Abstract

This research explores the performance of the euro area banking system between 2002:Q3 and 2021:Q1 using banks’ return on assets as a gauge. It finds that despite the Covid-19 pandemic, the banking sector’s performance has not been negatively affected in a statistically significant way. In addition, it shows that while the global financial crisis and the sovereign crisis both introduced significant uncertainty in the performance of the banking system in the euro area, such uncertainty has not been replicated during the worst part of the Covid-19 pandemic. From a purely technical viewpoint, uncertainty in the banking system’s performance in the euro area highlights the relevance of using methodological approaches that control for the endogeneity of most bank-specific determinants of return on assets and that are robust to changes in unconditional variance due to regime changes, to future random shocks or both.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and motivation

The objective of this research is to explore the performance of the euro area banking system as represented by the aggregate balance sheets and profit and loss accounts of the 27 major banking groups between 2002:Q3 and 2021:Q1, a period comprising the first five quarters of the Covid-19 pandemic. In a span of less than three months, Covid-19 spread from China across the world, becoming a global pandemic. By the end of March 2020, the virus had impacted every aspect of the global economy and people’s lives, from international finance and supply chains to employment and corporate distress, as well as education and income disparity. More than 5.5 m people have died at the end-December 2021 of Covid-19, and this may be an underestimate. Figures 1 and 2 summarize the effects of Covid-19 and provide a comparison with the effects of the Great Financial Crisis of 2007–2009. We observe that there is a sizeable higher negative magnitude of the shocks caused by Covid-19 relative to the ones caused by GFC in terms of growth and unemployment, both in advanced and emerging market economies.

Real GDP (Annual percent change, IMF 2021 forecast)

Unemployment rate (Annual percent of total labour force, IMF 2021 forecast)

Governments introduced a wide variety of containment measures, ranging from lockdowns and travel restrictions to school closures and bans on large gatherings, sometimes in waves and reflecting often not only local, but global conditions. Beyond public health measures, governments implemented massive expansionary fiscal policies, reinforced already loose monetary policy, and introduced expansionary macroprudential policies and broad-based regulatory forbearance that helped economies and mitigated risks to financial stability by avoiding the materialization of credit risk and liquidity spirals (see for example, Borio 2020).

In the euro area, monetary policy pandemic-related measures include the European Central Bank (ECB) Pandemic Emergency Purchase Programme, more favorable terms for the targeted longer-term refinancing operations and further easing of collateral rules.Footnote 1 The ECB Main Refinancing Operations Fixed Rate has continued to be at 0.00% and the Marginal Lending Facility rate at 0.25% percent since March 2016, while the Deposit Facility rate, reduced to −0.10% in June 2014, has remained at −0.50% since September 2019. Fiscal support amounted to 8% of real GDP in 2020 in the EU. Policy measures have resulted in the rise in the aggregate euro area sovereign debt-to-GDP ratio to 100% in 2020, up from 86% of GDP in 2019 (ECB Financial Stability Review, May 2021). In December 2020, the EU budget and Next Generation EU recovery package was approved to provide 750bn euro in grants and loans.

In the absence of prudential capital releases,Footnote 2 banks’ capital targets would have been pushed higher during 2020 by losses’ expectations while deleveraging pressures would have increased given that the Countercyclical Capital Buffer (CCyB) accounted just for 0.11% in the euro area against a Core Tier 1 (CET1) ratio of 14.9%. In addition, the ECB Banking Supervision Prudential regulators reduced incentives of banks to limit credit and banks were also allowed to operate transitorily below the liquidity coverage ratio. National macroprudential authorities released more than 20bn euro of capital buffer requirements including the release of the CCyB. The European Systemic Risk Board (ESRB 2020) issued a recommendation limiting dividends distributions. The Capital Requirement Regulation was relaxed to allow banks flexibility including by a reduction in minimum capital requirements against non-performing loans (NPL), allowing banks to exclude central bank exposures from their leverage ratio calculations and delaying until January 2023 the introduction of the leverage ratio buffer.

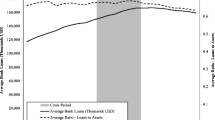

Against this background, this research has as objective to explore the performance of the euro area banking system as represented by the aggregate of 27 major banking groups between 2002:Q3 and 2021:Q1 using ROA as a gauge (Fig. 3).Footnote 3 It finds that despite the Covid-19 pandemic, the euro area banking sector’s performance has not been negatively affected in a statistically significant way. In addition, and in contrast, it shows that both the GFC and the sovereign crisis introduced significant uncertainty in the performance of the banking sector in the euro area. However, the uncertainty in performance observed after the GFC has not been replicated during the worst part of the pandemic in the euro area. From a purely technical viewpoint, uncertainty in banking performance in the euro area highlights the relevance of using methodological approaches that control for the endogeneity of most bank-specific determinants of ROA and that are robust to changes in ROA’s unconditional variance due to regime changes, to future random shocks or both.Footnote 4

The present paper contributes to the ongoing discussion on the effects of the Covid-19 pandemic on banking and financial conditions in the aftermath and during the pandemic. Most of the extant research on Covid-19 is heavily focused on the U.S. banking system. However, it is argued that to obtain a more complete picture of the impacts of the crisis and the government policies implemented and their efficacy we need to consider other main banking systems (Berger and Demirguc-Kunt 2021). There are several reasons to focus on the euro area banking system’s response to the pandemic. First, as Berger and Demirguc-Kunt (2021) make clear, it is important to investigate other banking systems which are likely to be experiencing more difficulties with the crisis compared to the U.S. Second, given this argument, it is evident that there is limited empirical evidence of how the euro area banking system responded to this purely external shock. Third, we expect that the euro area banking system behaved differently during the pandemic compared to the U.S. banks since as Sclurarick et al. (2020) point out their balance sheets were different than those of the U.S. banks with respect to the size of loan-losses reserves. This argument is reinforced in the study of Borri and di Giorgio (2022) who provide evidence that during the Covid-19 pandemic larger banks and banks with a business model more exposed to trading and financial market volatility significantly contribute to systemic risk. Elnahass et al. (2021) further show that the Covid-19 outbreak had significant negative effects on various indicators of financial performance. Finally, as it will be documented (see for example Acharya et al. 2021) the recovery of the European economies along with the European banking sector has been slower than that of the U.S. economy and U.S. banking.

The remainder of the paper is organized as follows. Section 2 briefly provides the related literature. The following section presents the data, sample selection and variables employed. Section 4 discusses the methodological approach followed and Sect. 5 presents our research strategy and discusses the results. Section 6 concludes and presents some policy implications.

2 Related literature

Over the years, euro area banks have substantially raised their capital adequacy to cope with the solvency and legacy problems created by the GFC and the euro area sovereign debt crisis aa well as the ensuing change in the regulatory paradigm represented by Basel III. However, it has also been observed that many banks, particularly in the European periphery, suffered from chronically low profitability including because of inefficient cost structures, reduced net interest margins and high levels of NPL. Several recent studies have studied the effects of the pandemic on European banks’ capital, the overall performance of the banking industry, bank lending, banks’ stock returns, banks’ resilience, and their response to support policies along with their response to governments’ support policies along with their reaction to changes in the prudential environment.

Our paper is related to the strand of literature that explores the banks’ performance during Covid-19. Ikeda et al. (2021) compare the phases of the Covid-19 crisis with the GFC and then re-evaluate the resilience of the largest banks in the world with the implementation of a market-adjusted risk-weighted capital ratio and through stress tests. The study employs data for 360 of the largest 500 institutions from 50 regions and it shows that market valuations have recovered to a large extent from the problems created to the banking industry on the outbreak of the pandemic. Moreover, this study shows that investors remain confident in the resilience of banks.

Berger and Demirguc-Kunt (2021) underline that despite the devastating global human and economic tolls of the Covid-19 crisis, it has led to a shorter U.S. recession than expected and a banking crisis has been avoided. They argue that the recession was short due to the speed and size of U.S. support programmes during Covid-19. In fact, Berger and Demirguc-Kunt (2021) underline that the economic recovery from Covid-19 was faster and larger than for the GFC. They conclude that the U.S. banking industry resilience is mainly due to the prudential policies adopted during and after the GFC.

Colak and Oztekin (2021) use a sample of 125 countries to evaluate the effects of the Covid-19 pandemic on global bank lending. They focus on bank and country characteristics that amplify or weaken the effect of the pandemic outbreak on bank credit. They find that bank lending is weaker in countries that are more affected by the health crisis associated with Covid-19. This effect depends mostly on the role that bank’s financial conditions, the regulatory and institutional environment, debt market developments as well as credit and bond market developments, and borrower heterogeneity play in shaping the banks’ reaction to the pandemic. Norden et al., (2021) find that in Brazil the pandemic had a significant negative impact on local credit. ‘Soft interventions’ (e. g., social distancing and mass gathering restrictions) and late reopening have a positive effect while ‘hard interventions’ (e.g., closure of non-essential services) and early reopening have a negative effect. As in Colak and Oztekin (2021), Norden et al. (2021) also find that state-owned banks grant more local credit than privately owned banks during the COVID-19, a difference possibly driven by the institutional environment (i.e. internal bank governance and political influence from the Brazilian federal government). Li et al. (2021) investigate the effect of the COVID-19 pandemic on the relation between the use of noninterest income and bank profit and risk. They find that noninterest revenue sources are positively related to performance but inversely related risk.

The paper is also related to another strand of literature that analyzes the effect of the pandemic on European banks’ capital, stock returns, resilience and responds changes in the prudential environment. Berger et al., (2021) underline that Basel III reforms on a global basis along with country-specific improvements in bank supervision and regulation made the banking industry more resilient to shocks, even in the case of Covid-19 pandemic. Therefore, Berger et al., (2021) argue that the improved resilience provided the background to the banking industry to cope with the social and economic challenges resulted from the Covid-19 pandemic. Moreover, because of the quantitative easing programmes implemented by central banks in most countries banks’ liquidity risks have remained low since the onset of the pandemic.

IMF (2021) provides a study that evaluates the impact of the pandemic on European banks’ capital. The analysis considers all significant government, E.U. and ECB policies aimed to support the financial and real sectors of the euro area and E.U. countries. The main finding of the analysis is that although European banks faced a substantial decline in capital ratios, they remain resilient to a great extent. Furthermore, it argues that several larger euro area banks may struggle to meet their capital threshold for the maximum distributable amount, possibly leading to funding pressures. While there has been some recovery throughout the euro area countries and sectors as lockdown measures have been eased, some near-risks remain, as business fragility remains high in the sectors which have been affected more severely by pandemic restrictions (ECB, Financial Stability Review 2021). A key issue that remains are the vulnerabilities of the euro area banks since their structural problems resurface during the pandemic. Thus, bank profitability remains hampered by euro area banks’ structural challenges.

In a related study, OECD (2021) investigates the extent of the potential rise of NPLs depending on the severity of the Covid-19 crisis on the global economic environment. The main implication of the OECD study (2021) is that banks’ NPL would increase substantially although extensive monetary and fiscal support measures would reduce the severity of the impact of the Covid-19 crisis in most regions. Moreover, this study analyzes the subsequent implications for bank capital since banks would face reductions in their common equity Tier 1 (CET1) and they argue that the likelihood that CET1 capital deterioration could trigger contingent convertible bond (CoCos) conversion into loss absorbing equity largely depends on a bank’s starting CET1 capital buffer.

Demirguc-Kunt et al. (2021) examine the impact of financial sector policy announcements on banks’ stocks around the world during the outbreak of the Covid-19 crisis. The main finding of their analysis is that the provision of liquidity, the implementation of borrower assistance programmes, and expansionary monetary policy moderated the negative effects of the pandemic. However, it is also documented that countercyclical prudential measures led to negative abnormal returns in bank stocks. Duan et al. (2021) using a large panel data of 1,584 listed banks from 64 countries to investigate the effect of the Covid-19 pandemic on bank systemic risk. The authors find that the pandemic has increased systemic risk across countries. They also argue that the negative effect on bank systemic stability is more evident among others in the case of large, highly leveraged, and undercapitalized banks.

Dursum-de Neef and Schandlbauer (2021) investigate the way European banks adjusted lending at the beginning of the Covid-19 pandemic. They employ a bank-level Covid-19 exposure measure and show that the better capitalized banks reduced their lending whereas the worse-capitalized banks increased their lending. Dursum-de Neef and Schandlbauer (2021) further show that better-capitalized banks experienced a substantial larger increase in their restructured loans. In a related paper Schularick et al. (2020) analyze 79 banks of the euro area that took part in the 2019 transparency exercise by the European Banking Authority. This study estimates the capital shortfall of these banks in response to Covid-19 crisis and the policy recommendation is that banks should recapitalize precautionarily to provide insurance against further economic shocks. Borri and di Giorgio (2022) discuss the systemic risk contribution of a set of large publicly traded European banks. The main finding of their analysis is that sovereign default risks significantly affected the systemic risk contribution of all banks. However, the implementation of the Pandemic Emergency Purchase Programme by ECB restored calm in the European banking sector. Elnahass et al. (2021) examine the impact of the Covid-19 pandemic on the global banking stability and to assess any potential recovery signals. They employ panel data for 1090 banks from 116 countries and they find that the Covid-19 pandemic had significant negative effects on financial performance in the global banking sector.

Igan et al. (2023) examine the resilience of banks as perceived by market participants during the Covid-19 crisis. They focus on investigating how bank stock returns during the start of the pandemic January 2022–March 2020 are related to the pre-crisis implementation of macroprudential policy using a cross-section data for 52 countries that includes eurozone. The main finding of Igan et al. (2023) is that a tighter macroprudential policy stance is beneficial for bank systemic risk, as evaluated by equity market investors. The main factors in the reduction in bank risk are credit growth limits, reserve requirements and dynamic provisioning. Silva et al. (2023) examines how Covid-19 pandemic and digitalization have changed bank lending behavior. The employ microdata from Brazil, to investigate the determinants of these changes at the bank branch level and by credit type. They argue that branches in areas more affected by Covid-19 reduced loan issuances and experienced lower credit revenues. Overall, Silva et al. (2023) show that during periods of distress digitalization plays a critical role in increasing financial stability since it enables banks to respond more swiftly and effectively. Boubakri et al. (2023) using a sample of 421 banks from 17 countries, show that while lending growth of conventional and Islamic banks decrease during the initial phase of the Covid-19 crisis it is statistically significant only for conventional banks only.

In a related study Dumbar et al. (2022) uses changes in investors’ forward-looking net long hedging choices to determine the effect of a change in the FED’s capital buffer requirement on banks’ financial soundness. The main finding of the analysis is that an innovation that lowers the banking system’s capital buffer requirement improves both regulatory capital and Tier-1 capital. Tran et al. (2022) empirically evaluates the accounting and market-based risks of banks using a quarterly panel of international banks over the period 2020:Q1-2021:Q1,. They find that U.S. and non U.S. banks from high- and low-income countries exhibit greater accounting risk and increased return volatility during the pandemic.

3 Data, sample selection and variables

This study uses quarterly seasonally adjusted data covering the period 2002:Q3–2021:Q1. It includes balance sheet and profit-and-loss accounts data of the 27 largest euro area banking groups of the euro area, 12 of which are classified as Global Systemically Important Banks by the Financial Stability Board. These data are aggregated with equal weights to represent the euro area banking system.Footnote 5 Appendix 1 displays the list of euro area banking groups. Data on real GDP and the Harmonized Consumer Price Index (HCPI) are retrieved from the ECB Data Warehouse and all required data on banks’ balance sheets and capital adequacy are retrieved from Bloomberg. The diversification index and Henrfindhal-Hirschman index are authors’ estimates. Diversification is defined as the ratio of non-interest income to total bank revenue, following Kok et al., (2015). Finally, the study uses three Covid-19 measures.Footnote 6 First, the Stringency Index records the strictness of ‘lockdown style’ policies that primarily restrict people’s behaviour. It is calculated using all ordinal containment and closure policy indicators plus an indicator recording public information campaigns. Second, the Economic Support Index records measures such as income support and debt relief. It is calculated using ordinal economic policies indicators. Third, the number of Confirmed Deaths is used. Data for these measures is retrieved from Blavatnik School of Government and Oxford University and the Covid-19 Government Response Tracker. The definitions of all the variables employed in the present analysis are in Appendix 2. Table 1 presents the summary statistics for our data.

Table 2 provides the cross-correlations among ROA determinants. It is shown that most of the correlation coefficients of the bank-specific determinants are statistically significant at the five-percent level of significance.

When needed, non-stationary time series are made stationary using the Corbae-Ouliaris’ Ideal Band-pass Filter (Corbae and Ouliaris 1996).Footnote 7 This approach avoids having to first-difference non-stationary time series given that first-differencing is a high-pass filter with a gain function ‘‘that deviates substantially from the squared gain function of an ideal high-pass filter’’ (Koopmans 1974).Footnote 8 In addition, it avoids taking ad-hoc decisions following the frequent conflicting results on the degree of integration of most time series using currently available (low-power) unit-root tests with a null hypothesis of stationarity and a null hypothesis of non-stationarity. Corbae-Ouliaris’ filter has no finite sampling error, superior end-point properties and lower mean-squared error than popular time domain filters such as Christiano and Fitzgerald (2003). In addition, it is consistent, in contrast to Baxter and King (1995) filter.

To illustrate the econometric importance of the issue at stake, Fig. 4 displays the spectrum of the real GDP series of the euro area filtered by Corbae-Ouliaris and by first-differencing. The ordinates are in logs and represented using the same ordinates’ scale to evince the distinctive impact that both filters have on the data. While there is a minor difference at zero frequency, the significant reduction in the spectrum mass in the business-cycle frequency bandFootnote 9 that first-differencing produces clearly hampers econometric identification and estimation. All data are standardized.

4 Methodological approach

The data characteristics and the sample period, which covers the GFC and six quarters of the Covid-19 pandemic, justify the choice made about the econometric methodological approaches to use. Each of the estimators used addresses the likelihood that at least one of the following standard assumptions of the multiple regression model may be violated: (1) regressors’ exogeneity, (2) no significant collinearity among regressors, and (3) an error term that has zero expected value and homoskedasticity for all observations.Footnote 10 Correspondingly, three sets of models will be used. First, while macroeconomic and structural factors can safely be considered exogenous drivers of banks’ ROA, bank-specific factors such as loan-loss provisions, loan growth and efficiency measures are certainly simultaneously determined with measures of banks’ performance. In addition, it is customary in applied econometric work to include the lagged dependent variable in regressions, which may lead to biased and inconsistent estimates due to the correlation between the lagged dependent variable and the error term. To address these issues, this paper uses the well-known Generalized Method of Moments (GMM) and treats all bank-specific variables as endogenous, keeping the assumption of exogeneity for macroeconomic and structural variables.Footnote 11 This will be referred to henceforth as the canonical model with different versions of it in Tables 3 and 4: models 1 to 6.Footnote 12

Second, traditional bank-specific explanatory variables often capture bank size (e.g. total assets), operational efficiency (e.g. cost-to-income ratio), risk management quality (e.g. operating expenses-to-total assets ratio), asset quality (e.g. NPL ratio), bank solvency (e.g. Tier1 capital ratio), business models (e.g. interest-to-non-interest income ratio), and diversification.Footnote 13 These measures of drivers of banks’ performance have a high degree of collinearity, which while not biasing estimated coefficients, generate high standard errors with the implication that the null hypothesis often cannot be rejected.Footnote 14 This is especially problematic because most theoretical models suggest that these features of banks’ performance ought to be in a model seeking to explain it. Table 2 shows that over 60% of correlation coefficients among bank-specific drivers of ROA are significant at least at 5%. To address this econometric and data matter, this study uses another well-known econometric methodology, i.e. Partial Least Squares.Footnote 15 This will be referred to henceforth as the Partial Least Squared model and results of two versions of it are presented in Table 5: models 7 and 8. Partial Least Squares regressions, also known as projection to latent structures, derive a set of inputs that are linear combinations of the original regressors and account for the variance in them and are highly correlated with the dependent variable. The approach handles collinearity efficiently. As with GMM, given that Partial Least Squares is a well-known econometric estimation technique, to conserve space, it is not presented here. The number of factors used in models 7 and 8 is determined following Hallin and Liska (2007).

Finally, a simple calculation of ROA volatility as a 4-quarter moving average suggests that the classical assumption of homoskedasticity may be compromised (Fig. 5).Footnote 16 This suggests that coefficient estimates, while unbiased and consistent, may not be efficient. Therefore, a two-prong approach is taken. Firstly, when estimating models using the GMM and Partial Least Squares estimators, heteroskedasticity is tested. The estimates of the covariance matrix allow for the presence of heteroskedasticity as in White (1980).

Secondly, models with time-varying parameters (TVP) and models with TVP and Markov switching are also estimated: models 9 to 12. Results are presented in Table 6. This strategy allows to check the robustness of previous results. For example, this strategy permits exploring whether the serial correlation of the residuals found in the canonical model without a lagged dependent variable can be the result of not allowing for time variation in the coefficients, or not allowing for changes in ROA uncertainty (unconditional variance) due to future random shocks. This is a distinct possibility because the TVP cum Markov switching model encompasses changes in the conditional variance of ROA due to time-varying coefficients (i.e. economic agents’ learning process) and to structural changes, respectively. Taking into account the possibility of structural changes explicitly seems an important robustness check when studying the determinants of banks’ performance during a sample period which comprises the GFC, the euro area sovereign crisis and the Covid-19 shock.

Given that TVP and TVP cum Markov switching models are perhaps less well known, they are briefly presented below.

4.1 The TVP model

The TVP model of ROA with changes in conditional variance because of economic agents’ learning process can be written as follows:

where Mt refers to the macroeconomic determinants of ROA, Bt-1 refers to the bank-specific determinants of ROA lagged once, St refers to the structural determinants of ROA, the β coefficients are time-varying and et is an error term distributed as N(0, \({\sigma }_{e}^{2}\)).Footnote 17 The β coefficients follow a random walk:

where vit is an error term distributed as N(0, \({\sigma }_{vi}^{2}\)), and i = 1,…,3.

In the TVP model, uncertainty about regression coefficients produces a changing conditional variance in ROA. This is captured in Eq. (3), which is the variance of the conditional forecast error in the Kalman filter \({f}_{t, t-1}\):

where x are all the determinants of ROA, \({P}_{t, t-1}\) is the covariance matrix of the \({\beta }_{it}\) coefficients conditional on information up to period t-1. This model provides an interesting framework to test whether rational economic agents revise their coefficient estimates in a Bayesian manner when new information becomes available. As stated above, this is a distinct possibility during the sample period of this study during which three major shocks took place. Equation (3) will allow to test whether the conditional variance of the forecast error is due to unknown changing coefficients.

4.2 The TVP model with Markov switching

This model differs from the TVP Model because besides Eqs. (1) and (2), now et is assumed to be an error term distributed as N(0, \({\sigma }_{e,{S}_{t}}^{2}\)) and:

where \({S}_{t}\) is a discrete variable that depends upon \({S}_{t-1}\) and is therefore a two-state, 1st-order Markov-switching process where \({\sigma }_{e1}{> \sigma }_{e0}\). This process has the transition probabilities represented in Eqs. (5) and (6) where normal times are associated with \({S}_{t}=1\) and abnormal, unstable times linked to regime changes are associated with \({S}_{t}=0\):

The TVP model with Markov switching encompasses two possible sources of changes in the conditional variance of the error term: first, uncertainty due to agents’ learning process and second, uncertainty due to future random shocks associated with regime changes.Footnote 18

5 Research strategy and discussion of results

The motivation for using the three sets of models described above is tightly linked to the research strategy adopted. First, the canonical model with the macroeconomic, banking-specific and structural drivers is estimated during the period 2002:Q3-2019:Q2. There are two versions of it, one excluding the lagged dependent variable and another one including it: i.e. models (1) and (2). Second, these two canonical versions of the model are used to forecast ROA in the second half of 2019, i.e. pre-Covid period, and during the five following quarters, i.e. the Covid period. Given that three out of ten ten regressors of the canonical model are not statistically significant at usual significance levels, two reduced versions of the canonical model that exclude the insignificant regressors are also estimated: i.e. models (3) and (4).

Next, the four previous models are estimated again covering the full sample period (2002Q3–2021Q1) to compare their goodness of fit relative to the same canonical models (with lagged dependent variable), but also augmented by three regressors intended to capture key features of the Covid period, i.e., 2020Q1-2021Q1: i.e. models (5) and (6). The regressors are a Stringency Index, a Government Support Index, and the number of Confirmed Covid-19 Deaths.

Two models using Partial Least Squares are run, model (7) for the pre-Covid period, and model (8) for the whole sample period which includes the three Covid-19 regressors. For robustness, model (7) is also used to forecast ROA during the Covid-19 period and compared to the forecast obtained using GMM.

Finally, the TVP and the TVP with Markov-switching models without the Covid-19 regressors, i.e. models (9) and (11), respectively, are run over the whole sample period to explore the causes of possible heteroskedasticity. The corresponding models run over the whole sample period including the Covid-19 regressors serve to assess the role of Covid-19 variables in the behavior of ROA, i.e. models (10) and (12).

The assumptions of fixed coefficients and constant unconditional variance of the canonical models are tested against the TVP and the TVP with Markov-switching models, without and with Covid-19 regressors. In addition, the source(s) of ROA uncertainty, i.e., agents’ learning process–as in the TVP model—or also regime shifts—as in the TVP model with Markov switching—are evaluated using a battery of Likelihood Ratio tests.

5.1 The canonical models

Table 3 shows the regression results for the four different specifications of the canonical model using the explanatory variables discussed above for the period 2002:Q3-2019:Q2. The Hansen specification test (J-test) cannot reject the null that the over-identification restrictions are valid.Footnote 19 Overall, all statistically significant coefficients have the expected signs. The lagged dependent variable is never significant. However, there is some evidence of serial correlation in the residuals when it is excluded (see notes to Table 3). As discussed above, heteroskedasticity is a distinct possibility. While standard errors are robustly estimated (Eicker-White), it is noteworthy that the null hypothesis of homoskedasticity can be rejected for the reduced versions of the canonical model, i.e. models (3) and (4), which exclude the three statistically insignificant regressors total loans, loan-loss provisions, and management quality. The possible causes of this result are explored below.

GDP and inflation have a positive effect on ROA, as expected, albeit in models (1) and (2), GDP is only significant at the 10% significance level. Bank size is negatively and significantly related to ROA. While this is a common result in the empirical literature, usually explained by referring to the more costly structure of larger banks as in Kok et al. (2015), there is no agreement.Footnote 20 The authors do point out the low significance of the regressor in their estimates as well and to its statistical insignificance when the top-five bank concentration index is simultaneously present in their model. However, in this research, the Herfindhal-Hirschman Index is significantly negative, suggesting that more concentration, and thus larger banks, may be associated with lower ROA.Footnote 21 This result evinces clearly when the canonical model is run excluding the statistically insignificant regressors: total loans, loan-loss provisions, and management quality (i.e. models 3 and 4). This is a clear illustration of the effects of the high collinearity among traditional drivers of ROA as shown in Table 2. It supports the use of Partial Least Squares to address collinearity as it will be discussed below.

Total loans or any other metrics proxying bank credit (not shown) are never significant, perhaps due to the high comovement between euro area real GDP and loans in a sample containing the largest 27 euro area banking groups. It is also likely that as capital tends to comove with the economy’s growth rate, Basel III-prudential policy aiming at increasing the capital ratio may have dampened loan growth (Yilla and Liang 2020). Loan-loss provisions or other measures of asset quality, such as NPL or probabilities of default (not shown), are never significant at usual significance levels. In the empirical literature there is no agreement on their role in explaining ROA. Some authors claim that loan-loss provisions are negatively associated with ROA, probably because worsening asset quality often implies higher provisioning costs and forgone interest income (Kok et al. 2015). Other authors argue instead that higher loan-loss provisions point to higher risk-taking behavior and thus higher ROA (Jiménez et al., 2014).

Non-interest income is significant at 8% and 9% significance levels in models (1) and (2), respectively. These significance levels improve when the statistically insignificant regressors are excluded in the reduced canonical models (3) and (4). This outcome contrasts with Stiroh (2004) but agrees with Hahm’s (2008) study of large banks of 29 OECD countries, Chiorazzo et al.’s (2008) results on Italian banks and Saunders et al.’s (2014) results on 10,341 U.S. banks. This finding is also consistent with the low-interest environment during the sample period and the observation that for the European banking groups used in this research to represent the euro area banking system, fees and commissions constitute a large part of their income accounts.Footnote 22 The search-for-yield behavior documented in a great bulk of recent research may also partly explain the importance of income generate by trading and risky activities (e.g. Faia and Karau 2021, and Kabundi and Nadal De Simone 2020).Footnote 23 Consistently, the diversification regressor is statistically significant across all models in Table 3. In the empirical literature, the impact of diversification on ROA has been controversial as well. Hamdi et al. (2017) find that diversification increases banks’ revenue in a sample of 20 Tunisian banks. Similar results are found for Pakistani banks (Ismail et al. 2015), Indian banks (Trivedi 2015), Philippino banks (Meslier et al. 2014) and for banks in 22 Asian countries (Lee et al. 2014). Li et al. (2021) focus their analysis specifically on the effects of Covid-19 on diversification and find evidence in favour of a beneficial diversification effect during the pandemic since banks move towards non-interest income activities. However, Githaiga (2020) found that human capital and income diversification significantly influence bank performance, and while human capital has a positive effect, income diversification has a negative effect. It may very well be that the impact of income diversification on profits is non-linear, with diversification benefits accumulating up to a certain degree, as suggested by Gambacorta et al. (2014). Given the relative higher level of human capital in euro area banking groups, diversification may be expected to have a positive effect on ROA as in Githaiga (2020).

The T1 capital ratio is negatively related to banks’ returns and highly significant across all models. Since the start of the phasing-in of Basel III capital requirements in the EU, their potential unintended consequences on banks’ return have been the subject of much heated debate. The matter is still unsettled. While contributing to improved banks’ balance sheets and funding resilience, prudential reforms have occasionally been associated with a decrease in bank profitability via their possibly dampening effects on lending. A large Committee on the Global Financial System (CGFS 2018) study concludes that bank credit declined significantly relative to economic activity in advanced economies, and in most cases started to recover only since 2015. Akinci and Olmstead-Rumsey (2015) as well as Aiyar et al. (2014) argue that the tightening of capital requirements reduced lending significantly albeit with net social benefits. In contrast, while Polizzi et al. (2020) find that capital and liquidity have a negative direct impact on bank stability in a sample of 117 economies, their influence is counteracted by an indirect positive effect through the increased level of credit. Naceur et al. (2020) find that U.S. banks reinforce their risk absorption capacities while expanding lending. In contrast, capital ratios have a significant negative impact on bank-retail-and-other-lending-growth for large European banks because of the deleveraging process and the “credit crunch” that followed the GFC. In addition, the authors also find that capital ratios do not affect commercial-bank-lending growth in Europe which may be due to “zombie lending”, deteriorated economic conditions and a reaction to accommodative monetary policy. The results of this paper are consistent with this view (see also Economist 2020; Financial Times 2020; Dursum-de Neef and Schandlbauer 2021).

Specification (2) of the canonical model, which has no serial correlation or heteroskedasticity, is used to forecast ROA out-of-sample 7-quarters ahead. The model tracks well ROA during 2019Q3–2019Q4; only in 2020Q1 the forecast is outside the 95% confidence interval (Fig. 6). The ability of the model to forecast ROA out-of-sample relatively well indicates that the model captures ROA dynamics effectively. It might be speculated that Basel III reforms and the vast fiscal, monetary, and prudential measures summarized above have been effective in shielding European banking groups during the Covid-19 pandemic as argued by Berger et al. (2021) and the IMF (2021).Footnote 24

This finding is reinforced by running all four specifications of the canonical model over the entire sample period 2002Q2–2021Q1 (Table 4). The Hansen specification test (J-test) cannot reject the null that the over-identification restrictions are valid. Coefficients’ signs remain correct and significance patterns are the same. Interestingly, the higher volatility of output in the Covid-19 period allows a better estimation of its coefficient which now displays p-values below 1%. The structure of residuals is unaltered with models (2) and (4), which include the lagged dependent variable, displaying no serial correlation at acceptable significance levels, but indicating the presence of heteroskedasticity in the reduced model specifications (3) and (4). In a nutshell we note that our results about ROA in the Covid-19 period are consistent with the detailed analysis of supervisors in the Basel committee on Banking Supervision (BCBS) Basel III Monitoring Report, February (2022).

It is noteworthy to contrast these results with those of the canonical model run adding the three Covid-19 variables, i.e. the Stringency Index, the Economic Support Index and Confirmed Deaths (models 5 and 6), henceforth the Covid-19 model. All regressors retain their signs and broadly their values and significance levels, except the three Covid-19 variables (compare models 2 and 5 and 4 and 6, respectively). The Covid-19 variables are significant and display the expected signs in the case of the full Covid-19 model (model 5), but become all insignificant when the reduced Covid-19 model is run (model 6). Tests for the hypothesis that all three coefficients are zero and that their sum is zero reject the null for model (5) and do not reject the null for model (6). Tests for heteroskedasticity cannot reject the null of homoskedasticity and there is no serial correlation in the models (note that both models include the lagged dependent variable). These results seem to point to the presence of underlying collinearity among the three Covid-19 regressors and (some) other regressors of the canonical model, notably real GDP (Table 2). In fact, the Stringency Index and the Economic Support Index reflect the enactment of policies with the main objective of sheltering the economy from the pandemic shock.Footnote 25 This interpretation is also supported by the observation that the Covid-19 model’s residuals, while well into the 95% confidence interval of the canonical model forecast residuals, slightly coincide with the upper bound in 2020Q1, the same single period in which the pre-Covid canonical model out-of-sample 7-quarter forecast is also outside the 95% confidence interval (Fig. 7).

As argued in the previous section, endogeneity, and high collinearity among (certain) regressors in the reduced canonical model during the sample period complicates the analysis. This subject is addressed fully in the next subsection.

5.2 Partial least square models

Table 5 displays the results of the Partial Least Squares models for the pre-Covid period 2002Q3–2019Q2 (model 7) and for the whole sample period (model 8) including all regressors. The method requires the estimation of principal components (also referred to as latent factors). Following Hallin and Liska (2007), 5 factors are selected and estimated. Figure 8 shows the explained factor variance using 5 factors.

The model for the pre-Covid period has all coefficients with the right sign and significant except for diversification.Footnote 26 In contrast to the GMM results (model 2), total loans, loan-loss provisions and management quality are significant and have the expected signs. An increase in loan boosts banks’ balance sheets and improves ROA. In contrast, loan-loss provisions suggest a deteriorating asset quality and thus reduce banks’ performance. As expected, when banks’ management quality (measured as operating expenses to total assets) deteriorates, ROA falls. This may result from the required rise in expenses to monitor the risk of a given assets stock.

Residuals show no correlation, but the null of homoskedasticity can be rejected at all tested lags. The model’s 7-quarter out-of-sample forecasts of ROA are within the 95% percent confidence band except for 2021Q1 when, like in the GMM estimated model, ROA’s forecast is underestimated (Fig. 9).

When the model is extended to cover the whole sample period and includes the three Covid-19 regressors (model 9), coefficients are like those that the GMM estimation produces (model 5). Again, total loans, loan-loss provisions, management quality and confirmed deaths are not significant. In addition, the Stringency Index is significant, but has the wrong sign. While the residuals do not display serial correlation, heteroskedasticity is present. As a result of the presence of a wrong significant coefficient and heteroskedasticity, model (9) does not seem to be robust.

Overall, the main advantage of the Partial Least Squares model is to be able to provide better estimated coefficients and standard errors because it explicitly considers the high collinearity present in the data.

5.3 The TVP and TVP with Markov-switching models

Given that in all models, except (5) and (6), the null hypothesis of homoskedasticity can be rejected with high confidence, and given the visible uncertainty in ROA (Fig. 5), this subsection explores two, non-mutually-exclusive, possible sources of heteroskedasticity, i.e. time-variation in regression coefficients due to the learning process of economic agents (models 9 and 10)—both excluding and including Covid-19 variables—and likely shifts in ROA conditional variance due to regime changes (models 11 and 12). Table 6 summarizes the results.

In TVP models (9) and (10) the conditional variance of ROA (\({\sigma }_{e}^{2}\)) is not statistically significant.Footnote 27 There is, however, uncertainty about the regression coefficient of real GDP and the measure of competition in the euro area banking sector as proxied by the Hirschman-Herfindhal Index when the Covid-10 variables are excluded (model 9); this is also shown in Figs. 10 and 11. When the Covid-19 regressors are included, the assumption of a fixed real GDP coefficient cannot be rejected suggesting that the Covid-19 regressors capture the historically large drop in economic activity that the pandemic caused. While there is no serial correlation in the standardized forecast errors, it is present in the squares of the standardized forecast errors. These results are confirmed using the Q-statistics for lags 12, 24 and 36.Footnote 28 Therefore, while some heteroskedasticity may result from the two regressors, real GDP and the Hirschman-Herfindhal Index, the TVP parameter model cannot explain ROA uncertainty over the full sample period, with or without Covid-19 variables.

Models (11) and (12) also allow for uncertainty that may result from the learning process of economic agents. However, models (11) and (12) allow as well for uncertainty that may be due to heteroskedasticity in the disturbance term \({\sigma }_{e{S}_{t}}\) following endogenous regime changes in the variance structure. Results are equivalent to those of the TVP model, both excluding and including Covid-19 regressors. This applies to the time-varying coefficients, the disturbance term, serial correlation and heteroskedasticity. The Markov-switching transition probabilities are not statistically different from zero.

Table 7 displays a battery of Likelihood Ratio tests that compare the fixed-parameter canonical models excluding and including Covid-19 regressors with both the corresponding TVP and the TVP with Markov-switching models. The tests are all below the critical value of the \({\chi }^{2}\) statistics. Therefore, it is not possible to reject the null hypothesis that the restrictions do not apply, i.e. the coefficients of the canonical model are fixed and or there are no significant changes in ROA conditional variance.

To summarize, the canonical model (2) run during the pre-Covid period and during the whole sample period seems to be the preferred model specification. Its coefficients are statistically significant and with the expected signs; residuals display no serial correlation or heteroskedasticity. Model specification (2) also has good out-of-sample forecasting capabilities. Total loans, loan-loss provisions and management quality do not seem to belong to the canonical model of major euro area banking groups during the sample period, unless the high degree of collinearity is explicitly considered (model 7), in which case all three regressors have the expected signs. The use of Covid-19 variables does not improve upon the models’ performance, in full agreement with the actual behavior of ROA between 2020Q1 and 2021Q1.

6 Conclusion

This research studies the performance of the euro area banking system as represented by the aggregate of the balance sheets and profit and loss accounts of the largest 27 euro area banking groups. Performance is measured by the banking system’s ROA between 2002:Q3 and 2021:Q1, with particular attention given to the Covid-19 pandemic sub-period. This study finds that despite the Covid-19 pandemic, the euro area banking system’s performance has not been negatively affected. In addition, it shows that the global financial crisis and the sovereign crisis both introduced significant uncertainty in the performance of the banking sector in the euro area. However, the performance uncertainty observed during these crises has not been replicated during the worst part of the Covid-19 pandemic in the euro area. From a purely technical viewpoint, uncertainty in banking performance in the euro area highlights the relevance of using in this research methodological approaches that control for the endogeneity of most bank-specific determinants of return on assets and that are robust to changes in unconditional variance due to regime changes, to future random shocks or both.

While part of the literature on banks’ and banking systems’ performance during the pandemic has found that both the regulatory reforms of Basel III (e.g. Ikeda et al. 2021) and the massive policy measures enacted during the pandemic have sheltered banks’ returns effectively and offset the shock’s negative impact, this matter is clearly beyond the scope and methodology used in this paper. Nevertheless, results are consistent with such literature. Policy measures may have allowed the euro area banking industry to buy time to adjust to a major low-frequency-high-impact shock (e.g. IMF 2021). Looking forward, however, the same policies may have reduced the effect of competitive forces on banks’ performance and perhaps increased inefficiencies and vulnerabilities because of risk-taking behavior. As a result, the phasing-out of Covid-19 driven policies may entail risks for the euro area banking industry stemming from the expected rise in NPL and the underlying structural vulnerabilities of banks increased during the long period of low interest rates and assets returns that characterized the sector since the end of the sovereign crisis until end-2021.

Reuters reported on February 8, 2023, that “ECB supervisors will zero in on bad loans this year after finding that some euro zone banks had set too little money aside for them or were slow in recognizing the problem. The ECB said that while eurozone banks generally had more capital than required, and a profit boost from rising interest rates had offset the economic damage from the war in Ukraine, this may not last. In addition, the ECB has already demanded more capital from 24 banks that "fell short of coverage expectations related to non-performing loans", inviting them to close that gap this year. More generally, the ECB found "persisting risk control deficiencies", particularly in how to classify loans that are at risk of going unpaid”.Footnote 29 These arguments are in line with the findings of the present analysis.

Addressing these issues constitutes a clear way to extend this research. Other possible extension would be to use individual banks’ balance sheet data to better disentangle possible disparities in performance among them during the Covid-19 pandemic.

Notes

The International Monetary Fund (IMF) has the following URL dedicated to track the evolution of pandemic-related policy measures of member countries https://www.imf.org/en/Topics/imf-and-covid19.

As an illustration of these measures, the ECB Banking Supervision Prudential regulators reduced incentives of banks to limit credit by, e.g. a temporary release of Pillar 2 guidance and adjustments to Pillar 2 requirements, which made 120bn euro immediately available to banks to absorb losses and support lending.

ROA is calculated as the ratio of EBITDA to total assets using equal weights across banks. EBITDA refers to earnings before interest, taxes, depreciations and amortization. While it excludes the cost of capital investment in plant and equipment, it is a more precise measure of banks’ performance since it can show earnings before the influence of accounting and financial deductions. This measure of performance is widely used in the reviewed literature (see below).

ROA volatility computations suggest that the classical assumption of homoskedasticity may be compromised, especially during the GFC period. In this case, coefficient estimates, while unbiased and consistent, may not be efficient.

Using weights such as, for instance, size of each bank,would provide wrong inferences about the performance of the banking system as estimates would be biased by the weighting scheme.

This approach is statistically preferred to the use of dummy variables. These measures have a specific Covid-19 information content.

Euro area real GDP is integrated of order 2 (I (2)) over the sample period. Thus, Corbae-Ouliaris’ Ideal Band-pass Filter for I(2) time series was used. It was kindly provided by Sam Ouliaris.

See Igan et al. (2011) for a detailed discussion and examples.

According to the NBER, the business cycle frequency band comprises between 6 and 32 quarters.

. If one or more of these assumptions are violated, standard estimators, such as OLS, will produce coefficient estimates that lack one or more of their desired features, i.e. to be the most efficient linear unbiased estimators in the sense they have the minimum variance of all linear unbiased estimators.

See Hamilton (1994), for example.

Given that GMM is a standard regression method, to conserve space, it is not presented here.

In a sample comprising of 662 mostly large commercial banks in 29 OECD countries during the period 1992 to 2006, Hahm (2008) found that one of the main drivers of non-interest income is bank size and macroeconomic factors such as GDP growth and inflation.

See Abdi (2010), for example. This study does not use the Ridge Regression method as it tends to shrink the estimated coefficients to zero, and some coefficients can become very small. While the Lasso method was developed to deal with this issue as well as with the election of subsets of coefficients by shrinkage, when there are groups of predictors with high pairwise correlations, as in this study, the Lasso method will select one group without discriminating so as to choose the optimal one. Zou and Hastie (2005) developed an approach that keeps the best of the Lasso method while addressing the issues mentioned above, the Elastic Net approach. Thus, this approach was also used besides PLS as a robustness check. Results were similar and are not reported.

It is noteworthy that the Covid-19 pandemic has resulted in less uncertainty than the GFC did on ROA.

Mt comprises euro area real GPD and the Harmonized Index of Consumer Prices. Bt comprises bank size, total loans, loan-loss provisions, non-interest income, T1 capital ratio, and management quality. St comprises diversification and the Hirschman-Herfindhal Index.

For a detailed analysis of TVP and TVP with Markov Switching Models see e.g. Kim and Nelson (1999).

Hansen J test is more robust than Sargan test. In addition, to avoid weaking the test when several instruments are used, the test is “robustified” as described in Hansen (1982) by computing an adjusted covariance matrix A for Z’u so that u’ZAZ’u ~ χ2 (Z is the matrix of instruments and u the residuals).

The empirical literature is not unanimous about whether more concentration (larger banks), as measured by the Herfindhal-Hirschman Index (HHI), is associated with lower ROA or the other way round. As stated above, as negative association between more concentration and ROA may be explained by the more costly structure of larger banks. In contrast, the association is sometimes found to be positive, a result that is explained by arguing that banks with higher market power enjoy higher profits (e.g. Hellman et al 2000). These mixed empirical results broadly match the two main strands of theoretical literature seeking to explain why banks exist. The “incomplete market approach” argues that more competition (i.e. a lower HHI) increases banks’ efficiency and rises their profits (Kalomiris and Khan 1991). In contrast, research based on the industrial organization strand of literature argue that more competition reduces efficiency and may reduce banks’ profits (e.g. Clark et al 2021).

A distinct possibility is that the negative relationship between total assets and ROA is a statistical outcome due to measurement of ROA as the ratio of EBITDA to total assets. In fact, when models (1) and (2) are run using EBITDA as the dependent variable, total assets are not statistically different from zero (not shown).

Hahm (2008) found that banks with relatively large asset sizes, low net interest margins, high impaired loan ratios, and high cost-income ratios tend to exhibit higher non-interest income shares, especially when faced with slow economic growth and a stable inflation environment. These features can characterize well the reality of European banking groups, especially in the period after the GFC.

A retail ratio regressor was never statistically significant, in contrast to Kok et al. (2015). To save space this result is made available upon request.

This crucial topic, which is beyond the scope of this study, requires further research.

The main issue of concern is the endogeneity of some regressors. To illustrate, an alternative would be to estimate a two-equation model, one explaining, say, confirmed deaths due to Covid-19, and another one such as the canonical ROA equation including the Covid-19 variables, that respond to confirmed deaths. This research alternative is not pursued here.

Diversification was significant with a p-value of 8% in model (2). Diversification is insignificant in all but one of Kok et al. (2015) model specifications.

Although as much as 14 quarters are used to allow for the uncertainty regarding the initial state of the system, the impact on parameters’ variability following the GFC is clear. The effect of major shocks on agents’ learning process is noteworthy.

The Q-statistic for lag 36 has a p-value of 11.1% only for the standardized forecast errors of the model specification (10) containing the Covid-19 regressors. This is consistent with results obtained for the canonical model specifications (5) and (6).

References

Abdi H (2010) Partial least squares regression and projection on latent structure regression (PLS regression). Wiley Interdiscipl Rev: Comput Stat 2:97–106

Acharya VV, Borchert L, Jager M, Steffen S (2021) Kicking the can down to road: government interventions in the European banking sector. Revi Financ Studies 34:4090–4131

Aiyar S, Calomiris CW, Wieladek T (2014) Does macro-prudential regulation leak? Evidence from a UK policy experiment. J Money Credit Bank 46:181–214

Akinci O, Olmstead-Rumsey J (2015) How effective are macroprudential policies? An empirical investigation. International Finance Discussion Papers 1136

Baxter M, King RG (1995) Measuring business cycles, approximate band-pass filters for economic time series. NBER Working Paper No. 5022

Berger AN, Demirguc-Kunt A (2021) Banking research in the time of COVID-19. J Financ Stab 57:200939

Berger AN, Demirguc-Kunt A, Moshirian F, Saunders A (2021) The way forward for banks during the COVID-19 crisis and beyond: government and central bank responses, threats to the global banking. J Bank Finance 133:106303

Borio C (2020) The prudential response to the Covid-19 crisis. Speech on the occasion of the BIS’s Annual General Meeting, 30 June

Borri N, di Giorgio G (2022) Systemic risk and the COVID challenge in the European banking. J Bank Finance 140:106073

Boubakri N, Mizraei A, Saad M (2023) Bank lending during the COVID-19 pandemic: a comparison of Islamic and conventional banks. J Int Finan Markets Inst Money 84:101743

Chiorazzo V, Milani C, Salvini F (2008) Income diversification and bank performance evidence from Italian banks. J Financ Serv Res 33:181–203

Christiano LJ, Fitzerald TJ (2003) The band pass filter. Int Econ Rev 44:435–465

Clark R, Houde JF, Kastl J (2021) The industrial organization of financial markets. Handbook Ind Organ 5(1):427–520

Colak G, Oztekin O (2021) The impact of COVID-19 pandemic on bank lending around the world. J Bank Finance 133:106207

Basel Committee on Banking Supervision Basel III Monitoring Report, February 2022

Committee on the Global Financial System (2018) Structural changes in banking after the crisis. Bank for International Settlements, CGFS Papers No. 60

Corbae D, Ouliaris S (1996) Extracting cycles from non-stationary data. Econometric theory and practice: frontiers of analysis and applied research

Demirguc-Kunt A, Pedraza A, Ruiz-Ortega C (2021) Banking sector performance during the COVID-19 crisis. J Bank Finance 133:106305

Duan Y, El GhoulGuedhami SO, Li H (2021) Bank systemic risk around COVID-19: a cross-country analysis. J Bank Finance 133:106299

Dumbar K (2022) Impact of the COVID-19 event on US banks’ financial soundness. Res Int Bus Finance 59:101520

Dursun-de-Neef HO, Schandlbauer A (2021) COVID-19 and lending responses of European banks. J Bank Finance 133:106236

Economist (2020) Why COVID-19 will make killing zombie firms off harder. 26 September.

Elnahass M, Quang Trinh N, Li T (2021) Global banking stability in the shadow of Covid-19 outbreak. J Int Finan Markets Inst Money 72:101322

European Central Bank (2021) Financial Stability Review

European Systemic Risk Board (2020) Recommendation ESRB/2020/7 on restriction of distributions during the COVID-19 pandemic (ESRB/2020/15)

Financial Times (2020) European zombification becomes even scarier

Faia E, Karau S (2021) Systemic bank risk and monetary policy. Int J Cent Bank 17:137–176

Gambacorta L, Hofmann B, Peersman G (2014) The effectiveness of unconventional monetary policy at the zero lower bound: a cross country analysis. J Money Credit Bank 44:615–642

Githaiga PN (2020) Income diversification, market power and performance. J Econ Financ Anal 3:1–21

Hahm J-H (2008) Determinants and consequences of non-interest income diversification of commercial banks in OECD countries. East Asian Econ Rev 12:3–31

Hallin M, Liska R (2007) Determining the number of factors in the general dynamic factor model. J Am Stat Assoc 102:603–617

Hamdi H, Hakimi A, Zaghdoudi K (2017) Diversification, bank performance and risk: have Tunisian banks adopted the new business model? Financ Innov 22:1–25

Hamilton JD (1994) Time series analysis. Princeton University Press, Princeton

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029–1054

Hellman TF, Murdoch KC, Stiglitz JE (2000) Liberalization, moral hazar, in banking and prudential regulation: are capital requirements enough. Am Econ Rev 90:147–165

Igan D, Kabundi A, Nadal De Simone F, Pinheiro M, Tamirisa N (2011) Housing, credit, and real activity cycles: characteristics and comovement. J Hous Econ 20(3):210–231

Igan D, Mirzaei A, Moore T (2023) Does macroprudential policy alleviate the adverse impact of COVID-19 on the resilience of banks? J Bank Finance 147:106419

Ikeda Y, Kerry W, Lewrick U, Schmieder C (2021) Covid-19 and bank resilience: Where do we stand?. BIS Working Paper No 44

International Monetary Fund (2021) COVID-19: How will European banks fare?. European Department, Research Report No. 21/08

Ismail A, Hanif R, Choudhary S, Ahmad N (2015) Income-diversification in banking sector of Pakistan: A blessing or curse? J Commer 7:11–22

Jimenez G, Ongena S, Peydro J-L, Saurina J (2014) Hazardous times for monetary policy: What do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking? Econometrica 82:463–505

Kabundi A, De Simone FN (2020) Monetary policy and systemic risk-taking in the European area banking sector. Econ Model 91:736–758

Kalomiris CW, Khan CM (1991) The roel of debt in structuring optimal banking arrangements. Am Econ Rev 81(3):497–513

Kim C-J, Nelson CR (1999) State-space models with regime switching models. MIT Press, Cambridge

Kok C, More C, Pancaro C (2015) Bank profitability challenges in euro area banks: the role of cyclical and structural factors. European Central Bank, Financial Stability Report

Koopmans LH (1974) The spectral analysis of time series. Probability and mathematical statistics, vol 22. Elsevier, Amsterdam

Lee C-C, Yang S-J, Chang C-H (2014) Non-interest income, profitability, and risk in banking industry: a cross-country analysis. North Am J Econ Finance 27:48–67

Li X, Feng H, Zhao S, Carter DA (2021) The effect of revenue diversification on bank profitability and risk during the COVID-19 pandemic. Finance Res Lett 43:101957

Meslier C, Tacneng R, Tarazi A (2014) Is bank income diversification beneficial? Evidence form an emerging economy. SSRN-id1557010

Naceur SB, Marton K, Roulet C (2020) Basel II and bank-lending: evidence from the United States and Europe. J Financ Stab 39:1–27

Norden L, Mesquita D, Wang W (2021) COVID-19, policy interventions and credit: the Brazilian experience. J Financ Intermed 48:100933

OECD (2021) The COVID-19 crisis and banking system resilience: simulation of losses on non-performing loans and policy implications. OECD Paris, Paris

Polizzi S, Scanella E, Suarez N (2020) The role of capital and liquidity in bank lending: Are banks safer? Global Pol 11:28–38

Saunders A, Schmid M, Walter I (2014) Non-interest income and bank performance: is banks’ increased reliance on non-interest bad? School of Finance, University of St, Gallen

Schularick M, Steffen S, Troger TH (2020) Bank capital and the European recovery from the COVID-19 crisis. No 17, ECONtribute Discussion Papers Series, University of Bonn and University of Cologne

Silva TC, de Souza SRS, Guerra SM, Tabak BM (2023) COVID-19 and bank branch lending: the moderating effect of digitalization. J Bank Finance 152:106869

Stiroh KJ (2004) Diversification in banking: Is non-interest income the answer? J Money Credit, Bank 36:853–882

Tran DV, Hassan MK, Alam AW, Dau N (2022) Banks’ financial soundness during the COVID-19 pandemic. J Econ Finance 46:713–735

Trivedi SR (2015) Banking innovations and new income streams: impact on banks’ performance. Vikalpa 40:28–41

White H (1980) A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica 48:817–838

Yilla K, Liang N (2020) What are macroprudential tools ? Brookings Institution, Washington

Zou H, Hastie T (2005) Regularization and variable selection via the elastic net. R Stat Soc 67:301–320

Funding

Open access funding provided by HEAL-Link Greece.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Euro Area Banking Groups. Banks with an asterisk are classified as globally systemic important banks according to the Financial Stability Board, November 2020 list.

Banca Popolare dell Emilia Romagna Sc |

Banco Santander SA * |

BNP Paribas SA * |

Commerzbank AG |

Credit Agricole SA * |

Crédit Suisse Group AG * |

Credito Emiliano Spa |

Danske Bank A/S |

Deere & Co |

Deutsche Bank AG * |

Deutsche Börse AG |

EFG Eurobank Ergasias SA |

HSBC Holdings plc * |

ING Groep N.V. * |

Intesa SanPaolo SpA |

JP Morgan Chase & Co * |

KBC Groep NV |

Mediobanca S.p.A |

Natixis |

Nomura Holdings Inc |

Nordea Bank AB |

Royal Bank of Canada * |

Royal Bank of Scotland Group plc |

Skandinaviska Enskilda Banken AB |

Societe Generale * |

UBS AG * |

UniCredit SpA * |

Appendix 2

Variable Definitions

Panel A: Bank characteristics | |

ROA | ROA is return on assets measured as the ratio of EBITDA to total assets. EBITDA refers to earnings before interest, taxes, depreciations, and amortization |

Total loans | Banks’ total loans in euros |

Loan-loss provisions | Provisions for non-performing loans. Non-performing loans defined αs the ratio of non-performing loans to total loans |

Non-interest income | Income excluding interest income in euros |

T1 capital ratio | The ratio of core equity capital to risk-weighted assets |

Management quality | Ratio of operational expenses to total assets |

Bank size | Total assets in euros |

Panel B: Macroeconomic variables | |

Real GDP | Gross Domestic Product of euro area in 2010 constant prices |

Unemployment rate | Unemployment rate, from 15 to 74 years of age, percentage of active population |

Harmonized consumer price index (HCPI) | HCIPs are compiled based on harmonised standards, binding for all European Union Member States. Conceptually, The HCIP are Laspeyres-type price indices and are computed as annual chain-indices allowing for weights changing each year, reference period (2015 = 100). The common classification for Harmonized Indices of Consumer Prices is the COICOP (Classification of Individual Consumption by Purpose) |

Panel C: Market structure | |

Diversification | The ratio of non- interest income to total bank revenue |

Herfindhal–Hirschman index | The sum of the squared market shares in total assets of the individual banks |

Panel D: Covid-19 measures | |

Stringency index | The index records the strictness of ‘lockdown style’ policies that primarily restrict people’s behaviour. It is calculated using all ordinal containment and closure policy indicators plus an indicator recording public information campaigns |

Economic support index | The index records measures such as income support and debt relief. It is calculated using ordinal economic policies indicators |

Confirmed deaths | The number of Confirmed Deaths |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Agoraki, ME.K., Kouretas, G.P. & De Simone, F.N. The performance of the euro area banking system: the pandemic in perspective. Rev Quant Finan Acc (2023). https://doi.org/10.1007/s11156-023-01180-1

Accepted:

Published:

DOI: https://doi.org/10.1007/s11156-023-01180-1

Keywords

- Euro area bank performance

- Covid-19 pandemic

- Bank resilience

- Canonical models

- Time-varying parameters models

- Markov-switching models