Abstract

We assess the impact of the EU Regional Policy on regional economic growth by applying a new evaluation strategy, which integrates mediation analysis with a quasi-experimental framework. Using the R&D expenditure as an indicator of innovation capability, we evaluate how much of the total effect of the EU Regional Policy is due to R&D in the poorest EU regions. Consistently with the previous literature, we found a positive impact of the overall policy on economic growth, but, among the convergence regions, those investing a higher proportion of funds in R&D have the same convergence rate as regions investing more in other priorities. These findings confirm that the EU Regional Policy played an important role in the economic recovery of the poorest regions in the aftermath of the Great Recession. However, focusing resources on R&D does not seem to provide additional economic benefits, at least in the short run.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Research, Development and Innovation (R&D) are among the most important drivers of long-run productivity growth and investing in R&D has long been considered one of the keys to the economic success of developed economies (Romer, 1990). Indeed, R&D investments contribute to the accumulation of intangible capital, which is one of the determinants of the competitive advantage of countries (Coccia, 2011), and increasing investment in R&D leads to greater technological potential, thus to innovation and growth (Dechezleprêtre et al., 2019; Trajtenberg, 1990). At the firm level, R&D is expected to increase productivity by improving the quality or reducing the average production costs of existing goods or simply by widening the spectrum of final goods or intermediate inputs (Hall et al., 2010). However, since the seminal work of Arrow (1962), economists have demonstrated that the equilibrium level of private resources allocated to R&D ends up being below the socially optimal level. The reason is that perfect competition is unable to maximize social welfare because the outputs of innovative activities are strongly affected by problems of non-appropriability, non-divisibility and uncertainty that prevent firms from completely internalizing the benefits of R&D investments. Therefore, most industrial countries and regions have proposed public policies that support private R&D activity, aiming to reduce the costs of the innovative outlays and stimulate investments in innovation (see, for instance, Bronzini & Piselli, 2016). In Europe, this effort is strongly supported by the EU Regional Policy, also known as Cohesion Policy (henceforth CP). Such place-based policy supports public and private R&D investments to increase regional competitiveness, especially in lagging regions and, consequently, reduce territorial disparities and increase economic growth. In the 2007–2013 programming period, 25% of the CP funds were devoted to R&D, while in the following programming period (2014–2020), this share was raised to 30% (European Commission, 2021). The question is whether the choice of allocating a high share of the EU Regional Policy resources to R&D is actually paying off in terms of growth and regional convergence, especially for the poorest EU regions, where innovation processes are struggling, and the absorptive capacity, explicitly concerning the ability to produce R&D, is lower.

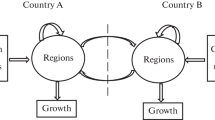

In such a context, it seems vital to understand the transmission mechanisms of CP and whether the high R&D investments are paying off in terms of economic growth. This study estimates the causal effect of the EU Regional Policy on the economic growth of convergence regions—the regions with a GDP per capita of less than 75% of the EU average—which received the largest amount of funds (see Becker et al., 2012) and, more importantly, what part of this effect is due to R&D expenditure. We use the regional R&D expenditure as an indicator of innovation capability and then exploit mediation analysis to test whether the share of R&D investments is a driver of economic growth in lagging regions. There are two main elements of methodological innovation in our paper. First, for the first time in this context, a statistical method called mediation analysis is used (see, for instance, Baron & Kenny, 1986; Pearl, 2001; Imai et al., 2011). This methodology allows studying the causal mechanisms through which a policy works by disentangling the total average treatment effect (ATE) into the direct effect and the indirect effect of the policy. The application of mediation analysis in a counterfactual framework is scarce and particularly appropriate in our context. Second, we adopt a novel quasi-experimental econometric method recently developed by Celli (2020), which constructs a mediation estimator in a regression discontinuity design (RDD) framework. To identify the effects of interest, we apply a spatial RDD, a quasi-experimental approach that exploits the geographical borders as discontinuities (see, among others, Keele et al., 2015). To this end, we use a regional dataset stemming from the European Commission and the spatial grid defined by the EU-27 regions at level 3 of the 2006 NUTS classificationFootnote 1 (see Sect. 3 for more details).Footnote 2

We find that CP had a positive and significant impact on regional economic growth in the 2007–2013 programming period, in line with the findings relative to previous programming periods (Becker et al., 2010; Pellegrini et al., 2013). Even more importantly, we find that, among convergence regions, those investing a larger share of funds in R&D did not experience higher economic growth. These results are robust to several sensitivity checks. Our findings imply that boosting R&D expenditure in lagging-behind areas does not significantly affect short-term economic growth. Such result might be due to several factors: for instance, lack of qualified labor force, absence of a network of firms with good practices, a system of institutions that is not supportive of entrepreneurial initiatives (Fratesi & Perucca, 2019), or, more generally, lack of absorptive capacity, in this case explicitly concerning the ability to produce R&D (see Becker et al., 2013). Our results suggest a profound rethinking of the allocation scheme of the CP resources in lagging areas, which should take more into account pre-existing local resources and favor the transfer of knowledge from other regions.

The paper is structured as follows: in Sect. 2, the EU Regional Policy is presented; in Sect. 3, data are introduced; in Sect. 4, the econometric approach is explained and applied. Finally, Sect. 5 presents the empirical results, while Sect. 6 concludes.

2 . R&D Investments in the EU Regional Policy Context

2.1 The 2007–2013 Programming Period

The EU Regional Policy is a system of public transfers from European countries to subnational regions aimed at boosting economic growth, especially in less-developed regions, and tackling social, political, and economic inequalities across states and regions (Iammarino et al., 2018). Social and economic disparities have been substantial among European countries and even larger at the regional level. To give an overview, the wealthiest region in 2007 was Inner London with 290% of the EU-27’s average gross domestic product (GDP) per capita, while the poorest region was North-East Romania with 23% of the EU average.

The CP framework is established for a period of seven years. In this paper, we focus on the 2007–2013 programming period.Footnote 3 The main aims of this programming period concerned changes in the job market and globalization, the expansion of R&D, the creation of a more dynamic business environment, the sustainability of a greener economy, and climate change. As in the previous programming period, there has been a persistent focus on long-run growth and the promotion of regional competitiveness (Bachtler et al., 2001). However, since the 2007–2013 programming period, CP has made a radical shift in investment priorities, with a quarter of the total resources dedicated to R&D. In particular, in the 2007–2013 programming period, CP allocated 86.8 billion across all member states (almost 25% of the total budget) to R&D, including the mainstreaming of innovative actions and experimentation (Charles et al., 2012). Of this total, 50.6 billion went to R&D in the narrow sense, 8.4 billion to entrepreneurship, 13.3 billion to innovative information and communication technologies to foster the demand side of ICT, and 14.5 billion to human capital. These investments represented more than a tripling of absolute financial resources dedicated to innovation and R&D compared to the previous programming period (2000–2006). However, there is important heterogeneity in resource allocation: the share invested in R&D with respect to the total amount of the EU funds for convergence regions is 18%, whereas the non-convergence regions dedicate about 28% of their budget to this priority. This heterogeneity is even more evident at the regional level, as shown in Fig. 1. The difference between more and less developed regions in the share of R&D expenditure is large, whereas important differences also emerge within countries. In particular, those investing more in this priority among convergence regions are the NUTS 2 territories generally belonging to the most developed countries, such as Germany, Italy, Portugal, and the United Kingdom.

The 2007–2013 programming period was the first full period in which the Central and Eastern European countries were in receipt of CP funding. It is, then, essential to evaluate the overall performance of the policy, in light of the particular needs of these countries, which were mainly concerned with strengthening their endowment of infrastructure and overcoming other constraints on development, such as the competitiveness of their firms and the relatively low expenditure on R&D.

At the same time, it seems equally critical to evaluate how EU funds were invested and what the results were, in light of the different priorities. In this paper, we investigate the impact of the EU Regional Policy at the NUTS 3 level and then focus on the impact of R&D investments on economic growth for convergence regions.Footnote 4 Indeed, apart from the allocation of funds to thematic priorities in a region, the intraregional distribution of funds to specific projects and beneficiaries has been a black box to researchers and European policy makers so far (Bachtrögler et al., 2019).

2.2 Territorial Competitiveness, Growth and R&D Expenditure

In recent years, the role of innovation as a tool for increasing global competitiveness has been intensively discussed in the literature (Kiselakova et al., 2018). A key factor of the states’ increasing competitiveness is assumed to be the innovation performance of enterprises, which is projected through innovative business processes into the innovation performance of the economy as a whole (Ivanová & Čepel, 2018). Dima et al. (2018) analyze the Global Competitiveness Index (GCI) in relation to R&D expenditure. Their findings highlight the crucial role of both innovation and education as determinants of EU competitiveness and economic convergence and growth.Footnote 5 Kiselakova et al. (2018) analyze the relationship between the GCI and the innovation performance measured on the basis of R&D expenditure per capita in eleven Central and Eastern European countries. They find that the growth of R&D expenditure can significantly contribute to increasing the countries’ competitiveness levels. Simionescu et al. (2017) studied determinants of economic growth and competitiveness in the Czech Republic, Hungary, Poland, Slovakia, and Romania. The main results indicate that FDI promoted economic growth and competitiveness in all countries, except Slovakia, while the R&D expenditure had positive effects in Romania, Hungary, and the Czech Republic.

All these studies underline the positive relationship between R&D expenditure and territorial competitiveness, which in turn boosts economic growth. Nations investing heavily in the development of technology are considered to be bound to grow at a greater pace than neighboring countries, not only because of the high returns related to this type of technology but also because of the multiplier effects and the external and agglomeration economies generated by innovation centers, and their greater capacity to assimilate technological spillovers (Rodríguez-Pose, 1999). Although it is commonly accepted that investing in R&D is a catalyst for the genesis of economic activity, there is less consensus on the spatial significance and returns of the R&D effort for regional economies. Policies targeting R&D are expected to be more effective when the region has a qualified labor force, is rich in human capital, has a network of firms with good practices, and a system of institutions that is supportive of entrepreneurial initiatives (Fratesi & Perucca, 2019; Ganau & Grandinetti, 2021). Then, the question is whether it is worthwhile in terms of economic growth for the less-developed regions across Europe to invest a large share of their resources in R&D. The answer requires an accurate empirical analysis, which is conducted in our paper through a causal model that considers R&D as a specific channel of transmission of the policy.

2.3 Challenges in Evaluating the EU Regional Policy and its Support to R&D

CP is one of the most important regional policies worldwide, and a large and growing body of literature has investigated the policy’s contribution to convergence and the economic growth of the European regions. Most studies based on the counterfactual approach find that CP positively impacts disadvantaged areas. For instance, Becker et al. (2010) and Pellegrini et al. (2013) estimate a positive effect on economic growth and employment, Ferrara et al. (2016) find a positive effect on innovation and transport infrastructure, while there is a positive relationship between absorptive capacity—human capital and good institutions and the effectiveness of the CP (Becker et al., 2013). All these studies focus on estimating the causal effect of CP, answering questions on the effectiveness of the policy or the magnitude of the impact, but without considering the policy mix that, on average, can be more suited for regional development.

Following the literature and the European Commission guidelines, the rate of innovation is an important determinant of a region’s economic growth, and expenditure on R&D is a major way in which this can be stimulated, as recognized in the Europe 2020 Strategy. However, the European Commission highlights the need to invest in R&D in peripheral areas. According to the neoclassical growth theory, decreasing returns render investment in core areas increasingly less efficient (see Becker et al., 2012; Cerqua & Pellegrini, 2018), making investment in peripheries a more suitable option. This line of thinking also emphasizes that the sole reliance on spillovers may not only lead to a severe R&D underinvestment in lagging areas but may also condemn them to technological dependence, especially since the capacity of these areas to free-ride on technological advances generated elsewhere is limited (Rodríguez-Pose, 2001). Conversely, the Schumpeterian approach argues that returns from R&D rely heavily on the quality of the personnel conducting the research, on the concentration of R&D centers in limited areas, on the quality of the local human capital (Audretsch & Feldman, 1996; De Bondt, 1997; Engelbrecht, 1997), and above all, on the amount of investment (Dosi, 1988; Scherer, 1982). Limited and/or dispersed investment in R&D in lagging areas may not yield the expected returns in terms of technological progress since most R&D projects might lack optimal circumstances to conduct competitive research. In addition, local scientists and researchers are likely to be more isolated than in advanced technological centers. The local economy may also lack the capacity to successfully achieve the passage from technological progress to innovation and economic growth (Rodríguez-Pose, 1999). In this context, the effects of R&D investments are indeterminate. Our paper aims precisely to understand whether a large share of CP funds should be spent on R&D in the least developed regions.

3 Data

This study is based on a new, reliable, and comparable dataset, stemming from the European Commission, which collected and mapped information on the regional breakdown of the European Regional Development Fund (ERDF) and the Cohesion Fund (CF). The spatial grid used in this work is defined by all the NUTS 3 regions belonging to the EU-27 countries.Footnote 6 Although the transfer eligibility is determined at the NUTS 2 level, we analyze NUTS 3 regions because R&D expenditure tends to be concentrated in small areas (especially in territories with high-tech clusters of companies). Therefore, the use of NUTS 3 data allows capturing the heterogeneity in R&D expenditure much better than the larger NUTS 2 regions. In this study, we exploit the data of the geographical expenditure work package (WP 13), which collects data from Managing Authorities (MAs) of 303 Operational Programs (OPs) on expenditure and allocations in the different NUTS 3 regions within member states by category of expenditure and broken down by the 86 priority themes (defined in Commission Regulation no. 1828/2006). The database covers the convergence, regional competitiveness, and employment as well as the European territorial cooperation objectives for the period 2007–2013. We link this data with information on various sub-regional pre-treatment characteristics stemming from the European Commission dataset. In particular, we use at the NUTS 3 level: the 2001 and 2006 per capita GDP, the employment level, the share of the total employment on the active population, the total and per capita Gross Value Added (GVA), the GVA of the services sector, the population and active population level, the population density per square kilometer and the per capita EU funds intensity. As outcome variable, we use the average annual growth rate between 2006 and 2015. Following the main strand of literature, we consider per capita GDP as a good indicator of many key characteristics of the regions: economies at similar income levels often share many structural attributes, including education levels, science and technology endowments, infrastructure and institutional quality (Iammarino et al., 2018). As already mentioned, we want to test whether part of the effect of CP on economic growth is due to the R&D investment share in convergence regions. Exploiting the mediation framework to identify this causal mechanism of transmission, we use as mediator a dummy variable that takes the value 1 for convergence NUTS 3 regions investing at least 21% of the total expenditure in these priorities and takes the value 0 otherwise. The 21% threshold corresponds to the median of the R&D expenditure in the convergence regions. The R&D share is computed as the share of EU funds invested in priority themes from 1 to 9, corresponding to the Research and Technological development (R&TD),Footnote 7 Innovation and entrepreneurship over the 2007–2013 programming period. Table 6 in the Appendix gives a more detailed description of the R&D expenditure at the country level, whereas Fig. 2 shows the composition of the R&D indicator. It is composed of 9 areas of investments, respectively: R&TD activities in research centers (PC_1), R&TD infrastructure and centers of competence in a specific technology (PC_2), Technology transfer and improvement of cooperation networks (PC_3), Assistance to R&TD, particularly in SMEs, including access to R&TD services in research centers (PC_4), Advanced support services for firms and groups of firms (PC_5), Assistance to SMEs for the promotion of environmentally-friendly products and production processes (PC_6), Investment in firms directly linked to research and innovation (PC_7), Other investment in firms (PC_8), Other measures to stimulate research and innovation and entrepreneurship in SMEs (PC_9). Figure 2 shows an important heterogeneity in the composition of the R&D indicator at the country level. At first glance, we can see that Eastern countries invest more in R&TD infrastructure and centers of competence in a specific technology (PC_2), in Investment in firms directly linked to research and innovation (PC_7) and Other investment in firms (PC_8). The Central and the Western part of the EU invests more in R&TD activities in research centers (PC_1), in Assistance to R&TD (PC_4), in Advanced support services for firms and groups of firms (PC_5), and Other investment in firms (PC_8) as well.

3.1 Some Descriptive Statistics

In line with the RDD approach, we select a restricted sample, including the closest regions to the discontinuity. We thus exclude from the analysis all the regions with a per capita GDP greater than 150% of the EU average.Footnote 8 Furthermore, because we exploit the geographic dimension, we exclude the Islands of France (Guadeloupe, Martinique, Guyane and Reunion), the Canary Islands of Spain and Portugal's Islands (Madeira and Azores).

Croatia entered into the EU in 2013; therefore, it was not eligible for the ERDF or CF in this period, receiving only pre-accession support. Because of the much smaller amount of support received than other countries with similar GDP levels per head and because of the absence of any data about pre-treatment variables, Croatia is excluded from the analysis. Therefore, at the end of this process, we compile data on 1,166 NUTS 3 regions: 385 are defined as treated regions, i.e. receiving objective convergence funds, while 781 as non-treated, as shown in Fig. 3. The map presents the geographical position of treated and non-treated regions in the EU: the standard core-periphery picture is clearly outlined.

In Table 1, we compare treated and non-treated regions with respect to several pre-treatment characteristics. As the Table indicates, treated regions are generally more highly populated than non-treated ones. Of course, non-treated regions are more prosperous and more productive. Still, the average per capita GDP growth rate is lower than that of the treated regions. On the other hand, the employment rate is relatively similar between the two groups.

Among treated regions, we are interested in knowing which of them have invested a higher share in R&D (at least 21% of the EU funds). Figure 4 shows the geographical position of treated NUTS 3 regions with high and low intensity of R&D investments. The distribution of these regions is less clustered, with a larger variability even within each country. This distribution is not surprising: there is a positive correlation between the country’s income levels and the share of R&D spending, while Eastern European countries generally have lower ratios. Moreover, the quotas appear greater in the convergence areas of the more developed countries like Germany, Italy, the United Kingdom, and Spain. This pattern is in line with expectations: the developed countries have generally already built the infrastructure needed and therefore can devote more resources to the intangible and human capital such as R&D in a narrow sense.

In Table 2, we summarize the main characteristics of treated regions divided by mediator status. On average, regions investing more in R&D are generally wealthier, less populated and with a lower growth rate with respect to non-mediated regions.

4 Mediation Framework

Imai et al. (2013) define a causal mechanism as a process where a causal variable of interest, namely a treatment, influences an outcome through an intermediate—and hence endogenous—variable, the mediator, that lies in the causal pathway between the treatment and the outcome variable. Thus, studying causal mechanisms helps understand social and economic implications better than the total effect alone. Then, our estimation strategy aims to study whether one variable affects another and how such a causal relationship arises. However, analyzing causal mechanisms requires more binding identifying assumptions than estimating the ATE.

Even in the ideal scenario of random assignment of the treatment, this does not imply that the mediator is randomly assigned (Robins & Greenland, 1992). Indeed, the total effect cannot be unraveled by simply conditioning on the mediator because this generally introduces selection bias (Rosembaum, 1984). The typical approach used to study causal mechanisms is the structural equation model (SEM) (see, for instance, the seminal work by Baron & Kenny, 1986), but SEM relies on untestable assumptions (Imai et al., 2011). In particular, conventional exogeneity assumptions alone are insufficient for identifying causal mechanisms. By contrast, they can serve as a sufficient condition for identifying the ATE. In addition, because the mediator should be considered as an intermediate outcome, we must control for a large set of covariates to tackle the potential presence not only of pre-treatment but also post-treatment confounders. Thus, we run the risk of obtaining different estimates depending on the covariates chosen, increasing the sensitivity of the estimates. To overcome these limits, we propose a new estimator that can capture the direct and indirect causal effect of a treatment, based on an identification strategy that allows for nonlinearities and heterogeneity, and uses a spatial RDD approach to control for the endogeneity of the mediator (see Celli, 2020).

4.1 Evaluation Strategy

Our evaluation strategy gauges the causal effect of the 2007–2013 programming period of the CP on the economic growth of NUTS 3 regions and estimates what part of this effect is due to funds invested in R&D for lagging-behind regions. To this end, we exploit the allocation rule of regional EU transfers and define as treated the regions having a per capita GDP lower than 75% of the EU average—the so-called convergence regions–and as non-treated all the other regions (see Sect. 3.1 for more details on the sample). Furthermore, among treated regions, those investing more than 21% of their EU funds in R&D are considered as mediated.

In addition, we look at the spatial distribution of the CP, by using the spatial RDD (see, for example, Giua, 2017) to identify the direct and indirect effects: thanks to the geo-referenced data, we exploit the geographical discontinuities in funds to identify the parameters of interest. The idea behind the spatial RDD is to interpret the distance to the regional border as an assignment variable: location acts as the forcing variable allowing us to exploit the discontinuities change in R&D intensity at the geographical border, tackling the endogeneity of the mediator. In our context, even if we have multiple geographical discontinuities among mediated regions (see Fig. 4), the addition of latitude and longitude (as well as their squared terms and their interaction) as control variables allows comparing mediated and non-mediated regions similar to each other also in terms of non-observable characteristics.

To define the parameters of interest in this new setting that combines the mediation framework and the spatial RDD approach, we make use of potential outcome notation, see for instance Neyman (1923) and Rubin (1974). We denote by Y(d’,m) and M(d) the potential outcome and the potential mediator state, with d,d’,m ∈ {0,1}. Furthermore, we denote by Z = z∗ the cut-off point at which the mediator state changes sharply, according to the following deterministic rule: M = {1[Z ≥ z∗]}.

We can define the direct effect as:

where θ(d) is the average natural direct effect (Pearl, 2001)Footnote 9 for the population near the threshold and it expresses how much the mean potential outcome would change if the treatment was set from 1 to 0 and the mediator was kept at the potential level M(d). It captures what the effect of the treatment on the outcome would remain if we were to disable the pathway from the treatment to the mediator.

In the same way, we can define the local natural average indirect effect as:

where δ(d) corresponds to the change in the mean potential outcome for the population near the threshold when exogenously shifting the mediator to its potential values under treatment and non-treatment state, but keeping the treatment fixed at D = d to switch off the direct effect.

It can be easily shown that the ATE, even for the local population, is the sum of the natural direct and indirect effects defined upon opposite treatment states, like in the traditional mediation framework, but looking only at the individuals just above and below the cut-off point:

where the third equality comes from adding and subtracting the quantity E[Y(0, M(1))] and the fifth equality comes from adding and subtracting the quantity E[Y(1, M(0))]. The main issue with this analysis is identifying the counterfactual quantities E[Y(d, M(d')], never observed for each individual and hardly identified in non-experimental designs with the classic assumptions. A second issue is that only one of Y(1, M(1)) and Y(0, M(0)) is observed for any unit, the so-called fundamental problem of causal inference (Holland, 1986). Identification of direct and indirect effects hinges on exploiting exogenous variation in the treatment and the mediator. Following the studies of Pearl (2001), Imai et al. (2011) and Celli (2020), to identify the counterfactual quantities, we use the following estimatorsFootnote 10:

where \(\hat{\rho }\left( {m_{i} ,x_{i} } \right)\) and \(1 - \hat{p}\left( {x_{i} } \right)\) denote the respective estimates of the propensity scores Pr(D = 1|M = mi, X = xi) and Pr(D = 1|X = xi). Treatment propensity scores are estimated by probit specification, see for instance Huber (2014) and Tchetgen Tchetgen (2013). The outcome variable \(Y_{i}\) is the GDP growth rate between 2006 and 2015 for the NUTS 3 region i. We have chosen 2006 as pre-treatment year given that it corresponds to the year before the beginning of the programming period and 2015 as the final year to take into account that regions were allowed by the European Commission to absorb all the funds by the end of 2015. \(D_{i}\) is the binary indicator variable for treatment which is 1 in case of convergence regions during the 2007–2013 programming period and 0 otherwise, \(M_{i}\) is the binary indicator variable for mediator which is 1 if regions invest at least 21% of EU Cohesion Fund in R&D and 0 otherwise, \(X_{i}\) is a set of pre-treatment variables to control for differences in treated and non-treated regions. In this application, we used as control variables the population and the active population level, the population density, the employment level, the share of the total employment on the active population, the total GVA, the GVA per capita and the GVA of the services sector, the 2001–2006 GDP growth rate, the per capita EU funds intensity, a dummy variable for the Accession countries, a dummy for the peripheral countries, and a border dummy variable to take into account regions contiguous to the policy-change boundary as well.

We use Z as the forcing variable, specifying the function as the two-dimensional RDD latitude–longitude space proposed by Dell (2010), which corresponds to the geographical coordinates of the centroids of NUTS 3 regions (Eurostat) and which controls for smooth functions of geographic location. We employ a 2nd order polynomial which allows comparison of units that are very close to each other and absorbs all smooth variations in the outcome. The key identification assumption behind the spatial RDD strategy is that the potential outcomes are independent of treatment assignment—in our case, the mediator assignment—for regions close to the boundary that separates regions with high and low intensity of R&D investments, conditional on pre-treatment characteristics. With this approach, we are able to estimate the direct effect for non-treated regions θ(0), i.e. the effect net of R&D investments and then due to other components of EU Regional expenditure, and the indirect effect for treated regions δ(1), i.e. the effect that goes from the policy to the outcome—the GDP growth—through R&D investments, among convergence regions.Footnote 11 As explained, the sum of these two effects gives the average total effect.

5 Empirical Analysis

In Table 3, we report our main empirical results. Looking at the overall impact of the EU Regional Policy, we estimate a positive and significant average effect of the policy on the 2006–2015 GDP per capita growth rate. This result confirms the fundamental role of the CP for the economic growth of the least developed regions, and it is in line with previous literature (see the meta-analysis by Dall’Erba & Fang, 2017). Treated regions converge towards more developed countries and the yearly impact of CP on economic growth is + 0.74 percentage points for the period under consideration in convergence regions. Our estimation strategy enables studying the role of R&D as a causal channel of transmission of the policy among convergence regions. Opening the black box of causality, we observe that the effect of R&D investments is negligible for the least developed EU regions. Notably, the δ(1) estimate is negative, which suggests that among convergence regions, the ones investing more in R&D grow less than regions investing more in other priorities. However, the δ(1) estimate is not statistically significant. Our findings would therefore support the widespread idea that R&D investments have positive returns only in regions having an adequate capacity to absorb this type of investment. Unfortunately, this is not the case for most convergence regions. As shown by Becker et al. (2013), the CP impact on economic growth depends on the absorptive capacity of the treated regions. In addition, as underlined by Becker (2014), in times of financial crisis and economic austerity, available funds must be used and targeted effectively. Part of the literature also underlines how public subsidies often crowd-out private R&D (David et al., 2000; García-Quevedo, 2004), producing an ambiguous final effect. However, it is worth noting that the outcome of interest is the GDP growth rate for the period 2006–2015 and that R&D investments usually have a long-run effect on productivity growth (Bloom et al., 2019). Our findings have significant implications for the effectiveness of R&D policies in lagging areas and should encourage an in-depth analysis for understanding why this is the case.

5.1 Robustness Checks

We have checked the sensitivity of the results. We replicated the analysis, changing the threshold for the R&D indicator assignment and consequently the number of observations that are mediated and not. Table 4 shows the estimates of the total, direct and indirect effects. Each block shows the outcomes for a different number of units, augmenting (diminishing) the threshold up to the 60th (40th) percentile. The estimates are similar to the ones we obtained in the main analysis.

To test the sensitivity of the results, we also repeated the analysis using a first−order RDD polynomial specification of the geographical coordinates (the longitude and latitude of the centroids). As reported in Panel A of Table 5, the results are in line with the main analysis.

Following other papers in the RDD literature, we also replicated the analysis excluding the lower quarter (in terms of the initial level of per capita GDP) of the treated regions. Indeed, these regions are not close to the 75% threshold, and their exclusion should not affect the overall impact of CP. As expected, the results change only marginally, as reported in Panel B of Table 5.

6 Conclusions

In this study, we have estimated the impact of CP on regional convergence and, more importantly, we have investigated whether the high R&D investments are paying off in terms of economic growth in the least developed EU regions. The work focuses on R&D expenditure, as it is one of the most important factors of territorial development. We have developed a novel causal model based on an indicator that selects the EU NUTS 3 regions with low levels of R&D expenditure and that uses the spatial RDD and the mediation analysis to identify the role played by the R&D channel on economic growth. Therefore, our model captures the overall causal effect of the EU Regional Policy as well as the effect only due to R&D expenditure for the lagging-behind regions. Our findings are at least partly unexpected. While we confirm the positive and significant impact of CP on regional economic growth (the total yearly effect is + 0.74 percentage points between 2006 and 2015), this effect is not driven by the share of R&D expenditure. The latter result means that, among lagging-behind regions, those investing the most in R&D have the same growth rate as the others.

Our findings give rise to two considerations. First, they confirm that R&D investments stimulate economic growth only under certain circumstances, such as the capacity to successfully achieve the passage from technological progress to innovation and economic growth (Rodríguez-Pose, 1999), the agglomeration of innovative firms and human capital (Bloom et al., 2019), as well as the link with the innovative value chain. Unfortunately, these conditions are rarely met in lagging-behind areas. This is particularly true if these incentives are given in abundance without considering the specialization and resources of the areas concerned and, therefore, their actual absorptive capacity. Second, we should question whether the lack of sizable economic effects in less developed regions should undermine the strong support given by the EU Regional Policy to R&D expenditure in the least-developed areas. Our opinion is that we must be very cautious in interpreting the results in this direction. The main reason is that CP changed markedly in the 2014–2020 programming period due to the implementation of the S3 (Smart Specialization Strategy). S3 aims to enhance the capabilities and opportunities for technological development of the European regions, taking into account the specific technological and human capital equipment of the area (see, for instance, Pellegrini & Di Stefano, 2017). This profound change of strategy, therefore, goes in the direction of regional policies to support R&D directly targeted to the specific needs of each region.

It is now clear that CP cannot be a "one size fits all" policy and that there is a strong need for flexibility to adapt the policy to local conditions. On the other hand, the S3 requires time to create synergies with the territory and enhance its resources, and indeed, its effects will be seen in the next few years. Furthermore, this strategy necessarily involves developing specific indicators for the analysis of R&D and innovation activities, the availability of which will also allow the improvement of analyses such as the one described in the paper.

Lastly, we argue that robust causal analysis techniques, such as the mediation analysis presented in this paper, together with the development of an adequate system of indicators, have the potential to answer important policy questions, providing crucial insights into the debate on the channels of transmission of the EU Regional Policy.

Data Availability

Data files available upon request.

Notes

Eurostat created the "nomenclature of territorial units for statistics" (NUTS) to apply a common statistical standard across the EU. NUTS levels are geographical areas used to collect harmonized data in the EU. They have been used in the CP since 1989 and play an important role in allocating CP funds. The current nomenclature subdivides each member states into three levels (NUTS 1, NUTS 2 and NUTS 3), according to specific population thresholds. NUTS 3 regions generally have a population between 150,000 and 800,000 inhabitants.

It is important to note that mediation analysis identifies one mechanism, in our case the R&D expenditure, named the indirect effect, whereas all the other mechanisms fall in the so-called direct effect (for more details, see Imai et al., 2011).

Following the European Commission guidelines, we do not distinguish between the support given by different European financial funds in this paper. They are all treated as CP.

In the period under analysis, CP had three different objectives to achieve its goals. The first was the "convergence" objective (the ex-Objective 1, w.r.t. the 2000–2006 period) that uses the European Regional Development Fund (ERDF), the European Social Fund (ESF), and the Cohesion Fund (CF). In the EU-27, there were 84 NUTS 2 regions, with a per capita GDP less than 75% of the EU average. In addition, there is transitional support for the phasing-out regions, i.e. regions that would have been eligible for the convergence status if the 75% threshold had been calculated for the EU-15 rather than the EU-25. The second was the "competitiveness and employment" objective (the ex-Objective 2, w.r.t. the 2000–2006 programming period). It covers the remaining 168 NUTS 2 regions not eligible for the convergence objective. Within these, 15 regions are phasing-in areas: they receive transitional support because they were covered by Objective 1 in 2000–2006 but had a GDP above 75% of the EU-15 average. The third objective is the European territorial cooperation covering NUTS 3 regions on land-based internal borders and some regions on external borders and maritime borders separated by a maximum distance of 150 km.

It is not easy to find indicators for R&D that are comparable for the EU-27 regions. The primary source of information is the Regional Innovation Scoreboard (RIS), published every two years by the European Commission. This indicator provides a comparative assessment of the performance of innovation systems across 238 regions of 23 EU Member States, plus Norway, Serbia, and Switzerland. The system is based on 17 indicators of education, economic, and innovation outputs. Unfortunately, not all indicators are always available for all European regions.

We use the NUTS 2006 classification. Regions—Nomenclature of territorial units for statistics NUTS 2006/EU27.

Commission Regulation no. 1828/20.

We do not exclude from the analysis regions with a per capita GDP lower than 50% of the average EU because, in our analysis, we are interested in estimating the indirect effect among all treated regions.

See Celli (2020) for the assumptions and estimators’ identification strategy.

With this new estimator, it is not possible to identify the potential parameters, θ(1) and δ(0), because of the underlying assumptions in the identification strategy as explained in Celli (2020).

References

Arrow, K. J. (1962). Economic welfare and the allocation of resources for invention. In R. R. Nelson (Ed.), The rate and direction of inventive activity: economic and social factors (pp. 609–625). Princeton University Press.

Audretsch, D., & Feldman, M. (1996). Innovative clusters and the industry life cycle. Review of Industrial Organization, 11, 253–273.

Bachtler, J., & Yuill, D. (2001). Policies and strategies for regional development: a shift in paradigm? Regional and Industrial Policy Research Paper, 46. University of Strathclyde in Glasgow.

Bachtrögler, J., Hammer, C., Reuter, W. H., & Schwendinger, F. (2019). Guide to the galaxy of EU regional funds recipients: Evidence from new data. Empirica, 46, 103–150.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182.

Becker, B. (2014). Public R&D policies and private R&D investment: A survey of the empirical evidence. Journal of Economic Surveys, 29(5), 917–942.

Becker, S. O., Egger, P. H., & von Ehrlich, M. (2010). Going NUTS: The effect of EU structural funds on regional performance. Journal of Public Economics, 94(9–10), 578–590.

Becker, S. O., Egger, P. H., & von Ehrlich, M. (2012). Too much of a good thing? On the growth effects of the EU’s regional policy. European Economic Review, 56(4), 648–668.

Becker, S. O., Egger, P. H., & von Ehrlich, M. (2013). Absorptive capacity and the growth and investment effects of regional transfers: Regression discontinuity design with heterogeneous treatment effects. American Economic Journal: Economic Policy, 5(4), 29–77.

Bloom, N., Van Reenen, J., & Williams, H. (2019). A toolkit of policies to promote innovation. Journal of Economic Perspectives, 33(3), 163–184.

Bronzini, R., & Piselli, P. (2016). The impact of R&D subsidies on firm innovation. Research Policy, 45(2), 442–457.

Celli, V. (2020). Identification of causal mechanisms through an RD approach. DISSE Working Paper Series No. 15/2020.

Cerqua, A., & Pellegrini, G. (2018). Are we spending too much to grow? The case of structural funds. Journal of Regional Science, 58(3), 535–563.

Charles, D., Gross, F., Bachtler, J. (2012). Smart Specialisation and Cohesion Policy - A strategy for all regions? IQ-Net Thematic Paper No. 30 (2), Glasgow, European Policies Research Centre, University of Strathclyde.

Coccia, M. (2011). The interaction between public and private R&D expenditure and national productivity. Prometheus, 29(2), 121–130.

Dall’Erba, S., & Fang, F. (2017). Meta-analysis of the impact of European union structural Funds on regional growth. Regional Studies, 51(6), 822–832.

David, P. A., Hall, B. H., & Toole, A. A. (2000). Is public R&D a complement or substitute for private R&D? A review of the econometric evidence. Research Policy, 29, 497–529.

De Bondt, R. (1997). Spillovers and innovative activities. International Journal of Industrial Organization, 15(1), 1–28.

Dechezleprêtre, A., Einiö, E., Martin, R., Nguyen, K. T., & Van Reenen, J. (2019). Do tax incentives increase firm innovation? (p. 1413). CEP Discussion Paper No: An RD Design for R&D.

Dell, M. (2010). The persistent effects of peru’s mining mita. Econometrica, 78(6), 1863–1903.

Dima, A. M., Begu, L., Vasilescu, M. D., & Maasen, M. A. (2018). The relationship between the knowledge economy and global competitiveness in the European union. Sustainability, 10(6), 1706.

Dosi, G. (1988). Sources, procedures and microeconomic effects of innovation. Journal of Economic Literature, 26(3), 1120–1171.

Engelbrecht, H. J. (1997). International R&D spillovers, human capital and productivity in OECD economies: An empirical investigation. European Economic Review, 41(8), 1479–1488.

Ferrara, A. R., McCann, P., Pellegrini, G., Stelder, D., & Terribile, F. (2016). Assessing the impacts of Cohesion Policy on EU regions: A non-parametric analysis on interventions promoting research and innovation and transport accessibility. Papers in Regional Science, 96(4), 817–841.

Fratesi, U., & Perucca, G. (2019). EU regional development policy and territorial capital: A systemic approach. Papers in Regional Science, 98(1), 265–281.

Ganau, R., & Grandinetti, R. (2021). Disentangling regional innovation capability: what really matters? Industry and Innovation, 28(6), 749–772.

Garcìa-Quevedo, J. (2004). Do public subsidies complement business R&D? A meta-analysis of the econometric evidence. Kyklos, 57, 87–102.

Giua, M. (2017). Spatial discontinuity for the impact assessment of the EU regional policy: The case of the Italian objective 1 regions. Journal of Regional Science, 57(1), 109–131.

Hall, B. H., & Lerner, J. (2010). The Financing of R&D and Innovation. In B. H. Hall & N. Rosenberg (Eds.), Handbook of the economics of innovation (Vol. 1, pp. 609–639). Elsevier.

Holland, P. W. (1986). Statistics and causal inference. Journal of the American Statistical Association, 81(396), 945–960.

Huber, M. (2014). Identifying causal mechanisms (primarily) based on inverse probability weighting. Journal of Applied Econometrics, 29(6), 920–943.

Iammarino, S., Rodrìguez-Pose, A., & Storper, M. (2018). Regional inequality in Europe: Evidence, theory and policy implications. Journal of Economic Geography, 19(2), 273–298.

Imai, K., Keele, L., Tingley, D., & Yamamoto, T. (2011). Unpacking the black box of causality: Learning about causal mechanisms from experimental and observational studies. American Political Science Review, 105(4), 765–789.

Imai, K., Tingley, D., & Yamamoto, T. (2013). Experimental designs for identifying causal mechanisms. Journal of the Royal Statistical Society, Series A, 176(1), 5–51.

Ivanová, E., & Čepel, M. (2018). The impact of innovation performance on the competitiveness of the visegrad 4 countries. Journal of Competitiveness, 10(1), 54–72.

Keele, L. J., & Titiunik, R. (2015). Geographic boundaries as regression discontinuities. Political Analysis, 23(1), 127–155.

Kiselakova, D., Sofrankova, B., Cabinova, V., Onuferova, E., & Soltesova, J. (2018). The impact of R&D expenditure on the development of global competitiveness within the CEE EU countries. Journal of Competitiveness, 10(3), 34–50.

Neyman, J. (1990). On the application of probability theory to agricultural experiments: Essay on principles, section 9. Statistical Science, 5(4), 465–472.

Pearl, J. (2001) Direct and indirect effects. In Proceedings of the seventeenth conference on uncertainty in artificial intelligence: 411–420, San Francisco. Morgan Kaufman.

Pellegrini, G., & Di Stefano, R. (2017). La strategia di specializzazione intelligente nazionale e regionale in Italia: Analisi di coerenza. Rivista Economica Del Mezzogiorno, 4, 959–980.

Pellegrini, G., Terribile, F., Tarola, O., Muccigrosso, T., & Busillo, F. (2013). Measuring the effects of European regional policy on economic growth: A regression discontinuity approach. Papers in Regional Science, 92(1), 217–233.

European Commission (2021). Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. European Structural and Investment Funds 2014–2020, 2020 Summary report of the programme annual implementation reports covering implementation in 2014–2019 Brussels, 28.4.2021.

Robins, J. M. (2003). Semantics of causal DAG models and the identification of direct and indirect effects. In P. Green, N. Hjort, & S. Richardson (Eds.), In highly structured stochastic systems (pp. 70–81). Oxford University Press.

Robins, J. M., & Greenland, S. (1992). Identifiability and exchangeability for direct and indirect effect. Epidemiology, 3(2), 143–155.

Rodríguez-Pose, A. (1999). Innovation prone and innovation averse societies: Economic performance in Europe. Growth and Change, 30(1), 75–105.

Rodríguez-Pose, A. (2001). Is R&D investment in lagging areas of Europe worthwhile? Theory and empirical evidence. Papers in Regional Science, 80(3), 275–295.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98(5), 71–102.

Rosembaum, P. (1984). The consequences of adjustment for a concomitant variable that has been affected by the treatment. Journal of Royal Statistical Society, Series A, 147(5), 656–666.

Rubin, D. B. (1974). Estimating causal effects of treatments in randomized and nonrandomized studies. Journal of Educational Psychology, 66(5), 688–701.

Scherer, F. M. (1982). Inter-industry technology flows in the United States. Research Policy, 11(4), 227–245.

Simionescu, M., Lazányi, K., Sopková, G., Dobeš, K., & Balcerzak, P. A. (2017). Determinants of economic growth in V4 countries and Romania. Journal of Competitiveness, 9(1), 103–116.

TchetgenTchetgen, E. J. (2013). Inverse odds ratio-weighted estimation for causal mediation analysis. Statistics in Medicine, 32(26), 4567–4580.

Trajtenberg, M. (1990). A penny for your quotes: Patent citations and the value of innovations. Journal of Economics, 21(1), 172–187.

Funding

Open access funding provided by Università degli Studi di Roma La Sapienza within the CRUI-CARE Agreement. This study was not funded by any institution.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no financial arrangements that might give rise to conflicts of interest with respect to the research reported in this paper.

Code Availability

R scripts available upon request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Table 6.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Celli, V., Cerqua, A. & Pellegrini, G. Does R&D Expenditure Boost Economic Growth in Lagging Regions?. Soc Indic Res 173, 249–268 (2024). https://doi.org/10.1007/s11205-021-02786-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-021-02786-5