Abstract

When randomly assigning participants to experimental roles and the according payment prospects, participants seem to receive “manna from heaven.” In our view, this seriously questions the validity of laboratory findings. We depart from this by auctioning off player roles via the incentive compatible random price mechanism thus avoiding the selection effect of competitive second price auctions. Our experiment employs the generosity game where the proposer chooses the size of the pie, facing an exogenously given own agreement payoff, and the responder is the residual claimant. We find that entitlement crowds out equality seeking and strengthens efficiency seeking. More generally, we find that inducing entitlement for the roles in which participants find themselves makes a difference. Interpreting participants’ willingness to pay for their role as their aspiration level further allows to test satisficing and explore “mutual satisficing.” We find that responder participants apparently do not anticipate proposer generosity in aspiration formation.

Similar content being viewed by others

Notes

For a theoretical and experimental study of three-person generosity games in which either the responder or a third “dummy” player is the residual claimant, see Güth et al. (2010).

According to the findings by Güth et al. (2012) from their “manna from heaven” experiment, this risk is negligible for pie sizes \(p\ge 2x\).

As there might not have been an equal number of \(X\)- and \(Y\)-participants acquiring the \(X\)- and the \(Y\)-role in each session, we used the decision of some participants repeatedly but, of course, paid them only once, according to one randomly selected partner. Since there is no feedback information, the fact that one participant affects the payoffs of several others (without knowing this) is unproblematic.

The costs \(r_{i}\) for acquiring role \(i=X,Y\), may exceed what was subsequently earned in the generosity game, e.g., due to \(\delta \left( p\right) =0\). Possible losses were subtracted from the show-up fee or could be paid out of pocket when exceeding the show-up fee. Otherwise, participants had to fulfill an additional task at the end of the experiment to cover their losses. This occurred only twice, and as we had participants register for a long enough time interval to cover potential losses, none of the participants left the experiment with negative earnings. The instructions clearly stated that payoffs amount to the earnings from the generosity game minus the role price. One of the provided examples in the instructions (see Appendix 3, example 2) showed that negative payoffs were possible.

Exogenously induced true values avoid the problem that the true value may depend on the random price (see Horowitz 2006).

We cannot use the a posteriori-aspirations because they might be biased when the actual price is much lower than the bid.

To explore whether or not participants have rational expectations concerning the behavior of the other player in the subsequent generosity game, we asked participants what they expect their counterparts to choose. Specifically, we asked proposers \(X\) which responder choice \(\widehat{\delta }\left( p\right) \) for their chosen \(p\)-value they expect. Responders \(Y\) were asked: “Which \(p\)-choice by \(X\) do you expect (\( \widehat{p}_{y}\))?” Of course, also the bids \({b}_{i}\) are informing about such expectations.

Such reasoning may, of course, be a false consensus when behavior is heterogeneous.

These questions (including the ones on proposer and responder expectations, see footnote 8) were asked in each round. Although one might be concerned that participants would not answer them carefully and although hedging confounds have been shown not to be a major problem (see Blanco et al. 2009), we refrained from incentivizing these questions to not cognitively overburden participants. Answering the questions regarding hypothetical behavior and expected behavior of one’s counterpart might be considered as a “mental preparation” for own decisions.

For \(X\)-participants there are no monotonic aggregate dynamics (see Fig. 6 in Appendix 2). The distribution of bids \(b_{x}\left( t\right) \) does not differ significantly across rounds \(t=1,\ldots 12\) according to a Mann–Whitney \(U\) test comparing pairs of rounds (significance levels \(>0.1\) for all \(t=1,\ldots ,12\)).

Note that responders did not learn to anticipate the strong efficiency concerns of proposers due to not receiving feedback information.

We have decided for such a “recommendation” rather than proving why this is the only dominant strategy and then testing the acceptance of this proof by a pretest (see Güth and Tietz 1986).

References

Becker, G. M., DeGroot, M. H., & Marshak, J. (1964). Measuring utility by a single-response sequential method. Behavioral Science, 9, 226–232.

Blanco, M., Engelmann, D., Koch, A. K., & Normann, H.-T. (2009). Preferences and beliefs in a sequential social dilemma: A within-subjects analysis. IZA discussion papers 4624. Institute for the Study of Labor (IZA).

Bosman, R., & van Winden, F. (2002). Emotional hazard in a power-to-take experiment. Economic Journal, 112, 147–169.

Cappelen, A., Hole, A., Srensen, E., & Tungodden, B. (2007). The pluralism of fairness ideals: An experimental approach. American Economic Review, 97, 818–827.

Cherry, T. L., Kroll, S., & Shogren, J. F. (2005). The impact of endowment heterogeneity and origin on public good contributions. Journal of Economic Behavior and Organization, 57, 357–365.

Fischbacher, U. (2007). Zurich toolbox for readymade economic experiments. Experimental Economics, 10, 171–178.

Friedlander, F., & Pickle, H. (1968). Components of effectiveness in small organizations. Administrative Science Quarterly, 13, 289–304.

Gantner, A., Güth, W., & Königstein, M. (2001). Equitable choices in bargaining games with joint production. Journal of Economic Behavior and Organization, 46, 209–225.

Güth, W., Kliemt, H. Local equity—(L)abstraction does not guarantee generality. CESifo Economic Studies. forthcoming.

Güth, W., Levati, M. V., & Ploner, M. (2012). An experimental study of the generosity game. Theory and Decision, 72, 51–63.

Güth, W., Pull, K., Stadler, M., & Stribeck, A. (2010). Equity versus efficiency?—evidence from three-person generosity experiments. Games, 1, 89–102.

Güth, W., & Schwarze, B. (1983). Auctioning strategic roles to observe aspiration levels for conflict situations. In R. Tietz (Ed.), Aspiration levels in bargaining and economic decisions. Berlin: Springer.

Güth, W., & Tietz, R. (1986). Auctioning ultimatum bargaining positions—how to act if rational decisions are unacceptable? current issues in west German decision research. Frankfurt: P. Lang Publisher.

Hackett, S. C. (1993). Incomplete contracting: A laboratory experimental analysis. Economic Inquiry, 31, 274–297.

Hoffman, E., & Spitzer, M. L. (1985). Entitlements, rights and fairness: An experimental examination of subjects’ concepts of distributive justice. Journal of Legal Studies, 14, 259–297.

Homans, G. C. (1961). Social behaviour: Its elementary forms. London: Routledge and Keegan Paul.

Horowitz, J. (2006). The Becker-DeGroot-Marschak mechanism is not necessarily incentive compatible, even for non-random goods. Economics Letters, 93, 6–11.

Königstein, M. (2000). Equity, efficiency and evolutionary stability in Bargaining games with joint production. Berlin: Springer.

Mikula, G. (1973). Gewinnaufteilungsverhalten in Dyaden bei variiertem Leistungsverhältnis. Zeitschrift für Sozialpsychologie, 3, 126–133.

Ruffle, B. J. (1998). More is better, but fair is fair: Tipping in dictator and ultimatum games. Games and Economic Behavior, 23, 247–265.

Rutström, E., & Williams, M. (2000). Entitlements and fairness: An experimental study of distributive preferences. Journal of Economic Behavior and Organisation, 43, 75–89.

Simon, H. A. (1955). A behavioral model of rational choice. Quarterly Journal of Economics, 69, 99–118.

Author information

Authors and Affiliations

Corresponding author

Appendices

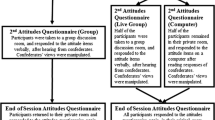

Appendix 1: Timeline of the experimental procedure

Appendix 2: Familiarity dynamics of bids

Appendix 3: Instructions

Welcome and thanks for participating in this experiment. You will receive 2.50 euros for having shown up on time. Please remain quiet and switch off your mobile phone. Please read the instructions—which are the same for everyone—carefully. You are not allowed to talk to other participants during the experiment. If you do not follow these rules, we will have to exclude you from the experiment and therefore from any payment. To make sure you have understood the instructions, you have to answer several control questions before you can begin with the experiment. You will receive 3 euros for correctly answering the control questions. If you answer a control question three times incorrectly, you will be excluded from the experiment. If you have a question, please raise your hand. An experimenter will then come to you and answer your question in private. The show-up fee of 2.50 euros, the 3 euros for answering the control questions, as well as any additional amount of money that you may earn during the experiment, will be paid out to you in cash at the end of the experiment. The payments are made in private so that no other participant will know the amount of your payment. In the experiment, all amounts are denoted in ECU (experimental currency units). At the end of the experiment, the ECU earned will be converted into euros according to the following exchange rate:

Please note that it is also possible to incur losses in this experiment. In this case, you can choose whether you pay for the incurred losses out of your own pocket or compensate for them by fulfilling an additional task at the end of the experiment. In this task, you will be asked to search for certain letters in a text and to count them. By doing so, you can compensate a 1 euro loss per extra task. Please note that these additional tasks can only be used to counterbalance possible losses but not to increase your earnings.

1.1 Proceedings of the experiment

The experiment consists of a pre-phase, followed by twelve rounds with the identical course of action in every round. You will be paid for the pre-phase and two of the following twelve rounds. One of these two payoff relevant rounds is randomly drawn from the first six rounds, and the other from the second six rounds. In every round, two participants will interact with each other just once; afterwards, new pairs will be formed. Hence, it is very unlikely that you will encounter the same participant twice in the course of the experiment. Your identity will not be revealed to any other participant.

At the outset of the experiment, you will be assigned one of two possible roles: X or Y. You will be informed of your role following the pre-phase, i.e., at the beginning of the first round. You will keep your role through all twelve rounds of the experiment. However, whether you will be able to act in your role depends on luck as well as on how much you are willing to pay for the opportunity to act in your role.

1.1.1 Part 1: instructions for acquiring the role

Following the pre-phase, i.e., at the beginning of the first round, half of the participants are randomly selected as candidates for role X and the other half as candidates for role Y. Thus, an X-candidate cannot acquire the role of Y, and vice versa.

At the outset of the first round, you will be told whether you are an X- or an Y-participant, and thus, which role you can acquire. You are then asked to name the maximal price \(b\) you are willing to pay to act in your designated role in this round. As your willingness to pay \(b\), you can choose a number between 0 and 13 ECU (at most two decimal places): \(0\le b\le 13\).

Subsequently, we randomly draw the actual price \(r\) that you would have to pay to acquire the right to act in your designated role in the given round. The actual price \(r\) is a number between 1 and 12 ECU (at most two decimal places): \(1\le r\le 12\). If the actual price \(r\) is higher than your maximal willingness to pay \(b(r>b)\), you do not acquire the right to act in your role. Consequently, your payoff for this round is zero. If the actual price \(r\) does not exceed the price you named, \(b,(r\le b)\), then you acquire the right to act in your role in that round and pay the amount \( r \) for it.

If you acquire the right to act in your designated role in a given round, you can earn a payoff (see part 2). The price \(r\), which you paid for the acquirement of your role, will be subtracted from this payoff. However, if you do not acquire your role, you will receive no payoff and do not have to pay for acting in your role.

We recommendFootnote 13 that you choose b so that you are indifferent between “paying \(b\) and acting in the role with the prospect of receiving a payoff”and “not paying b (if the randomly drawn actual price \(r\) equals your bid \(b\)) and receiving a zero payoff”. If you choose a price \(b\) that lies below your true maximal willingness to pay, you may not acquire the right to act in your designated role even though you would have been willing to pay for it. If you choose a price \(b\) that lies above your true maximal willingness to pay, you might be required to pay more for acting in your role than you are willing to pay.

Irrespective of whether or not you acquired your role in a given round of the experiment, you will be asked in each round to make the decisions in your role according to the following instructions:

1.1.2 Part 2: instructions for acting in the role

In each round, each pair of X- and Y-participants can share a certain amount of ECU. In the following, we will abbreviate this amount of money by \(p\).

-

If you are the X-participant in your pair, it is your task to propose the amount of money \(p\) to be shared. More specifically, you can propose the amounts \(p\), i.e., 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, or 17 ECU. Independently of the amount of money \(p\) you propose, you will always receive 6 ECU for yourself, and the remaining \((p-6)\) ECU of the amount will be offered to Y. For example, if you propose \(p=7\), you may claim 6 ECU for yourself, and 1 ECU will be offered to Y; if you propose \(p=8\), you may claim 6 ECU for yourself, and 2 ECU will be offered to Y, and so on.

-

If you are the Y-participant in your pair, it is your task to decide for each possible amount of money \(p\) that X may propose, if you “accept” or “reject” it. You will face the following table on your computer screen:

Amount of money \(p\) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | |

Accept | o | o | o | o | o | o | o | o | o | o | o |

Reject | o | o | o | o | o | o | o | o | o | o | o |

For every amount of money \(p\), you have to specify in advance whether you accept or reject it by clicking the corresponding button (i.e., you are required to take 11 decisions per round).

After all participants have made their choices, your earnings and the earnings of the other participant in your pair will be determined as follows: for the amount of money \(p\) actually proposed by the X-participant, the computer will check whether the respective Y-participant in the pair accepted this amount. If so, X will earn 6 ECU and Y will earn (p–6) ECU. If Y rejected the amount of money chosen by X, then both X and Y will earn nothing.

The possible earnings that the two participants in the pair will receive are summarized in the table below:

X earns in euro | Y earns in euro | ||

|---|---|---|---|

X chooses \(p = 7\) | Y accepts | 6 | 1 |

Y rejects | 0 | 0 | |

X chooses \(p = 8\) | Y accepts | 6 | 2 |

Y rejects | 0 | 0 | |

X chooses \(p = 9\) | Y accepts | 6 | 3 |

Y rejects | 0 | 0 | |

X chooses \(p = 10\) | Y accepts | 6 | 4 |

Y rejects | 0 | 0 | |

X chooses \(p = 11\) | Y accepts | 6 | 5 |

Y rejects | 0 | 0 | |

X chooses \(p = 12\) | Y accepts | 6 | 6 |

Y rejects | 0 | 0 | |

X chooses \(p = 13\) | Y accepts | 6 | 7 |

Y rejects | 0 | 0 | |

X chooses \(p = 14\) | Y accepts | 6 | 8 |

Y rejects | 0 | 0 | |

X chooses \(p = 15\) | Y accepts | 6 | 9 |

Y rejects | 0 | 0 | |

X chooses \(p = 16\) | Y accepts | 6 | 10 |

Y rejects | 0 | 0 | |

X chooses \(p = 17\) | Y accepts | 6 | 11 |

Y rejects | 0 | 0 |

1.2 Two examples for the course of a round

Example 1

As a willingness to pay \(b\), the X-participant in a pair names the amount of 4.91 ECU. The willingness to pay \( b \) of the Y-participant is 7.62 ECU. The randomly generated actual price \(r\) is 3.20 ECU for X and 4.33 ECU for Y. Since both participants offered more than the actual price, they acquire the right to act in their respective roles. In his role, X chooses the amount of money \(p = 15\) ECU. Y accepts this amount. Accordingly, both participants receive a payoff from this interaction.

-

X receives 6 ECU, from which the price \(r = 3.20\) ECU for the acquirement of his role is subtracted. Thus, \(X\)’s payoff in this round amounts to 2.80 ECU.

-

Y receives 15–6 = 9 ECU, from which the price \(r = 4.33\) ECU for the acquirement of the role is subtracted. Accordingly, \(Y\)’s payoff amounts to 4.67 ECU.

Example 2

As a willingness to pay \(b\), the X-participant in a pair names the amount of 7.80 ECU. The Y-participant’s willingness to pay \( b \) is 5.01 ECU. The randomly generated actual price \(r\) is 6.20 ECU for X and 8.03 ECU for Y. In this case, X acquires the right to act in his role, but Y does not. For the following decisions, X is therefore matched with another Y-participant, who acquired his role at a price of 6 ECU. In his role, X chooses an amount of \(p = 13\) ECU. Y refuses this amount. Accordingly, both participants do not receive a payoff but need to pay the price for the acquirement of their role.

-

X receives 0–6.20 \(=\) \(-\)6.20 ECU

-

Y receives 0–6 \(=\) \(-\)6 ECU

1.3 Your payoff

Your final payoff consists of: An amount of money for showing-up on time (2.50 EUR)

-

+ an amount of money for answering the control questions correctly (3 EUR).

-

+ earnings from the pre-phase.

-

+ earnings from a round randomly drawn from rounds 1–6.

-

+ earnings from a round randomly drawn round from rounds 7–12.

Please remain quiet. If you have any questions, please raise your hand.

Rights and permissions

About this article

Cite this article

Bäker, A., Güth, W., Pull, K. et al. Entitlement and the efficiency-equality trade-off: an experimental study. Theory Decis 76, 225–240 (2014). https://doi.org/10.1007/s11238-013-9364-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-013-9364-5