Abstract

This study conducts a detailed investigation into the interplay between major sporting events, specifically the ICC Cricket World Cups and FIFA Football World Cups, and their potential impact on the relationship between dividend announcements and stock market returns. Beyond the customary exploration of investor sentiment and its connection to stock market returns, our research thoroughly examines the effects of these significant sports events on the stock market's reaction to dividend announcements. Drawing on extensive FTSE 350 index data spanning January 1990 to December 2021, we employ event study methodology as the primary analytical framework. To bolster the reliability of our findings, we apply the Generalized Method of Moments (GMM) estimation method, addressing potential endogeneity concerns. Our results uncover a distinct pattern—the stock market exhibits a less favourable response to dividend increases announced following England's victories in major sporting events, such as the FIFA Football World Cup and ICC Cricket World Cup, compared to instances where they faced defeat. Additionally, we observe a more negative market response to dividend decreases announced following England's losses in these pivotal sporting events, as opposed to England emerging victorious in these key contests. This research contributes valuable insights into the intricate relationship between sports passion and market dynamics, offering implications for both scholarly discourse and investment strategy formulation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While the profound impact of sports on the economy is universally acknowledged, the equally influential role of investor sentiment in stock markets cannot be overlooked (Baker and Wurgler 2006). A substantial body of research has delved into the relationship between investor sentiment and stock market returns, utilizing diverse proxies including sports, weather, and calendar anomalies (Ashton et al. 2003; Edmans et al. 2007; Hasan and Islam 2022; Kaplanski and Levy 2010; Fan and Wang 2018). In this study, we build upon this existing research by leveraging major sports events, such as the ICC Cricket World Cup and FIFA Football World Cups, as investor sentiment proxies. Our aim is to empirically examine the influence of these events on the stock market's response to dividend announcements, contributing to the evolving understanding of sports' impact on market dynamics.

As emphasized by Ashton et al. (2003), two plausible reasons underlie the stock market's reaction to significant sporting events like the ICC Cricket World Cup and FIFA Football World Cup. Firstly, national sporting success may generate a "feel-good" effect, fostering future confidence. Secondly, an efficient stock market would recalibrate expectations of potential economic benefits linked to national team performance, weighing match results and the likelihood of the team advancing further in the tournament, given the growing commercial importance of such events. Notably, our expectation is that the stock market's response will be more subdued in friendly matches, contrasting significantly in qualifying and final matches where the feel-good factor is more pronounced.

Football game outcomes are intertwined with stock market performance through two distinct theories. Neoclassical finance posits that investors' response is fundamental, stemming from a reassessment of the economic effects of matches (the efficient market hypothesis) (Fama 1970). For instance, triumph in a football game translates into augmented revenue from merchandise sales, broadcasting contracts, gate attendance, or prize money (and vice versa for defeats) (Geyer-Klingeberg et al. 2018). Contrary to this, behavioral finance theory challenges the rationality paradigm, suggesting that investors are susceptible to behaviorally driven effects (Shiller 1984), including mood swings following sporting events (the sports sentiment hypothesis). Consequently, asset valuation factors in psychological elements, such as the "positive vibes" or potential overconfidence induced by match outcomes (Kerr et al. 2005; Schwarz et al. 1987; Wann et al. 1994). Recent investigations (Geyer-Klingeberg et al. 2018; Dimic et al. 2018; Wang and Markellos 2018; Payne et al. 2018; Hiremath et al. 2019; Gao et al. 2022; Hayduk 2022) intimate that outcomes of significant sports competitions, like the FIFA Football World Cup and the ICC Cricket World Cup, might reshape investors' outlooks and subsequently influence stock returns. This is further accentuated by psychological studies revealing varied responses to wins and losses, where the stock market tends to react positively to a triumph and unfavorably to a defeat. This pattern explains the strategic timing of businesses releasing their dividend announcements after major sporting events like the FIFA Football World Cup and the ICC Cricket World Cup.

Diverging from earlier studies primarily focused on scrutinizing the correlation between investor sentiment, using diverse indicators including sports, and stock market outcomes (Geyer-Klingeberg et al. 2018; Dimic et al. 2018; Wang and Markellos 2018; Payne et al. 2018; Hiremath et al. 2019; Gao et al. 2022; Hayduk 2022; Das et al. 2024; Hasan, 2021b; Hasan 2024), our investigation takes a nuanced approach. We delve into whether significant sports events, like the FIFA Football World Cup and ICC Cricket World Cup, not only influence the association between investor sentiment and stock market returns but also impact the stock market's reaction to dividend announcements. Our results, derived from the FTSE 350 index, uncover that the stock market responds less favorably to dividend increases announced following England's victories in major sporting events, such as the FIFA Football World Cup and ICC Cricket World Cup, compared to scenarios where they had lost. Additionally, a more negative reaction is observed in the stock market to dividend decreases following England's victories in key sports events compared to situations where they had lost.

This study makes a substantial contribution to the extant literature on multiple fronts. Firstly, it introduces a partially novel model, the "binary model specification," to empirically examine the impact of major sports events, like the ICC Cricket World Cup and FIFA Football World Cup, on the association between dividend announcements and stock returns. Secondly, our research draws on key theories, specifically dividend signaling theory and investor sentiment theory. Lastly, the study holds significant implications for investors, underscoring the noteworthy influence of major sports events on stock market reactions.

The subsequent sections of this paper are structured as follows: Section 2 provides a relevant literature review and develops hypotheses, Section 3 outlines our data and empirical analysis, Section 4 discusses the results, and Section 5 addresses endogeneity and robustness checks. The final Section 6 concludes this paper.

2 Theoretical background and theoretical development

The influence of major sporting events on the stock market has been a subject of substantial interest. Rooted in the Efficient Market Hypothesis (EMH), which posits that all traded assets in a regulated market should already incorporate significant information related to traders, the Event Study Methodology introduced by Fama et al. (1969) has been pivotal in assessing the impact of public information on share prices. According to EMH, share prices should only change in response to new information emerging from FIFA Football World Cup matches and ICC Cricket World Cup matches. This perspective aligns with prior research indicating that share prices respond to various events, including profit and dividend announcements, as well as asset sales (e.g., Hasan et al. 2023; Pritamani and Singal 2001; Thompson et al. 1987).

Major sporting events, such as the FIFA World Cup and ICC Cricket World Cup, hold a significant sway over the stock market, as highlighted in previous studies. Samagaio et al. (2009) emphasized two key factors directly influencing the stock market during these events: sporting performance and financial performance. Payne et al.'s (2018) findings suggested that investors might possess some ability to predict game results, impacting subsequent stock market returns. Notably, Gerrard's work from 2005 found no distinction in the ranking of financial and athletic success goals between listed and non-listed English clubs.

Exploring the connection between sporting events and investor sentiment reveals that winning major games, like the FIFA World Cup and ICC Cricket World Cup, has the potential to alter investors' expectations and impact stock returns. Edmans et al. (2007) provide psychological evidence indicating a substantial influence of key sporting events on investor sentiment. For instance, Wann et al. (1994) reported strong positive reactions from supporters when their team wins, and conversely, a negative reaction when their team loses. This divergence in fan behavior following wins and losses is well-documented in psychology literature, suggesting that losses have a more pronounced impact on stock market returns compared to wins, in line with Kahneman and Tversky's (1979) Prospect Theory.

Moving to the intersection of stock returns and dividend policy, a longstanding debate in financial research, we find that companies listed in the FTSE 350 index strategically time their dividend announcements after major sports events like the FIFA Football World Cup and ICC Cricket World Cup. Recent studies by Geyer-Klingeberg et al. (2018), Dimic et al. (2018), Wang and Markellos (2018), Payne et al. (2018), Hiremath et al. (2019), Gao et al. (2022), and Hayduk (2022) suggest that sports event outcomes can alter investors' expectations and impact stock returns. This strategic timing is rooted in the observed psychological reactions of people to wins and losses, with the stock market responding positively to a favored team's victory and negatively to a loss.

The broader implication is that individual club stocks react more directly to wins or losses, reflecting investor sentiments tied to specific teams. Yet, concerning national teams such as England achieving victories or facing defeats in events like the FIFA Football World Cup or ICC Cricket World Cup, the influence on the overall market becomes more noticeable. Our study aims to explore the correlation between major sports events and the stock market's response to dividend announcements, suggesting that the results of these events play a substantial role in shaping the market's reaction to such declarations.

-

H1: Big sports events (FIFA football world cup and ICC cricket world cup) affect the reaction of the stock market to dividend increase (decrease) announcements.

3 Data and empirical analysis

3.1 Data

In this study, we employ FTSE-350 index data spanning from January 1990 to December 2021. Our sample selection criteria closely align with Hasan's previous work (2021a and 2022). We specifically included only the last dividend announcements made by firms listed in the FTSE-350 index, and these announcements were consistently made following the conclusion of the FIFA football World Cup and ICC cricket World Cup events. It is important to note that announcements regarding interim dividends and stock dividends made during the event period were excluded from our analysis. Additionally, we excluded firms from the financial and utility sectors due to their distinct financial document maintenance practices, as discussed by Claessens and Laeven (2006) and Pindado et al. (2015). We also, excluded any foreign firms listed in the FTSE-350 index to mitigate the potential noise.

Our data set exclusively comprises dividend announcements that occurred after the conclusion of major sports events, specifically the FIFA Football World Cup and ICC Cricket World Cup. This pattern strongly suggests that firms intentionally time their dividend announcements to coincide with these significant sports events, as also noted by Das et al. (2023). Following Das et al. (2023) we winsorized our data set at 2.5%. Any additional company announcements (such as earnings reports, stock splits, share buybacks, stoke dividends, rights issues, mergers, and acquisitions) made between T-10 and T + 10 are not included because they could "contaminate" the findings. Shares must be exchanged frequently. Firms that did not transact for more than 100 days during the estimation time are excluded.Footnote 1

From January 1990 to December 2021, we gathered the closing prices for all FTSE-350 businesses on a daily basis. We have 231 firms in the sample and 4,021 observations after using all the sample selection factors (see Table 1).

3.2 Descriptive statistics

Table 2 presents insightful descriptive statistics for the ICC Cricket World Cup and FIFA Football World Cup events. Notably, the ICC Cricket World Cup comprises 244 observations, encompassing 194 dividend increases, 12 dividend decreases, and 38 unchanged dividends. In contrast, the FIFA Football World Cup involves 84 observations, with 53 dividend increases, 15 decreases, and 16 unchanged dividends.

Moving to Table 3, we examine the descriptive statistics for dividend event observations across various panels. Panel A provides an overview of the entire sample, highlighting minimal mean values for control variables reversal and momentum (0.001 and 0.003, respectively). The dividend's range spans from -0.50 to + 0.50, with a mean and standard deviation of CAR [+1, -1] at 0.013 and 0.059, respectively. Panels B, C, D, and E focus on winning and losing samples for both FIFA Football World Cup and ICC Cricket World Cup. Notably, winning CAR [+1, -1] standard deviation values (Panels B and D) surpass those of losing CAR [+1, -1] (Panels C and E).

Table 4 enriches our understanding through a pairwise correlation matrix. For both the ICC Cricket World Cup and FIFA Football World Cup, dividend changes exhibit positive correlations with all variables except dividend yield. Additionally, reversal and momentum show negative and statistically significant correlations with other variables.

3.3 Empirical analysis

In this research, we employ the CAR [-1, +1] and regression analysis standard event study methodologies. We utilize two distinct linear model specifications — one for a linear interaction model and the other for a linear binary model — to evaluate our main hypothesis. The linear interaction model uses two explanatory variables, each of which reflects the impact of an interaction. Our first independent variable in the linear interaction model is the percentage change in dividends (RΔDIV), which is combined with a dividend increase dummy (DPI). The second independent variable is the change in dividends (RΔDIV), which interacts with a dividend decline dummy (DPD). In contrast, we only use the dummy variables DPI and DPD as explanatory variables in our linear binary model.

The raw returns are calculated following the methodology outlined in Hasan (2022):

The computation of abnormal returns involves assessing the variance between the anticipated returns and the realized stock returns of firm i on day t. Expected returns are estimated through Sharpe’s (1963) market model, as outlined by Campbell et al. (1997):

where \({\widehat{R}}_{i,t}\) represents the estimated normal stock returns of firm i on day t, α_i is the regression line's intercept, and γi is the slope of the regression line. R_(mkt,t) denotes the benchmark market index on day t. In this study, anticipated returns were computed using the FTSE-350 Index as the benchmark market. ε_(i,t) denotes the standard error.

To estimate γi, which measures the stock's association with the market index, a window ranging from − 200 days to − 20 days before the announcement date was utilized. Various event window lengths, both preceding and following the announcements, were considered, recognizing that information might be available before its formal disclosure. The abnormal return (AR_(i,t)) of firm i for day t is determined as:

We calculate the CAR for each stock i, \({CAR}_{i, ({\tau }_{1},{\tau }_{2})}\), as the sum of the average abnormal returns for all day’s t in the event window:

Finally, we estimate the mean CAR in the event windows (\(\overline{CAR(\tau_1,\tau_2)}\)) by measuring the average \({CAR}_{({\tau }_{1},{\tau }_{2})}\) for all n firms:

In the following, we use CAR to measure market reactions of dividend announcements.

For ICC Cricket world cup dummy and FIFA Football dummy variables defines as follows:

In both models, CAR serves as the dependent variable, while the five control factors encompass size, reversal, momentum, dividend yield, and shock. In two of our models, we incorporate yearly dummies alongside either company or industry dummies. The industry fixed effect utilizes Fama and French (FF) 17 industry categories.

3.4 Linear interaction model

For both dividend increases and decreases, the association between dividend changes and stock returns likely exhibits asymmetry. Consequently, we formulate the following interaction model, which incorporates momentum in stock returns and uniform mean reversion while permitting disparate responses to dividend increases and decreases. In this model, we introduce one interaction term for the positive dividend-change group and another for the negative change in the dividend group. The results of this model reveal that announcements of dividend increases have a positive impact on stock returns, while decreases have a negative influence.

where, \({CAR}_{it}^{[-1, +1]}\) is cumulative abnormal returns [-1, + 1]. For Big sports events see the above definitions (Eqs. 6 to 9). \({R\Delta DIV}_{it}\) are dividend payment changes for firm i (in percentage). \({DPI}_{it}\) is 1 for positive dividend change, and otherwise 0. \({DPD}_{it}\) is 1 for negative dividend change, and otherwise 0. We use big sports events (Football and Cricket world cup) as one of the controls (for definition see Appendix Table 14). \({SIZE}_{it}\) is firm size, calculated using the logarithmic market capitalization. \({REVERSAL}_{it}\) is reversal, which is determined by accumulating stock earnings from the prior month. \({MOMENTUM}_{it}\) is momentum, which represents the monthly stock results added together from months t-12 to t-2. \(DIVIDEN{D}_{{YIELD}_{it}}\) is dividend yield for firm i calculated using the price one day before the dividend declaration divided by the annual dividend. Shock is a dummy variable takes value 1 if data falls in year 1995–2001 (Dot-com-Bubble), 2008–2009 (Global financial crisis) and 2020–2021 (COVID-19), and otherwise 0. DOW is Day-of -the-week dummy, where Monday, Tuesday, Wednesday, Thursday and Friday each take value 1 and otherwise 0. \({\mu }_{it}\) is standard error. \(YEAR\;DUMMIES\) are year fixed effect dummies from 1990 to 2021. \(FIXED\;EFFECTS\) are either industry dummies or firm dummies.

Football matches are typically scheduled in the evening or at night, and their impact is observed in the stock market on the following day. In contrast, cricket matches, which span the entire day, typically yield results in the evening, reflecting their influence on the stock market the following day. The alignment between the timing of the game and the trading day is outlined in Table 5. It indicates that matches held from Monday to Thursday correspond to trading days from Tuesday to Friday, while matches held from Friday to Sunday align with the trading day on Monday.

3.5 Linear binary model

In the binary model, one variable signifies the positive effect of dividend changes, while the other represents the negative impact. Binary models concentrate solely on whether there is a dividend increase or decrease, without considering the magnitude of the changes. Unlike the linear interaction model, the linear binary specification does not factor in the size of dividend changes, potentially mitigating the influence of outliers on the results. The omitted dummy for the intercept captures firms where \({R\Delta DIV}_{it}\)= 0, indicating no change in dividends.

By excluding the consideration of the magnitude of dividend changes, our focus centers on assessing whether a firm's decision to increase or decrease dividend payments significantly impacts returns, regardless of the extent of the dividend adjustment. We anticipate obtaining comparable significant results for both model specifications—the interaction model and the binary model. This anticipation is grounded in the understanding that these two model specifications complement each other in our analysis.Footnote 2

4 Results and Discussions

4.1 Value creation of dividend announcements

Table 6 illustrates the average abnormal return and cumulative average abnormal returns, expressed as percentages, for two significant sports events: the FIFA Football World Cup and ICC Cricket World Cup. These values represent the average outcomes observed across the sample during the period surrounding the event day for each specific transaction. Our findings concerning the returns linked to dividend announcements for FTSE-350 firms are consistent with previous research in this field, particularly studies conducted in developed countries like the UK. Significantly, the calculated CAR values in both of our event windows are positive and demonstrate statistical significance. These values represent the average \(\overline{CAR }\) across the sample during the period surrounding the event day for the particular transaction, from T2 = − 20 to T3 = 20.

4.2 Linear interaction model

Table 7 outlines that, in the case of the Cricket World Cup, all three primary independent variables in dividend increase (Panel A) exhibit both statistical and economic significance across the four model specifications. However, for dividend decrease (Panel B), only two main independent variables reach statistical and economic significance. These outcomes indicate that the relationship between dividend-increase (decrease) announcements and stock returns was notably influenced by the Cricket World Cup. These results align with our hypothesis and are consistent with prior literature, such as Gao et al. (2022) and Payne et al. (2018). The subsequent calculations elucidate the methodology employed to determine the partial impact of a dividend declaration made during the Cricket and Football World Cup.

After conducting the joint significant test, our results indicate that for Cricket World Cups, a firm fixed effect model holds significance in Table 7. Specifically, Table 7 reveals that a 10% growth in dividends increases stock returns by 1.11% in Model 4 on the day following England's victory in a cricket World Cup match, compared to a 0.48% increase if England loses. Conversely, Model 4 suggests that a 10% decrease in dividends reduces stock returns by 1.34% the following day when England wins a cricket World Cup match. The partial derivatives results in Table 8 further elaborate on these findings.

In Table 7, with the introduction of controls for big sports event outcomes (win or loss), our "Big sports event win" (loss) variable shows statistical significance. These results align with Edmans et al. (2007), who identified the impact of international soccer game results on stock market outcomes. By incorporating the "Big sports events effect" into our analysis, we mitigate the risk of attributing returns solely to sports outcomes, ensuring that the effects of dividends are accurately captured. These findings indicate that the stock market reaction is more positive to dividend-increase announcements following England's victories in cricket World Cup matches than after losses, and conversely, the reaction is more negative to dividend-decrease announcements following England's losses in cricket World Cup matches than after victories. This suggests that investors would react more negatively if, on the night before, the England cricket team lost any World Cup matches and the following day a dividend decrease was announced. These results primarily indicate that when firms announce dividends on or before a major sports event, the stock market reacts differently than it does under normal circumstances. Thus, our hypothesis is supported, and our findings are consistent with previous literature (see Gao et al. 2022; Payne et al. 2018).

Table 7 documents that for the Football World Cup, all three main independent variables are statistically and economically significant in the four different model specifications in Panel A. In Panel B, only two variables are statistically significant. These findings illustrate that the link between dividend-increase (decrease) announcements and stock returns was significantly influenced by the Football World Cup. These results align with our hypothesis and previous literature (see Dimic et al. 2018; Godinho and Cerqueira 2018).

Based on the joint significant test results, we observe that for Football World Cup firms, the fixed effect model is significant, mirroring the findings for Cricket World Cups. The outcomes in Table 7 suggest that a 10% dividend increase leads to a growth in stock returns by 1.00% in Model 4 on the day following England's victory in a football World Cup match, while it raises stock returns by only 0.48% if England lost a World Cup match. Conversely, Model 4 indicates that a 10% dividend decline reduces stock returns by 1.22% on the day after England wins a football World Cup match. These findings imply that the stock market reaction is more positive to dividend-increase announcements following England's victories in football World Cup matches than after losses, and conversely, the reaction is more negative to dividend-decrease announcements following England's losses in football World Cup matches than after victories. This suggests that the stock market would react more positively if a dividend announcement occurred on the day after the England team wins a football World Cup match. These results indicate that our hypotheses are supported, aligning with previous literature such as Dimic et al. (2018) and Godinho and Cerqueira (2018), which report that the stock market reacts positively the day after favourite teams win football matches.

4.3 Linear binary model

Table 9 documents that all three independent variables are statistically and economically significant in the four model specifications for both cricket world cups and football world cups in both panel A and panel B. The following are the calculations we use to determine the partial impact of a dividend declaration made during the football and cricket world cup.

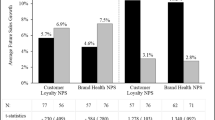

The joint significant test results indicate that for Cricket World Cups, a firm fixed effect model is statistically significant in Table 8, similar to our interaction model (baseline model). However, three other models are also considered. Table 10 presents the partial derivatives results. Table 9 reveals that any increase in dividends enhances stock returns (on average) across firms by 2.10% in Model 4 on the day after England wins a cricket World Cup match, while it improves stock returns by only 0.63% if England loses a World Cup match. Conversely, Model 4 indicates that a dividend decrease reduces stock returns on average across firms by -1.68% on the day after England won a cricket World Cup match, while it diminishes stock returns by -3.09% if England lost a cricket World Cup match. These results indicate that the stock market reaction is more positive to dividend-increase announcements following an England win in cricket World Cup matches than if they lose their matches, and the stock market reaction is more negative to dividend-decrease announcements following any England loss in cricket World Cup matches than if they had won. These results align with our baseline model (interaction model specification).

Now, from the joint significant test for Football World Cups, Model 4 is found to be significant. Table 8 suggests that an increase in dividend payments would increase stock returns, on average, across firms by 2.34% in Model 4 on the day after England wins the football World Cup match, while it boosts stock returns by only 0.68% if the England team lost their football World Cup match. On the other hand, Model 4 in Table 9 indicates that any dividend decrease will condense stock returns, on average, across firms by -2.01% on the day after England wins the football World Cup match, while it reduces stock returns by -3.03% if they have lost a football World Cup match. These results suggest that the market reacts more positively to any announcement of an increase in dividend following England's win in a football World Cup match than if they lost their matches, and the stock market reacts more negatively to dividend-decrease announcements following England's loss in football World Cup matches than if they won matches. Our results are supported by previous studies and are consistent with our baseline model.

5 Additional test

Test based on firm size

In this section, we provide details on the additional tests conducted to further support our preliminary findings. The entire sample was divided into two distinct subsamples based on firm size. Firms with a size mean value ranging between "2.00 and 3.00" were classified as small, while those with an average size between "6.00 and 7.00" were classified as large. This firm size-based approach aimed to produce more reliable findings for two key reasons. First, larger companies tend to pay more cash dividends while generating higher returns. In contrast, smaller companies often have lower returns and may pay fewer or no cash dividends, choosing to invest their funds in projects with a positive NPV (Net Present Value). Second, larger companies are more likely to pay higher cash dividends because they are more focused on safeguarding investor interests, as highlighted by Hasan et al. (2022).

Additionally, we observed that investors in larger firms tend to allocate substantial amounts of money to the markets. They are aware that the firms they invest in will pay dividends and are more likely to enjoy higher returns. Consequently, these investors place greater emphasis on the success or failure of their favourite sports teams (such as England) rather than being overly concerned with dividend increases or decreases. There are two main reasons for this behavioural pattern. Firstly, investors in larger firms have more substantial financial resources, so they are less perturbed by whether dividends increase or decrease during major sporting events like the FIFA Football World Cup and ICC Cricket World Cup. Secondly, these investors understand that their investments will yield higher returns, given that larger firms have greater capital to invest in new NPV-positive projects, which, in turn, generate higher returns. Conversely, investors in smaller firms are more focused on receiving dividends. Therefore, their sentiment tends to decrease if dividends decrease, even if their favourite sports team wins a major event. Conversely, their mood improves when firms announce dividend increases, even if their favourite team loses the event.

Table 11 provides further insight that aligns with the previous explanations. In Table 11, Panel A reveals that when dividend changes are interacted with the dividend increase dummy and big sports event wins, our results are statistically and economically significant across the four different models (for both cricket and football) for both small and large size firms. However, when dividend changes are interacted with the dividend increase dummy and big sports event losses, our results are statistically significant for large size firms but not statistically significant for small firms. These outcomes suggest that small size firms react differently to dividend announcements and big sports events in comparison to stock market returns.

Conversely, in Panel B of Table 11, we observe that when dividend changes are interacted with the dividend decrease dummy and big sports event wins, our results are statistically and economically significant across the four different models (for both cricket and football) for both small and large size firms. Nevertheless, when dividend changes are interacted with the dividend decrease dummy and big sports event losses, our results are statistically significant for small size firms but not statistically significant for large firms. These findings are in line with our primary empirical results and are consistent with previous literature (see Baker and Wurgler 2006).

Test based on stock repurchase

In this section, we present additional tests using stock repurchase announcements as a substitute for dividend announcements. Prior literature suggests that stock repurchases serve as a substitute for dividends (see Golden and Kohlbeck 2019; Grullon and Michaely 2002; Jiang et al. 2013). According to the dividend substitution theory, companies might favor stock repurchases over dividends to avoid the dilution effect on earnings associated with exercising stock options. Additionally, managers may opt for stock repurchases to benefit from favorable tax treatment. The dividend substitution theory is supported by studies such as Kahle (2002), which demonstrates a relation between the rise in stock options and the increasing preference for stock repurchases. This is based on the observation that dividends negatively impact the value of managerial stock options, while stock repurchases do not. Skinner (2008) and the work by Grullon and Michaely (2002) posit that companies opt for stock repurchases instead of dividends for capital payout to avoid dilution of EPS (Earnings per share) stemming from the utilization of stock options, aligning with their research conclusions.

Jiang et al. (2013) put forth a novel hypothesis contending that managers perceive stock repurchases and dividend payments as interchangeable. However, previous literature provides mixed evidence on this matter. On one hand, DeAngelo et al. (2000) report that, although special dividends have become less frequent over time, share repurchases have not replaced them. Jagannathan et al. (2000) argue that companies use repurchases to release short-term cash flows and dividends to release permanent cash flows, indicating a complementary role rather than substitution. Grullon and Michaely (2002) find that companies paying fewer dividends than anticipated tend to buy back a comparatively larger number of shares, supporting a substitution effect.

Based on the previous literature, our prediction is that stock repurchases serve as a substitute for dividends. In this section, we replace the dividend announcement date with the repurchase announcement date to investigate whether repurchase announcements have any effect on England's win or loss in major sports events. It is evident from the literature that firms usually repurchase stocks at higher prices (see Golden and Kohlbeck 2019; Grullon and Michaely 2002; Jiang et al. 2013). Additionally, some firms repurchase their stocks infrequently, and we include those firms in the repurchase initiation method, while others repurchase their stocks frequently, and we include those firms in the repurchase continuation method (See Appendix Table 14 for definition) (see Golden and Kohlbeck 2019; Grullon and Michaely 2002; Jiang et al. 2013). Here, we use repurchase premium as one of our main independent variables and then interact repurchase premium with big sports event win and big sports event loss dummy. Our controls and fixed effects are consistent with our previous tests, and we also cluster our results using firm ID and date. In this analysis, our dependent variable is CAR [-1, + 1]. We use the following equation to run our regression.

where, \({Repurchase\_Premium}_{t}\) is the difference between the logarithm of book-value-weighted market-to-book ratios of firms classified as Frequent Repurchasers (firms that repurchase shares in year t, t − 1, and t − 2) and the logs of book-value-weighted market-to-book ratios of Nonfrequent Repurchasers (shares repurchase in year t but not in year t − 1).

Panel A in Table 12 employs the repurchase initiation method, revealing that the repurchase premium variable is both economically and statistically significant at the 1% level for both cricket and football World Cup matches. In the same panel, when the repurchase premium interacts with the big sports events win variable, our results are economically and statistically significant at the 1% level for both cricket and football World Cup matches in both models. Similarly, when the repurchase premium interacts with the big sports events loss variable, our results are economically and statistically significant at the 1% level, displaying negative signs for both cricket and football World Cup matches in both models.

Panel B in Table 12 presents repurchase continuation results, which align with our Panel A findings. These results suggest that whether firms are nonfrequent repurchasers or frequent repurchasers, the difference is not substantial. In both situations, when a firm announces stock repurchase and England wins (loses) any big sports events matches, the stock market will react more positively (more negatively). These findings consistently support our previous test results and our hypothesis.

6 Endogeneity and robustness check

6.1 GMM estimation

In both of our model specifications, we incorporate five different control variables to alleviate the omitted variable bias. However, potential spurious results due to reversal causality necessitate addressing endogeneity problems. To tackle any established causality issues, we employ the Two-Step GMM dynamic panel estimation method, a methodology proposed by Arellano and Bond (1991), Arellano and Bover (1995), Blundell and Bond (2000), and Hasan et al. (2022).

This study opts for system GMM over difference GMM due to its higher efficiency, as established by Blundell and Bond (1998), while the latter tends to suffer from weak instrument problems, as noted by Alonso-Borrego and Arellano (1999). The choice of a two-step estimation approach over a one-step estimation is based on the rationale that two-step estimation is more efficient, as indicated by Alam et al. (2020). System GMM proves to be an efficient choice when dealing with panel data characterized by a smaller time dimension (T = 31) compared to its cross-sectional dimension (N = 4,021), as highlighted by Asongu et al. (2018). This method aligns well with the panel data structure, making it suitable for addressing various issues such as endogeneity, unobserved heterogeneity, measurement errors, and omitted variable bias resulting from reverse causality, as discussed in prior research (Alam et al. 2019; Hasan et al., 2024; Mthanti and Ojah 2017).

The concern of reverse causality arises because dividends can influence a company's profitability, while earnings may also impact dividend payments. For instance, a higher firm valuation may motivate managers to initiate dividend payments, creating a situation of reverse causality, often referred to as simultaneity bias. The potential simultaneity bias underscores the need for employing System GMM estimation, as it helps mitigate these issues and provides more reliable results compared to OLS regressions, as emphasized by Frijns et al. (2014).

The Two-Step GMM method results are presented in Table 13. From these results, we observe consistency with our main empirical findings. Therefore, the findings indicate that the stock market reacts more positively to dividend-increase announcements following any England win in big sports event matches than if they have lost their matches, and the stock market reacts more negatively to dividend-decrease announcements after any England match loss in such big sports event matches than if they win matches.

7 Conclusion

In our research, we contribute significantly to the current academic discourse by delving into an aspect often overlooked in prior studies. While existing literature has primarily explored the broader connection between sports and investor sentiment, our focus extends to the specific impact of major sporting events, notably the ICC Cricket and FIFA Football World Cups. Our empirical investigation aims to explain the relationship between dividend announcements and stock market returns within the context of these high-profile sports events. Drawing on comprehensive data from the UK FTSE 350 index spanning from January 1990 to December 2021, our thorough analysis strives to uncover how these prominent sporting occasions distinctly shape the reaction of the London Stock Exchange (LSE) to announcements regarding changes in dividends.

Our empirical findings, derived from both linear interaction and linear binary models, unveil distinctive patterns in the stock market's reaction. Following victories by the England team in the World Cup (both in cricket and football), the stock market exhibits a more favourable response to announcements of dividend increases compared to instances when they face defeat. Conversely, the stock market's reaction turns more negative when confronted with announcements of dividend decreases following losses by the English team in the World Cup, in both cricket and football, compared to when they emerge victorious. Importantly, these results withstand scrutiny when employing the GMM method to account for endogeneity, suggesting the robustness of our findings.

These findings hold significant practical implications. Firstly, we advocate for further research into the impact of major sporting events on dividend announcements and subsequent stock market reactions. Such investigations could offer deeper insights into diverse behavioural investment actions. Secondly, investors are urged to recognize the significance of these events in shaping stock prices and the resulting investment behaviour. Lastly, policymakers should acknowledge the importance of major sports events and consider taking appropriate measures to support the market as needed.

7.1 Limitations and further research

This research paper is not without its limitations, and we recommend that future research address these gaps. One potential limitation is the possibility that the observed loss effect can be attributed to fluctuations in liquidity. Investors, influenced by the outcome of a match, may be less inclined to participate in the stock market the following day, resulting in reduced order flow. If a substantial number of investors refrain from trading, the increased time required to execute trades may force sellers to accept lower prices. To investigate this possibility, access to aggregate trading volume data for the stocks under study would have been required. Unfortunately, collecting such data exceeded the scope of this research paper. Therefore, we suggest that future researchers strive to gather relevant aggregated trading volume data for stocks and explore whether they yield results similar to or different from our findings.

Furthermore, this paper has other limitations, including the focus on firms listed on the FTSE-350. However, some of these firms may also be listed on other stock exchanges in different countries. Future researchers could investigate the potential impact of dual listing on stock returns. Additionally, our analysis concentrated on the performance of the English national team. Future researchers might explore whether the outcomes of matches involving other UK teams (such as Scottish or Northern Irish teams) have any discernible effects on the London Stock Exchange, given that all four UK nations trade on the same stock exchange.

Considering that international traders participate in the London Stock Exchange, questions arise about whether these traders uniformly react to the performance of the English national team. Investigating this issue is beyond the scope of our research paper but represents a potential avenue for further exploration. Lastly, we lack data on how many traders typically watch matches. Future research could incorporate such data to assess whether professional traders react differently based on their match-watching habits. In conclusion, while this research provides valuable insights, it is essential to acknowledge these limitations and encourage future researchers to address them to enhance our understanding of the relationship between sports events, investor sentiment, and stock market behaviour.

References

Alam A, Uddin M, Yazdifar H (2019) Institutional determinants of R&D investment: evidence from emerging markets. Technol Forecast Soc Chang 138:34–44

Alam A, Uddin M, Yazdifar H, Shafique S, Lartey T (2020) R&D investment, firm performance and moderating role of system and safeguard: evidence from emerging markets. J Bus Res 106:94–105

Alonso-Borrego C, Arellano M (1999) Symmetrically normalnormalized instrumental-variable estimation using panel data. J Bus Econ Stat 17:36–49

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variables estimation of error-components models. J Econ 68(10):29–51

Ashton JK, Gerrard B, Hudson R (2003) Economic impact of national sporting success: evidence from London stock exchange. Appl Econ Lett 10(12):783–785

Asongu SA, Nwachukwu JC, Orim S-MI (2018) Mobile phones, institutional quality and entrepreneurship in sub-Saharan Africa. Technol Forecast Soc Chang 131:183–203

Baker M, Wurgler J (2006) Investor sentiment and the crosssection of stock return. J Finance 61(4):1645–1680

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Economet Rev 19(3):321–340

Brown SJ, Warner JB (1985) Using Daily Stock Returns: The Case of Event Studies. J Financ Econ 14:3–31

Campbell JY, Lo AW, MacKinley AC (1997) The econometrics of financial markets. Princeton University Press, Princeton

Claessens S, Laeven L (2006) A reader in international corporate finance, 1. World Bank, Washington, DC

Das BC, Hasan F, Suthadhar SR, Shafique S (2023) Impact of Russia-Ukraine war on stock returns in European stock markets. Glob J Flex Syst Manag 24(3):395–407

Das BC, Hasan F, Suthadhar SR (2024) Impact of economic policy uncertainty and inflation risk on corporate cash holdings. Rev Quant Financ Acc 62(3):865–887

DeAngelo H, DeAngelo L, Skinner D (2000) Special dividends and the evolution of dividend signaling. J Financ Econ 57:309–354

Dimic N, Neudl M, Orlov V, Äijö J (2018) Investor sentiment, soccer games and stock returns. Res Int Bus Finance 43(C):90–98

Edmans A, Garcia D, Norli O (2007) Sports sentiment and stock returns. J Finance 62(4):1967–1998

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Financ 25(2):383–417

Fama EF, Fisher L, Jensen MC, Roll R (1969) The adjustment of stock prices to new information. Int Econ Rev 10:1–21

Fan Q, Wang T (2018) Game day effect on stock market: Evidence from four major sports leagues in US. J Behav Exp Finance 20(C):9–18

Frijns B, Gilbert A, Tourani-Rad A (2014) Learning by doing: the role of financial experience in financial literacy. J Publ Policy 34:123–154

Gao Y, Wang Y, Hafsi T (2022) Stock market reaction to affiliated sports teams’ performance: evidence from China. Chin Manag Stud 17:787–807

Geyer-Klingeberg J, Hang M, Walter M, Rathgeber A (2018) Do stock markets react to soccer games? A meta-regression analysis. Appl Econ 50(19):2171–2189

Godinho P, Cerqueira P (2018) The impact of expectations, match importance, and results in the stock prices of european football teams. J Sports Econ 19(2):230–278

Golden J, Kohlbeck M (2019) The unintended effects of financial accounting standard 123R on stock repurchase and dividend activity. J Acc Audit Financ 34(3):411–433

Grullon G, Michaely R (2002) Dividends, share repurchases, and the substitution hypothesis. J Financ 57:1649–1684

Hasan F (2021a) Dividend changes as predictors of future profitability. J Prediction Markets 15(1):37–66

Hasan F (2021b) Relationship between orthodox finance and dividend policy: a literature review. Indian-Pacific J Account Finance 5(1):13–40

Hasan F (2022) Using UK data to study the effects of dividends announcements on stock market returns. J Prediction Markets 16(2):47–75

Hasan F (2024) The impact of climate change on dividend policy in the UK stock market. Int J Manag Financ Account 16(1):119–137

Hasan F, Islam MR (2022) The relationship between behavioural finance and dividend policy: a literature review. Acad Account Financ Stud J 26(5):1–11

Hasan F, Shafique S, Das BC, Shome R (2022) R&D intensity and firms dividend policy: evidence from BRICS countries. J Appl Acc Res 23(4):846–862

Hasan F, Kayani UN, Choudhury T (2023) Behavioral risk preferences and dividend changes: exploring the linkages with prospect theory through empirical analysis. Glob J Flex Syst Manag 24(4):517–535

Hasan F, Al-Okaily M, Choudhury T, Kayani UN (2024) A comparative analysis between fintech and traditional stock markets: using Russia and Ukraine WAR data. Electron Commer Res (In Press)

Hayduk T (2022) Who benefitted from the pyeongchang olympic announcement? evidence from the South Korean stock market. J Sports Econ 23(1):39–75

Hiremath GS, Venkatesh H, Choudhury M (2019) Sports sentiment and behavior of stock prices: a case of T-20 and IPL cricket matches. Rev Behav Finance 11(3):266–276

Jagannathan M, Stephens CP, Weisbach MS (2000) Financial flexibility and the choice between dividends and stock repurchases. J Financ Econ 57:355–384

Jiang Z, Kim KA, Lie E, Yang S (2013) Share repurchases, catering, and dividend substitution. J Corp Finan 21:36–50

Kahle K (2002) When a buyback isn’t a buyback: Open market repurchases and employee options. J Financ Econ 63:235–261

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47:263–292

Kaplanski G, Levy H (2010) Exploitable predictable irrationality: the FIFA world cup effect on the U. S. stock market. J Financ Quant Anal 45(2):535–553

Kerr JH, Wilson GV, Nakamura I, Sudo Y (2005) Emotional dynamics of soccer fans at winning and losing games. Personal Individ Differ 38(8):1855–1866

Mthanti T, Ojah P (2017) Entrepreneurial orientation (EO): measurement and policy implications of entrepreneurship at the macroeconomic level. Res Policy 46(4):724–739

Payne BC, Tresl J, Friesen GC (2018) Sentiment and stock returns: anticipating a major sporting event. J Sports Econ 19(6):843–872

Pindado J, Queiroz V, Torre C (2015) How do country level governance characteristics impact the relationship between R&D and firm value? R&D Manag 45(5):515–526

Pritamani M, Singal V (2001) Return predictability following large price changes and information releases. J Bank Financ 25:631–656

Samagaio A, Couto E, Caiado J (2009) Sporting, financial and stock market performance in english football: an empirical analysis of structural relationships. Work Pap 0906, Centre for Applied Mathematics and Economics (CEMAPRE), School of Economics and Management (ISEG), Technical University of Lisbon

Schwarz N, Strack F, Kommer D, Wagner D (1987) Soccer, rooms, and the quality of your life: mood effects on judgment. Eur J Soc Psychol 17(1):69–79

Sharpe WF (1963) A simplified model for portfolio analysis. Manag Sci 9(2):277–293

Shiller RJ (1984) Stock prices and social dynamics. Brook Pap Econ Act 2:457–510

Skinner D (2008) The evolving relation between earnings, dividend, and stock repurchases. J Financ Econ 87:582–609

Thompson RB, Olsen C, Dietrich JR (1987) Attributes of news about firms: an analysis of firm-specific new reported in the wall street journal index. J Account Res 25:245–274

Wang JY, Markellos RN (2018) Is there an olympic gold medal rush in the stock market? Eur J Finance 24(17):1631–1648

Wann D, Dolan T, Mcgeorge K, Allison J (1994) Relationships between spectator identification and spectators’ perceptions of influence, spectators’ emotions, and competition outcome. J Sport Exerc Psychol 16:347–364

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hasan, F., Al-Najjar, B. Exploring the connections: Dividend announcements, stock market returns, and major sporting events. Rev Quant Finan Acc (2024). https://doi.org/10.1007/s11156-024-01277-1

Accepted:

Published:

DOI: https://doi.org/10.1007/s11156-024-01277-1