Abstract

This study compares the development of insurance markets in countries such as Portugal, Italy, Greece and Spain to mature markets in countries such as the UK and Germany during the 2007 financial crisis. Markets are examined from the product innovation perspective. The market in a country is assessed using taxonomic measures, such as distance and similarity. Markets are described by a set of features divided into five groups: market structure, technical sphere, finance and investment, effectiveness, and product. The measures are calculated at two points in time, 1997 and 2010. The data were gathered from publications of the World Bank, European Union Commission (statistics offices), National Polish Bank and insurance associations. The financial crisis has slowed the speed of market development and influenced other spheres. In countries like Greece and Portugal, progress was even slower than in post-Soviet states, like Poland. The crisis has not imposed structural changes within the selected markets and the influence of the crisis is visible. The sectors were not very innovative, particularly in the product sphere. The literature on the influence of the crisis on insurance is contradictory. This study’s novelty is that it applies multidimensional analysis when comparing insurance-market innovativeness and development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The 2007 financial crisis suggests that, at the turn of the 21st century, financial markets exhibited more intensive symptoms of chaos. Products, as well as regulations concerning insurance institutions, were affected.

This paper was inspired by several observations. First, few studies focus on innovation and development in the insurance sector and its influence on economic growth (Laeven et al., 2009; Tufano 2003; Allen and Gale, 1994). The impact exerted by the financial sector, in which the insurance industry plays a crucial role on economic growth, remains rather unclear. History provides clear examples of the role of financiers in enhancing economic growth. For instance, the special category of investment banks and an accounting system that enables screening and monitoring to distant investors were developed to finance the construction of railroads in the 19th and 20th centuries (Laeven et al., 2009). Another example of the role insurance plays in creating and supporting economic growth is the activity of Lloyd’s of London, one of the world’s biggest risk markets. Some historians claim that this market played a substantial role in helping England become a global empire by speeding up the shipbuilding process (Hodgson 1984). Although published studies have not confirmed the influence of insurance-sector development on economic growth, it could be assumed that such influence exists and is positive. Nevertheless, the direction and significance of impact depend on the behavior of insurance entities and kind of insurance coverage (Cummins et al., 2016).

This paper analyses whether the insurance sector in chosen European countries has been innovative and if so, can support the process of economic recovery following the 2007 financial crisis. The paper compares the state of development of insurance sectors in chosen European Union (EU) countries at two points in time, 1997 and 2010. The research builds on Michalski’s (2001) study that analysed the state of development of insurance sectors in EU countries in 1997. The year 2010 was selected for the analysis because there were some signs of economic recovery following the 2007 crisis. This approach permits the examination of changes taking place in insurance sectors during the crisis. The main feature that distinguishes the paper from previous studies is application of a taxonomy that permits the comparison of the state of development of insurance sectors in chosen countries at the two different points in time. The conclusions drawn from the analysis can be used in an assessment of the innovativeness of the sector.

Literature Review

Much research attempted to explain the impact of the banking sector on economic growth. Few studies have examined the role of the insurance sector. One of the first studies was carried out by Outreville (1996), who analyzed the relationship between insurance-industry development and gross domestic product (GDP) growth. Ward and Zurbruegg (2000) also contributed to this literature. Neither study has clearly confirmed the impact of the insurance sector on the economy. Only a few articles have reported empirical findings concerning the relationship between insurance-industry performance and real economic growth (e.g., Webb et al., 2005; Haiss and Sümegi, 2008; Kugler and Ofoghi, 2005; Adams et al., 2009; Wadlamannati 2008; Zouhaier 2014). Most papers have looked at the demand side when analyzing the economic importance of the insurance sector. The stage and level of economic development are explanatory variables among other factors that affect the demand for insurance (Outreville 2013). In the presented studies, the authors focused on the supply side when examining the progress of the insurance-sector innovativeness (not on the demand side).

Studies devoted to innovation in the insurance sector are even less prevalent. This topic was studied by Laeven et al. (2009) and is not alien to Polish scientists. However, research in this area is sparse (e.g., Śliwiński et al., 2017). Authors have discussed the pros and cons of a variety of methods that were implemented to assess innovativeness in the insurance sector not focusing on the level of innovativeness and its influence on economic growth. Therefore, it seems reasonable to conduct studies aimed at answering this basic question. Does the development of the insurance sector promote economic growth and innovation? If it does, to what extent? As a tool for transferring risk, insurance operates at the macroeconomic level, fulfilling not just its main protective function but also redistributing capital. The following research hypothesis is formulated: the development of the sector has an impact on economic growth and the promotion of innovative activities in a positive way.

The second reason for this study is the situation that developed following the 2007 financial crisis. According to many economists, the 2007 crisis was one of the most severe since the Great Depression in 1930. It affected a number of countries. However, from this paper’s perspective, what happened within the insurance sector in terms of innovation and its influence on economic growth is of primary interest. The study presented focuses on selected European countries, such as Portugal, Italy, Greece and Spain, i.e., the so-called PIGS countries. The paper aims to assess the insurance-sector development in these European countries and others. The study compares the progress of insurance sectors in the PIGS countries with the mature markets of the United Kingdom (UK) and Germany during the financial crisis, especially from the product-innovation viewpoint. The results define the role of insurance in economic processes, planning and innovation, and are a vital source of knowledge about finance for business practitioners and economic policy decision-makers.

Economic Situation in Selected EU Countries

The 2007–2008 financial crisis (global financial crisis) is considered by many economists to be the worst crisis since the Great Depression in the 1930s (Krugman 2009). It began in 2007 with a crisis in the subprime mortgage market in the U.S. and developed into an international banking crisis. Disturbances in the financial system, together with the continuous deterioration in the performance of the global economy, caused a recession in the EU countries (especially in the eurozone).

In the EU, the crisis developed in two successive stages. In stage one (2007–2009), the negative supply shock in the euro area was attributed to the systematic increase in competitiveness of individual member states. This led to the deterioration of their competitive position in the pre-crisis period and also to the reduction in their share in global and European exports. As a result, the current account deficit in these countries continuously increased. The GDP growth rate achieved by the euro area in 2009 was 4.0 percentage points lower than that of 2007 (3%). In stage two (2010–2013), the year 2010 brought a slight recovery in the European economy after nearly two years of deep recession. The GDP growth in the EU was 2.1% compared to a 4.3% decline in 2009 (mainly due to the improvement in world trade). The outbreak of the second phase of the eurozone crisis triggered a negative reaction in global financial markets to the deepening of public debt. This situation especially concerned Greece and Portugal.

Due to the global financial crisis, the name PIGS (P - Portugal, I - Ireland, G - Greece and S - Spain) was created. It identified countries particularly affected by the crisis, suffering from a difficult budgetary situation and running high-public debt (Fig. 1). When Italy (I) was later included in this group, its name changed to PIIGS. Ireland has been excluded from this study due to the relatively efficient anti-crisis policy and economic diversity.

Public-sector debt [in % of GDP]. Source: Based on OECD (2020) statistics

High-public debt was already recorded in 2002 (the year of joining the eurozone). The PIGS countries (except Spain) did not meet the criteria of the Maastricht Treaty, and some of them reduced debt and deficit by applying restrictive policies. After the first period of crisis in the eurozone, only Greece continued to experience an unsustainable situation in public finances, while the situation of other PIGS countries was critical (as a result of the restrictions imposed by the Maastricht Treaty). In the second phase of the crisis, the situation of public finances (especially public debt) got worse. Recession in the PIGS countries was deeper than in other EU countries. However, the impact of the crisis on the economic situation in more mature economies, such as Germany and the UK, are also visible (Fig. 2).

GDP growth in Germany and in the UK [in %]. Source: Own calculations based on OECD (2020)

The effects of the crisis on the economic situation have been frequently studied. It is not the aim of this paper to investigate them in more detail. This paper focuses on insurance markets in selected countries. However, this general economic overview demonstrates the impact of the crisis. The impact from the simple perspective of GDP growth is very similar in all the analysed states. A rapid decline was observed in 2009. Nevertheless, some countries recovered quicker than others. The slowest recovery from the crisis was observed in Greece. While the situation in Germany and the UK were very similar, they were very different than in countries like Italy, Portugal or Spain. Insurance-market development throughout the crisis is more interesting.

Insurance Market Development in Selected Countries after the 2007 Financial Crisis

Gross written premium is the best indicator of the effect of the crisis in affected countries. A general measurement of the impact of the crisis on the insurance industry can be obtained from a review of the overall level of premiums. A comparison of premium volume in 2008 and subsequent years shows a severe drop in more heavily affected countries, e.g., Ireland, Italy and Greece (Neelsen 2014).

Insurance markets in the PIGS countries differ essentially when it comes to their development. The penetration rate is most commonly used to determine the level of market expansion. Among the PIGS countries, the Greek market was the least developed. Indicators of penetration for the Italian market were close to the European average, while the Portuguese market seemed to be more developed. Nevertheless, in 2011 the situation changed. The indicator for the Portuguese market dropped below the EU average. At the same time, the ratio for Germany was very stable ranging from 6.49% to 6.64%. At that time, the UK was the country with the highest penetration level among all the EU countries. For instance, the UK’s ratio in 2012 exceeded 12% but exhibited a downward tendency, while the average ratio for Europe at that time was 7.48% (Insurance Europe 2014). The penetration of insurance in the UK was substantially affected by the crisis, dropping from 17.6% to 12.2% in 2013.

Insurance markets in the PIGS countries performed differently in the collection of premiums and compensation amounts paid after the crisis (Table 1). In Greece, a huge drop in contributions could be observed. At the same time, an increase in compensation took place. A similar situation was observed in Portugal (although premiums decreased by only 4%). Only the Italian insurance market reported a big increase in premiums and a decrease in compensation.

Additionally, the market structure in terms of life and non-life insurance differed across the selected countries (Table 2). In Portugal and Italy, more than 60% of premiums were collected from life insurance. In the UK, the share of life insurance was the highest, ranging from 72% in 2007, peaking at 81% in 2010 and then declining to 70% in 2013. A similar market structure was observed in Spain and Germany.

Research Methodology

To conduct this study, a comparative approach using taxonomic procedures was applied. This study measured distance and similarity. The measure μ, which describes the degree of similarity between the dimension structures of the two objects, is defined by the following equation:

where zi ° zp denotes the scalar multiple of vectors zi and zp containing all dimensions of particular objects and the |z| length of the vectors. This means that the value of μ ranges between −1 and 1 as the scalar multiple is the cosine of the angle between the vectors.

The measure of similarity of object dimensions d ∗ (i, p) is defined by the following equation:

where k denotes the number of objects and n denotes the number of dimensions and is a normalized version of the differentiation of object dimensions d(i,p).

where dip denotes the distance between objects i and p, and zijzpj represents the values of dimension j of objects i and p, respectively.

The analysis of the insurance-sector development was conducted concerning five groups of features: market structure, technical aspects, finance and investment, effectiveness and products. For each group, there was a set of diagnostic features. A database for the selected diagnostic features during the years 1997 and 2010 was created based on data published by Insurance Europe and Eurostat. The data for 1997 were taken from Michalski (2001). Eventually, the decision about the number of features was made after correlations between them had been analysed. The point (moment) of observation was determined based on the implementation of features from all the groups.

The groups taken into consideration include the list of features, respectively. A market structure group includes diagnostic features, such as the number of insurance entities, speed with which their population evolved, market share of the biggest insurers, market concentration, number of people employed in the insurance sector or the presence of foreign insurers in the market. The technical aspects refer to insurance operations. This group included such features as the value of and changes in gross written premium, retention ratio, share of European countries in the total gross written premium divided into non-life and life insurance as well as the reinsurance ratio. The finance and investment group were represented by features like the value of total insurance investments in the European countries, the relationship between investment and gross written premium, and changes in investment level between 1997 and 2010 (separate for non-life and life insurers). Effectiveness represents features that could be used to assess insurance-sector development from the macro perspective. In this group, the following features are included: share of gross written premium in GDP, relationship between insurers’ investment to GDP, and gross written premium per capita separately for non-life and life insurance. The most important group in relation to the main aim of this paper is the products (group E). The following 15 features are included in the group: motor insurance gross written premium per capita, growth of motor insurance premium, share of the motor insurance premium in total non-life insurance premium, health insurance premium per capita, growth in health insurance premium, share of health insurance premium in the total non-life insurance premium, property insurance per capita, growth of property insurance, share of the property insurance premium in the total non-life insurance premium, liability insurance premium per capita, growth in liability insurance premium, share of the liability insurance premium in the total non-life insurance premium, marine, air and cargo insurance premium per capita, growth in marine, air and cargo insurance premium, and share of the marine, air and cargo insurance premium in the total non-life insurance premium.

Results: Situation in Insurance Sectors in the PIGS Countries

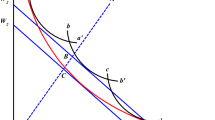

For clarity of presentation, radar charts were used to present the results. Radar charts are used for comparisons of the situation in two different years, but it is necessary to keep the same order of features in both of them which is true in terms of presented studies. The chart axes represent the analysed groups (for sector analysis). Thus, A stands for the market structure, B for technical aspects, C for finance and investment, D for effectiveness and E for products. The results for the measure of differentiation of levels d* and structure similarity μ* are presented in the charts. The values of the similarity measures are compared with each other within groups at two points in time (1997 and 2010). This permitted some conclusions to be drawn about what happened throughout the crisis. Therefore, the impact of the crisis on the insurance-sector development in PIGS and other countries (e.g., the UK and Germany) could be recognized. On the other hand, the insurance sector in each of the PIGS countries is compared to the so-called reference object (benchmark). In this study, the benchmark based on algorithms was set by experts and elaborated on by renowned statisticians (Hellwig 1999), separately for individual diagnostic features. The benchmark is a kind of virtual object that is interpreted as the best possible option from the study’s viewpoint. In the case analysed it represents the best-developed insurance market. In the case of stimulants (the higher the value of the feature, the better the development of the insurance sector), the benchmark was calculated as a diagnostic feature of the maximum value in the period increased by the standard deviation for the whole time series. In the case of destimulants (negative relationship to the development of insurance sector), the benchmark value is 0, or the minimum value decreased by the standard deviation, depending on which of the two is higher. The benchmark for nominants (the value of the features should remain within a specific range or should be fixed) is set as an average value increased by the standard deviation or median depending on the nature of the feature and the number of available observations. The value of the reference object after normalization is equal to 1. The value of objects to be compared (insurance sectors in selected countries) varies from 0 to 1. When the value reaches the proximity of 1, the analysed object is similar to the reference object (in terms of the structure and distance of selected features). As previous stated, calculation of the taxonomy measures at two different points in time allows changes to be associated with selected periods. In the study, this period is the 2007 financial crisis. The results are presented in Fig. 3 and Fig. 4.

Measure of structure similarity μ* for the UK, Germany and the PIGS countries in 1997 and 2010. Notes: Group A – market structure; Group B – technical sphere; Group C – financial and investments; Group D – effectiveness; Group E – product. Source: Author’s calculations of structure similarity measures based on Insurance Europe (2020) and Eurostat (2014) data

Differentiation of levels d*(i, p) for the UK, Germany and the PIGS countries in 1997 and 2010. Notes: Group A – market structure; Group B – technical sphere; Group C – financial and investments; Group D – effectiveness; Group E – product. Source: Author’s calculations of structure similarity measures based on Insurance Europe (2020) and Eurostat (2014) data.

The values of the measures of structure similarity for all groups at two points in time (1997 and 2010) are presented in Table 3. At first glance, important changes in the market structure during the period could be observed. The UK market is still very similar to the benchmark. However, it was hit by the crisis the most.

The analysis shows that there are noteworthy differences among the PIGS countries. The differences are visible especially in comparison to the benchmark. In general, following the crisis, the situation slightly improved. For example, when looking at Portugal, improvement could be observed in all groups except for group E (products). Portugal is the only country among those analysed where there was no improvement in this group. Generally speaking, the similarity of structure in the products group is the lowest in all countries. The level of similarity of the structure to the benchmark for group E is below 50% in all PIGS countries. Such a level should be interpreted as very low. The highest value for similarity was found in Italy, followed by Greece and Spain. The similarity of the structure of features included in group B (technical aspects) is the highest for Italy. Technical aspects contain features connected with market development in terms of gross written premium, such as changes in gross written premium separately for life and non-life insurance, penetration ratio, reinsurance ratio and premium per insurance-sector employee. Italy is one of the most developed countries among those included in the analysis (except for the UK and Germany) and its insurance market is well developed. That is probably why, in terms of market indicators, the similarity of the structure is approximately 80% for Italy. However, values for other groups are below 50%, e.g., group E, where it is equal to 42%. At the same time, the value for Poland (a country after transformation) has reached approximately 73% of similarity to the structure of the reference object. Changes within the product group in the PIGS countries have been very slow. This is probably an effect of the crisis. Following the crisis, insurers in the analysed countries failed to actively engage in proposing innovative solutions for their products. This lack of innovation has left the structure of the markets unchanged, with motor insurance remaining the most important source of premium. What is worth highlighting is the change in group D (effectiveness) in the German market.

As shown in Table 4, the value of measure d* (differentiation of levels) is very stable, which confirms the earlier conclusion that the financial crisis inhibited the progress of the insurance sectors in these countries. The highest similarity in the level of diagnostic features is observed for group C in 2010 in all the countries. Group C contains features of finance and investment, such as per capita value of insurer investment, changes in levels of investment, share of life insurer investments in the total insurance-market investment, and the relationship of investment to gross written premium for both life and non-life insurers. It should be noted that in group E the level of similarity is lower in 2010 in comparison to 1997, except for Greece where the change is very small. The measure d* in 1997 was 0.069 and rose to 0.70 in 2010. The analysis of results shown in Table 5 confirms the assumption that the development of insurance markets following the crisis was slower, especially in product innovation. Differentiations in level decreased in the majority of analysed countries. A slight increase was only reported in the UK and Greece. Structure similarity slightly improved in countries such as Spain, Italy, Greece and the UK. However, the changes were not very substantial and all the markets, except for the UK, are still far from the benchmark. In the majority of countries, the values of the structure similarity measure were less than 0.5. Results for the countries analysed at two points in time for group E are graphically presented in Fig. 5.

Conclusions

The main conclusion from the study is that the financial crisis has considerably impeded market development and influenced other spheres. In countries like Greece and Portugal, progress was even slower than in the post-Soviet countries, such as Poland. External circumstances have not caused structural changes in selected insurance markets. However, the overall environment had been favourable for the expansion of insurance markets until 2007. The impact of the crisis is visible. The analysis of the aforementioned results shows the lack of substantial changes in similarities of structure and the level of differentiation. Structure similarity has changed more considerably, especially in Spain. The lack of important changes in the structure and products indicate a poor innovation profile of the insurance sector, especially when it comes to products. The most visible change, group E (products), occurred in the German and Portuguese markets. In all the countries analysed, group C (finance and investment) was brought closer to the benchmark.

The last conclusion is that sectors were not very innovative with respect to products. Product innovations provide an insurer with the opportunity to play an important role in contributing to sustainable development at the macroeconomic scale, or even at the global scale. In the age of innovation, the insurance sector should be sensitive to the need for innovation, not only in the business model of insurance companies but also when it comes to products. Innovations within the insurance sector become even more important in relation to competition on the market increase. An innovative offer could maximise the insurer’s revenue and profits and thus influence economic growth.

The confirmation of the influence of the crisis on insurance markets is valuable for insurance professionals, academics and students. Moreover, the application of multidimensional analysis in the research of the development of insurance sectors is an innovation in the paper. The results could also be useful for state officers, supervisory authorities and other state entities who create market policy to impose incentives for insurers to be more innovative especially in terms of product innovations.

References

Adams, M., Andersson, J., Andersson, L. F., & Lindmark, M. (2009). Commercial banking, insurance and economic growth in Sweden between 1830 and 1998. Accounting, Business & Financial History, 19, 21–38. https://doi.org/10.1080/09585200802667139.

Allen, F., & Gale, D. (1994). Financial innovations and risk sharing. Cambridge Massachusetts: The MIT Press.

Cummins D., Cragg M., Zhou B., deFonseka J., (2016). The social and economics contributions of the life insurance industry, The Brattle Group Report, https://brattlefiles.blob.core.windows.net/files/7063_the_social_and_economic_contributions_of_the_life_insurance_industry.pdf Accessed 25 May 2020.

Eurostat (2014). Database. https://ec.europa.eu/eurostat/help/first-visit/database. Accessed 04 August 2019.

Haiss, P., & Sümegi, K. (2008). The relationship between insurance and economic growth in Europe: A theoretical and empirical analysis. Empirica, 35(4), 405–431.

Hellwig, Z. (1999). Metody ilościowe w ekonomii. Pisma wybrane. Wrocław: Wydawnictwo Akademii Ekonomicznej we Wrocławiu. (Hellwig, Z (1999), Quantitative methods in economics. Selected essays. Breslau: Publishing house of the Breslau University of Economics).

Hodgson, G. (1984). Lloyd’s of London. Reputation at risk, London: Allan Lane.

Insurance Europe (2014). European Insurance in Figures, Statistics N°50, (https://www.insuranceeurope.eu/sites/default/files/attachments/StatisticsNo50EuropeanInsuranceinFigures.pdf. Accessed 03 August 2019.

Insurance Europe (2020). Insurance data. https://insuranceeurope.eu/insurancedata. Accessed 07 August 2019.

Krugman, P. (2009). The return of depression economics and the crisis of 2008. New York London: W. W. Norton & Company.

Kugler, M. and Ofoghi, R., (2005). Does insurance promote economic growth? Evidence from the UK. Working Paper, Division of Economics, University of Southampton, http://repec.org/mmfc05/paper8.pdf. Accessed 23 February 2009.

Laeven, L., Levine, R., Michalopoulos, S., (2009), Financial innovation and endogenous growth, NBER Working Paper No. 15356 http://www.nber.org/papers/w15356. Accessed 07 August 2019.

Michalski T., ed. (2001), Ubezpieczenia Gospodarcze w Polsce i UE, Difin, Warszawa (Michalski T., ed. (2001), Insurance in Poland and the EU, Difin, Warsaw).

Neelsen K., (2014). Economy, stupid – Financial crisis and insurance, Gen Re, Cologne, 8(4). http://media.genre.com/documents/ri14-4-neelsen-en.pdf. Accessed by 8 august 2019.

OECD (2020). Data: General government debt. https://data.oecd.org/gga/general-government-debt.htm. Accessed 02 August 2020.

Outreville, J. F. (2013). The relationship between insurance and economic development: 85 empirical papers for a review of the literature. Risk Management and Insurance Review, 16(1), 71–122.

Outreville, J. F. (1996). Life Insurance Markets in Developing Countries. The Journal of Risk and Insurance, 63(2), 262–278.

Śliwiński, A., Karmańska, A., & Michalski, T. (2017). European insurance markets in face of financial crisis. Application of learning curve concept as a tool of insurance products innovation – discussion. Journal of Reviews on Global Economics, 6, 404–419.

Tufano, P. (2003). Financial Innovation. In G. Constantinidis (Ed.), Handbook of the economics of finance, volume 1a: Corporate finance (pp.307–336). North-Holland: Elsevier.

Ward, D., & Zurbruegg, R. (2000). Does insurance promote economic growth? Evidence from OECD countries. The Journal of Risk and Insurance, 67(4), 489–506.

Wadlamannati, K. C. (2008). Do Insurance Sector Growth & Reforms Effect Economic Development? - empirical evidence from India. The Journal of Applied Economic Research, 2(1), 43–86.

Webb, I., Grace, M. F., & Skipper, H. (2005). The effect of banking and insurance on the growth of capital and output. SBS Revista de Temas Financieros (Journal of Financial Issues), 2(2), 1–32.

Zouhaier, H. (2014). Insurance and economic growth. Journal of Economics and Sustainable Development, 5(12), 102–112.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Śliwiński, A., Michalski, T. European Insurance Markets in the Face of the 2007 Financial Crisis. Int Adv Econ Res 26, 419–432 (2020). https://doi.org/10.1007/s11294-020-09808-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-020-09808-x