res Rev 34(3):252–265. https://doi.org/10.1108/01409171111116286

Levine R (2005) Measuring corporate reputation, Handbook of economic growth, (1st ed), pp 865–934

Lewis S (2001) Measuring corporate reputation. Corp Commun: Int J 6(1):31–35

Li S et al (2010) Corporate social responsibility in emerging markets. Manag Int Rev 50(5):635–654

Lindblom CK (1993) The implications of organizational legitimacy for corporate social performance and disclosure In: Paper presented at the Critical Perspectives on Accounting. Conference, New York, NY

Lui TK et al (2020) Corporate social responsibility disclosures ( CSRDs ) in the banking industry : a study of conventional banks and Islamic banks in Malaysia. Int J Bank Market. https://doi.org/10.1108/IJBM-04-2020-0192

Mackenzie C (2007) Boards, incentives and corporate social responsibility: the case for a change of emphasis. Corp Gov: an Int Rev 15(5):935–943. https://doi.org/10.1111/j.1467-8683.2007.00623.x

Majumder MTH, Akter A, Li X (2017) Corporate governance and corporate social disclosures: A meta-analytical review. Int J Account Inf Manag 25(4):434–458. https://doi.org/10.1108/IJAIM-01-2017-0005

Margolis J, Elfenbein H and Walsh J (2007) Does it pay to be good? A meta-analysis and redirection of research on the relationship between corporate social and financial performance. Harvard Business School Working Paper

Masud MAK, Hossain MS, Kim JD (2018) Is green regulation effective or a failure: comparative analysis between Bangladesh Bank (BB) green guidelines and global reporting initiative guidelines. Sustainability (switzerland). https://doi.org/10.3390/su10041267

McWilliams A, Siegel DS (2001) Corporate social responsibility: a theory of firm perspective. Acad Manag Rev 26(1):117–127

Money K, Schepers H (2007) Are CSR and corporate governance converging? A view from boardroom directors and company secretaries in FTSE100 companies in the UK. J Gen Manag 33(2):1–11

Morris CN (1983) Parametric empirical Bayes inference: theory and applications. J Am Stat Assoc 78:47–55. https://doi.org/10.2307/2287098

Morsing M, Schultz M (2006) Corporate social responsibility communication: stakeholder information, response and involvement strategies. Bus Ethics: Eur Rev 15(4):323–338

Newson M, Deegan C (2002) Global expectations and their association with corporate social disclosure practices in Australia Singapore and South Korea. Int J Account 37:183–213

Nurunnabi M (2016) Who cares about climate change reporting in developing countries? The market response to, and corporate accountability for, climate change in Bangladesh. Environ Dev Sustain 18:157–186

Nwude EC, Nwude CA (2021) Board structure and corporate social responsibility: evidence from developing economy. SAGE Open. https://doi.org/10.1177/2158244020988543

OECD (1999) OECD principles of corporate governance. OECD Publications Service, Paris

Olander S (2007) Stakeholder impact analysis in construction project management. Constr Manag Econ 25(3):277–287

ONU AG (2000) Declaración del Milenio. NY 55(2):1–17

Orlitzky M, Schmidt FL, Rynes SL (2003) Corporate social and financial performance: a meta-analysis. Organ Stud 24(3):403–441. https://doi.org/10.1177/0170840603024003910

Ortiz N, Aguilera J, Morales M (2016) Corporate governance and environmental sustainability: the moderating role of the national institutional context. Corp Soc Responsib Environ Manag 23:150–164

Patten DM (1991) Exposure, legitimacy, and social disclosure. J Account Public Policy 10:297–308

Platonova E et al (2016) The impact of corporate social responsibility disclosure on financial performance: evidence from the GCC Islamic banking sector. J Bus Ethics 151(2):451–471. https://doi.org/10.1007/s10551-016-3229-0

Polishchuk L (2009) Corporate social responsibility or government regulation: an analysis of institutional choice. Probl Econ Transit 52(8):73–94

Preuss L, Barkemeyer R, Glavas A (2016) Corporate social responsibility in developing country multinationals: identifying company and country-level influences. Bus Ethics Q 26(3):347–378. https://doi.org/10.1017/beq.2016.42

Raudenbush SW (2009) Analyzing effect sizes: random-effects models. In: Cooper H, Hedges LV, Valentine JC (eds) The handbook of research synthesis and meta-analysis, 2nd edn. Russell Sage Foundation, New York, pp 295–316

Reynaud E, Walas B (2015) Discours sur la RSE dans le processus de légitimation de la banque. Rev Fr Gest 41(248):187–209

Rosenthal R (1991) Applied social research methods series, In: Meta-analytic procedures for social research (Rev. ed.), vol 6, Sage Publications

Rouf MA, Hossan MA (2020) The effects of board size and board composition on CSR disclosure: a study of banking sectors in Bangladesh. Int J Ethics Syst 37(1):105–121. https://doi.org/10.1108/IJOES-06-2020-0079

Sanchez-Meca J (1999) Metaanálisis para la investigación cientifica., In: Metodología para la investigación en marketing y dirección de empresas, pp 173–199

Schröder P (2021) Corporate social responsibility (CSR) website disclosures: empirical evidence from the German banking industry. Int J Bank Mark. https://doi.org/10.1108/IJBM-06-2020-0321

Shen CH, Lee CC (2005) Same financial development yet different economic growt and why? J Money, Credit, Bank 38:1907–1944

Shukor MH et al (2020) CSR disclosure, corporate governance and firm value: a study on GCC Islamic banks. Int J Account Inf Manag 28(4):607–638. https://doi.org/10.1108/IJAIM-08-2019-0103

Siddiqui SS (2015) The association between corporate governance and firm performance—a meta-analysis. Int J Account Inf Manag 23(3):218–237. https://doi.org/10.1108/IJAIM-04-2014-0023

Simpson W, Kohers T (2002) The link between social and financial performance: evidence from the banking industry. J Bus Ethics 35:97–109

Soana MG (2011) The relationship between corporate social performance and corporate financial performance in the banking sector. J Bus Ethics 104:133–148

Starks LT (2009) EFA keynote speech: corporate governance and corporate social responsibility: What do investors care about? What should investors care about? The Financial Review 44(4):461–468

Suchman M (1995) Managing legitimacy: strategic & institutional approaches. Acad Manag Rev 20(3):571–610

Tasnia M, AlHabshi SJ, S. M. and Rosman, R. (2020) The impact of corporate social responsibility on stock price volatility of the US banks: a moderating role of tax. J Financ Report Account. https://doi.org/10.1108/JFRA-01-2020-0020

Urrútia G, Bonfill X (2010) PRISMA declaration: a proposal to improve the publication of systematic reviews and meta-analyses. Med Clin 135(11):507–511. https://doi.org/10.1016/j.medcli.2010.01.015

Vanhamme J, Lindgreen A, Reast J, Van Popering N (2012) To do well by doing good: improving corporate image through cause-related marketing. J Bus Ethics 109(3):259–274

Velte P (2021) Meta-analyses on corporate social responsibility (CSR): a literature review. Manag Rev Q. https://doi.org/10.1007/s11301-021-00211-2

Ven BV, Jeurissen R (2005) Competing responsibly”, Business Ethics Quarterly. Bus Ethics Q 15(2):299–317

Veronesi P, Zingales L (2010) Pauson’s gift. J Financ Econ 97(3):339–368

Walden WD, Schwartz BN (1997) Environmental disclosures and public policy pressure. J Account Public Policy 16(2):125–154

Wu MW, Shen CH (2013) Corporate social responsibility in the banking industry: motives and financial performance. J Bank Financ 37(9):3529–3547. https://doi.org/10.1016/j.jbankfin.2013.04.023

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. Financial support was received from Agustiniana University to write the report.

Author information

Authors and Affiliations

Contributions

Rojas Leidy: Previous literature, methodology, results, and conclusions. Pérez José: Review of previous literature, methodology, results, conclusions, and supervision. Campos Soledad: Review of previous literature, methodology, results, conclusions, and supervision.

Corresponding authors

Ethics declarations

Conflict of interest

All authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Rojas Molina, L.K., Pérez López, J.Á. & Campos Lucena, M.S. Meta-analysis: associated factors for the adoption and disclosure of CSR practices in the banking sector. Manag Rev Q 73, 1017–1044 (2023). https://doi.org/10.1007/s11301-022-00267-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-022-00267-8