Abstract

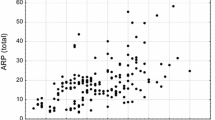

Replacement rates have gained acceptance as a useful metric for assessing the conditions of retirees and households at point of retirement. Here we use data from the SHARE longitudinal database to investigate income dynamics within a comparative European context. Our analysis, centering on households as opposed to the individuals on whom international data commonly focus, reduces replacement rates to their components—pension, work income, etc.—and looks at the dynamics among household members in relation to work and pension income.

Total replacement rates vary widely among the fourteen countries sampled: overall replacement rates are around the Bismarckian 70% across the entire sample, 80% in countries that have Social Democratic and Continental social-policy regimes, and 60% in countries that have East European and Middle Eastern regimes. Looking at the pension and wage components, however, the latter accounts for about 30% of household income—an important fact for decision-makers to consider. Couples tend to retire together, especially if close in age, and work income compensates amply for lower pension income. The Gini coefficients of our sample are compared before/after retirement to determine whether the social programs that underlie pensions mitigate income inequality after retirement.

Finally, we examine the well-being and quality of life of retirees and their households. We find a positive correlation between replacement rate and indicators of retirees’ and their households’ quality of life, e.g., satisfaction with life, ability to consume healthcare services, and ability to cover unforeseen expenses.

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Source: Authors’ computations based on SHARE Wave 5 and Wave 6 databases

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Source: Author’s computations based on SHARE Wave 5 and Wave 6 databases

Similar content being viewed by others

Notes

The Gini coefficient is a measure of statistical dispersion intended to represent the income inequality or wealth inequality within a nation or any other group of people. It ranges between 0 and 1, where 0 is full equality and 1 is maximum inequality. The calculation of the Gini index in this study is based on total household income under each of the welfare regimes before or after the head of household’s retirement and on the component of work income or of pension income that the household has at each investigation time.

Importantly, the resulting sample avoids the problem of over- or under-representation of any particular population group on the basis of geographic location, because the SHARE research sample is chosen in a way that assures accurate representation of each relevant group.

For a detailed discussion of the use of this variable in international comparisons, see Jürges (2007).

To avoid a situation of endogeneity and causation between the household-income variable and the health variables at the same investigation time, we estimated each of the equations with health variables (self-rated health status /EURO depression/ADL/IADL) in the previous period (a lagged variable) as the explanatory variables. This obviated the possibility of endogeneity and causation between the variables.

Income elasticity is measured as the ratio of the percentage change in income at Time 2 to the percentage change in income at Time 1.

The replacement-rate equation was estimated using an OLS regression model and not a fixed effect (panel) model basically because the dependent variable was constructed on the basis of only two years’ data.

References

Alonso-Fernandez, J. J., Meneu-Gaya, R., Devesa-Carpio, E., Devesa-Carpio, M., Dominguez-Fabian, I., & Encinas-Goenechea, B. (2018). From the replacement rate to the synthetic indicator: A global and gender measure of pension adequacy in the European Union. Social Indicators Research, 138(1), 165–186.

Atalay, K., Barrett, G. F., & Siminski, P. (2019). Pension incentives and the joint retirement of couples: Evidence from two natural experiments. Journal of Population Economics, 32(3), 735–767.

Bernheim, B. D. (1987). Dissaving after retirement: Testing the pure life cycle hypothesis. In Z. Bodie, J. Shoven, & D. Wise (Eds.), Issues in Pension Economics (pp. 237–280). University of Chicago Press.

Bernheim, B.D., Della Vigna, S. and D. Laibson, Handbook of Behavioral Economics-Foundations and Applications, Vol. 2. North-Holland, Elsevier, 2019.

Blundell, R., French, E., & Tetlow, G. “Retirement incentives and labor supply”. In Handbook of the economics of population aging (Vol. 1, pp. 457–566). North-Holland, 2016.

Boskin, M. and J. Shoven, (1987) Concepts and measurement of earnings replacements during retirement (No. w1360). National Bureau of Economic Research.

Brady, P. J. (2010). Measuring retirement resource adequacy. Journal of Pension Economics & Finance, 9(2), 235–262.

Börsch-Supan, A., Brandt, M., Hunkler, C., Kneip, T., Korbmacher, J., Malter, F., & Zuber, S. (2013). Data resource profile: The survey of health, ageing and retirement in Europe (SHARE). International Journal of Epidemiology, 42(4), 992–1001.

Carmel, S., & Tur-Sinai, A. (2021). Cognitive decline among european retirees: Impact of early retirement, nation-related and personal characteristics: A longitudinal study. Ageing & Society. https://doi.org/10.1017/S0144686X21000064

Curtis, J., & McMullin, J. (2019). Dynamics of retirement income inequality in Canada, 1991–2011. Journal of Population Ageing, 12(1), 51–68.

Dewey, M.E. and M.J. Prince. (2005) Cognitive function. Health, aging and retirement in Europe: First results from the survey of health aging and retirement in Europe, 118–125

Esping-Andersen, G. (1990). The Three Worlds of Welfare Capitalism. Princeton University Press.

Gustman, A. L. and Steinmeier, T. L. A (1986) structural retirement model. Econometrica: Journal of the Econometric Society, 54 555–584

Haveman, R., Holden, K., Romanov, A., & Wolfe, B. (2007). Assessing the maintenance of savings sufficiency over the first decade of retirement. International Tax and Public Finance, 14(4), 481–502.

Hershey, D. A., & Jacobs-Lawson, J. M. (2012). Bridging the gap: Anticipated shortfalls in future retirement income. Journal of Family and Economic Issues, 33(3), 306–314.

Hyde, M., Wiggins, R. D., Higgs, P., & Blane, D. B. (2003). A measure of quality of life in early old age: The theory, development and properties of a needs satisfaction model (CASP-19). Aging & Mental Health, 7(3), 186–194.

Jürges, H. (2007). True health vs response styles: Exploring cross-country differences in self-reported health. Health Economics, 16(2), 163–178.

Katz, R., Lowenstein, A., Halperin, D. and A. Tur-Sinai, (2015) “Generational solidarity in Europe and Israel,” Canadian Journal of Aging/La Revue canadienne du vieillissement, 34(3), 342–355, Special Issue on Families and Aging: from Private Troubles to a Global Agenda.

Khan, A.R., Griffin, K., Riskin, C. and Z. Renwei, (2017) “Household income and its distribution in China,” in Chinese Economic History Since 1949, Brill, Leyden, pp. 1054–1089.

Knoef, M., Been, J., Alessie, R., Caminada, K., Goudswaard, K., & Kalwij, A. (2016). Measuring retirement savings adequacy: Developing a multi-pillar approach in the Netherlands. Journal of Pension Economics & Finance, 15(1), 55–89.

Larrimore, J., Mortenson, J., & Splinter, D. (2019). Household incomes in tax data: Using addresses to move from tax unit to household income distributions. Journal of Human Resources. https://doi.org/10.3368/jhr.56.2.0718-9647R1

Lhing, N. N., Nanseki, T., & Takeuchi, S. (2013). An analysis of factors influencing household income: A case study of PACT microfinance in Kyaukpadaung Township of Myanmar. American Journal of Human Ecology, 2(2), 94–102.

Litwin, H., & Tur-Sinai, A. (2015). The role of the social network in early retirement among older Europeans. Work, Aging and Retirement, 1(4), 340–349.

Lowenstein, A., & Katz, R. (2019). and A. Tur-Sinai, “Intergenerational family relationships and successful aging.” In R. Fernandez-Ballesteros, J. M. Robine, & A. Benetos (Eds.), The Cambridge Handbook of Successful Aging (pp. 455–474). Cambridge University Press.

MacDonald, B. J., Osberg, L., & Moore, K. D. (2016). How accurately does 70% final employment earnings replacement measure retirement income (in) adequacy? Introducing the Living Standards Replacement Rate (LSRR). ASTIN Bulletin: The Journal of the IAA, 46(3), 627–676.

Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. Franco Modigliani, 1(1), 388–436.

Mínguez, A. M. (2017). Understanding the impact of economic crisis on inequality, household structure, and family support in Spain from a comparative perspective. Journal of Poverty, 21(5), 454–481.

OECD, Pensions at a Glance, OECD Publications, different years.

OECD, Pensions at a Glance 2017, OECD Publications, 2017.

Okuyama, N., & Francis, G. (2010). Revealing the Information Content of Investment Decisions. Edward Elgar Publishing.

Scholz, J. K., Seshadri, A., & Khitatrakun, S. (2006). Are Americans saving “optimally” for retirement? Journal of Political Economy, 114(4), 607–643.

Silverstein, M., Tur-Sinai, A., & Lewin-Epstein, N. (2020). Intergenerational support of older adults by the “mature” sandwich generation: The relevance of national policy regimes. Theoretical Inquiries in Law, 21(1), 55–76.

Skinner, J. (2007). Are you sure you’re saving enough for retirement? Journal of Economic Perspectives, 21(3), 59–80.

Social Protection Committee, EMPL, E., (2012 ) Pension Adequacy in the European Union 2010–2050. Publications Office of the European Union, Luxembourg, 7.

Srakar, A., Hrast, M.F., Hlebec, V. and B. Majcen, “Social exclusion, welfare regime and unmet long-term care need: Evidence from SHARE,” in Börsch-Supan, A. Kneip, T., Litwin, H., Myck, M., and Weber, G. (eds), Ageing in Europe-Supporting Policies for an Inclusive Society, De Gruyter, Berlin, p. 189, 2015.

Truesdale, B. C., & Jencks, C. (2016). The health effects of income inequality: Averages and disparities. Annual Review of Public Health, 37, 413–430.

Tur-Sinai, A., Casanova, G., & Lamura, G. (2020). Changes in the provision of family care to frail older people in familistic welfare states: Lessons from Israel and Italy. Journal of aging and health, 32(9), 972–986.

Tur-Sinai, A., & Lewin-Epstein, N. (2020). Transitions in giving and receiving intergenerational financial support in middle and old age. Social Indicators Research, 150(3), 765–791.

Tur-Sinai, A., & Litwin, H. (2015). Forgone visits to the doctor due to cost or lengthly waiting time among older adults in Europe. In A. Börsch-Supan, T. Kneip, H. Litwin, M. Myck, & G. Weber (Eds.), Ageing in Europe-Supporting Policies for an Inclusive Society (pp. 291–300). De Gruyter.

Tur-Sinai, A., & Soskolne, V. (2021). Socioeconomic status and health behaviors as predictors of changes in self-rated health among older persons in Israel. Health and Social Care in the Community, 29(5), 1461–1472.

Acknowledgements

This paper uses data from SHARE Waves 5 and 6 (DOIs: 10.6103/SHARE.w5.700, 10.6103/SHARE.w6.700) see Börsch-Supan et al. (2013) for methodological details. The collection of SHARE data was funded by the European Commission through FP5 (QLK6-CT-2001-00360), FP6 (SHARE-I3: RII-CT-2006-062193, COMPARE: CIT5-CT-2005-028857, SHARELIFE: CIT4-CT-2006-028812), FP7 (SHARE-PREP: GA N°211909, SHARE-LEAP: GA N°227822, SHARE M4: GA N°261982) and Horizon 2020 (SHARE-DEV3: GA N°676536, SERISS: GA N°654221) and by DG Employment, Social Affairs & Inclusion. Additional funding from the German Ministry of Education and Research, the Max Planck Society for the Advancement of Science, the U.S. National Institute on Aging (U01_AG09740-13S2, P01_AG005842, P01_AG08291, P30_AG12815, R21_AG025169, Y1-AG-4553-01, IAG_BSR06-11, OGHA_04-064, HHSN271201300071C) and from various national funding sources is gratefully acknowledged (see www.share-project.org).

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tur-Sinai, A., Spivak, A. How Generous are Societies Toward Their Elderly? A European Comparative Study of Replacement Rates, Well-Being and Economic Adequacy. Soc Indic Res 162, 71–105 (2022). https://doi.org/10.1007/s11205-021-02822-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-021-02822-4