Abstract

In this paper, we outline a methodology to assess the contribution of SMEs in corporate patenting for an extended set of European countries. The methodology consists of harmonizing, matching and disambiguating corporate applicant names from patent databases on the one hand and company names obtained from financial directories on the other hand. In order to address remaining gaps, additional sampling and extrapolation efforts are required to obtain reliable indicators. We propose a method to devise such additional efforts by means of stratified random sampling. Combining both approaches yields accurate indicators about the contribution of SMEs to the patent stock of the countries under study. The resulting indicators can be instrumental in guiding and assessing IPR and innovation policy initiatives at European and/or member state level.

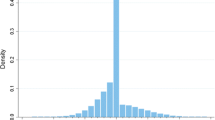

Source Amadeus 2012

Similar content being viewed by others

Notes

As a control we compared company counts from one of the Amadeus company databases used in the empirical section of this paper with non-financial firm counts reported in the Structural Business Statistics (SBS) section of the Eurostat website. For EU countries covered by both data sources, SBS reports 54% more non-financial firms in the year 2012 than the Amadeus company database of the same year does. Accounting for the fact that the SBS count only comprises non-holding firms that were active in the last year, whereas Amadeus covers holding firms as well, and does not remove companies from the provided database unless they have been inactive during the past 5 years, one could conclude that a proportion of the firm population, most likely consisting of the smallest firms exempt from (full) financial disclosure, is not covered by Amadeus. For instance, in the UK, a large number of firms remain unregistered according to Helmers and Rogers (2011).

More specifically we focus on the European Union as this study was prepared under a Eurostat contract. An earlier version of this paper was published in Eurostat’s Manuals and Guidelines series (2014). The authors wish to thank Caro Vereyen for her extensive contribution to the additional search procedure.

An overarching framework for the EU policy on SMEs was adopted in 2008 in the form of the Small Business Act (SBA) for Europe (a review was published in 2011). It recognises the central role of SMEs in the EU economy and aims to strengthen their role by alleviating a number of problems that are thought to hamper their development. The promotion of intellectual property (IP) protection and the encouragement of R&D are core elements of the mix of solutions presented in the SBA. Unquestionably then, the translation of both guidelines into further concrete policy measures should begin with thorough IP and R&D monitoring exercises such as the one presented in the current study.

A combination of ownership information from multiple Amadeus versions at fixed intervals in the investigated time window could provide a solution in which a more precise picture of the size of the matched corporate applicants at the precise time of filing can be obtained. However, on top of the other arguments mentioned, the even more fragmented nature of ownership information in pre-2012 versions of Amadeus exercised an equal influence on our decision to refrain from such efforts.

For 58% of the firm population in Amadeus 2012, the last available financial information covers the financial year 2010. For the remaining companies, the information dates back to prior years, with the number of firms decreasing as one goes further back in time.

Note that the reported shares are based on the population of EPO patents only. The automatic assignment of inventors to the list of applicants in PCT/USPTO applications inflates the share accounted for by individuals when derived from the full pool of patents under investigation in this study.

Patent applications filed by multiple corporate co-applicants from the same country are counted multiple times according to the number of co-applicants sharing the same nationality. This has a limited impact on the results as compared with counting such applications only once: the percentage contribution to patenting remains stable. Patents filed by co-applicants from different Member States are counted more than once at country level, according to the number of countries to which the co-application is assigned.

That is, industrial companies, holding companies and private equity firms. Majority shareholders in the form of institutional investors such as pension and mutual funds/trusts, banks and insurance companies are treated separately.

Given that the large majority of the parent company financials with a known reporting basis are unconsolidated, we assumed that this would also be the case for the available parent company financials with an unknown reporting basis.

In terms of resources implied, we deem that the recurrent creation of these indicators on a European scale could be achieved at a reasonable (labour) cost. We estimate a total of six person months’ work, consisting of roughly 2/3rds programming efforts (data input, name harmonizing and matching) and 1/3rd of additional extrapolation/search efforts (including sample size computation by a statistician and validation of extrapolation outcomes). Having multiple people work in parallel, for instance during the manual search stage, will reduce throughput time. Moreover, as financial databases undergo continuous improvements and increase coverage, especially with respect to ownership information, the required resources might be further reduced. License fees (regarding access to IP databases and financial directories) need to be taken into account separately..

With a 200-observation population threshold per stratum, a sample size was calculated for the following strata only, using the full sample size calculation methodology specified in Cochran (1977):

- for the population of matched applicants with insufficient financial data, the third stratum for Austria, Belgium, Germany, Denmark, Spain, Finland, France, the UK, Ireland, Italy, the Netherlands and Sweden, and the second stratum for Spain, the UK and Italy;

- for the non-matched applicants, the third stratum for Austria, Belgium, Germany, Spain, Finland, France, the UK, Hungary, Italy, Luxemburg, the Netherlands and Sweden, and the second stratum for Spain and Italy.

For the remaining strata, a sample of five was taken where the population of the stratum was greater than five.

References

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: an empirical analysis. The American Economic Review, 678–690.

Arundel, A. (2001). The relative effectiveness of patents and secrecy for appropriation. Research Policy, 30, 611–624.

Arundel, A., & Kabla, I. (1998). What percentage of innovations is patented? Research Policy, 27, 127–141.

Audretsch, D. B. (1995). Innovation and industry evolution. MIT Press.

Balsmeier, B., Assaf, M., Chesebro, T., Fierro, G., Johnson, K., Johnson, S., & Fleming, L. (2018). Machine learning and natural language processing on the patent corpus: Data, tools, and new measures. Journal of Economics & Management Strategy, 27(3), 535–553.

Baumol, W. J. (2002). The free-market innovation machine: Analysing the growth miracle of capitalism. Princeton University Press.

Baumol, W. J. (2004). Entrepreneurial enterprises, large established firms and other components of the free-market growth machine. Small Business Economics, 23, 9–21.

Blind, K., Edler, J., Frietsch, R., & Schmoch, U. (2006). Motives to patent: Empirical evidence from Germany. Research Policy, 35, 655–672.

Block, F., & Keller, M. R. (2009). Where do innovations come from? Transformations in the US economy 1970–2006. Socio-Economic Review, 7, 459–483.

Brouwer, E., & Kleinknecht, A. (1999). Innovative output and a firm’s propensity to patent. An exploration of CIS micro data. Research Policy, 28, 615–624.

BvDEP Ownership Database (2008).

CHI Research. (2003). Small serial innovators: the small firm contribution to technical change, for SBA Office of Advocacy (contract no. SBAHQ-01-C-0149).

Cochran, W. G. (1977). Sampling techniques, Third Edition. Wiley.

Cohen, W. H. (2010). Fifty years of empirical studies of innovative activity and performance. In B. H. Hall & N. Rosenberg (Eds.), Handbook of the economics of innovation. Elsevier.

Czarnitzki, D., & Hottenrott, H. (2010). R&D investment and financing constraints of small and medium-sized firms. Small Business Economics, 36(1), 195–206.

De Rassenfosse, G. (2012). How SMEs exploit their intellectual property assets: Evidence from survey data. Small Business Economics, 39, 437–452.

Edwards, K. L., & Gordon, T. (1984). Characterization of innovations Introduced in the U.S. Market in 1982, report no. PB84-212067, prepared by The Futures Group under contract with the U.S. Small Business Administration, Office of Advocacy. National Technical Information Service.

EPO and OHIM. (2013). Intellectual property rights intensive industries: contribution to economic performance and employment in the European Union. Industry-Level Analysis Report.

European Commission. (2005). The new SME definition: User guide and model declaration. Enterprise and Industry Publications.

European Commission. (2014). European Competitiveness Report 2014, Luxemburg.

European Commission. (2018). Annual report on European SMEs 2017/2018.

Eurostat. (2011a). Key figures on European business (with a special feature on SMEs), 2011a edition. Eurostat Pocketbooks.

Eurostat. (2011b). Patent Statistics at Eurostat: Methods for Regionalisation, Sector Allocation and Name Harmonisation, 2011 edition.

Frietsch, R., Neuhaeusler, P., & Rothengatter, O. (2013). SME patenting. An empirical analysis in nine countries. Fraunhofer Institute for Systems and Innovation Research ISI.

Giuri, P., Mariani, M., Brusoni, S., Crespi, G., Francoz, D., Gambardella, A., Garcia-Fontes, W., Geunac, A., Gonzales, R., Harhoff, D., Hoisl, K., Le Bas, C., Luzzi, A., Magazzini, L., Nesta, L., Nomaler, O., Palomeras, N., Patel, P., Romanelli, M., & Verspagen, B. (2007). Inventors and invention processes in Europe: Results from the PatVal-EU survey. Research Policy, 36, 1107–1127.

Griliches, Z. (1990). Patent statistics as economic indicators: A survey. Journal of Economic Literature, 28, 1661–1707.

Hall, B., Helmers, C., Rogers, M., & Sena, V. (2014). The choice between formal and informal intellectual property: A review. Journal of Economic Literature, 2(2), 375–423.

Helmers, C., & Rogers, M. (2011). Does patenting help high-tech start-ups? Research Policy, 40(7), 1016–1027.

Hsu, D. H., & Ziedonis, R. H. (2008). Patents as quality signals for entrepreneurial ventures. Academy of Management Proceedings, 2008(1), 1–6.

Iversen, E. J., Mäkinen, I., Lööf, H., Oh, D.-H., Jespersen, S.T., Junge, M., & Bech, J. (2009). Small Nordic enterprises, developing IPR in global competition. Nordic Innovation Centre study.

Jensen, P. H., & Webster, E. (2006). Firm size and the use of intellectual property rights. The Economic Records, 82(256), 44–55.

Keupp, M. M., Lhuillery, S., Garcia-Torres, M.A., & Raffo, J. (2009). SME-IP - 2nd report. Economic Focus Study on SMEs and intellectual property in Switzerland. Swiss Federal Institute of Intellectual Property. Publication No 5 (06.09).

Knott, A. M., & Vieregger, C. (2020). Reconciling the firm size and innovation puzzle. Organization Science, 31(2), 477–488.

Levy, P. S., & Lemeshow, S. (1999). Sampling of populations: Methods and applications. (3rd edn.). New York: Wiley and Sons.

Mtar, K., & Belazreg, W. (2021). Causal nexus between innovation, financial development, and economic growth: The case of OECD countries. Journal of the Knowledge Economy, 12(1), 310–341.

Pavitt, K. (1984). Sectoral patterns of technical change: Towards a taxonomy and a theory. Research Policy, 13(6), 343–373.

Pavitt, K., Robson, M., & Townsend, J. (1987). The size distribution of innovating firms in the UK: 1945–1983. The Journal of Industrial Economics, 35(3), 297–316.

Pavitt, K., Robson, M., & Townsend, J. (1989). Technological accumulation, diversification and organisation in UK companies, 1945–1983. Management Science, 35, 81–99.

Perrin, H., & Speck, K. (2004). SMEs as patent applicants, The dossiers from the Observatory for Intellectual Property (INPI), December 2004.

Peruzzi, M., Zachmann, G., & Veugelers, R. (2014). Remerge: Regression-based record linkage with an application to PATSTAT. Bruegel Working Paper 2014/10i ii.

Pradhan, R. P., Arvin, M. B., Nair, M., & Bennett, S. E. (2020). The dynamics among entrepreneurship, innovation, and economic growth in the Eurozone countries. Journal of Policy Modeling, 42(5), 1106–1122.

Prusa, T. J., & Schmitz, J. A. (1991). Are new firms an important source of innovation? Evidence from the Software Industry. Economics Letters, 35, 339–342.

Rammer, C., Gottschalk, S., Peters, B., Bersch, J., & Erdsiek, D. (2016). Die Rolle von KMU für Forschung und Innovation in Deutschland: Studie im Auftrag der Expertenkommission Forschung und Innovation, Studien zum deutschen Innovationssystem, No. 10-2016, Expertenkommission Forschung und Innovation (EFI)

Romer, P. M. (1990). Endogenous technical change. Journal of Political Economy, 98, 71–102.

Rothwell, R. (1989). Small firms, innovation and industrial change. Small Business Economics, 1(1), 51–64.

Rothwell, R., & Dodgson, M. (1992). European technology policy evolution: Convergence towards SMEs regional technology transfer. Technovation, 12(4), 223–238.

Scherer, F. M. (1991). Changing perspectives on the firm size problem. In Z. J. Acs & D. B. Audretsch (Eds.), Innovation and technological change an international comparison. University of Michigan Press.

Scherer, F. M., & Ross, D. (1990). Industrial market structure and economic performance. Houghton Mifflin.

Schumpeter, J. A. (1911). The theory of economic development. Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy (2nd ed.). Harper and Brothers.

Soete, L. (1979). Firm size and inventive activity. European Economic Review, 12, 319–340.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39, 312–320.

Squicciarini, M., & Dernis, H. (2012). A cross-country characterisation of the patenting behavior of firms based on matched firm and patent data. Working paper: OECD working Party on Industry Analysis (DSTI/EAS/IND/WPIA(2012)5.

Tarasconi, G., & Menon, C. (2017). Matching Crunchbase with patent data. OECD Science, Technology and Industry Working Papers, 2017/07.

Tether, B. S., Smith, I. J., & Thwaites, A. T. (1997). Smaller enterprises and innovation in the UK: The SPRU Innovations Database revisited. Research Policy, 2, 19–32.

Thoma, G., Torrisi, S., Gambardella, A., Guellec, D., Hall, B. H. & Harhoff, D. (2010). Harmonising and combining large datasets: An application to firm-level patent and accounting data. OECD Directorate for Science, Technology and Industry working paper 2010/99.

U.S. Small Business Administration. (1995). The state of small business: A report of the President, 1994. U.S. Government Printing Office.

Veugelers, R. (2009). A lifeline for Europe’s young radical innovator. Bruegel Policy Brief 2009/01.

Veugelers, R., & Schneider, C. (2010). On young highly innovative companies: Why they matter and how (not) to policy support them. Industrial and Corporate Change, 19(4), 969–1007.

Websites

Bessen, J. (2009). Matching patent data to Compustat firms, NBER PDP Project user documentation. http://www.nber.org/~jbessen/matchdoc.pdf

Company Registration Office (Ireland). http://www.cro.ie/search/CompanySearch.aspx

EPO patent filings survey. (2001–2018). https://www.epo.org/service-support/contact-us/surveys/patent-filings/archive.html

Kruispuntbank der Ondernemingen (Belgium). http://economie.fgov.be/nl/ondernemingen/KBO/

World Bank (2017), ‘Doing Business’ project website. http://www.doingbusiness.org/data

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Sampling methodology

The sample size is calculated by means of stratified random sampling. The sample size nD in the full target population D is calculated as:

where \(\mathrm{V}\left(\widehat{\theta }D\right)\) is the variance of the estimated overall share of SMEs, H is the number of strata in the target population D, Wh = Nh / ND, where Nh is the number of enterprises in stratum h; ND is the total number of enterprises in target population D; and \({S}_{h}^{2}\) is the stratum variance for the SME dummy variable ya. The numerator reflects the variance within each stratum multiplied by the size of the strata. In other words, for strata with more firms, more n will be included. A similar observation can be made with respect to the variance (Sh); this will be highest when the proportion of large and small firms is equal (50 × 50 = 2 500 whereas 90 × 10 = 900).

The stratum variance, \({S}_{h}^{2}\) can be expressed as follows:

In practice, the stratum variance Sh2 is not known. The variance per country per quantile for the matched applicants with sufficient information to determine company size is used as a proxy. To calculate the stratum variance for the SME dummy variable for strata reporting fewer than 10% SMEs among the matched applicants with sufficient information, the SME percentage was set to 10% to ensure that at least some firms were sampled.

The confidence interval for the estimated overall proportion of SMEs, with approximate confidence level of 95%, is given by:

The precision, α (set at 0.025 for a two-sided alternative) in terms of the length of the confidence interval:

From which one can deduce that the variance \(V\left({\widehat{\theta }}_{D}\right)\) can be expressed as:

In the formula for overall sample size we then substitute the variance \(V\left({\widehat{\theta }}_{D}\right)\), by the precision level we require. Aiming for greater precision will result in higher values for \({n}_{D}.\)

It is assumed that all strata are equally important and, hence, the Neyman allocation (Cochran, 1977) can be used. The total sample size in the target population is distributed among strata, so the sample size in stratum h, nh is given by:

Decimals resulting from strata sample size computation are rounded up to the next integer. In addition, due to the skewed patent volume distribution—a minority of companies tend to account for more than half of the patent volume in most countries—the minimum sample size for the on average smaller top quantiles with populations of 200 applicants or fewer is set at 5.Footnote 11 The resulting sample sizes per stratum, and the population values on which their computation is based, are reported in Table 8. Strata with 200 applicants or fewer account for 2952 of the total population of applicants. The calculated sample sizes for strata containing more than 200 applicants represent 72,804 applicants or the rest of the population. In total, 1,849 applicants have to be verified: 433 applicants represent strata containing no more than 200 applicants, 1416 applicants account for the remaining strata with more than 200 applicants.

To illustrate the sampling methodology, the computation of sample size for the third quantile of non-matched Belgian corporate applicants, containing 669 patentees (see Table 7), is explained. The computation of the parts constituting the formula for the stratum sample size nh is illustrated sequentially.

The proportion of the stratum population in the full target population is calculated as follows:

As a proxy for \({S}_{h}^{2}\)—the stratum variance for the SME dummy variable ya—the variance per country per quantile for the matched applicants with sufficient information to determine company size is used. In the case of the third quantile for Belgium (669 corporate applicants), matching Amadeus with PATSTAT resulted in the identification of 213 SMEs and 359 large companies.

Departing from a required 5% significance level for the proportion of SMEs, the \({\alpha }_{D}\) is set at 0.025 against a two-sided alternative:

The full sample size \({n}_{D}\) for all strata with populations of 200 or more (see above) is then computed asFootnote 12:

with i representing the quantile number of the strata with populations of more than 200 applicants.

Finally, the following formula computes the sample size that is representative for the third quantile of unmatched Belgian corporate applicants:

Appendix 2

Rights and permissions

About this article

Cite this article

Vervenne, JB., Callaert, J., Hoskens, M. et al. To what extent do SMEs contribute to Europe’s patent stock? A methodological outline for creating a Europe-wide SME technology indicator. Scientometrics 127, 3049–3082 (2022). https://doi.org/10.1007/s11192-022-04360-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11192-022-04360-3