Abstract

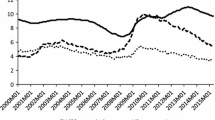

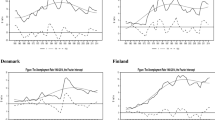

We apply a Quantile unit root test with both Sharp Shifts and Smooth Breaks to revisit hysteresis in unemployment for G7 countries using data for the period 1980–2017. Results from the conventional unit root tests indicate that hysteresis in unemployment does hold in half of these G7 countries during the period 1980–2017. A quantile Kolmogorov–Smirnov test fails to reject hysteresis in the unemployment hypothesis for our quarterly data but not in monthly data in G7 countries. Empirical results from our proposed quantile unit root test considering both sharp shifts and smooth breaks indicate that hysteresis in unemployment can be rejected over certain quantiles. A quantile Kolmogorov–Smirnov test results demonstrating hysteresis in unemployment does not hold in G7 countries for both monthly and quarterly data. These empirical findings have important policy implications in G7 countries.

Similar content being viewed by others

Notes

Regarding the tests on breaks of the distribution, we allow for two types of breaks: (1) breaks in the deterministic terms using dummy variable and Fourier expansion. (2) Allow that the auto-regressive term (ρ) differ among distribution of unemployment, in other words, we estimate the auto-regressive term (ρ) for each part of distribution.

Our study adjusted for smooth and sharp breaks are based on the breaks at the conditional mean and the paper does not test for breaks in the entire distribution.

References

Bahmani-Oskoee, M., Chang, T., Tzeng, H-W., & Chen T-H (2015) Bringing quantile unit root test back to retesting purchasing power parity: The roles of sharp shifts and smooth breaks, Working paper, No. 201511, Department of Finance, Feng Chia University, Taichung, TAIWAN.

Becker, R., Enders, W., & Lee, J. (2006). A stationarity test in the presence of an unknown number of smooth breaks. Journal of Time Series Analysis, 27(3), 381–409.

Blanchard, O., & Summers, L. (1986). Hysteresis and the European unemployment problem. In Stanley Fischer (Ed.), NBER macroeconomics annual (Vol. 1). Cambridge, MA: MIT Press.

Bolat, S., Tiwari, A. K., & Erdayi, A. U. (2014). Unemployment hysteresis in the eurozone area: evidences from nonlinear heterogeneous panel unit root test. Applied Economics Letters, 21(8), 536–540.

Brunello, G. (1990). Hysteresis and “the Japanese unemployment problem”: A preliminary investigation. Oxford Economic Papers, 42(3), 483–500.

Campbell, J. Y., & Mankiw, N. G. (1987). Are output fluctuations transitory? The Quarterly Journal of Economics, 102(4), 857–880.

Caner, M., & Hansen, B. (2001). Threshold autoregression with a unit root. Econometrica, 69(6), 1555–1596.

Carrion-i-Silvestre, L. J., Barrio-Castro, D., & López-Bazo, E. (2005). Breaking the panels: An application to the GDP per capita. The Econometrics Journal, 8(2), 159–175.

Chang, T. (2011). Hysteresis in unemployment for 17 OECD countries: Stationary test with a fourier function. Economic Modelling, 28(5), 2208–2214.

Chang, T., Ho, Y.-H., & Huang, C.-J. (2007). Revisiting hysteresis in unemployment for ten European countries: an empirical note on a more powerful nonlinear (logistic) unit root. Journal of Economic Development, 32(1), 49–57.

Chang, T., & Lee, Kuei-Chiu. (2011a). Hysteresis in unemployment for G-7 countries: Fourier unit root test. Economic and Finance Review, 1(2), 1–12.

Chang, T., & Lee, Chia-Hao. (2011b). Hysteresis in unemployment for G-7 countreis: Threshold unit root test. Romanian Journal of Economic Forecasting, 14(4), 5–14.

Enders, W., & Holt, M. T. (2012). Sharp breaks or smooth shifts? An investigation of the evolution of primary commodity prices. American Journal of Agricultural Economics, 94(3), 659–673.

Enders, W., & Lee, J. (2012). A unit root test using a Fourier series to approximate smooth breaks. Oxford Bulletin of Economics and Statistics, 74(4), 574–599.

Furuoka, F. (2014). Are unemployment rates stationary in Asia-Pacific countries? New findings from Fourier ADF test. Economic Research, 27(1), 34–45.

Gallant, A. R. (1981). On the bias in flexible functional forms and an essentially unbiased form. Journal of Econometrics, 15(2), 211–245.

Gustavsson, M., & Osterholm, P. (2010). The presence of unemployment hysteresis in the OECD: What can we learn from out-of-sample forecasts? Empirical Economics, 38(3), 779–792.

Jaeger, A., & Parkinson, M. (1994). Some evidence on hysteresis in unemployment rates. European Economic Review, 38, 329–342.

Koenker, R., & Xiao, Z. (2004). Unit root quantile autoregression inference. Journal of the American Statistical Association, 99(467), 775–787.

Lee, C.-F., Hu, T.-C., Li, P.-C., & Tsong, C.-C. (2013). Asymmetric behaviour of unemployment rates: evidence from the quantile covariate unit root test. Japan and the World Economy, 28, 72–84.

Lee, H.-Y., Wu, J.-L., & Lin, C.-C. (2010). Hysteresis in East Asia unemployment. Applied Economics, 42(7), 887–898.

Leybourne, S. J., Mills, T. C., & Newbold, P. (1998). Spurious rejections by Dickey—Fuller tests in the presence of a break under the null. Journal of Econometrics, 87(1), 191–203.

Lin, C.-H., Kuo, N.-F., & Yuan, C.-D. (2008). Nonlinear vs. nonstationary of hysteresis in unemployment: evidence from OECD economies. Applied Economics Letters, 15(11), 905.

Mitchell, W. F. (1993). Testing for unit roots and persistence in OECD unemployment rates. Applied Economics, 25, 1489–1501.

Ng, S., & Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica, 69(6), 1519–1554.

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica, 55, 277–302.

Roed, K. (1996). Unemployment hysteresis—macro evidence from 16 OECD countries. Empirical Economics, 21, 589–600.

Tsong, C. C., & Lee, C. F. (2011). Asymmetric inflation dynamics: Evidence from quantile regression analysis. Journal of Macroeconomics, 33(4), 668–680.

Acknowledgements

The first author, Yushi Jiang acknowledges financial support from National Natural Science Foundation of China in 2014. No: 71572156. The second Author, Yifei Cai acknowledges the support of “ University Postgraduate Award (UPA) and an Australian Government Research Training Program Scholarship (RTP)” at The University of Western Australia.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jiang, Y., Cai, Y., Peng, YT. et al. Testing Hysteresis in Unemployment in G7 Countries Using Quantile Unit Root Test with both Sharp Shifts and Smooth Breaks. Soc Indic Res 142, 1211–1229 (2019). https://doi.org/10.1007/s11205-018-1948-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-018-1948-6