Abstract

This paper investigates how reports concerning a given country’s prospects affect investment decisions in two stylized, artificial organizational settings. We designed a role-game laboratory experiment, where subjects were asked to make investment decisions for two types of fictitious companies from the same country. We found that when available reports included positive country prospects, subjects strategized more on investments regardless of the characteristics of their organization. When reports included negative prospects, however, certain organizational peculiarities influenced the subjects’ interpretations, with decision-makers opting for more prudent plans when managing a more traditional company. Cognitive maps of decision makers showed that subjects considered investment strategies as a means to fulfil a company’s role expectations regarding appropriate decisions. Notwithstanding all caveats due to the artificial and simplified nature of our experimental setting, our findings indicate the need for more research on the effect of reports and prospect analysis on strategic decisions of companies, especially when business prospects are uncertain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Managers formulate expectations about the future of their company often under conditions of uncertainty, especially when outcomes depend on external factors (Tapinos and Pyper 2018). Investing in innovative projects or cutting existing services are decisions involving opportunities and constraints, which often result from exogenous events (Goldstein, Hazy and Lichestein 2010; Daniel and Daniel 2018). These strategic decisions depend on subjective interpretation of risky options and multi-dimensional cognitive processes where subjective expectations and environmental factors interact in complex ways (Hubbard 2010; Cornelissen and Werner 2014; Giorgi, 2017; Chaxel et al. 2018).

Research has shown that organizational decision makers may differ as to how they perceive the environment (Weick and Roberts 1993), and certain characteristics of the business context in which they are immersed can have a constructive role in shaping their beliefs and expectations (George and Dane 2016; Christian et al. 2017; Giorgi 2017). However, while human behavior is often situational (Lengbeyer 2007), the “context” in which organizational decision-makers operate is often only vaguely defined (e.g., the ‘environment’), due to an interplay of macro, meso and micro level factors. These include internal constraints imposed by certain specific organizational characteristics on how managers perceive the context.

Previous research has considered the “organizational social context” as an umbrella concept covering a variety of factors—from proficiency culture to stressful climate, from leadership to diversity (Beidas et al. 2014; Lord, Gatti and Chui 2016)—more or less directly linked to job satisfaction (Glisson et al. 2014). Other studies on social influence and market behavior have conflated this concept with ‘information’ (e.g., Beber and Brandt 2010; Boero et al. 2010; Rao and Srivastava 2014). For instance, organizational research has mainly focused on the micro level by examining proximate factors of decision-making in certain organizational structures (Mesut 2009), with relevant implications on organizational culture (Alvesson 2002; Yates and de Oliveira 2016; Jalal, 2017), climate (Arnaud and Schminke 2012), power (Bunderson and Reagans 2011), and leadership and ethics (Sarwar 2013; Lord, Gatti and Chui, 2016). While these organizational studies have often focused on specific characteristics of ‘internal’ organization, research on business scenarios has considered large-scale aggregates and macro socio-economic trends. As a result, less attention has been paid to certain mediating organizational factors that might influence decision-making (e.g., Axelsson et al. 2009; Sovacool 2016).

Our paper aims to improve our understanding of certain organizational mechanisms mediating between macro contexts and micro decision processes. Previous research has shown that when facing relatively well-structured problems, decision makers tend to economize on cognitive resources by relying, even unintentionally, on framing effects, such as opinions of relevant others or defensive routines (Simon 1973; Levinthal and Rerup 2006; Kheirandish and Mousavi 2018). When problems are ill-structured, decision makers tend to follow adaptive heuristics by exploiting experience and analogies that reduce strategic and operational uncertainty into a coherent ‘problem-space’ – to paraphrase Nevel and Simon (1972; see also Goel 1992; Casnici et al. 2019).

In this respect, research on organizational cognition has emphasized the importance of frames and sense-making (Levin et al. 1998; Maitlis and Christianson 2014; Giorgi 2017). Following Weick (1995), rather than merely processing available information, organizational subjects actively “construct” the meaning of their environment searching for “mindfulness”. This includes demanding scrutiny of existing expectations and continuously improving expectations based on experience and foresight. Indeed, purposeful choices require a mindful infrastructure that allows decision makers to resist oversimplification, adapt and learn from experience (Weick and Sutcliffe 2007).

This implies that subjective perceptions of organizational decision-makers concerning the business scenario can be either amplified or mitigated by company-specific organizational settings (Elbanna and Child 2007; Whittington 2007). These can be viewed as “distributed cognition” artefacts, which either constrain or enable meaningful individual or collective decisions (Lant and Shapira 2001; Chow 2017; Secchi and Bardone 2009).

We argue that in situations of risky options, the organizational setting of a company, such as its line of business, structure, and control mechanisms could help decision makers filter context-induced perceptions by imposing a certain degree of coherence between individual propensities and role expectations (Sitkin and Pablo 1992; Wiseman and Gomez-Mejia 1998). For instance, consider two managers, one leading a manufacturing family firm, another leading a biotech quoted on the stock market. Not only will they react differently to business scenario information, they also will interpret critical external factors differently, due to company-specific role expectations (e.g., Ainsworth and Cox 2003). Furthermore, it is probable that under critical conditions, their investment decisions will reflect not only specific and relevant business information but also more general social and political prospects exogenous to the company (Larrick 2016). This could be “irrational” in strictly ‘economic’ terms as expected marginal returns from information on country reports and the general business context are often questionable. However, we know that decision-makers often tend to cope with risky options by relying on social information and making sense of the larger socio-economic and political environment in which they operate (Elbanna and Child 2007).

The fact that decision makers can be influenced by a larger set of contextual factors to assess available investment options has been found in previous studies (e.g. Berger 2005; Shama 1993; Curran 1996; Latham 2009; Soroka 2006; Juanchich et al. 2012; Casarin and Squazzoni 2013). Indeed, one of the most distinctive sources characterizing organizational heterogeneity is how decision makers constructively filter and make sense of these contextual factors (Weick et al. 2005). First, decision makers do not have a single best way to respond to an increasingly complex business landscape, including the possible effect of socio-political trends and events (Berger 2005; Goldstein, Hazy and Lichstein 2010). Second, the variety of business strategies, including multiplicity of experiments, entrepreneurial risk-taking and new combinations of organizational forms, does not affect the specific dynamic capabilities of companies. The organizational capability of adaptively reacting to complex circumstances also depends on how contextual factors are filtered and constructively interpreted by decision makers (Fainshmidt et al. 2016).

Our study aims to explore the mediating function of organizational settings, including role expectation, to help decision-makers filtering the available information on the more general socio-political context in which their organization operates. We did so by building a role-game laboratory experiment where subjects were embedded in fictious, stylized organizational settings and had to make investment decisions after receiving manipulated information on country prospects. The article is structured as follows: The following section presents our study, with particular attention to the hypotheses that guided it, the experimental scenario and the related variables. The third section illustrates our results, while the fourth discusses our findings and study limitations.

2 Hypotheses

Research has shown that managerial responses to the business context are influenced by certain organizational characteristics of the company in which decision-makers are called on to take responsibility (Shama 1993; Curran 1996; Latham 2009). The subjective capability of contextualizing task-environment factors depends on a mix of cognitive and organizational processes, which often influence role expectations (O’Connor 2008; Prange et al. 2018).

For instance, if we consider decision-makers’ general tendency of taking risks especially when conditions are positive, negative information on social, economic or political conditions could induce decision makers embedded in traditional organizations to reduce their risky attitudes to protect their company. On the contrary, in dynamic and innovative organizational settings decision makers could even reverse the potential effect of negative information on social, economic or political conditions and make riskier decisions (Johnson and Tversky 1983), especially when time pressures are considerable (Saqib and Chan 2015). Previous studies found that high level decision-makers in innovative organizations would be more comfortable dealing with complex situations, such as socio-economic shutdown (Manohar and Pandit 2014), decline (Miller 1983) or turbulence (Kjærgaard 2009). Whenever negative contextual conditions prevail, it is probable that the organizational identity of decision-makers is even more important to mediate subjects’ cognitive representations of future scenarios (Staw 1997).

This has led to our first hypothesis on the link between context reports, organizational setting, and decisions:

Hypothesis 1

Whenever country reports include negative prospects, decision makers leading more innovative organizations will make riskier decisions than those in more traditional organizations.

Research suggests that subjects tend to risk more when under positive emotional conditions, because they perceive the environment as more certain and secure (Yuen and Lee 2003, 12). “Unrealistic optimism” (Shepperd et al. 2015) and “irrational optimism” (Shiller 2000; 2008) are terms that reflect the idea that in positive scenarios, decision makers believe they have a higher locus of control, which often backfires on perceived behavioral control (Ajzen 2002). Even unconscious internal pressures stimulate risky behavior, due to self-serving effects (Lin et al. 2017). The fact of being “internal” rather than “external” leaders is positively associated with a higher locus of control, regardless of the organizational setting being traditional, simple or innovative (Miller 1983).

The internal locus of control means people’s propensity to control events such that success or failure could possibly be directly ascribed to their own personal skills or abilities. Given that the internal locus of control significantly correlates with risk seeking (Miller et al. 1982), we hypothesized that:

Hypothesis 2

Whenever country reports included positive prospects, differences in organizational settings will have negligible effects on subjects’ investment decisions.

If we consider symmetric and adaptive reactions to positive or negative information, we should expect an increasing subjective perception of the level of risk—probably of different magnitude—when comparing negative and positive information, depending on the organizational context. Here, following the previously considered experiment, we assumed that leading a traditional family firm could make-decision makers more sensitive to context changes and so more prone to adaptations (Kerzner 1979). This includes risking less in cases of negative information (following Hypothesis 1) but also risking more in cases of positive information. This is reasonable if we consider role expectations that characterize traditional organizations, in which leading decision makers are closer to each process, from cost control to technology development (Day 1994), and are sensitive to the responsibility of protecting family ownership from business fluctuations (Vandekerkhof et al. 2018).

On the other hand, a stronger focus on internal strategies, solid confidence on long-term planning and reactions to unforeseen events are typical of innovative organizations (Calantone et al. 2003; Teece et al. 2016). These aspects would make organizational identity relatively stable against the variation of contextual factors (Morsing 1999), with decision-makers more sensitive to leadership role expectations (Carroll and Levy 2008).

This has led to the following hypothesis:

Hypothesis 3

(a) When embedded in a traditional organizational setting, decision makers will invest more whenever prospects are positive and less when prospects are negative; (b) When embedded in an innovative organizational setting, decision makers will invest regardless of prospects and scenarios.

3 The experiment

Our experiment included 160 participants, 87 males (54.37%) and 73 females (45.63%). Participation was restricted to undergraduate students of the University of Brescia, Faculty of Economics and Business Administration, Brescia, Italy. They were recruited on a voluntary basis and gave informed consent via ORSEE (http://neworsee.unibs.it//public), which is a standard online tool to manage experimental recruitment. All students could participate in only one of the experimental treatments. The age range of subjects was between 19 and 30 years old. The experiment was run at the GECS laboratory of the Department of Economics and Management of the University of Brescia, which was equipped with the experiment software z-Tree (Fischbacher 2007). The experiment was based on a 2 × 2 factorial design (see Table 1), where subjects were randomly assigned to one of four treatments combining the type of company that we asked them to lead and the type of country report in which the company operated (negative vs positive).

Before the experiment, each subject was pretested on risk propensity. The experiment took about 55 min. Instructions were read on a computer screen and subjects could not communicate during the experiment (for further information about the experiment instructions and the risk propensity test, see the Appendix). Subjects’ compensation was fixed, i.e., 15 euro, plus a show-up fee of 5 euro, which was paid in cash immediately after the experiment. Full anonymity in each stage of the experiment was guaranteed. We deliberately used deception to add realism to the experiment as subjects were induced to believe that their earnings depended on their decisions.

The structure of our role-game included information, decision and result feedback. Subjects were provided with a short report of their company, which aimed to help them contextualize decisions by understanding certain salient characteristics of the organizational setting (for a summary of the company report, see Table 2). Note that our idealized examples of traditional/innovative organizational settings were selected to reflect the typical characteristics of the business industry in Brescia (Minetti et al. 2015; Giacomini, Muzzi and Albertini 2016), which is dominated by two business archetypes: the family-owned manufacturing companies versus the high-biotech companies quoted on the stock market. This allowed us to ensure that subjects would find these experimental conditions familiar.

Subsequently, subjects received a second report on the business context, which included information on market and business conditions. This included the state of the economy of the fictitious country in which the company operated (called “Wordland”), and the trend of the stock market and the bank sector. This was to trigger the subjects’ perception on the prospects of their business context, which represented a steady moderately positive economy, whose trends were made coherent with the real economy of the experimental subjects’ country. This report was available to everyone in the same version in all treatments.

Additionally, an initial group of subjects received a country report including negative political and social prospects while a second received the same report but with positive prospects. This part included information about Wordland’s population growth/decline, immigration rates, women and young employment rate, and the percentage of students graduating in engineering and science. Note that all of these country reports were pre-tested through a survey on a large population of students, who were asked to rate the perceived positivity/negativity of country general prospects. These students did not participate in the experiment (see detail on the pre-test in the Appendix).

Subjects were provided with a fictitious budget for the current business year and were asked to decide how to allocate it between the given options. They were provided with a pre-arranged list of investment options such as: “improving existing products”, “cutting costs”, “disinvesting in unprofitable products and business sectors”, “launching new markets”, developing new products”, “establishing a large-scale off-the-job, professional training program for the personnel”. They were then asked to allocate budget resources among all these available options.

Following Kitching et al. (2009), we hypothesized three possible business strategies (see Table 3) as follows:

-

1.

Retrenchment strategy (lowest risk ratio of profit and loss): i.e., prudential decisions intended to cut operating costs and disinvest from non-core assets, e.g., “cutting costs” (B) and “disinvesting in unprofitable products and business sectors” (C);

-

2.

Investment strategy (highest risk ratio of profit and loss): i.e., exploration decisions addressed to innovation and market diversification, e.g., “launching new markets” (X) and “off-job, professional training programs for the personnel” (Y);

-

3.

Ambidextrous strategy (moderate risk ratio of profit and loss): i.e., a mix of retrenchment and investment strategies, e.g., “improving existing products” (Z) and “developing new products” (A).

Each decision was assigned an expected level profit as well as a probability of failure. While certain decisions were more risky but at the same time more potentially profitable, others were more prudential but had lower expected returns. Expected payoffs were the same for all strategies and calculated as (1–R)*P, where R indicated the risk and P the profit. Subjects knew that decisions with a higher risk potentially yielded higher returns.

After the investment decision, subjects received a response from a fictitious simulated market, in terms of percentage of revenues lost or gained by their company. The response was fully randomized independent of the subjects’ investment decision.

Finally, subjects were asked to fill in an ex-post questionnaire on motivation, where we asked them to explain their decisions and reflect on the business and country context. We used these data by applying cognitive mapping techniques that allowed us to control for perceptions, either individually or collectively for each combination of our factorial design (Laukkanen 1994). The text of their response was used to identify a simplified scheme of constructs (Clarkson and Hodgkinson 2005). These were then transformed into semantic networks that reflected each main causal relationship found in the text (“X led to Y”; “X caused Y”; “X was why I chose Y”), including patterns of causal beliefs.

The cognitive mapping technique was instrumental to examine complex relationships between concepts either individually or collectively. This technique has been widely used for problem diagnosis in political science and organizational decision-making (e.g., Axelrod 1976; Eden 1992, 2004; Weick 1995). Starting from the questionnaire, we first analyzed how subjects explained the reasons which informed their investment strategies (e.g., Carley 1997; Steyvers and Kooijman 2009). We then built a collective map of cognitive reasoning for each treatment (Carley and Palmquist 1992) by concentrating only on causal links (Fournier 1996).

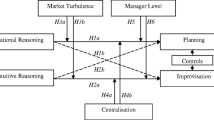

For the sake of readability, we clustered each map into four domains, each of them pertaining to different stages of subject decisions: (1) Choice Domain (CD), i.e., the final investment choice; (2) Final Causes Domain (FCD), which included the ultimate link between one or more decision-makers’ strategies and their investment choice; (3) Argumentative Domain (AD), which included concepts with at least one causal link to FCD concepts; (4) Peripheral Domain (PD), which represented concepts that were not directly related to any other domain.

For “causal links”, we meant any connections that a concept w had both with its causes (e.g., “w was generated/affected by h”) and its consequences k (e.g., “w brought to/led to/influenced k”) or possible consequences (e.g., “w will bring to/will lead to/will influence k”). Each of the four congregate maps was built by aggregating connections between concepts as they were established by individuals of the same experimental treatment. Rather than clustering concepts around the same topics (e.g., see Eden 1988), we grouped together concepts (variables) in a diagrammatic form (i.e., graph theory) depending on the role played in the argumentative chain extracted from subject responses. For instance: “I selected option W (choice) because I think it should have for the company a positive consequence K (final causes/reason) on X, and X has proven to be crucial in similar previous conditions (argumentation)”.

In order to perform our analysis, we used the following software: CmapTools (version 6) for cognitive mapping, Ucinet (version 6) for network indicators, Gephi (version 0.9) for network visualization and Stata (version 14) for data analysis.

4 Variables

Dependent variable. As a measure for the dependent variable, we defined an “Average Investment Index” (AI) that consisted of the sum S invested by subject i in each strategy—from X to C -weighted by the corresponding risk ratio r (see Table 3).

5 Independent variables

Our independent variables were mainly concerned with controlling individual traits, such as year of study, gender, age and individual risk-propensity. For the latter, we performed an ex-ante risk propensity test already used by Casarin et al. (2015). Following Casarin et al. (2015), we aggregated indicators to formulate a composite index that measured this factor individually for each subject.

In order to corroborate our analysis, collective cognitive maps were built from the text of the ex-post questionnaire as semantic social networks, upon which we performed both structural network measures—i.e., density and E-I index of homophily for each map domain, ratio between reactive vs. proactive attitude—and nodes indexes—i.e., betweenness centrality, in-degree and out-degree index (see details below).

6 Results

First, it is worth noting that risk propensity was normally distributed amongst subjects (Shapiro–Wilk test: W = 0.997; p = 0.982). Figure 1 shows treatment differences in the AI index as follows (standard deviation in parenthesis): T1 (family firm + negative prospects), M = 232,125 (37,335.58); T2 (family firm + positive prospects), M = 246,730 (27,969.94), T3 (biotech firm + negative context), M = 252,075 (27,571.48); T4 (biotech firm + positive prospects), M = 245,992.5 (23,711.51). Figure 2 shows that subjects followed riskier investment strategies more frequently than ambidextrous in T1 (family firm + negative prospects), T2 (family firm + positive prospects), and T3 (biotech firm + negative prospects), while retrenchment strategies were followed less frequently in T2 (family firm + positive prospects), T3 (biotech firm + negative prospects), and T4 (biotech firm + positive prospects).

Considering cross-treatment results, we found that Hypothesis 1 (when leading a bio-tech company, subjects were less sensitive to negative prospects) was corroborated as the AI index was significantly higher in T3 (biotech firm + negative prospects) than in T1 (family firm + negative prospects) (t(78) = −2.72, p = 0.0040). Hypothesis 2 (when prospects are positive, no significant difference in investment decisions) was corroborated, as we did not find any significant difference in the AI index of T4 (biotech firm + positive prospects) and T2 (family firm + positive prospects) (t(78) = 0.13, p = 0.5504). Hypothesis 3a (less risky investments when subjects lead a family firm and prospects are negative) was corroborated as the AI index was significantly higher in T2 (family firm + positive prospects) than in T1 (family firm + negative prospects) (t(78) = −1.98, p = 0.0256). The same occurred with Hypothesis 3b (no context-specific differences on risky investments when subjects lead a biotech) as we did not find any significant difference in the AI index of T4 (biotech firm + positive prospects) and T3 (biotech firm + negative prospects) (t(78) = 1.06, p = 0.8533).

We then corroborated this mean-comparison test with a linear regression analysis, in which we considered the potential effect of socio-demographic characteristics on subject investments. We recoded treatments into dummy variables and considered gender, study seniority, age and risk propensity as control variables. Note that in order to improve control and comparability, we did not consider the absolute value of subjective risk propensity but its deviation from the average.

The second column of Table 4 shows the coefficients of the regression for each model’s variable. We used T1 (family firm + negative prospects) as the reference category because in this treatment, the level of subjects’ investments varied more. Results of the regression model indicated that subject’s gender and risk propensity had a significant effect on the AI index, with females investing more than males. An OLS analysis considering the effect of average risk propensity on the AI index confirmed that there was a significant difference between subject investment in T2 (family firm + positive prospects), T3 (biotech firm + negative prospects) and T4 (biotech firm + positive prospects) compared to T1 (family firm + negative prospects) (see Table 5). Further tests confirmed that females risked more than males especially in T3 (biotech firm + negative prospects).

We then checked the model on contrasts of marginal linear predictions. Results of the Helmert subsequent contrast effects test confirmed that the AI Index was significantly different when subjects were asked to lead a family manufacturing firm facing negative prospects to other treatments (see Table 5).

The results of the Helmert’s subsequent contrast effects corriborated our hypotheses, as already estimated with the mean-comparison test. Indeed, T1 (family firm + negative prospects) was significantly different from any other treatment (see first row in Table 5), in regards to Hypothesis 1, 3(a) and 4, while T2 (family firm + positive prospects) was not significantly different from T3 (biotech firm + negative prospects) or T4 (biotech firm + positive prospects) (see second row in Table 4), in regards to Hypothesis 2, and T3 (biotech firm + negative prospects) was not significantly different from T4 (biotech firm + positive prospects) (see third row in Table 4), in regards to Hypothesis 3(b).

We then used a two-stage coding technique on concepts and links based on the text of each answer to the ex-post questionnaire (Carley 1997). We only considered causal links and concepts were considered both as factual beliefs concerning possible consequences of subject decisions and expected reasons for subject decisions.

Note that this simplified our causal maps (Markíczy and Goldberg 1995), by highlighting tie weight and node dimension from multiple use by different subjects (Cuhna and Morais 2016). Defining different clusters inside collective causal maps was instrumental to achieve a more systematic representation of the map itself (Marx and Dagan 2001).

We then built a collective causal map for each treatment, ℳ(n) = {; ; } where n was the treatment number, the set of variables (points/vertices), the set of ties (arrows) and the set of weights where : → (Chaib-Draa and Desharnais 1998). Our causal maps could therefore be seen as directed graphs representing subjects’ assertions about their factual beliefs. Descriptive graph statistics were as follows:

-

ℳ (T1) = {75; 92}; Density = 0.017

-

ℳ (T2) = {69; 100}; Density = 0.021

-

ℳ (T3) = {66; 122}; Density = 0.028

-

ℳ (T4) = {53; 82}; Density = 0.030

Concerning Hypothesis 1 (when leading a bio-tech firm, subjects are less sensitive to negative prospects), we found that the collective cognitive map contained two leading nodes, both concerned with the social context, i.e., “negative social context” with a weighted degree degw (n) = 24, and “Wordland economic condition”, with degw(n) = 23. These two nodes were crucial as they linked argumentation and final cause (in blue). They respectively showed betweenness centrality CB(n) = 43.0and CB(n) = 32.0, with also high levels of closeness centrality CC(n) = 0.49 and CC(n) = 0.60. This would confirm that all subjects considered retrenchment strategies (yellow on the right-bottom of the map) as a rational response to the negative nature of prospects reflected in the country report.

The same occurred for the ambidextrous strategies (yellow area on the middle-right of the map), which had a lower impact when compared with T2 (family firm + positive prospects), T3 (biotech firm + negative prospects) and T4 (biotech firm + positive prospects). Note that investment decisions on “vocational training” (CB(n) = 47.6) were also generically justified by external critical events.

The subjective perception of a critical context was confirmed by high levels of betweenness centrality of specific-related events in the same domain, such as “compromised social development”, “lack of demand in specific sectors”, and “possible loss of current customers”. These concepts were linked by only one individual construct (“avoid risk-seeking”, with a CB(n) = 11.0, and a CC(n) = 0.46) (see Fig. 3 and 4).

Collective causal map of T1 (family firm + negative prospects), with each domain displayed with a different color (peripheral domain in green, argumentative domain in orange, final causes domain in blue, and choice domain in yellow). The thickness of ties is proportional to their weight, while tie colors are the source node’s ones

Collective causal map of T3 (biotech firm + negative prospects), domain colors, ties thickness and ties colours are the same as Fig. 3

As regard Hypothesis 1, the T3 graph has a different structure. Items included in the argumentative domain were both larger and less concentrated than those in Treatment 1. The broad perception of the social context was limited to “Worldland economic conditions”, which showed a similar weighted degree when compared with T1 (family firm + negative prospects) (degw(n) = 20.0. Unlike T1, T3 (biotech firm + negative prospects) had not only source (causal logic) but also target-items (consequential logic). This meant that the argumentative support of the subject’s final decision was coupled with causes and effects, including for example, “long-term advantage”, “high possible returns”, “secure employees’ loyalty” and “maintaining competitiveness” (see the four arcs of blue from the final causes toward the argumentative domain).

The fact that subjects’ decisions in T3 (biotech firm + negative prospects) were coherent across domains, is confirmed by looking at an E-I index that we calculated for each domain (see Table 6), by using Krackhardt and Stern (1988) as follows:

where EL was the number of links connecting nodes inside and outside the domain, while IL was the number of links connecting only nodes inside the domain. This meant a maximum score of 1.0, when all links crossed the domain border and a minimum score of −1.0, where links were only inside the domain.

Table 6 shows that T3 (biotech firm + negative prospects) domains were only characterized by external links (E-I index = 1.0), which suggests full integration between each part of the map. Hence, even if subjects were exposed in T3 (biotech firm + negative prospects) to the same negative scenario of T1 (family firm + negative prospects), their reasoning was linear, forward-looking and not conditioned by the negative social context. Furthermore, while a few subjects rationalized their decision via personal beliefs, most investment decisions were due to organizational expectations. They stressed market opportunities and the company’s growth through “vocational training” (note that this item frequently linked argumentative domains and final causes) as a means to maintain innovation and competitiveness.

For instance, two subjects in T3 (biotech firm + negative prospects) similarly reported that:

“I invested mostly on training. The reason is simple. Not only inadequate training is negative for the company; there is always the possibility that the potential emerging from each individual during a training course specialization is much greater than the potential of an individual with experience.” (Subject # 153 in T3).

“In a society where there is a drop of science graduates and a climate of distrust, investing on employees’ training can help the company being competitive despite the stagnant scenarios and retain the workforce. In the short-term, you may get negative feedback, but in the long-term the company will increase its competitiveness by developing new products that shall be even improved later on.” (Subject # 152 in T3).

Furthermore, subjects in T3 (biotech firm + negative prospects) tended to explain their risk taking as a means to fulfil the expectation of an innovative biotech.

“My choice goes beyond the motivation to favor the community, which would obviously benefit from new job opportunities. I adjusted my risk-profit calculations to the company's need for implementing training programs for the personnel as a means to react against the general “depression”. Indeed, Worldland was characterized by unskilled labor.” (Subject # 17 in T3).

If we compare T2 (family firm + positive prospects) and T4 (biotech firm + positive prospects) collective cognitive maps (Figs. 5 and 6, respectively), there is support for Hypothesis 2 (when prospects are positive, no significant organizational difference in subject decisions). It is worth noting here that the two maps were very similar. Indeed, in their argumentative domains the most connected nodes were similarly referred to the social context (“Social stability and positive social context” in T2 (family firm + positive prospects) and “Favorable economic conditions” in T4 (biotech firm + positive prospects), each one with a degree value d = 4), while nodes concerned with the organizational setting were irrelevant (“Strengths of the company” in T2 (family firm + positive prospects) with a degree value d = 4, and "Organizational setup of the company" in T4 (biotech firm + positive prospects), with a degree value d = 2). This would suggest that the subjects’ reasons were influenced more by their social context than by their organizational setting. Note that final causes were similar for both maps, with nodes with average degrees of 8.91 in T2 (family firm + positive context) and 10.10 in T4 (biotech firm + positive prospects) (see Figs. 5 and 6).

Collective causal map of T2 (family firm + positive prospects), domain colors, ties thickness and ties colors are the same as Fig. 3

Collective causal map of T4 (biotech firm + positive prospects), domain colors, ties thickness and ties colors are the same as Fig. 3

The cognitive maps also supported Hypothesis 3(a) (less risky investments when subjects were leading a family firm in times of negative prospects). We found various links between items related to the negative prospects and the family settings of the company. For instance, we found various social and organizational items related to the “negative social context” (out-degree = 9), including "increasing corporate social responsibility", "people mistrust" or "re-analyzing and grabbing new people needs". Similar outcomes were found in T2 (family firm + positive prospects), where “current Worldland economic conditions” conveyed direct links with other elements of the positive social context, such as “social stability and positive social context” and even indirect connections with organizational factors, such as “strength of the company” via “vocational training”.

The fact that subjects’ decision combined social context, organizational setting and strategic decisions, was not found when comparing T3 (biotech firm + negative prospects) and T4 (biotech firm + positive prospects). This corroborated Hypothesis 3(b) (no context-specific differences on risky investments when subjects were leading a biotech firm). In this case, the high-risk assumptions of decision-makers which emerged when comparing T3 (biotech firm + negative prospects) and T1 (family firm + negative prospects), were not found when comparing T4 (biotech firm + positive prospects) and T3 (biotech firm + negative prospects).

Here, the organizational setting did not affect subjects’ perceptions and so did not trigger an adaptive attitude towards investment risk. For instance, in T4 (biotech firm + positive prospects) the main node related to the social context, i.e., “Favorable economic conditions” (degree value d = 4), did not convey a significant line of thought (betweenness centrality of CB(n) = 29.00), while in T3 (biotech firm + negative prospects), “Worldland economic conditions” showed a degree value d = 6 but a betweenness centrality of CB(n) = 46.00.

7 Discussion and conclusions

Our results point to the sensitivity of decision makers to information from country reports and prospects, including very general information on the socio-economic and political scenario in which the company operates (Daniels and Zlatev 2019). We also found that certain characteristics of the organizational setting could mediate perceptions via role expectations, especially when prospects were critical (Blay et al. 2012). While risky investment options were typically more problematic when prospects were negative, certain company-specific characteristics could make decision makers less sensitive to external contextual factors (Ortiz-de-Mandojana and Bansal 2016). This would suggest that the macro social and economic scenarios and the organizational context around decision makers might have composite effects depending on their mutual characteristics (Johns 2006).

Following Newell and Simon (1972), these effects influence how decision makers frame the ‘problem space’. Indeed, we found that innovative organizational settings could provide decision makers role expectations leading to autonomy and confidence that protect decision makers from potentially critical external factors and so more prone to invest in riskier strategies. We also found that in these settings, information on negative prospects could even stimulate decision makers to consider high-risk decisions (Ekvall 1996). An interesting example was the case of women, whose risky decisions were more sensitive to the treatment effect when asked to lead a biotech firm exposed to a negative context. This would confirm recent findings on gender differences in risk attitudes, which highlighted the fact that tasks, domains and contexts can make females at least as risky as males (Nicholson et al. 2005; Filippin and Crosetto 2016). Furthermore, we found that more traditional organizational settings, such as a manufacturing family firm, made decision makers more sensitive to prospects especially when these convey negative information. In these cases, ambidextrous and defensive strategies seem to create a comfort zone against riskier options (Arregle et al. 2007).

Our cognitive map analysis suggested that investment decisions reflected role expectations, which were intrinsic to specific organizational characteristics of the company more than subjective characteristics (Nadiv et al. 2017). While subjects followed defensive strategies to protect the family manufacturing business from critical scenarios, they took risky strategies to fulfil the expectations of a biotech company quoted on the stock market regardless of external factors. At an individual level, our analysis of cognitive maps confirmed that when exposed to information on positive prospects, subjects focused more on objectives and strategic goals, eventually blaming external factors when prospects were critical.

To conclude, our findings showed that organizational settings (Parker 2006) could be seen as repositories of “cognitive resources”, which are part of the mindful infrastructure of the organization (e.g., Parker 2006; Grégoire et al. 2011; Weick and Sutcliffe 2007). Secondly, the importance of information concerning the larger social context surrounding organizations calls for reconsideration of the importance of exogenous information. Indeed, business organizations are immersed in a redundant world in which a variety of other actors, including public and private agencies and the media, release and distribute information on scenarios and prospects (Casarin and Squazzoni 2013). The complexity of the current business landscape implies that economic, political, and social events are systematically intertwined, making organizations vulnerable to unforeseen events (Goldstein, Hazy and Lichtenstein 2010). While the context has always been important to understand organizational decision-making, it is probable that, today, the unpredictability of future scenarios has made decision-makers even more sensitive to reports and business prospects as this can potentially reveal future business trends. This has raised concerns on the increasing dependence of organizations from external information sources, which often requires re-interpretation and contextualization (Savani and King 2015).

Obviously, our study is only explorative, with all due caveats concerning the simplification and artificiality of our experimental settings and findings generalizability (Levitt and List 2007; Falk and Heckman 2009). While our experiment allowed us to examine important macro, meso and micro factors via idealized controlled scenarios, it is questionable whether these decisions would be identical for high-level decision-makers in real organizational settings (e.g., Tosi et al. 2003). Furthermore, while the context and organizational fictitious examples of our design were intended to reflect an idealized business scenario familiar to our subjects, it is probable that repeating our explorative study with subjects from other countries would require adaptations (Burke et al. 2009). Another possible extension would be to test the effect of country reports and prospects on deeper forms of semantic, strategic and operational uncertainty rather than simply on risky investment options, as we have done here (e.g., Lane & Maxfield 2005).

Finally, although considering all these limitations, our study proposes an original integration of experimental and (semantic network) cognitive analysis. As regards cognitive factors, our analysis expanded on traditional approaches, such as “cognitive map connectivity” (Calori et al. 1994) or “conceptual map complexity” (Curşeu et al. 2010), by focusing on the clustering process of causal and argumentative domains of choice, so trying to reflect the aggregation of beliefs at the group cognitive level. We believe that combining different methods and measurements is instrumental to reconstruct macro–micro mediating factors, which are difficult to capture without tracing cognitive processes of decision makers. We hope that this mixed methods example could inspire further organizational research that tests hypotheses experimentally, while inducing experimental researchers to consider socio-cognitive factors in more detail.

References

Ainsworth S, Cox WJ (2003) Families divided: culture and control in small family business. Organ Stud 24(9):1463–1485

Ajzen I (2002) Perceived behavioral control, self-efficacy, locus of control, and the theory of planned behavior. J Appl Soc Psychol 32(4):665–683

Alvesson M (2002) Understanding organizational culture. Sage Publications, London

Arnaud A, Schminke M (2012) The ethical climate and context of organizations: a comprehensive model. Organ Sci 23(6):1767–1780

Arregle J-L, Hitt MA, Sirmon DG, Very P (2007) The development of organizational social capital: attributes of family firms. J Manage Stud 44(1):73–95

Axelrod R (1976) Structure of decision: the cognitive maps of political elites. Princeton University Press, Princeton

Axelsson E, Harvey S, Berntsson T (2009) A Tool for creating energy market scenarios for evaluation of investments in energy intensive industry. Energy 43(12):20692074

Beber A, Brandt MW (2010) When it can’t get better of worse: the asymmetric impact of good and bad news on bond returns in expansions and recessions. Rev Finance 14:119–155

Beidas RS, Benjamin Wolk CL, Walsh LM, Evans AC Jr, Hurford MO, Barg FK (2014) A complementary marriage of perspectives: understanding organizational social context using mixed methods. Implement Sci 9(1):1–15

Berger S (2005) How we compete. What companies around the world are doing to make it in today’s global economy. Doubleday, Random House Inc, New York

Blay AD, Kadous K, Sawers K (2012) The Impact of risk and affect on information search efficiency. Organ Behav Hum Decis Process 117:80–87

Boero R, Bravo G, Castellani M, Squazzoni F (2010) Why bother with what others tell you? An experimental data-driven agent-based model. J Artif Soc Soc Simul 13(3):6

Bunderson JS, Reagans RE (2011) Power, status, and learning in organizations. Organ Sci 22(5):1182–1194

Burke NJ, Joseph G, Pasick RJ, Barker JC (2009) Theorizing social context: rethinking behavioral theory. Health Educ Behav 36(1):55S-70S

Calantone R, Garcia R, Dröge C (2003) The effects of environmental turbulence on new product development strategy planning. J Product Innov Manag 20:90–103

Calori R, Johnson G, Sarnin P (1994) CEOs’ Cognitive maps and the scope of the organization. Strateg Manag J 15(6):437–457

Carley KM (1997) Extracting team mental models through textual analysis. J Organ Behav 11:533–558

Carley K, Palmquist M (1992) Extracting, representing, and analysing mental models. Soc Forces 70(3):601–636

Carroll B, Levy L (2008) Defaulting to management: leadership defined by what it is not. Organization 15(1):75–96

Casarin R, Squazzoni F (2013) Being on the field when the game is still under way. The financial press and stock markets in times of crisis. PLoS ONE 8(7):e67721

Casarin R, Casnici N, Dondio P, Squazzoni F (2015) Back to basics! The educational gap of online investors and the conundrum of virtual communities. J Financ Manag, Mark Inst 3(1):51–68

Casnici N, Castellani M, Squazzoni F, Testa M, Dondio P (2019) Adaptive heuristics that (Could) fit. information search and communication patterns in an online forum of investors under market uncertainty. Soc Sci Comput Rev 37(6):734–749

Chaib-Draa B, Desharnais J (1998) A relational model of cognitive maps. Int J Hum Comput Stud 49:181–200

Chaxel A-S, Wiggins C, Xie J (2018) The impact of a limited time perspective on information distorsion. Organ Behav Hum Decis Process 149:35–46

Chow JS (2017) How reason confronts experience: on naturalistic accounts of reason. Mind Soc 16:51–80

Christian JS, Christian MS, Pearsall MJ, Long EC (2017) Team adaptation in context: an integrated conceptual model and meta-analytic review. Organ Behav Hum Decis Process 140:62–89

Clarkson G, Hodgkinson G (2005) Introducing CognizerTM: a comprehensive computer package for the elicitation and analysis of cause maps. Organ Res Methods 8(3):317–341

Cornelissen JP, Werner MD (2014) Putting framing in perspective: a review of framing and frame analysis across the management and organizational literature. Acad Manag Ann 8(1):181–235

Cuhna AAR, Morais DC (2016) Analysing the use of cognitive maps in an experiment on a group decision process. J Op Res Soc 67:1459–1468

Curran J (1996) Small business strategy. In: Warner M (ed) The concise international encyclopedia of business and management. International Thomson Business Press, London, pp 4510–4520

Curşeu PL, Schalk R, Schruijer S (2010) The use of cognitive mapping in eliciting and evaluating group cognitions. J Appl Soc Psychol 40(5):1258–1291

Daniel PA, Daniel C (2018) Complexity, uncertainty and mental models: from a paradigm of regulation to a paradigm of emergence in project management. Int J Project Manage 36(1):184–197

Daniels DP, Zlatex JJ (2019) Choice architects reveal a bias toward positivity and certainty. Organ Behav Hum Decis Process 151:132–149

Day GS (1994) The capabilities of market-driven organizations. J Mark 58(4):37–52

Eden C (1988) Cognitive mapping. Eur J Oper Res 36(1):1–13

Eden C (1992) On the nature of cognitive maps. J Manage Stud 29:261–265

Eden C (2004) Analysing cognitive maps to help structure issues or problems. Eur J Oper Res 159(3):673–686

Ekvall G (1996) Organizational climate for creativity and innovation. Eur J Work Organ Psy 5(19):105–123

Elbanna S, Child J (2007) The influence of decision, environmental and firm characteristics on the rationality of strategic decision-making. J Manage Stud 44(4):561–591

Fainshmidt S, Pezeshkan A, Lance Frazier M, Nair A, Markowski E (2016) Dynamic capabilities and organizational performance: a meta-analytic evaluation and extension. J Manage Stud 53(8):1348–1380

Falk A, Heckman JJ (2009) Lab experiments are a major source of knowledge in the social sciences. Science 326:535–538

Filippin A, Crosetto P (2016) A Reconsideration of gender differences in risk attitudes. Manage Sci 62(11):3138–3160

Fischbacher U (2007) Z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fournier V (1996) Cognitive maps in the analysis of personal change during work role transition. Br J Manag 7:87–105

George JM, Dane E (2016) Affect, emotions, and decision making. Organ Behav Hum Decis Process 136:47–55

Giacomini D, Muzzi C, Albertini S (2016) Micro-context and institutional entrepreneurship: multiple case-studies of innovative start-ups. In: Visintin F, Pittino D (eds) Fast growing firms in a slow growth economy. Institutional conditions for innovation. Edward Elgar Publishing, Cheltenham

Giorgi S (2017) The mind and heart of resonance: the role of cognition and emotions in frame effectiveness. J Manage Stud 54(5):713–738

Glisson C, Williams NJ, Green P, Hemmelgarn A, Hoagwood K (2014) The organizational social context of mental health medicaid waiver programs with family support services: implications for research and practice. Adm Policy Mental Health Mental Health Serv Res 41(1):32–42

Goel, V. (1992). A Comparison of Well-structured and Ill-structured Task Environments and Problem Spaces. In: Proceedings of the fourteenth annual conference of the cognitive science society. Hillsdale: Erlbaum

Goldstein J, Hazy JK, Lichtestein BB (2010) Complexity and the nexus of leadership. Leveraging nonlinear science to create ecologies of innovation. Palgrave Macmillan, New York

Grégoire DA, Corbett AC, McMullen JS (2011) The cognitive perspective in entrepreneurship: an agenda for future research. J Manage Stud 48(6):1443–1477

Hubbard DW (2010) How to measure anything: finding the values of “intangibles” in business, 2nd edn. John Wiley, Hoboken

Jalal G (2017) Impacts of organizational culture on leadership’s decision making. J Adv Manag Sci Inf Syst 3:1–8

Johns G (2006) The essential impact of context on organizational behavior. Acad Manag Rev 31(2):386–408

Johnson EJ, Tversky A (1983) Affect, generalization and the perception of risk. J Pers Soc Psychol 45:20–31

Juanchich M, Sirota M, Butler CL (2012) The perceived functions of linguistic risk quantifiers and their effect on risk, negativity perception and decision making. Organ Behav Hum Decis Process 118(1):72–81

Kerzner H (1979) Project management: a systems approach to planning, scheduling, and controlling. Van Nostrand Reinhold, New York

Kheirandish R, Mousavi S (2018) Herbert Simon, innovation, and heuristics. Mind Soc 17:97–109

Kitching, J., Blackburn, R., Smallbone, D., and Dixon, S. (2009). Business Strategies and Performance During Difficult Economic Conditions. Project Report, Department for Business Innovation and Skills (BIS), London.

Kjærgaard AL (2009) Organizational identity and strategy: an empirical study of organizational identity’s influence on the strategy-making process. Int Stud Manag Organ 39(1):50–69

Krackhardt D, Stern RN (1998) Informal networks and organizational crises: an experimental simulation. Soc Psychol Q 51(2):123–140

Lane D, Maxfield RR (2005) Ontological uncertainty and innovation. J Evol Econ 15:3–50

Lant T, Shapira Z (2001) New research directions on organizational cognition. In: Lant T, Shapira Z (eds) Organizational cognition: computation and interpretation. Lawrence Erlbaum Associates Inc, Mahwah, pp 367–376

Larrick RP (2016) The social context of decisions. Annual Rev Organ Psychol Organ Behav 3:441–467

Latham S (2009) Contrasting strategic response to economic recession in start-up versus established software firms. J Small Bus Manage 47(2):180–201

Laukkanen M (1994) Comparative cause mapping of organisational cognitions. Organ Sci 5(3):322–343

Lengbeyer L (2007) Situated cognition: the perspect model. In: Spurrett D, Ross D, Kincaid H, Stephens L (eds) Distributed cognition and the will: individual volition and social context. MIT Press, Cambridge, pp 227–254

Levin LP, Schneider SL, Gaeth GJ (1998) All frames are not created equal: a typology and critical analysis of framing effects. Organ Behav Hum Decis Process 76(2):149–188

Levinthal D, Rerup C (2006) Crossing an apparent chasm: bridging mindful and less-mindful perspectives on organizational learning. Organ Sci 17(4):502–513

Levitt SD, List JA (2007) What do laboratory experiments measuring social preferences reveal about the real world? J Econ Perspect 21:153–174

Lin SC, Zlatev JJ, Miller DT (2017) Moral traps: when self-serving attributions backfire in prosocial behavior. J Exp Soc Psychol 70:198–203

Lord RG, Gatti P, Chiu SLM (2016) Social-cognitive, relational, and identity-based approaches to leadership. Organ Behav Hum Decis Process 136:119–134

Maitlis S, Christianson M (2014) Sensemaking in organizations: taking stock and moving forward. Acad Manag Ann 8(1):57–125

Manohar SS, Pandit SR (2014) Core values and beliefs: a study of leading innovative organizations. J Bus Ethics 125:667–680

Markíczy L, Goldberg J (1995) A method for eliciting and comparing causal maps. J Manag 21(2):305–333

Marx Z, Dagan I (2001) Conceptual magging through keyword coupled clustering. Mind Soc 4(2):59–86

Mesut A (2009) An organization development framework in decision making: implications for practice. Organ Dev J 27(4):47–56

Miller D (1983) The correlates of entrepreneurship in three types of firms. Manage Sci 29(7):770–791

Miller D, Kets De Vries MFR, Toulouse J-M (1982) Top executive locus of control and its relationship to strategy, environment and structure. Acad Manag J 25(2):237–253

Minetti R, Murro P, Paiella M (2015) Ownership structure, governance, and innovation. Eur Econ Rev 80:165–193

Morsing M (1999) The media boomerang: the media’s role in changing identity by changing image. Corp Reput Rev 2(2):116–136

Nadiv R, Raz A, Kuna S (2017) What a difference a role makes: occupational and organizational characteristics related to the hr strategic role among human resource managers. Empl Relat 39(7):131–1147

Newell A, Simon HA (1972) Human problem solving. Prentice-Hall, Englewood Cliffs

Nicholson N, Soane E, Fenton-O’Creevy M, Willman P (2005) Personality and domain-specific risk taking. J Risk Res 8(2):157–176

O’Connor GC (2008) Major innovation as a dynamic capability: a systems approach. J Prod Innov Manag 25:313–330

Ortiz-de-Mandojana N, Bansal P (2016) The long-term benefits of organizational resilience through sustainable business practices. Strateg Manag J 37:1615–1631

Parker WD (2006). The Socionomic Perspective on Social Mood and Voting: Report on New Mood Measures in the 2006 ANES Pilot Study. ANES Pilot Study Reports, Ann Arbor, MI: American National Election Studies.

Prange C, Bruyaka O, Marmenout K (2018) Investigating the transformation and transition processes between dynamic capabilities: evidence from DHL. Organ Stud 39(11):1547–1573

Rao T, Srivastava S (2014) Twitter sentiment analysis: how to hedge your bets in the stock markets. In: Can F, Tansel O, Faruk P (eds) State of the art applications of social network analysis. Springer International Publishing Switzerland, Heidelberg, pp 227–247

Saqib NU, Chan EY (2015) Time pressure reverses risk preferences. Organ Behav Hum Decis Process 130:58–68

Sarwar CI (2013) Future of ethically effective leadership. J Bus Ethics 113(1):81–89

Savani K, King D (2015) Perceiving outcomes as determined by external forces: the role of event construal in attenuating the outcome bias. Organ Behav Hum Decis Process 130:136–146

Secchi D, Bardone E (2009) Super-docility in organizations. Int J Organ Theory Behav 12(3):339–379

Shama A (1993) Marketing strategies during recession: a comparison of small and large firms. J Small Bus Manage 31(3):62–72

Shepperd JA, Waters EA, Weinstein ND, Klein WMP (2015) A primer on unrealistic optimism, current directions. Psychol Sci 24(3):232–237

Shiller RJ (2000) Irrational exuberance. Princeton University Press, Princeton

Shiller RJ (2008) The subprime solution: how today’s global financial crisis happened, and what to do about it. Princeton University Press, Princeton

Simon HA (1973) The structure of Ill structured problems. Artif Intell 4(3–4):181–201

Sitkin SB, Pablo AL (1992) Reconceptualizing the determinants of risk behavior source. Acad Manag Rev 17(1):9–38

Soroka SN (2006) Good News and bad news: asymmetric responses to economic information. J Politics 68(2):372–385

Sovacool BK (2016) How long will it take? conceptualizing the temporal dynaics of energy transitions. Energy Res Soc Sci 13:202–215

Staw BM (1997) The escalation of commitment: an update and appraisal. In: Shapira Z (ed) Organizational decision-making. Cambridge University Press, Cambridge, pp 191–215

Steyvers F, Kooijman A (2009) Using route and survey information to generate cognitive maps: differences between normally sighted and visually impaired individuals. Appl Cogn Psychol 23:223–235

Tapinos E, Pyper N (2018) Forward looking analysis: investigating how individuals ‘do? Foresight and make sense of the future. Technol Forecast Soc Chang 126:292–302

Teece D, Peteraf M, Leih S (2016) Dynamic capabilities and organizational agility: risk, uncertainty, and strategy in the economy. Calif Manage Rev 58(4):13–35

Tosi HL, Brownlee AL, Silva P, Katz JP (2003) An empirical exploration of decision-making under agency controls and stewardship structure. J Manage Stud 40(8):2053–2071

Vandekerkhof P, Steijvers T, Hendriks W, Voordeckers W (2018) Socio-emotional wealth separation and decision-making quality in family firm TMTs: the moderating role of psychological safety. J Manage Stud 55(4):648–676

Weick KE (1995) Sensemaking in organisations. Sage, Thousand Oaks

Weick KE, Roberts KH (1993) Collective minds in organizations: heedful interrelating on flight decks. Adm Sci Q 38:357–381

Weick KE, Sutcliffe KM (2007) Managing the unexpected: resilient performance in an age of uncertainty. Jossey-Bass, San Francisco

Weick KE, Sutcliffe KM, Obstfeld D (2005) Organizing and the process of sense making. Organ Sci 16(4):409–421

Whittington R (2007) Strategy practice and strategy process: family differences and the sociological eye. Organ Stud 28(10):1575–1586

Wiseman RM, Gomez-Mejia LR (1998) A behavioral agency model of managerial risk taking. Acad Manag Rev 23(1):133–153

Yates FJ, de Oliveira S (2016) Culture and decision making. Organ Behav Hum Decis Process 136:106–118

Yuen KSL, Lee TMC (2003) Could mood state affect risk-taking decisions? J Affect Disord 75:11–18

Funding

FS acknowledges support by a “Department of Excellence” grant from the Italian Ministry of Education, University and Research to the Department of Social and Political Sciences of the University of Milan and by a PRIN grant, no. 20178TRM3F_001. The funders had no role in the study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Experimental scenario

Subjects received the information on the company they were called to manage and on the business environment in which the company operates (see Information I). They were provided with a fictitious budget of 500,000.00 Euros for one business year and were asked to decide how to use this budget.

The description of the Information I

Profile of the high-tech organisation:

“You are the manager of ALPHA, a recently established biomedical company that includes three business units, i.e., biochemical, biotechnical, R&D departments and has its own patent office. Its core business is the development of new medical methods and substances for hospitals and patients. Clients are concentrated in the WORLDLAND zone. The company has been recently quoted on the GOLD stock market, with a mix of properties including individual shareholders and big investment funds. ALPHA has a staff of 80 employees, mostly researchers and technicians.

You have a budget of 500,000.00 euro for this year. As a manager, you are called to decide how to invest this budget into your business. Shortly, you will receive a short report that includes relevant information on WORLDLAND. Then, you will receive some options for investment, with expected profit and relative risk probability. Please, take this information into account before to decide.

Remember that your earning at the end of the game will depend on your business decision. We simulated a market composed by WORLDLAND customers who will evaluate your business strategy. Depending on their evaluation, you will receive a final earning”.

Profile of traditional organisation:

“You are the manager of BETA, a gas cooking components manufacturer that is organized in seven departments (R&D, planning and control, purchases, sales, production, human resources, administration). BETA has been established in 1965 and is owned and controlled by the family ROSSI. It has a staff of over 250 employees, including mechanical, electrical, process and chemical engineers and technicians. It core business is developing valves for different types of professional gas appliances, e.g., grills, fryers, cookers, ovens and barbecues, as well as electronically controlled gas systems. Clients are concentrated in the WORLDLAND zone.

You have a budget of 500,000.00 euro for this year. As a manager, you are called to decide how to invest this budget into your business. Shortly, you will receive a short report that includes relevant information on WORLDLAND. Then, you will receive some options for investment, with expected profit and relative risk probability. Please, take this information into account before to decide.

Remember that your earning at the end of the game will depend on your business decision. We simulated a market composed by WORLDLAND customers that will evaluate your business strategy. Depending on their evaluation, you will receive a final earning.

After receiving this first report, subjects received a second report on the business environment (Information II). This report included standard information on WORLDLAND, including business information, plus two different social contexts reports, one positive, the other negative.

Information II

Common information about the economy of WORDLAND

WORLDLAND is a relatively vibrant economy that expanded with a percentage of 1.00% aggregate GDP growth in the last two years. Stock prices of WORLDLAND quoted companies are steadily growing and the bank sector did not encounter significant problems.

Positive country report:

Reports of the WORLDLAND authorities indicate that population is growing, the area is attracting well-qualified immigrants by other regions, family income is growing, the construction market indicators are positive, with increasing loans for new constructions by public and private actors by local banks.

Reports indicate that the percentage of women occupied grew 2.00% in the last two years, while the percentage of unemployment among the young population has significantly decreased by 5.00% on yearly base in the last two years. The percentage of students graduated in WORLDLAND universities is steadily growing especially in engineering and science.

A recent survey carried out by the public authorities of the WORLDLAND on a representative sample of residents in the area, indicating 20% growth in the propensity to trust in personal relationships and in public institutions, compared to two years ago. In addition, the statistics about the area of WORDLAND show a significant reduction in the number of strikes both in the private and in the public sectors over the last two years. Finally, the central government of WORLDLAND recently achieved a strong reaffirmation in the recent national elections, thus ensuring continuity in government for the next four years.

Negative country report:

Reports of the WORLDLAND authorities indicate that population is decreasing, the area is attracting only low-skilled immigrants by other regions, family income is decreasing, the construction market indicators are negative, with decreasing loans for new constructions by public and private actors by local banks.

Reports indicate that the percentage of women occupied felt 2.00% in the last two years, while the percentage of unemployment among the young population has significantly increased by 5.00% on yearly base in the last two years. The percentage of students graduated in WORLDLAND universities is steadily decreasing especially in engineering and science.

Survey carried out by certified organisations of WORLDLAND, conducted on a representative sample of residents, shows a fall of around 20%, of the trust that citizens have in interpersonal relationships and in the functioning of public institutions, compared to two years ago. The statistics about the area of WORLDLAND related to the final two years also show a surge in the number of strikes, both in the private and in the public sector. In recent elections, finally, there was the defeat of the incumbent government.

After the second report, the subjects received a set of possible investment options (see Table 3). The subjects were asked to decide to invest the given budget (500.000,00 euro) and allocate resources between all the possible strategies (categories), that are mentioned above. Some of these strategies were more risky, but at the same time more potentially profitable, while others were more secure with the low stable return.

Questionnaire on the pre-test of country report (example of the negative country report with three blocks of information)

Please, read carefully the information below.

This is the pre-test questionnaire that was filled by a sample of students (N = 224 students) who did not take part in the experiment. Each questionnaire included one of the three blocks of information, which varied only in the positive/negative content. Subjects were randomized to receive only one of these versions. The examples below include a negative content in three type of information. The positive version followed the same structure with only positive information instead of negative. After collecting ratings from subjects, we decided to select the positive/negative versions of reports that ensured a clear positive/negative meaning with the minimal amount of information.

Please, read carefully the information below.

Example 1: Reports of the WORLDLAND authorities indicate that the population is decreasing, the area is attracting only low-skilled immigrants by other regions, family income is decreasing, and the construction market indicators are negative, with decreasing loans for new constructions by public and private actors by local banks.

Example 2. Reports indicate that the percentage of women occupied felt 2.00% in the last two years, while the percentage of unemployment among the young population has significantly increased by 5.00% on yearly base in the last two years. The percentage of students graduated in WORLDLAND universities is steadily decreasing especially in engineering and science.

Example 3. Survey carried out by certified organisations of WORLDLAND, conducted on a representative sample of residents, shows a fall of around 20%, of the trust that citizens have in interpersonal relationships and in the functioning of public institutions, compared to two years ago. The statistics about the area of WORLDLAND related to the last two years also showed a surge in the number of strikes, both in the private and in the public sector. In recent elections, finally, there was the defeat of the incumbent government.

Please, evaluate the perception of the text on the scale, where 1 means that you perceived the meaning of the content as completely negative, 10 is completely positive.

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

Questionnaire on the risk attitude

1. Only 60 days after having made an investment the price of your stock fell by 20%. Since none of the economic fundamentals has changed, what would you do?

a) to sell to avoid further concern and try another way;

b) to do nothing and wait until the price of stocks goes back;

c) to increase the share of investment in that stock. If it was good before, now it is also cheap.

2. Your stock fell 20%, but it is a part of a diversified portfolio on the basis of three different time expires

2A. What would you do if you had to disinvest in 5 years?

a) to sell;

b) to do nothing;

c) will acquire more.

2B. What would you do if you had to disinvest in 15 years?

a) to sell;

b) to do nothing;

c) will acquire more.

2C. What would you do if you had to disinvest in 30 years?

a) to sell;

b) to do nothing;

c) will acquire more.

3. Your fund value increases by 25% after one month of subscription. The economic fundamentals have not changed. After you triumph, what would you do?

a) to sell and deposit in bank earnings;

b) to remain and hope to earn even though;

c) to buy more. Could continue the upside.

4. You are investing for a pension in 15 years. What would you prefer?

a) to invest in a fund, excluding big gains, but having the security of not losing the capital;

b) to invest in a balanced fund (50% bonds, 50% equities) in the hope of increasing the capital, but also protecting the interests of safe bonds;

c) to invest in an aggressive equity fund, whose value fluctuates significantly, but it may offer potential strong gains in 5 or 10 years.

5. You have won a prize. Choose which:

a) 4 million in cash;

b) 50% chance of winning 10 million;

c) 20% chance of winning 30 million.

6. You are in front of a good investment opportunity, but you have to exploit it into debt. Would you ask for a loan?

a) absolutely not;

b) perhaps;

c) yes.

7. The company where you work is selling shares to employees. In three years the company will become a "public company", until then you will not sell the shares and will not have dividends. But the value of your investment could tenfold in 3 years. How much would you invest?

a) nothing;

b) the salary of two months;

c) the salary of four months.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Castellani, M., Alengoz, L., Casnici, N. et al. A role-game laboratory experiment on the influence of country prospects reports on investment decisions in two artificial organizational settings. Mind Soc 21, 121–149 (2022). https://doi.org/10.1007/s11299-021-00283-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11299-021-00283-3