Abstract

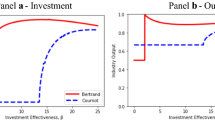

This paper presents a new theoretical justification for the Cournot–Bertrand model to arise in equilibrium when firms have, at the outset, the same cost structure and sell symmetrically differentiated products. The Cournot–Bertrand model assumes some firms compete on price, adjusting their production to meet demand, while others set quantities and let their price adjust until market equilibrium is reached. We show that this may occur endogenously due to the possibility of entry, which may be deterred when some of the incumbents decide to set prices, while others free ride on this behavior and choose quantities.

Similar content being viewed by others

Notes

Examples include the markets for alcoholic beverages, small cars retailing, Japanese home electronics, personal computers and computer software. See Tremblay and Tremblay (2019) and the references therein.

The prevalence of a single type of competition has been obtained in other settings. Tanaka (2001) shows that in the case of vertically differentiated substitutes, choosing to compete in quantities in a first stage of the game dominates the choice to compete in prices. Chirco and Scrimitore (2013) show that the introduction of network effects does not modify this choice when firms are profit maximizers.

On the role of uncertainty, see also Klemperer and Meyer (1986).

The choice of which strategic variable to use has also been studied in highly specific settings. Kopel (2015) and Nakamura (2017a) study this choice in a mixed duopoly involving a profit maximizer and a public firm without and with network externalities, respectively. Nakamura (2020) considers two profit maximizers instead and allows for different types of consumer expectations. Nakamura (2017a) introduces a bargaining stage between owners and managers with respect to their delegation contract after the price/quantity decision. Matsumura and Ogawa (2012) and Haraguchi and Matsumura (2016) introduce a public firm and, respectively, one or more private firms and characterize the equilibrium of the strategic variable choice.

With respect to delegation games, Miller and Pazgal (2001) show that when owners are able to compensate their managers in such a way that each manager maximizes a linear combination of the firm’s own profit and its rival’s profit, the market outcome is the same regardless of the strategic variable that managers decide to control (both firms setting prices or quantities, or one firm choosing price and the other choosing quantity). In the presence of delegation, the strategic variables are thus irrelevant.

Tremblay et al. (2013) also consider different unit cost, which they attribute to learning-by-doing by one of the specific small car producers.

We thank an anonymous referee for indicating this related line of literature.

The impact of assuming that firms of different types have different costs is discussed below.

Results with this demand structure are available upon request.

This follows from \(\pi _{i}^{Q} (n,k+1)>\pi _{i}^{Q}(n,k)>\pi _{i}^{P}(n,k).\)

The proof of these inequalities is presented in the proof of Lemma 1.

This profit difference can be written as a function of the number of price setters, \(g=n-k.\) It can be showed that it decreases with g and is equal to \(\overline{D}=\frac{2\gamma ^{3}\left( 1-\gamma \right) }{\left( 4+6\gamma \left( n-2\right) +\gamma ^{2}\left( n-1\right) \left( 2n-7\right) \right) ^{2}\left( \gamma \left( n-2\right) +1\right) }\) when evaluated at \(g=n-1\). Hence, \(F^{Q} -F^{P}<\overline{D}\) ensures that the profit inequality holds for any market configuration with two types of firms.

Following Barthel and Hoffman (2020)’s notation, the first argument in P(, ) stands for the number of price competitors and the second one stands for the number of quantity competitors.

We thank an anonymous referee for pointing this out.

Because

$$\begin{aligned} \frac{\gamma +\gamma ^{2}-2}{\left( \gamma +1\right) (2-\gamma )}-\frac{\gamma +\gamma ^{2}-2}{\left( 2-\gamma ^{2}\right) }&=\frac{\gamma \left( \gamma +2\right) \left( 1-\gamma \right) }{\left( 2-\gamma \right) \left( \gamma +1\right) \left( 2-\gamma ^{2}\right) }>0\\ \frac{\gamma +\gamma ^{2}-2}{\left( \gamma +1\right) (2-\gamma )}-\frac{1}{2}\left( 3\gamma +2\right) \frac{1-\gamma }{-\gamma +\gamma ^{2}-1}&=\frac{\gamma \left( 1-\gamma \right) \left( 2+3\gamma -\gamma ^{2}\right) }{2\left( 2-\gamma \right) \left( \gamma +1\right) \left( 1+\gamma -\gamma ^{2}\right) }>0 \end{aligned}.$$

References

Askar, S. S. (2014). On Cournot-Bertrand competition with differentiated products. Annals of Operations Research, 223(1), 81–93.

Barthel, A.-C., & Hoffman, E. (2020). On the existence and stability of equilibria in N-firm Cournot-Bertrand oligopolies. Theory and Decision, 88(4), 471–491.

Bylka, S., & Komar, J. (1976). Cournot-Bertrand mixed oligopolies. In M. W. Los, J. Los, & A. Wieczorek (Eds.), Warsaw Fall Seminars in Mathematical Economics, 1975 (pp. 22–33). New York: Springer-Verlag.

Cellini, R., Lambertini, L., & Ottaviano, G. I. P. (2004). Welfare in a differentiated oligopoly with free entry: A cautionary note. Research in Economics, 58(2), 125–133.

Chirco, A., & Scrimitore, M. (2013). Choosing price or quantity? The role of delegation and network externalities. Economics Letters, 121(3), 482–486.

Correa-López, M. (2007). Price and quantity competition in a differentiated duopoly with upstream suppliers. Journal of Economics and Management Strategy, 16(2), 469–505.

d’Aspremont, C., Dos Santos Ferreira, R. (2009). Price-quantity competition with varying toughness. Games and Economic Behavior, 65(1), 62–82.

d’Aspremont, C., Dos Santos Ferreira, R., & Thépot, J. (2016). Hawks and Doves in Segmented Markets: Profit Maximization with Varying Competitive Aggressiveness. Annals of Economics and Statistics, 121(122), 45–66.

d’Aspremont, C., Dos Santos Ferreira, R., & Gérard-Varet, L.-A. (2007). Competition for market share or for market size: Oligopolistic equilibria with varying competitive toughness. International Economic Review, 48, 761–784.

Hackner, J. (2000). A note on price and quantity competition in differentiated oligopolies. Journal of Economic Theory, 93(2), 233–239.

Haraguchi, J., & Matsumura, T. (2016). Cournot–Bertrand comparison in a mixed oligopoly. Journal of Economics, 117(2), 117–36.

Hsu, J., & Wang, X. H. (2005). On welfare under Cournot and Bertrand competition in differentiated oligopolies. Review of Industrial Organization, 27(2), 185–191.

Klemperer, P. ,Meyer, M. (1986). Price competition vs. quantity competition: The role of uncertainty. RAND Journal of Economics, 17(4), 618–638.

Kopel, M. (2015). Price and quantity contracts in a mixed duopoly with a socially concerned firm. Managerial and Decision Economics, 36(8), 559–566.

Kopel, M., & Putz, E. M. (2021). Information sharing in a Cournot–Bertrand duopoly. Managerial and Decision Economics, 42, 1645–1655.

Matsumura, T., & Ogawa, A. (2012). Price versus quantity in a mixed duopoly. Economics Letters, 116(2), 174–177.

Miller, N. H., & Pazgal, A. I. (2001). The equivalence of price and quantity competition with delegation. The RAND Journal of Economics, 32(2), 284–301.

Motta, M. (2004). Competition Policy: Theory and Practice. Cambridge: Cambridge University Press. https://doi.org/10.1017/CBO9780511804038

Mukherjee, A. (2005). Price and quantity competition under free entry. Research in Economics, 59(4), 335–344.

Nakamura, Y. (2017). Choosing price or quantity? The role of delegation and network externalities in a mixed duopoly. Australian Economic Papers, 56(2), 174–200.

Nakamura, Y. (2017). Price versus quantity in a duopolistic market with bargaining over managerial delegation contracts. Managerial and Decision Economics, 38(3), 326–343.

Nakamura, Y. (2020). Price versus quantity in a duopoly with network externalities under active and passive expectations. Managerial and Decision Economics, 42(1), 120–133.

Reisinger, M., & Ressner, L. (2009). The choice of prices versus quantities under uncertainty. Journal of Economics and Management Strategy, 18(4), 1155–1177.

Sakai, Y., Eguchi, S., & Ishigaki, H. (1995). Price and quantity competition: Do mixed oligopolies constitute an equilibrium? Keio Economic Studies, 32(2), 15–25.

Shubik, M., & Levitan, R. (1980). Market Structure and Behavior. Cambridge, MA: Harvard University Press.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. RAND Journal of Economics, 15(4), 546–554.

Tanaka, Y. (2001). Profitability of price and quantity strategies in a duopoly with vertical product differentiation. Economic Theory, 17(3), 693–700.

Tremblay, C. H., & Tremblay, V. J. (2011). The Cournot–Bertrand model and the degree of product differentiation. Economics Letters, 111(3), 233–235.

Tremblay, C. H., & Tremblay, V. J. (2019). Oligopoly games and the Cournot–Bertrand model: A survey. Journal of Economic Surveys, 33(3), 1555–1577.

Tremblay, V. J., Tremblay, C. H., & Isariyawongse, K. (2013). Endogenous timing and strategic choice: The Cournot–Bertrand model. Bulletin of Economic Research, 65(4), 332–342.

Acknowledgements

Margarida Catalão-Lopes gratefully acknowledges financial support from Fundação para Ciência e Tecnologia (FCT), through PTDC/EGE-ECO/29332/2017 and UIDB/00097/2020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Proof of Lemma 1: Let there be n firms, k of which set quantities with \(k\in \left[ 1,n-1\right] \). Without loss of generality let these firms be firm \(1,\ldots ,k\). Firms \(k+1,\ldots ,n\) set prices. There are such \(n-k\) firms.

Aggregating the demand functions (1) for the two types of firms we obtain, respectively, for the firms that set quantities and for the firms that set prices

with \(P_{k}=\sum _{j=1}^{k}p_{j}\) and \(P_{n-k}=\sum _{j=k+1}^{n}p_{j}\) and likewise for quantities. As \(Q=Q_{k}+Q_{n-k}\), we have

or

Consider one of the quantity setting firms. Its inverse demand is

We want to write this as a function of the quantities of the other quantity setting firms, \(Q_{k-i}\), and of the sum of prices of the price setting firms, \(P_{n-k}\). Plugging (8) into (9) and simplifying we obtain

where \(Q_{k-i}=Q_{k}-q_{i}\).

Consider now one of the price setting firms. The demand for its product is

We want to write this as a function of the quantities of the other quantity setting firms, \(Q_{k}\), and of the sum of the prices of the other price setting firms, \(P_{n-k-i}\). Plugging (8) into (11) and simplifying we obtain

where \(P_{n-k-i}=\left( P_{n-k}-p_{i}\right) \).

The profit function of the quantity setting firms is then

and the first-order conditions for profit maximization are

The profit function of the price setting firms is then

and the first-order conditions for profit maximization are

Under symmetry we have \(q_{1}=\cdots =q_{k}=q\) and \(p_{k+1}=\cdots =p_{n}=p\). Solving the system of first-order conditions with respect to p, q yields:

Plugging these prices and quantities into (12) and (10) yields the quantity of a price setting firm (say firm \(k+1\)):

and the price of a quantity setting firm (say firm 1):

It can be showed that the quantities of both types of firms are always positive.

Finally, normalized equilibrium profits (i.e., profits divided by \(\frac{\left( a-c\right) ^{2}}{b})\) are

and

with

and

Given the equilibrium profits presented above, it is straightforward to check that:

(i) \(\pi _{i}^{Q}(n,k)-\pi _{i}^{P}(n,k)>0:\)

(ii) \(\pi _{i}^{Q}(n,k+1)>\pi _{i}^{Q}(n,k).\)

Let \(k\le n-1\). The result follows from the sign of

This expression has the same sign as the numerator, which is a U-shaped parabola in k minimized at

As \(k^{*}>n-1\ \)if and only if \(n>\frac{2-7\gamma }{2\left( 2-\gamma \right) }\), which is always true, we have that the minimum of the numerator occurs at \(k=n-1\) and is equal to

Therefore, the derivative is positive.

If \(k>n-1\) we have that

The numerator is minimized in n at \(n^{*}=\frac{\gamma ^{2}+2-4\gamma }{\gamma \left( \gamma -2\right) }<1\). Therefore, the minimum occurs at \(n=2\) and the numerator takes value \(\left( 2-2\right) \left( 4\gamma ^{2}+2\gamma ^{3}+8\right) +24\gamma +\gamma ^{3}+8*2\gamma ^{2}-20*2\gamma +4*2^{2}\gamma \left( 1-\gamma \right) =\gamma ^{3}>0.\)

(iii) If firms are of the same type, profits decrease with the number of firms

because \(2n^{2}\gamma ^{2}+n\left( 4\gamma -7\gamma ^{2}\right) -8\gamma +7\gamma ^{2}+2\) is increasing in n for \(n\ge 2\), and evaluated at \(n=2\) is equal to \(\gamma ^{2}+2>0.\) In addition

(iv) \(\pi _{i}^{Q}(n,k)>\pi _{i}^{Q}(n+1,k+1)\) and \(\pi _{i} ^{P}(n,k)>\pi _{i}^{P}(n+1,k+1).\)

Let the number of price setters be given by g: then \(k=\left( n-g\right) \). If \(g=0\) the result follows from the fact that if all firms are Cournot competitors profits decrease with the number of firms. If \(g\ge 1,\)

\(\blacksquare \)

Proof of Proposition 1:

Parts (a) and (d) are trivial. If the number of firms does not depend on the incumbents’ decision no firm would profit from being a price competitor instead of a quantity competitor.

(b) Assume that \(g^{*}(f)=1\). Having \(n-1\) quantity setters and one price setter is an equilibrium if any quantity setter does not profit from changing to become a price setter, and the price setter does not profit from changing to become a quantity setter, which will trigger entry.

The first part is implied by

As for the second part, the price setter changing to become a quantity setter, which will trigger entry, is not profitable if

which, with

is equivalent to

with the first inequality verified trivially.

(c) Assume that \(g^{*}(f)>1\).

(i) Having all n firms choosing quantities is a Nash equilibrium (with entry), because no firm profits from changing its decision. If any single firm decides to be a price setter this is not enough to deter entry and the profit of this firm will decrease.

(ii) Having \(n-g^{*}(f)\) firms choosing quantities and the remaining \(g^{*}(f)\) firms choosing prices is a Nash equilibrium (with no entry) if no firm wants to change its decision.

Any price setter does not want to change its decision (which leads to entry) if and only if

Any quantity setter does not want to change its decision (which leads to no entry) if and only if

which is always true.

Finally, regardless of the value taken by \(g^{*}(f)\), having more than \(g^{*}(f)\) firms choosing prices is not an equilibrium as, if one of these firms deviated to become a quantity setter, this would not lead to entry and would be profitable. In addition, having at least one but less than \(g^{*}(f)\) firms choosing prices is not also an equilibrium as the deviation to become a quantity setter would still lead to entry and would be profitable.\(\blacksquare \)

Proof of Corollary 1: For this equilibrium to exist, we need

with \(k=\frac{n}{2}\).

The interval in the first condition always exists.

We now move to the second condition, assuming n is even and \(k=n/2\) and using

It can be shown that \(\pi ^{P}(n,n/2)-\pi ^{Q}(n+1,n/2+2)\) has the same sign as

for \(n\ge 6\).

Both roots of \(\frac{\partial g(n,\gamma )}{\partial \gamma }\) with respect to \(\gamma \) are negative for \(n\ge 8\), so this derivative is always positive and \(g(n,\gamma )\) increases with \(\gamma \). As \(g(n,0)=8>0\) we have that \(g(n,0)>0\) for all \(\gamma \) if \(n\ge 8\).

For the other values of n we proceed case by case. Inequality \(\pi ^{P}(n,k)>\pi ^{Q}(n+1,k+2)\) with \(k=n/2\) is equivalent to:

(i) if \(n=2\): \(\gamma <0.78078\) as presented in the numeric example.

(ii) if \(n=4\):

which holds if and only if \(\gamma <0.87067\).

(iii) if \(n=6\):

which is true for any \(\gamma \in \left( 0,1\right) .\)

This concludes the proof.\(\blacksquare \)

Appendix B

In this appendix we detail the three firm example in Sect. 3.2.1 for the case of cost asymmetries.

It is straightforward to show, following the same steps as in the proof of Lemma 1, that in the presence of cost asymmetries the equilibrium profits are given by

where \(Z=\frac{c(1-\alpha )}{a-c}\) is a normalization of the difference in the marginal costs of quantity setters, c, and price setters, \(\alpha c.\)

The payoffs involved in Sect. 3 are:

All quantities involved in these cases must be positive, that is, cost differences cannot be too large to ensure positive quantities for all firms involved.

The equilibrium quantities (divided by \(\frac{a-c}{b}\)) are

The following table presents the upper and lower bounds on Z, such that all quantities are positive.

\(q^{Q}>0\) | \(q^{P}>0\) | |

|---|---|---|

\(n=3;k=2\) | \(Z<\frac{2-\gamma }{\gamma }\) | \(Z>\frac{\gamma +\gamma ^{2} -2}{\left( \gamma +1\right) (2-\gamma )}\) |

\(n=3;k=1\) | \(Z<\frac{1}{2}\frac{2-\gamma }{\gamma }-\frac{1}{2}\gamma \) | \(Z>\frac{1}{2}\left( 3\gamma +2\right) \frac{1-\gamma }{-\gamma +\gamma ^{2}-1} \) |

\(n=2;k=1\) | \(Z<\frac{2-\gamma }{\gamma }\) | \(Z>\frac{\gamma +\gamma ^{2} -2}{\left( 2-\gamma ^{2}\right) }\) |

All these are implied byFootnote 15

This merely states that the cost differences between the two types of firms cannot be too large.

With respect to the preliminary assumption in Sect. 3:

one needs that \(\pi ^{Q}(3,3)<\pi ^{Q}(2,1),\) \(\pi _{i}^{Q}(3,2)<\pi _{i} ^{Q}(3,3)\), \(\pi _{i}^{Q}(3,1)<\pi _{i}^{Q}(3,2)\), which yield, respectively:

with

The first (second) condition imposes that the individual profit in a “pure” Cournot tripoloy is lower (higher) than a quantity setters’ profit when it is competing with a price setter. This is easier to verify if the quantity setter’s cost disadvantage (advantage) is sufficiently low (high). The third condition imposes that the profit of a quantity setter when competing with another quantity setter plus a price setter is higher than when competing with two price setters.

In addition, two more conditions are needed to have an equilibrium with Bertrand-Cournot competition:

(i) \(\pi ^{P}(2,1)>\pi ^{Q}(3,3)\), which holds for

and;

(ii) \(\pi ^{Q}(2,1)>\pi ^{P}(2,0)\), which holds for

The first condition ensures that it is more profitable to deter entry by being a price setter than to be a quantity setter and allow entry. This is more likely to happen the greater the cost disadvantage of quantity setters. The second condition ensures that the quantity setter in the Cournot–Bertrand duopoly does not want to switch to be a price competitor, which is easier to verify when the quantity setters’ cost disadvantage is small.

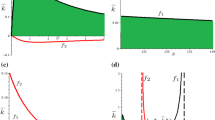

Let \(\underline{Z}=\max \left\{ \underline{Z_{1}},\underline{Z_{2} },\underline{Z_{3}},\underline{Z_{4}}\right\} \) and \(\overline{Z} =\min \left\{ \overline{Z_{1}},\overline{Z_{2}},\overline{Z_{3}} ,\overline{Z_{4}}\right\} \). Figure 2 presents these thresholds and for \(\underline{Z}<Z<\overline{Z}\) an equilibrium with Cournot–Bertrand competition exists.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Brito, D., Catalão-Lopes, M. Cournot–Bertrand endogenous behavior in a differentiated oligopoly with entry deterrence. Theory Decis 95, 55–78 (2023). https://doi.org/10.1007/s11238-022-09909-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-022-09909-5