Abstract

The contribution of serial entrepreneurs to entrepreneurial activity is significant: in Europe, 18–30% of entrepreneurs are serial; in the US, their contribution is about one-eighth. Yet, theories of entrepreneurship and industry dynamics presume that all firms are launched by novice entrepreneurs and firm failure is synonymous with exit from entrepreneurship. We propose a theory of serial entrepreneurship in which an entrepreneur has three occupational choices: maintain his business in operation, shut it down to enter the labor market to earn an exogenous wage, or shut it down to launch a new venture while incurring a serial startup cost. In equilibrium, a high-skill entrepreneur shuts down a business of low quality to become a serial entrepreneur, launching and subsequently closing firms until a high quality business is found; a low-skill entrepreneur shuts down a business of low quality to enter the labor market, never to become a serial entrepreneur. A decrease in the wage or serial startup cost, or an increase in the startup capital, enhances the contribution of serial entrepreneurs to entrepreneurial activity and promotes new firm formation (by increasing entrepreneurship and the number of new firms that survive), but its effect on the exit rate of new firms is ambiguous. We show the model is consistent with evidence relating to the impact of an entrepreneur’s characteristics and prior experience in entrepreneurship on the survival of his firm and his entry into and survival in entrepreneurship.

Similar content being viewed by others

Notes

See Parker (2004, pp. 43–65) for a detailed discussion of theories of entrepreneurship.

In theory, Tobin’s q is the market value of a firm’s assets divided by the replacement value of its assets, while in empirical studies, it is the market value of common equity, preferred equity, and long-term debt divided by net total physical assets plus current assets minus current liabilities. In corporate finance, Tobin’s q is used to measure the quality of management and the long-term prospects of the firm.

See Chap. 6 in Parker (2004) for an overview of sources of finance other than debt.

See Chap. 5 in Parker (2004) for an overview of theories relating to the debt finance of entrepreneurial ventures and Chap. 7 for an overview of empirical evidence of credit rationing.

This assumption may be interpreted in the context of Jovanovic (1994) as follows. Managerial and labor skills are positively correlated, and output is increasing in managerial skill to a greater extent than wage income is increasing in labor skill, such that, in equilibrium, highly skilled individuals become managers.

These studies all pertain to the US. However, Rees and Shah (1986) find that the return to education is greater for employees than the self-employed in the UK.

Some empirical studies find a negative effect of education on self-employment. Parker (2004, p. 73) summarizes the studies finding positive, negative, and no effects to argue that, overall, the evidence generally points to a positive relationship between educational attainment and the probability of being or becoming self-employed.

Some evidence pertains to the probability of being self-employed, whereas other evidence concerns the probability of transitioning into self-employment. We examine the latter as its properties were derived in Proposition 3.

However, it is unclear whether startups and small firms account for a significant portion of job creation. See Parker (2004, pp. 193–197) for a discussion on the evidence for and against this claim.

See Chap. 10 in Parker (2004) for an overview of government policy options relating to entrepreneurship.

References

Bates, T. (1990). Entrepreneur human capital inputs and small business longevity. Review of Economics and Statistics, 72(4), 551–559.

Blanchflower, D. G., & Oswald, A. J. (1998). What makes an entrepreneur? Journal of Labor Economics, 16(1), 26–60.

Borjas, G. J., & Bronars, S. G. (1989). Consumer discrimination and self-employment. Journal of Political Economy, 97(3), 581–605.

Bruderl, J., Preisendorfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57(2), 227–242.

Burke, A. E., Felix, R. F., & Nolan, M. A. (2008). What makes a die-hard entrepreneur? Beyond the ‘Employee or Entrepreneur’ dichotomy. Small Business Economics, 31(2), 93–115.

Cooper, A. C., Javier Gimeno-Gascon, F., & Woo, C. Y. (1994). Initial human and financial capital as predictors of new venture performance. Journal of Business Venturing, 9(5), 371–395.

Cressy, R. (1996). Are business startups debt-rationed? Economic Journal, 106(438), 1253–1270.

Evans, D. S., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97(4), 808–827.

Evans, D. S., & Leighton, L. S. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79(3), 519–535.

Fairlie, R. W., & Meyer, B. D. (1996). Ethnic and racial self-employment differences and possible explanations. Journal of Human Resources, 31(4), 757–793.

Gimeno, J., Folta, T. B., Cooper, A. C., & Woo, C. Y. (1997). Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms. Administrative Science Quarterly, 42(4), 750–783.

Gromb, D., & Scharfstein, D. (2002). Entrepreneurship in equilibrium. NBER Working Paper No. 9001.

Hamilton, B. H. (2000). Does entrepreneurship pay? An empirical analysis of the returns of self-employment. Journal of Political Economy, 108(3), 604–631.

Headd, B. (2003). Redefining business success: Distinguishing between closure and failure. Small Business Economics, 21(1), 51–61.

Holmes, T. J., & Schmitz, J. A., Jr. (1990). A theory of entrepreneurship and its application to the study of business transfers. Journal of Political Economy, 98(2), 265–294.

Holmes, T. J., & Schmitz, J. A., Jr. (1996). Managerial tenure, business age, and small business turnover. Journal of Labor Economics, 14(1), 79–99.

Holtz-Eakin, D., Joulfaian, D., & Rosen, H. S. (1994). Sticking it out: Entrepreneurial survival and liquidity constraints. Journal of Political Economy, 102(1), 53–75.

Hopenhayn, H. (1992). Entry, exit, and firm dynamics in long run equilibrium. Econometrica, 60(5), 1127–1150.

Hurst, E., & Lusardi, A. (2004). Liquidity constraints, household wealth, and entrepreneurship. Journal of Political Economy, 112(2), 319–347.

Hyytinen, A., & Ilmakunnas, P. (2007). What distinguishes a serial entrepreneur? Industrial and Corporate Change, 16(5), 793–821.

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 50(3), 649–670.

Jovanovic, B. (1994). Firm formation with heterogeneous management and labor skills. Small Business Economics, 6, 185–191.

Jovanovic, B., & MacDonald, G. (1994). The life cycle of a competitive industry. Journal of Political Economy, 102(2), 322–347.

Khilstrom, R. E., & Laffont, J.-J. (1979). A general equilibrium entrepreneurial theory of firm formation based on risk aversion. Journal of Political Economy, 87(4), 719–748.

Lazear, E. P. (2005). Entrepreneurship. Journal of Labor Economics, 23(4), 649–680.

Lucas, R. E., Jr. (1978). On the size distribution of business firms. Bell Journal of Economics, 9(2), 508–523.

Parker, S. C. (2004). The economics of self-employment and entrepreneurship. Cambridge, UK: Cambridge University Press.

Quadrini, V. (1999). The importance of entrepreneurship for wealth concentration and mobility. Review of Income and Wealth, 45(1), 1–19.

Rees, H., & Shah, A. (1986). An empirical analysis of self-employment in the UK. Journal of Applied Econometrics, 1(1), 95–108.

Taylor, M. P. (1999). Survival of the fittest? An analysis of self-employment duration in Britain. Economic Journal, 109(454), C140–C155.

Van Praag, C. M. (2003). Business survival and success of young small business owners. Small Business Economics, 21(1), 1–17.

Wagner, Joachim. (2003). Taking a second chance: Entrepreneurial restarters in Germany. Applied Economics Quarterly, 49, 255–272.

Westhead, P., Ucbasaran, D., Wright, M., & Binks, M. (2005). Novice, serial, and portfolio entrepreneur behavior and contributions. Small Business Economics, 25, 109–132.

Westhead, P., & Wright, M. (1998). Novice, serial, and portfolio founders: Are they different? Journal of Business Venturing, 13(3), 173–204.

Acknowledgements

I would like to thank the editor Simon C. Parker, two anonymous referees, and seminar participants at the Workshop on Firm Exit and Serial Entrepreneurship organized by the Entrepreneurship Research and Public Policy Group of the Max Planck Institute of Economics held in Jena, Germany, in January 2006.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

LetV C (q; s, K) denote the (continuation) value of maintaining the business in operation. Because the quality of a business is permanent, if the entrepreneur decides to maintain the business in operation, he does so forever, implying

We infer the continuation value satisfies \( V_{C} (q;s,(1 - \delta )K) = (1 - \delta )V_{C} (q; s, K) \) and equals

An entrepreneur maintains the business in operation to earn (1 − δ)V C (q; s, K), shuts down the business to enter the labor market to earn ws, or shuts down the business to launch a new venture to earn E[V(q′;s(1 − T)(1 − δ)K)]. We cannot compare the latter two options without knowing the expected value of the entrepreneur, but we cannot calculate the expected value without knowing the exit strategy of the entrepreneur. As such, we begin by hypothesizing the entrepreneur never finds it optimal to shut down his business to enter the labor market and calculate his expected value under this presumption. We then determine the condition under which this exit strategy is optimal.

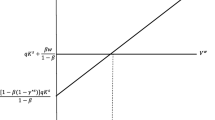

Consider an entrepreneur that never shuts down his business to enter the labor market. From (A.2), the continuation value of maintaining the business in operation is strictly increasing in the quality of the business q. Therefore, a (unique) threshold quality \( \hat{q} \) exists at which an entrepreneur with skill s is indifferent between maintaining the business in operation versus shutting down the business to launch a new venture, which is defined by \( (1 - \delta )V_{C} (\hat{q};s,K) \equiv E[V(q^{\prime};s,(1 - T)(1 - \delta )K)],\) to yield:

where \( \Updelta \equiv 1/(1 - \delta).\)

The entrepreneur shuts down the business to launch a new venture if the quality of his business is below the threshold \( \hat{q};\) otherwise, he maintains his business in operation. The present value of shutting down the business to launch a new venture is

while the present value of maintaining his business in operation is V C (q; s, K). The expected value of the entrepreneur thus satisfies

Combining (A.2)–(A.5), we infer that E[V(q′; s, (1 − T)(1 − δ)K] = (1 − T)(1 − δ)E[V(q′; s, K)], to obtain the following implicit equation for the threshold business quality:

We derived the expected value of the entrepreneur under the presumption that he never shuts down the firm to enter the labor market, which yields a payoff of ws. For this to be true, it must be the case that shutting down the firm to launch a new venture yields a greater payoff, i.e., (1 − T)(1 − δ)E[V(q′; s, K)] ≥ ws. The threshold business quality \( \hat{q},\) given by (A.6), is independent of entrepreneurial skill; thus, the expected value of the entrepreneur,

is increasing in skill to a greater extent than the outside option. It follows that we may define the cutoff \( \hat{s}\) as the unique skill level at which an entrepreneur is indifferent between shutting down his business to launch a new venture versus shutting down his business to enter the labor market, i.e., \( \left( {1 - T} \right)\left( {1 - \delta } \right)E\left[ {V\left( {q\prime ;\hat{s},K} \right)} \right] \equiv w\hat{s},\) to obtain:

We infer that an entrepreneur with skill \( s \in [\hat{s},\infty),\) termed a high-skill entrepreneur, pursues the following trigger strategy: if the quality of the business is below the threshold \( \hat{q},\) termed a bad business, then he shuts down the business to launch a new venture; otherwise, he maintains the (good) business in operation.

Consider an individual with entrepreneurial skill s that is considering launching a new venture to become a novice entrepreneur. If he works in the labor market, he earns ws. If he enters the entrepreneurial occupation, he earns E[V(q′; s, K)]. Therefore, because there is no initial entry cost, the individual becomes an entrepreneur if E[V(q′; s, K)] ≥ ws. Since E[V(q′; s, K)] is increasing in skill to a greater extent than the outside option, we may define the cutoff \( \underline{s} \) as the unique skill level at which an individual is indifferent between working in the labor market versus becoming a novice entrepreneur, i.e., \( E\left[ {V\left( {q\prime ;\underline{s} ,K} \right)} \right] \equiv w\underline{s},\) to obtain:

which satisfies \( \underline{s} = \left[ {\left( {1 - T} \right)\left( {1 - \delta } \right)} \right]^{1/\alpha } \hat{s}.\) We infer that an individual with skill \( s \in [0,\underline{s} ),\) termed a low-skill individual, works in the labor market; an individual with skill \( s \in [\underline{s} ,\infty), \) termed a high-skill individual, becomes an entrepreneur.

Entrepreneurs with skill \( s \in [\underline{s} ,\hat{s}) \) are not sufficiently skilled to become serial entrepreneurs; thus, they choose between maintaining the business in operation versus shutting down the business to enter the labor market. For an entrepreneur with skill s, the value of running a business with quality q, i.e., V C (q; s, (1 − δ)K), is strictly increasing in q, while the payoff of shutting down the business to enter the labor market is ws. We infer that low-skill entrepreneurs shut down the business to enter the labor market if the quality of the business is sufficiently small, and maintain the business in operation otherwise. Define \( \tilde{q}(s) \) as the threshold business quality at which an entrepreneur with skill s is indifferent between maintaining the business in operation versus shutting down the business to enter the labor market, i.e., \( V_{C} \left( {\tilde{q}\left( s \right);s,\left( {1 - \delta } \right)K} \right) \equiv ws, \) to obtain:

We infer that an entrepreneur with skill \( s \in [\underline{s} ,\hat{s}), \) termed a low-skill entrepreneur, pursues the following trigger strategy: if the quality of the business is below the threshold \( \tilde{q}(s), \) then the entrepreneur shuts down the business to enter the labor market; otherwise, he maintains the business in operation.□

Proof of Proposition 3

A high-skill individual (i.e., for which \( s \in [\underline{s} ,\infty) \)) becomes an entrepreneur; thus, the probability an individual becomes a novice entrepreneur is \( P_{\text{N}} = 1 - G(\underline{s}).\)

A novice entrepreneur with skill s shuts down his business to enter the labor market if he is of low skill (i.e., \( s \in [\underline{s} ,\hat{s}) \)) and his business has a quality inferior to \( \tilde{q}(s).\) The measure of this region is \( \int_{{\underline{s} }}^{{\hat{s}}} {F\left( {\tilde{q}\left( s \right)} \right){\text{d}}G\left( s \right)},\) while the probability an individual becomes a novice entrepreneur to begin with is \( P_{\text{N}} = 1 - G(\underline{s}),\) so we have \( P_{\text{NW}} = [1 - G(\underline{s} )]^{ - 1} \int_{{\underline{s} }}^{{\hat{s}}} {F(\tilde{q}(s)){\text{d}}G(s)}.\) A novice entrepreneur with skill s shuts down his business to launch a new venture (and become a serial entrepreneur) if he is of high skill (i.e., \( s \in [\hat{s},\infty) \)) and his business is bad (i.e., \( q \in [0,\hat{q}) \)). The measure of this region is \( [1 - G(\hat{s})]F(\hat{q}), \) while the probability an individual will become a novice entrepreneur to begin with is \( P_{\text{N}} = 1 - G(\underline{s}),\) so we have \( P_{\text{NS}} = [1 - G(\underline{s} )]^{ - 1} [1 - G(\hat{s})]F(\hat{q}). \)

A serial entrepreneur maintains his business in operation if it is good (i.e., \( q \in [\hat{q},\infty)\)); thus, we have \( P_{\text{SB}} = 1 - F(\hat{q}). \)

An individual becomes a serial entrepreneur if he is sufficiently skilled to be classified as a high-skill entrepreneur (i.e., for which \( s \in [\hat{s},\infty)\)) and his business is of sufficiently low quality to be classified as bad (i.e., for which \( q \in [0,\hat{q}) \)); thus, the probability an individual will become a serial entrepreneur is \( P_{\text{S}} = \left[ {1 - G\left( {\hat{s}} \right)} \right]F\left( {\hat{q}} \right). \)

From (A.6) to (A.10), we infer the following: \( \underline{s} \) and \( \hat{s} \) are increasing in the wage w and the serial startup cost T, and decreasing in the startup capital K; \( \hat{q} \) is decreasing in T and independent of w and K; \( \tilde{q}(s) \) is independent of T, increasing in w, and decreasing in K. The results then follow.□

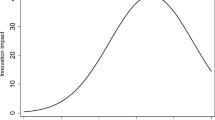

Proof of the Corollary of Proposition 3

Let b denote the number of ventures a serial entrepreneur launches to find a business profitable enough to maintain open. We derive its expected value B as follows. Consider a high-skill novice entrepreneur that owns a bad business. He shuts it down to launch a new venture and become a serial entrepreneur. The high-skill entrepreneur repeats this process as long as it takes to find a good business, i.e., for which \( q \ge \hat{q}. \) Each i.i.d. attempt is successful with probability \( 1 - F\left( {\hat{q}} \right), \) so b has a geometric distribution with the expectation \( B = 1/[1 - F(\hat{q})]. \) Thus, B is increasing in the threshold quality \( \hat{q}. \)

We showed in the proof of Proposition 3 that \( \hat{q} \) is decreasing in the serial startup cost T and independent of the wage w and the startup capital K, so the results follow.□

Proof of Proposition 4

We first derive the number of serial entrepreneurs. Every period, there are

new novice entrepreneurs. Let \( E(q,s) \) denote the total number of entrepreneurs with skill s that launch a new business with quality q at the beginning of the period. Let \( S(q,s) \) denote the number of serial entrepreneurs with skill s that launch a new venture with quality q at the beginning of the period. Novice and serial entrepreneurs learn the quality of their business upon startup. With probability \( f(q), \) a novice or serial entrepreneur launches a business with quality q; with probability \( h(s), \) a novice entrepreneur has the skill s. The total number of entrepreneurs equals the number of novice and serial entrepreneurs:

In a steady state, the number of serial entrepreneurs with skill s that launch a new venture with quality q at the beginning of the period equals the number of entrepreneurs with skill s that shut down a business to launch a new venture at the end of the previous period times the probability of drawing the quality q. No entrepreneurs with skill below \( \hat{s} \) become serial entrepreneurs; thus, \( S\left( {q,s} \right) = 0\,\,{\text{if}}\,\,s \le \hat{s}. \) Entrepreneurs with skill exceeding \( \hat{s} \) shut down their business to launch a new venture if their business is bad, i.e., the quality θ of their business satisfies \( \theta \le \hat{q}. \) The total number of entrepreneurs with skill s running a new firm with quality θ is \( E(\theta ,s). \) Among bad businesses with the quality θ, all the \( E(\theta ,s) \) entrepreneurs with skill \( s > \hat{s} \) shut down their firm to launch a new venture. The probability that a serial entrepreneur launches a business with quality q is \( f(q), \) implying

Using (A.12), we obtain the recursion

Define \( S(s) \equiv S(q,s)/f(q), \) such that (A.14) becomes \( S(s) = \int_{0}^{{\hat{q}}} {[h(s)N + S(s)]f(\theta ){\text{d}}\theta},\) to obtain \( S(s) = [1 - F(\hat{q})]^{ - 1} h(s)F(\hat{q})N,\) which yields the number of serial entrepreneurs with skill s that launch a business with quality q:

The total number of serial entrepreneurs that launch a business with quality q at the beginning of the period equals \( S(q) = \int_{{\hat{s}}}^{\infty } {S(q,s){\text{d}}s}.\) Applying (A.15), we find \( S(q) = [1 - F(\hat{q})]^{ - 1} [1 - H(\hat{s})]F(\hat{q})f(q)N. \) We infer the total number of serial entrepreneurs that launch a business at the beginning of the period, \( S = \int_{0}^{\infty } {S(q){\text{d}}q}, \) is

We next derive the total number of entrepreneurs. Because no entrepreneurs with skill below \( \hat{s} \) become serial entrepreneurs, the total number of entrepreneurs with skill \( s \le \hat{s} \) that launch a new venture with quality q at the beginning of the period equals the number of novice entrepreneurs:

The total number of entrepreneurs with skill \( s > \hat{s} \) that launch a new venture with quality q equals the number of novice plus serial entrepreneurs, \( E(q,s) = h(s)f(q)N + S(q,s). \) Applying (A.15), we obtain

The total number of entrepreneurs that launch a new venture with quality q at the beginning of the period is \( E(q) = \int_{{\underline{s} }}^{\infty } {E(q,s){\text{d}}s}. \) Applying (A.17) and (A.18), we obtain \( E(q) = [1 - F(\hat{q})]^{ - 1} [1 - F(\hat{q})H(\hat{s})]f(q)N.\) We infer the total number of entrepreneurs that launch a new venture at the beginning of the period, \( E = \int_{0}^{\infty } {E(q){\text{d}}q},\) is

We showed in the proof of Proposition 3 that \( \underline{s} \) and \( \hat{s} \) are increasing in the wage w and the serial startup cost T, and decreasing in the startup capital K; \( \hat{q} \) is decreasing in T and independent of w and K. The results then follow.□

Proof of Proposition 5

We first derive the number of entrepreneurs shutting down their business at the end of the period to launch a new venture. No entrepreneur shuts down his business to launch a new venture if the business is good: \( SDNV_{\text{Good}} (q) = 0. \) All entrepreneurs with skill exceeding \( \hat{s} \) shut down their bad business to launch a new venture: \( SDNV_{\text{Bad}} (q) = \int_{{\hat{s}}}^{\infty } {E(q,s){\text{d}}s}. \) Applying (A.18), we obtain

We infer the total number of entrepreneurs that shut down their firm at the end of the period to launch a new venture, \( SDNV = \int_{0}^{{\hat{q}}} {SDNV_{\text{Bad}} \left( q \right){\text{d}}q} + \int_{{\hat{q}}}^{\infty } {SDNV_{\text{Good}} \left( q \right){\text{d}}q},\) is

We next derive the number of entrepreneurs shutting down their business at the end of the period to enter the labor market. Let \( SDLM_{\text{Good}} (q) \) denote the number of entrepreneurs with a good business of quality q that shut down their business at the end of the period to enter the labor market. All entrepreneurs with skill below \( \tilde{s}(q) \) shut down their good business to enter the labor market, yielding \( SDLM_{\text{Good}} (q) = \int_{{\underline{s} }}^{{\tilde{s}(q)}} {E(q,s){\text{d}}s}.\) Because \( q > \hat{q}, \) we have \( \tilde{s}(q) < \hat{s}, \) implying the expression for \( E(q,s) \) given by (A.17) is applicable. Therefore, the number of entrepreneurs with a good business of quality q that shut down their business at the end of the period to enter the labor market equals

All entrepreneurs with skill below \( \hat{s} \) shut down their bad business at the end of the period to enter the labor market: \( SDLM_{\text{Bad}} (q) = \int_{{\underline{s} }}^{{\hat{s}}} {E(q,s){\text{d}}s}. \) No serial entrepreneurs shut down their bad business to enter the labor market (because, to be serial entrepreneurs, they had to have skill exceeding \( \hat{s} \)); thus, all entrepreneurs that shut down their bad business to enter the labor market are novice entrepreneurs: \( E(q,s) = h(s)f(q)N.\) Therefore, the number of entrepreneurs with a bad business of quality q that shut down their business at the end of the period to enter the labor market equals

We infer the total number of entrepreneurs shutting down their firm at the end of the period to enter the labor market, \( SDLM = \int_{0}^{{\hat{q}}} {SDLM_{\text{Bad}} (q){\text{d}}q} + \int_{{\hat{q}}}^{\infty } {SDLM_{\text{Good}} (q){\text{d}}q}, \) is

Finally, the total number of entrepreneurs shutting down their firm at the end of the period, \( SD = SDLM + SDNV, \) is

We showed in the proof of Proposition 3 that \( \hat{s} \) is increasing in the wage w and the serial startup cost T, and decreasing in the startup capital K, and \( \hat{q} \) is decreasing in T and independent of w and K. The results then follow.□

Proof of Lemma 1

We first show that the greater the skill s of an entrepreneur is, the more likely his business is to survive. An entrepreneur with skill \( s \in [\underline{s} ,\hat{s}) \) (i.e., a low-skill entrepreneur) maintains his business in operation if it has a quality \( q \in [\tilde{q}(s),\infty),\) where \( \tilde{q}(s) \) is decreasing in skill s, and an entrepreneur with skill \( s \in [\hat{s},\infty)\) (i.e. a high-skill entrepreneur) maintains his business in operation if it has a quality \( q \in [\hat{q},\infty)\) (i.e., the business is good). Therefore, among low-skill entrepreneurs, the more skilled an entrepreneur is, the more likely his business is to survive. Because \( \tilde{q}(s) > \hat{q}, \) a business launched by a high-skill entrepreneur is more likely to survive than a business launched by a low-skill entrepreneur.

We next show that the greater is the startup capital K of an entrepreneur, the more likely is his business to survive. There are two ways in which this arises. First, consider the conditional probability a novice entrepreneur maintains his business in operation \( P_{\text{NB}}, \) and the equivalent probability for a serial entrepreneur \( P_{\text{SB}}. \) From Proposition 3, if the probability an individual becomes a novice entrepreneur is held constant (i.e., \( \underline{s} \) is fixed), then \( P_{\text{NB}} \) is increasing in the startup capital K. Moreover, \( P_{\text{SB}} \) is independent of K. Therefore, overall, holding \( \underline{s} \) constant, an entrepreneur is more likely to maintain his business in operation the larger K is. Second, consider the exit rate \( SD/E. \) From Proposition 5, if \( \underline{s} \) is held constant, then \( SD/E \) is decreasing in K. Because the empirical results are drawn from samples of existing firms, this is equivalent theoretically to holding \( \underline{s} \) constant.□

Proof of Lemma 2

Only high-skill entrepreneurs (i.e., those with a skill level \( s \in [\hat{s},\infty)\)) have the potential to become serial, whereas novice entrepreneurs are drawn from the entire (censored) skill distribution of individuals that become entrepreneurs (i.e., those with a skill level \( s \in [\underline{s} ,\infty),\) where \( \underline{s} < \hat{s} \)). The more skilled an entrepreneur, the more likely his business is to survive. From Proposition 3, the probability a novice entrepreneur maintains his business in operation is \( P_{\text{NB}} = [1 - G(\underline{s} )]^{ - 1} \left( {1 - G(\underline{s} ) - [1 - G(\hat{s})]F(\hat{q}) - \int_{{\underline{s} }}^{{\hat{s}}} {F(\tilde{q}(s)){\text{d}}G(s)} } \right);\) the probability a serial entrepreneur will maintain his business in operation is \( P_{\text{SB}} = 1 - F(\hat{q}).\) We find that \( P_{\text{SB}} > P_{\text{NB}}\) since \( \int_{{\underline{s} }}^{{\hat{s}}} {F(\tilde{q}(s)){\text{d}}G(s)} > [G(\hat{s}) - G(\underline{s} )]F(\hat{q}),\) which holds because \( \tilde{q}(s) > \hat{q}.\)□

Proof of Lemma 3

A novice entrepreneur has three options: he may shut down his business to enter the labor market with probability \( P_{\text{NW}},\) maintain his business in operation with probability \( P_{\text{NB}},\) or shut down his business to launch a new venture (and thereby become a serial entrepreneur) with probability \( P_{\text{NS}};\) thus, the likelihood a novice entrepreneur remains an entrepreneur is \( P_{\text{NB}} + P_{\text{NS}},\) which is less than one since \( P_{\text{NW}} > 0.\) A serial entrepreneur has two options: he may maintain his business in operation or shut down his business to launch a new venture; thus, all serial entrepreneurs remain entrepreneurs.□

Proof of Lemma 4

From Proposition 3, if the probability an individual becomes a novice entrepreneur is held constant (i.e., \( \underline{s} \) is fixed), then the (conditional) probability a novice entrepreneur remains an entrepreneur \( 1 - P_{\text{NW}} \) is increasing in the startup capital K. Moreover, all serial entrepreneurs remain entrepreneurs. Therefore, overall, holding \( \underline{s} \) constant, an entrepreneur is more likely to remain an entrepreneur the larger K is. Because the empirical results are drawn from samples of existing firms, this is equivalent theoretically to holding \( \underline{s} \) constant.□

Proof of Lemma 5

An individual with skill \( s \in [0,\underline{s})\) enters the labor market, while an individual with skill \( s \in [\underline{s} ,\infty)\) becomes an entrepreneur; thus, the more skilled an individual, the more likely he is to become an entrepreneur.

From Proposition 3, the probability an individual becomes a novice entrepreneur \( P_{\text{N}}\) is decreasing in the wage w and increasing in the startup capital K.□

Rights and permissions

About this article

Cite this article

Plehn-Dujowich, J. A theory of serial entrepreneurship. Small Bus Econ 35, 377–398 (2010). https://doi.org/10.1007/s11187-008-9171-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-008-9171-5

Keywords

- Business longevity

- Firm survival

- Entry and exit

- Industry dynamics

- Habitual entrepreneur

- Serial entrepreneur

- Novice entrepreneur