Abstract

Drawing from prospect theory, we use an experimental study design to explore how and why reference points of managers of family and nonfamily firms differ. We contribute to research on the role of economic theories for family businesses by elaborating on decision-making mechanisms in the context of family firms. Furthermore, we investigate whether family and nonfamily managers within family firms vary in their investment decisions. Our study demonstrates the importance of price volatility as a determinant of reference points and shows how the same type of information can lead to different reference points based on whether the manager is from a family or nonfamily firm.

Plain English Summary

Family and Nonfamily Firm Managers View Investment Information Differently. It is not clear why. We show that family firm managers were less sensitive to volatility leading to more patient investments. #ManagerialChoices #Investments #FamilyFirms. To better understand why the investments of family and nonfamily firms tend to differ, we investigated how the family and nonfamily firm context shapes managers’ assessment of investment pricing information. Using an experimental study, we examined how family versus nonfamily managers react to a series of investment pricing information and whether they set a higher or lower benchmark for returns. Surprisingly, we found that the organizational context matters greatly: The type of company – family or nonfamily-owned – significantly influenced managers’ mental benchmark values for investments (reference points) and their risk perceptions. Our study also revealed that while family and nonfamily firm managers react similarly to investment purchase price, current price, and average price, their response to price volatility significantly varied. Managers from family firms were shown to be less sensitive to price volatility (i.e., great investment price fluctuations) than managers from nonfamily firms, thus suggesting that nonfamily firm managers are more likely to focus on short-term gains from investments. Understanding these dynamics offers important insight into why managers from family versus nonfamily firms approach investments differently – their benchmarks for investments vary. Recognizing managers’ diverse reactions to investment risk and price changes should therefore help firms to make more informed investment decisions and to offer more tailored training to their managers, thereby fostering more informed decisions and positive investment outcomes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Research comparing nonfamily firms and family firms, i.e., firms where family members have ownership control and are involved in management (Eddleston et al., 2008; Zahra, 2003), often asserts that their investment decisions vary because they have different reference points (Alessandri et al., 2018; Gomez‐Mejia et al., 2010; Kotlar et al., 2014a). A reference point is a baseline value used as a benchmark to classify potential outcomes as gains or losses; i.e., earnings are high or low compared to a reference point (Kahneman & Tversky, 1979). High reference points indicate higher return expectations and greater perceived risk, which implies a higher benchmark to achieve satisfaction with an investment. Conversely, low reference points indicate lower expectations and less perceived risk, which implies a lower benchmark to achieve satisfaction with an investment (Kahneman & Tversky, 1979). According to prospect theory, a behavioral economics theory, reference points are therefore key to understanding investment decision biases and why the riskiness of an investment can be evaluated differently (Kahneman & Tversky, 1979; Saqib & Chan, 2015). Indeed, prospect theory has been used to explain differences between family and nonfamily firms’ reference points and to describe family firm bias; that is, how the interplay of goals related to financial and socioemotional wealthFootnote 1 shifts family firms’ investment preferences (Chrisman & Patel, 2012; Kotlar et al., 2014a; Lude & Prügl, 2019). Reference points have also been used to explain why family firms’ long-term orientation leads them to be more patient with their investments and tolerant of financial loss than nonfamily firms (Alessandri et al., 2018; Gomez‐Mejia et al., 2010; Patel & Chrisman, 2014).

However, while research comparing the investments of family and nonfamily firms is certainly informative, surprisingly few studies have considered how managers of family and nonfamily firms actually make investment decisions (Bianco et al., 2013; Kotlar et al., 2014a; Lude & Prügl, 2021). Because managers are responsible for determining their firm’s investment strategies, it is important to understand how their reference points are formed (Baillon et al., 2020) and adapted to changes in risk (Kotlar et al., 2014a). Specifically, despite a plethora of research that assumes their reference points differ and they respond to risk differently, we know little about how managers of family and nonfamily firms form and adapt their reference points in response to risk. For example, although family firms have been described as both risk seeking and risk averse relative to nonfamily firms (e.g., Alessandri et al., 2018; Kempers et al., 2019; Zahra, 2018), no known study has considered how their managers respond to investment volatility, even though volatility, captured via graphical price sequences, is the most prominent measure of risk used by investors (Duxbury & Summers, 2018; Merkle, 2018). As such, we do not know if managers of family and nonfamily firms form their reference points differently in response to investment pricing information including volatility. Furthermore, given research suggesting that nonfamily managers from family firms are more accepting of risk than family managers (Huybrechts et al., 2013; Tabor et al., 2018), research needs to explore whether their reference points vary.

To address these gaps in the literature, we build on previous research on reference point formation (Baillon et al., 2020; Baucells et al., 2011) to investigate how the family and nonfamily firm context shapes managers’ reference points. We do so by extending the seminal experimental study of Baucells et al. (2011), which examined the influence of pricing information (i.e., purchase, current, and average price) on reference points over time, by including price volatility. Additionally, drawing from prospect theory, we argue that the same investment pricing information is interpreted differently depending on whether the manager is a family manager, nonfamily manager in a family firm, or manager in a nonfamily firm.

This study contributes to family business and prospect theory research in several ways. First, it offers a nuanced understanding of prospect theory by examining how managers’ reference points systematically differ based on the organizational context of the investment. Applying the family business context as a decision-frame, we find that reference points are contingent upon the organizational context. Thus, we shed light on the heterogeneity in reference points observed among decision-makers despite the same available information (Kotlar et al., 2014a; Stålnacke, 2019). Second, we offer insight on why the investment decisions of family firms can vary by including both family and nonfamily managers from family firms in our study and exploring the influence of family ownership. As such, we highlight the importance of considering the micro-foundations of investment decisions, like the organizational context and diversity of decision-makers within family firms, to fully understand their investment strategies. Third, we introduce price volatility as an important determinant of reference points. We discuss how price fluctuations have different effects across different organizational contexts and add to the ongoing debate in the prospect theory literature about which information most significantly affects reference points (e.g., André et al., 2018; Baillon et al., 2020; Bartling et al., 2015). Finally, whereas Baucells et al. (2011) conducted their experiment with students, we utilize a sample of managers from business practice using a realistic investment scenario. Our approach therefore provides a more accurate depiction of the effect of pricing information on reference points in family and nonfamily firms that should help organizations and their managers make more informed investment decisions.

2 Theoretical framework and hypotheses

2.1 Prospect theory and reference points

Prospect theory is a theory of behavioral economics that describes how individuals make decisions in situations of uncertainty, specifically in situations in which they exhibit risk-taking versus risk-avoiding behavior (Kahneman, 2003). The theory depicts individuals as risk-seeking or risk-averse depending on whether they frame their decision in the domain of losses or gains (Fiegenbaum et al., 1996; Hack & Bieberstein, 2015). A general assumption of prospect theory is that individuals are particularly averse to losing what they already possess, as “losses loom larger than gains” (Kahneman & Tversky, 1979, p. 279). Moreover, individuals tend to prefer certain outcomes over probable ones. Referred to as the certainty effect, individuals tend to be risk-averse when a sure loss needs to be avoided and risk-seeking once a sure loss needs to be recovered (Kahneman & Tversky, 1979; Meng & Weng, 2018). Additionally, the certainty effect explains how greater uncertainty leads to a perception of loss and thus, displeasure.

An important premise of prospect theory is that individuals make decisions based on a potential outcome relative to a reference point rather than on the potential outcome itself (Holmes, Jr. et al. 2011; Meng & Weng, 2018; Allen et al., 2017). A reference point is used to classify whether a potential outcome is considered a success, i.e., a gain, or an underachievement, i.e., a loss. For example, a return of five percent from an investment project is only considered a gain if the reference point is below the five percent mark. If the reference point is above the five percent mark, the same return is perceived as a loss. It therefore follows that the higher the reference point, the more likely a potential outcome will be perceived in the loss domain. Conversely, the lower the reference point, the more likely a potential outcome will be considered a gain.

Research on reference points is important in predicting investor sentiments and how feelings of losses versus gains affect decisions (Saqib & Chan, 2015). As such, research often seeks to identify how reference points are formed and specifically, how personal investment preferences and a multitude of relevant available information shape individuals’ reference points (e.g., Barbosa et al., 2019; Kotlar et al., 2014a; Lefebvre & Vieider, 2014; Weingarten et al., 2019). For example, Heath et al. (1999) argued that although the status quo, i.e., current level of wealth, is a dominant determinant, other factors like goals or aspiration levels also have decisive effects on reference points. Building on these insights, Baucells et al. (2011) examined how individuals define and adapt their reference point based on multiple pieces of price information that were updated over time. Using an investment scenario, Baucells et al. (2011) found that the purchase price and current price of an investment have the most influence, while the intermediate average price also had a small weighting.

Although Baucells et al.’s (2011) study of price information made a significant contribution to research on reference points, it did not consider price volatility, which should be an important source of information to consider given that it is the most prominent measure of risk used by investors (Duxbury & Summers, 2018; Merkle, 2018). By graphically depicting the price fluctuations of an investment over time, price volatility provides critical information about the riskiness of an investment decision (Patton & Sheppard, 2015; Stålnacke, 2019). Unfortunately, no study has yet corroborated the specific importance of price volatility for reference point formation. Additionally, because Baucells et al.'s (2011) experiment was performed with students, it is unclear if its results hold true for actual managers, particularly since managers do not make investment decisions in isolation but against the background of the organizational context in which they operate (Kotlar et al., 2014a, 2014b). In fact, prospect theory assumes that individuals are subject to cognitive biases, leading them to evaluate investment options within a cognitive frame (Ganegoda & Folger, 2015; Gonzalez & Mehlhorn, 2016). This ‘framing effect’ is likely anchored in the organizational culture surrounding decision-makers (Carney, 2005). To our knowledge, however, no study has explored if managers in diverse organizational contexts form different reference points based on exposure to the same price information.

In the following, we explore implications of the influence of price volatility on reference points and develop hypotheses on the interpretation of various pricing information based on the organizational context (i.e., family versus nonfamily firm) of the decision-makers, focusing on differences in the reference points of managers from family firms and nonfamily firms as well as differences among family and nonfamily managers from family firms.

2.2 Price volatility as a determinant of reference points

Volatility is the most commonly used measure of risk in finance (e.g., Atasoy et al., 2022; Duxbury & Summers, 2018; Merkle, 2018). It is captured as observable price fluctuations over a period of time, indicating the dispersion of returns for a given investment (Cole & Bruch, 2006; Eberlein et al., 2003). The higher the volatility, the greater the risk because the return is less predictable (Blair, 2020). In contrast, low volatility is associated with a more predictable value and, thus, less risk (Erickson et al., 2017). In considering how decision-makers view investments, it has been argued that graphic depictions of historical price sequences are the most prevalent and widely used (Duclos, 2015; Duxbury & Summers, 2018), suggesting that the visual display of price volatility is essential in predicting reference points. Information about price volatility helps managers weigh inherent risks and returns of an investment, offering additional information above and beyond other price-relevant data (Stålnacke, 2019). Indeed, research on investment expectations indicates that extreme points on a price sequence chart are highly influential in setting expectations about future performance (Mussweiler & Schneller, 2003), thus suggesting that high volatility increases reference points.

This aligns with the certainty effect of prospect theory, i.e., the assumption that individuals give greater utility to certain outcomes and place less weight on outcomes that are only probable (Tversky & Kahneman, 1986). Applied to investments, it suggests that individuals expect a higher payout when the reward from an investment is less certain. In fact, higher price volatility introduces increased uncertainty, leading investors to perceive a higher likelihood of extreme outcomes, both positive and negative (Baker et al., 2012). Individuals may react to this uncertainty by anchoring their reference points at a level that provides a sense of security (Baker et al., 2012). By setting a higher reference point, investors mentally establish a threshold beyond which they consider their investment to be in a favorable gain position. Consequently, investments with greater price volatility would need to exhibit larger price increases relative to the higher reference point for investors to perceive them as profitable and worth the risk. Therefore, greater price volatility should lead managers to set higher reference points. Thus, in addition to the influences of the purchase price, current price, and average price in Baucells et al.'s (2011) model, price volatility should be a significant determinant of a reference point such that greater volatility increases and lesser volatility decreases a manager’s reference point.

-

Hypothesis 1: Taking into account purchase price, current price, and average price, greater price volatility leads to a higher reference point.

2.3 Context dependency of reference point formation: The case of family businesses

Having established the significance of price volatility as a determinant of reference points, it is important to note that any information evaluated by decision-makers is processed against the background of personal investment preferences (Ganegoda & Folger, 2015; Gonzalez & Mehlhorn, 2016) and that the organizational context may also affect how decision-makers frame risk and evaluate options (Barbosa et al., 2019; Lude & Prügl, 2019; Powell et al., 2011). Early research on decision making focused on how individuals’ frame of reference influences their view of the environment, thus explaining why individuals in the same environment tend to make similar decisions (Cyert & March, 1963). Such cognitive frames of reference serve as knowledge structures that help individuals organize and interpret information (Atasoy et al., 2022; Cornelissen & Werner, 2014; Ganegoda & Folger, 2015; Starbuck & Milliken, 1988). For example, the cultural-cognitive aspect of institutions involves the creation of shared conceptions and ideals that shape behavioral scripts and logic (Arkes et al., 2010; Scott, 2003). Das and Teng (2001) argued that decision-makers adjust their behavior against the background of their general aspiration levels and their current situation because decision options are weighted differently depending on their relative importance in a respective context.

This view of framing thus suggests that the organizational context offers individuals a frame of reference that shapes how they interpret events and systematically influences their decision-making (Ganegoda & Folger, 2015). Research comparing family and nonfamily firms has long argued that due to different frames of reference, how decision-makers approach risk and investments tends to differ (e.g., Alessandri et al., 2018; Carney, 2005; Gómez-Meija et al., 2011). For example, Lude and Prügl (2019) demonstrated that family firms’ unique governance and capital structures create a range of psychological frames that influence the decision-making of family managers and how they weigh options. In their experimental study of nonprofessional investors, they also found that investment decisions vary depending on whether the subjects were presented with an opportunity to invest in a family or nonfamily firm. Lude and Prügl's (2019) study showed that the family nature of a firm mitigates risk aversion in the gain domain but reinforces risk seeking in the loss domain, thus suggesting that investors have a more positive view of family firms than previously thought.

According to research on family firms’ reference points, the owning family’s SEW takes precedence leading to differences in how managers from family and nonfamily firms view losses and gains associated with strategic decisions (Nason et al., 2019). This prioritization of SEW leads families to view their firm as an asset to be passed down to descendants rather than a source of wealth to be consumed during their lifetime (Anderson & Reeb, 2003). As such, SEW serves as an additional nonfinancial reference point that family firms consciously or unconsciously take into account when considering investments (Jaskiewicz et al., 2019). The family’s ability to exercise dominance over the business is a defining characteristic of family firms (Spranger et al., 2012) and maintaining control beyond the current generation is a central goal that impacts their attitude toward risk (Chrisman et al., 2012; Gómez-Mejía et al., 2007).

In turn, family firms tend to have a long-term orientation and a more patient approach toward investments that comes into play when family managers need to make strategic decisions (Alessandri et al., 2018; Chrisman & Patel, 2012). The use of extended time horizons when evaluating investments explains why family managers often accept that some investments become productive only after an appreciable delay and why they are often willing to make investments that are beneficial for a future generation but not for the family’s current generation (Breton-Miller and Miller, 2006; Lumpkin & Brigham, 2011). Accordingly, their longer investment horizon, driven by both nonfinancial and financial considerations, leads to investments that maximize the long-term value of the family firm rather than those that simply boost current earnings (Anderson & Reeb, 2003). This in turn prevents myopic loss aversion (Bianco et al., 2013). Myopic loss aversion is a derivative of prospect theory that describes how investors’ preoccupation with avoiding losses is amplified when goals are short-term and corresponding time horizons are narrower (Alessandri et al., 2018; Benartzi & Thaler, 1995; Chrisman & Patel, 2012).

Family managers’ concern for SEW also causes them to be willing to be vulnerable to the possibility of financial loss (Gomez‐Mejia et al., 2010, p. 225). Above all else, family managers are theorized to prioritize family control of their firm even if this means taking decisions that increase the risk of poor performance (Gómez-Meija et al., 2011; Gómez-Mejía et al., 2007). Some even go as far as accepting greater strategic risk for the current generation in order to preserve the discretionary power of the family in the long run (Bianco et al., 2013; Gómez-Mejía et al., 2007; Kotlar et al., 2014a, 2014b). The longer time horizons family managers use when evaluating investments thereby impacts how they frame strategic choices, making them less sensitive to short-term losses from investments (Alessandri et al., 2018).

Conversely, managers of nonfamily firms place greater emphasis on short-term financial criteria when making investment decisions and place greater value on current earnings than family managers of family firms (Gómez-Mejía et al., 2007; Gomez‐Mejia et al., 2010; Breton-Miller and Miller, 2006). This preference for current earnings suggests a short-term investment horizon with frequent evaluation of outcomes and greater myopic loss aversion (Alessandri et al., 2018; Chrisman & Patel, 2012). Indeed, research suggests that managers of nonfamily firms are more likely to suffer from myopia than managers of family firms (Alessandri et al., 2018; Ali et al., 2007). Therefore, because the predominant frame of reference of nonfamily firm managers is economic with an emphasis on short-term gains, they should be more averse to losses than family managers of family firms. Accordingly, when presented with the same investment pricing information, managers of nonfamily firms are expected to have a higher reference point than family managers of family firms.

Additionally, we consider the comparative reference points of nonfamily managers in family firms. Although nonfamily managers make decisions in a family business context, their family does not own the business and thus, they are not socialized to prioritize its SEW (Block, 2011; Rau et al., 2019). In fact, nonfamily managers of family firms appear to have a different perspective on the firm’s SEW (Gomez-Mejia et al., 2019; Swab et al., 2020), with nonfamily managers exhibiting behaviors and attitudes that are less aligned with the business-owning family’s interests than family managers (James et al., 2017; Spranger et al., 2012). As a result, nonfamily managers are expected to make more objective strategic decisions that align more with economic goals than family managers (Fang et al., 2021; Stanley, 2010).

However, because they work in a family firm, nonfamily managers’ approach toward investments and risk is likely shaped by the family business context. For example, research indicates that nonfamily managers often adopt cultural competencies and norms of the business-owning family in an effort to gain support in their managerial roles (Mitchell et al., 2003; Morris et al., 2010). They also often seek to balance the perspective of family owners with their own goals and time horizons (Waldkirch, 2020; Zellweger et al., 2012). As such, nonfamily managers can be seen as having a hybrid frame of reference whereby the family business context encourages them to extend their investment time horizons, but their lack of family status promotes a greater emphasis on economic than socioemotional goals. This distinctiveness represents an important micro-level difference within family firms that likely affects macro-level outcomes (micro-to-macro causation, see Lude & Prügl, 2021). Taken together, we therefore hypothesize that nonfamily managers of family firms will have a higher reference point than family managers of family firms and a lower reference point than managers of nonfamily firms when presented with the same sequence of investment price information.

-

Hypothesis 2a: Taking into account purchase price, current price, average price, and price volatility, managers in nonfamily firms have a higher reference point than nonfamily managers in family firms.

-

Hypothesis 2b: Taking into account purchase price, current price, average price, and price volatility, nonfamily managers in family firms have a higher reference point than family managers in family firms.

3 Sample, experimental design, and methods

3.1 Sample

To collect our data, we contacted managers through different mailing lists provided by a family business center affiliated with a German university, social community groups from Xing (a German business network community similar to LinkedIn), and alumni associations of two German universities. We conducted an experiment, which was executed via an online questionnaire sent to 2,100. To ensure that participants were in one of our three focal groups of managers (i.e., family managers in family firms, nonfamily managers in family firms, and managers in nonfamily firms), we asked them: “What kind of designation is best applicable to you: Family manager in a family-owned firm, external manager in a family-owned firm, external manager in a nonfamily firm, or other.” Further, we asked respondents if they identify their firm as a family firm (Arregle et al., 2007), if the firm employs family members (Kellermanns & Eddleston, 2007), which family generations are actively involved in management (Zahra, 2005), and, in case of a family manager, to which generation the participant belongs.

From the mailing list, 315 questionnaires were received. We dropped respondents who supplied incomplete surveys. The final sample consists of 108 respondents, of which 57 were family managers, 23 were nonfamily managers in family firms (FFs), and 28 were managers in nonfamily firms (NFFs). The response rate was 5.14%. Given the sensitive nature of the questions and the required seniority of our respondents, this rate is not surprising and comparable to previous studies on family firms (e.g., Zellweger et al., 2012) and reference points (e.g., Arkes et al., 2008). The average age of respondents was 43.21 years and 10% were female. All respondents were managers in top positions of the firm, e.g., the CEO (31%), or the chairman/chairwoman of the supervisory board (23%). The average age of the firm was 86.19 years, and average sales were 259 million euros. The firms in our sample represent a broad range of industries, e.g., finance, trade, logistics, and commerce.

3.2 Experimental design

We designed our study similar to the approach of Baucells et al. (2011) and estimated the reference point directly by asking individuals which selling price would leave them emotionally neutral, i.e., make them neither happy nor unhappy, after they observed a multi-period stock price path. However, while Baucells et al. (2011) used a hypothetical scenario that students evaluated, we used a real-life context with actual decision-makers from family and nonfamily firms. Instead of a stock price scenario, we opted for an investment scenario, as we sought to examine the reference points of managers who make business-relevant decisions. The average processing time for the price sequences and additional questionnaire items was 29 min.

We provided the managers with several sequences of a hypothetical case in which they purchase a critical investment for their company in period one at price y1 (see Appendix A for a scenario description). In the following periods i = 2, 3, …, the managers see the performance of the investment on a graph with a three second delay before each new price is added. Thus, the participants see the development of their investment from the purchase to the current price on a graphical display. During that time, they assumingly experience feelings of gains and losses, which occur from a comparison of the current return on investment price, yn+1, to some neutral price in the future, i.e., the individual reference point at which they would feel neither happy nor unhappy about a sale. Participants indicated this price by clicking on the graph at period n + 1. Thus, the reference point is the return-on-investment price that produces zero experienced utility (ŷn+1) at period n + 1. The single reference point, r + 1, is a function of the information observed in the past. The prospect value function with v (0) = 0 denoting the emotional neutrality (Kahneman et al., 1997) in period n + 1 is given by:

As the investigated price-related information may be highly correlated and their effects difficult to isolate, Baucells et al. (2011) designed 60 price sequences to create 33 pair comparisons. The respective pairs for the investigated price-related information are identical except for one higher value for one investigated price-related information in one sequence. This way, a two-fold manipulation can be achieved: 1) Applying different price-related information and 2) applying different levels among the same kind of price-related information in a pair comparison.

We chose only the price-related information and sequences that best described the reference point in the study of Baucells et al. (2011) and added price volatility as an additional price-related information to keep the average processing time of the experiment within a tolerable scope. This resulted in a total of 22 sequences per participant and 14 pairs to test the predictors’ purchase price, current price, average price, and price volatility. This mirrored and adapted design allows us to directly build on the findings of Baucells et al. (2011) and to extend their indications in order to further our knowledge about what combination of price related information influence reference points across organizational contexts.

Because the experimental design described above is comparably complex, we implemented a range of measures and checkpoints at various stages of the research process, aiming to minimize any potential misinterpretations. First, in the pre-experimental phase, we placed significant emphasis on faithfully replicating the already tested and published study design by Baucells et al. (2011) with minimal amendment (investment vs. stock price scenario). Second, we conducted pre-tests with five managers to discuss and assess the comprehensibility of the task. Third, in the post-experimental questionnaire, we asked participants to gauge the comprehensibility of the experimental task on a five-point scale (1 = very comprehensible; 5 = not comprehensible at all). On average, participants rated the experiment as comprehensible (2.1).

Table 1 contains all sequences of price paths that were presented to the managers. The length of the sequences varied between 3 and 8 periods and their order was randomized.

3.3 Measures

The study was conducted in German. Thus, validated scales based on measures of related constructs in the literature were used and translated into German. To ensure consistency with the original form, an independent English-native and German-speaking person back-translated the scales into English. No inconsistency occurred.

3.3.1 Dependent and independent variables

We measured our dependent variable as the individual reference point (RP) for each manager m at a price sequence k and log transformed it for normality. Price volatility (PR) is measured as a volatility index of each sequence k, expressed by the standard deviation (σ SD) of the average reference point of each sequence k and the logarithmic time period P:

In order to test whether price volatility has a significant effect on reference points alongside the indicators as presented by Baucells et al. (2011), we also included the purchase price (PP), the current price (CP), and the average price of the price sequences k (AP) as independent variables in our model. Accordingly, the regression model including em,k as error term and C as constant is:

3.4 Control variables

We controlled for several variables that may affect the relationship between the reference point and the independent variables. We controlled for firm size, captured by the number of full-time employees and sales, as strategic decision processes tend to vary with firm size (Josefy et al., 2015). We also controlled for firm age to address the potential for higher levels of risk-taking in younger organizations (Goldenstein et al., 2019). To obtain normal distribution of the firm-level variables, we log transformed them. As reference points of executives may also be affected by framing effects of the industrial environment, we controlled for industry effects by using nine dummy variables.

We further controlled for gender, personal willingness to take risks, family ownership, influence by other family members, and job position. Willingness to take risks has been found to vary across gender, suggesting that women are less willing to take risks than men (e.g., Charness & Gneezy, 2012). We controlled for personal willingness to take risks by asking respondents to rate themselves regarding their risk attitudes for three specific domains of life (financial matters, career, and health) on a 10-point scale ranging from 0 (“not at all prepared to take risk”) to 10 (“very much prepared to take risk”) (Dohmen et al., 2011). Cronbach’s alpha of this three-item measure was 0.76. To account for the job position of the respondents, we used four dummy variables indicating if respondents serve as CEO (31%), a member of the top management team (28%), chairman of the supervisory board (23%), or member of the supervisory board (6%). Furthermore, we accounted for family ownership with a measure of the logarithm percentage of company stock held by the family manager as the level of ownership is indicative of a family manager’s personal stake in the welfare of the firm. Our approach is consistent with common criteria in the family business literature (van Essen et al., 2015; Zahra, 2005). We also considered if other family members, who are actively involved in the family firm, affect the reference point setting of the respondents. To control for this effect, we asked the respondents if other family members are actively involved in the family firm. To obtain normal distribution, this variable was log transformed.

4 Analysis and results

The zero-order correlations, means, and standard deviations of the sample for all manager groups are shown in Table 2.

4.1 Pre-Tests

Prior to running our analyses, we conducted several pre-tests. As late respondents tend to be more similar to non-respondents than early respondents (Chrisman et al., 2004; Zellweger et al., 2012), we compared the data from early and late respondents with an analysis of variance. No statistically significant differences were found in either sample, which at least partially reduces non-response bias concerns. Furthermore, we performed a Harman single-factor test to identify possible common method bias (Heyden et al., 2017). 15 factors with eigenvalues > 1.0 emerged, in total accounting for 73.61% of the variance. As the first factor (12.76%) does not explain the majority of variance, we can alleviate concerns of common method bias (Podsakoff et al., 2012).

To rule out that the non-findings in our regression analysis could be an artifact of insufficient statistical power, we conducted an a priory power analysis (Faul et al., 2009) to establish the required sample size with the following conservative assumptions of small effect sizes (0.02), a high statistical power level of 0.95, and an alpha of 0.05. Based on Table 6, we used 19 independent variables (counting moderators and interactions effects). The resulting minimum sample size was 217, which we far exceed with 1,254 in Table 6, which is the smaller of our two sample sizes for the regression analysis. Accordingly, we assume that statistical power is not a significant concern in our analysis.

In a last step, we conducted a binomial test (Siegel and Castellan, Jr. 1956) to check whether the findings of our experimental study generally reflect the results of Baucells et al. (2011) and whether price volatility has a significant effect on reference points alongside the purchase price, the current price, and the average price. Table 3 shows the results of this test. To interpret Table 3, consider the pair of sequence 1 and 2 in Table 1. The reference point in column “All” is RP1 = 243.94 for sequence 1 and RP2 = 200.63 for sequence 2. These sequences only vary in their purchase price (i.e., same current price (200), same average price (200), same lowest (150), and highest price (250)), which is higher in sequence 1 (250 vs. 150). To measure the effect that every unit increase in the purchase price has on the reference point, we divided the differences into reference points, RP1 – RP2 = 43.31, by the difference of 100 in the purchase price (Baucells et al., 2011). These unit effects for each factor and pair are the data for the binomial test. This test is of goodness-of-fit type which matches the 22 reference points pairs to check if differences are significant. The reference point pair for sequence 1 and sequence 2 are matched as follows: “subject 1 sequence 1” vs. “subject 1 sequence 2”, “subject 2 sequence 1” vs. “subject 2 sequence 2”, etc. Following Baucells et al. (2011), we allocate the number 1 to each individual, if the reference point for sequence 1 goes beyond the reference point for sequence 2, the number 0 if the reference point for sequence 2 goes beyond the one for sequence 1, and excise the cases where both reference points are equal. Then, we tested if number 1 appears more often than expected under the hypothesis that zero and one are equally likely. The column “All” of the binomial test supports the findings of Baucells et al. (2011) and provides initial evidence that price volatility has a significant effect on the reference point alongside the predictors of purchase price, current price, and average price.

4.2 Hypothesis test

To test our hypotheses, we used a pooled OLS regression model, which allowed us to cluster error terms by participants to control for within subject effects (White, 1980). To alleviate concerns of multicollinearity, we generated variance inflation factors. As these did not exceed 1.71, multicollinearity does not appear to be a concern (Baum & Christopher, 2006).

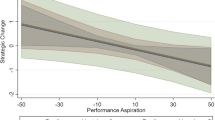

In a first step as shown in Table 4, we entered the control variables in Model 1 and added the independent variables in Model 2. Model 2 shows that the purchase price (β = 0.064, p < 0.001), the current price (β = 0.027, p < 0.001), and price volatility (β = 0.020, p < 0.001) are positively and significantly related to the reference point. The average price is not significantly related to the dependent variable. The adjusted R2 of Model 2 equals 0.186, which is comparable to other regression models of comparable experimental settings (Mayer & Davis, 1999; Smith et al., 1990). While these findings offer support for the laboratory experiment of Baucells et al. (2011), they extend this research by demonstrating that greater price volatility leads to higher reference points. Hence, Hypothesis 1 was supported.

We did not find significant differences among the three groups of managers for the purchase price, current price, and average price. However, we observed significant differences for price volatility. The average price volatility score for pair of sequence 1 and 2 and the comparison between the three types of managers of price volatility are displayed in Table 5. The average answers to the price-related information price volatility were 28.08 (pair 1) / 42.50 (pair 2) for family managers; 26.95 / 43.91 for nonfamily managers in FFs, and 61.33 / 99.26 for managers in NFFs. The unit effect for pair 1 is 33.25 higher for managers of NFFs relative to family managers (61.33 – 28.08), and 34.38 higher than for nonfamily managers in FFs (61.33 – 26.95). For pair 2, the unit effect of NFF managers is 56.76 higher than for family managers (99.26 – 42.50) and 55.36 higher than for nonfamily managers in FFs (99.26 – 43.91).

The independent t-test between the three groups of managers showed significant differences in the groups of family managers versus NFF managers (pair 1: F = 0.485, p = 0.050; pair 2: F = 8.502; p = 0.016), nonfamily managers in FFs versus managers in NFFs (pair 1: F = 3.235; p = 0.050; pair 2: F = 1.366; p = 0.022), and family managers & nonfamily managers in FFs versus NFF managers (pair 1: F = 1.326; p = 0.041; pair 2: F = 6.916; p = 0.011). Thus, volatile price sequences lead to lower unit effects for family managers as well as nonfamily managers in FFs, relative to NFF managers.

Overall, the reference point of NFF managers is higher than the reference point of nonfamily managers in FFs and family managers. Although no significant differences were found for purchase price, current price, and average price, support for Hypothesis 2a was found for price volatility. In contrast, Hypothesis 2b was not supported; no significant differences were found between family and nonfamily managers from family firms.

4.3 Post-hoc analysis

To explore the family business context as a decision frame for reference points in more detail, we conducted a post-hoc analysis with a subsample of family managers. Among the group of managers which we investigated in our study, family managers stand out because they are both financially tied to their family’s business, and their identity is personally tied to that of the business (Kelleci et al., 2019; Koropp et al., 2013). We assume that the intensity of this involvement will uniquely shape their reference points because it leads them to consider how investment opportunities will affect their financial wealth as well as their SEW (Alessandri et al., 2018; Gomez‐Mejia et al., 2010; Gomez-Mejia et al., 2019). We captured the involvement of family managers by the level of family ownership, i.e., the logarithm percentage of company ownership held by the family in the business. We tested if family ownership interacted with the four predictors applied in our OLS regression (i.e., purchase price, current price, average price, and price volatility) to influence the levels of the reference point. The results of the corresponding regression analyses are displayed in Table 6.

We find that three of the four interaction terms are positively and significantly related to the dependent variable. To interpret these interactions, we plotted the results in Fig. 1, 2, and 3 (Aiken et al., 1991). Figure 1 suggests that as family ownership increases, the purchase price has a stronger, more positive influence on a family manager’s reference point. Similarly, Fig. 2 suggests that a high current price leads to a significantly higher reference point for family managers in family firms with greater, versus lesser, family ownership. Figure 3 suggests that price volatility increases a family manager’s reference point only when family ownership is high.

5 Discussion

The findings of our study contribute to research on family businesses and prospect theory in several ways. First, we provide nuance to prospect theory by investigating how systematic differences in reference points can be traced back to the organizational framing of investment decisions (Ganegoda & Folger, 2015; Riley et al., 2020), thus supporting a contingency perspective on individual reference points (Kotlar et al., 2014a). Although Kahneman and Tversky (1981) mentioned the possible impact of decision frames on an individual’s risk-return considerations, very few studies have investigated how context-related factors shape investment decisions via reference point formation at an individual-level (e.g., Das & Teng, 2001; Kotlar et al., 2014a). Indeed, given that contextual determinants are very challenging to consider in experimental studies, they are often ignored (Fisher, 2021; Lude & Prügl, 2021; Mellers et al., 1997; Weber & Milliman, 1997). Using the family business context as a decision-frame, our study reveals that managers from family firms have lower reference points than managers from nonfamily firms. Our study therefore adds insight into why the investment decisions of family and nonfamily firms tend to vary: they react to risk, captured via price volatility, differently. Given that managers from nonfamily firms were found to have a higher reference point, our results offer support for the contention that managers of nonfamily firms prefer short-term gains and are subject to greater myopic loss aversion than managers of family firms. It appears that greater price volatility prompts managers of nonfamily firms to set a higher reference point for investment decisions as a means of coping with increased uncertainty. In contrast, because SEW plays an important role in family firms, the prospect of economic and socioemotional gains may make managers in the family business context more resilient to myopic loss aversion (Alessandri et al., 2018). That is, because family firms, relative to nonfamily firms, are more patient with their investments (Alessandri et al., 2018; Gomez‐Mejia et al., 2010; Patel & Chrisman, 2014), their managers may be more tolerant of potential losses associated with price volatility. Accordingly, our findings emphasize that the same type of investment information can be perceived differently depending on the organizational context of the manager, thus providing new insight into why the investments of family and nonfamily firms tend to vary.

However, the results of our study did not support our assumptions concerning differences between family and nonfamily managers within family firms. That is, we did not find significant differences in the reference points of family managers and nonfamily managers in family firms. This is surprising given previous research that has long argued that nonfamily managers offer family firms a less emotional and more objective viewpoint (e.g., Fang et al., 2021; Stanley, 2010). These unexpected findings lead us to propose two possible explanations, which we hope inspire future research. First, both family and nonfamily managers alike may be influenced by the family business context, leading them to adapt their investment behaviors to the goals of the business-owning family. An important question for future research is whether these similarities in investment behaviors emerge and evolve as nonfamily managers gradually integrate in the firm or whether these similarities exist from the beginning of the employment relationship, i.e., nonfamily managers are hired for their shared values with the business-owning family (Hauswald et al., 2016). Future studies could investigate the socialization process of nonfamily managers in family firms to explore how and when they align their decision making with the investment preferences of the business-owning family. This would provide important insight on whether nonfamily managers genuinely share the same investment preferences of the business-owning family or whether they adapt their personal preferences to align with those of the business-owning family.

Second, the reference points of family and nonfamily managers from family firms may have failed to significantly differ because of the investment scenario of our experiment, which centered on the survival of the firm. Whereas our experiment prompted managers to consider an important investment decision essential to the survival of the firm, a less critical scenario might have revealed reference point differences within the family business context. For example, while family firms tend to pursue riskier investments when suffering from poor performance, they tend to be risk averse when their performance is strong (Alessandri et al., 2018; Gomez‐Mejia et al., 2010; Kotlar et al., 2014a). Yet, it is not known how family versus nonfamily managers from family firms respond to these performance scenarios. Perhaps the reference points of family and nonfamily managers differ when the investments of the family firm are less critical. Future research should therefore extend our study by exploring how the performance of the family firm affects family and nonfamily managers’ reference points.

Indeed, the results of our post-hoc analysis on family ownership indicate that greater heterogeneity exists in the reference points of managers from family firms. Specifically, we found that the level of family ownership affects how pricing information influences the reference points of family managers. For family managers in firms with high family ownership, greater purchase price, current price, and price volatility significantly increased their reference point, relative to those in firms with lower family ownership. This suggests that greater family ownership leads family managers to set higher reference points, and thus desire higher returns, when an investment is reflecting high volatility and pricing information. By demonstrating how family ownership shapes the reference points of family managers, our study offers insight on why the investments of family firms vary, with some appearing risk seeking while others being more risk averse. Future research should build on our analyses by exploring how other sources of family firm heterogeneity, such as changes in family ownership, generation in control, and family versus nonfamily CEO, affect the reference points of family and nonfamily managers. Another opportunity for future researchers would be to differentiate between investments the firm makes versus investments the business-owning family initiates. One might assume that reference points in investment decisions on the family side are strongly influenced by the SEW considerations of the family. Thus, depending on the level of SEW, reference points for family investments might be higher or lower compared to those on the business side, thereby explaining heterogeneity among family firms.

Finally, as our study focuses on a realistic scenario, with real-life decision-makers from existing businesses, our research enhances a crucial element of experimental design research aimed at studying reference points and the implications of prospect theory (Baillon et al., 2020; Baucells et al., 2011; Lude & Prügl, 2019; Riley et al., 2020; Weingarten et al., 2019). By exploring the micro level of individual decision making and using a choice-based experiment with managers (e.g., Lude & Prügl, 2019; Mensching et al., 2016), our study provides a more accurate picture of contingency effects in the relationship between pricing information and reference points. Additionally, by studying actual managers from family and nonfamily firms, we were able to showcase how the organizational context can be an important factor to consider in experimental studies; something that would be difficult to discern with a student sample. We hope our study’s design inspires additional experimental studies on family and nonfamily firm managers, and specifically, their decision-making processes.

6 Limitations and future research

As with any experimental or empirical analysis, our study is not without limitations. First, although showing good internal validity, the most important question facing experimental economists is whether, and to what extent, behavior in experimental settings is a good indicator of behavior in the field. Experimental environments inherently differ from naturally occurring environments on various dimensions: Subjects have awareness of being under scrutiny, decisions and final allocations receive special attention in the process, stakes are typically minimal or absent, and participants self-select. However, as aptly articulated by List and Levitt (2005, p. 29f.), “experiments can provide a crucial first understanding of treatment effects that can happen, and they usefully provide an underlying mechanism that might be at work when certain data patterns are observed.” Furthermore, tentative evidence suggests that results from experiments hold informative value regarding real-world behavior (Englmaier & Gebhardt, 2016; Franzen & Pointner, 2013). Nevertheless, to strengthen external validity, important results derived from ‘the lab’ should be scrutinized in realistic settings. For example, future researchers might identify managers who have recently made an investment decision and conduct a subsequent diary study in which these managers are repeatedly asked about the value trajectory of their investment, their satisfaction with it, and the desired future value development.

Second, the potential for non-response bias and common method bias may exist given our low response rate and the single respondents in our sample. While our final response rate of 5.14% is admittedly low, this is well in line with similar studies on family firms (e.g., Zellweger et al., 2012) and reference points (e.g., Arkes et al., 2008). Moreover, given our requirement that respondents needed to be top managers in their respective firms and were asked to perform an experiment, a low response rate does not come as a surprise. However, because we conducted an experiment (and did not ask about real life situations), the low response rate should not impact our results. Most important in experimental studies is the effective number of respondents. Furthermore, along with the results of our pre-test, the results of the univariate and multivariate analyses corroborate the results of Baucells et al. (2011), thereby providing evidence of the reliability and validity of our findings.

Third, we anchored the decisions in our quasi-experiment to an investment situation that would be important to the survival of the firm. To prime our participants, we provided examples of important investment decisions without narrowing down or restricting the specific situation. This approach may have introduced a bias into our study as different investment decisions, such as investing in internally developed innovation versus acquiring innovation, could lead to or result in different emotional attachments for the decision-maker. Future studies can build on our experiment by varying decision situations, such as R&D decisions, acquisitions, or asset investments, to test how the general differences in reference points we detected apply to different types of investment scenarios, further advancing our knowledge about the heterogeneity of family firms and individual reference points of managers in the family and nonfamily firm context.

Fourth, given the plethora of possible reference points decision-makers may form, our study does not claim to be exhaustive. We therefore encourage future scholars to extend our findings to other operationalizations of reference points beyond price levels. Future research may benefit from collecting more individual-level data on the decision-makers, such as personality traits or motivational states to further explore the contingency of reference points and to test our model with alternate conceptualizations of reference points. Another useful extension of our study would be to investigate informational conditions for the formation of reference points, for instance, expectation and aspiration levels.

7 Conclusion

We aimed to contribute to research on the role of economic theories for family businesses by showing that the investments of family and nonfamily firms tend to vary due to differences in the reference points of their managers. Guided by prospect theory, we explored how family and nonfamily managers make investment decisions under conditions of uncertainty and how the organizational context affects decision frames. We tested our hypotheses using an experiment with actual managers from family and nonfamily firms, thus offering unique insight into multiple relevant reference point settings in multiple time series. Our findings revealed the importance of price volatility to reference points and how the family firm context uniquely shapes the investment decisions of their managers. As such, we show how incorporating price volatility and the framing effect of the decision context can lead to more accurate predictions of managers’ reference points and the investment decisions of family and nonfamily firms.

Notes

Socioemotional wealth (SEW) refers to the family’s affective endowment in the firm which includes benefits associated with family control, identification with the firm, and intentions for transgenerational succession (Berrone et al., 2012).

References

Aiken, L. S., West, S. G., & Reno, R. R. (1991). Multiple regression: Testing and interpreting interactions. Newbury Park: SAGE.

Alessandri, T. M., Mammen, J., & Eddleston, K. (2018). Managerial incentives, myopic loss aversion, and firm risk: A comparison of family and non-family firms. Journal of Business Research, 91, 19–27. https://doi.org/10.1016/j.jbusres.2018.05.030

Ali, A., Chen, T.-Y., & Radhakrishnan, S. (2007). Corporate disclosures by family firms. Journal of Accounting and Economics, 44, 238–286. https://doi.org/10.1016/j.jacceco.2007.01.006

Allen, E. J., Dechow, P. M., Pope, D. G., & Wu, G. (2017). Reference-dependent preferences: Evidence from marathon runners. Management Science, 63, 1657–1672. https://doi.org/10.1287/mnsc.2015.2417

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58, 1301–1328. https://doi.org/10.1111/1540-6261.00567

André, K., Cho, C. H., & Laine, M. (2018). Reference points for measuring social performance: Case study of a social business venture. Journal of Business Venturing, 33, 660–678. https://doi.org/10.1016/j.jbusvent.2017.12.002

Arkes, H. R., Hirshleifer, D., Jiang, D., & Lim, S. (2008). Reference point adaptation: Tests in the domain of security trading. Organizational Behavior and Human Decision Processes, 105, 67–81. https://doi.org/10.1016/j.obhdp.2007.04.005

Arkes, H. R., Hirshleifer, D., Jiang, D., & Lim, S. S. (2010). A cross-cultural study of reference point adaptation: Evidence from China, Korea, and the US. Organizational Behavior and Human Decision Processes, 112, 99–111. https://doi.org/10.1016/j.obhdp.2010.02.002

Arregle, J.-L., Hitt, M. A., Sirmon, D. G., & Very, P. (2007). The development of organizational social capital: Attributes of family firms. Journal of Management Studies, 44, 73–95. https://doi.org/10.1111/j.1467-6486.2007.00665.x

Atasoy, Ö., Trudel, R., Noseworthy, T. J., & Kaufmann, P. J. (2022). Tangibility bias in investment risk judgments. Organizational Behavior and Human Decision Processes, 171, 104150. https://doi.org/10.1016/j.obhdp.2022.104150

Baillon, A., Bleichrodt, H., & Spinu, V. (2020). Searching for the reference point. Management Science, 66, 93–112. https://doi.org/10.1287/mnsc.2018.3224

Baker, M., Pan, X., & Wurgler, J. (2012). The effect of reference point prices on mergers and acquisitions. Journal of Financial Economics, 106, 49–71. https://doi.org/10.1016/j.jfineco.2012.04.010

Barbosa, S. D., Fayolle, A., & Smith, B. R. (2019). Biased and overconfident, unbiased but going for it: How framing and anchoring affect the decision to start a new venture. Journal of Business Venturing, 34, 528–557. https://doi.org/10.1016/j.jbusvent.2018.12.006

Bartling, B., Brandes, L., & Schunk, D. (2015). Expectations as reference points: Field evidence from professional soccer. Management Science, 61, 2646–2661. https://doi.org/10.1287/mnsc.2014.2048

Baucells, M., Weber, M., & Welfens, F. (2011). Reference-point formation and updating. Management Science, 57, 506–519. https://doi.org/10.1287/mnsc.1100.1286

Baum, C. F., & Christopher, F. (2006). An introduction to modern econometrics using Stata. Stata Press.

Benartzi, S., & Thaler, R. H. (1995). Myopic loss aversion and the equity premium puzzle. The Quarterly Journal of Economics, 110, 73–92. https://doi.org/10.2307/2118511

Berrone, P., Cruz, C. C., & Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25, 258–279. https://doi.org/10.1177/0894486511435355

Bianco, M., Bontempi, M. E., Golinelli, R., & Parigi, G. (2013). Family firms’ investments, uncertainty and opacity. Small Business Economics, 40, 1035–1058. https://doi.org/10.1007/s11187-012-9414-3

Blair, S. (2020). How lacking control drives fluency effects in evaluative judgment. Organizational Behavior and Human Decision Processes, 156, 97–112. https://doi.org/10.1016/j.obhdp.2019.11.003

Block, J. H. (2011). How to pay nonfamily managers in large family firms: A principal—agent model. Family Business Review, 24, 9–27. https://doi.org/10.1177/0894486510394359

Carney, M. (2005). Corporate governance and competitive advantage in family–controlled firms. Entrepreneurship: Theory & Practice, 29, 249–265. doi:https://doi.org/10.1111/j.1540-6520.2005.00081.x.

Charness, G., & Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83, 50–58. https://doi.org/10.1016/j.jebo.2011.06.007

Chrisman, J. J., Chua, J. H., & Litz, R. A. (2004). Comparing the agency costs of family and non‐family firms: Conceptual issues and exploratory evidence. Entrepreneurship: Theory & Practice, 28, 335–354. doi:https://doi.org/10.1111/j.1540-6520.2004.00049.x.

Chrisman, J. J., Chua, J. H., Pearson, A. W., & Barnett, T. (2012). Family involvement, family influence, and family–centered non–economic goals in small firms. Entrepreneurship: Theory & Practice, 36, 267–293. doi:https://doi.org/10.1111/j.1540-6520.2010.00407.x.

Chrisman, J. J., & Patel, P. C. (2012). Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. The Academy of Management Journal, 55, 976–997. https://doi.org/10.5465/amj.2011.0211

Cole, M. S., & Bruch, H. (2006). Organizational identity strength, identification, and commitment and their relationships to turnover intention: Does organizational hierarchy matter? Journal of Organizational Behavior, 27, 585–605. https://doi.org/10.1002/job.378

Cornelissen, J. P., & Werner, M. D. (2014). Putting framing in perspective: A review of framing and frame analysis across the management and organizational literature. The Academy of Management Annals, 8, 181–235. https://doi.org/10.5465/19416520.2014.875669

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm (Vol. 4). Englewood Cliffs, NJ.

Das, T. K., & Teng, B.-S. (2001). Strategic risk behaviour and its temporalities: Between risk propensity and decision context. Journal of Management Studies, 38, 515–534. https://doi.org/10.1111/1467-6486.00247

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9, 522–550. https://doi.org/10.1111/j.1542-4774.2011.01015.x

Duclos, R. (2015). The psychology of investment behavior: (De) biasing financial decision-making one graph at a time. Journal of Consumer Psychology, 25, 317–325. https://doi.org/10.1016/j.jcps.2014.11.005

Duxbury, D., & Summers, B. (2018). On perceptions of financial volatility in price sequences. The European Journal of Finance, 24, 521–543. https://doi.org/10.1080/1351847X.2017.1282882

Eberlein, E., Kallsen, J., & Kristen, J. (2003). Risk management based on stochastic volatility. Journal of Risk, 5(2), 19–44.

Eddleston, K. A., Kellermanns, F. W., & Sarathy, R. (2008). Resource configuration in family firms: Linking resources, strategic planning and technological opportunities to performance. Journal of Management Studies, 45, 26–50. https://doi.org/10.1111/j.1467-6486.2007.00717.x

Englmaier, F., & Gebhardt, G. (2016). Social dilemmas in the laboratory and in the field. Journal of Economic Behavior & Organization, 128, 85–96. https://doi.org/10.1016/j.jebo.2016.03.006

Erickson, D., Hewitt, M., & Maines, L. A. (2017). Do investors perceive low risk when earnings are smooth relative to the volatility of operating cash flows? Discerning opportunity and incentive to report smooth earnings. The Accounting Review, 92, 137–154. https://doi.org/10.2308/accr-51568

Fang, H. C., Memili, E., Chrisman, J. J., & Tang, L. (2021). Narrow-framing and risk preferences in family and non-family firms. Journal of Management Studies, 58, 201–235. https://doi.org/10.1111/joms.12671

Faul, F., Erdfelder, E., Buchner, A., & Lang, A.-G. (2009). Statistical power analyses using G* Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods, 41, 1149–1160. https://doi.org/10.3758/BRM.41.4.1149

Fiegenbaum, A., Hart, S., & Schendel, D. (1996). Strategic reference point theory. Strategic Management Journal, 17, 219–235. https://doi.org/10.1002/(SICI)1097-0266(199603)17:3/3C219:AID-SMJ806/3E3.0.CO;2-N

Fisher, G. (2021). A multiattribute attentional drift diffusion model. Organizational Behavior and Human Decision Processes, 165, 167–182. https://doi.org/10.1016/j.obhdp.2021.04.004

Franzen, A., & Pointner, S. (2013). The external validity of giving in the dictator game: A field experiment using the misdirected letter technique. Experimental Economics, 16, 155–169. https://doi.org/10.1007/s10683-012-9337-5

Ganegoda, D. B., & Folger, R. (2015). Framing effects in justice perceptions: Prospect theory and counterfactuals. Organizational Behavior and Human Decision Processes, 126, 27–36. https://doi.org/10.1016/j.obhdp.2014.10.002

Goldenstein, J., Hunoldt, M., & Oertel, S. (2019). How optimal distinctiveness affects new ventures’ failure risk: A contingency perspective. Journal of Business Venturing, 34, 477–495. https://doi.org/10.1016/j.jbusvent.2019.01.004

Gómez-Meija, L. R., Cruz, C. C., Berrone, P., & de Castro, J. (2011). The bind that ties: Socioemotional wealth preservation in family firms. The Academy of Management Annals, 5, 653–707. https://doi.org/10.1080/19416520.2011.593320

Gomez-Mejia, L. R., Neacsu, I., & Martin, G. (2019). CEO risk-taking and socioemotional wealth: The behavioral agency model, family control, and CEO option wealth. Journal of Management, 45, 1713–1738. https://doi.org/10.1177/0149206317723711

Gomez-Mejia, L. R., Makri, M., & Kintana, M. L. (2010). Diversification decisions in family-controlled firms. Journal of Management Studies, 47, 223–252. https://doi.org/10.1111/j.1467-6486.2009.00889.x

Gómez-Mejía, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J. L., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52, 106–137. https://doi.org/10.2189/asqu.52.1.106

Gonzalez, C., & Mehlhorn, K. (2016). Framing from experience: Cognitive processes and predictions of risky choice. Cognitive Science, 40, 1163–1191. https://doi.org/10.1111/cogs.12268

Hack, A., & von Bieberstein, F. (2015). How expectations affect reference point formation: An experimental investigation. Review of Managerial Science, 9, 33–59. https://doi.org/10.1007/s11846-014-0121-0

Hauswald, H., Hack, A., Kellermanns, F. W., & Patzelt, H. (2016). Attracting new talent to family firms: Who is attracted and under what conditions? Entrepreneurship: Theory & Practice, 40, 963–989. doi:https://doi.org/10.1111/etap.12153.

Heath, C., Larrick, R. P., & Wu, G. (1999). Goals as reference points. Cognitive Psychology, 38, 79–109. https://doi.org/10.1006/cogp.1998.0708

Heyden, M. L. M., Fourné, S. P. L., Koene, B. A. S., Werkman, R., & Ansari, S. (2017). Rethinking ‘top-down’and ‘bottom-up’roles of top and middle managers in organizational change: Implications for employee support. Journal of Management Studies, 54(7), 961–985.

Holmes, R. M., Jr., Bromiley, P., Devers, C. E., Holcomb, T. R., & McGuire, J. B. (2011). Management theory applications of prospect theory: Accomplishments, challenges, and opportunities. Journal of Management, 37, 1069–1107. https://doi.org/10.1177/0149206310394863

Huybrechts, J., Voordeckers, W., & Lybaert, N. (2013). Entrepreneurial risk taking of private family firms: The influence of a nonfamily CEO and the moderating effect of CEO tenure. Family Business Review, 26, 161–179. https://doi.org/10.1177/0894486512469252

James, A. E., Jennings, J. E., & Jennings, P. D. (2017). Is it better to govern managers via agency or stewardship? Examining asymmetries by family versus nonfamily affiliation. Family Business Review, 30, 262–283. https://doi.org/10.1177/0894486517717532

Jaskiewicz, P., Combs, J. G., & Ketchen, D. J., Jr. (2019). Moving toward a generalizable theory of business-owning families’ reference point shifts by embracing family differences. Academy of Management Review, 44, 916–918. https://doi.org/10.5465/amr.2018.0365

Josefy, M., Kuban, S., Ireland, R. D., & Hitt, M. A. (2015). All things great and small: Organizational size, boundaries of the firm, and a changing environment. Academy of Management Annals, 9, 715–802. https://doi.org/10.5465/19416520.2015.1027086

Kahneman, D. (2003). Maps of bounded rationality: Psychology for behavioral economics. The American Economic Review, 93, 1449–1475. https://doi.org/10.1257/000282803322655392

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Kahneman, D., & Tversky, A. (1981). The simulation heuristic. Stanford Univ CA Dept of Psychology.

Kahneman, D., Wakker, P. P., & Sarin, R. (1997). Back to Bentham? Explorations of experienced utility. The Quarterly Journal of Economics, 112, 375–406. https://doi.org/10.1162/003355397555235

Kelleci, R., Lambrechts, F., Voordeckers, W., & Huybrechts, J. (2019). CEO personality: A different perspective on the nonfamily versus family CEO debate. Family Business Review, 32, 31–57. https://doi.org/10.1177/0894486518811222

Kellermanns, F. W., & Eddleston, K. A. (2007). A family perspective on when conflict benefits family firm performance. Journal of Business Research, 60, 1048–1057. https://doi.org/10.1016/j.jbusres.2006.12.018

Kempers, M., Leitterstorf, M. P., & Kammerlander, N. (2019). Risk behavior of family firms: A literature review, framework, and research agenda. The Palgrave handbook of heterogeneity among family firms, 431–460. doi:https://doi.org/10.1007/978-3-319-77676-7_16.

Koropp, C., Grichnik, D., & Kellermanns, F. W. (2013). Financial attitudes in family firms: The moderating role of family commitment. Journal of Small Business Management, 51, 114–137. https://doi.org/10.1111/j.1540-627X.2012.00380.x

Kotlar, J., DeMassis, A., Fang, H., & Frattini, F. (2014a). Strategic reference points in family firms. Small Business Economics, 43, 597–619. https://doi.org/10.1007/s11187-014-9556-6

Kotlar, J., Fang, H., DeMassis, A., & Frattini, F. (2014b). Profitability goals, control goals, and the R & D investment decisions of family and nonfamily firms. Journal of Product Innovation Management, 31, 1128–1145. https://doi.org/10.1111/jpim.12165

Le Breton–Miller, I., & Miller, D. (2006). Why do some family businesses out–compete? Governance, long–term orientations, and sustainable capability. Entrepreneurship: Theory & Practice, 30, 731–746. doi:https://doi.org/10.1111/j.1540-6520.2006.00147.x.

Lefebvre, M., & Vieider, F. M. (2014). Risk taking of executives under different incentive contracts: Experimental evidence. Journal of Economic Behavior & Organization, 97, 27–36.

List, J. A., & Levitt, S. D. (2005). What do laboratory experiments tell us about the real world. NBER working paper, 14–20.

Lude, M., & Prügl, R. (2019). Risky decisions and the family firm bias: An experimental study based on prospect theory. Entrepreneurship: Theory & Practice, 43, 386–408. doi:https://doi.org/10.1177/1042258718796078.

Lude, M., & Prügl, R. (2021). Experimental studies in family business research. Journal of Family Business Strategy, 12, 100361. https://doi.org/10.1016/j.jfbs.2020.100361

Lumpkin, G. T., & Brigham, K. H. (2011). Long–term orientation and intertemporal choice in family firms. Entrepreneurship: Theory & Practice, 35, 1149–1169. doi:https://doi.org/10.1111/j.1540-6520.2011.00495.x.

Mayer, R. C., & Davis, J. H. (1999). The effect of the performance appraisal system on trust for management: A field quasi-experiment. Journal of Applied Psychology, 84, 123–136. https://doi.org/10.1037/0021-9010.84.1.123

Mellers, B. A., Schwartz, A., Ho, K., & Ritov, I. (1997). Decision affect theory: Emotional reactions to the outcomes of risky options. Psychological Science, 8, 423–429. https://doi.org/10.1111/j.1467-9280.1997.tb00455.x

Meng, J., & Weng, X. (2018). Can prospect theory explain the disposition effect? A new perspective on reference points. Management Science, 64, 3331–3351. https://doi.org/10.1287/mnsc.2016.2711

Mensching, H., Calabrò, A., Eggers, F., & Kraus, S. (2016). Internationalisation of family and non-family firms: A conjoint experiment among CEOs. European Journal of International Management, 10, 581–604. https://doi.org/10.1504/EJIM.2016.078795

Merkle, C. (2018). The curious case of negative volatility. Journal of Financial Markets, 40, 92–108. https://doi.org/10.1016/j.finmar.2017.11.001

Mitchell, R. K., Morse, E. A., & Sharma, P. (2003). The transacting cognitions of nonfamily employees in the family businesses setting. Journal of Business Venturing, 18, 533–551. https://doi.org/10.1016/S0883-9026(03)00059-4

Morris, M. H., Allen, J. A., Kuratko, D. F., & Brannon, D. (2010). Experiencing family business creation: Differences between founders, nonfamily managers, and founders of nonfamily firms. Entrepreneurship: Theory & Practice, 34, 1057–1084. doi:https://doi.org/10.1111/j.1540-6520.2010.00413.x.

Mussweiler, T., & Schneller, K. (2003). “What goes up must come down” - How charts influence decisions to buy and sell stocks. The Journal of Behavioral Finance, 4, 121–130. https://doi.org/10.1207/S15427579JPFM0403_2

Nason, R., Mazzelli, A., & Carney, M. (2019). The ties that unbind: Socialization and business-owning family reference point shift. Academy of Management Review, 44, 846–870. https://doi.org/10.5465/amr.2017.0289

Patel, P. C., & Chrisman, J. J. (2014). Risk abatement as a strategy for R&D investments in family firms. Strategic Management Journal, 35, 617–627. https://doi.org/10.1002/smj.2119

Patton, A. J., & Sheppard, K. (2015). Good volatility, bad volatility: Signed jumps and the persistence of volatility. Review of Economics and Statistics, 97, 683–697. https://doi.org/10.1162/REST_a_00503

Podsakoff, P. M., MacKenzie, S. B., & Podsakoff, N. P. (2012). Sources of method bias in social science research and recommendations on how to control it. Annual Review of Psychology, 63, 539–569. https://doi.org/10.1146/annurev-psych-120710-100452

Powell, T. C., Lovallo, D., & Fox, C. R. (2011). Behavioral strategy. Strategic Management Journal, 32, 1369–1386. https://doi.org/10.1002/smj.968

Rau, S. B., Schneider-Siebke, V., & Günther, C. (2019). Family firm values explaining family firm heterogeneity. Family Business Review, 32, 195–215. https://doi.org/10.1177/0894486519846670

Riley, C., Summers, B., & Duxbury, D. (2020). Capital gains overhang with a dynamic reference point. Management Science, 66, 4726–4745. https://doi.org/10.1287/mnsc.2019.3404

Saqib, N. U., & Chan, E. Y. (2015). Time pressure reverses risk preferences. Organizational Behavior and Human Decision Processes, 130, 58–68. https://doi.org/10.1016/j.obhdp.2015.06.004

Scott, W. R. (2003). Institutional carriers: Reviewing modes of transporting ideas over time and space and considering their consequences. Industrial and Corporate Change, 12, 879–894. https://doi.org/10.1093/icc/12.4.879

Siegel, S., & Castellan, N. J., Jr. (1956). Nonparametric statistics for the behavioral sciences. McGraw-Hill.

Smith, K. G., Locke, E. A., & Barry, D. (1990). Goal setting, planning, and organizational performance: An experimental simulation. Organizational Behavior and Human Decision Processes, 46, 118–134. https://doi.org/10.1016/0749-5978(90)90025-5

Spranger, J. L., Colarelli, S. M., Dimotakis, N., Jacob, A. C., & Arvey, R. D. (2012). Effects of kin density within family-owned businesses. Organizational Behavior and Human Decision Processes, 119, 151–162. https://doi.org/10.1016/j.obhdp.2012.07.001

Stålnacke, O. (2019). Individual investors’ information use, subjective expectations, and portfolio risk and return. The European Journal of Finance, 25, 1351–1376. https://doi.org/10.1080/1351847X.2019.1592769

Stanley, L. J. (2010). Emotions and family business creation: An extension and implications. Entrepreneurship: Theory & Practice, 34, 1085–1092. doi:https://doi.org/10.1111/j.1540-6520.2010.00414.x.

Starbuck, W. H., & Milliken, F. J. (1988). Executives’ perceptual filters: What they notice and how they make sense. In Donald Hambrick (Ed.), The executive effect: Concepts and methods for studying top managers. (pp. 35–65). Greenwich: CT:JAI Press.

Swab, R. G., Sherlock, C., Markin, E., & Dibrell, C. (2020). “SEW” what do we know and where do we go? A review of socioemotional wealth and a way forward. Family Business Review, 33, 424–445. https://doi.org/10.1177/0894486520961938

Tabor, W., Chrisman, J. J., Madison, K., & Vardaman, J. M. (2018). Nonfamily members in family firms: A review and future research agenda. Family Business Review, 31, 54–79. https://doi.org/10.1177/0894486517734683

Tversky, A., & Kahneman, D. (1986). The framing of decisions and the evaluation of prospects. Studies in Logic and the Foundations of Mathematics, 114, 503–520.