Abstract

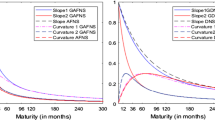

In this paper, we present a robust predictive comparison of several continuous-time multi-factor models in the context of interbank rates. Recognizing the specific dynamics of the short-term segment of the yield curve, we examine the U.S. money market by extending two continuous-time frameworks with different factor structures, the Chan-Karolyi-Longstaff-Sanders (CKLS) model and the arbitrage-free dynamic Nelson-Siegel (AFDNS) model. A battery of formal forecasting accuracy tests is employed to select a subset of superior predictive models. Despite a better goodness-of-fit measure, additional factors improve the forecasting performance only for the CKLS family. With implications for monetary policy formulation, we found evidence of two separate maturity segments as the three-factor AFDNS and the five-factor CKLS models outperform parsimonious benchmarks in predicting the interbank rates for very short maturities. Our comparative forecasting results are re-confirmed with stronger out-of-sample performance for the five-factor CKLS model when the post global financial crisis sub-sample is analyzed.

Similar content being viewed by others

Notes

Joslin et al. (2013) differentiates between macro and yield-based models of the term structure of interest rates.

Sharef and Filipovic (2004) propose another four-factor arbitrage DNSS model by assuming square root processes as in the CIR model instead of Ornstein–Uhlenbeck processes for the state variables.

The Kalman filter estimation approach in the context of AFDNS is presented in detail in Christensen et al. (2007).

For the four-factor CKLS model, we used the first four maturities of the LIBOR curve that are available. The reason for not including the one-year LIBOR rate in the initial four-factor CKLS specification is based on the possibility of producing one-year maturity rates from other financial products such as Eurodollar futures and one-year swaps.

To avoid the long-term impact of the GFC on the forecasting performance of the models, one could employ different techniques based on non-parametric models such as weighted historical simulation where different weights are given to different age data, more weight is given to more recent data, and less weight to more distant data.

Because of space constraints, we only present the results for the SPA test while the results for the White (2000) reality check are available from the authors upon request.

References

Adrian T, Crump RK, Moench E (2013) Pricing the term structure with linear regressions. J Financ Econ 110:110–138

Afonso A, Martins MMF (2012) Level, slope, curvature of the sovereign yield curve, and fiscal behaviour. J Bank Finance 36:1789–1807

Ait-Sahalia Y (1996) Testing continuous-time models of the spot interest rate. Rev Financ Stud 9:385–432

Ajello A, Benzoni L, Chyruk O (2020) Core and ‘crust’: consumer prices and the term structure of interest rates. Rev Financ Stud 33:3719–3765

Almeida C, Vicente J (2008) The role of no-arbitrage on forecasting: lessons from a parametric term structure model. J Bank Finance 32:2695–2705

Ang A, Piazzesi M (2003) A no arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J Monet Econ 50:745–787

Armstrong JS (2001) Evaluating forecasting methods. In: Armstrong JS (ed) Principles of forecasting: a handbook for researchers and practitioners. Kluwer Academic Publishers, Norwell, MA

Balduzzi P, Das SR, Foresi S, Sundaram R (1996) A simple approach to three factor affine term structure models. J Fixed Income 6(3):43–53

Bali T, Wu L (2006) A comprehensive analysis of the short-term interest-rate dynamics. J Bank Finance 30:1269–1290

Basel Committee on Banking Supervision (2010). Basel III: a global regulatory framework for more resilient banks and banking systems. https://www.bis.org/publ/bcbs189.htm

Bergstrom AR (1984) Continuous time stochastic models and issues of aggregation over time. In: Griliches Z, Intriligator MD (eds) Handbook of econometrics. Elsevier, North-Holland

Bjork T, Christensen BJ (1999) Interest rate dynamics and consistent forward rate curves. Math Financ 9:323–348

Brennan MJ, Schwartz ES (1980) Analyzing convertible bonds. J Financ Quant Anal 15:907–929

Campbell J, Shiller R (1991) Yield spreads and interest rate movements: a bird’s eye view. Rev Econ Stud 58(3):495–514

Campbell JY, Lo AW, MacKinlay C (1997) The econometrics of financial markets. Princeton University Press, Princeton

Carriero A (2011) Forecasting the yield curve using priors from no-arbitrage affine term structure models. Int Econ Rev 52:425–459

Carriero A, Giacomini R (2011) How useful are no-arbitrage restrictions for forecasting the yield curve? J Econom 164:21–34

Caruso A, Coroneo L (2023) Does real-time macroeconomic information help to predict interest rates? J Money Credit Bank. Forthcoming.

Chan KC, Karolyi GA, Longstaff FA, Sanders AB (1992) An empirical comparison of alternative models of the short-term interest rate. J Finance 47:1209–1227

Chen L (1996) Stochastic mean and stochastic volatility—a three-factor model of the term structure of interest rates and its application to the pricing of interest rate derivatives. Financ Mark Inst Instrum 5:1–88

Christensen JHE, Diebold FX, Rudebusch GD (2009) An arbitrage-free generalized Nelson-Siegel term structure model. Econom J 12:C33–C64

Christensen JHE, Diebold FX, Rudebusch GD (2011) The affine arbitrage-free class of Nelson-Siegel term structure models. J Econom 164:4–20

Christensen JHE, Diebold FX, Rudebusch GD (2007) The affine arbitrage-free class of Nelson-Siegel term structure models. NBER Working Paper 13611

Clark TE, West KD (2007) Approximately normal tests for equal predictive accuracy in nested models. J Econom 138:291–311

Cochrane J, Piazzesi M (2005) Bond risk premia. Am Econ Rev 95:138–160

Coroneo L, Nyholm K, Vidova-Koleva R (2011) How arbitrage-free is the Nelson-Siegel model? J Empir Finance 18(3):393–407

Cox JC, Ingersoll JE, Ross SA (1985) A theory of the term structure of interest rates. Econometrica 53:385–408

Dai Q, Singleton KJ (2000) Specification analysis of affine term structure models. J Finance 55:1943–1978

Davydenko A, Fildes R (2016) Forecast error measures: critical review and practical recommendations. In: Business forecasting: practical problems and solutions. John Wiley & Sons Inc., New York

Diaz D, Theodoulidis B, Dupouy C (2016) Modelling and forecasting interest rates during stages of the economic cycle: a knowledge-discovery approach. Expert Syst Appl 44:245–264

Diebold FX (1993) On the limitations of comparing mean square forecasts errors: comment. J Forecast 12:641–642

Diebold FX (2015) Comparing predictive accuracy, twenty years later: a personal perspective on the use and abuse of Diebold-Mariano tests. J Bus Econ Stat 33:1–1

Diebold FX, Li C (2006) Forecasting the term structure of government bond yields. J Econom 130:337–364

Diebold FX, Lopez JA (1996) Forecast evaluation and combination. Handbook Stat 14:241–268

Diebold FX, Mariano RS (1995) Comparing predictive accuracy. J Bus Econ Stat 13:253–263

Diebold FX, Rudebusch GD (2013) Yield curve modeling and forecasting: the dynamic Nelson-Siegel approach. Princeton University Press, Princeton

Doshi H, Jacobs K, Liu R (2021) Information in the term structure: a forecasting perspective. Manag Sci 67(8):5255–5277

Duffee GR (2002) Term premia and interest rates forecasts in affine models. J Finance 57:405–443

Duffee GR (2011) Information in (and not in) the term structure. Rev Financ Stud 24:2895–2934

Duffie D, Kan R (1996) A yield-factor model of interest rates. Math Finance 6:379–406

Episcopos A (2000) Further evidence on alternative continuous time models of the short term interest rate. J Int Finan Mark Inst Money 10:199–212

Farooq AQ, Christophersen C (2010) Interbank overnight interest rates—gains from systemic importance. Working Paper, No. 2010/11, ISBN978-82-7553-562-5, Norges Bank, Oslo

Filipović D (1999) A note on the Nelson-Siegel family. Math Financ 9:349–359

Filipovic D, Larsson M, Trolle A (2014) Linear-rational term structure model. J Finance 72:655–704

Gerlow ME, Irwin SH, Liu T (1993) Economic evaluation of commodity price forecasting models. Int J Forecast 9:387–397

Gimeno R, Marques JM (2009) Extraction of financial market expectations about inflation and interest rates from a liquid market. Banco de Espana, Working Paper 0906.

Gurkaynak RS, Sack B, Wright JH (2007) The U.S. treasury yield curve: 1961 to the present. J Monet Econ 54:2291–2304

Hansen PR (2005) A test for superior predictive ability. J Bus Econ Stat 23:365–380

Hansen PR, Lunde A, Nason JM (2011) The model confidence set. Econometrica 79:453–497

Hyndman RJ, Koehler AB (2005) Another look at measures of forecast accuracy. Int J Forecast 22:679–688

Joslin S, Singleton K, Zhou H (2011) A new perspective on Gaussian dynamic term structure models. Rev Financ Stud 24:926–970

Joslin S, Le A, Singleton K (2013) Why Gaussian macro-finance term structure models are (nearly) unconstrained factor-VARs. J Financ Econ 109:604–622

Litterman R, Scheinkman J (1991) Common factors affecting bond returns. J Fixed Income 1:54–61

Lo KM (2005) An evaluation of MLE in a model of the nonlinear continuous-time short-term interest rate. Working Paper Number 45, Bank of Canada, Canada

Martellini L, Priaulet P, Priaulet, S (2003) Fixed-income securities: valuation, risk-management and portfolio strategies. John Wiley & Sons Ltd., Chichester

Matsumura M, Moreira A, Vicente J (2011) Forecasting the yield curve with linear factor models. Int Rev Financ Anal 20:237–243

Moench E (2010) Term structure surprises: the predictive content of curvature, level, and slope. J Appl Econom 27(4):574–602

Monech E (2008) Forecasting the Yield curve in a data-rich environment: a no-arbitrage factor-augmented VAR approach. J Econom 146:26–43

Nelson CR, Siegel AF (1987) Parsimonious modelling of yield curve. J Bus. https://doi.org/10.1086/296409

Nowman KB (1997) Gaussian estimation of single-factor continuous time models of the term structure of interest rates. J Finance 52:1695–1706

Nowman KB (2006) Japanese fixed income markets: money, bond and interest rate derivatives. Elsevier, Amsterdam

Nymand-Andersen P (2018) Yield curve modelling and a conceptual framework for estimating yield curves: evidence from the European Central Bank’s yield curves. Report 9289933569. ECB Statistics Paper.

Piazzesi M, Cochrane J (2009) Decomposing the yield curve, Meeting Papers 18, Society for Economic Dynamics.

Refenes AP (1995) Neural networks within the capital markets. Wiley, Chichester

Sharef E, Filipovic D (2004) Conditions for consistent exponential-polynomial forward rate processes with multiple nontrivial factors. Int J Theor Appl Finance 7:685–700

Steeley J (1990) Modelling the dynamics of the term structure of interest rates. Econ Soc Rev Symp Finance 21:337–362

Steeley J (2014a) Yield curve dimensionality when short rates are near the zero lower bound. In: Chadha JS, Duree A, Joyce MS, Sarno L (eds) Development in macro-finance yield curve modelling. Cambridge University Press, Cambridge

Steeley J (2014b) Forecasting the term structure when short-term rates are near zero. J Forecast 33:350–363

Steeley J (2014c) A shape-based decomposition of the yield adjustment term in the arbitrage-free Nelson and Siegel (AFDNS) model of the yield curve. Appl Financ Econ 24:661–669

Svensson LEO (1995) Estimating forward interest rates with the extended Nelson-Siegel method. Sveriges Riskbank Q Rev 3:13–26

Van Deventer DR, Imai K, Mesler M (2013) Advanced financial risk management: tools and techniques for integrated credit risk and interest rate risk management. John Wiley & Sons, Singapore

Vasicek OA (1977) An equilibrium characterization of the term structure. J Financ Econ 5:177–188

Vayanos D, Vila JL (2021) A preferred-habitat model of the term structure of interest rates. Econometrica 89:77-112

Wahlstrom RR, Paraschiv F, Shurle M (2022) Comparative analysis of parsimonious yield curve models with focus on the Nelson-Siegel, Svensson and Bliss versions. Comput Econ 59:967–1004

West KD (2006) Forecast evaluation. In: Elliott G, Granger CWJ, Timmermann A (eds) Handbook of economic forecasting. Elsevier, Amsterdam

White H (2000) A reality check for data snooping. Econometrica 68:1097–1196

Wu Y, Zhang H (1996) Mean reversion in interest rates: new evidence from a panel of OECD countries. J Money Credit Bank 28:604–621

Funding

Funding was provided by EDHEC Business School.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Fabozzi, F.J., Fabozzi, F.A. & Tunaru, D. A comparison of multi-factor term structure models for interbank rates. Rev Quant Finan Acc 61, 323–356 (2023). https://doi.org/10.1007/s11156-023-01147-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-023-01147-2