Abstract

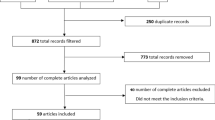

Although CSR is an extensively studied topic, a systematic, comprehensive and diverse review in the domain of CSR and Islamic banking is missing. This paper intends to present a broad review of this domain. Through a state-of-the-art review, we have divided the paper into different sections, the first two are general i.e. CSR measurement, it deals with measuring methods of CSR in Islamic banking, and CSR theories, it gives a brief overview of theories referred in under-review studies. While, the other three sections are separated according to the nature of studies i.e. CSR narrative under the Islamic paradigm, CSR disclosure by Islamic banks, and CSR exposition in Islamic banks. At the end of each section, we have included a ‘commentary’ to discuss and summarize major points, highlight trends and issues, provide insights into limitations and suggest future research directions.

Similar content being viewed by others

Notes

Tawarruq is one of the Islamic financial instrument (see: Mohamad and Rahman 2014).

Zakat is a religious tax which is often used for social goals, and Qard al Hassan is an instrument of loan under interest-free assumption, in which debtor has to pay only the principal amount, so this instrument is often considered as good for social goals as well.

AAOIFI stands for Accounting and Auditing Organization for Islamic Financial Institutions. This is Bahrain-based non-for-profit organization that is established to promote and maintain the Shariah standards for Islamic financial institutions.

References

Abbott WF, Monsen RJ (1979) On the measurement of corporate social responsibility: self-reported disclosures as a method of measuring corporate social involvement. Acad Manag J 22:501–515. https://doi.org/10.2307/255740

Abduh M, AlAgeely HAM (2015) The impact of corporate governance on CSR disclosure in Islamic banks: empirical evidence from GCC countries. Middle East J Manag 2:283–295. https://doi.org/10.1504/MEJM.2015.073558

Ahmed A, El-Belihy A (2017) An investigation of the disclosure of corporate social responsibility in UK Islamic Banks. Acad Account Financ Stud J 21:1–32

Ahmed S, Zalailah S, Hafiza S, Hashim A (2016) Corporate governance and corporate social responsibility disclosure of Islamic banks : a call for additional transparency. In: 4th international conference on accounting, business and economics. pp 1–8

Alamer ARA, Salamon HB, Qureshi MI, Rasli A (2015a) Measuring corporate social responsibility practice in Islamic banking: a review. Int J Econ Financ Issues 5:198–206

Alamer ARA, Salamon HB, Qureshi MI, Rasli AM (2015b) A new business process and outcome oriented corporate social responsibility index for Islamic banking. Int J Econ Financ Issues 5:207–214

Alamer ARA, Salamon HB, Qureshi MI, Rasli AM (2015c) How do we measure corporate social responsibility of Islamic banks through their business processes and oriented outcomes? Int J Econ Financ Issues 5:190–197

Ali I, Rehman KU, Ali SI et al (2010) Corporate social responsibility influences, employee commitment and organizational performance. Afr J Bus Manag 4:2796–2801

Aliyu S, Hassan MK, Mohd Yusof R, Naiimi N (2017) Islamic banking sustainability: a review of literature and directions for future research. Emerg Mark Financ Trade 53:440–470

Almunawar MN, Low KCP (2013) Islamic Ethics and CSR. In: Idowu SO, Capaldi N, Zu LGAD (eds) Encyclopedia of corporate social responsibility. Springer, Berlin, pp 1500–1507

Alsaadi A, Ebrahim MS, Jaafar A (2017) Corporate social responsibility, Shariah-compliance, and earnings quality. J Financ Serv Res 51:169–194. https://doi.org/10.1007/s10693-016-0263-0

Amran A, Fauzi H, Purwanto Y et al (2017) Social responsibility disclosure in Islamic banks: a comparative study of Indonesia and Malaysia. J Financ Report Account 15:99–115. https://doi.org/10.1108/JFRA-01-2015-0016

Aribi ZA, Arun T (2015) Corporate social responsibility and Islamic Financial Institutions (IFIs): management perceptions from IFIs in Bahrain. J Bus Ethics 129:785–794. https://doi.org/10.1007/s10551-014-2132-9

Aribi ZA, Gao S (2010) Corporate social responsibility disclosure: a comparison between Islamic and conventional financial institutions. J Financ Report Account 8:72–91. https://doi.org/10.1108/19852511011088352

Aribi ZA, Gao SS (2011) Narrative disclosure of corporate social responsibility in Islamic financial institutions. Manag Audit J 27:199–222. https://doi.org/10.1108/02686901211189862

Arsad S, Said R, Yusoff H et al (2014) The relationship between Islamic corporate social responsibility and firm’s performance: empirical evidence from Shari’ah compliant companies. Eur J Bus Manag 6:161–174

Arshad R, Othman S, Othman R (2012) Islamic corporate social responsibility, corporate reputation and performance. Proc World Acad Sci Eng Technol 6:1070

Ashforth BE, Mael F (1989) Social identity theory and the organization. Acad Manag Rev 14:20–39

Aziz MN, Mohamad OB (2016) Islamic social business to alleviate poverty and social inequality. Int J Soc Econ 43:573–592. https://doi.org/10.1108/IJSE-06-2014-0129

Babatunde JH, Adeyemi AA (2015) The effectiveness of Islamic banks’ corporate social responsibility as perceived by gender in Malaysia: an exploratory research. J Creat Writ 1:1–18

Bakar FA, Yusof MAM (2016a) Challenges in CSR engagements: the case of bank Islam. Information 19:2949–2954

Bakar FA, Yusof MAM (2016b) Managing CSR initiatives from the Islamic perspective: the case of Bank Islam Malaysia Berhad (BIMB). J Pengur 46:67–76

Bani H, Ariffin NM, Rahman ARA (2015) The corporate social performance indicators for Islamic banks: the manager’s perception. In: El-Karanshawy HA, Omar A, Khan T et al (eds) Ethics, governance and regulation in Islamic finance. Bloomsbury Qatar Foundation, Doha, Qatar, pp 105–118

Baydoun N, Willett R (2000) Islamic Corporate Reports. Abacus 36:71–90. https://doi.org/10.1111/1467-6281.00054

Belal AR, Abdelsalam O, Nizamee SS (2015) Ethical reporting in Islami Bank Bangladesh Limited (1983–2010). J Bus Ethics 129:769–784. https://doi.org/10.1007/s10551-014-2133-8

Belkacem M, Ladraa K (2015) The role of Islamic banks in the establishment of social responsibility within Islamic Countries. J Emerg Issues Econ Financ Bank 4:1377–1384

Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Source Acad Manag Rev 4:497–505

Cebeci I (2012) Integrating the social maslaha into Islamic finance. Account Res J 25:166–184. https://doi.org/10.1108/10309611211290158

Choudhury MA (2014) Evolutionary learning organization in a system orientation of ethico-economics. In: Learning models for innovation in organizations: examining roles of knowledge transfer and human resources management. pp 242–250

Darus F, Amran A, Nejati M, Yusoff H (2014a) Corporate social responsibility towards the community: evidence from Islamic financial institutions in Malaysia. Int J Green Econ 8:273. https://doi.org/10.1504/IJGE.2014.067729

Darus F, Fauzi H, Purwanto Y et al (2014b) Social responsibility reporting of Islamic banks: evidence from Indonesia. Int J Bus Gov Ethics 9:356. https://doi.org/10.1504/IJBGE.2014.066275

Di Bella V, Al-Fayoumi N (2016) Perception of stakeholders on corporate social responsibility of Islamic Banks in Jordan. EuroMed J Bus 11:30–56. https://doi.org/10.1108/EMJB-01-2015-0003

Donaldson T, Preston LE, Preston LEEE (1995) The stakeholder theory of the corporation: concepts, evidence, and implications. Source Acad Manag Rev 20:65–91

Durrani B (2016) Islamic concept and contemporary corporate social responsibility: comparative study between Islamic banks and conventional banks in Pakistan. J Manag Sci 10:317–332

Dusuki AW (2005) CSR of Islamic banks of Malaysia: a synthesis of islamic and stakeholders’ prespective. PhD dissertation. Loughborough University, UK

Dusuki AW (2007) The ideal of Islamic banking: a survey of stakeholders’ perceptions. Rev Islam Econ 11:29–52

Dusuki AW (2008a) What does islam say about corporate social responsibility? Rev Islam Econ 12:5–28. https://doi.org/10.2190/86QB-KKY1-F27L-3KHK

Dusuki AW (2008b) Understanding the objectives of Islamic banking: a survey of stakeholders’ perspectives. Int J Islam Middle East Financ Manag 1:132–148. https://doi.org/10.1108/17538390810880982

Dusuki AW, Abdullah NI (2007a) Maqasid al-Shari’ah, Maslahah, and corporate social responsibility. Am J Islam Soc Sci 24:25–45

Dusuki AW, Abdullah NI (2007b) Why do Malaysian customers patronise Islamic banks? Int J Bank Mark 25:142–160. https://doi.org/10.1108/02652320710739850

Dusuki AW, Dar H (2007) Stakeholders’ Perceptions of corporate social responsibility of Islamic banks: evidence from Malaysian economy. In: Advances in Islamic economics and finance—proceedings of 6th international conference on Islamic economics and Finance, vol 1, pp 249–277

El Mosaid F, Boutti R (2012) Relationship between corporate social responsibility and financial performance in Islamic banking. Res J Financ Account 3:93–103

El-Halaby S, Hussainey K (2016) Determinants of compliance with AAOIFI standards by Islamic banks. Int J Islam Middle East Financ Manag 9:143–168. https://doi.org/10.1108/IMEFM-06-2015-0074

Ernst and Young (2016) World Islamic banking competitiveness report 2016

Farag H (2014) Corporate governance and corporate social responsibility in financial institutions: evidence from Islamic banks. In: Boubaker S, Nguyen DK (eds) Corporate governance and corporate social responsibility: emerging markets focus. World Scientific, Singapore, pp 405–436

Farook S (2007) On corporate social responsibility of Islamic financial institutions. Islam Econ Stud 15:31–46

Farook S, Lanis R (2007) Banking on Islam? Determinants of corporate social responsibility disclosure. In: Iqbal M, Ali SS, Muljawan D (eds) Advances in Islamic economics and finance: 6th international conference on Islamic economics and finance. pp 217–248

Farook S, Kabir Hassan M, Lanis R (2011) Determinants of corporate social responsibility disclosure: the case of Islamic banks. J Islam Account Bus Res 2:114–141. https://doi.org/10.1108/17590811111170539

Fatma M, Rahman Z, Khan I (2014) Multi-item stakeholder based scale to measure CSR in the banking industry. Int Strateg Manag Rev 2:9–20. https://doi.org/10.1016/j.ism.2014.06.001

Fisch C, Block J (2018) Six tips for your (systematic) literature review in business and management research. Manag Rev Q 68:103–106. https://doi.org/10.1007/s11301-018-0142-x

Franzoni S, Allali AA (2018) Principles of Islamic finance and principles of corporate social responsibility: what convergence? Sustainability 10:637. https://doi.org/10.3390/su10030637

Gallardo-Vázquez D, Sanchez-Hernandez MI (2014) Measuring corporate social responsibility for competitive success at a regional level. J Clean Prod 72:14–22. https://doi.org/10.1016/j.jclepro.2014.02.051

Gambling TE, Karim RAA (1986) Islam and social accounting. J Bus Financ Account 13:39–50. https://doi.org/10.1111/j.1468-5957.1986.tb01171.x

Hamdan MH (2014) Corporate social responsibility of Islamic banks in Brunei Darussalam. In: Low K, Idowu SAS (eds) Corporate social responsibility in Asia. Springer, Cham, pp 85–107

Hamidu AA, Haron HM, Amran A (2015) Corporate social responsibility: a review on definitions, core characteristics and theoretical perspectives. Mediterr J Soc Sci 6:83–95. https://doi.org/10.5901/mjss.2015.v6n4p83

Haniffa R, Hudaib M (2002) A theoretical framework for the development of the Islamic perspective of accounting. Account Commer Financ Islam Perspect J 6:1–42

Haniffa R, Hudaib M (2004) Disclosure practices of Islamic financial institutions: an exploratory studyWorking paper series (No 04/32). School of Management, Bradford University. https://www.brad.ac.uk/acad/management/external/pdf/workingpapers/2004/Booklet_04-32.pdf. Accessed 12 Nov 2017

Haniffa R, Hudaib M (2007) Exploring the ethical identity of Islamic Banks via communication in annual reports. J Bus Ethics 76:97–116. https://doi.org/10.1007/s10551-006-9272-5

Harahap SS (2003) The disclosure of Islamic values—annual report. The analysis of Bank Muamalat Indonesia’s annual report. Manag Financ 29:70–89. https://doi.org/10.1108/03074350310768355

Harun MSB (2016) The impact of corporate governance on CSR disclosure in Islamic banks: empirical evidence from GCC countries. PhD dissertation. Plymouth University, UK

Hassan A, Harahap SS (2010) Exploring corporate social responsibility disclosure: the case of Islamic banks. Int J Islam Middle East Financ Manag 3:203–227. https://doi.org/10.1108/17538391011072417

Hassan A, Latiff HSBA (2009) Corporate social responsibility of Islamic financial institutions and businesses. Humanomics 25:177–188. https://doi.org/10.1108/08288660910986900

Hassan MK, Rashid M, Imran MY, Shahid AI (2010) Ethical gaps and market value in the Islamic banks of Bangladesh. Rev Islam Econ 14:49–75

Hassan MT, Kausar A, Ashiq H et al (2012) Corporate social responsibility disclosure (a comparison between Islamic and conventional financial institutions in Bahawalpur Region). Int J Learn Dev 2:628–642

Helfaya A, Kotb A, Hanafi R (2016) Qur’anic ethics for environmental responsibility: implications for business practice. J Bus Ethics. https://doi.org/10.1007/s10551-016-3195-6

Hussain M, Shahmoradi A, Turk R (2015) An overview of Islamic finance. IMF Work Pap 15:1. https://doi.org/10.5089/9781513590745.001

Ibrahim A, Yahya S, Abdalla Y (2015) Examining the influence of the characteristics of Islamic banks and Shariah supervisory board on the level of social responsibility disclosure: a review from Sudan. Int J Bus Innov 2:23–51

Indrawaty, Wardayati SM (2016) Implementing Islamic Corporate Governance (ICG) and Islamic Social Reporting (ISR) in Islamic Financial Institution (IFI). Procedia 219:338–343. https://doi.org/10.1016/j.sbspro.2016.04.042

Jaiyeoba HB, Adewale AA, Quadry MO (2018) Are Malaysian Islamic banks’ corporate social responsibilities effective? A stakeholders’ view. Int J Bank Mark 36:111–125. https://doi.org/10.1108/IJBM-10-2016-0146

Jones TM (1995) Instrumental stakeholder theory: a synthesis of ethics and economics. Source Acad Manag Rev 20:404–437

Jusoh WNHW, Ibrahim U (2016) Corporate social responsibility of Islamic Bank’s practices: an exploratory study. Int J Islam Bus Ethics 1:95–109

Jusoh WNHW, Ibrahim U, Napiah MDM (2015) An Islamic perspective on corporate social responsibility of Islamic banks. Mediterr J Soc Sci 6:308–315. https://doi.org/10.5901/mjss.2015.v6n2s1p308

Kamil NM, Jan MT (2014) Islamic corporate social responsibility (ICSR): validating a higher-order measurement model Islamic corporate social responsibility (ICSR): validating a higher-order measurement model. Malays Manag Rev 49:21–34

Kamla R, Rammal GH (2013) Social reporting by Islamic banks: does social justice matter? Account Audit Account J 26:911–945. https://doi.org/10.1108/AAAJ-03-2013-1268

Khan MM (2013) Developing a conceptual framework to appraise the corporate social responsibility performance of Islamic banking and finance institutions. Account Public Interes 13:191–207. https://doi.org/10.2308/apin-10375

Khan MM (2016) CSR standards and Islamic banking practice: a case of Meezan Bank of Pakistan. J Dev Areas 50:295–306. https://doi.org/10.1353/jda.2016.0046

Khan MM, Usman M (2016) Corporate social responsibility in Islamic banks in Pakistan. J Islam Bus Manag 6:179–190

Khurshid MA, Al-Aali A, Soliman AA, Amin SM (2014) Developing an Islamic corporate social responsibility model (ICSR). Compet Rev 24:258–274. https://doi.org/10.1108/CR-01-2013-0004

Koku PS, Savas S (2014) On corporate social responsibility and Islamic marketing. J Islam Mark 5:33–48. https://doi.org/10.1108/JIMA-04-2013-0028

Latif KF, Sajjad A (2018) Measuring corporate social responsibility: a critical review of survey instruments. Corp Soc Responsib Environ Manag 1:1–2. https://doi.org/10.1002/csr.1630

Maali B, Casson P, Napier C (2003) Social reporting by Islamic banks

Maali B, Casson P, Napier C (2006) Social reporting by Islamic banks. Abacus 42:266–289. https://doi.org/10.1111/j.1467-6281.2006.00200.x

Mairafi SL, Hassan S, Arshad SBM (2018) An analysis of the literature on Islamic bank risk-taking. Acad Account Financ Stud J 22:1–7

Mallin C, Farag H, Ow-Yong K (2014) Corporate social responsibility and financial performance in Islamic banks. J Econ Behav Organ 103:S21–S38. https://doi.org/10.1016/j.jebo.2014.03.001

Marsidi A, Annuar HA, Abdul Rahman AR (2017) Disclosures and perceptions of practitioners on items of financial and social reporting index developed for Malaysian Islamic banks. Int J Bus Soc 18:563–578

Maulan S, Omar NA, Ahmad M (2016) Measuring halal brand association (HalBA) for Islamic banks. J Islam Mark 7:331–354. https://doi.org/10.1108/JIMA-09-2014-0058

Meinhardt R, Junge S, Weiss M (2018) The organizational environment with its measures, antecedents, and consequences: a review and research agenda. Manag Rev Q. https://doi.org/10.1007/s11301-018-0137-7

Melo T (2012) Slack-resources hypothesis: a critical analysis under a multidimensional approach to corporate social performance. Soc Responsib J 8:257–269. https://doi.org/10.1108/17471111211234879

Menne F (2016) Evidence of CSR practices of Islamic Financial Institutions in Indonesia. In: Mutum Dilip S, Mohammad Mohsin Butt MR (eds) Advances in Islamic finance, marketing, and management. Emerald Group Publishing Limited, Bingley, pp 341–362

Meutia I, Febrianti D (2017) Islamic social reporting in Islamic banking: stakeholders theory perspective. In: SHS Web of conferences. pp 1–8

Migdad AM (2017) CSR practices of Palestinian Islamic banks: contribution to socio-economic development. ISRA Int J Islam Financ 9:133–147. https://doi.org/10.1108/IJIF-06-2017-0001

Mir UR, Hassan SM, Hassan SS (2016) Islamic perspective of corporate social responsibility. Al-Adwa 31:77–90

Mishra S, Suar D (2010) Does corporate social responsibility influence firm performance of Indian companies? J Bus Ethics 95:571–601. https://doi.org/10.1007/s10551-010-0441-1

Mohamad N, Rahman AA (2014) Tawarruq application in Islamic banking: a review of the literature. Int J Islam Middle East Financ Manag 7:485–501. https://doi.org/10.1108/IMEFM-10-2013-0106

Mohammed JA (2007) Corporate social responsibility in Islam. PhD dissertation. Auckland University of Technology, New Zealand

Morgado FFR, Meireles JFF, Neves CM et al (2018) Scale development: ten main limitations and recommendations to improve future research practices. Psicol Reflexão e Crítica 30:3. https://doi.org/10.1186/s41155-016-0057-1

Mostafa RB, ElSahn F (2016) Exploring the mechanism of consumer responses to CSR activities of Islamic banks. Int J Bank Mark 34:940–962. https://doi.org/10.1108/IJBM-11-2015-0179

Muhamad R, Sukor MEA, Muwazir MR (2008) Corporate social responsibility: an Islamic perspective. J Account Perspect 1:43–56

Muhamat AA, Jaafar MN, Basri MF (2017) Corporate social performance (CSP) influences on Islamic bank’s financial performance. J Int Bus Econ Entrep 2:11–16

Mukhazir MRM, Muhamad R, Noordin K (2006) Corporate social responsibility disclosure: a Tawhidic approach. J Syariah 14:125–142

Murphy MJ, Smolarski JM (2018) Religion and CSR: an Islamic political model of corporate governance. Bus Soc. https://doi.org/10.1177/0007650317749222

Musa MA (2011) Islamic business ethics & finance: an exploratory study of Islamic banks in Malaysia. In: 8th Conference on Islamic Economics and Finance. pp 1–27

Narayan PK, Phan DHB (2017) A survey of Islamic banking and finance literature: issues, challenges and future directions. Pac Basin Financ J. https://doi.org/10.1016/j.pacfin.2017.06.006

Nawi FAM, Yazid AS, Mohammed MO (2013) A critical literature review for Islamic banks selection criteria in Malaysia. Int Bus Res. https://doi.org/10.5539/ibr.v6n6p143

Nobanee H, Ellili N (2016) Corporate sustainability disclosure in annual reports: evidence from UAE banks: Islamic versus conventional. Renew Sustain Energy Rev 55:1336–1341. https://doi.org/10.1016/j.rser.2015.07.084

Noor F, Sofian RM, Muhamad R (2016) Corporate Social Responsibility (CSR) and Islamic banks: a synthesis of literature review. Int Conf Account Stud. https://doi.org/10.1016/j.sbspro.2013.04.058

Nor SM, Hashim NA (2015) CSR and sustainability of Islamic banking: the bankers view. J Pengur 45:73–81

Odeduntan AK, Adewale AA (2015) Financial stability of Islamic banks: a review of the literature. Eur J Islam Financ. https://doi.org/10.13135/2421-2172/848

Othman R, Thani AM (2010) Islamic social reporting of listed companies in Malaysia. Int Bus Econ Res J. https://doi.org/10.19030/iber.v9i4.561

Perez A, del Bosque IR (2013) Measuring CSR image: three studies to develop and to validate a reliable measurement tool. J Bus Ethics 118:265–286. https://doi.org/10.1007/s10551-012-1588-8

Pinang P, Yahya SB, Pinang P (2017) The analysis of Islamic banks websites and reports regarding the effectiveness of their corporate citizenship and community development. Glob Bus Manag Res An Int J 9:1–13

Platonova E (2013) Corporate social responsibility from an Islamic moral economy perspective: a literature survey. Afro EUrasian Stud 2:272–297

Platonova E, Asutay M, Dixon R, Mohammad S (2016) The impact of corporate social responsibility disclosure on financial performance: evidence from the GCC Islamic banking sector. J Bus Ethics 151:451–471

Rahman AA, Bukair AA (2013) The influence of the Shariah supervision board on corporate social responsibility disclosure by Islamic banks of Gulf co-operation council countries. Asian J Bus Account 6:65–104

Rahman AA, Bukair AA (2015) The effect of the board of directors’ characteristics on corporate social responsibility disclosure by Islamic Banks. J Manag Res 7:506. https://doi.org/10.5296/jmr.v7i2.6989

Rahman AA, Asraf MF, Bakar FA (2010) Corporate social reporting: a preliminary study of bank Islam Malaysia Berhad (BIMB). Issues Soc Environ Account 4:18–39. https://doi.org/10.22164/isea.v4i1.45

Rahman RA, Saimi NS, Danbatta BL (2016) Determinants of ethical identity disclosure in Islamic banks: an analysis of practices in Bahrain and Malaysia. J Pengur 46:13–22

Rashid M, Abdeljawad I, Ngalim SM, Hassan MK (2013) Customer-centric corporate social responsibility: a framework for Islamic banks on ethical efficiency. Manag Res Rev 36:359–378. https://doi.org/10.1108/01409171311314978

Rawashdeh OH, Azid T, Qureshi MA (2017) Philanthropy, markets, and Islamic financial institutions: a new paradigm. Humanomics 33:563–578. https://doi.org/10.1108/H-08-2016-0063

Rice G (1999) Islamic ethics and the implications for business. J Bus Ethics 18:345–358

Röhm P (2018) Exploring the landscape of corporate venture capital: a systematic review of the entrepreneurial and finance literature. Manag Rev Q. https://doi.org/10.1007/s11301-018-0140-z

Ruf BM, Muralidhar K, Paul K (1998) The development of a systematic, aggregate measure of corporate social performance. J Manag 24:119–133. https://doi.org/10.1177/014920639802400101

Sairally BS (2006) A study on the corporate social responsibility of Islamic Financial Institutions: learning from the experience of socially responsible financial institutions in the UK. PhD dissertation. Loughborough University

Sairally BS (2007) Evaluating the ‘social responsibility’ of Islamic finance: learning from the experiences of socially responsible investment funds. In: Iqbal M, Ali SS, Muljawan D (eds) Advances in Islamic economics and finance: 6th international conference on Islamic economics and finance. pp 279–320

Sairally BS (2013) Evaluating the corporate social performance of Islamic financial institutions: an empirical study. Int J Islam Middle East Financ Manag 6:238–260. https://doi.org/10.1108/IMEFM-02-2013-0026

Samina QS (2012) Practice of corporate social responsibility in Islamic banks of Bangladesh. World J Soc Sci 2:1–13

Schmidt U, Günther T (2016) Public sector accounting research in the higher education sector: a systematic literature review. Manag Rev Q 66:235–265. https://doi.org/10.1007/s11301-016-0120-0

Shabbir MS, Shariff MNM, Yusof MSB et al (2018) Corporate social responsibility and customer loyalty in Islamic banks of Pakistan: a mediating role of brand image. Acad Account Financ Stud J 22:1–6

Sujana A (2015) The extent of corporate social responsibility engagement in Malaysian banks offering Islamic banking services. J Internet Bank Commer 20:1–31. https://doi.org/10.4172/1204-5357.1000113

Tafti SF, Hosseini SF, Emami SA (2012) Assessment the corporate social responsibility according to Islamic values (case study: Sarmayeh Bank). Procedia 58:1139–1148. https://doi.org/10.1016/j.sbspro.2012.09.1095

Thani AM, Ahmad MAN, Amat MA, Hashim A (2016) The development of Islamic corporate social responsibility (I-CSR) Disclosure Index. In: Konferensi Akademik KONAKA. pp 193–201

Thiele FK (2017) Family businesses and non-family equity: literature review and avenues for future research. Manag Rev Q 67:31–63. https://doi.org/10.1007/s11301-017-0123-5

Turker D (2009a) Measuring corporate social responsibility: a scale development study. J Bus Ethics 85:411–427. https://doi.org/10.1007/s10551-008-9780-6

Turker D (2009b) How corporate social responsibility influences organizational commitment. J Bus Ethics 89:189–204. https://doi.org/10.1007/s10551-008-9993-8

Turker D (2016) Islamic roots of corporate social responsibility. In: Habisch A, Schmidpeter R (eds) Cultural roots of sustainable management. Springer, Cham, pp 133–144

Ullah S, Jamali D, Harwood IA (2014) Socially responsible investment: insights from Shari’a departments in Islamic financial institutions. Bus Ethics Eur Rev 23:218–233. https://doi.org/10.1111/beer.12045

Usmani MMT (2004) An introduction to Islamic finance. Arham Shamsi, Karachi

van Marrewijk M (2003) Concepts and definitions of CSR and corporate sustainability: between agency and communion. J Bus Ethics 44:95–105. https://doi.org/10.2307/25075020

Williams G, Zinkin J (2010) Islam and CSR: a study of the compatibility between the Tenets of Islam and the UN global compact. J Bus Ethics 91:519–533. https://doi.org/10.1007/s10551-009-0097-x

Wood DJ (1991) Corporate social performance revisited. Acad Manag Rev 16:691–718

Wu H-Y (2012) Constructing a strategy map for banking institutions with key performance indicators of the balanced scorecard. Eval Program Plan 35:303–320. https://doi.org/10.1016/j.evalprogplan.2011.11.009

Wu H-Y, Tzeng G-H, Chen Y-H (2009) A fuzzy MCDM approach for evaluating banking performance based on balanced scorecard. Expert Syst Appl 36:10135–10147. https://doi.org/10.1016/j.eswa.2009.01.005

Yazis M, Basah A, Yusuf MM (2013) Islamic bank and corporate social responsibility (CSR). Islam Manag Bus 5:194–209

Yusoff H, Darus F (2014) Mitigation of climate change and prevention of pollution activities: environmental disclosure practice in Islamic financial institutions. Procedia 145:195–203. https://doi.org/10.1016/j.sbspro.2014.06.027

Yusoff SW, Idris AF, Adeyemi A, Haruna J (2013) Islamic banks CSR and its impact on societal development in Malaysia: an analysis from Islamic and conventional economics perspectives. In: iECONS. pp 142–155

Yusuf MY, Bahari ZB (2015) Islamic corporate social responsibility in Islamic banking: towards poverty alleviation. In: El-Karanshawy HA, Omar A, Khan T et al (eds) Ethics, Governance and Regulation in Islamic Finance. Bloomsbury Qatar Foundation, Doha, pp 73–90

Zaher TS, Hassan MK (2001) A comparative literature survey of Islamic finance and banking. Financ Mark Inst Instrum 10:155–199. https://doi.org/10.1111/1468-0416.00044

Zahid MA, Hassan KH (2012) Corporate social responsibility to employees: considering common law vis-a-vis Islamic law principles. Pertanika J Soc Sci Humanit 20:87–100

Zaidi A, Low KCP (2014) The koranic discourse on corporate social responsibility. In: Low K, Idowu SAS (eds) Corporate social responsibility in Asia. Springer, Cham, pp 109–124

Zain MM, Darus F, Ramli A (2015) Islamic ethical practices and the marketplace: evidence from Islamic financial institutions. Procedia Econ Financ 28:266–273. https://doi.org/10.1016/S2212-5671(15)01110-7

Zainol Z, Kassim SH (2012) A critical review of the literature on the rate of return risk in Islamic banks. J Islam Account Bus Res 3:121–137. https://doi.org/10.1108/17590811211265948

Zainon S, Sanusi ZM, Ahmad RAR et al (2014) New improved reporting index of corporate social reporting for Shariah-compliant companies. Procedia 145:146–151. https://doi.org/10.1016/j.sbspro.2014.06.021

Zaki A, Sholihin M, Barokah Z (2014) The association of Islamic bank ethical identity and financial performance: evidence from Asia. Asian J Bus Ethics 3:97–110. https://doi.org/10.1007/s13520-014-0034-7

Acknowledgements

The authors would like to acknowledge the kind guidance of the editor-in-chief (Prof. Dr. Jörn Block), and the anonymous reviewers for their constructive comments and invaluable suggestions throughout the review process.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Zafar, M.B., Sulaiman, A.A. Corporate social responsibility and Islamic banks: a systematic literature review. Manag Rev Q 69, 159–206 (2019). https://doi.org/10.1007/s11301-018-0150-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-018-0150-x