Abstract

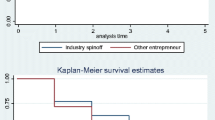

Using insights from strategic human resource management, we examine how employee benefits affect new venture performance. We hypothesize that two categories of benefits affect new venture performance and might do so differently: benefits that promote stability and flexibility. Using employee benefits data from the Kauffman Firm Survey, we find that new ventures that provide stability benefits—healthcare plans, tuition reimbursement, and retirement plans—have lower rates of exit and higher odds of earning a profit. Conversely, we find that firms that provide flexibility benefits—financial packages, stock ownership, bonus pay, and paid sick and vacation leave—do not affect firm exit rates but, with the exception of stock options, also have higher profits. We use IV methods to control for the possibility of reverse causality—firms that can afford to provide better employee benefits probably have better performance. Our IV results support our findings and suggest that firms that provide better employee benefits have lower exit rates and higher odds of earning a profit.

Similar content being viewed by others

Notes

Recent work also suggests that although some employer policies are intended to prevent employees from leaving to join competitor companies, they may actually encourage employees to become entrepreneurs (Campbell et al. 2017).

We thank an anonymous reviewer for pointing this out.

Other reasons for exit include (1) temporary closure, (2) sale, and (3) merger or acquisition. Our analysis estimates the odds of failure due to going out of business only, which helps ensure an equal comparison. Refer to the data analysis section for more detail.

Strategic HRM is defined as “the study of HRM systems (and/or subsystems) and their interrelationships with other elements comprising an organizational system, including the organization’s external and internal environments, the multiple players who enact HRM systems, and the multiple stakeholders who evaluate the organization’s effectiveness and determine its long-term survival.” (Jackson et al. 2014, p. 2).

Except in Hawaii

500 employees or more

Between 100 and 499 employees

Fewer than 100 employees

Wells et al. (2003) found that growth-oriented business owners were more likely than the maintenance-oriented to offer 13 of the 14 benefits listed. The maintenance-oriented owners were nearly twice as likely to offer no benefits at all. Balkin and Logan (1988) reinforce that specific benefits, like lump-sum pay structures, encourage a greater entrepreneurship mentality among employees.

Survival models allow us to estimate the odds of failure due to going out of business. This should not be confused with an empirical analysis of failing businesses only.

Interpretation of hazard rates is often counterintuitive to those who are unfamiliar with these estimation methods. A hazard rate h(t) < 1 indicates that increases in the variable are associated with a reduced hazard of failure while hazard rates h(t) > 1 indicate an increased hazard of failure.

The Hausman test checks whether the idiosyncratic errors (in our case firm-specific errors) are correlated with the model’s predictors. The null hypothesis is that they are not correlated, which supports the choice of random-effect regression. A rejection of the null hypothesis (i.e., p < 0.05) would instead support fixed-effect logistic regression. We do not reject the null hypothesis so we can be confident that the random-effect model is appropriate (and in fact more efficient).

The transformation follows three steps: (1) estimate a Poisson regression with the failure indicator as the response variable, (2) add time dummies, and (3) create an exposure variable that records the length of each time span.

In additional robustness tests, we also included all employee benefits in one regression model. This adjusts for the fact that some start-up firms provide multiple benefits to employees. The results are very similar to those reported here and are available upon request.

Non-linear fixed effects models (e.g., logit with firm fixed effects) suffer from the incidental parameters problem. Thus, we rely on random effects panel data models for estimation. The Hausman test supports the choice of random effects over fixed effects (χ2 = 13.36; p = 0.861).

This can be seen from the instrumental variable regressions reported in Table 6.

References

Acs, Z., Armington, C., & Zhang, T. (2007). The determinants of new-firm survival across regional economies: the role of human capital stock and knowledge spillover*. Papers in Regional Science, 86(3), 367–391. https://doi.org/10.1111/j.1435-5957.2007.00129.x.

Acs, Z., Åstebro, T., Audretsch, D., & Robinson, D. T. (2016). Public policy to promote entrepreneurship: a call to arms. Small Business Economics, 47(1), 35–51. https://doi.org/10.1007/s11187-016-9712-2.

Aflac. (2013). Findings from the 2013 Aflac WorkForces Report reveal distinct differences between companies leveraging key HR and benefits practices and workforce engagement and satisfaction. Retrieved from https://www.aflac.com/docs/awr/pdf/archive/aflac_viewpoint_thecompetitiveedge_2013.pdf. Accessed 18 May 2018.

Amin Zargarzadeh, M., Verbeke, A., & Osiyevskyy, O. (2014). Internalization theory, entrepreneurship and international new ventures. Multinational Business Review, 22(3), 246–269. https://doi.org/10.1108/MBR-06-2014-0023.

Ang, S., Slaughter, S., & Yee Ng, K. (2002). Human capital and institutional determinants of information technology compensation: modeling multilevel and cross-level interactions. Management Science, 48(11), 1427–1445. https://doi.org/10.1287/mnsc.48.11.1427.264.

Bakke, E. W. (1961). The human resources function. Management International, 1(2), 16–24.

Balkin, D. B., & Logan, J. W. (1988). Reward policies that support entrepreneurship. Compensation and Benefits Review, 20(1), 18–25. https://doi.org/10.1177/088636878802000103.

Ballou, J., Barton, T., DesRoches, D., Potter, F., Reedy, E. J., Robb, A., … Zhao, Z. (2008). The Kauffman Firm Survey: results from the baseline and first follow-up surveys (SSRN scholarly paper no. ID 1098173). Retrieved from social science research network website: https://papers.ssrn.com/abstract=1098173. Accessed 2 Feb 2017.

Barber, A. E., Dunham, R. B., & Formisano, R. A. (1992). The impact of flexible benefits on employee satisfaction: a field study. Personnel Psychology, 45(1), 55–74.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108.

Barro, R. J. (1991). Economic growth in a cross section of countries. The Quarterly Journal of Economics, 106(2), 407–443. https://doi.org/10.2307/2937943.

Bates, T., & Robb, A. (2014). Small-business viability in America’s urban minority communities. Urban Studies, 51(13), 2844–2862. https://doi.org/10.1177/0042098013514462.

Becker, G. S., Murphy, K. M., & Tamura, R. (1990). Human capital, fertility, and economic growth. Journal of Political Economy, 98(5, Part 2), S12–S37. https://doi.org/10.1086/261723.

Black, J., de Meza, D., & Jeffreys, D. (1996). House Price, the supply of collateral and the Enterprise economy. Economic Journal, 106(434), 60–75. https://doi.org/10.2307/2234931.

Bloomberg. (2015). Benefits Are the New Salary. Retrieved from https://www.bloomberg.com/news/articles/2015-06-30/benefits-are-the-new-salary. Accessed 18 May 2018.

BLS. (2018). Employee Benefits in the United States. Retrieved from http://bls.gov/news.release/pdf/ebs2.pdf. Accessed 18 May 2018.

Boudreaux, C. J. (2018). Ethnic diversity and small business venturing. Small Business Economics. https://doi.org/10.1007/s11187-018-0087-4.

Boudreaux, C. J. (2019). The importance of industry to strategic entrepreneurship: evidence from the Kauffman Firm Survey. Journal of Industry, Competition and Trade. https://doi.org/10.1007/s10842-019-00310-7.

Boudreaux, C. J., & Nikolaev, B. (2018). Capital is not enough: opportunity entrepreneurship and formal institutions. Small Business Economics, 1–30. https://doi.org/10.1007/s11187-018-0068-7.

Branco, M. C., & Rodrigues, L. L. (2006). Corporate social responsibility and resource-based perspectives. Journal of Business Ethics, 69(2), 111–132. https://doi.org/10.1007/s10551-006-9071-z.

Bryant, P. C., & Allen, D. G. (2013). Compensation, benefits and employee turnover: HR strategies for retaining top talent. Compensation and Benefits Review, 45(3), 171–175. https://doi.org/10.1177/0886368713494342.

Campbell, B. A., Kryscynski, D., & Olson, D. M. (2017). Bridging strategic human capital and employee entrepreneurship research: a labor market frictions approach. Strategic Entrepreneurship Journal, 11(3), 344–356. https://doi.org/10.1002/sej.1264.

Carraher, S. M., & Buckley, M. R. (2005). Attitudes towards benefits among SME owners in Western Europe: an 18-month study. Journal of Applied Management and Entrepreneurship; Sheffield, 10(4), 45–57.

Carraher, S. M., & Whitely, W. T. (1998). Motivations for work and their influence on pay across six countries. Global Business and Finance Review, 3, 49–56.

Cassar, G. (2014). Industry and startup experience on entrepreneur forecast performance in new firms. Journal of Business Venturing, 29(1), 137–151. https://doi.org/10.1016/j.jbusvent.2012.10.002.

Cleves, M., Gould, W., Gutierrez, R. G., & Marchenko, Y. (2010). An Introduction to Survival Analysis Using Stata [Stata press books]. Retrieved from StataCorp LP website: http://econpapers.repec.org/bookchap/tsjspbook/saus3.htm. Accessed 2 Feb 2017.

Clinch, G. (1991). Employee compensation and firms’ Research and Development activity. Journal of Accounting Research, 29(1), 59–78. https://doi.org/10.2307/2491028.

Cochran, W. G. (2007). Sampling techniques. John Wiley & Sons.

Cole, R. A., & Sokolyk, T. (2018a). Debt financing, survival, and growth of start-up firms. Journal of Corporate Finance, 50, 609–625. https://doi.org/10.1016/j.jcorpfin.2017.10.013.

Cole, R. A., & Sokolyk, T. (2018b). How Do Firms Choose Legal Form of Organization? (SSRN scholarly paper no. ID 2028176). Retrieved from social science research network website: https://papers.ssrn.com/abstract=2028176. Accessed 10 Sep 2019.

Cole, R. A., & Sokolyk, T. (2019). Financing Patterns and Performance Outcomes of Women-versus Men-Owned Young Entrepreneurial Firms (SSRN scholarly paper no. ID 3044957). Retrieved from social science research network website: https://papers.ssrn.com/abstract=3044957. Accessed 10 Sep 2019.

Coleman, S., Cotei, C., & Farhat, J. (2013). A resource-based view of new firm survival: new perspectives on the role of industry and exit route. Journal of Developmental Entrepreneurship, 18(01), 1350002. https://doi.org/10.1142/S1084946713500027.

Cooper, A. C., Gimeno-Gascon, F. J., & Woo, C. Y. (1994). Initial human and financial capital as predictors of new venture performance. Journal of Business Venturing, 9(5), 371–395. https://doi.org/10.1016/0883-9026(94)90013-2.

Deshpande, S. P., & Golhar, D. Y. (1994). HRM practices in large and small manufacturing firms: a comparative study. Journal of Small Business Management, 32(2), 49.

Doms, M., Lewis, E., & Robb, A. (2010). Local labor force education, new business characteristics, and firm performance. Journal of Urban Economics, 67(1), 61–77. https://doi.org/10.1016/j.jue.2009.10.002.

Drucker, P. (2012). The practice of management. Routledge.

Dunford, B. B., Oler, D. K., & Boudreau, J. W. (2008). Underwater Stock options and voluntary executive turnover: a multidisciplinary perspective integrating behavioral and economic theories. Personnel Psychology, 61(4), 687–726. https://doi.org/10.1111/j.1744-6570.2008.00128.x.

Eaton, S. C. (2003). If you can use them: flexibility policies, organizational commitment, and perceived performance. Industrial Relations: A Journal of Economy and Society, 42(2), 145–167. https://doi.org/10.1111/1468-232X.00285.

Entrepreneur. (2005). The Basics of Employee Benefits. Retrieved August 29, 2019, from Entrepreneur website: https://www.entrepreneur.com/article/80158

Etzion, D. (2003). Annual vacation: duration of relief from job stressors and burnout. Anxiety, Stress, and Coping, 16(2), 213–226. https://doi.org/10.1080/10615806.2003.10382974.

Etzion, D., Eden, D., & Lapidot, Y. (1998). Relief from job stressors and burnout: reserve service as a respite. Journal of Applied Psychology, 83(4), 577.

Fairlie, R. W., & Robb, A. M. (2007). Why are Black-owned businesses less successful than white-owned businesses? The role of families, inheritances, and business human capital. Journal of Labor Economics, 25(2), 289–323. https://doi.org/10.1086/510763.

Fairlie, R. W., & Robb, A. M. (2009). Gender differences in business performance: evidence from the characteristics of business owners survey. Small Business Economics, 33(4), 375. https://doi.org/10.1007/s11187-009-9207-5.

Farhat, J., Matusik, S., Robb, A., & Robinson, D. T. (2018). New directions in entrepreneurship research with the Kauffman firm survey. Small Business Economics, 50(3), 521–532. https://doi.org/10.1007/s11187-017-9905-3.

Fichman, M., & Levinthal, D. A. (1991). Honeymoons and the liability of adolescence: a new perspective on duration dependence in social and organizational relationships. Academy of Management Review, 16(2), 442–468. https://doi.org/10.5465/AMR.1991.4278962.

Fisher, I. (1930). The theory of interest. New York, 43.

Freeman, J., Carroll, G. R., & Hannan, M. T. (1983). The liability of newness: age dependence in organizational death rates. American Sociological Review, 48(5), 692–710. https://doi.org/10.2307/2094928.

Friedman, M. (1957). Theory of the consumption function. Princeton university press.

Greene, W. (2004). Fixed effects and Bias due to the incidental parameters problem in the Tobit model. Econometric Reviews, 23(2), 125–147. https://doi.org/10.1081/ETC-120039606.

Greene, W. H. (2003). Econometric analysis. Pearson Education India.

Guthrie, J. P. (2001). High-involvement work practices, turnover, and productivity: evidence from New Zealand. Academy of Management Journal, 44(1), 180–190. https://doi.org/10.5465/3069345.

Hall, B. J. (2000). What you need to know about Stock options. Retrieved September 10, 2019, from Harvard business review website: https://link.galegroup.com/apps/doc/A60471889/AONE?sid=lms

Hannan, M. T., & Freeman, J. (1988). Density dependence in the growth of organizational populations. Cambridge, Massachusetts: Ballinger Books.

Hausknecht, J. P., Rodda, J., & Howard, M. J. (2009). Targeted employee retention: performance-based and job-related differences in reported reasons for staying. Human Resource Management, 48(2), 269–288.

Haveman, R., & Smeeding, T. (2006). The role of higher education in social mobility. The Future of Children, 16(2), 125–150.

Holtz-Eakin, D., Joulfaian, D., & Rosen, H. (1994). Entrepreneurial decisions and liquidity constraints. RAND Journal of Economics, 25, 334–347.

Hornsby, J. S., & Kuratko, D. F. (1990). Human resource management in small business: critical issues for the 1990’s. Journal of Small Business Management, 28(3), 9.

Huselid, M. A. (1995). The impact of human resource management practices on turnover, productivity, and corporate financial performance. Academy of Management Journal, 38(3), 635–672. https://doi.org/10.2307/256741.

Jackson, S. E., Schuler, R. S., & Jiang, K. (2014). An aspirational framework for strategic human resource management. The Academy of Management Annals, 8(1), 1–56. https://doi.org/10.1080/19416520.2014.872335.

Jha, A., & Cox, J. (2015). Corporate social responsibility and social capital. Journal of Banking & Finance, 60, 252–270. https://doi.org/10.1016/j.jbankfin.2015.08.003.

Kehoe, R. R., & Wright, P. M. (2013). The impact of high-performance human resource practices on employees’ attitudes and behaviors. Journal of Management, 39(2), 366–391. https://doi.org/10.1177/0149206310365901.

Knight, F. (1921). Risk, uncertainty and profit. New York: Hart, Schaffner and Marx.

Korn, E. L., & Graubard, B. I. (2011). Analysis of health surveys (Vol. 323). John Wiley & Sons.

Koys, D. J. (2001). The effects of employee satisfaction, organizational citizenship behavior, and turnover on organizational effectiveness: a unit-level, longitudinal study. Personnel Psychology, 54(1), 101–114. https://doi.org/10.1111/j.1744-6570.2001.tb00087.x.

Lancaster, T. (2000). The incidental parameter problem since 1948. Journal of Econometrics, 95(2), 391–413. https://doi.org/10.1016/S0304-4076(99)00044-5.

Levy, P. S., & Lemeshow, S. (2013). Sampling of populations: methods and applications. John Wiley & Sons.

Lindh, T., & Ohlsson, H. (1996). Self-employment and windfall gains: evidence from the Swedish lottery. Economic Journal, 106(439), 1515–1526. https://doi.org/10.2307/2235198.

Martin, B. C., McNally, J. J., & Kay, M. J. (2013). Examining the formation of human capital in entrepreneurship: a meta-analysis of entrepreneurship education outcomes. Journal of Business Venturing, 28(2), 211–224. https://doi.org/10.1016/j.jbusvent.2012.03.002.

Maslow, A. H. (1943). A theory of human motivation. Psychological Review, 50(4), 370–396. https://doi.org/10.1037/h0054346.

Mathis, R. L., & Jackson, J. H. (1991). Personnel/human resource management. West Publishing Company.

McClean, E., & Collins, C. J. (2011). High-commitment HR practices, employee effort, and firm performance: investigating the effects of HR practices across employee groups within professional services firms. Human Resource Management, 50(3), 341–363. https://doi.org/10.1002/hrm.20429.

Morgan, A. G., & Poulsen, A. B. (2001). Linking pay to performance—Compensation proposals in the S&P 500. Journal of Financial Economics, 62(3), 489–523. https://doi.org/10.1016/S0304-405X(01)00084-8.

Neyman, J., & Scott, E. L. (1948). Consistent estimates based on partially consistent observations. Econometrica, 16(1), 1–32. https://doi.org/10.2307/1914288.

Pandher, G. S., Mutlu, G., & Samnani, A.-K. (2017). Employee-based innovation in organizations: overcoming strategic risks from opportunism and governance. Strategic Entrepreneurship Journal, 11(4), 464–482. https://doi.org/10.1002/sej.1252.

Pe’er, A., & Keil, T. (2013). Are all startups affected similarly by clusters? Agglomeration, competition, firm heterogeneity, and survival. Journal of Business Venturing, 28(3), 354–372. https://doi.org/10.1016/j.jbusvent.2012.03.004.

Peters, P., den Dulk, L., & van der Lippe, T. (2009). The effects of time-spatial flexibility and new working conditions on employees’ work–life balance: the Dutch case. Community, Work & Family, 12(3), 279–297. https://doi.org/10.1080/13668800902968907.

Pfeffer, J. (1994). Competitive advantage through people. California Management Review; Berkeley, 36(2), 9.

Plummer, L. A., & Acs, Z. J. (2014). Localized competition in the knowledge spillover theory of entrepreneurship. Journal of Business Venturing, 29(1), 121–136. https://doi.org/10.1016/j.jbusvent.2012.10.003.

Prahalad, C. K. (1983). Developing strategic capability: an agenda for top management. Human Resource Management, 22(3), 237–254. https://doi.org/10.1002/hrm.3930220304.

Ramsey, F. P. (1928). A mathematical theory of saving. The Economic Journal, 38(152), 543–559.

Robb, A. M. (2002). Entrepreneurial performance by women and minorities: the case of new firms. Journal of Developmental Entrepreneurship, 7(4), 383.

Robb, A. M., & Robinson, D. T. (2014). The capital structure decisions of new firms. The Review of Financial Studies, 27(1), 153–179. https://doi.org/10.1093/rfs/hhs072.

Royston, P., & Lambert, P. C. (2011). Flexible parametric survival analysis using Stata: beyond the Cox model.

Rubin, D. B. (2004). Multiple imputation for nonresponse in surveys (Vol. 81). John Wiley & Sons.

Sauermann, H. (2018). Fire in the belly? Employee motives and innovative performance in start-ups versus established firms. Strategic Entrepreneurship Journal. https://doi.org/10.1002/sej.1267.

Sesil, J. C., & Lin, Y. P. (2011). The impact of employee Stock option adoption and incidence on productivity: evidence from U.S. panel data. Industrial Relations: A Journal of Economy and Society, 50(3), 514–534. https://doi.org/10.1111/j.1468-232X.2011.00648.x.

Shane, S. (2003). A general theory of entrepreneurship: the individual-opportunity nexus. Edward Elgar Publishing.

Shane, S. (2008). The illusions of entrepreneurship: the costly myths that entrepreneurs, investors, and policy makers live by. Yale University Press.

Shane, S., & Stuart, T. (2002). Organizational endowments and the performance of university start-ups. Management Science, 48(1), 154–170. https://doi.org/10.1287/mnsc.48.1.154.14280.

Sheehan, M. (2014). Human resource management and performance: evidence from small and medium-sized firms. International Small Business Journal, 32(5), 545–570. https://doi.org/10.1177/0266242612465454.

Sheridan, A., & Conway, L. (2001). Workplace flexibility: reconciling the needs of employers and employees. Women in Management Review. https://doi.org/10.1108/09649420110380238.

Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: a conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 30(6), 708–723. https://doi.org/10.1016/j.appdev.2009.02.003.

Staiger, D., & Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica; Evanston, 65(3), 557–586.

Stinchcombe, A. L. (1965). Social structure and organizations. In March, J. (Ed.), Handbook of organizations (pp. 153–193). Rand McNally.

Subramony, M. (2009). A meta-analytic investigation of the relationship between HRM bundles and firm performance. Human Resource Management, 48(5), 745–768. https://doi.org/10.1002/hrm.20315.

Sutton, N. A. (1985). Do employee benefits reduce labor turnover? Benefits Quarterly, 1(2), 16–22.

Tarkan, L. (2011). The Benefits of Flextime (to Employers). Retrieved September 10, 2019, from https://www.cbsnews.com/news/the-benefits-of-flextime-to-employers/

Valverde, M., Tregaskis, O., & Brewster, C. (2000). Labor flexibility and firm performance. International Advances in Economic Research, 6(4), 649–661. https://doi.org/10.1007/BF02295375.

Wells, B. L., Pfantz, T. J., & Bryne, J. L. (2003). Russian women business owners: evidence of entrepreneurship in a transition economy. Journal of Developmental Entrepreneurship; Norfolk, 8(1), 59–71.

Westman, M., & Eden, D. (1997). Effects of a respite from work on burnout: vacation relief and fade-out. Journal of Applied Psychology, 82(4), 516.

Whitehead, J. (1980). Fitting Cox’s regression model to survival data using glim. Journal of the Royal Statistical Society: Series C: Applied Statistics, 29(3), 268–275. https://doi.org/10.2307/2346901.

Wooden, M., & Warren, D. (2004). Non-standard employment and job satisfaction: evidence from the HILDA survey. The Journal of Industrial Relations, 46(3), 275–297. https://doi.org/10.1111/j.0022-1856.2004.00142.x.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. MIT press.

Wright, P. M., Gardner, T. M., & Moynihan, L. M. (2003). The impact of HR practices on the performance of business units. Human Resource Management Journal, 13(3), 21–36. https://doi.org/10.1111/j.1748-8583.2003.tb00096.x.

Wright, P. M., McMahan, G. C., & McWilliams, A. (1994). Human resources and sustained competitive advantage: a resource-based perspective. The International Journal of Human Resource Management, 5(2), 301–326. https://doi.org/10.1080/09585199400000020.

Youndt, M. A., Snell, S. A., Dean, J. W., & Lepak, D. P. (1996). Human resource management, manufacturing strategy, and firm performance. Academy of Management Journal, 39(4), 836–866. https://doi.org/10.5465/256714.

Young, S. L., Welter, C., & Conger, M. (2018). Stability vs. flexibility: the effect of regulatory institutions on opportunity type. Journal of International Business Studies, 49(4), 407–441. https://doi.org/10.1057/s41267-017-0095-7.

Acknowledgments

Certain data included herein are derived from the Ewing Marion Kauffman Foundation, Kansas City, MO. Any opinions, findings, and conclusions or recommendations expressed in the material are those of the authors and do not necessarily reflect the views of the Ewing Marion Kauffman Foundation. We thank Rebel Cole, two anonymous referees, and Associate Editor David Urbano for helpful discussions and comments. All results have been reviewed to ensure that no confidential information on individual firms is disclosed. Any remaining errors are our own.

Funding

Funding and support were received from the Ewing Marion Kauffman Foundation and the NORC enclave at the University of Chicago.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(DOCX 20 kb)

Rights and permissions

About this article

Cite this article

Boudreaux, C.J. Employee compensation and new venture performance: does benefit type matter?. Small Bus Econ 57, 1453–1477 (2021). https://doi.org/10.1007/s11187-020-00357-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-020-00357-5