Abstract

This study is an attempt to assess the impact of policy initiatives launched by Japan’s new Prime Minister Shinzo Abe on Japan’s real gross domestic product (GDP) in his first quarter in office. We use as a benchmark for measurement a counterfactual estimate of GDP. Since the Japanese economy is also in the midst of reconstruction from the 2011 Tohoku disaster in the first quarter of 2013, we first estimate the counterfactual GDP that would have materialized in the absence of that disaster. We will use a dummy variable method and the statistical method proposed by Cheng Hsiao and others. We check the validity of these methods with regard to the Kobe earthquake of 1995 and then estimate the post-disaster counterfactual GDP in the absence of the Tohoku disaster. We measure the impact of government policies as the difference between the actual and counterfactual GDP. By doing so, we conclude that government policies have failed to lift Japan’s GDP to the expected level. Even with the help of Abenomics, the gap remains in the range of 6 to 14 trillion yen per year.

Similar content being viewed by others

Notes

This was formally approved at a BOJ’s Monetary Policy Meeting. See BOJ, “Launching a Quantitative and Qualitative Monetary Easing Policy,” April 4, 2013.

The Wall Street Journal, “Communication Skills Boosted BOJ Governor Nominee,” March 1, 2013.

The Nikkei started from 10,398.61 on January 4 and rose to 15,627 on May 22, before falling to 12,289 on June 12. The high volatility in the stock market seems to reflect uncertainties with regard to Abenomics as well as to international economic conditions.

Japan Real Estate Institute, May 28, 2013.

This was first pointed out by Hoshi and Kashyap (2000) in the context of post-bubble Japanese economy.

In the speech delivered on June 5, PM Abe gave an outline of his growth plan. The stock market responded with the third largest fall of the year.

For a ruthless critique, see Hama (2013).

They concluded that the political integration had had hardly any impact on the growth of the Hong Kong economy, whereas the economic integration raised Hong Kong’s annual real GDP by about 4 %.

Estimated direct damage figures ranged from 18 to 30 trillion yen. See Hayashi (2012).

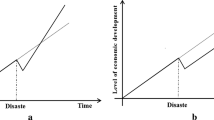

For the local economy of Hyogo Prefecture, and most notably the 11 cities that were hardest hit, recovery did not mean returning to the pre-disaster state, but instead embarking on a new development path. See Hayashi (2011), pp.202–204.

The data we use is quarterly GDP in the national currency, which is converted to a volume index for each country so that they represent real GDP as reported by each country.

We note in passing that the estimated coefficients for Canada are negative both in estimate (1) and estimate (2). This simply means that Canada’s GDP and Japan’s GDP were negatively correlated statistically during the observation period.

This conclusion endorses the textbook argument that disasters boost GDP because post-disaster expenditures are counted in GDP figures while losses in capital stock are not.

According to the National Police Agency, the number of victims confirmed dead is 15,883 and missing is 2,671 as of June 10, 2013.

The fiscal consequences of debt-financed spending is another matter of concern for a government with 224 % debt-GDP ratio, the highest among advanced countries.

References

Cheng Hsiao, H., Ching, S., & Wan, S. K. (2012). A panel data approach for program evaluation: measuring the benefits of political and economic integration of Hong Kong with mainland China. Journal of Applied Econometrics, 27(5), 705–740. doi:10.1002/jae.1230.

Hama, N. (2013). Abenomics no Shinso (The truth about Abenomics) (pp. 1–191). Tokyo: Chukei Shuppan.

Hayashi, T. (2011), Daisaigai no Economics (Economics of great disasters) (pp. 1–283). Tokyo: PHP publishing.

Hayashi, M. (2012). A quick method for assessing economic damage caused by natural disasters: an epidemiological approach. International Advances in Economic Research, 18(4), 417–427.

Hoshi T., Kashyap A. K. (2000). The Japanese banking crisis: Where did it come from and how will it end?” In B. S. Bernanke & J. J. Rotemberg (Eds.), NBER macroeconomics annual 1999, pp.129–201.

Krugman, P. (2013). Japan the Model. The New York Times, May 23.

Stiglitz, J. E. (2013). The promise of Abenomics. CFO insight (www.cfo-insight.com/markets-economy/global-economy/the-promise-of-abenomics/.

Acknowledgments

This work was inspired by discussions with Cheng Hsiao while he was staying in Tokyo. All idiosyncrasies are the author’s sole responsibility. Thanks are also due to James Brady who made this essay more readable.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hayashi, T. Is it Abenomics or Post-Disaster Recovery? A Counterfactual Analysis. Int Adv Econ Res 20, 23–31 (2014). https://doi.org/10.1007/s11294-013-9450-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-013-9450-z