Abstract

It is a familiar observation that entrepreneurship is not easily accommodated within the framework of neoclassical economic theory. Drawing inspiration from an ancient critique of neoclassicism by Veblen (Q J Econ 12(4):373–397, 1898), this paper attributes the difficulty to the tension between normative accounts of decision making (as in mainstream theory) and ideas of causation that are standard in the sciences. Normative theories naturally privilege the conjectured future over the experienced past in the quest for explanatory factors. Evolutionary theories elucidate instead the mechanisms of “cumulative causation” (Veblen) that perpetually produce the present from the past. Entrepreneurship of the innovative (Schumpeterian) kind seizes opportunities that emerge in complex, evolving contexts of technological and institutional change. A theory that gives due weight to cumulative causation sheds greater light on these processes than prevailing mainstream theory can, and that is a key advantage of an evolutionary theory.

Similar content being viewed by others

1 Introduction

In this paper, I discuss the phenomenon of entrepreneurship in relation to the current state of the economics discipline, and especially the state of economic theory. It is no secret that the place of entrepreneurship in economic theory is an awkward one, and has been so for a long time. Indeed, in his classic book The Theory of Economic Development (Schumpeter 1934 [1911, 1926]; Becker et al. 2011),Footnote 1 Joseph Schumpeter was at points quite emphatic on the distinction between the phenomena that concerned him, involving entrepreneurship and development, and the less dynamic aspects of economic life that were analyzed in the mainstream theory of his day. Schumpeter’s critique was tempered by his good scholarly manners and by his admiration for some of his contemporaries, particularly Walras. Since his day, the fact that entrepreneurship is a misfit in mainstream theory has been remarked many times.Footnote 2

The discussion of entrepreneurship has taken place in the context of a much larger and more diverse discussion about the economics discipline. Has economics made real progress in understanding economic life? Has it contributed usefully to economic policy discussion? Is economics a science, or could it be? Is it correct to say that it is dominated today by “neoclassical” economic theory, and if so, just what does that mean? The size, range and durability of that discussion are remarkable (Mazzoleni and Nelson 2013). It is noteworthy that the critics of “the mainstream” agree much more on the criticisms than they do on the reform program.

The controversy about the discipline has grown more intense since the Financial Crisis of 2008 and The Great Recession, with some voices arguing that economists have some collective responsibility for the misunderstandings and policy failures that produced those very costly developments. There have been many books, many conferences and also foundings of new institutions like the “Institute for New Economic Thinking.” But, far above that energetic intellectual storm there floats the serene impression that, for the most part, business as usual still rules in the economics discipline.

I share the view that many have expressed, that mainstream economic theory has often stood in the way of progress in understanding entrepreneurship. I hold also, with perhaps less company, that this situation has deep roots and cannot be remedied without major adjustments in our theories of economic behavior. An economic theory that provided a more natural home for the study of entrepreneurship would also facilitate research on many other phenomena in which institutional contexts and ongoing change are central—the prominent recent example being the operation of the financial system (Jacobides 2015).

My central objective here is to propose a diagnosis of the ailments of economic theory and to relate that diagnosis to the problems and promise of entrepreneurship research. It is a novel diagnosis at least in the sense that it is not to be found in the more recent part of the larger discussion. Broadly speaking, the diagnosis relates to what Marshall called “the manifold influences of the element of time”—which, as he pointed out, tend to promote a tendency “… towards assigning wrong proportions to economic forces, those elements being most emphasized which lend themselves most easily to analytical methods” (Marshall 1920, p. 850).Footnote 3 The diagnosis points to a program of reform that has much overlap with what I and others have done under the heading of evolutionary economics over recent decades. I do not, however, provide here a full review of the evolutionary position, but focus on arguments based on relatively recent developments in my thinking. I critique the present state of the discipline by offering a view of “The Economics that Might Have Been,” an impressionistic picture of how economics might have developed had it taken a different path more than century ago. I hope that this will add a deeper layer to the current discussions of the economics discipline, of a kind that might lead to an economics that is more successful as a science and more useful to society.

My argument depends critically on the meanings I assign to key terms in my title: “economics” and “entrepreneurship.” The following section describes my understandings of those terms. In Sect. 3, I introduce the path not taken—the evolutionary perspective on economics propounded by Thorstein Veblen more than a century ago. The next section explores the fundamental differences in the understanding of behavior that distinguish Veblen’s recommendation from the historical course of the “mainstream,” with particular attention to the quite different ideas of causation that rule in the two systems. Section 5 relates these differences to the distinction between the “important aspects of economic reality that the mainstream tends to neglect (“sins of omission”), as contrasted with what it tends to get wrong (“sins of commission”). Then, in Sect. 6, I seek to evoke an image of how the innovative opportunities seized by entrepreneurs today have emerged from historical processes that vividly illustrate Veblen’s idea of “cumulative causation.” Section 7 sketches how entrepreneurship might be appraised in the context of an economics that had followed Veblen’s recommendations. The final section offers my conclusions—in brief, that the path not taken still beckons.

2 The terms of the discussion

Productive discussion is frequently impaired by a lack of sufficient clarity as to what the discussion is about. Such a hazard is particularly significant hazard for my topic here.

The task of setting the boundaries of the discussion is complicated by the fact that the economics discipline as a whole is enormously diverse, and it harbors many heterodox thinkers and substantial schools of thought and research practice. Partly as a result of this diversity, there is seemingly less consensus regarding the boundaries of the discipline than there is regarding the character of its “mainstream.” Accordingly, I begin with the latter: What exactly is “the mainstream” (alternatively, “neoclassical economics,” or “contemporary orthodoxy”)? One view of it was well summarized by the late Gary Becker with the phrase “unflinching application of the combined postulates of maximizing behavior, stable preferences, and market equilibrium” (Becker 1976, p. 5).Footnote 4 This definition responds quite effectively to the occasional claims that there really is no definable “mainstream,” because the discipline’s approach to problems is so diverse and flexible in practice. It is true enough, fortunately, that not all economists pursue the mainstream paradigm. It is also true that the paradigm has a lot of flexibility around the edges, particularly as practiced by economists with a deep interest in the empirical realities. Nevertheless, the mainstream paradigm is real, easily recognized and dominant. One important effect of that dominance is to impede alternative lines of development, particularly theoretical development, of the discipline.

Whether positioned near or far from the mainstream, the achievements of the economics discipline as it exists today include much that is admirable. Various contributions are, however, admirable for different reasons. Sometimes the basic reason is mainly aesthetic, which may relate to mathematical precision, literary style or the sheer power of a coherent, systematic argument. Aesthetic criteria can, of course, be applied regardless of questions of truth and falsity, or even of the reality of the subject matter. In economic theory, such criteria are a powerful influence on the construction of mathematical models, today’s principal scholarly genre for the presentation of economic insights. Such models can usefully be viewed as abstract parables (Cartwright 2008; Winter 2014a, b); they generate pointed lessons about a piece of reality that is represented in a highly schematic fashion. Aside from their aesthetic virtues, such parables may offer an organized way of thinking about a whole class of situations—while making no attempt at a complete or predictive account of any of them. By contrast, in many fields of applied economics, policy-relevant insights are often developed that owe relatively little to mainstream ideas, and may or may not be expressed in model form. Finally, there is the ever-expanding fund of increasingly sophisticated econometric studies, many of which are admirable in the degree to which they convincingly answer some significant empirical question.

Granting that there is valuable insight to be found among these diverse contributions, overarching questions remain about the specific purposes being served and the priorities for allocations of effort. These questions have their philosophical and methodological aspects, and also their practical aspects, e.g., in the domain of faculty appointments and in the maintenance of intellectual diversity.Footnote 5 Similar questions arise across the sciences. Economics seems distinctive, however, with regard to the extent of the ambiguity about the purposes it is supposed to serve.

Remarkably, the controversies about the economics discipline revolve to a substantial degree around ambiguities in the very definition of the discipline. What is the object of study? Do a Google search on “economics definition” and you will find that there is an interesting range of opinion. One thing you will find is Alfred Marshall’s proposal “a study of mankind in the ordinary business of life.” But you will see prominent alternatives that do not feature the study of the economy or of economic life; they feature economizing, or economic choice—essentially, the logic of resource allocation, which is sometimes rendered as “the best use of limited resources.” This type of definition assimilates the complex phenomena of economic life to the logic of choice; the realities of economic life are seen primarily as illustrations of that logic and considered worthy of attention for that primary reason (Bianchi and Henrekson 2005).

Whether the logic of choice should be considered central to the definition of the discipline is debatable, and in my view it should not. Regardless of that, the mainstream paradigm is certainly centered on a normative theory of choice, sometimes under the label “optimization” or “maximizing behavior” (as in Becker’s definition).Footnote 6 Over the years since the time of Adam Smith, the mode of theoretical expression of this core idea went from everyday language to abstract mathematics. A significant turn was taken around the middle of the twentieth century with the advances in utility theory, first with the interpretation of utility as ordinal and then with the axiomatic treatments of choice under risk and uncertainty.Footnote 7 Although theoretical discussion and innovation in this area have continued, those twentieth-century advances still define the limits of the tools in use in pedagogy and on the research frontier, outside of decision theory itself.

A major marker of those contributions is the theory of subjective expected utility as developed particularly by Leonard J. Savage, The Foundations of Statistics (Savage 1954).Footnote 8 This theory is normative and highly general; it characterizes how a rational individual might best confront an economic decision in order to … in order to what? Get wealthy? Dominate the market? Win the war? Leave a mark on posterity? No, none of that, because to do those things you have to be in touch with reality. Savage’s theory is not about being in touch with reality, it is about being internally consistent in your beliefs and choices. Thus it is a good representative of the mainstream emphasis on the logic of choice over the historically contextualized substance of choice. You can believe that you are Napoleon, finding yourself confined to an insane asylum you call Elba, and rationally plotting your return to power. That by itself raises no question about your “rationality” as understood in Savage’s theory. Such a theory elevates internal consistency above all other considerations. In so doing it offers subtle encouragement to fantasy, provided only that it is internally consistent fantasy.

In short, we find in contemporary economics two complementary premises. The first is curiously equivocal, involving acceptance of substantial ambiguity about whether it is really economic life that the discipline is supposed to understand, or whether instead the discipline is by definition about economizing—about the principles of efficiency in resource allocation, whose claim to our attention rests on the reality of resource scarcity. (That economic life is in part about coping with resource scarcity is, of course, not contestable—but what part, and which scarcities?) The second premise is characteristic of the economics mainstream specifically, and involves an unequivocal commitment to reliance on normative theories of choice (ranging from the simple accounts in the intermediate textbooks to and beyond Savage’s theory) as the principal guide to addressing the implications of scarcity. This reliance is displayed not only in the treatment of individual behavior, but in the treatment of firm behavior as well—since in the traditional/textbook treatment, firms are “unitary rational actors”; their choice behavior is that of a rational individual.

In what follows, I argue from a basic commitment to a definition of the discipline that follows Marshall’s lead. Whatsoever serves the ultimate purpose of understanding economic life as it is, that is “good economics”—and that principle must prevail over the a priori appeal of every specific theory and method that lacks compelling connection to that ultimate purpose. Exactly such a lack afflicts, in my view, the unqualified commitment to normative theories of decision as the central analytical tool that economists deploy to understand economic behavior. To be clear, the understanding referred to here is descriptive understanding; the purposes in view are those of “positive economics.” For a real actor deliberating a real decision, the normative stance is more or less inevitable, and the tool kit of normative decision theory may be helpful to such an actor.Footnote 9 Similarly, economic policy discussion could be hardly conducted without an admixture of positive and normative elements. The normative stance is at least helpful, to some degree, in many parts of the positive economics domain. Understanding the limits of that contribution is an important task, one little pursued by the mainstream, but hopefully illuminated by this essay.

It remains to pin down the term “entrepreneurship.” The concept of entrepreneurship with which I deal is basically Schumpeter’s concept, emphasizing individual agency in the production of innovation and of economic change generally. I do not equate entrepreneurship with self-employment or with the founding or operation of a small business; these phenomena are better viewed as aspects of the functioning of the labor market than as essential correlates of innovative activity. To address them under the entrepreneurship heading tends to diffuse attention over too broad a field of inquiry, thus diverting it from the question of greatest interest—how capitalism actually works as an “engine of progress.” Entrepreneurship of the innovative kind, on the other hand, is sometimes found among the managers of large enterprises (as Schumpeter ultimately argued), and also within government bureaucracies and not-for-profit organizations.

Regarding the relationship of (Schumpeterian) entrepreneurship to self-employment or new, small firms, I note that the subtleties of this issue have long challenged research in entrepreneurship, and continue to do so. If innovative behavior is the defining feature of the entrepreneurial role as Schumpeter conceived it, then we have to be able to recognize innovation if we want to count Schumpeterian entrepreneurs. It is, however, considerably harder to measure innovation than it is to count new or small firms, or self-employed individuals. Thus, in policy discussions about “entrepreneurship,” there is often some reliance on statistics relating to business startups and other measures of the small business environment. How much these statistics reveal about the health of Schumpeterian entrepreneurship is hard to ascertain. This problem has been brought to the fore, once again, in the current discussion about an apparent decline in “business dynamism” in the USA (Decker et al. 2014). Related concerns arise in connection with the assessment of policies to promote “entrepreneurship,” which are often advocated with the benefits of Schumpeterian entrepreneurship and the example of Silicon Valley in view, but often fail to deliver as promised (Nightingale and Coad 2014).

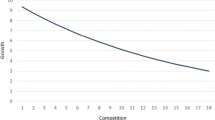

Before proceeding, I pause to explain the point above about the “misfit” status of entrepreneurship in contemporary economic theory. Consider a class in which all of the students are extremely capable and hard-working. As a result of this, they all consistently get perfect scores on the examinations, and the professor justly gives them all a grade of A+. In the second term, a new, very talented student joins the group. Can this student stand out, can he or she raise the average or win a prize for a distinctive achievement? No, because the competition is already perfect; they literally cannot be beat. What then is the “place” of the new student? At best, it is to get an A+ like everybody else. In mainstream economic theory, all of the decision makers are A+ students, and they are perfect at precisely the economic tasks often associated with entrepreneurship—at the accurate perception of opportunity and its effective exploitation in the economy. A distinctive “place” for entrepreneurship, or indeed for any kind of creativity, cannot be located amidst all of that pre-existing perfection.

I do not mean to suggest that entrepreneurship research has been hampered inordinately by this situation. Fifteen or twenty years ago, a plausible case to that effect might have been made, but the field has flourished remarkably in recent years, and continues to do so today. Empirical research, in particular, has flourished distinctively in entrepreneurship studies, as it has elsewhere, under the influence of the computers, the software and the data sets. As elsewhere, much of the empirical work relies on rather simple theoretical guidance and proceeds with indifference to mainstream critiques of its theoretical underpinnings. Today, the main problem is not that entrepreneurship research is impoverished by weak support from economic theory, but that economics is impoverished by weak assimilation of the implications of entrepreneurship. In other words, Schumpeter’s original ambition for an economics that would acknowledge the centrality of entrepreneurship in economic development is still largely unrealized; some of the reasons are explicated below.

3 Economics in space–time: cumulative causation

In 1898, the American economist Thorstein Veblen published a paper in the Quarterly Journal of Economics entitled “Why is Economics Not an Evolutionary Science?” (Veblen 1898). Many consider this to be the founding paper of evolutionary economics, and apparently it marks the origin of that term. Veblen offered a critique of the neoclassical economics of his time and contrasted the situation of economics with that in what he called “the evolutionary sciences.” Many elements of his critique anticipate similar comments about the economics discipline today; with some stylistic adjustments they could be transplanted to the post-2008 discussion and not seem out of place.

Veblen’s notion of the “evolutionary sciences” went well beyond biology, as illustrated in the following passage:

It may be taken as the consensus of those men who are doing the serious work of modern anthropology, ethnology, and psychology, as well as of those in the biological sciences proper, that economics is helplessly behind the times, and unable to handle its subject matter in a way to entitle it to standing as a modern science. (Veblen 1898, p. 373)

Veblen’s analysis of the situation pointed to a key methodological feature that the “evolutionary sciences” shared but economics lacked—the emphasis on “cumulative causation” as the key manifestation of cause and effect operative in nature. In what specific respects does economics fail to embrace cumulative causation? Veblen (1898, p. 387) says (in effect) “with respect to the micro-detail of technological change and the relationship of technology to prevalent habits of thought.”

As to the scientific objectives of an economics governed by the same principles, he declared:

For the purpose of economic science the process of cumulative change that is to be accounted for is the sequence of change in the methods of doing thing—the methods of dealing with the material means of life. (Veblen 1898, p. 387)

This in 1898, before the twentieth century had even dawned. This is before physics was transformed by relativity and quantum mechanics. It was before the size and expansion of the Universe were known. Though it was well after Darwin, a point that is obviously crucial in this story, 1898 was roughly in the middle of the period sometimes called the “eclipse of Darwinism,” before the “modern synthesis” took hold in biology. Thus, even in biology, evolution was understood differently and much less completely than it is today.Footnote 10

What Veblen could not anticipate was that so many developments in twentieth-century science and technology would expand the scope of the “evolutionary sciences” and further underscore the significance of the “cumulative causation” processes that he emphasized. A particularly compelling example is the current understanding of the creation of most of the chemical elements by successive generations of nucleo-synthesis in exploding stars, which is the science that underpins the poetic observation that “we are all made of stardust.” Veblen certainly did not know that chemistry was an “evolutionary science” in this sense, much less about the many layered processes of cumulative causation that now form the explanatory links tracing our current situation back to a start at the Big Bang.Footnote 11 But the central importance of the cumulative causation story is evident throughout: Effects set the initial conditions and produce starting points for new causes, including new kinds of causes, which display regularities characteristic of emergent entities, like the chemical elements. And that is basically how the Universe got to be as interesting and complex as it is today.

I propose that Veblen was not only right, he was much more right than he knew or could have known. We can try to imagine what would be different about economics now, 117 years later, if economists had somehow gotten his message, in spite of the much thinner support it had at the time, and diligently followed that guidance. Such an exercise of the imagination is what generates “The Economics That Might Have Been” referenced in my title.Footnote 12 It is an image of an economics that is securely lodged in the same framework of space–time and the same notions of causation that form the taken-for-granted foundation and background of most of the sciences today.Footnote 13

It does not impose any strain on the imagination to produce a list of differences between the economics we have and the economics that might have been. Respect for cumulative causation as a unifying scientific principle would certainly imply respect for the evolutionary account of the origins of the human species. That carries the implication that the human nature we seek to understand for the purposes of economic science is the same human nature that other sciences seek to understand, and it is the result of biological and cultural evolution. So much for homo economicus, the specialized version of humanity that serves the purposes of economic theorists and evolved only in their imaginations. If the regime switch were somehow to occur today, recent books reflecting the influence on economics of psychology and cognitive science would suddenly dominate the economics reading lists. Place that switch 117 years back and it does become difficult to imagine what the cumulative implications for contemporary economics would be. Consider also what has happened to the field of economic history. Recent commentary on the state of the discipline deplores the fact that graduate curricula no longer include economic history, and some propose that the Financial Crisis suggests a need to reverse that.Footnote 14 Such a neglect of history would hardly be a feature of the “might have been” economics that granted the importance of cumulative causation.

The most consequential of the many differences between the economics that might have been and the contemporary discipline is that the former could hardly give central billing to formalized theories of rational choice—not while pursuing the theme of cumulative causation as Veblen proposed. This issue deserves a more extensive discussion, presented in the following section.

4 Rational choice and the causation of behavior

The barrier that most fundamentally separates mainstream economics from the evolutionary sciences is the mainstream’s commitment to rational choice—or, more broadly, the commitment to modeling economic behavior in decision-theoretical terms, through the application of normative theories of decision. It is an approach that seeks to understand decision by imagining the actor to contemplate possible alternative futures, i.e., the consequences of various decisions. Figuratively, the theorist stands in the shoes of the decision maker and looks forward, coping as best he or she can, within the constraint of internal consistency.

In this representation, “deciding” includes evaluation, according to the decision criterion, of the different futures corresponding to alternative actions. Thus, the decision criteria—or “preferences”—are fundamental causes and relate to circumstances in the future. The effects include the optimal decisions, taken in the present. You might be tempted to think that decisions themselves are causes, but they are not so when they are inevitable logical deductions from the other data of the problem. The representation of decisions as having that logically determined character is precisely what the “optimization” component of the mainstream paradigm is about.Footnote 15

Economists have long proceeded in this way, and certainly there are powerful reasons for doing so. First and foremost, there is the importance of economic motivation as a driver of human behavior, plus the fact that much behavior is apparently intentional or even carefully calculated—especially in the economic sphere. The elevation of anticipated outcomes to the status of causes is fundamentally a move that honors the importance of intentionality. It is an approach seemingly supported by the evidence we gain from reflection on the sources of own behavior, which also supports our subjective confidence in our own free will. Such considerations make the appropriateness of a decision-theoretical approach to economic behavior seem self-evident to some. Many economists react in precisely this way; they see no reason to distinguish conceptually between the “maximizing behavior” that they posit in their theories and behavior that is economically motivated, apparently intentional, and sometimes calculated. To blur that distinction, however, is to avoid the task of determining which behaviors are genuinely future-oriented and which are, causally speaking, largely the captives of past experience—though possibly still adaptive in the current environment.

Outside of mainstream economics, however, that inferential leap from “apparently intentional” to “intentional” has been criticized from a variety of angles. The classic case of such disputation is in biology, where Darwinian theory challenges what is now called the “intelligent design” interpretation of the highly adaptive “designs” manifested by many organisms. Evolutionary theorists in biology argue the sufficiency of evolutionary explanations for such adaptation, challenging explanations that invoke intentionality at the highest level. Evolutionary adaptation is a non-teleological explanation for the effective, “apparently intentional” pursuit of economic (or survival) objectives—and according to this explanation, the causes of the adaptations seen today lie in the past. In evolutionary economics, similar issues arise in connection with skills and habits (including “habits of thought”), at the individual level, and with routines and capabilities, at the organizational level. Effective action today is seen as reflecting learning from past experience (when it is not a reflection of adaptation produced by biological evolution.) By contrast, mainstream economists see behavior through a lens similar to “intelligent design”: They have difficulty in accepting (for example) the idea that complex, profit-oriented business behavior (e.g., a sophisticated price discrimination scheme) could have any explanation other than a deliberate calculation that references, at least implicitly, the textbook account of that behavior (in the price discrimination case, a rational response to differing elasticities of demand in separable markets).Footnote 16

Beyond these considerations, it should be noted that even the evidence deriving from self-awareness of our own decision processes or motives is strongly challenged in psychology and cognitive science. The use of “priming” manipulations in social psychology experiments provides powerful evidence on this point.Footnote 17

The general implication is clear: Rather than jumping to the inference “intentional” when we see “apparently intentional,” we should consider the many reasons why “apparently intentional” might be true, but “intentional” is not. All of these reasons reference the determinative role of the past, whether operating through processes of biological evolution, habit formation or associative memory processes. All treat the causation of economic behavior in a manner consistent with the understanding of causation that is general in the sciences and in much everyday discourse.

The development of that understanding has a long history, and a large number of complexities and subtleties have been noted. For present purposes, I do not need to elaborate a complete view of causation—or a whole heterogeneous family of such views, as proposed by Cartwright (2004)—I can rely on the opening affirmations in David Hume’s classic discussion, the first relating to what we would now call “no action at a distance”:

[…]I find in the first place, that whatever objects are considered as causes or effects, are contiguous, and that nothing can operate in a time or place, which is ever so little remov’d from its existence. Tho’ distant objects may sometimes seem productive of each other, they are commonly found upon examination to be link’d by a chain of causes which are contiguous among themselves, and to the distant objects; and when in any particular instance we cannot discover this connexion, we still presume it to exist. We may therefore consider the relation of CONTIGUITY as essential to that of causation[…] The second relation I shall observe as essential to causes and effects is not so universally acknowledged, but is liable to some controversy. ‘Tis that of PRIORITY Of (sic) time in the cause before the effect.” (Hume 1738, Book I, Part III, Section II p. 45)

For easy reference, I label the conjunction of these points as a “conventional” view of causation, recognizing that it is also a partial view.Footnote 18 It would be easy to document that Hume’s views on these points continue to prevail in contemporary scientific practice, but I forebear doing so because of the space requirement. I believe that it is also conventional to assume that short-range prediction is more reliable than long-range prediction—which tends to be true in any system that incorporates random events along the causal path.

When Veblen contrasted economics with the “evolutionary sciences,” it was quite clear that the latter were committed to thinking of causation in the “conventional” way just described. That this was less true of economics was at least implicit in the suggestions he offered for how economics could join the evolutionary path. At that point, however, the commitment to the normative stance in economic theory was far less developed than it is today. Prevailing understandings of causality seem to have adapted gradually, with minimal confrontation with the problem that I address next.

4.1 Countering the time-inversion complaint

Does the unconventional treatment of causality in the mainstream paradigm actually make a substantive difference to the progress of economic science? Or is it just a harmless accommodation to the need to give intentionality the place that it deserves? These are crucial questions, and not simple ones. One can imagine a line of defense for the practice that would begin by conceding some central points: It would concede that effects do not precede causes in time. It would concede that some real process is involved in the selection of an (apparently) optimal choice from an array of alternatives. It would concede that, in reality, the elements of a postulated decision problem—including consumer preferences, firm technologies, the futures contemplated and the actual process of choice—are all “given” in reality only in the sense that they are the result of cumulative causation, i.e., are outcomes of prior evolutionary processes. Further, they are “given” only for the moment of choice in the present, and will be subject to further change by evolutionary processes before the contemplated future arrives. At that point, the argument moves over to the offensive. It says that the conceded points do not amount to a serious mistake, but reflect only a fruitful instrumental shortcut that is adopted in the pursuit of truth about the social consequences of economically motivated intentionality. Thus, the critique of time-inversion is naïve in the sense that it is premised on ignorance of the tacit understandings reflected in neoclassical practice. When those understandings are taken into account, notions of causality in economics are no longer out of step with those of other sciences.

Or so the argument would go. For convenience, I refer to it henceforth as “the approximation thesis.” In short form, this thesis says: “Imagined futures influence action in the present; imagined futures themselves reside in the present and reflect the causal influence of the past in a conventional way. Standard practice in economic theory actually implements this type of causal story, though the point is rarely if ever mentioned.”

If this argument were actually the accepted rationale for the paradigmatic commitment to rational choice, one would be expect to see much more evinced concern with the validity of its premises. The theorist’s time-inverted world would be understood as an analytical device for a world where causation works according to the conventional understanding of it. The question of the quality of the approximation long-term would presumably receive attention, at least occasionally. Clearly, the time horizon relevant to the decision should matter a great deal in that connection. A future that is only minutes way (as, e.g., in a repetitive game played at high frequency) is quite a different thing from one that is years or decades away (as in consumer savings decisions or firm decisions on pharmaceutical R&D spending). In the latter cases, a serious devotee of the “approximation” interpretation should be attentive to the possible causal role of events temporally prior and proximate to the decision itself, even ones that would have little bearing on an optimal decision directed to long-term goals.Footnote 19 For example, would the default contribution rates for retirement plan affect saver choices; would a single recent setback at the FDA affect a pharma firm’s long-term R&D commitments?

There is, however, as little sign of concerns of this kind in mainstream literature as there is explicit avowal of the approximation thesis itself. The conclusion is that the thesis does not describe the reality of the commitments of mainstream theoretical thinking that are revealed in the practice of theorizing. Mainstream economists do not think they need the defense I have sketched above; they are accustomed to endorsing the commitment to optimization analysis in an unadulterated form, not as a simple approximation to a more complicated reality. In that unadulterated form, it clearly entails the causal time-inversion, and thus it is plainly at odds with the ideas of causation that are generally accepted in the sciences.

Whether or not it has any role in mainstream thinking, the approximation thesis does bear on the substantive importance of the time-inversion problem. As suggested above, the hazards presented by time-inversion are likely to be greater when the time horizons of the postulated decision problem are long than when they are short. Thus, the considerations adduced above become particularly prominent when the actor is conceived as attempting an inter-temporal optimization. It is unsurprising, then, that the causal time-inversion problem has received some attention in mainstream literature going back to Strotz (1956), under the heading of time-inconsistency of preferences. That wedge by itself is enough to open the door to my claim that rational choice violates conventional understanding of causation—especially since the potential inconsistency problem relates not just to “tastes” but also to the actor’s basic understanding of the problem (“cognitive frames”).

4.2 Complementary considerations

Equally important, for present purposes, are two other considerations that operate to magnify the substantive importance of time-inversion. The first is analytical tractability. The contemporary mainstream aesthetic for economic models is one that favors mathematical expression, logical tightness, and simplicity (meaning structural and conceptual simplicity, not mathematical simplicity). These seemingly desirable attributes are favored alongside an unqualified commitment to optimization analysis, and an understandable enthusiasm for telling stories that have punch lines. The resulting problem is that considerations of tractability, in the pursuit of a logically tight inter-temporal optimization, squeeze complexity out of the picture. For example, the inter-temporal structure of the theoretical model is often limited to a single state variable. That result is not, of course, logically dictated by the inter-temporal optimization approach by itself, but arises in practice when tractability is factored in. The collective tendency of these dispositions is to further legitimize extremism in the peculiar joint cause of mathematical complexity and substantive oversimplification. “Sometimes it even seems that sophisticated treatment of optimization is believed to have a talismanic effect: It is a charm that magically confers immunity against the consequences of absurd over-simplification in other parts of the model specification” (Winter 2014b: 621). Thus, the gap between a conventional approach to causation and the time-inverted mainstream approach is wider in practice than in principle—contrary to the defensive argument of the approximation thesis.

The second amplifying consideration is the simple point that there are no actual data available about the future, whereas there is quite a wealth of data available about the past, especially the recent past. The imagined future that a theorist imputes to a model actor cannot be checked directly against any facts; it is a creature of the theorist’s imaginings about the model actor’s imaginings. Or, at best, the plausibility of the imputation might be supported by reference to (notionally) current conditions and observable trends—which is to say, by a passing concession to the approximation thesis. A serious engagement with the approximation thesis would, however, imply a widened search for relevant facts about, for example, the prevailing beliefs, cognitive frames, computational capacities, habits and routines of the real actors. Such engagement would illuminate how behavior emerges from its antecedents, in a specific context, as opposed to relatively generic “objectives” located in the future. But it is deemed unnecessary and even undesirable given typical applications of optimization techniques in the discipline, which, as noted above, do not invoke the approximation thesis in defense of the causal time-inversion. The evident lack of research interest in these sorts of considerations just named is both a powerful indicator of the strength of the commitment and an important substantive consequence in its own right. It means that we have a mainstream economic theory that is, by design, fact-deprived in the critical area of behavioral understanding. Necessarily, it is also a theory that generally fails to address situations where facts are abundant but too complex for a simple decision model—even if they are likely to be highly relevant according to conventional criteria of temporal priority and spatio-temporal contiguity. This type of failure is the topic of the next section.

5 Sins of omission

In the long-running debates about rational choice (or optimization),Footnote 20 the critics have focused almost entirely on the descriptive shortcomings of such theories. The issues featured above, about how the causation of behavior works in time, rarely form part of such challenges. They are sometimes involved implicitly—as when a critic emphasizes the importance of habit formation. In general, however, the critics emphasize the “sins of commission” of the rational choice approach—the facial implausibility of many formulations, the many clashes with experimental, case study and historical evidence. While those sins certainly deserve the critical attention they get, there are also “sins of omission” that impose heavy burdens, and are much less remarked. Those involve the neglect of issues that economists certainly might be expected to address, if their significance in the “everyday business of life” is a relevant criterion for the allocation of attention.

Viewed from the perspective of evolutionary economics, the leading example of a mainstream sin of omission is the neglect of technological change. When Richard Nelson and I began the collaboration that led to our 1982 book (Nelson and Winter 1982), a focal issue for us was the fact that the neoclassical theorizing of the time had minimal contact with the micro-detail of technological change, as understood from economic history, technology studies and studies of R&D management. We sought to develop concepts and models that had greater verisimilitude in the sense of greater contact with that detail. An early effort in that direction (Nelson et al. 1976) offered an evolutionary alternative to one of the classics of neoclassical growth theory (Solow 1957). Solow's article strongly promoted interest in the sources of growth at the national economy level. Subsequently, that became a major field of economic inquiry—conducted from a largely, or at least avowedly, mainstream perspective.

Nevertheless, the gaps that Nelson and I noted more than a half century ago remain very much in evidence today. The production set/production function apparatus rules the mainstream scene all the way from the theory textbooks to the frontiers of applied economics. Indeed, the production theory used at the frontier is separated by only a short distance from the production theory expounded in the advanced texts, a situation that does not obtain in many other areas of economics. The problems to which the apparatus is applied typically have a major concern with the factor distribution of income, a theme that runs with great continuity from David Ricardo to Thomas Piketty (Piketty 2014). This apparatus was not invented for the purpose of expounding the relations between knowledge and production, or between the advance of productive knowledge and the advance of productivity (Winter 1982). It does not engage the details of the latter topics, and it does not illuminate the role of cumulative causation or the social role of entrepreneurship.

Evolutionary economists have devoted to considerable effort to the development of alternative approaches to production that respect the empirical micro-detail and embrace the historical processes of changing knowledge. For an overview of such contributions, see Dosi and Nelson (2010). Outstanding examples of the fruitfulness of alternative approaches including Merman (2003) and Lipsey et al. (2005).

A second important example of theoretical neglect is the behavior of large organizations. In the economics textbooks and on a large segment of the research frontier, the realm of business organization is fully occupied by the abstract “firm”—which might as well be a small single proprietorship for all one can tell. But unlike most single proprietorships, it does not have a short-run budget constraint. Relatedly, it does not have financial statements, or visible relations to capital markets. (If the textbook firm were otherwise appealing as a model of an entrepreneurial startup, the indifference to finance would quash that enthusiasm in short order.) Questions of ownership versus control do not arise. In fact, virtually none of the issues addressed in transactions cost economics arise; for example, workers do not require supervision. Firm scale differences, and their sources and implications, may be entirely neglected, or addressed only in the context of a highly traditional discussion of long-run cost curves. It is easy, of course, to find areas of the economics discipline where these habitual patterns do not prevail, where in fact the avoidance of one oversimplification or another may be central to the research endeavor.Footnote 21 Outside of those areas, traditional textbook simplifications continue to prevail.

In the quest for understanding of the behavior and social role of large organizations, there are places to turn outside of the economics discipline. In particular, there are the research fields that are prominent in the business schools. These fields have their own research traditions, and collectively they borrow very extensively from the other social science disciplines, and sometimes from law, operations research and engineering. It is the empirical findings from those research traditions, plus business and economic history, that inform the judgments of those of us who see the economics discipline as largely blind to the role of organizations in the economic system. Across the wide intellectual span of that activity, the decision-theoretical paradigm of the mainstream has much less influence than it does in economics proper. In most of the territory, therefore, ideas of causation adhere to the same principles found in the natural sciences.

Of particular relevance here are the efforts in various fields, including evolutionary economics, organization studies and management theory, to develop theoretical models that capture at least some of the distinctive features of observed behavior in large organizations—or at least, are not blatantly inconsistent with those features. Many of these efforts have common roots in the work of the Carnegie School, and particularly in the book The Behavioral Theory of the Firm (Cyert and March 1963).Footnote 22 There is little if any of that in mainstream economics today, in spite of the contemporary resurgence of “behavioral economics.” To understand why this is the case, consider that it is very hard to represent a large organizations in terms consistent with normative decision analysis at the individual level, especially if consistency must extend to the relationship between the organizational expectations shaping decisions and the actual structure of the environment (rational expectations). Thus, the aesthetic criteria that rule mainstream modeling are very hard to satisfy. Those criteria do not burden the theoretical work on organizations that goes on outside of mainstream economics, and therefore such research does not respect the corresponding constraints.

As a result, theoretical research in those traditions is free to adopt the conventional view of causation, and does so without apology. Theory is often expressed in the form of computational models, which are essentially large systems of stochastic difference equations. They describe how the situation at time t + 1 is generated from the situation at time t, often with random factors entering into the transition. Explicit long-run optimization calculations are not attributed to the actors in these models. This emphatically does not mean, however, that economic motivation plays no role. Instead, and in parallel with the situation in evolutionary biology, behavioral rules of one sort or another embody organizational goals and/or survival requirements. Those rules are frequently treated as subject to change by various processes, including learning, local search, random mutation and the dictates of higher-order rules. In these models, nothing guarantees that different actors envisage the same future, or that any of their conjectured futures will actually come about. To the extent that coherence appears, it is largely the result of myopic extrapolations by model actors whose opinions have a common grounding in past events, and whose behavior is subject to inertia.

In the study of large organizations there is still a large opportunity waiting to be seized through the joining of systematic empiricism with computer simulation techniques. Only those techniques offer real long-run promise of dealing with the complexity that a large organization presents.

There is a wide range of possibilities for such modeling, in terms of the specificity of the empirical basis and the character of the engagement. A (neglected) classic at the extreme of specific grounding, is Cyert and March (1992 [1963], Chapter 7).Footnote 23 Perhaps not at the other extreme, but a good illustration of the point, is a more recent classic (Levinthal 1997), which introduced NK modeling techniques and the “rugged landscape” metaphor to management research This has facilitated formal analysis of questions of organizational structure and design that are well known to be real issues, but have resisted formal representation. Yet another approach to joining formal modeling and empiricism is found in a new book by Malerba et al. (2016). They present simulations at the industry level that are “history-friendly”—i.e., empirically grounded in historical episodes of particular industries. The firms in these simulations are abstract entities in the sense that they are not individually modeled on historical firms, but they are modeled in what the authors consider to be behaviorally plausible ways. This work represents an incremental step toward more empirically grounded approach to simulation modeling of organizations—but, as noted above, this arena is basically wide open for future research. The opportunity to exploit the intrinsic advantages offered by access to factual knowledge of the past—history—remains far under-exploited.

6 Economics in space-time: the evolution of opportunity

In the economy that has emerged in the “advanced” part of the world since the Industrial Revolution, progress in science and technology has played a crucial role. In the statistics and models of economic growth, the picture of that progress generally takes on a bland, undifferentiated character. There is capital and labor, or human capital, and there is technical progress, which may or may not be “neutral” in one or another sense, and so on. Under the heading of “endogenous growth theory,” and of course in policy discussions relating to intellectual property, considerable attention has been given to the incentive aspects of innovation and technological change. On the other hand, the emphasis on “methods of doing things,” and the mechanisms of cumulative causation, as propounded by Veblen, are largely missing in these accounts.

By contrast, histories of particular technologies typically show these processes vigorously at work. Time and again, progress appears in the form of a long series of incremental modifications and improvements to particular products and processes, building on and modifying what has gone before. This is true from the Industrial Revolution’s classic examples in textile machinery to the modern electronic computer, and from steam engines to steelmaking to electricity and chemicals, to automobiles and aircraft. It is true in particular in the repeated generations of innovation in semiconductor devices, the single most transformative technology of the present time. Who could doubt that these cumulative processes are causal and fundamental to the origins of our modern world?

A doubter might point out that some fundamental scientific breakthroughs and key inventions have anchored the grand story, and in these the “cumulative causation” aspect is less apparent. This is true, and important, but it mainly means that the cumulative causation story takes a different form in these cases, not that it is absent. Generally, the histories show one improvement following another as challenges are overcome and opportunities seized. To see where our deliverance from want and poverty has come from, look to the details of innovation in technology and economic organization—not to the statistical histories of those grand aggregates, the classical “factors of production.”

An instructive approach to exploring such details is this: Pick a prominent product of the contemporary economy and ask where that came from. At some late stage of the process, some inventor may have invented it, and some entrepreneur may have introduced it to practice, i.e., innovated. But before that late stage happened, what happened, and when, and by the way, who paid for it?

Consider, for example, that iconic example of contemporary technology, the smart phone. We owe its existence to Ben Franklin, right? Not exactly, but somebody had to initiate the modern understanding of electricity, and Ben Franklin was very prominent in that process. Somebody also had to understand the relationship of electricity to magnetism at a deep level, and much of that understanding was pulled together by James Clerk Maxwell. Maxwell understood electromagnetism very well, but did not understand the massive implications of his own work, which were left as inspirations for Einstein and Marconi, among others, to elaborate. The history of computation, and of the electronic computer in particular, forms another major chapter in the smart phone story. It brings to the index such names as Babbage, Lovelace, von Neumann, Turing, and Eckert and Mauchly. As that chapter of the history ends, an electronic computer fits in a large room, but not in a pocket.

To recognize the intermediate steps between the “large room” and “pocket” stages of that evolution, we need first to acknowledge the transistor. The transistor was invented by a team at Bell Labs led by William Shockley, a team funded by the then-monopolist AT&T, at the general expense of the rate-payers for telephone service. The cluster of names that follow in the history, relating to the integrated circuit, and the microprocessor, is too long and too clouded by priority disputes to be reviewed here. In any case, the stage was set for the long-running miniaturization trajectory in semiconductor technology, the meta-logic of which is expounded in one of the classics of the evolutionary economics literature on technology (Dosi 1982). That trajectory reduced the space requirements of a given amount of computing power by a factor of about six million over the half century after the invention of the integrated circuit.

Entrepreneurship entered the story in a big way when Shockley, who co-invented the transistor as a Bell Labs employee, quit his job and became Shockley the entrepreneur and founder of the semiconductor industry. As the late Steven Klepper liked to point out, the phenomenon we know as Silicon Valley arguably owes its locational aspect to the fact that Shockley located his new firm, Shockley Semiconductor Laboratory, in Mountain View, CA, not far the Palo Alto residence of his mother (Klepper 2011, p. 150). Shockley’s firm formed the root of the “semiconductor family tree”—the 100+ entrepreneurial firms that can be traced back to that root by the quasi-genetic inheritance relation that classifies startup B as the offspring of parent firm A if the founder of B is a former employee of A.Footnote 24

Then, thanks to progress on quite different trajectories, funded for quite different reasons, we learned how to put satellites into Earth orbit—shall we acknowledge Robert Goddard and Werner Von Braun? Their contributions were important in creating the capabilities that gave us today’s great array of artificial satellites, including the 24 satellites of the GPS system. The GPS system supports, among other things, the “location services” functions of our smart phones. The tiny circuits of the semiconductor devices inside the phone perform the calculations required to convert satellite ranges into the user’s position. Those calculations involve reliance on Einstein’s theories of both special and general relativity: Without the relativistic corrections for the time signals derived from the atomic clocks, the system would accumulate location error at a rate on the order of 10 km per day.Footnote 25 Of course, the location services from only a part of the functionality of a smart phone, which serves, among other things, as a phone.

With the mention of the semiconductors and the GPS satellites, we reach the several intersections of the history of the smart phone with the history of American national security policy—or more specifically, the history of the Cold War. In the evolution of the multiple technological novelties embedded in the phone, R&D financed for US national security reasons generally played a large role. That role varied from one technology to another, but was generally more important early than late in the development of a particular technology—that is, more important relative to other sources of funding at that stage. This part of the smart phone story (specifically, the iPhone) has recently been systematically reviewed by Marianna Mazzucato (Mazzucato 2014: Chapter 5). There is neither need nor space for a recapitulation of Mazzucato’s detailed review, but I declare her account to be incorporated by reference here.Footnote 26 In several of the technologies she discusses, including the GPS, the initial applications were military technologies, and much of the science behind the technology was of twentieth-century origin.

Only now do I get to the mention of Steve Jobs, whom many might consider the most important Schumpeterian entrepreneur in the story, nor have I mentioned the organizational achievements represented by Apple’s global supply chain (close to 800 suppliers, more than 30 countries). The contributions in those parts of the story account, respectively, for design features and for the low production costs that made the phones available to so many consumers around the world while creating great wealth for the shareholders of Apple.

Finally, the entrepreneurship element in the total story again becomes extremely prominent at its end, in the development process for apps. According to recent announcements by Apple, there are now 1.2 million apps for its iPhone and iPad products, representing the work of 9 million registered developers.Footnote 27 These app developers illustrate the point that the entrepreneur’s role is sometimes more like picking the fruit than planting the orchard—and orchards are often planted by processes operating far from the for-profit market economy. Still, if the fruit go unpicked, the orchard is not of much use.

One can repeat this sort of exercise on many, many products, with results that obviously differ greatly in detail, but generally produce a similar “poetry.” It is a poetry about how recent achievement builds directly on the achievements of the fairly recent past, and though that on the achievements of the more remote past. The poetry typically involves the advance of science and technology in intimate interaction with entrepreneurship, but the degree of that interaction and its temporal position(s) in the process vary greatly from case to case.

7 The place of entrepreneurship

Early in this essay, I indicated that it would be based on a Schumpeterian understanding of “entrepreneurship,” according to which the phenomenon centers on “individual agency in the production of innovation and of economic change generally.” I maintain that basic orientation as I turn to the task of providing the promised perspective on the “place” of entrepreneurship in an alternative economics—and by obvious extension, in the economy itself.

The “economics that might have been” makes two fundamental contributions to the appraisal of entrepreneurship. Both involve opening the intellectual borders of economics,Footnote 28 allowing entrepreneurship research to reap the benefits of stronger complementarities with the neighboring disciplines of greatest relevance. First by freeing us from the theoretical prison of rational choice over well-defined alternatives, it allows entrepreneurship research to acknowledge human nature as it now exists—beginning with reliance on an empirically plausible psychology that exemplifies conventional understanding of causation. In this psychologically realistic perspective, entrepreneurial behavior is seen as similar in kind to ordinary economic behavior, but markedly less constrained by the forces of habit, and markedly less fearful about uncertainty (for whatever reason). Secondly, by directing attention to the shaping power of cumulative causation in technology and organization, it guides empirical inquiry into the sources from which specific entrepreneurial innovations emerge. Such inquiry is free to find and report the facts as they are found, without reference to any philosophical or ideological pre-commitments. It is already quite clear that such inquiry generally delivers token support for everybody, and emphatic support for nobody, in those ideological battles. The problem is to sort it out.

These two types of expanded possibilities might be labeled “better psychology/sociology” and “better technological/organizational history,” and both deserve more thorough discussion than can be offered here. Partly on grounds of personal comparative advantage, I will focus mainly on the second. First, however, I take note of a long tradition in entrepreneurship research that has focused on the psychological attributes of entrepreneurs, such as leadership qualities, perseverance, feelings of self-efficacy and attitudes toward risk. The question has long been asked whether entrepreneurs collectively differ in these dimensions from other business people, and what role such differences play in entrepreneurial activity. In his early (1911) book, Schumpeter vigorously affirmed the existence of such differences and emphasized their role in entrepreneurial success. In later work, however, he offered a significantly different appraisal (see Becker et al. 2011). Entrepreneurship as a social function became largely detached from the personal role of the entrepreneur, and with that change the claim that entrepreneurs collectively have distinctive attributes was pushed into the background. The earlier conceptions continue to be important, however, as a theme of entrepreneurship research.

As he reduced his focus on the personal attributes of entrepreneurs, Schumpeter might have chosen to emphasize instead the importance of understanding the causal histories of particular innovations. He did not do that, and in fact rejected such a course in vigorous terms:

“Therefore one of the most annoying misunderstandings that grew out of the first edition of this book was that this theory of development neglects all historical factors of change except one, the individuality of entrepreneurs[…] (My representation) is not at all concerned with the concrete factors of change, but with the method by which these work, with the mechanism of change. And I have taken account of not one factor of historical change but of none.” Schumpeter (1934 [1911, 1926], p. 61, footnote 1)

I understand Schumpeter’s “historical factors of change” to be included among what I am calling the results of cumulative causation. If that understanding is correct—if the Schumpeterian approach to entrepreneurship emphasizes the objective importance of the attributes of entrepreneurs relative to the historical circumstances of innovation—then my view here diverges sharply from Schumpeter’s. Any account of a particular episode of entrepreneurial innovation will, if it probes to any depth at all, uncover an interplay between the “historical factors of change” and the endogenous “mechanism of change”—understanding by the latter the mechanisms involving private economic incentives for innovation.

A wide variety of these “historical factors” shape entrepreneurial opportunity through multiple channels; such channels touch the prevailing economic system and society generally, at many different points. Each such contact point can be thought of as corresponding to a pool of latent demand for the innovative prowess of entrepreneurs, a class of problems that it might be useful and/or profitable to solve, and that are potentially solvable by the combination of general entrepreneurial attributes with specialized knowledge or access associated with the contact point itself. The contact points are widely dispersed in multiple dimensions, and the contacts themselves are established by diverse processes.

Oftentimes, these “pools” can be assigned geographical locations, i.e., they are regions or localities where the causal antecedents of entrepreneurial opportunity happen to be concentrated. In other cases, the pool may be a virtual location, on the Internet, or it may be organized around a focal set of challenges, such as the improvement in a particular product or the performance of a particular function, or around a focal set of new resources, such as a new general purpose technology. The literatures of entrepreneurship and innovation have documented many times over the importance of these various sorts of pools and the various sorts of network relations that they often involve. Under this broad rubric, we can classify the multiple roles of regions and new industries (McKelvey 1996; Klepper and Simons 2000; Klepper 2002, 2011).Footnote 29

That untapped opportunities exist at all is of course puzzling from a mainstream point of view, by the same logic that explains the awkward fit of entrepreneurship in mainstream theory. According to that logic, the unexploited opportunities at any point of time are “remaining” for good reason, they are like the shirts on the “odd sizes and colors” table in men’s furnishings. A major part of this puzzle derives from the perceptual powers that unbounded rationality confers upon the actors in mainstream theory; conversion to more realistic psychology, with some complementary sociology, resolves that part. Another major part derives from the failure to fully acknowledge the reality of evolutionary change in general, powered as it is by processes of cumulative causation in diverse spheres, but manifested particularly in the technological and organizational antecedents of economic activity. Because of those currents of change, the economic problem facing society includes the task of exploring ill-defined possibilities that are newly generated by “historical factors of change” that are in large part extra-economic. Much of that exploration task falls to entrepreneurs.

The cumulative character of the generation of opportunity is revealed in the histories of innovation failure as well as in the successes. Time and again, history shows us that the insights and achievements derived from failed innovation can rise again from the ashes, by one mechanism or another. At one extreme is a recapitalization or a reorganization in bankruptcy, where the “failed” enterprise is renewed with new funding and perhaps new control.Footnote 30 At the other, the enterprise disappears entirely, but its human participants go off to new adventures carrying new skills and new understandings (Knott and Posen 2005; Hoetker and Agarwal 2007).Footnote 31 Note that this important mechanism of cumulative causation is naturally prominent when causation is viewed in conventional terms of temporal priority and proximity (“what happened just before that new founding?”) and obscured when causation is time-inverted for decision-theoretical reasons (“bygones are bygones”).

I return to the question of where those pools come from in the first place. It has recently been argued, by Arora et al. (2015), that the observed decline in the funding of scientific research by large corporations might represent “killing the golden goose” of corporate R&D. These authors document a collateral decline in the premia paid by corporations when acquiring science-based entrepreneurial startups, a trend that has negative implications for the average futures of such startups, and hence for the incentive to found one. It important to take note of the larger issue that is illustrated by this analysis: The fact is that there is whole unruly flock of these golden geese, and it is their collective productivity that generates entrepreneurial opportunity. Today, similarly pessimistic prognostications also apply to other parts of the flock, such as the branches of science and technology that were generously funded by the US government during the Cold War (Mazzucato 2014). Pessimistic assessments of this kind have been offered for some time now (Rosenbloom and Spencer 1996). Against these possibly disturbing trends (at least in the USA), we have to set what appear to be favorable trends in the conversion of opportunities into innovations. Processes of recombination and global diffusion seem to be running along in robust fashion; the still-rising “open innovation” model has considerable advantages as well as positive implications for entrepreneurship.Footnote 32 Thus, it seems that the ruling “techno-economic paradigm” (Perez 2002) based on large investments made in the past, may still have a lot of room to run.

A more concerning question is whether the legacy pools of opportunity are well matched to the contemporary social needs of society, particularly the problem of addressing climate change. The answer to that seems to be a resounding NO. In spite of fuss, furor and political contention, the modest policy initiatives in this area fall far short of what is needed, and far short of what governments have mustered in contexts where political support for action was much stronger—which is basically to say, in wartime (Janeway 2012, pp. 277–278).

The conclusion on the “place” of entrepreneurship is that, in reality, it is profoundly shaped by history and by contemporary social context in a way that goes far beyond economic considerations. Its place in economic theory should reflect that, in spite of the genuine challenges of maintaining flexible and cooperative relations between economics and neighboring disciplines.

8 What might have been, or could be

There is admittedly a pessimistic note in my title. What I call “The Economics that Might Have Been” could be viewed more hopefully as suggesting a reform program for economics as it is. As has been apparent at some points in this essay, the reform program has much in common with evolutionary economics. There are, however, many specific features of the evolutionary program to which I have given scant attention here. The elements of the reform program that have been sketched are at a higher level of generality, where they might conceivably attract attention from readers who are not much interested in the detailed issues that separate the evolutionary camp from the mainstream. In my view, it is more promising as a line of reform than much of the “new economic thinking” that has recently challenged the mainstream, because it goes to more fundamental issues.

Many others have pursued similar goals, and here I mention again my principal collaborator in evolutionary economics, Richard Nelson. I also acknowledge the many colleagues, both in the evolutionary economics community and more broadly in the social sciences, who have pursued scholarly objectives that help us understand economic life as it is and are not constrained by the particular theoretical commitments of mainstream economics.

It is certainly doubtful whether the reform program can ever achieve the depth of change in the economics discipline that is needed; such a change would mean the substantial overthrow of the optimization-equilibrium paradigm. The paradigm is not likely to be overthrown anytime soon, but it is at least being challenged and qualified from many directions at once. As noted at the start of this essay, the awkward fit between the phenomenon of entrepreneurship and mainstream theory, has historically made the study of entrepreneurship a key source of challenges; it will likely continue in that role. Future progress on the reform program might well come from other sources outside the familiar academic discipline of today. There is a latent demand for an approach to economics that responds to the need to understand the economy, or “the ordinary business of life,” and entrepreneurship research is just one of the visible manifestations of that demand.

I have proposed that a central issue is how causation works in time. As Veblen (1898, p. 396) said, “In the general body of knowledge in modern times the facts are apprehended in terms of causal sequence.” An economics that rejoined the sciences in this respect could progress free of unrealistic factual commitments and unnecessary methodological constraints. Such liberation would, if it could be achieved, confer benefits in many areas. The field of entrepreneurship research is perhaps not so much in need of liberation as many others, having achieved so much of it on its own, and much has been accomplished that contributes to the cause of reform. Interactions with a newly liberated, newly reality-based economics discipline could, however, further energize the entrepreneurship research of the future.

Notes

My life-long routine has been cite to Schumpeter’s early work as dated 1934 [1911]. But Becker et al. (2011) have recently underscored for me the fact that the 1934 English translation by Rendigs Fels is a translation of the second German edition, dated 1926, not the 1911 version, and that this distinction is highly significant.

I will argue that this tendency still holds today, in spite of the massive improvement in the tool kit for analysis of dynamical systems.

Nelson and I have proposed that the mainstream is best identified with the content of the intermediate microeconomics textbooks (Nelson and Winter 1982, p. 7). In effect, our suggestion is very close to Becker’s.

For a penetrating study of a recent example of these divisive practicalities see Bouchikhi and Kimberly (2012).

There is a superficial sense in which the axiomatization supported a return to cardinal utility. Confusion regarding that point is still sometimes encountered.

Savage’s theory is still beyond the practical frontier in the sense that more specialized theories of choice dominate the scene for most purposes, from the intermediate textbooks to financial economics.

That sort of help is also on offer from outside of economics, and in particular from operations research.

Note that this characterization of Veblen’s context is also largely relevant to the context of Schumpeter's early work.

For an account of these processes that is at once authoritative, accessible and inspirational, see Hazen (2012).

The weight that I give to Veblen in this essay reflects the influence of Geoff Hodgson, who has long emphasized the elements of commonality and continuity among the “old” institutional economics (Veblen, Commons), the “new” institutional economics (Coase, Williamson), and modern evolutionary approaches (Nelson and Winter). See, e.g., Hodgson (2004) or Hodgson and Stoelhorst (2014).

“Most”? Are there other significant exceptions besides economics?

As actors choose, they are necessarily involved in predicting the future, conditional on their own actions. The question arises as to how they allow for the impact on those futures of the actions of other actors. This question leads in the direction of equilibrium analysis, and of rational expectations in particular. These significant complications will have left aside in the present essay.

Regarding “implicitly”: The influence of (Friedman 1953) is reflected in the continuing invocation of his notion of “as if” maximization, a notion that rejects concern with process details about “maximization.” Acceptance of mystery about the nature of the intelligence involved is also a feature of the “intelligent design” position, so the parallelism is strong. In both cases, concern with understandable process is displaced by awe: “How could He (God), or they (capitalist managers) be so smart? Don’t ask us, just accept it!”

See Kahneman (2011) for a discussion of this powerful evidence—of which he says “The thing you should focus on, however, is that disbelief is not an option.” (p. 57).