Abstract

This paper examines the existence of a well documented (Heston et al. in J Finance 65:1369–1407) (hereafter HKS 2010) intraday momentum pattern in the cross section of stock returns for three previously un-examined markets outside the US—UK, China and Brazil. While the stocks in UK and Brazil exhibit the pattern, the evidence from China is lacklustre. We utlitlize the presence of dual listed A-shares (dominated by domestic retail investors) and their B- and H-share counterparts (dominated by foreign institutional investors) of the same firms which provide a natural experiment setting to analyse the impact of investor clientele on the proliferation of HKS (2010) pattern. Our findings indicate that pattern is much weaker in A-shares (owned mostly by domestic retail investors) as compared to their B- and H-share counterparts. As a further robustness test we examine the impact of an exogenous shock that leads to an increase in institutional ownership namely the partial index inclusion of A-shares in the Morgan Stanley Capital International (MSCI) Emerging Markets Index. Our findings indicate an increasing level of the manifestation of the intraday pattern upon inclusion of A-shares to the MSCI.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

“China is opening up faster than most people believe or think. We do not see any regression of that. If anything, we see a speeding up.Footnote 1”

(Henry Fernandez, CEO, Morgan Stanley Capital International.)

“The mainland China stock market is mostly owned by retail investors, so it is very driven by sentiment. Those retail investors are really worried about trade wars, so this foreign investment will help institutionalize the market and slowly make it more dominated by professional investors.Footnote 2”

(Brendan Ahern, CEO, KraneShares MSCI China A Shares ETF.)

1 Introduction

The seminal study by Jegadeesh and Titman (1993) documents positive returns on momentum strategies in the US for the holding periods of 3- to 12-months. This form of conventional momentum has since been widely documented in various studies across the world (see Rouwenhorst 1999; Jegadeesh and Titman 2001; Griffin et al. 2003). While momentum is pervasive across markets and several asset classes (Daniel and Moskowitz 2016) and provides a large magnitude return of 12 % in the US and Europe (Chui et al. 2010) there is still a noteworthy exception-China. The Chinese markets demonstrate poor performance of the conventional momentum strategy as demonstrated by studies such as Pan et al. (2013) and Gao et al. (2021). Also, since the US and China are the two largest markets in the world, this difference in their momentum patterns attracts a lot of interest from global investors (Ma et al. 2024).

TechnologicalFootnote 3 and structuralFootnote 4 advancements in financial markets in a HFT trading world have brought about a revolution (O’hara 2015) and have enabled investors to formulate high frequency momentum strategies ranging from few hours to few days. With the increasing availability of intraday data, focus has turned to studying high frequency momentum. Initially, we witnessed a flurry of intraday momentum studies focusing on the US markets (see for example Renault 2017 and Gao et al. 2018) which soon led to studies focusing on Chinese markets. The exponential rise of the Chinese economyFootnote 5 and the elevation of its status as the world’s second most valuable stock marketFootnote 6 only behind the US in terms of market capitalisation, but ahead of the US in terms of new initial public offerings in recent times (Qian et al. 2024)it has been the focus of attention by international investors (Carpenter et al. 2021.Hence, there has been increased interest in studying intraday momentum in Chinese markets.

Jin et al. (2020) find that the first half hour of returns predict the last half hour of returns for four Chinese commodity markets namely—copper, steel, soyabean and soyabean meal futures. Gao et al. (2019) find intraday momentum in stocks such that the first half hour of returns positively predict the last half hour of daily returns. Limkriangkrai et al. (2023) document intraday momentum effect for ETFs in China. Our study is linked to other studies of high frequency momentum in China as we look for evidence of the existence of the HKS (2010) in Chinese markets. We observe that the HKS (2010) pattern is much weaker in China as compared to the other two markets that we study—UK and Brazil. We also test for existence of the pattern in the UK (developed market) and Brazil (developing market) to provide further out of sample evidence on the existence of the HKS (2010) intraday momentum patterns. It is also to ensure that the non-existence of the pattern in China is not merely due to factors such as academic attention which tends to weaken the proliferation of existing effects and anomalies (Shanaev and Ghimire 2021).

In contrast to the US markets,Footnote 7 the Chinese markets are dominated by individual retail investors with an average age of 50 years and poor education and they exhibit speculative trading (characterized by the highest turnover ratios in the world) and are subject to various regulatory constraints (Pan et al. 2015). Kong et al. (2017) provide further support to the findings of Pan et al. (2015) and postulate that the unusually high turnover of around 500 percent alludes to the highly speculative or ’gambling’ nature of investors in China. Furthermore, even the most sophisticated investors and analysts regard the Chinese stock market as a “casino" who blame the “erratic and irrational" behaviour on the individual retail investors.Footnote 8

China’s structural differences make it an ideal laboratory to study the HKS (2010) effect. Chinese stock market’s unique share class structure which is split into A-, B- and H-shares with the presence of dual listed shares provides us with an opportunity to delineate the role that investor clientele plays in the effect’s proliferation. In this study, we examine the HKS (2010) intraday momentum pattern in the cross-section of stock returns for the main Chinese share sub-classes namely the A-shares (available under QFII and RQFII quota restrictions to foreign investors), B-shares (available to foreign investors without restrictions) and H-shares(listed in Hong Kong but available to domestic investors through the stock connect program).

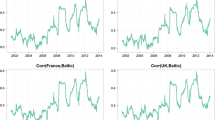

Figure 1 shows that the intraday momentum pattern in the cross-section of stock returns is relatively weaker in the all A-shares sample compared to the UK (chosen due to its size) and Brazil (chosen because it is an emerging market). We attribute these findings to the retail investor dominated markets of China. This study offers a unique opportunity to study the impact of investor composition on the proliferation of the intraday momentum pattern in the cross-section of stock returns. Table 1 highlights the unique features of China’s various shares sub-classes.

We exploit the dual listed A- and B-shares and the dual listed A- and H-shares as these stocks have the same balance sheets and cash flows and only differ in terms of ownership-individual versus foreign/institutional investors. Also, the dual-listed A-shares are different from their H-share counterparts since the Hong Kong stock market doesn’t constitute the same level of limits of arbitrage in terms of price limits and day trading rules as do the Chinese markets (see Gu et al. 2018). The Chinese A-shares are often exploited by researchers to unravel the impact that their idiosyncrasies have on various momentum anomalies (Ouyang et al. 2024). Figures 2 and 3 show the findings for dual-listed B-shares and H-shares respectively. These dual-listed B- and H-shares show greater strength of the pattern than their A-share counterparts. The difference in the strength of the momentum pattern is even higher for the H-shares and their A-share counterparts because the H-shares provide lower limits of arbitrage which are even more desirable for institutional investors. These findings are consistent with studies in the past such as Kaniel et al. (2008). They find that individual investors have a tendency to take a contrarian strategy as opposed to a momentum strategy typical of institutions and mutual funds (Grinblatt et al. 1995). Our findings further support the findings of Baltzer et al. (2019) who study the entire German stock market and find that foreign investors and financial institutions, particularly mutual funds investors are momentum investors whereas, individual investors are contrarians.

The reforms carried out by Chinese policymakers and regulators paved the way for a landmark event. On June 1, 2018 Morgan Stanley Capital International(MSCI hereafter) initiated its first phase of including China’s A-shares into its Emerging Markets Index. This was then followed by the second phase of inclusion on September 1, 2018 of what analysts believe to be a multi-year plan to increase the weight of A-shares by MSCI in its Emerging Markets Index. The index is followed by active and passive managers controlling assets worth 1.6 trillion US Dollars and some analysts are forecasting a net inflow of upto 600 billion US Dollars into the Chinese A-shares over the next five to ten years after one hundred percent inclusion is achieved.Footnote 9

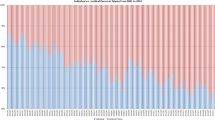

While these reforms have led to the partial inclusion of A-shares in the Emerging Markets Index by MSCI, there are investors who are optimistic and some are sceptic of the impact of partial inclusion of A-shares into the MSCI Emerging Markets Index and will not be influenced by it in terms of their stock pickingFootnote 10. We shed more light on the impact of index inclusion on the 233 A-shares and show that institutional ownership, percentage of float held by institutions, number of institutions holding the stocks and foreign ownership all four measures show an increase post inclusion. Other studies such as Cortina et al. (2024) have also shown a rise in foreign ownership of Chinese A-shares post MSCI inclusion. The changes in key variables of institutional ownership are shown in Table 11. Institutional holdings rise from 49 percent before inclusion to 55 percent after inclusion. The percentage of float held by institutions rises from 18 percent to 29 percent. The institutional base in terms of the number of institutions owning or trading the stocks has risen to 150 from a pre-inclusion level of 100. Also, domestic ownership declined by 2 percent and made way for an increase in foreign ownership.

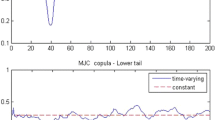

We use the exogenous increase in institutional ownership as a result of MSCI Emerging Markets index inclusion of 233 A-shares to further study its impact on the intraday momentum pattern in the cross-section of stock returns. MSCI inclusion of Chinese A-shares has attracted massive interest and studies like Li et al. (2024a) show that MSCI inclusion has reduced implicit market barriers for foreign investors which has attracted them to A-shares and led to greater market integration. The results of the impact of inclusion in the index are depicted in Fig. 4. We observe that following the inclusion in the MSCI Emerging Markets Index, the 233 A-shares exhibit the intraday momentum with greater strength and point to the importance of institutional investors in explaining the intraday momentum in the cross-section of stock returns. This provides further evidence as to the impact of institutionalization on prevalence of the pattern and also further re-enforces our initial findings which differ between all A-shares and the UK and China as well as between A-shares and their dual listed B-share and H-share counterparts. These findings are consistent with Nofsinger and Sias (1999). They show that herding and feed back trading by institutional investors is more effective in leading to the momentum effect as compared to that by individual investors.

Li and Wang (2010) show that institutional investors in China have a tendency to pick large stocks and concentrate their daily trades in large market cap stocks. Therefore, we turn our focus to the impact of size on the propensity with which the intraday momentum pattern propagates. Figure 5 shows the dispersion of the intraday momentum pattern across small, medium and large stocks. We classify the all A-shares sample into small, medium and large stocks based on size terciles. Our regression results indicate that the pattern is strongest in large stocks and weakest in small stocks. This confirms findings of Li and Wang (2010) and further re-enforces the fact that the pattern is weaker in Chinese A-shares due to a lower level of institutional holdings and more active participation by retail investors.Furthermore, Campbell et al. (2009) lend support to our findings of relatively weaker presence of the intraday momentum pattern in our study as they point to the highly persistent trading behaviour of institutions in daily trading which is a pre-requisite for the intraday momentum effect that we are studying.

This study goes further beyond just examining the existence of the HKS (2010) pattern in the Chinese stock market. We now focus on half-hour trading intervals which are not exact half-hour multiples of a trading day, but are actually within the trading day and extend this to all intervals for up to three trading days. This allows us to study the markets for any patterns that may arise therein and that may shed more light on the Chinese retail investor’s trading preferences. Our findings indicate the presence of a strong reversal pattern during the first three half-hour intervals immediately after the passing of 24-hour period or a whole trading day for up to two days in a row. These findings re-enforce the contrarian nature of retail investors that has been previously documented in the literature (Kaniel et al. 2008. It shows that retail investors place contrarian trades that are predictable and their holding periods are just over 24-hour and point to the day trading rule as playing a role in their behaviour. This is not the case for the UK markets which demonstrate no such reversals just beyond the daily trading lag.

In addition, when we run the regression for half-hour returns on intraday lags within the trading day, we notice that short-term return reversals last for 0 to 30 minutes for Chinese markets and they last for 0 to 30 minutes for the UK market as well. However, the regression estimate and t-statistics are higher for the Chinese markets. This shows that Chinese markets as a whole are somewhat less efficient than the UK markets. These findings are consistent with Chordia et al. (2005) who find that it takes between 30 to 60 minutes for the US markets to become efficient but their sample period ends in 2002.

Gao et al. (2018) discuss various reasons such as macroeconomic news releases and high volumes of trading activity owing to portfolio adjustments that make the opening and closing half-hour intervals particularly important. Our cross-sectional regression results also indicate that the Heston et al. (2010) pattern is mainly concentrated in the first- and the last half-hour of the trading day for Chinese markets. This is in contrast with the findings of Heston et al. (2010) who document the presence of the pattern throughout the day. The findings provide further support to the impact of index inclusion on the Chinese A-shares as mostly indexers are most active during the opening and closing half-hour intervals of the trading day (Gao et al. 2018).

The remainder of this paper is organized as follows. In Sect. 2, we dicuss the related literature. Section 3 discusses the data and methodology. Section 4 provides the empirical findings and the discussion. Finally, Sect. 5 offers a conclusion to the paper.

2 Literature review

Our study is linked to two strands of literature. The first strand of literature is based on studies which attempt to study evidence linked to momentum patterns documented in the US and the non-US markets.The interest in momentum studies stems from the fact that momentum strategy profits could be as high as 12% in the US and Europe as reported by Chui et al. (2010). Heston and Sadka (2008) initially found that seasonality exists for individual stocks in the cross-section of returns for the same calendar month for a period of up to twenty years. Heston and Sadka (2010) find that a stock that outperforms the broader market in a particular month continues to outperform in that same particular month over the next 5 years and provide international evidence of the pattern in Canada, Japan and 12 European markets. Li et al. (2018) study the Heston and Sadka (2008) seasonality pattern for 42 advanced and emerging markets between 1995 to 2013 and conclude that return seasonality is economically significant primarily in advanced markets but not in emerging markets.

HKS (2010) was the first study to provide empirical evidence on the existence of intraday patterns in the cross-section of stock returns. The pattern can be interpreted as an intraday momentum phenomenon that leads to significant predictability in daily (24-h) multiples of each half-hour interval returns, during the trading day; for up to forty trading days in a row. To put it into perspective, the returns on a stock today between 1:00 to 1:30 pm exhibit momentum over the same interval for up to forty trading days in a row.

Our study is related to several other studies that examine the momentum effect at relatively longer horizons (see Chui et al. 2010, 2022) in Chinese markets and other international markets beyond the United States. However, to our best knowledge, this is the first study that examines the HKS (2010) intraday momentum in the cross-section of stock returns beyond the US market. International evidence on any momentum pattern observed in the US is significant as it provides out-of-sample evidence (Heston and Sadka 2010) and also gives external validity to the existence of the anomaly solely observed in a particular market (Cakici et al. 2023). Hence, our study makes a major contribution by being the first to test HKS (2010) beyond the US market in three markets-China (emerging market), UK(developed market) and Brazil(emerging market).

The second strand of literature that our study is linked to is the role that institutional investors play in financial markets. Chui et al. (2022) go as far as calling the segmented Chinese market with A- and B-shares as an \('\)ideal laboratory\('\) for studying the varying impacts of investor composition on the momentum effect. Institutional investors are believed to have various desirable impacts on financial markets. For instance, institutional investors reduce firm mis-valuation (Borochin and Yang 2017), increase innovation output (Bena et al. 2017), improve long-run performance (Appel et al. 2016) and reduce information asymmetry (Boone and White 2015) among various others. More specifically, an empirical study on the Chinese markets by Tian et al. (2018) finds that institutional investors provide stability to the market by reducing the impact of extreme swings.

Chui et al. (2022) highlight how dual listed A- and B-class shares of some Chinese firms allow us to differentiate between their momentum patterns based on their unique clienteles as both the share classes essentially have the same cash flows. Furthermore, Chui et al. (2022) elaborate and attribute clientele differences in dual listed A- and B-class shares to three exogenous features in Chinese financial markets-currency regulations restrict domestic investors from participating in purchase of B-shares (settled in USD or HKD), foreign institutions are restricted by regulatory quotas to invest in A-shares and the inability of domestic institutions to be able to purchase B-shares making all B-shares institutional ownership foreign.

Luo et al. (2023) show that retail investors are mostly contrarian traders(who facilitate return reversals rather than producing momentum) by utilizing trader specific data from a large panel of US brokerage accounts. On the other hand, (Chui et al. 2022) postulate that momentum arises due to the under-reaction of active investors to fundamental information. The hypothesis that active investors under-react to fundamental information and therefore drive momentum, is confirmed by the baseline momentum results for B-shares obtained by (Chui et al. 2022) that are dominated by foreign institutional investors (who are active investors) but not noise traders and hence under-react to fundamental information thereby allowing a pattern of returns to continue and produce momentum. Furthermore, they also provide evidence that the post-earnings drift is only found in B-shares further confirming the conjecture that active foreign institutional investors under-react to fundamental information. Foreign institutional investors are known to be more sophisticated than retail investors who are considered novice therefore, the clienteles of A-shares are dominated by more noise traders than their dual listed B-share counterparts dominated by active investors who under-react to fundamental information and refrain from undertaking contrarian strategies (Chui et al. 2022).

Given the importance of institutional investors, Chinese policymakers and regulators have been steadfast to make the necessary reforms to attract institutional investors. The main reforms can be chronologically summarized as follows-capital mobility restrictions were eased by relaxing rules on Qualified Foreign Institutional Investor (hereafter QFII) repatriation (2013), launching of Shanghai connectFootnote 11 (2014), tremendous alleviation of uncertainties regarding the capital gains tax (2014), tightening of rules on stock trading suspensions(2016), QFII and Renminbi Qualified Foreign Institutional Investor (hereafter RQFII) quotas linked to fund size (2016), beneficiary ownership rules made more investor friendly and transparent(2016), Shenzen connect launched in 2016 and an easing of requirements that previously restricted creation of index-linked investment products(2017)Footnote 12. These attempts to liberalize the stock markets and open them up to foreign investors has led to significant increase in investment and capital inflows (Li et al. 2024b).

HKS (2010) identify two potential reasons for this seasonality in return predictability namely—high auto-correlations in institutional fund flows and algorithmic trading. Bogousslavsky (2021) further study the HKS (2010) pattern and find evidence that clientele effects drive the pattern. To study the impact of institutional fund flows and investors on the HKS (2010) we further use an exogenous shock to insitutional fund flows that came through the inclusion of some Chinese stocks in the MSCI index as evident in Table 11. MSCI index inclusion has also been used to study the impact of increase in institutional funds flows on price efficiency by Jiao et al. (2024). Therefore, this study uses MSCI index inclusion (which led to a significant increase in institutional ownership) on the strength of the HKS (2010) intraday momentum pattern. In doing so, this study contributes to the existing literature and allows the policymakers to understand the impact of changes that allowed the incorporation of Chinese stocks in MSCI index. The second major contribution of this study is that it demonstrates the positive impact that MSCI index inclusion has on the included shares that start to behave like developed market shares which have a high percentage of institutional investors and exhibit a much stronger HKS (2010) intraday momentum pattern.

Various studies that have been conducted to examine the presence of the momentum effect in China have also attempted to provide potential explanations for the absence of the effect in China. For instance, Chui et al. (2010) demonstrate cultural differences explain the weaker presence of momentum in Asian emerging markets including China. Yao et al. (2022) demonstrate that individual investor preferences play a large role in the diminishing of the momentum effect in China. We make an incremental contribution to the understanding of the factors hampering the momentum effect in China by controlling for price limits and day trading rule which according to Gao et al. (2018) cause trading frictions and create barriers to executing intraday trades particularly in short time windows of up to 24 h. This provides further evidence on the role that limits of arbitrage (henceforth LOA) play in the manifestation of intraday momentum effects in China.

This study intends to answer several unanswered questions not previously examined by researchers. In doing so, we intend to make several important contributions to the existing body of literature. First, we examine if the HKS (2010) momentum pattern found for the US also exists in non-US markets. This question is particularly important as previous studies such as Heston and Sadka (2010) and Chui et al. (2010) have explained that any international evidence on the existence and profitability of a momentum effect serves as a robustness check to the existence of the momentum pattern within the United States as well as providing an opportunity to study the pattern in light of country-specific characteristics.

The second major contribution we make is provide evidence on the impact of investor clientele on intraday momentum patterns. Our study provides complementary evidence to the findings by Chui et al. (2022) who demonstrate that B-shares of dual listed firms demonstrate stronger momentum patterns over the long horizon. However, our study uses the HKS (2010) intraday momentum pattern to study the impact of investor clientele. Moreover, we also use dual listed A- and H-shares and an exogenous shock to investor composition stemming from inclusion of some A-shares in the MSCI index.

The third contribution that comes to light is that we show that price limits and day trading rule where are a form of LOA and unique to the highly regulated Chinese market play a role in hampering the intraday momentum effect. This helps in demonstrating the various impacts that price limits and other LOA have on Chinese markets. Also, not only do we demonstrate weak presence of the HKS (2010) intraday momentum pattern in China, we also highlight the potential channels hampering the prominence of the pattern in China. This study provides additional evidence on the factors that explain the absence of the momentum effect in China.

3 Data and methodology

Two distinct databases have been used to collect all the data required. The high-frequency intraday trading data is collected from Bloomberg. We use Bloomberg to collect data for China, the UK and Brazil in order to compare the Chinese market results with a well-developed UK market and another developing BRIC country, the Brazilian market. The appropriate Bloomberg data collection screening filter is used to screen out common stocks that are traded in the domestic currency and are domiciled within the country. The exception to this rule is the collection of data for B-shares which are traded in US Dollars and Hong Kong Dollars and not in the domestic currency. Also, for the Chinese dual-listed H-shares we consider the shares even though they are traded outside mainland China on the Hong Kong stock exchange.

For China, this data is then classified as A-shares, B-shares or dual-listed in Hong Kong as H-shares and as B-shares in either Shanghai or Shenzen. This is done through the firm classification data collected from The China Stock Market and Accounting Research database (CSMAR). CSMAR is widely used by researchers and there are no reports of discrepancies in share classifications i.e., A-, B-shares or dual-listed in Hong Kong and China and also no classification errors are known to date. The final sample contains all firms for which the data can be matched from CSMAR and to further avoid inclusion of exchange traded funds, preference shares, bonds etcetera we manually check and verify the International Securities Identification Number (ISIN) of each and every security to ensure only equity listings are included in the dataset.

To study intraday patterns in the cross-section of stock returns, following the methodology of Heston and Sadka (2010) all firms that can be matched on both Bloomberg and CSMAR are considered. We follow Fong et al. (2017)’s methodology to apply specific filters to match trades with quotes and leave out potentially spurious observations such as those with negative spreads (where bids are higher than asks), zero or negative volume, and those conducted outside regular market trading hours. This will ensure that our results are not driven by spurious observations. Also, the data from Bloomberg is considered to have a high correlation with the Thomson Reuters Tick History (TRTH) database. The correlation is known to be as high as 99.19% (Fong et al. 2017). This should alleviate any concerns about the accuracy of data obtained from Bloomberg.

Our primary sample period for all Chinese, UK and Brazilian stocks starts on June 1, 2016 and ends on March 1, 2019. The sample period is divided into two periods before June 1, 2018 and after June 1, 2018 for the 232 A-shares that were included in the Morgan Stanley Capital International (MSCI) index for Emerging markets beginning from 1st June, 2018. This is done to study the impact of index inclusion on the intraday pattern exhibited by the included stocks.

We begin by providing summary statistics of the sample of stocks that we consider for the UK, Brazil, and China. For China the sample is sub-divided into three parts A-shares only, dual-listed A- and B-shares, and dual-listed A-shares and H-shares in Table 1. The total number of firms considered for the UK and Brazil are 1457 and 365 respectively. For China, there are 3238 firms listed as A-shares. The number of dual-listed A and B-shares is 84 and the number of dual-listed A and H-shares is 87. Table 2 also provides summary statistics of half-hour returns for the sample.

3.1 Description of variables used throughout the paper

1.R: These returns are calculated using the last trading price at the end of each half-hour interval less the opening price at the beginning of the interval divided by the opening price as calculated by HKS (2010).

2. MPR( Midpoint Returns): These returns are calculated for the interval t using the average of the bid-ask prices at the end of interval \(t-1\) and the average of the bid-ask prices at the end of interval t. The difference between the two is divided by the average of the bid-ask prices at the end of interval \(t-1\) to obtain the midpoint returns.

3.2 Methodology

Our aim in this study is to examine the existence of an intraday pattern in Chinese Markets as observed by HKS (2010) and modelled by Bogousslavsky (2016). These two studies examine and model a continuation pattern in the cross section of stock returns at 24-hour multiples for each trading interval between 8:00 am to 4:30 pm on the NYSE considering a sample of all NYSE firms. The pattern is studied using the cross sectional regression approach following the footsteps of Jegadeesh (1990) and further checking the statistical significance of the estimates by incorporating Fama and MacBeth (1973) t-statistics.

While the cross-sectional regression approach is the first step in examining the existence of the return continuation pattern at integer multiples of the trading day for each half-hour interval, a second method is employed by HKS (2010) to study the economic significance of the pattern in line with Jegadeesh and Titman (1993). They sort the portfolios into top (best) and bottom (worst) performing deciles sorted every half-hour. These top and bottom deciles are then composed into a portfolio where the top decile stocks are bought and bottom decile stocks are shorted during the same half-hour interval for the next forty days. The net return on the strategy turns out to be economically and statistically significant for the next forty days as found by HKS (2010). They show that on the first day the strategy earns a mean return of 3.01 basis points which is enough to offset the equity premium. In our study, we employ the same techniques as employed by HKS (2010). We sort the stocks based on their half-hour returns into top and bottom deciles with an equal number of stocks in each decile. These stocks are then held on for the next forty days during the corresponding 24-hour multiple of the interval in question. The trading day is slightly shorter in the Chinese markets and we end up with 8 half hour intervals from 9:30 to 11:30 am and then 1:00 pm to 3:00 pm post lunch break.

Where t is the collection of all half-hour intervals for which the stock trades during the sample period, for China this leads to 8 half-hour intervals from 9:30–11:30 am and from 1:00 to 3:00 pm; respectively. \(R_{i,t}\) is the return on the stock of firm i in interval t and \(R_{i,t-k}\) is the return on the stock of firm i lagged by k intervals. k is multiple of 8 (which makes it a lag equivalent to a whole trading day), it assumes values of 8, 16, 24, 32, 40,..., 312, and 320 for a daily lag of 1, 2, 3,4,..., 39 and 40 days.

We first estimate mid-point returns based on the average of bid-ask prices for each half-hour interval of the trading day for each market. We don’t use trade price returns to avoid any potential bid-ask bounce effects. Most recently Hasbrouck (2018) has highlighted that for intervals of up to 1 h, the trade price change may simply be the artifact of the bid-ask bounce and also there is an issue with calculating the returns since the trades may not necessarily be at precisely the beginning and the ending of a half-hour interval. Also, as pointed out by HKS (2010), short-term return reversals that they find at lags less than 1 trading day are merely due to the bid-ask bounce. Since we intend to study short-term return reversals as well, it is prudent that we choose mid-point returns to rule out the influence of the bid-ask bounce in our findings.

We then run cross-sectional regressions of these half-hour interval returns on lagged half-hour returns during the same daily interval for up to 40 days. The coefficients are then averaged over time as per Fama and MacBeth (1973) approach. We further split the Chinese stocks into Chinese A-shares, dual-listed A-shares and their B-share counterparts, and Chinese A-shares and their dual-listed H-share counterparts. The Chinese A-shares are open for investment to only domestic investors, the B-shares are open to both domestic and foreign investors, and the H-shares are listed in Hong Kong. This segmentation leads to significant differences in investor composition. The Chinese A-shares are characterized by retail investor ownership (Nartea et al. 2017). Whereas, the B-shares are primarily held by foreign investors (Chui et al. 2022). The main advantage is that there are some shares that are dual-listed as A and B-shares. A summary of the salient features of all share classes of interest in the Chinese markets is provided in Table 1.

We perform the regression analyses explained above on both A-shares and their B-share counterparts. Segregating the sample into dual-listed A- and B-shares provides an insight into the role of investor composition in explaining the intraday momentum pattern of HKS (2010). We now turn to segregating the sample into dual-listed A and H-share counterparts. This provides an avenue to study the impact of limits of arbitrage on the intraday momentum pattern. We run cross-sectional regressions of current 30-minute (half-hour) interval returns on returns during the same interval on previous days for up to 40 days and then average the coefficients over time as per Fama and MacBeth (1973) approach. The results indicate that the intraday momentum is much stronger in the H-shares as compared to their A-share counterparts. This difference can be attributed to low limits of arbitrage in the Hong Kong stock markets. They are not subject to limits of arbitrage such as price limits and the day trading rule as is applicable to the Chinese markets.

Initially, we consider all A-shares listed in Chinese Markets. We then segregate our sample into dual-listed A-shares and dual-listed B-shares following Chui et al. (2022).Chui et al. (2022) find that the absence of momentum in the A-shares is due to differences in investor composition as dual-listed B-shares with nearly the same features exhibit momentum in returns much more profoundly than their A-share counterparts. This motivates us to exploit this unique feature of the Chinese markets to study the differential impact of investor composition on intraday momentum. Furthermore, we split the sample into dual-listed A-shares versus their H-listed counterparts. We find that the intraday momentum pattern is far more profound in the H-shares market than in the corresponding A-shares market. We can hence infer that investor composition as well as market regulations can play a major role in explaining the differences in intraday momentum patterns as exhibited by these ‘twin’ shares.

To investigate the impact of limits of arbitrage on the Chinese A-shares, we conduct yet some more tests. We drop the stocks that traded in the top and bottom deciles for each half-hour interval that are considered. This ensures that any stocks that hit the price limit whether upper or lower or are likely to hit the higher or lower price limit are excluded. When these stocks are removed, the strength of the intraday pattern in the Chinese A-shares rises considerably based on the regression coefficients for the regression discussed above in detail.

Our analyses also involves analysing the intraday momentum pattern among the Chinese A-shares market based on cross-sectional differences in stocks. The entire sample is split into large, medium, and small stocks based on market capitalisation. There is no significant difference in the pattern in terms of the regression coefficients obtained and size doesn’t explain the pattern. Furthermore, motivated by the recent study Gao et al. (2018) who state that the first half hour and last half hour of trading are particularly important we run another regressions as in HKS (2010) to check the concentration of the pattern in the first and last half hours where the first and last half-hour intervals are dropped. The reason cited by Gao et al. (2018) for the significance of the first and last hour of trading are that-important announcements are typically made during the first half hour of trading and institutional investors, mutual funds etcetera rebalance their portfolios during the last half hour prior to market close.

To further determine the economic significance and statistical significance of this pattern for China, the UK, and Brazil we now turn to intraday momentum portfolio analyses as conducted by HKS (2010). The performance for the portfolios formed on the basis of each half-hour interval’s returns is tested. The stocks are sorted every half hour and portfolios are formed using the top and bottom deciles and their half-hour returns are observed for the next forty days (during the same half-hour interval). The average return spreads(top minus bottom decile) on portfolios formed on the basis of the performance during the relevant historical half-hour (with lags 1 to 40 days) interval are reported. The stocks are grouped into ten portfolios with an equal number of stocks in each portfolio.

We use alternative measures of returns such as trade, bid to bid, and ask to ask returns as used by HKS (2010) and find that at the daily lag level, it doesn’t affect our results. The only difference is that for lags close to \(k=1\), the negative coefficients are observed beyond one lag. This is in line with the findings of HKS (2010) who cite the bid-ask bounce as the reason for finding negative coefficients using trade returns. Moreover, we use intervals of 5-minutes to 60-minutes to see if a similar intraday pattern is prevalent for any of these intervals and we find no evidence to believe that any other pattern of return continuation beyond the half-hour interval exists. This alleviates concerns that our findings may be driven by other effects that we may not have considered.

4 Empirical findings and discussion

4.1 Intraday return predictability based on previous day’s return in the same half hour interval

Our initial sample contains 3,238 A-shares listed on the Chinese stock exchanges from June 1, 2016 to March 1, 2019. We report the regression results for the regression of each trading interval from 9:30 to 11:30 am and from 1:00 to 3:00 pm (which makes a total of 8 daily trading intervals) on their lagged returns for lags of 8,16, 24,32,...,312 and 320 which corresponds to daily lags of 1,2,3,4,..., 39 and 40. Like HKS (2010) we employ the cross sectional regression approach applied by Jegadeesh (1990) and report the corresponding Fama and MacBeth (1973) t-statistics. The results are reported in Table 3.

We observe that in general, the pattern is less profound in terms of both the estimates and the t-statistics for the Chinese A-shares. To provide a sense of the magnitude of this difference, the pattern as reported for a daily lag of 1 day is most profound for the U.S. market as reported by HKS (2010) in their Table I, the estimate has a co-efficient of 1.19 and a t-statistic of 18.22. Whereas, our estimate for a daily lag of 1 day has an estimate with a co-efficient of 0.36 and a t-statistic of 2.94. This is a very striking contrast as when we look and compare the estimates for other lags up to forty days, we observe that for the U.S. markets the highest report estimate and t-statistic is that for the daily lag of 1 day. However, for the Chinese market it appears that the lowest estimate and corresponding t-statistic is that for the lag of 1 day. The estimates for greater lags are somewhat comparable in terms of statistical significance i.e. the t-statistics, but relatively weaker in terms of economic significance i.e., the actual regression co-efficients.

To add to the validity of our analyses and to provide a robustness check, we also include the UK market (which is a large market outside the US like China) and Brazil (which is another emerging market like China). As can be seen in Table 3, the regression coefficients and relevant t-statistics showing the results for China are visibly smaller than that of the UK and Brazil which are 1.82 (1.12) and 10.18 (7.22) for a lag of one trading day for UK (Brazil) respectively.

This finding can be simply interpreted as a very weak intraday momentum effect for a daily lag of 1 day. However, contrary to the US, the UK, and Brazilian markets where the effect is most profound for a daily lag of 1-day, it is the weakest for China. As the effect tapers off with increasing lags of up to forty days, the effect in China seems to be more stable beyond the first day. Unlike the US, the UK, and Brazil we see a peaking out of this effect on the third trading day. This motivates us to study the factors that are essentially curtailing this effect for a daily lag of 1-day.

This finding contributes to the evidence provided by earlier studies such as Chui et al. (2022) which find a weaker prevalence of the momentum effect in Chinese A-shares. Also, Li et al. (2018) study the Heston and Sadka (2008) seasonality pattern for 42 advanced and emerging markets from 1995 to 2013 and conclude that return seasonality is economically significant primarily in advanced markets but not in emerging markets. Furthermore, Chui et al. (2010) study the profitability of some long-term momentum strategies across international markets and suggest that they generally underperform in Asian markets owing to cultural differences in terms of the level of individualism.

4.2 The existence of intraday momentum in A-shares versus B-shares

The Chinese market offers a very unique opportunity to study the impact of investor composition as explained in detail by Chui et al. (2022). Chui et al. (2022) argue that the dual listed stocks which have both A and B-shares trading in the market have essentially the same type of features in terms of voting rights and cash flow rights but differ in investor composition. The Chinese A-shares are owned by domestic investors the majority of whom are retail investors versus B-shares that are held mostly by foreign investors who are mainly sophisticated institutional investors.

We only consider the sample of A-shares which have a corresponding listing of B-share and are dual-listed. We end up with a sample of 84 dual-listed A- and B-shares. The results for the cross-sectional regressions to examine the intraday pattern observed by HKS (2010) are reported in Table 4. We observe that the regression co-efficient for the dual-listed A-shares is somewhat better than the aggregate A-share sample. The estimate has a co-efficient of 0.55 and a t-statistic of 2.85 for a daily lag of 1 day. Whereas, our dual-listed B-share sample has an estimate with a co-efficient of 1.30 and a corresponding t-statistic of 6.32. While both these estimates for the A-shares and B-shares have estimates that are statistically much less significant than the U.S. estimate which had a t-statistic of 18.22 for the first daily lag, it is evident that B-shares clearly demonstrate a higher alignment with the US markets in terms of exhibiting this pattern.

Interestingly, Chui et al. (2022) also find that the momentum effect for longer horizons is more prevalent in B-shares compared to A-shares. They use this evidence to arrive at the conclusion that since the only significant difference between dual-listed A- and B-shares is investor composition, it is plausible to say that it is the difference in investor composition that determines the existence of the momentum effect. Our findings, support and complement their findings by providing evidence that even very short-term momentum effect at the intraday level is much stronger in the B-shares as compared to A-shares and provides further support for the argument that it is indeed investor composition that explains why the momentum effect is not very strong in China as observed by Chui et al. (2010). Nofsinger and Sias (1999) further support our findings they show that herding and feed back trading by institutional investors is more effective in leading to the momentum effect as compared to that by individual investors. Our findings are also consistent with Akbas et al. (2015) who show that mutual funds have a tendency to invest in past holdings that were winners and liquidating past losers, thereby exacerbating the momentum effect itself.

4.3 The existence of intraday momentum in A-shares versus H-shares

We now turn our attention to dual-listed A- and H-shares. In addition to the difference in investor composition as discussed in section 3.3, the A- and H-shares differ in the fact that Hong Kong is a developed market and has negligible trading constraints as compared to China where there are price limits, short selling constraints, and day trading constraints (see Gu et al. 2018; Chui et al. 2022). We have 87 firms in our sample that our dual-listed with both A-share listings and H-share listings.

We conduct the same regression analysis based on HKS (2010) as described in earlier sections. The results for the dual-listed A-shares and their cross-listed H-share counterparts are reported in Table 5. The comparison sheds light on a very substantial difference in the existence of the intraday momentum pattern documented by HKS (2010) and modelled by Bogousslavsky (2016) for U.S. markets among the A-shares and their cross-listed H-share counterparts.

The pattern appears to be quite subdued for the A-shares with the estimates for the co-efficient and t-statistics corresponding to a daily lag of 1 day being most weak relative to those of the H-shares at 0.50 and 2.69 respectively. Then on, the pattern seems to manifest itself more strongly and is statistically significant for up to twenty days. This is in sharp contrast to the manifestation of the pattern both in terms of the estimates for the co-efficient and the corresponding t-statistics for the cross-listed H-shares in the Hong Kong market which are the highest for a daily lag of 1 day with a regression estimate of 4.02 and a t-statistic of 10.45 respectively. For the H-shares, the effect seems to decay from the first day as we move towards a lag of 40 days. However, the pattern is still significant for forty days with the last t-statistic being higher than 3 for all but one day.

This evidence is the first intraday evidence from outside the United States that documents the existence of the pattern discovered in HKS (2010). It also sheds light on the fact that while investor composition explains the momentum effect in part, as demonstrated by a stronger presence of the pattern in dual-listed B-shares as compared to their A-share counterparts, the difference is even more substantial if the trading constraints are removed as in cross-listed H-shares. This provides further motivation to study the impact of trading constraints on the intraday momentum effect.

4.4 Controlling for size

Li and Wang (2010) show that institutional investors in Chinese markets have the tendency to herd in large stocks. There may be various reasons for this phenomenon. Previous studies have regarded large stocks as being more price efficient and liquid (Chordia et al. 2005). Also, owing to the need to be able to liquidate securities urgently in the event of poor performance, specifically open ended funds have to be sure that they will be able to liquidate the securities at any cost(Coval and Stafford 2007). This is easier if an institution invests in to large and generally more liquid stocks in an emerging market.

We now therefore, conduct our analysis to examine the existence of the intraday pattern in the Chinese Markets by segregating our sample into small, medium, and large firms by size (market capitalization) terciles. The results are reported in Table 6. We find that the pattern manifests itself more strongly as we move from small to medium and from medium to large firms.

The weakest estimate for the lag of 1 day comes from the small firms, 0.28 with a t-statistic of 2.82 and then there is a monotonous rise to 0.33 with a t-statistic of 2.96 for the medium firms and the strongest estimate for a daily lag is shown by large firms with an estimate of 0.46 and a t-statistic of 3.05. We do notice however that across small, medium and large firms alike, the momentum pattern is strongest for the lag of 3 days. This is also true for the all A-share sample discussed in Section 3.1 and presented in Table 3.

4.5 Controlling for time of day

Gao et al. (2018) find evidence of the existence of an intraday momentum pattern where the first half-hour returns on the S &P ETF predict the last half-hour of returns. In addition to the S &P ETF, Gao et al. (2018) find similar evidence of the existence of an intraday momentum pattern in ten other domestic and international ETFs that are actively traded. Bogousslavsky (2016) cite some anecdotal evidence that some investors are only active at the beginning and the end of the day. However, they find that their pattern is not limited to the opening and ending half-hour intervals. To examine this further, we exclude the first and last half-hour from our sample and conduct the regression analysis once again to see if it makes any difference. The results from this analysis are reported in Table 7. Our regression is the same as done in previous sections following HKS (2010).

We find that none out of the forty regression estimates have a t-statistic that is greater than 3. The effect is almost non-existing as demonstrated by the weakness of the estimates and their corresponding t-statistics. This provides some evidence that the existence of the effect is strongly dependent on the time of the day for the Chinese A-share market. To further clarify the findings in simple words, we can say that the first half-hour interval and last half-hour interval exhibit the bulk of the intraday momentum for the Chinese A-share markets and the effect is not consistent HKS (2010) who find the pattern as being prevalent across all half-hour intervals of the trading day and not just the first and last half-hour. Our findings are more consistent with Khademalomoom and Narayan (2019) who study the intraday patterns in currency markets and find the existence of a time of the day effect.

4.6 Controlling for price limits

This section provides perhaps the most compelling evidence that the effect documented by HKS (2010) is not observed in China and the presence of the intraday momentum pattern is weakest for the daily lag of 1 day. Whereas, in the US it is strongest for a daily lag of 1 day. In other words, it is found in the US that the returns for instance between 10:00 and 10:30 today for a particular stock will predict its returns for the same interval tomorrow. However, in China it is observed that this predictability is the lowest between today and the next day. We explore major reasons for it and the existence of price limits is a good candidate to explain this effect as stocks that are affected by price limits experience significant trading frictions and the likelihood of execution of trades over the subsequent days also becomes low (Gu et al. 2018).

We do this by dropping out the top and bottom decile from our sample for every half-hour interval reported in our sample. This is done to avoid the market frictions that traders face in the existence of price limits as explained in Gu et al. (2018) where the likelihood of trade execution falls as the stock hits its price limits. As the top and bottom decile for each half-hour exhibit the extremes in terms of price movements, it is plausible to remove them from our analyses and determine whether it is the daily price limits which curtails the intraday momentum pattern in Chinese markets.

To filter out the effect of price limits, we adopt an innovative approach which is to sort the stocks into deciles every half-hour, and remove the top and bottom decile from the sample. Thereafter, we conduct similar regression analysis that we have conducted thus far based on HKS (2010). The results from the analysis are reported in Table 8.

The results highlight the impact of price limits which are mostly likely to affect top and bottom decile of stocks sorted on returns at the end of each half-hour interval. We notice that the regression estimates for the daily lag of 1 day are much better in this sample with a co-efficient of 0.52 and a t-statistic of 4.92 versus a co-efficient of 0.36 and a t-statistic of 2.94 for the wider all A-share sample which doesn’t drop the top and bottom decile stocks. This provides evidence that price limits hamper the intraday momentum effect that is the subject of our analysis in this study.

4.7 Day trading rule, return reversals and contrarian strategies

HKS (2010) document that short-term return reversals last for 30–60 min in the US markets. We document similar results for the UK where return reversals last for up to thirty minutes. However, cross-sectional regression results indicate that for China return reversals last for 30–60 min. This indicates that it takes longer for Chinese stocks to converge to market efficiency. Also, the resolving of return reversals within 30 min by the UK market as a whole indicates that markets have become more efficient since 2005 when HKS (2010) period of study ends.

In Table 9 we report the cross-sectional regression results for the regression of each trading interval from 9:30 to 11:30 am and from 1:00 to 3:00 pm (which makes a total of 8 daily trading intervals) on their lagged returns for lags of 1,2,3,...20 for China and 1,2,3,...51 for the UK since they have 17 half-hour intervals as they trade from 8:00 am to 4:30pm. Like HKS (2010) we employ the cross-sectional regression approach applied by Jegadeesh (1990) and report the corresponding Fama and MacBeth (1973) t-statistics.

The most striking feature is the return reversibility in China at intervals just beyond the 1 day lag. This suggests that due to the ban on day trading, a lot of traders rush to unwind their positions and potentially book profits on trades from the previous day as suggested by the negative sign of the co-efficient, and this effect is highly significant. Additionally, it can be interpreted as investors taking a contrarian strategy. This eventually has implications for market efficiency as the ban on day trading leads to aggressive behaviour to reverse positions as soon as the 24-hour period passes. The evidence is supportive of the findings of Kaniel et al. (2008) and Baltzer et al. (2019) who find that domestic individual investors are most likely to be contrarians and engage in contrarian strategies rather than momentum strategies. Our findings are consistent with Li et al. (2019) who find that the day trading rule or ‘T+1’ settlement rule which restricts intraday buying and then selling in Chinese markets is also responsible for the weaker presence of herding phenomenon on the sell side as compared to the buy side.

4.8 Intraday momentum portfolio returns

Following the methodology of HKS (2010) who follow the portfolio formation of Jegadeesh and Titman (1993) we also conduct a similar analysis. Table 10 reports the performance of the portfolios formed on the basis of each half-hour interval’s returns. The stocks are sorted every half-hour and portfolios are formed using the top and bottom deciles and their half-hour returns are observed for the next forty days (during the same half-hour interval). We ensure that all deciles have the same number of stocks as required by HKS (2010) as it is critical to form equal-weighted portfolios. All intervals from 8:00 to 16:30 are taken and stocks are sorted every half-hour for the UK markets. The sample includes all UK firms from 1\(^{st}\) January, 2017 to 31\(^{st}\) December, 2017. For the Chinese A-share markets all intervals from 9:30 to 11:30 and then 1:00 to 3:00 pm are taken. The average return spreads (top minus bottom decile) on portfolios formed on the basis on the performance during the relevant historical half-hour (with lags 1 to 40 days) interval are reported. The stocks are grouped into ten portfolios with an equal number of stocks in each portfolio. The returns are reported in basis points to make more economic sense.

We find that the pattern is quite strong in the UK markets and for a daily lag of 1 day, the portfolio returns are nearly 4 basis points, which is higher than what has been reported for the US and the t-statistics are highly significant with a value of 13.85. This evidence is the first intraday evidence of the pattern documented by HKS (2010) outside the US in terms of an equally weighted portfolio return. This is a striking finding since usually it is seen that post-publication return predictability of variables declines (McLean and Pontiff 2016). We observe that for the UK, the effect yields significant and positive returns specially during the first ten days.

For Chinese A-shares, the picture is rather different. We observe that the spreads are much narrower and the effect is not significant. Particularly for the strategy based on 1 daily lag and the lags beyond 10 days, it is insignificant. The high minus low portfolio return on a strategy based on a 1-day lag for Chinese A-shares is 0.55 basis points and has a t-statistic of 1.52. We find that the intraday momentum pattern is strongest for the strategy based on the high minus low portfolio returns with a lag of 3 days.

The Brazilian markets and the dual-listed B- and H-shares are much like the UK and the US. We see a peaking of the intraday momentum pattern in terms of returns when we use a 1-day lag strategy to form a portfolio based on high minus low stocks. The profits are of the range of 2.36 basis points for B-shares, 3.54 basis points for H-shares, and 3.09 basis points for Brazil for a portfolio formed based on a 1-day lag. These markets are dominated by institutional investors and the intraday predictability in the cross-section of stock returns seems synonymous with them. Whereas, in the retail investors dominated market of Chinese A-shares, the pattern is weakest for a 1-day lag. The day trading rule, the price limit rule, and retail investor procrastination serve to explain the different set of findings for the Chinese A-shares.

4.9 Inclusion of A-shares in the MSCI emerging markets index

We now consider 233 A-shares that were included in the Morgan Stanley Capital International (MSCI) Emerging Markets Index from June 1, 2018. It is believed that the inclusion of these Chinese A shares in the MSCI index has significantly increased the attractiveness of these shares as well as the Chinese stock market as a whole to international investors and thus their liquidity. Indeed Table 11 shows that since the inclusion, these shares have had a substantial increase in institutional owners.

We study these stocks from June 1, 2016 to May 31, 2018 (before inclusion in the index) and from June 1, 2018 to March 1, 2019 (after inclusion in the index). In Table 12, we report the regression comparison before and after the inclusion in the MSCI index. We notice that the cross-sectional regression estimates experience a significant increase after the inclusion in the MSCI Emerging Markets Index. Also, the statistical significance experiences an increase across the board ranging from 1 to 40 days post-inclusion. Of particular interest is the fact that post inclusion, the 1-day lag co-efficient estimate is the biggest economically and most significant statistically. This further signals behaviour similar to the US and UK. Therefore, it leads us to conclude that inclusion has lead to a shift in behaviour of these stocks that now behave more in line with stocks that have a greater institutional base of investors.

Furthermore, as a robustness check to our regression estimates, as in Table 10, we construct a high minus low portfolio in which we go long on the top decile stocks and short the bottom decile stocks based on each half-hour’s return performance during the day and hold it until the same interval the following trading day (for up to 40 days). The results are reported in Table 13. The average return spreads (top minus bottom decile) on portfolios formed on the basis of the performance during the relevant historical half-hour (with lags 1 to 40 days) intervals are reported. The high minus low portfolio returns experience a significant increase in the amount of returns generated. For instance, for a strategy that considers a lag of 1 day the returns before inclusion in the index were 1.44 basis points, whereas, after the inclusion these returns rise to 2.85 basis points.

5 Conclusion

This study is the first to provide empirical evidence on the existence of the intraday pattern documented in the literature by HKS (2010) and further modelled by Bogousslavsky (2016) in markets outside the United States. The pattern is observed in the UK, Brazil, B-shares, and Hong Kong listed Chinese H-shares and exhibits all similarities to the pattern observed by HKS (2010). It further proves that HKS (2010) intraday momentum pattern is not a product of data snooping etcetera as discussed by Heston and Sadka (2010) when they find international evidence for the existence of return seasonality using longer horizon data on International Markets. However, the evidence on the existence of the pattern in Chinese A-shares indicates that it manifests itself with a much weaker magnitude.

We are able to explain the weakness of the pattern in Chinese A-shares and the proliferation of the pattern in Chinese B-shares by virtue of difference in investor composition. The Chinese A-shares market is dominated by domestic individual investors (Nartea et al. 2017) while the Chinese B-shares market is dominated by foreign institutional investors (Chui et al. 2022). Since the dual listed B-shares exhibit the pattern more strongly in terms of cross-sectional regression coefficients we infer that the investor composition plays an important role in the propagation of the pattern. This is in line with the studies like Kaniel et al. (2008) and Baltzer et al. (2019) that claim that individual investors are contrarians and institutional investors engage in momentum strategies.

Furthermore, with regards to China, the pattern manifests itself as best as it can given the level of trading restrictions. These trading restrictions have raised a lot of debate in recent years as some studies like Gu et al. (2018) have argued that these restrictions actually hurt markets and hamper market efficiency. We provide specific evidence with regards to price limits and day trading restrictions. We show that if we remove the top and bottom deciles from our sample, the remaining stocks are less prone to hitting price limits and the sample behaves more like the US, and the UK, Brazil, and dual-listed B- and H-shares and the HKS (2010) pattern that we are studying here is more profound. This provides some evidence that limits of arbitrage act as a deterrent for smooth propagation of the momentum pattern.

We provide evidence into the impact of the partial inclusion of A-shares into the highly coveted MSCI Emerging Markets Index and show that it increases the level of institutional ownership, the number of participating institutions, the percentage float held by institutions, and foreign ownership in the included stocks. We use this inclusion as an exogenous shock to the level of institutional ownership in the 233 A-shares stocks. We show that after the inclusion in the index, the 233 A-shares demonstrate the existence of the pattern that is closer to the US, the UK, Brazil, and the dual listed B- and H-shares. This further confirms the role of institutional investors in explaining the intraday momentum effect.

We show that at intervals just beyond daily multiples of the trading day, we see extreme evidence of return reversals. This shows that retail investors desperately wait to reverse short-term positions and rush to reverse their positions as soon 24-hour limit passes. It can actually lead to lots of selling pressure and market volatility. This is once again in line with studies like Kaniel et al. (2008) and Baltzer et al. (2019) that claim that individual investors are contrarians. Since, our A-shares investors are mostly domestic individual investors (Nartea et al. 2017) we can say that our results are in line with the existing evidence. These findings also have implications from a regulatory perspective.

We find that the manifestation of the pattern is subject to the size of the firms. We find that large market capitalization group exhibits the intraday momentum pattern with the greatest strength owing to the tendency of institutional investors to herd in large stocks (Li and Wang 2010). However, we find that the time of the day explains the majority of the existence of the pattern. If we remove the first and last trading intervals, the pattern almost diminishes. Also, a portfolio analyses conducted in the spirit of Jegadeesh and Titman (1993) reveals that the returns on top minus bottom decile portfolios sorted by past half-hour returns and held on for the next forty days have positive but significant returns, but are mostly weaker than the US, UK, Brazil and dual listed B- and H-share counterparts. Consistent with our findings, Chui et al. (2022) find that over the longer horizon the momentum effect is more prevalent in Chinese B-shares than in their A-share counterparts. Our evidence further supports the findings of Chui et al. (2022).

Overall, our study also provides evidence that the tireless efforts of the Chinese regulators and policy makers to institutionalize the Chinese A-shares market is bearing fruit. Indeed, the plan for inclusion of 168 mid-cap stocks has been fast tracked and our results show that the dawn of a new era in Chinese stock markets has begun. In this era, the market will mature and will continue to get institutionalized gradually and move away from the ‘casino’ like features that it has come to be associated with. Future research should focus on providing empirical evidence regarding all the positive benefits of institutional investors in the context of China.

Notes

Riordan and Storkenmaier (2012) suggest that improvements in exchange technology have enabled traders to receive feedback on their orders quicker, thereby reducing latency, increasing liquidity, and decreasing transaction costs.

Brogaard et al. (2014) and references therein, suggest that high frequency trading (HFT) and Algorithmic Trading (AT) have changed the landscape and enhanced price efficiency and market quality, with HFT and AT acting as liquidity providers and enabling smoother, faster transactions at lower costs.

Allen et al. (2024) reports that Chinese GDP in 1980 was 11% of the US GDP in constant dollars as per IMF, but in 2018 China was 23% larger than the US economy in terms of the purchasing power parity.

According to Borochin and Yang (2017) institutional ownership in the United States has risen immensely over the past 30 years and in the 2010s, on average every firm had 65 percent institutional ownership.

This is according to an interview with Jing Ulrich, Vice Chairman for Asia Pacific with JP Morgan Chase Bank. See: https://www.cnbc.com/2016/01/08/jpmorgan-heres-what-china-needs-to-stabilize.html and an article published in the Economist which suggests that the Chinese stock market is often referred to as a casino See: https://www.economist.com/free-exchange/2015/05/26/a-crazy-casino.

The 600 billion USD figure has been estimated by Steven Sun, head of research at HSBC Qianhai, a Shenzhen-based securities company. This article can be found at https://www.ft.com/content/3ea51148-632f-11e8-a39d-4df188287fff

Nicholas Yeo from Aberdeen Standard Investments sees no immediate effect of the inclusion on his investment picks. Eric Brian from JP Morgan Asset Management views the move as largely symbolic and sees no impact on the firm’s approach to stock picking and portfolio selection. See: https://www.bloomberg.com/news/articles/2019-03-01/msci-s-latest-china-call-positive-but-mostly-symbolic-analysts

Stock connect programs facilitate traders between mainland China and Hong Kong stock exchanges to trade seamlessly using local brokers.

These reforms have been summarized in a report by Ching Ping Chia, MSCI Head of Research for Asia Pacific which is the source of this information. See: https://www.msci.com/www/blog-posts/the-world-comes-to-china/01002067599.

References

Akbas F, Armstrong WJ, Sorescu S, Subrahmanyam A (2015) Smart money, dumb money, and capital market anomalies. J Financ Econ 118:355–382

Allen F, Qian J, Shan C, Zhu JL (2024) Dissecting the long-term performance of the Chinese stock market. J Finance 79:993–1054

Appel IR, Gormley TA, Keim DB (2016) Passive investors, not passive owners. J Financ Econ 121:111–141

Baltzer M, Jank S, Smajlbegovic E (2019) Who trades on momentum? J Financ Mark 42:56–74

Bena J, Ferreira MA, Matos P, Pires P (2017) Are foreign investors locusts? The long-term effects of foreign institutional ownership. J Financ Econ 126:122–146

Bogousslavsky V (2016) Infrequent rebalancing, return autocorrelation, and seasonality. J Finance 71:2967–3006

Bogousslavsky V (2021) The cross-section of intraday and overnight returns. J Financ Econ 141:172–194

Boone AL, White JT (2015) The effect of institutional ownership on firm transparency and information production. J Financ Econ 117:508–533

Borochin P, Yang J (2017) The effects of institutional investor objectives on firm valuation and governance. J Financ Econ 126:171–199

Brogaard J, Hendershott T, Riordan R (2014) High-frequency trading and price discovery. Rev Financ Stud 27:2267–2306

Cakici N, Fieberg C, Metko D, Zaremba A (2023) Do anomalies really predict market returns? New data and new evidence. Rev Finance 28:1–44

Campbell JY, Ramadorai T, Schwartz A (2009) Caught on tape: institutional trading, stock returns, and earnings announcements. J Financ Econ 92:66–91

Carpenter JN, Lu F, Whitelaw RF (2021) The real value of China’s stock market. J Financ Econ 139:679–696

Chen J, Haboub A, Khan A (2024) Limits of arbitrage and their impact on market efficiency: evidence from China. Glob Financ J 59:100916

Chordia T, Roll R, Subrahmanyam A (2005) Evidence on the speed of convergence to market efficiency. J Financ Econ 76:271–292

Chui ACW, Titman S, Wei KCJ (2010) Individualism and momentum around the world. J Finance 65:361–392

Chui ACW, Subrahmanyam A, Titman S (2022) Momentum, reversals, and investor clientele. Rev Finance 26:217–255

Cortina JJ, Peria MSM, Schmukler SL, Xiao J (2024) The internationalization of China’s equity markets. IMF Econ Rev 8:1–57

Coval J, Stafford E (2007) Asset fire sales (and purchases) in equity markets. J Financ Econ 86:479–512

Daniel K, Moskowitz TJ (2016) Momentum crashes. J Financ Econ 122:221–247

Fama EF, MacBeth JD (1973) Risk, return, and equilibrium: empirical tests. J Polit Econ 81:607–636

Fong KYL, Holden CW, Trzcinka CA (2017) What are the best liquidity proxies for global research? Rev Finance 4:1355–1401

Gao L, Han Y, Li SZ, Zhou G (2018) Market intraday momentum. J Financ Econ 129:394–414

Gao Y, Han X, Li Y, Xiong X (2019) Overnight momentum, informational shocks, and late informed trading in China. Int Rev Financ Anal 66:101394

Gao Y, Han X, Li Y, Xiong X (2021) Investor heterogeneity and momentum-based trading strategies in China. Int Rev Financ Anal 74:101654

Griffin JM, Ji X, Martin JS (2003) Momentum investing and business cycle risk: evidence from pole to pole. J Finance 58:2515–2547

Grinblatt M, Sheridan T, Russ W (1995) Momentum investment strategies, portfolio performance, and herding: a study of mutual fund behavior. Am Econ Rev 8:1088–1105

Gu M, Kang W, Xu B (2018) Limits of arbitrage and idiosyncratic volatility: evidence from China stock market. J Bank Finance 86:240–258

Hasbrouck J (2018) High-frequency quoting: short-term volatility in bids and offers. J Financ Quant Anal 53:613–614

Heston SL, Sadka R (2008) Seasonality in the cross-section of stock returns. J Financ Econ 87:418–445

Heston SL, Korajczyk RA, Sadka R (2010) Intraday patterns in the cross-section of stock returns. J Finance 65:1369–1407

Heston SL, Sadka R (2010) Seasonality in the cross section of stock returns: the international evidence. J Financ Quant Anal 45:1133–1160

Jegadeesh N (1990) Evidence of predictable behavior of security returns. J Finance 45:881–898

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Finance 48:65–91

Jegadeesh N, Titman S (2001) Profitability of momentum strategies: an evaluation of alternative explanations. J Financ 56:699–720

Jiao M, Xinping X, Antai L (2024) Msci index inclusion and price efficiency evidence from china. Int Rev Financ Anal 20:103328

Jin M, Kearney F, Li Y, Yang YC (2020) Intraday time-series momentum: evidence from China. J Futur Mark 40:632–650

Kaniel R, Saar G, Titman S (2008) Individual investor trading and stock returns. J Finance 63:273–310

Khademalomoom S, Narayan PK (2019) Intraday effects of the currency market. J Int Finan Markets Inst Money 58:65–77

Kong D, Lin C, Liu S (2017) Does information acquisition alleviate market anomalies? Categorization bias in stock splits. Rev Finance 23:245–277

Li W, Wang SS (2010) Daily institutional trades and stock price volatility in a retail investor dominated emerging market. J Financ Mark 13:448–474

Li F, Zhang H, Zheng D (2018) Seasonality in the cross-section of stock returns: advanced markets versus emerging markets. J Empir Financ 49:263–281

Li J, Zhang Y, Xu F, An Y (2019) Which kind of investor causes comovement? J Int Finan Markets Inst Money 61:1–15

Li B, Sun Q, Wei Z (2024a) Implicit barriers, market integration and asset prices: evidence from the inclusion of china a-shares in msci global indices. J Int Financ Mark Instd Money 93:101998

Li Z, Liu C, Ni X, Pang J (2024b) Stock market liberalization and corporate investment revisited: evidence from china. J Bank Finance 158:107053

Limkriangkrai M, Chai D, Zheng G (2023) Market intraday momentum: Apac evidence. Pac Basin Financ J 80:102086

Luo CP, Ravina E, Sammon M, Viceira LM (2023) Retail investors’ contrarian behavior around news, attention, and the momentum effect. FRB of Chicago Working Paper WP 2023-34

Ma T, Liao C, Jiang F (2024) Factor momentum in the Chinese stock market. J Empir Financ 75:101458

McLean RD, Pontiff J (2016) Does academic research destroy stock return predictability? J Finance 71:5–32

Nartea GV, Kong D, Wu J (2017) Do extreme returns matter in emerging markets? Evidence from the Chinese stock market. J Bank Finance 71:189–197

Nofsinger JR, Sias RW (1999) Herding and feedback trading by institutional and individual investors. J Finance 54:2263–2295

Ouyang R, Zhang K, Zhang X, Zhu D (2024) Can factor momentum beat momentum factor? Evidence from china. Financ Res Lett 62:105021

O’hara M (2015) High frequency market microstructure. J Financ Econ 116:257–270

Pan L, Tang Y, Jianguo X (2013) Weekly momentum by return interval ranking. Pac Basin Financ J 21:1191–1208

Pan L, Tang Y, Jianguo X (2015) Speculative trading and stock returns. Rev Finance 20:1835–1865

Qian Y, Ritter JR, Shao X (2024) Initial public offerings Chinese style. J Financ Quant Anal 59:1–38

Renault T (2017) Intraday online investor sentiment and return patterns in the us stock market. J Bank Finance 84:25–40

Riordan R, Storkenmaier A (2012) Latency, liquidity and price discovery. J Financ Mark 15:416–437

Rouwenhorst KG (1999) Local return factors and turnover in emerging stock markets. J Finance 54:1439–1464

Sanjay S, Jain AT, Florent D (2024) The tale of two tails and stock returns for two major emerging markets. Rev Quant Finance Account 6:1–27

Shanaev S, Ghimire B (2021) Efficient scholars: academic attention and the disappearance of anomalies. Eur J Financ 27:278–304

Tian S, Wu E, Wu Q (2018) Who exacerbates the extreme swings in the Chinese stock market? Int Rev Financ Anal 55:50–59

Yao S, Qin Y, Cheng F, Wu JG, Goodell JW (2022) Missing momentum in China: considering individual investor preference. Financ Res Lett 49:103110

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest to declare that are relevant to the content of this article.