Abstract

We study the impacts of immigration quotas and immigrant eligibility restrictions on destination countries’ early-stage entrepreneurial activity. Taking advantage of cross-country variation in immigration quotas and eligibility restrictions, we find that increases in the strictness of labor migration quotas and eligibility requirements are associated with significantly less early-stage entrepreneurship in the short run. Further, we find two important sources of heterogeneity that impact our results. First, these results are driven by a connection between quotas and early-stage necessity-driven entrepreneurship—our results lose significance when adding opportunity-driven entrepreneurship to the analysis. Second, the magnitude of the relationship between quotas and early-stage entrepreneurial activity is lower when analyzing female entrepreneurship. Overall, our results suggest that immigrants clearly influence entrepreneurship positively, but the overall welfare effects on the host country of marginal increases in entrepreneurial activity associated with a relaxation of labor market restrictions are more nuanced. At the same time, our results also suggest room for immigration policy to improve the welfare of immigrants and natives. Importantly, our estimates likely act as a lower bound given that we are not able to measure impacts in the long run. Because immigrants’ participation in the labor market is often delayed by labor market restrictions after entry, estimates of the impact of quotas and other restrictions that limit entry into the host country would likely yield more negative results given a longer time horizon.

Plain English Summary

Immigration quotas make new business creation more difficult: we study how immigration quotas affect entrepreneurship. We find that immigration quotas lower entrepreneurship, but only necessity-motivated entrepreneurship, or entrepreneurship because of a lack of other job opportunities. We argue that this is because immigrants with low levels of education are most impacted by immigration restrictions, and these are also the immigrants most likely to engage in necessity-motivated entrepreneurship or to impact others who are necessity-motivated entrepreneurs. We also find that immigration quotas impact male entrepreneurship more than female entrepreneurship. This means that quotas reduce entrepreneurship gender gaps, but only at the expense of discouraging entrepreneurship for both men and women. However, even though the economic impacts of necessity-motivated businesses are relatively low compared to other businesses, we caution against using these results to recommend an immigration policy that discourages immigrants with little education. Immigration by those with little education has a complex variety of long-term, often positive, impacts on the host country. More importantly, our study only considers the short-term effects of quotas on entrepreneurship. Because many immigrants are not allowed to work at first, restrictions that limit entry should reduce entrepreneurship more after this delay in immigrants’ labor market participation is considered.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Joseph Schumpeter famously positioned the entrepreneur as an instrument of economic growth, one who creatively destroys and transforms older and less efficient ways of doing things into innovative and efficient processes and products (Schumpeter, 1934). Since then, the connection between entrepreneurship and economic growth has been well established (Kirzner, 2009; Urbano et al., 2019; Wennekers & Thurik, 1999), and this important realization has been the justification for a broad line of research that looks at the determinants of entrepreneurial activity (Baumol & Strom, 2007; García, 2014; Nicolaou & Shane, 2010).

One characteristic that has consistently been linked to greater entrepreneurial tendencies in a variety of contexts is relatively free migration (Azoulay et al., 2022; Fairlie & Lofstrom, 2015; Levie, 2007). Besides the fact that immigrants are more likely than natives to open a business and become entrepreneurs in most countries surveyed around the world (Vandor & Franke, 2018), this strand of literature also demonstrates that immigration can provide strong positive externalities for native entrepreneurs (Hunt & Gauthier-Loiselle, 2010). However, while reforms easing the costs of starting a business across the globe indicate that policymakers have been heeding evidence on the important relationship between business creation and economic growth (Djankov, 2009), immigration restrictions still prevent a large portion of would-be immigrants from making their journeys (Clemens, 2011).

At the same time, literature on immigrant entrepreneurship calls to question the potential welfare effects of relaxed immigration control. Opportunity-driven, growth-oriented entrepreneurship that is often associated with economic growth is largely driven by highly educated, rather than low-educated, immigrants (Peroni et al., 2016; Shane, 2009). Thus, because host countries typically favor highly educated immigrants and are more likely to restrict the entry of immigrants with low education (Cerna, 2009; Cerna, 2014), the economic impact of decreases in the restrictiveness of immigration quotas on entrepreneurial activity and subsequent policy implications are potentially quite nuanced.

The high stakes involved in the relationships between immigration, entrepreneurship, and economic growth, coupled with a lack of theoretical clarity on the welfare effects of potential connections between immigration quotas and entrepreneurial activity, motivate the subject matter of this study—the relationship between immigration quotas, or quantitative restrictions on migration, and eligibility restrictions, or qualitative eligibility requirements for legal migration, on rates of new, early-stage business ownership in the host country.

We contribute to the literature on immigration and entrepreneurship, particularly on immigration quotas and entrepreneurial outcomes in the host country, in several important ways. First, we contribute by using cross-country variation in immigration quotas and eligibility restrictions to estimate their impacts on entrepreneurial outcomes in the host country. While some attention has been paid to this topic in the context of a single country (Mahuteau et al., 2014), to our knowledge, we are the first to tackle this specific question using a panel dataset, to be described below. In doing so, we can lend more external validity to single-country studies on immigration quotas and entrepreneurial outcomes.

We also differentiate our study from other studies on immigrant entrepreneurship in that we do not focus on immigrant entrepreneurship exclusively. Rather, we question whether immigration quotas are generally associated with entrepreneurship in the host country. We do this for a few reasons. First, since immigrants are consumers, it could be that legal immigration arising because of lower restrictions puts upward pressure on demand for goods and services, in turn motivating immigrants and natives alike to open businesses to satisfy this higher demand (Bedi & Wiseman, 2021). Second, in addition to direct increases in productivity, immigrants also may free up productive native resources to engage in more entrepreneurial activities, because immigrant labor often acts as a complement to native labor, not a substitute (Foged & Peri, 2016; Greenwood & Hunt, 1995).

Further, we build on current literature by dividing entrepreneurship rates according to motivation (e.g., opportunity-motivated businesses vs. necessity-motivated businesses), so we can disentangle the possible relationships between immigration quotas and early-stage business ownership rates according to entrepreneurial motive. While others have studied how the severity of immigration restrictions impacts the probability immigrants engage in entrepreneurship (Mahuteau et al., 2014), we add to the conversation by documenting which types of businesses are most impacted by changes in immigration restrictions. This is an important distinction, as the economic impact and policy implications of entrepreneurship can heavily depend on the motivations behind business formation (Block & Wagner, 2010; Shane, 2009).

Finally, we add to the ongoing conversation regarding immigrant entrepreneurship and immigration restrictions by disentangling the effects of quotas on entrepreneurship according to entrepreneurs’ gender. While a gender gap in entrepreneurship for immigrants has been documented (Azmat, 2013; Vaccarino et al., 2011), there still exists a dearth of literature on how contextual factors influence this gap (Brieger & Gielnik, 2021). By documenting how quotas impact female and male entrepreneurs differently, we shed light on how additional barriers to entrepreneurship may differentially impact women and men and widen or narrow the gender gap in immigrant entrepreneurship.

In short, although the existing literature does not lack studies examining the positive role that immigrants play in entrepreneurship (Hunt & Gauthier-Loiselle, 2010; Peroni et al., 2016; Vandor & Franke, 2018), the economic gains from reducing migration barriers (Clemens, 2011), or the importance of entrepreneurship (Kirzner, 2009; Urbano et al., 2019; Wennekers & Thurik, 1999), few have directly investigated the potential effects that immigration restrictions have on entrepreneurship. To our best knowledge, this is the very first attempt to examine this relation with cross-country panel data that distinguishes between different types of entrepreneurship according to motivation. We are also the first, to our knowledge, to look at how quotas may influence entrepreneurship gender gaps.

2 Background and hypothesis development

2.1 A primer on immigration restrictions

Immigration restrictions comprise a group of policies that are heterogeneous along multiple dimensions. This calls for a more targeted discussion of what we mean by quotas and eligibility restrictions.

First, immigration restrictions can be dichotomized conceptually according to when in the immigration process they restrict behavior. More specifically, immigration restrictions can prevent individuals from entering, in the case of external restrictions, or they can limit the behavior of immigrants after they enter the host country, in the case of internal restrictions. External restrictions can restrict the number of people allowed to enter, in the case of quantitative quotas, or the types of people allowed to enter and the conditions they need to fulfill in order to enter, in the case of eligibility restrictions. Often, these eligibility restrictions are based on education levels, with more highly educated immigrants generally receiving preference (DEMIG, 2015). On the other hand, internal restrictions define legal immigrant behavior after arrival. These restrictions can limit the security of an immigrant’s stay or the rights an immigrant is entitled to, including the right to vote or receive welfare. For the purposes of this paper, we are concerned with external restrictions, which impact who can enter, because we wish to study how quotas impact entrepreneurship and external restrictions more closely measure quantitative restrictions in the form of quotas than internal restrictions.

One can also differentiate between immigration restrictions based on the motivations of immigrants targeted by those restrictions. There are three broad reasons for immigrating: to participate in a foreign labor market, to reunite with family, or to flee persecution or natural disasters (including climate change)Footnote 1. Thus, external (and internal) immigration restrictions can be further subdivided into labor market restrictions that impact immigrants wishing to participate in the labor force, family reunion restrictions that impact immigrants wishing to reunite with family, and refugee/asylum restrictions that target people fleeing persecution or natural disaster (Helbling et al., 2017).

The two dimensions used to differentiate between different types of immigration restrictions lead to six possible combinations—labor migrant restrictions that can be external or internal, family reunification restrictions that can be external or internal, and refugee/asylum restrictions that can be external or internal. For the purposes of this paper, we focus our attention on external restrictions targeted toward labor market immigrants. The reason for this is two-fold. First, we expect labor market immigrants to impact entrepreneurship more than those migrating to reunite with family or to escape war or famine for theoretical reasons: labor market immigrants, by definition, are more likely to participate in the labor force upon arrival compared to other immigrants, and many of these people must have jobs lined up before they come into the host country, making their labor market impacts relatively immediate. Second, external restrictions on immigrants migrating for family reunions or to escape war or famine should have little impact on entrepreneurship in the short run, because internal restrictions often do the leg work by preventing these people from participating in the labor market even after they have come into the host country (Bjerre et al., 2016). On the other hand, labor market migrants are, by definition, allowed to work and experience fewer internal restrictions compared to other immigrants. While it is true in some settings that non-labor market migrants, especially refugees, are very likely to engage in self-employment and experience greater improvements in economic outcomes than even labor market immigrants (American Immigration Council, 2023; Cortes, 2004; New American Economy, 2017), this process takes time because of restrictions to labor market participation experienced by many refugees and family reunification immigrants (Helbling et al., 2017; Nepal & Ramón, 2022). So, in the context of external migration restrictions, we expect restrictions targeting labor market migrants to be most relevant for entrepreneurial outcomes in the short run. Because of the long-term entrepreneurial propensities of non-labor market immigrants, this time dimension is crucial to our argument. Given a longer time frame and a relaxation of internal constraints for refugees, we would expect refugee and family reunification quotas to have effects more similar to, or even greater than, those of labor market immigrant quotas.

None of this is to say that immigration policies are homogenous across countries. Indeed, external immigration restrictions differ widely from country to country, meaning that there is considerable variation across countries in exactly which types of immigrants are favored by quotas. For example, places like Canada and Australia have long been known to favor immigrants with high education (Donald, 2016), while the USA is famous for its liberal family reunification visa policy (Bedi, 2023). At the same time, cross-country studies on immigration restrictions indicate broad patterns, and immigrant-receiving countries across the world tend to both favor immigrants with high education and limit the labor market participation of refugees and family reunification immigrants in the short run (DEMIG, 2015; Helbling et al., 2017).

Thus, our focus is on external immigration restrictions that impact immigrants migrating for the express purpose of participating in the labor market.

2.2 Immigrant entrepreneurship

One of the driving justifications for studying the relationship between immigration quotas and entrepreneurship, aside from the importance of entrepreneurship for economic growth, is the fact that immigrants are indeed more likely to become entrepreneurs and open their own businesses than natives in most contexts studied. Not only are immigrants more likely than natives to become entrepreneurs in most countries (Vandor & Franke, 2018), but this phenomenon applies to immigrants on both sides of the education distribution (Kahn et al., 2017), meaning that both low-educated immigrants and high-educated immigrants are more likely than their native counterparts to work for themselves. However, the businesses low-educated entrepreneurs own are different from the businesses high-educated entrepreneurs own in that firms owned by highly educated entrepreneurs tend to have better performance and growth opportunities (Kolstad & Wiig, 2015; Van der Sluis et al., 2008). This is also true for immigrant entrepreneurs—research in the USA suggests that while highly educated immigrant entrepreneurs tend to run high-impact firms in the technology sector (Hart & Acs, 2011), immigrants with little education tend to run low-impact, low-tech firms with little growth opportunity and often are more financially rewarded when engaging in salaried or wage employment (Kerr & Kerr, 2020; Lofstrom, 2011). These findings are corroborated by research that finds that education is an important determinant of success and future growth for immigrant businesses in the context of other OECD countries that receive large numbers of immigrants, including Britain, Australia, and the Netherlands (Basu & Goswami, 1999; Beckers & Blumberg, 2013; Collins & Low, 2010).

These broad differences between different types of entrepreneurs have led to a rough typology of entrepreneurship whereby entrepreneurs can be grouped into two-course categories: necessity-motivated entrepreneurs and opportunity-motivated entrepreneurs. Necessity-motivated entrepreneurs, who are mostly low educated with low incomes, largely open up shop because of a lack of available opportunities in waged or salaried employment, whereas opportunity-motivated entrepreneurs, who are mostly highly educated with high incomes, open up shop to take advantage of arbitrage or business opportunities (Fairlie & Fossen, 2020). While an opportunity-motivated entrepreneur is best typified by a tech-based entrepreneur in Silicon Valley (Saxenian, 2005), a necessity-motivated entrepreneur is represented by immigrants who open up nail salons, gas stations, or restaurants (Bedi & Jia, 2022; Deakin, 1992).

Of course, these course typologies hide important nuances. For one, distinctions between necessity motivation and opportunity motivation are made based on subjective conceptions of what necessity and opportunity really mean. While research based on these distinctions defines necessity-motivated entrepreneurship as entrepreneurship undertaken because of no other good labor market options (Bosma & Kelly, 2019), different business owners within the same industry and with similar levels of performance may have different ideas about whether their businesses are necessity- or opportunity-motivated. And both of these course categories of entrepreneurs entail considerable amounts of variability—entrepreneurs need not be in tech-based industries to identify as being motivated by opportunity. Motivation is also not perfectly predicted by individual-level characteristics. It is true that education is a crucial proxy for entrepreneurial motivation, but highly educated immigrants often find themselves owning necessity-motivated enterprises because of labor market mismatches, meaning that these labor market mismatches are also crucial predictors of entrepreneurial motivation (OECD/European Union, 2015). Finally, these categories are fluid in that necessity-motivated entrepreneurs can become opportunity-motivated and grow their businesses given enough time. For example, Yoon (2010) finds that Korean entrepreneurs in Chicago transformed their businesses over time from low-impact businesses into capital-intensive, high-performing enterprises.

Despite these nuances, prior work shows differences in motivation, and other individual-level characteristics like education lead to average differences in performance and impact—research in Germany and the UK demonstrates that business owners who identify as opportunity-motivated outperform those who identify as necessity-motivated (Block & Wagner, 2010; Huggins et al., 2017). Further cross-country analysis indicates a number of consistent and robust determinants of entrepreneurial motivation (Nikolaev et al., 2018), suggesting that differentiation between necessity and opportunity motivation is useful despite important nuances. These differences in motivation and characteristics and attendant average differences in performance between opportunity- and necessity-motivated entrepreneurship thus call for distinguishing the theoretical antecedents of the two.

When researchers discuss the reasons behind the high entrepreneurial propensities of opportunity-driven, mostly high-educated immigrants with relatively high incomes, they usually rely on explanations highlighting how the average immigrant may be systematically different from the average native regarding relatively unobservable traits that are conducive to opportunity recognition. For example, because both immigration and entrepreneurship entail a great deal of risk, it is reasonable to expect individuals who are not risk-averse to self-select into migration and entrepreneurship (Vandor, 2021). Besides risk attitudes, it is also reasonable to suspect that immigrants differ from natives systematically in terms of cross-cultural experience (Vandor & Franke, 2016). This is relevant for entrepreneurship, because cross-cultural experience can become a catalyst for new ideas, and immigrants bring with them a local knowledge foreign to many natives. Immigrants may be pulled into self-employment by opportunities that encourage them to try, in the host country, business ventures that have been successful elsewhere.

Thus, because immigration and entrepreneurship are similar in that risk and diverse perspectives and ideas are crucial for both processes, we should expect some sort of “entrepreneurial selection bias” among immigrants. Insofar as immigration quotas limit the ability of immigrants with an “entrepreneurial selection bias” to enter host countries and actively contribute to entrepreneurial ventures, these restrictions should stifle entrepreneurial activity.

However, when discussing the logic behind why mostly low-educated immigrants with relatively low incomes are relatively likely to engage in necessity-driven entrepreneurship, scholars focus on explanations of poor opportunities in the labor market for wage and salaried employment, which push immigrants into self-employment as a means of survival (Bedi & Jia, 2022; Reynolds et al., 2001). These poor opportunities in the labor market for wage and salaried employment often arise because of mismatches in the labor market (Åstebro et al., 2011), and immigrants are particularly susceptible to labor market mismatches (Kahn et al., 2017). One major source of mismatches in the labor market for immigrants arises due to a lack of language proficiency, and as immigrants become more proficient in the local language, productivity increases (Dustmann & Van Soest, 2002). Even immigrants who are not low educated can be susceptible to labor market mismatches that create a situation where only jobs that require low education are available. Indicative of this is the fact that immigrants are substantially more likely to be over-educated, or to have a job in which they are over-qualified, compared to natives, and this can make self-employment a relatively appealing option (OECD/European Union, 2015). As immigrants integrate into the labor market through work experience, the risk of over-education decreases, and immigrants become better matched in the labor market (Nielsen, 2011).

Further sources of necessity-motivated self-employment come from various barriers immigrants face that are absent for natives. For example, explicit taste-based discrimination in the labor market can drive immigrants into self-employment (Bates, 1997; Light, 1972). This discrimination could come from consumers, employers, or coworkers (Bradley-Geist & Schmidtke, 2018; Combes et al., 2016; Hirsch & Jahn, 2015). If this discrimination makes it difficult to obtain a job, immigrants may be pushed into self-employment. Indeed, informal discrimination is not the only way to push immigrants into necessity-motivated self-employment—formal, policy-driven discrimination can have similar effects. For example, Wang and Lofstrom (2020) find that increased internal immigration restrictions and enforcement after 9/11 drove Mexican immigrants away from opportunity-motivated self-employment into necessity-motivated self-employment by tightening labor markets for undocumented immigrants.

Thus, how a reduction in immigration quotas and other external restrictions impacts entrepreneurship depends on the types of immigrants that are allowed to enter the host country as a result of those reductions. If the result is an increase in high-educated immigrant workers who are not likely to be mismatched in the labor market, we should expect an increase in opportunity-driven entrepreneurship; if the result is an increase in relatively low-educated immigrants or even high-educated immigrants who are not likely to be matched well in the labor market, we should expect an increase in necessity-motivated entrepreneurship.

2.3 Immigrants and general rates of entrepreneurship

Recall, though, that our focus is not on immigrant entrepreneurship exclusively, but on the relationship between immigration restrictions and early-stage business ownership rates in the host country generally. While the two broad theories of immigrant entrepreneurship outlined above explain why we might expect immigrant entrepreneurship to respond to changes in immigration quotas, it is important to explain why we expect immigration quotas and other external regulations to be important for entrepreneurship even when analyzing native rates of entrepreneurship in the form of business ownership as well. That is, it is important to explain why we expect immigration quotas also to be important for entrepreneurship generally. In doing so, we can make our theory and predictions more generalizable. We expect immigration quotas to be important for general rates of entrepreneurship for a few reasons. More specifically, similar to our expectations regarding how immigrant entrepreneurship rates will respond to changes in quotas, how we expect immigration quotas to stifle general rates of entrepreneurship will depend on the types of immigrants most impacted by quotas on the margin. If a reduction in quotas impacts primarily low-education workers or workers who are more likely to be mismatched in the labor market, we expect general rates of necessity-motivated entrepreneurship to increase; if a reduction in quotas impacts primarily high-education workers or workers who are not likely to be mismatched in the labor market, we expect general rates of opportunity-motivated entrepreneurship to increase.

First, as consumers, immigrants in general increase demand for the products and services of entrepreneurs, and as consumers with potentially different average tastes and preferences compared to natives, it is also reasonable to expect these immigrants to bring with them a more diverse set of tastes and preferences. This new diverse set of tastes and preferences can be taken advantage of by both immigrant and native entrepreneurs (Bedi & Wiseman, 2021). However, if immigration quotas prevent immigrants from entering the host country, these restrictions also prevent the increased and more diverse demand these immigrants would bring with them. At the same time, if immigration quotas primarily impact low-education or over-educated immigrants with low earning potentials, one should not expect increases in growth-oriented, opportunity-motivated entrepreneurship, as immigrant income mobility is quite low for first-generation immigrants (Abramtizky & Boustan, 2022), and the income of immigrants with low earnings is seldom sufficient to expect their demand to elicit increases in growth-oriented business formation, at least not in the short-term.

Further, because immigrants, particularly low-education immigrants, are imperfect substitutes for natives and specialize in manual tasks as opposed to tasks requiring communication (Peri & Sparber, 2009), immigrant labor often compliments native labor (Greenwood & Hunt, 1995). Evidence of this process in the context of Denmark is provided by Foged and Peri (2016), who show influxes of refugees caused natives with little education to transition into less manual-intensive occupations. As a result, immigrants, as employees, can free up productive native resources to engage in entrepreneurship. This means that a migrant need not own a construction company to contribute productively to entrepreneurship; she or he could simply work for a native (Bedi & Wiseman, 2021). Indeed, empirical evidence of this theoretical possibility has been documented by Lee et al. (2022), who demonstrate mass deportations in the USA in the 1930s led to decreases in native employment as well as occupational downgrading of natives. According to the authors, part of this decrease in native employment opportunities happened due to decreases in entrepreneurship in Mexican-intensive sectors as Mexicans left, and because these Mexicans were undocumented, it is reasonable to assume at least some of this decrease in entrepreneurship was a decrease in native entrepreneurship due to a negative shock in potential low-education employees.

In the case of limits to highly educated immigrants or immigrants who are unlikely to be mismatched in the labor market, we expect quotas to primarily impact opportunity-motivated entrepreneurship, as highly educated immigrants are likely to be employed in high-tech, growth-oriented firms typical of those in Silicon Valley (Saxenian, 2002). Further, the contributions of highly educated immigrants tend to compliment, not crowd out, those of native high-education workers (Hunt & Gauthier-Loiselle, 2010).

The preceding discussion implies that stricter immigration quotas will negatively impact the general rates of entrepreneurship. More specifically, the types of entrepreneurship we expect to be most impacted by quotas will depend on the types of immigrants most impacted by those quotas—if quotas serve to primarily limit low-educated immigration or over-educated immigrants likely to be mismatched in the labor market, we expect necessity-motivated entrepreneurship to be primarily impacted. If quotas primarily serve to limit the migration of highly educated immigrants or immigrants not likely to be mismatched in the labor market, we expect opportunity-motivated entrepreneurship to be primarily impacted. This begs the question: what types of labor market migrants are most impacted by external immigration restrictions like quotas?

2.4 Immigration quotas and immigrant composition

The preceding discussion implies that one must have an idea of what types of immigrants are most impacted by quotas in order to have an idea of how quotas will impact entrepreneurship. If high-educated immigrants or immigrants with little chance of being mismatched in the labor market are most impacted, we expect opportunity-motivated entrepreneurship to be most sensitive to changes in quotas. If low-education immigrants or immigrants with high chances of being mismatched in the labor market are most affected by quotas, we expect necessity-motivated entrepreneurship to be most sensitive to changes in quotas.

In reality, policies often explicitly target immigrants based on education, especially labor market quotas. Most notably, countries in the Commonwealth of NationsFootnote 2, like Canada and Australia, rely heavily on labor market immigrant quotas that restrict immigration based on education and other criteria positively correlated with skill levels and considered important in the labor market, like language acquisition and work experience. These types of immigration systems are more commonly referred to as point-based systems, Canada being the first country to implement such a system (Donald, 2016). While other types of quotas, like family reunification quotas and refugee/asylum quotas, do not target immigrants based on education level, labor market migration restrictions, by and large, are prone to favoring high-education immigrants and making immigration more difficult for low-education immigrants (Cerna, 2009; Cerna, 2014), though there are notable exceptions for seasonal workers with low education when labor shortages arise (Brickenstein, 2015; Massey & Liang, 1989).

Even if high-income, immigrant-receiving national governments did not explicitly favor high-education immigrants, we would expect quotas and other external restrictions to impact low-education immigrants with relatively low incomes more compared to high-education immigrants with relatively high incomes, because those with high education levels and high incomes are more able to absorb the additional fixed costs of immigrating that immigration quotas and restrictions represent. To understand why, consider how bureaucratic, administrative, and other costs that immigration quotas entail differentially impact those with a low earnings potential compared to those with a high earning potential. Even if the absolute value of those costs is the same for high-education and low-education immigrants, the value of those costs relative to income is still higher for those with low education and low income compared to those with high education and high income. Indeed, this line of logic is like a supply-side version of the Alchian-Allen effect, which states that when the prices of two substitute goods are increased by a fixed per-unit amount, consumption will shift towards the higher-priced good (Alchian, 1983). In the case of immigrants and their supply of labor, immigration costs can act as per-unit increases in the input costs of immigrant labor in the host country. These input costs represent marginally greater increases in cost relative to income for low-education immigrants compared to high-education immigrants, even if all immigrants are subject to the same costs in terms of absolute value.

The above arguments are not meant to imply that highly educated individuals select into migration. Indeed, the question of whether or not high- or low-education individuals select into migration is a subject of debate, partly because it depends on a number of factors including relative differences between home and host countries and migrant networks (Abramitzky et al., 2012; Borjas, 1987; Chiquiar & Hanson, 2005; Chiswick, 1999; McKenzie & Rapoport, 2010). Rather, we argue that immigration policy in host countries selects for highly educated individuals by making it easier for the highly educated to immigrate. This is particularly the case for labor migrants, who are often given preference when they have high levels of human capital (Cerna, 2009; Cerna, 2014; Donald, 2016). While there are some exceptions, like in the case of temporary, seasonal worker programs (Brickenstein, 2015; Massey & Liang, 1989), immigrant-receiving countries generally favorably select immigrants based on education (Helbling et al., 2017), and voter opinion on highly educated immigrants is favorable while voter opinion on low educated immigrants is often negative (Mayda et al., 2022). Indeed, major immigrant-receiving countries favor high levels of human capital so much that cross-country studies indicate that migrants invest in human capital pre-migration in an effort to increase their chances of successful immigration (Beine et al., 2008).

Thus, we expect immigration quotas and other external restrictions to primarily impact low-education, low-income immigrants. We also expect high-education immigrants who are impacted by quotas on the margin to be more likely to be mismatched in the labor market and, therefore, more likely to be over-educated compared to high-education immigrants who are not impacted by quotas on the margin, because most countries have immigration schemes that facilitate matching high-education immigrants with domestic companies (Helbling et al., 2017). This means that high-education immigrants who arrive under relatively strict immigration quotas are very likely to have a job lined up before moving. As a result, we also expect immigration quotas to primarily impact necessity-motivated entrepreneurship. This leads to our core hypothesis:

Hypothesis 1: As the strictness of labor market immigration quotas increases, necessity-motivated early-stage business ownership rates in the host country will decrease.

2.5 Immigration quotas and entrepreneurial gender gaps

While we expect immigration quotas to negatively impact both male and female rates of necessity-motivated early-stage entrepreneurship, there is also reason to expect the magnitude of this effect to be greater for male entrepreneurs. First, males, particularly immigrant males, are more likely to engage in entrepreneurship compared to women in most contexts (Brieger & Gielnik, 2021). Of course, there are certainly exceptions to the general trend that women are less likely than men to own their own businesses. For example, women may be particularly inclined to enter into self-employment that looks like necessity-motivated entrepreneurship but, in reality, is motivated by a desire for flexibility and work-life balance (Conroy & Low, 2022). Further, cultural attitudes and capital related to religion can impact entrepreneurship gender gaps (Avnimelech & Zelekha, 2023). Still, though rising levels of entrepreneurship in places like India are being driven by women, there is still a long way to go before parity in entrepreneurship is achieved (Chatterjee & Ramu, 2018), and on average, immigrant entrepreneurs are usually male (Brieger & Gielnik, 2021). This means that an increase in female immigrants may not necessarily translate to an increase in female immigrant entrepreneurship, and an increase in immigration generally may not necessarily translate to large increases in native female rates of entrepreneurship. Second, even if a reduction in immigration quotas results in more potential female immigrant entrepreneurs and/or more workers and consumers for native female entrepreneurs, barriers to female entrepreneurship within host countries mitigate the potential benefits of a reduction in quotas and other immigrant restrictions.

Indeed, a variety of institutional-level barriers have been identified in the literature that explains why entrepreneurship gender gaps exist in many parts of the world (Allen et al., 2008). For example, research supports the idea that women are less likely than men to become entrepreneurs because of lower self-efficacy—because entrepreneurship is often seen as a male endeavor, many women feel they do not have the skills to successfully engage in entrepreneurship (Wilson et al., 2007). Other evidence has been provided that women experience gender discrimination from investors when seeking entrepreneurial finance (Fay & Williams, 1993; Guzman & Kacperczyk, 2019), and female entrepreneurs have been found to experience discrimination from their own employees (Kacperczyk et al., 2022). Further institutional barriers to female entrepreneurship include a lack of perceived legitimacy due to high degrees of occupational segregation, a lack of childcare support, and a lack of female business leadership (Elam & Terjesen, 2010). And, while there are country-level differences in formal and informal institutions that widen or shorten the entrepreneurship gender gap (Baughn et al., 2006; Klyver et al., 2013; Shinnar et al., 2012), female entrepreneurs across the world are still disadvantaged compared to their male counterparts for institutional reasons outlined above. This means that any marginal benefits or costs that occur due to a change in quotas should impact entrepreneurship among women, whose rates of entrepreneurship are stifled because of institutional barriers internal to host countries, less compared to men, who suffer much less due to institutional constraints compared to women.

The above arguments are similar to the argument Brieger and Gielnik (2021) make, who argue that the marginal utility of supportive entrepreneurial institutions is greater for women compared to men, because women suffer from institutional-level factors, like a dearth of entrepreneurial finance and discrimination, that decrease their participation and success in entrepreneurship. We argue that changes in quotas will have less of a marginal impact on female entrepreneurs compared to male entrepreneurs because institutional-level factors that are internal to host countries stifle female entrepreneurship compared to male entrepreneurship. This argument is also similar to the argument that labor market quotas should impact entrepreneurship rates much more than family reunification or refugee/asylum quotas. Like family reunification and refugee/asylum statuses come with internal barriers to engaging in the labor market, at least in the short run, institutional constraints act as internal barriers for women who attempt to enter entrepreneurship. However, women, including migrant women with labor market visas, are allowed to participate in the labor market, by definition. Thus, we suspect that female entrepreneurship rates will be less impacted by external immigration restrictions than male entrepreneurship rates because of internal institutional barriers women face that men do not. However, because native women and immigrant women with labor market visas are allowed to participate in the labor market, and because women often become entrepreneurs despite entrepreneurship gender gaps, we also still expect labor migrant quotas to negatively and significantly lower female entrepreneurship rates. We arrive at our second hypothesis:

Hypothesis 2: Changes in quotas will impact female early-stage entrepreneurship rates negatively, but marginally less negatively compared to their impacts on male early-stage entrepreneurship rates.

We now turn to a test of our hypotheses, after outlining our data and methodology below.

3 Data and methodology

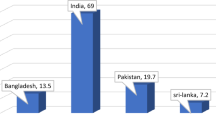

To empirically explore what impact immigration restrictions have on entrepreneurship, we utilize two cross-country data sets. The first dataset measures our explanatory variable of interest—immigration policies, specifically external immigration quotas and eligibility restrictions. The Immigration Policies in Comparison (IMPIC) project (Helbling et al., 2017) provides systematic and quantitative measures on immigration policy changes in all the Organization for Economic Co-operation and Development (OECD) countries, including changes in immigration quotas, between 1980 and 2010. While the IMPIC dataset differentiates between labor migration quotas, which target immigrants who migrate for work-related reasons, and family reunification quotas and refugee/asylum quotas, which target immigrants who migrate to be with family or to escape persecution or natural disaster, we focus on the impact of labor migration quotas. This is because family reunification quotas and refugee/asylum quotas are unlikely to impact entrepreneurship to a great extent, at least in the short run, because immigrants with family reunification or refugee/asylum residence permits are not allowed to work upon arrival in many countries (Helbling et al., 2017). This dataset also includes two measures of quotas and external restrictions. One measure considers only quotas, or quantitative restrictions on immigration, measured in per capita terms. The other measure considers both quotas as well as eligibility restrictions, or qualitative restrictions on immigration. Eligibility restrictions consider conditions for entry, like education levels and language requirements. When host countries require immigrants to have a certain level of education for admittance into the country, the restrictiveness of eligibility restrictions increases. In this way, eligibility restrictions more directly measure external restrictions that exclude those with little education.

To match with the above immigration quota measures, the entrepreneurship measurements, our dependent variables of interest, are selected from a second dataset—the Global Entrepreneurship Monitor (GEM) (Bosma & Kelly, 2019). GEM is the most influential cross-country entrepreneurship dataset employed in the current empirical entrepreneurship literature. According to GEM statistics, GEM data has appeared in 1030 publications in 530 journals covering a broad number of business and social science subjects, including management, economics, political science, sociology, and psychology (Ács & Varga, 2005; Frederick & Bygrave, 2004; Gielnik et al., 2018; Hessels & van Stel, 2011)Footnote 3. Compared with other available entrepreneurship data sources, such as that from the World Bank, GEM not only covers the most extended period, from 1999 to 2016, but it also includes the most comprehensive measurements of entrepreneurial activities and outcomes, covering diverse variables including enterprises at different stages and entrepreneurs with different motivations and economic and cultural backgrounds. In particular, as per our front-end theory, this analysis focuses on entrepreneurial motivation and differentiates between opportunity- and necessity-motivated entrepreneurship. As a survey-based dataset, all these measures are aggregated at the national level based on responses from over 200,000 individuals interviewed annually, and all variables are expressed in per capita termsFootnote 4. While GEM data differentiates entrepreneurship according to stages, or how old businesses are, we focus on early-stage entrepreneurship. We do this because a variety of evidence suggests that business regulations hurt early-stage and small businesses disproportionately more than late-stage and large businesses (Bailey & Thomas, 2017; Branstetter et al., 2014; Thomas, 1990) by acting as a fixed cost (Calcagno & Russell, 2014). Immigration quotas act similarly in that they increase the cost of a major input, labor. Further, our front-end theory suggests that most effects of quotas should be due to new businesses’ ability to open, not changes in businesses that are already established, and the time period we study does not allow us to look at possible long-term impacts like changes in rates of established business ownership.

After merging the two datasets and adjusting for missing countries in the initial 5 years of the GEM data between 1999 and 2003, our final dataset employed in this research covers an unbalanced panel of 30 OECD countries during the period between 2005 and 2011. Refer to Table 1 for a full list of all the 30 OECD countries covered in our sample.

Our measure of labor quotas can be divided into two categories: one narrow category measures only quotas in the index, where quotas are measured in per capita terms to account for population, while the other broader category also includes in the index measures of other migration eligibility requirements for entry like age, nationality, language skills, and occupations. IMPIC rates the labor migration quotas and the overall eligibility restrictions with a scale between 0 and 1, with a value closer to one indicating more strict immigration restrictionsFootnote 5.

With the current cross-country panel dataset, our analysis is based on a fixed effects model (FE). FE models help to capture time-invariant and unobservable heterogeneities across units, in this case, countries. Additionally, because arguing for strictly exogenous independent variables or controlling for potential endogeneity can be challenging for cross-country panel research, we also adopt a popular treatment—the generalized method of moments (GMM) estimators (Blundell & Bond, 1998)—as a robustness check. Instead of relying on an additional variable as an instrument, the GMM estimator utilizes lags of the dependent variable (starting from the second lag) as its own instruments to account for endogeneitiesFootnote 6. The GMM estimator typically works for samples with few time periods relative to observations (Roodman, 2009), which fits our current sample, spanning 7 years and covering 30 countries, well. Thus, the specifications of our FE estimator (1) and GMM estimator (2) can be written as

where i and t are subscripts for country and year, respectively. Entreit is the dependent variable that takes the form of various entrepreneurship measures from the GEM dataset in year t, and Entreit − 1 represents the same variable in year t − 1. Specifically, the entrepreneurship measures examined in the current paper include the total early-stage entrepreneurial activity rate (TEA), broken down by entrepreneurial motivations and gender of the entrepreneurs. All of these entrepreneurial activity variables are measured in percentage terms at the country level. Our independent variable of interest, the score attached to a given labor migration restriction index in year t − 1, is denoted as Quotasit − 1, which is measured by a labor migration restriction score from the IMPIC data, either in terms of labor migration quotas or the overall labor migration eligibility restrictions; recall, this score ranges between 0 and 1, with a higher value indicating more strict restrictions in country i and year t − 1. Additionally, we include five country-level control variables in year t − 1, as represented by the vector Zit − 1 in the above specification. Respectively, the five controls included in Zit − 1 are GDP per capita, capturing the income differences between countries in year t − 1; GDP growth rate, controlling for potential effects of business cycles on entrepreneurial activities; a measure for the economically active proportion of the population—the labor force participation rate; and average gross secondary enrollment between 1981 and 1995 to capture the confounding impact of average human capital on entrepreneurial outcomesFootnote 7. The data source for GDP per capita, GDP growth rate, labor force participation rate, and gross secondary school enrollment is the World Development Indicators (2019) of the World Bank Group. Additionally, as pointed out by the current institutional economics literature and entrepreneurship literature, institutions are the “rules of the game” entrepreneurs must follow to avoid penalties, and institutions mainly affect entrepreneurial outcomes by affecting the incentives to engage in entrepreneurial activities (Baumol, 1996; Boettke & Coyne, 2003; North, 1991). One mechanism by which institutions in a country can change immigrant entrepreneurs’ decisions could be through securing property rights, which is believed to be one of the critical predictors of wealth-enhancing entrepreneurship (Sobel, 2008). Changes in institutional quality can change an entrepreneur’s expectations and, therefore, change his/her business plan in the future. Thus, we also include an institutional quality measure, the Economic Freedom of the World Index (Gwartney et al., 2008), as a fifth control variable. The economic freedom index is measured on a scale between 0 and 10, with a higher score indicating better economic institutions in a country. Finally, αi is the country-fixed effects dummy, θt is the time-fixed effects dummy, and εit is the random error term.

Note that all explanatory variables in the above specifications are lagged for one period. This is a common treatment in cross-country panel studies, which is intended to partially address reverse causality concerns and allow time for the independent variables of interest, in our case immigration restrictions, to affect the dependent variables of interest, in our case entrepreneurship. Refer to Table 2 for the summary statistics of all the variables in our sample.

4 Results

In this section, we present the analyses of the impacts that labor migration restrictions have on several entrepreneurship measures at the early stage in Tables 3, 4, and 5. While Table 3 reports the fixed effects estimates for the opportunity-motivated total early-stage (businesses that have been open less than 3.5 years) entrepreneurship rates (TEA) as the dependent variable and broken down by gender, Table 4 does the same, but with necessity-motivated early-stage entrepreneurship rates as the dependent variable. In each table, control variables are included in the specifications one at a time and reported in separate columns. Finally, Table 5 reexamines the specifications from all the previous tables, with all previous control variables included, but employing GMM estimators. Further, indexes of two categories of labor migration restrictions are reported in all tables: an index of labor migration quotas and an index of overall labor migration eligibility restrictions, which also considers labor migration quotas.

In Table 3, we clearly see that opportunity-motivated entrepreneurship is unrelated to quotas when including all our controls, precisely as our front-end theory predicts—because quotas are unlikely to impact high-education immigrants or immigrants who are likely to be matched well in the labor market compared to low-education immigrants or immigrants who are less likely to be matched well in the labor market, we do not expect immigration quotas to impact opportunity-motivated entrepreneurship at the margin.

Moving on to Table 4, we find support for our core hypothesis: more strict immigration quotas negatively affect early-stage, necessity-motivated entrepreneurial outcomes in the OECD countries, as suggested by the significantly negative coefficients from all columns. Moreover, because quotas are included in our measure of labor migration eligibility restrictions, the fact that the absolute value of the coefficient for quotas (panel A) is consistently smaller than that of the coefficient for overall labor migration eligibility restrictions (panel B) in all columns suggests that labor migration eligibility restrictions, which typically target low-education immigrants, are counter-productive to necessity-motivated entrepreneurship per se.

Further, we find support for our second hypothesis as well—the magnitude of the negative impact of quotas and eligibility restrictions is higher for male entrepreneurship rates compared to female entrepreneurship rates. Indeed, in the specification where we employ all our controls, the magnitude of the impact of quotas on female entrepreneurship rates is around one-third of the magnitude of the impact quotas have on male entrepreneurship rates.

These results are consistent, and the sign and significance of our estimates are not subject to changes in control variables. Still, we want to add robustness to our results by considering possible reverse endogeneity issues FE models may suffer from. Thus, we replicate the specifications in columns (5) and (10) of Tables 3 and 4 in Table 5, but with a GMM frameworkFootnote 8. Consistent with our FE estimates, labor migration restrictions only negatively and significantly impact necessity-motivated early-stage entrepreneurship rates in the OECD countries (columns 5–7). For example, a one standard deviation increase in labor immigration quotas decreases necessity-driven early-stage entrepreneurship rates by 0.39 standard deviations (panel A, column 5); a one standard deviation increase in labor immigration eligibility restrictions scores decreases necessity-driven early-stage entrepreneurship rates by 0.38 standard deviations (panel B, column 5). We also find evidence that the effects of changes in labor migration quotas or eligibility restrictions are larger in magnitude and more significant for male early-stage entrepreneurs (column 6) than female early-stage entrepreneurs (column 7).

Our results highlight how critical labor migration eligibility restrictions and quotas are for early-stage entrepreneurship in the OECD countries. Particularly, these restrictions are harmful to necessity-motivated male entrepreneurs attempting to start a new business.

Though less theoretically relevant, we still test whether family reunion and asylum/refugee quotas and immigration eligibility restrictions are related to entrepreneurship in the host country by replicating the same specifications. According to our front-end logic, we would expect that external immigration restrictions targeting those reunifying with family or fleeing war or natural disaster are less related to host country early-stage entrepreneurship, because these immigrants are prevented from working, at least in the short run, by internal restrictions. Overall, we find no significant results that suggest that family reunion quotas or immigration eligibility restrictions matter for early-stage entrepreneurship rates (Appendix Tables 6 and 7)Footnote 9. At the same time, we do observe negative and significant effects of asylum/refugee immigration quotas and overall eligibility restrictions on opportunity-driven early-stage entrepreneurship rates in some of the specifications; however, these results are sensitive and depend on the specifications. When enough controls are added, significance is lost (Appendix Table 8). Asylum/refugee immigration does not seem to matter for necessity-driven early-stage entrepreneurship in our sample (Appendix Tables 9 and 10). Overall, our GMM specifications suggest that the significance we do observe may be suspicious. At the same time, these results do not rule out potential effects in the long-term—our sample period is not wide enough to test long-term impacts.

In general, we find evidence that labor migration quotas are most relevant for entrepreneurial outcomes, at least in the short term.

5 Conclusions and implications

What are the implications of our above results? First, our results largely lend support to our prior hypotheses.

As predicted, we first find quotas, specifically labor market quotas, to be negatively associated with entrepreneurship, particularly early-stage necessity-motivated entrepreneurship. At the same time, we find that the effects of changes in quotas are stronger for male early-stage necessity-motivated entrepreneurship compared to female early-stage necessity-motivated entrepreneurship, though more strict quotas are negatively and significantly related to entrepreneurship rates for both genders.

Overall, it seems labor market quotas have noticeably negative impacts, but only for necessity-motivated entrepreneurship. It also seems that immigration quotas can lead to reductions in the entrepreneurship gender gap, but only at the expense of negatively impacting the entrepreneurship rates of both men and women. However, the policy implications of our findings are quite nuanced and depend on normative policy goals. To start, changes in quotas seem to only impact necessity-motivated entrepreneurship. So one implication is that current immigration policies that favor high-education immigrants may be driving some of the relationships between immigration and opportunity-motivated entrepreneurship and innovation currently found in the literature (Azoulay et al., 2022; Hunt & Gauthier-Loiselle, 2010; Vandor & Franke, 2018). If this is indeed the case, simply lowering quotas on the margin will do little to encourage the type of entrepreneurship that induces economic growth, at least in the short run. This line of reasoning and empirical evidence may seem to vindicate scholars in the entrepreneurship literature who have called for policies that explicitly favor high-education immigrants (Peroni et al., 2016). However, we encourage caution before such recommendations, for a few reasons.

First, it is crucial to emphasize that we have only narrowly examined the impact of immigration quotas on a very specific metric—early-stage entrepreneurship rates in the form of business ownership. There are a myriad of other potentially positive and/or negative impacts of changing immigration patterns, in particular, low-education immigration patterns, due to changes in quotas. And, to complicate matters, many of these impacts are only felt in the long term, meaning that they are not captured by our relatively short sample period. For example, household services typically provided by low-education immigrants tend to encourage female labor force participation (Cortés & Tessada, 2011; Furtado & Hock, 2010) and decrease the gender wage gap (Cortés & Pan, 2019). Additionally, Hunt (2017) provides evidence that low-education immigration encourages native college attendance rates. And Abramtizky and Boustan (2022) provide compelling evidence that even though first-generation immigrants rarely show much income mobility, their descendants outperform natives by a wide margin. There is also reason to expect opportunity-motivated entrepreneurship to be impacted by immigration quotas in the long run, especially since many high-skilled immigrants in some countries are not allowed to contribute directly to entrepreneurship for several years after arrival because of internal restrictions (Agarwal et al., 2022). And there is potential for refugee and family reunification quotas to impact entrepreneurship given a longer sample period (American Immigration Council, 2023; Cortes, 2004; New American Economy, 2017).

Further, just because the impact of necessity-motivated entrepreneurship generally falls short of the impact provided by opportunity-motivated entrepreneurship (Block & Wagner, 2010), necessity-motivated enterprises still generally contribute to the subjective well-being of owners (Amorós et al., 2021), and in the long run, what starts out as a necessity-motivated enterprise can turn into a more capital-intensive, growth-oriented opportunity-motivated firm (Yoon, 2010).

Finally, though our findings suggest that a reduction in quotas can lead to an increase in the entrepreneurship gender gap, they also suggest that immigration quotas are bad for both female and male entrepreneurship. So, while our results imply that lowering quotas will be less beneficial for female entrepreneurship in host countries than it will be for male entrepreneurship, the implication of our theory and empirical evidence is not that quotas are good for female entrepreneurship, but that other barriers to female entrepreneurship at the individual and institutional level may mitigate the impact of quotas on female entrepreneurship rates. This implies that as internal restrictions are lowered for women, increases in external immigration restrictions should have a more marked effect on female entrepreneurship. Still, female entrepreneurship is benefited from a reduction in quotas.

Finally, though our results suggest that female necessity-motivated entrepreneurs are discouraged by quotas on average, our results do not rule out the possibility that female necessity-motivated entrepreneurs are more likely than male necessity-motivated entrepreneurs to exit from self-employment, given a reduction in quotas. There is evidence that more immigration leads to more female labor force participation (Cortés & Tessada, 2011) and a reduction in the gender pay gap (Cortés & Pan, 2019). There is also evidence women engage in what looks like necessity self-employment because it provides more flexibility and a better work-life balance (Conroy & Low, 2022). If immigrant laborers free up the time of native women by taking care of household chores, women need not self-employ to achieve desired work-life balances. So it is entirely possible that relaxations in immigrant quotas result in marginally more native women exiting self-employment and more necessity-motivated enterprises led by female immigrants.

Thus, if one has the very narrow policy goal of using immigration policy to encourage opportunity-motivated entrepreneurship in the short run, using policy to favor high-education immigrants may be an appropriate policy prescription. Given the complex nature of the overall impacts of immigration and immigration quotas, we refrain from such policy advice. Indeed, given the overall line of literature on immigration and necessity-motivated entrepreneurship, we believe lowering quotas and other external restrictions into host countries for immigrants represents a great way to improve the well-being of immigrants, especially low-education immigrants. Given the extreme increases in quality of life and income many derive from migration, the long-term impacts of reductions in quotas could be beneficial for natives as well (Caplan, 2019; Foged & Peri, 2016). And though it may not be wise to encourage necessity-motivated entrepreneurship (Shane, 2009), we also do not think it wise to discourage the immigration of low-education individuals because they are prone to engaging in necessity-motivated entrepreneurship nor do we find it wise to actively discourage necessity-motivated entrepreneurship, though it may be good policy advice to try to improve labor market conditions so that genuine subsistence entrepreneurship is unnecessary.

This line of research also opens the door to further research on the impacts of quotas on entrepreneurship generally, as well as on the differential impacts of quotas on male and female entrepreneurship more specifically. For example, one drawback of our study is that we are unable to differentiate impacts on native vs. immigrant rates of entrepreneurship. Further research on whether changes in entrepreneurship as a result of changes in quotas are driven by immigrant or native entrepreneurs would shed more light on the mechanisms behind our findings, particularly our findings related to the entrepreneurship gender gap. Further, our results suggest that more research should be done on family reunification and refugee/asylum quotas. While we find null results when we relate family reunification and refugee/asylum external restrictions with entrepreneurship, this does not mean immigration restrictions that target these types of immigrants are not important for entrepreneurship or other relevant variables. Indeed, our results and accompanying theory suggest that there is room to research how internal immigration restrictions that target family reunification and refugee/asylum immigrants impact entrepreneurship and other important metrics.

And while we touch the surface of how quotas can differentially impact male and female entrepreneurship, more work can be done. One potential area of future research could involve using microdata to study which kinds of women enter into or exit self-employment after a change in external restrictions. Our macro-data provides a good start, but we are unable to study important heterogeneities at the micro-level. Another particularly fruitful area of research would be to see how quotas may impact the entrepreneurship gender gap in different ways in countries with different levels of institutional support for women.

Finally, while the cross-country nature of our study provides external validity to our findings, further insight and internal validity can be gained with the use of a natural experiment in a single country setting or by examining changes in specific immigration laws.

Despite a keen academic interest in immigrant entrepreneurship, there has been little explicit exploration into how changes in external immigration restrictions and quotas impact entrepreneurship, with a few exceptions (Mahuteau et al., 2014). This research represents a beginning step in exploring this important phenomenon, and we hope it opens the door for other insights on how changes in freedom of movement impact entrepreneurship in receiving countries.

Notes

While many immigrants also migrate for express purposes of education (Dustmann & Glitz, 2011), these immigrants do not normally participate in host country labor markets enough to expect them to impact entrepreneurship. The ones that do can be classified as labor market immigrants, because restrictions pertaining to labor market immigrants become relevant for them.

The Commonwealth of Nations refers to a voluntary association of independent nations that were once British colonies and consists of 56 member states situated across all six inhabited continents.

Counted based on GEM’s publication statistics as of August 30, 2023

For example, the measure “female opportunity-motivated total early-stage entrepreneurial activity rate” is aggregated based on the survey question “percentage of 18–64-year-old female individuals in a country that either own or manage a new business for less than 42 months.”

For a detailed description of how these indexes are constructed, see Bjerre et al. (2016).

Valid GMM estimators rely on satisfying two assumptions: the second-order correlation test (identification of serial correlation issues with the error terms) and the Hansen-J test (restriction for overidentification issues with the instruments).

This is a one-point observation for each country and is therefore pushed into the country fixed effects term, αi, and not estimated separately in the specification.

Also included in this table are the total early-stage entrepreneurship rate (TEA), the opportunity-driven TEA, and the necessity-driven TEA with the GMM method. These results stay consistent with those based on the fixed effects model, which are not tabulated to save space.

Due to a lack of variation in family reunion quotas, no FE outputs are reported.

References

Abramitzky, R., Boustan, L. P., & Eriksson, K. (2012). Europe’s tired, poor, huddled masses: Self-selection and economic returns in the age of mass migration. American Economic Review, 102(5), 1832–1856. https://doi.org/10.1257/aer.102.5.1832

Abramtizky, R., & Boustan, L. (2022). Streets of gold: America’s untold story of immigrant success. Hachette UK.

Ács, Z. J., & Varga, A. (2005). Entrepreneurship, agglomeration, and technological change. Small Business Economics, 24(3), 323–334. https://doi.org/10.1007/s11187-005-1998-4

Agarwal, R., Ganco, M., & Raffiee, J. (2022). Immigrant entrepreneurship: The effect of early career constraints on new venture formation. Organization Science, 33(4), 1372–1395. https://doi.org/10.1287/orsc.2021.1485

Alchian, A. A. (1983). Exchange and production: Competition, coordination, and control. Wadsworth Publishing Company.

Allen, I. E., Elam, A., Langowitz, N., & Dean, M. (2008). GEM 2007 report on women and entrepreneurship: Global entrepreneurship monitor program. Babson Park, MA.

American Immigration Council. (2023). The economic impact of refugees in America. America Immigration Council. https://www.americanimmigrationcouncil.org/sites/default/files/research/05.23_refugee_report_v3_0.pdf

Amorós, J. E., Cristi, O., & Naudé, W. (2021). Entrepreneurship and subjective well-being: Does the motivation to start-up a firm matter? Journal of Business Research, 127, 389–398. https://doi.org/10.1016/j.jbusres.2020.11.044

Åstebro, T. B., Chen, J., & Thompson, P. (2011). Stars and misfits: Self employment and labor market frictions. Management Science, 57(11), 1999–2017. https://doi.org/10.1287/mnsc.1110.1400

Avnimelech, G., & Zelekha, Y. (2023). Religion and the gender gap in entrepreneurship. International Entrepreneurship and Management Journal, 19, 629–665. https://doi.org/10.1007/s11365-023-00855-4

Azmat, F. (2013). Opportunities or obstacles? Understanding the challenges faced by migrant women entrepreneurs. International Journal of Gender and Entrepreneurship, 5(2), 198–215. https://doi.org/10.1108/17566261311328855

Azoulay, P., Jones, B. F., Kim, J. D., & Miranda, J. (2022). Immigration and entrepreneurship in the United States. American Economic Review: Insights, 4(1), 71–88. https://doi.org/10.1257/aeri.20200588

Bailey, J. B., & Thomas, D. W. (2017). Regulating away competition: The effect of regulation on entrepreneurship and employment. Journal of Regulatory Economics, 52(3), 237–254. https://doi.org/10.1007/s11149-017-9343-9

Basu, A., & Goswami, A. (1999). Determinants of South Asian entrepreneurial growth in Britain: A multivariate analysis. Small Business Economics, 13, 57–70. https://doi.org/10.1023/A:1008025628570

Bates, T. (1997). Financing small business creation: The case of Chinese and Korean immigrant entrepreneurs. Journal of Business Venturing, 12(2), 109–124. https://doi.org/10.1016/S0883-9026(96)00054-7

Baughn, C. C., Chua, B. L., & Neupert, K. E. (2006). The normative context for women’s participation in entrepreneurship: A multicountry study. Entrepreneurship Theory and Practice, 30(5), 687–708. https://doi.org/10.1111/j.1540-6520.2006.00142.x

Baumol, W. J. (1996). Entrepreneurship: Productive, unproductive, and destructive. Journal of Business Venturing, 11(1), 3–22. https://doi.org/10.1016/0883-9026(94)00014-X

Baumol, W. J., & Strom, R. J. (2007). Entrepreneurship and economic growth. Strategic Entrepreneurship Journal, 1(3-4), 233–237. https://doi.org/10.1002/sej.26

Beckers, P., & Blumberg, B. F. (2013). Immigrant entrepreneurship on the move: A longitudinal analysis of first- and second-generation immigrant entrepreneurship in the Netherlands. Entrepreneurship and Regional Development, 25(7-8), 654–691. https://doi.org/10.1080/08985626.2013.808270

Bedi, J. K. (2023). Fake marriages, asylum, and gas station robberies: Institutional determinants of migrants’ strategies. Constitutional Political Economy, forthcoming. https://doi.org/10.1007/s10602-023-09400-5

Bedi, J. K., & Jia, S. (2022). Give me your rested, your wealthy, your educated few? A critical discussion of the current literature on immigrant self-employment. Journal of Entrepreneurship and Public Policy, 11(1), 53–69. https://doi.org/10.1108/JEPP-08-2021-0105

Bedi, J. K., & Wiseman, T. (2021). Immigration and Baumolian entrepreneurship in the United States. Journal of Private Enterprise, 36(3), 1–26 http://journal.apee.org/index.php?title=2021_Journal_of_Private_Enterprise_Vol_36_No_3_Fall_parte1

Beine, M., Docquier, F., & Rapoport, H. (2008). Brain drain and human capital formation in developing countries: Winners and losers. The Economic Journal, 118(528), 631–652. https://doi.org/10.1111/j.1468-0297.2008.02135.x

Bjerre, L., Helbling, M., Römer, F., & Zobel, M. Z. (2016). The Immigration Policies in Comparison (IMPIC) dataset: Technical report. Wissenschaftszentrum Berlin für Sozialforschung gGmbH. https://hdl.handle.net/10419/145970

Block, J. H., & Wagner, M. (2010). Necessity and opportunity entrepreneurs in Germany: Characteristics and earnings differentials. Schmalenbach Business Review, 62(2), 154–174. https://doi.org/10.1007/BF03396803

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Boettke, P. J., & Coyne, C. J. (2003). Entrepreneurship and development: Cause or consequence? In R. Koppl, J. Birner, & P. Kurrild-Klitgaard (Eds.), Austrian economics and entrepreneurial studies (Advances in Austrian economics) (Vol. 6, pp. 67–87). Emerald Group Publishing Limited.

Borjas, G. J. (1987). Self-selection and the earnings of immigrants. American Economic Review, 77, 531–553.

Bosma, N., & Kelly, D. (2019). Global entrepreneurship monitor, The 2018/2019 global report. Santiago, Chile.

Bradley-Geist, J. C., & Schmidtke, J. M. (2018). Immigrants in the workplace: Stereotyping and discrimination. In A. J. Colella & E. B. King (Eds.), The Oxford handbook of workplace discrimination (pp. 159–176). Oxford.

Branstetter, L., Lima, F., Taylor, L. J., & Venâncio, A. (2014). Do entry regulations deter entrepreneurship and job creation? Evidence from recent reforms in Portugal. The Economic Journal, 124(577), 805–832. https://doi.org/10.1111/ecoj.12044

Brickenstein, C. (2015). Social protection of foreign seasonal workers: From state to best practice. Comparative Migration Studies, 3(1), 1–18. https://doi.org/10.1007/s40878-015-0004-9

Brieger, S. A., & Gielnik, M. M. (2021). Understanding the gender gap in immigrant entrepreneurship: A multi-country study of immigrants’ embeddedness in economic, social, and institutional contexts. Small Business Economics, 56, 1007–1031. https://doi.org/10.1007/s11187-019-00314-x

Calcagno, P. T., & Russell, S. (2014). Regulatory costs on entrepreneurship and established employment size. Small Business Economics, 42(3), 541–559. https://doi.org/10.1007/s11187-013-9493-9

Caplan, B. (2019). Open borders: The science and ethics of immigration. First Second.

Cerna, L. (2009). The varieties of high-skilled immigration policies: Coalitions and policy outputs in advanced industrial countries. Journal of European Public Policy, 16(1), 144–161. https://doi.org/10.1080/13501760802453148

Cerna, L. (2014). Attracting high-skilled immigrants: Policies in comparative perspective. International Migration, 52(3), 69–84. https://doi.org/10.1111/imig.12158

Chatterjee, C., & Ramu, S. (2018). Gender and its rising role in modern Indian innovation and entrepreneurship. IIMB Management Review, 30(1), 62–72. https://doi.org/10.1016/j.iimb.2017.11.006

Chiquiar, D., & Hanson, G. H. (2005). International migration, self-selection, and the distribution of wages: Evidence from Mexico and the United States. Journal of Political Economy, 113(2), 239–281. https://doi.org/10.1086/427464

Chiswick, B. R. (1999). Are immigrants favorably self-selected? American Economic Review, 89(2), 181–185. https://doi.org/10.1257/aer.89.2.181

Clemens, M. A. (2011). Economics and emigration: Trillion-dollar bills on the sidewalk? Journal of Economic Perspectives, 25(3), 83–106. https://doi.org/10.1257/jep.25.3.83

Collins, J., & Low, A. (2010). Asian female immigrant entrepreneurs in small and medium-sized businesses in Australia. Entrepreneurship and Regional Development, 22(1), 97–111. https://doi.org/10.1080/08985620903220553

Combes, P. P., Decreuse, B., Laouenan, M., & Trannoy, A. (2016). Consumer discrimination and employment outcomes: Theory and evidence from the French labor market. Journal of Labor Economics, 34(1), 107–160. https://doi.org/10.1086/682332

Conroy, T., & Low, S. A. (2022). Opportunity, necessity, and no one in the middle: A closer look at small, rural, and female-led entrepreneurship in the United States. Applied Economic Perspectives and Policy, 44(1), 162–196. https://doi.org/10.1002/aepp.13193

Cortes, K. E. (2004). Are refugees different from economic migrants? Some empirical evidence on the heterogeneity of immigrant groups in the United States. Review of Economics and Statistics, 86(2), 465–480. https://doi.org/10.1162/003465304323031058

Cortés, P., & Pan, J. (2019). When time binds: Substitutes for household production, returns to working long hours, and the skilled gender wage gap. Journal of Labor Economics, 37(2), 351–398. https://doi.org/10.1086/700185

Cortés, P., & Tessada, J. (2011). Low-skilled immigration and the labor supply of highly skilled women. American Economic Journal: Applied Economics, 3(3), 88–123. https://doi.org/10.1257/app.3.3.88