Abstract

This research explores whose trades contribute to price discovery in the Taiwan Stock Exchange. We estimate the information share (IS) on a stock-trader-direction basis. Our empirical results present several new findings as follows. Institutional investors exhibit higher IS per order and contribute to price discovery more significantly than do individuals, no matter what measures or which trade directions. While overall price aggressiveness negatively impacts IS, price aggressiveness by professional investors (i.e., foreign investors and domestic investment trusts) has a positive influence on IS. Although the impact of trade size on IS is on average significantly positive, the marginal effects for professional investors are smaller than for individuals. Institutional investors’ herding behavior significantly deteriorates IS. Moreover, trading in less liquid stocks contributes more to IS than trading under other stock characteristics. Foreign investors contribute to price discovery of cross-listed firms more significantly than domestic investors do. Lastly, substantive conclusions remain valid for various robustness checks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Price discovery refers to the process of determining a common price for a security by incorporating all relevant information from the interactions between buyers and sellers in a regulated exchange. The efficiency that prices react to new information may correlate to traders’ habits and behavior (Brogaard et al. 2019; Chen et al. 2019; Piccotti and Schreiber 2020), connectivity of interrelated assets (e.g., Ahn et al. 2019; Gonzalo and Granger 1995; Hasbrouck 1995; Lien and Shrestha 2009, 2014), measurement interval (Hasbrouck 2019), liquidity factors (Shive 2012), short-selling activities (Boehmer and Wu 2013; Cheng et al. 2012; Saffi and Sigurdsson 2011), market mechanism changes (Chakrabarty et al. 2021), and micro- or macro-economic events (Baruch et al. 2017; Chakrabarty et al. 2021). Typically, the interaction between sellers and buyers is an essential determinant of a market’s demand and supply and thus acts as a major driver of price changes. The issue on whose trades move stock prices is very important to academicians, market participants, and regulators. Traditionally, price discovery measures correlate to the informativeness of trades, linking to how stock prices are determined and transactions are executed. This study aims to empirically investigate contributions to price discovery across investor types in the order-driven stock market of the Taiwan Stock Exchange (TWSE).

Given the simultaneous trading of related but different markets, Hasbrouck (1995) suggests a popular information share (IS) measure for homogeneous securities. In this sense, contribution to price discovery for a specific market is derived from the proportion attributed to that market relative to the variance of the unobservable efficient price innovations. Many follow-up endeavors extend the above price discovery measure in the related literature.Footnote 1 For example, Lien and Shrestha (2009) propose a modified IS based on a different factor structure and the eigenvalue–eigenvector decomposition method. Although a considerable body of literature has illuminated price discovery across closely-linked assets or multiple markets, research into the nexus between price discovery and trading behavior across investor types remains limited. By analyzing a unique and detailed dataset, this study investigates price discovery across investors types in TWSE. Specifically, we concentrate on stock investors’ order submission behavior (order aggressiveness and trade size), herding behavior, and order imbalances to examine whose trading behavior is more responsible for moving stock prices toward the fundamental value. Moreover, the existing literature confirms that buy and sell trades show different patterns and asymmetric effects; i.e., the so-called buy-sell asymmetry (Baruch et al. 2017; Chou and Wang 2009; Hung 2016; Hung et al. 2015; Lien et al. 2020a, b). There also exist major differences between buy and sell orders in respect of transaction costs, short-sale restrictions and their effects of trade initiation in TWSE. To accommodate with these differences, we split up buy and sell sides to accommodate possibly different consequences.

Beyond multiple markets, several studies apply price discovery measures to multiple types of investors in equity markets (Brogaard et al. 2019), option markets (Chen et al. 2019; Kang et al. 2016), and foreign exchange markets (Hagströmer and Menkveld 2019; Piccotti and Schreiber 2020). For instance, Kang et al. (2016) and Chen et al. (2019) present that foreign investors exhibit higher IS than individuals and thus are more informed in Asian derivatives markets. Brogaard et al. (2019) document that high frequency traders’ (HFTs’) limit orders contribute more price discovery compared to non-HFT traders in the Canada stock markets. Piccotti and Schreiber (2020) find that different types of investors exhibit different degrees of price discovery in two-tier (dealer-customer and inter-dealer) foreign exchange markets. Chaboud et al. (2021) further show that informed traders tend to use more limit orders in the foreign exchange market, revealing that price discovery becomes faster and market efficiency improves. In brief, previous studies confirm that different types of investors offer different levels of price discovery in derivatives or foreign exchange markets. As far as we know, no previous research has explored empirical evidence on daily stock-trader-direction price discovery measures in stock markets.

An order-driven market collects all bids and asks of orders placed by buyers and sellers, respectively, for a specific security, while a quote-driven market display both bids and asks quoted by market makers or specialists. In an order-driven market, the settlement price is decided through the interactions of buyers and sellers, rather than the quotes of dealers. As a result, order submission decisions across identified investors have more profound influences on the settlement price in an order-driven market than in a quote-driven market. While the vast majority of existing studies analyze price discovery based on various perspectives or analytical approaches in multiple markets, researchers have not reached a consensus on price discovery in stock markets. As of now, contribution to price discovery across identified investor types in stock markets is undetermined in the related literature. It is very interesting and helpful to know who contributes more to price discovery or which investor type dominantly moves the price in a single stock market. Additional investigations to more completely understand the impacts of trading behavior across investor types on price discovery are required in the financial arena.

We choose to investigate price discovery in TWSE for the following reasons. First, we can explicitly identify trade directions to construct a more meticulous stock-trader-direction IS measure, while the U.S. TAQ (trade and quote) dataset has no such features and usually encounters the common issue of trade direction inference. Unique data attributes allow us to extend the depth of the related literature so that such investigation in the Taiwanese market may be of interest to the general audience. Second, being in the heart of Asia and considered one of the three Asian tigers, along with Singapore and Hong Kong, Taiwan has a free market economy in which there is little government intervention. It is one of the most stable economies around the world and the stock market can be regarded as a showcase for the economy. TWSE is the 11th largest stock market in terms of market capitalization around the world at the end of 2021. Third, many global investors (both institutional and individual investors) are looking to expand their business or investments to Taiwan. Investors find Taiwan appealing because it is financially solid and shows many portents of future economic stability and industrial growth. For example, the semiconductor industry has quietly become one of the most important supply sources in the world. Lastly, Taiwan has some advantages on higher educated workforce, sound infrastructure, and safeguarded legal environment, and strong industrial clusters. Hence, Taiwanese investment environment has received significant international recognition. In short, Taiwan is a well-developed market economy. It has been attracting an increasing number of domestic and foreign investors. Price discovery in TWSE is not only an important concern to government authorities, but also of great interest to market participants.

This study offers new insights related to price discovery across identified investor types within the framework of various trading behaviors in market microstructure and behavioral finance fields. First, explicit investigation of price discovery based on the daily stock-trader-direction measure sheds light on what type of investors is more likely to engage in informed trading. Who efficiently drives stock prices is primarily critical to understand how the settlement price is decided in an order-driven market, providing implications for trading strategies. Second, we relate the determinants of price discovery to both trader-related and firm-specific characteristics due to convincing evidence that price discovery can be attributed to investor types’ trading activities toward specific stocks. This paper deepens our understanding of the sources of price discovery in a single stock, rather than across different but related markets. Third and lastly, our findings provide direct evidence on the linkages between information leadership and various trading behaviors, contributing to the extant literature of relative informativeness of institutional investors and individuals.

Our results demonstrate that different types of investors contribute to price discovery to a variable extent. Institutional investors on average have higher IS per order than do individuals, although individuals serve as dominant participants and account for the largest contribution of price discovery in TWSE. Among professional institutions, domestic investment trusts display higher IS per order than do foreign investors. Investor types, trading activities, and firm characteristics are all important determinants of price discovery. Both price aggressiveness and trade size have significant impacts on price discovery but in different ways. While overall price aggressiveness has a negative impact on price discovery, price aggressiveness of professional investors (i.e., foreign investors and investment trusts) has a positive influence on price discovery. Although overall trade size positively affects the contribution to price discovery, the marginal effects for professional investors are smaller than for individuals. Moreover, the more intensive institutional herding is, the more the level of price discovery will slump.

As to firm characteristics, trading in stocks with small size, growth orientation, low turnover, wider spread, or low institutional ownership improves price discovery more significantly than in other stocks, regardless of trade directions or investor types. Foreign investors also contribute more to the price discovery of cross-listed firms than domestic investors do, but individuals present the opposite result.

Our empirical analysis provides several economic implications for both market participants and government authorities. For stock investors, trading by sophisticated institutional investors carries private information. Retail investors should refrain from blindly crowding into or getting out of stock markets to evade suffering from massive losses. Uninformed market participants may track public information of transactions of professional institutions as the daily trading volume of the three types of top institutions is publicly disclosed on the TWSE website. For policymakers, price discovery plays a decisive role in deciding stock market quality. Institutional traders’ behavior substantially affects price discovery, and they thus have a forceful capability to influence overall market quality. Major policy changes or any financial reform should take into account the direction and magnitude of institutional trading activities.

The rest of the paper proceeds as follows. Section 2 introduces the market structure and institutional background. Section 3 develops the research hypotheses and presents the data sources and sample description, followed by measurements in Sect. 4. Section 5 presents the model specifications and empirical results. Lastly, Sect. 6 concludes this paper.

2 Institutional background

TWSE currently operates an order-driven call market, simultaneously adopting a multiple tick-size system and daily price fluctuation limits. As of the end of 2021, TWSE had 959 listed companies and ranked as the 11th largest stock market in the world with a market capitalization of approximately US$2.03 trillion. TWSE is also widely known for being one of the most active stock markets, having the 4th highest turnover rate (176.61% annually) in the world. Regarding the ratio of market capitalization to gross domestic product (GDP), TWSE is in 2nd place (almost 2.27 times).Footnote 2 In recent years, modern finance functions have supported listed companies’ growth and healthy competition. Most noticeably, the electronics industry plays a pivotal role as Taiwan’s most important export sector. Electronics companies maintain primary strengths that involve the manufacture, design, assembly, and servicing of many consumer electronics goods, and they are globally famous for exporting a wide variety of electronic materials and products.

There are several types of market structures in the world, such as quote-driven, order-driven, hybrid, and brokered. Each type of market structure has its own advantages and disadvantages. As of March 20, 2020, TWSE adopts an order-driven call auction mechanism through the fully automated trading system (FATS). Different from a quote-driven regime under which market makers quote the bids and asks for a given security, in an order-driven stock exchange both buyers and sellers individually display their bids and asks. While a continuous market executes trades whenever any buy and sell orders match up, a call market collects buy- and sell-side orders altogether and each auction takes place at isometric time intervals.Footnote 3 In TWSE, FATS collects all buy and sell orders during a call auction and determines the settlement price based on the principle of transaction volume maximization. During our sample period, orders are matched in each call auction every five seconds. A call auction gathers small orders together to make big trades (i.e., to increase liquidity or decrease transaction costs) in which all participants arrive at one price at the same time. To enhance market transparency, TWSE has disclosed the best five bids and five asks of pending orders since January 1, 2003. Real-time information disclosure helps market participants make fair decisions.

Regarding order informativeness across investor types, Taiwanese order-driven call market offers us a more appropriate opportunity to investigate the issue than quote-driven markets. Individuals dominate institutional investors in TWSE in terms of equity ownership and trading value. Among the institutional investors, foreign investors account for the largest portion of trading value, while corporations (other institutions) and investment trusts are the second and third largest players in terms of trading value, respectively. Order informativeness and investor groups are strongly correlated and thus are worthy of further investigation. Dominant retail investors do not necessarily contribute more to price discovery. Information contribution of different groups of investors to price discovery may correlate to order choices, firm characteristics, etc.

3 Research hypotheses and data

3.1 Research hypotheses

While retail investors are dominant participants and their trading value accounts for the largest proportion in TWSE, conventional wisdom reveals that institutional investors have larger capitalization funds, better information gathering and processing abilities, and higher cognitive abilities than do amateur investors (e.g., Barber et al. 2009; Kuo et al. 2015). Institutional investors tend to place orders in a more aggressive manner (i.e., higher order immediacy) with larger trade size (Chou and Wang 2009; Hung et al. 2015; Lien et al. 2020a, b) and are likely to reflect new information earlier than individuals. Among professional institutions (foreign investors and domestic investment trusts), domestic institutions seem to have better information advantages or higher cognitive skills toward domestic investment environments (Dvořák 2005; Kalev et al. 2008; Lee et al. 2004). Investment trusts prefer short-term investing and make use of local advantages to incorporate firm-specific information into security prices via their trading activities (Kim and Yi 2015). Moreover, they tend to place the most aggressive orders and have the highest weighted price contribution per order among all types of traders in Taiwan (Lien et al. 2020a, b). Thus, this study proposes price discovery hypotheses H1A and H1B as follows.

H1A

Institutional investors on average have a larger information share per order than do individuals.

H1B

Among professional institutional investors, domestic institutions have a larger information share per order than do foreign investors.

Previous literature documents that price aggressiveness is associated with information content (Benos and Sagade 2016; Foucault et al. 2005; Lien et al. 2019; Rosu 2009). For example, informed traders may place more aggressive orders to reduce the negotiation time or avoid non-execution risk. Among professional investors, domestic institutions are likely to have better information or cognitive advantages in local markets (e.g., Dvořák 2005; Kalev et al. 2008). Accordingly, we state hypotheses H2A and H2B related to stock traders’ order submission behavior as follows.

H2A

Professional institutions’ price aggressiveness positively affects their information share.

H2B

Among professional institutions, domestic institutions’ price aggressiveness affects information share more significantly than foreign investors’ price aggressiveness.

Several existing studies have linked the informational content of trading activities to order size, realizing a common view that larger orders are more likely to be placed by informed traders (Ahn et al. 2010; Chan and Fong 2000; Gradojevic et al. 2017). Thus, hypotheses H3A and H3B are stated as follows.

H3A

Professional institutions’ trade size positively correlates to their information share.

H3B

Among professional institutions, domestic institutions’ trade size affects their information share more significantly than foreign investors’ trade size.

The existing literature has confirmed that price discovery relates to specific firm characteristics, such as liquidity (e.g., Brogaard et al. 2014; Shive 2012; Zhu 2013). Stocks with lower liquidity are more likely to convey less information (Osler et al. 2011). For example, a wider bid-ask spread correlates to higher transaction and adverse selection costs and thus tends to exhibit low liquidity. Stocks with small size, low turnover rate, or low institutional shareholdings are also prone to be less liquid. On the other hand, the presence of institutional investors enhances stock price informativeness (Luo et al. 2014). Thus, we expect that stock investors trading in stocks with lower liquidity should have a greater marginal effect on price discovery. In accordance, we propose hypothesis H4A.

H4A

Institutional investors’ trades affect their information share in low liquid stocks more significantly than in high liquid stocks.

Cross-listed firms generally have higher international visibility than do pure domestic firms. To be cross-listed, a company must comply with the requirements of all the stock exchanges on which it is listed, thus sending signals of better corporate governance and greater financial transparency to stock investors (Madhani 2014). Firms listed abroad with dual-class shares exhibit stock price informativeness, investor protection interests, global business strategies, or geographic proximity in different markets (Ghadhab and M’rad 2018). Compared to domestic investors, seasoned foreign investors more likely have expertise in trading shares of the same firm in multiple markets. Thus, hypothesis H4B is stated as follows.

H4B

Foreign investors’ trading in cross-listed stocks affects their information share more significantly than domestic investors do.

3.2 Data sources and sample description

This paper uses two data sources. The historical intraday trading data are from the Taiwan Stock Exchange Corporation (TSEC), including order, trade-, and quote-level data. We obtain daily trading data and yearly financial data from the Taiwan Economic Journal (TEJ) database. Our sample firms are limited to common stocks that have full information of price series with four types of investors. We also require the sample firms to have complete data of firm characteristics, including newly added and delisted firms. In order to maintain data integrity, we exclude after-hours trading that applies different trading rules from the regular sessions for block trades and odd lot trading.

The sample period is in total 3 years and 7 months from June 2015 to December 2018. In order to enhance market efficiency, TWSE changed the price limits on daily fluctuations from \(\pm\) 7% to \(\pm\) 10% on June 1, 2015. To avoid any possible interference from this big policy change, our sample period starts from then. In addition, TSEC currently carries out a 1-year embargo scheme for disclosing the intraday trading information so that the latest available intraday data cover up to the end of 2018 when we started this research at the beginning of 2020. Consequently, our sample period expires at the end of December 2018. Lastly, we obtain 444 sample firms during 884 trading days, for a total of 41,424 firm-day observations. At the end of each year, these stocks account for more than 76% of total market capitalization of all common shares listed on TWSE. Therefore, this sample is very representative of TWSE.

4 Measurements

4.1 Information share

To evaluate the importance of a single market among several markets in price discovery, Hasbrouck (1995) proposes information share (IS), which calculates the proportion of the innovation variance in the efficient price process that can be attributed to each market. His analysis is based upon the cointegration framework. Two non-stationary time series are cointegrated if a linear combination of them becomes stationary. In other words, there is a common stochastic trend. When a cointegration relationship (i.e., a long-run relationship) prevails in price series, the short-run relationship between the price series can be represented by a Vector Error Correction Model (VECM).

Many papers adopt IS to measure price discovery across different markets (e.g., Blanco et al. 2005; Gonzalo and Granger 1995; Hasbrouck 1995; Lien and Shrestha 2009, 2014; Piccotti and Schreiber 2020; Putniņš 2013). This study constructs a stock-trader-direction measure of price discovery for each specific stock, investor group, and trade direction by calculating its contribution to total variance. Essentially, the price series from a different investor group is treated as a price series from a different market. Therefore, the Hasbrouck (1995) analysis can be directly applied. More precisely, we compute the IS metrics across investor types for a given stock on each trading day by trade directions in the same market, rather than across multiple markets.

We construct the stock-trader-direction price discovery measure based on the following three reasons. First, various stocks have their own characteristics in terms of different perspectives such as liquidity, growth, solvency, profitability, etc. (e.g., Abudy 2020; Cornell 2020). Second, trading styles differ from person to person. There are no decisive best trading rules in the stock market. Investment performance closely correlates to informational advantages across investor types (Agudelo et al. 2019). Third, buy-sell asymmetry is ubiquitous in the stock markets (e.g., Baruch et al. 2017; Lien et al. 2020a, b). The buy-sell asymmetry phenomena offer new insights that informed traders influence price discovery under different market conditions by different ways. For example, institutional investors tend to buy stocks less aggressively during the up markets than during the down markets, whereas individuals do the opposite price aggressiveness. The marginal effects of trading behavior on price discovery exhibit somewhat different degree across investor types and between buy and sell sides. Our IS measure reflects the contribution of each type of investors to the total variance of the efficient price innovations reflected in their bid (ask) prices of a certain stock. If the innovation in one type of investor accounts for the largest proportion of variation of the efficient price innovations, then this investor category could be regarded as informed participants, contributing the most to price discovery.

We construct the stock-trader-direction price discovery measure based on the following three reasons. First, various stocks have their own characteristics in terms of different perspectives such as liquidity, growth, solvency, profitability, etc. (e.g., Abudy 2020; Cornell 2020). Second, trading styles differ from person to person. There are no decisive best trading rules in the stock market because success trading comes to those who ace their own strategies, i.e., investment performance closely correlates to informational advantages across investor types (Agudelo et al. 2019). Third, buy-sell asymmetry is ubiquitous in the stock markets (e.g., Baruch et al. 2017; Lien et al. 2020a, b). Buy-sell asymmetry phenomena in response to information available so that informed traders influence price discovery in stock markets by different ways.

We describe below the method to construct price series for each type of traders. TWSE adopts an order-driven mechanism with a call caution taking place approximately every 5 s during the daily regular trading session over our sample period. We pool together consecutive sessions where different traders have submitted various trade prices and volumes and then collect the 5-s price series for each stock, investor type, and trade direction on a daily basis. We consider four different types of investors: foreign investors, investment trusts, other institutions,Footnote 4 and individuals. In total, we construct four price series corresponding to these four investor types in a single common stock market either on the buy or sell side. At each 5-s interval, the four prices constitute a (\(4\times 1\)) column vector of \({P}_{t}\) (here, subscript \(t\) denotes the intraday trading interval). To apply the Hasbrouck analysis, each price variable is assumed to be a unit-root series (i.e., containing a random-walk component) while the price changes are assumed to be covariance stationary—that is, these series could be represented by the vector error-correction models (Engle and Granger 1987):

Each column of \(\alpha\) indicates the VEC coefficients. Here, \(\beta\) denotes the cointegration vector such that \({\beta }^{T}{P}_{t-1}\) (the superscript denotes the vector transpose operator) is the cointegrated stationary series; i.e., the error correction term. Following Hasbrouck (1995), each price is non-stationary, whereas the difference between any two prices is stationary, Thus, the price series are cointegrated of order 3, implying both \(\mathrm{\alpha }\) and \(\beta\) are \(4\times 3\) matrices. Moreover, \({A}_{q}\) is a \(4\times 4\) matrix reflecting the short-term effects, and \({\varepsilon }_{t}\) is a zero-mean vector of serially uncorrelated error terms with covariance matrix \(E\left({\varepsilon }_{t}{\varepsilon }_{t}^{T}\right)=\Omega\).

Equation (1) can be further transformed into the vector moving average (VMA) model (Hasbrouck 1995; Stock and Watson 1988) as follows:

where \(\Psi \left(L\right)\) is a matrix polynomial in the lag operator. Consequently, we have:

where \({P}_{0}\) is a vector of initial values; \(\psi \left(1\right)\sum_{q=1}^{t}{\varepsilon }_{q}\) represents the long-term cumulative impacts in response to unit shocks in each price series; finally, \({\psi }^{*}\left(L\right){\varepsilon }_{t}\sim I\left(0\right)\) is a zero-mean covariance stationary process, while \({\psi }^{*}\left(L\right)\) is a matrix polynomial in the lag operator. The nature of the cointegrating relationships among the unit-root price series (i.e., \({\beta }^{T}{P}_{t-1}\) is stationary) implies that \({\beta }^{T}\psi \left(1\right)=0\) and \(\psi \left(1\right)\alpha =0\) (Engle and Granger 1987; Lehmann 2002). We denote \(\psi =({\psi }_{1}, {\psi }_{2},{\psi }_{3, }{\psi }_{4})\) as the common row vector of \(\psi \left(1\right)\).

Following Hasbrouck (1995), all the price series are assumed to be equal at the equilibrium. Thus, each of the pairwise cointegrating vectors is [1, − 1]. For the 4 unit-root price series, the transposed \(\beta\) is given by:

where \({\iota }_{3}\) is a 3-element column vector with all elements equal to 1, and \({I}_{3}\) is the \(3\times 3\) identity matrix.

We calculate Hasbrouck-style IS, \({IS}_{n}\), for the contribution of investor type \(n\) to price discovery based on the relative contribution of that investor type’s volatility to the total volatility of the long-run impact.

where \({[\psi F]}_{n}\) indicates the nth element of the row matrix \(\psi F\), and \(F\) is the lower triangular matrix obtained from the Cholesky factorization of \(\Omega\) such that \(\Omega =F{F}^{T}\). This factorization imposes a hierarchy such that the first price series has the maximum IS value, and the last one has the minimum. Consequently, the ordering of the price series affects the IS values. To resolve the non-uniqueness issue on the price discovery measurement driven by the ordering of the Cholesky decomposition, we use different sequences of four price series, for a total 24 combinations, and calculate the representative Hasbrouck-style (1995) IS by average, median, and the average of the maximum and minimum of the 24 values, respectively.

Lien and Shrestha (2009) apply diagonalization to the correlation matrix instead of the covariance matrix. Let \(\Lambda\) be the diagonal matrix with the eigenvalues of the correlation matrix on the diagonal, and the corresponding eigenvectors are given by the columns of matrix \(G\). Let \(V\) be the diagonal matrix with the innovation standard deviations on the diagonal. The modified information share (MIS) is proposed as:

where \({\psi }^{M}=\psi \widehat{F}\), \({\psi }_{n}^{\mathrm{M}}\) is the \(n\)th element of \({\psi }^{M}\), and \(\widehat{F}={\left[G{\Lambda }^{-1/2}{G}^{T}{V}^{-1}\right]}^{-1}\) such that \(\Omega =\widehat{F}{\widehat{F}}^{T}\). MIS is unique and independent of the ordering of the Cholesky decomposition.Footnote 5

4.2 4.2 Trader-specific characteristics

4.2.1 Trader dummies

Through the following paragraphs, we refer to superscript \(d\) as trade direction (buy or sell side) and also use subscripts \(i\) and \(j\) to denote stock and investor type, respectively. Hereafter, to be in line with convention, subscript t refers to the trading day, instead of the intraday 5-s interval in the previous section. There are four investor types among our sample firms, and we define three trader dummies. The foreign investor dummy, \({For}_{it}\), equals one if the trader is a foreign investor and zero otherwise. In a similar way, \({Trust}_{it}\) and \({OthInst}_{it}\) are investor indicators for investment trusts and other institutions, respectively.

4.2.2 Price aggressiveness

It is inevitable that IS and stock price movements are originally driven by stock investors’ order submission behavior. We summarize basic trading activities by price aggressiveness (price dimension) and trade size (quantity dimension). Specifically, price aggressiveness, \({TrdAgg}_{ijt}^{d}\), is computed by the natural logarithm of the ratio of the average trade price for a specific trader type to the overall volume-weighted average price expressed as a percentage.

where \({TrdAgg}_{ijt}^{d}\) is the daily-level price aggressiveness for investor type \(j\); \({AP}_{ijt}^{d}\) indicates the average price traded; \(VW{AP}_{it}\) denotes the volume-weighted average price of all investors; and \(I\) expresses an indicator that equals one for buy-side trades and minus one for sell-side trades. Accordingly, the higher (lower) the buy (sell) price is, the more aggressive the order decision will be.

4.2.3 Trade size

Trade size, \({TrdSize}_{ijt}^{d}\), is calculated by the natural logarithm of the average trade value per order as follows:

Note that \({TrdVal}_{ijt}^{d}\) and \({OdrN}_{ijt}^{d}\) are respectively the daily trade value and the number of orders for investor type \(j\).

4.2.4 Herding intensity

According to Chen et al. (2019), herding intensity and order imbalance correlate to price discovery. We extend Lakonishok et al. (1992) and Wermers (1999) to construct stock-trader-direction herding intensity as:

where \({Herd}_{ijt}\) is the herding intensity for investor type \(j\); \({Brat}_{ijt}\) denotes the relative buy ratio (i.e., dividing the numbers of buy orders by the total number of buy and sell orders); and \(E({Brat}_{ijt})\) is the average buy ratio of the total investors. The adjusted factor, \(E[\left|{Brat}_{ijt}-E({Brat}_{ijt})\right|]\), represents the expected value of \(\left|{Brat}_{ijt}-E({Brat}_{ijt})\right|\) under the null hypothesis of no herding. Based on a binominal distribution of the buy ratio with a buy probability of \(E({Brat}_{ijt})\), the adjusted factor is calculated by the expected value of the difference between one investor type’s buy ratio and all investor types’ average buy ratio. \({Herd}_{ijt}^{b}\) and \({Herd}_{ijt}^{s}\) indicate buy- and sell-side herding intensities, respectively. We classify herding intensity as buy-oriented herding if \({Brat}_{ijt}\) is greater than \(E({Brat}_{ijt})\) and sell-oriented herding when \({Brat}_{ijt}\) is smaller than \(E({Brat}_{ijt})\).

4.2.5 Order imbalance

Order imbalance, \({Imbal}_{ijt}^{d}\), is computed as the difference in the market value between the buyer- and seller-initiated shares traded, divided by the market value of total shares traded.Footnote 6 Order imbalance is categorized as buy-side order imbalance, \({Imbal}_{ijt}^{b}\), when the market value of buyer-initiated trades is larger than that of seller-initiated trades. In this case, \({Imbal}_{ijt}^{s}\) is assigned to be zero. Similarly, order imbalance is classified as sell-side order imbalance, \({Imbal}_{ijt}^{s}\), when the market value of seller-initiated trades is larger than that of buyer-initiated trades. At this time, \({Imbal}_{ijt}^{b}\) is set to zero.

4.3 4.3 Firm-specific characteristics

Prior studies have confirmed that firm characteristics affect stock investors’ preferences or trading behavior.Footnote 7 Thus, we consider firm-specific characteristics, including firm size, book-to-market ratio, turnover rate, percentage spread, intraday volatility, institutional shareholdings, cross-listing indicator, return conditions, and tick size indicators.

Firm size, \({Size}_{i,t-1}\), is defined as the natural logarithm of the market capitalization (in NT$ million); book-to-market ratio. \({BM}_{i,t-1}\), is computed as the ratio of the book value at the end of the latest fiscal year to the market capitalization of common shares at the previous trading day; and turnover rate, \({TO}_{i,t-1}\), is calculated by the number of shares traded relative to the number of the shares outstanding. Percentage spread, \({Spr}_{i,t-1}\), is defined as the time-weighted percentage spread of all bid-ask quotes at the previous trading day.

In a conventional way, we first calculate the quote-level spread by the difference between the lowest offer and highest bid quotes divided by the midpoint for each bid-ask pair expressed as a percentage. We then compute the time-weighted percentage spread on a daily basis, using the prevailing time length of the quote-level spread. Intraday volatility, \({Vol}_{i,t-1}\), is a measure of the dispersion around the mean transitory return of intraday-level trades. It is defined as the standard deviation of logarithmic returns of all trade price series in a given trading day for each stock. Institutional shareholding, \({InstHold}_{i,t-1}\), is measured by the percentage ownership of the top three types of institutional investors (foreign investors, investment trusts, and dealers),Footnote 8 divided by the number of shares outstanding at the previous trading day. Cross-listed firms generally have higher international visibility than pure domestic firms. The cross-listed dummy, \({CroList}_{i,t-1}\), equals one when the firm has issued American depository receipts (ADRs) or global depositary receipts (GDRs) overseas and zero otherwise.

To control for possible asymmetric return effects, we construct two return variables, \(Pos{Ret}_{it}\) and \(Neg{Ret}_{it}\), based on the rising and falling current-day returns, respectively. \(Pos{Ret}_{it}\) equals the current-day return if it is larger than zero and zero otherwise; i.e., \(Pos{Ret}_{it}=Max\left[0,{Ret}_{it}\right]\). Similarly, \({NegRet}_{it}\) equals the current-day return if the return is lower than zero and zero otherwise; i.e., \(Neg{Ret}_{it}=Min\left[0,{R\mathrm{e}t}_{it}\right]\).

Tick sizes or price levels closely relate to fragmentation of liquidity, bid-ask spread width, and transaction costs. In this multiple-tick market, all stocks can be classified into six tick sizes. We consider five tick size indicators according to the ranges of stock prices. A tick group dummy, \({Tick}_{gi,t-1}\), equals one if the previous closing price is categorized into the \(g\)th tick size group and zero otherwise. Here, \(g\) ranges from 1 to 5 in the queue of the ordinal tick sizes: NT$0.01, 0.05, 0.1, 0.5, and 1.0. For instance, the smallest tick size \({Tick}_{1i,t-1}=1\) if the stock price is greater than or equal to NT$0.01 and smaller than NT$10 and \({Tick}_{1i,t-1}=0\) otherwise. In a similar fashion, the fifth tick size \({Tick}_{5i,t-1}=1\) when the stock price is greater than or equal to NT$500 and smaller than NT$1000 and \({Tick}_{5i,t-1}=0\) otherwise. The largest tick size of NT$5 plays the role of the reference group.

5 Model specifications and empirical results

5.1 Summary statistics

Table 1 presents the descriptive statistics of firm characteristics. Firm size (the logarithm of market capitalization in NT$ million) is on average 10.62 with a standard deviation of 1.27; book-to-market ratio is approximately 0.21; and daily turnover rate is 1.34%. The average bid-ask spread is 0.27%; intraday volatility averages 0.14 basis points; and the shareholdings of the top three types of institutions is 32.55%. Compared to overall common stocks listed on TWSE, our sample firms tend to have larger firm size, growth orientation, higher turnover, lower transaction cost, lower intraday volatility, and higher institutional ownership.

Table 2 presents the information shares across investor types. Panels A and B correspond to various IS measures and IS per thousand orders, respectively. We first calculate Hasbrouck-style (1995) IS based on different permutations of four price series, creating a total of 24 numerical value. These original figures are expressed by average, median, and the average of the maximum and minimum, respectively. We then calculate Lien and Shrestha’s (2009) modified IS.

Panel A of Table 2 shows that individuals overall have larger IS than institutional investors no matter what measures or which trade directions. Various Hasbrouck-style IS measures offer similar results; the modified IS measures are very close to Hasbrouck-style average IS measures. The evidence mainly supports the role of individuals as the dominant participants in TWSE. Among institutional investors, foreign investors have the highest IS. The results are in line with foreign investors contributing significant growth to TWSE. The empirical results are also consistent with Lien et al. (2020a, b) who analyze whose trades move stock prices within the framework of the weighted price contribution.

Panel B of Table 2 further presents various IS measures per thousand orders. While individuals all together account for the largest proportion (about 37–38%) of overall price discovery, their scaled IS is the smallest, no matter which trade directions or what IS measures are considered. Among institutional investors, investment trusts have the highest IS per thousand orders, followed by other institutions and then foreign investors. On average, domestic institutions contribute more to price discovery than do foreign investors from the perspective of IS per thousand orders, regardless of measurements or trade directions. The results verify that different types of investors contribute to price discovery to a varying extent. The modified IS estimates are once again very close to Hasbrouck-style IS measures. We hereafter consider IS per thousand orders instead of IS, because the former is more suitable to reflect the role of information arrival process in the market.

Foreign investors comprise about 25% of the total trading value, and their average scaled IS is more than twice that of retail investors. While investment trusts only account for about 2% of the total trading value in TWSE, they act as dominant participants in terms of scaled IS. The reason could be that, investment trusts have better access to private information or being clever at analyzing public information. Although other institutions also have higher scaled IS than do individuals, they are not investment-oriented and generally lack persisting and consistent trading strategies. Thus, both foreign investors and investment trusts often act as information leaders and their trading activities generally attract the attention of most individuals.

There exist differences in transaction features between foreign investors and investment trusts. The former mostly attaches great importance to corporate fundaments and usually sets mid- to long-term investment goals. Based on the abundant financial resources, foreign investors generally prefer large stocks and their large buying or selling often cause the market to move violently. On the other hand, investment trusts issue many mutual funds that substantially value short- or medium-term performance compared to foreign investors. Fund managers prefer small or medium stocks and generally think highly of corporate fundaments and immediate news events. Moreover, they need to disclose the information of portfolio holdings at the quarter end. As a sequence, investment trusts tend to use the most aggressive price to complete their short-term goals quickly. For individuals, it may be not easy to accurately distinguish who is informed in a timely manner. A great part of retail investors may be accustomed to paying attention to the transaction dynamics of foreign investors, but a fraction of them may pay special attention to the quarter-end transactions of investment trusts.

Our preliminary findings support hypothesis H1A. Institutional investors exhibit higher scaled IS than do individuals. Among professional institutions, domestic investment trusts remarkably have higher IS compared to foreign investors, which supports hypothesis H1B. However, our findings are somewhat different from Chen et al. (2019) in the Taiwan Futures Exchange (TFE). They reveal that foreign investors contribute the most to price discovery in terms of specific futures contracts. In Taiwan, the development of the stock market has a longer history and is more mature than the futures market. People also prefer stocks to futures as popular investment vehicles. Domestic institutions have more information advantages toward local industries and legal environments than foreign investors. Consequently, in terms of scaled IS, they contribute more to price discovery than do foreign investors in TWSE. On the other hand, foreign investors possess profound experience in diversification among global investments and have superior trading skills in forming strategies between stock and derivatives markets. Although foreign investors contribute less to price discovery than domestic institutions, they still contribute more than do individuals, regardless of measures or trade directions. Overall, our empirical results provide more comprehensive evidence on price discovery across investor types in TWSE.

Table 3 reports the summary of trading statistics across investor types, including price aggressiveness, number of orders, trade value, herding intensity, and order imbalance. Price and quantity are important core factors for an order submission decision. We measure price dimension by price aggressiveness and quantity dimension by trade-size-related metrics. Herding intensity and order imbalance are also considered.

Panel A of Table 3 shows that investment trusts, on the buy side, act as the most aggressive traders among all investor types, followed by other institutions. Individuals exhibit higher price aggressiveness than foreign investors—that is, domestic investors (both institutional investors and individuals) are more aggressive than foreign investors in terms of trade prices executed. Investment trusts are liable to place aggressive orders, arising from a fact that they tend to set short- or medium-term performance goals. Fund managers oversee and handle their financial institutions’ cash flows. The most important responsibility for them is to manage funds and investments for their clients in order to create the highest possible growth on their total net assets. Fund managers have an obligation to disclose quarter-end reports for their portfolio components. Based on self-interest consideration, fund managers’ career reputation and job tenure highly correlate to fund performance. Due to their career concerns and quarter-end report requirement, investment trusts are prone to trade more aggressively than do other domestic investors and foreign investors. Their price aggressiveness might also correlate to fund managers’ motivation to window dress or pump portfolios for their financial reports (Agarwal et al. 2014; Giambona and Golec 2010; Hung et al. 2020; Lien et al. 2019; Morey and O’Neal 2006; Ng and Wang 2004).

Foreign investors conversely react more quickly to intraday market changes than other investors (Lien et al. 2019). Their low price aggressiveness possibly correlates to the algorithmic trading that relies on advanced mathematical tools and strategies to facilitate trading decisions in the financial markets. Foreign investors also tend to split orders (Chakravarty 2001; Chan and Lakonishok 1995) and can quickly adjust prices or change orders so as to choose more favorable prices. Lower price aggressiveness has some advantages such as saving costs, avoiding violent price fluctuations, and hiding private information.

With respect to trade-size-related metrics, individuals account for about 69% of the total number of orders on the buy side, foreign investors make up approximately 18%, whereas investment trusts only contribute around 2%. Concerning trade value, individuals account for almost 60%, followed by foreign investors (about 24%), and next is other institutions (around 14%). There exist substantial differences in trade size among investor types. While individuals act as the dominant participants in TWSE in the number of orders or total trade value, their average trade is much smaller than institutional investors’ average trade. Foreign investors relatively take the largest average trade value per order, followed by other institutions. Even though foreign investors are apt to slice their large orders into smaller ones to disguise their private information and downplay possible price impacts (Chou and Wang 2009), their average trade value is still larger than that of domestic investors. Evidently, different groups of investors manifest their own trading habits and contribute to price discovery to different degrees.

Herding intensity measures the tendency that a group of investors tracks each other into and out of the same assets in the same direction over a certain period of time. In recent years, market participants have become increasingly concerned about herding behavior in financial markets (Cai et al. 2019). We find different types of investors expose dissimilar herding intensity. Specifically, individuals reveal a much lower degree of herding than institutional investors. As dominant participants in TWSE, individuals are usually referred to as less sophisticated investors. Numerous retail investors may lack systematic and consistent trading strategies, leading to lower herding intensity. Among institutional investors, investment trusts display the highest degree of herding intensity, followed by other institutions. Fund managers’ high herding intensity considerably correlates to their personal career concerns or portfolio disclosure requirements (Agarwal et al. 2014; Lien et al. 2020a, b; Morey and O’Neal 2006; Ng and Wang 2004). Foreign investors demonstrate a lower degree of herding versus domestic institutions. In Taiwan’s stock markets, foreign investors mainly encompass foreign mutual funds and financial institutions and possess abundant global investment experience and great financial capabilities. Foreign investors concentrate on medium- and long-term performances, and their investment strategies highly pay attention to corporate fundamentals. Compared to domestic institutions, foreign investors take on relatively mild herding behavior. In brief, institutional investors are bound to more intensive herding than individuals in TWSE, and domestic institutions herd more strenuously than do foreign investors. Order imbalance refers to the difference in the market value of transactions between buyer- and sell-driven trades (converted to a percentage), which represents the order flow within a period of time. Previous studies confirm that order imbalance can explain stock price changes better than does trading volume (Chan and Fong 2000; Chordia et al. 2002). Table 3 shows that sell-side order imbalance is stronger than buy-side order imbalance during our sample period.

To further investigate whether institutional investors’ versus individuals’ trading behaviors vary during the up and down markets, we perform the difference tests in abnormal trading behaviors between them conditional on up and down markets, respectively. The abnormal trading behavior for a specific group of investors is defined by the trading behavior measure minus their own average of the trading behavior measure on the same trade direction over our sample period. The difference test is based on the hypothesis of no difference in abnormal trading behavior between institutional investors and individuals. On average, all institutional investors tend to buy stocks more aggressively during down markets than during up market, whereas they prefer to sell stocks more aggressively during up markets than during down markets. By contrast, individuals display the opposite. The results seem to imply that institutional investors have better abilities of timing the markets than individuals and thus have a greater potential for making profits since they tend to buy at lower costs but sell on higher prices.

Looking at the difference in abnormal trading behaviors between institutional investors and individuals, we first focus on the buy-side during up markets. The difference tests show that institutional investors have relatively lower abnormal price aggressiveness, trade size, and order imbalance during up markets. The evidence indicates that institutional investors seem to be less overconfident during up markets compared to individuals. They also tend to buy more winners than individuals do in terms of the number of orders and trade value. On the sell side, we concentrate on the sell-side during down markets. The difference tests show that institutional investors experience higher selling herding intensity, order imbalances as well as the trade value of selling losers during down markets. Relatively speaking, individuals experience a negative abnormal number of orders and trade value during down markets. The empirical results are in accordance with the traditional wisdom that institutional investors are less likely subject to the disposition effect (i.e. desire to breakeven by holding onto losers too long). Institutional investors are less subject to loss aversion and more likely to dump losing investments than individuals are. Please see Table 6 of the “Appendix”.

5.2 Determinants of information shares

In order to examine who and which behavior initiate private information, we estimate the regression model with heteroscedasticity and autocorrelation standard error correction (Newey and West 1987). To perform the Newey-West approach, we use the generalized method of moments (GMM) to estimate parameters in the following model:

We note that \({MIS}_{ijt}^{d}\) indicates the modified IS per thousand orders according to Lien and Shrestha (2009). To save space, we hereafter only report results of the modified IS per thousand orders (hereafter scaled IS). Three investor type dummies represent foreign investors, investment trusts, and other institutions, respectively. Individuals serve as the reference group, and independent variables are defined in Sect. 4.2. To allow the trading behavior of different investors to have varying impacts on price discovery, we incorporate the interaction terms of investor type dummies and various trading activities into the model. We further add the prior-day IS, \({MIS}_{ij,t-1}^{d}\), to control for possible auto-correlation. Moreover, fixed industry, yearly, monthly, and weekday effects are included. Finally, \({\varepsilon }_{ijt}^{d}\) is the error term.

Table 4 presents the determinants of IS measures. Panels A and B correspond to buy and sell sides, respectively. For each trade direction, the first four models are for various investor types separately, and the fifth model pools all investors. Looking at the buy side, in Panel A the estimated coefficients on price aggressiveness, \({TrdAgg}_{ijt}^{d}\), for foreign investors, other institutions, and individuals are significantly negative. Moreover, the magnitude of non-professional investors is larger than that of foreign investors. In short, price aggressiveness negatively correlates to IS in most investors except for investment trusts. All coefficients on trade size, \({TrdSize}_{ijt}^{d}\), for the first three types of investors (i.e., institutional investors) are significantly positive, while the estimate for individuals is insignificant. The result indicates that institutions’ larger trades contribute to more price discovery than do their smaller trades.

In the first four individual regressions, all coefficients on herding intensity are significantly negative. Compared with investors in the same group, intensive herding by either institutional investors or individuals reduces the contribution to the price discovery process. While many previous studies offer contradictory findings on the impacts of herding on stock returns,Footnote 9 we provide evidence for the impacts of herding on price discovery, showing a new angle on previous results. The empirical results show that daily herding intensity has an adverse impact on price discovery when comparing investors with their own group traders. Moreover, the coefficients on order imbalance, \({Imbal}_{ijt}^{d}\), for foreign investors and individuals are significantly positive, but the estimate for investment trusts is negative. The impact of order imbalance on price discovery varies among different type of groups.

Stacking all investors into the last model (with individual traders serving as the reference group), all estimated coefficients on investor dummies are significantly positive. The results show that institutional investors’ trades offer higher scaled IS than do individuals, reconfirming hypothesis H1A. As to price aggressiveness, the coefficient on \({TrdAgg}_{ijt}^{d}\) is significantly negative (-0.31); however, the coefficients on both \({For}_{it}\times {TrdAgg}_{ijt}^{d}\) (0.18) and \({Trust}_{it}\times {TrdAgg}_{ijt}^{d}\) (0.38) are significantly positive. The results support hypothesis H2A, indicating that professional institutions aggressive trades affect information share more powerfully compared to individuals, although the average effect of price aggressiveness on price discovery is negative.

To further verify whether domestic investment trusts’ price aggressiveness positively affects IS more significantly than do foreign investors’, we apply the Wald statistic to test the null hypothesis of \({\beta }_{12}-{\beta }_{8}=0\). The null hypothesis is rejected, and thus hypothesis H2B is supported. Among investor types, investment trusts conduct the most aggressive trading behavior in terms of the trade price (see Table 3), and their more aggressive trading activities enhance the price discovery process more significantly than foreign investors’. Investment trusts’ price aggressiveness positively correlates to price discovery, suggesting these more aggressive trades may be driven by their private information.

We now turn to the trade size effects in the pooled regression of Panel A of Table 4. The coefficient on \({TrdSize}_{ijt}^{d}\) is significantly positive (1.19), but the coefficient on \({For}_{it}\times {TrdSize}_{ijt}^{d}\) (-0.40) is significantly negative. The results show that larger-size trades by foreign investors on average contribute to price discovery more significantly than do smaller-size trades; however, their sensitivity of price discovery to trade size is smaller compared to individuals. For example, a 1% increase in the daily trade size of foreign investors increases IS by 0.79% (1.19 – 0.40 = 0.79). The net impacts of trade size on price discovery are still positive, supporting hypothesis H3A. However, the marginal effect of trade size on IS is weaker for professional institutions than for individuals. The results likely are caused by the fact that institutional investors tend to place larger-size orders (see Table 3) and price discovery increases with trade size at a decreasing rate, and thus foreign investors’ marginal effect for trade size is relatively lower than individuals’.

We further test whether domestic investment trusts’ trade size affects IS more significantly than do foreign investors’. For investment trusts, the coefficient on \({Trust}_{it}\times {TrdSize}_{ijt}^{d}\) is insignificant, indicating that their marginal effect of trade size is indifferent from individuals’. The Wald statistic rejects the null hypothesis of \({\beta }_{13}-{\beta }_{9}=0\), and thus hypothesis H3B is supported. Investment trusts’ trade size affects IS more significantly than do foreign investors’. To summarize, investments trusts have a larger impact of trade size on price discovery than foreign investors do.

As to herding effects, the coefficients on \({Herd}_{ijt}^{d}\) for the various investor types are significantly negative; however, the coefficient for the pooled investors is significantly positive, and the estimates on various interaction terms are negative. Our results cast a new light on the relationships between herding intensity and price discovery. From the results, it is clear that herding intensity on average negatively correlates to IS, but the impacts varies from investor to investor. For instance, the coefficients for \({Herd}_{ijt}^{d}\) and \({For}_{it}\times {Herd}_{ijt}^{d}\) are 1.34 and − 5.28, respectively, and hence a 1% increase in foreign investors’ buy-oriented herding intensity lowers the corresponding IS by 3.94%. Similar patterns are observed for investment trusts. A 1% increase in the buy herding intensity of investment trusts lowers the corresponding IS by 2.41%. Overall, the results indicate that professional institutions’ herding behavior deteriorates price discovery, but the margin effect varies among different types of investors. Herding behavior may cause prices of a specific stock to deviate from its fundamental value, produce excessive inflows or outflows of capital in a short-run period, or worsen micro-economic conditions (e.g., biased systematic risk). As a consequence, institutional investors’ herding intensity deteriorates price discovery significantly. Relating to order imbalance, the coefficient on \({Imbal}_{ijt}^{d}\) for the pooled regression is significantly positive (0.01), and the estimates on interaction terms are significantly negative for domestic institutions, but insignificant for foreign investors. A 1% increase in order imbalance of investment trusts lowers the corresponding IS by 0.01%. Overall, the impact of order imbalance on price discovery is not as vigorous as that of herding intensity. The Wald test further confirms that investment trusts’ order imbalance deteriorates price discovery more significantly than foreign investors’ order imbalance.

Regarding firm characteristics, different types of investors exhibit different IS levels in conjunction with firm-specific attributes. On average, firm size, book-to-market ratio, and turnover rate negatively correlate to price discovery no matter what investor types. Investors who trade smaller-size, growth-oriented, or lower-turnover stocks exhibit higher IS, while investors trading in stocks with a wider bid-ask spread have higher IS except for investment trusts. One possible reason may be that these stocks are, in general, less liquid and likely have higher adverse selection costs. Trading in them helps with the price discovery process. The results support hypothesis H4A. Institutional trading in low liquid stocks contributes to price discovery more significantly than trading in high liquid stocks.

Stocks with larger intraday volatility positively correlate to foreign investors’ IS, but negatively to domestic institutions’ IS. A greater degree of intraday volatility indicates a greater likelihood of larger price movements, implying higher risk, larger uncertainty, or more volatile information. Foreign investors contribute more to price discovery when trading higher intraday-volatile stocks, domestic institutions exhibit the opposite, and individuals seem to be irrelevant to intraday volatility. While volatility suggests investment risk, it provides numerous profit-making opportunities for day traders, swing traders, and even patient investors. Volatility is also one of the crucial factors in the pricing of derivatives. Foreign investors are more familiar with trading volatility-based securities than non-professional investors and hence contribute more to price discovery toward higher volatile stocks.

Higher institutional ownership generally exhibits greater firm transparencies (Boone and White 2015; Hsu et al. 2016). We find that trading in stocks with lower institutional shareholdings contributes more to price discovery, regardless of investor types. The results again support hypothesis H4A. Overall, trading in stocks with lower institutional ownership (by either institutional investors or individuals) contributes to price discovery more significantly than trading in those with higher institutional ownership. Institutional investors’ trades also affect their information share in low liquid stocks more significantly than in high liquid stocks.

We now turn to the effects of cross-listed firms on price discovery. It is expected that cross-listed firms are more closely linked to firm visibility, market liquidity, information disclosure, and investor protection. Global investors can trade cross-listed stocks in numerous time zones and multiple currencies. We find foreign investors and other institutions contribute more to the price discovery process when they trade cross-listed firms, but individuals produce the opposite result. The evidence at least partially coincides with hypothesis H4B. Foreign investors contribute to price discovery more significantly than investment trusts when buying cross-listed stocks. They are generally more apt at trading cross-listed shares in multiple markets than domestic investors are and thus contribute more to price discovery for these stocks. The results also fit in with the premise that foreign investor have superior global experiences in international financial markets. Other institutions still contribute more to price discovery when buying cross-listed stocks. Finally, tick size does not have systematic and consistent effects on price discovery.

Sell-side analysis in Panel B of Table 4 presents similar patterns with the buy-side findings. Overall, investor type, trading behavior, and firm characteristics all correlate to the price discovery process, regardless of trade directions. On average, institutional investors contribute more to price discovery than do individuals; among them, domestic institutions have a larger IS per order than do foreign investors. Price aggressiveness, trade size, herding intensity, and order imbalance all have significant impacts on price discovery, but in different ways and to varying degrees. Overall, the sell-side empirical results again provide clear support for our above hypotheses.

Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC) is the largest Taiwanese multinational semiconductor contract manufacturing and design corporation. It was ranked 10th largest company around the world, in terms of the market value in mid-2022.Footnote 10 In order to check whether the main results are driven by TSMC, we re-estimate Eq. (13) excluding TSMC. The empirical results remain unchanged. Please see Table 7 of the “Appendix”. In addition, we estimate regression results for the key factors of information shares using Taiwan 50 components, shown on Table 8 of the “Appendix”. On average, price aggressiveness, trade size, herding intensity, and order imbalance all have significant impacts on price discovery, but in different ways and to varying degrees. Institutional investors do not necessarily contribute more to price discovery than do individuals when trading on the Taiwan 50 components. It is especially worth mentioning that foreign investors’ price aggressiveness, trade size, and herding intensity have positive impacts on the price discovery measure than do individuals. It appears the foreign investors dominate the Taiwan 50 component companies, and individual traders follow the suit. In other words, while our general analysis suggests that retail investors should focus on some of the largest stocks since they are less likely to be at an information disadvantage, the analysis on the Taiwan 50 component companies may indicate retail traders may have already taken the approach.

5.3 Robustness checks

This section proceeds to perform several robustness checks to address some important concerns. We consider an alternative IS measure, stock volatility, earnings reports, and macroeconomic factors.Footnote 11 First, we change the 5-s IS to a 1-min IS measure to mitigate bid-ask bounce effects. The major results remain unvaried. In spite of buy or sell trade directions, domestic institutions have higher IS per order and still contribute more to price discovery than foreign investors. Individuals present the smallest contribution to price discovery in TWSE. To conserve space, we do not show the details, but the results are available by request. Subsequently, we partition all observations into subsamples according to stock volatility, price-to-earnings (PE) ratio, earnings growth forecast, appreciation versus depreciation of the New Taiwan dollar against US dollar, high versus low deposit rates, and bull versus bear periods, respectively.

Table 5 exhibits the extended tests for the determinants of IS by subsamples. Panels A and B correspond to buy and sell sides, respectively. Stock volatility symbolizes how fluctuating stock prices swing around the average share price within a certain period. Volatile stocks are often deemed riskier than less volatile stocks, because their stock price is anticipated to be less predictable and conceivably more dispersed over a larger range of values. We define stock volatility by the standard deviation of the logarithmic returns of intraday trades for each stock on a daily basis. High (low) volatility stocks indicate those stocks with intraday volatility higher (lower) than the median under the daily comparison rule. After separating the full sample into two parts, we find the main results are valid for these two subsamples with the trader dummies, trading behavior, and interaction terms exerting more profound influences on price discovery for high volatile stocks than for low volatile stocks. Institutional investors on average perform more price discovery functions than individuals. Professional institutions’ price aggressiveness positively correlates to price discovery, although the average effect of price aggressiveness negatively affects price discovery. In addition, price discovery on the whole runs positively in accordance with trade size. The marginal effects of professional institutions’ trade size are lower (but still positive) compared to individuals. Professional institutions’ herding behavior deteriorates price discovery, especially for volatile stocks. Institutional investors’ order imbalance tends to negatively influence price discovery, but the effect is less than that of herding intensity.

Earnings reports supply stock investors with fundamental information to evaluate the financial health of a specific company and help investors judge whether the company deserves investing in. The PE ratio is a proxy for valuing a company measured by the ratio of the current-day share price to its latest earnings per share (EPS). High (low) PE stocks are classified into those that have higher (lower) PE ratios than the day-to-day median. A high PE stock is usually expected to have high growth rates in the future (excluding extreme low earnings in the denominator). Our PE subsample findings support the full-sample conclusions. Institutional investors have greater price discovery than individuals. Professional institutions’ price aggressiveness has larger impacts on price discovery than individuals’ for either high or low PE stocks, although price aggressiveness on average negatively correlates to price discovery. Moreover, price discovery positively accords with trade size, but professional institutions’ marginal effects of trade size are lower than individuals’. Professional institutions’ herding behavior deteriorates price discovery as do the order imbalances by domestic institutions. The PE subsample results are synonymous with the full sample conclusions.

We proceed to break all observations into positive versus negative sales and earnings growth samples. Stocks on specific days are categorized into the group with the positive (negative) earnings growth forecast if research analysts issue positive (negative) sales and earnings growth rates over a 1-month period right after their announcements. The results are comparable with those for the PE subsamples. However, the impacts of institutional trading behavior on price discovery are stronger for stocks with positive earnings forecast than for negative ones.

With respect to macroeconomic factors, foreign exchange rate and interest rate are prominent determining factors of a country’s economy and thereby could greatly influence stock markets. Foreign exchange rates play a vital role in a free market economy, and changes in exchange rates immensely influence the real rate of return of an investor’s portfolio. We split up the sample periods into appreciation or depreciation days contingent on changes in the foreign exchange rates of the New Taiwan dollar to the US dollar during the previous month. Likewise, the sample span can be separated into high versus low interest rate days according to the midpoint of bid and ask of 1-month deposit rates in Taiwan obtained from Refinitiv Eikon Datastream. From investors’ standpoint, the level of interest rate (cost of capital) is equivalent to the minimum required rate of return on a portfolio. Taking into account the effects of foreign exchange rate and interest rate, the main results remain unchanged.

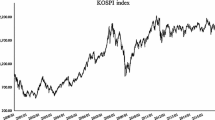

We follow Bry and Boschan (1971) and Pagan and Sossounov (2003) and use the monthly index of the Taiwan Stock Exchange Weighted Index (TAIEX) to identify the bull and bear markets by first identifying potential peaks and troughs over an 8-month rolling window period. We then delete either the lower of adjacent peaks or the higher of adjacent troughs, and eliminate any phase lasting less than 4 months unless the changes in monthly stock prices exceed 20%. We also eliminate the cycles sustained less than 16 months. Based on this dating algorithm, a bull market occurs when the index is on the rise for a sustained period of time, while a bear market occurs when the index declines from a peak to a trough. The overall empirical results indicate that the impacts of professional institutions’ trading behavior on price discovery are stronger in the bull period than in the bear period, but other institutions present the opposite result. In sum, the full sample conclusions remain valid when we partition all observations into a variety of subsamples.

We consider the effects of short sales on IS and estimate regression models to analyze whether short selling is closely correlated with IS. The dependent variable is the modified IS per thousand orders. TWSE allows individuals to borrow stocks from a specific broker to sell short and then buy back the stocks to return to the broker during 6 months, namely credit transactions. Generally, institutional investors cannot be allowed to engage in credit transactions but they can borrow securities via TWSE’s securities lending system. The borrowed securities by institutional investors can be used to sell short, exercise stock options or other financial instruments, repurchase exchange traded funds (ETFs), etc. In order to avoid stock price crash and maintain market stability, TWSE may periodically ban short selling. We further take both individuals’ credit transactions and institutional investors’ borrowing and selling stocks into consideration. It is worth mentioning that the investment trusts devote themselves to security investment on behalf of mutual fund clients, and there are thus no borrowing and selling securities in our intraday data. We measure short selling in terms of the relative and absolute perspectives, respectively. The relative short selling value is computed by the short selling value of a specific group of investors relative to their total trade value in percentage terms, while the absolute short selling value is defined as the logarithm of the short selling value. We find the differences in scaled IS between the regular and ban periods are insignificant. On average, short selling negatively correlates to IS, regardless of the relative and absolute short selling measures. Larger relative short selling by foreign investors and other institutions experiences lower IS, whereas their absolute short selling does not necessarily reduce IS. Please see Table 9 of the “Appendix”.

To examine whether different investor types tend to make different order choices, we investigate the frequency distribution of order sizes across investor types, reported on Table 10 of the “Appendix”. We classify all order sizes into 6 categories: 1000, 2000–4000, 5000–10,000, 11,000–20,000, 21,000–50,000, and more than 50,000 shares (one lot = 1000 shares). On the buy side, one-lot orders account for 53.08% of total orders, followed by 2–4 lots at 24.73%, and then 5–10 lots at 16.60%. The remainder is only 5.59%. Among one-lot orders, most of them are placed by individuals in terms of the absolute number of orders, regardless of buy or sell sides. Within each group of investors, we find foreign investors have the largest proportion of one-lot orders (about 58%), echoing to their order splitting (or slicing) algorithms. Overall, the buy and sell sides show similar patterns. Looking at the last two categories with more than 21,000 shares, we find institutional investors relatively account for larger proportion than individuals do. Overall, different types of investors have somewhat different preferences of order choices.

Although institutional investors may break their trades into small batches to minimize market impact, their block trades are much larger than do individuals’ block orders. Retail investors still have the opportunity to "piggyback" off of institutional moves. We now proceed to take block trades into account. An order can be defined as a block order if it meets the following criteria: (1) the number of shares submitted in relation to daily trading volume is in the top one-thousandth; and (2) the ratio of the number of shares submitted to shares outstanding is also in the top one-thousandth. We delete orders with values less than NT$1 million to exclude thinly traded penny stocks. We first measure block trades in terms of the relative value, defined by the block trade value of a specific group of investors relative to their total trade value in percentage. We then consider the absolute block value by taking the logarithm of the block trade value. The results are presented in Table 11 of the “Appendix”. Trades by both foreign investors and investment trusts still have larger IS compared to individuals, consistent with our previous findings. Overall, relative block trades experience higher IS. However, professional investors’ marginal effects of relative block trades on IS are lower compared to individuals. While institutional investors tend to break their trades into small batches to minimize market impact (i.e., order splitting or slicing), their average size of block trades is much larger than that of individuals and their marginal effects of high-level block trades on IS are relatively lower than those of individuals’ block trades.