Abstract

Venture capital (VC) often involves complex equity contracts with so-called preferential rights affecting the allocation of exit proceeds among different share classes and investors. We structure exit-relevant preferential rights in a two-dimensional framework and develop a contingent claims model that allows for ex-ante valuation of separate shareholdings. The model generates insights on the valuation effects of varying setups in VC financing and indicates considerable mispricing potential of VC investments when applying commonly used heuristics such as the most recent funding round. Applying the model to a sample of ventures indicated an average ’overvaluation’ on a per-share basis of \(26.7\%\), with common stocks and early-stage investments being the most affected. In addition, our analysis provides different implications regarding the effects of preferential right structuring for early and late stage investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Acknowledged amongst investors and research professionals, returns of venture capital (‘VC’) investments are defined by special characteristics. Korteweg and Sorensen (2010) report that only one-third of VC-backed firms go public or are acquired while the majority of companies have been either liquidated or have become ’living zombies’ with no profitable path. In consequence, high returns on a few successful exits stand against many exits with negative returns. Second, this translates into high average returns at high risk: Cochrane (2005) presents lognormal average returns for VC investments of \(15\%\) p.a. with a standard deviation of \(89\%\) p.a. implying \(37\%\) of investments end up in negative returns on an annual basis. To put these numbers into context: The average return of the MSCI World Index over the last 30 years has been at approximately \(7.5\%\) p.a. with a standard deviation of approx. \(15\%\) p.a.

To hedge themselves at least partially against adverse outcomes and to set incentives for the entrepreneur to be financed, VCs regularly require various rights specified in financial contracts such as information rights, control rights, exit rights, and cash flow rights (see Sahlman 1990). The latter are generally intended to allocate cash flows to the venture’s shareholders in case of an ‘exit’. Differences in these rights create varying classes of shares within a venture’s equity. Ignoring these differences can potentially be consequential: First, transposing the price of shares with special preferred rights simply proportionally to the value of the total enterprise—which is typically the case when the most recent financing round is published via ‘post-money valuations’,Footnote 1 evoke mispricing. Gornall and Strebulaev (2020) empirically estimate an overvaluation of 37% for so-called ’unicorns’ when using post-money valuation compared to reflecting those rights correctly. Second, with VCs usually staging investments over several financing rounds with varying rights, different classes of shares are created. Thus, investors not participating in a particular round need to understand whether dilutions of their earlier investments due to the prioritization of later investors are compensated by the increase in enterprise value assumed in the post-money valuation. Third, ignoring these differences regularly results in inflated net asset values reported in annual statements of VC funds. While any fair value measurement compliant with IFRS or US GAAP has to account for such cash flow rights as recently claimed by the IPEV Board in their International Private Equity and Venture Capital Valuation Guidelines IPEV (2018), founders and investors tend to ignore cash flow rights influencing their VC investments when communicating to the public for different reasons (see Chakraborty and Ewens (2017) and Agarwal et al. (2019) for detailed discussions) and often publish most recent financing round valuations, i.e., post-money values, instead. Likewise, such valuation practices may have cash-relevant implications in case of inheritance tax issues or in case of ’dry income’ for employees, management, or advisors, since compensation packages are often tied to the performance of specific share classes of the venture instead of the performance of the venture as a whole.

An illustrative example regarding the consequences of cash flow rights is the case of Good Technology, a mobile security startup, which became a ’unicorn’ in 2013. The company was expected to exit via an IPO in 2014 at a valuation of around USD 1.1 billion. The IPO would have erased all preferential claims resulting in an exit value per stock of USD 4.32, irrespective of the underlying share class. However, the IPO did not go through due to struggles experienced by other tech start-ups going public, and because Good Technology missed its growth forecasts. During the process of postponing the IPO, the company turned down a cash offer of USD 825 million in March 2015, and was eventually sold to BlackBerry in September 2015 for only USD 425 million. Venture capital investors with preferred shares involving cash flow rights were largely protected by that deal still receiving more than USD 3 a share. In turn, common stocks, for instance held by employees, plummeted disproportionally towards an exit value of USD 0.44.Footnote 2 Even worse than having just lost a huge amount of money on paper was the fact that many employees had already paid taxes on their common stocks based on the ’unicorn’ valuation from a previous funding round (Table 1).

Such a setup is not an exception but the standard. Specifically, in case of mediocre or poor performance, cash flow rights result in an allocation of ’exit proceeds’, i.e., total proceeds received for the stakes sold in the event of an exit, skewed away from the usual ’pro-rata’ allocation, which refers to an allocation based on the respective relative share in nominal capital. As a study by Broughman and Fried (2010) reveals: \(84\%\) of ventures within their sample have investors exiting as preferred shareholders, i.e., exit proceed distribution has been determined by cash flow rights rather than pro-rata. In our paper, we develop a structured contingent claim valuation approach for such exit-relevant cash flow rights that allows identifying mispricing ex-ante. In contrast to existing literature, our model captures all features of preferential claims that are empirically known and distinguishes mispricing on share class level as well as on shareholder level (see Table 2 in the appendix for a summary of the literature review). Further, we apply the model on a sample of 49 ventures capturing 407 financing rounds and 2,098 transactions. The economic impact is measured by the difference between the model-based (implied) value and the (imposed) post-money value. As a consequence, we do not only confirm the results of Gornall and Strebulaev (2020) but in addition reveal that:

-

on average, valuation discounts on venture level grow with the number of financing rounds and share classes.

-

valuation discounts vary significantly on shareholding level within ventures with growing discounts for lower, more subordinated share classes and lower entry prices.

-

even valuation premia may occur on shareholding level if one or more subsequent investments have been made in a down-round.Footnote 3

-

shareholdings affected by down-rounds show lower total returns on average and may even turn negative.

-

valuation discounts on shares are greater for ventures where the seniority of preferential claims is based on a ’stacking’-approach or mixed seniority in comparison to ventures where seniority of claims is based on pari-passu

-

valuation discounts are greatest under shareholder-based (SHB) remainder allocation in comparison to conversion-based (CPR) and share class-based (SCB) remainder allocation.

Based on these findings, which we detail in section six, we deliver strategic implications for founders, early-stage investors, and late-stage investors regarding a contract design tilting fair share values to their respective benefits. These implications are presented in section seven.

In general, being unaware of the implications of preferential rights may have severe consequences. First, communicating inflated valuations may result in disadvantageous investment decisions. Second, the burden of preferential claims may be so substantial that common stocks held by founders and employees lose their incentive function. Third, the asymmetry of exit proceeds among shareholders may endanger the execution of beneficial exit strategies.

The remainder of the paper is structured as follows: In section two, we give a brief overview of the related literature. In section three, we introduce the elements of exit-relevant preferential rights and present our modeling framework as well as the underlying economic concepts. Thereafter, we develop the model by separately valuing preferential claims and the remainder. Within the fifth section, we introduce our sample and the assumptions concerning the implementation of the model. Subsequently, we summarize our results and provide comparative statics to our exogenous parameters in the sixth section focusing on the skewness of relative value allocation resulting from preferential claims. We conclude the paper in section seven discussing the main implications and suggesting areas for further research.

2 Literature

Our paper adds to several literature strands on venture capital and builds upon classic contingent claims valuation frameworks. In particular, we apply the pricing kernel for European call options as famously presented by Black (1973) and Merton (1974) to value stacked claims arising from preferential rights in VC-backed companies.

In terms of venture capital literature, our paper is firstly related to the discussion on financial contract design in VC investments. Sahlman (1990), Gompers (1997), Hellmann (1998), Kaplan and Strömberg (2001), Cumming (2005), and Bengtsson and Sensoy (2015) analyze principal-agent conflicts inherent in the uncertain setting of growth firms and how they can be mitigated using specific designs. We incorporate most of the contractual mitigation instruments discussed into our framework, quantify their impact ex-ante, and allow for joint effects. Thus, we can provide some guidance on the effectiveness of specific terms or general setups.

Another strand of VC literature is concerned with the relation of risk and return of VC as an asset class. Kaplan (2005), Cochrane (2005), Korteweg and Sorensen (2010), Harris (2016) and Korteweg (2016) analyze investment performance but rely primarily on post-money valuations (PMV) in their empirical work. As our paper in accordance with Gornall and Strebulaev (2020) shows, basing performance analysis on PMV may inflate results. Applying fair value models like the one presented in this paper to empirical analyses may make findings more accurate.

Finally, we contribute to the literature on VC and mutual funds reporting (see, e.g., Barber and Yasuda (2017), Chakraborty and Ewens (2017), Brown et al. (2019), Agarwal et al. (2019), Kwon et al. (2019)) as we provide model-backed evidence regarding inflated fund performances and standardized fund write-ups towards the share values paid in the most recent financing rounds. This is of particular practical relevance since VC investments largely represent minority interests, where different investors tend to invest in selected stages holding different share classes.

The literature strand regarding valuation approaches for VC investments itself is rather narrow, although the economic value of such investments is of utmost importance for founders, employees, and investors. Cossin et al. (2002) and Metrick and Yasuda (2011) propose valuation approaches to assess the value of single VC investments but only consider a rather limited set of preferential rights. Leisen (2012) uses a similar approach to evaluate the impact of preferred shares on the feasibility of later-round financings. Although he explicitly considers the interaction of two different preferential rights, the model is still very limited in its capacity to reflect interactions among investors and various preferential rights. Similarly, Arcot (2014) uses a principal-agent model to analyze how information asymmetry between venture and investors in the event of an exit can be mitigated by using preferential claims. Again, the model is restricted to a rather simple setup and does not allow for assessing interacting effects of different preferential rights.

The greatest advance so far has been provided by Gornall and Strebulaev (2020) who develop a contingent claim valuation framework for valuing VC-backed companies. They compare their comprehensive alternative fair value assessment, which is based on appropriately reflected cash flow rights, to popular PMV in order to reveal significant overvaluation on the venture level. Similar to Cossin et al. (2002) and Metrick and Yasuda (2011) and other than Gornall and Strebulaev (2020), we focus on the rather granular level of the VC investment, i.e., the share class level. In our contingent claim model, we reflect all practically relevant forms of preferential claims. In particular, we incorporate the different designs of remainder allocation, which have not been addressed by the literature so far. By doing so, our results reveal that the shareholder-based allocation mechanism triggers on average even higher implied valuation discounts on share class level and should therefore be avoided by early-stage investors. We present and explain all contractual features covered in the analysis in Sect. 3 and provide empirical findings in Sect. 6.

In our analysis, we focus on the dispersion of valuation discounts among share classes and the dynamics that exist between them. Thus, we go beyond the venture level analysis of Gornall and Strebulaev (2020) and find strategic implications for early-stage shareholders, namely founders and junior investors. We summarize these findings in Sect. 7.

In Appendix A, we provide a complementary overview and comparison regarding the existing valuation literature on the value effects of preferential claims discussed briefly in this section.

3 General framework

3.1 Exit and investment scenario

In our model, ventures are exited at time T via two stylized exit routes accounting for the most common exit choices in the VC context: (1) recapitalization via IPO and (2) sale of the entire venture to another investor, i.e., an M&A transaction. To distinguish between the two is necessary since cash flow rights, also referred to as preferential rights, attached to specific investments in a venture are treated differently depending on the exit route. They take full effect in the allocation of exit proceeds among investors, entrepreneurs, and managementFootnote 4 in an M&A transaction while they are usually waived in an IPO.Footnote 5 In case of a waiver, exit proceeds are split pro-rata, i.e., accurately reflecting investors’ shares in the venture. We define a venture’s IPO probability by \(\pi _{IPO}\) and consequently the probability of an M&A exit by \(\pi _{M \& A}=1-\pi _{IPO}\).

We denote the date of valuation as t, with \(t<T\), resulting in a time to exit of \(T-t\). Regarding further financing in the interval [t, T], we assume that either no additional rounds take place or if there are such rounds the net present value effect of those are zero for all investors, i.e., no redistribution of wealth is created among investors. Clearly, the assumption represents a limitation to our model as financing rounds occur on average every 1.2 years (see, e.g., NVCA 2021) and as not having any present value effects on investors’ level is unlikely in such transactions. Still, we restrict our framework in the described way because further financing rounds cannot be modelled in a more detailed way as four highly uncertain inputs need to be estimated simultaneously: (a) development of future venture values, (b) timing of future financing rounds, (c) size of new investments, and (d) then prevailing preferential claims.

However, our results are not compromised since any further financing round is usually increasing valuation discounts and would make our findings even more significant. In addition, our assumption is fully in line with other models dealing with preferred shares in VC-backed companies (see, e.g., Gornall and Strebulaev 2020; Arcot 2014; Hsu 2010). The only other article discussing the limitation in further detail is Gornall and Strebulaev (2020), who arrive at similar conclusions as they “need that future financings occur at a fair price and do not redistribute wealth between the existing investors.”

Subsequently, we determine the investment scenario which defines the venture’s shareholding by investor, share class and respective pricing. Matrix \({\mathbf {S}_{\mathbf {T}}}\) in Eq. (3.1) contains all individual shareholdings \(s_{i,j,T}\) at date T, where i, with \(i=1,...,m\), represents the index of share classes \(SC_{i}\) while j, with \(j=1,...,n\), indexes the venture’s investors \(Inv_{j}\):

We define the corresponding share prices per shareholding at the time of investment by \(p_{i,j}\). As investment times deviate among investors and share classes, we do not subindex \(p_{i,j}\) but rather capture the time of investment for every single shareholding by \(\theta _{i,j} \le t < T\). In aggregation, we summarize all prices of shareholdings in a price matrix \({\mathbf {P}_{\mathbf {}}}\) equivalent to \({\mathbf {S}_{\mathbf {T}}}\) from Eq. (3.1). Note that stocks of the same share class are always issued at the same single original issue price (see also Metrick and Yasuda 2011; Gornall and Strebulaev 2020).

Altogether, we refer to the set of shareholdings \(\mathbf {S_T}\) and its prices \({\mathbf {P}_{\mathbf {}}}\) as the investment scenario of the venture. All notations applied in the article can be found in App. 1.

3.2 Set of preferential rights

We structure the allocation mechanisms of exit proceeds subject to exit relevant cash flow rights in two consecutive phases.Footnote 6 The first phase contains the allocation due to explicit preferential claims, i.e., liquidation preferences or preferential return rates, thus called preferential claim allocation. The second phase regards the allocation of the remaining exit proceeds after all preferential claims have been served. While this part of the allocation follows pro-rata in general, it may be characterized by implicit claims, which arise due to conversion features, set-offs of preferential claims, or caps. We refer to this phase as remainder allocation. See Metrick and Yasuda (2011), pp. 252, for a more detailed illustration of the two phases.

When characterizing the preferential claim allocation, we distinguish between the dimensions amount of preferential claims and allocation of preferential claims. The amount of preferential claims is determined by the preference basis and can be scaled by a preference multiple or a preference return. Furthermore, it may be restricted by a preference cap. The allocation of preferential claims as well as the remainder allocation are determined by preference seniority, remainder allocation basis and preference conversion.

We introduce each of the elements in the subsequent paragraphs and start with all elements related to the amount of preferential claims. Figure 1 summarizes structure and interplay of the elements constituting preferential claims.

Definition 1

(Preference basis) The preference basis is equivalent to the initial investment amount \(p_{i,j} s_{i,j,T}\), where \(p_{i,j}\) represents the price paid per share and \(s_{i,j,T}\) reflects the number of shares acquired.

Definition 2

(Preference multiple) In general, referred to as ’liquidation preference multiple’ or ’multiple’, the preference multiple \({m}_{i,j}\) scales the preference basis and determines the amount of the preferential claim per share.

According to Bengtsson and Sensoy (2015), a multiple of one is applied in more than 90 per cent of funding agreements. In these cases, respective preferential claims are often referred to as ’ordinary’ liquidation preferences (see, e.g. Metrick and Yasuda 2011, p. 153).

Definition 3

(Preference return) The preference return \({rr}_{i,j,u}\) captures any cumulative dividend, preferential dividend, or other rates applied to the preference amount. In addition to the applicable rate \({rr}_{i,j}\), a period u, starting at \(\theta\), has to be specified.

Multiples greater than one or preference returns only occur occasionally in practice (see, e.g.,Bengtsson and Sensoy 2015 who find such clauses in only 7 per cent of all contracts they examined). In addition to a pure investment protection, they provide a minimum return which requires investors usually to have a rather strong negotiation position (see, e.g., Simon 2010).

Based on Definitions 1 to 3, the preferential claim per share reflecting preference basis, preference multiple and preference return is determined by

Oftentimes, u is not agreed upon explicitly but rather depends on pre-defined events such as the next financing round or subsequent exit. For sake of simplicity but without loss of generality, we assume \(u \le T - \theta\) (see, e.g., Simon 2010).

While Eq. (3.2) depicts the explicit preferential claim per share, we define any further implicit claim concerning the remainder allocation per share as \({ra}_{i,j,T}\). Thus, the total (uncapped) claim per share at exit T, \({pt}_{i,j,T}\), amounts to

Definition 4

(Preference cap) A preference cap \({cap}_{i,j}\) limits the amount of exit proceeds allocated to an investor concerning her shareholdings and resulting preferential claims.

Hence, the cap is applied to the total (uncapped) claim per share \({pt}_{i,j,T}\) such that

Bengtsson and Sensoy (2015) report the existence of caps for 23% of investments in their sample. Note that we assume the cap \({cap}_{i,j}\) to be at least as large as any preferential claim, i.e., \(\forall {cap}_{i,j}: {cap}_{i,j} \ge pc_{i,j,T}\) (see, e.g., Metrick and Yasuda 2011, pp. 163 for a more detailed discussion of caps).

After having concluded on the features regarding the amount of preferential claims, we consider the mechanisms determining the allocation of preferential claims and the remainder allocation.

Definition 5

(Preference seniority) Preferential claims are served based on pre-defined hierarchies. Although various structures are possible, there are generally two distinct schemes: (1) a pari-passu treatment of preferential payments where all preferential claims are served (pro-rata) at once but before any common shares are served (see, e.g., Metrick and Yasuda 2011, p. 153); and (2) strict seniority where share classes and respective preference claims are served in a specified order, also called ’stacking’ (see Woronoff and Rosen 2005, p. 110).

For modelling purposes, we will set up an index \(h_{i,j}\), with \(h_{i,j}=1, \ldots , v\), for each shareholding and the respective level of seniority. \(h_{i,j}=v\) denotes the lowest level of seniority and \(h_{i,j}=1\) ranks highest with respect to seniority. The number of seniority levels is limited by the number of shareholdings but often corresponds to the number of share classes (strict seniority). Empirically, Bengtsson and Sensoy (2015) find 42% of their sample investments featuring senior preferential claims, while 57% have pari-passu rights. Junior claims are only observed in 0.4% of their sample cases.

After preferential claims have been served, remaining exit proceeds, if existing, are distributed. In general, we observe two different allocation mechanisms which apply to different legal settings and result in three different remainder allocation models (see Metrick and Yasuda 2011, pp. 165). Those are defined as follows:

Definition 6

(Remainder allocation basis) The remainder can either be allocated on a share class basis or a shareholder basis. Depending on jurisdiction and legal form, companies may not issue preferred shares. However, respective provisions may resemble the conversion feature of preferred shares. Instead of converting preferred shares, the preferential claims are ’credited’ or rather ’set off’ against any remainder allocation. Set-off takes place on share class or shareholder level, where conversion only applies to a share class-based setting. Thus, we consider remainder allocation based on (1) conversion and (non-)participation (’CPR’) as well as remainder allocation based on (2) set-off determined by share class (’SCB’), and (3) set-off determined by shareholder (’SHB’).

Preferential claims can affect the subsequent distribution in different ways. In general, we distinguish between conversion and set-off mechanisms, which we both define subsequently.

Definition 7

(Preference participation and conversion, CPR) Conversion clauses can take different forms. On the one hand, shares might be eligible to receive a pro-rata share of remaining exit proceeds without any consideration of previous claims, thus, called ’participating convertible preferred shares’. On the other hand, they might be restricted to their preferential claim only. In this case, shareholders usually have the right to convert to common shares, thereby waiving all their rights participating in the allocation on an as-converted (to common shares) basis. We refer to this feature as ’(non-participating) convertible preferred shares’.

We denote participation by \(y_{i,j,T}\) for each shareholding, where \(y_{i,j,T}=1\) indicates participation and \(y_{i,j,T}=0\) non-participation. Note that the conversion feature also applies whenever a cap is agreed upon the shares’ participation. If the cap is hit, the respective shareholding will stop participating. However, once the as-converted shares have ’caught up’, i.e., common shares are allocated as much as the capped participating convertible preferred shares, investors eventually convert their shares. See Metrick and Yasuda (2011), pp. 164, for a more detailed illustration of participation and conversion.

Definition 8

(Preference participation and set-off, SCB and SHB) Similar to conversion, set-off allows other (more junior) shareholdings to ’catch up’. However, in contrast to the conversion feature, set-off applies to shareholdings regarding a specific share class (SCB) or to entire shareholdings of a specific shareholder (SHB) itself (see Woronoff and Rosen 2005, p. 115).Footnote 7

Set-off is denoted by \(x_{i,j,T}\) for each shareholding, where \(x_{i,j,T}=0\) indicates if respective preferential claims of the shareholding are to be set off and \(x_{i,j,T}=1\) if not. The participation in the remainder allocation might be capped, however, the contract usually allows for further ratable participation once all other common shares have been allocated an amount up to the cap.

In total, the specific elements of preferential claims and remainder allocation have to be aligned for the entire venture: First, seniority is a relative measure and is set in relation to all other share classes and will generally not deviate within a share class. Second, the remainder allocation basis is also set for the entire investment scenario, without deviations across or within shareholdings and share classes.

4 Valuation model

To assess the economic impact of the aforementioned claims and allocation mechanisms on a share level, we require both, the fair value of the venture as a whole and the fair value of each share. While we begin with a basic model for the venture value itself, our focus is to determine the respective share values, which themselves consist of the values of explicit and implicit claims.

We assume the venture value \(V_t\) to follow a diffusion process under the risk-neutral probability measure \({\mathbb {Q}}\) with constant annual volatility \(\sigma\) and constant annual drift rate of return r, where t denotes the valuation date and \(t < T\). Following classic option pricing literature in general (see, e.g. Black 1973; Merton 1974) and preferential claim valuation in particular (see Leisen 2012), we choose a geometric Brownian motion (gBm) to describe a venture’s value at exit with

where \(Z {\tilde{N}}(0,1)\) is a standard-normally distributed random variable (see, e.g. Hull and White 1988; Trigeorgis 1996 for a more detailed discussion). Please note that the stochastic process is presumed to remain unaffected by the equity capital structure.

To determine the value of each share, we need to price each claim the share under consideration participates in. These explicit and implicit (stacked) claims represent contingent payments with respect to the stochastic venture value at exit \(V_T\). Such a setting is predestined for the application of option pricing theory as also proposed by existing literature (see, e.g., Gornall and Strebulaev 2020; Leisen 2012). More precisely, all stacked contingent claims can be transferred to the pricing kernel of European call options, where the preferential rights from Sect. 3 follow a well-defined pecking order and, thus, can be represented by different strike prices.

We refer to each of the stacked claims as a proceed step \(PS_{T}\) which is always characterized by the nominal claim per share, the number of participating shares and its respective order. The latter adheres either to the seniority within the preferential claim allocation or is driven by the height of the per share amount in case of the remainder allocation. Each proceed step constitutes a strike price in the option model which we call breakpoints BP. For instance, the first proceed step (i.e., the first breakpoint), represents a claim superior to any other claim regarding the exit proceeds of the venture. In other words, all other claims have a call on the venture at an exercise price corresponding to the first breakpoint. Combining claim-specific breakpoints BP with the assumed time to exit \(T-t\), the underlying venture value \(V_t\) and its stochastic properties given by r and \(\sigma\), we can determine the value of each breakpoint VBP. Subtracting these values from each other yields the respective values for each proceed step VPS.

We illustrate the general idea in Fig. 2. Subsequently, we first derive the valuation framework regarding preferential claims, and move further to examining the different types of remainder allocation in Sect. 4.2.

Contingent claim based valuation approach. Notes: The valuation of the calculated preferential claims is shown for a case of \(1, 2, \ldots , N\) preferential claim with strict seniority, where index pc denotes the respective PS and BP of the preferential claim allocation. The proceed steps \(PS_{T}^{pc,h}\) are calculated based on the sum of preferential claims \(pc_{i,j,T}\) of each seniority rank h. Thereupon, the breakpoints \({BP}_{T}^{pc,h}\) can be calculated as the sum of respective proceed steps to determine the breakpoint values \({VBP}_{T}^{pc,h}\) which are used to determine the value of each proceed step \(PS_{T}^{pc,h}\) as a difference of consecutive breakpoint values. To determine the value of the first proceed step, the difference is taken with respect to the entire value of the venture and the first breakpoint value. Thereafter, the proceed step values are allocated on the respective shares to determine the value of each shareholdings preferential claim per share

4.1 Pricing preferential claims

We define the nominal preferential claims per share by \(pc_{i,j,T}\) and denote the i x j matrix subsuming those by \({\mathbf {PC}_{\mathbf {T}}}\) with the shareholding matrix \(S_{T}\) from Eq. (3.1) and pooling as well as ordering those amounts by seniority \(h=1, \ldots , v\), the proceed steps within preferential claims can be fully determined by

where \(PS_{T}^{pc,h}\) denotes the cumulative amount of preferential claims on the h-th seniority level, thus, called the h-th proceed step.Footnote 8\({\mathbf {1}_{\mathbf {H_{T}=h}}}\) represents an indicator function for the respective seniority level h.

Additionally, we define \({ps}_{i,j,T}^{pc,h,\%}\) to be the percentage share of proceeds of shareholding \(s_{i,j,T}\) regarding \(PS_{T}^{pc,h}\), where we describe the percentage share for all shareholdings regarding \(PS_{T}^{pc,h}\) by matrices \({\mathbf {{S}}_{\mathbf {T}}^{\mathbf {pc,h,\%}}}\). Ordered proceed steps will be stacked consecutively to determine breakpoints \(BP_{T}^{pc,h}\), where \(h=1, \ldots , v\) indicates the ordering of breakpoints:

To further illustrate the setting: The first breakpoint \(BP_{T}^{pc,1}\) entails the first proceed step \(PS_{T}^{pc,1}\), representing the cumulative preferential claims with highest seniority. The second breakpoint \(BP_{T}^{pc,2}\) amounts to the sum of the first and the second proceed step, and so on.

The value of each breakpoint \(VBP_{T}^{pc,h}\) takes the form of the already postulated European call option:

As the first, most senior, proceed step is fully served, its value \(VPS_{t}^{pc,1}\) is determined by deducting the value of the first breakpoint \(VBP_{T}^{pc,1}\) from the value of the venture \(V_t\). We obtain the subsequent proceed step values, for \(h>1\), by calculating the difference between the more senior breakpoint value \(VBP_{t}^{pc,h-1}\) and \(VBP_{t}^{pc,h}\), the breakpoint value under consideration. Thus, we have

Note that \(VBP_{t}^{pc,v}\) is usually equal to zero since it describes the lowest seniority level which does not feature any preferential claims. Moreover, we can see that the values of each claim represented by the proceed steps \(VPS_{t}^{pc,h}\) are restricted, resembling a ’call spread option’ where the short call option has a higher strike price than the long call option (see Hull 2014). The value of the respective proceed step h is determined by the sum of claims being long in a call option on the venture \(VBP_{t}^{pc,h-1}\) at an exercise price \(BP_{t}^{pc,h-1}\) and being short in a call option \(VBP_{t}^{pc,h}\) at an exercise price \(BP_{t}^{pc,h}\). Thus, any upside potential due to a higher venture value is transferred to the next proceed step.

Knowing the value of each proceed step \(VPS_{t}^{pc,h}\) and the relative share of each shareholding \({\mathbf {{S}_{\mathbf {T}}^{pc,h,\%}}}\), we can allocate the preferential claim values per shareholding, subsumed by the i x j matrix \(\begin{aligned} {\mathbf {VPC}_{\mathbf {t}}}. \end{aligned}\) with

4.2 Pricing remainder allocations

In addition to \({\mathbf {VPC}_{\mathbf {t}}}\), we need to determine the allocation and value of the remaining exit proceeds. As described in Sect. 3.2, the remainder allocation basis and how previously allocated preferential claims are considered can differ: A conversion-based approach generally applies to a share basis only, while set-off can either be pursued on a share class level or a shareholder level.

Thus, the setting requires three different models to which we refer as ’conversion-based’, ’share class-based’, and ’shareholder-based’ remainder allocation. However, apart from the determination of proceeding steps, structure and valuation approach remain the same across all models. Thus, we develop one model in full, the conversion-based one, and only elaborate on the determination of proceeding steps for the other models. All steps of the approach applying to all three models of remainder allocation are indexed by ra and allow for the following values:

Figure 3 summarizes and compares the three models.

Remainder allocation base. Notes: The remainder allocation depends on the given legal framework: For some jurisdictions, the issuance of preferred shares is not possible given specific legal forms such as private limited companies. Whereas the share class-based mechanism mimics the allocation under a conversion-based regime, the shareholder based mechanism considers preferential rights and remainder allocation a shareholder level. The plots above characterize the mechanisms based on shareholdings in different share classes of a single investor

4.2.1 Conversion-based allocation

A conversion-based allocation mechanism gives the investor the right to decide on whether to take the preferential claim or to convert it into common shares. Rationally, she would choose the maximum thereof. The critical amounts at which a shareholder would convert her preferential shares rather than retain her preferential claim depend on the actual amount of preferential claims per share as well as whether it is participating or capped. At the same time, preferential claims impose implied claims for all other participating shares. We denote the number of participating shares per shareholding by \(s_{i,j,T}^{cc,y=1} = y_{i,j,T} s_{i,j,T}\) and the number of non-participating ones by \(s_{i,j,T}^{cc,y=0} = (1-y_{i,j,T}) s_{i,j,T}\).

Next, we determine the implied claims evoked by the conversion feature. Conversion will only take place, if the per-share amount of remaining exit proceeds allocated to all common and participating preferred shares exceeds the respective preferential per share claim. Whenever that happens, the respective shares convert and participate ratably on an as-converted basis. The critical amounts of remaining exit proceeds triggering conversion can be regarded as implicit claims. For shareholdings of share class i, we denote such implicit claims by \({ps}_{i,j,T}^{cc,pc}={pc}_{i,j,T} s_{i,j,T}^{cc, y=0}\), for \({pc}_{i,j,T} > 0\).

Caps can be easily implemented into the approach by considering them as critical amounts. As described in Sect. 3.2, capped (participating) shares are converted to common if all common and other participating or converted shares receive at least as much as the amount of the respective cap. We define this first implicit claim created by caps as \({cap}_{i,j,T}^{adj} s_{i,j,T}^{cc, y=1}\) and obtain the resulting proceed step by

where \({cap}_{i,j,T}\) represents the nominal cap of a shareholding. Thereafter, capped convertible (participating) preferred shares participate ratably on an as-converted basis, if all common and all as-converted common shares have been allocated an amount per share equalling the nominal cap \({cap}_{i,j,T}\). Thus, the second implicit, cap-related claim, i.e., proceed step is defined as follows:

Thus, proceed steps in the remainder allocation are determined by preferential claims as well as caps. Subsequently, we order related claims on a per share amount basis in ascending order. We refer to the ordered proceed step claims as \({ps}_{T}^{cc,k}\), where \({ps}_{T}^{cc,k}\in \{{ps}_{i,j,T}^{cc,pc}, {ps}_{i,j,T}^{cc,cap}, {ps}_{i,j,T}^{cc,cap,adj}\}\). \(k=1, \ldots , w\) defines the index of ascending order, i.e., \(ps_{T}^{cc, 1}\) reflects the preferential claim of the lowest level (\(min\{pc_{i,j,T}\}\)), which usually corresponds to common shares without any preferential claim.Footnote 9w depicts the highest claim and its absolute number depends on the different levels of preferential claims and (adjusted) caps.

As subsequent procedures apply to all models of remainder allocation, we use the superscript ra, as defined in Eq. (4.9), in the upcoming derivations. We begin with determining the cumulative number of shares per implied claim \(ps_{T}^{ra,k}\) byFootnote 10

where \(\mathbf {1}\) is an indicator function with respect to the indicated claims, e.g., whenever \({ps}_{T}^{ra,k} \ge pc_{i,j,T}\), \({\mathbf {1}}_{\mathbf {{ps}_{T}^{ra,k} \ge pc_{i,j,T}}}\) is equal to one and zero otherwise. Apparently, participating shares \(s_{i,j,T}^{ra,y=1}\) participate in any proceed step, whereas non-participating shares only participate when \({ps}_{T}^{ra,k} \ge pc_{i,j,T}\). Capped shares are subtracted whenever the implicit claim of the proceed step \({ps}_{T}^{ra,k}\) is greater than \({cap}_{i,j,T}^{adj}\). The subtraction is reversed via the fourth term in Eq. (4.12), whenever \({ps}_{T}^{ra,k}\) is greater than \({cap}_{i,j,T}\), i.e., if all other shares have ’caught up’. Based on \(S_{T}^{ra,k}\), the percentage share of each shareholding \(s_{i,j,T}^{ra, k, \%}\) per level k can be derived for each level of k, where we refer to the percentage of all shareholdings per level k via matrices \({\mathbf {S}_{\mathbf {T}^{ra, k, \%}}}\).

Further, we obtain the total claim amounts for each ordered proceed step \({PS}_{T}^{ra,k}\) by multiplying the number of shares per proceed step \(S_{T}^{ra,k}\) with the price differential of the current and the previous implied claim per share, \({ps}_{T}^{ra,k} - {ps}_{T}^{ra,k-1}\). It follows that

Ordered proceed steps \({PS}_{T}^{ra,k}\) provide the basis for the determination of respective breakpoints \({BP}_{T}^{ra,k}\) with

Next, we calculate the corresponding option-based values of the breakpoints by applying Eq. (4.4) from Sect. 4.1 such that

Based on the sequence of breakpoint values \({VBP}_{t}^{ra,k}\) from remainder allocation and by reflecting the breakpoint value of the most junior preferential claim \({VBP}_{t}^{pc,v}\), the values of proceed steps \({VPS}_{t}^{ra,k}\) are obtained via

where \({VBP}_{t}^{ra, w}\) represents the final residual claim and is allocated among all investors pro-rata as no subsequent explicit or implicit claims exist anymore. Note that all proceed steps \({VPS}_{t}^{ra,k}\), \(k<w\) are restricted and decrease in value with increasing volatility.Footnote 11

With the values of proceed steps at hand, we determine the values of remainder allocation \(vra_{i,j,t}^{ra}\) for each shareholding by applying the percentage distribution matrices \(\mathbf {S_{T}^{ra, k, \%}}\) per level k to the respective \({VPS}_{t}^{ra,k}\) and summing the amounts per shareholding \(s_{i,j,T}\). In accordance with our methodology regarding the values of preferential claims per shareholding, we summarize all \(vra_{i,j,t}^{ra}\) in an i x j matrix denoted by \({\mathbf {{VRA}}_{\mathbf {t}}^{\mathbf {ra}}}\) with

Note again that the superscript ra has been introduced as a general indicator for the type of remainder allocation and can take any of the three forms as defined by Eq. (4.9).

We present the determination of the value of total claims \({\mathbf {{VTC}}_{\mathbf {t}}^{\mathbf {ra}}}\) and the reflection of IPO probabilities in Sect. 4.3. Before that, we specify the distinctions between the other two remainder allocation mechanisms and the previously discussed conversion-based approach.

4.2.2 Share class-based allocation

Under share class-based allocation, the remaining exit proceeds are allocated among all shares pro-rata but previously allocated preferential claims \(pc_{i,j,T}\) may be credited (’set-off’) against such allocation if specified. We denote the number of shares for each shareholding where preferential claims are set-off by \(s_{i,j,T}^{sc,x=0}=(1-x_{i,j,T} s_{i,j,T})\) and if no set-off occurs by \(s_{i,j,T}^{sc,x=1} = x_{i,j,T} s_{i,j,T}\), with \(x_{i,j,T}\) being a set-off indicator. Similar to the option of conversion, the set-off per share up to the amount of the preferential claim allows common (and other more junior) shares to catch-up in the remaining exit proceeds, imparting an implied claim. Determining these implied claims per proceed step is straightforward as

where \({ps}_{i,j,T}^{sc, pc}\) denotes the implied claims due to the preferential claim \({pc}_{i,j,T}\). As already noted in Sect. 4.2.1, the nominal cap per respective share \({cap}_{i,j,T}\) translates into two values: \({cap}_{i,j,T}\) and \({cap}_{i,j,T}^{adj}\). We denote the implied claims due to the cap by \({ps}_{i,j,T}^{sc,cap}\) and \({ps}_{i,j,T}^{sc,cap,adj}\) respectively and determine them analogously to Sect. 4.2.1, Eq. (4.11).

Again, amount-based ordering of proceed steps is required, considering unique values of \({ps}_{i,j,T}^{sc,pc}\), \({ps}_{i,j,T}^{sc,cap}\) and \({ps}_{i,j,T}^{sc,cap,adj}\). Here, \({ps}_{T}^{sc,k}\) denotes the claim per share related to the k-th proceed step, where \(k=1, \ldots , w\) depicts the index in ascending order. Based on the different levels and the order of claims per proceed step, we follow the modeling approach depicted in Sect. 4.2.1, Eq. (4.12)–(4.17), to determine per share values.

4.2.3 Shareholder-based allocation

The share holder-based mechanism is similar to the share class-based mechanism as it features a set-off of preferential claims instead of a conversion of share classes. However, it differs with respect to the set-off mechanism itself. Instead of crediting the allocated preferential claims as per share, they are all pooled for each investor individually and credited against the ratable allocation of remaining exit proceeds corresponding to the total shareholding of the investor—regardless of the shareholding’s underlying share classes. Analogously to Sect. 4.2.2, we begin with defining the number of shares for each shareholding where preferential claims are set-off by \(s_{i,j,T}^{sh,x=0}=(1-x_{i,j,T}) s_{i,j,T}\) and if no set-off occurs by \(s_{i,j,T}^{sh,x=1}=x_{i,j,T} s_{i,j,T}\). In contrast to the previous section, implied claims created by the set-off feature have to be based on shareholder level rather than on share class level. Thus, we generate the average amount to be set off per share for a specific shareholder j by

where the numerator represents the pooled amount of preferential claims to be set off for jFootnote 12 and where the denominator corresponds to the total number of shares owned by j.

To be precise, if the remaining exit proceeds per share exceed \({\overline{pc}}_{j,T}\), shareholder j is going to participate in the remainder allocation. Thus, we determine the implied claim per proceed step by

The primary difference to the other remainder allocation models is that \({ps}_{i,j,T}^{sh,pc}\) depends on the shareholding structure of investors due to the direct link to \({\overline{pc}}_{j,T}\). However, the significance of the difference decreases with a rising concentration of shareholdings, i.e., if each shareholder would only be invested in one share class, there would be no deviation from the share class-based approach.

Just as described in Sects. 4.2.1 and 4.2.2, the existence of caps with regard to the exit proceed allocation results in implied claims of other shares, since caps are assumed not to be pooled but rather refer to the respective shareholding or share class. Thus, we define the implied claims per share due to a cap by \({ps}_{i,j,T}^{sh,cap}\) and \({ps}_{i,j,T}^{sh,cap,adj}\) analogously to Sect. 4.2.1, Eq. (4.11).

Again, proceed steps need to be ordered by amount considering unique values of \({ps}_{i,j,T}^{sh,pc}\), \({ps}_{i,j,T}^{sh,cap}\) and \({ps}_{i,j,T}^{sh,cap,adj}\). We denote ordered proceed steps by \({ps}_{T}^{sh,k}\), where \(k=1, \ldots , w\) depicts the index in ascending order. Equivalently to Sect. 4.2.1, Eq. (4.12–4.17), we follow the modeling approach along the order determined and obtain the values per share.

4.3 Consolidating share values

After having determined the values of preferential claims \({\mathbf {{VPC}}_{\mathbf {t}^{}}}\) and the values of remainder allocation \({\mathbf{VRA}}_{{\mathbf{t}}}^{{{\mathbf{ra}}}}\) for all three mechanisms, we can generate the values of total claims in a further i x j matrix as

Finally, we incorporate the IPO probability \(\pi _{IPO}\), as defined in Sect.5.2, into the valuation model. As a reminder, value allocation in case of an IPO is rather straightforward since all shares convert and the naive approach of pro-rata allocation applies. Thus, the pro-rata value of each share at time t corresponds to \(V_t / \sum _{i=1,j=1}^{m,n}{s_{i,j,T}}\). We consolidate the per share values of each shareholding in the IPO scenario in matrix \({\mathbf {{VIPO}}_{\mathbf {t}}}\) and \({\mathbf {{VTC}}_{\mathbf {t}^{ra}}}\) by the IPO probability \(\pi _{IPO}\) and its counter probability yields an i x j matrix \({\mathbf {{VS}}_{\mathbf {t}}^{\mathbf{ra}}}\) depicting the expected share values per shareholding. We formalize the idea by

Eq. (4.22) illustrates that the more likely the venture will end up in an IPO, the more the value allocation will converge to a pro-rata allocation.

5 Application of the model

With the comprehensive framework developed above, we are equipped to analyze the effects of preferential rights in settings with many different investors holding shares from various share classes for a sample of real ventures. In contrast to other contributions in the field, we can distinguish results on share class level from the ones on venture level and by that reveal significant deviations.

5.1 Description of the sample

The implementation of our model and its variants requires a detailed level of data (e.g., shareholding information for each investor per share class), which—to the best of our knowledge—is not systematically provided by any commercial database. Instead, we retrieve data from various VC investors for a total sample of 49 ventures, where financing took place between 2009 and 2017 and which were incorporated between 2003 and 2017. We are bound to non-disclosure agreements with participating funds covering non-disclosure of data and prohibiting the dissemination of data or publication of results on fund or venture level. We transcribed the relevant information from shareholder agreements and capitalization tables to anonymized data frames for each venture. Hereby, we refer to a ’share class’ as a distinct class of equity issued by the respective venture.Footnote 13 We supplement and cross-check the data with basic information from federal registers as well as from commercial VC data sets such as CrunchBase.

In contrast to Gornall and Strebulaev (2020), our approach allows us to retrieve the exact number of issued shares as per the date of the last financing round and does not require us to make any assumptions, e.g., basing it on the number of shares authorized. As already stated in Sect. 2, the number of shares issued and shares authorized can vary significantly (Chernenko et al. 2017).

Our sample ventures reflect a broad range of industries (e.g., E-Commerce, Financial Technology, Software, Energy) and business models (e.g., marketplace/platform, services, products). The size of the ventures in terms of post-money valuation spans from EUR 2.5m to EUR 4.3bn, where the total funding amount per venture varies between EUR 0.6m and EUR 818.8m (average approx. EUR 96.5m, median approx. EUR 21.7m).Footnote 14 Thus, our sample contains a broad range of general investment scenarios. It is worth noting that investments in the most recent financing rounds represent on average about \(47\%\) of the total funding amount per venture (median approx. \(44\%\)). According to the observations by Gornall and Strebulaev (2020), a high funding share contained in the most recent financing round is likely to result in stronger ’overvaluation’.

We provide major descriptives on our sample in Table 1. As can be seen in panel A of Table 1, the number of investors and share classes vary considerably among ventures. While the average count of investors per venture amounts to 29 (median of 20)Footnote 15, the average count of share classes per venture is 6 (median of 5). Looking at the amounts infused per investor and share class, we find a skewed distribution (average of EUR 0.7m; median of EUR 0.2m) where a few investors account for some outstanding investment amounts. Another insight on investors’ behavior is revealed when examining how often investors engage in the same venture. Across the sample, each investor is on average present in 1.7 share classes (min: 1.0, max: 3.4). Relating the absolute numbers to the total number of share classes per venture, we observe that investors infuse, on average, capital in \(36\%\) of a venture’s outstanding share classes (min: \(12\%\), max: \(72\%\)). The relative investment amount of each investor in a venture lies at \(24\%\) of the total funding amount with a maximum of \(50\%\) (median: \(20\%\), min \(5\%\)). Hence, the sample data shows that VC investors go for syndications of minority investments instead of sole or majority ownership.

Aside from sizing and slicing of financing rounds in general, investors are concerned with the respective pricing of these rounds, i.e., whether it is an up-round, flat-round or down-round (see Bengtsson and Sensoy 2015). We refer to a down-round as stated by Bartlett (2003), p.23, that is "the issuance of securities [...] at a price that is below the price previously paid by the company’s investors". Up-rounds are defined vice versa while flat-rounds refer to a stagnating but stable pricing level. \(34.7\%\) of our sample ventures include at least one down-round in their funding history. More specifically, there are 14 ventures with one down-round and three ventures with two of those in their funding history. On average, our collected down-rounds represent a decrease of \(38.6\%\) in prices compared to the previous round (median of \(40.0\%\)).

The elements of preferential claims vary significantly with respect to allocation mechanism and seniority, but there are just two ventures in our sample that rely on participating or non-set-off rights. Considering allocations, we find that convertible-preferred and share class-based mechanisms dominate our sample while shareholder-based mechanisms are only present in around \(20\%\) of all ventures. With regard to seniority, we observe that seniority is neither guided by a pure pari-passu nor by a strict seniority mechanism but rather by a mixture of both. Notably, there is just very few variation within the preferential claim amount. On average, the preference multiple amounts to one and there are just a few financing agreements including a preference return rate. For none of our sample ventures a cap has been set for any of the share classes.

Note that we prescind from any other terms and provisions having an impact on the economic value of the venture or any share thereof. Further, all ventures are free of debt as has been checked in capitalization tables and available contracts. There are some other limitations to take note of: (1) A common feature of venture capital finance is the provision of so-called option pools. As we had no systematical access to the contracts of such programs, we assume those shares to be fully equivalent to common shares. (2) We also refrain from the existence of any deferred or forfeited shares, i.e., we assume the number of deferred shares at exit to be zero. (3) The vesting of the shares of founders is often an issue in venture capital financial contracts. We abstract from this feature by assuming founders’ shares to be fully vested at exit.

5.2 Parameter setting: exit scenario, annual volatility and risk-free rate

When implementing the model with respect to the sample, we have to make assumptions regarding the exit scenario, namely, the IPO probability \(\pi _{IPO}\) and the time to exit \(T-t\). We explicitly refrain from modeling these assumptions in order to show the impact of the variation in such later on and to allow for a closed-form solution.

Based on our sample and the average findings of Gornall and Strebulaev (2020) we assume the time to exit \(T-t=4\) years. In the US, the average time from a first VC investment to exit varied between 6.3 and 7.3 years in the time span from 2016 to 2020 (NVCA 2021). Since we have a median of five share classes (see Table 1) in our sample, we can approximate an average of four VC investments for each of the ventures. With median times of 1.2 years between funding rounds (NVCA 2021), our assumption regarding \(T-t\) is backed by empirical findings.

Similarly, we set the IPO probability at a fixed rate of \(\pi _{IPO}=25\%\), which is in line with the results of a recent study by Gompers et al. (2016) indicating that about \(75\%\) of the venture capitalists exit their investment via an M &A transaction rather than an IPO.Footnote 16

In addition to specifying the exit scenario, we have to make assumptions with respect to volatility and risk-free rate. We follow Leisen (2012) and Gornall and Strebulaev (2020) by applying an annual volatility of \(\sigma =90\%\) based on the results provided by Cochrane (2005). Other researchers such as Ewens (2009) and Korteweg and Sorensen (2010), estimated annual volatilities ranging from 88 to 130%. For the risk-free rate, we follow Gornall and Strebulaev (2020) and apply \(r=2.5\%\) p.a.. Apparently, at a time of rather low interest rates this rate lies at the upper end of a reasonable range. However, the impact on implied valuation discounts is negligible as an increase in the interest rate will yield monotonically higher implied equity values.

For all four input parameters, \(\pi _{IPO}\), \(T-t\), \(\sigma\), and r, we provide sensitivity analyses in the Appendices D1 (venture level) and D2 (share level).

6 Model solving and empirical results

In determining the implied venture values by calibration to the last funding, we assume the most recent share class to be fairly priced. Thereupon, we backsolve the model for the implied venture value \(V_{t}\) numerically and determine the implied values of all single shares simultaneously.

On venture level, we compare implied venture values with post-money values and consider differences as over- or undervaluation. More precisely, we refer to the percentage difference in relation to the post-money value as ’implied valuation discount’. Such implied valuation discounts are positive in overvaluation settings where the post-money value exceeds the implied venture value and negative in undervaluation settings. The methodology is analogous to the one applied by Gornall and Strebulaev (2020). On share level, we are concerned with comparing the price of the most recent share class with the implied share values of previous classes, respectively, and with revealing individual discounts borne by those shares to show the relative skewness in value allocation.

Implied valuation discounts on a venture and share level. Notes: Analyses rest upon base parameter setting with \(\pi _{IPO}=25\%\), \(T-t=4\), \(\sigma =90\%\), and \(r=2.5\%\). Within the plot, we present the implied valuation discounts on a venture level (horizontal axis) and respective implied valuation discounts on a share level (vertical axis). Within the table, we report statistics on the distribution of the implied valuation discounts across all ventures. We also report statistics on the distribution of the implied valuation discounts across all shares per share class as well as implied valuation discounts across all ventures, where we averaged implied valuation discounts for each venture. In case of the former, we also separated statistics for shares with and without preferential rights. For the plot, we exclude the calculated discounts for the most recent funding rounds, since they are equal to zero by assumption

As depicted in the table of Fig. 4, our model indicates a general overvaluation on venture level of \(22.1\%\) on average, ranging from \(0.6\%\) to \(40.8\%\). While this result is well in line with the findings of Gornall and Strebulaev (2020), it also demands a closer look beyond venture level in order to understand the drivers of the high dispersion of discounts. Moreover, venture level results per se have rather limited implications for venture capital investments since they rarely constitute entire ventures. Instead, they usually hold minority stakes consisting of shareholdings in a single or in multiple share classes. Thus, they are rather concerned with discounts on their specific shareholdings.Footnote 17

Diving down to share level, our analysis reveals a considerably broader distribution of implied valuation discounts ranging from a maximum discount of \(56.8\%\) to a maximum premium of \(36.6\%\), where the average discount is \(26.6\%\).Footnote 18 These results indicate that the mispricing issue in general and identifying the driving forces behind is even more severe on the level that really bothers investors—the share level. We summarize our first observations as follows:

Finding 1

Implied valuation discounts on share level are significant (avg. \(26.6\%\)) and even higher than on venture level, indicating high skewness in the relative allocation of venture values. As the share level is the relevant valuation dimension for investors and as discounts are highly dispersed, ranging from \(56.8\%\) to \(-36.6\%\), drivers of the valuation discounts need to be identified.

We provide sensitivities with regard to the valuation assumptions in Table 4 in Appendix D1 and Appendix D2.

A first decomposition of the results on share level shows that shares without preferential rights (mostly common shares) feature, on average, higher discounts (\(30.3\%\) versus \(25.6\%\)) at a lower interquartile range (\(24.8\%-35.1\%\) versus \(18.6\%-34.2\%\)). From this analysis, we derive another finding:

Finding 2

Shares without preferential rights carry a disproportionately high share of a venture’s general overvaluation. In turn, preferential rights entail some level of protection against value dilution but, on average, do not preserve full protection in relation to the price level of the most recent funding round. Common stocks without any preferential rights are primarily held by founders and employees pointing towards potential incentive issues.

In order to understand the driving forces behind the dispersion of discounts, we conduct several analyses. First, we assess the impact of differences in issue prices between shares from the most recent funding round and from all other rounds, respectively.Footnote 19 We standardize relative pricing by dividing the issue price per share for each share class by the issue price per share of the most recent funding round of the respective venture. Figure 5 shows the results and delivers support for a strong negative relationship, where lower relative prices trigger higher implied valuation discounts per share.

Implied valuation discounts and relative pricing. Notes: Analyses rest upon base parameter setting with \(\pi _{IPO}=25\%\), \(T-t=4\), \(\sigma =90\%\), and \(r=2.5\%\). The plot depicts implied valuation discounts regarding relative pricing. Within the table, we report statistics on the distribution of the implied valuation discounts across all shares per share class (by the occurrence of a down-round) as well as simple fitted linear model results. n denotes the number of observations. Grey shaded areas within the plots describe standard error (SE) of the forecasts of the fitted linear models at a \(5\%\)-confidence level, i.e. \(\alpha =.05\)

We conclude:

Finding 3

On average, implied valuation discounts per share grow with decreasing issue price when related to the most recent funding round of the respective venture. Thus, the further issue prices move upwards in new funding rounds the lower becomes the protection level provided by existing liquidation preferences. Moreover, it becomes clear that features increasing the amount of the preferential claim, e.g., multiples or returns, reduce implied valuation discounts.

Second, we identify and analyze share classes that have been exposed to down-rounds, where a funding round is denoted as such, if its underlying issue price is below the issue price of the previous funding round. In Fig. 5, we mark all share classes with at least one subsequent down-round with a \(+\) and find a similar negative relationship between relative pricing and implied valuation discount (see the regression table in Fig. 5). Moreover, the analysis shows that implied valuation premia only occur, if the most recent funding round has been a down-round, i.e., relative pricing exceeds \(100\%\). In turn, it becomes also clear that even a most recent down-round is not safe protection against valuation discounts as we find share classes with relative pricing beyond \(100\%\) that still carry a discount. We formalize this mixed finding as follows:

Finding 4

For share classes affected by down-rounds, the distribution of implied valuation discounts is more dispersed. In addition, if and only if a down-round occurred in the most recent funding round, the affected share classes may carry an implied valuation premium. However, even in such a setting share classes may be exposed to a discount as other more senior share classes, sitting in the premium area and originally issued in an up-round, skew the allocation in their direction based on high outstanding preferential claims.

Third, we assess the relation of investment and return more generally. As Fig. 5 depicts, the original issue price and the implied value will coincide for a relative pricing of \(200\%\) given that the implied valuation premium amounts to \(100\%\). If the implied valuation premium is lower, the share class will be valued below its original issue price. The share class is protected from a relative perspective, but protection from an absolute perspective is incomplete since the current implied investment value is lower than the initial investment volume. We depict this inverse relation via the dotted line, where all share classes above or left to the dotted line can be regarded as positive return investments since their current implied per share value lies above the original issue price. Vice versa, share classes below or right to the dotted line currently entails negative returns. The vast majority of share classes is valued above their issue price but lower than the most recent funding round (above dotted line but below horizontal axis). Regarding returns we can draw the following conclusion:

Finding 5

The total median return of VC investments with preferential claims preferred shares lies at \(68.3\%\) in our sample (\(25\%\) and \(75\%\) quartile: \(23.9\%\) and \(388\%\), respectively). While \(93.2\%\) of the examined share classes are not affected by a down-round range positive, \(29.2\%\) of down-round affected share classes carry negative returns. The total median return of down-round affected share classes is still \(63.4\%\) but with \(25\%\) and \(75\%\) quartiles ranging from \(-10.3\%\) to \(349\%\). Thus, down-rounds are significantly shaking up investment performance, not only by skewing them to the lower end but also by making them more widespread.

Another key characteristic of preferential claims is their allocation. In particular, we examine its seniority vis-a-vis other claims and allocations of exit proceeds. Within our model, we consider pari-passu, strict, and mixed seniority. In addition to the previous analysis, we plot implied valuation discounts (and premia) with respect to the prevailing seniority scheme applicable in the venture. We further indicate the level of relative seniority. Similar to relative pricing, we form relative seniority by indexing the seniority of preferential claims in ascending order and dividing the seniority index of each claim by the highest seniority index per venture.

Within the plots and adjacent table of Fig. 6, we observe that average and median discounts vary among groups, where discounts are smallest for shares of ventures with a pari-passu seniority. Comparing the upper and lower plot, we observe the most considerable impact of relative pricing on implied valuation discount for pari-passu. These results can be explained by the claim structure: While all preferential claims are served in the same step under pari-passu, i.e., claims are ’pooled’, more senior claims are served before more junior claims under strict seniority, i.e., claims are ’stacked’. Thus, we observe the lowest impact of relative pricing on implied valuation discounts for such a setup. Even observations with relatively high pricing still carry noticeable implied valuation discounts as the most recent funding round always represents the highest level of relative seniority.

Surprisingly, we find somewhat higher average implied valuation discounts for shares of mixed seniority, although it represents a mix of pari-passu and strict seniority. One explanation to this unanticipated observation can be, again, drawn from the occurrence of down-rounds in the respective venture’s funding history as down-rounds are a well-known trigger for a change in seniority terms. In fact, for \(72\%\) of all cases where a down-round occurred in the funding history of the venture, a mixed seniority approach applies. If there has not been a down-round, mixed seniority only occurs in \(35\%\) of such cases. Oftentimes, there is a change from a pari-passu to a mixed approach when earlier classes are served pari-passu and more recent rounds are given seniority (see Bengtsson and Sensoy (2015)). With high preferential claims of existing share classes (due to their relatively high original issue price) anyways triggering higher discounts, a down-round in the most recent financing cycle implies even lower valuations of the remaining shares due to the low pricing. Interestingly, we find that share classes that carry a premium do not only feature high relative pricing but are also of highest relative seniority, while those of high relative pricing but with low relative seniority carry considerable implied valuation discounts. This observation results in a further finding:

Finding 6

Implied valuation discounts on shares are significantly higher for ventures where the seniority of preferential claims is based on a ’stacking’-approach (strict seniority, average: \(28.2\%\)) or mixed seniority (average: \(29.8\%\)) in comparison to ventures where seniority of claims is based on pari-passu (average: \(15.9\%\)), where preferential claims are ’pooled’. Thus, choosing the pari-passu mechanism triggers more balanced implied share values among share classes. Moreover, it becomes clear that low relative pricing alone does not result in higher implied valuation discounts. Instead, discounts critically depend on the seniority scheme and, for ’stacking’ approaches, on the relative seniority.

Another characteristic that shows a lot of variation across our sample is the remainder allocation. While conversion-based allocation (CPR) and share class-based allocation (SCB) are technically identical, shareholder-based allocation (SHB) differs as preferential claim amounts are offset among the shares of respective shareholders rather than just among shares of the same share class. Note that any differences in the results of CPR- and SCB-based ventures result from the underlying preferential claims and respective pricing. In order to observe any effect of SHB in comparison to SCB, an investor must hold at least two different share classes of the same venture with deviating preferential claim. In our sample, an investor holds on average shares from 1.7 different share classes. While this seems low, it is important to note that the average increases to 2.9 for investors holding shares from more than one share class. For ventures applying SHB, the average is even higher at 3.3.

Allocation mechanisms have a significant impact on implied valuation discounts among share classes. Simply comparing average discounts delivers a first indication: SHB remainder allocation results in an average discount of \(33.8\%\), while CPR and SCB arrive at \(20.2\%\) and \(29.1\%\), respectively (see Fig. 7). However, it becomes apparent that the allocation mechanism may not be the only driver as we would expect identical results for CPR and SCB. Thus, we isolate allocation effects by recalculating the implied valuation discounts for CPR-related ventures using SCB and by repeating the procedure for SHB-related ventures. As expected, we do not find any differences in results when applying SCB for CPR-related ventures, but we can reveal important insights with the second analysis where SCB is applied to SHB-related ventures.Footnote 20 The discounts are higher for SHB with an average of \(33.8\%\) in comparison to \(29.4\%\). Similar indication is given by the left-hand plot of Fig. 7 where we compare implied valuation discounts for SHB-related ventures (x-axis) and the respective recalculated alternative discounts when SCB/CPR is applied (y-axis). All observations above the diagonal line indicate that SHB has led to higher discounts on share class level in comparison to SCB/CPR. The right-hand plot depicts the difference between recalculated as well as original discounts (y-axis), and it illustrates down-rounds as well as seniority. Interestingly, we find that only down-round affected share classes bear the potential to flip the pattern, i.e., SHB results in lower discounts than SCB/CPR.

Implied valuation discounts and seniority. Notes: Analyses rest upon base parameter setting with \(\pi _{IPO}=25\%\), \(T-t=4\), \(\sigma =90\%\), and \(r=2.5\%\). The plot depicts implied valuation discounts with respect to the relative pricing (upper plots) and relative seniority (lower plots) of preferential claims of the respective venture. Within the table, we report statistics on the distribution of the implied valuation discounts across all shares per share class as well as simple linear regression results. n denotes the number of observations. Grey shaded areas within the plots describe standard error (SE) of the forecasts of the fitted linear models at a \(5\%\)-confidence level, i.e. \(\alpha =.05\)

In addition, we analyze whether the allocation mechanism has a more general impact on the discount on venture level. In the last two lines of the table depicted in Fig. 7, we recalculate the discounts for all SHB-based ventures applying SCB/CPR and find that SHB also triggers increasing discounts on venture level as the average over the sample is \(4.2\%\)-pts (\(27.4\%\) versus \(23.2\%\)) higher. Hence, we conclude:

Finding 7

Allocation mechanisms only affect implied valuation discounts if investors hold shares from more than one share class with deviating preferential claims. In such scenarios, discounts are, on average, greatest under shareholder-based (SHB) remainder allocation—both on share class and on venture level. Only in very rare settings involving down-rounds, results may flip. Thus, in general, SHB is most costly for very junior shareholders, e.g., founders and employees holding common stocks. Share class-based (SCB) allocation and conversion-based (CPR) allocation do not deviate in financial results as they are technically identical.

Overall, our univariate exploratory analysis shows that variations in contract structures or financing setups have a severe impact on the value of shares in a venture. Beyond existing literature, we reveal that the impact is not uniform for all shares in a venture but strongly depends on the respective relative share class level and the chosen preferential rights. We lay out the implications of our findings in the subsequent section.

Implied valuation discounts and remainder allocation. Notes: Analyses rest upon base parameter setting with \(\pi _{IPO}=25\%\), \(T-t=4\), \(\sigma =90\%\), and \(r=2.5\%\). Within the table, we report statistics on the distribution of the implied valuation discounts across all shares per share class. We also present share level and venture level results of share holder-based remainder allocation using share class-based allocation. The left-hand plot relates implied valuation discounts on a share level for shares of share holder-based remainder allocation (horizontal axis) to the implied valuation discounts based on the alternate allocation of share class-based allocation (vertical axis). The right hand plot depicts the difference between the original and alternate implied valuation discounts with respect to relative pricing and relative seniority

7 Implications

Our framework delivers an approach that supports the explicit design of equity securities in follow-up rounds, restructuring, down-rounds or secondaries for all relevant stakeholders, i.e., founders or management, venture capital funds and also limited partners investing in those funds. Based on our framework of preferential rights in venture capital (VC) finance, we present a structured valuation approach to assess the impact of variations in investment, exit proceeds and risk-return relationship on a shareholding level. Our model offers closed form solutions for numerous realistic, complex setups of VC investments. Thus, we provide a powerful tool for decision making regarding investment and exit in VC financing.

By applying our approach to a hand-collected sample of 49 mainly European ventures with 407 financing rounds and 2,098 transactions, we can investigate the impact of preferential claims on venture level, share class level and on single shareholdings. The findings 1 to 7 from Sect. 6 provide insights regarding overvaluation on venture level and on share classes while further explaining who carries most of the implied valuation discounts, which mechanisms lower or increase discounts on share class level, and how special events like down-rounds shake up the setting.

From these findings, we infer several implications for the venture capital ecosystem:

-

From the perspective of founders and early-stage investors, it is important to reflect that they will inevitably be affected by subsequent share classes via preferential claims, skewing the relative value allocation. Thus, they should not bluntly exchange higher post money valuations if those come with higher preferential claims.

-

Moreover, founders and early-stage investors should set initial terms that are more likely to result in lower discounts. Thus, they should stipulate a pari-passu basis of claims and an SCB/CPR remainder allocation.

-

In contrast, late-stage investors should opt for terms favouring them if they have the negotiation power to do so. For instance, they should try to transform pari-passu agreements to strict seniority in order to secure their own preferential claim.

-

While VC investors often focus on a specific venture development phase, they tend to invest in more than one share class. Thereby, they should consider the effects of new investments on their existing shareholding value. For example, SHB remainder allocation benefits serial investors thereby providing a strong incentive to participate in new rounds. In contrast, strict seniority or high preferential amounts of new shares may have adverse effects on existing shares, cannibalizing part of their value.

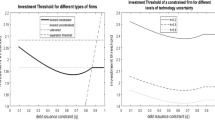

-