Abstract

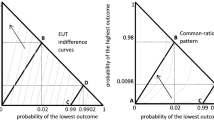

The results of a new experimental study reveal highly systematic violations of expected utility theory. The pattern of these violations is exactly the opposite of the classical common ratio effect discovered by Allais (1953). Two recent decision theories—stochastic expected utility theory (Blavatskyy 2007) and perceived relative argument model (Loomes 2008)—predicted the existence of a reverse common ratio effect. However, these theories can rationalize only one part of the new experimental data reported in this paper. The other part appears to be neither predicted by existing theories nor documented in the existing empirical studies.

Similar content being viewed by others

Notes

I am indebted to Ganna Pogrebna for conducting the second experiment in the US.

This possibility has been pointed out to me by an anonymous referee whose writing style remarkably resembles that of Graham Loomes.

References

Allais, M. (1953). Le Comportement de l’Homme Rationnel devant le Risque: Critique des Postulates et Axiomes de l’Ecole Américaine. Econometrica, 21, 503–546.

Ballinger, P., & Wilcox, N. (1997). Decisions, error and heterogeneity. Economic Journal, 107, 1090–1105.

Battalio, R., Kagel, J., & Jiranyakul, K. (1990). Testing between alternative models of choice under uncertainty: some initial results. Journal of Risk and Uncertainty, 3, 25–50.

Blavatskyy, P. (2007). Stochastic expected utility theory. Journal of Risk and Uncertainty, 34, 259–286.

Butler, D., & Loomes, G. (2007). Imprecision as an account of the preference reversal phenomenon. American Economic Review, 97(1), 277–297.

Camerer, C. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2, 61–104.

Conlisk, J. (1989). Three variants on the Allais example. American Economic Review, 79(3), 392–407.

Gul, F. (1991). A theory of disappointment aversion. Econometrica, 59, 667–686.

Gul, F., & Pesendorfer, W. (2006). Random expected utility. Econometrica, 71, 121–146.

Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica, 47, 263–291.

Loomes, G. (2005). Modelling the stochastic component of behavior in experiments: some issues for the interpretation of data. Experimental Economics, 8, 301–323.

Loomes, G. (2008). Modelling choice and valuation in decision experiments. University of East Anglia working paper.

Loomes, G., & Sugden, R. (1995). Incorporating a stochastic element into decision theories. European Economic Review, 39, 641–648.

Loomes, G., & Sugden, R. (1998). Testing different stochastic specifications of risky choice. Economica, 65, 581–598.

MacCrimmon, K., & Smith, M. (1986). Imprecise equivalences: preference reversals in money and probability. University of British Columbia working paper #1211.

Quiggin, J. (1981). Risk perception and risk aversion among Australian farmers. Australian Journal of Agricultural Economics, 25, 160–169.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Viscusi, W. K. (1989). Prospective reference theory: toward an explanation of the paradoxes. Journal of Risk and Uncertainty, 2, 235–264.

Yaari, M. (1987). The dual theory of choice under risk. Econometrica, 55, 95–115.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Instructions

Welcome to our experiment! This is an experiment in decision theory. This experiment is financed from research funds. In this experiment we would like to ask you to take a number of decisions.

At the end of the experiment we will determine how much money you get. Your payoff depends only on your decisions and the realization of random events. Your payoff does not depend on the decisions of other participants. Your anonymity will be preserved during and after the experiment.

During the experiment you need to answer a number of questions that appear on your computer screen one by one. Please note that that there are no right or wrong answers in this experiment. Here is an example of a typical question that you may receive during the experiment:

At the end of the experiment you have to spin a roulette wheel to randomly select one question number. This question will be used to determine your payoff. For example, suppose that the roulette wheel stops at number 1. Then question 1 is selected. Suppose that your question 1 is a question shown above. If you have chosen the right alternative in this question, you receive $20. If you have chosen the left alternative in this question, you need to draw one of four cards. You receive $80 if your drawn card is red and you receive nothing if your drawn card is black. Please note that any question can be randomly selected at the end to determine your payoff. So it is in your best interest to answer all questions carefully.

Rights and permissions

About this article

Cite this article

Blavatskyy, P.R. Reverse common ratio effect. J Risk Uncertain 40, 219–241 (2010). https://doi.org/10.1007/s11166-010-9093-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-010-9093-x