Abstract

Housing taxation is considered the most obvious tax system inequity. Therefore, this type of taxation should be in line with the benefit principle. This article examines the attitudes of citizens towards residential building taxation in the Czech Republic. The aim of this paper is to evaluate the perception of residential building tax burden by taxpayers who own a house or apartment for housing based on primary research. The research was conducted in the Czech Republic using a questionnaire in 2021 and 2022. Differences in the tax burden perception in relation to improvements in quality of life in a municipality and use of compensation by providing financial benefit in favor of resident citizens are investigated in the context of municipality size. It was found that the majority of respondents in all municipality size categories perceived the tax burden as reasonable. Citizens' positive attitudes towards the taxation of their residential buildings were influenced not only by the quality-of-life improvement in the municipality, but also by the transparency of the municipality's financial management. By compensating for the tax on residential buildings through providing a financial benefit, some municipalities reduced the tax burden for their resident citizens and shifted the tax burden, within the limits of the law, to buildings for business and recreation. The most common forms of financial benefits included reducing or eliminating municipal waste fees.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Real estate tax is not a popular tax, but some economists are inclined to believe that the tax is fair based on the principles of benefit and ability to pay (Alm 2013; Ihlanfeldt 2013). The property tax meets the principle of equitable taxation benefits when it is a price for local public services. Property tax can be a progressive tax if the tax is understood as a tax on capital. Despite being considered a fair tax by economists, property tax has consistently been cited as the least popular tax in surveys (e.g., Cabral and Hoxby, 2012) of taxpayers. This is because people are more aware of paying it compared to other taxes.

Immovable property tax revenue is negligible in relation to total tax revenue in the majority of the European Union (EU) member states. The share of the immovable property tax was 0.1% to 6.1% of total tax revenues (the EU 27 average was 2.6%) in 2021. In particular, the highest rates were in Greece (6.1%) and 5% in France. The Czech Republic is one of the countries with low immovable property tax revenues (property tax accounts for only 0.5% of total tax revenue) (European Commission 2023).

According to an Organization for Economic Co-operation and Development (OECD) study (2021), the Czech Republic is characterized by a large number of small municipalities with up to 2,000 inhabitants (89%). The trend of self-ownership continues and 78.9% of people live in their own home. The property tax burden can influence voters' perceptions and potentially affect electoral results. Municipal governments should carefully consider any property tax increase in terms of what is expected from the revenue increase, and whether it will be consistent with the satisfaction of the citizens who vote for them.

This paper examines citizens’ attitudes towards the taxation of residential buildings in the Czech Republic. The aim of this paper is to evaluate the perception of the residential building tax burden by taxpayers who own a detached or semi-detached house (hereafter house) or apartment for housing based on primary research. Differences between perceptions of the tax burden in relation to quality-of-life improvement in a municipality and the provision of financial benefits to resident citizens are investigated in the context of the size of the municipality.

Literature Review

Discussions about the rationale for the immovable property tax have been ongoing for a long time. Economists are looking for a method of taxation that will be acceptable to citizens and concurrently ensure sufficient tax revenue. Several contentious issues in the context of valuation are related to this tax (Horne and Felsenstein, 2010; Presbitero et al., 2014; Raslanas et al., 2010). These authors addressed the determination of the tax rate and disputes over whether to tax property at all.

Immovable property taxes were levied in most EU member states (except Malta, Cyprus, Estonia, Hungary, Italy, and Croatia) in 2019. The importance of this taxation increased, in particular, in the Czech Republic, Greece, Spain, Portugal, Slovenia, and Finland. Recurrent property taxes have remained fairly constant in other countries (Barrios et al., 2019). Different tax rates are applied to different types of buildings in most EU member states. Residential buildings tend to be taxed at lower rates than buildings for recreation and business (Brunetti and Torricelli, 2017). The immovable property tax can be used by local governments to influence revenues in favor of improving quality of life in the community (Bird 2011; Haider-Markel 2014; Hesse 2021; Roubínek et al., 2015).

Kono et al. (2019) also highlighted the importance of immovable property tax revenues for local budgets and discussed the formal application of immovable property tax rates uniformly across locations. The simplicity of this uniformity is seen as an important practical advantage. The immovable property tax rate is formally adjusted according to the characteristics of the building, such as age, purpose of use, and tenure, and also according to the characteristics of the homeowner, such as disability and seniority, in many countries (e.g., France, the United Kingdom (UK), and Sweden). The effective tax rate may deviate from its formal uniform structure due to the assessment and calculation of tax procedures (e.g., in the United States (U.S.)). In addition, a metropolitan area may include several independent tax jurisdictions, so that the tax rate may vary spatially.

Afon (2014) investigated residents’ perceptions of the immovable property rating in a traditional African city. The study concluded that the tax should be portrayed as charges for services provided and that residents’ present negative perceptions of the tax would change if services were provided to meet minimal residents’ satisfaction. Zdražil and Pernica (2018) discussed the relationship between immovable property tax increases and the quality of life in a municipality. They pointed out that a tax increase implied the potential for municipal development and the stability of the supply of public services, and did not affect population decline in general.

The immovable property tax burden and its impact on local citizens was discussed by Beal-Hodges et al. (2016). The authors emphasized the need to consider both income and demographic variables when assessing the immovable property tax burden and its impact on different groups of homeowners. Blaufus et al. (2022) acknowledged that a tax change can affect voters' perceptions of the tax burden and their decision-making process when it comes to elections. Perceptions of the tax burden may also be affected by factors such as tax complexity, tax significance, tax morale, and fairness.

The motivation for our research was to assess taxpayer perceptions of the tax burden on residential buildings. The research results can be used by municipality governments in the Czech Republic when deciding on immovable property tax increases.

Taxation of Residential Buildings in the Czech Republic

A unitary system that does not reflect the value of the property is used for building taxation in the Czech Republic. The tax base for buildings is the acreage of the built-up area. Tax rates are set by law and differ according to the use of the buildings. The lowest tax rates are set for residential buildings, and the highest ones are applied to business buildings. An increase in the tax rates applies if the building has more than one floor above ground.

Municipalities should have a great deal of power in setting the amount of tax, particularly in the area of residential building taxation. The infrastructure and services must match the composition of the population of the municipality. Municipalities can affect the amount of the tax on residential buildings only by coefficients (corrective and local) in the Czech Republic.

The corrective coefficient takes into account the population size of the municipality. The municipality has the ability to influence the amount of the coefficient by decreasing it by one to three categories or increasing it by one category for each part of the municipality. Therefore, the corrective coefficient can have both a positive and a negative effect on the amount of the tax on residential buildings. When adjusting the corrective coefficients, the aim is usually different from affecting the municipality's revenue. This coefficient is used most often to differentiate between parts of a municipality according to the infrastructure and attractiveness of a given location.

The local coefficient can also be used by municipalities to affect the tax revenues of residential buildings. This coefficient may be set at a value between 1.1 and 5 by the decision of the municipal government. This coefficient can be used both to secure tax revenue in the long term and in cases where the municipality needs non-recurrent resources to finance a necessary investment (Janoušková and Sobotovičová, 2019). The local coefficient is the most important tool that municipalities can use to increase immovable property tax revenues. The local coefficient was used by 719 municipalities in 2021 (the Czech Republic has a total of 6,258 municipalities) (FACR 2021).

The tax for all buildings in a given locality is multiplied by a local coefficient, when the municipality sets the coefficient by a generally binding decree. Some municipalities prefer to increase taxation only on buildings for business and recreation. However, the local coefficient will also increase the tax on residential buildings. Therefore, municipalities provide financial benefits to citizens who own residential buildings. Various forms of financial benefits are used by municipalities. Financial benefits can take the form of a reduction or abolition of municipal waste fees. Another example of financial benefit is the granting of a financial contribution to residents to improve the quality of their housing (e.g., building improvements, thermal insulation of the house, replacement of the heating system with an environmentally friendly one). Improving the services provided by the municipality is considered a form of non-financial benefit.

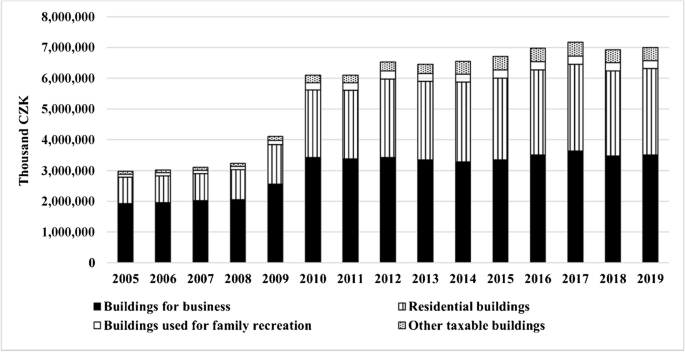

Development of the tax on buildings by type of building is shown in Fig. 1. The share of residential building (houses and apartments for housing) taxation in building tax revenues ranges from 29 to 39% and is clearly reflected in the approach of municipalities when introducing or adjusting coefficients.

Development of the tax imposed by type of building (in thousand CZK). Source: Own illustration using data from the Financial Administration of the Czech Republic (2021)

Objective and Methodology

The aim of the paper is to evaluate the perception of residential building tax burden by taxpayers who own a house or apartment for housing based on primary research. Differences between the perception of the tax burden in relation to the improvement in quality of life in a municipality and the use of financial benefits to citizens are investigated in the context of the size of the municipality. Two research questions (RQs) were established to meet the research objective.

RQ1: How do taxpayers perceive the residential building tax burden? RQ2: Does improvement in quality of life in the municipality and financial benefits to citizens for the residential building tax paid affect their perception of the tax burden?

An online questionnaire was set up to collect relevant data. The survey was conducted in the Czech Republic in the years 2021 and 2022. The questionnaire contained a total of 11 questions, both open and closed. A total of 1,580 owners of residential buildings were contacted (online and in person). The response rate was 53.1% and 839 valid questionnaires were included in the survey. Personal interviews were also conducted with 43 respondents to further enrich the data set. Their responses are included among the 839 valid questionnaires.

The Statistical Package for the Social Sciences (SPSS) program was chosen for this task due to its robust capabilities. Pearson's chi-square test was used to assess the relationship between X and Y (Řehák and Brom, 2015).

Based on contingency tables of absolute and hypothetical values, the test criterion was calculated, expressed by the following formula:

where nij are absolute values and φij hypothetical. nij represents the number of subjects for which the random variable X is equal to i and the random variable Y is equal to j. The values r and c represent the number of rows and columns of the contingency table. The calculated \({\chi }_{P}^{2}\) value is then compared to the critical value \({\chi }_{1-\alpha }^{2}\) from the distribution table with degrees of freedom df = (c-1) (r-1) and chosen confidence level α = 0.05. If the calculated \({\chi }_{P}^{2}\) value > the critical \({\chi }_{1-\alpha }^{2}\) value, then the null hypothesis is rejected.

Moreover, to understand the intensity of the relationship between two nominal variables, Cramer's V was used. Cramer's V is a statistic used to measure the strength of dependence between two nominal variables, and it takes values from 0 to 1. Values close to 0 indicate a weak dependence between the variables and values close to 1 indicate a strong dependence between the variables. Cramer's V was computed using the following formula:

where n is the number of observations and h is the smaller of the pair of numbers r-1, c-1, where r is the number in rows of the pivot table and c is the number of columns of the pivot table.

The open-ended responses, which invariably provide deeper insight, were meticulously sorted into thematic or semantic categories. These responses shed light on both the general characteristics of the respondents and their subjective views on the tax burden on immovable property.

Results and Discussion

The characteristics of the respondents by the size of the municipality are shown in Table 1. The number of respondents living in houses decreases as the size of the municipality increases and the number of respondents living in apartments grows. In small municipalities, more than 90% of the respondents live in houses. The reverse situation occurs in municipalities with more than 100,000 inhabitants, where more than 81% of the respondents live in apartments.

The research focused on the subjective perception of the tax burden on residential buildings by respondents. Additionally, selected factors that influenced this perception were investigated.

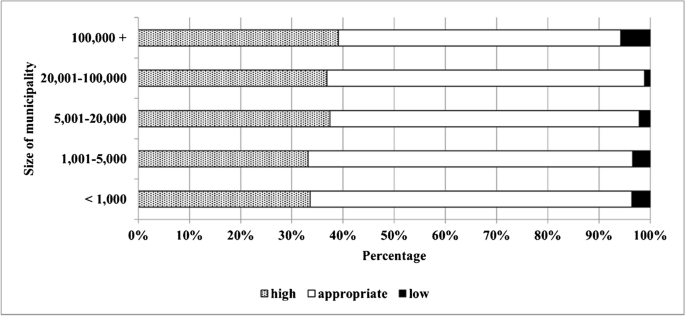

Perception of Tax Burden on Residential Properties

Perception of the tax burden in relation to the size of the municipality is shown in Fig. 2. Most respondents in all municipality size categories perceived the tax burden as appropriate (on average almost 61%). This result corresponds to the Czech Republic’s ranking among the countries with the lowest immovable property tax revenues. The percentage of respondents who perceived the tax burden as high ranged from 33 to 39%. The tax burden was considered appropriate or low by most respondents in the smallest municipalities. This phenomenon can be explained by the fact that citizens in smaller municipalities are better informed about the need for immovable property tax revenues and their utilization.

Perception of the tax burden was further examined by several factors that can affect the subjective opinion of taxpayers. According to the research question RQ1, hypotheses H0 was formulated for each aspect. H0: There is no difference between respondents' perceptions of tax burden related to the introduction of a local coefficient in a municipality (tax change in the last 3 years, type of housing, quality of life improvement, financial benefit to citizens, size of the municipality, family income, gender, age, and education). The results are presented in Table 2.

Of particular interest is the finding that the tax burden perception does not depend on the type of housing or family income (Table 2). This may be influenced by the low property taxation in the Czech Republic or the absence of a substantial difference between the taxation of houses and apartments. In addition, the null hypothesis cannot be rejected for family income, gender, age and education.

The levels of statistical significance for the remaining factors are less than 0.05 and, therefore, the null hypothesis is rejected. The tax burden perception depends on the introduction of the local coefficient and the change in the tax on residential buildings in the last three years. Both of these changes usually result in a tax increase. The tax burden perception also depends on perceptions of quality-of-life improvement in the municipality and whether taxpayers are financially compensated for the residential building tax. Statistically significant moderate dependence was found between the tax burden perception and quality-of-life improvement in the municipality (Cramer's V 0.304, N = 839).

Higher tax burden, especially in smaller municipalities, may not be perceived negatively by taxpayers when transparency is ensured in the use of tax revenues. Municipalities have the opportunity to adjust the structural elements of the tax, explain the reasons for increasing the tax to citizens, and subsequently can manage the tax revenue. The results show that municipalities should not be afraid of introducing a local coefficient and should use this option more frequently.

The immovable property tax is a marginal source of income in most municipalities, but in unfavorable economic situations it leads to a strengthening of municipal revenues. Specific investment projects of the municipality can then be financed from tax revenues with the support of direct democracy instruments at the local level. Emphasis should be placed on the quality of civil society, mutual cooperation, and the responsibility of citizens in relation to public events. It is essential to communicate with residents of the municipality and explain how the funds will be used.

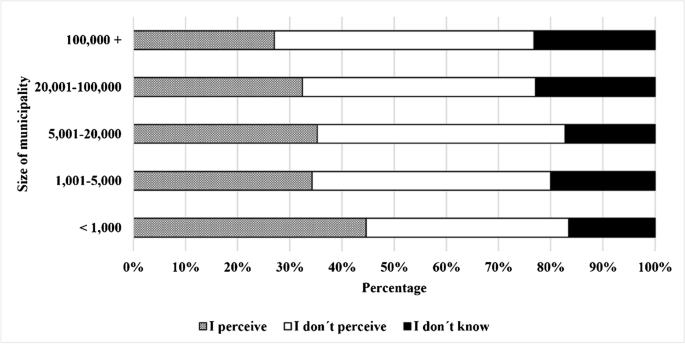

Perception of Quality-of-Life Improvement in Municipalities

As can be seen in Fig. 3, the results vary by the municipality size category. In the smallest municipalities, almost 45% of the respondents perceived an improvement in quality of life in the municipality, but in the largest municipalities the opposite is true. Almost 50% of the respondents did not perceive a quality-of-life improvement. The null hypothesis (H0) that the perception of the improvement in quality of life in a municipality does not depend on the size of the municipality, could not be rejected based on Pearson’s chi-square test (p = 0.109). This phenomenon is related to well-informed citizens, as reflected in the questionnaire. Especially in smaller municipalities, there is good communication between citizens and municipality government.

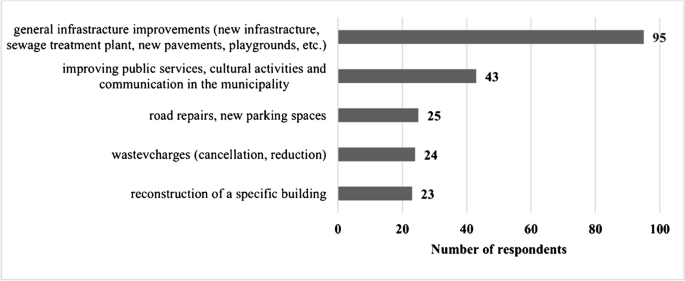

Specific improvements in quality of life in municipalities were indicated by 210 respondents. These responses were classified into semantic categories (Fig. 4). The answers show that the respondents most often positively evaluated improvement of municipality infrastructure. The respondents mentioned new pavements, greenery maintenance, lighting, repairs of local roads and flood protection measures. The respondents also appreciated the construction or reconstruction of playgrounds, football stadiums, and school buildings, and the construction of a sewage treatment plant. Some citizens realized that infrastructure improvements in the municipality would increase the value of their properties.

A total of 34 respondents also expressed negative opinions. Criticism of specific investment projects or the way they were implemented in some municipalities prevailed among negative opinions. Some opinions both critical and positive were influenced by people who were involved in the municipal council, their behavior, and communication with them. Based on some answers, it can be concluded that respondents do not realize the link between the immovable property tax and municipal budgets (they do not know that this tax is an income item in the municipal budget).

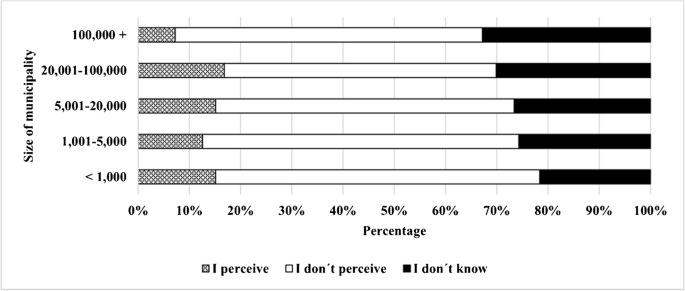

Financial Benefits Related to Residential Building Tax Increase

Most of the respondents in all size categories reported that the municipality does not provide financial benefits related to residential building tax increases (Fig. 5). This number is not surprising, as the financial benefits are provided mainly in municipalities that introduced a local coefficient in their territory (just under 21% of respondents reported this). Many respondents were not interested in the issue of property taxation. They did not know if the municipality provides financial benefits related to residential building tax increases. The percentage of such respondents increases in larger municipalities. Low property taxation in the Czech Republic may be the reason for the lack of citizen interest in using the revenues from this tax.

Based on the results of Pearson’s chi-square test (p = 0.000), we reject the null hypotheses (H0) that the perception of the improvement in quality of life in the municipality does not depend on providing financial benefits related to the residential building tax increase. The perception of the quality-of-life improvement in the municipality depends on whether financial benefits are provided to citizens. Statistically significant dependence was identified between the perception of quality-of-life improvement in the municipality and financial benefits to citizens (Cramer's V 0.293, N = 839).

The most common form of financial benefit used by municipalities is the abolition or reduction of fees for municipal waste and other waste-related services (containers for bio waste). The elimination of fees for waste also has an advantage for the municipality, as it reduces the administrative burden related to the collection of fees. Some municipalities also provide interest-free loans or contributions to improve the quality of housing (e.g., repair or thermal insulation of the house, replacement of the heating system). Criticism of the immovable property tax as representing multiple taxation or criticism of taxation in general prevailed among the negative opinions. Low literacy regarding the immovable property tax and municipal budgets was evident in some of the respondents' opinions.

Conclusion

The Czech Republic is characterized by a high number of municipalities with less than 2,000 inhabitants compared to OECD countries (OECD 2021). This enables better management and allocative efficiency. The aim of this paper was to evaluate the perception of the tax burden on residential buildings by taxpayers who own houses or apartments for housing. Based on the results of the research, most respondents in all size categories of municipalities perceive the tax burden as appropriate. A statistically significant moderate dependence was found between the perception of the tax burden on residential buildings and quality-of-life improvement in municipalities.

The research results show that the immovable property tax may not be perceived negatively by taxpayers if they also see an improvement in quality of life in the municipality. Municipalities can benefit from the possibility of introducing a local coefficient. However, the municipal government must explain the use of the funds to the residents. This fulfills the principle of subsidiarity, where decision-making and accountability in public affairs take place at the lowest level of the government which is closest to the citizens.

Approximately one-third of the respondents perceived an improvement in quality of life in the municipality. Most of them also identified areas in which they saw improvement. The financial benefits to citizens and the improvement in quality of life in the municipality were intertwined in the questionnaire. In addition to financial benefit, some respondents also considered specific improvements of municipal infrastructure as beneficial.

The research found that the perception of residential building tax burden is also influenced by transparency in income management in the municipality. Some municipalities try to reduce the tax burden on residents by providing financial benefits. The higher tax burden will then affect only buildings for business and recreation. The most common forms of financial benefits include reducing or eliminating fees for municipal waste.

The Czech Republic is currently facing a public deficit, and municipalities will be looking for ways to increase revenues. The immovable property tax can be used for this purpose. The results of our research may challenge municipality governments to increase communication with citizens. More information provided by the municipality government to citizens can contribute to better perception of the immovable property tax. Local governments can use the immovable property tax to influence the revenue portion of their own budgets to improve the quality of life in their municipality without worrying about losing votes (voters).

Although the sample size in the survey is sufficient for statistical analyzes, it is not large enough to conduct more detailed analyzes of perceptions of quality-of-life improvements in municipalities. One limitation of the research could be the different requirements for municipal infrastructure in different municipalities. There is scope for further research focusing on whether municipalities are using the tax increase effectively and justifiably in the context of offering public services and providing the potential for further municipal development. Another potential limitation of the study is that the basic characteristics of respondents were not compared to those of non-respondents.

References

Afon, A. (2014). Residents’ perceptions of property rating in a traditional African City. Africa Development, 38(3–4), 97–120.

Alm, J. (2013). A convenient truth: Property taxes and revenue stability. Cityscape: A Journal of Policy Development and Research, 15(1), 243–245. https://doi.org/10.2307/41958967.

Barrios S., Denis C., Ivaškaitė-Tamošiūnė V., Reut A., & Vázquez Torres E. (2019). Housing taxation: a new database for Europe. JRC Working Papers on Taxation and Structural Reforms No 08/2019. European Commission, Joint Research Centre, Seville. Available at: https://joint-research-centre.ec.europa.eu/document/download/f41b4847-dbe4-4edc-aae2-aa8e8094af32_en. Accessed 15 Apr 2023

Beal-Hodges, M., Borg, M. O., & Stranahan, H. A. (2016). A re-examination of the property tax burden. Journal of Business and Economics Research, 14(2), 51–60.

Bird, R. M. (2011). Subnational taxation in developing countries: A review of the literature. Journal of International Commerce, Economics and Policy, 2(1), 139–161. https://doi.org/10.1142/S1793993311000269

Blaufus, K., Chirvi, M., Huber, H.-P., Maiterth, R., & Sureth-Sloane, C. (2022). Tax misperception and its effects on decision making – Literature review and behavioral taxpayer response model. European Accounting Review, 31(1), 111–144. https://doi.org/10.1080/09638180.2020.1852095

Brunetti, M., & Torricelli, C. (2017). Second homes in Italy: Every household’s dream or (un)profitable investments? Housing Studies, 32(2), 168–185. https://doi.org/10.1080/02673037.2016.1181720

Cabral, M. & Hoxby, C. M. (2012). The Hated Property Tax: Salience, Tax Rates, and Tax Revolts. NBER Working Paper No. w18514. Available at SSRN: https://ssrn.com/abstract=2170637. Accessed 15 April 2023.

European Commission. (2023). Data on taxation trends. Available at: https://taxation-customs.ec.europa.eu/taxation-1/economic-analysis-taxation/data-taxation-trends_en. Accessed 15 April 2023.

Financial Administration of the Czech Republic (FACR). (2021). Tax statistics. Available at: http://www.financnisprava.cz/cs/dane/analyzy-a-statistiky/danova-statistika. Accessed 10 Dec 2022.

Haider-Markel, D. P. (2014). Oxford Handbook of State and Local Government. Ed., Oxford University Press (Verlag).

Hesse, M. (2021). Higher taxes for fiscal consolidation? Expected and unexpected effects of municipal tax. International Advances in Economic Research, 27(4), 287–302.

Horne, R., & Felsenstein, D. (2010). Is property assessment really essential for taxation? Evaluating the performance of an ‘Alternative Assessment’ method. Land Use Policy, 27(4), 1181–1189.

Ihlanfeldt, K. R. (2013). The property tax is a bad tax, but it need not be. A Journal of Policy Development and Research, 15(1), 219–223.

Janoušková, J., & Sobotovičová, Š. (2019). Fiscal autonomy of municipalities in the context of land taxation in the Czech Republic. Land Use Policy, 82(March), 30–36.

Kono, T., Pines, D., & Yokoi, T. (2019). Spatially-variable property tax and optimal tax composition in congested monocentric cities. Journal of Urban Economics, 112(July), 122–132.

OECD. (2021). Subnational governments in OECD countries: Key data (brochure), OECD, Paris. Available at: https://doi.org/10.1787/region-data-en. Accessed10 Jan 2023.

Presbitero, A. F., Sacchi, A., & Zazzaro, A. (2014). Property tax and fiscal discipline in OECD countries. Economics Letters, 124(3), 428–433.

Raslanas, S., Zavadskas, E. K., Kaklauskas, A., & Zabulenas, A. R. (2010). Land value tax in the context of sustainable urban development and assessment. Part II – analysis of land valuation techniques: the case of Vilnius. International Journal of Strategic Property Management, 14(2), 173–190.

Řehák, J., & Brom, O. (2015). SPSS – Practical analysis. Brno, Czech Republic: Computer Press.

Roubínek, P., Kladivo, P., Halás, M., Koutský, J., & Opravil, Z. (2015). Changes in the financing of municipalities and local governments of selected cities: Possible effects on disintegration processes and municipal policy. E&M: Economics & Management, 18(1), 134–150. https://doi.org/10.15240/tul/001/2015-1-011

Zdražil, P., & Pernica, B. (2018). Property tax and quality of life in the Czech municipalities: Does the policy of raising local coefficient imply potential or risk for development? Review of Economic Perspectives, 18(2), 123–136.

Acknowledgements

This paper was supported by the Ministry of Education, Youth and Sports Czech Republic within the Institutional Support for Long-term Development of a Research Organization in 2023.

Funding

Open access publishing supported by the National Technical Library in Prague.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Janoušková, J., Sobotovičová, Š. Perception of Housing Taxation in the Czech Republic. Int Adv Econ Res 30, 199–214 (2024). https://doi.org/10.1007/s11294-024-09894-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-024-09894-1

Keywords

- Fiscal autonomy

- Immovable property tax

- Local tax

- Perception of tax

- Housing taxation

- Tax on residential buildings