Abstract

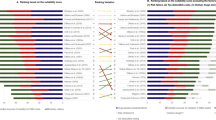

This paper considers the determinants and effects of domestic versus cross-border mergers and acquisitions (M&As) in the pharmaceutical industry. Results show that companies that have had large research and development (R&D) expenditures as a percentage of sales in the past, but which have not had a significant number of drug approvals in the previous five years, tend to merge with foreign firms. Domestic mergers are formed between two firms within the same country, which typically have lower R&D expenditures as a percentage of sales and drug approvals in the previous five years. In addition, results show that domestic mergers increase drug approvals in the short run, but the effect diminishes three years after an M&A is finalized. However, cross-border mergers, which occur between two companies from different countries, largely have long-lasting (five years or more) positive effects on new drug approvals.

Similar content being viewed by others

Notes

It is important to include target firms’ pre-merger R&D productivity in the counterfactual and compare the change in targets’ pre-merger R&D productivity after the merger. But for international mergers, targets’ pre-merger R&D productivity is not observable due to inaccessibility of appropriate data. The comparison of the acquiring companies’ R&D productivity captures how companies are able to obtain more NDA approvals after the merger. We thank an anonymous reviewer for this comment.

The size of the target firm, the nature of the molecules (branded vs. generic, small molecule vs. large molecule) and target locations are not observable in the data. Our estimation technique controls for the level of the firm’s heterogeneity and controls for unobserved effects. For future studies, we plan to expand this analysis by including this information. We are thankful to an anonymous reviewer for these comments.

We repeated the second stage for domestic and international mergers in two separate analyses.

References

Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms: a longitudinal study. Strategic Management Journal, 22, 197–220.

Arnold, J., & Smarzynska, B. (2005). Gifted kids or pushy parents? Foreign acquisitions and plant performance in Indonesia. http://www-wds.worldbank.org/servlet/WDSContentServer/WDSP/IB/2005/05/15/000090341_20050515144920/Rendered/PDF/wps3597.pdf.

Barros, P., & Cabral, L. (1994). Merger policies in open economies. European Economic Review, 38, 1041–1055.

Bertrand, O. (2009). Effects of foreign acquisitions on R&D activity: evidence from firm-level data for France. Research Policy, 38(6), 1021–1031.

Bertrand, O., & Zitouna, H. (2008). Domestic versus cross-border acquisitions: which impact on the target firms’ performance? Applied Economics, 40(17), 2221–2238.

Bertrand, O., & Zuninga, P. (2006). R&D and M&A: are cross-border M&A different? An investigation on OECD countries. International Journal of Industrial Organization, 24, 401–423.

Blonigen, B., & Taylor, C. (2000). R&D activity and acquisitions in high technology industries: evidence from the US Electronics Industry. Journal of Industrial Economics, 47(1), 4771.

Brand, J.E., & Thomas, J.S. (2013). Casual effect heterogenity. Handbooks of Sociology and Social Research, 189–213.

Brand, J.E., & Xie, Y. (2010). Who benefits most from college? Evidence for negative selection in heterogeneous economic returns to higher education. American Sociological Review, 75, 273–302.

Bresman, H., Birkinshaw, J., & Nobel, R. (1999). Knowledge transfers in international acquisitions. Journal of International Business Studies, 439–462.

Capron, L. (1999). The long term performance of horizontal acquisitions. Strategic Management Journal, 20, 987–1018.

Cassiman, M., Colombo, B., Garrone, P., & Veugelers, R. (2005). The impact of M&A on the R&D process: an empirical analysis of the role of technological and market- relatedness. Research Policy, 34(2), 195–220.

Collie, D. (2003). Mergers and trade policy under oligopoly. Review of International Economics, 11, 55–71.

Comanor, W.S., & Scherer, F.M. (2013). Mergers and innovation in the pharmaceutical industry. Journal of Health Economics, 32, 106–113.

Conyon, M.J., Girma, S., Thompson, S., & Wright, P. (2002). The productivity and wage effects of foreign acquisition in the United Kingdom. Journal of Industrial Economics, 50, 85–102.

Danzon, P.M., Andrew, E., & Sean, N. (2007). Mergers and acquisitions in the pharmaceutical and Biotech Industries. Managerial and Decision Economics, 28, 307–328.

Dixit, A. (1984). International trade policy for oligopolistic industries. Economic Journal, 94, 1–16.

Ernst, H., & Vitt, J. (2000). The influence of corporate acquisitions on the behaviour of key inventors. R&D Management, 30, 105–119.

Grabowski, H., & Kyle, M. (2008). Mergers and alliances in pharmaceuticals: effects on innovation and R&D productivity. In K. P. Gugler & B. B. Yurtoglu (Eds.), The economics of corporate governance and mergers, chapter 11 (pp. 262–287). Cheltenham: Edward Elgar Publishing.

Griliches, Z. (1977). Estimating the returns to schooling: some econometric problems. Econometrica, 45, 122.

Gugler, K., Mueller, D., Yurtoglu, B.B., & Zulehner, C. (2003). The effects of mergers: an international comparison. International Journal of Industrial Organization, 21(5), 625–653.

Head, K., & Ries, J. (1997). International mergers and welfare under decentralized competition policy. Canadian Journal of Economics, 30, 1104–1123.

Higgins, M.J., & Rodriguez, D. (2006). The outsourcing of R&D through acquisitions in the pharmaceutical industry. Journal of Financial Economics, 80, 351–383.

Hitt, M.A., & Hoskisson, R.E. (1990). Mergers and acquisitions and managerial commitment to innovation in M-form firms. Strategic Management Journal, 11, 2947.

Hitt, M.A., Hoskisson, R.E., Ireland, R. D., & Harrison, J.S. (1991). Effects of acquisitions on R&D inputs and outputs. Academy of Management Journal, 34, 693–706.

Hitt, M., Hoskisson, R., Johnson, R., & Moesel, D. (1996). The market for corporate control and firm innovation. Academy of Management Journal, 39, 1084–1119.

Horn, H., & Levinsohn, J. (2001). Merger policies and trade liberalization. Economic Journal, 111, 244–276.

Koenig, M., & Elizabeth, M. (2004). Impact of mergers and acquisitions on research productivity within the pharmaceutical industry. Scientometrics, 59(1), 15769.

Long, N.V., & Vousden, N. (1995). The effect of trade liberalization on cost reducing horizontal mergers. Review of International Economics, 3, 141–155.

Miller, R.R. (1990). Do mergers and acquisitions hurt R&D? Research-Technology Management, 33, 1115.

Munos, B. (2009). Lessons from 60 years of pharmaceutical innovation. Nature Reviews Drug Discovery, 8, 959–968.

Ornaghi, C. (2009). Mergers and innovation in big pharma. International Journal of Industrial Organization, 27, 70–79.

Paruchuri, S., Nerkar, A., Donald, C.H. (2006). Acquisition integration and productivity losses in the technical core: disruption of inventors in acquired companies. Organization Science, 17, 545–562.

Prabhu, J.C., Rajesh K.C., Mark E.E. (2005). The impact of acquisitions on innovation poison: pill, placebo, or tonic? Journal of Marketing, 69(1), 114–130.

Richardson, M. (1999). Trade and competition policies: concordia discors? Oxford Economic Papers, 51, 649–664.

Takechi, K. (2011). R&D intensity and domestic and cross-border M&A of Japanese firms before domestic M&A deregulation. Japan and the World Economy, 23, 112–118.

Wooldridge, J.M. (2002). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Acknowledgments

We are thankful to our anonymous reviewer for these comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Banerjee, T., Nayak, A. Comparing Domestic and Cross-Border Mergers and Acquisitions in the Pharmaceutical Industry. Atl Econ J 43, 489–499 (2015). https://doi.org/10.1007/s11293-015-9476-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-015-9476-0