Abstract

We analyze the impact of risk aversion and ambiguity aversion on the competing demands for annuities and bequeathable savings using a lifecycle recursive utility model. Our main finding is that risk aversion and ambiguity aversion have similar effects: an increase in either of the two reduces annuity demand and enhances bond holdings. We obtain this unequivocal result in the flexible intertemporal framework of Hayashi and Miao (2011) by assuming that the agent’s preferences are monotone with respect to first-order stochastic dominance. Our contribution is then twofold. First, from a decision-theoretic point of view, we show that monotonicity allows one to obtain clear-cut results about the respective roles of risk and ambiguity aversion. Second, from the insurance point of view, our result that the demand for annuities decreases with risk and ambiguity aversion stands in contrast with what is usually found with other insurance products. As such, it may help explain the low annuitization level observed in the data.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Risk aversion and ambiguity aversion are two central behavioral traits affecting economic lifecycle problems, such as saving and portfolio choices. A natural question is whether ambiguity and risk aversion have different impacts, or whether they generate qualitatively similar effects, especially when they are considered simultaneously. Although these traits appear to have certain similarities, with both traits aiming to model attitudes towards (objective or subjective) uncertainty, they have generally been studied in two separate strands of the economic literature. As pointed out in Guetlein (2016), the reason for the lack of joint analysis is that doing this is complicated and may in general lead to non-clear-cut results. Some insights have been given in static setups for self-insurance and self-protection questions (see among others, Treich 2010; Snow 2011; Alary et al. 2013), for the value of information (e.g., Hoy et al. 2014), and for portfolio choice problems (see e.g., Dow and Werlang 1992; Gollier 2011). However, the question has never really been theoretically addressed in intertemporal problems.

In this paper, we succeed in deriving non-ambiguous results regarding the joint role of risk and ambiguity aversion in a lifecycle model. A lifecycle model with uncertain lifetime is a natural workhorse for such an analysis. Not only is mortality a large risk in life, but life expectancies are also highly heterogeneous, as measured by so-called life disparity. Furthermore, even if life disparity can be partly explained by socio-economic factors, or differences in health systems, significant unexplained factors remain (Shkolnikov et al. 2003; Edwards and Tuljapurkar 2005; Shkolnikov et al. 2011). Mortality can therefore be seen as both risky and ambiguous.

Our results indicate that the demand for annuities decreases with both ambiguity and risk aversion, while the demand for (bequeathable) savings increases. The underlying intuition is that annuities are financial products that pay only when the agent survives, that is in good states of the world, while savings pay independently of the agent’s survival. Thus, investing in annuities can be seen as a bet on the agent’s own survival, with positive pay-offs in good states, but no pay-off in bad states. Quite logically, we find that the willingness to take such bets is reduced by both risk and ambiguity aversion. These findings have several interesting implications. First, they highlight that annuities, which are often presented as an insurance against the “risk” of having a long life, also imply the risk of losing wealth in the case of an early death. When living long is seen as a favorable outcome, annuities then appear to be a risk-taking device (when mortality rates are fully predictable), or an uncertainty-taking device (when survival probabilities are ambiguous). This stands in stark contrast with usual insurance products, such as car, health or unemployment insurance, and leads to opposite results regarding the impact of risk aversion and ambiguity aversion. The second implication of our results is that, qualitatively speaking, risk and ambiguity aversion turn out to have similar impacts. What fundamentally matters is not whether probabilities are known (as in a risk setting) or unknown (as in an ambiguity setting) but more fundamentally the possibility of either adverse realizations (like an early death) or favorable outcomes (like a long life). Risk and ambiguity aversion, though formally different, both reflect a similar willingness to “transfer” welfare from good states of the world to bad states of the world.

To derive our results, we focus on a smooth ambiguity model à la Hayashi and Miao (2011), which nests some standard models such as that of Klibanoff et al. (2009) or the recursive specification of Epstein and Zin (1989). We analyze the saving decisions of an agent who is both ambiguity and risk averse, and who may invest both in risk-free bonds and in annuities. Mortality is the sole risk faced by the agent, and she can live at most for two periods. The key feature of our approach is that we additionally assume that the agent’s preferences are monotone with respect to first-order stochastic dominance. This property enables us to jointly characterize the respective roles of ambiguity and risk aversion.

What does the monotonicity property imply? In a nutshell, monotonicity prevents agents from opting for dominated choices. More precisely, if two choices are available, with the first one yielding preferred outcomes in all circumstances, then an agent with monotone preferences will always prefer the first choice to the second. This property has already been studied in a risk setting. Bommier et al. (2017) show that the only Kreps and Porteus (1978) monotone preferences able to disentangle risk aversion and intertemporal elasticity of substitution are the so-called risk-sensitive preferences introduced by Hansen and Sargent (1995). These preferences have proved to be useful for characterizing the role of risk aversion for various consumption-saving problems. For instance, in a general infinite-horizon setting, Bommier and Le Grand (2019) show that once monotonicity is imposed, risk aversion unambiguously increases precautionary savings.

While the impact of monotonicity has already been explored in a risk setting, we are not aware of any extension to an uncertainty setting, apart from the representation results provided in Bommier and Le Grand (2014a) and Bommier et al. (2017). In particular, no application has been developed, leaving the practical implications of using monotone preferences in an ambiguity setting unclear. The current paper fills this gap, showing that monotone preferences can be used to derive clear-cut and intuitive predictions regarding the impact of risk and ambiguity aversion on savings and annuity purchases. As already mentioned, we find that greater risk aversion or greater ambiguity aversion tends to reduce annuity purchases and enhance investments in bonds. To be fully precise, we prove that a higher ambiguity aversion, while maintaining risk aversion constant, leads to higher holdings of riskless bonds but smaller holdings of annuities. This result holds for interior solutions, where agents purchase positive quantities of bonds and annuities. We also derive slightly different results for corner solutions, where either annuity or bond holdings hit non-negativity constraints and are equal to zero. With respect to risk aversion, an increase in risk aversion in the sense introduced by Guetlein (2016) – which does not preserve ambiguity attitudes – typically leads to non-clear-cut results. However, a compensated or “net” change in risk aversion, where the ambiguity parameter is modified together with the risk aversion parameter so as to keep ambiguity attitudes unchanged, is shown to have unambiguous implications, with an impact on asset demands similar to that of an increase in ambiguity aversion. Overall, uncertainty aversion (be it greater risk aversion or greater ambiguity aversion) appears to be a natural candidate for explaining the low annuitization level observed in the data (see Johnson et al., 2004 for empirical evidence in the US). This confirms the early findings of Bommier and Le Grand (2014b), who examined risk aversion, and those of d’Albis and Thibault (2018), who focused on ambiguity aversion in a static, one-period model.

To the best of our knowledge, this is the first paper to derive clear-cut results regarding the joint impact of risk and ambiguity aversion in an intertemporal framework. Our article obviously connects to the literature that discusses the roles of risk and ambiguity aversion separately. In the risk setting, there is an abundant literature on precautionary savings (see, among others, Drèze and Modigliani 1972; Kimball 1990; Bleichrodt and Eeckhoudt 2005; Courbage and Rey 2007; Kimball and Weil 2009; Jouini et al. 2013; Nocetti 2016) and on annuity choices (Yaari 1965; Davidoff et al. 2005; Lockwood 2012; Pashchenko 2013, among many others). The role of risk aversion is, however, not often studied because most of the literature relies on the standard time-additive setup, which makes it impossible to isolate the role of risk aversion, since intertemporal elasticity of substitution and risk aversion are intertwined. Among the exceptions, we find papers that use recursive frameworks, such as van der Ploeg (1993), Weil (1993), Kimball and Weil (2009), and several others. Nevertheless, most of these contributions rely on non-monotone preferences (notably those using the most popular Epstein-Zin specification with an intertemporal elasticity of substitution different from 1), with recursivity and monotonicity being combined in very few papers, including van der Ploeg (1993), Tallarini (2000) and Bommier and Le Grand (2014b, 2019). None of these articles feature ambiguity aversion.

The literature on ambiguity aversion developed after that on risk aversion, but grew very rapidly.Footnote 1 Most theoretical and experimental contributions initially focused on static settings. Intertemporal problems in an ambiguity setting are typically addressed using recursive extensions of standard static ambiguity models, though without having enough flexibility to change both risk and ambiguity aversion. We note, among others, the analyses of Osaki and Schlesinger (2014), Berger (2014), and Kajii and Xue (2016), who examine the precautionary savings of ambiguity-averse agents, or the study of Collard et al. (2018), who investigate whether ambiguity aversion can explain historical values of the equity premium. All of these papers focus on ambiguity aversion, while restricting their analyses to models that reduce to the standard time-additive model when uncertainty is purely objective (in cases where there is no ambiguity). In other words, they retain the lack of flexibility of the standard time-additive model, which makes it impossible to explore the role of risk aversion. An exception is Peter (2019), who considers a more flexible framework, relying on a non-separable, two-period utility function, although the author does not investigate the role of risk aversion. The current paper introduces flexibility by using the recursive framework of Hayashi and Miao (2011), a route also followed by more quantitatively oriented papers (see e.g., Backus et al. 2015). Our contribution is notable for its use of monotone preferences, which in addition to being an intuitive assumption, affords great tractability and the ability to derive formal results.

2 Risk and ambiguity aversions in intertemporal frameworks

2.1 The recursive smooth ambiguity model

To study the effect of risk and ambiguity aversion on the optimal decisions of an agent who faces an ambiguous mortality risk, we adopt the recursive smooth ambiguity utility model axiomatized by Hayashi and Miao (2011), in which Seo’s (2009) construction of a static smooth ambiguity model using Anscombe and Aumann (1963) acts is embedded into an infinite horizon setting.

Let \(\Omega\) be the finite state space and let \(\mathcal {X}\) be the set of consequences. The set of Anscombe-Aumann acts is \(\mathcal {G}_{0}\equiv \left( \Delta \left( \mathcal {\mathcal {X}}\right) \right) ^{\Omega }\), where \(\Delta \left( \mathcal {\mathcal {X}}\right)\) denotes the set of Borel probability measures defined on the Borel subsets of \(\mathcal {\mathcal {X}}\). We refer to Hayashi (2005) for the formal construction of the domain of compound lottery-acts, which are defined as the subset of dynamically coherent acts in the product space \(\prod _{t=0}^{\infty }\mathcal {G}_{t}\), where the spaces \(\mathcal {G}_{t}\) are defined by the recursion \(\mathcal {G}_{t}=\left( \Delta \left( \mathcal {\mathcal {X}}\times \mathcal {G}_{t-1}\right) \right) ^{\Omega }\).

The representation result of Hayashi and Miao (2011) states that the following exist: an aggregator \(W:\mathcal {\mathcal {X}}\times \mathbb {R}\rightarrow \mathbb {R}\), continuous and increasing in its second argument; two continuous and strictly increasing functions \(\psi _{A},\psi _{R}:\mathbb {R}\rightarrow \mathbb {R}\); and a probability measure \(\mu \in \Delta \left( \Delta \left( \Omega \right) \right)\) over the set of objective distributions, such that the utility of \(\left( x,g\right) \in \mathcal {X}\times \mathcal {G}\) is given by:

Preferences exhibit ambiguity aversion if \(\psi _{A}\circ \psi _{R}^{-1}\) is concave.

2.2 Monotone preferences

For our analysis, we will additionally require preferences to be monotone with respect to first order stochastic dominance. Loosely speaking, a monotonicity property means that if an agent prefers the outcomes of a given action to those of another action in all states of the world, she should always prefer the former action to the latter. This property is a consistency requirement between preferences over deterministic outcomes, subjective beliefs, and preferences in the presence of risk and ambiguity.

Monotonicity has already been analyzed in risk settings. It has straightforward implications for saving behaviors. Consider, for instance, an agent who is likely to live for one or two periods. With monotone preferences, her savings in the presence of mortality risk will be bound by her savings when she is sure to live for either one or two periods. These savings will, in particular, be smaller than her savings when she is sure to live for two periods. With non-monotone preferences, and for certain parameterizations, the agent is likely to save more in the presence of mortality risk than she would save knowing that she is sure to live for two periods.Footnote 2 Aside from this implication regarding saving behaviors, monotonicity imposes strong restrictions on preference representations, as shown in Bommier et al. (2017). This latter contribution shows, in particular, that risk-sensitive preferences are the only Kreps and Porteus (1978) monotone preferences able to disentangle risk aversion and the elasticity of intertemporal substitution.Footnote 3 Because of monotonicity, these preferences may yield clear-cut insights into the role of risk aversion.

In the setting of Hayashi and Miao (2011), monotonicity requires the representation in (1) to have an affine aggregator W and functions \(\psi _{R}\) and \(\psi _{A}\) to be of the “constant absolute risk aversion” kind. See Bommier and Le Grand (2014a) for a formal proof. The specification (1) can then be written as:

where \(f:\mathcal {X}\rightarrow \mathbb {R}_{+}\) is the instantaneous utility function. The parameters \(k_{A}\) and \(k_{R}\) drive ambiguity and risk aversion. Formally, two agents are comparable in terms of ambiguity aversion if they differ only by the parameter \(k_{A}\), the agent with greater \(k_{A}\) being more ambiguity averse. Two agents are comparable in terms of risk aversion if they differ only by the parameter \(k_{R}\), the agent with greater \(k_{R}\) being more risk averse. It is therefore natural to refer to \(k_{A}\) as being the ambiguity-aversion parameter, and to \(k_{R}\) as being the risk-aversion parameter.

However, as emphasized by Guetlein (2016), the smooth model does not offer a straightforward separation between ambiguity and risk attitudes. In particular, whether the agent is ambiguity averse or ambiguity lover depends on whether the ratio \(\frac{k_{A}}{k_{R}}\) is greater or smaller than one. Ambiguity neutrality is obtained when this ratio is equal to one. It follows that increasing the risk aversion parameter \(k_{R}\) while keeping \(k_{A}\) constant will change ambiguity attitudes. For example, an agent who is more risk averse than an agent who is ambiguity neutral will necessarily be ambiguity lover (see discussion in Section II of Guetlein).

To avoid such shortcomings, Guetlein (2016) suggests considering a simultaneous increase in both risk and ambiguity aversion that leaves ambiguity attitudes unchanged (see Section III of her paper). In the general framework of Guetlein (2016), such joint increases can be rather complex, involving different transformations of the risk-aversion and ambiguity-aversion functions. Under the assumption of preference monotonicity considered in the current paper, the situation is, however, much simpler. Increasing uncertainty aversion – to use Guetlein’s terminology – while preserving ambiguity attitudes is obtained by increasing both \(k_{A}\) and \(k_{R}\), while keeping the ratio \(\frac{k_{A}}{k_{R}}\) constant. To avoid confusion, we will introduce the terminology “net” vs. “gross” to distinguish two possible forms of the increase in risk aversion. By definition, an increase in “gross risk aversion” involves increasing \(k_{R}\) while keeping \(k_{A}\) constant. An increase in “net risk aversion” involves increasing \(k_{A}\) and \(k_{R}\), while keeping the ratio \(\frac{k_{A}}{k_{R}}\) unchanged, so as to preserve ambiguity attitudes. Here, the adjective “net” refers to an approach where risk aversion would be defined residually by looking at the difference (in fact the ratio here) between uncertainty aversion and ambiguity aversion.

3 Results in a two-period framework

3.1 Preference specifications

We use the above setting to study the effect of risk and ambiguity aversion on the optimal annuitization of an agent who faces an ambiguous mortality risk.

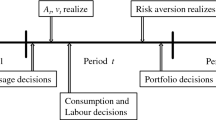

There are two periods, indexed by \(t=1,2\). The agent is alive in the first period, and can be either dead or alive in the second period. When alive, the agent consumes, when dead she may bequeath wealth to her heirs. The formal connection between our two-period setting and the infinite horizon setting of Hayashi and Miao (2011) can be made by assuming that the first two periods are always followed by an infinite sequence of periods where the agent is dead and bequeaths nothing. In the second period, the state of the agent can be described by two variables: (i) a dummy variable \(d\in \left\{ alive,dead\right\}\), indicating whether the agent is alive or dead, and (ii) a real number indicating how much she consumes (if alive) or bequeaths (if dead). Thus, formally, the set of consequences for the second period is \(\mathcal {X}=\left\{ alive,dead\right\} \times \mathbb {R_{+}}\). Because of our assumption that the agent is always alive in period 1, the first-period set of consequences is simply \(\left\{ alive\right\} \times \mathbb {R_{+}}\) and the domain of choice is \(\left( \left\{ alive\right\} \times \mathbb {R_{+}}\right) \times \left( \Delta \left( \mathcal {X}\right) \right) ^{\Omega }\), where \(\Omega\) is a finite subjective state space.

This can be simplified since we assume that mortality is the only source of uncertainty. The agent’s subjective prior can then be described by a probability distribution over survival probabilities, i.e. a list of pairs \((m_{i},p_{i})\in [0,1]^{2}\) for \(i=1,\ldots ,n\) such that \(\sum _{i=1}^{n}m_{i}=1\). The interpretation is that there are n subjective states and that the agent (subjectively) associates the probability \(m_{i}\) with the state \(i\in \{1,\ldots ,n\}\) that corresponds to a survival probability equal to \(p_{i}\) (and a mortality probability equal to \(1-p_{i}\)). A setting with no ambiguity is one in which \(m_{i}=1\) for some i and \(m_{j}=0\) for all \(j\ne i\): The agent is certain to survive with probability \(p_{i}\). Conversely, ambiguity occurs whenever there are two states i and j with \(p_{i}\ne p_{j}\) and \(m_{i},m_{j}\ne 0.\)

The instantaneous utility function f that appears in specification (2) is formally defined on \(\mathcal {X}=\left\{ alive,dead\right\} \times \mathbb {R_{+}}\). In other words, \(f:(d,x)\in \left\{ alive,dead\right\} \times \mathbb {R_{+}}\mapsto f(d,x)\in \mathbb {R}\). To simplify the notation, rather than introducing the dummy variable d to indicate whether the agent is alive or dead, we will simply use different letters c and w to indicate whether it refers to a level of consumption or a bequest level. A number \(c\in \mathbb {R}_{+}\) must therefore be interpreted as an element \((alive,c)\in \mathcal {X}\), while a number \(w\in \mathbb {R}_{+}\) must be interpreted as an element \((dead,w)\in \mathcal {X}\). We will introduce the notation \(u(c)=f(alive,c)\) for the instantaneous utility of consumption (if alive) and \(v(w)=f(dead,w)\) for the instantaneous utility of bequest (if dead). As is standard, functions u and v are both assumed to be twice continuously differentiable, strictly increasing, and concave. In representation (2), the instantaneous utility f is defined up to a constant, and we can assume without loss of generality that \(v(0)=0\). Note that once this normalization has been adopted, adding or subtracting a constant to u cannot then be seen as mere normalization. The utility gap \(u(c)-v(w)\) in fact measures how much the agent values being alive and consuming c versus being dead and bequeathing wealth w. The larger the utility gap, the more attractive being alive and consuming becomes compared to being dead and bequeathing. The baseline situation corresponds to the one where the agent exhibits no altruism towards her heirs, that is, to the case in which v is constant (and thus equal to 0).

Using the above notation and representation (2), the utility of an agent who consumes \(c_{1}\) in period 1 and consumes \(c_{2}\) or bequeaths w in period 2 (depending on whether she survives or not) is given by:

From this equation we can formally show how the utility gap \(u(c_2)-v(w)\) closely relates to the value of life concept, which quantifies how much an agent is willing to pay for increasing her survival probabilities. Consider for example the case where agents could increase their survival probability by an infinitesimal amount \(\varepsilon\) in all states of the world. Their utility would then be obtained by replacing \(p_{i}\) by \(p_{i}+\varepsilon\), for all i, in Eq. 3. Assuming that asset returns are independent of \(\varepsilon\), one can compute the willingness to pay in period 1 for such a mortality risk reduction:

which has the same sign as \(u(c_{2})-v(w)\). Notice that in the limit case where \(k_{A}\) and \(k_{R}\) tend to zero, which corresponds to the standard additive model, the above formula provides \(\left. \frac{\partial U(c_{1},c_{2},w)}{\partial \varepsilon }/\frac{\partial U(c_{1},c_{2},w)}{\partial c_{1}}\right| _{\varepsilon =0}=\beta \frac{u(c_{2})-v(w)}{u^{\prime }(c_{1})}\) which corresponds to the standard expression for the so-called value of a statistical life.Footnote 4

As shown in Bommier et al. (2021), the sign of the value of life is crucial for understanding the role of risk aversion on savings. There is a wide empirical literature on value-of-life estimates, both from academics (see for instance Viscusi and Aldy 2003 for a survey of value-of-life estimates throughout the world) and from institutions (see Environmental Protection Agency Office and of Air and Radiation 2011, for instance). Despite the heterogeneity in estimates, there is a strong consensus that the value of life is positive and large. An up-to-date estimate for the US is around 10 million in 2015 US dollars (Viscusi 2018).

In the remainder of the paper, we will assume that mortality is exogenous. The utility specification \(U(c_{1},c_{2},w)\) in Eq. 3 will therefore be the objective function that the agent maximizes, subject to the budget constraints that will be introduced later on. We will derive comparative statics results regarding savings and annuity purchases related to the ambiguity and risk aversion parameters \(k_{A}\) and \(k_{R}\), while assuming that individuals’ beliefs (the \(m_{i}\) and \(p_{i}\)) are unchanged. Interestingly, we will see that our results strongly depend on whether the value of life is positive (which occurs when \(u(c_{2})>v(w)\)) – as suggested by the empirical literature – or negative (i.e, when \(u(c_{2})<v(w)\)).

3.2 Particular cases

The general preference representation (3) embeds several particular cases that we describe below.

No ambiguity

The no-ambiguity case corresponds to \(m_{i_{0}}=1\) for some \(i_{0}\) and \(m_{i}=0\) for \(i\ne i_{0}\). The preference representation (3) becomes:

which corresponds to the risk-sensitive preferences of Hansen and Sargent (1995). In particular, the parameter \(k_{A}\) no longer plays a role and risk aversion is driven by the parameter \(k_{R}\), where more risk averse agents correspond to larger values of the parameter \(k_{R}\).

The case \(k_{R}=0\) can be obtained by taking the limit of expression (5) when \(k_{R}\rightarrow 0\), and corresponds to the standard additive model where \(U(c_{1},c_{2},w)=u(c_{1})+\beta \left( p_{i_{0}}u(c_{2})+(1-p_{i_{0}})v(w)\right)\).

Ambiguity neutrality

Ambiguity neutrality corresponds to \(k_{A}=k_{R}\). The utility expression (3) becomes:

where \(p=\sum _{i=1}^{n}m_{i}p_{i}\) is the average mortality probability. Formally, this setup is similar to the no-ambiguity case and expression (6) looks very much like expression (5). Again, when \(k_{R}=0\), we fall back on the additive model.

Temporal risk neutrality

The case \(k_{R}=0\) implies temporal risk neutrality. By continuity, for \(k_{R}\rightarrow 0\) from expression (3), we deduce that the utility expression becomes:

This fits into the Klibanoff et al. (2009) recursive framework and exactly corresponds to the specification used in Collard et al. (2018).

No objective probabilities

The last case corresponds to a setup where all information is subjective. In other words, a situation where, for all i, we have either \(p_{i}=0\) or \(p_{i}=1\). This situation reduces to a two (subjective)-state model, where \(p_{1}=1\) occurs with subjective probability \(m_{1}\) and \(p_{2}=0\) with subjective probability \(m_{2}=1-m_{1}\). We then have:

similar to expressions (5) and (6), with \(k_{A}\) instead of \(k_{R}\).

3.3 The agent’s program

We consider an ambiguity-and-risk-averse agent, whose preferences are assumed to be represented by the utility function defined in Eq. (3). In the first period, the agent is endowed with an initial wealth \(W>0\). She has no other source of income during the two periods but can transfer consumption from the first period to the second through savings in a bond and in an annuity. These savings are denoted by s and a, respectively, and the first-period budget constraint is simply \(W=c_{1}+s+a\). The bond pays off the riskless gross interest rate \(r>0\) in the second period, regardless of whether the agent is alive or not. Bond pay-offs, in particular, can be bequeathed to the agent’s heirs. The annuity pays off the gross rate \(r_{a}>r\), which is assumed to be higher than the riskless rate. Annuity pay-offs are made only in cases of survival. This means that the second-period budget constraints are \(c_{2}=r_{a}a+rs\) when the agent lives for two periods and consumes the outcomes of her savings and \(w=rs\) when the agent dies and bequeaths her bond savings.

We make two observations regarding the annuity return \(r_{a}\). First, in our ambiguity setting, the notion of an actuarially fair annuity is not a very relevant concept. An objective survival probability can still be defined, as can an objective definition of actuarially fair annuities. However, from the agent’s perspective, what actually matters is a subjective notion of fairness, which is not generally unequivocally defined due to the ambiguity setting. We therefore define the annuity return simply by using the gross rate \(r_{a}\), higher than r, instead of defining it using the riskless interest rate and some survival probability. The second observation is that the annuity return rate \(r_{a}\) is not affected by ambiguity and is assumed to be perceived as constant by the agent. This implicitly means that the return \(r_{a}\) actually comes from pooling the heterogeneous mortality risk, such that the agent cannot infer her objective survival probability from the gross rates \(r_{a}\) and r. Another (nonexclusive) possibility would be to assume that the annuity return embeds a fee that cannot be observed by the agent.

Using the previous notation, the agent’s program can therefore be written as:

where we exclude negative consumption levels, borrowings, and annuity short-sellings.

3.4 The role of risk and ambiguity aversion

The impact of \(k_{A}\) and \(k_{R}\) on saving choices is summarized in the following proposition, whose proof is given in the Appendix.

Proposition 1

Consider the consumption-saving program of Eqs. (7) and (8) with \(k_{A}\ge k_{R}>0\). We denote by \(a(k_{A},k_{R})\ge 0\) and \(s(k_{A},k_{R})\ge 0\) the optimal savings in annuities and bonds, respectively.

We assume that the optimum is characterized by a positive value of life, i.e., formally, \(u(r_{a}a(k_{A},k_{R})+rs(k_{A},k_{R}))>v(rs(k_{A},k_{R}))\).

We distinguish three cases (besides the trivial case \(a(k_{A},k_{R})=s(k_{A},k_{R})=0\)).

-

1.

Case \(a(k_{A},k_{R})>0\) and \(s(k_{A},k_{R})>0\).

-

(a)

Ambiguity aversion. We have: \(\left. \frac{\partial a(k_{A},k_{R})}{\partial k_{A}}\right| _{k_{R}}<0\), \(\left. \frac{\partial s(k_{A},k_{R})}{\partial k_{A}}\right| _{k_{R}}>0\), as well as \(\left. \frac{\partial (r_{a}a(k_{A},k_{R})+rb(k_{A},k_{R}))}{\partial k_{A}}\right| _{k_{R}}<0\).

-

(b)

Net risk aversion. We have: \(\left. \frac{\partial a(k_{A},k_{R})}{\partial k_{R}}\right| _{k_{A}/k_{R}}<0\), \(\left. \frac{\partial s(k_{A},k_{R})}{\partial k_{R}}\right| _{k_{A}/k_{R}}>0\), \(\left. \frac{\partial (r_{a}a(k_{A},k_{R})+rb(k_{A},k_{R}))}{\partial k_{R}}\right| _{k_{A}/k_{R}}<0\).

-

(a)

-

2.

Case \(a(k_{A},k_{R})>0\) and \(s(k_{A},k_{R})=0\): \(\left. \frac{\partial a(k_{A},k_{R})}{\partial k_{A}}\right| _{k_{R}}<0\) and \(\left. \frac{\partial a(k_{A},k_{R})}{\partial k_{R}}\right| _{k_{A}/k_{R}}<0\).

-

3.

Case \(a(k_{A},k_{R})=0\) and \(s(k_{A},k_{R})>0\): \(\left. \frac{\partial s(k_{A},k_{R})}{\partial k_{A}}\right| _{k_{R}}\) and \(\left. \frac{\partial s(k_{A},k_{R})}{\partial k_{R}}\right| _{k_{A}/k_{R}}\) have the same sign as \(\left( v^{\prime }\left( rs(k_{A},k_{R})\right) -u^{\prime }\left( rs(k_{A},k_{R})\right) \right)\).

The proposition characterizes the role of ambiguity and net risk aversion for an ambiguity-and-risk-averse agent (\(k_{A}\ge k_{R}>0\)). The only condition required to derive the results of Proposition 1 is that, at the optimum, the utility of being alive in the second period and consuming is greater than the utility of being dead and bequeathing one’s wealth. Formally: \(u(r_{a}a+rs)>v(rs)\). In other words, the condition simply means that life is worth living, or that the value of life is positive (see also Eq. 4). As already mentioned, despite some measurement heterogeneity, there is plenty of empirical evidence that the value of life is large and positive. This assumption is therefore reasonable and not very restrictive.

Proposition 1 distinguishes three cases depending on whether saving is constrained to one instrument. The interior case, corresponding to unconstrained annuity and bond holdings, is reported in case 1. Varying the ambiguity aversion parameter \(k_{A}\) – while keeping the risk aversion parameter \(k_{R}\) fixed – has an unambiguous impact on security holdings. A larger ambiguity aversion diminishes the demand for annuities but increases the demand for bonds. The overall impact is such that second-period consumption (equal to the quantity \(r_{a}a(k_{A},k_{R})+rb(k_{A},k_{R})\)) also diminishes when ambiguity aversion rises.

The role of the “net” risk aversion parameter is obtained by increasing \(k_{R}\) and \(k_{A}\) while maintaining a constant ratio \(k_{A}/k_{R}\). We find that the impact of an increase in net risk aversion is qualitatively similar to that of an increase in ambiguity aversion.

Case 2, which corresponds to constrained bond savings, is very similar to case 1. Since only one saving instrument is available and no portfolio choice is possible, the result is much simpler to state. A higher ambiguity aversion – or a higher net risk aversion – implies smaller annuity holdings.

Case 3 corresponds to constrained annuity holdings. The result, be it for the role of ambiguity aversion or the role of net risk aversion, depends on the sign of the difference between the marginal utility of consumption when alive and the marginal utility of bequest. The intuition is as follows. An increase in ambiguity aversion – or in net risk aversion – translates into the willingness to increase lifetime utility in the bad state (i.e., death). With monotone preferences, this necessarily reduces the lifetime utility in the good state (i.e., survival) and diminishes the dispersion in lifetime utilities. In the absence of an annuity holding, the dispersion in lifetime utilities amounts to \(\beta (u(rs)-v(rs))\), which is positive because the value of life is positive. The way in which the riskless saving s should be varied to reduce the dispersion in lifetime utilities therefore depends on whether \(u(rs)-v(rs)\) is increasing or decreasing with s, and thus on the sign of the derivative \(u^{\prime }(rs)-v^{\prime }(rs)\). When the marginal utility in the good state is higher than the marginal utility in the bad state (\(u^{\prime }(rs)-v^{\prime }(rs)>0\)), reducing the dispersion in lifetime utilities will involve smaller savings. Conversely, if \(u^{\prime }(rs)-v^{\prime }(rs)<0\), an increase in ambiguity aversion or in net risk aversion will increase savings.

In the absence of a bequest motive (\(v'=0\)), the sign of the derivatives in case 3 is clear, and an increase in either net risk aversion or ambiguity aversion diminishes both savings and second-period consumption. With non-trivial bequest motives, a very common specification (up to a normalization constant) is \(v(w)=\theta (u(\underline{w}+w)-u(\underline{w}))\), where \(\theta \ge 0\) reflects the intensity of the altruistic motive, and \(\underline{w}>0\) makes a bequest a luxury good. Furthermore, the intertemporal elasticity of substitution is also often assumed to be constant, with \(u^{\prime }(c)=c^{-\sigma }\).Footnote 5 In such a case, the sign of \(u^{\prime }(rs)-v^{\prime }(rs)\) is not clear-cut: it is typically positive for small values of s and becomes negative for larger values. The impact of ambiguity and net risk aversion will then depend on this sign, as shown in Proposition 1.

4 Discussion

We have proved that the comparative statics of ambiguity and net risk aversion yield non-ambiguous results in an ambiguity setting à la Anscombe-Auman. A larger ambiguity aversion or a larger net risk aversion means a smaller demand for annuities and a larger demand for riskless bonds. To obtain the intuition, note that annuities are uncertain assets that pay off in the good state of the world (i.e., when the agent lives a long life) and pay nothing in the bad state (i.e., in case of an early death). By analogy with finance, we can therefore consider that an annuity has the fundamental properties of a pro-cyclical asset. It is then quite natural that uncertainty aversion, be it ambiguity or risk aversion, reduces investment in such an asset. We would of course have found a converse result if we had considered hedging assets (such as life-insurance products that pay only in the case of death).

While our results may look intuitive, we emphasize that they go against the common claim that, annuities being insurance products, the demand for annuities should increase with uncertainty aversion. Since mortality risk makes preferences state-dependent, the link between insurance demand and risk aversion is not that obvious. As our results indicate, there are cases where the demand for insurance may decrease (and not increase) with risk aversion.

Preference monotonicity is the key ingredient, as it enables us to highlight the fundamental assumptions required for our analysis, and in particular the assumptions related to the value of life. Because of the monotonicity assumption, we may view the agent’s decision as being a trade-off between welfares in different states (without monotonicity the agent may want to reduce welfare in all states). Uncertainty aversion then has a fairly clear role, dictating how much weight to put on bad states compared to good ones. To derive the impact of an increase in uncertainty aversion, it is therefore necessary to properly identify good and bad states – or in our framework to identify whether survival should be viewed as a good or a bad realization. In the tradition of revealed preferences, this involves looking at the literature on endogenous mortality, which clearly indicates that the value of life is positive.

A final take-home message is that to make predictions regarding the impact of uncertainty aversion in the presence of an exogenous, non-monetary background risk (mortality risk in our paper, although this could also be health risk, for instance), it is necessary to use information that can be gleaned only from decisions where the degree of background risk is endogenous.

Notes

See for example the seminal early review of Camerer and Weber (1992).

See Bommier et al. (2021) for a detailed example.

In cases when the increase in survival probability \(\varepsilon\) would impact asset returns (for example with annuities returns that adapt to an agent’s mortality choices), correcting terms would be needed – even though these terms are typically quantitatively small.

References

Alary, D., Gollier, C., & Treich, N. (2013). The effect of ambiguity aversion on insurance and self-protection. The Economic Journal, 123(573), 1188–1202.

Ameriks, J., Caplin, A., Laufer, S., & Van Nieuwerburgh, S. (2011). The joy of giving or assisted living? using strategic surveys to separate bequest and precautionary motives. Journal of Finance, 66(2), 519–561.

Anscombe, F. J., & Aumann, R. J. (1963). A definition of subjective probability. The Annals of Mathematical Statistics, 34(1), 199–205.

Backus, D., Ferriere, A., & Zin, S. (2015). Risk and ambiguity in models of business cycles. Journal of Monetary Economics, 69, 42–63.

Baillon, A., Bleichrodt, H., Huang, Z., & Potter van Loon, R. (2017). Measuring ambiguity attitude: (extended) multiplier preferences for the american and the dutch population. Journal of Risk and Uncertainty, 54(3), 269–281.

Berger, L. (2014). Precautionary saving and the notion of ambiguity prudence. Economics Letters, 123(2), 248–251.

Bleichrodt, H., & Eeckhoudt, L. (2005). Saving under rank-dependent utility. Economic Theory, 25(2), 505–511.

Bommier, A., & Le Grand, F. (2014a). A robust approach to risk aversion. Working Paper, ETH Zurich

Bommier, A., & Le Grand, F. (2014b). Too risk averse to purchase insurance? Journal of Risk and Uncertainty, 48(2):135–166

Bommier, A., & Le Grand, F. (2019). Risk aversion and precautionary savings in dynamic settings. Management Science, 65(3), 1386–1397.

Bommier, A., Kochov, A., & Le Grand, F. (2017). On monotone recursive preferences. Econometrica, 85(5), 1433–1466.

Bommier, A., Harenberg, D., Le Grand, F., & O’Dea, C. (2021). Recursive preferences, the value of life, and household finance. Working Paper, ETH Zurich

Camerer, C., & Weber, M. (1992). Recent developments in modeling preferences: Uncertainty and ambiguity. Journal of Risk and Uncertainty, 5(4), 325–370.

Collard, F., Mukerji, S., Sheppard, K., & Tallon, J. M. (2018). Ambiguity and the historical equity premium. Quantitative Economics, 9(2), 945–993.

Courbage, C., & Rey, B. (2007). Precautionary saving in the presence of other risks. Economic Theory, 32(2), 414–424.

d’Albis, H., & Thibault, E. (2018). Ambiguous life expectancy and the demand for annuities. Theory and Decision, 85(3), 303–319.

Davidoff, T., Brown, J. R., & Diamond, P. A. (2005). Annuities and individual welfare. American Economic Review, 95(5), 1573–1590.

De Nardi, M. (2004). Wealth inequality and intergenerational links. Review of Economic Studies, 71, 743–768.

De Nardi, M., French, E., & Jones, J. B. (2010). Why do the elderly save? the role of medical expenses. Journal of Political Economy, 118(1), 39–75.

Dow, J., & Werlang, SRd. C. (1992). Uncertainty aversion, risk aversion, and the optimal choice of portfolio. Econometrica, 60(1), 197–204.

Drèze, J. H., & Modigliani, F. (1972). Consumption decisions under uncertainty. Journal of Economic Theory, 5(3), 308–335.

Edwards, R. D., & Tuljapurkar, S. (2005). Inequality in life spans and a new perspective on mortality convergence across industrialized countries. Population and Development Review, 31(4), 645–674.

Epstein, L. G., & Zin, S. E. (1989). Substitution, risk aversion, and the temporal behavior of consumption and asset returns: A theoretical framework. Econometrica, 57(4), 937–969.

Gollier, C. (2011). Portfolio choices and asset prices: The comparative statics of ambiguity aversion. Review of Economic Studies, 78(4), 1329–1344.

Guetlein, M. C. (2016). Comparative risk aversion in the presence of ambiguity. American Economic Journal: Microeconomics, 8(3), 51–63.

Hansen, L. P., & Sargent, T. J. (1995). Discounted linear exponential quadratic gaussian control. IEEE Transactions on Automatic Control, 40(5), 968–971.

Hayashi, T. (2005). Intertemporal substitution, risk aversion and ambiguity aversion. Economic Theory, 25(4), 933–956.

Hayashi, T., & Miao, J. (2011). Intertemporal substitution and recursive smooth ambiguity preferences. Theoretical Economics, 6(3), 423–472.

Hoy, M., Peter, R., & Richter, A. (2014). Take-up for genetic tests and ambiguity. Journal of Risk and Uncertainty, 48(2), 111–133.

Johnson, R. W., Burman, L. E., & Kobes, D. I. (2004). Annuitized wealth at older ages: Evidence from the health and retirement study. Department of Labor, The Urban Institute: Final report to the Employee Benefits Security Administration of the U.S.

Jouini, E., Napp, C., & Nocetti, D. (2013). On multivariate prudence. Journal of Economic Theory, 148(3), 1255–1267.

Kajii, A., & Xue, J. (2016). Precautionary saving with changing income ambiguity. KIER Working Paper 940, Kyoto University, Institute of Economic Research

Kimball, M. S. (1990). Precautionary savings in the small and in the large. Econometrica, 58(1), 53–73.

Kimball, M. S., & Weil, P. (2009). Precautionary saving and consumption smoothing across time and possibilities. Journal of Money, Credit, and Banking, 41(2–3), 245–284.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2009). Recursive smooth ambiguity preferences. Journal of Economic Theory, 144(3), 930–976.

Kreps, D. M., & Porteus, E. L. (1978). Temporal resolution of uncertainty and dynamic choice theory. Econometrica, 46(1), 185–200.

Lockwood, L. M. (2012). Bequest motives and the annuity puzzle. Review of Economic Dynamics, 15(2), 226–243.

Nocetti, D. C. (2016). Robust comparative statics of risk changes. Management Science, 62(5), 1381–1392.

Osaki, Y., & Schlesinger, H. (2014). Precautionary saving and ambiguity. Working Paper, Waseda University

Pashchenko, S. (2013). Accounting for non-annuitization. Journal of Public Economics, 98, 53–67.

Peter, R. (2019). Revisiting precautionary saving under ambiguity. Economics Letters, 174, 123–127.

Seo, K. (2009). Ambiguity and second-order belief. Econometrica, 77(5), 1575–1605.

Shkolnikov, V. M., Andreev, E. E., & Begun, A. Z. (2003). Gini coefficient as a life table function: Computation from discrete data, decomposition of differences and empirical examples. Demographic Research, 8, 305–358.

Shkolnikov, V. M., Andreev, E. M., Zhang, Z., Oeppen, J., & Vaupel, J. W. (2011). Losses of expected lifetime in the United States and other developed countries: Methods and empirical analyses. Demography, 48(1), 211–239.

Snow, A. (2011). Ambiguity aversion and the propensities for self-insurance and self-protection. Journal of Risk and Uncertainty, 42(1), 27–43.

Strzalecki, T. (2011). Axiomatic foundations of multiplier preferences. Econometrica, 79(1), 47–73.

Tallarini, T. D. J. (2000). Risk-sensitive real business cycles. Journal of Monetary Economics, 45(3), 507–532.

Treich, N. (2010). The value of a statistical life under ambiguity aversion. Journal of Environmental Economics and Management, 59(1), 15–26.

US Environmental Protection Agency Office of Air and Radiation. (2011). The benefits and costs of the clean air act from 1990 to 2020. Second Prospective Report: Environmental Protection Agency.

van der Ploeg, F. (1993). A closed-form solution for a model of precautionary saving. Review of Economic Studies, 60(2), 385–395.

Viscusi, W. K. (2018). Pricing Lives: Guideposts for a Safer Society. Princeton: Princeton University Press.

Viscusi, W. K., & Aldy, J. E. (2003). The value of a statistical life: A critical review of market estimates throughout the world. Journal of Risk and Uncertainty, 27(1), 5–76.

Weil, P. (1993). Precautionary savings and the permanent income hypothesis. Review of Economic Studies, 60(2), 367–383.

Yaari, M. E. (1965). Uncertain lifetime, life insurance, and the theory of the consumer. Review of Economic Studies, 32(2), 137–150.

Acknowledgements

Bommier and Le Grand gratefully acknowledge support from the Swiss-Re Foundation and the ETH Zurich Foundation.

Funding

Open access funding provided by Swiss Federal Institute of Technology Zurich.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of proposition 1: Interior case \(a,s>0\)

The program can be written as:

Assuming an interior equilibrium, the first-order conditions are:

We introduce the following notation:

as well as the expectation \(E_{m}[\cdot ]\) and the covariance \(Cov_{m}\) (when well-defined):

Using this notation, the first-order condition (9) and (10) become:

1.1.1 Impact of \(k_{A}\)

First-order condition (14)

Computing the derivative of (14) with respect to \(k_{A}\) yields, using the notation \(\eta _{i}\) defined in (11):

Introducing the operator \(E_{m}\) of Eq. (12), we obtain after dividing both sides of equality by \(\beta r_{a}u^{\prime }(r_{a}a+rs)\) and using (14):

First-order condition (15)

We now compute the derivative of Eq. (15) with respect to \(k_{A}\). The computation is similar to the one for (14) and we get:

Conclusion

With matrix notation, Eqs. (16) and (17) can be rewritten as:

with \(M=(M_{ij})_{1\le i,j\le 2}\) and:

We also define:

We compute the determinant of the matrix M:

Since \(r_{a}\ge r\), we deduce that \(\det \, M>0\) and that the matrix M is invertible. We deduce from (18) the expression of partial derivatives \(\frac{\partial s}{\partial k_{A}}\) and \(\frac{\partial a}{\partial k_{A}}\).

Partial derivative \(\frac{\partial s}{\partial k_{A}}\)

Equality (20) yields:

From the definition (11), we deduce:

These two values imply the following equality:

and the determinant expression (11) simplifies into:

Definitions (22) and (23) imply that \(Cov_{m}\left( \frac{p}{\eta },\log (\eta )\right) <0\) and \(Cov_{m}\left( \frac{1-p}{\eta },\log (\eta )\right) >0\). Since \(\det M,k_{R}>0\), we obtain from (25) that: \(\frac{\partial s}{\partial k_{A}}>0.\)

Partial derivative \(\frac{\partial a}{\partial k_{A}}\)

Equality (20) also yields, using Eq. (24) which states that \(Cov_{m}\left( \frac{p}{\eta },\log (\eta )\right) +e^{k_{R}\left( u(r_{a}a+rs)-v(rs)\right) }\,Cov_{m}\left( \frac{1-p}{\eta },\log (\eta )\right) =0\),

As for (25), \(Cov_{m}\left( \frac{p}{\eta },\log (\eta )\right) <0\) and \(Cov_{m}\left( \frac{1-p}{\eta },\log (\eta )\right) >0\), which implies that \(\frac{\partial a}{\partial k_{A}}<0\) with \(k_{R}\det Mr_{a}>0\).

Sum of partial derivatives \(r\frac{\partial s}{\partial k_{A}}+r_{a}\frac{\partial s}{\partial k_{A}}\)

which is negative since \(Cov_{m}\left( \frac{p}{\eta },\log (\eta )\right) <0\) and \(Cov_{m}\left( \frac{1-p}{\eta },\log (\eta )\right) >0\). We deduce: \(r\frac{\partial s}{\partial k_{A}}+r_{a}\frac{\partial a}{\partial k_{A}}<0.\)

1.1.2 Impact of \(k_{R}\)

We will compute the derivatives of (14) and (15) with respect to \(k_{R}\), while keeping the ratio \(k_{A}/k_{R}\) unchanged. For the sake of clarity, we will denote such a derivative of a function f as \(\frac{\partial f}{\partial k_{R}}\) instead of \(\left. \frac{\partial f}{\partial k_{R}}\right| _{k_{A}/k_{R}}\). Computing the derivative of (14) yields:

Similarly, computing the derivative of (15) yields:

In matrix notation, we deduce from (27) and (28):

The matrix M is defined in (18) and \(\det M>0\), \(\kappa >0\) and \(u(r_{a}a+rs)-v(rs)>0\).

Partial derivative \(\frac{\partial s}{\partial k_{R}}\).

Using the expressions of \(M_{11}\) and \(M_{21}\), we obtain from (29):

which unambiguously yields: \(\frac{\partial s}{\partial k_{R}}>0.\)

Partial derivative \(\frac{\partial a}{\partial k_{R}}\).

The expressions of \(M_{12}\) and \(M_{22}\) imply, using (29)

which is negative and implies that: \(\frac{\partial a}{\partial k_{R}}<0.\)

Sum of partial derivatives \(r_{a}\frac{\partial a}{\partial k_{R}}+r\frac{\partial s}{\partial k_{R}}\).

Summing Eqs. (30) and (31) leads to:

which implies since \(r_{a}\ge r\) that: \(r_{a}\frac{\partial a}{\partial k_{R}}+r\frac{\partial s}{\partial k_{R}}<0.\)

1.2 Proof of proposition 1: Corner case: \(a=0\)

The annuity choice is zero and the riskless saving choice is determined by the following first-order condition (which is (10) with \(a=0\)):

1.2.1 Role of \(k_{A}\)

Computing the derivative of (32) with respect to \(k_{A}\) (with \(k_{R}\) constant) yields after some manipulation:

Since \(Cov_{m}\left( \frac{p}{\eta },\log (\eta )\right) <0\), this proves that \(\frac{\partial s}{\partial k_{A}}\) has the same sign as \(u^{\prime }(rs)-v^{\prime }(rs)\).

1.2.2 Role of \(k_{R}\)

Computing the derivative of (32) with respect to \(k_{R}\) (with \(k_{A}/k_{R}\) constant) yields:

which implies that \(\frac{\partial s}{\partial k_{R}}\) has the same sign as \(u^{\prime }(rs)-v^{\prime }(rs)\).

1.3 Proof: Corner case \(s=0\)

The annuity choice is determined by the following first-order condition – which is (9) with \(a=0\):

1.3.1 Role of \(k_{A}\)

Computing the derivative of (33) with respect to \(k_{A}\) (with \(k_{R}\) constant) yields:

which implies since \(\kappa >0\) and \(Cov_{m}\left( \frac{p}{\eta },\log (\eta )\right) <0\) that \(\frac{\partial a}{\partial k_{A}}<0.\)

1.3.2 Role of \(k_{R}\)

Computing the derivative of (33) with respect to \(k_{R}\) (with \(k_{R}/k_{A}\) constant) yields:

which implies since \(\kappa >0\): \(\frac{\partial a}{\partial k_{R}}<0.\)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

André, E., Bommier, A. & Le Grand, F. The impact of risk aversion and ambiguity aversion on annuity and saving choices. J Risk Uncertain 65, 33–56 (2022). https://doi.org/10.1007/s11166-022-09386-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-022-09386-9