Abstract

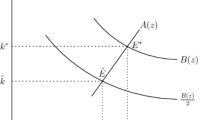

This paper employs Cournot’s (1838) model of complementary goods to analyze the optimal emission taxation under joint and independent ownership with pollution. When the marginal damage is small (large), an emission taxation is unnecessary (necessary), because the quantity (environmental) distortion is more serious than the environmental (quantity) distortion. This finding has never been presented in the literature. In contrast to Cournot (1838), a striking result is that independent ownership may be welfare superior to joint ownership when the marginal damage of externality is large in the absence of governmental intervention.

Similar content being viewed by others

Notes

The final product’s price is solely determined on the supply side. In fact, Cournot (1838) does not define the final market types. In our viewpoint, he implies that there are many buyers for the final product and thus all of them are price takers.

The casting of zinc actually produces some zinc oxide fumes which may cause serious diseases.

Goel and Hsieh (1997) show that convexity or concavity of the demand function may affect the welfare effect of an emission tax when solving the externality problem. To achieve closed-form solutions and without loss of generality, this paper assumes a linear inverse demand function.

As Fisher (1898, p.128) points out, “His [Cournot’s] study here, unlike the rest of his work, is confined to a special case; namely, that where the component articles enter in perfectly definite proportions into the joint article”. However, the essence of Cournot’s model is “mutual relations of producers” and the striking result is that these two firms share profit equally as long as the proportion is 0 < m 1 < 1. The economic intuition behind the mutual relations of producers is that both firms are indispensable for each other, instead of the fixed proportion of production. In reality, brass is produced with fixed proportion of zinc and copper. The more zinc, the more yellow color and the more hardness for the alloy. For example, it is called red brass when containing 15% of zinc and is called yellow brass when containing 35% of zinc. This is similar to the fact that the 18k gold contains a fixed proportion (75%) of gold. The key point of Cournot’s model is that both firms not only compete with each other, but also must cooperate together. In this sense, the fixed proportion in production may be considered as a normal case, instead of a special case.

The total damage is thus quadratic to the quantity produced.

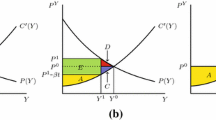

Note that there are two industries (the polluted industry and the damaged industry) in Buchanan’s (1969) model. Therefore, even though the polluted industry has been optimally taxed, the damaged industry will still be polluted and thus only the second-best goal can be reached. However, our model is a partial equilibrium analysis under one industry with one policy instrument. Thus, \( t_J^* \) indeed reaches the first-best solution. Plugging \( t_J^* \) into p J , q J , CS J , and W J yields \( p_J^* = {p^o} = \tfrac{{\alpha k}}{{\beta + k}} \), \( q_J^* = {q^o} = \tfrac{\alpha }{{\beta + k}} \), \( CS_J^* = C{S^o} = \tfrac{1}{2}\tfrac{{\beta {\alpha^2}}}{{{{\left( {\beta + k} \right)}^2}}} \), and \( W_J^* = {W^o} = \tfrac{{{\alpha^2}}}{{2(\beta + k)}} \), where the superscript “o” represents “optimum”.

Note that the social loss is due to the further reduction in output that would result in an already output constrained monopoly market. We owe this point to the Referee.

Note also p I > p J is without taxation. This is because the independent firms ignore the price markup externality to each other, while the integrated monopolist internalizes this externality (See Economides and Salop (1992), page 106).

Note that the demand function and marginal damage function are identical for both joint and independent ownerships. Thus, the social optimal quantity and price should be identical in both types of ownerships. Therefore, the optimal tax rate may not equal the marginal damage. At q 0, the marginal damage is \( \alpha k/\left( {\beta + k} \right) \), which is obviously greater than \( t_I^* \) and \( t_J^* \).

In fact, one can plug k = 0 into (17) to have W J −W I > 0.

For example, a vertical integration in successive monopolies will produce a higher quantity of the final product due to the elimination of double marginalization.

References

Barnett, A. (1980). The Pigouvian tax rule under monopoly. American Economic Review, 70, 1037–1041.

Baumol, W. (1972). On taxation and the control of externalities. American Economic Review, 62, 307–322.

Baumol, W., & Oates, W. (1975). The theory of environmental policy. Englewood Cliffs: Prentice Hall.

Brueckner, J. (2004). Network structure and airline scheduling. Journal of Industrial Economics, 52, 291–314.

Buchanan, J. (1969). External diseconomies, correction taxes, and market structures. American Economic Review, 59, 174–177.

Carlton, D., & Loury, G. (1986). The limitations of Pigouvian taxes as a long-run remedy for externalities: an extension of results. Quarterly Journal of Economics, 101(3), 631–634.

Carter, M., & Wright, J. (1994). Symbiotic production: the case of telecommunication pricing. Review of Industrial Organization, 9, 365–378.

Cournot, A., “Of the competition of producers,” Chapter 7 in Researches into the Mathematical Principles of the Theory of Wealth, 1838, translated by Nathanial T. Bacon, Macmillan, New York, 1897; reprinted with notes by Irving Fisher, Macmillan, New York, 1927; reprinted, Augustus M. Kelley, New York, 1960; originally published as “Recherches sur les principles mathématiques de la théorie des richesses,” L. Hachette, Paris, 1838.

Economides, N., & Salop, S. (1992). Competition and integration among complements, and network market structure. Journal of Industrial Economics, 40(1), 105–123.

Fisher, I. (1898). Cournot and mathematical economics. Quarterly Journal of Economics, 12(2), 119–138.

Goel, R., & Hsieh, E. (1997). Market structure, Pigouvian taxation, and welfare. Atlantic Economic Journal, 25(2), 128–138.

Kohn, R. (1986). The limitations of Pigouvian taxes as a long-run remedy for externalities: comment. Quarterly Journal of Economics, 101(3), 625–630.

Martin, R. (1986). Externality regulation and the monopoly firm. Journal of Public Economics, 29, 347–362.

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Atsushi Tsuneki, Noriaki Matsushima, Hong Hwang, Ming-Chung Chang, and Dao-Zhi Zeng for their valuable comments. The financial support from the National Science Council: NSC 94-2415-H-305-003 is greatly appreciated. All errors remain ours.

Rights and permissions

About this article

Cite this article

Liu, CJ., Mai, CC., Lai, FC. et al. Pollution, Factor Ownerships, and Emission Taxes. Atl Econ J 38, 209–216 (2010). https://doi.org/10.1007/s11293-010-9213-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-010-9213-7