Abstract

In this paper, we consider a two-period model where individual investors supply funds to entrepreneurs either indirectly, through a financial intermediary, or directly, using equity crowdfunding. The entrepreneurs vary in terms of the quality of their business projects and ex ante, both the investors and intermediaries are imperfectly informed about their types. The main trade off between the two forms of investment is that crowdfunding is assumed to involve lower costs and higher risk relative to how intermediaries invest their funds. Given this framework, we study investor behavior and find that at intermediate levels of risk for the crowdfunding investment, investors elect to utilize both crowdfunding and financial intermediation in equilibrium. Furthermore, we find that when transaction costs of investment are high, as can be the case with opaque types of small business ventures, this increases the incidence of crowdfunding as the optimal form of investment.

Plain English Summary

In a market where risky entrepreneurs are seeking external funds, crowdfunding and financial intermediation can be compatible methods of investment. Using a model where investors can finance entrepreneurs using either crowdfunding or an intermediary, we find that in some cases investors will prefer to utilize both methods. The availability of the two types of funding depends critically on how much risk new investors face when trying crowdfunding for the first time. The implication of this study is that investors will most benefit when they have access to both risky crowdfunding investment opportunities as well as the safer returns provided by financial intermediaries.

Similar content being viewed by others

Notes

See Kalil and Rand (2016).

While the direct finance choice by the investor is labeled as crowdfunding, to a certain extent in can represent other types of direct financing. However, we model this form of investment as a low cost, risky choice, which one can argue is perhaps more similar to crowdfunding than professional angel investors, who are likely to commit to more costly ex ante investigations of investment opportunities.

Investors are assumed to live for two periods in order to generate a framework where investors can learn about the quality of their direct financing investment choices over time. Keeping entrepreneurs’ lives at only one period is just to simplify the analysis.

We have assumed a low quality project generates $0 in revenue to simplify the analysis. Generally speaking we just need the project to deliver negative returns. The private benefit is only added to justify the entrepreneur’s demand for funds on a zero revenue project.

Note that in our model, since we have zero production costs, the project revenue is equivalent to profit.

This assumption is used only to simplify the analysis. Relaxing this assumption would likely lead to scenarios where successful investors could build larger, more diversified portfolios, but this is beyond the scope of the current research.

Implicitly, we assume that if the costs f or c are not paid, then the wide variation in the quality of firms seeking finance would lead to negative expected payoffs.

Assumption A1 implies this is less than 1.

See the papers mentioned in the previous footnote for some examples of specific actions entrepreneurs have used to successfully distinguish themselves in crowdfunding platforms. Also see Estrin et al. (2021) for an examination of the significance of soft information in a crowdfunding platform.

References

Agrawal, A., Catalini, C., & Goldfarb, A. (2014). Some simple economics of crowdfunding. Innovation Policy and the Economy, 14, 63–97.

Agrawal, A., Catalini, C., & Goldfarb, A. (2016). Are syndicates the killer app of equity crowdfunding? California Management Review, 58, 111–124.

Ahlers, G.K.C., Cumming, D., Gunther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39, 955–980.

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking and Finance, 11, 2931–2943.

Belleflamme, P., Lambert, T., & Schwienbacher, A. (2014). Crowdfunding: Tapping the right crowd. Journal of Business Venturing, 29, 585–609.

Berger, A.N., & Frame, W.S. (2007). Small business credit scoring and credit availability. Journal of Small Business Management, 45, 5–22.

Berger, A.N., & Udell, G.F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking and Finance, 22, 613–673.

Berger, A.N., & Udell, G.F. (2002). Small business credit availability and relationship lending: The importance of bank organizational structure. Economic Journal, 112, F32–F53.

Berger, A.N., & Udell, G.F. (2006). A more complete conceptual framework for SME finance. Journal of Banking and Finance, 30, 2945–2966.

Block, J.H., Colmbo, M.G., Cumming, D.J., & Vismara, S. (2018). New players in entrepreneurial finance and why they are there. Small Business Economics, 50, 239–250.

Brancati, E. (2015). Innovation financing and the role of relationship lending for SMEs. Small Business Economics, 44, 449–473.

Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19, 261–283.

Chang, J.W. (2020). The economics of crowdfunding. American Economic Journal: Microeconomics, 12, 257–280.

Chua, J.H., Chrisman, J.J., Kellermanns, F., & Wu, Z. (2011). Family involvement and new venture debt financing. Journal of Business Venturing, 26, 472–488.

Courtney, C., Dutta, S., & Li, Y. (2017). Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice, 41, 265–290.

Cumming, D.J., Hornuf, L., Karami, M., & Schweizer, D. (2020). Disentangling crowdfunding from fraudfunding, Max Planck Institute for Innovation & Competition. Research Paper No 16–09.

Cumming, D.J., Leboeuf, G., & Schwienbacher, A. (2019). Crowdfunding models: Keep-it-all vs. all-or-nothing. Financial Managment, 49, 331–360.

DeYoung, R., Frame, W.S., Glennon, D., & Nigro, P. (2011). The information revolution and small business lending: The missing evidence. Journal of Financial Services Research, 39, 19–33.

Ellman, M., & Hurkens, S. (2019). Optimal crowdfunding design. Journal of Economic Theory, 184.

Estrin, S., Gozman, D., & Khavul, S. (2018). The evolution and adoption of equity crowdfunding: entrepreneur and investor entry into a new market. Small Business Economics, 51, 425–439.

Estrin, S., Khavul, S., & Wright, M. (2021). Soft and hard information in equity contracts: Network effects in the digitalization of entrepreneurial finance. Small Business Economics.

Gompers, P., & Lerner, J. (2004). The venture capital cycle. Cambridge, Massachusetts: MIT Press.

Grüner, H.P., & Siemroth, C. (2019). Crowdfunding, efficiency, and inequality. Journal of the European Economic Association, 17, 1393–1427.

Hanley, A., & Girma, S. (2006). New ventures and their credit terms. Small Business Economics, 26, 351–364.

Hirsch, J., & Walz, U. (2019). The financing dynamics of newly founded firms. Journal of Banking and Finance, 100, 261–272.

Hornuf, L., & Schwienbacher, A. (2017). Should securities regulation promote equity crowdfunding Small Business Economics, 49, 579–593.

Hornuf, L., & Schwienbacher, A. (2018). Market mechanisms and funding dynamics in equity crowdfunding. Journal of Corporate Finance, 50, 556–574.

Hu, M., Li, X., & Shi, M. (2015). Product and pricing decisions in crowdfunding. Marketing Science, 34, 309–472.

Kalil, T., & Rand, D. (2016). The promise of crowdfunding and American innovation, press release. US White House.

La Rocca, M., La Rocca, T., & Cariola, A. (2011). Capital structure decisions during a firm’s life cycle. Small Business Economics, 37, 107–130.

Liberti, J.M., & Petersen, M.A. (2019). Information: Hard and soft. The Review of Corporate Finance Studies, 8, 1–41.

mac an Bhaid, C., & Lucey, B. (2010). Determinants of capital structure in Irish SMEs. Small Business Economics, 35, 357–375.

Miglo, A., & Miglo, V. (2019). Market imperfections and crowdfunding. Small Business Economics, 53, 51–79.

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29, 1–16.

Nitani, M., Riding, A., & He, B. (2019). One equity crowdfunding: investor rationality and success factors. Venture Capital An International Journal of Entrepreneurial Finance, 21, 243–272.

Parker, S.C. (2014). Crowdfunding, cascades and informed investors. Economics Letters, 125, 432–435.

Petit, A., & Wirtz, P. (2021). Experts in the crowd and their influence on herding in reward-based crowdfunding of cultural projects. Small Business Economics, forthcoming.

Robb, A.M., & Robinson, D.T. (2014). The capital structure decisions of new firms. Review of Financial Studies, 27, 153–179.

Saiedi, E., Mohammadi, A., Brostrom, A., & Shafi, K. (2020). Distrust in banks and fintech participation: The case of peer-to-peer lending. Entrepreneurship Theory and Practice, forthcoming.

Scholtens, B. (1999). Analytical issues in external financing alternatives for SBEs. Small Business Economics, 12, 137–148.

Schwienbacher, A. (2018). Entrepreneurial risk-taking in crowdfunding campaigns. Small Business Economics, 51, 843–859.

Short, J.C., Ketchen, D.J., Jr, A.F. McKenny, Allison, T.H., & Ireland, R.D. (2017). Research on crowdfunding: Reviewing the (very recent) past and celebrating the present. Entrepreneurship Theory and Practice, 41, 149–160.

Strausz, R. (2017). A theory of crowdfunding: A mechanism design approach with demand uncertainty and moral hazard. American Economic Review, 107, 1430– 1476.

Thakor, A.V. (2020). Fintech and banking: What do we know? Journal of Financial Intermediation, p 41.

Thakor, R.T., & Merton, R.C. (2018). Trust in lending, NBER Working Paper, #24778.

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46, 579–590.

Vismara, S. (2018). Information cascades among investors in equity crowdfunding. Entrepreneurship Theory and Practice, 42, 467–497.

Wang, W., Mahmood, A., Sismeiro, C., & Vulkan, N. (2019). The evolution of equity crowdfunding: Insights from co-investments of angels and the crowd. Research Policy, p 48.

Zhang, J., & Liu, P. (2012). Rational herding in microloan markets. Management Science, 58, iv-1038.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 2.

There are two cases to consider, depending on whether the crowdfunding investor monitors or not in the first period. First consider the case where \(\lambda <\overline {\lambda }\), implying that dj = dH and mj = 0. We show that the payoff in Eq. 9 exceeds the payoff in Eq. 10. Namely,

With a bit of simplification we then have

Since λ > λ1, it must be that \(\lambda \left (R -\frac {d_{H}}{1 -p}\right ) -f >R -\frac {d_{L}}{1 -p} -c\), so the above inequality holds as long as

This holds due to Assumption A1.

The second case is where \(\lambda \geq \overline {\lambda }\), meaning that dj = dL and mj = mL. Again, the payoff in Eq. 9 exceeds that in 10 if

With some simplification we have

Since λ > λ1, this implies that λ[R − dL/(1 − p)] − f > R − dL/(1 − p) − c, which along with assumption A1, is sufficient to guarantee that the above inequality holds. □

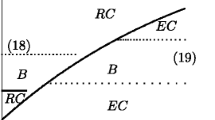

Proof of Proposition 1.

In Section 3.1 of the paper we established the optimal behavior of the investors in the second period of their lives. Furthermore, in Lemma 2 we proved that if λ > λ1, it is optimal for investors to always choose crowdfunding. For the case where λ ≤ λ1, we must pin down exactly when crowdfunding is a better choice than intermediation for the young investor. Specifically, the payoff in Eq. 11 exceeds the payoff in Eq. 12 if

With a bit of simplification we then have

This proves that crowdfunding is preferred by the young investor when λ2 < λ ≤ λ1. It also implies that if λ < λ2, then intermediation must be the optimal choice in the first period. Just to confirm that λ2 < λ1, note that

This holds due to assumption A3. □

Proof of Corollary 1.

Taking the partial derivatives we have

Note that in the numerator, − 2c + f + fL < 0 and mj − mL ≤ 0, meaning \(\frac { \partial }{ \partial \gamma }\widetilde {\lambda }_{2} <0\). □

Proof of Corollary 2.

Suppose entrepreneur pays cost b and λ2 drops to \(\widetilde {\lambda }_{2}\). Consider a case where, \(\lambda >\widetilde {\lambda }_{2}\). By Proposition 1, the young investor now chooses crowdfunding in the first period. Since \(\lambda <\overline {\lambda }\), the investor chooses to not monitor. As a result, the entrepreneur expects a first period payoff of pdH/(1 − p). This is all worthwhile for the entrepreneur if the increase in the first period payoff exceeds the initial cost, b. That is

□

Proof of Corollary 3.

Consider the following partial derivatives.

Crowdfunding occurs in equilibrium for all λ > λ2. Since λ2 decreases as x rises, this means that as entrepreneurs’ bargaining power over their equity share rises, there is a larger set of λ values over which crowdfunding will be selected. □

Rights and permissions

About this article

Cite this article

Van Tassel, E. Crowdfunding investors, intermediaries and risky entrepreneurs. Small Bus Econ 60, 1033–1050 (2023). https://doi.org/10.1007/s11187-022-00622-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00622-9