Abstract

Organizational learning begins with experience. However, it remains an open question whether firms learn from a particular type of experience: exporting. This study aims to speak into this debate by examining when learning by exporting occurs. Our core thesis is that the timing of learning by exporting depends on a firm’s home market economic development. Drawing on classic theories of organizational learning, we posit that firms in more developed home markets will enjoy greater opportunities for learning before exporting whereas firms in less developed home markets will enjoy greater opportunities for learning after exporting. The former will be observed as a divergence in productivity among firms from different home markets, whereas the latter will be observed as convergence over time. The proposed hypotheses were tested and supported using longitudinal data from the World Bank Enterprise Survey. A range of theoretical and practical contributions are discussed.

Plain English Summary

When do firms learn by exporting? Analysis of data from the World Bank suggests that the answer depends on a firm’s home market. Firms from more developed economies seem to learn before exporting whereas firms from less developed economies seem to learn after exporting. We argue that these differences in learning rates occur because firms in more developed countries are able to access more advanced knowledge and technology domestically in preparation for entering foreign markets whereas firms in less developed countries are only able to access such knowledge by serving foreign markets. The analysis conducted on longitudinal data from the World Bank corroborates our arguments and has important implications for firms and society in general. Importantly, it suggests that exporting may be one avenue through which firms are able to level the playing field in the global competitive landscape.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Organizational learning begins with experience. These experiences, in their various forms, enable organizational members to accumulate knowledge that is then translated into updated practices and routines (Argote et al., 2021; Argote & Miron-Spektor, 2011; Levitt & March, 1988). This accumulated knowledge can eventually be observed in the form of improved production efficiency and other performance-related outcomes, a phenomenon commonly referred to as the “learning curve” (Argote & Epple, 1990; Darr et al., 1995; for seminal work, see Wright, 1936). In this sense, learning is a process that unfolds over time. A wide range of experiences have been shown to accelerate learning; however, an ongoing debate has emerged over whether firms learn from a particular type of experience: exporting.

The central premise of the learning-by-exporting thesis is that the experience of exporting exposes firms to new ways of doing things due to interactions with foreign clients, suppliers, competitors, and other agents; this exposure, in turn, enables exporting firms to enjoy enhanced productivity over time (Aw et al., 2000; Clerides et al., 1998; Salomon & Shaver, 2005). The evidence, however, remains rather mixed (Wagner, 2007). Scholars have thus focused on understanding the conditions under which learning by exporting is most likely to be observed (see Martins & Yang, 2009; Yang & Mallick, 2014). Recent findings in this stream suggest that learning by exporting depends, at least in part, on the economic development of the home market (Vendrell-Herrero et al., 2022). If so, exporting could potentially be one mechanism through which firms may be able to begin leveling the playing field in the global competitive landscape. Nevertheless, these findings leave many unanswered questions.

The aim of this study is to extend these findings by examining when learning by exporting occurs. The assumption underlying learning by doing in general—and learning by exporting in particular—is that knowledge accumulates with repeated experience. The experience of exporting, however, does not typically occur in an episodic manner. Rather, it is often a long and deliberate process that requires both planning and execution (see Melitz, 2003). Consequently, opportunities for learning may exist before, during, and/or after exporting occurs.

Our core thesis is that the timing of learning by exporting will differ depending on a firm’s home market economic development. We suggest that higher levels of economic development will be associated with lower degrees of uncertainty and ambiguity and higher degrees of causal determinacy in the domestic market. Such environmental conditions aid decision-makers in extracting lessons from the home market, whereas the alternative conditions hamper such learning efforts (Kapoor & Wilde, 2022; also see March, 2010). Drawing on these foundations, we posit that firms in more developed home markets will enjoy greater opportunities for learning before exporting, whereas firms in less developed home markets will enjoy greater opportunities for learning after exporting. The former will be observed as a divergence in productivity among firms from different home markets, whereas the latter will be observed as convergence over time. The proposed hypotheses were tested and supported using longitudinal data from the World Bank Enterprise Survey.

The findings offer several key contributions. First, it extends the often-cited but rarely tested distinction between learning before versus learning after doing (Pisano, 1994 and 1996); exporting is a type of experience in which this distinction may be particularly important. Second, in doing so, it sheds new light on whether firms indeed learn by exporting (Wagner, 2007) by considering the likely processes underlying such learning. Third, it speaks to the ongoing debate between global divergence versus convergence (Baldwin, 2016; Pomeranz, 2021) by pointing to exporting as one possible pathway through which convergence might take place. Fourth, it adds to the dearth of evidence regarding SMEs across the spectrum of economic development; despite multiple calls for scholars to conduct research focused on less developed economies (e.g., Child et al., 2022; Teagarden et al., 2018), few have done so. In addition, the findings reported here offer several managerial and policy implications.

2 Theory and hypotheses

2.1 Impact of home market economic development on learning by exporting

The learning-by-exporting thesis posits that exporting activity opens the door to new learning opportunities unavailable in a firm’s home market. That is, exporting firms gain new knowledge by interacting with foreign clients, suppliers, competitors, and scientific agents, and this knowledge can be translated into increased productivity levels and enhanced innovation in the home country (Grossman & Helpman, 1991; Martin & Salomon, 2003; Salomon & Shaver, 2005; Westphal et al., 1984). This idea was introduced in the 1960s following observations of strong country-level relationships between exports and economic growth throughout many parts of Asia; the aim was to then establish linkages between exporting, innovation, and productivity at the firm level. From a policy viewpoint, the notion of learning by exporting represents a platform to test the effectiveness of export promotion programs (Malca et al., 2020). However, the empirical findings have been mixed (Wagner, 2007). Consequently, many studies have explored a range of contingencies, such as firm-level (e.g., innovation status: Cassiman & Golovko, 2011; Love & Ganotakis, 2013), industry-level (e.g., technology lagging or leading: Salomon & Jin, 2008; R&D intensity: Greenaway & Keller, 2007), and country-level (e.g., income level of host markets: Bastos et al., 2018; Brambilla et al., 2012; De Loecker, 2007) heterogeneities.

Previous evidence in this stream suggests that the magnitude of the learning-by-exporting effect also depends, at least in part, on a firm’s home market economic development (ISGEP, 2008; Martins & Yang, 2009; Vendrell-Herrero et al., 2022). Home market economic development refers to “the observed pattern, across countries and across time, in levels and rates of growth of per capita income” (Lucas, 1988: 3). Vendrell-Herrero et al. (2022) recently reported that firms from less developed home markets are better able to learn by exporting compared to counterparts in more developed home markets.

The logic is that firms from less developed home markets only have access to the latest technological developments and other knowledge advancements via engagement with foreign markets. In other words, such firms have fewer learning opportunities available in the domestic market.

Extending this logic, we consider the impact of home market economic development on likely differences in learning-by-exporting processes. More specifically, we suggest that different levels of economic development are associated with different levels of coupling. Tight (or loose) coupling has been defined in various ways (see Glassman, 1973; Orton & Weick, 1990; Weick, 1995), but one central theme among these definitions is the notion of causal (in)determinacy, that is, the clarity (or lack thereof) of means-ends connections (see Faulkner & Anderson, 1987; Orton & Weick, 1990). In tightly coupled systems, there is a shared understanding and a high degree of certainty about how actions and outcomes are linked. In loosely coupled systems, however, such linkages are ambiguous and variable.

This notion of causal attributions is a central theme in theoretical accounts of organizational learning. The knowledge that is gained from experience is derived from a shared understanding of linkages between causes and effects (Argote & Miron-Spektor, 2011; Argote et al., 2021). Yet, such linkages are often riddled with ambiguity (see Park et al., 2023). As March (2010: 106) put it: organizational learning “involves forming implicit or explicit causal inferences in situations that invite debate and error.” Causal indeterminacy thus impacts sensemaking and learning processes (see Maitlis & Christianson, 2014). Tight coupling, therefore, aids organizational decision-makers in the learning process, whereas loose coupling hinders it.

Extant research suggests that high levels of economic development will be associated with tighter coupling and a greater degree of causal determinacy, whereas low levels of economic development will be associated with looser coupling and a greater degree of causal indeterminacy. Firms in more developed economies tend to enjoy pro-market conditions with strong appropriability regimes and limited corruption (Acemoglu et al., 2005; Child & Tse, 2001). These conditions provide a clearer, even if competitive, route to productivity and success. In contrast, firms in less developed economies must operate within weak appropriability regimes and often high levels of corruption and uncertainty (Acemoglu et al., 2005; Child & Tse, 2001). Recent research shows that such environments make it exceedingly difficult to utilize new sources of information to improve forecast accuracy (Kapoor & Wilde, 2022; also see Denrell et al., 2004; Fang, 2012; March, 2010), hence making it very difficult to implement meaningful business planning. These conditions provide a more ambiguous, albeit also often quite competitive, route to productivity and success. In short, different levels of economic development provide different learning opportunities in the domestic market.

A consideration of these differences opens the door to the possibility that the timing of learning by exporting differs across the spectrum of home market economic development. Existing accounts of learning by exporting implicitly assume that learning begins when exporting begins (Aw et al., 2000). Indeed, empirical studies measure learning by exporting in terms of the productivity gains in the time periods after exporting commences (e.g., Salomon & Jin, 2008, 2010; Salomon & Shaver, 2005). However, foundational work on organizational learning curves points to the idea that firms might learn before as well as after doing (Pisano, 1994 and 1996). Prior to experience, firms might learn via forward-looking processes of planning, prototyping, piloting, and so on. After experience, firms might learn via a backward-looking process of sensemaking (also see Gavetti & Levinthal, 2000; Maitlis & Christianson, 2014). Of course, the distinction between learning before versus after experience is most applicable to complex experiences that extend over long periods of time—such as exporting.

2.2 Learning before exporting: divergence among firms across countries

Highly developed economies will be particularly conducive to learning before exporting. Due to strong appropriability regimes and limited corruption, these countries tend to have higher market stability. Firms, therefore, operate with higher levels of certainty and causal determinacy. Consequently, firms can more easily and effectively engage in managerial planning in advance of export activity (referred to by some as preadaptation: Cattani, 2005; also see Furr, 2019). Firms will therefore be able to make investments oriented towards reaching the export market that enable these firms to overcome the fixed and variable costs of exporting (Melitz, 2003). Importantly, a range of knowledge resources necessary for such planning will be more widely available in the home market in the form of more sophisticated suppliers, customers, competitors, and so on (see Vendrell-Herrero et al., 2022). In less developed economies, however, such learning prior to exporting will be more difficult. Due to weak appropriability regimes and high corruption, these countries tend to have a high informal sector and low protection from formal investments (La Porta & Shleifer, 2014). Firms, therefore, operate within uncertain conditions with a good deal of causal indeterminacy. Consequently, firms in these environments will find it difficult to plan; such difficulty, combined with limited access to more advanced knowledge in the domestic market, will produce challenges to learning prior to entry into the export market. Firms operating in more developed economies will thus be more likely to learn before exporting compared to firms in less developed economies.

These differences will lead to divergence among firms across countries. Not only will firm productivity be a stronger predictor of entrance into the export market among firms in more developed home markets (see Vendrell-Herrero et al., 2022), but firms operating in such environments will enjoy higher levels of firm productivity on average upon entry into the export market. Taken together, we propose the following:

-

Hypothesis 1. Productivity levels will exhibit divergence among firms that successfully enter the export market such that, on average, firms from more developed home markets will enter with higher levels of productivity compared to firms from less developed home markets

2.3 Learning after exporting: convergence among firms across countries

Less developed economies, on the other hand, will be more conducive to learning after exporting. Although initially farther from the “productivity frontier” upon entry into the export market, firms in such environments are more likely to be exposed to new technologies unavailable in the home market (Salomon & Jin, 2010). Consequently, several opportunities will emerge to learn after export activities begin. Specifically, participating in foreign markets may provide an opportunity for firms from less developed home markets to operate in more stable conditions. The more tightly coupled nature of these host markets will allow for greater sensemaking regarding how to make the most effective export-related investments. In more developed economies, however, such learning after the experience of exporting will be more difficult. Because these firms will be nearer to the “productivity frontier” upon entry into the export market, they are less likely to be exposed to new technologies unavailable in the home market (Blalock & Gertler, 2009). As a result, fewer opportunities will be available to learn after export activities begin. In sum, firms operating in less developed economies will be more likely to learn after exporting.

These differences will lead to convergence among firms across countries. Not only will export activity lead to greater productivity gains among firms in less developed home markets (see Vendrell-Herrero et al., 2022), but firms operating in such environments will be able to at least partially “catch up” with peers in more developed home markets as a result (for a discussion on catching up, see Meyer, 2018). Taken together, we propose the following:

-

Hypothesis 2. Productivity levels will exhibit convergence among firms that successfully enter (and remain in) the export market such that, on average, firms from less developed home markets will realize greater gains in productivity compared to firms from more developed home markets.

2.4 Summary

We have proposed that when learning by exporting occurs depends, at least in part, on home market economic development. Firms operating in more developed markets will be more likely to learn before exporting (H1), whereas firms operating in less developed markets will be more likely to learn after exporting (H2). The former is consistent with the “great divergence” hypothesis, which suggests that firms in the wealthiest and most powerful nations—presumably with the greatest access to technologies to aid in productivity—will reap an increasingly greater proportion of rewards compared to counterparts in poorer or weaker nations as globalization continues (see Pomeranz, 2021). The latter is consistent with the “great convergence” hypothesis, which suggests that internationalization trends might instead close the productivity gap, suggesting that firms in less developed home markets may realize the greatest gains from exporting activities (see Baldwin, 2016). Combining both hypotheses, the proposed model suggests that firms in less developed economies will be able to converge to productivity levels experienced by firms in more developed nations via participation in international trade.

3 Methods

3.1 Data and variables

The World Bank Enterprise Survey (WBES) collects firm- and industry-level data from a range of countries using a stratified random sampling technique based on firm size, geographical region, and business sector. The aim of the survey is to collect detailed data on the business climate prevailing in firms’ countries with a particular emphasis on underdeveloped and developing economies given the mission of the World Bank. Data collected include information on sales, costs, and firm characteristics such as age, size, and type of ownership, among others. WBES data has been used extensively in SME (e.g., Tajeddin & Carney, 2019; Williams et al., 2017; Darko et al., 2021) and learning-by-exporting (e.g., Vendrell-Herrero et al., 2022) research.

A longitudinal sample was constructed of firms responding to the WBES between 2006 and 2017. A firm was included if it was a nonexporter during its first observation in the study period and operated in either a high-income (HIC) or a low-income (LIC) country as its home market according to the World Bank’s income classification.Footnote 1 These income groups served as our measure of home market economic development (Child et al., 2022; Vendrell-Herrero et al., 2022). The sample consists of 2342 observations from 1171 firms across 21 countries; the categorization resulted in 335 firms in 9 HICsFootnote 2 and 836 firms in 12 LICs.Footnote 3

Three additional key variables are used: total factor productivity (TFP), export activity, and export experience. TFP is computed using Levinsohn and Petrin’s (2003) specification in which sales were used as a proxy for output, cost of labor for labor input, total costs for intermediate inputs, and the net book value of long-term assets for capital. All monetary variables were converted to US dollars using GDP deflators from the World Bank. Export activity is a dummy variable that determines whether the firm becomes an exporter (v = 1) or not (v = 0) in the subsequent period (Cassiman & Golovko, 2011; Lafuente et al., 2019). Export experience is calculated as the difference in exporting experience (measured in years) between the focal survey year (second wave) and the year in which the firm began exporting, as indicated by exporting firms in the second survey wave (Fernandes & Isgut, 2015; Lafuente et al., 2021; Vendrell-Herrero et al., 2022); this variable has a minimum of 1 and a maximum of 7 years.Footnote 4 We also include a number of control variables, including number of employees and elapsed time between periods. Other variables included in the empirical analysis are dummies indicating foreign ownership, business group membership, year, country, and industry. Following Marsili (2001), we categorize industries into four groups: science-based, extraction, fundamental processes, and product engineering. Table 1 provides summary statistics for the key variables by income group.

3.2 Estimation technique

A key feature of the analysis is the elimination of potential firm-level heterogeneities across income groups through the use of propensity score matching (PSM). PSM is used to construct a comparable subsample of firms in HICs and LICs with similar distributions in terms of firm size and industryFootnote 5 (e.g., Heckman & Pinto, 2022; Heckman & Todd, 2009; Lafuente & Abad, 2018). These subsamples allow us to then determine whether variables of interest have different effects in LICs compared to HICs. Propensity scores were obtained by estimating a logit regression in which the dependent variable is whether the firm is based in a HIC (1) or LIC (0). Independent variables included the number of employees, industry dummies, and foreign ownership dummies.

The PSM procedure employed imposed weights by implementing Kernel PSM (Deheija & Wahba, 2002). The Epanechnikov function was used to estimate matching weights according to the relative proximity of the “untreated” firms to the “treated” ones (Kraft & Ugarković, 2006). This approach allowed us to use a larger sample size than 1:1 matching (Aquilante & Vendrell-Herrero, 2021); specifically, the Kernel PSM resulted in the loss of only three observations. Table 2 presents results from the matching procedure and shows the mean differences in values before and after matching. The estimations reported in the tables use standard and weighted regression analysis; the weights produced by the Kernel matching procedure are used for the latter.

In addition, our analysis accounts for sample selection bias using the two-stage Heckman sample selection technique (Certo et al., 2016). The first stage (before export experience) estimates the propensity to export using probit, in which the dependent variable is an export activity in period t + 1, and all the independent variables are measured in period t. Equation 1 takes the form

where subindex j refers to the firm; Ej,t + 1 measures whether firm j at time t + 1 exports; HIC*TFPj,t and LIC*TFPj,t measure the TFP of firm j at time t for high- and low-income country groups, respectively; \({\Omega }_{j,t}\) is a vector of firm characteristics (i.e., number of employees, elapsed time, foreign ownership, and business group); \({\vartheta }_{s}\) indicates sector dummies; \({\vartheta }_{c}\) refers to country dummies; \({\vartheta }_{t}\) refers to year dummies; and \({\varepsilon }_{j,t}\) is the error term. The exclusion restriction used in the first stage of estimation is the business group to which the firm belongs; the rationale here is that the primary benefit of membership in a business group is to open up trading opportunities, not to increase productivity (Tajeddin & Carney, 2019).

The second stage (after export experience) estimation, which includes the inverse Mills ratio (IMR Lambda term) obtained from the first stage, examines the relationship between export experience and subsequent firm productivity through a log–log OLS function. The estimation sample only consists of exporting firms, and therefore, only data from time period 2 (t + 1) are used. Equation 2 is of the form:

where subindex j refers to the firm; Ln(TFP)j,t + 1 is the logarithm of TFP of firm j at time t + 1; HIC*LnYj,t + 1 and LIC*LnYj,t + 1 are the logarithm of years after exporting of firm j at time t + 1 for high- and low-income groups, respectively; \({\eta }_{j,t+1}\) is the firm characteristics (i.e., number of employees in period 2, IMR Lambda); \({\vartheta }_{s}\) indicates sector dummies; \({\vartheta }_{c}\) refers to country dummies; \({\vartheta }_{t+1}\) refers to year dummies; and \({\varepsilon }_{j,t+1}\) is the error term.

The difference in parameters α1 and α2 reflects the different effects of productivity on the decision to exporting. Hence, results will be consistent with H1 (i.e., divergence due to high rates of learning before experience in HICs) if α1 is higher than α2. The difference in parametes β1 and β2 reflects the difference in productivity gains after exporting. Hence, H2 (i.e., convergence due to higher rates of learning after experience in LICs) will be supported if β2 is higher than β1.

We further explored the post-exporting convergence between firms in HICs and LICs by estimating a version of Eq. 2 that includes a LIC dummy, so it is possible to account for the difference in entry productivity. The resulting Eq. 3 is of the form

where the parameter γ0 reflects the entry productivity of exporting firms in HIC and γ1 is the difference in entry productivity between HIC and LIC. H1 will be supported if γ1 is negative and significant. Parameter γ12 is the rate of convergence. γ12 parallels (β2 − β1) in Eq. 2, but they may differ because Eq. 3 does not contain country-fixed effects to avoid perfect colinearity with the income group dummy variable. Additionally, the main analysis treats HICs and LICs as markets that differ markedly but, at the same time, are internally homogeneous. Quantile regressions are used in the convergence analysis in order to relax this assumption (Heckman & Robb, 1985).

4 Results

4.1 Learning before exporting

The first stage includes all firms; the results are shown in columns 1 (full sample) and 3 (Kernel-weighted sample) of Table 3. According to the McFadden pseudo R2, both models have a good fit (e.g., 0.137 in the Kernel-weighted sample). Although the table shows probit coefficients, we interpret the results in the text using marginal effects, that is, an estimate of the slope that quantifies the economic effect of a particular independent variable (Greene, 2012). The estimation reveals two important findings. First, the relationship between TFP and exporting is weaker among LIC firms, reflected by the fact that α1 is higher than α2 (in both models, p < 0.01). The effect of TFP on the propensity to export is practically null in LIC (α2 = 0.0126 in Kernel-weighted model), but considerably positive in HIC (α1 = 0.1416 in Kernel-weighted model). This difference of 0.129 is translated in terms of marginal effects as follows: a 1% increase in TFP will increase the likelihood of exporting by 0.0224% points for HIC firms but only 0.0023% points for LIC firms. Second, the exclusion restriction, business group membership, is strongly significant (p < 0.05 in all cases) in the first stage estimation but insignificant in the second stage (p > 0.05 in all cases). Taken together, these results are consistent with H1.

4.2 Learning after exporting

The second stage includes only exporting firms; the results are shown in columns 2 (full sample) and 4 (Kernel-weighted sample) of Table 3. According to the R2, both models are again good fitting (e.g., 0.404 in the Kernel-weighted sample). Two findings are particularly noteworthy. First, the IMR Lambda term is significant in both equations, thus confirming evidence of selection bias. Second, the relationship between export experience and TFP is stronger for LIC firms. We test this effect by analyzing the difference between β1 and β2. The difference is 0.0576 for the full sample (p < 0.05) and 0.0661 for the Kernel-weighted sample (p < 0.01). According to the Kernel-weighted sample, a 1% increase in export experience results in a 0.066% greater increase in TFP in LIC firms than it would for HIC firms. These results thus lend support to H2.

4.3 Convergence analysis

The analysis so far suggests that exporting firms in HICs have a higher TFP at the start of exporting but that exporting firms in LICs are able to reduce this initial disadvantage over time. These results are consistent with a view of productivity divergence before exporting (i.e., H1) and productivity convergence after exporting (i.e., H2). However, it is important to understand how much time firms in LICs would require in order to converge fully to firms in HICs. An alternative second-stage equation is used to explore this process of convergence (i.e., Eq. 3). In order to isolate the effects of income group, a LIC dummy variable is included rather than country dummies.Footnote 6 Linear and quantile regression for the Kernel-weighted sample are reported in Table 4.Footnote 7 We discuss first the linear regression and then turn to the quantile regression.

Column 1 in Table 4 shows the results from the linear regression. Entry productivity is lower for LIC exporting firms than their HIC counterparts (γ1 < 0; p < 0.05), thereby lending direct support to H1. Because the dependent variable is in log, the Halvorsen-Palmquist correction is applied in order to interpret the coefficients. The correction for the estimation is computed as 100*(\({e}^{{\gamma }_{1}}\) − 1) and is equal to − 17.68, implying that entry-level TFP is up to 17.68% lower among LIC firms than HIC firms. Consistent with H2, this gap reduces with export experience. We find that a 1% increase in export experience results in a 0.057% greater increase in TFP in LIC firms than it would for HIC firms.Footnote 8

Columns 2 to 6 in Table 4 show results from the quantile regression using standard thresholds (see Dimelis & Louri, 2002). The differences in productivity, learning rates, and convergence time remain significant at the 0.10 and 0.25 percentiles but not significant at higher percentiles. This finding seems to indicate that learning after exporting is most likely to occur in firms that begin exporting with low or very low TFP. That is, learning after exporting is more important for firms at the bottom of the TFP distribution.

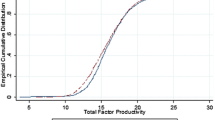

The findings reported above enable us to quantify how much time firms in LICs would require in order to converge fully to firms in HICs. Based on an arithmetic transformationFootnote 9 exporters in HICs and LICs will reach the same TFP approximately in 29 years (Kernel-weighted OLS, column 1 Table 4) after exporting commences. Of course, this is too long a period to draw any reliable conclusions. In an effort to offer more meaningful interpretations, we thus considered what percentage of the original productivity gap can be reduced by LIC exporters in periods of 5, 7, and 10 years. These results are reported at the bottom of Table 4. According to our linear regression, LIC exporters would recover 45%, 55%, and 66% after exporting for 5, 7, and 10 years, respectively. This recovery is shown graphically in Fig. 1.

Convergence analysis. Estimations based on Kernel-weighted sample. The gray solid line on the top reflects the mean entry productivity levels of HIC firms (as estimated by \({e}^{{\gamma }_{0}}\) in Table 4 OLS), whereas the gray solid line at the bottom reflects the mean entry productivity of LIC firms (as estimated by \({e}^{{\gamma }_{0}+{\gamma }_{1}}\) in Table 4 OLS). The difference between the two lines is the result of productivity divergence before exporting. The concave solid line exhibits the difference in learning-by-exporting coefficients, which is higher for LIC exporters (as specified in \({Y}^{{\gamma }_{12}}\) where Y is the years of export experience and \({\gamma }_{12}\) is the parameter estimated in Table 4 OLS). According to these estimations, LIC exporters are expected to reach the same productivity level as HIC exporters after 29.33 years of export experience. The dotted/dashed lines reflect the entry-level difference and convergence path for the different quantiles estimated in Table 4

Assuming that the productivity gap is as estimated in the linear regression, we can see what would be the estimated recovery time depending on the percentile in which a firm operates. Since the productivity gap for LIC exporting firms in the 10th and 25th percentiles is larger than the gap faced by the rest of LIC exporting firms, these firms would need 5 years to merely reach the bottom of the productivity gap (i.e., the starting point for the average LIC firm), but after this point, they would be able to recover 21% and 24% in 7 years, and 49% and 46% in 10 years, respectively. When looking at the other extreme, LIC exporting firms in the 75th and 90th percentile would be operating very close to the average productivity of HIC exporting firms from the outset.

5 Discussion

Experience is at the heart of organizational learning. This study examines organizational learning from a particular type of experience: exporting. The findings suggest that the timing of learning by exporting differs depending on a firm’s home market economic development. Specifically, firms in more developed home markets appear to engage in learning before exporting, whereas firms in less developed home markets appear to engage in learning after exporting. Such learning is observed as divergence and convergence among firms over time, respectively. These findings stand to contribute to several different research streams.

First, it contributes to the wide-ranging body of literature on experiential learning (see Argote et al., 2021; Argote & Levine, 2020; Argote & Miron-Spektor, 2011) by extending the notion of learning before versus after doing. This distinction was initially offered and tested in the context of problem-solving in R&D, noting that “in certain environments…most of the learning that needs to take place can be done before the process is moved to the [manufacturing] plant” (Pisano, 1996: 1117). Although this distinction is often cited, most studies of experiential learning have implicitly focused on the latter to the exclusion of the former (see Lapre et al., 2000; for seminal work, see Argote & Epple, 1991; Wright, 1936). Even managerial interventions tend to implicitly suggest that learning occurs after experiences (e.g., after-event reviews: Ellis & Davidi, 2005). Yet, the distinction is potentially particularly meaningful in contexts in which a good deal of planning must precede successful execution. Although this contextual relevance initially focused on a particular industry (i.e., biotechnology: Pisano, 1996), the findings reported here suggest that specific activities (e.g., exporting), irrespective of industry, may also be particularly meaningful. This may be especially true in the context of biexporting (i.e., exports of products and digitally-integrated services) given that product innovation often occurs prior to exporting, whereas service provision occurs after it (see Bustinza et al., 2020). These findings may also offer insights for other literatures related to organizational learning. For example, learning before versus after doing may be one framework for understanding how organizations learn to set performance targets, whether for exporting or other activities (see Aranda et al., 2017). It may also offer a useful framework for better understanding improvisation (i.e., the convergence of planning and action via a fusion of design and execution), particularly in emerging markets where organizations are more likely to design during execution through trial-and-error activities and from which knowledge is gained through retrospective sensemaking (see Cunha et al., 2022). We encourage other scholars to explore further this distinction between learning before versus after doing within these contexts and beyond.

Second, it contributes to the literature on globalization, particularly, on learning by exporting (for meta-analyses, see Martins & Yang, 2009; Yang & Mallick, 2014). As noted, the evidence for such an effect has remained rather mixed (Wagner, 2007), emphasizing in recent years a range of contingency factors (e.g., Vendrell-Herrero et al., 2022). The findings reported here offer an alternative yet complementary perspective by considering the possibility that the timing of learning differs across firms due to differences in home markets. In doing so, this study points to the importance of home-market factors in understanding firm competitiveness and internationalization (e.g., Meyer, 2018; Porter, 1990). While most studies have focused on the internationalization of multinational firms via foreign direct investment, evidence from our study shows that a firm’s home market plays a vital role. Although more developed home markets may provide an initial competitive advantage, those counterparts from less developed home markets may be able to overcome this disadvantage via exporting. Hence, this study points to the interesting possibility that the learning-by-exporting and self-selection hypotheses are perhaps less at odds than traditionally believed (see Bernard & Jensen, 1999; Melitz, 2003). Rather, firms that self-select into the export market also learn by exporting; however, the learning occurs before rather than after the experience. We encourage scholars to continue this line of inquiry as well.Footnote 10

Third, it speaks to contemporary debates on the impact of globalization on the competitive landscape. On one hand, the “great divergence” hypothesis suggests that firms in more advanced economies will reap an increasingly greater proportion of rewards compared to counterparts in poorer or weaker nations due to globalization (Pomeranz, 2021; also see Galor & Mountford, 2006). In contrast, the “great convergence” hypothesis suggests that internationalization might be a vehicle through which firms from less developed countries are able to close the gap in productivity levels compared to firms from more developed countries (Baldwin, 2016; also see Baumol, 1986; Slaughter, 1997; Zeira, 1998). This study offers rare evidence that exporting can prove to be a valuable means for firms from less developed countries to at least partially “catch up” on the learning curve of productivity with firms from more developed countries (also see Amendolagine et al., 2022). Of course, our most prudent estimations indicate that only partial convergence is most likely and that full convergence through exporting might be attainable only in the long run. One possible explanation is that certain knowledge cannot be directly acquired from export networks and may require a higher level of international commitment (Johanson & Vahlne, 1977). Uncovering the factors that might more fully explain the degree of convergence represents another potentially fruitful line of future inquiry.

Fourth, this study adds to the dearth of empirical evidence focused on SMEs, particularly in lower-income countries. Although various scholars have extended calls for research focused on less developed economies (e.g., Buckley et al., 2017; Teagarden et al., 2018), few have done so; according to Child et al. (2022), roughly 1% of international entrepreneurship studies focus on low-income countries. Of course, data availability from such countries often remains a challenge; as shown here and elsewhere, however, the WBES data offers new opportunities (also see Bhaumik et al., 2018; Jensen et al., 2010; Luo & Bu, 2016; Gomes et al., 2018; Tajeddin & Carney, 2019; Vendrell-Herrero et al., 2022). We hope others will investigate the important questions relevant to SMEs in such contexts.

Despite its merits, this study is not without limitations. Perhaps most notable is that we do not empirically observe knowledge accumulation or learning processes among firms. We did, however, observe differences in firm productivity rates over time in a manner consistent with both the learning-by-exporting (e.g., Salomon & Jin, 2010) and learning-by-doing (e.g., Argote & Epple, 1991) literatures. Nevertheless, future research should explore such learning processes further, both before and after exporting. Data from a longer time span for the same firms may shed additional light on the underlying learning processes. In addition, we do not account for those firms that attempt to enter the export market but fail. Unfortunately, such data does not exist to the best of our knowledge. Finally, a relatively low proportion of firms in the sample entered the export market during the study period (i.e., 13.2% or 156 firms). As additional waves of the WBES are collected, however, it may be possible to replicate and extend the findings reported with data from a higher number of exporting firms as well as countries.

These findings, implications, and even limitations together provide opportunities for possible empirical extensions. In our view, one particularly promising research question is directly related to the broader body of research on organizational learning and pertains to firm-level heterogeneities in rates of learning-by-exporting: Does export activity enhance absorptive capacity?Footnote 11 Absorptive capacity refers to a firm’s ability “to recognize the value of new external information, assimilate it, and apply it for business purposes” (Cohen & Levinthal, 1990: 128). Although the focus of this study was on the effect of country-level differences, it is possible that export activity might enhance absorptive capacity and that this effect might vary across firms. Interestingly, firms from less developed countries in the sample studied here were more likely than those from more developed countries to be members of business groups. These firms may have been uniquely positioned, due to these inter-firm relationships, to learn from new knowledge available as a result of exporting. Such possibilities promise to offer fresh insights into understandings of organizational learning, learning-by-exporting, and business groups (see Belderbos & Heijltjes, 2005; Peng et al., 2011). Of course, other exciting and new research questions abound.

This study offers several practical implications for managers and policymakers as well. For managers, these findings suggest that exporting is a valuable means for firms from less developed countries to learn and reduce the productivity gap. However, learning-by-exporting is not a panacea for all international competitiveness issues that firms from less developed home markets face. Other measures need to be implemented in order for these firms to reduce the productivity gap (e.g., global sourcing, international strategic alliances, FDI via mergers and acquisitions, and greenfield development; see Bai et al., 2017; Cuervo-Cazurra et al., 2018; Jabbour et al., 2019). As advocated by Johanson and Vahlne (1977), such alternative entry modes may represent higher levels of foreign market commitment and, in turn, may result in additional learning from foreign markets. This seems particularly important for firms from more developed countries because our results indicate that they are more capable of entering foreign markets, but they seem to learn less after exporting than their counterparts from less developed markets. For policymakers, these findings highlight the importance of developing export promotion practices in less developed countries (Malca et al., 2020). These policies should aim to reduce bureaucracy and other costs that negatively affect exports, enhance the knowledge base, and create incentives and export support mechanisms, such as the development of export zones.

In conclusion, by examining classic theories of organizational learning in the context of exporting, this study has provided important insights necessary to advance our understanding of learning before and after doing. By showing that firms in less developed countries exhibit lower rates of learning before exporting and higher rates of learning after exporting, this study highlights the important role that exporting can play in facilitating the “great convergence” by enabling firms in less developed home markets to at least partially catch up with the “productivity frontier.”

Data Availability

The data is proprietary and cannot be shared directly by the authors, but raw data can be accessed from the WorldBank.

Notes

Countries were classified as high income (HIC) if annual GNI per capita exceeds US$12,055 and low income (LIC) if annual GNI per capita is equal to or below US$995.

HICs: Chile, Croatia, Czech Republic, Estonia, Hungria, Latvia, Lithuania, Slovenia, and Uruguay.

LICs:Afghanistan, Benin, Burkina Faso, Dem. Rep. Congo, Ethiopia, Mali, Nepal, Niger, Rwanda, Senegal, Tanzania, and Zimbawe.

This measure was constructed from the following question in the World Bank Enterprise Survey: “In what year did this establishment first export directly or indirectly?” The response to this question in the second wave was used to calculate the years of export experience as the survey year minus the first year of exporting. Note that export experience in the first wave is considered to be zero because all firms are nonexporters by construction.

One could argue that the differences in learning before and after exporting happen at the industry level, and it is the uneven industrial distribution between HICs and LICs that could drive the results. For instance, Salomon and Jin (2008) show that firms in lagging industries learn more after exporting than firms in leading industries. To ensure that the industry-level effect is not influencing the results, we separated the industries into high-tech (science and engineering) and low-tech (extraction and fundamental processes) and estimate a regression in which low-tech is the moderator (i.e., the same role as LIC in our convergence analysis, Table 4). None of the relevant parameters (i.e., entry level productivity and the learning coefficient) were statistically significant. We can therefore conclude that no industry-level differences in learning before and after exporting are detected in the data. Results not provided in the tables are available upon request. We are grateful to an anonymous reviewer and the editor for suggesting this analysis.

Income groups and countries are, of course, perfectly collinear given that countries are embedded within income groups and are time invariant within the study period.

Results for the full sample are qualitatively the same and are available from the authors upon request.

The slight difference between γ12 = 0.057 and (β2 − β1) = 0.066 is because country-fixed effects are excluded in the convergence analysis.

Taking the antilog of Ln(TFP(t + 1)) = Ln(µ) + ω*Ln (Y(t + 1)) gives TFP(t + 1) = µ*Y(t + 1)ω where µ measures the entry productivity and ω is the learning coefficient. The parameters will be \({\mu }_{{\text{HIC}}}={e}^{{\gamma }_{0}}\), \({\mu }_{{\text{LIC}}}={e}^{{\gamma }_{2}+{\gamma }_{12}}\), \({\omega }_{{\text{HIC}}}= {\gamma }_{2}\), and \({\omega }_{{\text{LIC}}}= {\gamma }_{2}{+\gamma }_{12}\). This means that the difference in entry level TFP will be \({{\mu }_{{\text{LIC}}}-{\mu }_{{\text{HIC}}}= e}^{{\gamma }_{0}+{\gamma }_{1}}-{e}^{{\gamma }_{0}}\) and the difference in the learning coefficient will be \({{\omega }_{{\text{LIC}}}-{\omega }_{{\text{HIC}}}=\gamma }_{12}\). The years for convergence (Y) will be determined by the following: \({e}^{{\gamma }_{0}+{\gamma }_{1}}*{Y}^{{\gamma }_{12}}= {e}^{{\gamma }_{0}}= {\mu }_{{\text{HIC}}}\).

Coincidentally, Golovko et al. (2022) has examined the possibility of learning before exporting by analyzing whether investments in marketing before exporting could improve firm performance after exporting. This result is reported as non-significant.

We are grateful to the guest editor for introducing this interesting research question.

References

Acemoglu, D., Johnson, S., & Robinson, J. A. (2005). Institutions as a fundamental cause of long-run growth. Handbook of Economic Growth, 1, 385–472. https://doi.org/10.1016/S1574-0684(05)01006-3

Amendolagine, V., Chaminade, C., Guimón, J., & Rabellotti, R. (2022). Cross-border knowledge flows through R&D FDI: implications for low- and middle-income countries. In A. Taubman & J. Watal (Eds.), Trade in knowledge: Intellectual property, trade and development in a transformed global economy (pp. 352–375). Cambridge University Press. https://doi.org/10.1017/9781108780919.014.

Aquilante, T., & Vendrell-Herrero, F. (2021). Bundling and exporting: Evidence from German SMEs. Journal of Business Research, 132, 32–44. https://doi.org/10.1016/j.jbusres.2021.03.059

Aranda, C., Arellano, J., & Davila, A. (2017). Organizational learning in target setting. Academy of Management Journal, 60(3), 1189–1211. https://doi.org/10.5465/amj.2014.0897

Argote, L., & Epple, D. (1990). Learning curves in manufacturing. Science, 247(4945), 920–924. https://doi.org/10.1126/science.247.4945.920

Argote, L., & Miron-Spektor, E. (2011). Organizational learning: From experience to knowledge. Organization Science, 22(5), 1123–1137. https://doi.org/10.1287/orsc.1100.0621

Argote, L., Lee, S., & Park, J. (2021). Organizational learning processes and outcomes: Major findings and future research directions. Management Science, 67(9), 5399–5429. https://doi.org/10.1287/mnsc.2020.3693

Aw, B. Y., Chung, S., & Roberts, M. J. (2000). Productivity and turnover in the export market: Micro-level evidence from the Republic of Korea and Taiwan (China). The World Bank Economic Review, 14(1), 65–90. https://doi.org/10.1093/wber/14.1.65

Bai, X., Krishna, K., & Ma, H. (2017). How you export matters: Export mode, learning and productivity in China. Journal of International Economics, 104, 122–137. https://doi.org/10.1016/j.jinteco.2016.10.009

Baldwin, R. (2016). The great convergence. Harvard University Press. https://lccn.loc.gov/2016017378

Bastos, P., Silva, J., & Verhoogen, E. (2018). Export destinations and input prices. American Economic Review, 108(2), 353–392. https://doi.org/10.1257/aer.20140647

Baumol, W. J. (1986). Productivity growth, convergence, and welfare: What the long-run data show. American Economic Review, 76(5), 1072–1085. http://www.jstor.org/stable/1816469

Belderbos, R. A., & Heijltjes, M. G. (2005). The determinants of expatriate staffing by Japanese multinationals in Asia: Control, learning and vertical business groups. Journal of International Business Studies, 36, 341–354.

Bernard, A. B., & Jensen, J. B. (1999). Exceptional exporter performance: Cause, effect, or both? Journal of International Economics, 47(1), 1–25. https://doi.org/10.1016/S0022-1996(98)00027-0

Bhaumik, S. K., Dimova, R., Kumbhakar, S. C., & Sun, K. (2018). Is tinkering with institutional quality a panacea for firm performance? Insights from a semiparametric approach to modeling firm performance. Review of Development Economics, 22(1), 1–22. https://doi.org/10.1111/rode.12311

Blalock, G., & Gertler, P. J. (2009). How firm capabilities affect who benefits from foreign technology. Journal of Development Economics, 90(2), 192–199. https://doi.org/10.1016/j.jdeveco.2008.11.011

Brambilla, I., Lederman, D., & Porto, G. (2012). Exports, export destinations, and skills. American Economic Review, 102(7), 3406–3438. https://doi.org/10.1257/aer.102.7.3406

Buckley, P. J., Doh, J. P., & Benischke, M. H. (2017). Towards a renaissance in international business research? Big questions, grand challenges, and the future of IB scholarship. Journal of International Business Studies, 48(9), 1045–1064. https://doi.org/10.1057/s41267-017-0102-z

Bustinza, O. F., Vendrell-Herrero, F., & Gomes, E. (2020). Unpacking the effect of strategic ambidexterity on performance: A cross-country comparison of MMNEs developing product-service innovation. International Business Review, 29(6), 101569. https://doi.org/10.1016/j.ibusrev.2019.01.004

Cassiman, B., & Golovko, E. (2011). Innovation and internationalization through exports. Journal of International Business Studies, 42(1), 56–75. https://doi.org/10.1057/jibs.2010.36

Cattani, G. (2005). Preadaptation, firm heterogeneity, and technological performance: A study on the evolution of fiber optics, 1970–1995. Organization Science, 16(6), 563–580. https://doi.org/10.1287/orsc.1050.0145

Certo, S. T., Busenbark, J. R., Woo, H. S., & Semadeni, M. (2016). Sample selection bias and Heckman models in strategic management research. Strategic Management Journal, 37(13), 2639–2657. https://doi.org/10.1002/smj.2475

Child, J., & Tse, D. K. (2001). China’s transition and its implications for international business. Journal of International Business Studies, 32(1), 5–21. https://doi.org/10.1057/palgrave.jibs.8490935

Child, J., Karmowska, J., & Shenkar, O. (2022). The role of context in SME internationalization–A review. Journal of World Business, 57(1), 101267. https://doi.org/10.1016/j.jwb.2021.101267

Clerides, S. K., Lach, S., & Tybout, J. R. (1998). Is learning by exporting important? Micro-dynamic evidence from Colombia, Mexico, and Morocco. The Quarterly Journal of Economics, 113, 903–947. https://www.jstor.org/stable/i324113

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152. https://doi.org/10.2307/2393553

Cuervo-Cazurra, A., Ciravegna, L., Melgarejo, M., & Lopez, L. (2018). Home country uncertainty and the internationalization-performance relationship: Building an uncertainty management capability. Journal of World Business, 53(2), 209–221. https://doi.org/10.1016/j.jwb.2017.11.002

Cunha, M. P. E., Gomes, E., Kamoche, K., Mair, J., Miner, A., & Tarba, S. (2022). Improvisation, strategy, and strategic improvisation in emerging markets. European Management Review. In Press. https://doi.org/10.1111/emre.12543

Darko, C., Occhiali, G., & Vanino, E. (2021). The Chinese are here: Import penetration and firm productivity in sub-Saharan Africa. The Journal of Development Studies, 57(12), 2112–2135. https://doi.org/10.1080/00220388.2021.1956468

Darr, E. D., Argote, L., & Epple, D. (1995). The acquisition, transfer, and depreciation of knowledge in service organizations: Productivity in franchises. Management Science, 41(11), 1750–1762. https://doi.org/10.1287/mnsc.41.11.1750

De Loecker, J. (2007). Do exports generate higher productivity? Evidence from Slovenia. Journal of International Economics, 73(1), 69–98. https://doi.org/10.1016/j.jinteco.2007.03.003

Deheija, R., & Wahba, S. (2002). Propensity score matching methods for nonexperimental causal studies. Review of Economics and Statistics, 84, 151–161. https://doi.org/10.1162/003465302317331982

Denrell, J., Fang, C., & Levinthal, D. (2004). From T-mazes to labyrinths: Learning from model-based feedback. Management Science, 50(10), 1366–1378. https://doi.org/10.1287/mnsc.1040.0271

Dimelis, S., & Louri, H. (2002). Foreign ownership and production efficiency: A quantile regression analysis. Oxford Economic Papers, 54(3), 449–469. https://doi.org/10.1093/oep/54.3.449

Ellis, S., & Davidi, I. (2005). After-event reviews: Drawing lessons from successful and failed experience. Journal of Applied Psychology, 90(5), 857–871. https://doi.org/10.1037/0021-9010.90.5.857

Fang, C. (2012). Organizational learning as credit assignment: A model and two experiments. Organization Science, 23, 1717–1732. https://doi.org/10.1287/orsc.1110.0710

Faulkner, R. R., & Anderson, A. B. (1987) Short-term projects and emergent careers: Evidence from Hollywood. American Journal of Sociology, 92, 879–909. https://www.jstor.org/stable/2780042

Fernandes, A. M., & Isgut, A. E. (2015). Learning-by-exporting effects: Are they for real? Emerging Markets Finance and Trade, 51(1), 65–89. https://doi.org/10.1080/1540496X.2015.998073

Furr, N. R. (2019). Product adaptation during new industry emergence: The role of start-up team preentry experience. Organization Science, 30(5), 1076–1096. https://doi.org/10.1287/orsc.2018.1278

Galor, O., & Mountford, A. (2006). Trade and the great divergence: The family connection. American Economic Review, 96(2), 299–303. https://doi.org/10.1257/000282806777212378

Gavetti, G., & Levinthal, D. (2000). Looking forward and looking backward: Cognitive and experiential search. Administrative Science Quarterly, 45(1), 113–137. https://doi.org/10.2307/2666981

Glassman, R. B. (1973). Persistence and loose coupling in living systems. Behavioral Science, 18, 83–98. https://doi.org/10.1002/bs.3830180202

Golovko, E., Lopes-Bento, C., & Sofka, W. (2022). Marketing learning by exporting–How export-induced marketing expenditures improve firm performance. Journal of Business Research, 150, 194–207. https://doi.org/10.1016/j.jbusres.2022.06.015

Gomes, E., Vendrell-Herrero, F., Mellahi, K., Angwin, D. N., & Sousa, C. (2018). Testing the self-selection theory in high corruption environments: Evidence from African SMES. International Marketing Review, 35(5), 733–759. https://doi.org/10.1108/IMR-03-2017-0054

Greenaway, D., & Kneller, R. (2007). Industry differences in the effect of export market entry: Learning by exporting. Review of World Economics, 143(3), 416–432. https://doi.org/10.1007/s10290-007-0115-y

Greene (2012). Econometric analysis. London: Pearson. ISBN 978-0-13-139538-1

Grossman, G., & Helpman, E. (1991). Innovation and growth in the world economy. MIT Press. ISBN-9780262570978

Heckman, J. J., & Pinto, R. (2022). Causal inference of social experiments using orthogonal designs. Journal of Quantitative Economics, in Press,. https://doi.org/10.1007/s40953-022-00307-w

Heckman, J. J., & Robb, R., Jr. (1985). Alternative methods for evaluating the impact of interventions: An overview. Journal of Econometrics, 30(1–2), 239–267. https://doi.org/10.1016/0304-4076(85)90139-3

Heckman, J. J., & Todd, P. E. (2009). A note on adapting propensity score matching and selection models to choice based samples. The Econometrics Journal, 12(suppl_1), S230–S234. https://doi.org/10.1111/j.1368-423X.2008.00269.x

ISGEP. (2008). Understanding cross-country differences in exporter premia: Comparable evidence for 14 countries. Review of World Economics, 144(4), 596–635. https://doi.org/10.1007/s10290-008-0163-y

Jabbour, L., Tao, Z., Vanino, E., & Zhang, Y. (2019). The good, the bad and the ugly: Chinese imports, European Union anti-dumping measures and firm performance. Journal of International Economics, 117, 1–20. https://doi.org/10.1016/j.jinteco.2018.12.004

Jensen, N. M., Li, Q., & Rahman, A. (2010). Understanding corruption and firm responses in cross-national firm-level surveys. Journal of International Business Studies, 41(9), 1481–1504. https://doi.org/10.1057/jibs.2010.8

Johanson, J., & Vahlne, J. E. (1977). The internationalization process of the firm – A model of knowledge development and increasing foreign commitments. Journal of International Business Studies, 8(1), 23–32. https://doi.org/10.1057/palgrave.jibs.8490676

Kapoor, R., & Wilde, D. (2022). Peering into a crystal ball: Forecasting behavior and industry foresight. Strategic Management Journal, in Press. https://doi.org/10.1002/smj.3450

Kraft, K., & Ugarković, M. (2006). Profit sharing and the financial performance of firms: Evidence from Germany. Economics Letters, 92(3), 333–338. https://doi.org/10.1016/j.econlet.2006.03.008

La Porta, R., & Shleifer, A. (2014). Informality and development. Journal of Economic Perspectives, 28(3), 109–126. https://doi.org/10.1257/jep.28.3.109

Lafuente, E., & Abad, J. (2018). Analysis of the relationship between the adoption of the OHSAS 18001 and business performance in different organizational contexts. Safety Science, 103, 12–22. https://doi.org/10.1016/j.ssci.2017.11.002

Lafuente, E., Vaillant, Y., Vendrell-Herrero, F., & Gomes, E. (2019). Bouncing back from failure: Entrepreneurial resilience and the internationalisation of subsequent ventures created by serial entrepreneurs. Applied Psychology, 68(4), 658–694. https://doi.org/10.1111/apps.12175

Lafuente, E., Vaillant, Y., Alvarado, M., Mora-Esquivel, R., & Vendrell-Herrero, F. (2021). Experience as a catalyst of export destinations: The ambidextrous connection between international experience and past entrepreneurial experience. International Business Review, 30(1), 101765. https://doi.org/10.1016/j.ibusrev.2020.101765

Lapre, M. A., Mukherjee, A. S., & Van Wassenhove, N. (2000). Behind the learning curve: Linking learning activities to waste reduction. Management Science, 46(5), 597–611. https://doi.org/10.1287/mnsc.46.5.597.12049

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. The Review of Economic Studies, 70(2), 317–341. https://doi.org/10.1111/1467-937X.00246

Levitt, B., March, J. G. (1988) Organizational learning. Annual Review of Sociology,. 14:319–340. https://www.jstor.org/stable/2083321

Love, J. H., & Ganotakis, P. (2013). Learning by exporting: Lessons from high-technology SMEs. International Business Review, 22(1), 1–17. https://doi.org/10.1016/j.ibusrev.2012.01.006

Lucas, R. E., Jr. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3–42. https://doi.org/10.1016/0304-3932(88)90168-7

Luo, Y., & Bu, J. (2016). How valuable is information and communication technology? A study of emerging economy enterprises. Journal of World Business, 51(2), 200–211. https://doi.org/10.1016/j.jwb.2015.06.001

Maitlis, S., & Christianson, M. (2014). Sensemaking in organizations: Taking stock and moving forward. Academy of Management Annals, 8(1), 57–125. https://doi.org/10.5465/19416520.2014.873177

Malca, O., Peña-Vinces, J., & Acedo, F. J. (2020). Export promotion programmes as export performance catalysts for SMEs: Insights from an emerging economy. Small Business Economics, 55(3), 831–885. https://doi.org/10.1007/s11187-019-00185-2

March, J. G. (2010). The ambiguities of experience. Cornell University Press.

Marsili, O. (2001). The anatomy and evolution of industries. Edward Elgar, UK. ISBN: 978 1 840645590

Martin, X., & Salomon, R. (2003). Knowledge transfer capacity and its implications for the theory of the multinational corporation. Journal of International Business Studies, 34(4), 356–373. https://doi.org/10.1057/palgrave.jibs.8400037

Martins, P. S., & Yang, Y. (2009). The impact of exporting on firm productivity: A meta-analysis of the learning-by-exporting hypothesis. Review of World Economics, 145, 431–445. https://doi.org/10.1007/s10290-009-0021-6

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695–1725. https://doi.org/10.1111/1468-0262.00467

Meyer, K. E. (2018). Catch-up and leapfrogging: Emerging economy multinational enterprises on the global stage. International Journal of the Economics of Business, 25(1), 19–30. https://doi.org/10.1080/13571516.2017.1374624

Orton, J. D., & Weick, K. E. (1990). Loosely coupled systems: A reconceptualization. Academy of Management Review, 15(2), 202–223. https://doi.org/10.5465/amr.1990.4308154ps

Park, B., Lehman, D., & Ramanujam, R. (2023). Driven to distraction: The unintended consequences of organizational learning from failure caused by human error. Organization Science, 34(1), 283–382. https://doi.org/10.1287/orsc.2022.1573

Peng, Y. S., Yang, K. P., & Liang, C. C. (2011). The learning effect on business groups’ subsequent foreign entry decisions into transitional economies. Asia Pacific Management Review, 16(1), 1–21

Pisano, G. P. (1994). Knowledge, integration, and the locus of learning: An empirical analysis of process development. Strategic Management Journal, 15(S1), 85–100. https://doi.org/10.1002/smj.4250150907

Pisano, G. P. (1996). Learning-before-doing in the development of new process technology. Research Policy, 25, 1097–1119. https://doi.org/10.1016/S0048-7333(96)00896-7

Pomeranz, K. (2021). The great divergence. Princeton University Press.

Porter, M. E. (1990). The competitive advantage of nations. The Free Press.

Salomon, R., & Jin, B. (2008). Does knowledge spill to leaders or laggards? Exploring industry heterogeneity in learning by exporting. Journal of International Business Studies, 39(1), 132–150. https://doi.org/10.1057/palgrave.jibs.8400320

Salomon, R., & Jin, B. (2010). Do leading or lagging firms learn more from exporting? Strategic Management Journal, 31(10), 1088–1113. https://doi.org/10.1002/smj.850

Salomon, R. M., & Shaver, J. M. (2005). Learning by exporting: New insights from examining firm innovation. Journal of Economics & Management Strategy, 14(2), 431–460. https://doi.org/10.1111/j.1530-9134.2005.00047.x

Slaughter, M. J. (1997). Per capita income convergence and the role of international trade. The American Economic Review, 87(2), 194–199. https://www.jstor.org/stable/2950912

Tajeddin, M., & Carney, M. (2019). African business groups: How does group affiliation improve SMEs’ export intensity? Entrepreneurship Theory and Practice, 43(6), 1194–1222. https://doi.org/10.1177/1042258718779586

Teagarden, M. B., Von Glinow, M. A., & Mellahi, K. (2018). Contextualizing international business research: Enhancing rigor and relevance. Journal of World Business, 53(3), 303–306. https://doi.org/10.1016/j.jwb.2017.09.001

Vendrell-Herrero, F., Darko, C., Gomes, E., & Lehman, D. (2022). Home market economic development as a moderator of the self-selection and learning-by-exporting effects. Journal of International Business Studies., 53, 1519–1535. https://doi.org/10.1057/s41267-021-00481-8

Wagner, J. (2007). Exports and productivity: A survey of the evidence from firm-level data. World Economy, 30(1), 60–82. https://doi.org/10.1111/j.1467-9701.2007.00872.x

Sensemaking in organizations (SAGE Publications, Thousand Oaks, CA). ISBN : 978-0-8039-7176-9

Westphal, L. E., Rhee, Y. W., & Pursell, G. (1984). Sources of technological capability in South Korea. In Technological capability in the third world (pp. 279–300). Palgrave Macmillan, London. https://doi.org/10.1007/978-1-349-17487-4_15

Williams, C. C., Martinez-Perez, A., & Kedir, A. M. (2017). Informal entrepreneurship in developing economies: The impacts of starting up unregistered on firm performance. Entrepreneurship Theory and Practice, 41(5), 773–799. https://doi.org/10.1111/etap.12238

Wright, T. P. (1936). Factors affecting the cost of airplanes. Journal of the Aeronautical Sciences, 3(4), 122–128.

Yang, Y., & Mallick, S. (2014). Explaining cross-country differences in exporting performance: The role of country-level macroeconomic environment. International Business Review, 23(1), 246–259. https://doi.org/10.1016/j.ibusrev.2013.04.004

Zeira, J. (1998). Workers, machines and economic growth. Quarterly Journal of Economics, 113, 1091–1117. https://doi.org/10.1162/003355398555847

Acknowledgements

The authors are grateful to Esteban Lafuente, two anonymous reviewers, and attendants to the online paper development workshop for their insightful comments and suggestions during the review process. Ferran Vendrell-Herrero and Emanuel Gomes acknowledge financial support by the Spanish State Research Agency (SRA), Ministry of Science and Innovation (Reference: PID2022-136235NB-100).

Funding

Emanuel Gomes acknowledges financial support from Fundação para a Ciência e a Tecnologia (UID/ECO/00124/2019, UIDB/00124/2020 and Social Sciences DataLab, PINFRA/22209/2016), POR Lisboa and POR Norte (Social Sciences DataLab, PINFRA/22209/2016), and David Lehman acknowledges research support from the University of Virginia.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Vendrell-Herrero, F., Gomes, E., Darko, C.K. et al. When do firms learn? Learning before versus after exporting. Small Bus Econ (2024). https://doi.org/10.1007/s11187-024-00898-z

Accepted:

Published:

DOI: https://doi.org/10.1007/s11187-024-00898-z

Keywords

- Learning-by-exporting

- Organizational learning

- Home market economic development

- World Bank Enterprise Survey

- Great convergence

- Great divergence