Abstract

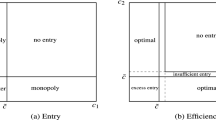

This paper examines how expected excess capacity fosters impediments to entry and incentives to exit. To examine this phenomenon, we apply the switching regime methods of Goldfeld and Quandt to a logit model using data from the U.S. aluminum industry over the period 1954 through 2010. The results show that both entry and exit decisions are statistically significantly affected by excess capacity. However, the correlation of entry and exit with capacity is more significant than with production. The evidence implies that excess capacity in the aluminum industry rises to be a substantial threat to entry only when the company produces ahead of demand growth. Excess capacity is also an impetus to exit during the later stage after primary aluminum production reverts to a declining trend.

Similar content being viewed by others

Notes

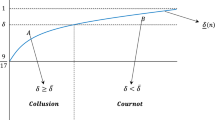

The excess capacity hypothesis, initially developed by Pashigian (1968) and Wenders (1971), was one of the two competing hypotheses for the study of entry-deterring behavior. The hypothesis is based on the belief that incumbents can profitably use excess capacity as a credible threat to render entry unprofitable.

According to Bresnahan and Suslow (1989), short-run marginal cost for aluminum is linear out to capacity and vertical at capacity.

Primary production involves converting raw materials into aluminum ingots, which is highly energy intensive, especially with regard to electricity. Secondary production involves recycling aluminum scrap to form new products, a significantly less energy-intensive process. The detailed discussion can be referred to the Industry Report of Primary Production of Aluminum (Highbeam Business 2012).

Secondary aluminum maintains the same physical properties as primary aluminum and has become almost a perfect substitute for primary aluminum in most applications; nevertheless, aircrafts still use primary aluminum because of quality and consistency restrictions, while beverage cans and automotive castings often use secondary aluminum (U.S. Energy Information Administration 2012).

Kirman and Masson (1986) questioned whether potential entrants entering the market would be cognizant that incumbents will be unwilling to expand output to their marginal cost curves. As a consequence, build-up of excess capacity, though irreversible, is not credible.

At the 10% level of significance, only price (PRICE), interest rates (INT), industry inventories (INV), and material costs (MATE) can be interpreted as having a stationary series. The other variables are not integrated of order zero. Therefore, each variable is taken as a first differenced data to produce a stationary process. Table 3 contains the results of the stationarity tests for both time-series and first-differenced data. As each individual variable is integrated of order one, the Engle-Granger cointegration test (Engle and Granger 1987) needs to be further applied to test relationships among variables so that linear combinations of the variables can be ascertained. This determination is essential for the results of any subsequent statistical analysis to be meaningful as the time series drifts together over the sample period.

New aluminum capacity requires a three-year construction period (Peck 1961, p. 145).

In this case, firms that receive economies of scale with relatively extensive investment of capacity are considered dominants in the market.

According to the stylized model, the production equation should also include ∆PRODt-3 as an exogenous variable. However, the variable did not perform well in the regression and was excluded to conserve degrees of freedom.

Unlike the Chow test that requires the breakpoint to be known, the Goldfeld-Quandt method maximizes the power of the test even without any sample separation information (Lee and Porter 1984). Other alternative tests where the break point can be unknown include the Quandt-Andrews test (Andrews 1993) and the Bai-Perron test (Bai and Perron 2003).

Detailed theoretical derivation of the Goldfeld and Quandt switching regime model is contained in the Online Supplemental Appendix.

Specific derivation of the logit model can be found in Gujarati (1992).

If excess capacity does not preempt entry, entry into the industry may be just due to shocks, with the effects spread through time and across firms. In such a case, FIRMi will be the only variable that is statistically significant in the entry equation.

The capacity a firm maintains should be in proportion to long-term demand forecasts. Extra capacity can lead to increases in fixed costs, which in turn impact profitability as a high fixed-to-variable cost ratio hurts per-unit profit margins.

References

Aluminum Association (1954–2010). Aluminum Statistical Review. Washington, DC. http://www.aluminum.org/aluminum-statistical-review-annual-fact-book

Andrews, D. W. K. (1993). Tests for parameter instability and structural change with unknown change point. Econometrica, 61(4), 821–856.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Bain, J. S. (1956). Barriers to new competition. Cambridge: Havard University Press.

Bresnahan, T. F., & Suslow, V. (1989). Short-run supply with capacity constraints. Journal of Law and Economics, 32, S11–S45.

Conlin, M., & Kadiyali, V. (2006). Entry-deterring capacity in the Texas lodging industry. Journal of Economics and Management Strategy, 15(1), 167–185.

Cookson, J. A. (2017). Anticipated entry and entry deterrence: Evidence from the American casino industry. Management Science, 64, 2325–2344.

Cowling, K. (1983). Excess capacity and the degree of collusion: Oligopoly behavior in the slump. Manchester School of Economic and Social Studies, 51(4), 341–359.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–443.

Dixit, A. (1980). The role of investment in entry-deterrence. The Economic Journal, 90, 95–106.

Ellison, G., & Ellison, S. F. (2011). Strategic entry deterrence and the behavior of pharmaceutical incumbents prior to patent expiration. American Economic Journal: Microeconomics, 3, 1–36.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction representation, estimation, and testing. Econometrica, 55, 251–276.

Ghemawat, P. and Nalebuff, B. (1985). Exit. Rand Journal of Economics, 16(2): 184–94.

Goldfeld, S., & Quandt, R. (1973). The estimation of structural shifts by switching regression. Annals of Economic and Social Measurement, 2(4), 475–485.

Gujarati, D. (1992). Essentials of econometrics. New York: McGraw-Hill.

Hilke, J. (1984). Excess capacity and entry: Some empirical evidence. The Journal of Industrial Economics, 33(2), 233–240.

International Monetary Fund (1954–2010) International Financial Statistics Yearbook. http://data.imf.org/?sk=4C514D48-B6BA-49ED-8AB9-52B0C1A0179B

King, S. P. (1998). The behaviour of declining industries. The Economic Record, 74(226), 217–230.

Kirman, W. I., & Masson, R. T. (1986). Capacity signals and entry deterrence. International Journal of Industrial Organization, 4(1), 25–42.

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., & Shin, Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics, 54, 159–178

Lee, L.-F., & Porter, R. H. (1984). Switching regression models with imperfect sample separation information-with an application of cartel stability. Econometrica, 52(2), 391–418.

Lieberman, M. B. (1990). Exit from declining industries: 'Shakeout' or 'stakeout'? RAND Journal of Economics, 21(4), 538–554.

Lieberman, M. B. (1987). Excess capacity as a barrier to entry: An empirical appraisal. Journal of Industrial Economics, 35(4), 607–627.

Masson, R. T., & Shaanan, J. (1986). Excess capacity and limit pricing: An empirical test. Economica, 53, 365–378.

Mathis, S., & Koscianski, J. (1996). Excess capacity as a barrier to entry in the US titanium industry. International Journal of Industrial Organization, 15, 263–281.

Pashigian, B. P. (1968). Limit price and the market share of the leading firm. Journal of Industrial Economics, 16, 165–177.

Peck, M. J. (1961). Competition in the aluminum industry: 1945–1958. Cambridge: Harvard University Press.

Poddar, S. (2003). Excess capacity: A note. Keio Economic Studies, 40(1), 75–83.

Prime Industry Reports (2012). Primary production of aluminum. Available at: http://myaccount.primeindustryreports.com/content/3334-Primary-Production-of-Aluminum.htm.

Savagar, A. and Dixon, H. (2017). Firm entry, excess capacity and endogenous productivity. Cardiff Economics Working Papers E2017/8. http://asavagar.com/documents/SavagarDixon_EntryCapUtil.pdf

Spence, A. M. (1977). Entry, capacity, investment oligopolistic pricing. Bell Journal of Economics, 8(2), 534–544.

Spulber, D. F. (1981). Capacity, output, and sequential entry. American Economic Review, 71(3), 503–514.

U.S. Bureau of the Census (1954–2010) Annual Survey of Manufacturers. https://www.census.gov/programs-surveys/asm/data/tables.html

U.S. Department of the Interior (1954–2010) Minerals Yearbook. https://minerals.usgs.gov/minerals/pubs/myb.html

U.S. Energy Information Administration (2012), Today in Energy, Washington, DC. https://www.eia.gov/todayinenergy/detail.php?id=7570

Wang, H., Gurnani, H., & Erkoc, M. (2016). Entry deterrence of capacitated competition using price and non-price strategies. Production and Operations Management, 25(4), 719–735.

Wenders, J. T. (1971). Excess capacity as a barrier to entry. Journal of Industrial Economics, 20, 14–19.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(PDF 135 kb)

Rights and permissions

About this article

Cite this article

Yang, SP. Entry and Exit Decisions with Switching Regime Excess Capacity. Int Adv Econ Res 24, 351–369 (2018). https://doi.org/10.1007/s11294-018-9716-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-018-9716-6