Abstract

This essay reflects on the last few decades’ evolution of Ideas, Evidence, Concepts, and Methods in the multidisciplinary, multi-level, and multi-methodological field of entrepreneurship research. Using illustrations from my own career and how prior recipients of the Global Award for Entrepreneurship Research guided and inspired them, I describe the journey from early empirical exploration to understand the nature of the phenomenon to more recent, endogenous theory-development and -testing, heralding each as an indispensable steppingstone in meaningful knowledge development. The essay ends with an ode to the collective, co-creating nature of our knowledge-building enterprise.

Plain English Summary

Over the past few decades, entrepreneurship research has developed an increasingly high-quality body of knowledge that is relevant to policy and business practice. This essay reflects on the co-creative nature of this development as well as my personal role in it. The main implications are (1) for research: contributions come in many flavors and are typically collaborative in one way or the other; (2) for practice: while some entrepreneurship research may seem esoteric to practitioners, it also offers solid research evidence on highly practice-relevant matters like how growth and profitability are related that practitioners ignore at their own peril; and (3) for society: entrepreneurship undoubtedly performs a very important, positive function in society; yet, we need to distinguish between those ‘entrepreneurial’ endeavors that make a net contribution to societal interests and those that do not.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This essay revolves around my personal reflections on what we do—as researchers in general and entrepreneurship researchers in particular—to contribute to knowledge development in our field. With this I hope to stimulate colleagues to make their own reflections and young entrants to learn and get inspiration for their future research contributions while also getting some glimpses of the history of our field. Writing the essay was triggered by my receiving the 2023 Global Award for Entrepreneurship Research—henceforth GAER—and is colored by my background in business studies with sporadic roots in psychology and economics.

Some of the issues I will discuss are likely treated more systematically and to greater depth by experts in the philosophy of science and/or the history of ideas. My reflections are intended as a complement based on rich experience from the field of entrepreneurship research, whose journey from relative obscurity to stardom within the economic and organizational sciences (Davidsson, 2016b; Landström, 2020; McMullen, 2019; Wiklund et al., 2019) I have witnessed closely over the past 38 years. I will rely embarrassingly heavily on examples from my own oeuvre because these are the ones I know best. These examples will mirror the development of the field of entrepreneurship by sometimes reserving the e-label narrowly for the emergence of new business activities while at other times implying a broader interpretation including growth and other indicators of business dynamism. Throughout, however, the examples will be based on works where citation statistics or evidence of other types of influence suggest they can count as examples of meaningful contributions. I will also highlight how these contributions have been co-created with collaborators and those who went before—not least prior GAER awardees—and end my egotistical exercise with an ode to the collective nature of our knowledge-building enterprise.

2 Ideas, evidence, concepts, and methods

What do we do as (entrepreneurship) researchers? We develop knowledge, individually and collectively. Within the research community with which I am most familiar the main emphasis in the past couple of decades has been on theoretical contributions expected from papers that also present empirical results. However, knowledge development requires multiple elements, and claims of piecemeal contributions to theory are not always those that attract the most citations or have the greatest impact on practice and future scholarship. I will therefore argue for a more nuanced view of what it entails to make meaningful scholarly contributions and receive appreciation for them (cf. Hambrick, 2007; Miller, 2007).

Granted, one important thing we do is to develop Ideas—carefully considered thoughts about how some part of the world works or could work. Often, these ideas involve causal relationships, but they may alternatively take other forms such as a process model or a typology (Cornelissen, 2017). When we are sufficiently impressed with them, we may afford the ‘theory’ label to the ideas (Bacharach, 1989; Shepherd & Suddaby, 2017; Whetten, 1989).

We also produce Evidence—data, observations, and analysis results. This is a rather different activity from developing ideas, and it arguably requires another set of knowledge, skills and processes. Yet, ideas and evidence are closely connected. Ideas do not spring out of nothing; they are typically inspired by some more or less systematic analysis of available evidence. We call this induction, or exploratory research. In other cases, the search for evidence is narrowly directed by pre-existing ideas and serves to support, disprove, or refine these ideas. We call this theory testing or theory elaboration, following a deductive process.Footnote 1

Further, some of us occasionally coin Concepts. Agreed-upon and well-defined concepts can guide our thinking and intellectual exchanges. They make it possible to develop and communicate ideas and accumulate evidence pertaining to these ideas. In daily life, we do not often reflect on how practical it is to have agreed-upon, abstracted concepts like “dog” and “cat” (and thousands of others) rather than having to refer to each instance by describing an array of features that hopefully define them correctly—including also those that happen to lack an eye, an ear, a leg, a tail, or a set of whiskers. In scholarly exchanges we use a plethora of concepts but unfortunately, far from all of them are agreed-upon and well-defined. As remarked by 2015 GAER awardee Sidney Winter: “Productive discussion is frequently impaired by a lack of sufficient clarity as to what the discussion is about” (Winter, 2016, p. 17; cf. Podsakoff et al., 2016; Suddaby, 2010). This has certainly been a source of frustration in entrepreneurship and many other fields of research alike (Davidsson, 2015, 2023).Footnote 2

Finally, we can contribute by developing or refining Methods for producing evidence. Many method tools for research design, data collection, and analysis are generic and may not have to be developed from scratch within an applied field like entrepreneurship. Yet, where we need our own concepts we also need measures to assess variance in the phenomena to which the concepts refer, and we may also need in part unique procedures for collecting evidence to explore our phenomena and test our field-specific ideas.

One of the frustrations and delights of operating in a young field like entrepreneurship is that there has been seemingly endless need as well as endless opportunities for making contributions on all four accounts—ideas, evidence, concepts, and methods. Moreover, it has been possible for an individual researcher to be active across these arenas. By entering the field of entrepreneurship when I did, I have been challenged and privileged to do so. Sometimes, I have had reason to reflect on whether the much more mature field we have today would be the right one to enter for someone with my young self’s temper and inclinations. Then again, for all the impressive progress of our field, we have arguably just scratched the surface. We can hardly say that we have a strong paradigm in the form of a set of well-established theories, concepts, and methods conventions that make life as an entrepreneurship researcher convenient, albeit constrained. Moreover, technological and societal developments change the phenomenon of entrepreneurship, triggering new research questions. There should thus be ample room for important contributions of various kinds also in the foreseeable future.

3 Early days—mostly (exploratory) evidence

Entrepreneurship—initially markedly intermingled with small/independent business—emerged as a separate field of research during the 1980s and 1990s.Footnote 3 In this era, evidence in the form of exploratory empirical fact-finding was the main game. Accordingly, my very first conference paper utilized a fellow PhD student’s broadly based data set on economic behavior of Swedish males to descriptively compare a long array of characteristics of business-owner managers with those of others (Davidsson & Wahlund, 1986). As late as year 2000, Frédéric Delmar and I published a paper whose title “Where do they come from? Prevalence and characteristics of nascent entrepreneurs” (Delmar & Davidsson, 2000) reflect a very similar type of contents. Three years further on, Bill Gartner—the 2005 GAER awardeeFootnote 4—helped us finally get a 1998 conference paper from our High-Growth Firms (HGF) project published in Journal of Business Venturing (JBV) after rejections from a couple of leading, mainstream management journals (Delmar et al., 2003). The results show that “high growth firm” is neither a stable nor well-defined category; selection of different growth measure(s) leads to quite different groups of HGFs. The rejection letters were almost comical with their praise for the quality of our data and the interestingness and importance of our results combined with flat rejection for lacking a front-end theory section.

3.1 Discovering the economic importance of new and small firms

This, of course, reflects an attitude that is now widespread in our own field and which I may at times have slid into myself. Actually, one has to “map out the territory” in order not to build one’s theorizing on a gross misconception of the theorized phenomenon. Further, the early, empirical fact-finding was absolutely essential for building the field by attracting interest and funding from policymakers and enticing other academics to join our community. Some of the empirical exploration led close to what can be called scientific discovery of a kind rarely seen in the social sciences. As a case in point, David Birch became the inaugural GAER awardee in 1996 “For having identified the key role of new and small firms in job creation” in Birch (1979) and follow-on works. This finding was totally unexpected at the time. The same largely applies to year 2001 GAER awardees Acs and Audretsch (1990) unveiling of small firms’ role in innovation. In the Business Dynamics in Sweden project, among much else we repeated Birch’s feat with Swedish data showing that “7 out of 10 new jobs come from small firms”—a result attracting considerable media and policymaker attention at the time (Davidsson et al., 1994, 1996).

3.2 The prevalence, heterogeneity, and modesty of (most) entrepreneurial activity

In the mid to late 1990s, year 2004 GAER awardee Paul Reynolds initiated and led two large-scale, international collaborations that are without comparison the most important explorations of entrepreneurship to date—the Global Entrepreneurship Monitor (GEM) to compare entrepreneurial activity across countries with harmonized methodology and the Panel Study of Entrepreneurial Dynamics (PSED) to follow business start-up processes as they happen (see Davidsson, 2005, 2006; Davidsson et al., 2012).Footnote 5 It is difficult today to comprehend how little we knew about the phenomenon of entrepreneurship before these projects, and hence how much we have learnt from Reynolds’ gargantuan efforts and the hundreds of journal articles, dissertations, books, and policy reports they have produced.

More than anything else, we have been set straight regarding the prevalence, heterogeneity, and—for the most part—modesty of entrepreneurial reality, as well as its processual and socially interactive nature. None of this was widely known in the early 1990s. The prevalence is higher than we would have guessed, meaning that a large proportion of the adult population is involved in a business start-up at some point in their career. The heterogeneity arises from the fact that all kinds of people (try to) start very different businesses with wildly different goals and resources. They do so on their own or in professional, kinship, or friendship-based teams and progress at very different pace (Davidsson & Gordon, 2012; Shim & Davidsson, 2018). This is important because it tells us that the salient drivers of the initiation, progress and outcomes of these efforts are also likely to vary tremendously, and hence that the idea of a unified, explanatory ‘theory of [all] entrepreneurship’ is futile.

As regards heterogeneity in magnitude and predominance of modesty, Howard Aldrich—the year 2000 GAER awardee—has illustrated the reality of entrepreneurship graphically as in Fig. 1. The data illustrate how extremely rare the types of start-ups are that are most exposed and discussed in popular media, and also how important the modest majority are because of their sheer numbers. Assuming the 500,000 that start hiring within one year only hire one person on average, the 24 IT IPO cases would have to hire 21,000 people each to match them. They will not. Without systematic collection of exploratory evidence, we would have no clue about these proportions. Sadly, neither scholarship nor policymaking nor investments are always informed to the extent they should be by this basic type of evidence.

A sobering portrayal of the prevalence of various entrepreneurship-related phenomena (After Aldrich & Ruef’s, 2018, compilation of US data from various post 2000 years)

While production of exploratory evidence seems to have low status in large parts of the management research community, there are other signs of appreciation. After all, Birch and Reynolds did become GAER awardees. And as it were, the two fact-finding papers with Delmar discussed above are currently my 3rd and 5th most cited papers, having close to 4,000 Google Scholar citations combined and collecting another 200 per annum to this day. Unless they are mostly cited as bad examples, this suggests the broader “market” considers them more useful than most articles claiming “theoretical contributions.” Today, the respective journals would not publish papers like these on such broad and nowadays more well-research topics. And rightly so—empirical fact-finding has its place with new and previously neglected phenomena. But since entrepreneurship practice is constantly evolving, the need for “mapping out the territory” never vanishes. Accordingly, more recent examples show that when important new phenomena emerge, largely descriptive but timely papers can achieve top tier publication as well as high citation counts (e.g., Fisch, 2019; Mollick, 2014).Footnote 6

4 The early days—not just evidence

4.1 Early conceptual contributions and my first baby-steps in that arena

Although exploratory fact-finding may have been prominent in the early days, there were also other types of contribution. For example, Bill Gartner—the 2005 GAER awardee mentioned as our co-author above—made several early, conceptual contributions that remain highly cited to this day (Gartner, 1985, 1989, 1990; Katz & Gartner, 1988). Low and MacMillan (1988)—the latter being the 1999 GAER awardee and JBV founding editor—also offered some conceptual order to the emerging field. Early development of important ideas includes contributions by Sue Birley (1985) along with year 2000 and 2008 GAER awardees Aldrich and Johannisson that took important steps away from the “heroic lone wolf” view of the entrepreneur by unveiling the importance of networks (e.g., Aldrich & Zimmer, 1986; Johannisson, 1988).

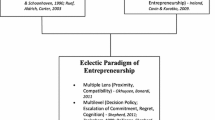

As to myself, my dissertation work involved a fair amount of conceptualization as well as ideas about how the concepts were related. My research problem concerned small firm growth conceived of as continued entrepreneurship—the ability and willingness to continue to grow and develop after a venture has been established. What I encountered in the then available literature—and this illustrates the downside of atheoretical empirical exploration—added up to an endless laundry list or overfull kitchen sink of various factors of different kinds and on different levels—that might for some reason be somehow related to the phenomenon to be explained. In Davidsson (2004, 2016a), I illustrate this with Fig. 2a.

The better alternative I developed and tested is shown in Fig. 2b. This model reflects the argument that any effects of the particularities in Fig. 2a occur because they represent one or more of three fundamental drivers: Ability to engage in continued entrepreneurship, the Need to do so, and the Opportunity to successfully take such action. A second important argument separates the objective and the subjective. The assumption is that agents act on perceptions, which are imperfect reflections of objective reality. These perceptions drive motivation, which leads to outcomes.Footnote 7 However, the latter are also influenced directly by objective reality, whether correctly perceived or not.

The main article from the thesis (Davidsson, 1991) as well as the dissertation itself (Davidsson, 1989) are well cited—just short of 2,000 Google Scholar citations combined at the time of writing. But does that make it a conceptual or even theoretical contribution? Examining the citing works, it is actually difficult to find elaborate applications of my conceptualizations and/or model.Footnote 8 Hopefully, the more structured and abstracted approach to knowledge development has served as inspiration for others, much like year 1997 GAER awardee Arnie Cooper quietly inspired by doing entrepreneurship research of a higher conceptual and empirical quality than most others at the time (e.g., Cooper et al., 1994; Gimeno et al., 1997). And this is how the example remains relevant today: each time a new, seemingly interesting and important phenomenon appears, it will attract ‘empirical fact-finding’ interest from researchers, as it should. But for this to contribute to durable knowledge creation someone will have to step up and bring conceptual structure and well-argued causal ideas to the table, because “No matter how intriguing an empirical result may seem here and now, it is the sensemaking of theory that makes it travel through space and stand the test of time” (Davidsson, 2016a, p. 41).

4.2 Methods contributions—some examples

Returning now to Birch (1979) and Acs and Audretsch (1990), they did not just take an existing data set and ran some analyses to demonstrate the importance of small and new firms for job creation and innovation. Their work required method development regarding how to identify, combine, and organize data in such a way that they could address and credibly answer these research questions. The same goes for our Business Dynamics in Sweden study. We spent the better part of a year collaborating with experts at Statistics Sweden to compile the best possible data from multiple sources and linking them over time while making umpteen careful decisions on how to attribute changing entities to industries, regions and size classes over time, cross-checking data against other sources, identifying and correcting erroneous data points, etc., as described in detail in Davidsson (2004, ch. 7). Researchers can make similar method contributions today by developing better ways to identify, refine, combine and analyze digital trace data for research purposes, thereby also paving the way for their own and others’ novel evidence- and idea-based contributions (e.g., Meurer, 2023; Ng & Stuart, 2016).

One methods- and evidence-related contribution from the Business Dynamics in Sweden project was the rebuttal of Davis et al.’s (1996) allegation that the evidence on the job creation prowess of small firms was driven by method biases. Specifically, we demonstrated that the “regression bias”—while real—did not substantively affect conclusions on the matter. Moreover, we developed a better method than theirs for correcting the bias, which was subsequently adopted by the US Bureau of Labor Statistics (2018) under the label dynamic sizing (Davidsson, 2004, pp. 163–170; Davidsson et al., 1998b; de Wit & de Kok, 2014). In terms of ideas, the project made us increasingly realize that newness rather than smallness was the name of the game; established SMEs are not great innovators or job creators (Davidsson et al., 1998a). This is a theme that year 2020 GAER awardee John Haltiwanger—who had been on the opposite side of the barricade on the regression bias issue—has subsequently pursued to greater depth and sophistication (Haltiwanger et al., 2013).

The High-Growth Firms project also required methods innovations to produce our empirical fact-finding. This included recoding firms as continuing when their identity in the underlying data changed due to change of location or industry classification (resulting in a false death and a false birth; see Geurts, 2016, on the importance of this issue). Even more uniquely, we developed a method for distinguishing between organic and acquisition-based modes of growth in business statistics. This is critically important because the two modes are associated with totally different management challenges (Penrose, 1959) and implications for job creation. Although jobs moving from one organization to another may reflect some important restructuring of the economy, these jobs do not constitute job creation.

This methods innovation also led us the closest I have come to making “scientific discoveries.” After classifying the top ten percent as “high growth firms” (HGF) based on their total employment growth, it turns out that the HGF’s proportion of total growth that is organic varies extremely by firm size and firm age (Davidsson & Delmar, 2002, 2006). In short, young and small firms grow organically, large and old ones do not. In fact, the HGFs in our largest firm size class shrank in organic terms. If this applies to other data sets—and it likely does—it means that not separating out acquisitions leads to considerable underestimation of small and young firms’ importance for job creation.

Another “discovery” was that HGFs do not stop growing during a deep recession but radically change the composition of their growth to rely much more on acquisition during the crisis, presumably based on increased supply of inexpensive acquisition targets in distress. This result, which is displayed in Fig. 3 is evidence I had reason to revisit for a conceptual paper I am currently working on (von Briel et al., 2023). Unfortunately, at the time we did not publish this particular result, making Fig. 3 the original publication of this important finding. John Haltiwanger is one of the few who has followed suit in separating organic from acquisition-based growth (e.g., Haltiwanger et al., 2013) but I have not been able to identify a published analysis by him or others of high-growth firms’ choice between growth modes through business cycle swings. Our omission not to publish our growth-mode-through-macroeconomic-swings results illustrates a point that remains relevant: insights that stay in the drawer are not scholarly contributions.

4.3 Co-creation of new evidence that drives new ideas

Regarding regional drivers of entrepreneurship, our Business Dynamics in Sweden project was part of a seven-country collaboration orchestrated by David Storey and Paul Reynolds, the 1998 respectively 2004 GAER awardees.Footnote 9 The special issue where we jointly published our main results is a microcosm that illustrates the dilemma and promise of knowledge accumulation our field is facing to this date. If you read the individual articles from each of the seven countries—which all address the same general issue—you will struggle to see a coherent pattern regarding the major, generalizable factors that influence the regional levels of new venturing. However, with forced harmonization of conceptualization and measurement across the country studies, Reynolds et al. (1994) arrived at rather clear conclusions suggesting that the three factors having a positive impact on firm birth rates were 1) growth in demand (indicated by population growth and growth in income); 2) the advantages of agglomeration (indicated by population size and density), and 3) a business population dominated by small firms (indicating presence of relevant knowledge and role models) while other factors related to unemployment, personal wealth, liberal political climate, and policy initiatives had weak or mixed impact.

Not only did this amount to the perhaps strongest cumulative evidence available at the time on any entrepreneurship-related issue; getting there also required considerable effort towards conceptualizing the drivers and deciding on how to best measure them with available data. The confused picture left by the individual country studies corresponds to the “free market” of independently designed studies addressing the same phenomena through their own choice of conceptual lenses that dominate our journals. We must have this “free market,” but important future contributions will be made also by those who organize larger, harmonized collaborations to provide more solid evidence on commonalities and contextual differences pertaining to important entrepreneurial phenomena.

Finally, Paul Reynold’s PSED and GEM mega-projects—which engaged many dozens of researchers across the globe—were not all about evidence. To begin with, these projects required the conception and development of an entirely new approach to obtaining random samples of on-going start-up processes (Reynolds, 2009) as well as novel operationalizations of a range of phenomena as documented and discussed in Gartner et al. (2004). Further, they led to the coining or underpinning of a range of new concepts such as nascent entrepreneur (Reynolds & White, 1992), gestation process and gestation activities (Alsos & Kolvereid, 1998); necessity entrepreneurship (Bosma & Wennekers, 2002); modest majority (Davidsson & Gordon, 2012); leisure-based founders (Kim et al., 2015); and many others.

Further, follow-up projects have been more theory-driven and conceptually sophisticated, making the data suitable for theory development, of which my most recent example is Steffens et al. (2023), where we refine the theory of entrepreneurial bricolage. And as I wrote in Davidsson (2005) based on the chapter conclusions in Reynolds and White (1997):

Empirics-heavy as these projects were, the battle was fundamentally a conceptual one: should the economy and its development be viewed essentially as a matter of large, rather stable organizations, start-ups and small firms being rather unimportant phenomena at the fringes? Or is dynamism and renewal of the business population the most important characteristic of the economy?

5 Post-2000: a sharp turn toward concepts and ideas

Around the year 2000, entrepreneurship research turned markedly more oriented toward concepts and ideas, that is, theory.Footnote 10 This was when Scott Shane—the 2009 GAER awardee—together with Sankaran Venkataraman redefined the entrepreneurship research domain in the influential “Promise” paper and when year 2022 GAER awardee Saras Sarasvathy’s effectuation paper gave us the first major example of theory development unique to that domain (Sarasvathy, 2001; Shane & Venkataraman, 2000). Notably, both appeared in Academy of Management Review (AMR)—the most prestigious outlet for conceptual contributions—and became two of the best cited AMR papers from that era.

Concepts are important and powerful tools in knowledge development. Good, agreed-upon concepts guide our thinking and debate and make it possible to accumulate evidence. This is why I care deeply about our concepts. When different concepts are used for the same phenomena it hampers knowledge accumulation. The same can result from using the same concept for different phenomena. Our review of research on entrepreneurship that is triggered by changes to the business environment exemplifies the former (Kimjeon & Davidsson, 2022; see also Podsakoff et al., 2016) while my scrutiny of research on ‘entrepreneurial opportunities’ (Davidsson, 2015) illustrates the latter. Because I believe in the importance of good concepts for knowledge development, I have in my later career poured significant intellectual effort into two central concepts: “entrepreneurship” and “entrepreneurial opportunity.” I have elsewhere elaborately described and motivated (Davidsson, 2003, 2015, 2016a, Chs, 1, 2, 8; 2017b; 2023) as well as commented on (Davidsson, 2016c) my stance on these concepts, so there is neither room nor need to repeat it all here.

Instead, I will try to address a difficult question sometimes asked by younger colleagues: how does one develop a conceptual contribution? Despite my skepticism against the reliability of introspection as a method and the realization that creativity research probably offers a much more well-founded answer, I will attempt at reply. To put it in a catchy framing, I would say in my case it comes down to curiosity, care, cockiness, circumstances, criterion, contrast, co-creation, chance, and contingencies. Some of these can be systematically managed, others voluntarily marshalled to a degree, others still one can make oneself open to, while some require luck to come about.

5.1 Refining the concepts of entrepreneurship and entrepreneurship research

Curiosity, care, and cockiness. My research has always been driven by curiosity rather than instrumental career management. I have addressed questions I found interesting and important. For people of my ilk, I think it is the best (or only) way to do well. I care about the development of our field because it addresses societally important issues (that were neglected). The GAER 2023 award motivation mentions my community-building efforts. My attempts at conceptual contributions grow from the same stem. Further, when I see something that does not quite work, my inclination is to want it fixed, and within our domain of research I somehow muster the cockiness to see myself as possibly fixing it.Footnote 11

Circumstances. However, as per my “external enablement” crusade (see further below) I am skeptical about overly person-focused explanations. I therefore believe it significant that when entrepreneurship research started to turn sharply toward concepts and ideas, I led the Program of Entrepreneurship and Growth in SMEs (PEG) at the Jönköping International Business School (JIBS), which may at the time have been the only business school apart from Babson College to have entrepreneurship as a main profile area. This made it possible for us to assemble quite a strong team of international affiliates that paid regular visits, including those who were to become year 2000, 2007, 2009, and 2014 GAER awardees—Howard Aldrich, Candy Brush, Scott Shane, and Shaker Zahra, respectively. Thanks to our regional economists, year 2001 awardees Zoltan Acs and David Audretsch also visited recurringly.Footnote 12 Drafts of the two seminal papers mentioned in the introduction to this section—Shane and Venkataraman (2000) and Sarasvathy (2001)—were presented at our seminars well before they were published. In all, we felt we were at the center of our field, and it was an environment where taking on its most central concepts did not seem alien at all.Footnote 13 An invitation from Jerry Katz to develop and share my thoughts on the matter served as another external impetus, setting things in motion with Davidsson (2003).

Criterion, contrast, and co-creation. It is neither necessary nor wise to develop concepts or conceptual refinements from scratch. By criterion I mean attending to the words of the giants that came before us, by contrast having the guts to see both what they did exceedingly well and what gaps and blurred areas they might have left, and by co-creation thus to take onboard one of the most important lessons we have learnt about successful entrepreneurs: rather than being heroic “lone wolves” they typically identify, cultivate, and utilize other people’s competencies.Footnote 14 Accordingly, my views on “entrepreneurship” (outlined in Davidsson, 2004, 2016a) build closely on four former GAER awardees, namely the previously mentioned Gartner and Shane (2005 and 2009 awardees) and economists Israel Kirzner (2006 awardee) and William Baumol (2003 awardee). From each, I retained what I found particularly good while altering or supplementing parts I found missing or less useful.

I liked that Shane and Venkataraman (2000, p. 218) attempted to delineate the domain of entrepreneurship rather than offering yet another definition of the phenomenon, so I started from their delineation of the field of entrepreneurship research in developing my own (admittedly verbose) version (cf. Davidsson, 2004, p. 21; 2016a, p. 26):

Starting from assumptions of uncertainty, heterogeneity, and disequilibrium, the domain of entrepreneurship research encompasses the study of processes of (real or induced, and completed as well as terminated) emergence of new economic ventures, across organizational contexts. This entails the study of new venture ideas and their contextual fit; of actors and their behaviors in the interrelated processes of discovery and exploitation of such ideas, and of how the characteristics of ideas, actors and behaviors link to antecedents and outcomes on different levels of analysis.

Here, “disequilibrium” was taken directly from Shane and Venkataraman (2000) with roots in Kirzner (1973). I added “uncertainty” (and “…as well as terminated”) because both of these sources sometimes argue as if we were only dealing with success cases. Heterogeneity I added to caution against the type of economic theory that represents the micro-level with a uniform “representative case” which seems antithetical to the essence of the phenomenon. The focus on “processes” of “emergence”—that it is a metamorphosis-prone journey from non-existence to existence—is from Gartner’s vernacular. Relatedly, “behaviors” reflects Gartner’s (1989) assertion that what is important about entrepreneurs is not who they are, but what they do. The focus on early development—which is also one of the intentions of Shane and Venkataraman’s emphasis on “opportunities” which I replace with “new venture ideas”—gives entrepreneurship research a unique role in the broader context of economic and organizational scholarship. Gartner’s emphasis on “behaviors” arguably gives more weight to exploitation (i.e., implementation; realization; actualization) than Shane and Venkataraman (2000) do, although their inclusion of exploitation was already and improvement on Kirzner’s (1973, p. 47) famous “ten-dollar bill” example, which suggests that “discovery” alone is the essence of entrepreneurship.Footnote 15

I added “real or induced” to invite experiments and simulations involving hypothetical situations. “Across organizational contexts” builds on Shane and Venkataraman’s (2000) “modes-of-exploitation” and removes the close association with “small” and/or “owner-managed” organizations that was prominent in the early years.Footnote 16 In turn, “contextual fit” is a broadening of Shane and Venkataraman’s (2000) individual-opportunity nexus idea. The elements’ relation to antecedents and outcomes is a generic focus of research while highlighting “different levels of analysis” encourages a move away from singular interest in venture/firm level outcomes (cf. Davidsson & Wiklund, 2001; Shepherd, 2011). It explicates the societal or economy-wide interest of Kirzner (1973) and Baumol (1990) and includes negative outcomes.

The domain delineation is intended as a “big tent” that has room for the “good, bad, and ugly” of what flesh-and-blood “entrepreneurs” do. But this does not satisfy economic-theoretical interest in entrepreneurship as a function in the economic system.Footnote 17 I felt that previous debates of whether success/impact was a necessary criterion for earning the e-label were rooted in this distinction and that some of Shane and Venkataraman’s (2000) arguments sat better with an “economic function” than a “research domain” understanding of entrepreneurship. This convinced me that the two needed to be explicitly separated. Accordingly, in discussing entrepreneurship as economic function I adopted Kirzner’s (1973) notion that entrepreneurship consists of the competitive behaviors that drive the market process,Footnote 18 and argued that this occurs by:

-

Providing customers with new choices perceived by some as better value for money,

-

Stimulating incumbents to improve what they are doing, and

-

Attracting additional entrants that enhance the above effects.Footnote 19

Under the right institutional arrangements—and this is where Baumol (1990) comes in—the above effects translate into increased efficiency and effectiveness of resource use in the economy. Entrepreneurship improves the economy. However, the criterion does neither mean that only successful ventures contribute to the entrepreneurial function nor that all profitable introduction of new economic activities does so. This is illustrated in Fig. 4 (from Davidsson, 2004, 2016a).Footnote 20

The interesting categories here are “catalyst” and “redistributive” ventures. The former are not successful in themselves but set something in motion that produces a net gain for society; the latter—those that Baumol (1990) call destructive—enrich their owners at the expense of societal value. In my schema they simply do not fulfill the entrepreneurial function. Regardless, I think both catalyst ventures and re-distributive ventures deserve closer attention in entrepreneurship theory and policymaking, acknowledging the importance of the former and stripping the latter category of ill-earned awe, admiration and support.

5.2 Reconceptualizing “entrepreneurial opportunities”

Agreeing on the exact meaning of “entrepreneurship” may have become less important over time because scholars tend to use more precise terms in their research models. That is, we do not often theorize or estimate causes or effects of “entrepreneurship” but of sub-aspects thereof, such as how entrepreneurial experience and negative feedback interact in influencing decisions to “pivot” (Burnell et al., 2023) to take one current example.

At the same time, the increased use of “opportunity” has become more problematic over time because it tends to be used in a core role as explanans or explanandum. Authoritative dictionaries define “opportunity” as “a set of circumstances that makes it possible to do something” or other phrasing along similar lines. It is a term that is almost impossible to avoid in any extended, lay conversation about entrepreneurship. As a scholarly concept denoting the entities that entrepreneurs are pursuing in the journey from non-existence to existence of new ventures, however, it has turned out to be highly problematic (Davidsson, 2015, 2017a, b, 2022, 2023). I had delighted in Shane and Venkataraman’s (2000) attempt—with the help of the individual-opportunity nexus idea—to emphasize the process of emergence and reduce the exaggerated reliance on person-based explanations of entrepreneurship. However, the ensuing “opportunity research” stream deteriorating into conceptual cacophony and non-progressing (and sometimes misinformed) philosophical debate left me utterly frustrated (Davidsson, 2023; Hansen et al., 2011, 2016; Kitching & Rouse, 2017). Hence, it was another expression of care for our field that made me invest my greatest intellectual effort to date in alternatives to the “opportunity” concept.Footnote 21

In the entrepreneurship research domain delineation discussed above I replaced Shane and Venkataraman’s (2000) “opportunities” with “new venture ideas.” Since they defined “opportunities” as objective, pre-existing entities, this is not a trivial change—and a costly one if one believes in the importance of favorable environmental conditions for entrepreneurial action and success. Accordingly, I reintroduced the external environment in my reconceptualization, which is depicted in Fig. 5.

From my long and hard engagement with prior literature I concluded that the notion of “opportunity” was so inherently complex as well as burdened with “extraneous meaning” (Suddaby, 2010) that the solution was not a mere redefinition of the term. Therefore, I suggested the essence of what prior research had tried to express by “opportunity” needed to be dealt with through three separate concepts: 1) External Enablers for aggregate-level circumstances—such as regulatory changes, technological breakthroughs, and demographic shifts—that may partially enable a variety of new venture creation attempts by different agents; 2) New Venture Ideas for envisioned future ventures, that is, conceived as possible combinations of product/service offerings, markets, and means of bringing these offerings into existence, and 3) Opportunity Confidence referring to agents’ (varying) subjective evaluation of the attractiveness of an external enabler or a new venture idea as the basis for entrepreneurial activity.

As I write in Davidsson (2017b, p. 67) these three concepts need to be separated because they represent “ontologically very different entities which also pertain to different levels of analysis […and…] can change independently from each other at different points in time.” Further, to separate them “makes important distinctions where prior conceptions have been blurred: between explananda and explanantia; between actor and the entity acted upon; between external conditions and subjective perceptions, and between the contents and the favorability of the entity acted upon. These distinctions facilitate theoretical precision and can guide empirical investigation towards more fruitful designs” (Davidsson, 2015, p. 674). I do not hesitate to call this an important conceptual contribution.

5.3 The external enablement framework: a product of chance, contingencies, co-creation, and contrast

When I published my reconceptualization of “entrepreneurial opportunities” in Davidsson (2015), I thought that “New Venture Idea” (NVI) would be my focus in coming years, fantasizing that I would develop something corresponding to the Big Five personality characteristics (Zhao & Seibert, 2006) as salient features of NVIs. As it were, I have only published one paper on NVIs (von Briel et al., 2018b) and one on “opportunity confidence” (rebranded as “venture idea assessment;” Davidsson et al., 2021) since then.

Instead, chance turned up in the form of Frederik von Briel—whom I did not know at the time—contacting me about a conference paper he was writing together with his post doc mentor Jan Recker—another new acquaintance—and where he thought my external enabler (EE) ideas could be of use. This led to very fruitful and enjoyable co-creation of what became von Briel et al. (2018a) and which made me see much greater potential in the EE concept than I had realized when I coined it. We were actually developing novel ideas (theory) with its help! This in turn inspired our joint creation of the EE framework (Davidsson et al., 2020, 2022) where we introduce scope and onset characteristics of EEs; expand (from von Briel et al., 2018a) the range of mechanisms that provide various types of benefits from environmental changes, and outline the triggering, shaping and outcome-enhancing roles that EEs can have in venture creation processes. We deemed these concepts relevant across seemingly different environmental changes (i.e., EEs), be they regulatory, technological, macroeconomic, sociocultural, demographic, natural-environmental, or otherwise.

The development of this conceptual toolbox started as an attempt to create a more workable conceptual alternative to realize Shane and Venkataraman’s (2000) individual-opportunity nexus idea, that is, to simultaneously account for important aspects of agents and agency on the one hand, and what the external environment offers on the other. Table 1 details how the ability to contrast with less desirable aspects of how they conceptualized this essentially good idea allowed us to carefully craft the EE concept and framework to do better in these regards.

Further contingencies affected the course forward, similar to how 2022 GAER awardee Saras Sarasvathy’s effectuation theory suggests entrepreneurial processes progress (Sarasvathy, 2001, 2008). An invitation to write an opinion piece for Academy of Management Discoveries (Davidsson, 2020) made me realize that the EE concept and framework actually address a neglect of the environment in general and environmental change in particular in entrepreneurship and strategy research—a neglect that stands in stark contrast to the obvious business impact of recent decades’ real-world developments such as the Global Financial Crisis/Great Recession; the digital technology revolution; climate change and its call for sustainability transformation; Covid-19 and its unprecedented regulatory responses, and the Ukrainian war. When we later thoroughly reviewed prior literature on entrepreneurship in response to different types of changes to the business environment (Kimjeon & Davidsson, 2022), I became aware of further potential, far beyond what I had realized when writing Davidsson (2015).Footnote 22 First, the often atheoretical or conceptually eclectic approaches in the reviewed line of research (despite appearing in top journals) along with evident lack of cross-citations strongly suggested a need for common theoretical language. Second, for the most part, we found that the EE framework terminology adequately covered the many facets of environmental facilitation across different types of environmental change that were addressed in the reviewed research and thus that it could provide the needed common language.

Taking a step back, one realizes that our development of the EE framework addresses the eternal issue of agency vs. structure (Archer, 2003; Giddens, 1984) in the particular context of new venture development (Davidsson, 2023). Specifically, it provides a toolbox for analyzing what exogenous changes in structure can offer entrepreneurial agents. This is not an argument for the primacy of structure, nor for agency or structure. Rather, following Shane and Venkataraman (2000), it is an attempt to move the emphasis to agency and structure, with the EE framework supplementing rather than supplanting the agent-based theories that currently dominate micro-level entrepreneurship and strategy research (Davidsson, 2020; Davidsson et al., 2023).

Granted, the EE framework is not flawless and my view of it is certainly not unbiased. And, of course, it is but one of many conceptual contributions that have appeared in entrepreneurship in the last couple of decades. This being said, my own recent experience of theorizing from it along with the increasing number of applications by other authors (e.g., Bennett, 2019; Cestino et al., 2023; Chalmers et al., 2021; Chen et al., 2020; Hinderer & Kuckertz, 2022; Juma et al., 2023; Lucas et al., 2023; Schade & Schuhmacher, 2022; Wood et al., 2023) make me hopeful that this conceptual toolbox will provide lasting substantial value for future research and practice within and beyond entrepreneurship.

6 Post 2000—not just ideas and concepts

Developments in entrepreneurship research over the last couple of decades have not been all about “talk”—concepts and ideas. Apart from an enrichment of the phenomena covered (e.g., bricolage; crowdfunding; digital affordances; mental health and well-being; microfinance and poverty alleviation; community, social and sustainability entrepreneurship, etc.) there has been a marked trend toward creating more reliable and cumulative knowledge. This takes many forms like using better and larger data sets; applying better validated operationalizations; development and application of computer-based tools for analysis of qualitative data; provision of robustness tests to show stability of results across alterations of analysis models and techniques; reporting multiple studies in the same article (e.g., Davidsson et al., 2021; Gielnik et al., 2015); systematic literature reviews supported by guidelines for how to conduct them (Bacq et al., 2021; Rauch, 2020); meta-analyses (e.g., Rauch & Frese, 2007; Unger et al., 2011) and special issues devoted to knowledge accumulation (Chrisman et al., 2022; Frese et al., 2014).

And finally (see Davidsson, 2004, 2016a; both ch. 9) there is interest in and efforts toward replication (e.g., Crawford et al., 2022; Shrout & Rodgers, 2018) and so far without emergence of the “replication crisis” reported from other fields. As a result, I have recently had the privilege of getting one of my favorite studies—Davidsson et al. (2009)—replicated by other researchers (Ben-Hafaïedh & Hamelin, 2023; Brännback et al., 2009). Focusing on the dynamics of growth and profitability, the example is not squarely within the entrepreneurship domain as I outlined it above, but it is certainly relevant to the focus on rapid scaling in contemporary entrepreneurship practice and research (Jansen et al., 2023).

In the original study we addressed the question “How do firms become high performers both regarding growth and profitability? Do they first achieve high profitability and then go for growth without forsaking profitability, or do they first achieve high growth and then turn above-average profitable as a result of their growth?” What we found was very clear—as well as controversial according to some. Our results showed that firms were much more likely to move to high performance on both dimensions if they started from high profitability. Firms going for high growth at low profitability did not often become profitable as a result of their growth; instead, they frequently transitioned to the least favorable category: low growth combined with low profitability. This pattern was largely stable across the two countries as well as various breakdowns by industry, firm age, and firm size.

However, our data had some shortcomings. At the time of publication, the most recent data were already more than 10 years old, and we could only follow the firms’ performance transitions for 2–3 years. So, skeptics had some valid reasons for concern. This has since been helped by replications. First, Brännback et al. (2009) achieved near identical results in a study of biotech ventures, taking care of concerns that the original results may not apply outside the realm of ‘traditional’ small- and medium-sized businesses. But theirs was a small study, especially compared with the more recent replication by Ben-Hafaïedh and Hamelin (2023). The latter’s main results show that in one-year transitions, firms starting from high profit/low growth were 2.5 times more likely to move to high profit/high growth than were firms starting from low profit/high growth (26.9% vs. 10.97%). Those starting from low profit/high growth were instead 2.5 times more likely to end up with low profit/low growth (32.55% vs. 13.76%). Moreover, with varying magnitude, the direction and statistical significance of these results held up in separate analysis:

-

Of each of the 28 (European) countries studied

-

Of both size classes

-

Of all 4 industry sectors

-

Of all 5 firm age classes

-

Of all alternative time lags (1–7 years)

-

Using all three alternative measures of growth (sales, assets, employment)

-

Using either measure of profitability (ROA, ROE)

-

Using our original and alternative analysis approaches

This level of consistency in the findings is rarely seen in the social sciences. I think it fair to suggest that if anyone is convinced that growth before profit is a sound strategy for some category of firm, the burden of providing systematic evidence for their case lies entirely with them. Given the widespread belief in growth-before-profit in (high-ambition) entrepreneurship practice in recent years I would call the above the most important evidence in whose production I have had a significant role.

7 Conclusion

The writing of this essay has in itself been a process of emergence. I started from the elements or dimensions of what we do when we develop new knowledge—conceive ideas, produce evidence, coin concepts, and develop method tools. What has emerged, I believe, is a story of how we do this better when we do it together.Footnote 23 We do it better when we “map out the territory” in a coordinated fashion as was done by PSED and GEM teams around the world acting on Paul Reynolds’ pioneering initiatives. We do it better when we harmonize concepts and measures’ and apply them to multiple contexts as was done in the reporting of the seven-country study orchestrated by Storey and Reynolds. We do it better when we collect and use more data with multiple methods before seeking publication, like we—thanks to my co-authors—did in Davidsson et al. (2021). We do it better when we invest the time and effort to make sense of our collective efforts through reviews and meta-analyses, as spearheaded by Michael Frese and his disciples. We do it better when we replicate seemingly important findings, an approach Ben-Hafaïedh and Hamelin (2023) recently took to new heights. And we do it better when we develop conceptual tools that make possible broader knowledge accumulation about important phenomena, like my colleagues and I have tried to do with the EE framework.

Even when the starting point is something we are critical about, we can productively co-create. We do this by not stopping at the criticism but moving on to creating a better alternative. This is what I tried to do by developing alternatives based on the problems others and I identified with Shane and Venkataraman’s (2000) conceptualization of opportunities. The same applies to us developing a better solution to correcting for the “regression bias” based on doubts about the soundness of Davis et al.’s (1996) suggestions for how to do so. Such cases make us realize that what we were critical about was an indispensable step on the journey toward our own knowledge contribution, and hence that also in such cases we need to pay respect and gratitude to those who went before us.

It has been an incredible privilege to be part of it all.

Notes

Apart from the “ideal types” of induction and deduction, abduction is sometimes argued to be a more realistic description of real research processes and is alternatively portrayed with a main emphasis on alternating the focus on ideas vs. evidence or on having a surprise finding as the starting point (Linneberg & Korsgaard, 2019; Sætre & Van de Ven, 2021). Apart from inductively building entirely new theory and deductively disproving it, the processes may result in revision of prevalent ideas through theory elaboration (Fisher & Aguinis, 2017).

However, note that Winter’s remark can be applied not only to lack of agreed upon meaning of concepts, but also to lack of shared understanding of the phenomenon because the evidence on its nature has not yet been produced or not yet absorbed (see Fig. 1).

For example, the annual Babson Conference started in 1981; Journal of Business Venturing in 1985; the Entrepreneurship Division of the Academy of Management in 1986; Small Business Economics in 1989, which year also saw the former American Small Business Journal rebranded as Entrepreneurship Theory and Practice.

From 1996 to 2007, the award was called the International Award for Entrepreneurship and Small Business Research. I will use the GAER (Global Award for Entrepreneurship Research) acronym throughout this manuscript.

The PSED also had a US-based follow-up (PSED II) and counterpart studies in a range of countries including the Swedish and Australian varieties in which I had a central role and from which I publish to this day (see Steffens et al., 2023). Reynolds himself has tirelessly continued to mine the data, his most recent book from the projects being published as Reynolds (2022).

This said with some reservation regarding the longer-term importance and viability of initial coin offerings.

Notably, the motivation-driven actions that more proximally lead to outcomes are treated in a “black box” manner in this model. As I declare in my dissertation (Davidsson, 1989, p. 10) but fail to mention in Davidsson (2004; 2016a) the model is an elaboration on Katona’s (1975) notion of willingness and ability as determinants of economic behavior. Given my more recent scholarship, some might find it ironic that I here have “opportunity” as a central concept. However, my early use was consistent with lexical definitions and with my later recommendations (Davidsson, 2023). That is, I use “opportunity” as an uncountable to denote favorable environmental conditions (operationalized with indicators characterizing the region and the industry) and not for pre-existing and inherently favorable entities that can be discovered and implemented.

Through a not overly thorough examination I could identify a couple of doctoral dissertations that do so (Fath, 2011; Kalbfleisch, 2017) but neither seems to have led to published journal articles. The empirical results have contributed to accumulation of evidence through reviews (e.g., Gherhes et al., 2016) and meta-analyses (e.g., Unger et al., 2011).

Which indicates how lucky I was that the senior partners in the project, professors Leif Lindmark and Christer Olofsson invited me to participate. Sadly, David Storey passed away in July, 2023.

To substantiate this point, I compared occurrences of “theory” and “concept” in regular research articles in JBV in 1999 (25 articles) and 2009 (35 articles). The results show that articles using inflections of “theory” once or not at all in the main body dropped from 36% to zero over that decade whereas instances of using them 10 times or more increased from 28 to 66%. For inflections of “concept” the corresponding figures are single or no use dropping from 52 to 15% and using them 5 times or more increasing from 16 to 44%.

I certainly do not have that cockiness in other domains, like cooking or even entrepreneurship practice (areas where the 2022 GAER awardee has considerable skill and experience).

Audretsch, Brush, and Zahra were eventually awarded honorary doctorates at JIBS for their contributions.

Colleagues who are into “institutional work”—how individuals contribute to building and changing institutions—may generously (but against the thrust of my external enablement crusade) suggest I had a significant role in building that environment. I would counter that without the USD 3 million grant from the Knut & Alice Wallenberg foundation toward the PEG program I would not have been able to do so.

I refrain from giving a reference here because this is an overall conclusion from a large body of work on social capital, networking, teams, and the leveraging of boards, mentors, investors, key employees, etc.

In the body text I explain “discovery” as idea development—the conceptual side of creating a new venture—rather than as finding a ready-to-implement “opportunity.”

As well as some contribution examples discussed in this essay. There is nothing wrong with studying small and owner-managed firms, but one can refrain from over-attributing the e-label to them. This is how I deal with the issue nowadays.

Kirzner (1973) developed this notion in contrast to the hapless “entrepreneur” in the microeconomic theory of “perfect competition”—a model which despite its name does not give room for any competitive action at all! I suggested introduction of new economic activities as an alternative expression for the same phenomenon, similar to Wernerfelt’s (1984) argument that resources and products are two sides of the same coin.

One can ascribe additional economic functions to entrepreneurship such as providing a mechanism for societal redistribution of wealth or a means of making better use of some people’s productive abilities, but I hold the three above to be the core functions.

The figure is, of course, a simplification. Determining what quadrant a specific case falls into is no easy task, and calculations of “societal value” are subject to the problem of aggregating individuals’ subjective views as well as to changing perceptions over time, meaning that today’s entrepreneurial heroes may become tomorrow’s villains. Yet, the conceptual categories are worth keeping in mind.

Possibly, my experience from an earlier exercise with year 2014 GAER awardee Shaker Zahra to sort out the “dynamic capabilities” concept (Zahra et al., 2006) contributed to giving me the courage to take on the task. Although Davidsson (2015) is a sole-authored work, its acknowledgements reflects that I sought and used more feedback from audiences, local colleagues, friendly previewers, and journal reviewers and editors than I have done with any other paper.

Which is thanks to my PhD student Jiyoung Kimjeon setting such high ambitions for her literature review as well as her addition of cross-citation analysis at a late stage which really revealed the importance of common conceptualizations as a glue that make studies co-create cumulative knowledge.

Which makes it an irony that this is a soul-authored paper.

References

Acs, Z. J., & Audretsch, D. B. (1990). Innovation and small firms. MIT Press.

Aldrich, H. E., & Ruef, M. (2018). Unicorns, gazelles, and other distractions on the way to understanding real entrepreneurship in the United States. Academy of Management Perspectives, 32(4), 458–472.

Aldrich, H. E., & Zimmer, C. (1986). Entrepreneurship through social networks. In D. L. Sexton & R. W. Smilor (Eds.), The art and science of entrepreneurship. Ballinger.

Alsos, G. A., & Kolvereid, L. (1998). The business gestation process of novice, serial, and parallel business founders. Entrepreneurship Theory and Practice, 22(4), 101–114.

Archer, M. S. (2003). Structure, agency, and the internal conversation. Cambridge University Press.

Bacharach, S. B. (1989). Organizational theories: Some criteria for evaluation. Academy of Management Review, 14(4), 496–515.

Bacq, S., Drover, W., & Kim, P. H. (2021). Writing bold, broad, and rigorous review articles in entrepreneurship. Journal of Business Venturing, 36(6), 106147.

Baumol, W. J. (1990). Entrepreneurship: Productive, unproductive, and destructive. Journal of Political Economy, 98(5), 893–921.

Ben-Hafaïedh, C., & Hamelin, A. (2023). Questioning the growth dogma: A replication study. Entrepreneurship Theory and Practice, 47(2), 628–647.

Bennett, D. L. (2019). Infrastructure investments and entrepreneurial dynamism in the US. Journal of Business Venturing, 34(5), 105907.

Birch, D. (1979). The Job Generation Process. Final Report to Economic Development Administration. MIT Program on Neighborhood and Regional Change.

Birley, S. (1985). The role of networks in the entrepreneurial process. Journal of Business Venturing, 1(1), 107–117.

Bosma, N., & Wennekers, S. (2002). Entrepreneurship under pressure. Global Entrepreneurship Monitor 2002: The Netherlands. EIM Business & Policy Research.

Brännback, M., Carsrud, A., Renko, M., Östermark, R., Aaltonen, J., & Kiviluoto, N. (2009). Growth and profitability in small privately held biotech firms: Preliminary findings. New Biotechnology, 25(5), 369–376.

Burnell, D., Stevenson, R., & Fisher, G. (2023). Early-stage business model experimentation and pivoting. Journal of Business Venturing, 38(4), 106314.

Cestino, J., Naldi, L., & Ots, M. (2023). External enablers in existing organizations: Emergence, novelty, and persistence of entrepreneurial initiatives. Strategic Entrepreneurship Journal, 17(2), 335–371.

Chalmers, D., Matthews, R., & Hyslop, A. (2021). Blockchain as an external enabler of new venture ideas: Digital entrepreneurs and the disintermediation of the global music industry. Journal of Business Research, 125, 577–591.

Chen, J. J., Cui, C., Hunt, R. A., & Li, L. S. Z. (2020). External enablement of new venture creation: An exploratory, query-driven assessment of China’s high-speed rail expansion. Journal of Business Venturing, 35(6), 106046.

Chrisman, J. J., Neubaum, D. O., Welter, F., & Wennberg, K. (2022). Knowledge accumulation in entrepreneurship. Entrepreneurship Theory and Practice, 46(3), 479–496.

Cooper, A. C., Gimeno-Gascon, F. J., & Woo, C. Y. (1994). Initial human and financial capital as predictors of new venture performance. Journal of Business Venturing, 9(5), 371–395.

Cornelissen, J. (2017). Editor’s comments: Developing propositions, a process model, or a typology? Addressing the challenges of writing theory without a boilerplate. Academy of Management Review, 42(1), 1–9.

Crawford, G. C., Skorodziyevskiy, V., Frid, C. J., Nelson, T. E., Booyavi, Z., Hechavarria, D. M., ..., & Teymourian, E. (2022). Advancing entrepreneurship theory through replication: A case study on contemporary methodological challenges, future best practices, and an entreaty for communality. Entrepreneurship Theory and Practice, 46(3), 779–799.

Davidsson, P. (1989). Continued entrepreneurship and small firm growth [Doctoral dissertation, EFI]. Stockholm, Sweden.

Davidsson, P. (1991). Continued entrepreneurship: Ability, need, and opportunity as determinants of small firm growth. Journal of Business Venturing, 6(6), 405–429.

Davidsson, P. (2003). The domain of entrepreneurship research: Some suggestions. In J.A. Katz, & D.A. Shepherd (Eds.), Cognitive approaches to entrepreneurship research. Advances in entrepreneurship research (vol. 6, pp. 315–372). Elsevier.

Davidsson, P. (2004). Researching entrepreneurship. Springer.

Davidsson, P. (2005). Paul D. Reynolds: Entrepreneurship research innovator, coordinator, and disseminator. Small Business Economics, 24(4), 351–358.

Davidsson, P. (2006). Nascent entrepreneurship: Empirical studies and developments. Foundations and Trends in Entrepreneurship Research, 2(1), 1–76.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: A re-conceptualization. Journal of Business Venturing, 30(5), 674–695.

Davidsson, P. (2016a). Researching entrepreneurship: Conceptualization and design (2nd ed.). Springer.

Davidsson, P. (2016b). The field of entrepreneurship research: Some significant developments. In D. Bögenhold, J. Bonnet, M. Dejardin, & D. Garcia Pérez de Lema (Eds.), Contemporary entrepreneurship: Multidisciplinary perspectives on innovation and growth (pp. 17–28). Springer.

Davidsson, P. (2016c). What an opportunity! In D. B. Audretsch & E. E. Lehmann (Eds.), The Routledge companion to the makers of modern entrepreneurship (pp. 86–102). Routledge.

Davidsson, P. (2017a). Entrepreneurial opportunities as propensities: Do Ramoglou & Tsang move the field forward? Journal of Business Venturing Insights, 7, 82–85.

Davidsson, P. (2017b). Reflections on misgivings about “dismantling” the opportunity construct. Journal of Business Venturing Insights, 7, 65–67.

Davidsson, P. (2020). Look out! See change? Sea change ahead! Academy of Management Discoveries, 6(3), 321–324.

Davidsson, P. (2022). McBride and Wuebker’s Socially Objective Opportunities: Do they move the field forward? Journal of Business Venturing Insights, 18, e00343.

Davidsson, P. (2023). Ditching discovery-creation for unified venture creation research. Entrepreneurship Theory and Practice, 47(2), 594–612.

Davidsson, P., & Delmar, F. (2002). Les entreprises à forte croissance et leur contribution à l’emploi: Le cas de la Suède 1987–1996. Revue Gestion, 2000(5), 167–190.

Davidsson, P., & Delmar, F. (2006). High-growth Firms and their Contribution to Employment: The Case of Sweden 1987–96. In P. Davidsson, F. Delmar, & J. Wiklund (Eds.), Entrepreneurship and the growth of firms (pp. 156–178). Elgar.

Davidsson, P., & Gordon, S. R. (2012). Panel studies of new venture creation: A methods-focused review and suggestions for future research. Small Business Economics, 39(4), 853–876.

Davidsson, P. & Wahlund, R. (1986). Småföretagare - hur speciella är de? (Small firm ownermanagers - how different are they?) In Boman, H. & Pousette, K. (Eds.) Konferensdokumentation småföretagsforskning i tiden. IV Nordiska forskningskonferensen om småföretag. Umeå universitet.

Davidsson, P., & Wiklund, J. (2001). Levels of analysis in entrepreneurship research: Current research practice and suggestions for the future. Entrepreneurship Theory and Practice, 25(4), 81–100.

Davidsson, P., Lindmark, L. & Olofsson, C. (1994). Dynamiken i svenskt näringsliv (Business Dynamics in Sweden). Lund: Studentlitteratur.

Davidsson, P., Lindmark, L. & Olofsson, C. (1996). Näringslivsdynamik under 90-talet (Business Dynamics in the ‘90s). NUTEK.

Davidsson, P., Lindmark, L., & Olofsson, C. (1998a). Smallness, newness, and regional development. Swedish Journal of Agricultural Research, 28(1), 57–71.

Davidsson, P., Lindmark, L., & Olofsson, C. (1998b). The extent of overestimation of small firm job creation–an empirical examination of the regression bias. Small Business Economics, 11(1), 87–100.

Davidsson, P., Steffens, P., & Fitzsimmons, J. (2009). Growing profitable or growing from profits: Putting the horse in front of the cart? Journal of Business Venturing, 24(4), 388–406.

Davidsson, P., Gordon, S. R., & Bergmann, H. (Eds.). (2012). Nascent entrepreneurship. Elgar.

Davidsson, P., Recker, J., & von Briel, F. (2020). External enablement of new venture creation: A framework. Academy of Management Perspectives, 34(3), 311–332.

Davidsson, P., Grégoire, D. A., & Lex, M. (2021). Venture Idea Assessment (VIA): Development of a needed concept, measure, and research agenda. Journal of Business Venturing, 36(5), 106130.

Davidsson, P., Recker, J., & von Briel, F. (2022). External enablers of entrepreneurship. Oxford Research Encyclopedia of Business and Management. https://doi.org/10.1093/acrefore/9780190224851.013.383

Davidsson, P., Recker, J., Chalmers, D., & Carter, S. (2023). Environmental change, strategic entrepreneurial action, and success: Introduction to a special issue on an important, neglected topic. Strategic Entrepreneurship Journal, 17(2), 322–334.

Davis, S. J., Haltiwanger, J., & Schuh, S. (1996). Small business and job creation: Dissecting the myth and reassessing the facts. Small Business Economics, 8(4), 297–315.

De Wit, G., & De Kok, J. (2014). Do small businesses create more jobs? New evidence for Europe. Small Business Economics, 42(2), 283–295.

Delmar, F., & Davidsson, P. (2000). Where do they come from? Prevalence and characteristics of nascent entrepreneurs. Entrepreneurship & Regional Development, 12(1), 1–23.

Delmar, F., Davidsson, P., & Gartner, W. B. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189–216.

Fath, B. P. (2011). Growing innovative ventures–An investigation of individual-opportunity nexuses [Doctoral dissertation, University of Auckland]. Auckland, New Zealand.

Fisch, C. (2019). Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing, 34(1), 1–22.

Fisher, G., & Aguinis, H. (2017). Using theory elaboration to make theoretical advancements. Organizational Research Methods, 20(3), 438–464.

Frese, M., Rousseau, D. M., & Wiklund, J. (2014). The emergence of evidence–based entrepreneurship. Entrepreneurship Theory and Practice, 38(2), 209–216.

Gartner, W. B. (1985). A conceptual framework for describing the phenomenon of new venture creation. Academy of Management Review, 10(4), 696–706.

Gartner, W. B. (1989). “Who is an entrepreneur?” Is the wrong question. Entrepreneurship Theory and Practice, 13(4), 47–68.

Gartner, W. B. (1990). What are we talking about when we talk about entrepreneurship? Journal of Business Venturing, 5(1), 15–28.

Gartner, W. B., Shaver, K. G., Carter, N. M., & Reynolds, P. D. (Eds.). (2004). Handbook of entrepreneurial dynamics: The process of business creation. Sage.

Geurts, K. (2016). Longitudinal firm-level data: Problems and solutions. Small Business Economics, 46, 425–445.

Gherhes, C., Williams, N., Vorley, T., & Vasconcelos, A. C. (2016). Distinguishing micro-businesses from SMEs: A systematic review of growth constraints. Journal of Small Business and Enterprise Development, 23(4), 939–963.

Giddens, A. (1984). The constitution of society: Outline of the theory of structuration. University of California Press.

Gielnik, M. M., Spitzmuller, M., Schmitt, A., Klemann, D. K., & Frese, M. (2015). “I put in effort, therefore I am passionate”: Investigating the path from effort to passion in entrepreneurship. Academy of Management Journal, 58(4), 1012–1031.

Gimeno, J., Folta, T. B., Cooper, A. C., & Woo, C. Y. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42(4), 750–783.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. Review of Economics and Statistics, 95(2), 347–361.

Hambrick, D. C. (2007). The field of management’s devotion to theory: Too much of a good thing? Academy of Management Journal, 50(6), 1346–1352.

Hansen, D. J., Shrader, R., & Monllor, J. (2011). Defragmenting definitions of entrepreneurial opportunity. Journal of Small Business Management, 49(2), 283–304.

Hansen, D. J., Monllor, J., & Shrader, R. C. (2016). Identifying the elements of entrepreneurial opportunity constructs: Recognizing what scholars are really examining. The International Journal of Entrepreneurship and Innovation, 17(4), 240–255.

Hinderer, S., & Kuckertz, A. (2022). The bioeconomy transformation as an external enabler of sustainable entrepreneurship. Business Strategy and the Environment, 31(7), 2947–2963.

Jansen, J. J., Heavey, C., Mom, T. J., Simsek, Z., & Zahra, S. A. (2023). Scaling‐up: Building, leading and sustaining rapid growth over time. Journal of Management Studies, 60(3), 581–604.

Johannisson, B. (1988). Business formation—a network approach. Scandinavian Journal of Management, 4(3–4), 83–99.

Juma, N., Olabisi, J., & Griffin-EL, E. (2023). External enablers and entrepreneurial ecosystems: The brokering role of the anchor tenant in capacitating grassroots ecopreneurs. Strategic Entrepreneurship Journal, 17(2), 372–407.

Kalbfleisch, R. L. (2017). Growth aspirations of young informal micro-entrepreneurs in Nairobi, Kenya: A case study of the Jua Kali manufacturing sector (Doctoral dissertation). Carleton University, Canada.

Katona, G. (1975). Psychological economics. Elsevier.

Katz, J., & Gartner, W. B. (1988). Properties of emerging organizations. Academy of Management Review, 13(3), 429–441.

Kim, P. H., Longest, K. C., & Lippmann, S. (2015). The tortoise versus the hare: Progress and business viability differences between conventional and leisure-based founders. Journal of Business Venturing, 30(2), 185–204.

Kimjeon, J., & Davidsson, P. (2022). External enablers of entrepreneurship: A review and agenda for accumulation of strategically actionable knowledge. Entrepreneurship Theory and Practice, 46(3), 643–687.

Kirzner, I. M. (1973). Competition and entrepreneurship. University of Chicago Press.

Kitching, J., & Rouse, J. (2017). Opportunity or dead end? Rethinking the study of entrepreneurial action without a concept of opportunity. International Small Business Journal, 35(5), 558–577.

Landström, H. (2020). The evolution of entrepreneurship as a scholarly field. Foundations and Trends in Entrepreneurship, 16(2), 65–243.

Linneberg, M. S., & Korsgaard, S. (2019). Coding qualitative data: A synthesis guiding the novice. Qualitative Research Journal, 19(3), 259–270.

Low, M. B., & MacMillan, I. C. (1988). Entrepreneurship: Past research and future challenges. Journal of Management, 14(2), 139–161.

Lucas, D. S., Bellavitis, C., & Park, U. D. (2023). A Cloud’s Silver Lining? The Impact of Policy Interventions on New and Maturing Technology Ventures’ Online Recruitment. Strategic Entrepreneurship Journal, 17(2), 445–484.

McMullen, J. S. (2019). A wakeup call for the field of entrepreneurship and its evaluators. Journal of Business Venturing, 34(3), 413–417.

Meurer, M. M. (2023). Qualitative text comparative analysis (QTCA): A mixed-method approach to large text data. Academy of Management Proceedings, 1. https://doi.org/10.5465/AMPROC.2023.15244abstract.

Miller, D. (2007). Paradigm prison, or in praise of atheoretic research. Strategic Organization, 5(2), 177–184.

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16.

Ng, W., & Stuart, T. E. (2016). Of hobos and highfliers: Disentangling the classes and careers of technology-based entrepreneurs. Haas School of Business, University of California, Berkeley. faculty.haas.berkeley.edu/tstuart/publications/2017/ng_stuart_oct_2016.pdf.

Penrose, E. (1959). The theory of the growth of the firm. Oxford University Press.

Podsakoff, P. M., MacKenzie, S. B., & Podsakoff, N. P. (2016). Recommendations for creating better concept definitions in the organizational, behavioral, and social sciences. Organizational Research Methods, 19(2), 159–203.

Rauch, A. (2020). Opportunities and threats in reviewing entrepreneurship theory and practice. Entrepreneurship Theory and Practice, 44(5), 847–860.

Rauch, A., & Frese, M. (2007). Let’s put the person back into entrepreneurship research: A meta-analysis on the relationship between business owners’ personality traits, business creation, and success. European Journal of Work and Organizational Psychology, 16(4), 353–385.

Reynolds, P. D. (2009). Screening item effects in estimating the prevalence of nascent entrepreneurs. Small Business Economics, 33(2), 151–163.

Reynolds, P. D. (2022). Entrepreneurship and economic development: The global scope of business creation. Edward Elgar Publishing.

Reynolds, P. D., & White, S. B. (1992). Finding the nascent entrepreneur: Network sampling and entrepreneurship gestation. In N. C. Churchill, S. Birley, W. D. Bygrave, D. E. Muzyka, C. Wahlbin, & W. E. Wetzel Jr. (Eds.), Frontiers of entrepreneurship research (pp. 199–208). Babson College.

Reynolds, P. D., & White, S. B. (1997). The entrepreneurial process: Economic growth, men, women, and minorities. Praeger.