Abstract

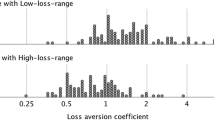

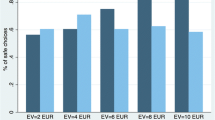

A behavioral condition of loss aversion is proposed and tested. Forty-nine students participated in experiments on binary choices among lotteries involving small scale real gains and losses. At the aggregate level, a significant proportion of the choices are in the direction predicted by loss aversion. Individuals can be classified as loss averse (28 participants), gain seeking (12), and unclassified (9). A comparison with risk behavior for binary choices on lotteries involving only gains shows that risk attitudes vary across these domains of lotteries. A gender effect is also observed: proportionally more women are loss averse. In contrast to the predictions of comonotonic independence, the size of common outcomes has systematic influence on choice behavior.

Similar content being viewed by others

References

Abdellaoui, Mohammed. (2000). “Parameter-free Elicitation of Utility and Probability Weighting Functions,” Management Science 46, 1497–1512.

Abdellaoui, Mohammed, Han Bleichrodt, and Corina Paraschiv. (2004) Measuring Loss Aversion under Prospect Theory: A Parameter-Free Approach. iMTA/iBMG, Erasmus University, Rotterdam, The Netherlands.

Abdellaoui, Mohammed, Frank Vossmann and Martin Weber. (2005). “Choice-based Elicitation and Decomposition of Decision Weights for Gains and Losses under Uncertainty,” forthcoming in Management Science.

Barberis, Nicholas and Richard H. Thaler. (2003). “A Survey of Behavioral Finance,” in George M. Constantinides, Milt Harris, and R. Stulz (eds.), Handbook of the Economics of Finance, Amsterdam: Elsevier.

Barron, Greg and Ido Erev. (2003). “Small Feedback-based Decisions and Their Limited Correspondence to Description-based Decisions,” Journal of Behavioral Decision Making 16, 215–233.

Bateman, Ian J., Alistair Munro, Bruce Rhodes, Chris Starmer and Robert Sugden. (1997). “A Test of the Theory of Reference-Dependent Preferences,” Quarterly Journal of Economics 112, 647–661.

Battalio, Raymond C., John H. Kagel and Komain Jiranyakul. (1990). “Testing Between Alternative Models of Choice Under Uncertainty: Some Initial Results,” Journal of Risk and Uncertainty 3, 25–50.

Beattie, Jane and Graham Loomes. (1997). “The Impact of Incentives upon Risky Choice Experiments,” Journal of Risk and Uncertainty 14, 155–168.

Benartzi, Shlomo and Richard H. Thaler. (1995). “Myopic Loss Aversion and the Equity Premium Puzzle,” Quarterly Journal of Economics 110, 73–92.

Benartzi, Shlomo and Richard H. Thaler. (1999). “Risk Aversion or Myopia? Choices in Repeated Gambles and Retirement Investments,” Management Science 45, 364–381.

Birnbaum, Michael H. (2004). “Causes of Allais Common Consequence Paradoxes: An Experimental Dissection,” Journal of Mathematical Psychology 48, 87–106.

Birnbaum, Michael H. and Juan B. Navarrete. (1998). “Testing Descriptive Utility Theories: Violations of Stochastic Dominance and Cumulative Independence,” Journal of Risk and Uncertainty 17, 49–78.

Bleichrodt, Han, Jose Luis Pinto and Peter P. Wakker. (2001). “Making Descriptive Use of Prospect Theory to Improve the Prescriptive Use of Expected Utility,” Management Science 47, 1498–1514.

Bleichrodt, Han and Jose Luis Pinto. (2000). “A Parameter-Free Elicitation of the Probability weighting Function in Medical Decision Analysis,” Management Science 46, 1485–1496.

Bowman, David, Deborah Minehart, and Matthew Rabin (1999) “Loss Aversion in a Consumption-Savings Model,” Journal of Economic Behavior and Organization 38, 155–178.

Camerer, Colin F. (1989). “An Experimental Test of Several Generalized Utility Theories,” Journal of Risk and Uncertainty 2, 61–104.

Camerer, Colin F. (1998). “Bounded Rationality in Individual Decision Making,” Experimental Economics 1, 163–183.

Camerer, Colin F. and Teck-Hua Ho. (1994). “Violations of the Betweenness Axiom and Nonlinearity in Probability,” Journal of Risk and Uncertainty 8, 167–196.

Camerer, Colin F. and Robin M. Hogarth. (1999). “The Effects of Financial Incentives in Experiments: A Review and Capital-Labor-Production Framework,” Journal of Risk and Uncertainty 19, 7–42.

Camerer, Colin F., George Loewenstein and Matthew Rabin. (2004). Advances in Behavioral Economics, Princeton, NJ: Princeton University Press.

Chateauneuf, Alain and Peter P. Wakker. (1999). “An Axiomatization of Cumulative Prospect Theory for Decision under Risk,” Journal of Risk and Uncertainty 18, 137–145.

Chew, Soo Hong and Peter P. Wakker. (1996). “The Comonotonic Sure-Thing Principle,” Journal of Risk and Uncertainty 12, 5–27.

Cubitt, Robin P., Chris Starmer and Robert Sugden. (1998). “On the Validity of the Random Lottery Incentive System,” Experimental Economics 1, 115–131.

Currim, Imran S. and Rakesh K. Sarin. (1989). “Prospect Versus Utility,” Management Science 35, 22–41.

Edwards, Ward. (1953). “Probability-Preferences in Gambling,” Americal Journal of Psychology 66, 349–364.

Edwards, Ward. (1954a). “Probability-Preferences Among Bets With Differing Expected Values,” Americal Journal of Psychology 67, 56–67.

Edwards, Ward. (1954b). “The Reliability of Probability-Preferences,” Americal Journal of Psychology 67, 68–95.

Edwards, Ward. (1955). “The Prediction of Decisions Among Bets,” Journal of Experimental Psychology 50, 201–214.

Edwards, Ward. (1962). “Subjective Probabilities Inferred from Decisions,” Psychological Review 69, 109–135.

Etchart-Vincent, Nathalie. (2004). “Is Probability Weighting Sensitive to the Magnitude of Consequences? An Experimental Investigation on Losses,” Journal of Risk and Uncertainty 28, 217–235.

Fennema, Hein and Peter P. Wakker. (1997). “Original and Cumulative Prospect Theory: A Discussion of Empirical Differences,” Journal of Behavioral Decision Making 10, 53–64.

Fennema, Hein and Marcel van Assen. (1999). “Measuring the Utility for Losses by Means of the Tradeoff Method,” Journal of Risk and Uncertainty 17, 277–295.

Fishburn, Peter C. (1977). “Mean-Risk Analysis with Risk Associated with Below-Target Returns,” American Economic Review 67, 116-126.

Gilboa, Itzhak (1987). “Expected Utility with Purely Subjective Non-Additive Probabilities,” Journal of Mathematical Economics 16, 65–88.

Harless, David W. (1992). “Predictions about Indifference Curves inside the Unit Triangle: A Test of Variants of Expected Utility Theory,” Journal of Economic Behavior and Organization 18, 391–414.

Harless, David W. and Colin F. Camerer. (1994). “The Predictive Utility of Generalized Expected UtilityTheories,” Econometrica 62, 1251–1289.

Heath, Chip, Steven Huddart and Mark Lang. (1999). “Psychological Factors and Stock Option Exercise,” Quarterly Journal of Economics 114, 601–627.

Hey, John D. and Chris Orme. (1994). “Investigating Generalizations of Expected Utility Theory Using Experimental Data,” Econometrica 62, 1291–1326.

Hogarth, Robin M. and Hillel J. Einhorn. (1990). “Venture Theory: A Model of Decision Weights,” Management Science 36, 780–803.

Holt, Charles A. and Susan K. Laury. (2002). “Risk Aversion and Incentive Effects,” American Economic Review 92, 1644–1655.

Holthausen, Duncan M. (1981). “A Risk-Return Model with Risk and Return Measured as Deviations from a Target Return,” The American Economic Review 71, 182–188.

Jullien, Bruno and Bernard Salanié. (2000). “Estimating Preferences under Risk: The Case of Racetrack Bettors,” Journal of Political Economy 108, 503–530.

Kahneman, Daniel, Jack L. Knetsch and Richard H. Thaler. (1990). “Experimental Tests of the Endowment Effect and the Coase Theorem,” Journal of Political Economy 98, 1325–1348.

Kahneman, Daniel and Amos Tversky. (1979). “Prospect Theory: An Analysis of Decision under Risk,” Econometrica 47, 263–291.

Kahneman, Daniel and Amos Tversky. (2000). Choices, Values, and Frames. New York: Cambridge University Press.

Kameda, Tatsuya and James H. Davis. (1990). “The Function of the Reference Point in Individual and Group Risk Decision Making,” Organizational Behavior and Human Decision Processes 46, 55–76.

Köbberling, Veronika and Peter P. Wakker. (2004). “A Simple Tool for Qualitatively Testing, Quantitatively Measuring, and Normatively Justifying Savage's Subjective Expected Utility,” Journal of Risk and Uncertainty 28, 135–145.

Köbberling, Veronika and Peter P. Wakker. (2005). “An Index of Loss Aversion,” Journal of Economic Theory 122, 119–131.

Laury, Susan K. and Charles A. Holt. (2000). “Further Reflections on Prospect Theory,” Working Paper, The Andrew Young School of Political Studies, Georgia State University, Atlanta, USA.

Loewenstein, George F. and Daniel Adler. (1995). “A Bias in the Prediction of Tastes,” Economic Journal 105, 929–937.

Loomes, Graham, Peter G. Moffatt and Robert Sugden. (2002). “A Microeconometric Test of Alternative Stochastic Theories of Risky Choice,” Journal of Risk and Uncertainty 24, 103–130.

Luce, Duncan R. (1991). “Rank- and-Sign Dependent Linear Utility Models for Binary Gambles,” Journal of Economic Theory 53, 75–100.

Luce, Duncan R. (2000). Utility of Gains and Losses: Measurement-Theoretical and Experimental Approaches, New Jersey: Lawrence Erlbaum Associates.

Luce, Duncan R. and Peter C. Fishburn. (1991). “Rank- and Sign-Dependent Linear Utility Models for Finite First-Order Gambles,” Journal of Risk and Uncertainty 4, 29–59.

Markowitz, Harry. (1952). “The Utility of Wealth,” The Journal of Political Economy 60, 151–158.

McClelland, Gary H., William D. Schulze and Don L. Coursey. (1993). “Insurance for Low-Probability Hazards: A Bimodal Response to Unlikely Events,” Journal of Risk and Uncertainty 7, 95–116.

Myagkov, Mikhail and Charles R. Plott. (1997). “Exchange Economies and Loss Exposure: Experiments Exploring Prospect Theory and Competitive Equilibria in Market Environments,” American Economic Review 87, 801–828.

Neilson, William S. (2002). “Comparative Risk Sensitivity with Reference-Dependent Preferences,” Journal of Risk and Uncertainty 24, 131–142.

Odean, Terrance. (1998). “Are Investors Reluctant to Realize Their Losses,” Journal of Finance 53, 1775–1798.

Payne, John W. (2005). “It is Whether You Win or Lose: The Importance of the Overall Probabilities of Winning or Losing in Risky Choice,” Journal of Risk and Uncertainty 30, 5–19.

Powell, Melanie, Renate Schubert and Matthias Gysler. (2001). “How to Predict Gender-Differences in Choice under Risk: A Case for the Use of Formalized Models,” Swiss Federal Institute of Technology, Zurich.

Rabin, Matthew. (2000). “Risk Aversion and Expected-utility Theory: A Calibration Theorem,” Econometrica 68, 1281–1292.

Rabin, Matthew and Richard H. Thaler. (2001). “Anomalies: Risk Aversion,” Journal of Economic Perspectives 15, 219–232.

Samuelson, William F. and Richard J. Zeckhauser. (1988). “Status Quo Bias in Decision Making,” Journal of Risk and Uncertainty 1, 7–59.

Schmeidler, David. (1989). “Subjective Probability and Expected Utility without Additivity,” Econometrica 57, 571–587.

Schmidt, Ulrich and Stefan Traub. (2002). “An Experimental Test of Loss Aversion,” Journal of Risk and Uncertainty 25, 233–249.

Schmidt, Ulrich and Horst Zank. (2005). “What is Loss Aversion?,” Journal of Risk and Uncertainty 30, 157–167.

Schoemaker, Paul J.H. (1990). “Are Risk- Attitudes Related across Domains and Response Modes?,” Management Science 36, 1451–1463.

Smith, Vernon L. and James M. Walker. (1993). “Monetary Rewards and Decision Cost in Experimental Economics,” Economic Inquiry 31, 245–261.

Starmer, Chris. (2000). “Developments in Non- Expected Utility Theory: The Hunt for a Descriptive Theory of Choice under Risk,” Journal of Economic Literature 38, 332–382.

Starmer, Chris and Robert Sugden. (1989). “Violations of the Independence Axiom in Common Ratio Problems: An Experimental Test of Some Competing Hypotheses,” Annals of Operations Research 19, 79–102.

Thaler, Richard H. (1980). “Toward a Positive Theory of Consumer Choice,” Journal of Economic Behavior and Organization 1, 39-60.

Thaler, Richard H. and Eric J. Johnson. (1990). “Gambling with the House Money and Trying to Break Even: The Effects of Prior Outcomes on Risky Choice,” Management Science 36, 643–660.

Tversky, Amos and Daniel Kahneman. (1992). “Advances in Prospect Theory: Cumulative Representation of Uncertainty,” Journal of Risk and Uncertainty 5, 297–323.

Viscusi, Kip W., Wesley A. Magat, and Joel Huber. (1987). “An Investigation of the Rationality of Consumer Valuations of Multiple Health Risks,” The Rand Journal of Economics 18, 465–479.

Wakker, Peter P. (1989). Additive Representations of Preferences, A New Foundation of Decision Analysis, Dordrecht, The Netherlands: Kluwer Academic Publishers.

Wakker, Peter P. (1994). “Separating Marginal Utility and Probabilistic Risk Aversion,” Theory and Decision 36, 1–44.

Wakker, Peter P. and Daniel Deneffe. (1996). “Eliciting von Neumann-Morgenstern Utilities When Probabilities Are Distorted or Unknown,” Management Science 42, 1131–1150.

Wakker, Peter P., Ido Erev and Elke U. Weber. (1994). “Comonotonic Independence: The Critical Test between Classical and Rank-Dependent Utility Theories,” Journal of Risk and Uncertainty 9, 195–230.

Wakker, P. Peter and Amos Tversky. (1993). “An Axiomatization of Cumulative Prospect Theory,” Journal of Risk and Uncertainty 7, 147–176.

Weber, Elke U. and Britt Kirsner. (1997). “Reasons for Rank-Dependent Utility Evaluation,” Journal of Risk and Uncertainty 14, 41–61.

Weber, Martin and Colin F. Camerer. (1998). “The Disposition Effect in Securities Trading: An Experimental Analysis,” Journal of Economic Behavior and Organization 33, 167–184.

Wu, George and Richard Gonzalez. (1996). “Curvature of the Probability Weighting Function,” Management Science 42, 1676–1690.

Wu, George and Richard Gonzalez. (1998). “Common Consequence Conditions in Decision Making under Risk,” Journal of Risk and Uncertainty 16, 115–139.

Wu, George and Alex Markle. (2004). “An Empirical Test of Gain-Loss Separability in Prospect Theory,” Working Paper, University of Chicago.

Zank, Horst. (2004). “On the Hypothesis of Loss Aversion: An Analytical Approach,” Economic Studies, University of Manchester, UK.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification: D81, C91

Rights and permissions

About this article

Cite this article

Brooks, P., Zank, H. Loss Averse Behavior. J Risk Uncertainty 31, 301–325 (2005). https://doi.org/10.1007/s11166-005-5105-7

Issue Date:

DOI: https://doi.org/10.1007/s11166-005-5105-7