Abstract

This study contributes to the discussion about wealth inequality, albeit from a more detailed housing perspective. It explores tenure inequality, as well as housing assets inequality. The latter includes a different approach than the one that prevails in the previous literature on wealth inequalities, which most often considers total net worth or net housing wealth. This study focuses on gross housing asset distribution, irrespective of mortgage debt, which corresponds with the potential of housing equity accumulation as a source of income in old age. It emphasises the intergenerational context, but simultaneously involves cross-country comparisons that allow for relative assessment of the intergenerational differences. Drawing from the Luxembourg Wealth Study (LWS) dataset the paper presents the results for fourteen developed countries. They suggest that the current working-age generation is to a lesser extent involved into homeownership, as compared to the older generation, which results in a smaller housing equity per household, but simultaneously it experiences greater housing inequality. Furthermore, as shown in a cross-country perspective, homeownership rates and housing asset inequality are negatively correlated. Consequently, higher housing asset inequality by lower homeownership rates are the factors that undermine the usefulness of the asset-based welfare concepts in a policy application. Such findings imply that in the macro perspective the potential of housing as a source of additional income in cash and in kind tends to shrink.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Housing is not only one of the key consumption goods, but also constitutes an important dimension of the socio-economic wellbeing. The central role of housing assets in wealth composition is widely acknowledged. As multiple studies prove real estate assets account for the greatest share in household portfolios irrespective of the country (see e.g., Arrondel et al., 2016; Causa et al., 2019; Cowell et al., 2017). Surprisingly, whereas wealth inequality is one of the central topics in the economic debate, among both academics and policymakers, specifically housing inequality per se is a relatively rarely addressed issue. As stated by Causa and Woloszko (2020) ‘one important dimension less explored in the literature, especially on a cross-country basis, is the distributional implications of housing from a wealth perspective’.

Polarisation in housing, as a kind of wealth inequality, is closely related to welfare. In particular, when the elderly perspective is considered, housing and more specifically homeownership, can be seen as a source of additional income that can potentially complement pension benefits. It includes several housing equity release strategies as well as income in kind in a form of imputed rent associated with rent-free housing. This is one of the key issues in the further discussion on housing wealth inequality in the generational perspective in the context of the pension systems. As some recent research suggest, the share of housing assets in total household portfolios to some extent is associated with pension system generosity (Marcinkiewicz & Chybalski, 2022). Nevertheless, as noted by Lux et al. (2021) ‘Most of the recent older generations have been able to enjoy both asset accumulation and a still generous system of public welfare’. However, in light of the projected increase of the old-age dependency ratio, on average by 95% in the developed countries between 2021 and 2050 (OECD, 2021), future cuts in pension benefits are also expected, which likely will entail a stronger emphasis on the consumption of housing resources to supplement public pensions. On the other hand, despite the so far indisputable and central role of residential property as a component of housing wealth, the new trend of decreasing homeownership opportunities has emerged. Namely, as some studies show, the expansion of homeownership has been hampered in the recent years, which mainly affects young adults, and has its origins in more precarious work, income insecurity and financial markets restrictions introduced after the Great Financial Crisis (Arundel & Doling, 2017; Arundel & Ronald, 2021; Dewilde, 2020; Smith et al., 2022). As argued by Ronald et al. (2017) since the crisis ‘the home has become even more central as an asset base of individual welfare’, but at the same time increasing housing wealth polarisation has put into question welfare security.

This study contributes to the discussion on wealth inequality, albeit from a more detailed housing perspective. As indicated by Pfeffer and Waitkus (2021), cross-national variation in wealth inequality is predominantly driven by the distribution of housing equity, and thus, to construct the institutional explanations of wealth inequality a special focus on housing is needed. This paper addresses the issue of housing inequality in a multidimensional approach and adds to the current literature in two ways. First, the paper highlights the differences between the elderly population and the working-age population in terms of housing inequalities. The main focus is on the intergenerational context, but simultaneously due to cross-country comparisons it allows for the relative assessment of the intergenerational differences. Second, apart from the tenure inequality, it also explores housing asset inequality. This is a somewhat different perspective than the one that prevails in the previous literature on wealth inequalities, which most often considers total net worth or net housing wealth. This paper focuses on gross housing asset distribution, irrespective of mortgage debt, which corresponds with the potential of housing equity accumulation as a source of income in old age. The main hypothesis verified empirically in this study is that the working-age generation experience greater housing inequality, both in terms of tenure and housing assets, than the elderly generation. The findings can be valuable for social policy, especially in a long-term perspective, in the context of welfare provision.

The study aims to identify the existing patterns as regards to the housing inequality and differences with this respect between elderly and non-elderly households. It also verifies how particular dimensions of housing inequality relate to each other. The empirical analysis presented in this paper employs micro-data from the Luxembourg Wealth Study (LWS) dataset. It investigates tenure and housing asset distributions and presents estimates of various indicators of housing inequality in the elderly and non-elderly households for fourteen developed countries.

The paper is structured as follows. First, it discusses various aspects of housing inequality and its welfare implications identified in the previous literature. The following two sections present the results of empirical research. They report tenure inequality and housing assets across income distribution, as well as housing asset inequality indicators in the context of the tenure cross-country and intergenerational differences. The paper ends with synthetic conclusions summarizing the results obtained.

2 Related Literature

In the current literature a lot of attention has been paid to the role of housing in the context of poverty alleviation, both on theoretical as well as empirical grounds. One of the most widely referenced theoretical advancements in this field is the Asset-Based Welfare (ABW) concept introduced by Sherraden (1991). It became the foundation for other further developed ideas, such as Housing Asset-Based Welfare (HABW) and Homeownership-Based Welfare (HBW) (for a discussion see Prabhakar, 2019; Ronald et al., 2015). They stress the role of housing asset accumulation as a means to offset less generous public transfers by ensuring income in kind and in cash. These ideas have been explicitly or implicitly implemented by policymakers through the ‘ideology of mass homeownership’, reflected in incentives and privileges for homeowners and homebuyers aimed at increasing homeownership rates (Arundel, 2017; Christophers, 2021). As argued by Lennartz and Ronald (2017) the ideas related to ABW despite their foundations rooted in self-provision can be considered as welfare concepts compatible to the ‘social investment strategy’. The beneficial effect of income poverty reduction and lesser exposure on the risk of resource deprivation associated with homeownership and housing asset accumulation is also empirically proved by a number of studies (see e.g., Borg, 2015; Bravo et al., 2019; Dewilde and Raeymaeckers, 2008; Doling and Ronald, 2010).

In the context of asset-based welfare where the provision of welfare is to a great extend an individual responsibility, an essential issue is how housing inequality may affect the situation of the most economically vulnerable groups. The study by Lux et al. (2021) is one of very few studies that directly invoke the problem of how housing (or housing wealth) inequality affects welfare in a macro scale. In a simulation procedure for the Czech economy it models housing wealth inequalities among the future elderly. The authors conclude that a reduction in intergenerational transfers as a result of housing asset consumption in the future may lead to the further increase in housing inequality, and thus entail greater social risks. As argued by Arundel (2017), as well as Arundel and Ronald (2021), rising housing (wealth) inequality questions the legitimacy of the ABW or HABW ideologies, which are based on the premise of widespread, equalising and secure homeownership.

Form the broader social policy perspective housing inequality seems to be an issue of special interest, as highly unequal distribution of residential wealth entails systematic problems. However, this is not an unidimensional category. Lux et al. (2013) captures housing inequality in four dimensions: tenure, housing quality, housing expenditure and housing wealth. Similarly, Filandri and Olagnero (2014), consider two broader dimensions of housing inequality: tenure and well-being. Whereas the former focuses on the homeowner and non-homeowner dichotomy, the latter accounts for several aspects such as overcrowding, neighbourhood quality, housing adequacy and affordability. Housing inequality is also a term closely related to housing stratification. As pointed out by Zhou and Ronald (2017), ‘within housing studies, stratification has been largely translated as housing segregation and inequality’. Lux et al. (2013) identify housing inequality with housing stratification, which corresponds to social stratification. Filandri and Olagnero (2014) also investigates housing inequality within a framework of social stratification and demonstrates that at the micro level there is a linkage between social class and housing conditions. Similarly, Dewilde (2020) proves that the access to homeownership in the case of young adults is conditioned by social class associated mainly with education. Forrest and Hirayama (2018) also indicate that housing tenure inequality is closely related to the social re-stratification. They explore the patterns of access to residential property in the intergenerational context, and distinguish between accumulating families, dissipating families, and perpetual renter families. In turn, Wind et al. (2017) demonstrates that a more unequal distribution of housing wealth across occupational classes is observed for the market-based housing system, as opposed to the systems where family-based risk sharing prevails in housing provision. Cohen Raviv and Lewin-Epstein (2021) argue in their recent study that the role of the family via intergenerational wealth transfer is the key distinguishing feature of current housing regimes, and specific regimes have different effects on class inequality in homeownership, as well as in mortgage burden, among young adults.

Some previous studies also refer directly to the above mentioned issue of the connection between housing systems and inequality. For example, Norris and Winston (2012) analyse the existing housing inequalities patterns in Western Europe from the perspective of the housing regimes identified in the current literature to conclude that there is a considerable disconnection between them. Causa et al. (2019), as well as Kaas et al. (2019) demonstrate that, in a cross-country perspective, the more universal access to homeownership, the more equal distribution of overall wealth.

As pointed out previously in this section, housing wealth inequality is a category that can be separated from housing inequality understood as polarisation in tenue, housing quality and affordability (expenditures). It refers solely to residential property value, and thus, stresses the financial dimension of housing seen as an asset. However, there is no doubt that both categories are closely related – housing wealth serves as a quantitative proxy for other qualitative dimensions of housing, i.e. tenure and well-being (housing quality and affordability). Housing inequality and housing wealth inequality can be also investigated independently. As noted by Christophers (2021) ‘the emergence of significant asset-based inequalities in recent decades is rooted in the policy-driven emergence of significant inequalities – ideological as much as economic – between tenure forms, whereby ownership has increasingly been privileged over rental’. Numerous studies prove that in recent decades housing wealth inequality has increased (Arundel, 2017; Arundel and Ronald, 2021; Christophers, 2021; Smith et al., 2022). Arundel (2017) argues that this phenomena is driven by a whole variety of factors originating from the labour market, housing market, state policy, as well as the intermediary processes. Additionally, if the generational context is taken into account, it can be shown that the within-family transfers of housing wealth from the older generation to the younger one plays a pivotal role in the reproduction of the wealth inequality (Christophers, 2018).

3 Homeownership and Housing Wealth Across Income distribution – Empirical Evidence

Taking the socio-economic perspective into account, households belonging to the lower income percentiles should be the main interest in terms of access to homeownership. It results from the fact that in this case homeownership may be an effective means to reduce poverty through different equity release strategies or as a source of additional income in the form of imputed rent. Therefore, homeownership rates in the lower income percentiles, rather than in the whole population, refer to the actual poverty-reducing potential of residential property. Additionally, the differences between income percentiles in terms of homeownership rates can be regarded as indicators of tenure inequality. Minor differences in homeownership between upper and lower income groups imply that the access to homeownership is more egalitarian, which also suggests a smaller housing stratification. Significant differences with this respect point to a higher housing stratification, which can result predominantly from the greater role of the financial markets in access to the (mortgaged) homeownership. This naturally entails limited availability of residential property to the less affluent households.

To investigate this phenomena the data obtained from the Luxembourg Wealth Study (LWS, 2022) is employed. LWS is a cross-national household survey comprising harmonised statistical information on household wealth, incomes, consumption expenditures, labour market activity, etc. The dataset used in this study covers wave X (surveys conducted in the years 2016–2017). It includes the following countries: Austria, Australia, Germany, Estonia, Spain, Finland, Greece, Italy, Luxembourg, Norway, Slovakia, Slovenia, the United Kingdom and the United StatesFootnote 1.

The key variables under investigation in this study are homeownership and housing wealth. The former is defined as a dummy variable that distinguishes between owned and not owned living quarters. It follows the country-specific guidelines concerning particular applicable legal arrangements. Additionally, this variable does not distinguish between outright and mortgaged homeownership. Consequently, the mortgage burden is not accounted for in the second variable, i.e. housing wealth. This is defined as the total value of housing assets that combine the market value of the principal residence and other real estate owned by household members. This variable allows involvement in homeownership to be studied, but in a more comprehensive manner than in the case of the owner/non-owner dichotomy. Namely, the value of a housing asset also indirectly accounts for housing quality and multiple property ownership. Housing wealth is given here as gross value, i.e. mortgage debt is not included. The reason for such a choice is the intergenerational perspective of this study. Given that it aims to investigate involvement in homeownership, comparisons that include mortgage debt would not be adequate as typically the working-age generation is more indebted than the elderly. Such an approach is similar to the one presented by Filandri and Olagnero (2014), who also do not distinguish between mortgaged and non-mortgaged households when exploring inequality in homeownership. As they argue, the age of the family, as well as the timing of access to ownership, are the factors strongly affecting the size of the mortgage burden.

Additionally, the unit of analysis in this study is a household. In line with the arguments presented by Cowell et al. (2017), housing assets are not adjusted for household size. As they discuss, when the emphasis is on the access to wealth by a household as a whole, not its particular members, and the analysis is static, i.e. it does not involve changes over time, equivalisation is not necessary. Furthermore, as proved by Sierminska and Smeeding (2005), the impact of different equivalisation choices on wealth distribution is minor or even negligible as compared to no equivalisation formula.

To ensure data representativeness and comparability all the presented results are estimated using normalised household weights. This makes the country samples adjusted to their population structures, and additionally, normalised it terms of each country sample size by 10,000 households. As a result, the aggregated estimates are not biased by significant disproportions in country sample sizes.

The main focus of this study is on the comparisons between elderly and non-elderly households. Therefore, in order to identify both these categories the following criterion is used. An elderly household is defined as a household where the head of the household is aged 65 or above. The selection of this specific age threshold results from the fact that this is a statutory pensionable age in most of the countries under the study (Eurostat, 2020). In turn, all the remaining households not meeting this requirement, are classified as the non-elderly households.

Table 1 presents the distribution of households in homeownership across income quintiles. The results obtained for elderly and non-elderly allow some patterns to be identified. First, there are noticeable differences in total homeownership rates for both groups. When elderly households are considered, almost all the countries studied (except for Austria and Germany) report high homeownership rates, which is above 75%. In the case of non-elderly households homeownership is less universal, and only in Slovakia it exceeds this threshold. However, there are significant country differences in this respect. Whereas for Austria, Slovakia and Estonia homeownership rates reported for elderly and non-elderly households remain at comparable levels within countries, for some states such as Australia, Luxembourg and the United States they are quite divergent.

When comparing homeownership rates between the lowest and the highest income groups it can be seen that, in general, the greater divergence is reported for non-elderly households than for the elderly ones. There are also large differences between countries in terms of tenure inequality. For example, for Slovakia, the reported share of non-elderly homeowners belonging to the least affluent group (Q1) is 76%, whereas in the case of the top income quintile (Q5) this rate amounts to 94%. Relatively small differences between both these income groups are reported also for Greece, Slovenia, and Australia. By contrast, for Norway, the shares amount to 18 and 88%, respectively. Other countries where the disparity between the highest and the lowest income groups in terms of homeownership is the greatest are Finland, the United States, the United Kingdom and Germany. For elderly households cross-country comparisons reveal similar traits, despite the smaller magnitude of divergence between Q1 and Q5 groups (except for Austria, where it is slightly greater). This implies that the differences between lower and upper quintiles in both household categories are highly positively correlated across countries. To assess whether the access to homeownership in case of the lower income households is hampered by financial market constraints, the mortgage debt-to-GDP ratio is also presented in Table 1. This ratio can be regarded as a proxy of homeownership stratification (Schwartz & Seabrooke, 2008). Based on the results of the correlation analysis (see Table A1 in the Appendix), one can conclude that there is a moderate positive correlation (r = 0.57) between mortgage size and the disparity between homeownership in the Q1 and Q5 income groups in the case of the non-elderly households. This relationship is weak in the case of elderly households, which have typically repaid their mortgage debt (r = 0.20). Furthermore, there is also a moderate correlation (r = 0.45) with respect to intergenerational disparity in terms of homeownership rates, i.e. the difference between total homeownership rates in both households groups, and involvement in a mortgage.

Table 2 presents the comparisons between elderly and non-elderly households in terms of the size of housing asset expressed relative to the country-specific annual average wage. As shown, there are also large country differences across respective categories of households in terms of average levels (per household) of relative housing assets owned. However, such divergence can arise from various circumstances - not only the differences in homeownership rates, but also the differences in real estate prices or purchasing power of the average wage in the countries under study. Consequently, such cross-country comparisons bring only limited information about the actual housing wealth and its potential as an income source. Therefore, a more suitable approach is to compare both households categories within each country and further examine in which countries the differences between the elderly and non-elderly are smaller, and in which they are greater. According to the results obtained, only in three countries (Austria, Estonia and Slovakia) non-elderly households hold on average greater housing assets than elderly ones. They are the same countries where homeownership in both categories are at comparable levels. For the rest of the countries in the sample elderly households report greater housing wealth. However, this prevalence can only partially be attributed to the fact, that in this category there is a greater fraction of homeowners. This is the case in the United Stated and Luxembourg, but not the case in Australia, Greece, Slovenia or Finland, where a relatively large disparity in homeownership rates between both generations is not accompanied by proportional disparity in housing assets.

A more comprehensive outlook is provided by the analyses of the average level of housing assets across income quintiles. As shown in Table 3 in most of the countries studied, i.e., Austria, Australia, Germany, Finland, Italy, Luxemburg, Norway, the United Kingdom and the United States, median housing assets in the non-elderly households category is equal to 0 in the lower income quintiles. Such a situation is less frequent in the case of elderly households (only in Austria and Germany). When analysing median housing assets in particular income quintiles for both household categories a fairly clear pattern can be identified. Namely, for both the elderly and non-elderly, higher income groups are naturally associated with greater housing assets, but the difference between these household categories is reported in terms of the size of housing assets. The prevalence of the elderly generation in this respect over the non-elderly one is observable irrespective of the income category. However, in some countries (Greece, Norway and Slovakia) this prevalence tends to be minor across all income quintiles, while in others the differences between generations are greater in particular income categories (e.g. the UK, Luxembourg and Australia).

4 Housing Wealth Inequality and Homeownership

As opposed to a great number of previous studies this work does not focus on wealth inequality measured by net worth, but it incorporates a somewhat different perspective, which includes a more detailed insight into housing wealth. Similarly to the results presented in the previous section, housing assets as gross value (mortgage debt not subtracted) are investigated. Additionally, in line with the previously presented reasoning, also for the purpose of inequality measurement, housing wealth has not been subjected to prior equivalisation.

Table 4 presents inequality statistics concerning housing assets in both groups under study: the Gini coefficient, the ratio between mean housing assets in the top 10% of households in the housing (gross) wealth distribution and in the bottom 50%, as well as the ratio between the mean and median. The first indicator, the Gini coefficient, is rarely reported for net wealth statistics, due to the large number of households with negative values (Balestra & Tonkin, 2018). However, this is not an issue in the case of gross housing assets. The results obtained for the Gini coefficient imply that in general, greater housing asset inequality is reported for non-elderly households (except for Estonia and Spain). However, the disparities between generations in particular countries are not greater than 0.1 in absolute values. There are also some noticeable cross-country differences with this respect. In Slovakia, Slovenia and Norway housing asset inequality is the smallest for both, elderly, and non-elderly households, while in Austria, Germany and the United States it is the greatest. A very similar trait can be identified with respect to the ratio between average housing assets in the upper decile and bottom half of the housing assets distribution. The third indicator under consideration is the mean to median ratio, which indicates the asymmetry in the distribution, and thus, reflects the scope of inequality. All the values reported are greater than 1, which implies a right-tail asymmetry in the distribution, i.e., the inequality is driven mainly by the upper half. Similarly, in the case of three countries, Austria, Germany and the United States, the mean departs from the median to a greatest extent, whereas for Norway and Slovakia the ratio is the smallest. These results can be directly compared to the OECD estimates of mean to median ratio (per household) calculated for net wealth (Balestra & Tonkin, 2018). Based on OECD estimates for the countries under study one can conclude that total net wealth inequality tends to be greater than housing asset inequality reported by this study.

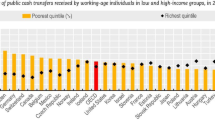

With reference to the above presented finding, a question can be posed on the role of homeownership as a driver of housing asset inequality. As shown in Fig. 1 the correlation between homeownership rates and Gini coefficient for the two respective groups indicates a strong negative relationship: higher homeownership is accompanied by smaller housing asset inequality. However, there is a large variation in the dataset, and after exclusion of the three countries with the greatest housing assets inequality (i.e. Austria, Germany and the United States) this trade-off becomes less evident, but still the correlation coefficient implies a moderate to strong negative relationship (r = -0.52 for the elderly households, and r= -0.71 for the non-elderly households). Additionally, as reported in Table A1 in the Appendix, contrary to the differences in homeownership rates (Q5-Q1) in both households categories, Gini coefficients obtained for housing assets are not correlated with mortgage-to-GDP ratio. These results imply that although greater homeownership translates into smaller housing asset inequality, the latter is not associated with the way housing is provisioned (market-based or family-based).

5 Conclusions

The results of this empirical study allow for several conclusions to be formulated with respect to the existing patterns and disparities between elderly and non-elderly households in terms of housing wealth, its inequality and homeownership. First, drawing from LWS survey microdata the study confirms that typically the elderly are more frequently homeowners and, in average terms, they hold greater housing wealth, even if gross values (mortgage not included) are taken into account. The latter seems to be simply a consequence of the former, namely, greater involvement in homeownership naturally implies greater housing wealth (per household). However, in countries where homeownership rates for the elderly and non-elderly are at a comparable level, i.e. Austria, Slovakia and Estonia, elderly households on average hold lesser housing equity. This allows it to be roughly concluded that in relative terms, in such countries non-elderly households are more eager or more economically capable to accumulate housing wealth. The question remains, what are the factors behind such patterns and whether they result from preferences or economic and demographic circumstances. When it comes to the cross-country comparisons, the intergenerational disparity (elderly vs. non-elderly) in terms of involvement in homeownership varies substantially between countries. This variation can be partly attributed to differences between countries as regards to the way households commonly enter homeownership (with a greater or lesser role of the financial market, i.e., with mortgage, or mortgage-free). Residential property acquisition through financial market (with mortgage) to some extent fosters the size of the intergenerational homeownership gap.

Second, in general, the reported housing asset inequalities are greater in the group of non-elderly households. This also applies to the tenure inequality as measured by comparisons between homeownership rates across income quintiles. These results confirm the hypothesis that the working-age generation faces greater housing inequalities than the elderly generation. Furthermore, the differences in homeownership between the least and the most affluent households observed in particular countries tend to be reproduced in both groups studied, i.e., the elderly and non-elderly. This implies that some country-specific factors, possibly rooted also in the housing systems, influence the magnitude of tenure inequality, yet they affect the elderly households with this respect typically to a lesser extent than the non-elderly households. Homeownership acquisition through the financial market (with mortgage) as a common solution translates into greater inequality in homeownership in the bottom and top income quintiles, but only as regards the working-age generation. In contrast, housing asset inequality in both groups under study seems to be unrelated (in a cross-country perspective) to the size of the mortgage debt.

Third, the study proved a negative correlation between homeownership rates and housing asset inequality in both households categories, albeit stronger in the case of non-elderly households. The most vivid examples for that trade-off are three countries: Austria, Germany and the USA, which have the lowest homeownership rates, and the highest housing asset inequalities. These findings can be compared to the results obtained by Kaas et al. (2019), who proved a similarly strong negative relationship between net wealth inequality and homeownership rates, which has been attributed, as a result of the decomposition formula, to the inequality between homeowners and renters, and implicitly to the housing wealth inequality. Despite only partly overlapping country coverage, their results as regards a few particular countries (Austria, Germany, Italy, Greece and Spain) imply that the observed pattern with respect to the net wealth inequality vs. homeownership converges with the pattern revealed by this study in terms of housing asset inequality vs. homeownership.

An approach to the inequality assessment based on gross housing assets, as elaborated in the previous sections, is justified by the intergenerational scope of the study. The older generation has largely repaid their mortgage, while for the younger generation it is unpaid. According to Arundel and Ronald (2021), such gross housing assets serve as a proxy for total potential housing wealth given full mortgage debt repayment. Thus, it regards housing wealth as a potential source of income in old age. This constitutes a different perspective to the one commonly applied in previous literature that employs net wealth for inequality measurement, which emphasises the current moment in time. Evaluation of the potential of housing wealth accumulation entails a long-term perspective. Consequently, the findings of this study have some policy implications especially, but not exclusively, as regards the welfare of the elderly in the future. They suggest that the current working-age generation (non-elderly households) is to a lesser extent involved in homeownership, as compared to the older generation (elderly households), which results in a smaller housing equity per household, but simultaneously it experiences greater housing inequality. Furthermore, as shown, also in a cross country perspective, homeownership rates and housing asset inequality are negatively correlated. Altogether, higher housing asset inequality by lower homeownership rates are the factors that undermine the usefulness of the ABW and HABW concepts in a policy application. Such findings imply that in the macro perspective the potential of housing as a source of additional income in cash and in kind tends to shrink. This applies especially to the current working-age generation that is expected to receive less adequate old-age benefits in the future from the public pension systems than the current retirees. Although this study represents a static approach, one cannot neglect the question whether the observed patterns with respect to housing inequality shall be reinforced in the future, when the current working-age generation gradually enters the retirement age.

This study covers countries with different housing systems, as well as different models of welfare state in general. They are not evenly affected by tenure and housing asset inequality. Additionally, various mixes of welfare arrangements make them more or less resistant to the potential negative effects of housing inequality. In line with Stephens’ (2006) view that ‘there is clearly a two-way relationship between the welfare systems (meaning labour markets and social security systems) and housing systems, but housing systems can have decommodifying impacts independently of the welfare regime’, it is justified to state that the socioeconomic effect of rising housing inequality can be mitigated by social policy, and vice versa, housing systems that promote more equal access to housing enhance welfare. That is why the overall consequences of housing inequality should not be considered in isolation from the country background.

This study has also some limitations. Firstly, as a common problem in surveys that require self-reported home values is the reliability of the information provided by respondents. Such problems arise, inter alia, from distribution-related issues, such as the under-representation of certain socioeconomic groups that may affect inequality measurement, and data quality issues (for an extended discussion see OECD, 2013). The latter covers deliberate misreporting, misreporting as a result of cognitive problems, reporting of incomplete or outdated information, etc. However, as proved by Tomal (2022a, b) self-reported dwelling valuation can substitute objective valuation based on market pricing quite adequately, also for the purpose of housing wealth inequality measurement. Furthermore, when intergenerational differences are considered, this study distinguishes only between the elderly and working-age generations, which can be considered as a somewhat rough division. As elaborated in the theoretical section of this paper, homeownership opportunities tend to shrink in the case of young adults, and they differ from older cohorts in terms of the patterns associated with entering homeownership. Thus, a more detailed analysis of the working-age generation that involves cohorts comprising Generation Z, Millennials or Generation X, would be beneficial to further explore the differences between them in terms of housing inequality.

Notes

For Greece and Luxembourg data from wave XI (2018) is used, as these countries were not covered by wave X of the survey.

References

Arrondel, L., Bartiloro, L., Fessler, P., Lindner, P., Mathä, T. Y., Rampazzi, C., et al. (2016). How do households allocate their assets? Stylized facts from the Eurosystem household finance and consumption survey. International Journal of Central Banking, 12(2), 129–220. https://doi.org/10.2139/ssrn.2490969.

Arundel, R. (2017). Equity Inequity: Housing Wealth Inequality, Inter and intra-generational divergences, and the rise of private landlordism. Housing Theory and Society, 34(2), 176–200. https://doi.org/10.1080/14036096.2017.1284154.

Arundel, R., & Doling, J. (2017). The end of mass homeownership? Changes in labour markets and housing tenure opportunities across Europe. Journal of Housing and the Built Environment, 32(4), 649–672. https://doi.org/10.1007/s10901-017-9551-8.

Arundel, R., & Ronald, R. (2021). The false promise of homeownership: Homeowner societies in an era of declining access and rising inequality. Urban Studies, 58(6), 1120–1140. https://doi.org/10.1177/0042098019895227.

Balestra, C., & Tonkin, R. (2018). Inequalities in household wealth across OECD countries: Evidence from the OECD wealth distribution database. No 2018/01. https://doi.org/10.1787/7e1bf673-en. Paris.

Borg, I. (2015). Housing Deprivation in Europe: On the role of rental tenure types. Housing Theory and Society, 32(1), 73–93. https://doi.org/10.1080/14036096.2014.969443.

Bravo, J. M., Ayuso, M., & Holzmann, R. (2019). Making Use of Home Equity: The Potential of Housing Wealth to Enhance Retirement Security. IZA Discussion Paper, 12656.

Causa, O., & Woloszko, N. (2020). Policy Considerations on Housing, Wealth, and Inequality. Cityscape, 22(3), 339–364.

Causa, O., Woloszko, N., & Leite, D. (2019). Housing, wealth accumulation and wealth distribution: Evidence and stylized facts. OECD Working Papers, 1588, https://doi.org/10.1787/86954c10-en.

Christophers, B. (2018). Intergenerational inequality? Labour, Capital, and Housing through the Ages. Antipode, 50(1), 101–121. https://doi.org/10.1111/anti.12339.

Christophers, B. (2021). A tale of two inequalities: Housing-wealth inequality and tenure inequality. Environment and Planning A: Economy and Space, 53(3), 573–594. https://doi.org/10.1177/0308518X19876946.

Cohen Raviv, O., & Lewin-Epstein, N. (2021). Homeownership regimes and class inequality among young adults. International Journal of Comparative Sociology, 62(5), https://doi.org/10.1177/00207152211070817.

Cowell, F., Nolan, B., Olivera, J., & Van Kerm, P. (2017). Wealth, top incomes, and Inequality. In K. Hamilton, & C. Hepburn (Eds.), National wealth: What is missing, why it matters (pp. 175–204). Oxford University Press. https://doi.org/10.1093/oso/9780198803720.003.0008.

Dewilde, C. (2020). Exploring Young Europeans’ Homeownership Opportunities. Critical Housing Analysis, 7(1), 86–102. https://doi.org/10.13060/23362839.2020.7.1.506.

Dewilde, C., & Raeymaeckers, P. (2008). The trade-off between home-ownership and pensions: Individual and institutional determinants of old-age poverty. Ageing and Society, 28(6), 805–830. https://doi.org/10.1017/S0144686X08007277.

Doling, J., & Ronald, R. (2010). Property-based welfare and european homeowners: How would housing perform as a pension? Journal of Housing and the Built Environment, 25, 227–241. https://doi.org/10.1007/s10901-010-9184-7.

Eurostat. (2020). Ageing Europe - looking at the lives of older people in the EU. Eurostat.

Filandri, M., & Olagnero, M. (2014). Housing Inequality and Social Class in Europe. Housing Studies, 29(7), 977–993. https://doi.org/10.1080/02673037.2014.925096.

Forrest, R., & Hirayama, Y. (2018). Late home ownership and social re-stratification. Economy and Society, 47(2), 257–279. https://doi.org/10.1080/03085147.2018.1459368.

Kaas, L., Kocharkov, G., & Preugschat, E. (2019). Wealth inequality and homeownership in Europe. Annals of Economics and Statistics, 136, 27. https://doi.org/10.15609/annaeconstat2009.136.0027.

Lennartz, C., & Ronald, R. (2017). Asset-based Welfare and Social Investment: Competing, compatible, or complementary social policy strategies for the New Welfare State? Housing Theory and Society, 34(2), 201–220. https://doi.org/10.1080/14036096.2016.1220422.

Lux, M., Sunega, P., & Katrňák, T. (2013). Classes and castles: Impact of social stratification on housing inequality in post-socialist states. European Sociological Review, 29, 274–288. https://doi.org/10.1093/esr/jcr060.

Lux, M., Sunega, P., & Kážmér, L. (2021). Simulating trends in housing wealth inequality in post-socialist czech society. Housing Studies, 36(6), 885–905. https://doi.org/10.1080/02673037.2020.1729961.

LWS (2022). Luxembourg Wealth Study (LWS) Database. Luxembourg. http://www.lisdatacenter.org.

Marcinkiewicz, E., & Chybalski, F. (2022). Is there a trade-off between housing and pension system generosity? Empirical evidence from the Luxembourg Wealth Study. Social Policy & Administration. https://doi.org/10.1111/spol.12865.

Norris, M., & Winston, N. (2012). Home-ownership, housing regimes and income inequalities in Western Europe. International Journal of Social Welfare, 21(2), 127–138. https://doi.org/10.1111/j.1468-2397.2011.00811.x.

OECD. (2013). Measuring household wealth through surveys. OECD Guidelines for Micro Statistics on Household Wealth. OECD Publishing. https://doi.org/10.1787/9789264194878-9-en.

OECD. (2021). Pensions at a glance 2021: OECD and G20 indicators. OECD Publishing. https://doi.org/10.1787/ca401ebd-en.

Pfeffer, F. T., & Waitkus, N. (2021). The Wealth Inequality of Nations. American Sociological Review, 86(4), https://doi.org/10.1177/00031224211027800.

Prabhakar, R. (2019). A house divided: Asset-based welfare and housing asset-based welfare. International Journal of Housing Policy, 19(2), 213–231. https://doi.org/10.1080/19491247.2018.1441008.

Ronald, R., Kadi, J., & Lennartz, C. (2015). Homeownership-based welfare in transition. Critical Housing Analysis, 2(1), 52–64. https://doi.org/10.13060/23362839.2015.2.1.176.

Ronald, R., Lennartz, C., & Kadi, J. (2017). What ever happened to asset-based welfare? Shifting approaches to housing wealth and welfare security. Policy and Politics, 45(2), 173–193. https://doi.org/10.1332/030557316X14786045239560.

Schwartz, H., & Seabrooke, L. (2008). Varieties of residential capitalism in the International Political Economy: Old Welfare States and the New Politics of Housing. Comparative European Politics, 6(3), 237–261. https://doi.org/10.1057/cep.2008.10.

Sherraden, M. (1991). Assets and the poor: A New American Welfare Policy. M.E. Sharpe.

Sierminska, E., & Smeeding, T. M. (2005). Measurement Issues: Equivalence Scales, Accounting Framework, and Reference Unit (No. Paper presented at the Luxembourg Wealth Study Workshop, Perugia, 27–29 January 2005).

Smith, S. J., Clark, W. A. V., Ong ViforJ, R., Wood, G. A., Lisowski, W., & Truong, N. T. K. (2022). Housing and economic inequality in the long run: The retreat of owner occupation. Economy and Society, 51(2), 161–186. https://doi.org/10.1080/03085147.2021.2003086.

Stephens, M. (2006). Housing and Decommodification in a Liberal Economy: The case of the UK. Paper presented at the ENHR conference “Housing in an expanding Europe: theory, policy, participation and implementation” Ljubljana, Slovenia, 2–5 July 2006, Retrieved from: https://www.enhr.net/documents/2006%20Slovenia/W02_stephens.pdf.

Tomal, M. (2022a). The applicability of self-reported home values in housing wealth inequality assessment: Evidence from an emerging country. Housing Studies. https://doi.org/10.1080/02673037.2022.2123902.

Tomal, M. (2022b). Self-reported and Market Home values in Housing Wealth Inequality Measurement: Evidence from Warsaw and Prague. Critical Housing Analysis, 9(1), https://doi.org/10.13060/23362839.2022.9.1.538.

Wind, B., Lersch, P., & Dewilde, C. (2017). The distribution of housing wealth in 16 european countries: Accounting for institutional differences. Journal of Housing and the Built Environment, 32(4), 625–647. https://doi.org/10.1007/s10901-016-9540-3.

Zhou, J., & Ronald, R. (2017). Housing and Welfare Regimes: Examining the changing role of Public Housing in China. Housing Theory and Society, 34(3), 253–276. https://doi.org/10.1080/14036096.2016.1223165.

Funding

This work was supported by the National Science Centre (Poland) under Grant Number DEC-2018/31/B/HS4/01270.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The author has no relevant financial or non-financial interests to disclose.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Marcinkiewicz, E. Elderly vs. Working-Age Generation: Homeownership and Housing Asset Inequality in a Cross-Country Perspective. Soc Indic Res 170, 447–463 (2023). https://doi.org/10.1007/s11205-023-03207-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-023-03207-5