Abstract

We improve upon the Pissarides-Weber method for estimating tax evasion among the self-employed by utilizing unique register-based consumption measures from the Swedish and Finnish mandatory registers for pleasure boats. This allows for more detailed and statistically powered analyses than survey-based applications. Our results indicate overall levels of hidden incomes that are in line with previous studies. However, the functional form analysis shows that the estimated sizes of underreporting in absolute monetary amounts are almost constant over reported income levels, whereas previous studies have assumed that the underreporting is proportional to income. The results from the preference analysis—in which we compare households that will become self-employed in the near future with households that will remain wage earners—are mixed; the two types of households have insignificant (Finland) or economically small (Sweden) preference differences. However, when we use engine power as a price proxy, the preference differences are larger in both countries.

Plain English Summary

Consumption of pleasure boats reveal tax evasion by the self-employed. We find that self-employed households are substantially more likely to own a pleasure boat than employee households, holding income constant, indicating income underreporting. Households that become self-employed in the near future, however, are only marginally more likely to own a boat. This suggests that differences in boat ownership are not mainly due to preference differences. We also find that underreporting is relatively constant in absolute monetary terms over the reported income distribution. Policy implications from this are (a) that the case for subsidizing entrepreneurship using public funds is weakened, as we can be more confident that actual self-employment income is higher than reported income and (b) that the income of self-employed with low household incomes may be considerably higher than reported, meaning that that the actual income distribution is less unequal compared to the reported income distribution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The consumption-based method for estimating underreporting among the self-employed (SE), introduced by Pissarides and Weber (1989), is widely used in the empirical literature on tax evasion/avoidance. The Pissarides-Weber (PW) method uses “excess consumption” (consumption conditional on reported income) among the self-employed as indirect evidence of income underreporting. The results of this type of research have also had bearing on the debate regarding why individuals choose self-employment and whether self-employment should be encouraged with various type of preferential tax schemes, a discussion that we will return to in this paper.

The PW method typically relies on survey data on consumption, which greatly limits its applicability as consumption surveys tend to be small and irregular and suffer from high non-response rates as well as potential recall bias. Using register-based proxies for household consumption is thus a possibility for improving this research. However, such proxies are generally very difficult to find, as most types of consumption are not registered, in addition to the fact that the data would also have to fit the PW methodology. For example, using data from car registers is sub-optimal since many of the self-employed use their car as an asset in their firm.

In this project, we use the mandatory pleasure boat registers in Finland and Sweden. These data fit the PW framework well for several reasons. First, the owner has no clear tax incentives to register the pleasure boat as an asset in the firm except when the boat is instrumental for operations (such as fishing and shipping, which we exclude). Second, pleasure boats are an important expenditure category, and next to Canada, the Nordic countries are the most pleasure-boat-dense countries in the world.Footnote 1 Third, bias resulting from selection and attrition should be small since it is currently (Finland) and used to be (Sweden) mandatory to register any pleasure boat satisfying certain length and engine power criteria. Furthermore, the registers are/were not used for tax purposes, in which case one could expect underreporting of boats to be correlated with underreporting of income.

We have access to the Finnish boat register from 2016 and the Swedish boat register from 1991 (it was abolished in 1992). These data are matched with population-wide, administrative databases from each country to get information on the employment status and other demographic characteristics of the boat owners. Having access to similar registers in two countries means that we can compare and validate the results.

By now, there is a host of applications of the PW method from different points in time, with different modifications of the basic PW model and using data from different countries. Apart from the UK (Lyssiotou et al., 2004; Pissarides & Weber, 1989), the method has been used in, for instance, Sweden (Apel, 1994; Engström & Hagen, 2017; Engström & Holmlund, 2009), Finland (Johansson, 2005), Canada (Schuetze, 2002), South Korea (Kim et al., 2017), Estonia (Kukk & Staehr, 2014), Spain (Martinez-Lopez, 2013), the USA (Hurst et al., 2014), and Norway (Nygård et al., 2019). These studies typically find evidence of substantial underreporting of income among the self-employed. Estimates typically range from about 20 to 50% of the total income being hidden. The most common consumption measure is food expenditure since it is sufficiently mundane for individuals not to be afraid of truthfully reporting it and because—with some exceptions—it is unlikely to be registered as a business expense.

The method has also spawned several innovative PW-related methods using a register-based traces-of-income approach in order to estimate underreporting. For example, Feldman and Slemrod (2007) use charitable contributions instead of consumption to infer the true income of the self-employed. Braguinsky et al., (2014, 2015) use the market value of cars as an alternative consumption measure in a modified PW setting, allowing for hidden incomes among many different types of workers (i.e., not only the self-employed). Finally, Artavanis et al. (2016) use microdata on household credit from a Greek bank and replicate the bank underwriting model to infer the banks’ estimates of individuals’ true income.

Compared to these previous studies, our main contributions are twofold. Both contributions made possible by the fact that we have population-wide, longitudinal data on reported incomes, SE-status, and a consumption measure (pleasure boats).

First, access to longitudinal data on income and employment status allows us to address a central critique against the PW method, namely, that potential “excess consumption” among the self-employed can be the result of heterogeneous preferences rather than income underreporting. We do this by comparing Engel curves between ordinary wage earner (WE) households and WE households that will switch to become SE households in the near future. If SE households had an intrinsically higher preference for pleasure boats, we would estimate an excess consumption for the soon-to-be SE households compared to stable WE households. The results from this analysis are mixed. In the baseline case, when we use an indicator for boat/no boat as the outcome variable, we find no differences (Finland) or economically small differences (Sweden) between future SE households and WE households. When we do the same analysis based on rough size–based proxies for boat prices (length, width, and area), the qualitative results are unchanged. However, when we instead proxy the boat prices by engine power, we find larger differences between future SE households and WE households. It seems, in both countries, that the future SE households have an intrinsically higher preference for more powerful engines. These consumption differences, however substantial, are much smaller than the corresponding differences between current SE and WE households.

Performing this type of analysis has not been possible in survey-based applications of the PW method since it requires a much larger dataset than what is offered in a typical survey. A well-powered PW study is based on around 5000 responding households. Typically, around 10% of these are coded as SE households (i.e., around 500 households). The number of WE households in the survey switching to SE the following year is typically lower than 50 households per year. When this is combined with a rather noisy survey-based consumption measure, there is simply not enough statistical power to distinguish between the consumption patterns of the two WE groups. Furthermore, this exercise relies on a panel dimension in the SE measure, which typically requires a register-based indicator of SE status (few consumption surveys are balanced panels).

Second, the estimated sizes of income underreporting are roughly in line with previous estimates (20–30% of true income in previous Swedish and Finnish studies). However, we find that the estimated underreporting in absolute monetary amounts is almost constant over reported income levels, while previous PW studies have assumed that underreporting is proportional to income. What enables us to make a much more informed choice regarding functional form is the statistical power that comes from measuring N in millions instead of thousands. This implies that the proportion of income that is hidden is much higher for the households reporting the lowest income, a finding consistent with, for instance, Brewer et al. (2017) and Braguinsky et al. (2014).

The rest of the paper is structured as follows. In Sect. 3, we describe the basic PW method and how we modify it so that we can use pleasure boats instead of food consumption (the standard consumption measure in PW studies). We also discuss and justify our choice of functional form. In Sect. 4, we describe the pleasure boat and income data from each country, as well as sample restrictions and key variables. Section 5 presents and compares PW estimates of income underreporting. Section 6 presents various robustness tests, including the preference-adjusted PW estimates and the functional form analysis. Section 6 concludes the paper.

2 Method

2.1 The basic PW method

The consumption-based method for estimating underreporting among the self-employed introduced by Pissarides and Weber (1989) is frequently used in the empirical literature on tax evasion/avoidance. The PW method is based on using excess consumption among the self-employed as indirect evidence of income underreporting. The analysis is typically conducted at the household level and uses different survey measures of food consumption as the outcome. The amount of underreporting is retrieved by estimating the following standard Engel curve:

where \({c}_{\mathrm{it}}\) is log consumption of household \(i\) at time \(t\), \({y}_{\mathrm{it}}\) log of disposable income, \({\overline{X} }_{\mathrm{i}}\) represents factors affecting consumption, and \(S{E}_{\mathrm{it}}\) is a dummy for self-employed households. Assuming that preferences for consumption, conditional on disposable income and covariates, are equal for the self-employed and wage earners, and that the self-employed systematically underreport their income by a constant factor, the amount of underreporting (in logged form) is given by \({y}_{\mathrm{h}}=\frac{\gamma }{\beta }\) (see Fig. 1). This implies that the underreported income as a share of the true income is given by \(1-\kappa\) where we can estimate \(\widehat{\kappa }=\mathrm{exp}(-\frac{\widehat{\gamma }}{\widehat{\beta }})\). The log–log specification of Eq. 1 implies that SE households underreport a constant share of the disposable income.

2.2 Modified method based on pleasure boats instead of food consumption

Instead of food consumption as the dependent variable, we use an indicator for boat ownership on the left-hand side of Eq. (1), which clearly invalidates the use of a standard log–log specification. However, the choice of whether to log the income measure remains. In Sect. 5.1, we show that using nominal income, as opposed to logged income, clearly fits the data better. When it comes to both Sweden and Finland, we get almost linear Engel curves for both groups (SE and WE) when using the nominal income measure (in EUR or SEK depending on country). Thus, the modified version of Eq. (1) that we estimate is:

where \({boat}_{\mathrm{it}}\) is boat ownership of household \(i\) at time \(t\) and \({y}_{\mathrm{it}}\) is a nominal income measure. This choice of functional form of the estimated Engel curves has important implications for the estimated underreporting. The standard log–log specification implies that the share of unreported income is assumed to be independent of income. The validity of this assumption is often tested by adding an interaction between the SE indicator and the (log) income measure in Eq. 1 (see, for instance, Engström & Hagen, 2017, and Hurst et al., 2014) . If the estimated interaction is negative (positive), it implies that the share of underreported income decreases (increases) in income.

Typically, the formal test does not reject the null of equal slopes. However, the standard PW applications are based on relatively small samples, which gives the above test relatively low power. Both Engström and Hagen (2017) and Hurst et al. (2014) estimate (insignificant) negative interaction terms. Furthermore, Kukk et al. (2020) examined the corresponding relationship in many European countries and found that the slopes of the Engel curves (log–log specification) are usually lower for the SE group than for the WE group. There is thus suggestive evidence that the standard assumption, that the share of underreporting is independent of income, is invalid. Our choice of functional form (i.e., using nominal income measures on the X-axis) instead implies that the nominal underreporting is independent of income, which is clearly consistent with a decreasing share of hidden income as income increases.Footnote 2

By visually inspecting the graphs in Sect. 5, we see that the slopes of the Engel curves based on nominal income are almost identical for the SE and WE groups. In Sect. 5 and Sect. 5.2, we also perform the corresponding formal tests and discuss the choice of functional form in more detail. Since we do not rely on small sample survey data, the statistical power of these tests is substantially higher compared to previous studies.

Apart from this modification of the functional form, our application of the PW method involves the usual interpretation. This means that we attribute any excess ownership of pleasure boats to income underreporting, conditional on reported disposable income (and a number of covariates). We match the data with register data on demographics and incomes in the respective country. This provides us with extensive panel data, thus enabling us to use measures of permanent household income in the analysis along the lines of Engström and Hagen (2017), which limits the need to find instruments for current income in the modified Engel curves.

3 Data

3.1 Pleasure boat register data

We use administrative data on pleasure boat ownership in two countries: Sweden and Finland. In Finland, pleasure boat owners are required to submit information about their boat(s) to the Finnish Communications Agency (TRAFI). The purpose of this register is to improve the safety of water traffic and facilitate control and rescue operations.Footnote 3 It is also used for planning the use of Finnish water areas. We argue that it is beneficial that the register is not used for taxation purposes. If it were to be used for these purposes, there would be a risk that underreporting income would be highly correlated with underreporting boat ownership.

We have access to the Finnish boat register from 2016. In this year, there were around 204,000 registered pleasure boats in Finland. The Swedish boat register was in place during 1988–1992, and we have access to the register from 1991. The register was implemented primarily for maritime safety and control reasons. The abolishment of the register was disputed, but critics argued that it infringed on personal integrity, was difficult and expensive to administer and even facilitated boat thefts (Motion 1989/90:T633). There were around 300,000 registered pleasure boats in Sweden during this period.Footnote 4 The boat registers cover all pleasure boats satisfying certain length and engine power criteria.Footnote 5 Hence, these registers include different types of boats, such as sailboats, powerboats, and jet skis.

Apart from size (length and width) and engine power, the registers also provide boat-level information on production year, date when the boat was purchased by the current owner and location of the boat (municipality). There is no information on the estimated value of the boat nor the purchase amount. Instead, we use engine power and size measures as proxies for value in the robustness section below (see Sect. 6). Boat owners are identified via a unique identification number that can be linked to other administrative databases (see 3.2).Footnote 6

3.2 Income data

To calculate household incomes, we use register-based longitudinal databases from each country. Nordic register data on income are of very high quality since they are automatically reported by third parties (for wage earners) and are reported separately for different types of income. Since the longitudinal income data are at the individual level, we aggregate incomes for the members of a given household to get the household income.

3.3 Key variables and sample restrictions

The three key variables are pleasure boat ownership, annual disposable income, and self-employment status. Boat ownership is a dummy variable taking the value of one if at least one household member is registered as a pleasure boat owner in year t. In the Swedish case, current disposable income is defined as the household’s disposable income in Statistics Sweden’s IOT database.Footnote 7 In the case of Finland, the corresponding data come from Statistics Finland’s FOLK database.Footnote 8 Disposable income is based on all types of (register-based) income, including transfers, income from labor and self-employment, and capital income.

We use past and future income records to create multiple-year average measures of income. This approach has been used in the literature to account for the fact that transitory income fluctuations may attenuate the estimate of the income elasticity of consumption, which, in turn, leads to overestimating the degree of income underreporting (see, for instance, Engström & Hagen, 2017). Specifically, for each household in year t, we compute income measures that average income between \(t-3\) and \(t+3.\) In the case of Finland, this concerns only the years \(t-3\) and \(t+2\) since the income data end in 2018.

The self-employment status of the household is based on information in the income register data. We define self-employed households as households where at least one of the adult members either report a positive income from self-employment or is considered linked to a closely held corporation (Johansson, 2005; Engström & Hagen, 2017).

From the full population of households in each country, we make four sample restrictions. First, we restrict the sample in each country to households where the oldest individual is between 18 and 64 years of age. In most cases, the oldest individual is also the registered boat owner. The individual variables such as age, gender, and education pertain to the oldest member of the household in the subsequent analysis, whereas all income measures pertain to the entire household. Note that we do not drop single-person households. Second, we restrict the sample to households where the composition of the adult members does not change over the relevant time (\(t-3\) to \(t+3\) for Swedish households and \(t-3\) to \(t+2\) for Finnish households). As shown in the next sub-section, between one-third and half of the households are defined as not stable and are thus dropped from the sample.Footnote 9 The main reason for restricting our analysis to what we henceforth refer to as “stable households” is for our multiple-year income measure to be comparable across households. Third, we drop households where at least one adult member is employed or self-employed in a boat-related sector, such as sea transport, ship dealing, and ship renovation. Fourth, we keep households with incomes between the 5th and 95th percentiles (based on the unrestricted population).

3.4 Descriptive statistics

The first part of Table 1 reports descriptive statistics for wage earners and the self-employed in Sweden in 1991. We note that on average, the self-employed are older, more likely to be male and married while also having higher incomes than wage earners. Interestingly, the self-employed individuals are almost twice as likely to own a boat—11% of self-employed households owned a boat in 1991 compared to 6% of employed households.

The second part of Table 1 reports corresponding statistics for Finnish households. The demographic patterns are very similar to those in Sweden—self-employed are on average older, have higher incomes, and are more likely to be male and married compared to wage earners. The boat ownership rates are slightly higher in Finland, but just as in Sweden, the SE group is more prone to owning a boat. The differences in boat ownership rates between Sweden and Finland get smaller as we include the non-stable households (see Table 13 in the Appendix). The reason for this is that the stability criterion removes relatively more households in Sweden since it applies to more years in Sweden compared to Finland.

4 Results

4.1 Graphical results

Figures 2 and 3 plot the relationship between permanent disposable income and boat ownership in Sweden (1991 data) and Finland (2016 data), respectively. Specifically, we plot boat ownership for equally spaced bins between the 5th and 95th percentiles.

These strikingly similar Engel curves reflect two interesting patterns. First, we see that the self-employed are more likely to own a boat at all income levels, thus indicating substantial underreporting.Footnote 10 We estimate the degree of underreporting in more detail in the next Sect. (4.2). Second, the linearity of the Engel curves, as well as the similar slopes, suggest that the self-employed underreport a certain amount of money, rather than a certain share of their income (note that we do not have logged values on the axes, as opposed to most previous studies). We thus provide new evidence on the functional form of underreporting, which has been a difficult task for previous studies using survey data including a quite small number of observations. The functional form will be explored further in robustness Sect. 5.2. This analysis will provide formal tests and show corresponding graphs and analyses for various proxies for the value of the boats.

4.2 PW estimates of boat ownership and income underreporting

In this section, we present the results from estimating Eq. (1). That is, we regress a dummy for boat ownership on annual disposable income and a set of control variables. The control variables include age, gender, level of education, sector affiliation of the oldest household member, number of household members, marital status, and municipality of residence. Tables 2 and 3 report regression estimates for Sweden and Finland, respectively. We report results with/without controls and with current/permanent measures of household disposable income. The income variables are expressed in 1000 s of SEK/Euro in order to reduce the number of decimal points.

Recall that we do not regress the log of household income on the log of food expenditure as in the standard PW specification. Instead, we regress current (or permanent) household income on boat ownership (0/1). The implied underreporting is simply given by the estimate of the SE dummy (\(\gamma )\) divided by the estimated slope of the Engel curve (\(\beta )\).

In line with the previous literature, we find that for Sweden, the self-employment dummy and the measure for income are both positive and statistically significant at the 1% level. The implied estimates of underreported income are in the range of SEK 70,000–80,000 for the current income measure. This corresponds to approximately 24–27 percent of mean disposable income in Sweden in 1991.Footnote 11 For the permanent income measure, the implied underreporting is, as expected, somewhat lower. The implied underreporting is in the range of SEK 60,000–71,000 for the permanent income measure, or 21–24% of disposable income. As argued in Engström and Hagen (2017), the permanent income measure is preferred since the current measure may suffer from an attenuation bias that risks overestimating the hidden incomes.

For Finland, we find estimates of underreporting also in the range of 20–30% of disposable income. For our preferred estimate based on permanent income in column (4), self-employed households on average underreported their income by about EUR 14,700, which is roughly 21% of the average household disposable income.

5 Robustness—evaluating the key assumptions

5.1 Proxies for boat value

So far, our analysis has disregarded which type of boat the household owns. Boats that cost several million EUR are thus lumped together with boats that only cost a few hundred EUR. Ideally, we would have access to exact prices and operating costs for all boats in the registers. In practice, however, such prices and costs are extremely difficult to estimate due to the massive number of different types of boats in the registers.Footnote 12 Instead, we use very crude proxies of the boats’ prices and operating costs, including length, width, area (width*length), and engine power. These proxies for a boat’s price and operating costs will replace the indicator variable on the left-hand side of the Engel curves estimated in this section. The interpretation is that a household that does not own a boat, technically owns a boat with a length of zero meters and so on. When analyzing engine power, we drop all households owning a sailing boat from the analysis since engine power is a bad proxy for the cost of a sailing boat. Table 4 (Sweden) and Table 5 (Finland) below report the results using the four cost/price proxies. To save space, we limit the analysis to the preferred specification using the full set of controls and the permanent income measure.

The estimates of underreporting based on the three size-based proxies for boat price (length, width and area) are very close to each other and highly consistent with the corresponding estimates in Tables 2 and 3. However, when it comes to engine power, we get much higher estimates than before. If we interpret the excess consumption of engine power as evidence of income underreporting, the estimated underreporting is about twice as high compared to the corresponding estimates based on the other price proxies. This result is puzzling, and we will have reason to return to this inconsistency in both Sect. 5.2 and Sect. 5.3.

5.2 Choice of functional form

In this section, we will explore the choice of functional form in greater detail. We start by performing two additional analyses to validate our choice of a nominal income measure on the X-axis. First, when we plot the Engel curves based on logged income, we clearly see that the standard assumption of linear Engel curves is violated in both countries (Figs. 12 and 13 in the Appendix). Second, we formally test the equality of slopes assumption in Table 6. For Sweden, we find that the slopes are almost identical: the insignificant point estimate is only 2.4% higher for SE based on the permanent income measure. The differences are somewhat greater in Finland: 7.0% lower for SE based on the permanent income measure and statistically significant on conventional levels.

We proceed by calculating the implied underreporting for the 25th, 50th, and 75th income percentile households.Footnote 13 The results are presented in Table 7. Recall that the standard log–log Engel curves presume that SE households underreport a constant share of true income, i.e., that the underreporting in Euro or SEK is increasing in income. In unlogged form, such a relationship would imply a steeper slope for the SE group compared to the WE group—the two curves need to diverge for the relative income underreporting to be constant. We do not find this diverging pattern for either country. For Sweden, the two Engel curves are almost parallel and the estimated underreporting is almost constant: ranging from SEK 57,000 for the low-income group to SEK 60,000 for the high-income group.

The Finnish pattern, with a slightly flatter Engel curve for the SE group, instead implies that high-income households underreport a lower absolute amount compared to the low-income self-employed. The underreporting is estimated to Euro 10,000 for the low-income group and decreases to slightly below Euro 8000 for the high-income group. This is not a huge decrease, so the assumption of equal slopes of the Engel curves is a reasonable first order approximation. Furthermore, the assumption of constant underreporting in absolute euro amount is a conservative, rather than bold, assertion since the standard PW method presumes that the underreporting (in euro) would rather increase in income.

We thus find that the relative share of income that is hidden is higher among SE households that report low incomes compared to households reporting high incomes. One rationale for these results is the direct mechanical effect of hiding income: households with a high “preference” for income underreporting will ceteris paribus end up with lower reported incomes compared to more truthful households. Hence, in relative terms, income underreporting will be more prominent among the (reported) low-income households.

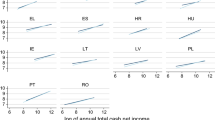

We now perform a similar exercise for the proxies for boat value analyzed in the previous section (Sect. 5.1). We start by plotting the relationships between nominal disposable income (X-axis) and our different proxies for boat value (length, width, area, and engine power) on the Y-axis. The graphs are found in Figs. 4 and 5, and they all pass an “eyeballing test” for linearity and (rough) equality of slopes, with the exception of engine power which seem to have a higher slope for the SE group.

We proceed with the formal tests of equality of slopes based on the boat value proxies instead of the 0/1 indicator. The results for the three size-based price proxies, which are shown in Tables 8 and 9, are consistent with the main analysis. For Sweden (Table 8), the estimated underreporting based on the size proxies ranges from SEK 45,000 to SEK 60,000, with higher estimated underreporting for higher income groups. This is explained by slightly steeper Engel curves for the SE group compared to the WE group. The steeper slope is statistically significant on conventional levels and hovers around 10% higher compared to the baseline WE slope. For Finland (Table 9), the pattern is reversed. In this case, the size proxies give slightly lower underreporting for higher reported incomes. The estimated underreporting is in the range Euro 11,000 to Euro 8700. The Engel curve for the SE group is around 7% lower, and statistically significant, compared to the WE group based on the three size proxies. Overall, these results suggest that our assumption of linear and parallel Engel curves is a good first-order approximation of the consumption patterns in the two countries.

However, when we turn to the Engine power proxy, the result is once again inconsistent with the baseline result. For both countries, the estimated underreporting is dramatically higher when using Engine power as dependent variable. Furthermore, and consistent with the analysis above, the slope of the Engel curve is much higher for the SE group compared to the WE group. In Sweden, the slope is roughly 50% higher for the SE group. In Finland, the corresponding figures are less dramatic but still significant. The slope is around 16% higher for the SE group compared to the WE group. The implied underreporting ranges from SEK 90,000 to SEK 140,000 in Sweden and from Euro 14,000 to Euro 20,000 in Finland. The result that the engine power analysis shows much higher levels of underreporting is consistent with a substantial preference difference for Engine power between WE and SE households, which is something that we will explore in detail in the next section.

5.3 Preferences for pleasure boats

How can we be sure that these ownership differences reflect income underreporting among the self-employed? One of the main critiques against the PW method is that excess consumption among the self-employed could be due to differences in preferences. Perhaps self-employed individuals simply have a stronger preference for boats than wage earners?Footnote 14 We address this issue by comparing boat ownership among households defined as wage earners in year t but which transition to self-employment in the near future to households that are wage earners in all observed time periods. The presumption is that the future self-employed resemble the current self-employed in terms of preferences for boats but do not (yet) have the opportunity to hide income.

Figure 6 (for Sweden) shows the Engel curves of employed households and future self-employed households. We define future self-employed as households with a member who was employed in 1991 but became self-employed within 4 years. Figure 7 shows the corresponding Engel curves for Finnish households. Since we only observe self-employment status up to 2018 (i.e., two years after the boat records), we define future self-employed households as those with a member who was a wage earner in 2016 but then transitioned to self-employment in 2017–2018. The income measure on the horizontal axis is permanent household disposable income.Footnote 15

Both figures show a similar pattern: future self-employed households are roughly as likely to own a boat in the year of interest as wage earners across all income groups. The only exception is a slightly higher share of boat owners among the Swedish SE with the lowest income. We interpret these results as evidence that the differences in boat ownership observed in Figs. 2 and 3 are unlikely accounted for by economically significant preference differences between SE and WE households.

We have also estimated these Engel curves in the PW regression framework used in 5.1. Reassuringly, the dummy indicating future self-employment is insignificant in the Finnish setting (Table 11. For Sweden (Table (10), the dummy coefficient is statistically significant but economically much less significant compared to the baseline results: around 0.005 compared to around 0.03 for the current SE group (see Table 2 versus Table 10).

Lastly, we have estimated the corresponding Engel curves for the price proxies as well. The results indicate that the size-based price proxies give results consistent with the baseline results using the 0/1 measure of boat ownership. For Sweden, the “underreporting” estimates based on the size proxies (Table 10, columns 3–5) hovers around SEK 10,000, which may be compared to SEK 9000 in the corresponding baseline analysis in Table 10 column 1. For Finland, the size-based proxies (Table 11, columns 3–5) give insignificant results for the future self-employed, which also corresponds closely to the baseline estimate in column 1. Once again, we find no indication of preference differences between SE and WE households when using size based price proxies in Finland, and economically small differences in Sweden.

However, the analysis based on engine power indicates larger preference differences between SE and WE households. The “underreporting” among the Swedish future SE households is estimated to almost SEK 30,000 (Table 10, column 2). This is substantially lower than the corresponding estimate for actual SE households reported in Table 4, column 1, but still a sizable difference. The underlying preference differences are substantial in Finland as well. The estimated “underreporting” among future SE households in 11, column 2, is almost Euro 5000. This estimate is also much lower than the corresponding estimate for actual SE households (Table 5, column 1) but still indicates economically significant differences in underlying preferences.

The results from this analysis are thus mixed. The size-based price proxies produce results that are consistent with small (Sweden) or no (Finland) differences in underlying preferences. Nevertheless, the price proxy based on engine size indicates that SE households have a higher preference for more engine power even before they become self-employed. This cautions against interpreting the difference between SE and WE households in terms of engine power as a clear trace of hidden income.

5.4 The firm as a saving vehicle

In this subsection, we address another important difference between SE and WE households that constitutes a challenge for the PW method. The SE households may have substantial savings within their firms. The Swedish tax rules for incorporated firms allow for accumulating profits within the firm that may be used for future dividends or salary to the owner (see, for instance, Alstadsæter and Jacob, 2012) . Furthermore, the firm may be sold in the future, generating a large one-time spike in income for that year. These possibilities to legally delay incomes for SE households represent a potential threat to the PW method since the current income measure does not include these legally delayed incomes (see, for instance, Hurst et al., 2014). Simply put, the PW method cannot separate legally hidden (delayed) incomes from illegally hidden incomes, while we only want the method to pick up the latter.

The permanent income measure addresses this problem to some extent since it includes future years in the income measure. As seen in Table 2 and Table 3, the permanent income measure also renders lower estimates of hidden income compared to the current income measure. This is consistent with the firm working as a saving vehicle for the SE group, but it may also only indicate that the permanent income measure works as intended. As discussed at length in Engström and Hagen (2017), the main reason why the permanent income measure presents lower estimates of underreporting is that current income is a rather noisy measure. Noise (i.e., classic measurement errors) in the income measure will attenuate the slope of the Engel curve, which, in turn, leads to an upward bias in the estimated underreporting.

In this subsection, we thus create an alternative income measure that is as forward-looking as possible, thus directly addressing the problem of legally hidden (delayed) incomes among SE households. Data access confines us to only use the Swedish data in this analysis since we only have 2 years of future data for Finland. We define “future income” as the average income between 1991 (the boat register year) and 1995 (the last year in our data). The idea is to capture future dividends and salaries saved by SE households within their firm (or the whole firm being sold off). We proceed by estimating the same type of modified Engel curves as in Table 2 and 3 above.

The results are presented in Table 12. When switching from the symmetric permanent income measure to the forward-looking income measure, the estimated income underreporting increases rather than decreases. This evidence speaks against SE households building up substantial savings within their companies. The estimated underreporting is almost SEK 100,000 compared to around SEK 60,000 in the preferred baseline specification (Table 2, column 4). We thus find no evidence that this asymmetry in saving techniques between SE households and WE households challenges the interpretation that the excess boat consumption among SE households is primarily due to non-compliance.

6 Conclusion

In this paper, we have proposed the notion that pleasure boats may be used as consumption measures in the Pissarides and Weber (1989) framework for estimating hidden incomes among the self-employed. The novelty of this paper is that we have register-based data on consumption (i.e., data from the pleasure boat registers of Sweden and Finland) that we link to high-quality panel data on income from registers for the entire populations of Sweden and Finland. This makes our estimates more reliable. Most importantly, however, our sample size is also much larger, by a factor of around 100–200, compared to what has been the norm in previous studies using the PW methodology. Furthermore, the use of panel data on income also limits the need to instrument for current income when using the PW methodology (Engström & Hagen, 2017).

The rich data allow us to present two main contributions to the existing literature. First, owing to the large sample sizes, we can challenge the functional form assumptions made in traditional PW studies. The choice of functional form of the estimated Engel curves has important implications for the estimated underreporting. The standard log–log specification implies that the share of unreported income is assumed to be independent of income. Instead, we find that a specification with a boat ownership indicator as dependent variable, and household disposable income level as explanatory variable, fits our data better. Our specification instead presumes that the absolute amount of hidden income is independent of income. This implies that the proportion of income that is hidden is much higher for the households reporting the lowest income, a finding consistent with, for instance, Brewer et al. (2017) and Braguinsky et al. (2014).

Second, we provide evidence partly in favor of self-employed and wage earners having the same intrinsic preferences for consumption (of pleasure boats)—one of the main assumptions behind the Pissarides-Weber model. This assumption has been notoriously hard to evaluate empirically. We analyze this by exploiting the panel dimension in SE status among the households, in combination with the large sample sizes. Specifically, we compare WE households that we know will become self-employed in the near future with ordinary WE households and find very small differences in boat ownership. This suggests that the excess boat consumption among SE households mainly manifests itself after the households have become self-employed. However, an important caveat is that we do find economically non-trivial preference differences between future SE households and WE households in terms of the boats’ engine powers in a robustness analysis. Another, more general caveat, is that this test can only account for differences in stable preferences, and not for preference differences that are endogenous to employment status.

That self-employed workers are particularly prone to underreport their true incomes is a central tenet in the empirical literature on tax evasion in general, and in the Pissarides/Weber (PW) framework in particular. However, as has been argued in this paper, the methods for investigating the occurrence and extent of entrepreneurial income underreporting is far from perfect. The methods rely on several identifying assumptions that are often hard to evaluate. One key such assumption in the PW framework is that self-employed households have the same consumption preferences as wage earning households. We test this assumption directly through the panel dimension of our data. The results indicate that the two types of households do not deviate far in terms of preferences for having a boat (even though they seem to differ in what type of boat they prefer). This lends, at least partial, support for that this discrepancy in observed earnings is more likely due to income underreporting than differences in consumption preferences between the self-employed and wage earners. Our results thus support the idea that entrepreneurial income is really not as bad as it seems, and that the entrepreneurship choice may be driven more by earnings prospects than previously thought.

The evidence presented in this paper has implications for the wider debate about the earnings of entrepreneurs and the taxation of entrepreneurial income. One starting point for this debate is that entrepreneurial income is seemingly lower and more variable than wage or salary income (e.g. Hamilton, 2000) . The “entrepreneurial earnings puzzle” is then why individuals select into entrepreneurship despite these worse earnings prospects. Among several possible explanations to this puzzle, a straightforward one is that entrepreneurial income is not really as bad as it seems because of entrepreneurial income underreporting (Åstebro & Chen, 2014). This also has bearing on the discussion regarding the taxation of entrepreneurs and public policy toward entrepreneurs more generally (Acs et al, 2016; Åstebro, 2017). If entrepreneurship entails positive externalities, for instance, with respect to innovation, and if entrepreneurship does not pay well enough, there is an argument for supporting entrepreneurship with tax incentives. However, in the presence of income underreporting among self-employed, this argument is weakened.

Notes

Population size/number of pleasure boats (SweBoat, 2019).

As noted by Braguinsky et al. (2014), independence of nominal underreporting and income is also consistent with a simple theoretical model of tax evasion. The argument is as follows: let the objective function of a taxpayer be \(txY-aC\left(xY\right)\) where \(t\) represents the tax rate, \(x\) is the share of hidden income (choice variable), \(Y\) is the (exogenous) income, \(a\) is a parameter capturing the risk of getting caught, and \(C(.)\) is a convex cost of getting caught. The first order condition directly gives that \(xY={{C}^{^{\prime}}}^{inv}(\frac{t}{a})\), which implies that the choice of nominal underreporting will be independent of income.

The boat register is preserved by the Swedish National Archives (Riksarkivet): https://riksarkivet.se/

In Sweden, boats that were either at least 5–6 m or powered by an engine of 10–15 kW had to be reported. The requirements in Finland are about the same (5.5 m or 15 kW).

For households owning more than one boat, we use the boat with the most recent production year.

Our results are robust to including non-stable households.

We get this by dividing the estimated amount of underreporting by the sum of mean reported disposable income from Table 1 and the amount of underreporting. Specifically, for the estimates in column (2), we have \(\mathrm{70,603}/(\mathrm{224,639}+\mathrm{70,603})=0.239\).

The boat model information in the data consists of a text field filled in by the owners themselves. The number of different entries is vast (> 1000). Furthermore, the production year is missing for a substantial share of the boats. This makes the task of estimating the prices and operating costs of the boats practically infeasible.

It is straightforward to extend the PW method to account for unequal slopes of the Engel curves. The implied underreporting is then given by: \({Y}_{SE}^{H}=\frac{\gamma }{\beta }+\frac{{\beta }_{SE}}{\beta }{Y}_{SE}^{R}\), where \(\gamma\) is the SE parameter, \(\beta\) is the slope of the Engel curve for the WE group, \({\beta }_{\mathrm{SE}}\) is the additional slope for the SE group, \({Y}_{SE}^{H}\) is the hidden income, and \({Y}^{R}\) is the reported income (in SEK or euro).

The corresponding graphs for current income are presented in Figs. 14 and 15.

References

Acs, Z., Åstebro, T., Audretsch, D., & Robinson, D. T. (2016). Public policy to promote entrepreneurship: A call to arms. Small Business Economics, 47(1), 35–51. https://doi.org/10.1007/s11187-016-9712-2

Alstadsæter, A., & Jacob, M. (2012). Income shifting in Sweden—an empirical evaluation of the 3:12 Rules. Report to the Expert Group for Public Economics.

Apel, M. (1994). An expenditure-based estimate of tax evasion in Sweden. In: Essays on Taxation and Economic Behavior. Economic Studies 18. Department of Economics, Uppsala University.

Artavanis, N., Morse, A., & Tsoutsoura, M. (2016). Measuring income tax evasion using bank credit: Evidence from Greece. The Quarterly Journal of Economics, 131(2), 739–798. https://doi.org/10.1093/qje/qjw009

Åstebro, T. (2017). The private financial gains to entrepreneurship: Is it a good use of public money to encourage individuals to become entrepreneurs? Small Business Economics, 48(2), 323–329. https://doi.org/10.1007/s11187-016-9777-y

Åstebro, T., & Chen, J. (2014). The entrepreneurial earnings puzzle: Mismeasurement or real? Journal of Business Venturing, 29(1), 88–105. https://doi.org/10.1016/j.jbusvent.2013.04.003

Braguinsky, S., & Mityakov, S. (2015). Foreign corporations and the culture of transparency: Evidence from Russian administrative data. Journal of Financial Economics, 117(1), 139–164. https://doi.org/10.1016/j.jfineco.2013.02.016

Braguinsky, S., Mityakov, S., & Liscovich, A. (2014). Direct estimation of hidden earnings: Evidence from Russian administrative data. The Journal of Law and Economics, 57(2), 281–319. https://doi.org/10.1086/675943

Brewer, M., Etheridge, B., & O’Dea, C. (2017). Why are households that report the lowest incomes so well-off? The Economic Journal, 127(605), 24–49. https://doi.org/10.1111/ecoj.12334

Engström, P., & Hagen, J. (2017). Income underreporting among the self-employed: A permanent income approach. European Economic Review, 92, 92–109.

Engström, P., & Holmlund, B. (2009). Tax evasion and self-employment in a high-tax country: Evidence from Sweden. Applied Economics, 41(19), 2419–2430. https://doi.org/10.1016/j.euroecorev.2016.12.001

Feldman, N. E., & Slemrod, J. (2007). Estimating tax noncompliance with evidence from unaudited tax returns. The Economic Journal, 117(518), 327–352. https://doi.org/10.1111/j.1468-0297.2007.02020.x

Glazer, A., & Konrad, K. A. (1996). A signaling explanation for charity. The American Economic Review, 86(4), 1019–1028.

Hamilton, B. H. (2000). Does entrepreneurship pay? An empirical analysis of the returns to self-employment. Journal of Political Economy, 108(3), 604–631.

Hirvonen, M., Lith, P., and Walden, R. (2010). Suomen kansainvälistyvä talous. Eduskunnan tarkastusvaliokunnan Julkaisu 1/10. https://www.eduskunta.fi/FI/naineduskuntatoimii/julkaisut/Documents/trvj_1+2010.pdf

Hurst, E., Li, G., & Pugsley, B. (2014). Are household surveys like tax forms? Evidence from income underreporting of the self-employed. Review of Economics and Statistics, 96(1), 19–33. https://doi.org/10.1162/REST_a_00363

Hyytinen, A., & Ruuskanen, O.-P. (2007). Time Use of the Self-Employed. KYKLOS, 60(1), 105–122. https://doi.org/10.1111/j.1467-6435.2007.00361.x

Johansson, E. (2005). An estimate of self-employment income underreporting in Finland. Nordic Journal of Political Economy, 31(1), 99–109. http://urn.fi/URN:ISBN:951-555-656-2

Kim, B., Gibson, J., & Chung, C. (2017). Using panel data to estimate income under-reporting by the self-employed. The Manchester School, 85(1), 41–64. https://doi.org/10.1111/manc.12135

Kukk, M., Paulus, A., & Staehr, K. (2020). Cheating in Europe: underreporting of self-employment income in comparative perspective. Int Tax Public Finance, 27, 363–390. https://doi.org/10.1007/s10797-019-09562-9

Kukk, M., & Staehr, K. (2014). Income underreporting by households with business income: Evidence from Estonia. Post-Communist Economies, 26(2), 257–276. https://doi.org/10.1080/14631377.2014.904110

Lyssiotou, P., Pashardes, P., & Stengos, T. (2004). Estimates of the black economy based on consumer demand approaches. The Economic Journal, 114(497), 622–640. https://doi.org/10.1111/j.1468-0297.2004.00234.x

Martinez-Lopez, D. (2013). The underreporting of income by self-employed workers in Spain. Series, 4(4), 353–371. https://doi.org/10.1007/s13209-012-0093-8

Motion 1989/90:T633. Avskaffande av båtregistret. https://www.riksdagen.se/sv/dokument-lagar/dokument/motion/avskaffande-av-batregistret_GD02T633

Nygård, O. E., Slemrod, J., & Thoresen, T. O. (2019). Distributional implications of joint tax evasion. The Economic Journal, 129(620), 1894–1923. https://doi.org/10.1111/ecoj.12619

Pissarides, C. A., & Weber, G. (1989). An expenditure-based estimate of Britain’s black economy. Journal of Public Economics, 39(1), 17–32. https://doi.org/10.1016/0047-2727(89)90052-2

Schuetze, H. J. (2002). Profiles of tax non-compliance among the self-employed in Canada: 1969 to 1992. Canadian Public Policy/Analyse de Politiques, 219–238. https://www.jstor.org/stable/3552326

Skatteverket (2008), Skattefelskarta för Sverige, Rapport 2008:1, https://skatteverket.se/download/18.6704c7931254eefbe718000349/1359706120429/rapport200801skattefelskarta.pdf

SweBoat (2019) Fakta om båtlivet i Sverige 2019, http://service.sweboat.se/file.aspx?afile=2385aaa5-fc30-49d6-b024-d981b8a3efa0

Acknowledgements

We are grateful to Spencer Bastani, Janya Hamaaki, Julie Brun Bjørkheim, and seminar participants at IIPF 2020, Jönköping University, University of Turku, the Finnish Tax Administration, and the Swedish Tax Agency, and two anonymous referees and the editor (Thomas Åstebro) for helpful comments. We acknowledge financial support from the Nordic Tax Research Council and Stiftelsen Inger, Arne och Astrid Oscarssons Donationsfond.

Funding

Open access funding provided by Abo Akademi University (ABO).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Engström, P., Hagen, J. & Johansson, E. Estimating tax noncompliance among the self-employed—evidence from pleasure boat registers. Small Bus Econ 61, 1747–1771 (2023). https://doi.org/10.1007/s11187-023-00749-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-023-00749-3