Abstract

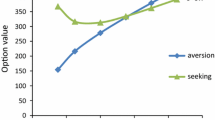

This article examines the effects of uncertainty aversion in competitive call option markets using a partial equilibrium model with the Choquet-expected utility setup. We find that the trading volume of a call option is negatively affected by uncertainty aversion, whereas the price of the call is practically independent of it.

Similar content being viewed by others

References

Carr P., Madan D. (2001), Optimal positioning in derivative securities. Quantitative Finance 1: 19–37

Chateauneuf A., Dana R.-A., Tallon J.-M. (2000), Optimal risk-sharing rules and equilibria with Choquet-expected-utility. Journal of Mathematical Economics 34: 191–214

Dekel E. (1989), Asset demand without the independence axiom.Econometrica 57: 163–169

Dow J., Werlang S.R.C. (1992), Uncertainty aversion, risk aversion, and the optimal choice of portfolio. Econometrica 60: 197–204

Duffie D. (2001), Dynamic Asset Pricing Theory. Princeton University Press, Princeton and Oxford

Epstein L.G., Wang T. (1994), Intertemporal asset pricing under Knightian uncertainty. Econometrica 62: 283–322

Ghirardato P., Marinacci M. (2002), Ambiguity made precise: A comparative foundation. Journal of Economic Theory 102: 251–289

Gilboa I. (1987), Expected utility with purely subjective non-additive probabilities. Journal of Mathematical Economics 16: 65–88

Kelsey D., Milne F. (1995), The arbitrage pricing theorem with non-expected utility preferences. Journal of Economic Theory 65: 557–574

Mas-Colell A., Whinston M.D., Green J.R. (1995), Microeconomic Theory. Oxford University Press, New York and Oxford

Montesano A., Giovannoni F. (1996), Uncertainty aversion and aversion to increasing uncertainty. Theory and Decision 41: 133–148

Montesano A. (1999) Risk and uncertainty aversion with reference to the theories of expected utility, rank dependent expected utility, and Choquet-expected utility. In: Luini L. (eds) Uncertain Decision. Bridging Theory and Experiments. Kluwer, Boston, pp 3–37

Mukerji S., Tallon J.-M. (2001), Ambiguity aversion and incompleteness of financial markets. Review of Economic Studies 68: 883–904

Shapley L.S. (1971), Cores of convex games. International Journal of Game Theory 1: 11–26

Schmeidler D. (1989), Subjective probability and expected utility without additivity. Econometrica 57: 571–587

Varian H.L. (1992), Microeconomic Analysis. W. W. Norton & Co., New York and London.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Montesano, A. Effects of Uncertainty Aversion on the Call Option Market. Theory Decis 65, 97–123 (2008). https://doi.org/10.1007/s11238-007-9095-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-007-9095-6