Abstract

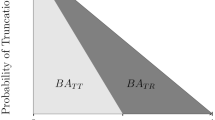

The experimental market entry paradigm has been used to illuminate the role of self-assessed skill in risk taking. Specifically, success only accompanies entry if a participant is one of the better ranked entrants on the skill criterion. We investigate what happens when participants face an additional source of uncertainty that perturbs relative skill rankings. Interestingly, this has asymmetric effects. On average, chances of success are increased for those with low rankings but decreased for those with high rankings. Thus, we predicted that the additional uncertainty would lead to more entry by the former but less by the latter. Our data supported the first prediction but, for those with high skill rankings, the existence of additional uncertainty made little difference. Finally, although we observed “excess entry” (i.e., too many participants entered markets), this could not be attributed to overconfidence. We conclude by contrasting our results with others in the literature.

Similar content being viewed by others

Notes

Whereas the equilibrium number of entrants calculated here does not assume learning, players who enter the market receive feedback and thus do have opportunities to learn across rounds. The equilibrium number of entrants is thus appropriate for the first round (no opportunities for learning) and serves as a no-learning benchmark for the others.

Population-averaged (marginal) specifications that do not account for the heterogeneity and test the effects of the chance manipulation on the average person yield qualitatively the same results (not reported here).

An analogous model without the interaction term yields a lower model fit (χ2 = 34.75). The difference in fit is statistically significant (p = 0.002).

We performed a similar analysis splitting participants in three groups: the best (rank between 1 and 5), medium (rank between 6 and 10), and the worst performance (rank between 11 and 15). This procedure yielded coefficients of “chance” of similar magnitudes for the best and the worst participants.

Initial confidence did not affect entry decision in the first round either. A logit model of entry that was fit on the data from the first rounds and included estimated and actual score and rank as independent variables, yielded no significant coefficients.

Overall, the gender difference in confidence about scores was not statistically significant (z = 0.94, n = 120, Wilcoxon rank-sum test), while the difference in confidence regarding placement in the ranking was significant (p < 0.01, z = 2.95, n = 120, Wilcoxon rank-sum test).

The gender gap in relative confidence echoes the findings of Niederle and Vesterlund (2007). In their experiment, men and women performed equally well on a test, but women were more likely to underrate their relative performance: 75% of men thought they were best in their group (of four participants), while only 43% of women shared this belief. In Niederle and Vesterlund’s experiment, higher overconfidence among men partially explained why men were more willing than women to select into a competitive environment.

p < 0.05, z = 2.33, Wilcoxon rank-sum test, n = 74 (“chance has been decisive”) and 46 (the opposite).

p < 0.001, z = -6.49, Wilcoxon rank-sum test, n = 51 (“outcomes are fair”) and 69 (the opposite).

References

Atkinson, J. W. (1957). Motivational determinants of risk-taking behavior. Psychological Review, 64, 359–372.

Barber, B., & Odean, T. (2001). Boys will be boys: gender, overconfidence, and common stock investment. Quarterly Journal of Economics, 116(1), 261–292.

Benoît, J.-P., & Dubra, J. (2009). Overconfidence? Unpublished working paper, London Business School and Universidad de Montevideo.

Byrnes, J. P., Miller, D. C., & Schafer, W. D. (1999). Gender differences in risk taking: a meta-analysis. Psychological Bulletin, 125(3), 367–383.

Camerer, C. F., & Lovallo, D. (1999). Overconfidence and excess entry: an experimental approach. American Economic Review, 89(1), 306–318.

Chevalier, J., & Ellison, G. (1997). Risk taking by mutual funds as a response to incentives. Journal of Political Economy, 105(6), 1167–1200.

Cohen, J., & Hansel, M. (1959). Preferences for different combinations of chance and skill in gambling. Nature, 183, 841–843.

Cohen, J., & Dearnaley, E. (1962). Skill and judgment of footballers in attempting to score goals: a study of psychological probability. British Journal of Psychology, 53, 71–86.

Cohen, J., Dearnaley, E. J., & Hansel, C. E. M. (1956). Risk and hazard: influence of training on the performance of bus drivers. Journal of the Operational Research Society, 7, 67–82.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448–474.

de Lara Resende, J. G., & Wu, G. (2010). Competence effects for choices involving gains and losses. Journal of Risk and Uncertainty, 40, 109–132.

Degeorge, F., Moselle, B., & Zeckhauser, R. (2004). The ecology of risk taking. Journal of Risk and Uncertainty, 28(3), 195–215.

Fischbacher, U. (1999). Ztree: A toolbox for readymade economic experiments. Working Paper, Institute For Empirical Research In Economics, University of Zurich.

Gaba, A., & Kalra, A. (1999). Risk behavior in response to quotas and contests. Marketing Science, 18(3), 417–434.

Gaba, A., Tsetlin, I., & Winkler, R. (2004). Modifying variability and correlation in winner-take-all contests. Operations Research, 52(3), 384–395.

Grieco, D., & Hogarth, R. M. (2009). Overconfidence in absolute and relative performance: the regression hypothesis and Bayesian updating. Journal of Economic Psychology, 30, 756–771.

Heath, C., & Tversky, A. (1991). Preference and belief: ambiguity and competence in choice under uncertainty. Journal of Risk and Uncertainty, 4, 5–28.

Hogarth, R. M., & Karelaia, N. (2009). Entrepreneurial success and failure: Confidence and fallible judgment. Working Paper, Universitat Pompeu Fabra, Barcelona.

Kahneman, D., & Lovallo, D. (1993). Timid choices and bold forecasts: a cognitive perspective on risk taking. Management Science, 39(1), 17–31.

Kőszegi, B. (2006). Ego utility, overconfidence, and task choice. Journal of the European Economic Association, 4(4), 673–707.

Kruger, J. (1999). Lake Wobegon be gone! The “below-average effect” and the egocentric nature of comparative ability judgments. Journal of Personality and Social Psychology, 77(2), 221–232.

Langer, E. J. (1975). The illusion of control. Journal of Personality and Social Psychology, 32(2), 311–328.

Larrick, R. P. (1993). Motivational factors in decision theories: the role of self-protection. Psychological Bulletin, 113, 440–450.

Lenney, E. (1977). Women’s self-confidence in achievement settings. Psychological Bulletin, 84, 1–13.

Miller, D. T., & Ross, M. (1975). Self-serving biases in the attribution of causality: fact or fiction? Psychological Bulletin, 82, 213–225.

Moore, D. A., & Cain, D. M. (2007). Overconfidence and underconfidence: when and why people underestimate (and overestimate) the competition. Organizational Behavior and Human Decision Processes, 103, 197–213.

Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review, 115(2), 502–517.

Moore, D. A., Oesch, J. M., & Zietsma, C. (2007). What competition? Myopic self-focus in market-entry decisions. Organization Science, 18(3), 440–454.

Niederle, M., & Vesterlund, L. (2007). Do women shy away from competition? Do men compete too much? Quarterly Journal of Economics, 122(3), 1067–1101.

Rapoport, A., Seale, D., Erev, I., & Sundali, J. (1998). Equilibrium play in large group market entry games. Management Science, 44(1), 119–141.

Rotter, J. B. (1966). Generalized expectancies for internal versus external control of reinforcements. Psychological Monographs, 80(1), 1–28.

Tsetlin, I., Gaba, A., & Winkler, R. L. (2004). Strategic choice of variability in multiround contests and contests with handicaps. Journal of Risk and Uncertainty, 29(2), 143–158.

Tversky, A., & Fox, C. R. (1995). Weighing risk and uncertainty. Psychological Review, 102, 269–283.

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors appreciate the insightful comments on earlier versions of this paper by Daniel Read and Don Moore as well as comments by seminar participants at the London Business School, the University of Trento, and Universitat Pompeu Fabra. They also thank Roger Rodrigo and Augusto Rupérez-Micola for help in conducting the experiments. This research was financed partially by grants from the Swiss National Science Foundation and the INSEAD Alumni Fund (Karelaia), and the Spanish Ministerio de Ciencia y Innovación (Hogarth), grant SEJ2006-14098.

Appendix

Appendix

1.1 Equilibrium entry predictions

Assuming risk neutrality and no private information about the probability of success on entry, there are multiple pure-strategy Nash equilibria with seven players (47%) entering a market that has a capacity of five. At equilibrium, participants do not expect to receive a larger payoff by changing their strategy, i.e., by entering if the decision was to stay out and staying out if the decision was to enter. In our game, when there are fewer than seven entrants, a participant who stayed out could have received a positive payoff by entering, and with more than seven entrants, a participant who entered could have avoided an expected loss by staying out. In particular, the expected payoff of each of seven entrants is  . If there are eight entrants, the individual expected payoff is

. If there are eight entrants, the individual expected payoff is  . Expected payoffs for all numbers of entrants are detailed in Table 5 (lower panel, first column).

. Expected payoffs for all numbers of entrants are detailed in Table 5 (lower panel, first column).

Provided that players cannot coordinate, there is a mixed-strategy equilibrium in which each risk-neutral player (without private information about the probability of success on entry) enters with a probability p. The value of p is found by equating the expected payoff of entry and the payoff of staying out (see also Rapoport et al. 1998):  . In this game, each player enters with probability p of 53%. That is, 7.9 players (out of 15) will enter on average each round (Table 5, lower panel, first column).

. In this game, each player enters with probability p of 53%. That is, 7.9 players (out of 15) will enter on average each round (Table 5, lower panel, first column).

If all players know their relative performance on the test, then clearly only the top five players (33% of all potential entrants) will enter. However, if players have imperfect information about their test performance, it is instructive to speculate how they might take account of competitors when assessing relative performance. Considerable evidence suggests that people tend focus on themselves and neglect others, thereby adopting a so-called “inside view” (Kahneman and Lovallo 1993; Camerer and Lovallo 1999; Kruger 1999; Moore et al. 2007). Thus, imperfect information about test performance could imply biased subjective estimates of probabilities of success. For example, assume that this bias is captured by a parameter α (-1 > α > 1) that adjusts the probability of success on entry. Then, a player’s (biased) expected payoff of entry when there are E entrants (E > 5) is  . Table 5 provides equilibrium results for α ≠ 0. For example, if α = 0.2, pure-strategy Nash equilibria occur when nine players (60%) enter the market, and if α = -0.2 six players (40%) enter. In terms of mixed strategies, if α = 0.2 the equilibrium probability of entry is 62% (9.3 entrants), and if α = -0.2 it is 46% (6.9 entrants).

. Table 5 provides equilibrium results for α ≠ 0. For example, if α = 0.2, pure-strategy Nash equilibria occur when nine players (60%) enter the market, and if α = -0.2 six players (40%) enter. In terms of mixed strategies, if α = 0.2 the equilibrium probability of entry is 62% (9.3 entrants), and if α = -0.2 it is 46% (6.9 entrants).

Rights and permissions

About this article

Cite this article

Karelaia, N., Hogarth, R.M. The attraction of uncertainty: Interactions between skill and levels of uncertainty in market-entry games. J Risk Uncertain 41, 141–166 (2010). https://doi.org/10.1007/s11166-010-9101-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-010-9101-1