Abstract

We present a novel framework for studying the evolving role of entrepreneurial finance over the stages of emergence for a regional entrepreneurial ecosystem. Drawing on entrepreneurial ecosystems, entrepreneurial finance, and territorial servitization, we explore how three different finance sources impact firm survival and how they relate to each other during ecosystem emergence. We analyze entrepreneurial firms in one industry and region over 36 years. We find that firm survival is differentially affected by funder type based on the stage of ecosystem emergence. Finance sources also have different interrelations depending on the stage of emergence. Based on our results, we abductively articulate a framework for stage-dependent ecosystem emergence microfoundations. This rectifies contradictory results that examine single sources of finance and use cross-sectional data. Had we not measured the emergence process, the results would have led to markedly different theoretical implications and practical takeaways for entrepreneurial finance and ecosystem emergence.

Plain English Summary

Measuring the stage of ecosystem emergence is key to success in financing start-up firms and developing entrepreneurial ecosystems. Using detailed firm-level data, we present a novel framework for studying entrepreneurial finance within a local entrepreneurial ecosystem over time. Entrepreneurial finance sources, whether public or private, interact with firms differently depending on the stage of entrepreneurial ecosystem emergence, as measured by firm density. We find that funding sources are associated with different rates of firm survival during different stages of ecosystem emergence, with a federal source more important during the nascency stage and venture capital more effective as firm density increases. Our results demonstrate that policymakers and ecosystem champions could make better decisions if finance is considered part of an emergence process.

Similar content being viewed by others

Notes

Though we use the term “stage,” our conceptualization of stages is distinct from life cycle studies (e.g., Auerswald & Dani, 2017; Cantner et al., 2021). Our study moves away from this deterministic model and focuses on the role of microfoundations and adaptive approaches (Kim et al., 2022; Klepper, 2007).

Data was obtained from the PLACE: RTP database in February of 2019. This region includes 13 counties which encompass the Raleigh and Durham-Chapel Hill MSAs surrounding Research Triangle Park as defined by the NC Research Triangle Regional Partnership in 2014. The 13 counties are Chatham, Durham, Franklin, Granville, Harnett, Johnston, Lee, Moore, Orange, Person, Vance, Wake, and Warren.

When aggregated, NC IDEA funding accounts for less than 4% of the state funding. There are 27 grants totaling approximately $50,000 to $60,000 each. While this small amount is unlikely to contribute significantly to the estimates, we decided to keep this funding in the model to provide a complete picture of state funding.

For some observations, the dollar amount of the investment was missing. If the amount could not be determined from online press releases or other sources, we used $100,000 as a modest imputation.

The second partial derivative with respect to time in (1) measures the rate of change in the firm density dynamic.

Estimation uses the threshold command in StataSE 15.1.

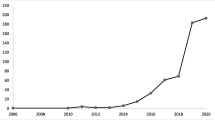

An important artifact from model 2, which imposes four stages, is that we still detect the same time periods for our three main stages: nascent stage (1980–1997), accelerated growth (1998–2009), and stabilization (2010–2016). By imposing a fourth stage, we detect the date when the dynamic of the acceleration stage becomes less convex. Overall, these results are robust. They confirm three industry stages from 1980 to 2016 and demonstrate the utility of our method for non-deterministically identifying industry stage changes.

Details are available from the authors upon request.

To determine the appropriate duration dependence, we take the hazard rate value obtained from the life table method and test which of three duration dependence specifications is able to explain the hazard rate. Efficiency criteria indicate that the polynomial form is most appropriate.

There are three main ways to model these unobservable variables: a normal distribution, gamma distribution, or non-parametric approach, which fits an arbitrary distribution using a set of parameters. These parameters comprise a set of mass points and the probabilities of a firm being located at each mass point. Additional details are available upon request.

It was impossible to determine values for some control variables for 31 firms. Eight firms are missing all founder data. The other 23 firms have founders with some missing data. For these firms, we used either the minimum or average value to replace missing values, whichever would cause any bias to be in the direction of a null funding. We inflated the same prior industry experience variable by founding team size for firms for which only some founders were missing this variable.

The dynamic random effects probit is appropriate because our setting is dynamic where lagged values of funding from each source are needed to estimate the probability of funding from that source in the current period. We are interested in the probability of securing funding, given the prior distribution of sources. As such, we must account for state-dependent processes. Furthermore, we do not use the funding amount because we are more interested in the links between funding sources and want to avoid a value effect from funding caused by noise related to large or erratic values. Thus, we have a binary outcome variable. Finally, the relationships between state, federal, and private VC funding are nonrecursive so we cannot estimate for each funding type simultaneously.

The \({c}_{i}\) term accounts for heterogeneity between firms and is written:

$${c}_{i}={\alpha }_{0}+{{\alpha }_{1}y}_{0}+{\alpha }_{2}\overline{X }+{\alpha }_{3}{X}_{0}+{\alpha }_{4}$$While \({\alpha }_{0}\) and \({\alpha }_{4}\) (the firm-specific time-constant error) are purely random, \({y}_{0}\) represents the initial value of the dependent variable. \({X}_{0}\) is a row matrix of the initial value of the time-varying covariates, and \(\overline{X }\) is a row matrix of the mean value of the time-varying covariates for all firms (the within-firm average based on all time periods). \({c}_{i}\) then accounts that the probability of receiving one type of funding is likely influenced by other funding sources in prior periods (Grotti & Cutuli, 2018; Rabe-Hesketh & Skrondal, 2013; Wooldridge, 2005). The \(X\) are a subset of \(Z\).

We use “Stage” when referring to the technical “regime”-switching analysis. The dynamic random effects probit model assesses state dependence in the probability of receiving funding but does not account for differences across regional industry stages.

Effect sizes for coefficients in survival analysis are calculated by the formula: 100*(exp(\((\widehat{\beta })\) − 1).

Meaning the likelihood of funding from one source given prior funding from the same or different sources.

This could also be an artifact of our use of the 1 year. Future studies may extend examination of the temporal lag.

References

Agarwal, R., & Tripsas, M. (2008). Technology and industry evolution. The Handbook of Technology and Innovation Management, 1, 1–55.

Aldrich, H. E. (1990). Using an ecological perspective to study organizational founding rates. Entrepreneurship Theory & Practice, 14(3), 7–24. https://doi.org/10.1177/104225879001400303

Argyres, N., & Bigelow, L. (2007). Does transaction misalignment matter for firm survival at all stages of the industry life cycle? Management Science, 53(8), 1332–1344. https://doi.org/10.1287/mnsc.1070.0706

Armanios, D. E., Lanahan, L., & Yu, D. (2020). Varieties of local government experimentation: US state-led technology-based economic development policies, 2000–2015. Academy of Management Discoveries, 6(2), 266–299. https://doi.org/10.5465/amd.2018.0014

Auerswald, P. E., & Dani, L. (2017). The adaptive life cycle of entrepreneurial ecosystems: The biotechnology cluster. Small Business Economics, 49(1), 97–117. https://doi.org/10.1007/s11187-017-9869-3

Auerswald, P., & Dani, L. (2022). Entrepreneurial opportunity and related specialization in economic ecosystems. Research Policy, 51(9), 104445. https://doi.org/10.1016/j.respol.2021.104445

Aversa, P., Furnari, S., & Jenkins, M. (2021). The primordial soup: Exploring the emotional microfoundations of cluster genesis. Organization Science, 33(4), 1251–1699. https://doi.org/10.1287/orsc.2021.1484

Avnimelech, G., & Teubal, M. (2006). Creating venture capital industries that co-evolve with high tech: Insights from an extended industry life cycle perspective of the Israeli experience. Research Policy, 35(10), 1477–1498. https://doi.org/10.1016/j.respol.2006.09.017

Avnimelech, G., & Teubal, M. (2008). Evolutionary targeting. Journal of Evolutionary Economics, 18(2), 151–166. https://doi.org/10.1007/s00191-007-0080-6

Baù, M., Sieger, P., Eddleston, K. A., & Chirico, F. (2016). Fail but try again? The effects of age, gender, and multiple owner experience on failed entrepreneurs’ reentry. Entrepreneurship Theory & Practice, 41(6), 909–941. https://doi.org/10.1111/etap.12233

Baum, J. A., & Singh, J. V. (Eds.). (1994). Evolutionary dynamics of organizations. Oxford: Oxford University Press.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6–8), 613–673. https://doi.org/10.1016/S0378-4266(98)00038-7

Berger, M., & Hottenrott, H. (2021). Start-up subsidies and the sources of venture capital. Journal of Business Venturing Insights, 16, e00272. https://doi.org/10.1016/j.jbvi.2021.e00272

Bigelow, L. S., Carroll, G. R., & Seidel, M. D. L. (1997). Legitimation, geographical scale, and organizational density: Regional patterns of foundings of American automobile producers, 1885–1981. Social Science Research, 26, 377–398. https://doi.org/10.1006/ssre.1997.0591

Boden, R. J., Jr., & Nucci, A. R. (2000). On the survival prospects of men’s and women’s new business ventures. Journal of Business Venturing, 15(4), 347–362. https://doi.org/10.1016/S0883-9026(98)00004-4

Breznitz, S. M. (2010). Improving or impairing? Following technology transfer changes at the University of Cambridge. Regional Studies. https://doi.org/10.1080/00343401003601909

Breznitz, D., & Taylor, M. (2014). The communal roots of entrepreneurial–technological growth–social fragmentation and stagnation: Reflection on Atlanta’s technology cluster. Entrepreneurship & Regional Development, 26(3–4), 375–396. https://doi.org/10.1080/08985626.2014.918183

Breznitz, S. M., Clayton, P. A., Defazio, D., & Isett, K. R. (2018). Have you been served? The impact of university entrepreneurial support on start-ups’ network formation. The Journal of Technology Transfer, 43(2), 343–367. https://doi.org/10.1007/s10961-017-9565-0

Brown, R., & Mawson, S. (2019). Entrepreneurial ecosystems and public policy in action: A critique of the latest industrial policy blockbuster. Cambridge Journal of Regions, Economy and Society, 12(3), 347–368. https://doi.org/10.1093/cjres/rsz011

Bruderl, J., & Schussler, R. (1990). Organizational mortality: The liabilities of newness and adolescence. Administrative Science Quarterly, 35(3), 530–547. https://doi.org/10.2307/2393316

Cantner, U., Cunningham, J. A., Lehmann, E. E., & Menter, M. (2021). Entrepreneurial ecosystems: A dynamic lifecycle model. Small Business Economics, 57(1), 407–423. https://doi.org/10.1007/s11187-020-00316-0

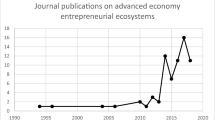

Cao, Z., & Shi, X. (2021). A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Business Economics, 57, 75–110.

Carroll, G. R., & Hannan, M. T. (2000). Why corporate demography matters: Policy implications of organizational diversity. California Management Review, 42(3), 148–163. https://doi.org/10.2307/41166046

Carroll, G. R., & Khessina, O. M. (2005). The ecology of entrepreneurship. In S. A. Alvarez, R. Agarwal, & O. Sorenson (Eds.), Handbook of entrepreneurship research (pp. 167–200). New York, NY: Springer. https://doi.org/10.1007/0-387-23622-8_9

Casper, S. (2007). How do technology clusters emerge and become sustainable? Social network formation and inter-firm mobility within the San Diego biotechnology cluster. Research Policy, 36(4), 438–455. https://doi.org/10.1016/j.respol.2007.02.018

CBRE. (2022). Life sciences research talent 2022: The search to sustain an industry boom. Available: https://www.cbre.com/insights/reports/us-life-sciences-talent-2022

Chemmanur, T., Tyler, T., Hull, J., & Krishnan, K. (2016). Do local and international venture capitalists play well together? The complementarity of local and international venture capitalists. Journal of Business Venturing, 31(5), 573–594. https://doi.org/10.1016/j.jbusvent.2016.07.002

Chen, H., Gompers, P., Kovner, A., & Lerner, J. (2010). Buy local? The geography of venture capital. Journal of Urban Economics, 67(1), 90–102. https://doi.org/10.1016/j.jue.2009.09.013

Chen, K., & Marchioni, M. (2008). Spatial clustering of venture capital-financed biotechnology firms in the US. Industrial Geographer, 5(2), 19–38.

Chung, W., & Kalnins, A. (2001). Agglomeration effects and performance: A test of the Texas lodging industry. Strategic Management Journal, 22(10), 969–988. https://doi.org/10.1002/smj.178

Clayton, P., Feldman, M., & Lowe, N. (2018). Behind the scenes: Intermediary organizations that facilitate science commercialization through entrepreneurship. Academy of Management Perspectives, 32(1), 104–124. https://doi.org/10.5465/amp.2016.0133

Clayton, P., Donegan, M., Feldman, M., Forbes, A., Lowe, N., & Polly, A. (2019). Local prior employment and ecosystem dynamics. ILR Review, 72(5), 1182–1199. https://doi.org/10.1177/0019793919836756

Clegg, S., Rhodes, C., & Kornberger, M. (2007). Desperately seeking legitimacy: Organizational identity and emerging industries. Organization Studies, 28, 495–513. https://doi.org/10.1177/0170840606067995

Coreynen, W., Vanderstraeten, J., van Witteloostuijn, A., Cannaerts, N., Loots, E., & Slabbinck, H. (2020). What drives product-service integration? An abductive study of decision-makers’ motives and value strategies. Journal of Business Research, 117, 189–200. https://doi.org/10.1016/j.jbusres.2020.05.058

Croce, A., Martí, J., & Reverte, C. (2019). The role of private versus governmental venture capital in fostering job creation during the crisis. Small Business Economics, 53, 879–900. https://doi.org/10.1007/s11187-018-0108-3

Cummings, A. S. (2020). Brain magnet: Research Triangle Park and the idea of the idea economy. Columbia University Press. https://doi.org/10.7312/cumm18490

Cumming, D., Deloof, M., Manigart, S., & Wright, M. (2019). New directions in entrepreneurial finance. Journal of Banking & Finance, 100, 252–260. https://doi.org/10.1016/j.jbankfin.2019.02.008

David, P. A., & Hall, B. H. (2000). Heart of darkness: Modeling public–private funding interactions inside the R&D black box. Research Policy, 29(9), 1165–1183. https://doi.org/10.1016/S0048-7333(00)00085-8

Davidsson, P., Recker, J., & von Briel, F. (2018). External enablement of new venture creation: A framework. Academy of Management Perspectives. https://doi.org/10.5465/amp.2017.0163

Delgado, M., Porter, M. E., & Stern, S. (2010). Clusters and entrepreneurship. Journal of Economic Geography, 10(4), 495–518. https://doi.org/10.1093/jeg/lbq010

Delgado, M., Porter, M. E., & Stern, S. (2016). Defining clusters of related industries. Journal of Economic Geography, 16(1), 1–38. https://doi.org/10.1093/jeg/lbv017

Delmar, F., & Shane, S. (2004). Legitimating first: Organizing activities and the survival of new ventures. Journal of Business Venturing, 19(3), 385–410. https://doi.org/10.1016/S0883-9026(03)00037-5

Dencker, J. C., Gruber, M., & Shah, S. K. (2009). Pre-entry knowledge, learning, and the survival of new firms. Organization Science, 20(3), 516–537. https://doi.org/10.1287/orsc.1080.0387

Dikova, D., Van Witteloostuijn, A., & Parker, S. (2017). Capability, environment and internationalization fit, and financial and marketing performance of MNEs’ foreign subsidiaries: An abductive contingency approach. Cross Cultural & Strategic Management. https://doi.org/10.1108/CCSM-01-2016-0003

Donahue, R., Parilla, J., & McDearman, B. (2018). Rethinking cluster initiatives. Brookings Institution: Washington, DC. Available: https://www.brookings.edu/articles/rethinking-cluster-initiatives/

Donegan, M., Forbes, A., Clayton, P., Polly, A., Feldman, M., & Lowe, N. (2019). The tortoise, the hare, and the hybrid: Effects of prior employment on the development of an entrepreneurial ecosystem. Industrial and Corporate Change, 28(4), 899–920. https://doi.org/10.1093/icc/dtz037

Dosi, G. (1990). Finance, innovation and industrial change. Journal of Economic Behavior & Organization, 13(3), 299–319. https://doi.org/10.1016/0167-2681(90)90003-V

Dubois, A., & Gadde, L. E. (2002). Systematic combining: An abductive approach to case research. Journal of Business Research, 55(7), 553–560. https://doi.org/10.1016/S0148-2963(00)00195-8

Elhorst, J. P., & Fréret, S. (2009). Evidence of political yardstick competition in France using a two-regime spatial Durbin model with fixed effects. Journal of Regional Science, 49, 931–951. https://doi.org/10.1111/j.1467-9787.2009.00613.x

Engberg, E., Tingvall, P. G., & Halvarsson, D. (2021). Direct and indirect effects of private- and government-sponsored venture capital. Empirical Economics, 60, 701–735.

Esposito, C. R. (2023). The geography of breakthrough invention in the United States over the 20th century. Research Policy, 52(7), 104810.

Feldman, M., & Lowe, N. (2015). Triangulating regional economies: Realizing the promise of digital data. Research Policy, 44(9), 1785–1793. https://doi.org/10.1016/j.respol.2015.01.015

Feldman, M., & Lowe, N. (2018). Policy and collective action in place. Cambridge Journal of Regions, Economy and Society, 11(2), 335–351. https://doi.org/10.1093/cjres/rsy011

Feldman, M., Siegel, D. S., & Wright, M. (2019). New developments in innovation and entrepreneurial ecosystems. Industrial and Corporate Change, 28(4), 817–826. https://doi.org/10.1093/icc/dtz031

Feldman, M., Johnson, E. E., Bellefleur, R., Dowden, S., & Talukder, E. (2022). Evaluating the tail of the distribution: The economic contributions of frequently awarded government R&D recipients. Research Policy, 51(7), 104539. https://doi.org/10.1016/j.respol.2022.104539

Figueroa-Armijos, M. (2019). Does public entrepreneurial financing contribute to territorial servitization in manufacturing and KIBS in the United States? Regional Studies, 53(3), 341–355. https://doi.org/10.1080/00343404.2018.1554900

Gimmon, E., & Levie, J. (2010). Founder’s human capital, external investment, and the survival of new high-technology ventures. Research Policy, 39(9), 1214–1226. https://doi.org/10.1016/j.respol.2010.05.017

Goldfarb, B., Kirsch, D., & Shen, A. (2012). Finance of new industries. In D. Cumming (Ed.), The Oxford handbook of entrepreneurial finance (pp. 9–44). Oxford: Oxford University Press. https://doi.org/10.1093/oxfordhb/9780195391244.013.0002

Gomes, E., Bustinza, O. F., Tarba, S., Khan, Z., & Ahammad, M. (2019). Antecedents and implications of territorial servitization. Regional Studies, 53(3), 410–423. https://doi.org/10.1080/00343404.2018.1468076

Grotti, R., & Cutuli, G. (2018). xtpdyn: A community-contributed command for fitting dynamic random-effects probit models with unobserved heterogeneity. The Stata Journal, 18(4), 844–862. https://doi.org/10.1177/1536867X1801800406

Hannan, M. T., & Freeman, J. (1977). The population ecology of organizations. American Journal of Sociology, 82(5), 929–964. https://doi.org/10.1086/226424

Hannan, M. T., & Freeman, J. (1989). Organizational ecology. Harvard University Press. https://doi.org/10.2307/j.ctvjz813k

Hannan, M. T., Carroll, G. R., Dundon, E. A., & Torres, J. C. (1995). Organizational evolution in a multinational context: Entries of automobile manufacturers in Belgium, Britain, France, Germany, and Italy. American Sociological Review, 60, 509–528. https://doi.org/10.2307/2096291

Hansen, B. E. (2000). Sample splitting and threshold estimation. Econometrica, 68(3), 575–603. https://doi.org/10.1111/1468-0262.00124

Hansen, B. E. (2011). Threshold autoregression in economics. Statistics & Its Interface, 4(2), 123–127. https://doi.org/10.4310/SII.2011.v4.n2.a4

Hassink, R., Isaksen, A., & Trippl, M. (2019). Towards a comprehensive understanding of new regional industrial path development. Regional Studies, 53(11), 1636–1645. https://doi.org/10.1080/00343404.2019.1566704

Heaton, S., Siegel, D., & Teece, D. (2019). Universities and innovation ecosystems: a dynamic capabilities perspective. Industrial and Corporate Change, 28(4), 921–993.

Horváth, K., & Rabetino, R. (2019). Knowledge-intensive territorial servitization: Regional driving forces and the role of the entrepreneurial ecosystem. Regional Studies, 53(3), 330–340. https://doi.org/10.1080/00343404.2018.1469741

Howell, S. T. (2017). Financing innovation: Evidence from R&D grants. American Economic Review, 107(4), 1136–1164. https://doi.org/10.1257/aer.20150808

Hsu, D. H. (2007). Experienced entrepreneurial founders, organizational capital, and venture capital funding. Research Policy, 36, 723–741. https://doi.org/10.1016/j.respol.2007.02.022

Hyytinen, A., Pajarinen, M., & Rouvinen, P. (2015). Does innovativeness reduce startup survival rates? Journal of Business Venturing, 30(4), 564–581. https://doi.org/10.1016/j.jbusvent.2014.10.001

Janney, J. J., & Folta, T. B. (2003). Signaling through private equity placements and its impact on the valuation of biotechnology firms. Journal of Business Venturing, 18(3), 361–380. https://doi.org/10.1016/S0883-9026(02)00100-3

Jansson, J. (2011). Emerging (internet) industry and agglomeration: Internet entrepreneurs coping with uncertainty. Entrepreneurship & Regional Development, 23(7–8), 499–521. https://doi.org/10.1080/08985620903505987

Jenkins, S. P. (2005). Survival analysis. Unpublished manuscript, Institute for Social and Economic Research, University of Essex. Available: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=9bb46b98492c0d8e33ffbddab4a0f99d84f3f0c0

Johnson, E., Hemmatian, I., Lanahan, L., & Joshi, A. M. (2022). A framework and databases for measuring entrepreneurial ecosystems. Research Policy, 51, 104398.

Joshi, A. M., Inouye, T. M., & Robinson, J. A. (2018). How does agency work- force diversity influence federal R&D funding of minority and women technology entrepreneurs? An analysis of the SBIR and STTR programs, 2001–2011. Small Business Economics, 50(3), 499–519.

Kalleberg, A. L., & Leicht, K. (1991). Gender and organizational performance: Determinants of small business survival and success. Academy of Management Journal, 34(1), 136–161. https://doi.org/10.5465/256305

Karniouchina, E. V., Carson, S. J., Short, J. C., & Ketchen, D. J., Jr. (2013). Extending the firm vs. industry debate: Does industry life cycle stage matter? Strategic Management Journal, 34(8), 1010–1018. https://doi.org/10.1002/smj.2042

Kim, M., Shaver, J., & Funk, R. (2022). From mass to motion: Conceptualizing and measuring the dynamics of industry clusters. Strategic Management Journal, 43(4), 822–846. https://doi.org/10.1002/smj.3354

King, R. G., & Levine, R. (1993). Finance, entrepreneurship and growth. Journal of Monetary Economics, 32(3), 513–542.

Klepper, S. (2007). Disagreements, spinoffs, and the evolution of Detroit as the capital of the US automobile industry. Management Science, 53(4), 616–631. https://doi.org/10.1287/mnsc.1060.0683

Klepper, S. (2010). The origin and growth of industry clusters: The making of Silicon Valley and Detroit. Journal of Urban Economics, 67(1), 15–32. https://doi.org/10.1016/j.jue.2009.09.004

Kolympirisa, C., Kalaitzandonakes, N., & Miller, D. (2014). Public funds and local biotechnology firm creation. Research Policy, 4(3), 121–137. https://doi.org/10.1016/j.respol.2013.07.012

Lafuente, E., Vaillant, Y., & Vendrell-Herrero, F. (2017). Territorial servitization: Exploring the virtuous circle connecting knowledge-intensive services and new manufacturing businesses. International Journal of Production Economics, 192, 19–28. https://doi.org/10.1016/j.ijpe.2016.12.006

Lafuente, E., Vaillant, Y., & Vendrell-Herrero, F. (2019). Territorial servitization and the manufacturing renaissance in knowledge-based economies. Regional Studies, 53(3), 313–319. https://doi.org/10.1080/00343404.2018.1542670

Lanahan, L., & Armanios, D. (2018). Does more certification always benefit a venture? Organization Science, 29(5), 931–947. https://doi.org/10.1287/orsc.2018.1211

Lanahan, L., & Feldman, M. P. (2015). Multilevel innovation policy mix: A closer look at state policies that augment the federal SBIR program. Research Policy, 44(7), 1387–1402. https://doi.org/10.1016/j.respol.2015.04.002

Lanahan, L., & Feldman, M. P. (2018). Approximating exogenous variation in R&D: Evidence from the Kentucky and North Carolina SBIR State Match programs. Review of Economics and Statistics, 100(4), 740–752. https://doi.org/10.1162/rest_a_00681

Lee, Y. S. (2018). Government guaranteed small business loans and regional growth. Journal of Business Venturing, 33(1), 70–83.

Leendertse, J., Schrijvers, M., & Stam, E. (2022). Measure twice, cut once: Entrepreneurial ecosystem metrics. Research Policy, 51(9), 104336. https://doi.org/10.1016/j.respol.2021.104336

Leicht, K. T., & Jenkins, J. C. (1998). Political resources and direct state intervention: The adoption of public venture capital programs in the American States, 1974–1990. Social Forces, 76(4), 1323–1345. https://doi.org/10.1093/sf/76.4.1323

Lerner, J. (2000). The government as venture capitalist: The long-run impact of the SBIR program. The Journal of Private Equity, 3(2), 55–78. https://doi.org/10.3905/jpe.2000.319960

Lerner, J. (2009). Boulevard of broken dreams: Why public efforts to boost entrepreneurship and venture capital have failed and what to do about it. Princeton University Press. https://doi.org/10.1080/00076791003765131

Lévesque, M., & Stephan, U. (2020). It’s time we talk about time in entrepreneurship. Entrepreneurship Theory & Practice, 44(2), 163–184. https://doi.org/10.1177/1042258719839711

Lombardi, S., Santini, E., & Vecciolini, C. (2022). Drivers of territorial servitization: An empirical analysis of manufacturing productivity in local value chains. International Journal of Production Economics, 253, 108607. https://doi.org/10.1016/j.ijpe.2022.108607

Lowe, N. J., & Feldman, M. P. (2017). Institutional life within an entrepreneurial region. Geography Compass, 11(3), e12306. https://doi.org/10.1111/gec3.12306

Mack, E., & Mayer, H. (2016). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53, 2118–2133. https://doi.org/10.1177/0042098015586547

Malecki, E. J. (2018). Entrepreneurship and entrepreneurial ecosystems. Geography. Compass, 12(3), 1–21.

Malizia, E., Feser, E. J., Renski, H., & Drucker, J. (2020). Understanding local economic development. Routledge. https://doi.org/10.4324/9780367815134

Marshall, A. (1890). The principles of economics. Macmillan. https://doi.org/10.1057/9781137375261

Martin, R., & Sunley, P. (2003). Deconstructing clusters: Chaotic concept or policy panacea? Journal of Economic Geography, 3, 5–35. https://doi.org/10.1093/jeg/3.1.5

Martin, R., & Sunley, P. (2011). Conceptualizing cluster evolution: Beyond the life cycle model? Regional Studies, 45(10), 1299–1318. https://doi.org/10.1080/00343404.2011.622263

Mason, C. M., & Harrison, R. T. (1995). Closing the regional equity capital gap: the role of informal venture capital. Small Business Economics, 7, 153–172.

McCann, B. T., & Vroom, G. (2010). Pricing response to entry and agglomeration effects. Strategic Management Journal, 31(3), 284–305. https://doi.org/10.1002/smj.805

McCorkle, M. (2012). History and the “new economy” narrative: The case of Research Triangle Park and North Carolina’s economic development. Journal of the Historical Society, 12(4), 479–525. https://doi.org/10.1111/j.1540-5923.2012.00378.x

Moeen, M., & Agarwal, R. (2017). Incubation of an industry: Heterogeneous knowledge bases and modes of value capture. Strategic Management Journal, 38(3), 566–587. https://doi.org/10.1002/smj.2511

Montmartin, B., & Massard, N. (2015). Is financial support for private R&D always justified? A discussion based on the literature on growth. Journal of Economic Surveys, 29(3), 479–505. https://doi.org/10.1111/joes.12067

Montmartin, B., Herrera, M., & Massard, N. (2018). The impact of the French policy mix on business R&D: How geography matters. Research Policy, 47(10), 2010–2027. https://doi.org/10.1016/j.respol.2018.07.009

Morgan, I. W., & Abetti, P. A. (2004). Private and public “cradle to maturity” financing patterns of U.S. biotech ventures (1970–2001). The Journal of Private Equity, 7(2), 9–25. https://doi.org/10.3905/jpe.2004.391047

Motoyama, Y. (2008). What was new about the cluster theory? What could it answer and what could it not answer? Economic Development Quarterly, 22(4), 353–363. https://doi.org/10.1177/0891242408324373

Munari, F., & Toschi, L. (2015). Assessing the impact of public venture capital programmes in the United Kingdom: Do regional characteristics matter? Journal of Business Venturing, 30(2), 205–226. https://doi.org/10.1016/j.jbusvent.2014.07.009

Nelson, R. R. (2008). Economic development from the perspective of evolutionary economic theory. Oxford Development Studies, 36(1), 9–21. https://doi.org/10.1080/13600810701848037

Nelson, R. R., & Winter, S. G. (2009). An evolutionary theory of economic change. Harvard University Press.

Ortiz-Villajos, J. M., & Sotoca, S. (2018). Innovation and business survival: A long-term approach. Research Policy, 47(8), 1418–1436. https://doi.org/10.1016/j.respol.2018.04.019

Pittz, T. G., White, R., & Zoller, T. (2019). Entrepreneurial ecosystems and social network centrality: The power of regional dealmakers. Small Business Economics, 56, 1273–1286. https://doi.org/10.1007/s11187-019-00228-8

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press.

Powell, W. W., White, D. R., Koput, K. W., & Owen-Smith, J. (2005). Network dynamics and field evolution: The growth of interorganizational collaboration in the life sciences. American Journal of Sociology, 110(4), 1132–1205. https://doi.org/10.1086/421508

Powell, W. W., Packalen, K., & Whittington, K. (2012). Organizational and institutional genesis: The emergence of high tech clusters in the life sciences. In J. F. Padgett & W. D. Powell (Eds.), The emergence of organizations and markets (pp. 434−465). New Jersey: Princeton University Press. https://doi.org/10.23943/princeton/9780691148670.003.0014

Quas, A., Martí, J., & Reverte, C. (2021). What money cannot buy: A new approach to measure venture capital ability to add non-financial resources. Small Business Economics, 57, 1361–1382. https://doi.org/10.1007/s11187-020-00352-w

Quigley, J. M. (1998). Urban diversity and economic growth. Journal of Economic Perspectives, 12, 127–138. https://doi.org/10.1257/jep.12.2.127

Rabe-Hesketh, S., & Skrondal, A. (2013). Avoiding biased versions of Wooldridge’s simple solution to the initial conditions problem. Economics Letters, 120(2), 346–349. https://doi.org/10.1016/j.econlet.2013.05.009

Radinger-Peer, V., Sedlacek, S., & Goldstein, H. (2018). The path-dependent evolution of the entrepreneurial ecosystem (EE)–dynamics and region-specific assets of the case of Vienna (Austria). European Planning Studies, 26(8), 1499–1518. https://doi.org/10.1080/09654313.2018.1494136

Romanelli, E., & Feldman, M. (2006). Anatomy of cluster development: Emergence and convergence in the US human biotherapeutics, 1976–2003. In M. Feldman & P. Braunerhjem (Eds.), Cluster genesis: Technology-based industrial development (pp. 87–112). https://doi.org/10.1093/acprof:oso/9780199207183.003.0005

Rosenbusch, N., Brinckmann, J., & Müller, V. (2013). Does acquiring venture capital pay off for the funded firms? A meta-analysis on the relationship between venture capital investment and funded firm financial performance. Journal of Business Venturing, 28(3), 335–353. https://doi.org/10.1016/j.jbusvent.2012.04.002

Sorenson, O. (2017). Regional ecologies of entrepreneurship. Journal of Economic Geography, 17(5), 959–974. https://doi.org/10.1093/jeg/lbx031

Sorenson, O., & Audia, P. G. (2000). The social structure of entrepreneurial activity: Geographic concentration of footwear production in the United States, 1940–1989. American Journal of Sociology, 106(2), 424–462. https://doi.org/10.1086/316962

Spigel, B. (2017). Bourdieu, culture, and the economic geography of practice: Entrepreneurial mentorship in Ottawa and Waterloo, Canada. Journal of Economic Geography, 17(2), 287–310. https://doi.org/10.1093/jeg/lbw019

Spigel, B., & Harrison, R. T. (2018). Towards a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 151–168. https://doi.org/10.1002/sej.1268

Stam, E. (2007). Why butterflies don’t leave: Locational behavior of entrepreneurial firms. Economic Geography, 83(1), 27–50. https://doi.org/10.1111/j.1944-8287.2007.tb00332.x

Stam, E., & Van de Ven, A. (2021). Entrepreneurial ecosystem elements. Small Business Economics, 56, 809–832. https://doi.org/10.1007/s11187-019-00270-6

Thompson, T. A., Purdy, J. M., & Ventresca, M. J. (2018). How entrepreneurial ecosystems take form: Evidence from social impact initiatives in Seattle. Strategic Entrepreneurship Journal, 12(1), 96–116. https://doi.org/10.1002/sej.1285

Toms, S., Wilson, N., & Wright, M. (2020). Innovation, intermediation, and the nature of entrepreneurship: A historical perspective. Strategic Entrepreneurship Journal, 14(1), 105–121. https://doi.org/10.1002/sej.1310

Turkina, E., Oreshkin, B., & Kali, R. (2019). Regional innovation clusters and firm innovation performance: An interactionist approach. Regional Studies, 53(8), 1193–1206. https://doi.org/10.1080/00343404.2019.1566697

Tykvová, T. (2018). Venture capital and private equity financing: An overview of recent literature and an agenda for future research. Journal of Business Economics, 88(3), 325–362. https://doi.org/10.1007/s11573-017-0874-4

Valliere, D., & Peterson, R. (2004). Inflating the bubble: Examining dot-com investor behaviour. Venture Capital, 6(1), 1–22. https://doi.org/10.1080/1369106032000152452

Van Evera, S. (1997). Guide to methods for students of political science. Cornell University Press, Ithaca, NY. https://doi.org/10.7591/9780801454455

Van Maanen, J., Sørensen, J. B., & Mitchell, T. R. (2007). The interplay between theory and method. Academy of Management Review, 32(4), 1145–1154. https://doi.org/10.5465/amr.2007.26586080

Wadhwani, R. D., Kirsch, D., Welter, F., Gartner, W. B., & Jones, G. G. (2020). Context, time, and change: Historical approaches to entrepreneurship research. Strategic Entrepreneurship Journal, 14(1), 3–19. https://doi.org/10.1002/sej.1346

Wang, L., Madhok, A., & Xiao Li, S. (2014). Agglomeration and clustering over the industry life cycle: Toward a dynamic model of geographic concentration. Strategic Management Journal, 35(7), 995–1012. https://doi.org/10.1002/smj.2141

Wenting, R., & Frenken, K. (2011). Firm entry and institutional lock-in: An organizational ecology analysis of the global fashion design industry. Industrial & Corporate Change, 20(4), 1031–1048. https://doi.org/10.1093/icc/dtr032

Wojan, T. R., Crown, D., & Rupasingha, A. (2018). Varieties of innovation and business survival: Does pursuit of incremental or far-ranging innovation make manufacturing establishments more resilient? Research Policy, 47(9), 1801–1810. https://doi.org/10.1016/j.respol.2018.06.011

Wooldridge, J. M. (2005). Simple solutions to the initial conditions problem in dynamic, nonlinear panel data models with unobserved heterogeneity. Journal of Applied Econometrics, 20(1), 39–54. https://doi.org/10.1002/jae.770

Woolley, J. L. (2014). The creation and configuration of infrastructure for entrepreneurship in emerging domains of activity. Entrepreneurship Theory & Practice, 38(4), 721–747. https://doi.org/10.1111/etap.12017

Wurth, B., Stam, E., & Spigel, B. (2022). Toward an entrepreneurial ecosystem research program. Entrepreneurship Theory and Practice, 46(3), 729–778. https://doi.org/10.1177/1042258721998948

Youtie, J., Bozeman, B., & Shapira, P. (1999). Using an evaluability assessment to select methods for evaluating state technology development programs: The case of the Georgia Research Alliance. Evaluation and Program Planning, 22(1), 55–64. https://doi.org/10.1016/S0149-7189(98)00041-X

Zarulli, V. (2016). Unobserved heterogeneity of frailty in the analysis of socioeconomic differences in health and mortality. European Journal Population, 32, 55–72. https://doi.org/10.1007/s10680-015-9361-1

Zucker, L. G., Darby, M. R., & Armstrong, J. (1998). Geographically localized knowledge: Spillovers or markets? Economic Inquiry, 36(1), 65–86. https://doi.org/10.1111/j.1465-7295.1998.tb01696.x

Zúñiga-Vicente, J. A., Alonso-Borrego, C., Forcadell, F. J., & Galán, J. I. (2014). Assessing the effect of public subsidies on firm R&D investment: A survey. Journal of Economic Surveys, 28(1), 36–67.

Acknowledgements

Funding for the development of the PLACE database was provided by the National Science Foundation and the Kauffman Foundation. This research was also supported by the University of North Carolina Dissertation Fellowship. We thank Christos Kolympirisa for NIH data. We would also like to thank Mercedes Delgado, Ludovic Dibiaggio, Andrew Nelson, Jose Lobo, and participants at AOM, APPAM, the Danish Research Unit for Industrial Dynamics (DRUID), the Atlanta Conference on Science and Innovation Policy, the UNC/TIM Emergence Workshop, and seminar participants at Kenan-Flagler Business School’s Entrepreneurship Working Group and MIT for comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. Stage-switching analysis modeling and net effect calculation

Appendix. Stage-switching analysis modeling and net effect calculation

Here, we provide an example of the stage-switching regression. The dynamic random effects probit model with stage-switching private VC in time (t) reads as follows:

\({\beta }_{pi}\) represent the focal funding source and coefficients of key interest (in this case, private VC), with \({\beta }_{si}\) and \({\beta }_{fi}\) representing lagged values of state and federal funding. \({\beta }_{i1}\) represent coefficients for stage 1 (base effect in nascent stage), while \(\Delta {\beta }_{i2}\) represent the change of the effect from stage 1 to 2 (nascence to acceleration).\({\Delta \beta }_{i3}\) represents the changing effect in stage 3 with respect to stage 1 (nascence to stabilized growth). Here, the \({c}_{i}\) unobserved effect covariates include only state and federal funding.

We calculate the net effect by stage by adding the coefficient of the base effect for the nascency stage and the coefficient of the associated change for the subsequent two stages of acceleration and stabilization. We calculate standard errors using the covariance matrix of the coefficients and calculate a t-statistic to discern statistical significance at the usual levels. All models are heteroskedastic robust. Full stage-switching results are shown in the Tables 9, 10, 11, and 12.

Results presented in Table 10 examine variations on the functional forms of the state, federal, and private VC variables. In this specification, we include all possible varieties of funding dummies that a firm might receive as a series of indicator variables, with the reference category being firms that received no support. These results confirm the previous results, demonstrating robustness. Receiving only private VC or any combination of sources is associated with a decreased probability of failure. Receiving only state funding or only federal funding has no influence, while receiving state and federal funding, even without private VC, does decrease the probability of failure. However, firms that received both private VC and federal funding, and firms that received all three sources of funding, have the lowest magnitude chances of failure.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Clayton, P., Feldman, M. & Montmartin, B. Entrepreneurial finance and regional ecosystem emergence. Small Bus Econ 62, 1493–1521 (2024). https://doi.org/10.1007/s11187-023-00827-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-023-00827-6

Keywords

- Entrepreneurial finance

- Entrepreneurial ecosystem

- Ecosystem emergence

- Industry cluster

- Territorial servitization