Abstract

Could the introduction of central bank digital currencies lead to the disappearance of physical cash from the payments system? This extinction would be fraught with several insidious risks, as most of the benefits of the other payments instruments hinge on the continued possibility to use cash for retail transactions. This paper investigates how the use of different payments instruments may evolve over time in a two-sided market where different types of agents can choose which instrument(s) they would use. It shows that while more instruments can continue to be used indefinitely in equilibrium, there are also cases where one instrument becomes extinct and this new equilibrium can be stable, hence, irreversible. The paper also shows that very different outcomes can be reached from very similar initial conditions, and that a minor perturbation, such as the introduction, even on a small scale, of a new instrument can lead to the eventual extinction of one instrument. These results call for caution with the introduction of digital currencies and, more generally, with the digitalization of the financial system.

Similar content being viewed by others

Data Availability

This study is not based on actual data. The data used for the examples and charts were generated by the authors by running simulations based on the formulas included in the text and in the Online Supplemental Appendix and on the parameters indicated in the text.

Notes

A discussion on the pros and cons of cashless societies can be found in Fabris (2019).

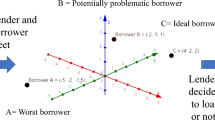

Depending on the values of the parameters, one or more of these lines may not intersect the set S, which may thus be divided into only two regions or may be entirely included in one. In such cases, one or two of the sets B, C, and D would be empty.

This is the standard extension to a two-sided market setting of the Nash equilibrium concept, whereby no agent can gain by changing his behavior insofar as all other agents keep their behavior unchanged.

The participation constraints for a single-currency equilibrium are somewhat looser. For the cash-only equilibrium, they require that pcH + qc < ξ and cf – βL < w and for the cards-only equilibrium that pdH + qd < ξ and cd – rd < w. If these constraints are violated, some agents leave the market, but this fact by itself does not result in the introduction of another payment instrument. It is assumed that these fairly obvious and general conditions are always satisfied.

Simulations show that this is a stable equilibrium, in the sense that the system converges back to it if the initial vector π lies in an open neighborhood of (0,0).

We abstract here from deficiencies in financial inclusion that prevent some customers from opening bank accounts or obtaining debit or credit cards. This model assumes that the entire population has full access to financial services, and their choice of instrument depends only on their preferences.

We are grateful to Professor David Humphrey for referring this source of data to us.

Here, the simple average of their estimates of the costs incurred were used for accepting different types of cards.

References

Agur, I., Ari, A., & dell’Ariccia, G. (2019). Designing central bank digital currencies. International monetary fund working paper WP/19/252, pp. 38. https://www.imf.org/en/Publications/WP/Issues/2019/11/18/Designing-Central-Bank-Digital-Currencies-48739. Accessed 2 Feb 2024.

Alvarez, F., & Lippi, F. (2017). Cash burns: An inventory model with a cash-credit choice. Journal of Monetary Economics, 90(October), 99–112. https://doi.org/10.1016/j.jmoneco.2017.07.001

Amromin, G., & Chakravorti, S. (2007). Debit card and cash usage: A cross-country analysis. Federal Reserve Bank of Chicago Working Paper 2007/4, pp. 45. https://www.chicagofed.org/publications/working-papers/2007/wp-04. Accessed 2 Feb 2024.

Arango, C., Kim, P. H., & Sabetti, L. (2015). Consumer payment choice: Merchant card acceptance versus pricing incentives. Journal of Banking & Finance, 55(June), 130–141. https://doi.org/10.1016/j.jbankfin.2015.02.005

Armstrong, M. (2006). Competition in two-sided markets. Rand Journal of Economics, 37(3), 668–691. https://doi.org/10.1111/j.1756-2171.2006.tb00037.x

Bounie, D., François, A., & Van Hove, L. (2016). Merchant acceptance of payment cards: “Must Take” or “Wanna Take”? Review of Network Economics, 15(3), 117–146. https://doi.org/10.1515/rne-2017-0011

Caillaud, B., & Jullien, B. (2003). Competition among intermediation service providers. RAND Journal of Economics, 34(2), 309–328. https://www.jstor.org/stable/1593720?seq=1

Damodaran, A. (2023). Profit margins (net, operating, and EBITDA). Available online at https://pages.stern.nyu.edu/~adamodar/New_Home_Page/data.html. Accessed 23 May 2023.

Duane, A. (2021). The war on cash: The digitalization and privatization of cash and a critical need for regulation. International Journal of Economics, Commerce and Management 9(7), 1–33. https://www.researchgate.net/publication/361617931_The_War_on_Cash_The_Digitization_and_Privatization_of_Cash_and_a_Critical_Need_for_Regulation. Accessed 2 Feb 2024.

Ellison, G., & Fudenberg, D. (2003). Knife-edge or plateau: When do market models tip? Quarterly Journal of Economics, 118(4), 1249–1278. https://doi.org/10.1162/003355303322552793

Fabris, N. (2019). Cashless Society – The Future of Money or a Utopia? Journal of Central Banking Theory and Practice, 8(1), 53–66. https://doi.org/10.2478/jcbtp-2019-0003

Garcia-Swartz, D., Hahn, R., & Layne-Farrar, A. (2006a). The move towards a cashless society: A closer look at payment instrument economics. Review of Network Economics, 5(2), 175–198. https://doi.org/10.2139/ssrn.641441

Garcia-Swartz, D., Hahn, R., & Layne-Farrar, A. (2006b). The move toward a cashless society: Calculating the costs and benefits. Review of Network Economics, 5(2), 199–228. https://doi.org/10.2202/1446-9022.1095

Garcia-Swartz, D., Hahn, R., & Layne-Farrar, A. (2007). Further thoughts on the cashless society: A reply to Dr. Shampine. Review of Network Economics, 6(4), 509–524. https://doi.org/10.2202/1446-9022.1132

Hayashi, F. (2024). Cash or debit cards? Payment acceptance costs for merchants. Federal Reserve Bank of Kansas City Economic Review, 3rd quarter, 45–61. https://www.kansascityfed.org/research/economic-review/cash-or-debit-cards-payment-acceptance-costs-for-merchants/. Accessed 2 Feb 2024.

Jacobsen, J.G.K., & Pedersen, A. M. (2012). Costs of card and cash payments in Denmark. Danmarks Nationalbank Monetary Review 2nd quarter, Part 1: 109–21. https://www.nationalbanken.dk/media/se3pwqe5/mon-rev-2q-2012-part1.pdf. Accessed 2 Feb 2024.

Khiaonarong, T., & Humphrey, D. (2022). Falling use of cash and demand for retail central bank digital currency. International monetary fund working paper WP/22/27, pp. 25. https://www.imf.org/en/Publications/WP/Issues/2022/02/04/Falling-Use-of-Cash-and-Demand-for-Retail-Central-Bank-Digital-Currency-512766. Accessed 2 Feb 2024.

Krueger, M., & Seitz, F. (2014). Costs and Benefits of cash and cashless payments instruments: Overview and initial estimates, study commissioned by the Deutsche Bundesbank, pp. 124. https://www.bundesbank.de/resource/blob/710096/a6c92243596ad425fd543cde59dcb2ee/mL/costs-and-benefits-of-cash-2014-data.pdf. Accessed 2 Feb 2024.

Marszałek, M., & Szarzec, K. (2022). Digitalization and the transition to a cashless society. In: Ratajczak-Mrozek, M., & Marszałek, P. (eds) Digitalization and firm performance, Palgrave, Macmillan, Cham 251–81. https://doi.org/10.1007/978-3-030-83360-2_10

McKinsey & Co. (2020). The 2020 McKinsey global payments report, October, pp. 37. https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/accelerating%20winds%20of%20change%20in%20global%20payments/2020-mckinsey-global-payments-report-vf.pdf. Accessed 2 Feb 2024.

Rochet, J.-C., & Tirole, J. (2003). Platform competition in two-sided markets. Journal of the European Economics Association, 1(4), 990–1029. https://doi.org/10.1162/154247603322493212

Rochet, J-C., & Tirole, J. (2006). Two-sided markets: A progress report. The Rand Journal of Economics, 37(3), 645–667. https://doi.org/10.1111/j.1756-2171.2006.tb00036.x

Rogoff, K. (2016). The curse of cash. Princeton University Press, pp x, 283.

Rysman, M. (2009). The Economics of Two-Sided Markets. Journal of Economic Perspectives, 23(3), 125–143. https://doi.org/10.1257/jep.23.3.125

Schmalensee, R. (2002). Payment Systems and Interchange Fees. The Journal of Industrial Economics, 50(2), 103–122. https://doi.org/10.1111/1467-6451.00170

Yoshizawa, K., Maehashi, K., Yanagihara, H., Kadogawa, Y., & Inada, M. (2021). Developments in Banknotes in Circulation since the Start of the Pandemic. Bank of Japan Review Series 21-E-6, pp. 7. https://www.boj.or.jp/en/research/wps_rev/rev_2021/data/rev21e06.pdf. Accessed 2 Feb 2024.

Acknowledgements

We are grateful to Alexei G. Goumilevski for valuable technical support in developing the code running the simulations, to Mohamad Nassar for precious technical help and advice, and to Tanai Khiaonarong, Trevor W. Chamberlain, Alvaro Pedraza, David Humphrey, Evan Kraft, Munacinga Simatele, and other participants at the 95th International Atlantic Economic Conference in Rome, Italy, 22-25 March 2023, and at the 2023 Annual Conference of the Society of Government Economists for valuable comments and suggestions. We are solely responsible for how we used their help and advice.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclaimer

The views expressed in this article are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Maino, R., Pani, M. Could CBDCs Lead to Cash Extinction? Insights from a “Merchant-Customer” Model. Int Adv Econ Res 30, 21–45 (2024). https://doi.org/10.1007/s11294-024-09888-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-024-09888-z